The Unleavened Thursday Report – 9.25.14

Some Kind of Wonderful – Can I Get a Witness?: Fifth Circuit Court of Appeals Leaves the IRS in a Grand Funk

Everything You Always Wanted to Know About Reverse Mortgages but Forgot to Ask

Worker Classification Issues in Professional Practices, an Article by William P. Prescott, Mark P. Altieri, and Kelly A. VanDenHaute, Part Two

Seminar Announcement – All Children’s Hospital 17th Annual Estate, Tax, Legal & Financial Planning Seminar

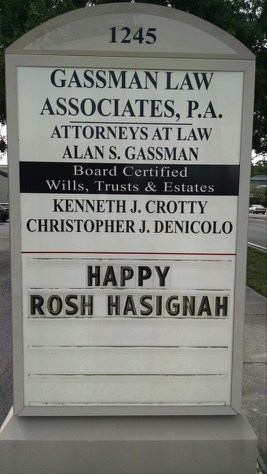

Humor! (Or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Some Kind of Wonderful – Can I Get a Witness?

Fifth Circuit Court of Appeals Leaves the IRS in a Grand Funk

The song “Some Kind of Wonderful” was written by John Ellison of Soul Brothers Six and released in 1967, peaking at number 91 on the US Billboard Hot 100. The song was covered by Mark Farner and Grand Funk Railroad in 1974 on their album All the Girls in the World Beware!!! It hit number 3 on the Billboard charts on February 22, 1975.

Mean Mistreater is a much better song by Mark Farner and rings well sometimes when the IRS is involved.

Tax Court overturned on decision to grant IRS-requested 10% discount on partial ownership of artwork where only the estate had experts to testify; 14 million dollar refund results.

Just 10 days ago, the Fifth Circuit Court of Appeals delivered an early Rosh Hashanah gift to the Elkins family, who stuck by their guns with reference to the valuation of a very special art collection.

The Fifth Circuit Court of Appeals rejected the Tax Court’s 10% discount, and applied the estate expert’s discount at 47.5%. In Estate of Elkins v. C.I.R., 2014 wl 4548527 (2014), the decedent had an aggregate 73.055% interest in the art, and his three children had the remaining interest divided equally among them. In the Tax Court proceedings, the estate had two experts testify that any hypothetical willing buyer would demand discounts because they would become co-owners with the Elkins decedents. The Commissioner, however, did not use any evidence to establish another fractional-ownership discount but instead stayed with his no-discount position.

The Court of Appeals stated that the Commissioner had the burden to refute the estate’s discounts under U.S.C. section 7491. The court held, however, that the Tax Court’s failure to give the burden of proof made no difference in the end. “This is because, having put all of his eggs in the one, no-discount basket at trial, the Commissioner cannot be heard on appeal to question the quantity, quality, or sufficiency of the evidence adduced by the estate to prove the quantum of the fractional-ownership discounts to be applied.”1 Thus, the Tax Court was required to accept the discounts that the estate proved through their expert’s testimony.

The Court of Appeals held the estate’s expert’s testimony was satisfactory to determine how much a hypothetical willing buyer would pay for the art: “a potential willing buyer would undoubtedly insist that his potential willing seller further discount the sales price to account for the virtual impossibility of making an immediate ‘flip’ of the art.”2 The Court of Appeals held that the Estate was entitled to a refund of $14,359,508.21.

The estate in this case was lucky that the Commissioner stuck to his no-discount guns and did not present an expert, and should be praised for their savvy use of expert witnesses.

****************************************************

1Estate of Elkins v. C.I.R., 2014 wl 4548527 (2014).

2Estate of Elkins v. C.I.R., 2014 wl 4548527 (2014).

Everything You Always Wanted to Know About Reverse Mortgages but Forgot to Ask

Last week, the Thursday Report featured an introduction and basic information on reverse mortgages. So far, we have had no response from Fred Thompson or “The Fonz,” but we noted last week that happy days are not here again for all reverse mortgage borrowers. The latest statistics we could find showed that over 9% of the borrowers were not willing or able to keep up with their insurance, property taxes, and home maintenance. Something is very wrong with that statistic.

For a copy of last week’s Thursday Report write up, please click here.

To continue with our discussion of reverse mortgages, we hope you enjoy the following:

Reverse Mortgage Concerns: The terms and conditions of reverse mortgages, combined with the demographics and decision-making of the target clientele, make these vehicles dangerous and far too good to be true for many, if not most, borrowers.

1.) Encouraging Unwise Financial Behavior. The 9% default rate gives a clear indication that a great many reverse mortgage borrowers should have downsized, postponed spending their home equity, or reduced their living expenses in order to actually be able to have a safe and appropriate home for retirement. A good many borrowers would have been better served by using one or more of the following strategies:

Alternatives to Reverse Mortgages:

- Do not borrow – Live within the homeowner’s means.

- Sell the house – Invest some of the sale proceeds, and use the other proceeds to purchase a less expensive, easier to maintain condominium or other home, which may be in a retirement community that will provide social and other community attributes.

