The Thursday Report – 11.10.16 – Don’t Thursday, Be Happy!

Approaching the Presidency of Donald Trump

Trump Wins, Republicans Control House & Senate: A Brave New World for Estate Planners by Jonathan Blattmachr & Martin Shenkman

New Amendments Pass in Florida

Ask Lester Perling

In-Sourcing: A Concept in Evolution by Dr. Pariksith Singh

Webinar Spotlight – Cornflakes & Estate Planning Mistakes with Alan Gassman

Richard Connolly’s World – The Surprising Trials of Passing Down Vacation Homes

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Don’t Thursday, Be Happy!

It has been a stressful week for most Americans. It seems clear that change is coming our way, both as citizens and as professionals.

Whether what we actually get is “more of the same” or dynamic changes, we can all make the best of this situation today and next year by making sure that we have the best interests of our customers, clients, and families at heart.

What we have been doing for the last 20 to 30 years may not be the best strategies going forward. As we approach the possibility of significant changes in the Tax Code and otherwise, we have an obligation to educate our clients and customers with respect to what they may expect and what they can do to minimize taxes and maximize the protection of their families.

The Thursday Report plans to be a strong contributor to this knowledge base, both in terms of reporting strategies and ideas and encouraging the development thereof.

We welcome all questions, comments, and suggestions for this, and we also need mediocre humor, innovative seminar ideas, and gift certificates for cole slaw, beans, and mashed potatoes & gravy at Kentucky Fried Chicken (if you have extras.)

Approaching the Presidency of Donald Trump

by Alan Gassman

Almost half the voters like him,

But many thought he was a rump.

Now he’s our next President,

Donald J. Trump.

His stated goal to make America great

Will hopefully improve everyone’s fate,

But what about me,

While I plan my estate?

I’ve been hearing about regulations

Under Section 2704

And was in the process of a big installment sale

To avoid the estate taxes I abhor.

But just in the past few days,

2704 events have been much less than a malaise

(And even somewhat of a maze!)

A Treasury spokesperson has said

That they are not trying to put discounts on their head,

And every Republican member of the Ways and Means Committee

Wrote a letter to the Treasury asking to change the regulations to a ditty

But with a Republican House, Senate, and Trump,

If he really is one,

The estate and gift tax law could be gone

Before the regulations are read in Lisbon.

So what is a planner and her clients to do?

Nothing, or everything, is the answer many planners eschew.

If the estate tax is eliminated, might it not be back four years later?

Having assets set aside in special trusts is not worse, but often better.

And if income rates are again going down,

Do what you can to delay income

And accelerate expenses this year, Mr. and Mrs. Brown.

Consider bunching deductions this year

And a charitable donation now,

To enable charitable giving for future years,

Using a Donor Advised Fund as your plow.

Some families will set up their own foundations

To get the best of the benefit of our present high brackets

While helping others in need

And planting more than one important seed.

Some life insurance holders may want to delay

Premiums till they know if the policy should stay.

If not needed for taxes to pay,

Perhaps reduce the death benefit so that cash values can stay.

And families now can concentrate

On the more fundamental aspects of planning

Such as buy/sell agreements, creditor proof Trusts,

And other arrangements that really are musts.

But to the extent that we can use structures not so strange,

That could be reversed as times will change,

Flexibility and future needs utility

Will fill needs utility

Will hopefully fill needs with good oscillility.

If you follow Murphy’s Law, then it should be planning as usual.

President Trump and Congress may trade the estate tax for something more visual.

Certainly more people will write on this topic,

Please send us your thoughts to add to our optics.

Planning for Probable & Possible Trump Tax Law Changes Webinar –

Just Announced!

Next Wednesday, November 16, 2016, Edwin Morrow, Christopher Denicolo, and Alan Gassman will be hosting a 30-minute webinar entitled “Planning Now for Probable and Possible Trump Tax Law Changes” for a more in-depth look at some of the ideas discussed in the poem above.

If you would like to register for this 12:30 PM webinar, please click here.

Trump Wins, Republicans Control House & Senate:

A Brave New World for Estate Planners

by Jonathan Blattmachr & Martin Shenkman

The following article was published on the Leimberg Services system on November 10, 2016. To see this article in its entirety, please click here.

Executive Summary:

The election of Donald J. Trump as our 45th President was largely unexpected. It is difficult to forecast what that will mean during his term, and, perhaps, his second term. However, he has proposed wide-ranging changes to the nation’s tax system which will affect virtually all Americans and their advisors. Estate planners in particular face a dramatic impact on their practices.

