The Thursday Report – 8.18.16 – Estate Tax, Don’t Be Lax!

An Update on Everything You Need to Know About the Defend Trade Secrets Act of 2016

A Laymen’s Guide to the New Proposed Regulations

The Numbers Tell it All

Using Split Dollar Loans to Fund Premiums on Trust-Owned Life Insurance Policies – A Primer

Don’t Miss the 42nd Annual Notre Dame Tax & Estate Planning Institute!

Webinar Spotlight: Proposed Regulations Under 2704 – How These Would Work & What May Be Done Now for Clients and Structures

Richard Connolly’s World: US Aims to Clamp Down on Tactic to Avoid Estate Tax

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“The only difference between death and taxes is that death

doesn’t get worse every time Congress meets.”

– Will Rogers

William Penn Adair Rogers was an American cowboy, vaudeville performer, humorist, newspaper columnist, social commentators, and actor. He was nationally known as “Oklahoma’s Favorite Son,” and, by the end of his career, made 71 films and wrote more than 4,000 nationally syndicated newspaper columns. He was considered to be one of the leading political commentators of the 1930s and was also, at one time, Hollywood’s highest paid movie star. His political sayings, many humorous in nature, are still widely quoted today.

Please Share This Thursday Report!

Please forward a copy of this Thursday Report to anyone who you think might like it and also, to anyone who you think might not like it. The Thursday Report is free of charge for those who would like to receive it and a pain to delete for those who do not. Our only growth comes from word of mouth, and our main reward is the motivation created from having a synergistic readership, knowing that certain items that we research and write for clients will be well-received by a broader audience (and also having someone somewhere at least pretend to like our sophomoric humor!)

Please share your Thursday Report and let us know of any email addresses that you would like to receive the Thursday Report at. Since we started The Thursday Report in 2012, advances in prosthetics have led to functional bionic limbs, and we’ve seen the creation of some pretty amazing inventions like Google Glass, the Tesla Models S and X, and the “Hoverboard” Scooter. We asked a famous photographer about this, and he said that he would shutter to think about what might not have happened without The Thursday Report. Similarly, one of our long-time readers refused to comment. Certainly, that reader got everything she paid for.

Please let us know any ideas for future Thursday Reports, and thank you for your continued support.

The Thursday Report

Is a newsletter of sort

Where we share our thoughts,

Sometimes little, sometimes lots!

We love the feedback,

And while social graces, we lack,

The friends we have made,

Makes the content unafraid.

We thank our loyal team,

Holding Ron Ross, Stephanie, Richard Connolly, and others in high esteem.

Stay current, and stay hip,

And regards to Gladys Knight and the Pip.

An Update on Everything You Need to Know

About the Defend Trade Secrets Act of 2016

This week, the LISI Leimberg Newsletter system released our Newsletter #154 on “Everything You Need to Know About the Defend Trade Secrets Act.”

This article was featured in the last Thursday Report and can also be accessed by clicking here.

Thanks very much to Colleen Flynn of the second best law firm in Clearwater, Florida and Mark Hansing for your patience and assistance with anything that might go wrong under this article.

A Laymen’s Guide to the New Proposed Regulations

The Treasury Department’s release of proposed regulations that are expected to significantly reduce valuation discounts, and thus increase federal estate tax, gives us good reason to cover these topics.

We provided brief coverage of the proposed regulations, and an explanation as to why these are very important for clients who have the opportunity to do appropriate discount planning this year. You can view our discussion by clicking here, but an example that we gave is as follows:

D and D’s children, A and B, are partners in a Limited Partnership. D owns a 98% limited partnership interest, and A and B each own a 1% general partnership interest. D wishes to transfer a 33% limited partnership interest to each of A and B. The Partnership Agreement prohibits the withdrawal of a limited partner, but under the new regulations since this restriction may be removed by the family acting collectively to amend the partnership agreement, it is disregarded in determining the value of transferred interests.

Therefore, the value of the 33% transfer to each of A and B is the fair market value of the 33% limited partnership interest determined without taking into account the restrictions on withdrawal. Upon D’s subsequent death, the value of his remaining 32% limited partnership interest also determined as if there were no restrictions on withdrawal.

Because of this, a good many clients will enter into gift and/or sale arrangements before the regulations are finalized. In the example above, the 70% partnership interest might be sold to a trust for the primary benefit of descendants for a $5,000,000 low-interest promissory note in order to “freeze the discount” before the law changes.

For professional advisors and colleagues, Steve Leimberg’s LISI newsletter service published an excellent summary of the specific issues that was written by Jonathan G. Blattmachr and Mitchell M. Gans. You can view this excellent article by clicking here.