- Borrow privately from family members whose CDs and/or bonds or bond funds pay far less than what the borrower will have to pay in interest and costs if the borrower goes with a traditional reverse mortgage.

- Sell the home and set aside the money to pay rent – Renting can be a good choice for many senior citizens, particularly if they eventually need assisted living facilities or nursing home care.

2.) Demographics. Government-guaranteed reverse mortgages are only available for people over the age of 62. Often, the elderly end up making decisions that are not to their benefit for a number of reasons, including:

(a) They are drawn to the sales pitch and the good nature of the salesperson;

(b) They do not adequately research the product, including their responsibilities in the agreement;

(c) They may be in an impaired mental state or fall under the influence of a “well-meaning” friend or family member;

(d) They are attracted to the selling points of the product, such as the low interest rate set forth at the start of a loan with a floating rate, and do not realize how quickly the rate can increase.

3.) Poor Planning. There is a real danger of default, primarily due to shortsighted spending practices by the borrowers. These products are advertised by trusted celebrity actors such as Henry Winkler (“The Fonz” from Happy Days) and Fred Thompson (actor and former Senator), who claim that you will “eliminate your mortgage payments” and receive “tax-free cash” all while “still owning your own home.” These advertisements fail to disclose that some of that tax-free cash needs to be set aside to cover the interest on the loan, real estate taxes, homeowners insurance, and maintenance expenses. If these items are not properly taken care of, the borrower will be in default.

It would seem to be an important piece of information that over 9% of reverse mortgages that are outstanding are in default. Why don’t Senator Thompson or “The Fonz” mention this when they say how easy it is to take a reverse mortgage?

It appears that approximately 80% of reverse mortgages are taken by elderly homeowners who opt for the Line of Credit loan option. This means they borrow a large lump sum in the first two (2) years and are then responsible for paying real estate taxes, insurances, and maintenance expenses until the home is sold. When the home is sold, the borrower has to pay all of the loan costs and interest charged, and there is no way to get out of the loan, other than refinancing, without paying it in full. Many borrowers simply do not spend this lump sum wisely; they miss an insurance payment and find themselves in default. Borrowers are often encouraged to take these loans by individuals or companies who want to sell them investment or other products; these financial planners advocate for the elderly to obtain a reverse mortgage and use the funds as a method to fund investments such as annuities.

4.) Unexpected Costs. Additionally, reverse mortgage lenders advertise that the borrower will not owe more than the market value of the home upon its eventual sale. However, this only applies to the principal of the loan; the interest on the loan is still due, regardless of what the borrower or borrower’s estate receives from the sale of the home. If the home sells for much more than the principal of the loan, perhaps the amount from the sale will also cover the interest. However, if the borrower or borrower’s estate sells the home for less than the amount of the loan principal, the responsibility for repaying the interest due on the loan remains and will not be forgiven by the government. Many borrowers do not have the money set aside for this type of interest repayment.

5.) Early Sale of the Home. Reverse mortgages were initially intended to provide the elderly with a way to live out their lives in their own homes and to deal with increased costs while living on a fixed income. However, two important factors have come into play that have changed the purpose of reverse mortgages for many borrowers:

(a) Borrowers are applying for reverse mortgages at much younger ages and are living longer lives than ever before. This means their loan payments are much larger because they hold the loans for a greater number of years (in the case of immediate and tenure loans). It also means they have increased interest and loan costs. In the event of default, the amount they owe is much greater.

(b) Because borrowers are starting younger and living longer, they are often selling their homes rather than living in them until they die. When the house is sold, the loan becomes due. As a result, many borrowers who sell find themselves unprepared to cover the cost of the reverse mortgage, and may find themselves in default or foreclosure.

6.) Medicaid Eligibility and Post-Medicaid Nursing Home Benefits Complications. None of the commercials or loan literature discuss the issues that can arise when a person who would have otherwise owned their home free and clear or subject to a conventional mortgage must go on Medicaid to pay for nursing home care. These individuals may have to sell off a majority of their assets in an effort to qualify for Medicaid long-term care. The rules for this vary in each state, but for many families, a home can be maintained free and clear of mortgage and can pass to family members without exposure to Medicaid claims, notwithstanding whether all taxes, insurance, and maintenance expenses have been maintained.

7.) Loss of SSI Benefits. An unexpected and negative outcome for some borrowers is that they end up being disqualified from specific Social Security benefits. The television commercials specifically note that Social Security benefits will not be impacted by a reverse mortgage. However, some individuals receive Supplemental Security Income (SSI) and may become disqualified because loan proceeds will be considered an asset that can cause a borrower to not meet the “limited resources” test described below.

