The Thursday Report (TTR) – 5.21.15 – Happiness is a Warm Gun Trust (HIAWGT)

Drafting a Gun Trust (DGT) – Don’t Take a Shotgun Approach, Part II

Appeals Court Corrects Bankruptcy Error (ACCBE) in Castellano, Part I

Feedback from the Florida Bar Asset Protection Program (FFBAPP)

Richard Connolly’s World – Finances Before & After Marriage (Uh-oh!)

Thoughtful Corner – Nothing But Initials (TC-NBI)

Humor! (or Lack Thereof!) (HLT)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Drafting a Gun Trust – Don’t Take a Shotgun Approach, Part II

by Alan Gassman, Seaver Brown, and Travis Arango

The debate over gun control and gun rights has certainly become a contentious topic in the last few years. As a result, gun trusts have become a popular mechanism for individuals to properly manage automatic weapons, suppressors, and certain permitted explosives that are restricted by federal and state laws. In 1934, Congress enacted the National Firearms Act to regulate an individual’s ability to buy and sell machine guns, sawed-off shotguns, suppressors (silencers) and other items.[1] The Gun Control Act of 1968 and regulations promulgated by the Bureau of Alcohol, Tobacco, Firearms, and Explosives (“Bureau of Alcohol”) provide rules for the possession and transfer of specified firearms and other items.[2]

In light of these regulations, gun enthusiasts are presented with three options when it comes to buying and selling certain restricted firearms/items. One option allows them to apply as an individual, another as a corporation, such as a limited liability company (LLC), and the last is through a gun trust. Each option has certain requirements that must be met in order for an individual to lawfully own and possess these types of firearms. This article will examine the various laws affecting gun owners’ rights, as well as the different methods that may be used to lawfully possess, use, buy, and sell these weapons.

Part I of our article, which ran in last week’s issue of The Thursday Report, can be viewed by clicking here.

Part II is as follows:

A gun trust is typically created to address three major concerns about the possession and transfer of firearms regulated by federal and state governments. First, they operate as a legitimate estate planning tool to determine the treatment of firearms upon the death or incapacity of a settlor. Second, they allow multiple trustees to lawfully possess and use the firearms held by the trust, which is contrary to a federal law that states that only on individual may possess a Title II firearm. Finally, they provide a way to avoid the requirement of providing fingerprints and obtaining the chief law enforcement officer’s signature of approval.

The gun trust must meet the requirements of the state’s trust laws where the trust is created. Most gun trusts are created strictly to deal with the complexities of owning and transferring Title II firearms, as opposed to Title I firearms. Thus, upon the death or incapacity of a settlor, special consideration must be given to whether or not the beneficiaries or remaining trustees are permitted to possess such firearms. Unfortunately, answering this question is never a simple task. As we discussed above, state and federal laws operate concurrently in the context of these firearms. When drafting a typical revocable trust, the drafter tends only to address the specific state laws in which the trust is created because it does not matter where a co-trustee or beneficiary resides upon the death of a settlor. This is simply not the case with a gun trust. For example, if you create a gun trust in the State of Florida and name your son, a Massachusetts resident, as either a co-trustee or a beneficiary, then they must have a Firearms Identification Card from Massachusetts to be in lawful possession of any firearm you leave them. The important point here is that each state has their own specific rules on gun ownership, possession, and transferability.

You are required to submit 1 of 2 forms to the Bureau of Alcohol in order to get authorization to own a Title II item. If you are buying a Title II item, then you will have to submit Form 4. If you are making a Title II item (i.e. shortening the barrel on a firearm, etc.) then you will have to submit Form 1. Regardless of whether you use a corporation, trust, or personal ownership, you must submit the form and gain approval before taking possession of the Title II item. Generally, you will go to a store and purchase the Title II item, get the necessary information, such as the serial number of the item, fill out the required form, and then send it in. While the application process takes place, the dealer will hold the item for you until you have been approved by the Bureau of Alcohol to take possession of the item.

