The Thursday Report – 11.24.16 – Frosty the Turkeyman

Frosty the Turkeyman

Exceptions to Limited Liability with Respect to LLCs in Florida—There is Not Absolute Immunity from Liability for Those Involved in Management and Certain Circumstances

How to Avoid Florida Sales Tax Transferee Liability When Purchasing a Business

The Authority of Florida LLC Members and Managers – Statutory Changes – It is Not Common Sense Anymore

The Six Major Time Addictions by David Finkel

Webinar Spotlight: What to Expect After the Unexpected – Planning for the Probable and Possible Trump Tax Law Changes

Just Announced!: What Physicians and Advisors Can Expect Under the Trump Administration Webinar Series

Richard Connolly’s World – 529 Plan Gift Cards

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Frosty the Turkeyman

by Arlo Gassman Guthrie

(with help from Kristen Sweeney)

**The National Association of Poetry Reviewers

wishes to point out that it has not reviewed this poem**

Frosty the Turkeyman was a very happy bird,

Come Thanksgiving Day he could laugh and play,

which is what he had preferred.

Frosty the Turkeyman used to be a holiday elf,

But his whole life changed, became a bit deranged,

He hit his head on Santa’s shelf.

He thought there was some magic in that old Thursday Report.

But they ran out of good jokes and this poem was their last resort!

Oh, Frosty the Turkeyman didn’t know where he should be,

On Thanksgiving Day, or way down Christmas way,

So he’s happy and carefree.

Thumpety-thump-thump, Thumpety-thump-thump,

Frosty gobbles to and fro,

Thumpety-thump-thump, Thumpety-thump-thump,

Let’s not tell him that there’s no snow.

Oh, Frosty the Turkeyman said this is not working out,

And I know just why, and he heaved a high,

The writers all drank extra stout.

Now those technical articles are done and read just fine,

But the song has mixed its holidays up,

We had to get it out on time!

He thought there was some magic in that old Thursday report.

But they ran out of good jokes and this poem was their last resort!

Frosty the Turkeyman called an Uber on his way,

And he waved goodbye with his tail feathers high,

I’ll be back on New Year’s Day!

Thumpety-thump-thump, Thumpety-thump-thump,

Frosty gobbles to and fro,

Thumpety-thump-thump, Thumpety-thump-thump,

Let’s not tell him that there’s no snow.

HAPPY THANKSGIVING EVERYONE!!!

Quote of the Week

“Pride slays Thanksgiving, but a humble mind is the soil out of which thanks naturally grow. A proud man is seldom a grateful man, for he never thinks he gets as much as he deserves.”

– Henry Ward Beecher

Henry Ward Beecher was an American Congregationalist clergyman, social reformer, and speaker. He first received national attention when he became involved in the break between “New School” and “Old School” Presbyterianism, which were split over questions of original sin and slavery. Beecher was a strong supporter of the abolition of slavery, as well as many other social causes including women’s suffrage and temperance. He also became a champion of Darwin’s Theory of Evolution, stating that it was not incompatible with Christian beliefs. A Henry Ward Beecher Monument now stands in Brooklyn, New York.

Exceptions to Limited Liability with Respect to LLCs in Florida—

There is Not Absolute Immunity from Liability for Those Involved in Management and Certain Circumstances

by Michael Stone and Alan Gassman

A Limited Liability Company is an attractive option for people looking to start a business in Florida because of the limited liability provided to the LLC’s members and others. The general rule under Florida Statute § 605.0304(1) (2016) is that “a debt, obligation or other liability of a limited liability company is solely the debt, obligation, or other liability of the company. A member or manager is not personally liable, directly or indirectly, by way of contribution or otherwise, for a debt, obligation, or other liability of the company solely by reason of being or acting as a member or manager.”

However, various exceptions to the limited liability of an LLC exist at common law and these exceptions are codified by Florida Statute § 605.04093, “Limitations of liability of managers and members.” The exceptions must meet both of the elements listed as follows.