Four of the main eligibility requirements for SSI are that the person: (1) is aged (65+), blind, or disabled; (2) has limited income; (3) has limited resources; and (4) is a U.S. citizen or national. SSI is a need-based benefit, and in order for a borrower to qualify, his/her countable resources must not be worth more than $2,000 for an individual, or $3,000 for a couple. Certain resources do not count toward determining whether an individual qualifies for SSI. The resources that do not count towards an individual’s $2,000 resource limit are:

- The home an individual lives in and the land on which it is located;

- Household good and personal effects (i.e. wedding and engagement rings);

- Burial spaces for the individual and his/her immediate family;

- Burial funds for the recipient and the recipient’s spouse valued at $1,500 or less;

- Life insurance policies with a combined face value of $1,500 or less;

- One vehicle, regardless of its value, used for transportation for the recipient or a member of the household;

- Retroactive SSI or Social Security benefits for up to 9 months after you receive them; and

- Grants, scholarships, fellowships, or gifts set aside to pay educational expenses for 9 months after receipt.

The federal monthly income limit for individuals whose income is only from wages is $1,527; if the income is not from wages, the limit is $741. The monthly income limit for couples whose income is only from wages is $2,249; if the income is not from wages, the limit is $1,102. As of January 1, 2014, the maximum federal benefit rate is a monthly payment of $721 for an individual and $1,082 for a couple.

Many states, including Florida, provide supplemental payments. In Florida, to be eligible for SSI, an individual’s monthly income may not exceed $752.40. The state supplement is up to $78.40 per person, meaning an individual could receive up to $799.40 per month in total SSI payments ($721 federal SSI + $78.40 state SSI). Couples could receive $1,238.80 per month ($1,082 federal SSI + $156.80 state SSI).

An issue arises when the individual receives loan payments that are not spent during the calendar month in which they are received or if the loan payments are used to purchase other assets or reduce debt in a way that causes a loss of eligibility for continued SSI benefits.

8.) Loss of Home Upon Default. While Senator Thompson and “The Fonz” indicate that the borrower cannot lose their home, the nagging statistic that over 9% of reverse mortgages are in default indicates the facts are to the contrary. Lenders are not required to perform due diligence to ascertain whether a borrower will have the financial wherewithal to maintain the home, particularly if the borrower becomes feeble and needs help living. The counselor in charge of certifying that the borrower has received guidance may not be qualified to help determine whether such financial wherewithal is likely to exist. There is no insurance rider or program offering assistance in situations where a reverse mortgage borrower becomes unable to pay taxes, insurance, and maintenance costs through no fault of his or her own.

9.) Mutual Mortgage Insurance Fund. The U.S. Department of Housing and Urban Development (HUD) contracted with Integrated Financial Engineering, Inc. to issue a December 11, 2013 Actuarial Review of the FHA Mutual Mortgage Insurance Fund HECM Loans for Fiscal Year 2013. Actuary and Chairman and CEO of Integrated Financial Engineering, Inc., Tyler T. Yang, Ph.D., stated that insurance-in-force, which is defined as the obligation on outstanding mortgages, was $87.67 billion and the economic value of the HECM Fund as of the end of fiscal year 2013 was $6.54 billion ($6.54 divided by $87.67 is 7.46%). The report further projected that at the end of the fiscal year 2020, the Fund’s economic value will be $15.38 billion and insurance in force will be $161.48 billion ($15.38 divided by $161.48 is 9.52%)!

The report noted that the 2013 year end value included a transfer of $4.263 billion dollars from a Mutual Mortgage Insurance capital account and a $1.686 billion mandatory appropriation. The report indicates that forecasts lead to the proposition that homes will grow in value each year on average at a rate of between 2%-4.5% for the next 38 years.

The report also includes the following statement:

The expected mortgage interest rate, which is calculated as the sum of the ten-year rate and the lender’s margin for a variable rate HECM, affects the percentage of equity available to borrowers. The PLF (principal limit factors) increases as the expected rate declines for a given borrower age. Moody’s has forecasted the ten-year Treasury rate to rise steadily to 3.5 percent by 2014 and then stabilize at around 4.6 percent after 2017. The ten-year Treasury rate forecast implies a continued low interest rate environment, which enables borrowers to access a large percentage of their home equity. However, even though ten-year Treasury rates remain at a low level, average lender margins have increased from an average of 1.5 percent for 2008 and prior years to 2.5 percentage points from 2009 to 2011. In 2012, lender margins further increased to 3.0 percentage points. According to FHA projections, for new originations starting from FY2014, lenders’ margin would be 2.73 percentage points for fixed-rate loans, and average lenders’ margin would be 2.67 percentage points for adjustable-rate loans. This increase may partially offset the impact of low interest rates and limit the increase in equity available to borrowers.

The report further indicated that HECM borrowers represent approximately 9/10 of 1% of all households that have one member who is 62 years or older. In 2010, 16% of the population was 62 or older, and this is forecasted to be 20% of the population by the year 2020, and 22% of the population by the year 2030. To review excerpts from the “Actuarial Review of the Federal Housing Administration Mutual Mortgage Insurance Fund HECM Loans for Fiscal Year 2013” report please see the Appendix.

