The Thursday Report 11.13.14 – De Thursdayfying IRA Distribution Rules and Dress for Success

Planning for Inherited IRAs – Converting Treasury Regulations into English by Christopher J. Denicolo

Richard Connolly’s World – Court Ruling Sparks Rush to Shield IRAs

The Men’s Guide to Dressing for Success: A Guide for First Year Lawyers and Others by Travis Arango

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Planning for Inherited IRAs – Converting Treasury Regulations into English

by Christopher J. Denicolo

Understanding the retirement plan and IRA required minimum distribution payout rules has long been challenging for planners and their clients. The Treasury Regulations set forth the applicable rules in a somewhat complicated and convoluted manner. Many technical “terms of art” are used throughout the Regulations, and the language of the Regulations is difficult for laypersons and planners who do not have a great deal of experience in this area to comprehend and apply to their applicable situation.

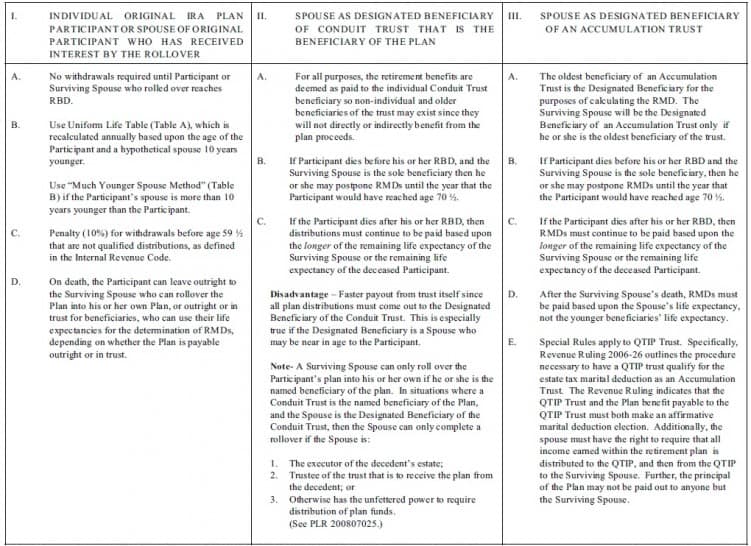

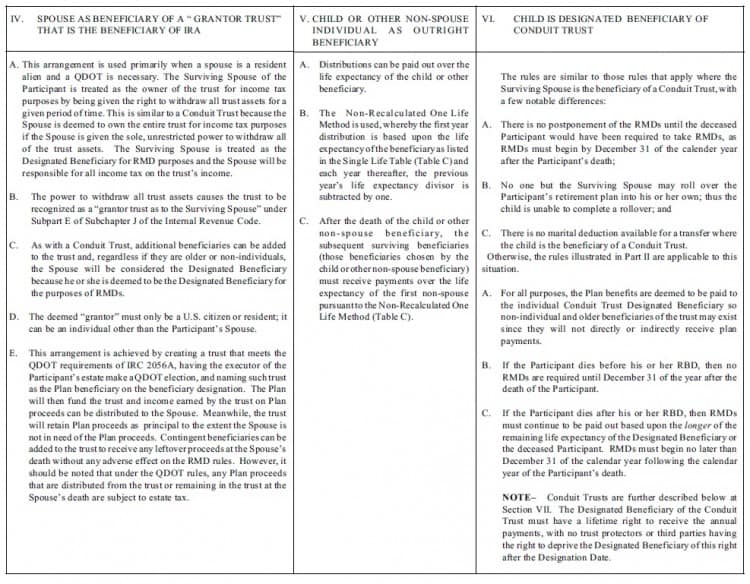

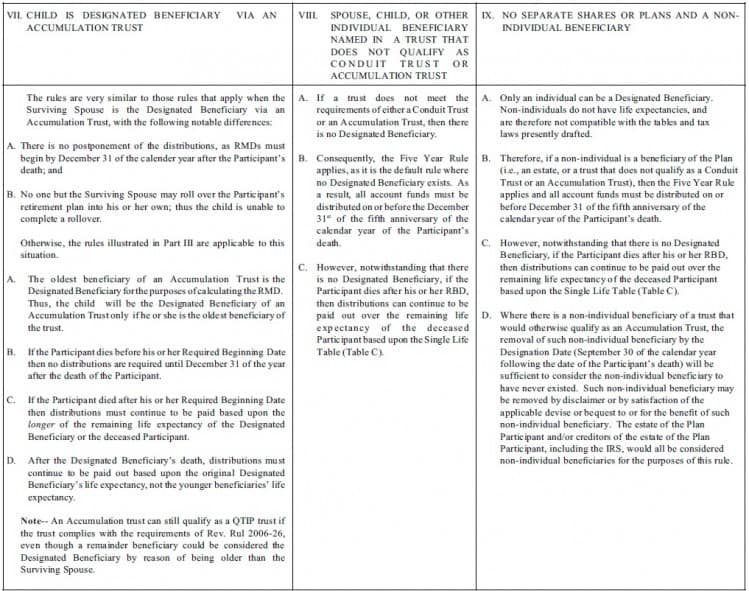

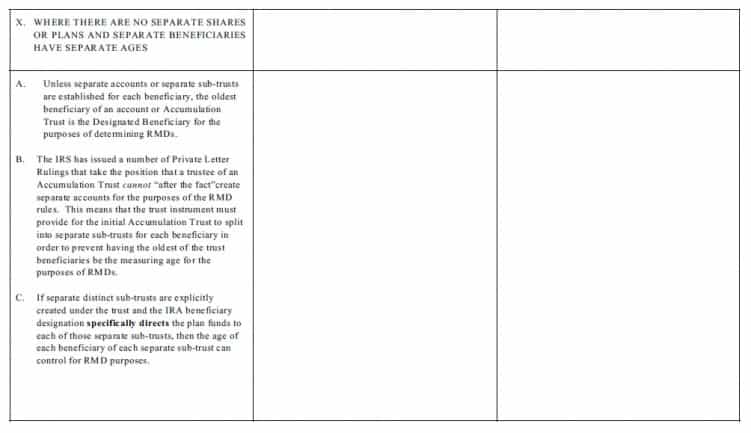

We have attempted to boil down and simplify these rules into the digestible charts and concise explanations below. The charts and explanations attempt to provide easy to understand definitions of key terms and rules, examples showing which required minimum distribution payout method must be used based on common situations and beneficiary designation structures, and the differences between the respective required minimum distribution payout methods.

We have spent countless hours working on these materials to simplify this complicated area for planners and their clients, and we hope that we have succeeded in helping you understand these rules.

PLAYERS AND DEFINITIONS:

PLAYERS:

IRA/Pension Plan/Plan/Retirement Plan. For the purposes of this booklet, we are using these terms interchangeably. The reader should be cautioned, however, that many pension plans and IRA custodians limit beneficiary designation rights, sometimes necessitating rollover to an IRA that will permit the desired planning configuration, whether before or after the death of the Participant.

Non-Person Beneficiary. An entity other than a person that may be the direct beneficiary of a qualified plan or IRA, or the beneficiary of a trust that is in turn the beneficiary of an IRA or plan.

Non-Spouse Beneficiary. Any Beneficiary other than the participant’s spouse.

Original Participant or Participant. The person who is the IRA owner or pension plan participant.

Participant’s Spouse/Surviving Spouse. For the purposes of this booklet, we are using these terms interchangeably. The individual who is married to the participant under federal law, including same sex married couples that are recognized as married under federal law.

Person. An individual.

Designated Beneficiary. The individual beneficiary whose life expectancy will be used for purposes of determining the RMDs that will apply to a given trust. The term will be discussed later in this booklet.

DEFINITIONS:

