The Thursday Report – 10.9.14 – Darkness at the Edge of the Thursday Report – What Happens When the Boss Works with KFC

Born to (HAVE THE) Run(S) (Over Budget)

Alaska Supreme Court Requires an Unmarried Surviving Same-Sex Partner to be Treated as if Married to Receive Workers’ Compensation Death Benefit (Now He Has Money To Buy Fresca And KFC)

And the Wave Continues: Arizona Court Recognizes Same-Sex Marriage Between Decedent and the Partner Who He Married in California (He Died Unmarried And Without A Fresca)

Physician Long-Term Disability Insurance: It’s the Small Things That Make the Difference in Receiving Money for a Claim, an article by Tom Davis

Worker Classification Issues in Professional Practices, an article by William P. Prescott, Mark P. Altieri, and Kelly A. VanDenHaute, Part Three

Thoughtful Corner: Denis Kleinfeld: Books of Interest for Individuals Who Want to Think Themselves Successful

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Born to (HAVE THE) Run(S) (Over Budget)

Last week’s Springsteen/Fresca Thursday Report edition caused significant outbursts of fanfare (thanks to both of you), encouraging us to complete the idea of Bruce Springsteen, a can of Fresca, and Colonel Sanders singing Born to Run with customized lyrics by our professional writer and Boston Conservatory graduate Kristen Sweeney. It begins below and continues in the Humor (or lack thereof!) section.

You can see last week’s edition (if you dare) which includes discussion of the recent Bross cast (Tax Court on transferring goodwill from one company to another) and Frescia case (Florida homestead status for inheritance bestowed upon property that the decedent did not live in and had bargained away to his now disappointed first spouse) by clicking here.

This week we cover the recent Alaska case of Harris v. Millennium Hotel and New Hampshire Insurance Co. where the court found that two men would have married if the law had permitted this, and that the state therefore owed a death benefit to the surviving partner who was a state agency employee.

We also cover the September 12, 2014 Arizona decision of Fred McQuire and George Martinez which came to the same conclusion. McQuire and Martinez were wed in California but were not recognized as married by Arizona.

The Arizona case is very interesting, since Bruce Springsteen CDs, Fresca, and Kentucky Fried Chicken are all sold in Arizona, notwithstanding its ban on same sex marriages.

We thank Stetson law student Dena Daniels, M.B.A. for providing most of the work on these articles.

Alaska Supreme Court Requires an Unmarried Surviving Same-Sex Partner to be Treated as if Married to Receive Workers’ Compensation Death Benefit (Now He Has Money To Buy Fresca And KFC!)

by Dena Daniels, M.B.A., J.D. Candidate, and Alan S. Gassman J.D., LL.M.

Dena Daniels is a law clerk at Gassman Law Associates and a third year law student at Stetson University College of Law. She is pursuing a concentration in Social Justice Advocacy. Dena holds a B.S. in Business Administration with a concentration in Management and a minor in Marketing from the University of South Florida. She also holds a MBA from Valdosta State University in Valdosta, GA.

Will states and other entities be required to provide surviving spouse and other benefits to unmarried same-sex couples who can prove that they would have been married in states that have denied them the right to do so?

The answer is yes in Alaska!

The July 25, 2014 Alaska Supreme Court’s decision of Harris v. Millennium Hotel and New Hampshire Insurance Co. took a very big step by permitting a surviving same-sex partner to be treated as if she had married her long-time significant other, where they were found to have been denied the right of marriage in contravention of the equal protection clause of the US Constitution (and of the Alaska Constitution).

The complaint was brought by Deborah Harris against Millennium Hotel and New Hampshire Insurance Co. Harris was the same-sex partner of Kerry Fadley, a manager at the Millennium Hotel. In October 2011, Fadley was shot and killed at work.

In March 2012, Harris filed a workers’ compensation claim for death benefits as Fadley’s spouse. The claim was denied by Millennium because it “had not received any documentation” that Harris was Fadley’s spouse. The notice provided by Millennium also identified Harris as an “unmarried co-habitant.”

Harris asserted through sworn affidavits that she was the surviving same-sex partner of Fadley, and because they were not permitted to marry under Alaska law, they could not marry each other. Harris and Fadley apparently lived in an exclusive, committed, and financially interdependent relationship for more than 10 years.

In the complaint, Harris presented two main arguments:

(1) The denial of the death benefits to her violated her right to equal protection under both the Alaska and the U.S. Constitutions; and

(2) The denial of death benefits to her unconstitutionally infringed on her rights to liberty and privacy under the Alaska and U.S. Constitutions.

Millennium argued that the Marriage Amendment of the Alaska Constitution should be interpreted to preclude same-sex couples from receiving death benefits under the Alaska Workers’ Compensation Act.

Both parties presented case law that supported their argument. Harris based her argument on the case of Alaska Civil Liberties Union v. State, 122 P.3d 781 (Alaska 2005), where the Alaska Supreme Court ruled that the government must provide employee benefits to the partners of same-sex couples.

