The Thursday Report – 2.12.15 – We Have Never Been in a War Helicopter

Delaware Trusts and the Statute of Limitations

Big Changes to the Rising Costs of State University Tuition

Obtaining a Taxpayer Identification Number

The New Rules of Estate Planning Question & Answer

Gregory Gay’s Corner – Health Care Surrogate Designations

Richard Connolly’s World – When a Will is Not Enough and Law School is Buyers’ Market with Top Students in Demand

Thoughtful Corner – Let’s All Slow Down by Gregory W. Coleman, President of the Florida Bar

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Delaware Trusts and the Statute of Limitations

by Travis Arango

TrustCo Bank v. Mathews is an ongoing Delaware case in which the judge has determined that a self-settled spendthrift trust will not be accessible to a creditor who has claimed that the grantor maintained “impermissible control” over property transferred to it. This will be the first of our continuing coverage and analysis of this important case.

Executive Summary:

TrustCo Bank v. Mathews is a case that involves a potential fraudulent transfer and an attempt by a creditor to gain access to these funds. The issue of whether the transfers are fraudulent was never discussed as a more pressing issue arose: whether the statute of limitations had run and which state’s statute applied. The case involved contacts in Delaware, Florida, and New York. The plaintiffs argued that New York law applied, while the defendants argued that Delaware or Florida law applied. You can probably guess that New York has the longer statute of limitations while Delaware and Florida have shorter statutes. The plaintiffs also contended that Ms. Mathews maintained impermissible control over the property that was transferred and thus, the Qualified Dispositions in Trust Act (QDTA) does not apply. The court stated, “I find it unnecessary to resolve the question of whether, in this case, the QDTA requires application of Delaware’s fraudulent transfer statute of limitation without regard to the normal choice of law analysis or the borrowing statute.” In the end, the plaintiff’s claims were barred for many reasons, regardless of which state law was used.

Facts:

In TrustCo Bank v. Mathews[1] the plaintiff TrustCo Bank had given a loan for $9,300,000 to the defendant StoreSmart, a Florida LLC. Ms. Mathews, a resident of Florida, had personally guaranteed the loan. Mathews had created three Delaware trusts in 2006. StoreSmart defaulted on the loan in 2011, and a foreclosure action was filed against it. A judgment was rendered in 2011 in favor of TrustCo for $8.2 million. TrustCo assigned its right in the foreclosure judgment to ORE in 2012. Plaintiffs, ORE and TrustCo, claimed that the transfers to the three trusts were fraudulent. However, the issue of whether the transfers were fraudulent or not was not reached by the court since the issue became whether the statute of limitations had run. “The parties dispute whether the initial transfers that funded the Three Trusts were fraudulent at all…however, I need not resolve this dispute.”[2]

There were two sets of transfers that occurred in January of 2007 where Ms. Mathews transferred stock to two of the trusts. The Plaintiffs claimed that they did not have sufficient notice of the transfers until July 19, 2011. Defendants stated that the Plaintiffs had multiple occasions of notice. One such time was when Ms. Mathews presented a financial statement showing a net worth of $11,773,446 on March 25, 2008. Then on April 11, 2008, a revised statement was sent to TrustCo showing her net worth at $5,578,857, and disclosed the presence of new irrevocable trusts. This statement also included information on the trusts.

The issue became what state statute of limitations would apply: Florida, Delaware, or New York. Under New York law, the statute of limitations states that a claim must be brought within “the greater of six years from the date the cause of action accrued or two years from the time the plaintiff or the person under whom the plaintiff claims discovered the fraud, or could with reasonable diligence have discovered it.”[3] Under Delaware law, a claim must be brought “within 4 years after the transfer was made or the obligation was incurred or, if later, within 1 year after the transfer or obligation was or could reasonably have been discovered by the claimant.”[4] Florida’s statute of limitations is the same as Delaware’s. The court stated that if Delaware or Florida’s statute applies then the transfers are outside the limitations period.

