The Thursday Report – 7.23.15 – The Whiter Shade of Thursday

The Whiter Shade of Thursday

Closing Letter Update

Florida CFPs Sue the CFP® Board and Lose in an Attempt to Circumvent or Avoid Ethical Violation Actions

Systems Thinking in Health Care and Cultural Shift by Pariksith Singh, M.D.

Life Insurance Definitions, Part III

Richard Connolly’s World – What to Do with IRA Funds

Thoughtful Corner – Office Efficiency and Logistics, Part I

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

The Whiter Shade of Thursday

“A Whiter Shade of Pale” was the debut single released on May 12, 1967 by the English rock band Procol Harum, pictured above. The band was nominated for induction into the Rock and Roll Hall of Fame in October of 2012.

The single “A Whiter Shade of Pale” was written by Gary Brooker, Keith Reid, and Matthew Fisher. The song reached number one on the UK Singles Chart and stayed there for six weeks. It reached number 5 on the equivalent US charts and is considered to be one of the counterculture anthems of the 1967 Summer of Love. As of 2009, it was the most-played song in public places in the United Kingdom. This song is one of fewer than 30 singles in music history to have sold over 10 million copies. You can hear the song by clicking here.

Closing Letter Update

Last week, we reported on a policy change at the IRS, which now requires attorneys to request a closing letter for an estate. You can see this report, as well as an article by Chuck Rubin about the policy change, by clicking here. In response, we received the following email from Thompson Coburn attorney and tax law giant Steven Gorin.

Steven said:

Regarding closing letters, you might add this to your next report:

See the first two Q&A of http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Frequently-Asked-Questions-on-Estate-Taxes for details about the closing letter situation. [These questions have been reproduced below.]

This is an IRS attempt to save money due to budget cuts.

At a meeting I attended after this policy was announced, a Treasury representative asked [that we] not call the number listed on that web page to get the status or the closing letter. Instead, file Form 4056-T to provide an account transcript that tells us the status. That was a request (more in the nature of a plea), not a directive.

Note that a closing letter cuts short the period for the Code §645 election to be treated as an estate. Therefore, in some circumstances, not getting the closing letter might be good.

As an aside, in addition to obtaining a closing letter, consider filing Forms 5495 for estate tax returns and 4810 for the decedent’s gift and income tax returns.

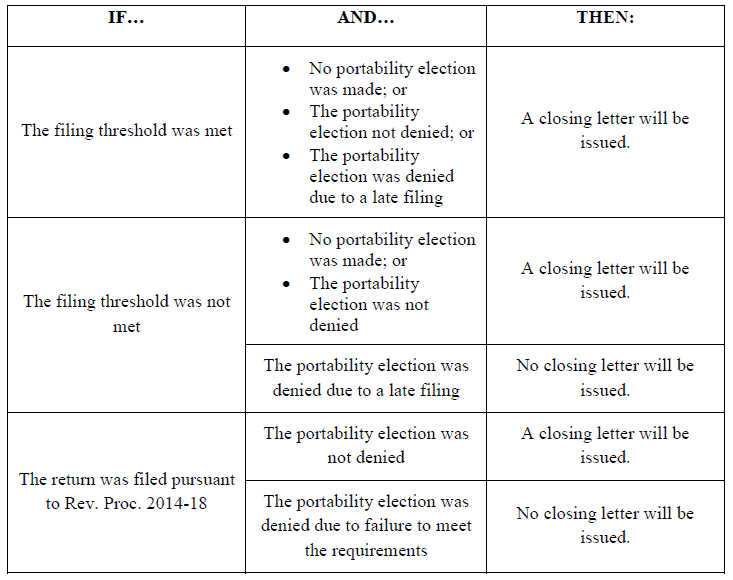

Thanks, Steve, for this contribution! The first two questions and answers from the IRS website recommended by Steve are as follows:

When can I expect the Estate Tax Closing Letter?

For all estate tax returns filed on or after June 1, 2015, estate tax closing letters will be issued only upon request by the taxpayer. Please wait at least four months after filing the return to make the closing letter request to allow time for processing. For questions about estate tax closing letter requests, call 1-866-699-4083.