Transferring the Title II item to the gun trust depends on who owns the item at the time. If the item is owned by a Class II dealer (i.e. a gun store that is licensed to sell Title II items) then the trust will purchase the item, and the store will hold the item until the Bureau of Alcohol approves the Form 4. You will want to purchase the item with a money order or with a bank account set up by the trust to avoid any issues with purchasing the item under your name. On the Form 4, which you will fill out and send in to the Bureau of Alcohol, the owner of the item will be the gun trust and the section requiring fingerprints and the chief law enforcement officer signature will be skipped. Detailed instructions for filling out the form can be found here: https://www.guntrustlawyer.com/form4.

If you are already the owner of a Title II item (i.e. you have already gone through the necessary steps to get a tax stamp through the Bureau of Alcohol for that item) and want to transfer it to a gun trust, then you will have to pay the stamp tax again for each item you want to send to the trust and fill out the required Form 4. This is because a stamp tax is required for each transfer of a Title II item, and transferring ownership from yourself to the trust (even if it is your trust) constitutes a transfer.

Gun Trust Benefits:

- All named trustees have the right to possess or use the National Firearms Act firearm or item. This protects you and anybody else that has access to the item from committing a felony.

- When compared to a corporation or LLC, which are generally open to the public, a gun trust will keep your information private, such as what items the trust owns and who owns them. However, while National Firearms Act firearms must still be registered with the Bureau of Alcohol, there is no need to notify local law enforcement.

- No fingerprints, photographs, or chief law enforcement officer signature required.

- Bureau of Alcohol approval is usually must faster than individual applications.

- Provides greater protection that National Firearms Act firearms are passed on responsibly when an owner dies or is deemed incapacitated. In also keeps them from falling into the wrong hands after divorce.

- Gun trusts protect the would-be executor of your estate. Normally, executors gather all your assets, pay off your debts, and then distribute what is left. However, this may lead to unintended consequences when the executor is not familiar with the National Firearms Act rules and restrictions on ownership, possession, and transfers of National Firearms Act firearms. This may cause them to inadvertently transfer the firearm to someone without registering it or obtaining approval from the Bureau of Alcohol.

- Firearms can remain in the trust after the grantor’s death, meaning there is no transfer of the item at the current owner’s death. This allows the beneficiary to avoid the $200 transfer fee as well as the application process discussed above.

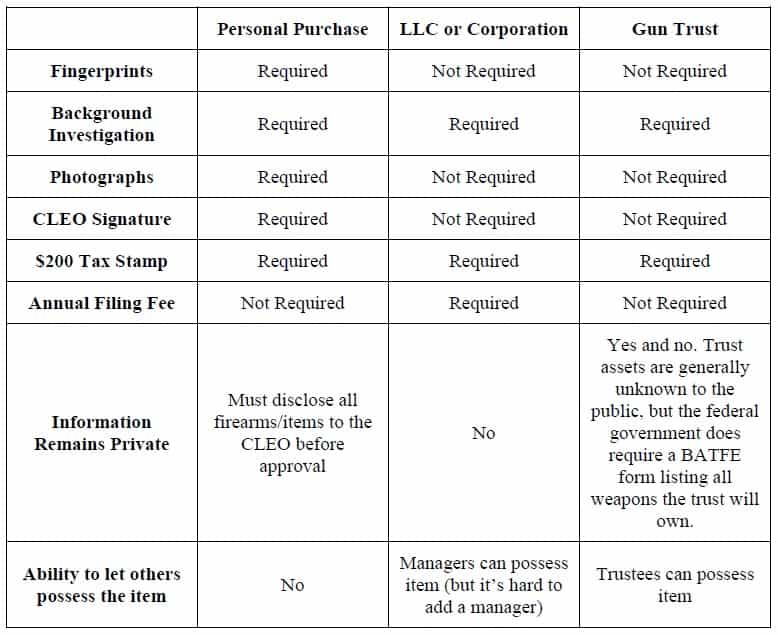

Below is a chart that shows what is required of each type of Title II purchase:

Another important point to note is that since 1986, there have not been any newly manufactured, fully automatic weapons that can be held in private possession. This has led to a decrease in the current supply of pre-1986 automatic weapons as they succumb to damage and poor maintenance. Thus, these older weapons have grown in value[3], which in turn has led to an ever growing market of collectors. In this sense, a gun trust is almost necessary to properly handle the weapon after the collector’s death. Using a trust ensures its value remains in the estate. It also ensures that when the beneficiaries or trustee of the gun trust decide to sell it, they will not be subject to any criminal liability.