- The manager or member breached or failed to perform duty and (b) the breach or failure to perform consists of one of the following:

- Violations of criminal law unless the manager or member had reasonable cause to believe his or her conduct was lawful. FLA.STAT. § 605.0493(1)(b)(1) (2015). See generally Woodham v. Blue Cross & Blue Shield of Florida, Inc., 829 So. 2d 891, 897 (Fla. 2002)(explaining that “unable to conclude” equating to “reasonable cause” would be contrary to the plain language of the statute” in question)

- A transaction whereby the manager or member derived an improper personal benefit, indirectly or directly. FLA. STAT. § 605.04093(1)(b)(2) (2015). See STAT. § 605.04093(3) (stating a manager or member is not deemed to have derived an improper personal benefit for any transaction approved in Florida Statute § 605.04092 or fair under Florida Statute § 605.04092(1)(c))

- Improper distribution to the extent that exceeds the amount not in violation of Florida Statute § 605.405; to the extent the operating agreement relieves and imposes authority and responsibility to consent to distributions; A person who receives a distribution knowing that the distribution violated Florida Statute § 605.0405 is liable to the LLC but, only for the amount that exceeded the amount that could have been properly paid. This statute bars action after 2 years from the improper distribution. FLA. STAT. § 605.0406 (2015).It is important to note the key word “knowing”, as articulated in the statute, because this signifies that congressional purpose demands a finding of intent under this subsection. Omission of a duty may meet this standard or any other standard requiring willfulness, depending on the facts.

- In a proceeding or in the right by the LLC to procure a judgment in its favor or by right of a member for the conscious disregard of the best interest of the limited liability company, or willful Conscious disregard and willful misconduct can be construed as gross negligence. FLA. STAT. § 605.04093 (1)(b)(4). See FLA. STAT. § 605.04091(3) (Stating that the duty of care in the standard of conduct for members and managers includes gross negligence).

- In a proceeding or in the right by a person other than the LLC, “recklessness or an act or omission that was committed in bad faith or with malicious purpose or in a manner exhibiting wanton and willful disregard of human rights, safety, or property.” FLA. STAT. § 605.04093 (1)(b)(5). Typically, a showing of harm is required. See STAT. § 605.04093( 2) (Defining recklessness as acting or failure to act in conscious disregard of a known risk or risk so obvious, that the high probability of harm should have been known to result from the action or failure to act).This statute encompasses the common law doctrines regarding fraudulent intent and tortious conduct. If an LLC is organized with the intent to mislead or deceive creditors, such action is considered with purpose or in bad faith. Dania Jai-Alai Palace, Inc., v. Sykes, 450 So. 2d 1114 (Fla. 1984).If a member or manager of a LLC engages in tortious conduct, vicarious liability and other tort theories may pierce the protective veil that the LLC provides. See, e.g., Buckner v. Campbell, No. 09-22815-CIV, 2010 WL 5058314, at *2 (S.D. Fla. Dec. 6, 2010) (Establishing that tortious conduct of officer, director or agent attaches to the corporation when in furtherance of the business). See also In re USACafes, L.P. Litigation, 600 A.2d 43 (Del. Ch. 1991) (expanding fiduciary duty of care and loyalty down the corporate trail to entity possessing ultimate control when examining conduct within a structured LLC). Structured LLCs is a business or business managed by a parent business.

Other exceptions to limited liability not codified in Chapter 605 of Florida Statutes include: (6) a “responsible person” subject to failure to pay over US wage and associated withholding taxes under IRC Section 6672, (7) someone who should have assured that the company received and remitted Florida sales and use taxes under FS Section 212.08, (8) someone operating a company within the “vicinity of insolvency” as noted In re Trafford Distribution Center, Inc., 431 B.R. 263 (Bankr. S.D. Fla. 2010). (9) A member’s violation of a written obligation to make future contributions and (10) violation of an agreement prior to the to-be formed LLC being up and running.

In conclusion the courts will presume that individual members are not liable for the LLC unless the operating agreement for the company stipulates otherwise, or one of the above exceptions applies. See, e.g., FLA. STAT. § 605.0105.

How to Avoid Florida Sales Tax Transferee

Liability When Purchasing a Business

by Brandon Ketron, J.D., LL.M., CPA

An important step for the purchaser in the due diligence process is to determine if the seller is up to date on all of its sales tax obligations. When a business is sold, regardless of whether the sale is an asset sale or a stock sale, the unpaid sales tax liabilities will transfer to the new owner of the business, unless the below steps are taken.

In order to avoid the transfer of liability, either the purchaser or the seller can request that the Department of Revenue issue a Transferee Liability Certificate.

The seller can request this by filing a Form DR-842 with the Department of Revenue. The purchaser can request this by filing a Form DR-843 with a signed sales agreement attached.

Upon receipt of one of the above forms, the Department of Revenue will conduct an audit of the seller’s sales tax liability. The process typically occurs within 5-7 business days, but can be shorter or longer depending on the DOR’s workload.