- Accumulation Trust (as referred to by Natalie Choate) or “See-Through Trust.” A trust where the RMD rules apply to a Designated Beneficiary who is the oldest individual beneficiary of the trust. Such trust can have no Non-Person Beneficiaries after September 30 of the calendar year following the death of the Participant. The Trustee can accumulate RMDs received from a plan, unlike a Conduit Trust where RMDs must flow out to the Designated Beneficiary.

Powers of appointment in an Accumulation Trust should be exercisable only in favor of individual ascertainable beneficiaries who are younger than the Designated Beneficiary, because an individual older than the power holder or an entity as permissible appointees under the Power of Appointment will be taken into account for the purposes of determining the Designated Beneficiary with respect to the Plan. Contingent beneficiaries that are older than the Designated Beneficiary should not be named in the trust document because their life expectancies, which are shorter than that of the Designated Beneficiary, will be used, thus minimizing tax deferral.

NOTE 1- Under most circumstances, the proceeds received by the Designated Beneficiary will not be protected because a Conduit Trust requires that he or she must receive all Plan distributions.

NOTE 2– It is possible to “toggle” the Conduit Trust with an Accumulation Trust within nine months after the death of the Participant in most states, as discussed under Section VII below.

NOTE 3– It is also possible to draft revocable trusts to provide that plan and IRA benefits will be payable to “shadow trusts” which may be identical to the intended Q-TIP/Bypass, GST, or Non-GST trusts, except as to those provisions that must be changed to qualify for maximum deferral of plan benefits. The non-plan assets do not have to be managed under the same rules that will apply for plan assets. The authors’ system for this (the Flexible IRA Trust Beneficiary System) is discussed below at Section VI.

- Conduit Trust. A trust which is a beneficiary of a Plan whereby a Designated Beneficiary is required to receive all Plan distributions. The Required Beginning Date and RMD rules will usually apply as if the Designated Beneficiary were the sole direct beneficiary. Thus all beneficiaries, other than the Designated Beneficiary, can be disregarded for qualification purposes, and the Designated Beneficiary will be treated as the individual beneficiary for RMD rule purposes.

NOTE– A Conduit Trust can have older beneficiaries, non-person beneficiaries, and unlimited power of appointment rights, so long as all distributions are required to be paid to the Designated Beneficiary.

- Designated Beneficiary. The individual beneficiary whose life expectancy will be used for purposes of determining the RMDs that will apply to a given trust. The term will be discussed later in this article.

- Designation Date. The Designation Date is September 30 of the calendar year following the death of the Participant. The date at which time the Designated Beneficiary is determined for the purposes of calculating the life expectancy of a beneficiary and therefore the RMD. Thus it may be necessary to pay or remove one or more beneficiaries shortly after the death of a Participant.