We agree with their conclusion, which included the following statement:

The proposed regulations issued under Section 2704 would, if adopted in final form, have a significant impact on the wealth transfer tax valuation of interest in family controlled entities. Essentially, almost no minority discounts would be allowed. Although an apparent exception is made for restrictions mandated under state or federal law, it seems doubtful there will be any such laws available as only laws under the United States may apply and any restriction contained in such a mandatory statute will not apply if the entity could have been formed under another statute of the state (or federal law). It is not certain if interests owned jointly (such as a tenancy in common) will produce discounts but it seems the IRS may contend that these too are covered by the proposed Disregarded Restrictions rule. It seems, although it is not certain, that any restriction or option (such as that contained in a so-called buy-sell agreement) that meets the criteria of Section 2703 will not fall under Section 2704.

In any case, practitioners should immediately contact clients whose interests would be affected by these new rules and advise them of opportunities to take action before they become effective.

Alan Gassman is preparing to moderate a Bloomberg BNA discussion of the new regulations, and what to do now in preparation for them. John Porter and Stacy Eastland will lead this discussion. Materials will be available to Thursday Report readers, but please consider signing up for this webinar, by clicking here.

Bloomberg BNA is charging for the webinar, but also offering to enable viewers to see not only this webinar, but also a host of other useful estate and tax planning webinars for a single price of $420. The price for this one webinar is $224. Gassman, Crotty & Denicolo, P.A. is not directly or indirectly compensated for moderating these webinars.

Obviously, we always appreciate those things that are about to be taken away, and while the political climate that will apply after November 8 is hard to predict, the outcome of the election could certainly result in significant tax changes, with normal grandfathering for those arrangements in place before law changes. This is why a great many affluent Americans should be meeting with their tax advisors, in order to determine how to best be situated.

One client who transferred significant interests in family limited partnerships last year asked us what might be done before year-end to best facilitate avoidance of estate taxes for their family.

Our answer is to look at how much exemption the client has, and what assets are available for planning, and to “lock-in discounts” with appropriate installment sale and/or grantor retained annuity trust planning.

These clients filed a gift tax return in 2013 to reflect 2012 gifting, and when the three year statute on the return runs this October, then we will know how much exemption the client has to work with. We are happy to report that, to our knowledge, none of the many clients who filed gift tax returns reporting gifts in 2012 have been notified of any planned gift tax return review or audit, and this is consistent with what other advisors are telling us, and very good news.

We cannot, however, predict what the potential audit situation for estate and gift tax returns will be in decades to come. Up through 2005, estate tax audits were very common, and estate tax auditors were almost always local, well-educated tax lawyers, who were normally reasonable but sometimes very aggressive.

Those days may return, but given the large amount of gifting activity expected over the next five months because of the potential loss of discounting as a tool, it is likely that there will not be enough IRS estate and gift tax auditors hired and trained even by 2020.

The real challenge now for our colleagues is to get the word out, and to make sure that there will be availability for the review of situations, planning conversations and proposals, and implementation.

For a possible letter you can send to your clients about the proposed regulations, please click here.

It is going to be a very busy 2016! May the force be with us.

The Numbers Tell it All

by Kenneth J. Crotty

As described above, the IRS has recently issued Proposed Regulations which will have a significant impact on the discounts which can be taken by people who sell limited partner interests or non-voting membership interests as part of their estate planning. Prior to the Proposed Regulations becoming final, people often were able to obtain valuation reports which applied a 35% combined discount for lack of control and lack of marketability. The Proposed Regulations would greatly reduce this combined discount.

To show the impact that this will have on the effectiveness of planning, we ran calculations based on the assumptions stated below. By reducing the discount from 35% to 10%, the effectiveness of the installment sale described below was greatly reduced. As a result, taxpayers will want to complete these installment sales within 30 days of the Proposed Regulations becoming final so that they will be able to take a larger discount with respect to the interest being sold.

Taxpayers also need to be aware of the “step transaction doctrine,” which could be applied by the IRS to reduce or eliminate the discount taken even before the Proposed Regulations are finalized. If the taxpayer funds the LLC or partnership and sells the interest too quickly, the IRS could take the position that the taxpayer really sold the assets of the LLC or partnership and not the non-voting membership interest or limited partner interest and that the discounts should be disallowed or reduced. To avoid this, taxpayers who are considering or will enter into an installment sale transaction should create and fund the LLC or partnership as soon as possible.

