The Thursday Report – 10.31.13 Tax-a-ween, SCIN-a-GRAT, Deaf Interpreters

Re-Tooling Estate Plans After ATRA 2012 for Married Couples with Estates Over $10.5 Million

Seminar Spotlight of the Week – The Florida Bar Advanced Health Law Topics and Certification Review Course 2014

Accommodations for Hearing Impaired Patients Under ADA Title III

SCIN-ing the GRAT

Phil Rarick’s Informative Blog: Dying Without a Will in Florida: Who Gets What

2013 Trust Nexus Survey by Steven Roll and Lauren Colandreo

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Our article “Re-Tooling Estate Plans After ATRA 2012 for Married Couples with Estates Over $10.5 Million”

We realized this week that we did not make our June 2013 Probate Practice Reporter article entitled “Re-Tooling Estate Plans After ATRA 2012 for Married Couples with Estates Over $10.5 Million” by Howard Zaritsky and Alan Gassman available to our readers.

This article is still current and can be viewed by clicking here.

We thank Howard Zaritsky for teaching us so much and giving us the opportunity to write with him.

Seminar Spotlight of the Week – The Florida Bar

Advanced Health Law Topics and Certification Review 2014

Alan Gassman will be speaking at The Florida Bar’s Advanced Health Law Topics and Certification Review course which takes place March 7th and 8th in Orlando, Florida. Alan will be speaking on Tax Aspects of Healthcare Entities. Please support this important event. Contact Jodi Laurence at jl@flhealthlaw.com for more information.

Accommodations for Hearing Impaired Patients Under ADA Title III

Under Title III of the ADA “[n]o individual shall be discriminated against on the basis of disability in the full and equal enjoyment of the goods, services, facilities, privileges, advantages, or accommodations of any place of public accommodation by any person who owns, leases (or leases to), or operates a place of public accommodation.”

A private medical office is an example of a place of public accommodation that must comply with Title III. Therefore, the client has a duty “to ensure that no individual with a disability is excluded, denied services, segregated or otherwise treated differently than other individuals because of the absence of auxiliary aids and services, unless the entity can demonstrate that taking such steps would fundamentally alter the nature of the good, service, facility, privilege, advantage, or accommodation being offered or would result in an undue burden (i.e. significant difficulty or expense).” 28 CFR §36.303(a).

Under Title III, the physician, not the hearing impaired person, chooses the appropriate accommodation and if an interpreter is needed, the physician chooses the interpreter. Tucker, Bonnie Access to Health Care for Individuals with Hearing Impairments, 37 Hous. L. Rev. 1101, 1115-1116 (2000). Therefore, although the physician may exercise broad discretion in choosing the type of aid, she must assure that it complies with Title III.

II. What Types of Aids are Required?

The ADA requires places of public accommodation to have “appropriate auxiliary aids and services where necessary to ensure effective communication with individuals with disabilities.” 28 CFR §36.303(c).

The following sections (A, B and C) are excerpts from the DOJ’s publication entitled The Americans with Disabilities Act: Title III Technical Assistance Manual 27, III-4 320 (1993). According to the DOJ, there is no requirement for a certified interpreter. The patient must only be provided a qualified interpreter who is capable of understanding the patient’s method of communication and is able to communicate specialized medical vocabulary from the physician to the patient. In other words, “[t]he interpreter must be able to interpret both receptively and expressively”.

In the case at hand, the client must make sure that her employee will be able to communicate specialized vocabulary to the patient. It is also important that the employee be able to understand the dialect of sign language or method of communication used by the particular patient (e.g. fingerspelling, lip reading, American Sign Language, Signed English, etc).

Further, the requirement of a qualified interpreter is not required in all scenarios, and can be supplemented with another alternative. The appropriateness of an accommodation depends on the nature and extent of the relationship. For example, according to the DOJ publication The Americans with Disabilities Act: Title III Technical Assistance Manual 27 , III-4.3200 (1994 Supplement), where a hearing impaired patient must go to his doctor for a bi-weekly check up, during which the nurse records the patient’s blood pressure and weight, “[e]xchanging notes and using gestures are likely to provide an effective means of communication at this type of check-up.” This accommodation is deemed appropriate due to the length of the visit and the nature of the communication.