- Required Minimum Distribution (“RMD”). The amount which must be paid out in a given year, based upon the life expectancy of the Participant or a beneficiary.

NOTE– While a Participant is living, he or she can always receive distributions earlier than required– but a 10% excise tax, in addition to the income tax, will be imposed if the Participant has not reached age 59 ½, with certain exceptions applicable in limited situations.

- Participant. The person who is the employee or individual that participates in a pension plan or is the or is the owner of an IRA or other Retirement Plan that is subject to these rules.

- Pension Plan/IRA/Plan/Retirement Plan. For the purposes of this booklet, we are using these terms interchangeably. A pension plan, defined benefit plan, defined contribution plan or IRA that meets the requirements of Internal Revenue Code Section 401(a), including retirement plans and IRAs referenced in Internal Revenue Code Sections 403(a), 403(b), 457, and 408, but not Roth IRAs that are referenced in Internal Revenue Code Section 408A.

- Q-TIP Rules. When Plan benefits are payable to a Q-TIP trust, Revenue Ruling 2006-26 indicates that to qualify for the estate tax marital deduction, the Plan and the Q-TIP trust must both make affirmative marital deduction elections, and all income from within the Plan must be paid to the Q-TIP trust annually. Further, the spouse must have the right to require that all income earned within the Plan be distributed to the Q-TIP trust, and then the surviving spouse must have a right to withdraw all income, as required by Internal Revenue Code Section 2056.

The Spouse is considered the Designated Beneficiary if the Plan is payable to the Q-TIP trust of the Participant.

- Required Beginning Date (“RBD”). The date on which lifetime distributions to the Participant from the Plan must begin. This date is April 1 of the calendar year following the later of (a) the calendar year in which the Participant attains the age of 70 ½; or (b) the calendar year in which the Participant retires from being employed by the company which maintains the Plan (if applicable).

- Separate Share Rule. A Plan beneficiary designation to a trust that provides for the trustee to establish separate shares for each beneficiary. Such a trust may qualify as an Accumulation Trust, but the life expectancy of the oldest Designated Beneficiary will apply to all beneficiaries, for the purpose of determining the RMDs.

EXAMPLE: An IRA payable to a trust which divides into separate equal trusts for three separate beneficiaries.

11. Separate Trust Rule. Where Plan assets are payable to distinct and separately established trusts which may exist before or after the death of the Participant, then as to each separately established trust, the Designated Beneficiary for life expectancy payout purposes can be the oldest individual beneficiary of each such separate trust.

EXAMPLE: An IRA that is payable 1/3 to a trust for one grandchild, 1/3 to a trust for another grandchild, and 1/3 to a trust for a third grandchild– Note that this can have a much better result than what would apply in the example of the Separate Share Rule, especially if there is a large age difference between the beneficiaries of a trust.

OTHER RULES:

Beneficiaries to whom Plan benefits were paid out or otherwise eliminated from a trust (for example by a disclaimer or satisfaction of a bequest) by September 30 of the calendar year following the year of Participant’s death will not be counted for RMD purposes. Only those beneficiaries present on the Designation Date are considered in determining the Designated Beneficiary.

The Plan administrator must receive appropriate trust documentation by October 31 of the calendar year after the Participant’s death. This will normally be accomplished by providing the Plan administrator with a copy of the actual trust document.

There is specialized drafting that is required for powers of appointment held by beneficiaries of an Accumulation Trust. Do not give any individual the right to appoint any individual (including spouses) older than the Designated Beneficiary and do not give a right to appoint or transfer assets to another trust that could have individuals older than the Designated Beneficiary or non-individuals as a beneficiary.

If the client does not have sufficient GST exemption, consider making an Accumulation Trust exempt from GST tax by giving a child (“non-skip person”) the power to appoint only to individual creditors of his or her estate who are younger than the Designated Beneficiary, or alternatively give the child a right to withdraw all principal, but only with the consent of a trustee who does not have a substantial adverse interest in the trust.

Additionally, prevent the legal adoption of any individual that is older than a Designated Beneficiary from causing such individual to be considered as a Designated Beneficiary.

Pursuant to Private Letter Ruling 200537044, it is possible to “toggle” from a Conduit Trust and an Accumulation Trust by providing certain powers to an independent trust protector in the trust agreement, if applicable state law provides that the exercise of such powers will be considered a disclaimer that will result in the disclaimed powers and rights being considered as never having existed (“void ab initio”).

The trust protector can be given the power to void the provision in the trust agreement that mandates that all RMDs be currently distributed to the Designated Beneficiary of the trust. This enables the trustee to accumulate plan distributions in trust, and distribute such funds according to his or her discretion. The trust agreement can also contain a provision that allows the trust protector to convert the Conduit Trust to a qualifying Accumulation Trust by doing the following:

Remove any non-individual beneficiary as a beneficiary of the trust.

Remove any possible individual beneficiary older than the Designated Beneficiary as a possible beneficiary of the trust.

Restrict any power of appointment held by a beneficiary to being exercisable solely in favor of identifiable individuals younger than the Designated Beneficiary. Most commentators believe that a blanket requirement that any living individual younger than the Designated Beneficiary will be sufficient, while one or more conservative commentators believe that only “individuals identifiable from the trust document” means that this has to be limited to a class of individuals, such as any descendant of the grandparents of the Participant who is younger than the Participant.