Installment Sale Analysis

The following analysis assumes that the taxpayer will fund an LLC with $1,000,000 and sell a 99% non-voting membership interest to a Trust in exchange for a nine year note which requires annual interest-only payments with a balloon payment of all outstanding interest and principal at the end of the nine-year term. The example assumes that the assets of the LLC will grow at 4% and compares the effectiveness of the planning when the 99% interest is sold applying a 35% discount (representing a sale occurring before the Proposed Regulations are finalized) and also applying a 10% discount (representing a sale occurring after the Proposed Regulations are finalized.)

Applying the 35% discount, the discounted value of the LLC is $650,000 ($1,000,000 x 35% = $350,000; $1,000,000 – $350,000 = $650,000). Therefore, the value of a 99% discounted LLC membership interest in the LLC is $643,500 ($650,000 x 99% = $643,500).

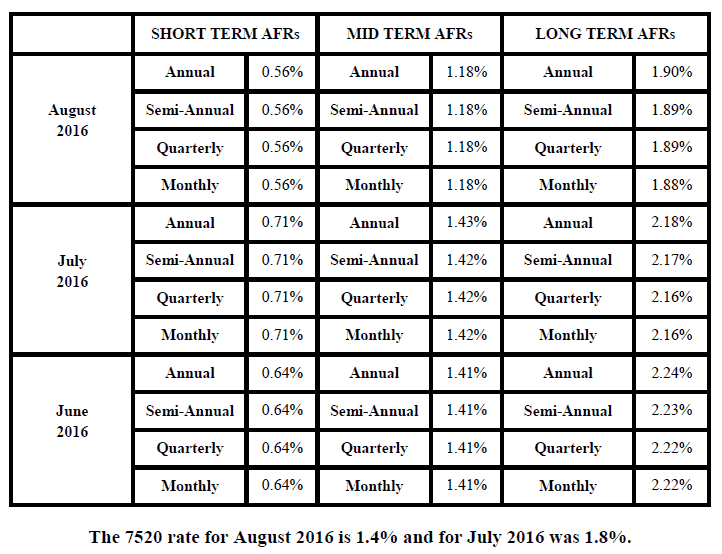

A nine-year promissory note can bear interest at the mid-term applicable federal rate, which is 1.18% for August. With a 35% discount, the annual interest due on the promissory note would be $7,593 ($643,500 x 1.18% = $7,593).

Assuming a 4% growth rate and that the interest-only payments are made on the promissory note at the end of the year, the value of the non-discounted 99% LLC membership interest after the first year would be $1,022,007 ($1,000,000 x 99% = $990,000; $990,000 x 4% = $39,600; $990,000 + $39,600 – $7,593 = $1,022,007). Assuming the assets of the LLC had continued to grow at 4% and that the annual interest payments were made at the end of each year, the value of the non-discounted 99% LLC membership interest after 8 years would be $1,284,916.98 ($1,242,798.34 x 4% = $49,711.93; $1,242,798.34 + $49,711.93 – $7,593 = $1,284,916.98).

At the end of the ninth year, the annual interest and the outstanding principal of the promissory note would be due. After paying the outstanding interest and principal, the value of the Trust owning the 99% LLC membership interest would be $685,220.35 ($1,284,916.98 x 4% = $51,396.68; $1,284,916.98 + $51,396.68 – $7,593 – $643,500 = $685,220.35).

If only a 10% discount was applied to the interest sold, the Trust would only be worth $406,813.30.

Therefore, by reducing the discount from 35% to 10%, the Trust has $278,407.05 less assets ($685,220.35 – $406,813.30 = $278,407.05). If we assume that the additional $278,407.05 that was paid by the Trust back to the taxpayer would be subject to estate tax at a 40% rate, this would generate $111,362.82 of estate tax liability. ($278,407.05 x 40% = $111,362.82).

Step Transaction

To utilize an installment sale, the taxpayer would (1) establish an LLC or a partnership while retaining all of the ownership; (2) contribute assets to the entity; and (3) sell a minority or non-voting interest in the entity to the Trust. This planning allows the taxpayer to sell discounted ownership interests at a discounted cost, while still retaining control over the entity owning the assets. Even if all of the proper steps are followed, the IRS may challenge the discount applied to the sale under the step transaction doctrine if the steps are done too quickly.

The step transaction doctrine has been used by the IRS to reduce or disregard valuation discounts if an entity is funded with assets and ownership interests in the entity are transferred without allowing for sufficient time to elapse since the contribution of assets to the entity. The IRS has taken the position that the transfer of ownership interests in the entity was essentially a transfer of the underlying assets of the entity, and therefore, little or no discount should apply to the value of the transfer.