In the case at hand, the client’s patient requires 12 sessions of physical therapy. Due to the length and nature of the relationship, the client should air on the side of caution and use a qualified (but not certified) interpreter.

The following excerpts can be found at: http://www.ada.gov/taman3.html

A. III-4.3100 General

Who decides what type of auxiliary aid should be provided? Public accommodations should consult with individuals with disabilities wherever possible to determine what type of auxiliary aid is needed to ensure effective communication. In many cases, more than one type of auxiliary aid or service may make effective communication possible. While consultation is strongly encouraged, the ultimate decision as to what measures to take to ensure effective communication rests in the hands of the public accommodation, provided that the method chosen results in effective communication.

ILLUSTRATION: A patient who is deaf brings his own sign language interpreter for an office visit without prior consultation and bills the physician for the cost of the interpreter. The physician is not obligated to comply with the unilateral determination by the patient that an interpreter is necessary. The physician must be given an opportunity to consult with the patient and make an independent assessment of what type of auxiliary aid, if any, is necessary to ensure effective communication. If the patient believes that the physician’s decision will not lead to effective communication, then the patient may challenge that decision under title III by initiating litigation or filing a complaint with the Department of Justice (see III-8.0000).

Who is a qualified interpreter? There are a number of sign language systems in use by persons who use sign language. (The most common systems of sign language are American Sign Language and signed English.) Individuals who use a particular system may not communicate effectively through an interpreter who uses another system. When an interpreter is required, the public accommodation should provide a qualified interpreter, that is, an interpreter who is able to sign to the individual who is deaf what is being said by the hearing person and who can voice to the hearing person what is being signed by the individual who is deaf. This communication must be conveyed effectively, accurately, and impartially, through the use of any necessary specialized vocabulary.

Can a public accommodation use a staff member who signs “pretty well” as an interpreter for meetings with individuals who use sign language to communicate? Signing and interpreting are not the same thing. Being able to sign does not mean that a person can process spoken communication into the proper signs, nor does it mean that he or she possesses the proper skills to observe someone signing and change their signed or fingerspelled communication into spoken words. The interpreter must be able to interpret both receptively and expressively.

If a sign language interpreter is required for effective communication, must only a certified interpreter be provided? No. The key question in determining whether effective communication will result is whether the interpreter is “qualified,” not whether he or she has been actually certified by an official licensing body. A qualified interpreter is one “who is able to interpret effectively, accurately and impartially, both receptively and expressively, using any necessary specialized vocabulary.” An individual does not have to be certified in order to meet this standard. A certified interpreter may not meet this standard in all situations, e.g. , where the interpreter is not familiar with the specialized vocabulary involved in the communication at issue.

B. III-4.3200 Effective communication.

In order to provide equal access, a public accommodation is required to make available appropriate auxiliary aids and services where necessary to ensure effective communication. The type of auxiliary aid or service necessary to ensure effective communication will vary in accordance with the length and complexity of the communication involved.

C. III-4.3300 Examples of auxiliary aids and services

Auxiliary aids and services include a wide range of services and devices that promote effective communication. Examples of auxiliary aids and services for individuals who are deaf or hard of hearing include qualified interpreters, notetakers, computer-aided transcription services, written materials, telephone handset amplifiers, assistive listening systems, telephones compatible with hearing aids, closed caption decoders, open and closed captioning, telecommunications devices for deaf persons (TDD’s), videotext displays, and exchange of written notes.

SCIN-ing the GRAT

Are you planning to use a SCIN?

If your client has a short life expectancy and estate tax exposure the SCIN may still be the best instrument around, despite the IRS’s challenges in the Davidson case and CCA 201330033.

