The Thursday Report – 7.16.15 – Tom waits for Closing (Time) Letters

Closing (Letter) Time

Firing on All Pistons – Who SCIN’d Who?

Cigna Files Lawsuit Against 11 Surgery Centers for Waiving Co-Pays – Will Doctor’s Offices Be Next?

Life Insurance Definitions, Part II

Richard Connolly’s World – Keeping Up with the IRS

Thoughtful Corner – Knowing When to Fold ‘Em

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Closing (Letter) Time

Nothing feels better to an estate tax planner than receiving a Closing Letter from the IRS, which indicates that the estate tax return examination and review resulted in a no change or negotiated final conclusion that no further estate tax will be owed and that the file is closed by the IRS. For decades, these letters have been issued at the time that the IRS closes its file, but now, it will be necessary to affirmatively ask for the letter.

Will asking and then reminding the IRS for a Closing Letter cause them to look at an estate situation that they might have otherwise missed? Will it be best to wait until the statute of limitations has run out before asking for a Closing Letter, and thus, extend the administration of a probate estate if the judge requires a Closing Letter for the estate to be closed?

Last night’s LISI commentary by board-certified tax attorney Chuck Rubin gives more background on this new planning question. Click here to read Chuck’s commentary on the LISI website.

*****************************

Executive Summary:

In a change to long-standing policy, the IRS will now require estates to request a closing letter if they want to receive one.

Facts:

The IRS issues closing letters to estates for federal estate tax purposes, acknowledging that it has accepted the estate tax return as filed or as adjusted pursuant to audit. This used to be an automatic process. In most cases, there will not be any further adjustments made by the IRS to the return after the closing letter is issued. Nonetheless, the IRS can still open or reopen an audit if there was a misstatement or fraud.

In a June 16, 2015 update to the IRS’ “Frequently Asked Questions on Estate Taxes,” (which can be viewed by clicking here) the IRS has indicated that for federal estate tax returns filed on or after June 1, 2015, closing letters will be issued only if the taxpayer requests it. The IRS also requests that such requests not be submitted until four months after the return is filed.

The FAQ also provides a table that details when a closing letter will be issued for returns filed between January 1, 2015 and June 1, 2015, depending on variables such as whether the filing threshold was met, whether a portability election was made or denied, and whether the return was filed pursuant to Rev. Proc. 2014-18.

Comment:

The new requirement does not yield any obvious benefit to taxpayers. Instead, it is just one more thing that will need to be added to the estate administration checklist. That the request should not be made until four months after filing adds to the inconvenience since the logical time to request it would be when the return is filed.

It is unclear if all returns will still receive a preliminary review by the IRS, as was required in the past so as to issue the closing letter. If not, then this raises the interesting question as to whether requesting the closing letter may trigger a return review that might not otherwise have occurred without the request. It may be that the IRS will be cutting back on the preliminary reviews, but just for returns making a portability election that are under the filing threshold.

The corollary question is whether it may be advantageous then to not request a closing letter to reduce audit risk. In many circumstances, not getting a closing letter is a nonstarter. For example, many local probate courts require a closing letter before they will close a probate administration, and title companies may require one in insuring real property passing at death. In other circumstances, fiduciaries who do not want to wait until the three-year statute of limitation runs on the estate tax return before making distributions will still want the closing letter to minimize risk in distribution before such statute of limitations expiration (or if such fiduciaries do not want to deal with impatient beneficiaries or probate court judges who are not desirous of waiting out the three-year period before inheritances are fully distributed.)

Should one request a closing letter for an estate that is making a portability election but is under the filing threshold? It’s unlikely that the closing letter establishes that the portability election was properly made per the particular portability requirements such as a “complete” return since the closing letter does not go to completeness, but requesting a closing letter may still fall in the category of “can’t hurt.”

How should the request be made? The website is silent – likely a letter requesting a closing letter should suffice.

It is not clear why filings under Rev. Proc. 2014-18 are included in the table addressing whether a closing letter will be issued for returns filed under that Revenue Procedure between January 1 and June 1, 2015, since filings on that procedure were due no later than December 31, 2014. This may be an error.

