The Thursday Report – 6.4.15 – Annie Get Your Thursday Report!

Gun Trust Questions & Answers – Explosive Coverage that Cannot be Silenced!

Are You Using the Right Durable Power of Attorney Forms?

Avoiding the Castellano Error by Always Leaving Assets in Trust, Not Outright, Part III

Richard Connolly’s World – Health Law & Estate Planning

Thoughtful Corner – Success Tips for First Year Lawyers

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Gun Trust Questions & Answers

Explosive Coverage that Cannot be Silenced!

We hope you haven’t yet gotten dis-gun-sted with our gun trust materials. It really helps to have an audience as we gear up for our upcoming webinar with Jonathan Blattmachr, Lee-Ford Tritt, and Sean Healy, so set your sights on this!

1. Why are Gun Trusts So Complicated?

Gun trusts can pose significant problems for all parties involved. Not only must trustees and beneficiaries comply with state laws for creating and properly maintaining a trust, but the gun trust must also address the various and equally complicated state and federal laws on gun ownership, as well as what happens to the trust property upon the death of the grantor. To gain a better understanding of just how complicated they can be, take a look at the following questions.

2. What is the National Firearms Act and Gun Control Act?

The National Firearms Act (NFA) and Gun Control Act (GCA) were enacted to restrict who may possess, buy, and sell certain restricted firearms and firearm accessories. The NFA operates primarily as a taxing statute by imposing a $200 statutory excise tax per item. It also requires the person to register all restricted firearms with the Bureau of Alcohol, Tobacco, Firearms, and Explosives.

The GCA, on the other hand, was enacted to restrict the transfer of certain types of firearms between individuals. The GCA places weapons into two categories, and each has different rules. Title I firearms primarily include long rifles, shotguns, and handguns. Title II firearms include automatic machine guns, short-barreled rifles, sawed-off shotguns, suppressors (silencers), and destructive devices such as: grenades, bombs, explosive missiles, and poison gas weapons.

Together, the NFA and GCA impose various restrictions on the rights of gun owners to possess and transfer certain weapons.

3. Why Use a Gun Trust When I Can Simply Register NFA Firearms as an Individual or Corporation?

A gun trust is the most comprehensive method to protect yourself and other individuals who you want to allow use or possession of NFA firearms. With a gun trust, the grantor can name as many trustees as they want to use and possess NFA firearms. A gun trust also allows you to properly pass those firearms to future beneficiaries, protecting them from criminal prosecution.

On the other hand, when a person registers an NFA firearm as an individual, they must satisfy several requirements, and even after that, it is not guaranteed they will be approved. Corporations, such as an LLC are usually easy to set up but do not offer the same estate planning tools that a gun trust does. Further, if you fail to pay the annual filing fee, the Secretary of State can dissolve the corporation, leaving you and its members in the unlawful possession of unregistered NFA firearms.

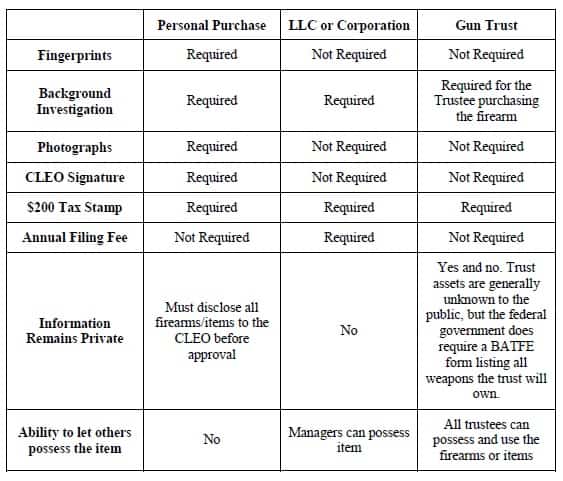

The chart below sums up the various requirements for registering a firearm as an individual, corporation, and gun trust.