Many predict a period of heightened market volatility, which may have an impact on existing planning (budgets, forecasts, market returns, etc.) Market uncertainty could also add to the uncertainty that the Trump tax proposals will create, making planning even more difficult.

Comment:

Trump Tax Legislation Generally

In addition to Trump’s personal victory, the Republicans were also victorious. The House of Representatives is controlled approximately 235 to 191 by the Republicans, and the Senate is controlled approximately 51 to 47 by the Republicans. This will make it more likely that many of Trump’s tax changes discussed throughout this newsletter could be enacted.

There are other perspectives:

- Although the strength of the Republican success was significant, some pundits suggest that it may not assure Trump the support to push all legislation he proposes to enactment. Trump, according to this view, may have to spend time building bridges with not only Democrats, but those in his own party. But the pundits could not have been more wrong about the election, so the weight to afford any particular prognostication is “iffy” at best.

- Another perspective some have suggested is that under the rules of Senate parliamentary procedure, a Senator can filibuster virtually any bill (unless 60 Senators vote to end it). However, a filibuster does not apply to a budget bill that uses the so-called “reconciliation” process, so that may present an option for Trump to circumvent a filibuster should one occur.

- With the array of substantial legislation a Trump administration might propose, the inevitable horse trading will almost assuredly shape any actual legislation enacted.

- As we just learned from the election, political matters are often very difficult to forecast. Although the Republican platform has long advocated for estate tax repeal, and although Trump has included it as part of his plan, there is no assurance it will happen.

Thus, while no one can determine without an Ouija Board what will happen, these authors believe that the estate tax is doomed.

The impact of the possible changes will likely be much broader encompassing changes to individual and corporate income taxes and that those changes may suggest reconsideration of entity format, divided/distribution policies and more.

Estate Tax Repeal

President-elect Trump has proposed a repeal of the estate tax. The Republicans have long wanted to repeal the estate tax, and the large march upward in the estate tax exemption may have been a prelude to the elimination of the tax. The dubbing of the estate tax as a “death tax” reflects (and perhaps contributed to) the hatred many Americans, surprisingly many not affected by the tax, have had for what has become viewed as an unfair double tax.

The reality is that the estate tax affects very few taxpayers and raises insignificant federal revenue. A recent Forbes article noted: “In tax year 2015, just 4,918 estates paid $17 billion in estate taxes (less than 1% of federal revenue). More than a third was raised from the richest of the rich—the 266 estates valued at $50 million or more brought in $7.4 billion to the Treasury.”

Many have viewed the estate tax not as a revenue raiser, but rather as a means of accomplishing a social objective of limiting the concentration of wealth. But statistics as to the concentration of wealth in the U.S. suggest that the estate tax has not been particularly successful at dampening wealth concentration. “The United States exhibits wider disparities of wealth between rich and poor than any other major developed nation.”

Timing of Repeal

If the estate tax is repealed, might repeal be effective January 1, 2017 or some other date? Might the Republicans delay repeal until 2018 because of income tax changes that will impact the federal fisc? Might repeal not be immediate but instead be phased in over a 10 year or other period? If the estate tax is repealed, might the tax come back at some future time in some different iteration? It also remains uncertain what might replace the estate tax. Might there be a capital gains tax on death? Could carryover basis become a reality? These possibilities are discussed in greater detail below. Another option might be to characterize inheritances as income. From an economic perspective if a lottery winning is treated as income, is it really unreasonable to treat an inheritance in a similar manner? So, while permanent estate tax repeal may be more likely than ever before, much uncertainty remains.

Tax History May Provide Some Lessons

Will President-elect Trump be able to push through an estate tax repeal? Although the Republicans will have a small majority in the Senate, that should be sufficient to pass a budget measure. That was the position George W. Bush was in as well. Bush was able to push through the 2001 tax act which substantially reduced the top income and capital gains tax rates, made dividends taxed as long term capital gain and repealed the estate tax, by making it part of the budget bill enacted that year. Because the repeal of the estate tax was postponed (so tax relief could be granted elsewhere—largely, income tax reductions), many estate tax planners (including, attorneys, accountants, life insurance representatives and trust officers) never really experienced the significant reduction in business that they could have. And for those practicing in decoupled states there may have been no impact (but see discussion below as to decoupled states post-Trump estate tax repeal).