********************************

Those of us who love Tom Waits, and love Estate Tax Closing Letters even more, will appreciate both Chuck Rubin’s LISI Newsletter and Tom Wait’s album and song “Closing Time.” You can click here to listen to the whole album, or jump forward to 4:55 to hear “Closing Time” or to 41:00 to hear a more rousing version of “Closing Time,” which is the best song ever to play while cleaning your office. Then, before you decide whether or not to take that next case without a retainer, check out “I Hope That I Don’t Fall in Love With You” beginning at 3:55.

We thank Steve Leimberg and Chuck Rubin for granting permission to share this story with Thursday Report readers.

Firing on All Pistons – Who SCIN’d Who?

Since When is $388 Million a Great Deal?

by Alyssa Eberle, J.D.

In an estate tax battle of gargantuan proportion, the Internal Revenue Service received $388 million in a settlement with the estate of Detroit Pistons owner William “Bill” Davidson. The IRS had originally asserted a deficiency of over $2 billion in estate, gift, and generation-skipping taxes.[1]

Davidson was born in Detroit, Michigan. At a young age, he took over his family’s business, Guardian Industries, one of the world’s leading makers of glass, automotive, and building parts. Davidson later went on to own the Detroit Pistons, the WNBA Detroit Shock, and our very own Tampa Bay Lightning. Davidson was worth about $5.5 billion during his lifetime, earning him a spot as Forbes’ 62nd richest American in 2008.[2] With the fortune he created through his business ventures, Davidson had trusts drawn up for his wife, children, and grandchildren that were worth tens of millions of dollars.

Shortly before his death, Davidson engaged in a variety of estate planning transfers, including gifts and sales to the number of different trusts he had established. Davidson had used traditional installment notes for sales to various trusts as well as sales of Guardian shares to other trusts in exchange for self-cancelling installment notes (SCINs). On January 2, 2009, a little less than three months before Davidson’s death, additional shares in Guardian were sold to trusts in exchange for SCINs. Each of those SCINs had a 5-year term, with a balloon payment of principal at the end of the term, with a 2.4% interest rate.[3] Other SCINs were issued two months prior to the death of Davidson. Soon after these SCINs were issued, Davidson was diagnosed with a medical condition that resulted in his death. Davidson died on March 13, 2009 at the age of 86. Ultimately, no payments were ever made on any of the SCINs because Davidson died before the interest payments were even due.

At the time of his death, Davidson’s estate was estimated to be worth $3 billion. His estate attorneys claimed that they ensured that all estate taxes had been paid to the Internal Revenue Service (IRS). Still, in May of 2013, four years after the death of Davidson, the IRS filed a notice of deficiency, alleging $2.8 billion in underpayments in estate taxes, gift taxes, and penalties. In response, Davidson’s estate brought the IRS to US Tax Court to challenge the assessment of the additional taxes. In their petition, the estate claimed that the IRS had mistakenly concluded that the value of the stocks transferred into the trust were more than the estate had claimed. The estate attorney asserted that the IRS severely overvalued those stocks, noting that after Davidson’s death, the stock values plummeted and it was “foreseeable…Guardian sales and profits would decline substantially.”[4]

The IRS responded in their answer, challenging the valuation on the self-cancelling installment notes (SCINs) that Davidson had used to transfer assets to his heirs. The IRS argued that because the payments on those SCINs were too low, some of the assets transferred should be viewed as gifts. The IRS argued that their method of determining the value was more reliable than that used by Davidson.[5] Further, the IRS contends that Davidson transferred the assets in anticipation of a five-year life expectancy, which, they contend, was longer than realistic. Tens of millions of dollars were also transferred to his wife, which she used to help her daughter and son-in-law build a house. The IRS also called this a gift. If the IRS were to be completely successful in the claim, the Service would be collecting approximately ten percent of the total estimated wealth transfer tax receipts for the year.[6]

SCINs as Estate Planning Tools and the IRS’ Litigation Position

A SCIN is an instrument used for estate tax purposes; they “freeze” the value of the asset while passing future appreciation without incurring any transfer taxes.[7] The way this is done is by selling an asset to a trust in exchange for a promissory note with interest imposed at the applicable federal rate. If done properly, upon the seller’s death, the asset sold is not included in the seller’s estate; instead, the fair market value of the promissory note is included in the seller’s gross estate.[8] Another variation on this concept is a SCIN: when the seller receives a source of repayment that will terminate upon the seller’s death, resulting in that repayment obligation not being included in the gross estate.[9]