4. Can I Use Software like Quicken Will and Trust Maker?

While nothing is technically going to keep you from using products such as this, you should realize that they are not designed to address the complex issues involved with creating a gun trust. Substituting a generic trust form for a gun trust can also be dangerous, as they do not typically address the applicable federal and state laws.

Generic forms tend to be very simple and tend to only address how an individual’s property will pass on after death. A gun trust should have specific language on how the firearms will be managed during the grantor’s life and direct who they will pass to after death. Important consideration must be given as to who will qualify as a co-trustee and beneficiary and whether they will be permitted by law to use and possess firearms.

Furthermore, the trust must be structured to ensure that, at no time, the sole trustee is also the sole beneficiary. Otherwise, the doctrine of merger would invalidate the trust, leaving that person in the unlawful possession of unregistered firearms.

Unlike a generic trust, a gun trust should also include provisions that address what happens to the trust property if a grantor, trustee, or beneficiary becomes a prohibited person who is unable to use or possess any type of firearm. Typically, the gun trust will automatically disqualify them from any rights they had from the trust agreement, thus protecting all the other trustees from an illegal transfer of possession.

5. Who May Access the Firearms Held by the Gun Trust?

The grantor can add as many or as few trustees as they want. Note that all trustees will have specific duties and obligations to perform pursuant to the trust’s provisions. In some states, trustees must be at least 18 years old to possess the firearms held by the trust, and in others, they must be at least 21 years old. However, in order to purchase firearms for the trust, trustees must always be at least 21 years old.

6. What Role Do Beneficiaries Play?

As is the case with other trusts, a beneficiary is the individual entitled to the benefits of that trust. For a gun trust, that means the firearms are held under the trust for their benefit. There is no age requirement for beneficiaries, and they typically include the grantor’s minor children, if any. However, the gun trust should address the potential scenario where the grantor dies and leaves the trust property to their minor child. In this instance, there would be someone under the age of 18 in possession of restricted firearms, which is unlawful. Thus, a provision should be included that will allow the trustees to use and possess the trust property until the beneficiaries are old enough and mature enough to inherit the trust property.

Finally, it is important to note that while the law remains unclear, most conservative attorneys conclude that beneficiaries cannot solely use or possess NFA firearms owned by the gun trust outside the presence of at least one trustee. Thus, an individual who is only a beneficiary, as opposed to a trustee and beneficiary, cannot safely be in sole possession of the NFA firearm, regardless of their age. However, other attorneys are willing to take a chance in allowing beneficiaries to be in sole possession of NFA firearms by including language in the gun trust document that allows a trustee to appoint an individual as a temporary trustee so that they may lawfully use and possess NFA firearms.[1] The appointed trustee’s trusteeship will end when the firearms are returned to the permanent trustee of the gun trust.[2]

7. What Must You Submit to the Bureau of Alcohol, Tobacco, Firearms, and Explosives When Registering and Transferring Firearms to the Trust?

First, when purchasing firearms or related items, the trust should be named as the purchaser, not the grantor or trustee. Furthermore, at the time of purchase, the trustee should submit the application form to the Bureau of Alcohol, Tobacco, Firearms, and Explosives. The most common forms include Form 1 fore firearm manufacturing, Form 4 for the taxable transfer of a firearm, Form 5 for a tax exempt firearm transfer, and Form 20 for the interstate transport of an NFA firearm.

You are also required to submit a complete copy of the gun trust document, any schedules or attachments referenced in the trust, and proof that each “responsible person” is entitled to possess firearms via a Certificate of Compliance. The last item that should be sent is a check or money order payable to the BATFE for $200.

8. I am Single. Should I Even Bother Setting Up a Gun Trust?

Presently, you may feel that it is unnecessary to establish a gun trust to hold NFA firearms just for yourself. However, doing so now will provide you with the flexibility to amend the trust during your lifetime so that you may add or remove additional trustees and beneficiaries as the occasion arises. While you may not have a spouse or children right now, that may not be the case in the future.

Furthermore, keep in mind that individuals purchasing NFA firearms must still pay the $200 tax stamp. Later on, if you wish to set up a gun trust so that you can lawfully pass your NFA firearms to friends and family, you must pay an additional $200 tax stamp for each weapon transferred to a trust.

