The Thursday Report – 5.28.15 – Bullet Points for Gun Trust Webinar

Bullet Points for Gun Trust Webinar with Jonathan Blattmachr, Lee-Ford Tritt, Sean Healy, and Alan Gassman

Appeals Court Corrects Bankruptcy Error in Castellano, Part II

50,000 Reasons to Buy Natalie Choate’s New Internet Based and Updated Life and Death Planning for Retirement Benefits

There is No Obligation to File an Annual Minutes Requirement Statement by Mike O’Leary and Teresa Good

Richard Connolly’s World – Philanthropy and the Future

Amy Bhatt Graduates from St. Petersburg College!

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Bullet Points for Gun Trust Webinar with Jonathan Blattmachr,

Lee-Ford Tritt, Sean Healy, and Alan Gassman

We are pleased to announce that Jonathan Blattmachr, Lee-Ford Tritt, Sean Healy, and Alan Gassman will present a one-hour, Bloomberg BNA webinar on Gun Trusts on Wednesday, August 5, 2015 at 12:00 PM.

Stay tuned for more information regarding this not-to-be-missed webinar, and don’t miss the bullet points below!

Appeals Court Corrects Bankruptcy Error in Castellano, Part II

by Jonathan E. Gopman, Ryan J. Beadle, Michael A. Sneeringer,

Evan R. Kaufman, and Alan S. Gassman

Last week, we began publishing an article (and poem!) on the Castellano case, Part I of which can be viewed by clicking here. This week, we continue with Part II of the article.

We are also pleased to announce that this article was published this week as a LISI Newsletter, which can be viewed by clicking here.

Analysis Under Section 548(e)

Section 548 (e)(1) of the Bankruptcy Code provides:

(e)(1) [T]he trustee may avoid any transfer of an interest of the debtor in property that was made on or within 10 years before the date of the filing of the petition if –

(A) Such transfer was made to a self-settled trust or similar device;

(B) Such transfer was by the debtor;

(C) The debtor is a beneficiary of such trust or similar device; and

(D) The debtor made such transfer with actual intent to hinder, delay, or defraud any entity to which the debtor was or became, on or after the date that the transfer was made, indebted.

Section 101(54) of the Bankruptcy Code provides:

The term “transfer” means –

(A) The creation of a lien;

(B) The retention of title as a security interest;

(C) The foreclosure of a debtor’s equity of redemption; or

(D) Each mode, direct or indirect, absolute or conditional, voluntary or involuntary, of disposing of or parting with –

(i) Property; or

(ii) An interest in property.

The terms of the Trust allowed Del Alcazar to transfer a portion of the Trust’s assets from one account to another. The court ruled that transferring assets of the Trust between accounts did not terminate the Trust’s ownership of such assets, or constitute a distribution to Linda, or otherwise create a new trust. According to the court, Linda’s share of the Trust “remained the property of the Trust in the custody of Merrill Lunch.”[1] The court ruled further that without a “transfer” (as defined in § 101(54) of the Bankruptcy Code) of an interest to Linda, § 548(e) did not apply. The court thus rejected the bankruptcy court’s application of § 548(e) of the Bankruptcy Code.

Unlike the court in Castellano I, the court in Castellano II did not provide extensive analysis on what a transfer of an “interest in property” delineates or what a “similar device” is or is not.

According to the court in Castellano I, Linda’s “interest” in “property” was “her share of the Trust assets.”[2] In Castellano II, the court noted that Linda had no interest; the $400,000 in the Spendthrift Trust Account was an interest in property of the Trust. Section 548(e)(1) of the Bankruptcy Code uses the term “interest,” as further modified by the phrase “of the debtor in property that was made on or within 10 years before the date of the filing of the petition”; while not explicitly defined elsewhere in the statute, the term “interest” was interpreted in In re Mortensen.[3] The court in Mortensen, quoting Butner v. U.S.,[4] remarked that “[o]rdinarily, it is state law, rather than the Bankruptcy Code, which creates and defines a debtor’s interest in property. Unless some federal interest requires a different result, there is no reason why such interests should be analyzed differently simply because an interested party is involved in a bankruptcy proceeding.” However, the Mortensen court noted that Congress codified a federal “interest” in passing Section 548(e)(1) which required an interpretation of “interest” different from state law as articulated in Butner.[5]