Conclusion:

Without a gun trust, individuals who wish to own a Title II firearm must satisfy several requirements set forth by the Bureau of Alcohol, Tobacco, Firearms, and Explosives. Those requirements include filling out a Form 1 or Form 4 for each item you want to register, paying a $200 tax stamp, submitting a photo and fingerprints, and allowing for a background check. They must also obtain a signature from the chief law enforcement officer in their area approving the application; however, most of this process can be bypassed by creating a gun trust.

If you are thinking about using a gun trust, make sure to use night vision goggles so you are not left in the dark. Stock gun trust forms and revocable trusts can be extremely dangerous when not properly drafted, even more so than the weapons they are intended to protect. Do not forget the safety either. Before you and your trustees decide to purchase or use any gun trust firearm, make sure that all trustees are required to take gun safety courses. Recommend they take physicals every year to ensure they are fit both mentally and physically. Be sure that they know to use protective eyewear and earplugs. Finally, ensure that the places they use these weapons allow for discharge of these types of weapons.

************************************************

[1] National Firearms Act of 1934, 26 U.S.C. §§ 5801 – 5872 (2006).

[2] Gun Control Act of 1968, 18 U.S.C. §§ 921 – 931 (2006).

[3] According to http://www.machinegunpriceguide.com/html/us_mg_4.html, as of December 2014, a pre-1986 fully automatic M16A1 rifle will cost on average $28,000, nearly a $13,000 increase from December of 2004.

Appeals Court Corrects Bankruptcy Error in Castellano, Part I

by Jonathan E. Gopman, Ryan J. Beadle, Michael A. Sneeringer, Evan R. Kaufman, and Alan S. Gassman

Faith Castellano died, and Linda Castellano was her daughter

Faith left her assets in a trust like she ought-er.

Del Alcazar was appointed Trustee

And noted that Castellano was filing for bankruptcy.

The spendthrift clause in the trust went beyond the norm

And specifically provided for an insolvent’s interest would be out torn

And would thus be applied in the sole discretion of the Trustee for education and support for life

With nothing there for the beneficiary’s husband or wife.

The bankruptcy judge took a look at it all

And for some reason decided that Castellano should take a fall.

The District Court on review, however, finally got it exactly right

So the drafter of the Trust and Castellano need no longer be uptight.

It would have been safer to have no outright distributions

And it is a shame they had to go to court and appeal to get the right solution.

Hats off to District Court Judge Manish Shah

And to Castellano and her lawyers for going this far.

The provision in this trust was the hero of the day

Put a stronger one in your trusts and some fortunes you may save.

The following is the initial executive summary and comment from a draft LISI newsletter presently in editing.

EXECUTIVE SUMMARY:

After much discussion in the LISI community[1], the result promulgated in In re Castellano[2] has been relegated to a footnote in history following the decision by the United States District Court for the Northern District of Illinois in Safanda v. Castellano.[3] While the decision may be considered on appeal, United States District Judge Manish S. Shah appears to have analyzed the pertinent issues properly to reach the correct result. The bankruptcy judge’s conclusion that a debtor who notified the trustee of a spendthrift trust that she was not entitled to receive distributions due to her insolvency and the clear language of the trust, was somehow considered to have made a contribution to the trust that would be set aside, or would be impacted under the ten year look back period for self-settled trusts.