Also, the 2001 tax act provisions were “sunsetted” on account of what is known as the “Byrd” rule which allows a senator to object to any bill that increases expenditures or decreases revenues. That objection can be overcome by a vote of 60 senators. Even if that happens under what will be the Trump/Republican tax proposal, it seems doubtful the estate tax will not be repealed.

Other topics discussed in this article include:

- Gift Tax Repeal Possible

- Carry Over Basis or Capital Gains Tax on Death?

- Possible Tax Transfer Scenarios

- Planning for Clients with Planning at Different Stages

- Reviewing Existing Wills and Revocable Trusts

- Life Insurance

- State Estate & Inheritance Taxes

- Future Trust Planning

- 2016 Year End Planning Considerations

- Business Planning Matters

- Portability Considerations

- Non-Residents

To see the author’s thoughts on all of these topics and how they will be affected by a Trump presidency, please click here to read the article in its entirety.

New Amendments Pass in Florida

by Dena Daniels & Seaver Brown

On Tuesday, November 8, 2016, Americans everywhere decided the future of our great nation. In Florida, we had additional matters to deal with in the form of constitutional amendments. Of the four amendments that were on the ballot, three passed with 70% or more of the votes.

Amendment 5, plainly titled as “Tax exemption for low-income, senior, and long-term residents,” passed with 78% of the votes. The language that voters saw on their ballots stated:

Proposing an amendment to the State Constitution to revise the homestead tax exemption that may be granted by counties or municipalities for property with just value less than $250,000 owned by certain senior, low-income, long-term residents to specify that just value is determined in the first tax year the owner applies and is eligible for the exemption. The amendment takes effect January 1, 2017, and applies retroactively to exemptions granted before January 1, 2017.

In a nutshell, this Amendment gives local governments the authority to provide a homestead exemption to residents who are 65 years of age and older and have resided at their homestead for at least 25 years. The exemption amount is equal to the assessed value of the property which results in the homeowner not having to pay any property taxes. In order to qualify for the exemption, the homeowner must also have a household income that does not exceed $20,000 in addition to the aforementioned requirements.

This Amendment will take effect on January 1, 2017 and will provide much needed tax relief to our low-income, elderly citizens. It will be interesting to see which local counties and/or municipalities will provide its residents with the opportunity to take advantage of this exemption.

Also on Tuesday, 71 percent of Florida voters overwhelmingly approved the Florida Medical Marijuana Legalization Initiative, also known as Amendment 2.

Amendment 2 will expand the use and availability of medical marijuana for those with specific debilitating diseases or conditions as determined by a licensed state physician. These diseases include cancer, epilepsy, glaucoma, HIV, AIDS, post-traumatic stress disorder, amyotrophic lateral sclerosis, Crohn’s disease, Parkinson’s disease, and multiple sclerosis.

The Florida Department of Health will now be charged with regulating marijuana production in the state, in addition to registering distribution centers that will grow the plant. The Department of Health will also issue identification cards to patients and those caregivers who wish to assist patients in medical use of marijuana.

Stayed tuned to the Thursday Report for future legislative updates as new laws and regulations are implemented. To read the amendments in their entirety along with the other amendments that were on this year’s ballot, click here.

Ask Lester Perling

We would like to start a new column called “Ask Lester Perling.”

Lester is one of the most knowledgeable and dedicated health care lawyers in the State of Florida, if not the nation, and has been a significant contributor to the Thursday Report.

Lester and Alan Gassman will be presenting at the February 3, 2017 Florida Bar Representing the Physician program in Orlando at the beautiful Rosen Centre Hotel.

Lester & Alan’s presentation is entitled “Structuring Medical Practices & Related Entities for Tax, Creditor Insulation and Regulatory Compliance Purposes – Turning the Snowflakes into Snowmen.” This presentation will follow Radha Bachman’s presentation called “Doctors & Snowflakes – So Many Possible Combinations of Business and Professional Organizations.”

Please send your questions, comments, and suggestions for us to incorporate into our long list of things to be covered in this presentation. There will be many surprises, as always, and the best suggestion will win a bucket of chicken from Kentucky Fried Chicken and a Colonel Sanders look-alike mask.

In-Sourcing: A Concept in Evolution

by Pariksith Singh, M.D.

Pariksith Singh, M.D. is a board-certified internal medicine physician who received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001.

We have all heard of out-sourcing and its deleterious effects on the US economy. We have heard politicians rail against it and try to block it one way or another. It seems to me that such an approach does not work in a global environment, where multi-national corporations or transnational organizations need to leverage the local resources to bring out the best of two worlds or many worlds, as the case may be.