There is a general rule that the court is to apply the forum state’s statute of limitations. However, Delaware modified this rule with its “Borrowing Statute,” which states:

Where a cause of action arises outside of this State, an action cannot be brought in a court of this State to enforce such cause of action after the expiration of whichever is shorter, the time limited by the law of this State, or the time limited by the law of the state or country where the cause of action arose, for bringing an action upon such cause of action. Where the cause of action originally accrued in favor of a person who at the time of such accrual was a resident of this State, the time limited by the law of this State shall apply. [5]

The Delaware Supreme Court has stated that there are some situations where the Borrowing Statute does not apply.[6] The exception to the statute is only when absurdity would result. The plaintiffs attempted to argue that the dispute arose only out of New York, and that it would not be fair to use the Borrowing Statute. However, the court stated that the contacts to New York are not as important as the plaintiffs claim. [7]

The court used the “most significant relationship” test to determine what state the cause of action arose out of. The court held that Florida had the most significant relationship, with Delaware a close second, and New York being last. The court was careful to point out that, even if it had found that New York has the most significant relationship, there is nothing in the facts that would allow an exception to the Borrowing Statute rule. Thus, the court held that the stock transfer claims were barred by the statute of limitations.

The court then gave an analysis as if the New York statute of limitations applied. The court held that, even if it applied, the claim was still barred. New York law has a duty of inquiry, which reads as follows:

“Where the circumstances are such as to suggest to a person of ordinary intelligence the probability that he has been defrauded, a duty of inquiry arises, and if he omits that inquiry when it would have developed the truth…knowledge of the fraud will be imputed to him.” [8]

The defendants had shown evidence of four other dates prior to July 19, 2011, where the plaintiffs had notice of the allegedly fraudulent transfer. The evidence consisted of deposition testimony in 2010 where the transfers were discussed. Thus, this shows that TrustCo had an official that was aware of the transfers by July 2010 and because they filed suit in March 2013, their claims were untimely under New York law.

Comment:

Vice Chancellor Parsons’ opinion is extremely well-written. I appreciate his thoroughness because most opinions will select the law that is to be used and just analyze it from that perspective. Here, however, Vice Chancellor Parsons not only applied the correct law but also analyzed the issues under the other laws in case he chose the wrong state law from the outset. This does not leave the reader guessing as to what would have happened if another state statute of limitations had applied. The analysis given seems correct and helps to support the proposition that asset protection trusts situated in states that have favorable statute of limitations and “borrowing” statutes can have important advantages for those who wish to protect their assets from creditor situations that have not yet arisen.

**********************************************

[1] A copy of the case can be found at http://courts.delaware.gov/opinions/download.aspx?ID=218050

[2] Id.

[3] N.Y. C.P.L.R. § 213(8).

[4] 6 Del. C. § 1309.

[5] 10 Del. C. § 8121.

[6] The court goes on to talk about Saudi Basic Industries Corp. v. Mobil Yanbu Petrochemical Co. 866 A.2d 1 (Del. 2005). In this cause, a Saudi Arabian sued his joint venture partners in Delaware. Saudi Basic argued that the Borrowing Statute required the court to use the Delaware statute of limitations. However, the court did not apply the statute because under Saudi law, the claims were “eternal,” and had no limitation period. The court held that applying the statute would “subvert the statute’s fundamental purpose…” Id. At 18-19.

[7] The court cited to Juran v. Bron 2000 WL 1521478 (Del. Ch. Oct. 6, 2000) and stated that this situation is not as severe as the facts in Juran.

[8] Gutkin v. Siegal, 926 N.Y.S.2D 485, 486 (A.D. 2011) (quoting Armstrong v. McAlpin, 699 F.2d 79, 88 (2d Cir. 1983)) (internal quotations omitted).

Big Changes to the Rising Costs of State University Tuition

by Travis Arango

Florida has been called many things, such as the Sunshine State or the Gunshine State, but what we should be known for is affordable state colleges. Florida has seven schools in the top seventy top values in public colleges and universities. Of the Top 10, the University of Florida, which comes in at number three, has the lowest total in-state cost.1 These costs will only get better, as House Bill 851 takes effect.2

House Bill 851 became law July 1, 2014. It reduces future costs at state universities. The bill accomplishes this by limiting increase of the Tuition Differential Fee that occurs annually. The maximum increase has been changed from 15% to 6%.3

People who purchased Florida Prepaid plans can already see these effects. Florida Prepaid sent out a letter stating that because of these changes, the monthly price has been drastically reduced. One customer had his monthly price of $879.52 reduced to $443.69. This decrease will add up to a total savings of $23,970.65 for that particular plan. This particular customer even got a refund check based on an overpayment to the account because of these changes. This is a serious change that any parent should be happy about.