With a SCIN, if the seller dies prior to the end of the term, then the purchaser of the note will not owe any additional consideration given to the seller. This additional consideration is referred to as the “risk premium,” which results in the note providing for higher payments.[10] The problem that estate attorneys and advisors have is determining how to calculate the appropriate amount of risk premium to ensure that there are adequate considerations to avoid the sale being treated as a gift.

The August 2013 Chief Counsel Advice (CCA) 201330033 declared the IRS’s litigation position regarding SCINs. Prior to the CCA 201330033, there was no Internal Revenue Code Section, Treasury Regulation, IRS Pronouncement, or court case directing how to calculate risk premiums for SCINs.[11] While the debate on how to calculate the premium numbers varies, the majority of advisors have used Section 7520 interest rates and IRS published mortality tables “which anecdotal evidence suggest are typically used by IRS agents in audits regarding SCINs where there are no particular health issues.”[12]

The seller’s health at the time of the sale is an important factor when determining whether the mortality tables may be relied upon for calculation of the risk premium.[13] According to the Treasury Regulation §25.7520-3(b)(3), mortality tables have been heavily relied upon for determining the actuarial calculation if the individual is not “terminally ill.”[14] According to the regulation, someone is defined as terminally ill when the individual “is known to have an incurable illness or other deteriorating physical condition…if there is at least a 50 percent probability that the individual will die within 1 year.”[15]

CCA 201330033 addressed the issues relating to Davidson’s SCINs and their valuation. The CCA surprised the estate planning community by announcing a major departure from the previously accepted method of valuing the risk premium associated with SCINs. Instead of using the traditional “terminally ill” test, the CCA concluded that the risk premiums for SCINs “should be valued based on a method that takes into account the willing-buyer willing-seller standard of §25.2512-8 and should also account for the decedent’s medical history on the date of the gift.”[16] The Chief Counsel’s Office further determined that “the terminally ill test can be disregarded[b]y its terms, §7520 applies only to value an annuity, any interest for life or term of years, or any remainder.”[17]

The IRS’ analysis of the issue centers on the decedent’s life expectancy at the time of the gift:

We do not believe that the §7520 tables apply to value the notes in this situation. By its terms, §7520 applies only to value an annuity, any interest for life or term of years, or any remainder. In the case at hand, the items that must be valued are the notes that decedent received in exchange for the stock that he sold to the grantor trusts. These notes should be valued based on a method that takes into account the willing-buyer willing-seller standard in §25.2512-8. In this regard, the decedent’s life expectancy, taking into consideration the decedent’s medical history on the date of the gift, should be taken into account.[18]

The CCA’s Office rejected the traditional practice of valuing SCINs using actuarial tables promulgated under Section 7520 and using the terminally ill test as applied to a SCIN, instead providing that the SCIN valuation “must account for the amount a willing buyer would pay a willing seller upon the execution date of the SCIN.”[19] This statement represents a significant departure from the generally accepted method and would play a significant impact on their argument in the Davidson case.

Davidson Settlement

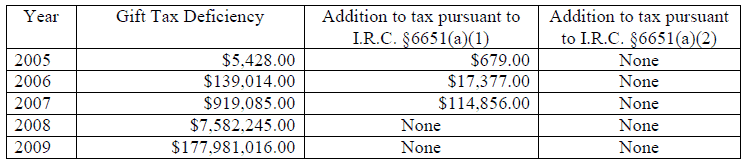

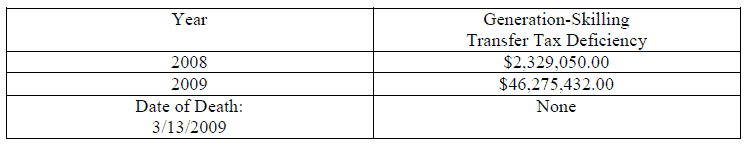

The Davidson case could have provided the Tax Court with an opportunity to clarify how a SCIN risk premium should be calculated. However, the case was ultimately settled by a stipulated decision entered into on July 6, 2015. It was therefore impossible to see how the valuation of the risk premium was resolved. However, what was made clear through that settlement was that there was a significant taxpayer victory. The total transfer liability stipulated was just over $380 million, a small fraction of the $2.7 billion deficiency that the IRS initially had assessed. The breakdown of the deficiencies in gift tax was as follows:[20]