What if my estate tax return was filed before June 1, 2015?

There can be some variation, but for returns that are accepted as filed and contain no other errors or special circumstances, you should expect to receive your closing letter about 4 to 6 months after the return is filed. Returns that are selected for examination or reviewed for statistical purposes will take longer.

For Estate Tax Returns Filed After January 1, 2015 and Before June 1, 2015

Florida CFPs Sue the CFP® Board and Lose in an Attempt to Circumvent or Avoid Ethical Violation Actions

by Alyssa Eberle, J.D. and Alan Gassman

Jeff and Kim Camarda, two Florida-based insurance advisors, filed a lawsuit against the CFP® Board in June of 2013. Prior to the lawsuit, the CFP® Board had completed an ethical investigation into the Camarda’s firm, Camarda Wealth Advisory. The Board had determined that the Camardas were in violation of the compensation disclosure rules by reason of having allegedly mislead consumers by using the “fee-only” characterization of their services, when, in fact, they also provided commissions-based business as well.[1] The disgruntled CFP® advisors sought to prevent the Board from publishing their public reprimand, claiming that they did not receive a fair hearing prior to the Board’s sanctioning.

The Certified Financial Planner Board of Standards, Inc. (CFP® Board) is the non-profit certifying and standard-setting organization that administers the Certified Financial Planner program and oversees the professionals using the CFP® certification in the United States. The CFP® certification requires additional education prerequisites, a six-hour examination, full-time experience, and an agreement to abide by the CFP® Board’s Standards of Professional Conduct.[2] The Standards of Professional Conduct include a Code of Ethics and Professional Responsibility. These rules must continue to be followed throughout a CFP®’s career and are essential to the designation.

When the Camardas decided to bring suit against the Board, it had recently been criticized for its failure to enforce rules fairly and consistently. In fact, in another recent case, Nigel Taylor, a CFP® certificant, had a complaint filed against him regarding his RIA firm. The complaint alleged that not only was his RIA firm “fee-only,” but also that Taylor owns a commission-based insurance agency.[3] Taylor disputed the claim, insisting that while he is personally a fee-and-commission-based CFP® advisor, his RIA firm did not receive any commission, and to state otherwise would be a “material misstatement.”[4]

Further, Taylor argued that the CFP® Board had no jurisdiction over his firm, only the CFP® certificants themselves. This issue aggravated Taylor to the point that he ended up dropping his CFP® certification marks. Upon Taylor’s decision to drop his CFP® certification, the Board halted their investigation into the matter.[5] The Board’s decision came as a surprise to the financial advisor community, therefore causing some to point out that ending the investigation without even rendering a decision “suggests the CFP® Board lacks confidence in its own rules and enforcement process.”[6]

The Camardas were apparently hoping to ride on the coat-tails of the arguments Taylor had initiated against the CFP® Board. The Camardas argued that the crux of the case against the Camardas relied on the idea that their fee-only firm and insurance agency together made them “functionally one entity,” such that their compensation model should have been disclosed as commission and fee. Yet the CFP® Board still has never publicly disclosed the “functionally one entity” precedent as a rule that all CFP® certificants must follow. While the Board insists that the notion has always been regarded, the precedent in the Camarda case hinged on a term that is not included in the Board’s terminology and has never been defined or explained.[7]

The case therefore centered around whether the CFP® Board is in breach of the contract with its certificants (the Camardas) by failing to establish clear cut rules to follow and/or failing to enforce those rules in a manner that would give the certificants proper due process. If the CFP® Board were to be found liable, the Board would not only face steep damage payments but also the risk of legal stigma for breaching its contract with CFP certificants by failing to establish clear rules that are enforced consistently. However, if the Board were to prevail against the Camardas, it would be legal validation of the organization’s ability to set its own practice standards and enforcement processes.[8]

Financial advisor, author, and lecturer Michael Kitces notes in his blog post entitled “Should CFP® Board Settle Camarda Case? My Argument and the Board’s Response,” that the Board had already racked up more than $1 million in legal fees as of 2014.[9] Would it really be worth it to try to win the case against the Camardas, especially if, at a minimum, the Board could be assessed the Camardas’ legal fees and business damages? Additionally, if the CFP® Board were to lose the case, the door is open for virtually every other CFP® certificant to question the organization that could lead to additional lawsuits and become a material threat to the Board’s financial stability. The Board could risk losing their standing as an ethical rule-making body for the profession, which would allow for alternative or state-based licensing arrangements to arise instead, rendering the Board obsolete.