While there is no “hard and fast” time period that must elapse between the contribution of assets to the entity and the subsequent transfer of ownership interests in the entity, to avoid the application of the step transaction doctrine, a “reasonable” amount of time must elapse. The time period depends on the type of assets being sold and the economic risk associated with them. For example, if the LLC is funded with bonds or real estate, the economic risk of the value changing significantly in a short period is relatively low. Therefore, the period of time between the funding of the LLC and the sale would need to be longer to avoid the application of the step transaction doctrine. If the asset is a volatile asset, the period can be shorter, with a Tax Court case holding that the step transaction did not apply when the time period between funding and sale was only six days.

The safest route for a taxpayer considering entering into an installment sale before the Proposed Regulations are finalized would be to fund the entity as soon as possible to provide for the longest period of time possible between the funding and subsequent sale. If the taxpayer decides not to complete the sale, the entity would still provide creditor protection for the taxpayer, assuming it was structured and maintained correctly. If the taxpayer decides to complete the sale before the Proposed Regulations become applicable, the taxpayer will be in a better position to avoid the application of the step transaction doctrine because the taxpayer had funded the entity well in advance of the sale.

Using Split Dollar Loans to Fund Premiums on

Trust-Owned Life Insurance Policies – A Primer

by Christopher J. Denicolo

One of the challenges in having life insurance owned by an irrevocable trust is determining how the premium payments will be funded. Several alternatives exist, although there are advantages and drawbacks to each of them.

A common approach is to have the grantor of the trust (who is typically the insured) make contributions to the trust by using his or her gift tax annual exclusions. In this scenario, the trust affords certain beneficiaries with “Crummey” withdrawal powers whereby they would have the power to withdraw such contributions within a specified number of days thereafter (such as 30 or 60 days). This would allow a total of $14,000 per trust beneficiary (or $28,000 per trust beneficiary, if the contribution is made by joint grantors or is split by the grantor and his or her spouse) to be used against contributions made to the trust for a particular year. Nevertheless, unless the grantor has a sufficient number of withdrawal power beneficiaries under the trust, the premium payment amounts can very easily exceed the available annual exclusion.

A solution to this issue would be for the grantor to simply utilize some of his or her $5,450,000 (plus inflation) lifetime gifting allowance. However, this is not the most efficient use of the grantor’s lifetime gifting allowance because the contributions made in each year will consistently deplete the grantor’s lifetime grifting exclusion, which will expose additional assets to estate tax upon the death of the grantor.

The concept of split-dollar loans is another solution to this issue, and it may be the most advantageous method to fund life insurance policies held under an irrevocable trust. This arrangement involves an individual or entity making split dollar loan advances to an irrevocable trust that owns a life insurance policy. The individual or entity advances monies needed to pay the annual premium costs and is entitled to receive repayment of its loan, plus interest, when the policy matures upon the death of the insured.

Each advance made under the split dollar arrangement is considered to be a separate loan, accruing interest at the then applicable federal rate (AFR) in effect with respect to the time period corresponding to the insured’s actuarial life expectancy under the appropriate table provided for in Treasury Regulation Section 1.72-9. For example, if the insured has an actuarial life expectancy of over 9 years, then the long-term AFR in effect at the time of the advance would apply. As the actuarial life expectancy of the insured decreases over time, the mid-term AFR would apply when a life expectancy is greater than 3 years but not more than 9 years, and the short-term AFR would apply when the life expectancy is 3 years or less.

Because the current AFRs are historically low (the short-term AFR is 0.56%, the mid-term AFR is 1.18%, and the long-term AFR is 1.90% for August 2016), there is an amazing opportunity for financial leverage in using low interest loans to secure a significant income tax-free return on investment upon the death of the grantor.

To document this arrangement, a promissory note is entered into to provide that the loan would be repaid upon the grantor’s death. Additionally, a private split dollar agreement is entered into by the parties as a thorough and comprehensive loan agreement that describes the arrangement in general. The parties also will enter into a restricted collateral assignment document which essentially operates as a security agreement to collateralize the lender’s right to receive its loan amounts, plus interest, upon maturity of the policy. This collateral assignment document is signed by and filed with the life insurance carrier to put it on notice of the amounts owed to the lender as part of the policy proceeds.

If the insured survives his actuarial life expectancy, then each split dollar loan advance is treated as having been retired and reissued as a split dollar demand loan. The AFR that was in effect when each advance was made will continue to apply as the interest rate, but the loan will be considered to provide for sufficient interest if the appropriate AFR was used when the advance was made. In other words, the loans will not be retested under the tax laws to determine if sufficient interest is being charged.