What type of interest in the trust is required to make it a “self-settled trust” or “similar device?” Can a transfer only be avoided under this provision to the extent the trust is self-settled? Suppose a debtor transfers property to a trust and retains only the right to receive income (such as a grantor retained annuity trust) from the trust for a term of years or for life or suppose the debtor can only receive such payments in the discretion of an independent trustee where the trust is settled in a jurisdiction such as Delaware with asset protection legislation. Is an inter vivos QTIP trust a self-settled trust or similar device where the beneficiary spouse is given a power to appoint assets back to the grantor spouse?

Consider the case of a transfer of wealth to a charitable lead trust established in a jurisdiction such as Delaware with asset protection legislation where the remainder interest is directed to be distributed to a trust in which the debtor is a discretionary beneficiary of the income and/or principal. Suppose the term of the lead trust extends over ten (10) years. Query whether this is a self-settled trust under the statute or a similar device. Would the asset protection trust’s vested remainder interest in the charitable lead trust be considered an attachable property interest under this rule? This would seem to be the correct result.[6] It appears that the retention of a certain amount of control over the trust assets is an indication of the trust being classified as “something like” a similar device.

Neither the phrase “self-settled trust or similar device,” nor the individual words “self-settled trust” or “similar device” are defined in the Bankruptcy Code. Castellano I cited to Black’s Law Dictionary for the definition of a self-settled trust, which states that a self-settled trust is “[a] trust in which the settlor is also the person who is to receive the benefits from the trust, usually set up in an attempt to protect the trust assets from creditors.”[7] It appears that Congress intended that the courts turn to state law for these definitions, as articulated by Representative Chris Cannon, R-UT:

Under the Restatement of Trusts, a self-settled trust is a trust created by a person for his or her own benefit with a provision restraining the voluntary or involuntary transfer of a person’s interest, so the Restatement provides that such trust can be pierced by the person’s creditors…So what is an asset protection trust or self-settled trust? Neither the Internal Revenue Code nor the entire United States Code contain any reference to either of these terms. This is a matter of State law.[8]

In In re Porco,[9] the court highlighted commentary in Collier on Bankruptcy that states: “[t]he congressional decision to leave these terms ‘self-settled trust[s],’ a court will have the power to scrutinize them under the ‘similar device’ provision.” The Porco court ultimately stated that “consideration should be given to Congress’s purpose in enacting § 548(e)…to reverse the actions of state legislatures that had overturned the common law that a self-settled spendthrift trust could be reached by creditors or a trustee in bankruptcy.”[10]

Cases may give practitioners some insight into what a “similar device” might be. In Porco, a 2011 decision, the court noted that years after Section 548(e) of the Bankruptcy Code had been enacted (2005), no bankruptcy court opinions had yet to construe the words “self-settled” or “similar device.” Relying on the legislative history of Section 548(e) and Collier on Bankruptcy, the court determined that a resulting or constructive trust was not a “self-settled trust or similar device.” The court noted that self-settled spendthrift trusts “generally require (1) an irrevocable trust; (2) an independent trustee; (3) absolute discretion; and (4) distributions to beneficiaries, including the settlor.”[11] According to the court, the four elements contemplate the creation of an express trust. The court went on to reason that if the purpose of Section 548(e) was to reverse actions of state legislatures overturning the common law ban on self-settled spendthrift trusts and self-settled spendthrift trusts are express trusts, the language in Section 548(e) requires an express trust; therefore, resulting or constructive trusts are created by the courts and not by the express grant of a settlor.[12]

The court in Castellano II noted that in Del Alcazar’s creation of the Spendthrift Trust Account and holding of the $400,000 at Merrill Lynch, there was no act of distribution or creation of a new trust; there was merely a division of the property of the Trust pursuant to the terms of the Trust. Thus, the court in Castellano II reached the correct result in holding that there was no transfer of an interest and that § 548(e) does not apply.

