The Thursday Report – Issue 291

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Thursday, October 22, 2020 – Issue 291

Having trouble viewing this? Use this link

In this week’s abridged Report we provide you:

Free 12:30 PM EDT Fun with Dick and Jane Webinar Today

Florida Bar 2020 Advanced Wealth Protection Workshop Tomorrow or On-Demand

When to Unplug Great Grandpa and Other Tax Strategies to Consider

Upcoming Events

Please consider joining us today at 12:30 PM EDT for a free webinar hosted by the Children’s Home Society of Florida.

You can learn more about their mission here.

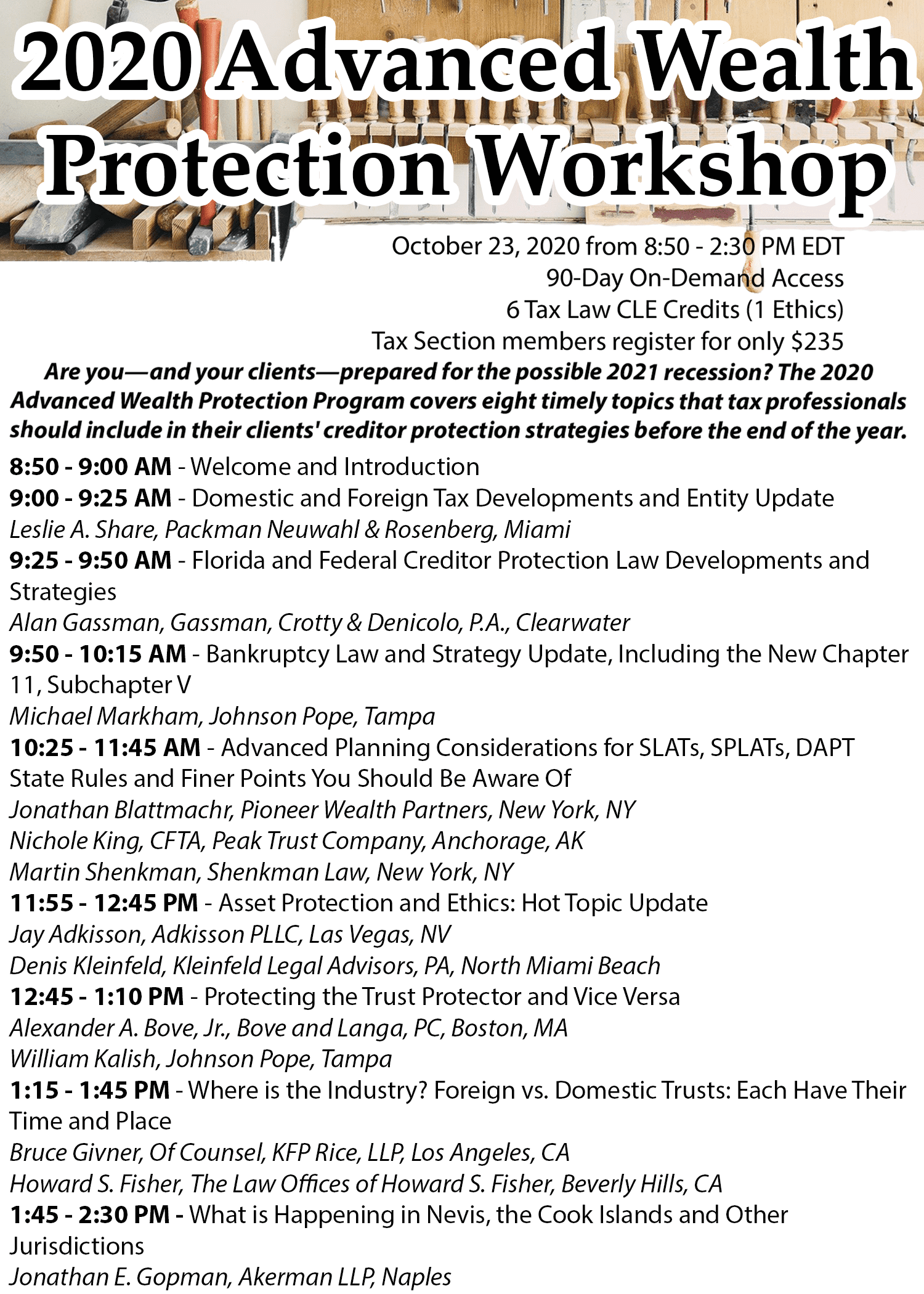

Lawyers, financial planners, and other professionals should consider attending tomorrow morning’s presentation sponsored by the Florida Bar Tax Section.