The realm of split dollar arrangements can be confusing and complicated, but the split-dollar loan regime approach described above is fairly understandable by advisors, their clients, and laymen alike. This approach can be advantageous in providing an arrangement for funding a life insurance policy without wasting the insured’s annual exclusion or lifetime gifting allowance so that these tax benefits can be used for other purposes to make the most of the insured’s estate plan. Nevertheless, it is important to assure that appropriate accounting occurs and that the parties keep track of all monies advanced and the amounts owed under the documents. The IRS will respect this type of arrangement if the formalities are followed, but they will be inclined to disregard it if shortcuts are taken and the parties do not accrue interest at the appropriate levels.

Don’t Miss the 42nd Annual Notre Dame Tax & Estate Planning Institute!

To the tune of “Alexander Hamilton” from the musical “Hamilton”

by Kristen Sweeney

How does a Hesch, that’s Jerome, extraordinary planner and professor

Set up in the middle of nowhere South Bend, Indiana,

helped out by fighting Irish (those crazy brawlers),

create such a convention of legal scholars?

Notre Dame Tax Institute

This is the Notre Dame Tax Institute

And there’s a million chances to register

We can’t wait

We can’t wait

Yo we’ve got Choate, Natalie,

Bove and Akers in the house,

We’ve got panels, we’ve got keynotes

And Blattmachr is around,

Par-Tay!

Sitting downstairs in the bar to unwind,

The presentations you will hear are gonna blow your mind.

Notre Dame Tax Institute

This is the Notre Dame Tax Institute

And there’s a million chances to register

We can’t wait

We can’t wait

Jerry Hesch does a fantastic job selecting and, oftentimes, commissioning and molding topics, outlines, and presentations for the Notre Dame Tax Institute in order to be sure that attendees get practical, well-balanced, and cutting edge strategies, materials, and practical knowledge.

This year’s Notre Dame Tax Institute two-track schedule is one of the best ever, which is why this conference is one of the most popular in the country.

The conference takes place at the Century Center in South Bend, Indiana, which is conveniently located across the street from a nice DoubleTree by Hilton Hotel. Notre Dame, Indiana is a friendly, small city just north of South Bend, and Notre Dame University is the largest thing in town.

The conference is always on a Thursday and Friday, and there is always a Notre Dame football game on the Saturday thereafter. South Bend is only a 2 hour drive from Chicago and a 3 hour drive from Detroit, so many colleagues spend the weekend in Chicago or Detroit to cap off a nice trip. An Uber ride from South Bend to Chicago is approximately $135 – $180 dollars, one way.

To support this worthy institution, our law firm will provide a one-year free subscription to EstateView estate and tax planning software to anyone who sends us an email confirming that you are a Thursday Report reader and have registered for the event. If you decide not to attend but still want access to EstateView, then you can donate $149.99 to the Notre Dame Law School when the Institute is held.