The breakdown of deficiency in estate tax was as follows:[21]

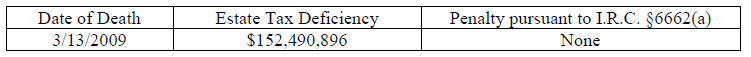

The breakdown of generation-skipping transfer tax deficiency is as follows:[22]

These numbers could have been vastly different had the case not come to a settlement. Other additional issues could have impacted the numbers, such as whether the SCIN was a bona-fide debt, and whether the shares had been valued properly – or at least valued in a way the IRS approved of. While the SCIN transactions ultimately worked well for the Davidson family, SCINs are proving to be vehicles that involve a risk versus reward balancing act. While the CCA does not have any precedential authority and the Davidson case has no binding effect on the taxpayer, those who are willing “to cross the line in the sand that may be moved by waves, tides, and sad kicking bullies in the years to come” should continue using SCINs as an estate planning tool.[23] As the Davidson case demonstrated, the taxpayer was much better off engaging in SCIN planning than having done no additional estate planning at all. Unfortunately, taxpayers and estate planners will not receive any clarification from the Tax Court as to the method for valuing SCINs any time soon. SCINs will continue to be an effective estate planning strategy, so long as a careful review of the transaction has been completed.

**********************************************

[1] Ashlea Ebeling, IRS Grabs $388 Million From Billionaire Davidson Estate, Forbes, July 8, 2015. To put the amount in perspective, consider that the Treasury took in a total of $12.7 billion in estate tax revenue in 2013, according to Forbes magazine.

[2] Forbes Magazine, The 400 Richest Americans, Sept. 17, 2008.

[3] LISI Estate Planning Newsletter #2322 (July 14, 2015) at www.leimbergservices.com. The 2.4% interest rate was the Section 7520 rate as opposed to the AFR rate for January 2009.

[4] Id.

[5] Todd Spangler, IRS Lawyers Defend $2B Tax Bill to Bill Davidson Estate, Detroit Free Press, August 18, 2013.

[6] LISI Estate Planning Newsletter #2135 (August 28, 2013) at http://LeimbergServices.com.

[7] Id.

[8] Id.

[9] Id.

[10] Crotty, Hesch, Wojnaroski, and Gassman, IRS Position Puts More Skin in the Game of Using SCINs.

[11] LISI #2322.

[12] Id citing Steve Akers, The Forty-Ninth Annual Heckerling Institute on Estate Planning, Estate Planning Issues with Intra-Family Loans and Notes, Chapter 5, 92-93 (2015).

[13] LISI #2322.

[14] Id.

[15] Treas. Reg. §25.7520-3(b)(3).

[16] CCA 201330033.

[17] Id.

[18] IRS Ge. Couns. Mem. 39503 (May 7, 1986).

[19] Ken Crotty, Jerome Hesch, Edward Wojnaroski, and Alan Gassman, IRS Position Puts More Skin in the Game of Using SCINs, Estate Planning, January 2014.

[20] Estate of William M. Davidson v. Comm’r, US Tax Court No. 013748-13, (filed June 14, 2013, stipulated decision entered July 6, 2015).

[21] Id.

[22] Id.

[23] See Ken Crotty, Jerry Hesch, and Alan Gassman, LISI Estate Planning Newsletter #2147 (Sept. 24, 2013).

Cigna Files Lawsuit Against 11 Surgery Centers for Waiving Co-Pays

Will Doctor’s Offices Be Next?

by Jeanne E. Helton

Jeanne E. Helton is an attorney and shareholder at Smith Hulsey & Busey in Jacksonville, Florida. She practices in Health Care, Intellectual Property, and Corporate, Securities, and Business Law, with a focus on the representation of health providers, including health systems, physicians, insurance entities, medical suppliers, continuing care retirement communities, ambulatory surgery centers, and more. She received her J.D. from the University of Florida.