Next week, we will give actual examples of reverse mortgages in action and show how to review a proposal and spreadsheet to help clients understand it.

Last week, we discussed circumstances where a professional worker would be properly classified as an employee or independent contractor for federal tax purposes. This week, our guest authors William Prescott, Mark P. Altieri, and Kelly A. (Means) VanDenHaute, profile some interesting cases relating to workers classification.

More information can be found at Tax Management Portfolios, BNA, Inc., 391-3rd Employment Status – Employee v. Independent Contractor, Helen Marmoll, Esq. P. A-47-A-139.

The following professionals are profiled in this week’s edition:

- Accountants

- Anesthetists

- Athletes

- Attorneys

- Barbers and Hair Stylists

- Consultants

- Dental Hygienists

- Dentists

- Physicians

Accountants

In Youngs v. Commissioner, 96-2 U.S. Tax Cas. (CCH) §50,579 (9th cir. 1996), an accountant for National Maintenance Contractors, Inc. was an independent contractor. The accountant had approximately 25 other clients in the years in question and was paid on a job-by-job basis.

In Rev. Rul. 58-504, 1958-2 C.B. 727. an accountant who was not licensed as a CPA but who worked only for an accounting firm was an employee. The work was done under the firm’s name and for the firm’s clients. The accountant had no clientele of his own.

In Rev. Rul. 57-109, 1957-1 C.B. 328, the IRS found that an individual engaged in performing part-time bookkeeping and tax services for a company was an independent contractor. The bookkeeper determined his own hours, worked without supervision, and was not guaranteed a minimum compensation. Although permitted to use the corporation’s business equipment without charge, the bookkeeper provided his own working papers and materials and paid his own expenses. The bookkeeper advertised his services in the city directory and newspapers and had other clients.

Anesthetists

In Rev. Rul. 57-380, 1957-2 C.B. 634, an anesthetist was held to be an independent contractor who contracted with two hospitals to provide services personally or by assistants paid by him when the need for services arose. Neither hospital issued instructions or directions, other than to advise him of the time for which operations were scheduled.

In Rev. Rul. 57-381, 1957-2 C.B. 636, an anesthetist who performed full-time and exclusive services during prescribed hours each week for a dental surgeon was an employee. The anesthetists worked in the office of the dental surgeon. Although she purchased her own supplies and kept separate records of her expenses and collections, the charges for her services were listed separately on the dentist’s statements and constituted her sole remuneration. She did not maintain an office or make her services generally available to other practitioners. Her name did not appear on the dentist’s letterhead or office door. The IRS found that the anesthetists was engaged by the dental surgeon to render professional services on a continuing basis, and such services were a necessary incident to the conduct of the dental surgeon’s practice. Although the anesthetist was qualified to perform the services without detailed supervision, the dental surgeon retained the right to control the services rendered to his patients even though it was not necessary for him to direct and control such services.

Athletes

In Tech. Adv. Mem. 86-25-003 (Feb. 28, 1986), professional athletes established “PSCs” through which services were made available to a professional “Team.” The PSCs and the Team entered into contracts in exchange for exclusive services. The IRS reviewed the following factors to determine that the Team was the employer of the athletes: instructions, training, integration of a person’s services into the business operation of the employer, whether the services must be rendered personally, payment in increments measured by time (hourly, monthly, etc.), payment of travel expenses, furnishing of tools (uniforms and equipment), the party investing in and furnishing the facilities used by the worker to perform the services (locker room and the back-up equipment needed to play), and control over availability of appearances and the right to discharge. The IRS noted that the payment by the Team to the PSCs rather than to the athletes did not negate the existence of an employer-employee relationship between the Team and the players. The PSCs were merely the agents for the receipt of compensation. The IRS concluded, despite the existence of the PSCs, that the Team exercised sufficient control over the athletes to be their common law employer. As such, the Team was liable for employment taxes, and subject to withholding, on all sums paid.

Taking markedly different positions on whether an athlete is an employee or independent contractor are Rev. Ruls. 68-625, 1968-2 C.B. 465, and 68-626, 1968-2 C.B. 466. Under Rev. Rul. 68-625, a golf professional was given the privilege of selling lessons and golf equipment on the premises of a golf club. The golf professional was furnished space in the caddy house and locker room and use of the club’s telephone. His activities were confined strictly to golf instruction and the sale of golf equipment. Because the golf professional made his own appointments for lessons, fixed his own prices, retained all remuneration received and bought, and sold golf equipment in the same manner as that of a retail merchant without orders or instructions from any member or official of the club, and because the club had no right to direct him in the manner or method of performance of his services, he was an independent contractor.

Alternatively, under Revenue Ruling 68-626, a golf professional performed services at a country club and received a fixed salary each month. Further, the golf professional received the proceeds from the operation of the golf shop, which consisted of a certain amount every month for each bag of clubs cleaned and kept in the shop and the profits from the sale of balls, bags, and supplies. In addition, the golf professional instructed club members at an hourly rate established by the club. The club had the right to direct and control the manner in which the golf professional managed the shop. His books were open to club inspection at all times and he was required to be available for and to keep lesson appointments and to engage in such further help as required by the club. Accordingly, the golf professional was found to be an employee of the club.