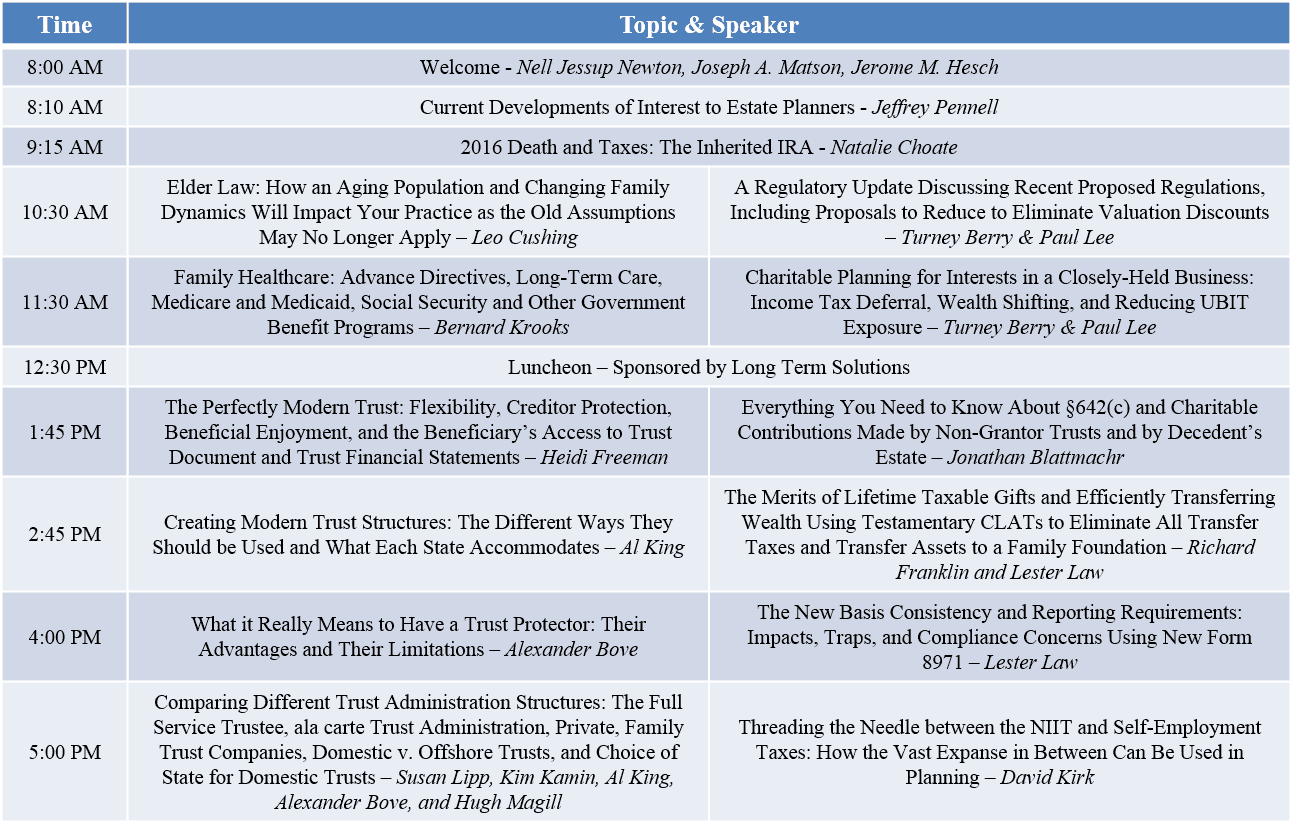

The topics and speakers are as follows:

Day 1:

Day 2:

For more information, please click here to download the conference brochure and click here to register.