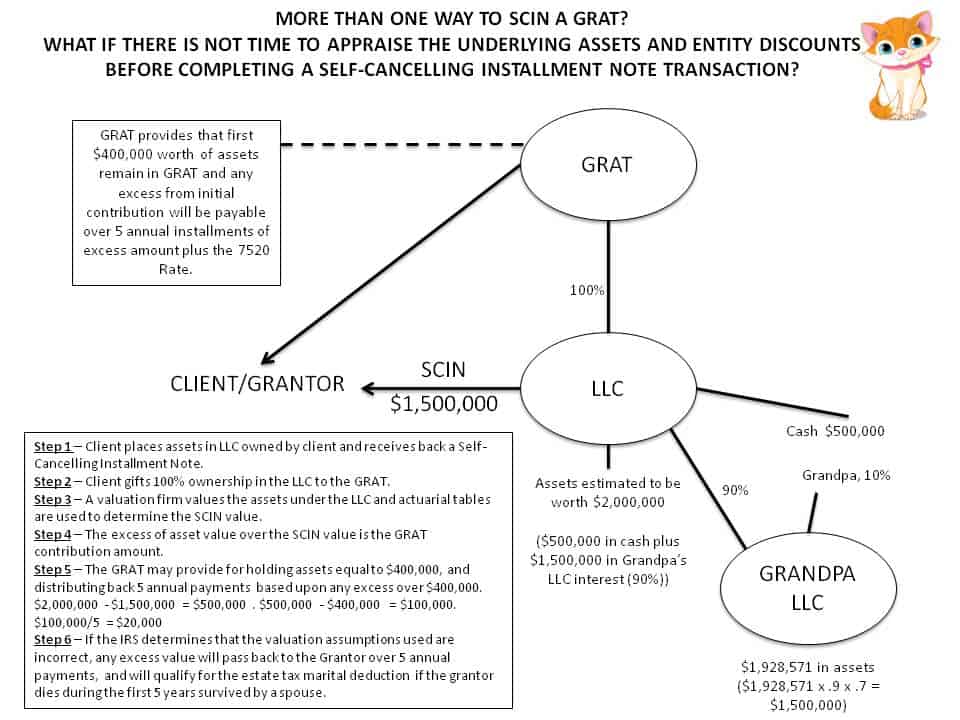

We might have a solution to insulate clients from potential estate tax issues if it turns out that SCINs have to be valued based upon what a willing buyer would pay a willing seller as opposed to using the standard tables. See our SCIN the GRAT Chart below.

An article we wrote with Jerry Hesch on this subject for Leimberg Information Services can be viewed by clicking here.

If you are interested in commenting the galleys for the article that we are presently working on for Estate Planning Magazine with Jerry Hesch and Ed Wojnaroski (who is the author of the BNA Portfolio on SCINs and Private Annuities) please clicking here.

A tentative chart that outlines the discussion that we will have with Jerry Hesch, Larry Katzenstein and Ed Wojnaroski at the Bloomberg BNA webinar scheduled for November 20, 2013 at 12:30 p.m. is shown below. To register for the webinar please click here. To receive a copy of the materials that will be used during the Webinar please email Janine Gunyan at Janine@gassmanpa.com.

| SCIN | PRIVATE ANNUITY | GRAT (not good if Grantor dies early) | |

| Can be valued based upon standard life expectancy tables, if taxpayer has better than 50% chance of living one year. | This is being contested by the IRS. | Safe, under Treasury Regulation Sections 20.2031-7(d); 20.7520-3(b) | Safe, under Internal Revenue Code Section 2702(a)(2)(B); 20.7520-3(b). |

| Must pass the “probability of exhaustion test” (significant minimum value held under trust and/or by guarantors). | No. | Yes- According to Treasury Regulation Section 1.7520-3(b)(2)(i); 20.7520-3(b)(2)(i); 25.7520-3(b)(2)(I), but is the IRS’s position under the Regulation incorrect? – See Katzenstein, Turning the Tables: When do the IRS Actuarial Tables Not Apply?, Thirty-Seventh Univ.of Miami Inst. On Est. Planning, Ch. 3 (2003). | No, if structured as a Walton-style GRAT. |

| Must make annual payments. | Probably, interest only until it balloons. | No- The Kite case allowed no payments for the first 9 years. | Yes. |

| Compatible with defective grantor trust. | Yes. | Subject to probability of exhaustion test. | Yes, it is a Grantor Trust. |

| Payments must include principal. | Not until it balloons. | Probably not- as in the Kite case. | Equal or increasing payments would represent income and principal conceptually. |

| Explainable to the client. | Yes. | Yes. | Slightly more complicated. |

| Income tax imposed upon death. | Possibly not, but IRS may not agree. (See Zaritsky, Tax Planning for Family Wealth Transfers §12.04[h], (4th ed. 2002)) | No. | No- but on death, there is a negative estate tax impact. |