| Friday, October 23, 2020 | Florida Bar Tax Section CLE |

Advanced Wealth Protection Workshop from 8:50 AM to 2:30 PM EDT

|

REGISTER for $310 |

|

|||

When to Unplug Great Grandpa and Other Tax Strategies to Consider

Alan Gassman & Wesley Dickson

EXECUTIVE SUMMARY:

2020 will long be remembered for the COVID-19 virus, an extremely rollicking presidential election and an especially challenging time for financial and tax advisors. Never in modern history has there been such a complicated and challenging situation facing small businesses and professionals than handling Covid-19, the PPP program, EIDL loans, medical provider programs and delayed tax filing deadlines.

Just as CPAs and other tax return preparers have finished corporate returns by October 15th, PPP borrowers must struggle with income tax planning as they realize that the expenses that they made sure to pay to obtain forgiveness for their loans will not be tax deductible, which is essentially the same as if the PPP loan forgiveness was taxable! In addition, a great many wealthy individuals and families are ardently working to organize their trust and estate planning situations in order to be ready for a possible reduction in the estate tax exemption amount that could occur before they have a chance to make use of the exemption.

If there is a Democratic sweep of the House, Senate, and presidency those making medical decisions for wealthy individuals in intensive care in late December might be influenced by taking advantage of the availability of the

$11,580,000 estate tax exclusion and the certainty of receiving a new fair market value income tax basis for Great Grandpa’s assets. This newsletter reviews a number of key estate planning opportunities that can be considered for 2020 planning while there is still time to do so.

FACTS:

History as a Map of Possibilities

The Merriam Webster Dictionary provides the definition of the word “permanent” as “continuing or enduring without fundamental or marked change.” The word is sometimes used in reference to parts of our tax laws. However, in the tax context, the term permanent can hardly be described as “continuing or enduring without fundamental or marked change.” There is probably no better example of this than in the estate and gift tax area.

Over the last 20 years we have seen enormous changes with respect to federal estate and gift taxes. In 2000, the lifetime exclusion for estate and gift tax purposes was only $675,000. In other words, hardly enough to cover the value of a home and a relatively modest retirement account.

And, for those of us old enough to remember, there was even a separate excise tax which was imposed at death on “excess accumulations” in certain retirement accounts.

Following passage of the Economic Growth and Tax Relief Reconciliation Act of 2001i (EGTRRA), the estate tax exclusion amount started to climb significantly. Beginning in 2002, it rose from $1 million to $3.5 million by 2009. The gift tax exclusion amount also rose under that legislation, but remained static through the decade at $1 million. Besides changes to the exclusion amounts, the maximum rate imposed on estates and gifts fell.

No longer were decedent’s estates and lifetime gifts subject to rates as high as 55 percent, or even higher for the largest estates.

Starting in 2010, additional changes occurred. In that year, the estate tax was to have been repealed, but was instead reinstated with an applicable exclusion amount of $5 million (although the rate for 2010 was zero, to the delight of the Steinbrenner and several other wealthy families).ii For gift tax purposes, the exclusion remained $1 million with a maximum rate of 35 percent. In 2011 and 2012, the estate and gift tax lifetime exclusions were once again paired at $5 million, adjusted for inflation and the concept of “portability” was added to Internal Revenue Code.

The so-called “fiscal cliff” negotiations at the end of 2012iii brought further changes for 2013 and later, including a rise in the maximum estate and gift tax rate to 40 percent. More recently, the 2017 Tax Cuts and Jobs Act,iv doubled the estate and gift tax exclusion amount to $10 million, adjusted for inflation, so that for decedents dying and gifts made in 2020 the amount is currently, $11.58 million.

There and Back Again

Looking at this slice of history one could easily conclude that change has been good for those facing possible estate and gift taxes. However, the future holds great peril. Although the overall economy has been strong over the last decade, 2020 has proven to be a very unpredictable and downright scary year. Unemployment spiked to historical numbers and the financial markets have swung wildly over the last few months. Over 200,000 people have died from Covid-19 related illnesses and the end is not in sight. A vaccine is months, if not a year or more, away. And, a volatile Presidential election is upon us.