If the seller obtains a transferee liability certificate, the purchaser will not be liable for any sales tax obligations that occurred prior to the issuance of the transferee liability certificate.

This relatively simply and quick process can provide peace of mind to the purchaser that he or she will not be responsible for the past mistakes or wrongdoing of a potential target.

The Authority of Florida LLC Members and Managers –

Statutory Changes – It is Not Common Sense Anymore

by Ken Crotty & Alan Gassman

The Florida Revised Limited Liability Company Act (the “Act”) was passed on May 3, 2013. The Act became effective for all new limited liability companies formed or registered to do business in Florida on or after January 1, 2014. As of January 1, 2015, it repealed the existing Florida LLC Act, which had been stated in Chapter 608. This existing Florida LLC Act, stated in Chapter 608, was passed in 1982 and was subject to several modifications through 2002.

We have noticed that there is significant confusion regarding the changes that have been made by the Act to the existing Florida LLC Act, that had been in Chapter 608. One change relates to the concept of statutory apparent authority, meaning the assumptions that can be made with respect to who or what entities have the authority to act to bind an LLC. Pursuant to the Act, a member is not automatically considered to be an agent of an LLC with the authority to bind an LLC. However, a member’s status as a member of an LLC does not prevent other sources of law from imposing liability on an LLC because of such member’s conduct.

The original Florida Limited Liability Company Act provided that members in a member-managed LLC had statutory apparent authority to act on behalf of the LLC. Managers in a manager-managed LLC also had the same statutory apparent authority. This concept of providing statutory apparent authority was based on the notion that the acts of a member or manager, as applicable, that appeared to carry on the usual business of the LLC would bind the LLC. The Act rejects this statutory apparent authority approach.

The concept of statutory apparent authority is logical for general and limited partnerships because a person dealing with such an entity can know by the form of the entity and the status of the partner if the partner has the ability to bind the entity. However, with an LLC, the ability of a member or manager to bind the LLC depends on whether the entity is manager-managed or member managed. The distinction between whether an LLC is member-managed or manager-managed is not apparent based on the name of the LLC, and is only apparent after reviewing the public record which shows who the manager is and/or by reviewing the operating agreement of the LLC which normally is not readily available to third parties.

The concept of statutory apparent authority had been developed to help protect third parties from exploitation in the context of dealings with general and limited partnerships. With an LLC, the distinction of authority between the authority of members and/or managers is not readily apparent, and can actually be a trap for a third party who does not check the public record. This problem is only made worse for third parties because of the wide range of management structures that can be provided for in operating agreements, and are permissible under the Act. To eliminate this problem, the Act has removed the concept of statutory apparent authority and requires the LLC publicly select whether the LLC is manager-managed or member-managed.

Under the Act, if an LLC is manager-managed, a member will not have the authority to bind the LLC if a third party dealing with the LLC knows that the LLC is managed-managed. This restriction on authority of a member also applies to situations where the member assures the third party that the LLC will stand by the member’s commitment to such third party. The member has no actual authority and the member’s status as a mere member prevents the third party from having a claim of statutory apparent authority. Even if the member honestly believes that the LLC will stand by a commitment made by the member, the member does not have the authority to bind the LLC. The member’s belief that the LLC will honor the member’s commitment is considered to be unreasonable, absent additional supporting facts, and as a result, the third party may not make a claim against the LLC that the member bound the LLC or was acting as its agent.

Under the Act, the member’s actual authority to bind the LLC is primarily dependent on the operating agreement. In some situations, circumstances and factors in addition to the operating agreement can be taken into account to determine the scope of the member’s actual authority. For example, if an LLC is a manager-managed LLC and the manager suddenly quits, the remaining members may request that a member step into the role of manager without appointing that member as an actual manager. If the other members manifest their ascent to the member assuming the new role, then such member will have the authority to bind the LLC notwithstanding the fact the member has not formally been appointed as a manager.

For member-managed LLCs, the Act provides that if two members form a member-managed LLC, absent provisions in the operating agreement to the contrary, neither member has the authority to commit the LLC to any matter outside of the ordinary course of business of the LLC. However, each of the members has the authority to commit the LLC to any matter that is in the ordinary course of the business of the LLC, provided that the member does not have any reason to think that the other member would disagree or would require consultation with respect to the act being taken.

As discussed above, the fact that a member is a member of a member-managed LLC does not by itself establish the authority of the member to commit any act. However, the member’s conduct of pattern can establish this. For example, if a member orders items from a third party signing as a member of the LLC and the LLC pays the third party, the third party could rely on the apparent authority of the member if there was a contest between the LLC and third party with respect to the member’s authority related to future purchases made by the member.

