The Thursday Report – 6.11.15 – 2704 Regulations – Watch Out Family Entities!

For Tax Lawyers Who Like to Worry – The Hopefully Remote Possibility of Treasury Regulations Being Issued Under Internal Revenue Code 2704

Upcoming Section 2704 Proposed Regulation May Impact Valuation Discounts for Family Entities by Steve R. Akers

Tax Court Approves the Mother of All Crummey Trusts with 60 Beneficiaries, Part I

Richard Connolly’s World – Asset Protection in a Digital World

Thoughtful Corner – Success Tips for First Year Lawyers, Part II

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

For Tax Lawyers Who Like to Worry:

The Hopefully Remote Possibility of Treasury Regulations Being Issued Under Internal Revenue Code 2704

Some commentators have long anticipated that the Treasury would release regulations under Internal Revenue Code 2704, although no proposed regulations have been issued. At a recent American Bar Association Tax Section meeting, Cathy Hughes of the United States Treasury had some comments about possible proposed regulations under the IRS proposed regulations under Internal Revenue Code Section 2704.

At this time, the release of such regulations is speculation and would not have any effect until proposed regulations are released by the Treasury, at the very earliest. Nevertheless, it is important to keep abreast of further developments on this topic.

Section 2704 was enacted in 1990 with the objective of limiting discounts for certain family partnership or LLC interests that are conveyed between family members. The Section operates to disregard certain “applicable restrictions” that apply to the interests in question for the purposes of valuing such interest. This would result in the value of such interests being higher than they would otherwise be if the applicable restrictions were recognized.

Ms. Hughes indicated that the new proposed regulations might expand the scope of restrictions that would be disregarded for the purposes of valuing an interest in a family limited partnership or LLC. These regulations might also disregard restrictions that apply to a transferee of an interest in a family limited partnership or LLC, and restrictions that might apply if a third party non-family member owns an interest in the applicable entity.

At this time, the discussion of the proposed regulations to Section 2704 is speculative, but it is possible that the Treasury and the IRS could push for any such proposed regulations to be retroactively effective on the date of which they were proposed, which could be later this year.

For a more in-depth discussion of possible regulations under Section 2704, please see the excellent discussion provided by Steve Akers of Bessemer Trust, which has been reproduced below with Steve’s permission.

Upcoming Section 2704 Proposed Regulation May Impact Valuation Discounts for Family Entities

by Steve R. Akers

Steve R. Akers is a Managing Director with Bessemer Trust in Dallas, Texas, where he is a Senior Fiduciary Counsel of the Southwest Region. Mr. Akers is a member of the Advisory Committee to the University of Miami Philip E. Heckerling Institute on Estate Planning and is a frequent speaker at the event, as well as other estate planning seminars across the country. He is a Fellow of the American College of Trust and Estate Counsel and currently serves as a member of the Executive Committee, Regent, and Chair of the Business Planning Committee. Akers is a co-author of A Planning Guide to Buy-Sell Agreements and Estate Planning After the Tax Relief and Job Creation Action Act of 2010. He can be reached at akers@bessemer.com.

IRS and Treasury officials have indicated that a new §2704 proposed regulation may be issued sometime this year. A proposal to amend §2704 (presumably to provide legislative support for positions the IRS will take in the proposed regulation) was dropped several years ago, but that legislative proposal reportedly points to the scope of what the proposed regulation will cover. Section 2704 deals with “liquidation restrictions,” but the new proposed regulation may create additional categories of “disregarded restrictions” that may impact valuation discounts for family entities. There is a possibility that the proposed regulation will be effective when finalized retroactive to the date of the issuance of the proposed regulation.

I. OVERVIEW

Section 2704(b)(3) gives the Treasury broad authorization to issue regulations that would disregard certain “other restrictions” in determining the value of an interest in a corporation or partnership transferred to a family member if the restriction “does not ultimately reduce the value of such interest to the transferee.” IRS and Treasury officials hinted about eight years ago that they were close to issuing such a proposed regulation (reflecting a §2704 guidance project that was placed on the IRS/Treasury Priority Guidance Plan in 2003), but President Obama’s first budget proposal included a revenue proposal to revise §2704, and the §2704 regulation project was put on hold pending the possible passage of such legislation that might provide legislative support for the positions the new proposed regulation might take. Not a single bill was ever introduced addressing the legislative proposal, however, and the §2704 legislative proposal was omitted from the President’s budget proposal released in February 2012.