Sunrise, Sunset

Similar to what occurred with EGTRRA, the changes made by the 2017 Tax Cuts and Jobs Act have a sunset date. In this case, it is the end of 2025. However, there is a distinct possibility that starting in 2021 we could see a major turnover in Washington D.C. with Democrats controlling both houses of Congress and the White House. If that occurs, what is to prevent a reversal of the trend toward more favorable estate and gift tax rules?

In addition, proposals made in recent years have indicated that the call for new revenues will not necessarily be limited to lowering the estate tax exclusion amount and raising the applicable transfer tax rates. Other targets include imposing capital gains to be paid on appreciated assets when a person dies, and higher ordinary income rates to apply when IRAs, annuity investments, and other items that are considered as income in respect of a decedent (IRD) are distributed. Restrictions on more esoteric estate planning strategies, such as grantor retained annuity trusts (GRATs), family limited partnerships (FLPs), and family limited liability companies (FLLCs) have also been proposed.

What Needs to Be Done?

During past critical moments in the history of estate and gift taxes, such as in 2010 and 2012, a number of articles were written with the tongue-in-cheek query asking whether it was time to unplug grandma or grandpa before the estate tax law changed drastically.v

All parody aside, affluent families should now be seriously planning how each individual member can best use his or her $11,580,000 exclusion if and when the time comes that they must “use it or lose it.” However, the fact is, many families with significant wealth have not addressed this issue, or done the type of planning with FLPs, FLLCs, sales to trusts in exchange for notes bearing interest at low rates, or other arrangements that might not be available in the future. This comment may seem harsh to some, but the “Survival of the Fittest” results from the fact that smart and responsible people and their families will survive economically, while not so smart, unresponsive, or ill-advised wealthy families may become much less wealthy because of failure to take the right steps, including the Biden 2- Step.vi You can read more about the Biden 2-Step in Estate Planning Newsletter #2813 by Alan S. Gassman, Jerome B. Hesch, and Martin B. Shenkman, or view their complementary LISI Webinar on this topic by clicking HERE.

The many significant tax law increases we may see include the elimination of a new fair market value income tax basis that occurs for most assets when someone dies (i.e., “stepped-up basis”), higher income tax rates, and even possibly a capital gains tax to be imposed at death, as if a person who died sold all of their assets. The latter would be similar to the tax law system that has prevailed in Canada for many years.

Spend Less, Earn More

At minimum, families should be budgeting for what the tax will be if these proposals are enacted. First, they should consider reducing living expenses (including “non-necessary luxuries”) so that family wealth reserves and investments do not have to be depleted to pay for lifestyles that might not be affordable now, or at least will be after a tax increase. Some may simply not be able to ratchet down spending, thus making room for the next generation of affluent families who may win the next round of the never-ending “Survival of the Fittest” challenges in our unique society.

COMMENT:

Given this backdrop, there are a number of planning techniques and issues that sophisticated advisors should be considering, including the following:

1. The Wait and See QTIP

A married donor signs and funds a flexible Qualified Terminable Interest Property (“QTIP”) trust that must pay all income to the spouse and can be

used only for the spouse’s benefit during his or her lifetime. The donor can file a gift tax return as late as October 15, 2021, if properly extended, to treat the QTIP trust as one or a combination of the following:

- A pure 100% marital deduction trust, in which event the grantor has not used any of the grantor’s $11,580,000 exclusion, and the trustee of the QTIP trust may elect to pay all of its assets to the spouse.

- The donor can elect to have the entire trust treated as having been a gift using the donor’s estate tax exemption. The trust will never be subject to estate tax in the estate of the beneficiary spouse. Even if the beneficiary spouse appoints the trust assets so that they benefit the grantor with expenses as reasonably needed for health, education, and maintenance after the donee spouse’s death.

- A partial election can be made by formula or dollar amount so that a certain portion of the QTIP Trust becomes a credit shelter trust like b. above, with the rest being a marital deduction trust as described in Section a. above.

Example: A donor owes a $10,000,000 note that may be worth only

$8,000,0000. The donor’s estate tax exemption amount is somewhere between $6,000,000 and $9,000,000, depending on whether discounts taken with prior gifting are challenged.

The donor has filed gift tax returns in the past using $1,580,000 of her estate and gift tax exclusion, leaving $10,000,000 that she can gift in 2020 without incurring a gift tax.