Millennium, on the other hand, relied upon Ranney v. Whitewater Engineering, 122 P.3d 214 (Alaska 2005), which held that unmarried co-habitants of employees were not entitled to death benefits under the Workers’ Compensation Law.

In its opinion, the court discussed the 2014 Alaska Supreme Court case of State v. Schmidt, 323 P.3d 647 (Alaska 2014), which addressed the question of whether the Marriage Amendment of the Alaska constitution barred equal protection for same-sex couples. The court in Schmidt stated that “the Marriage Amendment does not explicitly or implicitly prohibit the State from offering the same property tax exemption to an eligible applicant who has a same-sex domestic partner that the State offers to an eligible applicant who has a spouse.” In its holding, the court noted that such an interpretation of the Marriage Amendment could violate the federal equal protection clause.

The Alaska Supreme Court rejected Millennium’s argument that Ranney would apply, by stating that “unlike the survivor in Ranney, Harris could not legally marry her partner in Alaska or have an out-of-state marriage recognized here because of the Marriage Amendment.”

The court in Harris also held that the workers’ compensation statute discriminated between same-sex and opposite-sex couples, stating that “denying same-sex couples access to death benefits under the Workers’ Compensation statute does not bear a fair and substantial relationship to the purposes of the Marriage Amendment act as identified in Ranney.”

What does this mean?

This case points out that individuals who would have married, but for state law which has prevented it, may have to be treated as if they were married for certain legal purposes.

This position will doubtlessly be adopted by courts throughout the country, and eventually the U.S. Supreme Court will probably need to decide whether a same-sex couple that is unmarried as a result of state law, is entitled to benefits offered to the spouses of legally married couples. Subsequently, this will result in an abundance of lawsuits, filed in a number of states, where individuals will lose their significant other or have legal rights impacted by whether or not they are married, and will claim that they should be treated as if they were married.

Juries will then need to decide whether the people would have been married in order to allow courts to determine legal rights and responsibilities.

Examples of this may include homestead inheritance rights, inter-spousal tort immunity (whether somebody can sue someone who would have been their spouse if they could have been married), property rights and ownership, and medical benefits.

This case may cause a wave in same-sex inheritance rights and death benefits in non-recognizing states like Florida. It appears that the Florida courts are moving at a much quicker pace to catch up with society than its State Legislation. On August 21, 2014, Federal U.S. District Judge Robert Hinkle, sitting in Tallahassee, ruled that the state’s voter-approved ban on same-sex marriage is unconstitutional, however, he delayed permitting the county clerks in Florida from issuing marriage licenses, pending appeals. This ruling is the fifth of its kind in Florida. The ruling provides an avenue for same-sex couples to get married in the state and prohibits the state from denying benefits to same-sex couples who were legally married in other states. Although Judge Hinkle issued a Stay with his ruling, Florida appears to be well on its way to a journey to the U.S. Supreme Court.

With this in mind, we ponder the question of how a Florida court will rule in a case similar to that of Ms. Harris. What would happen in Florida if an individual in a same-sex couple died without a will, however, the partners held themselves out to be married (i.e.- joint property, commingling of funds, etc). What would be the State of Florida’s ruling if the surviving partner blamed their unmarried status on the state’s ban? It can be assumed, especially given the recent progress in the Florida courts concerning same-sex marriage, that Florida would reach the same conclusion as Alaska and afford the inheritance and/or surviving spouse rights to the living partner.

What are title companies to do if a same-sex couple has owned a home for many years, and would have married if the law permitted, and one partner dies owning the homestead the couple has resided in? Will the surviving partner have a life estate right if there are common minor children, and if so how much would the surviving partner be entitled to?

Although Florida is making progress, the ban has not been lifted as of yet, so same-sex couples will remain in a battle to be treated as traditional married couples. As of now, Florida same-sex couples are not able to gain inheritance rights so it is important that same-sex couples take the necessary precautions (i.e.- customizing an estate plan including will, power of attorney, etc.) to ensure that, upon the death of a partner, the assets will pass as intended to the surviving partner.

And the Wave Continues: Arizona Court Recognizes Same-Sex Marriage Between Decedent and the Partner Who He Married in California (He Died Unmarried And Without A Fresca)

by Dena Daniels, M.B.A., J.D. Candidate and Alan S. Gassman J.D., LL.M.

On September 12, 2014, a U.S. District Court in Arizona issued an emergency order requiring the state to recognize the same-sex marriage of Fred McQuire and George Martinez so that McQuire could be listed as Martinez’s “spouse” on his death certificate. This apparently did not entitle McQuire to receive any surviving spouse benefits.

Fred and George had been partners for 45 years, until George died in August of pancreatic cancer. Both Fred and George were disabled Vietnam veterans, and the couple was married in California this past summer. The complaint challenged the state of Arizona’s definition of marriage as only between a man and a woman, and many other plaintiffs joined in the complaint. The complaint was filed right after Martinez was diagnosed with pancreatic cancer in June but the court did not issue a decision until after Martinez died.