II. SECTION 2704 STATUTORY BACKGROUND

Section 2704 was enacted in 1990 as a part of Chapter 14. The goal in particular was to limit discounts for certain family partnership or LLC interests that are transferred to family members. Section 2704(b) is titled “Certain Restrictions on Liquidation Disregarded.” It provides that any “applicable restriction” is disregarded in valuing an interest in a corporation or partnership that is transferred to a family member if the transferor and family members control the entity. An “applicable restriction” is any restriction that (i) effectively limits the ability of the corporation or partnership to liquidate, and (ii) the restriction lapses (entirely or partially) after the transfer OR the transferor or family members can remove the restriction (entirely or partially), but an “applicable restriction” does not include “any restriction imposed, or required to be imposed, by any Federal or State law” (or commercially reasonable restrictions imposed by unrelated persons in a financing transaction).

Section 2704(b)(4) includes broad legislative authority for the IRS to issue regulations that would disregard “other restrictions”:

The Secretary may by regulations provide that other restrictions shall be disregarded in determining the value of the transfer of any interest in a corporation or partnership to a member of the transferor’s family if such restriction has the effect of reducing the value of the transferred interest for purposes of this subtitle but does not ultimately reduce the value of such interest to the transferee.

The title to §2704(b) is “Certain Restrictions on Liquidation Disregarded.” The authorization of regulatory authority in §2704(b)(4) does not specifically limit the regulations to “other liquidation restrictions” but merely refers to “other restrictions.” Does this provide legislative authority for regulations limiting discounts for reasons other than merely disregarding liquidation restrictions despite the title of §2704(b)?

III. SIGNIFICANCE OF STATE LAW EXCEPTION

The exception for “any restriction imposed, or required to be imposed, by any Federal or State law” is very important. The “state law” exception is clearly integrated into the existing regulations.

“An applicable restriction is a limitation on the ability to liquidate the entity (in whole or in part) that is more restrictive than the limitations that would apply under the State law generally applicable to the entity in the absence of the restriction…Ability to remove the restriction is determined by reference to the State law that would apply but for a more restrictive rule in the governing instrument of the entity…A restriction imposed or required to be imposed by Federal or State law is not an applicable restriction.” Treas. Reg. §25.2702-2(b).

“(c) Effect of disregarding an applicable restriction – If an applicable restriction is disregarded under this section, the transferred interest is valued as if the restriction does not exist and as if the rights of the transferor are determined under the State law that would apply but for the restriction” Treas. Reg. §25.2704-2(c).

The exception for restrictions imposed by State law has dramatically reduced the applicability of §2704 to partnership and LLC transfers. Many state legislatures have revised limited partnership and LLC laws after the passage of §2704 to provide various limitations on the rights of limited partners or LLC members to make transfers under default rules that apply unless the partnership or operating agreement specifically overrides those default rules.

IV. UPCOMING REGULATION PROJECTS

Cathy Hughes [of the Office of Tax Policy, Department of Treasury] provided insight as to the regulation projects impacting estate planners that we might expect to see in the near future. Projects that she mentioned include: (1) Final portability regulations (the temporary regulations expire June 15, 2015); (2) Guidance under the ABLE Act allowing states to create “Section 529-type” accounts for the disabled (which would also likely appear in June); (3) Final regulations regarding basis rules for interests in charitable remainder trusts; (4) Guidance regarding the §2801 tax on gifts by certain expatriates to US citizens and residents (this has been a “high priority” for several years); and after that guidance is issued (5) Section 2704 proposed regulations. (The preceding information is based on a summary of the ABA Tax Section meeting by Diane Freda. Freda, Guidance on Material Participation for Trusts, Estates May Emerge in Stages, BNA Daily Tax Report (May 12, 2015).)

This summary suggests that the §2704 regulations will not be issued within the next several months but might conceivably be issued later this summer or this fall. Cathy Hughes said that various Treasury initiatives (she did not specifically include all of the projects listed above) are likely to be delivered before the ABA Tax Section fall meeting (which is September 17-19, 2015).

V. POSSIBLE SCOPE OF NEW §2704 PROPOSED REGULATION

Cathy Hughes said that the scope of what the new regulations might include are indicated by the §2704 legislative proposal (last included in the Fiscal Year 2013 Greenbook, “General Explanations of the Administration’s Fiscal Year 2013 Revenue Proposals” dated February 2012). (This suggests that the new proposed regulations may include many of the items that were being considered eight years ago. The Treasury presumably suggested the §2704 legislative project to the Obama administration to support the provisions that it wanted to include in its new regulations.)

