The Thursday Report – 8.4.16 – 2704 Alert, Trade Secrets Law Change, and KFC for President

Red Alert for Estate Tax Planning Clients

Why You Need to Know About the Defend Trade Secrets Act of 2016

Webinar Spotlight: Estate & Trust Planning for IRA & Pension Account Assets with Edwin Morrow and Christopher Denicolo

Thoughtful Corner – The Overwhelmed Solution: An Interview with Dr. Srikumar Rao

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“People do not decide their futures. They decide their habits,

and their habits decide their futures.”

– F.M. Alexander

Frederick Matthias Alexander was an Australian actor who developed the educational process called the Alexander Technique. The Alexander Technique is a form of education that strives to help individuals recognize and overcome reactive, habitual limitations in movement and in thinking. His three-year training course was started in London in February of 1931, and the courses ran until his death in 1955. Many of his books and teachings can be found on Amazon by clicking here.

F.M. Alexander is not to be confused with Alexander Graham Bell, who is credited with patenting the first practical telephone, or his nephew, Alexander Graham Cracker, who inherited the patent upon Bell’s death. F.M. Alexander is also not to be confused with Alexander Bove, who invented the trust protector, or Alexander the Great, whose wife disagreed with the title. F.M. Alexander should also not be confused with Brandy Alexander, which consists of cognac and crème de cacao and is typically garnished with grated nutmeg.

Red Alert for Estate Tax Planning Clients

by Alan Gassman

“Discount planning” has been around for decades to enable individuals and married couples who would otherwise pay estate tax to avoid or significantly reduce such tax exposure. New proposed regulations from the IRS, which were released on August 2, 2016, would eliminate a significant portion of such discount, most notably the discount for a lack of control, and thus, significantly increase estate tax exposure.

The regulations are expected by many to become fully effective in early January 2017, so the rest of 2016 looks to be a highly active year for affluent families and their tax planners.

By way of example, a married couple with $10,000,000 worth of assets held in a family limited partnership may have gifted 30% in the past, after filing gift tax returns using much less than $3,000,000 of their allowances because of conventional discounting. If they die owning 70% of the partnership without holding voting control, then the remaining percentage ownership under today’s law could be valued at significantly less than $7,000,000.

Under the new regulations, the gift of a non-voting or limited partnership interest may have to be valued at or very close to $3,000,000 in the above example, and the remaining 70% non-controlling interest may have to be valued at or very close to $7,000,000.

The proposed regulations include the following examples related to restrictions on liquidation withdrawal rights:

D and D’s children, A and B, are partners in a Limited Partnership. D owns a 98% limited partnership interest, and A and B each own a 1% general partnership interest. D wishes to transfer a 33% limited partnership interest to each of A and B. The Partnership Agreement prohibits the withdrawal of a limited partner, but under the new regulations since this restriction may be removed by the family acting collectively to amend the partnership agreement, it is disregarded in determining the value of transferred interests.

Therefore, the value of the 33% transfer to each of A and B is the fair market value of the 33% limited partnership interest determined without taking into account the restrictions on withdrawal. Upon D’s subsequent death, the value of his remaining 32% limited partnership interest also determined as if there were no restrictions on withdrawal.

Because of this, a good many clients will enter into gift and/or sale arrangements before the regulations are finalized. In the example above, the 70% partnership interest might be sold to a trust for the primary benefit of descendants for a $5,000,000 low-interest promissory note in order to “freeze the discount” before the law changes.

2016 is also an important year because a great many clients engaged in discounted gifting in 2012 and filed gift tax returns in 2013 that gave the IRS three years to audit. Those clients will know that the discounts claimed on their gift tax returns definitely apply and can now use what remains of their $5,450,000 exemptions for further discount planning in 2016.

Such planning is made more attractive by the possibility of transferring assets to an irrevocable trust that could actually benefit the Grantor under some circumstances, such as if there were a significant financial reversal or the need to have access to what was gifted.

We are urging clients to get with us much sooner rather than later this year to review this situation. As we brace for possible changes like this, we are reminded that clients who have planned ahead and periodically in a conscientious manner typically pay significantly less in taxes and leave significantly larger estates for their descendants than those who put planning off until the last minute.

Alan Gassman is moderating a Bloomberg BNA webinar on the new regulations on Thursday, August 25th, 2016 at 12:00 PM Eastern that will feature discussion by two of the most well-respected experts in discount and associated estate tax planning, Stacey Eastland and John Porter. Information about this webinar will be posted soon by Bloomberg BNA, and we can make materials and information available thereafter.