9. Who are Considered to be Prohibited Persons, and Can They be a Trustee?

A prohibited person cannot be a trustee of a gun trust. Furthermore, they are precluded from directly owning, purchasing, shipping, or transferring any type of firearm. The trustees of a gun trust must also ensure that they do not inadvertently transfer firearms held by the gun trust to these individuals. The following is a list of those individuals that are deemed to be prohibited persons:

- Any person who has been convicted in any court of a crime punishable by imprisonment for a term greater than one year;

- Any fugitive from justice;

- Any unlawful user of or any person who is addicted to a controlled substance;

- Any person who has been adjudicated as having a mental defect or who has been committed to a mental institution;

- Any alien who is illegally or unlawfully in the United States or, except as provided in 18 U.S.C. 922 (y)(2), has been admitted to the United States under a non-immigrant visa (as that term is defined in 8 U.S.C. 1101(a)(26));

- Any person who has been discharged from the Armed Forces under dishonorable conditions;

- Any person who, having been a US citizen, has renounced his or her citizenship;

- Any person who is subject to a restraining order; and

- Any person who has been convicted of a crime of domestic violence.

10. If a Currently Own NFA Firearms, May I Transfer Them into the Gun Trust Without Paying the Transfer Tax?

No, this type of transaction will require a $200 tax stamp for each firearm transferred.

11. Can I Add an Individual as a Trustee of the Gun Trust if They Live in a State Where NFA Firearms are Illegal?

Yes. However, in this situation, the trustee will not be able to use or possess the NFA firearms within that state. They will only be able to use and possess them in those states that permit NFA firearms and items. Furthermore, if the trustee lives in a state that imposes additional restrictions on the use and possession of NFA firearms that are different than what the State of Florida requires, then they must also comply with those additional requirements. For example, the trustee’s state may require them to obtain a Firearms Identification Card before they can lawfully purchase or possess firearms.

12. Can my Friends and I Form a Gun Trust and Put NFA Firearms into the Trust?

Legally, there is nothing that will prevent someone from forming a trust in this manner. However, each friend must be aware of the potential consequences of sharing a gun trust. Most importantly, what happens to the trust property if the friendship ends?

**********************************************

[1] http://nwgunlawgroup.com/can-a-beneficiary-be-in-sole-possession-of-an-nfa-firearm

[2] http://nwgunlawgroup.com/beneficiary-in-sole-possession-issue-solved

Are You Using the Right Durable

Power of Attorney Forms?

Many post-September 2011 Durable Powers of Attorney are inadvertently inadequate because every single enumerated authority listed under the statute has to be signed or initialed, and initialing or signing once to indicate that all of them count together is insufficient. Just about every bookstore we have checked with has forms that do not comply with the statute and will cause significant harm to Floridians who use them.

Florida Statute 709.2202(1) provides that certain authorities can only be provided to an Agent under a Durable Power of Attorney if the principal signed or initialed next to each specific enumeration of authority.

Certain forms are being used by lawyers which provide for the principal to “initial here only if you want every power to apply.” This is an invitation to disaster.

Please get the word out so that those friends and colleagues can get back to their clients to tell them to come back in and re-sign after initialing each power individually.

The statute reads as follows:

709.2202 Authority that requires separate signed enumeration –

(1) Notwithstanding s. 709.2201, an agent may exercise the following authority only if the principal signed or initialed next to each specific enumeration of the authority, the exercise of the authority is consistent with the agent’s duties under s. 709.2114, and the exercise is not otherwise prohibited by another agreement or instrument:

(a) Create an inter vivos trust;

(b) With respect to a trust created by or on behalf of the principal, amend, modify, revoke, or terminate the trust, but only if the trust instrument explicitly provides for amendment, modification, revocation, or termination by the settlor’s agent;

(c) Make a gift, subject to subsection (3);

(d) Create or change rights of survivorship;

(e) Create or change a beneficiary designation;

(f) Waive the principal’s right to be a beneficiary of a joint and survivor annuity, including a survivor benefit under a retirement plan; or

(g) Disclaim property and powers of appointment

Our book, Florida Law for Tax, Business, and Financial Advisors, provides further information and Durable Power of Attorney forms. You can purchase and/or take advantage of a free look inside the book by clicking here.