The §2704 legislative proposal in the Greenbooks for the Obama administration, ending with the 2013 Fiscal Year Greenbook, includes five items. The new §2704 regulation may include some or all of these subjects.

a. Additional “Disregarded Restrictions.” – An additional category of restrictions (“disregarded restrictions,” which are in addition to the liquidation restrictions addressed in §2704) may be disregarded in determining the value of interests in “family-controlled entities” (observe, this is not limited just to partnerships and LLCs) that are transferred to family members. What are those additional restrictions? They are “to be specified in regulations.” Transferred interests would be valued by substituting for “disregarded restrictions certain assumptions to be specified in regulations. Disregarded restrictions would include limitations on a holder’s right to liquidate that holder’s interest that are more restrictive than a standard to be identified in regulations.”

b. Assignee Interests. – Restrictions on a transferee being able to become a full-fledged partner (or member of an LLC) would be a disregarded restriction.

c. Third Party Involvement in Removing Restrictions. – Section 2704(b)(2)(B)(ii) says that one of the general requirements of an “applicable restriction” is that the transferor or family members can remove the restriction. (The Greenbook proposal generally retains this family-removal requirement with respect to “disregarded restrictions.”) The Fifth Circuit in the Kerr case reasoned that §2704 did not apply to the partnership in that case because charities had small limited partnership interests, and all partners had to consent to removing restrictions; thus, the family acting alone could not remove the restrictions. Kerr v. Commissioner, 292 F.3d 490 (5th 2002). Under the legislative proposal, “certain interests (to be identified in regulations) held by charities or others who are not family members of the transferor would be deemed to be held by the family.”

d. Safe Harbor. – The statute would provide regulation authority that would include “the ability to create safe harbors to permit taxpayers to draft the governing documents of a family-controlled entity so as to avoid the application of section 2704 if certain standards are met.”

e. Marital and Charitable Deduction. – The legislation would include provisions dealing with the interaction of the marital and charitable deductions for transfer tax purposes. Therefore, if an interest is valued higher than its actual fair market value for transfer tax purposes, the higher value might also be applied for marital deduction and charitable deduction purposes (a taxpayer-friendly provision).

To view the legislative proposal that was included in the President’s budget proposals for fiscal years 2010-2013, click here.

VI. EFFECTIVE DATE

Treasury regulations are typically effective on the date final regulations are issued. At least several years typically lapse from the time proposed regulations are issued until the regulations are finalized. In very limited situations, proposed regulations provide they will be effective when finalized retroactive back to the date of the proposed regulations. For example, the proposed regulations regarding the income tax effects of private annuities issued in 2006 take that approach (and interestingly, those regulations still have not been finalized, nine years after the proposed regulations were issued, see REG-141901-05k proposing changes to Reg. §§1.72-6(e) & 1.100(j)). The initial “anti-Kohler” proposed regulations that were issued in 2008 also took that “retroactive effect” approach, but the revised proposed regulation issued in 2011 dropped that harsh effective date provision. See Prop. Treas. Reg. §20.2032-1(f). Cathy Hughes suggested at the ABA Tax Section meeting that the Treasury and IRS are still considering what should be the appropriate effective date of the proposed regulation.

VII. LEGISLATIVE HISTORY

Some planners have expressed concern that the proposed regulation may limit the availability of minority and marketability discounts for transfers involving family-controlled entities. See Freda, Guidance on Material Participation for Trusts, Estates May Emerge in Stages, BNA Daily Tax Report (May 12, 2015) (summarizing comments of Richard Dees). The legislative history (the 1990 Conference Report) makes clear that Chapter 14 was not intended to “affect minority discounts or other discounts available under [former] law.” The Senate’s discussion of the former law and the impact of Chapter 14 is rather emphatic.

“The value of property transferred by gift or includable in the decedent’s gross estate generally is its fair market value at the time of the gift or death. Fair market value is the price at which the property would change hands between a willing buyer and willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts (Treas. Reg. sec. 20.2031-1(b)). This standard looks to the value of the property to a hypothetical seller and buyer, not the actual parties to the transfer. Accordingly, courts generally have refused to consider familiar relationships among co-owners in valuing property. For example, courts allow corporate stock to be discounted to reflect minority ownership even when related persons together own most or all of the underlying stock.