Where an otherwise taxable non-generation skipping exempt trust needs to be considered an exempt generation skipping trust, a general Power of Appointment under a Conduit Trust that would otherwise be exercisable in favor of creditors of the power holder’s estate may be made exercisable solely in favor of individual creditors of the power holder who are younger than the Designated Beneficiary

For conservative planners who believe that only “individuals identifiable from the trust document” who are younger than the Designated Beneficiary may be named, then generation-skipping tax may still be avoided by giving the beneficiary a power to withdraw trust principal, subject to approval at the discretion of an independent trustee or trust protector. This power should achieve the same tax results as giving the beneficiary a power of appointment that is exercisable in favor of the individual creditors of the estate of the power holder.

Toggling from a Conduit Trust to an Accumulation Trust has several benefits, including creditor protection and asset management, especially if the beneficiary is young, unsophisticated, or is expected to have a creditor situation. Several states (including Florida) provide statutory protections for inherited IRAs held by beneficiaries in their individual name. However, any RMDs or other distributions from a retirement plan will not be exempt from the beneficiary’s creditors. This is one reason why using an Accumulation Trust might be favored over leaving an IRA outright to a Designated Beneficiary or to a Conduit Trust.

Conversely, toggling from an Accumulation Trust to a Conduit Trust can occur by giving the trust protector the ability to mandate distribution of all RMDs made to the trust to the Designated Beneficiary. This is beneficial in situations where a beneficiary, who once had creditor issues, is free of such issues. Also, toggling to Conduit Trust status can be helpful where an older successor beneficiary has acquired an interest in Accumulation Trusts, which would cause the older successor beneficiary to become the Designated Beneficiary.

Private Letter Ruling 200537044 provides that the conversion from one type of trust to another may only occur during the 9-month period following the Participant’s death in a state where the law will allow the conversion to be considered a disclaimer. Also, the conversion may only occur once, regardless of its direction, and the conversion must occur prior to the Designation Date.

Caution should be exercised when employing the toggling strategy. The endorsement of this strategy by the IRS occurred in a Private Letter Ruling, which is not precedential except as to the requesting party. Thus, it is possible that the IRS could take the position that the presence of the toggling powers by the Trust Protector can cause what was initially designed to be a Conduit Trust to be an Accumulation Trust because it is possible that distributions could be made to a person other than the Designated Beneficiary of the Conduit Trust. This is especially important in situations where a non-individual is a contingent beneficiary of a Conduit Trust.

PAYOUT METHODS (if Life Expectancy Rule distribution method is selected):

Joint Life Expectancy Method (“Uniform Lifetime Table”)–See Table A.

This table is based upon recalculation annually of the life expectancy of the Participant and a hypothetical Spouse who is 10 years younger. This method is used while the Participant is alive, no matter whether the Participant is married or has a younger spouse. This method may also be used by the Spouse of the original Participant if the Spouse becomes the owner of a spousal rollover Plan. For the purposes of this method, “Participant” includes the Spouse of the Original Participant if the Spouse is an owner of a spousal rollover IRA or other permissible plan.

- Much Younger Spouse Method (“Joint and Last Survivor Table”)- See Table B.

The table allows the use of a longer joint life expectancy for annual recalculation during the life of the Participant where:

- The spouse of the Participant is more than 10 years younger than the Participant; and

The spouse is the sole beneficiary of the plan.

Furthermore, the Surviving Spouse who rolls over the Participant’s Plan into his or her own can use this method only if he or she remarries someone who is more than 10 years younger than the Surviving Spouse. This is because once the Surviving Spouse rolls over the original Participant’s Account into his/her own, the Surviving Spouse is treated as the Participant of his/her account. Therefore, the general distribution rules, including the Much Younger Spouse Method, apply.

- Recalculated One-Life Method (“Single Life Table”)- See Table C.

This method is used for payouts made directly to the Participant’s Spouse after the Participant’s death where the Spouse is the sole beneficiary of the IRA. Additionally, where the Participant’s Spouse is the beneficiary of a trust that qualifies as a Conduit Trust, the Spouse’s life expectancy can be used and recalculated annually according to the Single Life Table.

- Non-Recalculated One-Life Method–Also Known As “Fixed Term” or “Single Life Reduced by One” Method (Single Life Table is used) -See Table C.

This method is used for payouts that are to be made:

- To the Participant’s Spouse after the death of the Participant, where the Participant’s Spouse is not the sole beneficiary;

- To a Non-Spouse Beneficiary after the death of the Participant; or

- To the Participant’s Spouse’s named beneficiary after the death of the Participant’s Spouse, where the Participant’s Spouse was the sole beneficiary of the Original Participant’s account and has not rolled over the account.

The first year distribution is based upon the life expectancy of the beneficiary as listed in the Single Life Table. (Table C) If the Participant’s Spouse is the beneficiary, the Spouse’s age in the calendar year following the calendar year of the Participant’s death is used in determining the RMD. If the named beneficiary of the Participant’s Spouse is the beneficiary, the beneficiary’s age in the calendar year of the Spouse’s death is used.