On July 6, 2015, Connecticut General Life Insurance Company and Cigna Health and Life Insurance Company (collectively “Cigna”) filed a complaint against eleven ambulatory surgery centers (“ASCs”) and two ambulatory surgery center development entities. The Complaint alleges that the development companies and the ASCs conspired to engage in fraudulent “dual pricing” and “fee forgiving” schemes, whereby the ASCs charged their patients little or nothing for out-of-network medical services while charging “exorbitant” rates to the patients’ insurance plans administered through Cigna. The ASCs did not have contractual arrangements with Cigna and, therefore, were “out-of-network” or “non-participating.”

The complaint alleges that the ASCs calculated their patients’ cost sharing responsibility by applying a 150% multiplier to Medicare rates for services performed by the ASC and then discounting those rates by the portion that the patients would have paid had they seen an in-network provider. The Complaint further alleges that when calculating Cigna’s charge, the ASCs utilized an 800% multiplier of Medicare rates (rather than 150%) resulting in tens of thousands of dollars of charges in excess of the rates charged for the patient responsibility component of the charges. Cigna is asserting that the inflated charges imposed by the ASCs on the carrier were fraudulent as they bear no relation to the charges imposed on the patients.

The Complaint reiterates some of the authorities advising that routine forgiveness of waiver or copayments may constitute fraud under state and federal law, including the AMA Ethics Advisory Opinion 6.12 (1993), the OIG Special Fraud Alert in 1994, and Florida Statutes §817.234. The Complaint alleges the surgery development company’s affiliated ASCs alone had induced Cigna to pay millions of dollars to the ASCs as a result of this fee-forgiving scheme. The Complaint states that the inflated “charges” submitted to Cigna by the ASCs were not their “normal charge” for the services at issue because these were not the charges that the ASCs actually charged to their patients. Rather, the “charges” submitted to Cigna were “phantom” charges bearing no relation to the charges submitted to patients.

The defendant ASCs and surgery center development companies have not yet filed an answer to the Complaint, a copy of which can be accessed below. This Complaint is further evidence of the types of patient “kickback” activities that were discussed in Lester Perling’s recent webinar “Financial Arrangements with Patients, Co-Payments, Gifts, and Graft,” available for viewing by clicking here.

You can read the complaint in its entirety by clicking here.