Benjamin Franklin’s statement that the only things we can be certain of are death and taxes was certainly correct, notwithstanding the continued hope that death and taxes do not happen at the same time or in addition to income taxes for those who plan ahead.

The Thursday Report will continue to report on the Section 2704 regulations and very much appreciate any and all questions, comments, or suggestions associated with our content.

Why You Need to Know About the Defend Trade Secrets Act of 2016

by Alan Gassman, Colleen Flynn, and Seaver Brown

The authors also thank Mark Hansing of the McKee, Voorhees & Sease law firm in Des Moines, Iowa for his review and support with respect to this article. Mark practices exclusively in the intellectual property specialty.

Executive Summary

As of July 20, 2016, all but three states have enacted some version of the Uniform Trade Secrets Act (“USTA”).[1] Due to the differences between State specific UTSA laws, the difficulty in coordinating these differing laws in multistate controversies, and the need to have Federal legislation that enables US companies to enforce trade secret protection rights against foreign entities and governments with a presence in the U.S., the federal Defend Trade Secrets Act (“DTSA”) was signed into law by President Obama on May 11, 2016.[2]

The DTSA enables the owner of a trade secret[3] to bring federal court actions when trade secrets are misappropriated or disclosed. It also requires employers to inform employees of certain exceptions to the law that exist for those seeking legal advice and filing whistleblower actions with respect to products or services used or intended to be used in interstate or foreign commerce.[4]

Facts

Prior to the enactment of the DTSA, there was no federal trade secret civil law available to victims of piracy and disclosure. The only remedies available were those provided under State trade secret statutes (if any), and any other claims one could bring for a breach of contract against employees and others with privity under a non-disclosure agreement. The DTSA does not override or interfere with the operation of a state’s trade secret laws or any remedies provided therein, or with any contractual remedies the owner of a trade secret may be entitled to in an agreement, unless a court finds that failure to provide the immunity disclosure discussed below gives the discloser any leverage or cause of action. Instead, DTSA provides US based businesses with an alternative/additional avenue to seek damages other than what the state allows.

An employer who files a DTSA cause of action against a current or former employee, consultant or contractor who has inappropriately disclosed trade secrets, cannot recover exemplary (punitive or double) damages[5] or attorney’s fees[6] under DTSA unless there is a written “notice of immunity” provision in the applicable agreement employment manual related materials that sets forth or cross-references the notice of immunity in an employer’s policies. If there is no such notice provision, however, courts are still permitted to grant injunctions[7] and/or award monetary damages for the actual loss incurred or unjust enrichment received by the employee.[8]

Comment

An employer can provide individuals who perform services as contractors, employees, or consultants with the mandated notice of immunity, which is required by the statute under any contract or agreement [entered into or updated after the date of enactment-May 11, 2016] that governs the use of any trade secret or other confidential information] in one of two ways:

- In any contract or agreement that governs the use of a trade secret or other confidential information; or

- By providing a cross-reference to a policy document given to the violating individual that sets forth the employer’s reporting policy for a suspected violation of the law.

While the statute does not mention providing the notice to business entities, it cannot hurt to do so, and to also provide that the entity will assure that its individual employees, contractors and consultants will be notified of this and will be required to comply with the terms of the given agreement.

The notice must state that the individual cannot be held civilly or criminally liable for disclosing a trade secret in confidence to a federal, state or local government official, or to an attorney if made to investigate or report a suspected violation of law by the employer, and that any law suit be under seal with the court, thus following the whistleblower protocols which require that such actions be confidential and known of only by the court and the government agency or agencies that would evaluate and prosecute such actions. The statute only provides for one explicit consequence when such notice has not been given, which is that the Employer who has not complied with the notice provision cannot receive exemplary damages or attorney’s fees in the action.[9]

We suggest employers preserve their right to pursue exemplary damages and attorney’s fees against an employee who discloses a trade secret by incorporating the following notice provision in all employment contracts, consulting agreements, restrictive covenant agreements, non-disclosure agreements, LLC agreements, and other agreements entered into on or after May 11, 2016:

Notice Under Federal Law. Pursuant to 18 USC § 1833(b), trade secret owners are required to notify individuals that they may not be held criminally or civilly liable under any federal or state trade secret law for disclosure of a trade secret: (i) made in confidence to a government official, either directly or indirectly, or to an attorney, solely for the purpose of reporting or investigating a suspected violation of law; and/or (ii) in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal (following applicable court procedures). Additionally, an individual suing an employer for retaliation based on the reporting of a suspected violation of law may disclose a trade secret to his or her attorney and use the trade secret information in the court proceeding, so long as any document containing the trade secret is filed under seal and the individual does not disclose the trade secret except pursuant to court order.