Attorneys

Under Rev. Rul. 68-324, 1968-1 C.B. 433, an associate attorney worked at a law firm and was paid a fixed annual salary. The attorney was furnished office space, stenographic help, was required to work daily hours, and was engaged mostly in research work that was assigned by the firm. Even though the attorney handled certain assigned cases from the firm for which the attorney received additional fees, the attorney was an employee.

In Van Camp & Bennion P.S. v. United States, 96-2 U.S. Tax Cas. §50,438 (E.D. Wash. 1996), the IRS concluded that one shareholder who handled the majority of corporate duties and whose name and reputation were instrumental in bringing in clients was an employee. The other shareholder who performed de minimis administrative duties, worked on a very limited basis, made no written reports to the practice, and did not make time entries was an independent contractor.

Barbers and Hair Stylists

A barber who rents a chair for a fixed weekly fee, furnishes his own barbering tools, determines his own work routine, is not required to perform a minimum amount of work or be on duty a specified number of hours, retains all fees collected by him, is not required to make an accounting to the barbershop owner, and was free to terminate the rental agreement at any time (as was the shop), is an independent contractor. Rev. Rul. 57-110, 1957-1 C.B. 329.

A beautician who rents a booth in a beauty shop for a fixed monthly fee, sells and styles wigs that she purchases herself, retains the proceeds, is not guaranteed a minimum amount, is free to select her own customers and set her own work schedule, is not required to adhere to the salon’s rules, is required to clean her own work area, furnishes her own uniforms, and maintains her own tools is an independent contractor. Rev. Rul. 73-592, 1973-2 C.B. 338.

However, compare Rev. Rul. 73-591, 1973-2 C.B. 327, where the beautician was held to be an employee. Here, the beautician leased space from the beauty salon, was required to be at her chair at 8:00 a.m. on days scheduled to work, and was paid a percentage of the fees taken in by her, where such fees were set by the beauty salon. The percentage of fees was based upon daily receipts furnished to the beauty salon.

Consultants

In Fuller v. Commissioner, 9 B.T.A. 708 (1927), the taxpayer was engaged by municipalities to perform services as a consulting engineer. Because the taxpayer was free to accept other engagements and was left to use his own judgment, discretion, and professional skill to bring the designed result without direction or control of the municipalities that engaged him, he was an independent contractor.

Dental Hygienists

In Rev. Rul. 58-268, 1958-1 C.B. 353, a hygienist was paid 50 percent of production under an oral contract. She did not secure patients but did arrange recall visits and completed charting. She did work for other dentists. Although the hygienist was qualified to provide the hygienic services without instructions and used her own discretion with respect to treatment methods, the dentists paid for all expenses, provided office space, and furnished all supplies and equipment. Under the facts, the dental hygienist was an employee.

Dentists

In Queensgate Dental Family Practice, Inc. v. United States, 91-2 U.S. Tax Cas. (CCH) §50,536 (M.D. Pa. 1991), the dentists were independent contractors. The dentists set their own fees, determined their own schedules, directed staff and planned their own patient treatment. They ordered supplies separately, consulted and referred to other dentists as they deemed appropriate, separately determined how to handle patients that did not pay, maintained records separately, paid their own entertainment and travel expenses, paid for their own malpractice insurance and continuing education costs, and risked the possibility of lost profits which were based exclusively upon the compensation received from each dentist’s patients. If the governent had inquired as to whether restrictive covenants existed between the dentists and the practice, the court may have found the dentists to be employers.

In Tech. Adv. Mem. 93-21-001 (Feb. 1, 1993), dentists were found not to be similar to the independent contractors in Queensgate, and the taxpayer was not entitled to relief under section 530 of the Revenue Act of 1978 with respect to employment tax liability arising from the services of the dentists.

Physicians

Under Rev. Rul. 72-203, 1972-1 C.B. 324, physicians paid by and working full-time for a hospital’s pathology department were employees. Their services were completely integrated into the operation of the pathology department, they performed substantial services on a regular and continuing basis, and the department had the right to fire them if they did not comply with the general policies of the pathology department.

Under Rev. Rul. 61-178, 1961-2 C.B. 153, a physician was found to be an employee. Although the physician maintained a private practice, he also regularly rendered medical treatment to employees of a company on its premises on a part-time basis, was required to conform to the company’s policies and procedures, was subject to supervision by the company’s head physician, worked a fixed schedule, and was provided benefits consistent with the company’s regular employees.

In Dutch Square Medical Center Limited Partnership v. United States, 94-2 U.S. Tax Cas. (CCH) §50,490 (D.S.C. 1994), a physician/medical director was held to be an employee of an urgent care facility due to the facility’s control over the medical director’s activities despite the fact that the medical director was paid through his own professional corporation. It did not help that the medical director’s professional services corporation was not formed until after his employment commenced with the urgent care center. However, this would probably not have mattered due to the facility’s control over his activities.