COMMENT:

The court in Safanda v. Castellano (“Castellano II”) relied on the facts of In re Castellano (“Castellano I”), which was previously reported to members in prior commentaries.[4] However, the court in Castellano II expounded on certain facts as such relate to Linda Castellano (“Linda”) and Bruno Castellano (“Bruno”) (collectively, the “Castellanos”). A brief summary of such facts is provided below.

CASTELLANO I and FACTS:

On February 18, 1997, Linda’s mother, Faith F. Campbell (“Faith”) settled the Faith F. Campbell Living Trust (the “Trust”) in South Carolina. Linda was a beneficiary of the Trust. Faith died on February 11, 2011. The Castellanos operated a moving company that closed in the summer of 2011 due to financial difficulties. On October 5, 2011, Linda’s attorney sent a letter (the “Insolvency Letter”)[5] to J. T. Del Alcazar (“Del Alcazar”), the trustee of the Trust. In November of 2011, the Castellanos filed for bankruptcy. The Trust provided that upon Faith’s death and “upon settlement of her estate, [the Trust] shall terminate.” The Insolvency Letter informed Del Alcazar that the Castellanos had closed their business, that the Castellanos were filing for bankruptcy protection, and that Linda’s insolvency required the trustee of the Trust to exercise the trustee’s authority under the Trust’s spendthrift provision to retain Linda’s interest in the trust.[6] Del Alcazar was the husband of Linda’s niece.

After Del Alcazar received the Insolvency Letter, he transferred approximately $400,000 from the Trust’s primary account at Merrill Lynch into a second Merrill Lynch account titled “Faith F. Campbell Spendthrift Trust f/b/o Linda Castellano” (the “Spendthrift Trust Account”). Although Del Alcazar opened the Spendthrift Trust Account, the court found no evidence suggesting that Del Alcazar created a new trust by simply transferring a portion of the Trust’s assets from one account at Merrill Lynch to another.

Three days after filing for bankruptcy, Linda signed a release (the “Release”), acknowledging that she received a trust accounting from Del Alcazar, that she approved Del Alcazar’s proposed distribution of the Trust’s assets in further trust, and that she released Del Alcazar from any claims she might have against Del Alcazar. Linda also agreed that (1) her interest in the Trust was terminated, (2) she had become a “life-time, limited beneficiary at the sole discretion of the trustee” of the Trust, (3) her insolvency required the trustee to retain her interest pursuant to the Trust’s “Spendthrift Provision,” and (4) she would receive no distribution from the Trust, but that the “Spendthrift Trust” (i.e., the second account at Merrill Lynch) would receive her “lifetime, limited beneficial interest … in full satisfaction of her rights and interests under the Trust, but reserving her beneficial interests pursuant to the Spendthrift Trust.”[7]

In December 2011, Del Alcazar made distributions from the Trust to Linda’s three siblings, however, no distributions were made to Linda. The bankruptcy trustee, Roy Safanda (“Safanda”) (Safanda, Linda, and Del Alcazar are hereinafter collectively referred to as the “Parties”), instituted an adversary proceeding against Linda and Del Alcazar. Safanda sought the avoidance of Del Alcazar’s transfer of the $400,000 to the Spendthrift Trust Account under § 548(e) of the Bankruptcy Code and the turnover of the $400,000 to Linda’s bankruptcy estate. In Castellano I, the bankruptcy court ruled in favor of Safanda, holding that Del Alcazar’s possession and retention of assets was avoidable somehow under § 548(e) of the Bankruptcy Code and that the funds should be turned over to the bankruptcy estate. Linda and Del Alcazar objected to the bankruptcy court’s findings.

CASTELLANO II and ANALYSIS

The district court reviewed the bankruptcy court’s proposed findings of fact and conclusions of law de novo. The court (1) reviewed Safanda’s claims under § 541 and 548 of the Bankruptcy Code, (2) sustained Linda’s and Del Alcazar’s objections, (3) entered a judgment in Linda and Del Alcazar’s favor, and (4) terminated the civil case filed by Safanda.