In the end, it seems that the CFP® Board was saved the embarrassment of a public trial. Instead, the case was dismissed in favor of the Board, allowing them to accelerate the process of updating the rules and moving past the issue. Indeed, Ray Ferrara, CFP®, the Chair of the CFP®’s Board of Directors, stated that:

The lawsuit fundamentally threatens the CFP® Board’s mission to benefit the public by challenging our ability to enforce these standards…The very integrity of the CFP® certification would be undermined if the CFP® Board backed down from enforcing a disciplinary decision that was imposted in accordance with its rules and procedures.[10]

In a July 6 order, US District Judge Richard J. Leon granted a motion for summary judgment in favor of the Board, and the case of Camarda v. CFP Board was dismissed. As the parties come to an agreement as to what information is redacted, the financial advisory community waits to see what is inside the Judge’s complete Order. This case is a terrific example of the CFP® ethics review and disciplinary processes that are similar to other professions such as accountants, doctors, and lawyers.

************************************************

[1] Diana Britton and Megan Leonhardt, Camardas May Appeal Judge’s Decision in CFP Board Suit, Jul. 8, 2015, WealthManagement.com, accessed July 14, 2015

[2] See “Certified Financial Planner Board of Standards Inc. – CFP® Certification Examination.” Cfp.net

[3] Michael Kitces, Should CFP Board Settle Camarda Case?, Think Advisor, December 30, 2014. Accessed on July 13, 2015.

[4] Id.

[5] Id.

[6] Id.

[7] Id.

[8] Id.

[9] Id.

[10] Id.

Systems Thinking in Health Care and Cultural Shift

by Pariksith Singh, M.D.

Pariksith Singh, M.D. is a true visionary in every sense of the word. Dr. Singh is a board-certified internal medicine physician who received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001.

Any attempt to change health care and the culture of providers, patients, or employees involved in health care must operate under a “Systems Thinking” approach: an appreciation that one is dealing with complex human social, financial, and cultural interactions. Any pressure at one point may cause unintended consequences at another. The system must compensate for an individual’s efforts to transform it in such a manner that it will not counteract and produce an entirely opposite effect of the original action.

Cures to any health care issues are seldom clear-cut, and any attempt to fix things in a simple manner often turns out to be simplistic. A deep understanding of the interactions must be involved; especially when dealing with Population Medicine or at a network level.

For example, imagine an instance where seasoned managed care providers are sent to a busy office to help improve utilization and quality. When unnecessary referrals were curtailed, the specialists became upset and threatened. The specialists then rallied patients against the primary care provider, filed complaints at the HMO plan level, used abusive language and threatened lawsuits. While this happened, the patients – who were aggrieved at what they saw as denial of care and fall in quality and choice – started calling the Center for Medicare & Medicaid Services with complaints and leaving the primary care physician in droves. At the same time, the staff at the primary physician’s office rebelled at his high-handedness and review of inappropriate referrals as unreasonable and against the culture of that office. Thus, an excellent provider ended up achieving the exact opposite of what he had intended when he attempted to change the culture of health care in that county.

In retrospect, the provider should have spent more time developing a deeper engagement with the patients, explaining to them the approach to excellent health care. Doing so would have allayed their fears and concerns while, at the same time, allowing the provider to spend more time with the patients, building relationships.