For this to happen, we need to be creative and practical. Without deploying business or employment jingoism, we can see that there are unique business propositions that the US offers, and these need to be harnessed. Creativity, freedom, disruptiveness in business models, the ease of business in a relatively corruption-free economy, world-class resources, infrastructure, culture, and economy are all things this country has to offer. How do we tap into them and move from a business drain to a business gain?

We have seen how Apple has leveraged this brilliantly by outsourcing the manufacturing of its phones to other countries, most notably China, and yet, has been able to get more than 95% of the profits from this process. Everyone notices the outsourcing. Most miss the insourcing.

What was insourced in Apple was Steve Jobs’s creativity, his insouciance, his intense passion, and his brilliant team with remarkable logistics. Also insourced was the wonderful designs of Jony Ives and the art aspect of technology, the strategy, and the brand. Can we insource more of this: the ability to innovate and create anew, the capacity to entirely challenge our whole model and to look at things afresh using the power of creative destruction?

I believe we can. The new economy is here in the form of Google, LinkedIn, Wikipedia, and Facebook. Can we move our model of education from useless degrees to useful innovation? Can we help open up our young minds (or rather not close them with our rigid curricula) and unleash their imaginations on the world? If the US can do that and change the focus of its education back to practical things, as the country did for hundreds of years with its emphasis of hard work and ethic of learning the trades, remarkable things can happen. Only the trades this time around might have a new slant to them: the ability to work in the new paradigm, the Information Age.

Thus, creative thinking is the key; perhaps we should call it creative non-thinking: creative feeling and creative sense. As more and more digitization happens, these characteristics and abilities (innovation, creativity, strong fundamentals education, and imagination) will be at a premium.

Similarly, the focus in India has been to take low-level outsourcing, even though it is in the information technology (IT) industry. India has its own remarkable and unique attributes, which it can leverage. These include India’s culture, art, literature, movies, spirituality, and philosophy. Indians have the hunger to succeed and are diligent about it. Until now, the Indian IT story has been as bottom-feeders. Only recently, with the explosion of start-ups in retail, health care, cab services, etc., have we seen a welcome shift. Similarly, the projection of India’s soft power by Prime Minister Modi has been a breath of fresh air.

How can the two countries leverage their respective expertise and make it a non-zero sum game? This is the question businessmen, entrepreneurs, and corporate executives must ask themselves. Creative solutions are possible in the post-scarcity economy.

The other insourcing possible is for organizations to find their own unique systems and processes which give them an edge in the business world. These operations can be digitized and systematized with algorithms found for standard workflows and decision-making steps, interfaces, and dashboards created to facilitate these. As the unique business systems are virtualized, new business possibilities might open up for the business, as we have seen in our organizational development. Here, too, the closer involvement of companies from other countries can be explored to create a composite of their respective strengths.

Webinar Spotlight

Cornflakes & Estate Planning Mistakes with Alan Gassman

To register for this webinar, please click here https://attendee.gotowebinar.com/register/6750752183381238786

Richard Connolly’s World

The Surprising Trials of Passing Down Vacation Homes

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “Surprising Trials of Passing Down Vacation Homes” by Liz Skinner. This article was published on InvestmentNews.com on August 23, 2016.

Richard’s description is as follows:

Vacation homes are more prevalent than ever but passing on these cherished properties to the next generation is turning out to be less than delightful in some cases.

Parents and their adult children can have different ideas about what’s to become of the family beach or mountain homes where they’ve celebrated many happy birthdays and holidays together over the years.

Planning ahead and structuring the transfer in a way that anticipates several sticky situations, though, can keep a family’s treasured vacation home from erupting into a problem, experts said.

Please click here http://www.investmentnews.com/article/20160823/FREE/160829980/surprising-trials-of-passing-down-vacation-homes to read this article in its entirety.

Humor! (Or Lack Thereof!)

Sign Sayings of the Week

**********************************************************

In the (Florida) News

by Ron Ross

Scientists have finally successfully translated a conversation between dolphins. It seems Flipper and Finney can’t stop gossiping about those manatees in Clearwater.

******************

Congressional committee investigation Disney has discovered that not only are many Disney characters orphans and not only do many Disney movies portray the death of parents, it also appears that Disney has capitalized on the emotions of the audience by inserting subliminal, promotional messages into the digitally remastered DVDs. For instance, after Bambi’s mother is killed, a message appears for just a millisecond saying, “Parents, take you children to Disney World before you get hurt by a hunter, too.”