Finally, it is worth noting that perhaps the term “similar device” refers to a trust that is not technically considered a “self-settled trust” nevertheless, the settlor retains (or likely retains) some significant benefit or benefits that are not necessarily apparent from the terms of the trust agreement, however, are either apparent from the facts and circumstances that occur after the trust is created and funded or because of powers and authority granted to certain parties who are closely related to the settlor or over whom a settlor can exert strong influence. Thus, for example, a trust for the benefit of a settlor’s spouse and descendants would not be considered a self-settled trust. Nevertheless, where the terms of the trust agreement grant the settlor’s spouse a broad special power of appointment that could be exercised in favor of the settlor, such a trust may be considered a “similar device.” A trust for the benefit of the settlor’s descendants may be considered a similar device where the settlor retains substantial control over the capital through broad investment authority either granted under the terms of the trust agreement or de facto control based on the facts and circumstances.

Next week, we will provide our conclusion and final thoughts regarding this important case.

***************************************************

[1] Safanda, 2015 WL 1911130 at *8.

[2] In re Castellano, 514 B.R. at 560.

[3] 2011 WL 5025249 (Bankr. D. Alaska).

[4] 440 U.S. 48, 55 (1979).

[5] In re Mortensen, at *6-7.

[6] See In re Yerushalmi, 487 B.R. 98 (Bankr. E.D. N.Y. 2012).

[7] Black’s Law Dictionary 1746, 10 ed., 2014.

[8] 5 COLLIER ON BANKRUPTCY ¶ 548.10[1] (N. Alan Resnick & Henry J. Sommer eds., 16th ed.) (2005), citing H.R. Rep. No. 109-31, 109th Cong., 1st Sess. 449 (statement of Rep. Cannon).

[9] 447 B.R. 590 (S.D. IL 2001).

[10] Id. at 596.

[11] Id. at 596-97.

[12] For another example of a court scrutinizing a device that is not technically a self-settled trust, see In re Thomas, 2012 WL 2792348 (Bankr. D. Id., Slip Copy, July 9, 2012), whereby the court briefly discussed the issue of whether an IRA was a self-settled trust or similar device.

50,000 Reasons to Buy Natalie Choate’s New Internet Based & Updated

Life and Death Planning for Retirement Benefits

by Alan S. Gassman and Christopher J. Denicolo

The following article was published as a LISI Newsletter, which can be viewed by clicking here.

EXECUTIVE SUMMARY:

Your practice cannot go without Natalie Choate’s new Life and Death Planning for Retirement Benefits, and you will be amazed at the new heightened level of accessibility and speed made available in the new, updated 2015 interactive electronic version. Our firm has been using this book in the electronic version since we purchased it at the Heckerling Institute in January, and we have been nothing short of amazed at how easy it is to navigate and to find balanced, thorough discussions and answers as and when needed.

If you don’t have this updated version and are operating on the 2011 printed edition, or if you are without this book at all, then stop reading this evaluation and order the book online. If there is any doubt at all, please keep reading.

ABOUT THE DYNAMIC AUTHOR AND THE UNPRECEDENTED PLATFORM:

Natalie B. Choate practices law in Boston, Massachusetts, with the firm of Nutter McClennen & Fish, LLP, and she is the undisputed top author, lecturer, and authority in this complicated area. She is also an amazing writer and speaker and our hero in this area. Her practice is limited to consulting on estate planning and retirement benefits matters. Her books Life and Death Planning for Retirement Benefits and The QPRT Manual are leading resources for estate planning professionals. Any professional attempting to practice in these areas needs to have these books. Her amazing writing talents and supremacy in this area are made all the more cogent and relevant by what Jonathan Blattmachr and his team at Interactive Legal Systems have done with Life and Death Planning by putting it on an interactive platform in the Cloud that is nothing short of amazing in terms of the usability, speed, and efficiency in this challenging area.

COMMENT:

Recent studies show that more than $20 trillion of assets are held under IRA and qualified retirement plans, making this the largest asset class held by Americans. More importantly, with the increase in the federal estate tax exemption, many Americans will no longer be subject to estate tax. Instead, their primary tax planning focus will shift to income tax, especially with respect to IRAs and qualified retirement plans, which will be subject to income tax when distributions are paid therefrom.