A “Systems Approach” is holistic and not random or arbitrary. It looks at the complex network of relationships, positions, and interests of various specialists, vendors, and patients. It also creates a shared vison and, thus, provides for team learning. The provider becomes a partner in the patients’ care, open to their suggestions while sharing his expertise and knowledge, and has conversations and discussions that are open-ended. He is no longer seen as a threat to the patients’ well-being. On the contrary, a bond of trust is developed between the provider and the patient.

Also, the provider should have had a dialogue with the specialists to review concerns about the quality of care, keeping the patients’ idea of quality of care at the center of the discussion and focusing on a decision process that is evidence-based, objective, and mutually shared. As soon as subjectivity is removed and lines of communication created, there is a shift in perspective among the specialists. To be sure, the specialists have an interest in continuing the status quo since they are primarily paid on a fee-for-service basis. This can be achieved by creating win-win situations where primary develops long-term relationships with the specialist and brings in the leverage of volume or better engagement with patients.

At the same time, the primary should communicate with his office staff, ensuring the staff understands the reason for the change and how it will improve quality and outcomes. Once the nature of communication has changed, any new change is not a surprise and will be understood, if not always welcome.

We see a similar situation if a provider is asked to be a Physician Adviser (PA) at a hospital. While administration expects the PA to improve length of stay, reduce the number of queries or unsigned Medicare forms, it does not want to prevent the attending physicians from admitting patients to the facility. If the PA contacts the attending physicians about the need to complete their records, and the attending is upset and complains to the administration, the usual response is for administration to back down, leaving the PA confused and upset. Thus, no fundamental shift in culture at the hospital is affected, and only superficial changes are accomplished.

A systemic change would entail administration and the PA working as a team, creating clear expectations among admitting providers, sharing report cards and performance data transparently with all hospital staff and creating objective means to evaluate the standard of care being practiced in the hospital. Such an approach would involve intense and constant dialogue among physicians and administration along with the PA, and creating a common platform with a goal to improve outcomes and patient care in the facility that is immediately measurable and achievable.

A “Systems Approach” takes away the blame-game, since we are neither for nor against the system. We are an integral part of the system. Once we realize that, the rest becomes easy. The sight turns inwards and personal mastery and responsibility becomes critical. With such a sensibility, a true leverage can be found which truly causes a change in the system that may be healthier, more wholesome, and healing to all the participants in the web of healthcare.