Analysis Under Section 541(c)(2)

In Castellano II, the court dedicated a majority of the analysis in its opinion to § 541(c)(2) of the Bankruptcy Code. Section 541(c)(2) states that: “a restriction on the transfer of a beneficial interest of the debtor in a trust that is enforceable under applicable nonbankruptcy law is enforceable in a case under this title.” This section was not discussed in Castellano I, where the bankruptcy court’s analysis instead focused on § 548(e), which seemed inappropriate and flawed. When a debtor files bankruptcy, a bankruptcy estate is created and contains “all legal or equitable interests of the debtor in property as of the commencement of the case.”[8] However, property of a debtor in bankruptcy is not transferred to the bankruptcy estate if (1) such property consists of a beneficial interest in a trust, (2) the trust agreement contains language restricting the transfer of the interest, and (3) the transfer restriction is enforceable under applicable non-bankruptcy law.[9] If a debtor’s interest in a trust is excluded from the bankruptcy estate under § 541(c)(2) of the Bankruptcy Code, the bankruptcy trustee has no basis to set aside a transfer of such an excluded interest.[10]

The court explained that if § 541(c)(2) applied to exclude Linda’s interest in the Trust, Safanda could not pursue any transfer and turnover claims regarding such interest. While Linda did not claim an exemption of the Spendthrift Trust Account § 541(c)(2) in her bankruptcy petition, property interests under § 541(c)(2) need not be listed on Schedule C of a bankruptcy petition, as such property is entirely excluded from the bankruptcy estate, not merely exempted from the bankruptcy estate.[11]

To successfully argue that § 541(c)(2) did not apply to exclude Linda’s interest in the Trust from the bankruptcy estate, Safanda had to prove by a preponderance of the evidence that Linda did not have an interest in the Trust when Linda filed for bankruptcy, or, in the alternative, that the Trust did not restrict transfers of Linda’s interest in the Trust under applicable state law.[12]

Linda’s Interest was an Interest in Trust

The court dismissed Safanda’s claim that Linda had no interest in the Trust, and also foreclosed the bankruptcy court’s conclusion that the Trust somehow ended and was considered to have been distributed outright to the beneficiaries instantly upon Faith’s death. The terms of the Trust stated that “[u]pon the death of Faith F. Campbell and upon settlement of her “estate”, [the Trust] shall terminate.”

Safanda argued that because the Trust did not define the term “estate,” such term referred to Faith’s probate estate, and since a probate estate was never opened, Safanda argued that the Trust terminated immediately upon Faith’s death. Safanda’s interpretation of the Trust’s termination provisions would lead to the result that at the time Linda filed her bankruptcy petition, Linda did not have an interest in the Trust.[13]

The court noted that the purpose in interpreting a trust is to discover a settlor’s intent.[14] Section 4.10 of the Trust allowed the trustee to make loans from the “Trust Estate” to the executor or other representative of the “Trustor’s estate.” This provision indicated to the court that Faith intended her estate and the Trust’s assets to be separate entities. Numerous other provisions of the Trust instructed the trustee to accomplish certain tasks, before final distribution of the Trust’s assets to the remainder beneficiaries (including Linda). The court noted that Safanda’s interpretation of the Trust’s termination provisions was inconsistent with the remaining terms of the Trust, after reiterating that the Trust should be read to best reflect Faith’s overall intent. Thus, the court ruled that on the date Linda filed for bankruptcy, (1) the Trust was still in effect and (2) Linda had a beneficial interest in the Trust.

The Trust had Spendthrift and Discretionary Provisions Which Restricted Transfers of Beneficiaries’ Interests

The court noted that the Parties and the bankruptcy court failed to identify that (1) the Trust contained a spendthrift provision (in the traditional sense), and (2) the Trust also contained a provision purporting to convert a beneficiary’s interest into a discretionary interest if such beneficiary was bankrupt or insolvent. The court interpreted the spendthrift provision and the discretionary holdback provision to mean that the Trust sought to restrict assignment of the beneficiaries’ interests twice.