The bill does not affect minority discounts or other discounts available under present law.

The bill does not affect the valuation of a gift of a partnership interest if all interests in the partnership share equally in all items of income, deduction, loss, and gain in the same proportion (i.e., straight-up allocations).” (136 Cong. Rec. § 15679, 15681 (October 18, 1990) (emphasis added)).”

Perhaps the existence of this legislative history is the reason that the IRS, beginning in 2009, sought legislative changes to §2704 before issuing its new proposed regulations.

To download this report, please click here.

Tax Court Approves the Mother of All Crummey Trusts with 60 Beneficiaries, Part I

by Ed Morrow and Alan Gassman

In April, we featured a LISI Newsletter article by Jonathan Gopman and others on the case of Mikel v. Commissioner, which you can view by clicking here. Last month, Ed Morrow and Alan Gassman published a follow-up LISI article on the case, which is featured below:

EXECUTIVE SUMMARY:

In the Tax Court Memorandum decision of Mikel v. Commissioner, Judge Lauber wrote a very well-reasoned opinion on summary judgment, that $1,440,000 of gifted property valued at $3,262,000 qualified for the gift tax annual exclusion, based on 60 beneficiaries having withdrawal rights of $24,000 each (the annual exclusion was $12,000 per year per donor at the time of gift). The Court ruled in favor of the Mikels despite the facts that the property was apparently illiquid, many of the beneficiaries were either minors or spouses of the immediate family, and the trust contained an ambiguous forfeiture clause and included a complicated provision for a religious arbitration panel.

This decision is contrary to a prior IRS Chief Counsel Memorandum issued in 2012 and continues a long line of defeats suffered by the IRS in this area. It gives encouragement to practitioners to maximize the use of Crummey trusts, not only for taxpayers with taxable estates, but also for those with non-taxable estates who can use such trusts for income tax and asset protection reasons. Conversely, it will give further ammunition to current Administration’s “Greenbook” proposals that limit such annual exclusion gifts to $50,000 per donor – no matter how many donees.

Ambiguities in the trust document gave the IRS a colorable argument that both the discretionary distribution language and the in terrorem clause would prevent beneficiaries from being able to exercise their withdrawal power. Judge Lauber referred to the trust language as being “not a paragon of draftsmanship,” as a reminder to us all that trust language should be as article and straightforward as possible.

While this case is instructive on a number of interesting issues, it must be stressed that it is merely a memorandum rather than a full Tax Court opinion. However, this merely indicates that the Tax Court considered any legal issues to be well-established and well-settled. After forty-seven years of attacking Crummey trusts, one would hope that the IRS will finally take the hint.

FACTS:

The Mikels, husband and wife, gifted three properties in Brooklyn and one in Florida to an irrevocable trust in 2007, with a total value of $3,262,000, the value of one property reported as “on the 2007/2008 New York City Real Property Tax Assessment Rolls” – which apparently the IRS did not contest. The trust contained a fairly standard “Crummey” provision which:

- Granted each beneficiary the right to withdraw property, including the property transferred, by pro rata formula, limited to “the maximum federal gift tax exclusion under 2503(b),” which was $12,000 at the time;

- Required the trustee to give notice of the withdrawal right to all beneficiaries or their guardians within a reasonable time;

- Required the trustee to “immediately distribute to such beneficiary or guardian the property allocable to them, free of trust;”

- Caused the withdrawal right to lapse if not exercised in writing within 30 days of receipt of such notice;

- Permitted the trustee to distribute cash or property or borrow to satisfy any demand right;

- Included a savings/construction clause outlining the settlors’ intent to qualify for the federal gift tax annual exclusion;

- Permitted the trustee to exclude beneficiary withdrawal rights with respect to future contributions of property.

All points except the last one above are common to nearly every Crummey trust drafted since 1968 when the Crummey case was decided. However, the last provision is usually an option left with the settlors rather than the trustee, but we know of no reason that a trustee could not be given the power to deny withdrawal power rights to certain beneficiaries if (and only if) announced by the trustee before gifts that would otherwise be subject to the withdrawal powers are made. It is unclear whether the trust had “hanging powers” as it was not discussed in the case. The attorney and trustee both signed uncontested affidavits that notices were sent four months after funding to each beneficiary/guardian pursuant to the trust. Neither the Tax Court nor the IRS argued that this four month delay was unreasonable, and the actual notice was not an issue for the Court.