In Azad v. United States, 388 F.2d 74 (8th Cir. 1968), a radiologist was held to be an independent contractor. The radiologist was not restricted to performance of services solely for one hospital and did work for other hospitals. Neither the head of the radiology department nor the hospital exercised any supervision over the professional services of the radiologist, and the radiologist was not required to work set hours nor account for absences from work. Finally, none of the radiologists in the department were required to comply with any set policies, rules, or regulations of the hospital.

In Technical Advisory Memorandum 94-13-002 (Dec. 3, 1993), a radiologist and other physicians were found to be employees. The hospital contracted with the radiologist to provide services to patients, provided a fully equipped and staffed department, and compensated all personnel. Although the radiologist billed the patients, the hospital collected the fees and compensated the radiologist under a guaranteed minimum income and paid two-thirds of the radiologist’s family health insurance premiums. The radiologist was required to visit the hospital at least once per day and be on-call at other times. The radiologist and the other physicians devoted their primary efforts to serving the hospital’s patients and were prohibited from competing with the hospital in its geographic area. It was concluded that the radiologist was under the hospital’s control, was integrated into the hospital’s business, had no investment in the business of the hospital or its buildings, had a continuing relationship with the hospital, and did not work for unrelated firms or hospitals.

In Professional & Executive Leasing, Inc. v. Commissioner 89 T.C. 225 (1987), aff’d, 862 F.2d 751 (9th Cir. 1988), management and professional workers were found not to be employees of the management leasing company that attempted to provide liberal retirement plans to the workers as employees. The court found that the leasing company did not exercise control over the workers, had no investment in the facilities of the workers, had no opportunity for profit or loss except for set-up fees and monthly service rate payments, had no right to discharge the workers, and had no employment relationship with them despite nominal employment agreements. The leasing company merely provided bookkeeping and payroll services. This case is interesting because the workers failed to obtain the favorable retirement plans that they were promised because they were not the leasing company’s common-law employees.

Next week, we will conclude the article with a discussion of the new professional, the retiring professional, and the three-entity approach.

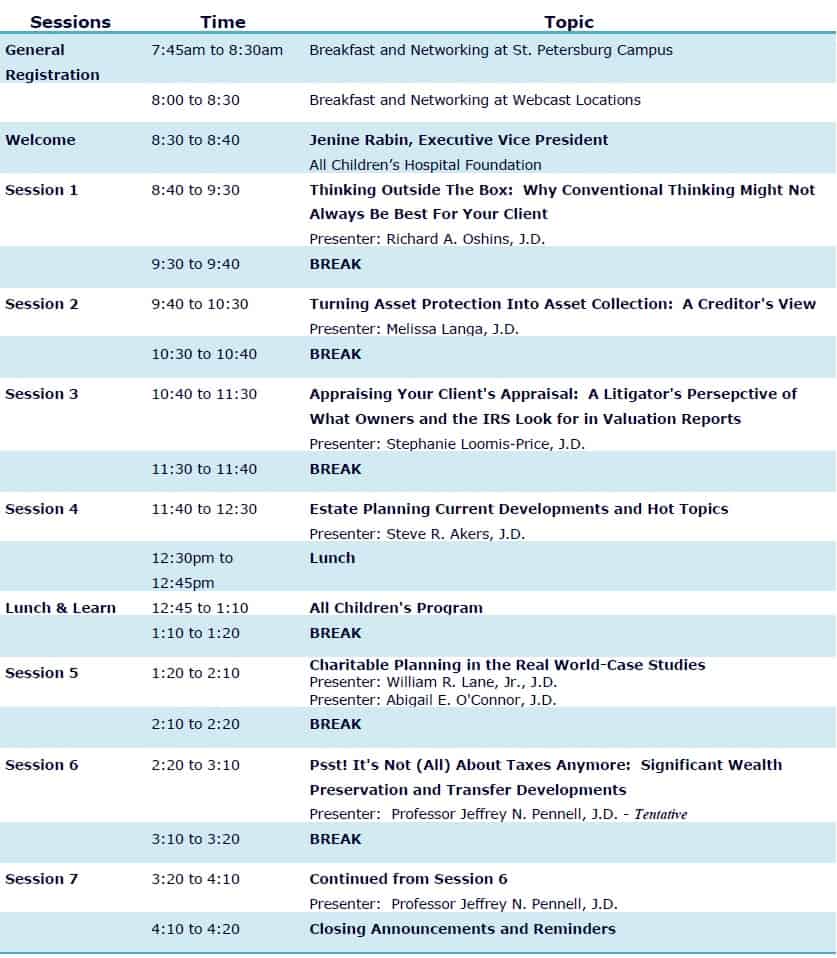

Seminar Announcement

All Children’s Hospital 17th Annual Estate, Tax, Legal & Financial Planning Seminar

Registration for the 17th Annual Estate, Tax, Legal & Financial Planning Seminar hosted by the All Children’s Hospital has begun!