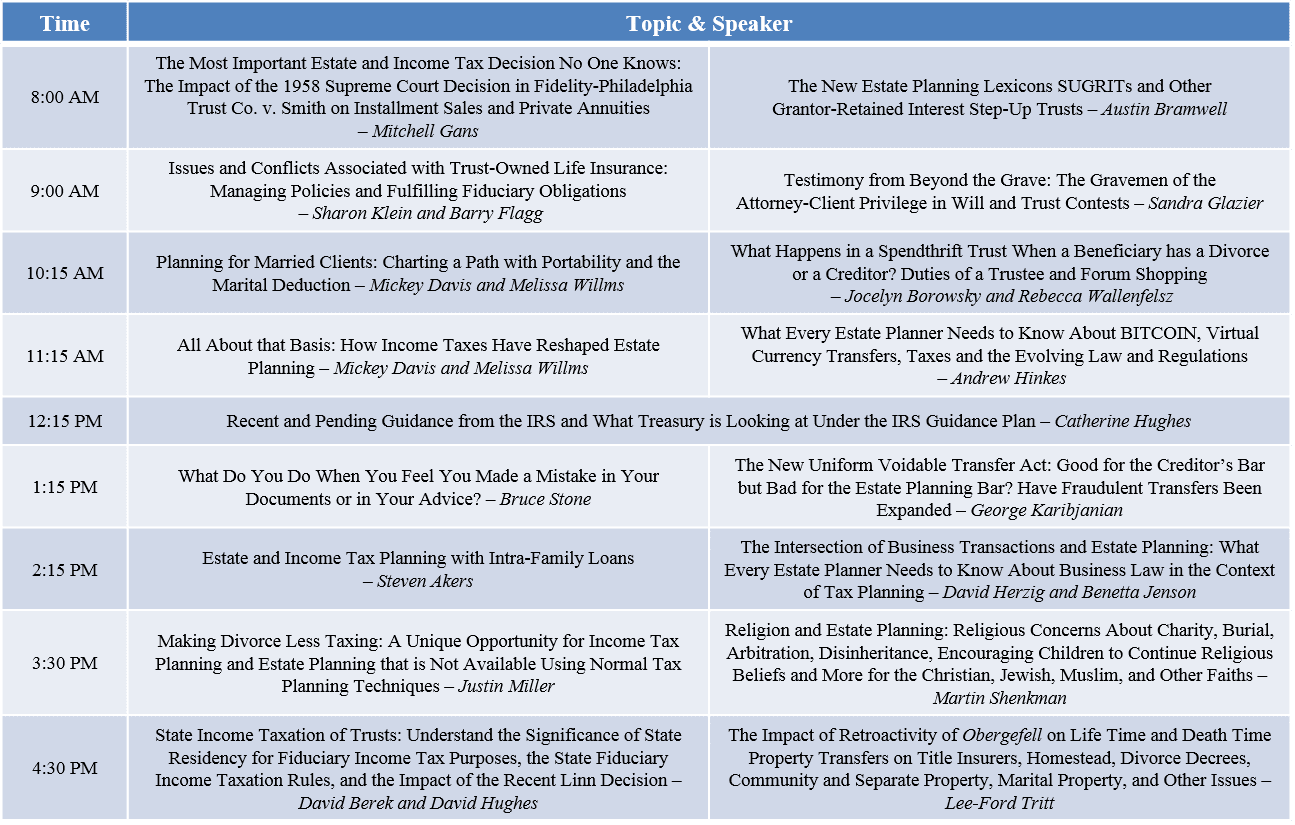

Webinar Spotlight

Proposed Regulations Under 2704 – How These Would Work &

What May Be Done Now for Clients and Structures

Join experts John Porter and Stacy Eastland with moderator Alan Gassman for a live, informative, and practical discussion on these new Proposed Regulations and related developments and insights.

In 60 minutes, the presenters will cover:

- Potential impact the proposed regulations have on the estate and gift taxation of family-owned entities.

- What types of entities are impacted?

- What planning opportunities should not be affected by the proposed regulations?

- The impact of the new test for “control”.

- “Disregarded Restrictions” and their impact.

- The effect of the proposed rules regarding the lapse of liquidation rights and the three year contemplation of death rule.

- The effect of proposed rules that would disregard small interests in an entity for purposes of determining ownership.

- When will these regulations become final, and what will be the effective date?

- What is the likelihood these regulations will be challenged if finalized and how can we address the possibility of a successful challenge?

What should be done now while we still can?

To register for the Proposed Regulations Under 2704 webinar, please click here.

Richard Connolly’s World

US Aims to Clamp Down on Tactic to Avoid Estate Tax

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “US Aims to Clamp Down on Tactic to Avoid Estate Tax” by Richard Rubin. This article was featured in The Wall Street Journal on August 2, 2016.

Richard’s description is as follows:

The US government on Tuesday proposed making it harder for wealthy business owners to transfer assets to heirs without paying estate and gift taxes.

The plan from the Treasury Department and Internal Revenue Service would place new limits on a common technique used to transfer interests in family businesses.

The regulations address the practice of discounting the value of ownership stakes in closely held businesses or land.

The government’s proposal would make it harder for taxpayers to claim valuation discounts that taxpayers typically have used to reflect the diminished value of minority interests, said Richard Dees, a partner at McDermott Will and Emery in Chicago. “This is going to be a major problem for all family-owned businesses,” Mr. Dees said. “This all boils down to the question of whether a family business should be valued as if it’s owned by one person.”

Please click here to read this article in its entirety.

Humor! (Or Lack Thereof!)

Sign Saying of the Week

*************************************

In the News

After 148 Years, Cohabitation Legal Again in Florida

Unlike many of the ‘news’ headlines we publish in our humor section, the headline featured this week is completely true!

After 148 years, Florida Governor Rick Scott repealed a law enacted in 1868 that made cohabitating with a romantic partner before marriage a second-degree misdemeanor, punishable by up to 60 days in jail and a $500 fine.

According to an article in the Tampa Bay Times by Kristen M. Clark, which can be viewed by clicking here, Florida was one of only three states to still have an anti-cohabitation law on the books, and the criminal penalties were rarely enforced.

The repeal bill passed unanimously in the Senate and was approved by the House in a 112-5 vote.

Before 1868, there was no record of anyone wanting to cohabitate with a Floridian. That was before air conditioning and antiperspirants were invented. We can only assume the five legislators who voted against repealing this law still not have access to air conditioning or antiperspirant.

Upcoming Seminars and Webinars

Calendar of Events

LIVE TAMPA PRESENTATION:

The Ameriprise Clearwater branch office, in conjunction with The Tampa Bay Gay and Lesbian Chamber of Commerce, will be hosting an event centered on LGBT estate planning, featuring Alan Gassman’s presentation on PRACTICAL PLANNING FOR MARRIED AND UNMARRIED COUPLES.

Date: August 18th, 2016 | 6:00 PM

Location: Safety Harbor Resort & Spa | 105 N Bayshore Drive, Safety Harbor, FL, 34695

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Philip Nelson at philip.nelson@ampf.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Stacey Eastland and John Porter will present a one-hour webinar on the topic of 2704 PROPOSED REGULATIONS. This webinar will be moderated by Alan Gassman.