The donor puts the $8,000,000 note and $2,000,000 of marketable securities into the QTIP trust in 2020.

In 2021 the donor makes a formula election to treat the note and marketable securities as being in the credit shelter trust to the extent of the value of the note plus sufficient marketable securities to completely use the donor’s 2020 estate tax exclusion.

Upon audit the IRS may conclude that past gifts exceeded what was reported by $1,000,000, so that the donor’s exemption is only

$9,000,000. The IRS may also value the note at $9,000,000 and conclude that the credit shelter portion of the QTIP trust consists entirely of the note, with the remaining $2,000,000 of marketable securities being in the marital deduction part of the QTIP trust.

The IRS will not be able to impose gift tax if the documents are drafted properly and an appropriate election is made in 2021. Please note that there are no “reasonable cause” exceptions to filing the marital deduction election by the due date in 2021. Be careful out there!

2. Running Numbers is Essential

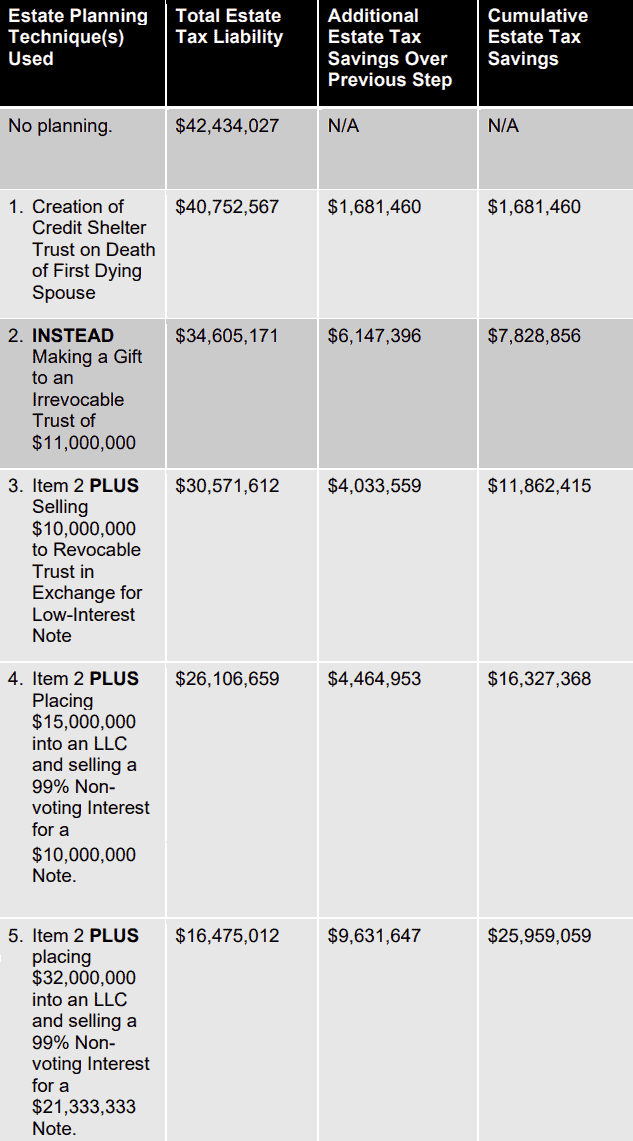

Anyone who has used an estate tax projection program knows that the numbers are often different than what would be expected from simple intuition or assumptions. For example, an installment sale for a low-interest note can have a very profound impact on estate tax avoidance, and this can be very surprising.

Assume, for example, that a married couple has $44,000,000 in assets that consist of a $4,000,000 house growing at 3.5% per year and $40,000,000 of investments growing at 5.5% per year. If the husband dies in 6 years and the wife dies in 15 years, and the two have done little in the way of estate planning, the estate tax due on the death of the wife would be

$42,434,027.

Assuming that one spouse would die in 2026 and could leave $6,790,000 in a credit shelter trust to be established on the death of the first dying spouse, then the estate tax liability on the second death in 2035 would be reduced to $40,752,567.

The following table quantifies the impact of implementing a variety of planning techniques:

One potential option for the couple would be to transfer $11,000,000 to an irrevocable trust in order to reduce their estate tax burden. Even if the couple does not wish to do further planning, this alone results in an estate tax of $34,605,171 for a total savings of $6,147,396 in estate tax.