In the request for the emergency order, McQuire argued that:

- He would lose the dignity associated with his marriage and suffer that loss in the midst of his grieving;

- He would lose significant financial benefits; and

- He would suffer a violation of his constitutional rights.

The forward-thinking order and opinion written by U.S. District Judge John Sedwick contains the following statement:

The court has not yet decided whether there is a conflict between Arizona law and the Constitution, but the court has decided that it is probable that there is such a conflict so that Arizona will be required to permit same-sex marriages. Thus, it is probable that the public interest would be advanced if the requested narrowly-limited injunctive relief is awarded. Conversely, it is probable that the public interest would be harmed if no such relief were provided.

In summary, the court agrees with defendants that McQuire has not shown irreparable harm based on the financial consequences of not recognizing his marriage to Martinez. Nevertheless, on the basis of the loss of dignity and status coming in the midst of an elderly man’s personal grief and on the fact that deprivation of a constitutional right constitutes irreparable harm, the court holds that McQuire has shown the requisite irreparable harm.

Judge Sedwick proceeded to order Will Humble, Director of Arizona’s Department of Health Services, to “promptly prepare, issue, and accept a death certificate for George Martinez which records his marital status as ‘married’ and his surviving spouse as Fred McQuire.”

Without this order, Martinez’s death certificate would have described the decedent as “never married” with no surviving spouse.

Although McQuire does not qualify for surviving spouse benefits because of the short tenure of their marriage, he is reportedly pleased with Judge Sedwick’s order because he knows the significance of this case and what it could possibly mean for other same-sex couples in Arizona.

Physician Long-Term Disability Insurance: It’s the Small Things That Make the Difference in Receiving Money for a Claim, an article by Tom Davis

Thomas C Davis, RFC, AIF,® is a spectacular technician and advisor. We have enjoyed working with him for many years, and look forward to many more.

Tom is an independent financial services representative and insurance agent who has specialized in working with physicians in the Tampa Bay area since 1973. He is a member of the Financial Services Institute, The National Association of Insurance and Financial Advisors, The National Association of Registered Financial Consultants, and an ACCREDITED INVESTMENT FIDUCIARY®. While Tom is a practicing advisor who can receive commissions from the sale of insurance and investment products, he and his staff also provide fee based analysis of insurance products. Many fee based clients simply engage Tom’s services to review their existing insurance policies and to better understand proposals for products being proposed for purchase. Tom’s contact information is below:

Thomas C Davis, RFC, AIF®

Integrated Wealth Management, LLC

3030 N Rocky Point Dr W, Suite 700

Tampa, FL 33607

Office Phone: 813-314-2284

Email: tdavis@tcdavisnet.com

Most physicians understand the need to carry long-term disability insurance. Unlike some business owners or executives whose business may continue to generate income while the owner or executive is unable to work due to sickness or accident, most physicians must see patients, perform procedures, and provide consultations in order to be paid. A physician who is unable to work will eventually stop receiving income. Long-Term disability income insurance may be one of the most important insurance coverages needed for a physician.

Much has been written on the importance of the definition of disability used in disability insurance policies. While the definition of disability is very important, other language in the disability policy may be the key to actually getting paid if one is unable to work due to a sickness or accident. It is the small things that can make the difference in submitting a claim and actually getting paid by the insurance company.

Most physicians will agree that the premiums for long-term disability insurance are expensive. In order to keep premiums at a minimum, many physicians may seek coverage through an association plan or other “group sponsored” disability plan. This article will focus on some of the key differences between association/group plans and individual disability policies. While our main focus will be to highlight the major differences between the AMA sponsored association plan underwritten by United States Life Insurance Company of New York and individual policies such as those offered by Guardian, MetLife, UNUM, Berkshire Life, Principal Life, Northwestern Mutual Life, Standard Life and others, the same general differences may be found when comparing ANY group plan and an individual policy. ANY group plan is especially important today as more physician groups are merging to form large practices. Many of these larger group practices may be eligible for employer sponsored group long-term disability plans.

The AMA and other group long-term disability plans require one to be a member of the association to be eligible for coverage. The AMA plan specifically requires an eligible participant to not only be a member of the association and pay dues, but also to be “actively at work” on a full-time basis to be covered for disability insurance. While this may not limit eligibility for a younger physician, it may cause an older physician who is “trying to wind down” to lose coverage just when he/she may be most likely to make a claim. I can think of two such examples: A gastroenterologist, age 59 and a member of a large group, reduces his schedule to three days a week and only does procedures. Under the AMA plan, he would not be full-time and therefore not eligible for coverage. He may even continue paying premiums, but at the time of a claim, he learns that he was not eligible for coverage because he was part-time. Another example: An ENT physician age 55 and owner of his practice mergers with a large group to eliminate the “management of running a practice”. Initially he continues his customary hours, but soon after the merger he reduces his hours to three days a week, then to two days a week. He then teaches at a medical school two days a week. Under the AMA plan, he may not be eligible for benefits under the disability policy due to the “Actively at Work” condition of the AMA policy. As with the prior example, he may not know about his ineligibility until the time of claim since he continued to pay premiums for the association plan and continued to pay dues.