This seminar will consist of a live event at the St. Petersburg Campus of All Children’s Hospital and webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota. Dress is business casual.

Register before November 14, 2014 to receive a $25 early bird discount!

The schedule for this event is as follows:

Thinking Outside the Box; Why Conventional Thinking Might Not Always Be Best For Your Client

Richard A. Oshins, J.D.

This session will address important estate, gift, and generation-skipping transfer tax developments. But because the wealth transfer taxes are waning in importance for most estate planners, it also will focus on procedure, income tax, and state law developments of significance to planners everywhere. All with an eye to their practical significance to everyday planning and drafting, particularly for middle rich clients, and with a focus on how the law as it is developing may apply to situations that have not yet tested the boundaries of the law.

Summary Turning Asset Protection into Asset Collection: A Creditor’s View

Melissa Langa, J.D.

A court judgment is just a piece of paper until an execution or levy attaches to the debtor’s property, and a transfer occurs in satisfaction of the debt. This lecture will focus on the tools available to an unsecured creditor faced with a debtor whose estate plan has been crafted with classic asset protection features. When is a home not a homestead? When is a retirement asset not a retirement asset? How can the creditor import more favorable law? Is it possible to shrink the globe? Was the debtor just too late? Can the creditor reach into the lawyer’s pockets? Can you disrespect the trust? All asset protection plans are not created equal – learn why.

Appraising Your Client’s Appraisal: A Litigator’s Perspective of what Owners and the IRS Look for in Valuation Reports

Stephanie Loomis-Price, J.D.

This session will provide guidance to estate planning attorneys in reading and commenting on valuation reports, with a focus on assisting readers in refining appraisals to ensure that gift, estate, and generation-skipping transfer tax returns are prepared in a manner that is most defensible in audit and in court, if need be.

- The role of advisors in reviewing appraisal reports in detail

- The backbone of appraisals

- The type and extent of review of the appraiser’s analysis and conclusions

Estate Planning Current Developments and Hot Topics

Steve R. Akers, J.D.

Current developments of topics important to estate planning advisors will include legislative and regulatory developments and priorities, new paradigms for estate planning for couples having under $10 million (including portability), basis adjustment planning flexibilities, trust and estate planning considerations for the net investment income tax on trusts, and gift and transfer planning issues for 2015 and beyond (including the use of defined value clauses, and developments regarding installment sales to grantor trusts and sales for self-canceling installment notes).

Charitable Planning in the Real World-Case Studies

William R. Lane, Jr., J.D.

Abigail E. O’Connor, J.D

This presentation will review the impact of future interest rate increases upon common estate and charitable planning techniques. We then will review multiple actual client scenarios as case studies to illustrate the multitude of interrelated estate planning issues often present within situations in which charitable planned gifts are the primary or principal transaction.

Psst! It’s Not (All) About Taxes Anymore: Significant Wealth Preservation and Transfer Developments

Professor Jeffrey N. Pennell, J.D. – Tentative

This session will address important estate, gift, and generation-skipping transfer tax developments. But because the wealth transfer taxes are waning in importance for most estate planners, it also will focus on procedure, income tax, and state law developments of significance to planners everywhere. All with an eye to their practical significance to everyday planning and drafting, particularly for middle rich clients, and with a focus on how the law as it is developing may apply to situations that have not yet tested the boundaries of the law.

For more information about the speakers, please click here.

To register, please click here!

Humor! (Or Lack Thereof!)

———————————————————————————

VERSES FROM THE BIBLE THAT DID NOT MAKE THE CUT:

“Blessed are they that stipulate, for they do not argue solely for the love of argument and may beget a contingency fee of milk and honey.”

———————————————————————————

LITIGATION IN AN ALTERNATE UNIVERSE:

“Scopes Monkey Trial” attorneys Clarence Darrow and William Jennings Bryan enact courtroom scene from “Waiting for Godot”.

Darrow: “I’m getting nervous. When will the judge be here?”

Bryan: “He’s coming. I promise.”

Darrow: “It’s been hours. Maybe he isn’t coming. Maybe there is no judge.”

Bryan: “Don’t say that.”

Darrow: “Maybe there is no judge. Maybe we have to judge ourselves.”

Bryan: “Anarchist.”

Darrow: “You’re bald!”

Bryan: “You’re fat.”

Darrow: “Is this the Scopes trial, or do you just need Scope Monkee breath?”

———————————————————————————

GLOSSARY TERM OF THE WEEK:

“Glossary”: an alphabetical list of words, usually pertaining to a specific subject, with a brief definition of the words. Often found at the beginning or end of a “book.” (See glossary for definition of “book.”)