If the couple would instead both fund an $11,000,000 trust and sell the trust another $10,000,000 in assets in exchange for a 3-year promissory note bearing interest at 1%, the estate tax on the second death will now be reduced to $30,571,612. The simple installment sale saves $4,033,559 in estate taxes.

If the couple would go one step further and place $15,000,000 in an LLC, and sell a 99% non-voting member interest in the LLC to the trust in exchange for a $10,000,000 note, instead of a sale for $10,000,000 in cash, then the additional estate tax savings would be $4,464,953.

If the couple would instead put $32,000,000 of investments into an LLC and sell a 99% non-voting interest to the trust in exchange for a $21,333,333 note, then the estate tax savings from putting $32,000,000 in the LLC in lieu of $15,000,000 and having the note be for $21,333,333 instead of

$10,000,000 would be another $9,631,647.

Please note that the estate tax savings from funding the first $11,000,000 into an irrevocable trust is only $6,147,396, and that the additional savings from having the trust purchase a 99% limited liability company interest would range from $4,464,953 to $9,631,647.

It may be difficult, but more than worth the effort, to educate clients on how this works.

These numbers assume that the clients will pay annual income taxes on the investments based upon 1.5% of value, and that no income tax would be imposed upon the trust that they establish if and when one or both of them die.

3. Slicing the SLAT

The most popular variety of trust for married couples in 2020 year-end planning is the Spousal Limited Access Trust (SLAT), which can be held by the donating grantor’s spouse for his or her health, education, and maintenance, and the health, education, and maintenance of their descendants. The spouse can also be given the power to make dispositions to charity, and to direct that the assets may be held for the health, education, and maintenance of the grantor if the grantor survives the surviving spouse.

The trust might also be established in an Asset Protection Trust (“APT”) jurisdiction and the grantor might be added as an additional beneficiary of the trust if and when the grantor would have unforeseen financial setbacks.

We do not recommend that a “reciprocal SLAT” be established by each spouse for the other, even though the case law in this area has permitted reciprocal SLATs. One concern is that a creditor might successfully claim that reciprocal SLATs formed by a married couple who do not live in a creditor protection jurisdiction could be invaded by creditors if they are formed in a domestic jurisdiction and the law of the state where the married couple resides is found to be controlling. If creditors could reach into the trust then either spouse could run up debt and have it paid by the trust, and therefore be considered to have obtained a lifetime retained interest under Internal Revenue Code 2036(a), which could cause each trust to be subject to federal estate tax on the assets of the trust that he or she is a beneficiary of.

4. The Code Section 682 Issue

IRC Section 682 provided that a grantor trust would no longer be considered as taxed to the grantor when the beneficiary of the trust was the grantor’s spouse, once they became divorced. The repeal of Section 682 as part of the 2017 Tax Act raised the question as to whether the defective grantor trust status can be removed in the event of a divorce. There is a possibility that it cannot be removed, so it seems most prudent to provide in trust documents that the grantor’s spouse would be removed as a beneficiary in the event of divorce.

5. The Disqualified Section 2701 Partnership – Allocating Exemption to an Asset that Will Continue to be Accessible to the Donor and Can Pass Under the $11,580,000 Exemption, Even after the Exemption Is Reduced

A recent LISI Newsletter discussed what Stephen Breitstone, Mary

O’Reilly and Joy Spence refer to as the GRIP Partnership.vii The taxpayer can establish an LLC and place more than the amount of the taxpayer’s estate tax exemption into the LLC. The LLC operating agreement can provide for a preferred interest and a common interest as described in their newsletter, and the gift of the common interest can trigger gift treatment of the entire LLC, thus using the taxpayer’s exemption amount, even though the taxpayer will have access to the preferred interest during her lifetime.

When the taxpayer dies the preferred interest will be subjected to estate tax, but this will be offset to the extent of the amount of exemption that was used when the gift was made. In other words, for example, the taxpayer can put $11,580,000 in an LLC, gift 10% of the LLC, and have this considered to be a gift of $11,580,000. If the taxpayer later dies when the exemption amount has gone down to $3,500,000 the entire preferred interest will be considered as owned by her, but not taxable to the extent not exceeding $11,580,000.viii

6. PPP Limitations

Finally, let’s not forget that PPP borrower entities are subject to transfer limitations pursuant to SBA Notice 5000-20057, which is discussed in Business Entities Newsletter #207 and includes charts which should be helpful.