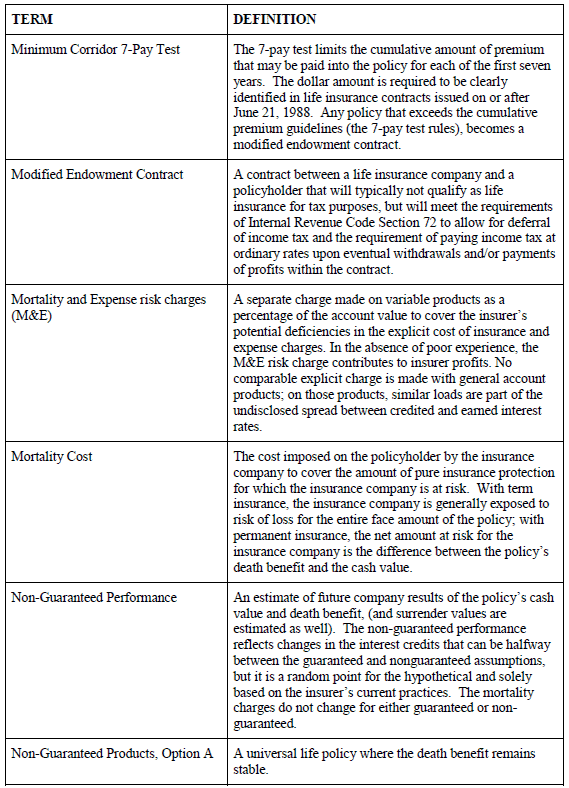

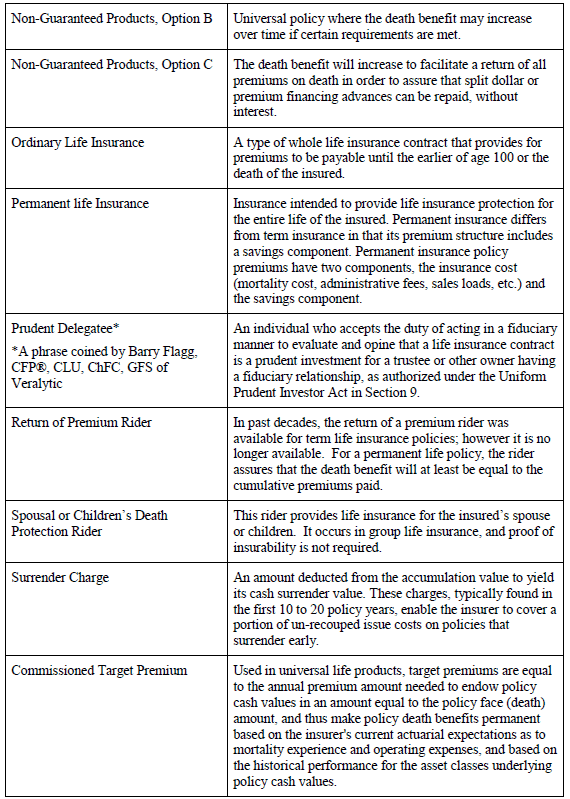

Life Insurance Definitions, Part II

This is a continuation of our series on life insurance fluency and is derived from the materials that we are preparing for the September 17th and 18th Notre Dame Tax Institute (please don’t miss this! Click here for more information.)

How many of the following definitions do you know?

We thank Barry Flagg of Veralytic for his co-authorship of our life insurance materials. Please stay tuned for further important information.

Richard Connolly’s World

Keeping Up with the IRS

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “IRS to Allow Do-Overs for Some Estates” by Ashlea Ebeling. This article was featured on Forbes.com on July 2, 2015.

Richard’s description is as follows:

Smaller estates may get a break, but larger estates are out of luck if they fail to timely claim a newfangled way to save estate taxes. That’s the conclusion the Internal Revenue Service came to in the final regulations on the portability of a deceased spousal unused exclusion amount. It’s as confusing as it sounds, but if you or your surviving spouse could be in estate tax territory, pay attention.

The final rules say that as long as the estate’s value is below the exclusion amount ($5.43 million for 2015), you will be able to file for Sec. 9100 relief to elect portability even if you’re past the 15-month extended filing period for filing as estate tax return. The IRS will probably grant it, allowing you to restore the DSUE for the surviving spouse.

The IRS took a tougher approach for larger estates. The final rules say that for estates valued above the exclusion amount, the only way to guarantee a portability election is to file an estate tax return when the first spouse dies.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “IRS Takes Aim at an Estate-Planning Strategy” by Liz Moyer. This article was featured in The Wall Street Journal on June 26, 2015.

Richard’s description is as follows:

The Internal Revenue Service is taking aim at the way wealthy families value certain assets they are passing along to heirs, a move that could crimp estate planning.

Family limited partnerships and limited liability companies long have been used to help pass family-owned businesses to younger generations in a way that may reduce gift or estate taxes. They also have been used in recent years to pass down portfolios of publicly traded securities at a discount, something the IRS is looking to end, some estate lawyers say.

Based on recent comments by IRS officials at industry gatherings, lawyers expect the department will propose to significantly limit or prevent these discounts, especially for entities holding primarily marketable securities.

This article may be the encouragement a client needs to move forward with a recommended FLP or LLC.

Please click here to read this article in its entirety.

Thoughtful Corner

Knowing When to Fold ‘Em

We often counsel clients who have challenging situations, and perseverance is certainly an admirable trait and quite often, the best strategy for a given situation.

On the other hand, how logical are our choices, and when and how does someone (or an organization) that has invested significant time, money, and emotion on a given project or challenge come about deciding that it is time to fold up the tent and find a more worthy use of future time, money, energy, and emotion?

Professional development coach Rick Solomon, CPA, applies what is known as the Sedona Method of Releasing to situations that may be impacted by personal tendencies that are beyond awareness of the decision-maker.