Avoiding the Castellano Error by Always Leaving

Assets in Trust, Not Outright, Part III

by Jonathan E. Gopman, Ryan J. Beadle, Michael A. Sneeringer,

Evan R. Kaufman, and Alan S. Gassman

Under the Castellano decision, a Will which provided that the inheritance of an insolvent beneficiary would instead be held in trust, was essentially set aside by a bankruptcy judge under the rationale that the beneficiary’s notification to the Trustee of insolvency constituted a fraudulent transfer into the trust system.

Click here to view Part I of this article. Click here to view Part II.

This article has also been published as a LISI Newsletter, which can be viewed by clicking here.

GOING FORWARD

Although Castellano I has been overruled, there remain practical lessons from Castellano II of which estate planning practitioners should be aware.

Spendthrift Provision Language

It is always better for asset protection purposes that family wealth is passed in wholly discretionary trusts for as long as possible under applicable law. If assets must be distributed outright to a trust beneficiary, practitioners may wish to draft the trust to clearly provide that such beneficiary will have no right to such distributions until the end of the trust administration or estate administration process. Additionally, practitioners may wish to give either an independent trustee or trust protector discretion over the timing of such distributions and the ability to withhold such distributions if such fiduciary is aware of creditor issues affecting the potential distributee. In those states that have adopted §504 of the Uniform Trust Code (“UTC”) or an equivalent provision, if the client insists upon the beneficiary serving as the trustee, a lifetime spendthrift trust is still possible. Such a trust would include an ascertainable standard for distributions.

Section 504 of the UTC provides:

(A) In this section, “child” includes any person for whom an order or judgment for child support has been entered in this or another State.

(B) Except as otherwise provided in the subsection (c), whether or not a trust contains a spendthrift provision, a creditor of a beneficiary may not compel a distribution that is subject to the trustee’s discretion, even if:

- The discretion is expressed in the form of a standard of distribution; or

- The trustee has abused the discretion.

(C) To the extent a trustee has not complied with a standard of distribution or has abused a discretion:

- A distribution may be ordered by the court to satisfy a judgment or court order against the beneficiary for support or maintenance of the beneficiary’s child, spouse, or former spouse; and

- The court shall direct the trustee to pay to the child, spouse, or former spouse such amount as is equitable under the circumstances but not more than the amount the trustee would have been required to distribute to or for the benefit of the beneficiary had the trustee complied with the standard or not abused the discretion.

(D) This section does not limit the right of a beneficiary to maintain a judicial proceeding against a trustee for an abuse of discretion or failure to comply with a standard for distribution.

(E) If the trustee’s or co-trustee’s discretion to make distributions for the trustee’s or co-trustee’s own benefit is limited by an ascertainable standard, a creditor may not reach or compel distribution of the beneficial interest except to the extent the interest would be subject to the creditor’s claim were the beneficiary not acting as trustee or co-trustee.

Practitioners should carefully consider applicable state law in drafting spendthrift provisions. The spendthrift clause in the Trust contained broad distribution authority (“Thereafter, the Trustee shall pay to or for the benefit of that beneficiary only those amounts that the Trustee, in its sole and absolute discretion, deems advisable…”), however, the spendthrift clause included a standard for distributions (“…for the education and support of that beneficiary until the death of the beneficiary…”).

A spendthrift provision should clearly provide that a trust beneficiary may not voluntarily and involuntarily assign such beneficiary’s interest. There is no reason to incorporate a standard (e.g., health, education, support, or maintenance) for distributions where the beneficiary is not the trustee. Finally, a trustee can be permitted to take actions or to make expenditures for the benefit of a beneficiary (such as purchasing a residence for the beneficiary to occupy rent free) without making a direct distribution to the beneficiary.