**********************************************************

Red Carpet for the Carnival Sideshow Awards

by Ron Ross

Here comes the Bearded Lady, with the fragrance of Chanel

Completely makes you forget the carnival audience smell

Here’s the Fire Eater in asbestos Armani jacket

Telling the press that awards shows are a “racket”

How cute, the midget horse is wearing Jimmy Choo

(If she doesn’t win an award this year, next year she’s glue)

Here’s the Human Pincushion, wearing Cartier

(We hear he’s doing the sequel to “Shades of Grey)

The Rubber Skin man is certainly looking fine

Wearing several different sizes, all by Calvin Klein

Finally, the two headed cow strides by with regal bearing

To the cries of the press, yelling: “Who are you wearing?”

Upcoming Seminars and Webinars

Calendar of Events

LIVE SATURDAY MORNING WEBINAR:

Alan Gassman will present a Saturday morning breakfast webinar entitled CORNFLAKES AND ESTATE PLANNING MISTAKES.

Date: Saturday, November 5, 2016

Location: Online webinar

Additional Information: To register for this program, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Howard Fisher, Denis Kleinfeld, and Alan Gassman will be presenting a Bloomberg BNA Practical & Creative Planning webinar entitled “Three Advanced Asset Protection Trust Structures That Advisors Will Want to Understand and May Want to Recommend.”

Date: Tuesday, November 15, 2016

Location: Online webinar

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MAUI PRESENTATION:

2016 MAUI MASTERMIND WEALTH SUMMIT

Alan Gassman will be speaking at the 2016 Maui Mastermind Wealth Summit with David Finkel and others. This event will connect attendees with many Maui Mastermind Wealth Advisors such as Alan.

During this week-long event, Alan will be speaking on the following topics:

- Getting Out of Bad Financial Partnerships, Joint Ventures, or Strategic Relationships

- Asset Protection and Estate Planning for Business Owners

- The Estate Planning and Asset Protecting “Choose Your Own Ending” Game

- The Language of Investing

- Engineering a Better Investment Deal

Thursday Report attendees will receive a free Mai-Tai with call brand liquor and their choice of a hula hoop or Hawaiian lei. Watch Don Juan sing the greatest hits of Conway Twitty on December 7th at 7:00 PM Hawaiian Time.

Date: December 4th – December 9th, 2016

Location: The Fairmont Kea Lani Maui | 4100 Wailea Alanui Drive, Maui, HI, 96753

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

ANNUAL ALEXANDER L. PASKAY MEMORIAL BANKRUPTCY SEMINAR

Alan Gassman will speak on a panel discussion at the American Bankruptcy Institute’s annual Alexander L. Paskay Memorial Bankruptcy Seminar on the topic of THE ETHICS OF ASSET PROTECTION.

Date: Thursday, February 2, 2017 | Time TBD

Location: The Embassy Suites Tampa Downtown Convention Center | 513 S. Florida Avenue, Tampa, FL, 33602

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: IT IS HARDER THAN IT LOOKS

Alan Gassman will present two talks at the 2017 Annual Florida Bar Health Law and Tax Section Representing the Physician Seminar. His topics include:

- A Brief Introduction to Representing the Physician (with Lester J. Perling)

- Structuring Medical Practices and Related Entities for Tax, Creditor Insulation, and Regulatory Compliance Purposes (with Lester J. Perling)

Other speakers at this event include William Eck, Susan Thomas, Melissa Mora, Sachi Mankodi, Kimberly Brandt, Al Gomez, Kathleen Premo, and Radha Bachman.

Other topics at this event include:

- The Brave New World of Medicare Physician Compensation Under MACRA and Beyond

- Office of Civil Rights HIPAA Audits – Preparing Your Clients and Yourself

- The Physician’s Role Under EMTALA and the Florida Access to Emergency Services Act

- Medical Marijuana in Florida – The Highs and Lows of its Regulation

- The Post-Election View from the Hill

- What the Doctor’s Lawyer and the Doctor Need to Know About Bankruptcy and How Creditors Approach Health Industry Related Situations

- Medicare and Other Risk Contracts

- Medical Entities and Rules You Must Know About

Date: Friday, February 3, 2017 | Alan speaks at 8:30 AM and 4:10 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: If you are interested in registering for this presentation, please email Stephanie at stephanie@gassmanpa.com. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BOCA RATON PRESENTATION:

Alan Gassman will present a lunch talk on the JEST Trust system for the South Palm Beach County Bar Association Tax Section. Attendees will receive copies of Alan’s JEST forms.