An individual policy provides for substantially more freedom. Individual policies typically do not require association membership or dues and typically do not require full-time active engagement in one’s occupation to receive benefits.

Another major difference in the AMA or other group sponsored plans and individual long term disability policies is the guarantee of premium and the guarantee of coverage. The AMA plan rates may change every 12 months. Further, the rates are tiered by age bands. Therefore one’s rate will increase with age. The rate for a resident physician may be substantially less than for an individual policy but one must consider the future premium increases in comparing policies. Since NO PREMIUMS ARE GUARANTEED under the AMA or other group sponsored plans (except for perhaps the first 1-3 years), one can never really know what the future holds. A large rate increase at age 55 may be unaffordable and come at a time when the probability of claim is most likely. Insurance companies may increase rates substantially in an attempt to “get off the risk” since they know substantial rate increases may force participants to drop coverage.

The AMA and other group plans may also be cancelled! The insurance company can cancel a plan at renewal. Further, there is no guarantee that the association or group employer will continue to offer group long-term disability coverage.

Many individual plans are guaranteed renewable and non-cancelable. A good individual plan cannot be cancelled by the insurance company and the rates are guaranteed not to increase. Can you imagine buying medical insurance with a guaranteed premium to age 65? Believe it or not, back in the ‘70’s and early ‘80’s insurance companies issued medical insurance with guaranteed rates to age 65. We have some clients who still hold those policies today. The day may come when insurance companies will no longer guarantee rates and coverage, just as they have with medical insurance. Locking in a rate now cannot be accomplished with the AMA or other group sponsored plans.

The AMA and many group sponsored plans offer “residual benefits” under the terms of their contracts.

Residual benefits are paid if, due to a sickness or injury, one cannot work full-time in his/her occupation and consequently sustains a loss of income. Under the AMA plan, the amount of residual benefit is determined by calculating the percentage drop in earnings. If the earnings are reduced by 20% or more, benefits are paid in the same proportion as the loss of earnings. For example, if the loss of earnings in 30%, one may be paid 30% of the regular monthly benefit. This calculation is done each month to determine if benefits are payable. In order to receive a residual claim under the AMA plan, one must sustain a loss of earnings of at least 20% of prior earnings. Most individual plans offer similar benefits.

The difference in the “small print” between the language for the residual benefit in the AMA plan and most good individual policies is the AMA plan specifically states that the residual benefit will be paid if: 1.) You can perform some but not all the material duties of your current occupation; or 2.) You are able to perform all the substantial duties of your current occupation but for less than full-time; and 3.) Sustain a loss of earnings of at least 20% of your prior earnings. Most group plans require a total disability before residual benefits are payable.

The small print in the residual language of the AMA plan could result in a huge loss of benefits compared to most good individual plans. The language in most individual plans will allow one to receive residual benefits even if one is working full-time and performing all the duties of the current occupation and sustains a loss of earnings of at least 20%. I have a surgeon who developed a neurological condition that caused him to have seizures. In this case he was totally disabled for about 2 years and then was able to go back to work on a full-time basis. During the two years he was not working, he lost about 80% of his referral base. His income was substantially reduced for about three years following his return to work. He continued to receive residual disability benefits until his earnings were back to 80% of his prior earnings adjusted for inflation. If he had been relying on the residual benefit of the AMA plan, benefits would have stopped as soon as he returned to work on a full-time basis. The provisions of the AMA plan might work for a salaried employee, but not so well for a surgeon/business owner.

Consider another example: An OB-GYN physician suffers a heart attack. She returns to work before the end of the elimination period (in this case 90 days). Her physician and psychiatrist advise her to stop doing OB but allow her to continue doing GYN. In this case she never suffered a total disability. Under an association/group plan, residual benefits would not be payable. One would expect her earnings to be reduced by well over 20% if she no longer performs OB and that certainly is the case in this example. Further, her earnings may be reduced for the rest of her career! The association plan would not have paid her a dime yet her individual policy continues to pay her residual benefits today. The small print made a big difference for this client.

One provision of the AMA plan that cannot be duplicated by most individual policies is the “student loan” provision. Under the AMA plan, if a physician was enrolled prior to age 40 and makes a claim for total and permanent disability before age 45, the AMA plan will make his/her installment payments for medical school student loans to a maximum of $200,000.

Some disability claims, even those made to quality individual disability insurance companies are denied. More frequently we see a claimant who has been receiving benefits denied ongoing benefits because the insurance company decides the claimant is no longer disabled. The insurance company simply stops paying benefits. What is the process for questioning or appealing a claim with the AMA or other group long-term disability plans compared to the process for appeal with individual plans?