Three questions that he asks are as follows:

- Is the decision or lack of a decision the result of an innate need for recognition or to avoid negative recognition? Is that rational, and does it serve you well?

- Is the decision or lack of a decision due to an innate need for security, and is the need realistic or somehow contrived by your personal psychology?

- Is the decision or lack of a decision the result of an innate need for control, and is it logical and actually useful or necessary for you to have control?

During each of the above three short conversations, Rick asks whether the person holding the need can release it in order to have better results with the situation and overall enhanced recognition, security, and control.

So when you are providing representation for a client that may be heading your project towards what might look like Custer’s Last Stand, or if you cannot be sure with respect to this, you can have the “Know when to hold ‘em and know when to fold ‘em” conversation and discuss potential better uses for the time, money, energy, and emotion being expended on the road that they are then traveling.

Some things to consider are as follows:

- Cost in money; Cost in lost opportunities

- Loss in personal time; Loss in energy

- Odds of outcome; Value of outcome

- Second opinion of odds of outcome & possible value of the outcome

- Distortion by need for recognition, for control, for security

- Alternatives to folding completely

- Make an offer to settle

- Use the 80/20 rule and get 80% of the solution for 20% of the time, effort, cost, or risk, if possible

Examples of situations where “folding ‘em” might work best include the following:

- Relationship situations – drop the relationship with as little effort and damage as possible

- Participation in organizations

- Trying to get things done within an organization

- Hobbies, trips, or endeavors that you are really no longer passionate about

Also, do not forget the feeling of joy and liberation when the mental baggage that comes with a project or responsibility can be cast aside.

Humor! (or Lack Thereof!)

Sign Saying of the Week

*******************************

IN THE NEWS

by Ron Ross

The Governor of Florida authorizes a bear-hunting season in a desperate attempt to prevent another Ted movie from being made.

**********************************

Toy stores across the nation report that while action figures for the new Jurassic World movie are selling very well, the all-time best-selling action figure is the T-Rex from the original Jurassic Park movie.

The second best-seller? The lawyer who gets eaten by the T-Rex in the original film.

Upcoming Seminars and Webinars

Calendar of Events

LIVE CLE TELECONFERENCE PRESENTATION:

Alan Gassman will serve as a speaker and panelist for an ABA Probate, Estate Planning and Trust section CLE teleconference on the topic of JEST planning as one of six participants in what will be a very interesting and practical collaborative presentation entitled COMPARING AND CONTRASTING VARIOUS METHODS TO ACHIEVE A STEP-UP BASIS ON A MARRIED COUPLE’S APPRECIATED ASSETS AT FIRST DEATH IN NON-COMMUNITY PROPERTY STATES.

Attorney David Slenn with Quarles Brady will moderate the conference. Other panelists include Edwin Morrow, III and Jim Blase.

Date: Tuesday, July 21, 2015 | 1:00 PM – 2:30 PM

Location: Teleconference

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Edwin Morrow at edwin_p_morrow@keybank.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

ORLANDO BUSINESS AND PROFESSIONAL PRACTICE OWNER SYMPOSIUM

Alan S. Gassman, business coach and author David Finkel, and others will present a two-day conference for high-net-worth business and professional practice owners sponsored by Maui Mastermind®.

Alan’s topics will include BASIC AND ADVANCED PLANNING TECHNIQUES FOR THE PROTECTION OF WEALTH, THE 10 BIGGEST MISTAKES THAT BUSINESS OWNERS AND PROFESSIONALS MAKE, and ESTATE TAX AVOIDANCE TECHNIQUES FOR BUSINESS OWNERS AND PROFESSIONALS.

Other topics include A Proven Map to Grow Your Business and Get Your Life Back, Building Wealth Outside of Your Company, Tax Reduction Strategies, and Understanding How Investments Work and What They Cost.

Date: July 30th and 31st, 2015

Location: Hyatt Regency Orlando | 9801 International Drive, Orlando, FL 32819

Additional Information: Interested individuals can contact agassman@gassmanpa.com or David Finkel at david@mauimastermind.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Christopher Denicolo will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

This 50 minute informative talk with extensive materials will cover essential aspects and trip-ups that doctors often encounter in the area of personal and practice entity asset protection. It will also discuss tax and investment planning, advisor selection, health law, compliance, and other areas of interest for physicians.