The trust agreement was read to specifically state that a beneficiary’s withdrawal power began immediately upon initial funding of the trust, but did not close until thirty days after written notice was received that the power existed. In order to obtain the benefits of the annual gift tax exclusion, drafters should be especially careful that they allow for the withdrawal power to begin at the moment of contribution, so that it is considered to be a “present” and not future interest. We discuss below whether the withdrawal power should close within a certain period of time after the contribution, or stay open until a certain period of time after written notice is given.

The interesting twist that probably caused the IRS to challenge the Crummey powers involved the somewhat ambiguous language that provided for an arbitration panel to preside over trust disputes and an in terrorem clause. The trust required a beneficiary to submit any dispute that might arise over interpretation of the trust to a beth din, which is Hebrew for an arbitration panel comprised of three Orthodox Jewish persons. If the beth din issued an adverse ruling, the beneficiary could go to state court. You would think this would be a positive factor to the IRS, based on their arguments in prior memoranda, to ensure an enforceable right, but the government argued that exercising this right would trigger an in terrorem clause, causing the beneficiary to forfeit all rights in the trust. If true, this would undercut any claim that the beneficiary had a “present interest” in the withdrawal right and make any such present interest “illusory.” Let’s review the actual clause:

In the event a beneficiary of the Trust shall directly or indirectly institute, conduct, or in any manner take part in or aid in any proceeding to oppose the distribution of the Trust Estate, or files any action in a court of law, or challenges any distribution set forth in this Trust in any court, arbitration panel or any other manner, then in such event the provision herein made for such beneficiary shall thereupon be revoked and such beneficiary shall be excluded from any participation in the Trust Estate.

The Tax Court disagreed with the IRS interpretation of the in terrorem clause, finding that the clause would only bar a beneficiary from enjoying benefits of the trust if he/she files suit to challenge distributions of trust property to another beneficiary, not mandatory ones triggered by a “Crummey” withdrawal request. Because the trust document required the trustee to comply with a beneficiary’s exercise of a Crummey withdrawal right, requiring the beth din to follow both state law and the in terrorem clause did not impair a Crummey withdrawal right. Meaning, $1.44 million of the trust qualified for the annual gift tax exclusion.

The court noted trust language to the effect that the intent of the withdrawal power provision was to qualify for the annual exclusion. Furthermore, the Court constructed the trust such that the trustee’s discretion to distribute some or all of the assets to less than all of the beneficiaries could not be exercised in a way that would deprive any beneficiaries of their withdrawal power. Based upon our reading of the trust agreement, this could have gone the other way.

Stay tuned next week for our commentary on this case!

Richard Connolly’s World

Asset Protection in a Digital World

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the first article of interest is “Digitally Storing Family Wealth” by Robert Milburn. This article was featured in Barron’s on February 17, 2015.

Richard’s description is as follows:

Private bankers and family office executives are rushing to upgrade their cyber security systems, after multi-billion dollar companies like Sony Pictures Entertainment, Target, and Home Depot have been hacked. Some wealth managers are spending millions of dollars per year to beef up so-called “digital vaults” that securely store their client’s confidential information, like tax returns and wills. These online safety-deposit boxes also keep track of their clients’ complex web of online brokerage, retirement, and bank accounts and their passwords – so next-gen heirs can get access, should a parent unexpectedly die.

As reassuring as that sounds, it still might not be a good enough system. To stay ahead of the slowly-evolving legislation at the state level, private bankers are advising clients they dictate in their wills precisely which heirs or trustees have access to which online accounts. That’s because a number of court cases have emerged in which surviving family members were posthumously denied access to a loved one’s online accounts.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “Estate Planning for Digital Assets” by Austin Kilham. It was featured in The Wall Street Journal on May 11, 2015.

Richard’s description is as follows:

After working with an estate lawyer on plans for one client’s digital assets, Minnesota-based adviser Kelly Pedersen says she now recommends to all her clients that they adopt a similar approach. It calls for empowering a trustee to modify, control, archive, transfer, and delete all digital assets, and it defines where those assets might be stored, including on the client’s computer and other devices or in the cloud.

Please click here to read this article in its entirety.

Thoughtful Corner

Success Tips for First Year Lawyers, Part II

Alan Gassman recently gave a five hour workshop on professional acceleration for a group of LL.M. in tax law students and some practicing lawyers at the University of Florida on Saturday, May 30, 2015. Last week, we shared some of Alan’s new tips for first year lawyers. To see the first eight tips, please click here.