If someone with an 8 year old child plans for that child to go to college in 2025 when they are 18, the monthly payment plan is $250.80, the 5 year payment plan is $522.69 and the lump sum payment is $27,250.34.

It is good to see that Florida is taking steps to stop the rise of education costs and to slow down the student loan debt crisis that many young Americans face today and will face in the future. This is certainly a step in the right direction and a big step nonetheless.

To see a copy of House Bill 851, please click here.

For more information about this topic, please click here.

****************************************************

1 Kiplinger’s Best College Values

2 Bill Text

3 Tampa Bay Times. “Florida Gov. Rick Scott signs bill to give in-state tuition to undocumented students.” June 9, 2014.

Obtaining a Taxpayer Identification Number

The following details how to obtain a taxpayer identification number and is excerpted from our New Entity Formation Letters.

Taxpayer Identification Number Application (Form SS-4):

Please click here to download the Form SS-4 Application for Employer Identification Number.

A taxpayer identification number can be obtained for [NAME OF ENTITY] in one of several ways. Please indicate which of the choices below you would prefer to use in order to obtain a taxpayer identification number. We typically suggest using alternative A, whereby you can simply execute the attachments and send them to our office so that we can handle this on your behalf with the IRS.

- Our office can contact the IRS on your behalf by internet to obtain the taxpayer identification number (“EIN”). This procedure requires that we have a signed and completed Form SS-4 (Taxpayer Identification Number Application) in our possession, which can be faxed, e-mailed, or physically given to us. If you want us to contact the IRS in this manner, please sign the attached Form SS-4, insert your social security number at Item 7b, and return the form to us by fax, email, or mail.

- You can fax the signed and completed Form SS-4 to the Internal Revenue Service at FAX-TIN: 1-631-447-8960. You must provide your fax number so that the IRS can fax the EIN back to you, which fax should be sent within 4 business days. By using this procedure, you are authorizing the IRS to fax the EIN without a cover sheet. Please feel free to provide the IRS with our fax number if you want us to receive this information from them.

- You can obtain this on the Internet (instantaneously) by going to irs.gov with the attached SS-4 form and answering the questions consistent with how we have filled out this form. After logging onto the website, select “Online EIN Application” located on the left-hand side under Online Tools. Scroll down and click on “Apply Online Now.” Please note, the information contained under the Third Party Designee portion of the form we have provided is only necessary when our office is applying for the EIN and not relative to the online process. Once you have completed the online application, an EIN will be issued immediately. You will be given the option of printing out an official letter awarding the EIN, and we recommend that you print this letter for your records and please provide your accountant and our office with copies.

In addition to applying for a taxpayer identification number, you will also need to apply for, register for, or comply with any and all other tax or governmental requirements, including but not limited to state sales tax, social security withholding, federal unemployment tax, state unemployment insurance tax, state corporate income tax, state intangible tax, county intangible and tangible tax, workers’ compensation, state and local occupational licenses, etc. Some of these may not be applicable to your particular business.

The New Rules of Estate Planning Question & Answer

A few months ago, we received the following email from a client:

Alan,

I read a Wall Street Journal article this weekend on “The New Rules of Estate Planning.” It mentioned that exemption equivalent trusts aren’t needed anymore due to the portability of the estate tax exemption between married couples (which we’ve discussed). It went on to say that the trusts may hurt tax-wise due to the loss of step-up in basis at the first death.

What are your thoughts on this, and should we meet to discuss?

Thanks for your thoughts,

John Client

We responded with the following email:

John,

The portability allowance does not grow with the CPI, and a credit shelter trust formed on the first death can grow as the investments grow. The portability allowance is lost or reduced if the surviving spouse remarries and the new spouse dies before the surviving spouse and leaves no such allowance, or leaves a smaller allowance, or has a personal representative that refuses to fill out the necessary estate tax return forms to allow for the allowance.