It is important to stress that all remedies available under a State UTSA statute, or those provided in a contract are preserved regardless of whether or not a notice of immunity is given. For example, the Florida Statute § 688.005 Uniform Trade Secrets Act does not require the owner of a trade secret to provide a notice of immunity in order to seek attorney’s fees, provided that the misappropriation of the trade secret was willful and malicious. The employee can also seek attorney’s fees if a claim for misappropriation is made against them in bad faith.

In addition to the remedies which are similar to those available under state law, the DTSA provides the right to seek a civil seizure to forcibly recover property that contains such trade secrets in order to “prevent the propagation or dissemination of the trade secret.” This is an extraordinary remedy and strict statutory requirements must be met for the court to enter a civil seizure order.

Conclusion

The new Defend Trade Secrets Act gives us a new arrow in our quiver to help protect clients from future disclosure and also theft of trade secrets and confidential information, but also provides us with a new burden—to get the word out to clients and put a new provision in our agreements. Over time, we expect that court decisions will confirm that the only remedy available against an employer for failure to make the “required disclosure” of immunity for retaliation or whistleblower actions will be the loss of the right to pursue exemplary damages and attorney fees, but lawyers defending those who may wish to invalidate non-compete and other agreements and have possible alleged causes of action for retaliation, or as would be whistleblowers may use lack of disclosure as an “unclean hands” defense. It is therefore safest to put the above recommended clause in all employment, contractor, non-disclosure, HIPPA Privacy and other Agreements for the foreseeable future.

*******************************************

[1] New York and Massachusetts have introduced legislation, while North Carolina has not.

[2] Section 5 of the House of Representatives’ Defend Trade Secrets Act Committee Report states “that it is the sense of Congress that trade secret theft occurs domestically and around the world, and that is it harmful to United States companies that own and depend on trade secrets. The Economic Espionage Act of 1996 protects trade secrets from theft under the criminal law. In enacting a civil remedy, it is important when seizing information to balance the need to prevent or remedy misappropriation with the need to avoid interrupting the legitimate interests of the party against whom a seizure is issued and the business of third parties.”

[3] A trade secret is generally defined as “information including a formula, pattern, compilation, program, device, method, technique, or process that” is not generally known or easily ascertainable by others and by which a business or person could obtain an economic advantage over competitors or customers from its disclosure or use.

[4] The Defend Trade Secrets Act, S. 1890, 114th Cong. § 2(b)(1)(2016).

[5] Id at § 2(b)(3)(C).

[6] Id at § 2(b)(3)(D).

[7] Id at § 2(b)(3)(A).

[8] Id at § 2(b)(3)(B).

[9] Section 7 of the House of Representatives’ Defend Trade Secrets Act Committee Report states that “Section 1833(b)(3) requires notice of the immunity in this subsection to be set forth in any employment contract that governs the use of trade secrets, although an employer may choose to provide such notice by reference to a policy document setting forth the employer’s reporting policy for a suspected violation of the law that provides notice of the immunity. An employer may not be awarded exemplary damages or attorney’s fees under this Act against an employee to whom such notice was not provided.” The notice requirements apply to contracts entered into or updated after the date of enactment of this subsection.