| Stepped up basis on death of seller if assets are sold or transferred to individuals or non-grantor trusts. | Only to the extent of payments made before the death of the seller. The purchaser only gets basis to the extent of payment actually made. | Only to the extent of payments made before the death of the seller. The purchaser only gets basis to the extent of payment actually made. | Non-applicable– GRATs do not involve sales of assets. |

| Stepped up basis if assets are sold or transferred to grantor trusts. | Yes, hopefully. (See Blattmachr, Gans and Jacobson, Income Tax Effects of Termination of Grantor Trust Status by Reason of the Grantor’s Death, Journal of Taxation, September 2002) | Yes, hopefully. (See Blattmachr, Gans and Jacobson, Income Tax Effects of Termination of Grantor Trust Status by Reason of the Grantor’s Death, Journal of Taxation, September 2002) | Yes, hopefully. Depending upon structuring. |

| Possible usury issues for older taxpayer. | Yes, unless the risk premium is applied to the note principal. | No. | No. |

| Are Payment Rights Creditor Protected? | Generally not, but can be held by family limited partnership or other entities that provide charging order or creditor protection. | Yes, in several states. | Yes, in several states. |

We welcome all questions, comments and suggestions on the above.

Phil Rarick’s Informative Blog: Dying Without a Will in Florida: Who Gets What

Phil Rarick is back with another great blog entry on the subject of dying without a Will in Florida.

“A common question we get from relatives of family members who die without a Will is who gets what. The answer depends on Florida’s laws of interstate succession.” – Phil Rarick.

For more information on this interesting topic please click here.

2013 Trust Nexus Survey by Steven Roll and Lauren Colandreo

Bloomberg BNA Tax & Accounting authors Steven Roll and Lauren Colandreo have just published an excellent special report on multi-state trust taxation and planning in the August 23 edition of Tax Management Weekly State Report. This is the first edition of a report that will be published annually. It should get better every year.

You can read the report in its entirety by clicking here.

If you have any questions on state taxation of irrevocable trusts, you can email Steven Roll at sroll@bna.com

We thank Steven and Lauren for their excellent article.

Applicable Federal Rates

|

SHORT TERM AFRs |

MID TERM AFRs |

LONG TERM AFRs |

||||

| November 2013 | Annual | 0.27% | Annual | 1.73% | Annual | 3.37% |

| Semi-Annual | 0.27% | Semi-Annual | 1.72% | Semi-Annual | 3.34% | |

| Quarterly | 0.27% | Quarterly | 1.72% | Quarterly | 3.33% | |

| Monthly | 0.27% | Monthly | 1.71% | Monthly | 3.32% | |

| October 2013 | Annual | 0.32% | Annual | 1.93% | Annual | 3.50% |

| Semi-Annual | 0.32% | Semi-Annual | 1.92% | Semi-Annual | 3.47% | |

| Quarterly | 0.32% | Quarterly | 1.92% | Quarterly | 3.46% | |

| Monthly | 0.32% | Monthly | 1.91% | Monthly | 3.45% | |

| September 2013 | Annual | 0.25% | Annual | 1.66% | Annual | 3.28% |

| Semi-Annual | 0.25% | Semi-Annual | 1.65% | Semi-Annual | 3.25% | |

| Quarterly | 0.25% | Quarterly | 1.65% | Quarterly | 3.24% | |

| Monthly | 0.25% | Monthly | 1.64% | Monthly | 3.23% | |

Seminars and Webinars

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) HEALTH LAW SYMPOSIUM – AN ALL DAY SEMINAR

Alan Gassman will be speaking on the topic of WHAT HEALTH LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Date: Friday, November 1, 2013 | 9am – 5pm (Mr. Gassman speaks from 1:10 pm until 2:10 p.m.)

Location:SetonHallLawSchool, Newark, New Jersey

Additional Information:SetonHallUniversity in South Orange, New Jersey was founded in 1856, and they have remodeled since. Today, Seton Hall has over 10,000 students in its undergraduate, graduate and law school programs and is in close proximity to several Kentucky Fried Chicken locations.