Each attendee will receive a complimentary copy of Mr. Gassman’s book, Creditor Protection for Florida Physicians and other valuable materials.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

I was fortunate to attend the Law Practice and Professional Development Workshop conducted by Alan Gassman, Esq. in Clearwater, Florida on August 3, 2014. The Workshop covered a wide range of topics from Goal Setting and Gratitude to as practical a topic as law office logistics. Alan’s approach was intimate, self-revelatory and highly instructive. I have been practicing law for 20 years and have never attended a program as broad ranging, practical and encouraging. The depth of Alan’s thought and experience is obvious in the materials and in the ease with which he led the discussions. This was not a dull lecture but a highly engaging workshop that was over before you expected it to be.

Daniel Medina, B.C.S

Board Certified in Wills, Trusts and Estates

Medina Law Group, P.A.

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

**********************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and a guest to be determined will present WHAT TAX PLANNERS NEED TO KNOW ABOUT NORTH DAKOTA TRUST LAW for Bloomberg BNA.

Date: Wednesday, September 9, 2015 | Time TBA

Location: Online webinar

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Christopher Denicolo, and Kenneth Crotty will present a 50-minute webinar entitled CREATIVE PLANNING FOR FLORIDA REAL ESTATE with a guest (victim) to be determined. This presentation will be free and worth every dollar!

There will be two opportunities to attend this presentation. This webinar will qualify for CLE and CPE credit.

Date: Wednesday, September 23, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE PINELLAS COUNTY PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online Webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE TAMPA EVENT:

TAMPA THEATRE 14TH ANNUAL WINEFEST

Bust out your sweet dance moves and come have a “killer time” with Napoleon, Pedro, Kip, and Lafawnduh at Tampa Theatre’s 14th annual WineFest, Napoleon Wineamite. This year’s event features snacks and samples from local independent restaurants, sips from the finest wineries, and evening of rare, top-rated wines and – for the first time this year – a “Movie Under the Stars” screening of this year’s theme, Napoleon Dynamite.

While the theme may be silly, the purpose is most serious. Now in its 14th year, the annual WineFest is Tampa Theatre’s biggest fundraising event of the year, benefitting the historic movie palace’s artistic and educational programs, as well as its ongoing preservation and restoration.

Date: September 10 – 17, 2015

Location: Tampa Theatre | 711 N. Franklin Street, Tampa, FL 33602

Additional Information: Tickets are on sale now at www.tampatheatre.org/winefest. Sponsorship opportunities are also available. Please contact Maggie Ciadella at maggie@tampatheatre.org for more information about sponsorship or the event.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: To be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

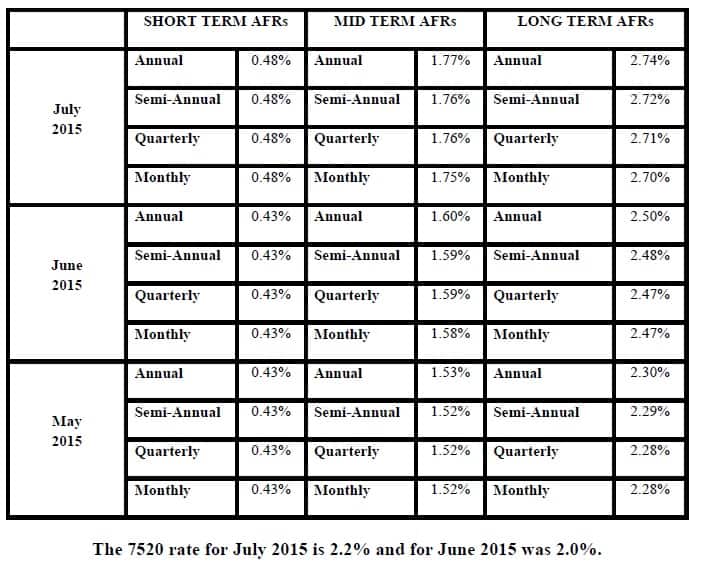

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.