This week, we continue with more of Alan’s tips, which read as follows:

9.) Always accept new work willingly and enthusiastically, but never restrain from mentioning that you will need to have it prioritized if there are other things that may not be done on time. The assignor is possibly not aware of what the new work might delay.

10.) Consider always having a list of tasks in progress with an extra copy that you can hand to your supervising lawyer and go over whenever they might ask.

11.) Ask for periodic feedback. In particular, ask, “What would you like for me to change in the way that I am doing things to improve your use of me and my productivity for the firm?”

12.) Always sincerely compliment as many people as you can as often as you can within the firm and outside the firm. What goes around comes around, and you need all of the good karma you can get!

13.) Draw up charts whenever you can to simplify matters, for purposes of memory, and for purposes of explanation. Charts with squares, circles, and lines can help significantly towards Confucius’s observation that a picture is worth a thousand words. Learn how to make charts in Excel and bring charts to meetings whenever you can with all key information that needs to be remembered for each particular client.

14.) Consider carrying a Dictaphone with you at all times, and offer to record any instructions or explanations that anyone is giving you to help make sure you get it right later. This allows people to talk faster and to provide you with assignments quickly, knowing that you will review every word of what they have said.

15.) Enter your time contemporaneously onto a written time slip and/or computer, and make sure all your time is entered by the end of each day. Enter all time, including time you have wasted. Make separate entries for time that you know is billable and the time that you think may be reduced or not billed for at all. Let the senior lawyer make this final decision; there may be more usable time than you think.

Firms expect to write a lot of time off, and if you are spending significantly more time than they expect, it is good for you to know and for them to know earlier rather than later.

You can have brief discussions from time to time when you feel that your wheels have been spinning or that you have wasted a lot of time. Use an apologetic tone. This is part of the mentoring process. The senior lawyers in your firm also write off a lot of time. It is a lifelong experience of an attorney to do so, so do not be bashful about it.

16.) Have the time of your life! Find what you like best about the practice of law and do that as much as you can, while ever improving and endeavoring to make 85% or more of your time in the office thoroughly enjoyable and satisfying. If you can do this, there is no doubt that you will have every success in your career, not to mention your personal life. Your wallet will thank you also!

Stay tuned for more tips for first year success next week. Alan’s next scheduled workshop for law students and professionals will be on Saturday, August 22, 2015, at Ave Maria Law School in Naples. Schedule your tax deductible weekend in Naples, and attend this Saturday eight hour interactive workshop, while making new friends and helping others (and yourself) immensely. Spouses are invited as well. A splendid time is guaranteed for all, not to mention one ethics credit hour and seven general credits.

Humor! (or Lack Thereof!)

Sign Saying of the Week

IN POLITICAL NEWS:

By Ron Ross

Because of the unusually high number of candidates in this election season, the battleground state of Iowa has been forced to find an alternative to the Ames Straw Poll. In order to narrow the field, candidates will instead be forced to find their way out of an authentic Iowa corn maze. Only the survivors will be allowed to participate in the Iowa caucus, the first event of the election season that actually awards delegates.

Perhaps because of this new development, another challenger had declared her candidacy for President: Ms. Pac Man.

*****************************

On the Democratic side of our national politics, Rhode Island Governor Lincoln Chafee has thrown his hat into the Presidential race as well. The Lincoln Chafee for President theme song is reproduced below:

Lincoln Chafee, man of the people;

He stands 183 centimeters high;

He weighs about 75 kilograms;

You can’t measure how much we love this guy!

His wife Stephanie is 170 centimeters;

The perfect mother, the perfect bride.

They’re from Rhode Island, the smallest state;

Seventy-seven kilometers tall, 60 kilometers wide

Americans who love the metric system

Will rally together and follow his path;

If everyone who ever did a gram votes for him,

He’ll be elected president (do the math!)

*****************************

NOTICE TO EMPLOYEES OF GASSMAN, CROTTY & DENICOLO, P.A.

In response to the numerous complaints regarding theft from the office refrigerator, we have called in the FDLE – The Florida Department of Lunch Enforcement.

Officers will find the guilty party by putting each of you in the refrigerator and see if the lights goes out.

Remember, you have the right to an attorney!