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be speaking on the topic of WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW – A 3 HOUR OVERVIEW BY ALAN S. GASSMAN

Date: Saturday, November 2, 2013

Location: Wilshire Grand Hotel, West Orange, New Jersey | 9am – 12pm

Additional Information: Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

SALT LAKE CITY ESTATE PLANNING COUNCIL’S FALL ONE DAY “TAX AND DEDUCTIBILITY OF YOUR SKI TRIP” INSTITUTE

Alan Gassman will be speaking on the topic of PRACTICAL ESTATE PLANNING, WITH A $5.25 MILLION EXEMPTION AMOUNT, ESTATE TAX PROJECTION PLANNING, AND WHY DENTISTS ARE DIFFERENT

Date: Thursday, November 7, 2013

Location: HiltonDowntownSaltLake City, Utah

Additional Information: Please support this one day annual seminar conveniently located near skiing and tourism opportunities. If you would like to attend this event or receive the materials please email agassman@gassmanpa.com

BP CALCULATIONS FOR CPAs: TRICKS & TRAPS

Date: Thursday, November 14, 2013 | 8:00 am and 6:00 p.m.

Location: Trenam Kemker, 101 E. Kennedy Boulevard, Suite 2700, Tampa, FL 33602

Additional Information: We will be holding two seminars on Thursday, November 14, 2013. To register for either seminar please email Janine Gunyan at Janine@gassmanpa.com.

ESTATE PLANNING COUNCIL OF MANATEE COUNTY SEMINAR

Alan Gassman will be speaking to the Estate Planning Council of Manatee County on “AN ESTATE AND TAX PLANNER’S YEAR END PLANNING CHECKLIST – PRACTICE SYSTEM STRATEGIES IDEAS AND TECHNIQUES”.

Date: Thursday, November 21, 2013 | 12:00 p.m – 1:00 p.m.

Location: Bradenton County Club, 4646 9th Avenue W, Bradenton, FL34209

Additional Information: To register for this event please visit the Estate Planning Council of Manatee County website at http://www.estateplanningcouncilofmanateecounty.org/events/event/10036

MEDICAL EDUCATION RESOURCES CONTINUING EDUACTION PRIMARY CARE CONFERENCE

Alan Gassman will be speaking on the topic of LEGAL, TAX AND FINANCIAL BOOT CAMP FOR THE MEDICAL PRACTICE – A SPECIAL TAX, ESTATE PLANNING AND LAW CONFERENCE FOR PRIMARY CARE PHYSICIANS

Date: December 13, 2013 – 12:00 pm – 4:40 pm and December 14, 2013 8:00 am – 3:00 pm

Topics and Meeting Times:

Friday, December 13, 2013

- 12:00 – 1:00 pm – 2013 Tax Changes

- 1:00 – 2:00 pm The 10 Biggest Mistakes that Physicians Make in their Investments and Business Planning

- 2:10 – 3:10 pm Lawsuits 101

- 3:10 – 3:40 pm – Essential Estate Planning

- 3:40 – 4:40 pm – Deductions for Physicians

Saturday, December 14, 2013

- 8:00 – 9:00 am – Medical Practice Financial Management

- 9:00 – 10:00 am – Physician Compensation

- 10:10 – 11:10 am – Asset Entity Planning for Creditor Protection and Buy/Sell Arrangements

- 11:10 – 11:40 am – Tax Structures for Medical Practices

- 12:00 – 1:00 pm – 50 Ways to Leave Your Overhead

- 1:00 – 2:00 pm – Retirement Plan Options for Physicians

- 2:00 – 3:00 pm – Stark Naked or Well Prepared? (Please do not come to this session naked.)

Location:GrandHyattTampaBay, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information please visit www.MER.org Please note that the program qualifies for continuing education credit for physicians.

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2013

Location: The Peabody Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Peabody Hotel near Walt Disney World.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2013, whether formally or informally. Anyone who would like to attend (dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland can include a room at the fantastic Peabody Hotel for a discounted rate per night, single occupancy.

THE FLORIDA BAR ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2013

Date: March 7-8, 2014

Location: Orlando, Florida – More Information to Follow

Additional Information: For more information on this event please email agassman@gassmanpa.com

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors:AveMariaSchool of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

NOTABLE SEMINARS PRESENTED BY OTHERS:

48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: OrlandoWorldCenter Marriott, Orlando, Florida

Sponsor:University of MiamiSchool of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and ConferenceCenter, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”