Trustee Succession

Despite Castellano II’s holding, practitioners should carefully plan for trustee succession. The court’s conclusion in Castellano I that the Debtor made a transfer was based in part on the familial relationship between Linda and Del Alcazar (albeit by marriage to Linda’s niece). Section 101(14) of the Bankruptcy Code provides:

The term “disinterested person” means a person that –

- Is not a creditor, an equity security holder, or an insider;

- Is not and was not, within 2 years before the date of the filing of the petition, a director, officer, or employee of the debtor; and

- Does not have an interest materially adverse to the interest of the estate or of any class of creditors or equity security holders, by reason of any direct or indirect relationship to, connection with, or interest in, the debtor, or for any other reason.

Del Alcazar likely fell within the definition of a “disinterested person,” as he had no interest “materially adverse to the interest of the estate or any class of creditors” by virtue of his relationship with Linda. “The court in Castellano I simply assumed that Linda had control of Del Alcazar due to their familial relationship; however, the Castellano I court’s conclusion that Linda made a transfer based on Linda’s alleged control over Del Alcazar had no apparent basis in fact or law.[1]

Many states have adopted some variation of § 504 of the UTC, which provides that a creditor may not compel a distribution for the trustee’s own benefit where the trustee’s discretion is subject to an ascertainable standard. Where asset protection is a concern, it is best to appoint an unrelated third party as trustee and specify that any successor trustee should be similarly unrelated. Where a related party must be appointed as a trustee, practitioners should carefully draft the ascertainable standard. It may also be helpful to have an independent trust protector appoint successor trustees to avoid any argument that the beneficiaries may install a subordinate trustee.

CONCLUSION

Castellano I will certainly not be the last case in which a court misapplies the law to benefit a creditor, and practitioners should draft very carefully and consider having all distributions held in trust and not passing outright to avoid a costly court battle that will not be resolved by the decision in Castellano II. The case is also a reminder that bankruptcy court decisions are no more than any other “court of first impression,” and can be overturned by a federal district court.

**************************************************

[1] Safanda, 2015 WL 1911130 at fn 4.

Richard Connolly’s World

Health Law & Estate Planning

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the first article of interest is “New Wrinkle for Health Law” by Stephanie Armour. This article was featured in The Wall Street Journal on April 12, 2015.

Richard’s description is as follows:

Millions of people have gained health coverage through Medicaid since states began expanding the program under the Affordable Care Act. That also means more Americans may find themselves caught in a little-known law that lets states go after their assets after they die.

For more than 20 years, federal law has allowed states to recover almost all Medicaid costs if recipients are 55 or older when they die. This now applies to many of the 11 million people who joined Medicaid since the health law’s expansion of the state-federal insurance program.

The upshot: Some families are discovering they may have to sell a home or other assets of a deceased relative to reimburse the government.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “How Freezing Eggs Can Affect Your Estate Plan” by Joan M. Burda. This article was featured on Forbes.com on December 10, 2014.

Richard’s description is as follows:

When Apple and Facebook made news for paying the expenses of their female employees to freeze their eggs, chances are you didn’t think it would have any effect on your estate plan, but if you have a daughter or a granddaughter, you may be mistaken.

If either decides to use assisted reproductive technology and freeze her eggs, you’ll need to consider whether to include unborn descendants in your estate plan.

Generally speaking, for estate planning purposes, children, descendants, and heirs refer to people who are genetically, biologically, or legally related to you. Egg freezing, however, increases the chances that you may have a descendant who is neither genetically nor biologically related to you. Then it’ll be up to you to decide whether to include him or her in your estate.

Ignoring how assisted reproductive technology could play a part in your estate plan can be a significant error. Someone you want to include as an heir may be wrongly excluded, and another you have no intention of including could be brought in to share your estate. By specifying whom you do and don’t want to include, you retain control over your estate.

Most clients are unaware of this issue. This article is one way to start the conversation.

Please click here to read this article in its entirety.