Each year thereafter, the previous year’s life expectancy divisor is subtracted by one. Thus, if the first year’s life expectancy divisor is 19.5, the second year’s divisor is 18.5, the third year’s 17.5, etc.

- “At Least As Rapidly” Rule Method.

This method is used where the Participant dies after his or her RBD or has, before death, begun receiving distributions from the Participant’s Plan. In such a situation, the Plan funds must be distributed “at least as rapidly” as they were being distributed at the time of the Participant’s death. However, the regulations provide for a longer distribution period if the Participant has named a Designated Beneficiary.

Where a Designated Beneficiary exists, RMDs can be made according to the longer of the remaining life expectancy of the Designated Beneficiary or the deceased Participant.

Where no Designated Beneficiary exists, RMDs can be made according to the remaining life expectancy of the deceased Participant, but only if the Participant dies after the RBD or after the Participant had already begun receiving distributions.

There is no special rule regarding use of a different table if the Participant has a terminal illness. This means that if a relatively younger Participant (just above age 59 ½) is diagnosed with a terminal illness, and all of his potential Designated Beneficiaries are much older than him, he should start taking distributions to have this method apply to achieve optimal tax savings.

- Five-Year Rule Method.

Under this method, all account funds must be distributed on or before December 31 of the fifth anniversary of the calendar year of the Participant’s death. It is the “default method,” which applies if there is no named Designated Beneficiary, the trust named as a beneficiary does not qualify as an Accumulation Trust or a Conduit Trust, or a non-individual entity is named as a beneficiary of the Plan (such as an estate, partnership, or corporation).

This method can be advantageous where the Designated Beneficiary (and entire realm of potential Designated Beneficiaries) has a life expectancy less than 5 years, as calculated by the applicable table.