The complexity and income tax planning associated with IRAs and qualified plan distributions has become a significant planning area where advisors can make a big difference to save tax money, preserve inheritances, and facilitate appropriate trust planning for clients who have or will inherit large IRA and pension accounts, and there are a great many of these. It is therefore critically important to understand the extremely complicated and somewhat cumbersome rules applicable to IRAs and qualified plans.

We know from experience that it is impossible to navigate this complicated and often otherwise uncharted area without a thorough and complete guide to the primary rules and all of the nooks and crannies that can create traps for the unwary. Fortunately, Life and Death Planning has been the one and only bible in this area for the vast majority of conscientious estate planners for more than 19 years. This is why it has sold more than 50,000 copies, and this is why everyone who has bought a copy in the past needs to be up to date in this area in this very special way.

This essential “red book” was last reprinted in 2011 as the seventh edition, but now, the book is available for the first time as an electronic version that is fully searchable. The electronic version will also be automatically updated to account for changes in the applicable tax law that will undoubtedly occur. The fantastic electronic platform was designed in coordination with Interactive Legal Systems, with input by Natalie’s good friend and unprecedented fellow tax planning genius, Jonathan Blattmachr, and with the notable participation and assistance of Michael L. Graham, who is also a tax heavyweight and a tremendous contributor to the tax and estate professional community.

This latest version of Life and Death Planning contains two additional chapters that are not included in the current print version: Chapter 10 on the topic of “Minimum Distribution Rules for Defined Benefit Plans and Annuitized IRAs,” and Chapter 11 on the topic of “Insurance, Annuities, and Retirement Plans.” Further, Chapter 7 on the topic of “Charitable Giving” has been updated through March 31, 2015 and expanded to include Natalie’s special report on charitable giving with retirement benefits that was previously sold as a stand-alone document. The latest edition also contains updates to the IRA and qualified retirement plan tax law that have occurred since the last edition was published in 2011.

What is even more impressive is an innovative and easy-to-use electronic platform, which enables the user to not only search for terms, code and regulation sections, and strategy and case names, but also to navigate by link from the table of contents and chosen words to other sections of the book (and back) with just a click. This feature is logical, intuitive, and very efficient to boot.

The applicable Internal Revenue Code and Treasury Regulations sections employ certain nomenclature and terms and art that need to be understood by those of us who work with IRAs and qualified retirement plans. Having a word search feature available at your fingertips greatly streamlines the ability to access and understand the authority and discussion with respect to IRAs and qualified retirement plan issues. Specifically, the search function allows readers to search the book for certain buzzwords and key terms relating to their desired area of discussion or to search for certain authority (such as Code and Treasury Regulation sections). This feature undoubtedly saves readers much time in thumbing through pages and expedites access to THE treatise on IRAs and qualified retirement plans.

For an example of the above, suppose that you need to know if a conduit trust could pay certain expenses, without jeopardizing the trust’s status as a qualifying conduit trust. Once you put the words “conduit trust” and “expenses” into the system, the following immediately pops up and provides an excellent answer to the question presented:

Section 6.3.05 (D) Payment of Trust Expenses

“Payment of trust expenses out of the retirement plan assets does not adversely affect conduit trust status.”

This search took mere seconds and eliminated the often cumbersome process of looking through a table of contents or index to determine the applicable pages, following by thumbing through a hard copy book to get to the desired page.

Any estate planner or advisor assisting clients in any fashion with respect to IRAs or qualified plans should not go without the newest edition of Life and Death Planning, and they are advised to strengthen their practice by adding this book to their library. Readers will be amazed by the new heightened level of accessibility and efficiency made available through this electronic version and will be pleased by the breadth and depth of the discussion of the tax law applicable to IRAs and qualified retirement plans.

The electronic version of the book reinforces its place as one of the sources that every estate planner should have in his or her library and is a testament to the enormous contribution that Natalie Choate has made to the estate planning industry.

We wholeheartedly agree with other testimonials for this book, which have included the following:

Must Have for Estate Planners

by Steven L. Zakrocki

As an estate planning attorney, this book is always within reach. It is a must have for understanding issues related to retirement benefits. I’ve also heard several other attorneys highly recommend this book.