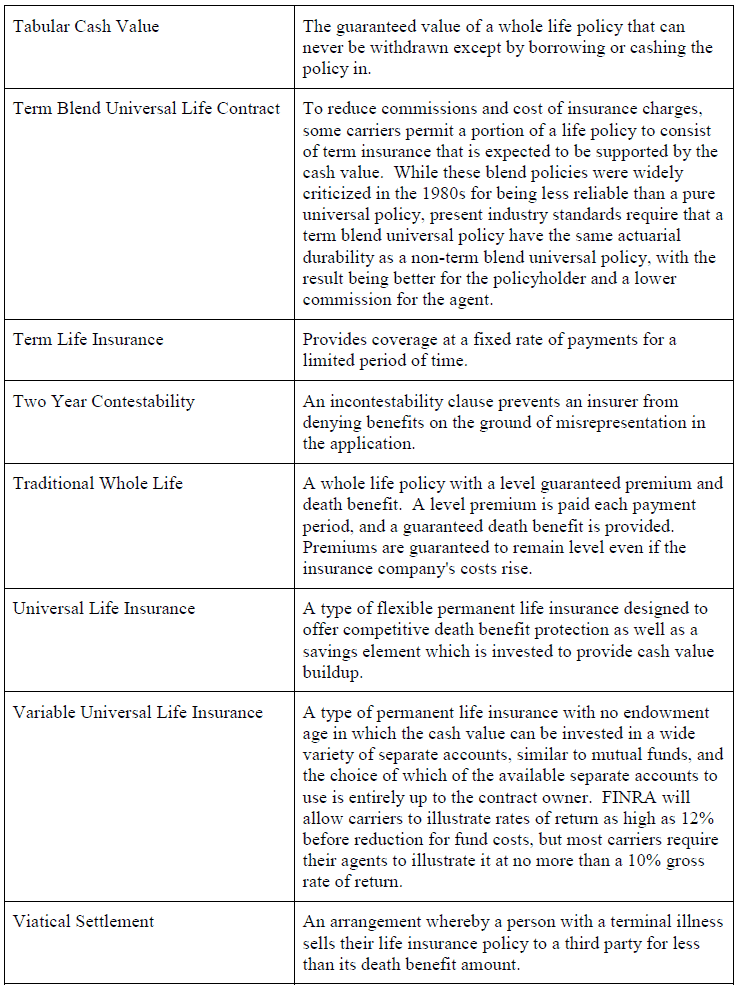

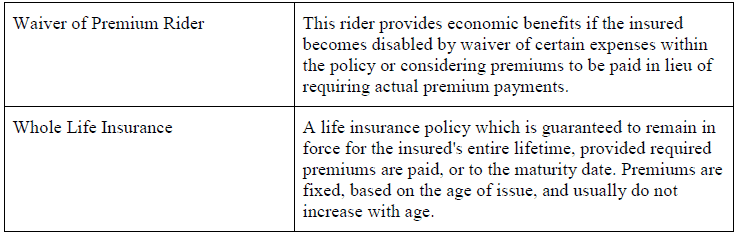

Life Insurance Definitions, Part III

This is a continuation of our series on life insurance fluency and is derived from the materials that we are preparing for the September 17th and 18th Notre Dame Tax Institute (please don’t miss this! Click here for more information.)

How many of the following definitions do you know?

We thank Barry Flagg of Veralytic for his co-authorship of our life insurance materials and Alyssa Eberle, J.D. for her contribution to the life insurance materials as well. Please stay tuned for further important information.

Richard Connolly’s World

What to Do with IRA Funds

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Using Your IRA Funds to Start a Business is Very Risky” by Peter J. Reilly. This article was featured on Forbes.com on June 16, 2015.

Richard’s description is as follows:

Mr. Ellis was an attorney who also wanted to get involved in the sale of used cars. He formed CST, LLC. CST had two members – Richard Brown, who worked for the LLC and contributed $20 for his 2% interest, and Mr. Ellis’s self-directed IRA, which contributed $319,500 for its 98% interest. The contribution to the LLC used up almost all of the IRA’s funds, which had been rolled over from a 401(k).

Mr. Ellis acted as the general manager of CST and drew a salary of $9,754 in 2005 and $29,263 in 2006. The two salary payments were properly reported on his return. That seems pretty innocent. Only it’s not.

On March 28, 2011, the Commissioner of the Internal Revenue Service sent the Ellises a notice of deficiency, identifying a $135,936 income-tax deficiency for 2005 or, in the alternative, a $133,067 deficiency for 2006. The notice also imposed a $27,187 accuracy-related penalty for 2005 or, in the alternative, a $26,613 accuracy-related penalty and $19,731 late-filing penalty for 2006. The Commissioner determined, in relevant part, that Mr. Ellis engaged in prohibited transactions under 26 U.S.C. § 4975(c) by (1) directing his IRA to acquire a membership interest in CST with the expectation that the company would employ him, and (2) receiving wages from CST. The notice explained that, as a result of these transactions, the IRA lost its status as an individual retirement account and its entire fair market value was treated as taxable income. See 26 U.S.C. § 408(e)(2).

It seems like an awfully harsh result, but the Circuit backed the Tax Court, which had backed the IRS.

The Tax Court found there was no prohibited transaction on the formation and original investment in the LLC by the IRA, but taking wages was a prohibited transaction. The 8th Circuit agreed (Ellis v. Comm’r of Internal Revenue, No. 14-1310 (8th Cir. 2015.)).

Please click here to read this article in its entirety.

The second article of interest this week is entitled “The Charitable IRA Stretch for Kids, Siblings, and Parents” by Ashlea Ebeling. This article was featured on Forbes.com on June 17, 2015.

Richard’s description is as follows:

You’re widowed and have a one million dollar individual retirement account. Do you leave it to charity or your kids?

Maybe both.