We do have new language that we use to give the surviving spouse and the Trustees the ability to decide whether to use portability or fund the credit shelter trust after the first death, and to also allow for a stepped up basis on the second death to allow for capital gains avoidance if the estate tax goes away or is less than the capital gains tax up the road.

It would be easy to add this language to your existing trusts.

It never hurts to have a sit-down review of where you stand. Please let me know if you have any other questions, thoughts, or comments.

Best regards,

Alan Gassman

To see the Wall Street Journal article in question, please click here.

Gregory Gay’s Corner

Health Care Surrogate Designations

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

This week Gregory Gay’s series continues with a brief conversation on health care surrogate designations, including what this means, what role the surrogate plays, and how a health care surrogate can be established.

Health Care Surrogate Designations

A person is presumed to be capable of making health care decisions until determined to be incapable of making such decisions. A patient is considered incapable of making health care decisions only after the patient’s attending physician gives an opinion that the patient lacks the mental ability to make health care decisions or give informed consent. The attending physician will indicate this in the patient’s medical chart.

Before becoming incapacitated, a person can sign a written document that names another person as a surrogate to make his or her health care decisions. This document must be signed by the person making the designation in the presence of two adult witnesses. A person physically unable to sign this document may, in the presence of two subscribing witnesses, direct that another person sign the document for him or her. The person who is to serve as the surrogate cannot serve as a witness to the signing of the document. At least one of the witnesses must be someone other than the patient’s spouse or blood relative. A document designating a health care surrogate may also designate an alternate surrogate. The alternate surrogate may assume his or her duties as surrogate if the person originally named as surrogate is unwilling or unable to perform his or her duties.

A health care surrogate has the authority to make all health care decisions for the person during a time of mental incapacity. A person may designate a separate surrogate to consent to mental health treatment in the event he or she is determined by a court to be incompetent to consent to mental health treatment and a guardian advocate is appointed.

The surrogate must make all health care decisions in accordance with the previous instructions of the person for whom he or she is serving. Health care decisions include consenting, refusing to consent, or withdrawing consent to any and all heath care, including life-prolonging procedures. If there is no indication of what the principal would have chosen, the surrogate may consider the patient’s best interest in deciding that proposed treatments are to be withheld or that treatments currently in effect are to be withdrawn. Health care decisions also include applying for private, public, government, or veterans’ benefits to defray the cost of health care. A health care surrogate also has the right to access all medical records of the person who designated him or her that are necessary for the health care surrogate to make decisions involving health care and to apply for benefits.

A surrogate’s authority to make health care decisions remains in effect until there is a determination that the person who signed the health care designation has regained the capacity to make medical decisions. Upon the commencement of the surrogate’s authority, the patient’s spouse and adult children must be notified that such an appointment has been made and that the surrogate has the authority to make decisions for the patient.

If the surrogate is not able or not willing to make health care decisions according to the patient’s wishes and no alternate health care surrogate is named, the health care facility caring for the patient may seek the appointment of a health care proxy.

Next time, Gregory Gay’s series will continue with a discussion of the purposes and specifications of the Baker Act statute, as well as a look at Guardian Advocate Provisions under the Baker Act. If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

Richard Connolly’s World Double Header:

“When a Will is Not Enough” &

“Law School is Buyers’ Market with Top Students in Demand”

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the first article of interest is “When a Will is Not Enough” by Lindsay Gellman. It was featured in The Wall Street Journal on November 15, 2014.

Richard’s description is as follows:

When there’s a will, there’s a way – and sometimes an ugly family feud.

To head off bickering over your personal possessions, consider supplementing your will with a letter of instruction…

Unlike a will, the letter of instruction is not legally binding, but it can be a helpful road map for your family in your absence and can provide more detail than is customary in a will.

Please click here to read this article in its entirety.

Our second article of interest this week is “Law School is Buyers’ Market, with Top Students in Demand” by Elizabeth Olson. This article was featured in The New York Times on December 1, 2014.