Thoughtful Corner

Success Tips for First Year Lawyers

Alan Gassman gave a five hour workshop on professional acceleration for a group of LL.M. and tax students and some practicing lawyers at the University of Florida last Saturday. So sorry you missed it! Some of Alan’s new tips for first year lawyers were as follows:

1.) Always show up with a legal pad and two pens in hand.

2.) Answer questions as concisely as possible and see whether more information is requested. Don’t try to explain anything beyond the absolute minimum information that the person needs when that person is another lawyer that you are working with. The person you are interacting with, be it client or other attorney, will ask you what they need to know in addition to that.

3.) Show up to a meeting with a memo you wrote on the topic to be discussed, and hand it to the lawyer you prepared it for. Bring an extra copy so you have one, too. They can glance through the memo and ask you what they need to know.

4.) Smile and be cheerful. If there is a serious situation, be serious, but in overall everyday interactions, be as friendly and humorous as you can.

5.) Say hello when you first see someone at your office during the day, and then say goodbye at the end of the day.

6.) Become the organizer of anything and everything that you are involved with. Use checklists, progress reports, and reminders. Once you manage a project, you “own it” and will become the go-to person. Always have your checklists and the latest progress on each item you are working on with you for meetings or otherwise. You never know when you will be asked about them.

7.) Consider sending anyone in the office that you have a project in progress with an email every evening at 7:00 PM enclosing where you are or anything they may want or need to see about the project. You can accomplish this by utilizing the delay function on your emails.

This email will (1) remind them that you are working on this and (2) establish a habit so that your colleagues know they can go to their 7:00 PM emails to access what you have been working on lately. Your colleagues will quickly learn that the 7:00 PM space in their Inbox always belongs to you!

8.) Work constantly to improve yourself beyond the law and what you do as a lawyer. Concentrate on what you like to do and do best to the extent that it is productive.

Stay tuned for more tips for first year success next week. Alan’s next scheduled workshop for law students and professionals will be on August 22, 2015, at Ave Maria Law School in Naples. Schedule your tax deductible trip weekend in Naples, and attend this Saturday eight hour interactive workshop, while making new friends and helping others (and yourself) immensely. A splendid time is guaranteed for all, not to mention one ethics credit hour and seven general credits.

Humor! (or Lack Thereof!)

Sign Saying of the Week

************************

IN THE NEWS

by Ron Ross

Fed-Ex/Kinko’s is proud to announce their latest merger, this time with Gassman, Crotty & Denicolo, PA! This exciting venture will greatly enhance Fed-Ex/Kinko’s ability to serve their customers. Now they can box and send a lawyer directly to your doorstep overnight!

*************************************

As you may have heard, parents across the country are complaining about the great number of standardized tests their children have to take. Here in Florida, a compromise has been reached. As an alternative to the FCAT, students may choose one of the following:

- Pull the sword from the stone

- Identify all of the Colonel’s secret herbs and spices

- Go on a scavenger hunt and find a well-paid teacher, a number one pencil, and someone who actually uses trigonometry in real life

- Attend an additional 40 days of school per year like the rest of the Western world

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alice Rokahr earned her Juris Doctor at The University of South Dakota School of Law. She was a partner at the firm of Kennedy, Rokahr, Pier & Knoff, LLP for 15 years and has also worked with Wells Fargo Bank and Bankers Trust Company of South Dakota. She currently serves as the President of Trident Trust Company (South Dakota) Inc.

Alice Rokahr and Alan S. Gassman will present a free, 30-minute webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA – DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

Date: Tuesday, June 9, 2015 | 12:30 pm

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or click here to register for this webinar.

**********************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE WEBINAR:

Alan Gassman will present a live, free, 30-minute webinar on the topic of THE NEW DOCTOR’S GUIDE TO WEALTH BUILDING, CREDITOR PROTECTION, TRUST PLANNING, AND WHAT THEY DIDN’T TELL YOU IN MEDICAL SCHOOL. There will be two opportunities to attend this presentation.