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman will present a live, free, 30-minute webinar on the topic of THE NEW DOCTOR’S GUIDE TO WEALTH BUILDING, CREDITOR PROTECTION, TRUST PLANNING, AND WHAT THEY DIDN’T TELL YOU IN MEDICAL SCHOOL. There will be two opportunities to attend this presentation.

Date: Wednesday, June 17, 2015 | 7:30 PM or Saturday, June 20, 2015 | 9:30 AM

Location: Online webinar

Additional Information: To register for the Wednesday/7:30 PM webinar, please click here. To register for the Saturday/9:30 AM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman, Christopher Denicolo, Jerome Hesch, and Stephen Breitstone will present a Bloomberg BNA Webinar on CREATIVE TAX PLANNING FOR REAL ESTATE TRANSACTIONS AND INVESTORS: A PRACTICAL GUIDE FOR REAL ESTATE AND TAX ADVISORS AND THEIR CLIENTS.

Date: Tuesday, June 23, 2015

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will present a free 30-minute webinar on HOW AND WHEN TO USE ARBITRATION CLAUSES FOR TRUSTS AND WILLS.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many very useful articles thereon.

Date: Thursday, June 25, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on FINANCIAL RELATIONSHIPS WITH PATIENTS, CO-PAYMENTS, GIFTS, AND GRAFT – HOW TO STAY OUT OF TROUBLE UNDER FLORIDA AND FEDERAL LAW.

This is an essential guide for medical practices and those who advise them. There will be two opportunities to attend this presentation.

Date: Tuesday, July 7, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman will present a webinar on the topic of WHAT FLORIDA CPAS NEED TO KNOW ABOUT ASSET PROTECTION for the Florida Institute of CPAs.

More information about this webinar will be forthcoming. Please stay tuned!

Date: Thursday, July 9, 2015 | 9:30 AM – 10:30 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com. To register, please contact Thelma Givens at givenst@ficpa.org.

**************************************************

LIVE ORLANDO PRESENTATION:

ORLANDO BUSINESS AND PROFESSIONAL PRACTICE OWNER SYMPOSIUM – PRIVATE EVENT OPEN ONLY TO CLIENTS OF MAUI MASTERMIND AND GASSMAN, CROTTY & DENICOLO, P.A.

Alan S. Gassman, business coach and author David Finkel, and others will present a two-day conference for high-net-worth business and professional practice owners sponsored by Maui Mastermind®.

Alan’s topics will include BASIC AND ADVANCED PLANNING TECHNIQUES FOR THE PROTECTION OF WEALTH, THE 10 BIGGEST MISTAKES THAT BUSINESS OWNERS AND PROFESSIONALS MAKE, and ESTATE TAX AVOIDANCE TECHNIQUES FOR BUSINESS OWNERS AND PROFESSIONALS.

Other topics include A Proven Map to Grow Your Business and Get Your Life Back, Building Wealth Outside of Your Company, Tax Reduction Strategies, and Understanding How Investments Work and What They Cost.

Interested individuals can contact agassman@gassmanpa.com or David Finkel at david@mauimastermind.com.

Date: July 30th and 31st, 2015

Location: Hyatt Regency Orlando | 9801 International Drive, Orlando, FL 32819

Additional Information: To register, please click here or email agassman@gassmanpa.com.

********************************************

LIVE WEBINAR:

Alan Gassman and Christopher Denicolo will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON, FLORIDA PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

This 50 minute informative talk with extensive materials will cover essential aspects and trip-ups that doctors often encounter in the area of personal and practice entity asset protection. It will also discuss tax and investment planning, advisor selection, health law, compliance, and other areas of interest for physicians.

Each attendee will receive a complimentary copy of Mr. Gassman’s book, Creditor Protection for Florida Physicians and other valuable materials.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

Quotes from previous workshops:

Alan Gassman’s Professional Acceleration Workshop was a fast-paced, information-packed, and highly instructional event. Through interactive discussions of time-tested professional and personal growth strategies ranging from goal setting and problem solving to office efficiency and effective team building, Alan provides a thoughtful and measured approach to becoming a highly effective professional. I left the workshop feeling invigorated and excited to implement the insights into my practice management and continued self-study. The course materials and Alan’s compilation of trusted additional resources will be an invaluable resource for years to come. Thank you for the opportunity to participate.

Christina Rankin, J.D., LL.M. (Taxation)

Trust and Estates Lawyer with Over 10 Years of Experience

Law Offices of Richard D. Green, J.D., LL.M.