The Trust Contained Valid Spendthrift and Discretionary Trust Provisions Under South Carolina Law, Illinois Law, and Wisconsin Law

The court had to decide if the relevant restrictions on the assignment of the beneficiaries’ interests in the Trust were valid under applicable state law such that the Spendthrift Trust Account would be excluded from the bankruptcy estate.[15] The court noted that the result would be the same under South Carolina law (the situs of the Trust), Illinois law (the state where the Castellanos filed bankruptcy), and Wisconsin law (the state where certain property owned by the Trust was located): at the time Linda filed for bankruptcy, the assignment of her interest in the Trust was validly restricted by the spendthrift and holdback discretionary trust provisions.

Next week, we will provide further commentary on this case.

*************************************************

[1] Bove, “Castellano: The Wrong Result for the Right Reasons,” LISI Asset Protection Planning Newsletter #270, (Nov. 20, 2014) at http://www.leimbergservices.com; Vandenack & Wintz, “Drafting Considerations for Third-Party Spendthrift Trust after In re Castellano,” LISI Asset Protection Planning Newsletter #259, (Sept. 10, 2014); and Adkisson, Slenn & Martino “In re Castellano: A Wake-Up Call for Self-Settled Trusts and Spendthrift Provisions,” LISI Asset Protection Planning Newsletter #258, (Sept. 8, 2014) at http://www.leimbergservices.com

[2] 514 B.R. 555 (Bankr. N.D. Ill. 2014).

[3] 2015 WL 1911130 (N.D. Ill. 2015).

[4] For the background facts of Safanda v. Castellano, see supra note 1.

[5] Id.

[6] For a more detailed analysis of the Castellano decision focusing on Linda’s attorney letter to Del Alcazar’s attorney, see Bove, supra note 1.

[7] Safanda, 2015 WL 1911130 at *3.

[8] 11 U.S.C. § 541(a)(1).

[9] 11 U.S.C. § 541(c)(2).

[10] See, e.g., In re Hill, 342 B.R. 183, 206 (Bankr. D.N.J. 2006) (“Even accepting the Trustee’s theory that Phyllis transferred a 17% interest in Daniel’s pension that should have been hers in equitable distribution, avoiding that transfer would not make any assets available for creditors.”); see also Matter of McClellan, 99 F.3d 1420, 1423 (7th Cir. 1996) (“Bankruptcy courts do not have subject matter jurisdiction and cannot administer property excluded from or outside the bankruptcy estate.”)

[11] See Safanda, 2015 WL 1911130 at fn 3. The court also explained that Linda’s misstatement of Illinois law on Schedule C did not preclude her from defending Safanda’s suit on the basis of § 541(c)(2) of the Bankruptcy Code, explaining:

On Schedule C of her petition, Castellano (or her attorney) cited 735 ILCS 5/12-1001(h)(3)-a wholly inapplicable Illinois law pertaining to payments made to a dependent under a life insurance policy. Safanda offers no authority for the rule, however, that such a mis-citation precludes Castellano from defending against this adversary proceeding on the basis of § 541 (c)(2) – especially when the statute was cited in the Joint Pretrial Statement and argued at trial. Moreover, “[a] voluntary petition, list, schedule, or statement may be amended by the debtor as a matter of course at any time before the case is closed.” Fed. R. Bankr. P. 1009(a). The bankruptcy case remains open here, so Castellano may revise the citation at any time.

Id.

[12] See Safanda, 2015 WL 1911130 at *2.

[13] Although Linda’s counter argument was that the term “estate” meant “Trust Estate,” the court rejected this interpretation. See Safanda 2015 WL 1911130 at *4.

[14] Harris Trust & Savings Bank v. Donovan, 145 Ill. 2d 166, 172 (1991).

[15] See 11 U.S.C. § 541 (c)(2).