Richard’s description is as follows:

Summer was waning and students were already packing for the fall semester, but Professor Daniel B. Rodriguez, dean of the Northwestern University School of Law, was still fielding phone calls from incoming students seeking to bargain down the tuition at the elite school.

“It’s insane,” Professor Rodriguez said. “We’re in hand-to-hand combat with other schools.”

In the new topsy-turvy law school world, students are increasingly in control as nearly all of the 204 accredited law schools battle for the students with the best academic credentials.

“Students are voting with their feet and demanding a better deal,” said Professor Rodriguez of Northwestern, who is also president of the Association of American Law Schools. “And they are willing to spend less,” he said, meaning they are seeking the best deal.

Please click here to read this article in its entirety.

Thoughtful Corner

Let’s All Slow Down

by Gregory W. Coleman

Gregory W. Coleman has been practicing law in Palm Beach County for more than two decades. He joined the Law Firm of Critton, Luttier & Coleman in 1995 and was named partner in June of 2000. In June 2014, he was sworn in as President of The Florida Bar. Coleman has been awarded the Florida Bar President’s Award of Merit by The Florida Bar three times; he is the first lawyer in Florida to receive such a distinction.

The following was published in The Florida Bar Journal in February 2015. You can see the original post by clicking here. Thanks to Gregory for allowing us to share this great article with our Thursday Report readers!

Let’s All Slow Down

Is it me or is the world we live in moving faster and faster? I remember the days when the only distraction at work was my phone, and it had a cord.

Today, we are bombarded with an endless array of digital information and communication. We feel compelled to constantly check our emails, text messages, Facebook page, Twitter account, voicemails, etc, etc, etc.

This never-ending cycle of checking our devices for mostly useless information has created a society of people who are constantly distracted and unable to focus on any one thing for more than five minutes. This is not a good thing.

Fifteen years ago, a trial lawyer could take a paper file and sit in a conference room undisturbed. He or she could spread out the pleadings, depositions, discovery, and exhibits and carefully, thoughtfully, and diligently create a strategy for the case. This quiet time was absolutely critical to creative and analytical thinking. As lawyers, this is what we were trained to do. He or she could really think about the case and use his or her education and training to properly prepare the matter for trial.

These uninterrupted blocks of time seem to be long gone. Today, the same lawyer often will not isolate himself or herself in the way necessary to conduct this thoughtful exercise. Instead, we run from email-created emergency to emergency. We are constantly putting out small fires or trying to avoid them.

Everyone today seems to expect an instant response to their instant communication. Often, if an email is not returned within 30 minutes, the client, opposing counsel, or managing partner is sending a follow-up email asking why you did not respond to this missive…and the cycle continues.

Additionally, instant communication sometimes creates an instant response often attached to an instant emotion. Fifteen years ago, if you received a nasty letter, you could dictate a nasty response, and it would take a day or so for you to get it back from your assistant. When you received the draft back, you would cross out all of the nasty parts of the response because there was a built-in cooling-off period. Today, people often respond with a visceral reaction due to the instant emotion.

So what do we do to combat this digital epidemic? We need to learn to use more self-control. We need to learn to use restraint. We need to take a deep breath and wait before we hit the “reply” button when we receive a nasty communication.

We need to slow down. This is easier said than done, but I am convinced we can do this together.

We also need to learn to step away from our devices. We need to re-engage with our surroundings. Watch a sunset or simply listen to the waves. Hug your child or loved one. Soak up a little bit of this beautiful world we live in, and remember, it won’t last forever.

Humor! (or Lack Thereof!)

Alan Gassman is back stateside again, but if you tried to email him while he was away on his tour of Italy, you might have received one of the following messages in return, written by Alan and Kristen Sweeney.

Rome

Great to hear from you, but I’m not at home-a,

I’m currently visiting the city of Roma.

There’s pasta to eat,

And a cool Pope to meet,

I hear the Pantheon’s just a big dome-a.

Did you know that Italy measures wine by the liter?

And the biggest church here is the home of St. Peter?

I’m so excited that I can

Go visit the Vatican,

I hope a Swiss guard is my greeter.

On seven great hills the city was founded,

By men raised by wolves- you could say they were “hounded.”

One killed the other,

Although they were brothers,

In this history Roma is grounded.