Upcoming Seminars and Webinars

FREE LIVE WEBINAR:

Attorney Leslie A. Share will be joining Alan Gassman for a free 30 minute webinar on DEMYSTIFYING U.S. TAX AND ESTATE PLANNING CONSIDERATIONS FOR FOREIGN INVESTORS – CONCEPTS THAT YOU CAN CLEARLY UNDERSTAND AND EXPLAIN TO CLIENTS

Date: Monday, September 29, 2014 | 5:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar, please click here.

********************************************

LIVE CLEARWATER PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will be joined by several experienced attorneys and other well respected industry experts during a full day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 5, 2014 | 8:30am – 5pm

Location: Clarion Hotel, 20967 US 19 N., Clearwater

Additional Information: To register for this program, please email agassman@gassmanpa.com

********************************************

FREE LIVE WEBINAR

THE BCA’s OF REVERSE MORTGAGES

Alan Gassman will be presenting a webinar about reverse mortgages.

Date: Wednesday, October 8, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar, please click here.

********************************************************

LIVE NEW JERSEY PRESENTATION – WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW TO REPRESENT SNOWBIRDS AND FLORIDA BASED BUSINESSES:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) SPECIAL 3 HOUR SESSION

New Jersey song trivia: What song includes the words “Counting the cars on the New Jersey Turnpike, they’ve all gone to look for America”? What year was it recorded and who wrote it?

Alan S. Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it is our second shore), own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida=s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Gain the knowledge you need to assist your clients with Florida matters including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 11, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors, and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information, please email agassman@gassmanpa.com

********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo will address the North FICPA Group on Financial Analysis and Tax Planning for Investment Products, Including Variable Annuities, Fixed Annuities, Life Insurance Contracts, and Mutual Funds – What Should the Tax and Financial Advisor Know and Advise?

Be there or be an equilateral triangle!

Date: Wednesday, October 15, 2014 | 4:30 p.m.

Location: Chili’s Port Richey, 9600 US 19 N, Port Richey, Florida

********************************************************

LIVE MIAMI LAKES PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman and Phil Rarick will be presenting a free half-day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 19, 2014 | 1pm – 5pm

Location: Shula’s Hotel, 6842 Main Street, Miami Lakes, FL 33014 | Boardroom

Cost: $35 per person

Additional Information: Click here for the program description. To register for this program, please email agassman@gassmanpa.com

********************************************************

LIVE CLEARWATER PRESENTATION

Alan Gassman will be speaking at the Pinellas County Estate Planning Council Fall Seminar on PLANNING FOR SAME GENDER COUPLES.

Date: Thursday, October 23, 2014 | 7:30 am

Location: Ruth Eckerd Hall, 1111 N. McMullen Booth Road, Clearwater, FL

Additional Information: To register for this event, please email agassman@gassmanpa.com

********************************************************

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifying the “Stretch in Trust” IRA and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: The Hyatt Regency, 1000 Blvd. of the Arts, Sarasota, FL 34236

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014 | 1:10 p.m. – 2:50 p.m.

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: For more information, please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

PARALEGAL ASSOCIATION OF FLORIDA – PINELLAS COUNTY CHAPTER

Alan Gassman will be presenting 8 STEPS TO A SUCCESSFUL TRUST AND ESTATE PLAN at the Paralegal Association of Florida – Pinellas County Chapter’s November meeting.

Date: November 11, 2014

Location: The Hangar Restaurant and Flight Lounge, 540 1st Street SE, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com

*********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on Planning Opportunities for Same Sex Couples.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Fox Hollow Golf Club, 10050 Robert Treat Jones Pkwy, Trinity, FL 34655

Additional Information: For more information, please contact agassman@gassmanpa.com.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

NOTABLE SEMINARS BY OTHERS

(We aren’t speaking but don’t tell our mothers!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

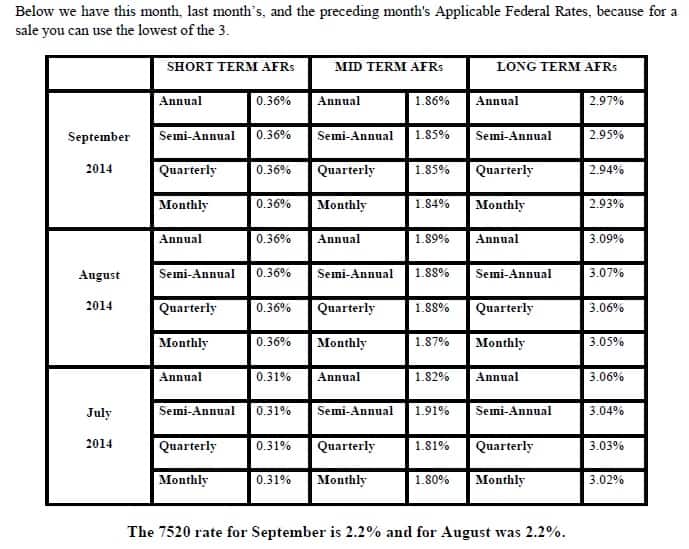

Applicable Federal Rates