Feedback from The Florida Bar Asset Protection Program

Earlier this month, on May 7th and May 8th, The Florida Bar Asset Protection Program, led by Alan Gassman and Dennis Kleinfeld, was held in Miami, Florida. Since the seminar, we have received the following responses about the experience (names have been withheld for anonymity):

“It was a tremendous professional delight and terrific learning experience to be able to attend the two-day Florida Bar Asset Protection Seminar in Miami earlier this month. After more than thirty years of practice, I must report that the seminar, with the hard-bound, accompanying exhaustive supporting reference materials, was the best legal education program I have ever attended. I also enjoyed the great dinner you and Dennis assembled and appreciate the personal time you so kindly shared with me. It was a delight to be able to be your student in Miami and to have dinner alongside you.”

*****************************************

“Alan, thanks to you and the other speakers for sharing your knowledge with all of us at the Asset Protection seminar. That was definitely one of the most valuable CLEs I’ve attended.”

*****************************************

“Alan, thanks to you and Dennis for putting on a great seminar. I’ve been attending these since 2010, and I have to say this has been the best one yet (and last year was pretty awesome with Jay Adkisson being there!) Two days is the way to go – asset protection is too complex for one day. The value provided far exceeded the extra sign-up fees for the second day, and all of the speakers were uniformly good. The drinks/dinner extravaganza was quite fun and much appreciated. My only regret is that we didn’t take a group photo. Thanks again for sharing your knowledge with us. I know I speak for a lot of our colleagues in saying that we really appreciate it. Well done!”

**************************************

In addition, we received the following comment from one of the conference’s speakers, Howard Fisher:

“Alan, Alex and I thank you very much for having invited us to speak at the Miami conference. We really enjoy the opportunity and the chance to see old friends. You asked why we stay for most of the program – it’s simple. The speakers are excellent, and we always learn something. That’s a real credit for the quality of the conference.”

A big thank you to everyone who attended the two-day Asset Protection seminar. We’ll see you all next year!

Richard Connolly’s World

Finances Before & After Marriage

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the first article of interest is “Divorce Funding Firms Help Spouses Expecting Big Payouts” by Paul Sullivan. This article was featured in The New York Times on February 27, 2015.

Richard’s description is as follows:

What these [divorce funding firms] are doing is offering high-interest money to people who have none and want to pursue a person they once loved for their share of what is always a lot of money. The firms all say their advances level the playing field against the moneyed spouse who can otherwise force the one without money to settle.

These companies generally lend around 20 to 25 percent of the value of an expected settlement and their minimum loans range from $100,000 to $250,000, meaning the settlements are $400,000 to $1,000,000 on the low end. The money doesn’t need to be paid back until months or years down the line when a settlement is reached. By design, divorce funding sharply reduces the value of the settlement, but there might not have been a settlement otherwise.

In turn, divorcees provide a hefty return for the companies in the industry, which are largely backed by private investors.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “A New Way to Use a Prenup” by Matthias Rieker. This article was featured in The Wall Street Journal on March 12, 2015.

Richard’s description is as follows:

Prenuptial agreements have long been used to protect the assets of a far wealthier partner in a marriage.

Now they are also being used by couples who enter marriage as financial peers to help establish financial parameters, according to experts and advisers. In many cases, both parties already have successful careers and significant assets, as well as important commitments to children from prior marriages, they say.

These kinds of prenups typically address issues such as how the couple will pay for a new shared home; which investments they will mingle or keep separate; and who will inherit each partner’s assets – not how much of a family’s fortune might be shielded from the newcomer.

Please click here to read this article in its entirety.

Thoughtful Corner

Nothing But Initials (NBI)

In 1973, Howard Selby founded a new computer corporation called NBI. At the time, NBI stood for Necton Bylinnium, Inc. Two years later, Selby turned leadership of NBI over to Thomas S. Kavanagh from Storage Technology Corporation, an off-shoot of technology giant IBM. When asked what NBI stood for, after it had become a 60 million dollar per year company with a large percentage share of the computer industry, Kavanagh replied that it meant, “Nothing But Initials,” which gives credence to the proposition that initials can be important from a communications, labeling, and perception of meaning standpoint.