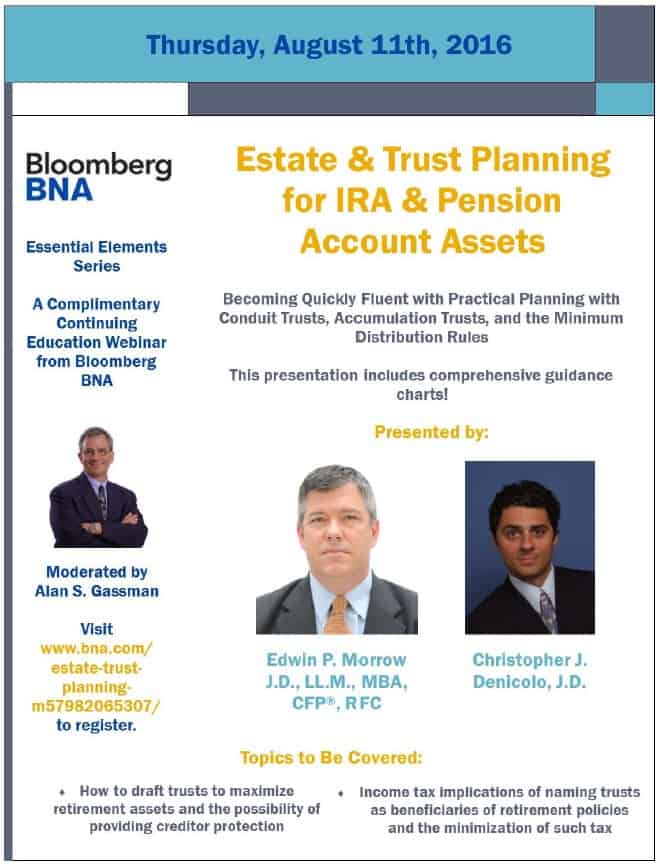

Webinar Spotlight

Estate & Trust Planning for IRA & Pension Account Assets

with Edwin Morrow and Christopher Denicolo

Please click here to register for this presentation.

Thoughtful Corner

The Overwhelmed Solution:

An Interview with Dr. Srikumar Rao

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and is the author of Happiness at Work and Are You Ready to Succeed?, which has been published in over 60 languages. You can visit Dr. Rao’s website at http://theraoinstitute.com/.

The following was excerpted from the webinar “An Ethical Framework for Dealing with Challenging Situations,” presented on Tuesday, June 28th, 2016. To obtain a copy of this webinar, please email stephanie@gassmanpa.com.

Alan Gassman (AG): One thing I want to talk about is feeling overwhelmed and what it can entail, because we find that when clients or other lawyers come to us with issues, oftentimes they were simply overwhelmed with a situation. Their judgment was destroyed or altered, and they didn’t think things through. In today’s world, we are running around trying to get all of our tasks done, so how do we do that responsibly and in a way that won’t make us feel overwhelmed?

Dr. Srikumar Rao (SR): There is actually a very simple solution to this, Alan. It is simple; I didn’t necessarily say it is easy, but with a little bit of practice, you will find that it makes a huge difference in your emotional domain, and this can happen in less than a week. So let’s first talk about that feeling of being overwhelmed. The feeling of being overwhelmed generally has two components. “There is so much to do that I can’t possibly do all of it as well as I would like” is the first component, and the second part of it is a general feeling of inadequacy, a feeling that, in some way, you’re not fulfilling your potential, and it is somehow your fault.

So there’s a feeling of inadequacy on top of a feeling that there is too much to do. You feel inadequate as a person because if you were efficient, obviously, you would be on top of everything and not be feeling overwhelmed. The first thing you have to do is recognize that thoughts like that are just in your head. As we go through the day, sometimes we feel overwhelmingly confident. Sometimes we’ll feel, “Yes, this is a case I can handle” or “This is a client I can do a great deal of good work for.” The feeling of being inadequate is just another feeling like that in your head. The feelings of, “Oh my god, this case is beyond me. There are too many complexities. I don’t have the slightest idea of how to deal with it,” are just parts in our heads. It doesn’t exist out there in the world. It’s just in your head.

So the point is, a thought in your head is like a cloud in the sky. You look up at the sky at any given moment, and there are a bunch of clouds, and you shut your eyes and take a nap, and when you open your eyes again, the clouds are gone, and there might be a different set of clouds in the sky. So recognize that when you are feeling overwhelmed, it’s just in your head, and if you can observe those feelings as just fleeting thoughts, like clouds, rather than being carried away in them and getting stuck in an emotional domain where you feel inadequate, you can step back and watch yourself thinking that you can’t handle it, and anchor yourself in what I call the “witness state.”

When you are in the witness state, you simply observe yourself as you would observe a cloud. Feeling overwhelmed, it’s just in your head, so when you go into the witness state, the feeling of overwhelmed is simply something you can observe as opposed to something that carries you away into an emotional domain that can do you a lot of damage. Having done that, what you then do is start thinking about all of the many things you need to do and pick any one that you prioritize as being the most important thing to do. Start doing that one thing without thinking about all of the other things that you could have done or perhaps should have done and maybe won’t get to.