I was fortunate to attend the Law Practice and Professional Development Workshop conducted by Alan Gassman, Esq. in Clearwater, Florida on August 3, 2014. The Workshop covered a wide range of topics from Goal Setting and Gratitude to as practical a topic as law office logistics. Alan’s approach was intimate, self-revelatory and highly instructive. I have been practicing law for 20 years and have never attended a program as broad ranging, practical and encouraging. The depth of Alan’s thought and experience is obvious in the materials and in the ease with which he led the discussions. This was not a dull lecture but a highly engaging workshop that was over before you expected it to be.

Daniel Medina, B.C.S

Board Certified in Wills, Trusts and Estates

Medina Law Group, P.A.

I am super charged from the workshop. I have already started to work towards my written goals and my subconscious has me waking up almost 2 hours earlier ready to start my day – one of my goals! It really works. I am very grateful to be a part of this and part of your professional community. All of this came from a New Year’s resolution last year – I was determined to reach out to professionals I admired even if I felt silly. I wrote you an email when you were in the Galapagos with Marcia & you responded! I was amazed. I had no idea how that email would change my life. Thanks for everything you do and all the ways you help me develop professionally and personally.

Debbie Faulkner, J.D., LL.M. (Taxation)

The Faulkner Firm, P.A.

I want to personally thank you again for providing me with the unbelievable opportunity to attend your professional acceleration workshop. I came away from your workshop with renewed excitement in improving my practice. While I had long let go of the notion that doing things the old way was the only way, I found myself mentally making changes in nearly every area of my practice. There were added bonuses that are intangible and difficult to articulate. I love what I do, but to be able to do it better, more efficiently, add to my bottom line and, all the while, allow me to have more personal time available in a 60-plus hour week, was truly unexpected. Simply implementing half a dozen of the changes I developed throughout the day as a result of your program will not only enhance the bottom line, but make my days innumerably easier. Thank you so much for giving your time to help other professionals with personal and professional growth.

Hamden H. Baskin, III, J.D., LL.M. (Taxation)

AV Rated, Estates and Trust Litigation Lawyer with Over 35 Years of Experience

Baskin Fleece Attorneys at Law

By having the opportunity to discuss my goals and the obstacles keeping me from achieving those goals with other professionals I was able to define my path to achieve those goals like never before. Not only was I able to improve myself personally, but I also had the unexpected opportunity of being able to have very candid discussions about law practice management and what actually works and doesn’t work with experienced lawyers who provided great advice for me as a new lawyer entering the field.

The entire experience was invaluable and far more than what I thought it may be. I am very much looking forward to our next session to continue to develop as a young lawyer both personally and professionally.

Brandon Ketron, CPA, Stetson Law Student

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To register for this event, please click here. For more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on a topic to be determined. We are open to suggestions!

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

*****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

****************************************************

LIVE WEBINAR:

Alan Gassman will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online Webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, Alan Gassman, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning. Alan Gassman will speak on Florida Law Tricks and Traps for Estate Planners.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: To be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

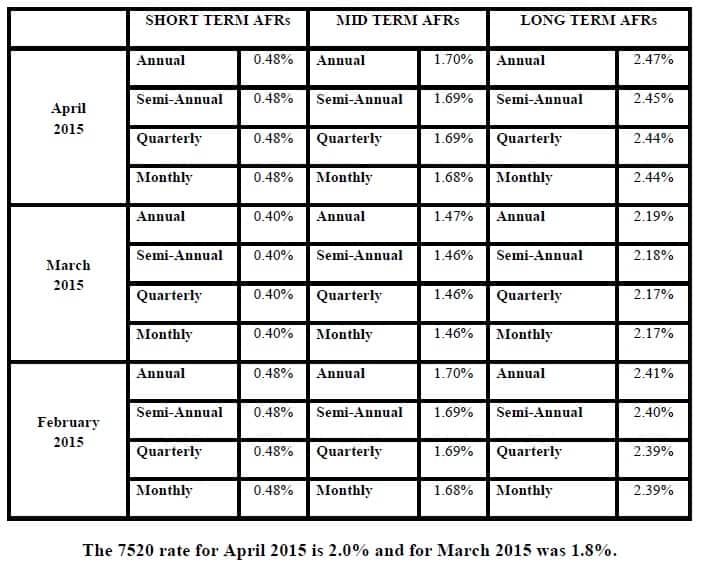

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.