The once obscure technique of leaving an IRA to a charitable remainder unitrust (CRUT) is getting new buzz, what with some politicians (most notably, President Obama) wanting to limit IRAs left directly to non-spousal heirs to a five-year life. “If you don’t trust Congress, this is a great answer to get you nearly all the benefits of the stretch locked in at a nominal cost for a good cause,” says Michael Jones, an estate planner in Monterey, California and author of Inheriting an IRA.

Please click here to read this article in its entirety.

Thoughtful Corner

Office Efficiency and Logistics, Part I

Handing a Note to Someone in a Meeting or on the Phone

Oftentimes, there is a question as to whether or not to interrupt someone in a meeting or someone who is on the phone. If it is necessary to interrupt, consider the possibility of writing a fairly thorough note and handing it to the person during the meeting.

This way, the other people in the meeting can continue talking and do not have to hear a conversation that a secretary or other team member might need to have with a lawyer about confidential matters.

Type up a quick note, print it out, and hand the note to the person in the meeting. Then, stand next to him or her and wait for his or her response. Possible responses might be, “we can handle this later,” or “let me take a quick break from the meeting and handle this.”

The person in the meeting may also provide instructions at the bottom of the note, such as:

- Schedule a call with this person for later today.

- Have another person in the office speak to the person needing urgent assistance and/or handle the matter appropriately.

- Take a message, and the matter will be dealt with when the meeting is over.

Identify Time Wasters

Examples of time wasters include:

- Clients that don’t pay their bills.

- Time wasted because of disorganization.

- Distractions.

- Time wasted because of others in the organization.

- Idle chatter.

- Going to lunch when there is no solid business or financial result.

- Time spent with people trying to sell you things.

Working in Absolute Solitude

How effective is your concentration and relaxation with challenging projects or routine work when you know that you may be interrupted at any time? Distractions come in many forms, such as being surrounded by distractions like computers that may carry new emails that you would like to see, people walking by and talking, and cell phone sounds that tell you that you have new messages and calls waiting.

Most successful lawyers have an appointed quiet time and a quiet place where they can be free of these interruptive intrusions in order to do appropriate work.

How will you find your oasis to enable you to do this?

Consider the following ideas:

- Use a room other than your normal office that has no computer, no phone, and proper surface and lighting to do what you need to do without interruption. Use it often.

- Make an appointment to cause this experience to happen multiple times during your day and week, and let the people who would normally interrupt you know how to tell when you are in this mode and what you expect them to do and not to do at that time.

- Check into a hotel room for the day so that you will not be interrupted.

- Identify your time wasters and stop them.

- If interruptions waste your time, go to a separate room with the work that needs concentrated efforts, close your door, unplug your phone, or turn off your cell phone.

Humor! (or Lack Thereof!)

Sign Saying of the Week

**********************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE ORLANDO PRESENTATION:

ORLANDO BUSINESS AND PROFESSIONAL PRACTICE OWNER SYMPOSIUM

Alan S. Gassman, business coach and author David Finkel, and others will present a two-day conference for high-net-worth business and professional practice owners sponsored by Maui Mastermind®.

Alan’s topics will include BASIC AND ADVANCED PLANNING TECHNIQUES FOR THE PROTECTION OF WEALTH, THE 10 BIGGEST MISTAKES THAT BUSINESS OWNERS AND PROFESSIONALS MAKE, and ESTATE TAX AVOIDANCE TECHNIQUES FOR BUSINESS OWNERS AND PROFESSIONALS.

Other topics include A Proven Map to Grow Your Business and Get Your Life Back, Building Wealth Outside of Your Company, Tax Reduction Strategies, and Understanding How Investments Work and What They Cost.

Date: July 30th and 31st, 2015

Location: Hyatt Regency Orlando | 9801 International Drive, Orlando, FL 32819

Additional Information: Interested individuals can contact agassman@gassmanpa.com or David Finkel at david@mauimastermind.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Christopher Denicolo will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

This 50 minute informative talk with extensive materials will cover essential aspects and trip-ups that doctors often encounter in the area of personal and practice entity asset protection. It will also discuss tax and investment planning, advisor selection, health law, compliance, and other areas of interest for physicians.