Even though the Act has eliminated statutory apparent authority, the Act specifically confirms that any other law outside of the Act which would cause the LLC to be liable for the conduct of a member may still be applicable. For example, an LLC could still be liable for the tortious conduct of a member or an LLC could still be liable if it is negligent in the supervision of the actions of the member who is acting on behalf of the LLC.

The common law of agency also still applies. As a result, when a third party deals with a member-managed LLC, what a third party knows or has reason to know related to the management of the LLC will be relevant. For example, the operating agreement may authorize a specific member to occupy a particular position or office in the LLC. Third parties interacting with such member may assume that the member has the authority to commit acts that are consistent with the title of such member’s position in the LLC, unless the third party has reason to know that such assumption may not be true.

The Six Major Time Addictions

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ business coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

Have you ever sat there at the end of the week wondering where the time went?

For 20 years I’ve been coaching business owners to scale their companies. During that time I’ve watched the things that habitually get in their way.

Here are what I consider to be the six most damaging Time Addictions™ that hurt entrepreneurs as they struggle to execute on their dreams and plans.

Please click here to continue reading this article on the Maui Mastermind website. You can also follow David on Twitter: @DavidFinkel.

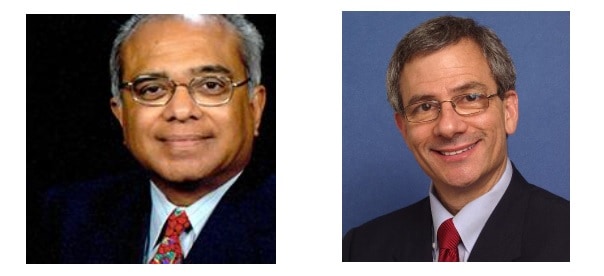

Webinar Spotlight:

What to Expect After the Unexpected –

Planning for the Probable and Possible Trump Tax Law Changes

James Barrett is the chair of the Miami office tax department and is a senior editor in Baker & McKenzie North America Tax Practice Group’s Tax News & Developments. He is the immediate past chair of the Florida Bar Tax Section. He has extensive experience in: (i) structuring offshore investments and transactions by U.S. multinationals; (ii) tax planning associated with cross-border mergers & acquisitions; (iii) advising clients with regard to tax issues arising in the formation, operation and liquidation of partnerships, and (iv) addressing issues relating to debt and equity investments in the U.S.

Mr. Barrett is recognized in Chambers USA tax in the Band 1 category, the highest ranking available. Mr. Barrett is the co-founder and legal counsel to CasaBlanca Academy, Inc., which provides a comprehensive program to address the unique sensory, perceptual and motor planning difficulties that many children with autism and developmental challenges have. Mr. Barrett is an adjunct professor at the University of Miami School of Law.

For more information about this webinar presentation, please email Alan Gassman at agassman@gassmanpa.com.

Just Announced!

What Physicians and Advisors Can Expect Under the

Trump Administration Webinar Series

Richard Connolly’s World

529 Plan Gift Cards

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “Want to Help Pay for a Child’s College? Grab a Gift Card” by Ann Carrns. This article was featured in The New York Times on October 5, 2016.

Richard’s description is as follows:

Parents are often reluctant to solicit gifts for their children’s college funds, even though they might prefer a gift of cash to another stuffed animal. But friends and relatives will soon have an option to contribute to a 529 saving account without being asked.

Giftofcollege.com, a registry for online gifts to 529 accounts, will make plastic 529 gift cards available at Toys “R” Us and Babies “R” Us retail stores, said Wayne Weber, founder and chief executive of Gift of College Inc.

The first cards are scheduled to be available starting Friday at stores in California, where the state’s ScholarShare College Savings program is the first 529 plan to join with Gift of College to market the co-branded cards in stores.

On Nov. 7, the 529 gift cards should be available at the retail chain nationally.

Please click here to read this article in its entirety.

Humor! (Or Lack Thereof!)

Sign Sayings of the Week

**********************************************************

**********************************************************

In the News

by Ron Ross

Kanye West was taken to the hospital this week after acting erratically.

When asked about his unusual behavior, the people who took him to the hospital

reported that he was seen reading a book.