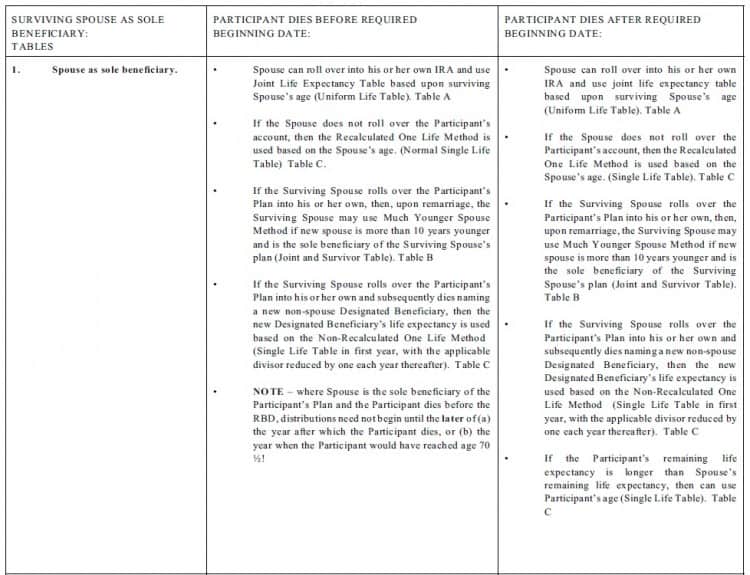

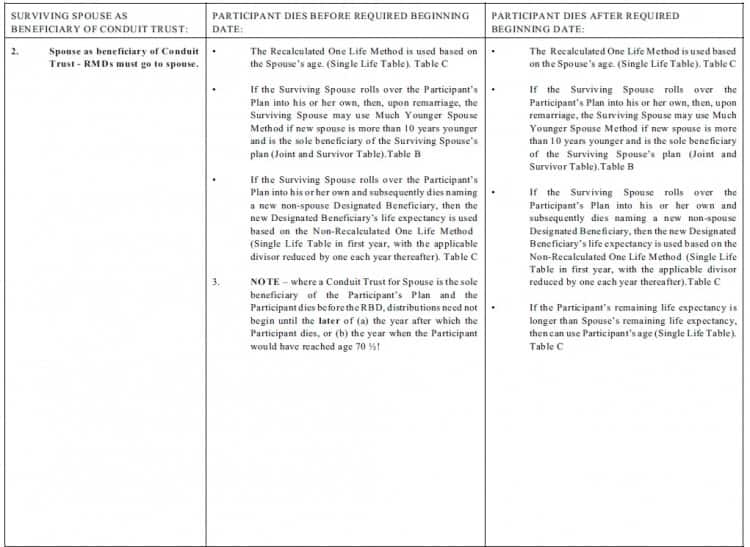

WHAT LIFE EXPECTANCY TABLE TO USE AFTER DEATH OF PARTICIPANT SURVIVING SPOUSE AS SOLE BENEFICIARY

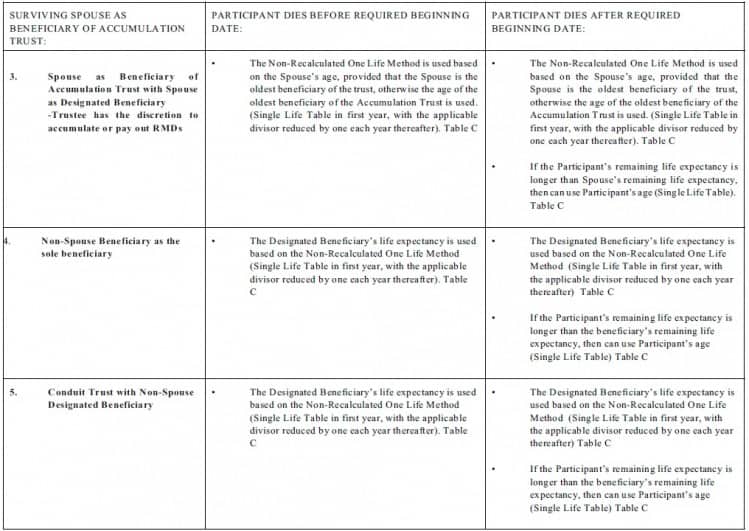

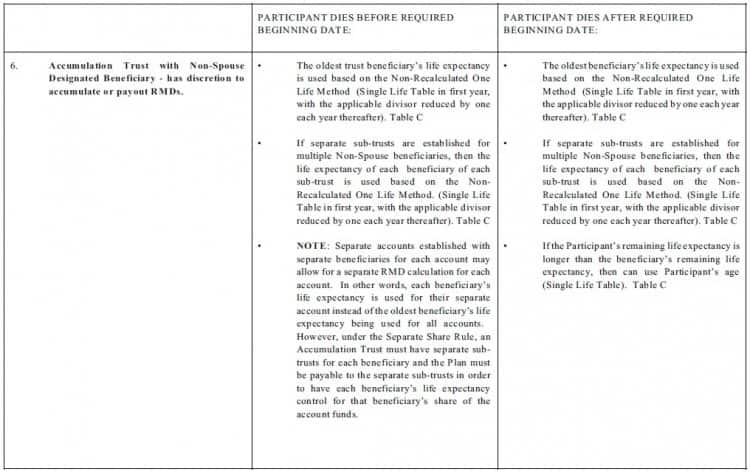

WHAT LIFE EXPECTANCY TABLE TO USE AFTER DEATH OF PARTICIPANT NON-SPOUSE AS BENEFICIARY OR AS DESIGNATED BENEFICIARY OF TRUST

INCOME TAXATION OF AN INHERITED IRA “QUICK & DIRTY” REFERENCE GUIDE

Alan Gassman and Christopher Denicolo will be speaking at the Tampa Bay Estate Planning Council Dinner Program on the topic of PLANNING WITH RETIREMENT ACCOUNTS on January 21, 2015. The event includes a cocktail/dinner event . 5:30 p.m. – 7:30 p.m–please fee free to contact us if you would like to attend this event at The Tampa Club located at 101 E Kennedy Boulevard, 41st Floor, Tampa, Florida.

Richard Connolly’s World

Court Ruling Sparks Rush to Shield IRAs

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is “Court Ruling Sparks Rush to Shield IRAs” by Robert Powell. It was featured in The Wall Street Journal. This case was written up by us in the Thursday Report dated June 19, 2014, and need not be of concern to clients living in Florida whose IRA beneficiaries also reside in Florida. However, out of state clients or beneficiaries can lose IRAs to creditors if proper trust planning is not employed with appropriate stretch trust rule compliance.

Richard’s description of the case is as follows:

When is an individual retirement account not a retirement account? When the Supreme Court says so.

In a unanimous decision in June, the Supreme Court ruled that an inherited IRA is no longer a retirement account – noting that a beneficiary can withdraw any amount from the account without penalty whenever he or she wishes – and so isn’t protected from creditors under federal bankruptcy law.

As a result, financial advisers and families are taking steps to shield IRA assets for children and other beneficiaries in case those heirs ever find themselves in bankruptcy proceedings.

Many advisers are urging clients to establish a trust as the IRA’s beneficiary or to set up an IRA as a trust account while the owner is still alive.

And what about those who already own an inherited IRA? Depending on where they live and how long they’ve lived there, those assets might still be protected in bankruptcy proceedings. Several states – including Alaska, Arizona, Florida, Missouri, North Carolina, Ohio, South Carolina, and Texas – have laws that afford such protection in certain cases…

Click here to view the full article.

To view our article on One Good Reason Not to do a Roth IRA Conversion, please click here.

Thoughtful Corner:

The Men’s Guide to Dressing for Success for First Year Lawyers and Others

by Travis Arango

Dress for Success was the name of a book by John T. Molloy that your parents may have purchased when it came out back in 1975. We find that, despite the passing of time, the words of wisdom offered in this book are still 90% accurate.

Must Have Suits

GQ recommends different suits you need in your closet to build your business wardrobe. You can check out this article by clicking here.

- The Solid Navy Suit – The solid navy suit is described by GQ as “a safe, classic choice.” Don’t be afraid to throw in a pocket square (though this tip can apply to any suit!).

- The Pin-Striped Navy Suit- Wear a solid color shirt and tie with it, or, if you are feeling bold, use a striped shirt and/or tie. If you’re opting for stripes, make sure to choose within the same color range and make sure the stripes are not too similar. Pinstripes can also be somewhat slenderizing.

- The Solid Black Suit – The solid black suit has become a staple in office wear. Make sure it is cut slim and that it is tailored to fit you correctly.

- The Gray Suit – GQ calls this the “anchor of your business wardrobe.” They recommend a medium gray suit, but any shade will do.