Date: Tuesday, February 7, 2017

Location: Location TBD

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE STETSON LAW SCHOOL PRESENTATION:

Do you need a positive jump start for 2017? Think about making a date with Srikumar Rao’s book Are You Ready to Succeed? followed by participation in one or more InterActive workshops that Professor Rao will lead in St. Petersburg, Florida, which are as follows:

Saturday, February 11, 2017

Professional Achievement Workshop with Dr. Srikumar Rao and Alan Gassman

Join Dr. Rao and Alan Gassman for a 6-hour interactive, very interesting workshop to enable recent law school graduates and others to reach new levels of enjoyment and achievement in your business or professions.

This is based on Alan’s workshop materials that have been presented on many occasions at the University of Florida, Ave Maria School of Law, State and City Bar conferences, and elsewhere. This workshop will be free of charge for law and MBA students; a donation will be determined for all other interested participants. This workshop includes free course materials and a subscription to The Thursday Report.

Sunday, February 12, 2017

Srikumar Rao’s Guide to Eliminating Stress and Anxiety for Professionals and Others

This 6-hour workshop will be a private event held by the Rao Institute at the request of Alan Gassman and friends. This will be provided for a limited number of attendees as a cost of $475 per person. Please RSVP now while spaces are available!

See Dr. Rao’s YouTube TED Talk, and you will see why he is so well-regarded and sought out worldwide as a presenter, coach, and author. Meet this gentle and brilliant man who has changed so many lives up close and personal!

You can see his best-selling books, Are You Ready to Succeed? and Happiness at Work on Amazon by clicking here. You can also see his TED Talk that has been viewed by well over 1 million people by clicking here.

Sarah Palin said that she would not leave Nome without them!

The official invitations for these events can be viewed by clicking here and here.

Date: Saturday, February 11, 2017 and Sunday, February 12, 2017

Location: Stetson Law School, Gulfport Campus | 1401 61st Street South, St. Petersburg, FL, 33707

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION (HOW MICKEY MOUSE CAN YOU GET?):

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ESTATE PLANNING COUNCIL OF NORTHEAST FLORIDA PRESENTATION:

Alan Gassman will be speaking for the Estate Planning Council of Northeast Florida on March 20, 2018 on the topic of DYNAMIC PLANNING STRATEGIES FOR THE SUCCESSFUL CLIENT. Watch this space, as more details will be forthcoming!

Date: Tuesday, March 20, 2018

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates!

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, and Jerry Hesch.

Date: Thursday, February 9th, 2017

Location: Johns Hopkins All Children’s Hospital Education and Conference Center, St. Petersburg, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, April 28th, 2017 on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples.

Alan Gassman will be speaking at this conference on the topic of THE ETHICS OF AVOIDING TRUSTS AND ESTATE LITIGATION.

Date: Friday, April 28th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: New York: October 20th – 22nd, 2017; Nassau: November 30th – December 3rd, 2017; Specific speaker dates are to be determined.

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

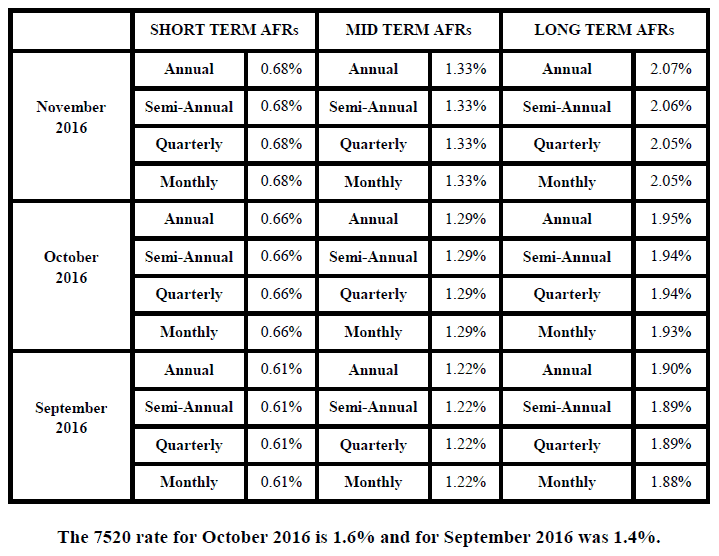

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates,

because for a sale you can use the lowest of the 3.