The AMA plan and other group long-term group insurance plans are regulated by ERISA (Employees Retirement Income Securities Act). Under an ERISA regulated plan, a claimant who appeals a claim must exhaust the insurance company’s internal appeals process before filing a lawsuit. Individual long-term disability plans need not exhaust the administrative appeals process before filing a lawsuit and the claimant may present new evidence in court during the lawsuit. Should a claimant fail to receive a remedy by exhausting the internal appeals process with the AMA or other group long-term disability plan, he/she can file a lawsuit in FEDERAL court. Claimants owning an individual policy may sue in STATE court for breach of contract, negligence, bad faith, or other causes. Unlike ERISA cases, which are decided by a judge, individual long-term disability claimants are entitled to a jury trial.

My experience has been that many attorneys are reluctant to take on a case for a disability appeal that is an ERISA claim filed in Federal court. If you have a group plan you must pay special attention to all the filing requirements and deadlines for the administrative appeal. If you miss even one requirement or miss a deadline, you will be denied the ability to sue in Federal court because you failed to completely exhaust the internal administrative appeals process. Further, ERISA makes it very difficult to introduce new evidence in Federal court. Therefore, a claimant must be sure to present all evidence during the administrative appeals process.

Finally, should you prevail in a Federal lawsuit for your AMA or other group plan, damages are limited only for the amount of back benefits plus interest. Individual policy owners filing in State court are entitled to receive compensatory damages, punitive damages and are more likely have attorney’s fees paid by the insurance company.

Some advisors suggest owning both individual and AMA/group long-term disability policies simultaneously. Combining an AMA or group plan with individual policies allows for possibly the best of both worlds; a lower but increasing premium on the AMA policy and better contract language in an individual plan. However, can the sequence of purchase of long-term disability insurance affect the amount of disability insurance you can receive? Absolutely! If you purchase the AMA or group policy before you purchase an individual policy, you may not be able to qualify for the individual policy. The AMA allows you to purchase 66 2/3% of your monthly income to a maximum of $20,000 monthly benefit. If you have purchased the maximum benefit from the AMA, it will be difficult to purchase any individual coverage.

My suggestion to clients is to buy the amount of individual disability they need to meet their basic needs and necessary wants. Any additional benefits can then be purchased through the AMA or other group long-term disability plans.

The last contrast between the AMA/group plans and individual plans I will make is the Definition of Disability. I have purposely chosen this to be the last comparison because most comparisons start with this contrast. As stated above, there are many differences beyond the definition of disability. Frankly, the other differences may have more to do with receiving benefits at the time of claim than simply the definition of disability.

Under the AMA plan total disability means your complete inability to perform the substantial and material duties of your current occupation beyond the elimination period, and you are not engaged in any other occupation. In addition you must also be under the regular care and attendance of an attending physician. Current occupation means the medical specialty then being practiced or the occupation performed immediately prior to disability.

I think this is a very good definition of disability. If we were only comparing the definition of disability, I can find no real fault in the AMA plan’s definition. We in the insurance business refer to this definition as “own occupation, not engaged”. If you are sure you would not attempt or enter a new occupation while you are receiving disability benefits under the AMA plan, this definition is just fine. Some physicians may be uncomfortable with the “not engaged in any other occupation” provision. They cannot see themselves sitting at home collecting benefits until they are age 65-70. The typical nature of many physicians is to attempt to stay “engaged”; if for no other reason they feel they spent extra years getting their education and entered the workplace later than many business owners or executives. Individual policies can be purchased with a definition that protects “your own occupation”, including a recognized specialty, and they do not limit your ability to work in another occupation. Some of these individual policies continue to pay your full benefits regardless of the income you receive in the other occupation.

For example, I had an urologist who was injured in a skiing accident and sustained a back injury. The back injury prevented him from taking call because he may or may not have been medicating for pain. He was also no longer able to do surgery because he was unable to stand for any period of time. He was only 39 years old at the time of his injury. He succeeded in claiming the full benefit under his disability policy. However, as time passed, he became depressed and felt he needed to go back to work doing “something”. He went to a community college, was trained to be a paralegal, and went to work for a law firm that specializes is suing attorneys for malpractice. He makes about $45,000 annually and he receives health insurance. He is happy! He can continue to receive 100% of his individual long-term disability insurance tax free because his individual policy has no restriction for “being engaged” in another occupation.

I have attempted to provide some of the major differences between the AMA and other group long-term disability plans to individual policies. They are other differences, many of them minor, that may not have the “claims paying” impact of those I have mentioned. The AMA plan costs less money initially than most all individual plans. The AMA plan is not a bad plan. It certainly makes sense to buy the AMA plan in lieu of going bare. One should take notice of the “small print” when considering the purchase of long-term disability insurance. This may be especially important for those who may be considering surrendering individual long-term disability policies, many of which cannot be duplicated in the market today, to save money by purchasing the AMA or other group long-term disability plans.