The Premier Book for IRA Planning

by Rick Fingerman, CFP, CDFA

Natalie Choate is one of the three top experts in this area. Well, she is probably THE top expert, but you get the idea. This is a very technical book, but if the answer isn’t in here, it probably doesn’t exist. I find this to be one of the best resource guides available.

One of the Best Resource Guides Available

by Anita Week

As an ERISA specialist, I find this to be one of the best resource guides available. It’s highly recommended.

Thanks again to Natalie and Jonathan for all that they have done for our industry, and now particularly, for those of us who engage in IRA and retirement planning. New doors are opened, and with an efficiency and finesse that can only be made available by industry leaders like Natalie and Jonathan.

TABLE OF CONTENTS:

Chapter 1: The Minimum Distribution Rules

Chapter 2: Income Tax Issues

Chapter 3: Marital Matters

Chapter 4: Inherited Benefits: Advising Executors and Beneficiaries

Chapter 5: Roth Retirement Plans

Chapter 6: Leaving Retirement Benefits in Trust

Chapter 7: Charitable Giving

Chapter 8: Investment Issues; Plan Types

Chapter 9: Distributions Before Age 59½

Chapter 10: RMD Rules for Annuitized Plans

Chapter 11: Insurance, Annuities, and Retirement Plans

Appendix A: Tables

Appendix B: Forms

Appendix C: Resources

HOW TO ORDER:

The new electronic version can be subscribed to at www.retirementbenefitsplanning.com. The 7th Edition is available for purchase in print at www.ataxplan.com. This is an essential guide, and the electronic version is a tremendous bargain at only $9 per month, which includes all updates and resources. Live long and prosper with the best of the best in this industry and perhaps any industry!

There is No Obligation to File an Annual Minutes Requirement Statement

by Mike O’Leary and Teresa Good

he following short article by Mike O’Leary and Teresa Good was featured in the Trenam Kemker Legal Update for March of 2015. You can see the article, which originally ran in the September 2014 Legal Update by clicking here.

If you would like to see more Trenam Kemker articles, please click here to sign up for their newsletters.

Many of our corporate clients have received a letter or email from Compliance Services, containing an Annual Minutes Requirement Statement. The letter or email requests that the Statement be completed and returned with a filing fee. Although the Statement and the request look very “official,” there is no obligation to complete or file such a Statement. Compliance Services is just one of several companies that attempt to get Florida corporations, partnerships, limited liability companies, and other entities to pay for services that are not required.

The communications from these companies are intentionally designed to look official, with the appearance that these companies are affiliated with the Florida Department of State. Don’t be fooled – they are not affiliated with the Florida Department of State, and, indeed, the Department of State has specifically advised against completing this form or paying this fee. The only document required to be filed annually for a business entity in Florida is an Annual Report, required to be filed with the Florida Department of State. If you receive a communication that appears official, don’t just fill it out and send it in the money.

Thanks to Trenam Kemker for passing this important message along! Mike O’Leary can be reached at 813-227-7454, and Teresa Good can be reached by calling 813-202-7827.

Richard Connolly’s World

Philanthropy and the Future

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the first article of interest is “Don’t Skip Charitable Planning for Wealthy Clients” by Paul Hechinger. This article was featured on OnWallStreet.com on May 10, 2015.

Richard’s description is as follows:

For the very rich, how they give away their money may be just as important as how they make it.

The role that philanthropy plays in the lives of wealthy individuals is so crucial that advisors who don’t properly understand it risk becoming irrelevant, according to wealth industry professionals.

Wealthy clients are eager to discuss philanthropy, according to Claire Costello, U.S. Trust’s National Practice Executive for Philanthropic Solutions. She points out that one-third of clients want the subject brought up in an initial meeting with an advisor, while 90% say the conversation has to take place within the first three meetings.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “How Family Foundations Can Pass on the Philanthropy Flame to the Next Generation” by Veronica Dagher. This article was featured in The Wall Street Journal on April 12, 2015.

Richard’s description is as follows:

Many family foundations are set up to exist indefinitely. But “indefinitely” is going to come a lot sooner than expected if future generations have no interest in the family’s charitable work.