Date: Wednesday, June 17, 2015 | 7:30 PM or Saturday, June 20, 2015 | 9:30 AM

Location: Online webinar

Additional Information: To register for the Wednesday/7:30 PM webinar, please click here. To register for the Saturday/9:30 AM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will be presenting a free 30-minute webinar on ARBITRATING TRUST AND ESTATES DISPUTES.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many very useful articles thereon.

Date: Thursday, June 25, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on FINANCIAL RELATIONSHIPS WITH PATIENTS, CO-PAYMENTS, GIFTS, AND GRAFT – HOW TO STAY OUT OF TROUBLE UNDER FLORIDA AND FEDERAL LAW.

This is an essential guide for medical practices and those who advise them. There will be two opportunities to attend this presentation.

Date: Tuesday, July 7, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman will present a webinar on the topic of WHAT FLORIDA CPAS NEED TO KNOW ABOUT ASSET PROTECTION for the Florida Institute of CPAs.

More information about this webinar will be forthcoming. Please stay tuned!

Date: Thursday, July 9, 2015 | 9:30 AM – 10:30 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com. To register, please contact Thelma Givens at givenst@ficpa.org.

**************************************************

LIVE ORLANDO PRESENTATION:

ORLANDO BUSINESS AND PROFESSIONAL PRACTICE OWNER SYMPOSIUM

Alan S. Gassman, business coach and author David Finkel, and others will present a two-day conference for high-net-worth business and professional practice owners sponsored by Maui Mastermind®.

Alan’s topics will include BASIC AND ADVANCED PLANNING TECHNIQUES FOR THE PROTECTION OF WEALTH, THE 10 BIGGEST MISTAKES THAT BUSINESS OWNERS AND PROFESSIONALS MAKE, and ESTATE TAX AVOIDANCE TECHNIQUES FOR BUSINESS OWNERS AND PROFESSIONALS.

Other topics include A Proven Map to Grow Your Business and Get Your Life Back, Building Wealth Outside of Your Company, Tax Reduction Strategies, and Understanding How Investments Work and What They Cost.

Interested individuals can contact agassman@gassmanpa.com or David Finkel at david@mauimastermind.com.

Date: July 30th and 31st, 2015

Location: Hyatt Regency Orlando | 9801 International Drive, Orlando, FL 32819

Additional Information: To register, please click here or call Kelli Goode at 1-888-889-0944 ext. 915.

********************************************

LIVE WEBINAR:

Alan Gassman will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON, FLORIDA PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on a topic to be determined. We are open to suggestions!

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

*****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

****************************************************

LIVE WEBINAR:

Alan Gassman will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online Webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, Alan Gassman, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning. Alan Gassman will speak on Florida Law Tricks and Traps for Estate Planners.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: To be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

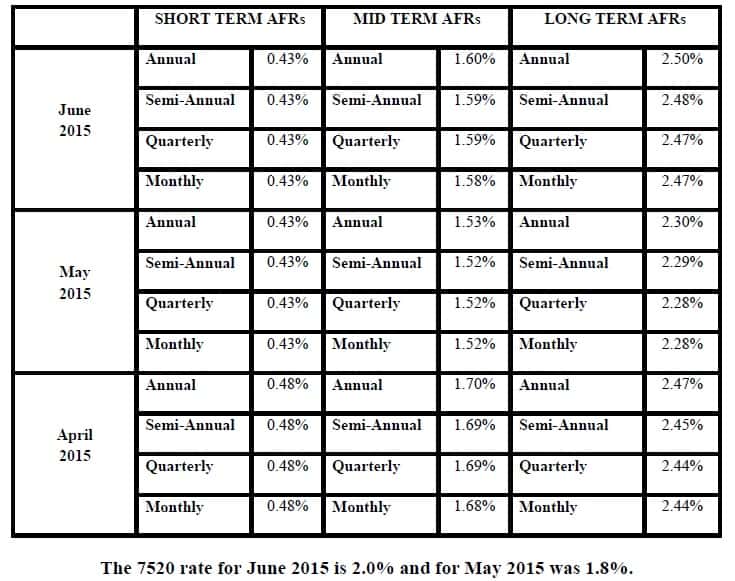

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.