Worker Classification Issues in Professional Practices, Part Three

by William P. Prescott, Mark P. Altieri, and Kelly A. VanDenHaute

Two weeks ago we discussed some interesting cases relating to the classification of a worker as an employee or an independent contractor. This week, our guest authors William Prescott, Mark P. Altieri, and Kelly A. (Means) VanDenHaute conclude their article with a discussion of the new professional, the retiring professional, and the three-entity approach to co-ownership.

You can view Part One of this article by clicking here. Part Two can be viewed by clicking here.

We once again thank these authors for making this excellent article available to our Thursday Report readers!

CONCLUSIONS

Let’s return to the three practice scenarios mentioned at the beginning of the article.

The New Professional

The fact that the new professional practices through a corporate entity, typically an S-corporation, does not mean that the new professional is not an employee of the professional practice. Typically, the practice and its owner retain a substantial degree of control, including mentorship, over the new professional, including setting fees, billing clients, providing clients and referral sources, establishing practice systems, and scheduling. Almost always, the new professional has a covenant not to compete, which arguably in and of itself shows behavioral control. With few exceptions, equipment is provided by the practice, hours of work and patients or clients are scheduled by the administrative staff, and the new professional has no investment in the practice facility and no risk of loss. Finally, the parties often contemplate future ownership of the practice, in whole or in part.

The Retiring Professional

The retiring professional usually renders professional, consulting, and administrative services to the new owner of the practice on those days, times, and hours per week and for compensation as mutually agreed to by the parties, subject to the needs of the new owner. Often, the retiring professional will agree to remain in the practice for a period of six months or a year and by mutual agreement thereafter. However, the new owner should retain the ability to terminate the relationship at any time after the transfer of goodwill is complete. Although there is a good argument that the retiring professional is an independent contractor because the new owner does not need to train the retiring professional, the practice typically maintains control over the retiring professional’s activities. In this case, the new owner’s practice bills the patients or clients, collects revenue, sets the fees, employs the staff, and provides the equipment to the retiring professional. The new owner’s systems and policies are in place, which may or may not be the same systems and policies that the retiring professional used. Finally, the retiring professional will almost always be subject to a restrictive covenant which shows behavioral control.

The retiring professional usually would like to be an independent contractor so that business expenses not paid by the practice can be fully written off. For example, retiring professionals are usually paid more than an associate new professional, e.g., 35 percent of adjusted production or collections, versus 30 percent to an associate. As such, the practice may claim it cannot afford to pay the retiring professional’s health insurance, malpractice, continuing education, professional dues and licenses, entertainment, or other direct business expenses. Due to the control exercised by the new owner’s practice over the provision of services by the retiring professional, it is unlikely that the retiring professional is an independent contractor. A more substantively correct and practical approach would be to have the retiring professional treated as an employee of the practice, have the practice directly pay the business expenses of the retiring professional, and reduce or offset the retiring professional’s compensation by the full cost of such expenses.

Three-Entity Approach

Under the three-entity approach to co-ownership, the new owner purchases one-half of the old practice owner’s personal goodwill. Each owner is the sole shareholder of a professional corporation which contracts with a newly formed limited liability company, owned by the corporations, to provide professional services to the public. The limited liability company bills patients or clients, collects revenue, employs the staff, adopts the retirement and medical plans, and pays the operating expenses. Profits are distributed to the respective professional corporations. The professionals are nominal employees of their respective corporations, but are they really employees of the limited liability company? Because the limited liability company bills the clients, pays expenses, employs staff, maintains fringe benefit plans, and establishes fees and office policies and systems, the professionals may be employees of the limited liability company or be deemed direct owners of it, and the interposed corporations could be disregarded, with the consequence that net operating profits are self-employment income subject to FICA and Medicare taxation. The IRS is attempting to figure out what to do with this increasingly popular approach.

The three-entity approach is also being promoted in an attempt to provide amortization for purchased goodwill by the incoming owner. There are, however, a number of issues to consider aside from worker classification. These include characterization of personal versus corporate goodwill and the valuation thereof, the anti-churning regulations under IRC section 197 that prohibit goodwill from being amortized by the new professional for a buy-in of a practice formed pre-1993, and the amortization for the buy-in and buy-out or complete sale of assets of a family member in a practice formed pre-1993.

Focusing again on the worker classification issue, for a professional to solidify independent contractor status in the professional practice setting, the professional should bill the patients or clients to which it, he, or she provides services, pay rent for use of the premises, perform administrative services, maintain the ability to control fees and hours, make an investment in equipment, not be subject to a restrictive covenant, not be subject to office policies and procedures, and schedule its, his, or her patients or clients. Although these factors are based on facts and circumstances and are a matter of degree, the more factors, the better the chances of a favorable finding. Obviously, not many professional relationships meet the criteria necessary for a finding that the professional is an independent contractor, a crucial finding in today’s environment when the Internal Revenue Service plans to audit 6,000 U.S. companies to determine whether such companies pay all required employment taxes, including a determination of whether workers are classified correctly. Ryan J. Donmoyer, Bloomberg.com, IRS to Audit 6,000 Companies to Test Employment Tax Compliance (September 18, 2009), www.bloomberg.com/apps/news?pid=20670001&sid-anpR2t09GIeU (Feb. 5, 2010). Accordingly, except in rare circumstances, the advisor should be very cautious of finding a proper independent contractor relationship in professional practice settings because if the practice is audited, it has probably already lost due to the cost of defense.