That’s a pressing issue these days as aging baby boomers look to their children and grandchildren to take the reins of the foundations they or their parents founded. Younger family members may be reluctant to step up, however, if they don’t feel a connection to the charities the foundation supports, are overshadowed by overbearing parents, or lack the time and skill needed to run a nonprofit organization.

This article features five things foundations can do to empower the next generation of leaders and ensure that the family’s philanthropic flame won’t burn out.

If you are helping clients set up their own foundations, or if you are advising clients with foundations, this article may be a good conversation starter.

Please click here to read this article in its entirety.

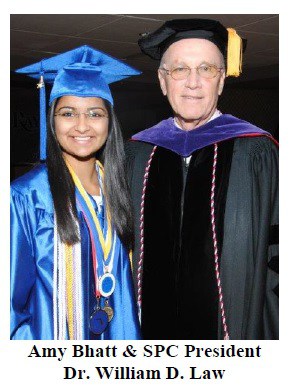

Amy Bhatt Graduates from St. Petersburg College!

Thursday Report contributor Amy Bhatt started working with our firm when she was just 15 years old. When she was in 10th grade, Amy took the highly demanding entrance test for the Early College Program and was one of the few students selected for the program from Pinellas County. Now, Amy has graduated from St. Petersburg College with an Associates of Arts degree – a degree she has earned before officially graduating from high school!

While in the Early College Program, Amy served as the President of the Honors College Student Consortium, the Lead Coordinator of the Honors College Research Conference, the Research Editor for the Interdisciplinary Journal (META), the Co-Chair of the Pre-Law Committee, and the Editor of the 6th Judicial Circuit Pro Bono Newsletter, which has been featured in the Thursday Report. She has also participated in the Teen Court Arbitration program since 2012.

During her first year at SPC, Amy received the Student of the Year Award in Honors Interdisciplinary Studies; she was one of the youngest students at SPC to ever receive this award. She has also won the All-Florida Academic Award conferred by the Commissioner of the Department of Education, the Dr. Theodore J. Mazzu Scholar of the Year Award, the Honors College Scholar of the Year Award, and the Early College Scholar of the Year Award.

Amy will be receiving the Presidential Scholarship Award in July, where she will be recognized as one of the most outstanding Pinellas County graduating high school seniors. She also won the prestigious Apollo Award from St. Petersburg College. The Apollo Award is the highest honor an Associate’s Degree graduate can receive, and it recognized Amy as the most outstanding student from all 10 SPC campuses in the areas of academics, service, and leadership.

Additionally, Amy conducted research on how the tactical victory of suffragettes resulted in the 19th Amendment women’s right to vote. She was invited to present this research at local, state, and regional research conferences. She has also been invited to present this research at the national level conference, which will be held in Chicago in November 2015.

Amy is continuing her studies at SPC, with a goal of earning a Bachelor’s Degree in Paralegal Studies by this time next year. She is also studying for the LSAT exam, with the hopes of attending a reputed law school next fall. Her ultimate dream is to serve as a Justice on the US Supreme Court.

Congratulations and good wishes can be sent to amy@gassmanpa.com.

Congratulations, Amy! We can’t wait to see what you accomplish next!

Humor! (or Lack Thereof!)

Sign Saying of the Week

Upcoming Seminars and Webinars

LIVE UNIVERSITY OF FLORIDA PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a five hour workshop on legal practice and making the most of your legal practice to Professor Dennis Calfee’s summer workshop class and friends. Thank you very much to those successful professionals who have signed up to help lead discussions and enjoy the opportunity for reflection. Experienced professionals are also welcome to attend by making a small donation to the Lind Chair.

Date: Saturday, May 30, 2015 | 10:00 AM – 3:00 PM

Location: University of Florida | 2500 SW 2nd AE, Gainesville, FL 32611

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alice Rokahr earned her Juris Doctor at The University of South Dakota School of Law. She was a partner at the firm of Kennedy, Rokahr, Pier & Knoff, LLP for 15 years and has also worked with Wells Fargo Bank and Bankers Trust Company of South Dakota. She currently serves as the President of Trident Trust Company (South Dakota) Inc.

Alice Rokahr and Alan S. Gassman will present a free, 30-minute webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA – DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

Date: Tuesday, June 9, 2015 | 12:30 pm

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or click here to register for this webinar.