Upcoming Seminars and Webinars

Calendar of Events

LIVE MAUI PRESENTATION:

2016 MAUI MASTERMIND WEALTH SUMMIT

Alan Gassman will be speaking at the 2016 Maui Mastermind Wealth Summit with David Finkel and others. During this week-long event, Alan will be speaking on the following topics:

- Asset Protection and Estate Planning for Business Owners

- The Estate Planning and Asset Protecting “Choose Your Own Ending” Game

- The Language of Investing

- Engineering a Better Investment Deal

Thursday Report attendees will receive a free Mai-Tai with call brand liquor and their choice of a hula hoop or Hawaiian lei. Watch Don Juan sing the greatest hits of Conway Twitty on December 7th at 7:00 PM Hawaiian Time.

Date: December 4th – December 9th, 2016

Location: The Fairmont Kea Lani Maui | 4100 Wailea Alanui Drive, Maui, HI, 96753

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE FLORIDA BAR WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a Florida Bar Tax Section CLE Webinar entitled WHAT TO EXPECT AFTER THE UNEXPECTED: PLANNNG FOR PROBABLE AND POSSIBLE TRUMP TAX LAW CHANGES.

The surprising results of the election almost certainly will cause significant and numerous changes to the tax law. Clients and their advisors need to understand the possibilities and how to appropriately plan for them. This program will discuss the potential changes to the tax law, their impact on tax and estate planning, and what advisors can do to prepare for them, including discussion of planning with irrevocable trusts that can be unwound or altered if law changes occur.

Date: Wednesday, December 14, 2016 | 12:00 PM (Eastern)

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LORMAN EDUCATION SERVICES WEBINAR:

Alan Gassman, Ken Crotty, Christopher Denicolo, and Brandon Ketron will present a Lorman Education Services Webinar entitled THE MATHEMATICS OF ESTATE PLANNING.

Date: Thursday, December 15, 2016 | 1:30 PM (Eastern)

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LARGO PRESENTATION:

Alan Gassman will present a talk to Largo Medical Center Residents & Fellows on What New Doctors Need to Know about Money, Savings, Creditor Protection and Everything Else that Matters

Date: Thursday, December 29, 2016 | 12:00 PM (Eastern)

Location: Bilgore Conference Center | Largo Medical Center | 201 14th St. SW, Largo, FL, 33770

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SAN DIEGO PRESENTATION:

Alan Gassman will ASSET PROTECTION AND ESTATE PLANNING FOR SAVVY BUSINESS OWNERS AND PROFESSIONALS at the 2017 Maui Mastermind Freedom Formula Workshop. You’ll get a “charge” out of this, whether you are a San Diego fan or not.

Date: Friday, January 27, 2017 – Sunday, January 29th, 2017 | Time TBD

Location: Hilton San Diego Mission Valley | 901 Camino del Rio South, San Diego, CA, 92108

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

ANNUAL ALEXANDER L. PASKAY MEMORIAL BANKRUPTCY SEMINAR

Alan Gassman will speak on a panel discussion at the American Bankruptcy Institute’s annual Alexander L. Paskay Memorial Bankruptcy Seminar on the topic of THE ETHICS OF ASSET PROTECTION.

Date: Thursday, February 2, 2017 | Time TBD

Location: The Embassy Suites Tampa Downtown Convention Center | 513 S. Florida Avenue, Tampa, FL, 33602

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

51ST ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING EVENTS

Alan will speak at InterActive Legal’s display area on the topic of SHOWING CLIENTS HOW ESTATE TAXES WORK AND THEIR UNIQUE SITUATIONS – THE ESTATEVIEW SOLUTION on Tuesday, January 10 at 8:40 AM.

The Alan Gassman Channel and EstateView Software will be profiled and demonstrated at the InterActive Legal station Monday through Thursday during conference hours. Please feel free to contact Alan at agassman@gassmanpa.com for an appointment and personal tour of how EstateView works.

Alan’s Bloomberg BNA moderated webinar series will present live questions and answer opportunities at the Bloomberg BNA booth. Stay tuned for more details!

Date: January 9th – January 13th, 2017

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: IT IS HARDER THAN IT LOOKS

Alan Gassman and Lester Perling will give a panel discussion talk on Structuring Medical Practices and Related Entities for Tax, Creditor Insulation, and Regulatory Compliance Purposes

Other speakers at this event include William Eck, Susan Thomas, Melissa Mora, Sachi Mankodi, Kimberly Brandt, Al Gomez, Kathleen Premo, and Radha Bachman.