Think of your life as an hourglass. In the hourglass, there is a bunch of sand in the top and a bunch of sand in the bottom, and it is connected by a very narrow neck, and through that neck, only one grain of sand can go through at a time. The grain of sand is the task at hand. So what you should do is you should not think about the stuff that you have done, which are all of the grains of sand on the bottom of the hourglass, and you should not think about the massive amount of stuff that you still have left to do, which are all of the grains of sand on the top of the hourglass. You are simply going to focus on the one grain of sand that is going through the neck of the hourglass at that moment, and that is the task you are going to focus on until it’s done.

This is difficult, because most of us are scatterbrained, but if you practice this, you’ll find that it is easy to do. You can learn to keep all of the overwhelming thoughts turned off and focus completely on the one grain of sand. When you do that, two things happen. One, the feeling of being overwhelmed leaves you, and two, you actually get a heck of a lot more done than you thought you would be able to.

AG: Well, that’s fascinating, Srikumar. So you become, as you say, not yourself with all of these thoughts, but the witness to yourself, separated from all these thoughts?

SR: The observer of your parts, correct.

AG: So in sitting down and making a list of things to do – I write all my things down, and then I prioritize them – that forces me to be a witness.

SR: Yes. In doing something like that, you are the person who is organizing. You are the witness. You are not lost in overwhelmed thoughts. Yes.

AG: What else can someone do to become a witness?

SR: Well, I would strongly urge for someone to set up a meditation practice. There is a book I recommend – The Art of Meditation by Joel Goldsmith – which describes in great detail both how to meditate and what its benefits are. If you set up a meditation practice and spend some time deliberately cultivating the ability to train your focus on where you would like it to be or go, you will find that this becomes a comfortable skill. It also helps if you get into yoga, because mindfulness is a part of something like that as well, so there are many things you can do like that to improve your ability to practice what I just said.

Stay tuned for more with Dr. Rao in upcoming Thursday Reports and live webinar presentations.

Humor! (Or Lack Thereof!)

Sign Saying of the Week

*************************************

In the News

by Ron Ross

Among those Republican notables who skipped the Republican National Convention last month were Clint Eastwood’s Empty Chair, made famous by its appearance at the 2012 Republican National Convention.

When asked, the Empty Chair claimed a scheduling conflict.

Upcoming Seminars and Webinars

Calendar of Events

LIVE COMPLIMENTARY WEBINAR:

Lester Perling and Alan Gassman will present a free, one-hour webinar on the topic of FRAUD AND ABUSE LAWS AS APPLIED TO DRUG TREATMENT CENTERS.

There will be two opportunities to attend this presentation.

Date: Tuesday, August 9, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

FLORIDA’S PREMIER BEHAVIORAL HEALTH ANNUAL CONFERENCE

Alan Gassman and Lester Perling will be speaking at Florida’s Premier Behavioral Health Annual Conference, sponsored by The Florida Alcohol and Drug Abuse Association and The Florida Council for Community Mental Health. The 2016 conference theme is Providing Value in Challenging Times and examines the latest advances in the fields of substance use disorders and mental health.

Alan and Lester will be speaking on the topic of ETHICAL AND LEGAL MARKETING FOR TREATMENT CENTERS.

Date: August 10th – 12th, 2016 | Alan & Lester will speak on 8/10/16 at 11:00 AM – 12:30 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: For more information or to register for this conference, please visit http://www.bhcon.org/. You may also email Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

FREE LIVE BLOOMBERG BNA WEBINAR:

Edwin Morrow and Christopher Denicolo will present a one-hour webinar on the topic of ESTATE & TRUST PLANNING FOR IRA & PENSION ACCOUNT ASSETS.

This webinar is part of the Essential Elements series moderated by Alan Gassman.

Date: Thursday, August 11th, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

The Ameriprise Clearwater branch office, in conjunction with The Tampa Bay Gay and Lesbian Chamber of Commerce, will be hosting an event centered on LGBT estate planning, featuring Alan Gassman’s presentation on PRACTICAL PLANNING FOR MARRIED AND UNMARRIED COUPLES.

Date: August 18th, 2016 | Time To Be Determined

Location: Safety Harbor Resort & Spa | 105 N Bayshore Drive, Safety Harbor, FL, 34695

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Philip Nelson at philip.nelson@ampf.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Stacey Eastland and John Porter will present a one-hour webinar on the topic of 2704 PROPOSED REGULATIONS. This webinar will be moderated by Alan Gassman.

Date: Thursday, August 25th, 2016 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this presentation, please email agassman@gassmanpa.com or stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Jay Adkisson and Alan Gassman will present a free, one-hour webinar on the topic of JAY ADKISSON’S MUSINGS ON CAPTIVE CARRIERS.