Conclusion

There are many planning opportunities that families can attempt to use to save taxes and facilitate sound decision making before the end of 2020. For many the question of whether to “unplug Great Grandpa” will be a difficult one. Families who plan ahead will not have this terrible problem. In order to maximize the benefits of detailed estate planning, families should maintain close contact and communication with their CPAs, tax lawyers, and financial advisors. This will be necessary to ensure that they are getting the best advice, especially between now and year-end, where the time and energy of such advisors may be relatively limited given the number of individuals and families that may be seeking advice “at the last minute” after the election.

Finally, the states that currently allow “legal suicide” for someone with a terminal condition with no realistic hope of recovery and the statutes that apply for each state are referenced below, and include Oregon, which allows an individual to become a resident by simply making the state his or her domicile:

- California End of Life Option Act: Part 1.85 (commencing with Section 443), Division 1 of the Health and Safety Code.

- Colorado End of Life Options Act: Colorado Revised Statutes, Title 25, Article 48.

- District of Columbia Death with Dignity Act of 2016: D.C. ACT 21-577

- Hawaii Our Care, Our Choice Act: HB 2739

- Maine Death with Dignity Act: MRSA, Title 22, Chapter 418

- Montana: by court decision (Baxter v. Montana; 224 P.3d 1211)

- New Jersey Aid in Dying for the Terminally Ill Act: Sections 1 through 20 of P.L.2019, c.59 (C.26:16-1 et seq.)

- Oregon Death with Dignity Act: ORS Chapter 127.800 et seq

- Vermont End of Life Choices: 18 V.S.A. chapter 113

- Washington Initiative 1000: RCWs, Title 70, Chapter 70.245

Remaining calm, evaluating all alternatives, planning well ahead of time, and staying out of intensive care are all good strategies that conscientious advisors can help assure that as many clients as possible have the opportunity to evaluate. We hope this helps you to roll up the sleeves or use good software, run the numbers, and educate the clients and planning teams on how this works.

HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE!

Alan Gassman

Wesley Dickson

CITE AS:

LISI Estate Planning Newsletter #2832 (October 20, 2020)

at http://www.leimbergservices.com Copyright 2020 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

CITATIONS:

- i – P.L. 107-16.

- ii – Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010; P.L. 111-312.

- iii – American Taxpayer Relief Act of 2012; P.L. 112-240.

- iv – P.L. 115-97.

- v – Alan Gassman, Unplugging Great-Grandpa: Curious Consequences of the Current Estate Tax Regime, ESTATE PLANNING, Vol. xx, No 9, September 2011.

- vi – See A. Gassman, S. Kess, and B. Graziano, The Biden Two-Step: An Estate Planning Strategy for Uncertain Times, ESTATE PLANNING REVIEW, Wolters Kluwer, September 17, 2020.

- vii – Estate Planning Newsletter #2827.

- viii – It is important to note that some advisors believe that there is a distinct possibility that the GRIP technique would trigger a future anti-abuse exception to the anti-clawback regulations.

Upcoming Events

FREE WEBINARS PROVIDED BY OUR FIRM ARE HIGHLIGHTED IN BLUE BELOW

| When | Who | What | How |

|---|---|---|---|

| Thursday, October 22, 2020 | Children’s Home Society of Florida Webinar |

Alan Gassman presents: Donor Appreciation Event: Will & Trust Planning from A – Z a.k.a. Fun with Dick and Jane as They Plan Their Estates (w/ a special guest appearance from Spot) from 12:30 to 1:30 PM EDT |

|

| Friday, October 23, 2020 | Florida Bar Tax Section CLE |

Alan Gassman, Leslie Share, Denis Kleinfeld, Michael Markham, Jonathan Blattmachr, Brandon Cintula, Martin Shenkman, Jay Adkisson, Alexander A. Bove, Jr., Bruce Givner, Howard S. Fisher, Jonathan E. Gopman present: Advanced Wealth Protection Workshop from 8:50 AM to 2:30 PM EDT |

REGISTER |

| Friday, October 23, 2020 | Leimberg Webinar Services (LISI) |

Alan Gassman and Christopher Denicolo present: Tax Planning for Insolvency and the Discharge of Indebtedness: What Business & Tax Planning Professionals Can Do to Reduce Taxes and Avoid Unpleasant Surprises from 1 to 2:30 PM EDT |