Thoughtful Corner: Denis Kleinfeld: Books of Interest for Individuals Who Want to Think Themselves Successful

We thank our friend, colleague, and always interesting professor, lawyer, and writer Denis Kleinfeld, CPA, JD, for becoming a regular contributor to the Thursday Report.

The following write-up on two important books that everyone should be familiar with comes from Denis, wisdom, and experience:

How to Speak How to Listen by Mortimer J. Adler

The premise of this text is that we spend 90% of our lives as adults speaking and listening. Yet we do not learn these skills in school, and we are largely uneducated and ill-trained when we get into the real world. Most of us speak without regard to who our audience is and how best to reach them; most of us hear rather than listen, interrupting the speaker, finishing his or her sentences, or waiting for the perfect moment to jump in with thoughts of our own, which we have formulated while pretending to listen to the other person!

Adler highlights different kinds of speaking and listening, and emphasizes the importance of making your speaking as impactful and effective as possible. He also sets up a clear distinction between listening and hearing. Listening is an activity of the mind more than of the ears, as the speaker’s words are transformed into thoughts inside the listener’s mind.

Credentials do not always equal great speaking skills, or listening skills for that matter! Speaking is a technique, as is listening, and this book trains you how to do both.

Why it’s important: For an individual to be successful, he or she must understand that there is more to getting your point across than simply saying words; rather, it is the impact those words have and their ability to make your message understood that truly matters.

This book also teaches us how to think rather than just react. We are programmed by nature to react emotionally, but the ability to think analytically is critical to retraining ourselves for a success-oriented mindset. The lessons of Mr. Adler can help us grow personally as well as professionally.

Happiness Is a Serious Problem: A Human Nature Repair Manual by Dennis Prager

Our next read is a national bestseller originally published in 1998. It addresses perhaps the single most important concept of our society: happiness – what it is, and how to find it. Underlying most of our daily choices is the question “Does this make me (or somebody else) happy?”

The first problem with happiness is that it is a difficult concept to define, and highly individual depending on the person and his or her current circumstances.

The book spans 31 very brief chapters addressing the premises of happiness, the major obstacles to happiness, and the behaviors and attitudes that can help us cultivate happiness.

Topics include the difference between fun and happiness, the difficulty of associating success with happiness (and what the heck is success anyway, now that you mention it?), how human nature works against our happiness, the great courage required to be happy, and overcoming tragedy in order to find happiness.

One of my favorite ideas which Prager presents is that happiness is a moral obligation. We owe it to ourselves, our loved ones, and the world in general to be as happy as we can. We are the only source of our own happiness; it cannot be derived from others.

Why it’s important. What we all ultimately seek is that “feeling inside” that we describe as happiness. We often define success as attaining the things we think will give us that happy feeling. In terms of a successful mindset, it is important to understand for what purpose you wish to be successful. What will it do for you? What about that success will make you happy, and what are some difficulties you can expect along the way? Does happiness occur as the result of the achievement, or in the process of attaining the result? These are not easy questions with which to grapple, but this book provides many guideposts for making good choices.

Next week Denis discusses A Time for Truth by William E. Simon and Rules for Radicals: A Pragmatic Primer for Realistic Radicals by Saul Alinsky.

Upcoming Seminars and Webinars

LIVE NEW JERSEY PRESENTATION:

Alan Gassman will be speaking to the New Jersey Bar Association ICLE on WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW TO REPRESENT SNOWBIRDS AND FLORIDA BASED BUSINESSES:

Date: Saturday, October 11, 2014

Location: New Jersey Law Center, 1 Constitution Square, New Brunswick, NJ 08901

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors, and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information, please email agassman@gassmanpa.com

********************************************************

LIVE TELECONFERENCE:

Alan Gassman and Christopher Denicolo will be presenting a teleconference for The Ultimate Estate Planner entitled THE JOINT EXEMPT STEP-UP TRUST: WEALTH PROTECTION AND INCOME TAX BENEFITS FOR NON-COMMUNITY PROPERTY STATE CLIENTS

During the 60 minute teleconference, you will learn:

- Which clients should consider implementing a JEST structure

- How does the JEST work?

- What are the tax advantages associated with the JEST?

- IRS guidance and Rulings regarding joint trusts

- Other considerations in drafting joint trusts

- How the JEST Trust provides for unique situations

- And much, much more!

Date: Tuesday, October 14, 2014 | 12:00 p.m.

Location: Online teleconference.

Additional Information: For more information and to register for this teleconference please click here. Registration includes participating in the call (including a live Q&A session), handout materials, an audio recording of the teleconference and a certificate of completion. The cost to attend the teleconference is $149.