Other topics at this event include:

- The Brave New World of Medicare Physician Compensation Under MACRA and Beyond

- Office of Civil Rights HIPAA Audits – Preparing Your Clients and Yourself

- The Physician’s Role Under EMTALA and the Florida Access to Emergency Services Act

- Medical Marijuana in Florida – The Highs and Lows of its Regulation

- The Post-Election View from the Hill

- What the Doctor’s Lawyer and the Doctor Need to Know About Bankruptcy and How Creditors Approach Health Industry Related Situations

- Medicare and Other Risk Contracts

- Medical Entities and Rules You Must Know About

To download the complete schedule, please click here.

Date: Friday, February 3, 2017 | Alan speaks at 8:30 AM and 4:10 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE STETSON LAW SCHOOL PRESENTATIONS:

Do you need a positive jump start for 2017? Think about making a date with Srikumar Rao’s book Are You Ready to Succeed? followed by participation in one or more InterActive workshops that Professor Rao will lead in St. Petersburg, Florida, which are as follows:

Saturday, February 11, 2017

Professional Achievement Workshop with Dr. Srikumar Rao and Alan Gassman

Join Dr. Rao and Alan Gassman for a 6-hour interactive, very interesting workshop to enable recent law school graduates and others to reach new levels of enjoyment and achievement in your business or professions.

This is based on Alan’s workshop materials that have been presented on many occasions at the University of Florida, Ave Maria School of Law, State and City Bar conferences, and elsewhere. This workshop will be free of charge for law and MBA students; a donation will be determined for all other interested participants. This workshop includes free course materials and a subscription to The Thursday Report.

Sunday, February 12, 2017

The Anxiety Solution: How to Replace Worry and Stress with Clear Direction, Confidence, and Joyous Life Experience at Work and at Home with Dr. Srikumar Rao

This 6-hour workshop will be a private event held by the Rao Institute at the request of Alan Gassman and friends. This will be provided for a limited number of attendees as a cost of $475 per person. Please RSVP now while spaces are available!

See Dr. Rao’s YouTube TED Talk, and you will see why he is so well-regarded and sought out worldwide as a presenter, coach, and author. Meet this gentle and brilliant man who has changed so many lives up close and personal!

You can see his best-selling books, Are You Ready to Succeed? and Happiness at Work on Amazon by clicking here. You can also see his TED Talk that has been viewed by well over 1 million people by clicking here.

Sarah Palin said that she would not leave Nome without them!

The official invitations for these events can be viewed by clicking here for Saturday’s invite and here for Sunday’s invite.

Date: Saturday, February 11, 2017 and Sunday, February 12, 2017

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION (HOW MICKEY MOUSE CAN YOU GET?):

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

Alan Gassman will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT. Watch this space, as more details will be forthcoming!

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, April 28th, 2017 on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples.

Alan Gassman will be speaking at this conference on the topic of THE ETHICS OF AVOIDING TRUSTS AND ESTATE LITIGATION.

Date: Friday, April 28th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates!

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, and Jerry Hesch.

Date: Thursday, February 9th, 2017

Location: Johns Hopkins All Children’s Hospital Education and Conference Center, St. Petersburg, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017; Nassau: November 30th – December 3rd, 2017

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

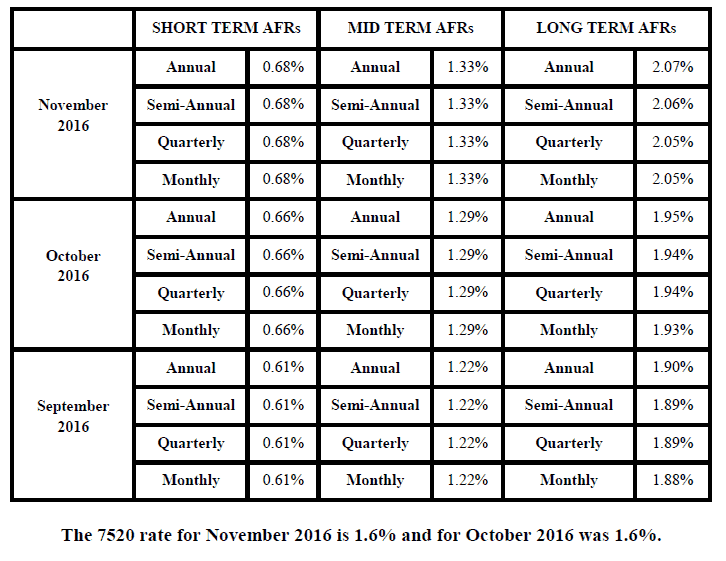

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.