REGISTER |

|

|||

| Monday, October 26, 2020 | Free webinar from our firm |

Alan Gassman and Sean Healy present: LETHAL PITFALLS IN DRAFTING GUN TRUSTS from 12:30 to 1:20 PM EDT |

REGISTER |

| Monday, October 26, 2020 | CPA Academy |

Ken Crotty presents: The Impact of Powell and Strangi on Estate Planning with family LLCs and Partnerships from 5:30 to 6:30 PM EDT |

Coming Soon |

| Tuesday, October 27, 2020 | CPA Academy |

Alan Gassman and Christopher Denicolo present: Tax Planning For Insolvency and the Discharge of Indebtedness Part 2 with Creditor Protection Planning from 5:30 to 6:30 PM EDT |

REGISTER |

| Wednesday, October 28, 2020 | Leimberg Webinar Services (LISI) |

Alan Gassman and Brandon Ketron present: DYNAMIC AND CREATIVE STRATEGIES FOR 2020 YEAR-END PLANNING from 3 to 4:30 PM EDT |

REGISTER |

| Wednesday, October 28, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Christopher Denicolo presents: A Comprehensive Review of the SECURE Act And How To Draft For What Is Still Not Clear from 3 to 5 PM EDT |

REGISTER |

| Thursday, October 29, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Alan Gassman participates in panel on: Termination of Charitable Trusts – Everything you wanted to know about CLAT (termination). from 3:50 to 5 PM EDT |

REGISTER |

| Friday, October 30, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Alan Gassman moderates: CARES Act Loan Forgiveness: Tax Issues and Related Aftermath of COVID-19 if the Loan Is Repaid Presented by David Herzig and Herbert Austin from 8 to 9 AM EDT |

REGISTER |

| Wednesday, November 4, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Andrew Barg present: Taxation of Individuals and Businesses in Bankruptcy from 12:30 to 1 PM EST |

REGISTER |

| Thursday, November 12, 2020 | Leimberg Webinar Services (LISI) |

Alan Gassman, Michael Lehmann and Brandon Ketron present: Innovative Charitable Year-End Planning from 3 to 4:30 PM EST |

Coming Soon |

| Saturday, November 14, 2020 | Frenchy’s Big Clays For Kids |

Gassman, Crotty & Denicolo, P.A. sponsor: Frenchy’s Big Clays For Kids Charity Tournament |

More Information |

| Monday, November 16, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman presents: Dynamic Planning for Professionals and Their Entities from 4:45 to 5:35 PM EST |

REGISTER |

| Tuesday, November 17, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman and Brandon Lagarde present: COVID 19: What Did We Learn About Financial Viability During a Pandemic: Parts 1 and 2 from 12:40 PM to 2:30 PM EST |

REGISTER |

| Wednesday, November 18, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Andrew Barg present: Advanced Tax Planning And Strategies For Insolvent Taxpayers – Including State Law Impact And State Taxes from 12:30 to 1 PM EST |

REGISTER |

| Thursday, November 19, 2020 | Clearwater Jazz Holiday Foundation |

Alan Gassman sponsors: Wanderlust – A Reimagined Live Music Experience for 2020 from 6 to 9 PM EST |

More Information |

| Thursday, November 19, 2020 | FICPA Scholarship Foundation |

Gassman, Crotty & Denicolo, P.A. sponsors: The 16th Annual Suncoast Scramble Golf and Wine Tasting event |

More Information |

| Tuesday, December 1, 2020 | Ohio Bar Association’s Great Lakes Asset Protection Institute |

Alan Gassman presents: Asset Protection Plans that Actually Work! 60 Minutes On Asset Protection |

More Information |

| Friday, December 4, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Michael Markham, Esquire present: What We Know About Subchapter 5 Bankruptcies from 12:30 to 1 PM EST |

REGISTER |

| Friday, January 29, 2021 | Florida Bar CLE: Representing the Physician | Alan Gassman presents: Medical Practices And PPP, EIDL, and Provider Relief Fund Planning and Implications | Coming Soon |

| Thursday, February 11, 2021 | Johns Hopkins All Children’s Annual Estate Planning Seminar |

Alan Gassman virtually sponsors: Introducing Speakers and Listening Carefully! |

More Information |

| Friday, March 26, 2021 | Florida Bar Tax Section CLE |

Alan Gassman and Leslie Share present: Creditor Protection Nuts & Bolts |

Coming Soon |

Call us now! Bookings accepted for haunted houses, bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200