Date: Thursday, August 25th, 2016 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this presentation, please email agassman@gassmanpa.com or stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

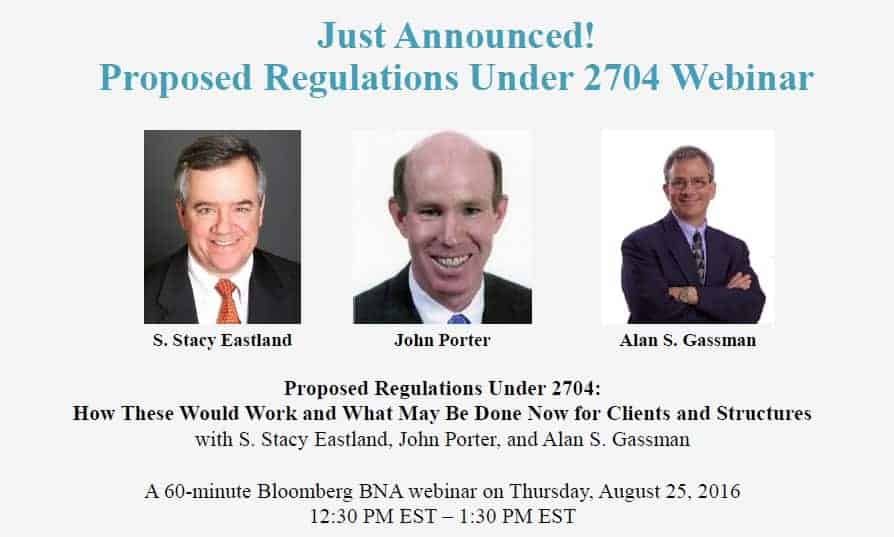

LIVE COMPLIMENTARY WEBINAR:

Jay Adkisson and Alan Gassman will present a free, one-hour webinar on the topic of JAY ADKISSON’S MUSINGS ON CAPTIVE CARRIERS.

There will be two opportunities to attend this presentation.

Date: Tuesday, August 30, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Marty Shenkman and Alan Gassman will present a free, 30-minute webinar on the topic of AVOIDING FAMILY STRIFE FOR ELDERLY CLIENTS BY HAVING A SUPPORT TEAM IN PLACE.

There will be two opportunities to attend this presentation.

Date: Thursday, September 8, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Al Gomez and Alan Gassman will present a free, 30-minute webinar on the topic of FRAUDULENT TRANSFERS UNDER FLORIDA LAW.

There will be two opportunities to attend this presentation.

Date: Tuesday, September 27, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

58th ANNUAL FLORIDA BANKERS ASSOCIATION TRUST & WEALTH MANAGEMENT CONFERENCE

Alan Gassman will be speaking at the 58th Annual Florida Bankers Association Trust & Wealth Management Conference on the topic of PLANNING TO AVOID AND HANDLE ESTATE AND TRUST DISPUTES.

Date: Thursday, September 29th, 2016 | 4:15 PM – 5:15 PM

Location: The Ritz-Carlton Sarasota | 1111 Ritz Carlton Drive, Sarasota, FL, 34236

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Sandra Greenblatt and Alan Gassman will present a free, 30-minute webinar on the topic of AVOIDING THE TRAPS IN EMR/TECHNOLOGY CONTRACTS.

There will be two opportunities to attend this presentation.

Date: Thursday, October 20, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Sean Healy and Alan Gassman will present a free, 30-minute webinar on the topic of GUN TRUST UPDATE – NEW RULES AND REGULATIONS YOU NEED TO KNOW ABOUT.

There will be two opportunities to attend this presentation.

Date: Tuesday, October 25, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MAUI PRESENTATION:

2016 MAUI MASTERMIND WEALTH SUMMIT

Alan Gassman will be speaking at the 2016 Maui Mastermind Wealth Summit with David Finkel and others. This event will connect attendees with many Maui Mastermind Wealth Advisors such as Alan. Details on his topics and the event are forthcoming, so watch this space!

Date: December 4th – December 9th, 2016

Location: The Fairmont Kea Lani Maui | 4100 Wailea Alanui Drive, Maui, HI, 96753

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking on the following topics at the Medical Education Resources (MER) Internal Medicine for Primary Care event:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates!

LIVE SOUTH BEND, INDIANA PRESENTATION:

42ND ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please put Thursday, October 27th and Friday, October 28th on your calendars for the 42nd Annual Notre Dame Tax & Estate Planning Institute. To see the complete schedule and for registration details, please click here.

Date: Thursday, October 27th, 2016 and Friday, October 28th, 2016

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN, 46601

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Date: Thursday, February 9th, 2017

Location: To Be Announced

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, May 5th, 2017 and the weekend that follows on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples with the person or persons of your choice. Watch this space for more details to be announced!

Date: Friday, May 5th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is DYNAMIC PLANNING STRATEGIES THAT YOU ALREADY KNOW ABOUT BUT HAVE NOT YET APPLIED.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau Bahamas

Stay tuned for more information about these events!

Date: Speaker dates are to be determined.

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.