********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo will address the North FICPA Group on Financial Analysis and Tax Planning for Investment Products, Including Variable Annuities, Fixed Annuities, Life Insurance Contracts, and Mutual Funds – What Should the Tax and Financial Advisor Know and Advise?

Be there or be an equilateral triangle!

Date: Wednesday, October 15, 2014 | 4:30 p.m.

Location: Chili’s Port Richey, 9600 US 19 N, Port Richey, Florida

********************************************************

LIVE MIAMI LAKES PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman and Phil Rarick will be presenting a half-day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 19, 2014 | 1pm – 5pm

Location: Shula’s Hotel, 6842 Main Street, Miami Lakes, FL 33014 | Boardroom

Cost: $35 per person

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************************

LIVE WEBINAR:

Alan Gassman will be joined by reverse mortgage specialist Elena Katsulos for a webinar on REVERSE MORTGAGES, A DEEPER DIVE

Date: Wednesday, October 22, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for this webinar please click here.

********************************************************

LIVE CLEARWATER PRESENTATION

Alan Gassman will be speaking at the Pinellas County Estate Planning Council Fall Seminar on PLANNING FOR SAME GENDER COUPLES.

Date: Thursday, October 23, 2014 | Program begins at 7:30 am. Mr. Gassman speaks at 9:00 am.

Location: Ruth Eckerd Hall, 1111 N. McMullen Booth Road, Clearwater, FL

Additional Information: To register for this event please email agassman@gassmanpa.com

********************************************************

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION

Alan Gassman, Ken Crotty, and Christopher Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on PLANNING FOR INHERITED IRA’S IN VIEW OF THE RECENT SUPREME COURT CASE – AND DEMYSTIFYING THE “STRETCH IN TRUST” IRA AND PENSION RULES

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: Hyatt Regency Sarasota, 1000 Boulevard of the Arts, Sarasota, Florida 34236

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

LIVE DOUBLE HEADER INTERNATIONAL TAX WEBINAR

Alan Gassman and Leslie A. Share will be presenting a double header webinar on two topics:

- US Tax and Compliance Issues Affecting Americans Abroad – You Can Run, But You Can’t Hide (5:00 p.m.)

- Door #7 – Planning Techniques for Non-Resident Aliens Who Invest in Florida Real Estate – The Irrevocable Trust Structure Explained (5:30 p.m.)

Date: Monday, October 27, 2015 | 5:00 p.m. and 5:30 p.m.

Additional Information: To register for the 5pm webinar please click here. To register for the 5:30 pm webinar please click here.

*********************************************************

LIVE CLEARWATER PRESENTATION

TAMPA BAY CPA GROUP

TRUSTS = MC2

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014 | 1:10 p.m. – 2:50 p.m.

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION

PARALEGAL ASSOCIATION OF FLORIDA – PINELLAS COUNTY CHAPTER

Alan Gassman will be presenting THE ABCS OF LLCS; MORE MOVES AND OPTIONS THAN YOUR GYM TEACHER’S TRAPEZE at the Paralegal Association of Florida – Pinellas County Chapter’s November meeting. This program will cover the basics of Wills, trusts, LLCs and coordination thereof for paralegals. The presentation includes a 4 color slide show called “THE STORY OF DICK AND JANE” and all attendees will receive one copy of the Thursday Report.

Date: November 11, 2014 | 6:00 p.m. – 8:00 p.m. (Alan Gassman speaks at 7pm)

Location: The Hangar Restaurant and Flight Lounge, 540 1st Street SE, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com

*********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATION

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on Planning Opportunities for Same Sex Couples.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Fox Hollow Golf Club, 10050 Robert Treat Jones Pkwy, Trinity, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE NAPLES PRESENTATION

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

NOTABLE SEMINARS BY OTHERS

(We aren’t speaking but don’t tell our mothers!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

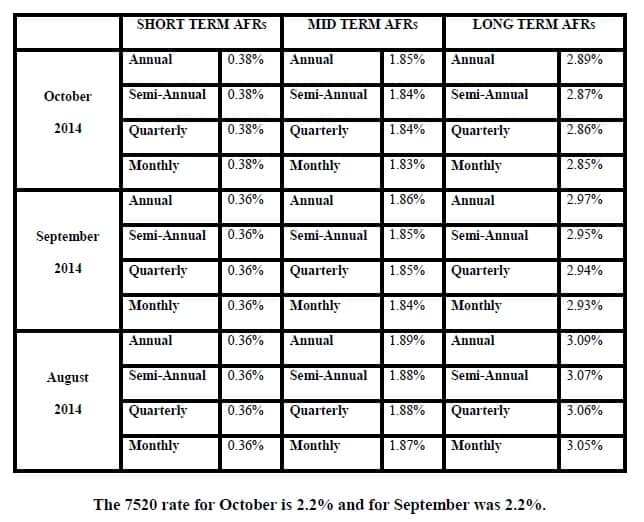

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.