Each attendee will receive a complimentary copy of Mr. Gassman’s book, Creditor Protection for Florida Physicians and other valuable materials.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

I was fortunate to attend the Law Practice and Professional Development Workshop conducted by Alan Gassman, Esq. in Clearwater, Florida on August 3, 2014. The Workshop covered a wide range of topics from Goal Setting and Gratitude to as practical a topic as law office logistics. Alan’s approach was intimate, self-revelatory and highly instructive. I have been practicing law for 20 years and have never attended a program as broad ranging, practical and encouraging. The depth of Alan’s thought and experience is obvious in the materials and in the ease with which he led the discussions. This was not a dull lecture but a highly engaging workshop that was over before you expected it to be.

Daniel Medina, B.C.S

Board Certified in Wills, Trusts and Estates

Medina Law Group, P.A.

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

**********************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and a guest to be determined will present WHAT TAX PLANNERS NEED TO KNOW ABOUT NORTH DAKOTA TRUST LAW for Bloomberg BNA.

Date: Wednesday, September 9, 2015 | Time TBA

Location: Online webinar

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Christopher Denicolo, and Kenneth Crotty will present a 50-minute webinar entitled CREATIVE PLANNING FOR FLORIDA REAL ESTATE with a guest (victim) to be determined. This presentation will be free and worth every dollar!

There will be two opportunities to attend this presentation. This webinar will qualify for CLE and CPE credit.

Date: Wednesday, September 23, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE PINELLAS COUNTY PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online Webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE TAMPA EVENT:

TAMPA THEATRE 14TH ANNUAL WINEFEST

Bust out your sweet dance moves and come have a “killer time” with Napoleon, Pedro, Kip, and Lafawnduh at Tampa Theatre’s 14th annual WineFest, Napoleon Wineamite. This year’s event features snacks and samples from local independent restaurants, sips from the finest wineries, and evening of rare, top-rated wines and – for the first time this year – a “Movie Under the Stars” screening of this year’s theme, Napoleon Dynamite.

While the theme may be silly, the purpose is most serious. Now in its 14th year, the annual WineFest is Tampa Theatre’s biggest fundraising event of the year, benefitting the historic movie palace’s artistic and educational programs, as well as its ongoing preservation and restoration.

Date: September 10 – 17, 2015

Location: Tampa Theatre | 711 N. Franklin Street, Tampa, FL 33602

Additional Information: Tickets are on sale now at www.tampatheatre.org/winefest. Sponsorship opportunities are also available. Please contact Maggie Ciadella at maggie@tampatheatre.org for more information about sponsorship or the event.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: To be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

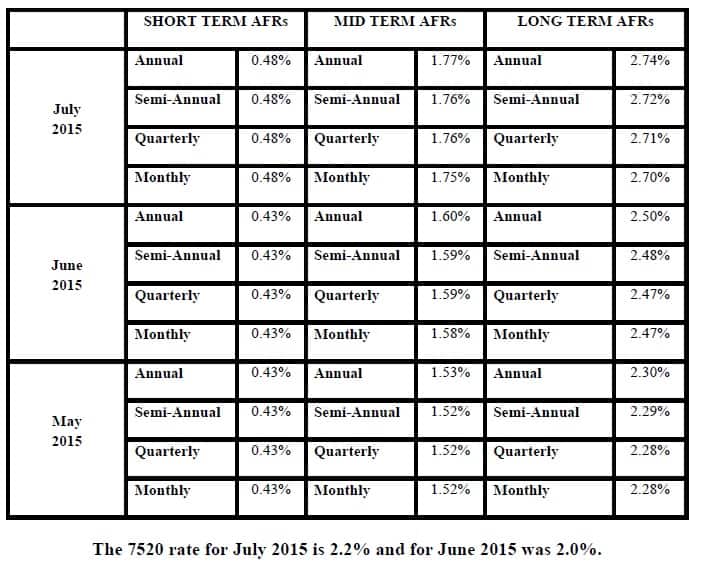

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.