Marcia, Brent, and I are planning to visit,

Old Trevi Fountain, magical- is it?

Lots of museums,

And of course the Colosseum,

Before you toss your coin, kiss it!

Before you fret or say what a hack!

I’m definitely coming back.

Maribeth or Tina are your guides,

They are always on your side,

So that nothing you need you will lack.

Pompeii

I’ve left on a trip,

To a place pretty hip,

We are away to visit Pompeii.

There’s a whole lot here stewin’,

It’s more than just ruin,

I’ll tell Brent and Marcia you said hey.

Though Pompeii’s pretty tiny,

It’s famous from Pliny,

Who wrote all about it in a letter.

There was lots of destruction,

A population reduction,

Events not exactly for the better.

The gold and the cash

Were all trapped in the ash

When the great big volcano erupted.

Although you could say,

In a curious way,

Those assets could now be deducted.

If you should need help,

Give Maribeth or Tina a yelp,

(You can always bribe them with guava).

They’re totally free,

To take notes for me,

Until I’m done exploring the lava.

Upcoming Seminars and Webinars

LIVE WEBINAR:

John D. Goldsmith and Alan S. Gassman will present a webinar on BP OIL SPILL CLAIMS – IMPORTANT ISSUES FOR ADVISORS.

Date: February 17, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for this webinar, please click here or email agassman@gassmanpa.com for more information.

******************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on CRITICISM OF HYBRID INDEX LIFE INSURANCE PRODUCTS – WHAT THE HECK ARE THESE AND WHY ARE THEY BECOMING SO POPULAR?

Date: February 18, 2015 | 5:00 p.m.

Location: Online webinar

Please note the below announcements for subsequent installments of this series:

March 4, 2015 – Premium Financing in 22.5 Minutes

March 17, 2015 – Split-Dollar in 22.5 Minutes

March 31, 2015 – Comparing the Financial Strength and Risks Associated with Different Life Insurance Carriers

Gassman, Crotty & Denicolo, P.A., and The Thursday Report receive no direct or indirect compensation from any investment advisors and have no financial relationship with Barry Flagg or Veralytic. We thank Barry for putting together what we are sure will be an informative and objective program!

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY.

This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced. See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well. You can sign up for this free webinar by clicking here.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: February 19, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: February 21, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here.

To register for this program please email agassman@gassmanpa.com.

*******************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on PREMIUM FINANCING IN 15 MINUTES.

Date: March 4, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015 on HEALTHCARE TAX ISSUES.

To see the complete schedule for this program, please click here.

Date: March 6 – 7, 2015 ǀ Alan Gassman will speak on March 6 at 11:00 AM

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on SPLIT-DOLLAR IN 15 MINUTES.

Date: March 17, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

******************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

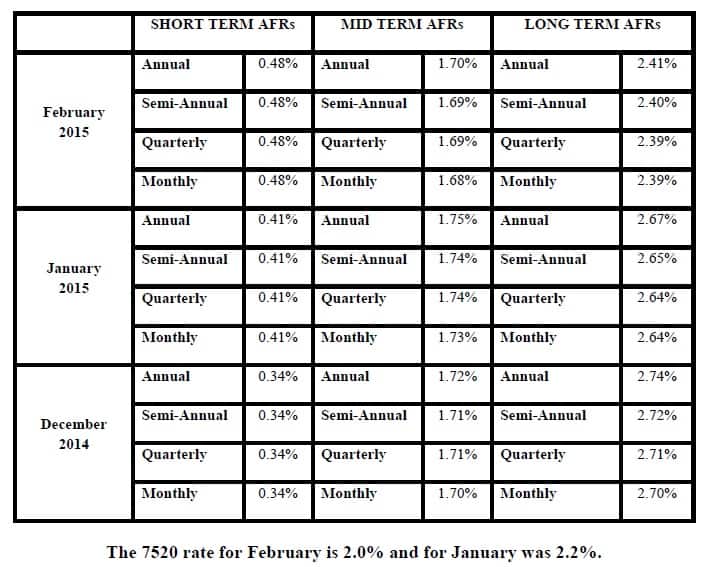

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.