A Fitting End

Fitting a suit correctly is important. The shoulders of the suit should hug yours, and the pads should not go beyond your own shoulders. The button on the suit should easily button without stressing it, and there shouldn’t be too much space between the button and your body. A quarter of an inch of your shirt cuff should show with your arms to your side.

Let’s Talk Buttons

The 3-button suit was dominant in the 90’s, and it is still popular with the young men’s crowd today. The 2-button used to be known as the look for politicians, but it is now the most in-style design. One-button suits are a bold move and can be pulled off, but this look is not for everyone.

It’s Time to Vent

The center vent is the conservative, modern play that you can’t go wrong with. Side vents are slightly bolder but still a great look. Ventless is not an option, as it is not the 80’s anymore.

On to the Lapel

A notch lapel is the safe play, and you will want one that is narrower. A peak lapel is an old-school look that is being revived in both the business community and fashion community. If you go for a peak lapel, make sure you don’t get this lapel too wide.

Time to Tailor This Suit Just For You

Having your suit tailored is a great investment. There is nothing worse than having an ill-fitting suit in front of anyone, whether it is high up executives, friends, or that person you think is particularly attractive. There is nothing flattering about a poncho suit or a suit that looks like you bought it for a middle school dance and held on to it. While a tailor can help you with most things, there are some things they can’t do. One thing a tailor probably can’t help you with is the fit in the shoulder area; if it doesn’t fit right there, it is not going to fit. If your pants are too tight or too large by more than an inch or so, you are also looking at trouble. A tailor can adjust the length of your jacket sleeves (generally, you want a quarter-inch of the shirt cuff to show), fix the roll in the back of the suit jacket by the neck that is generally there, and make the jacket fit your torso cleanly. See how a good suit should look and feel by going to Nordstrom’s, Brooks Brothers, Saks, or one of the other well-respected suit sellers.

It’s What’s Underneath That Counts

In terms of shirts, you can’t go wrong with blue, light blue, and white, as they will go with just about everything. Don’t be afraid to explore striped shirts or shirts with the little squares (checker and plaid).

The type of collar on the shirt is important when picking a tie. The button-down collar is a more casual look and works well with medium width ties. You will want the button-down to be cut from broadcloth so it doesn’t look too casual. The straight-point collar works well with narrow or skinny ties. The spread collar works best with a medium or wide tie.

For shirts, there is the single-button standard cuff, French cuff, and two-button barrel cuff. The single-button is the most common, most moderately priced, and should reach your wrist. The French is the dressiest cuff and requires cuff links. If using cuff links, don’t get too flashy and don’t worry about matching them to anything in particular. The two-button barrel is the flashiest of the three (though not in a bad way).

Some brands that are well-respected and will look and feel good include Giorgio Armani, Hugo Boss, Kenneth Cole and Zegna. These are just a few; there are many well-respected suit brands.

Don’t Bottom Out!

If you’ve followed the advice thus far, you now look good from the top to almost the bottom. Seal the deal with the right shoes. GQ suggests adding toe and heel taps to your shoes. Using shoe trees when they are not in use will increase the life span of the shoes. The cap-toe is a must have in black lace-up, as they work with every suit and have a professional look. Having a pair of brown shoes is a good idea, but the rule is that a brown shoe works with everything except a black suit. A plain-toe shoe is sleeker and dressier than the cap-toe and can be worn with a tux, but it also can be worn with jeans and a jacket, giving you a wide range of options. The wingtip shoe is the go-to business shoe and is back in style with a vengeance. The loafer can also be a good addition to the wardrobe. Try to find a dressier version to wear with a business suit. For more information about how to choose the right shoe, please click here.

Sock It To Me!

Socks should be over the calf so that when you sit down, you don’t show any leg. Match your sock to your suit, not your shoes. However, match your belt to your shoes.

Be a Square

A pocket square gives your suit that extra pop. Avoid the pattern squares, keep it simple, and wear it square. GQ says to never buy a matching tie and pocket square set.

Watch Out

You will want to include a watch, but keep it clean. You don’t want the attention to be on your watch instead of on the work you have done on everything else.

Remember, it is better to have 2 good suits and wear them every other day than it is to have 4 mediocre suits. With different shirt and tie combinations, you can turn those two great suits into an unlimited selection of different looks. Keep in mind you generally get what you pay for when it comes to suits. Think of them as an investment, and you will impress your clients, bosses, and potential future bosses.

Upcoming Seminars and Webinars

LIVE UNIVERSITY OF NOTRE DAME PRESENTATIONS:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Fox Hollow Golf Club, 10050 Robert Treat Jones Pkwy, Trinity, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Alan Gassman will be joined by Ron Cohen, CPA for two webinars on POST MORTEM TAX PLANNING.

Date: Tuesday, December 2, 2014 12:30 p.m. or 5:00 p.m. (50 minutes each)

Location: Online webinar

Additional Information: To register for the 12:30 p.m. webinar please click here. To register for the 5:00 p.m. webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman will be presenting a 30 minute webinar on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES

Date: Tuesday, December 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE CLEARWATER PRESENTATION:

Alan Gassman will be hosting a workshop for lawyers and other professionals who are interested in improving their futures both personally and professionally. Topics to be explored include goal setting, overcoming frustrations, problem solving, and strategies to help attract and retain the type of clients that will help grow your practice.