**********************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

For a 25% discount (and an autographed copy of the PowerPoint printed on yellow paper!) please click here and follow the instructions.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE WEBINAR:

Alan Gassman will present a live, free, 30-minute webinar on the topic of THE NEW DOCTOR’S GUIDE TO WEALTH BUILDING, CREDITOR PROTECTION, TRUST PLANNING, AND WHAT THEY DIDN’T TELL YOU IN MEDICAL SCHOOL. There will be two opportunities to attend this presentation.

Date: Wednesday, June 17, 2015 | 7:30 PM

Saturday, June 20, 2015 | 9:30 AM

Location: Online webinar

Additional Information: To register for the Wednesday/7:30 PM webinar, please click here. To register for the Saturday/9:30 AM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will be presenting a free 30-minute webinar on ARBITRATING TRUST AND ESTATES DISPUTES.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many very useful articles thereon.

Date: Thursday, June 25, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on FINANCIAL RELATIONSHIPS WITH PATIENTS, CO-PAYMENTS, GIFTS, AND GRAFT – HOW TO STAY OUT OF TROUBLE UNDER FLORIDA AND FEDERAL LAW.

This is an essential guide for medical practices and those who advise them. There will be two opportunities to attend this presentation.

Date: Tuesday, July 7, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman will present a webinar on the topic of WHAT FLORIDA CPAS NEED TO KNOW ABOUT ASSET PROTECTION for the Florida Institute of CPAs.

More information about this webinar will be forthcoming. Please stay tuned!

Date: Thursday, July 9, 2015 | 9:30 AM – 10:30 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com. To register, please contact Thelma Givens at givenst@ficpa.org.

**************************************************

LIVE WEBINAR:

Alan Gassman will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON, FLORIDA PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on a topic to be determined. We are open to suggestions!

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

*****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

****************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, Alan Gassman, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning. Alan Gassman will speak on Florida Law Tricks and Traps for Estate Planners.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE TAMPA PRESENTATION:

THE FLORIDA BAR TAX SECTION LUNCHEON

The Florida Bar Tax Section’s New Tax Lawyers Committee is holding a luncheon featuring The Honorable Juan F. Vasquez of The United States Tax Court as its guest speaker. The topic of the discussion will be CURRENT DEVELOPMENTS BEFORE THE TAX COURT.

There is no cost to attend the lunch, but an RSVP is required.

Date: Wednesday, June 3, 2015 | 11:45 AM – 1:15 PM

Location: The University Club of Tampa | 201 N. Franklin Street, Tampa, FL 33602 | 38th Floor

Additional Information: To RSVP, please email assistant@schmidtlawoffice.com if you would like to attend. A confirmation email will be sent a few days prior to the program.

****************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: To be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

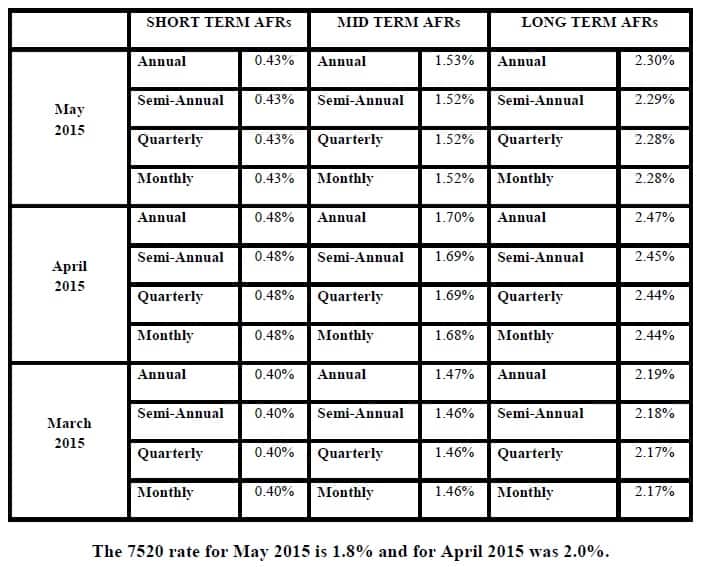

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.