There will be two opportunities to attend this presentation.

Date: Tuesday, August 30, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Marty Shenkman and Alan Gassman will present a free, 30-minute webinar on the topic of AVOIDING FAMILY STRIFE FOR ELDERLY CLIENTS BY HAVING A SUPPORT TEAM IN PLACE.

There will be two opportunities to attend this presentation.

Date: Thursday, September 8, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Al Gomez and Alan Gassman will present a free, 30-minute webinar on the topic of FRAUDULENT TRANSFERS UNDER FLORIDA LAW.

There will be two opportunities to attend this presentation.

Date: Tuesday, September 27, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

58th ANNUAL FLORIDA BANKERS ASSOCIATION TRUST & WEALTH MANAGEMENT CONFERENCE

Alan Gassman will be speaking at the 58th Annual Florida Bankers Association Trust & Wealth Management Conference on the topic of PLANNING TO AVOID AND HANDLE ESTATE AND TRUST DISPUTES.

Date: Thursday, September 29th, 2016 | 4:15 PM – 5:15 PM

Location: The Ritz-Carlton Sarasota | 1111 Ritz Carlton Drive, Sarasota, FL, 34236

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Sandra Greenblatt and Alan Gassman will present a free, 30-minute webinar on the topic of AVOIDING THE TRAPS IN EMR/TECHNOLOGY CONTRACTS.

There will be two opportunities to attend this presentation.

Date: Thursday, October 20, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Sean Healy and Alan Gassman will present a free, 30-minute webinar on the topic of GUN TRUST UPDATE – NEW RULES AND REGULATIONS YOU NEED TO KNOW ABOUT.

There will be two opportunities to attend this presentation.

Date: Tuesday, October 25, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MAUI PRESENTATION:

2016 MAUI MASTERMIND WEALTH SUMMIT

Alan Gassman will be speaking at the 2016 Maui Mastermind Wealth Summit with David Finkel and others. This event will connect attendees with many Maui Mastermind Wealth Advisors such as Alan. Details on his topics and the event are forthcoming, so watch this space!

Date: December 4th – December 9th, 2016

Location: The Fairmont Kea Lani Maui | 4100 Wailea Alanui Drive, Maui, HI, 96753

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking on the following topics at the Medical Education Resources (MER) Internal Medicine for Primary Care event:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates!

LIVE SOUTH BEND, INDIANA PRESENTATION:

42ND ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please put Thursday, October 27th and Friday, October 28th on your calendars for the 42nd Annual Notre Dame Tax & Estate Planning Institute. To see the complete schedule and for registration details, please click here.

Date: Thursday, October 27th, 2016 and Friday, October 28th, 2016

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN, 46601

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Date: Thursday, February 9th, 2017

Location: To Be Announced

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, May 5th, 2017 and the weekend that follows on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples with the person or persons of your choice. Watch this space for more details to be announced!

Date: Friday, May 5th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is DYNAMIC PLANNING STRATEGIES THAT YOU ALREADY KNOW ABOUT BUT HAVE NOT YET APPLIED.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau Bahamas

Stay tuned for more information about these events!

Date: Speaker dates are to be determined.

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

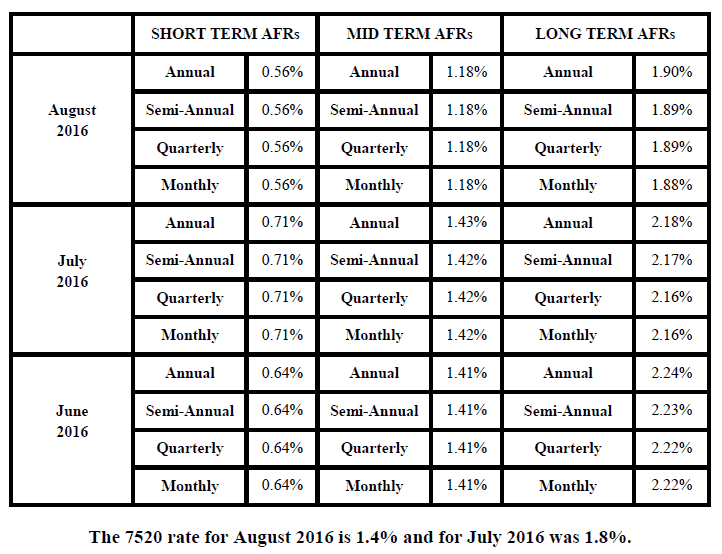

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.