This workshop will be followed by a tour of the Gassman Law Associates office.

Date: December 14, 2014 | 9:00 a.m. – 3:00 p.m.

Location: 1245 Court Street, Ste 102, Clearwater, FL

Additional Information: For more information, or to register for this workshop, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will be presenting a 30 minute webinar on LESSONS LEARNED FROM THE HALIFAX CASE

Date: Tuesday, December 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE 2015 CLEARWATER PROFESSIONAL ACCELERATION WORKSHOPS:

Alan Gassman will be presenting a year-long Professional Acceleration Workshop that will enable participants to look down from 30,000 feet to supercharge their practices and professional lives.

5-6 hour sessions will be held on the following dates:

- Friday, January 30, 2015

- Friday, March 20, 2015

- Friday, June 26, 2015

- Friday, September 25, 2015

- Friday, December 4, 2015

Location: A Clearwater, Florida hotel to be determined.

Additional Information: For more information or to register for the program please contact Alan Gassman at agassman@gassmanpa.com or at 727-442-1200.

********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will be presenting a webinar on TRUST PLANNING FROM A TO Z with the Florida Institute of CPAs.

Date: January 6, 2015 | 11:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org.

*******************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers.

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE TAMPA PRESENTATION:

Alan Gassman and Christopher Denicolo will be speaking at the Tampa Bay Estate Planning Council Dinner Program on the topic of PLANNING WITH RETIREMENT ACCOUNTS.

Date: January 21, 2015 | 5:30 p.m. – 7:30 p.m.; Alan Gassman will be speaking from 6:45 to 7:15.

Location: The Tampa Club, 101 E Kennedy Boulevard, 41st Floor, Tampa, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

***********************************************************

LIVE NEWPORT BEACH PRESENTATION:

THE MATHEMATICS OF ESTATE PLANNING by Jerry Hesch, Alan Gassman, Ken Crotty, and Chris Denicolo will be presented by Jerry Hesch to the Society of Trust and Estate Practitioners 4th Annual Institute on Tax, Estate Planning, and the Economy. This conference is a collaboration between STEP Orange County and the University of California, Los Angeles, School of Law.

This presentation will be using the materials that Jerry Hesch, Alan Gassman, Ken Crotty, and Chris Denicolo presented to the 40th Annual Notre Dame Tax & Estate Planning Institute on November 14, 2014.

Date: January 22 – 24, 2015

Location: California Marriott Hotel and Spa at Fashion Island, Newport Beach, CA

Additional Information: For more information, please email agassman@gassmanpa.com or visit http://www.step.org/4th-annual-institute-tax-estate-planning-and-economy.

**************************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: January 31, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To register for this program please email agassman@gassmanpa.com.

*************************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

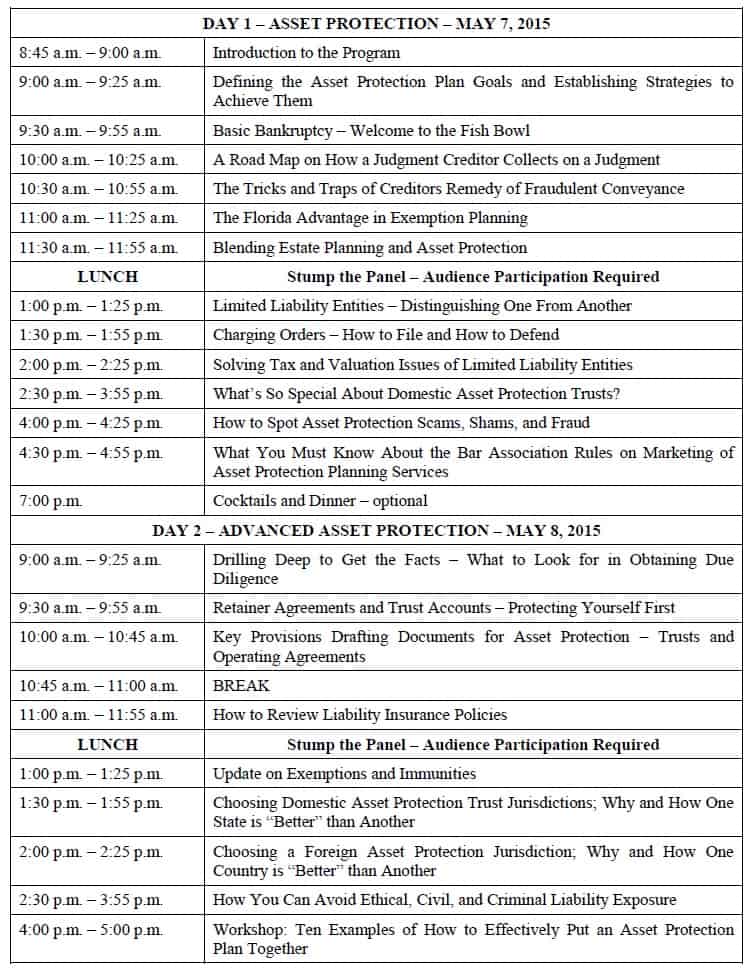

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Topics and Times are as follows:

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.