On the other hand, initials can be a grand pain in the behind when anyone reviewing a document doesn’t know or remember what they mean, so quite often, we find ourselves going into documents and even reference texts and replacing the initials with the words that they stand for.

Perhaps 65 percent of the population that reads your documents will not memorize the initials and will then have less understanding and even less meaning to continue with a document.

Don’t forget the NBI story – when your clients read your documents, are they seeing “nothing but initials” or are they understanding what every provision of the document means?

Footnotes can work in the same way. If you want the client to read what you are sending, why would you put it in 10 point print at the bottom of the page and require the mental and physical calisthenics of going up and down and up and down while reading?

We prefer the way that Bloomberg BNA footnotes, which is directly under each section, as opposed to being at the bottom of each page.

NBI went bankrupt in 1991, which may tell you something about the strategy of overusing initials.

DUMBAS (Don’t Use Multiple Binary Abbreviations Systematically!)

WHYFTTBH[1]

*************************************************

[1] We hope you find this to be helpful.

Humor! (or Lack Thereof!)

Sign Saying of the Week (SSW)

************************************

Upcoming Seminars and Webinars

LIVE UNIVERSITY OF FLORIDA PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a five hour workshop on legal practice and making the most of your legal practice to Professor Dennis Calfee’s summer workshop class and friends. Thank you very much to those successful professionals who have signed up to help lead discussions and enjoy the opportunity for reflection. Experienced professionals are also welcome to attend by making a small donation to the Lind Chair.

Date: Saturday, May 30, 2015 | 10:00 AM – 3:00 PM

Location: University of Florida | 2500 SW 2nd AE, Gainesville, FL 32611

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alice Rokahr earned her Juris Doctor at The University of South Dakota School of Law. She was a partner at the firm of Kennedy, Rokahr, Pier & Knoff, LLP for 15 years and has also worked with Wells Fargo Bank and Bankers Trust Company of South Dakota. She currently serves as the President of Trident Trust Company (South Dakota) Inc.

Alice Rokahr and Alan S. Gassman will present a free, 30-minute webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA – DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

Date: Tuesday, June 9, 2015 | 12:30 pm

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or click here to register for this webinar.

**********************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

For a 25% discount (and an autographed copy of the PowerPoint printed on yellow paper!) please click here and follow the instructions.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE WEBINAR:

Alan Gassman will present a live, free, 30-minute webinar on the topic of THE NEW DOCTOR’S GUIDE TO WEALTH BUILDING, CREDITOR PROTECTION, TRUST PLANNING, AND WHAT THEY DIDN’T TELL YOU IN MEDICAL SCHOOL. There will be two opportunities to attend this presentation.

Date: Wednesday, June 17, 2015 | 7:30 PM

Saturday, June 20, 2015 | 9:30 AM

Location: Online webinar

Additional Information: To register for the Wednesday/7:30 PM webinar, please click here. To register for the Saturday/9:30 AM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will be presenting a free 30-minute webinar on ARBITRATING TRUST AND ESTATES DISPUTES.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many very useful articles thereon.

Date: Thursday, June 25, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on FINANCIAL RELATIONSHIPS WITH PATIENTS, CO-PAYMENTS, GIFTS, AND GRAFT – HOW TO STAY OUT OF TROUBLE UNDER FLORIDA AND FEDERAL LAW.

This is an essential guide for medical practices and those who advise them. There will be two opportunities to attend this presentation.

Date: Tuesday, July 7, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman will present a webinar on the topic of WHAT FLORIDA CPAS NEED TO KNOW ABOUT ASSET PROTECTION for the Florida Institute of CPAs.

More information about this webinar will be forthcoming. Please stay tuned!

Date: Thursday, July 9, 2015 | 9:30 AM – 10:30 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com. To register, please contact Thelma Givens at givenst@ficpa.org.

**************************************************

LIVE WEBINAR:

Alan Gassman will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON, FLORIDA PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on a topic to be determined. We are open to suggestions!

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

*****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

****************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE TAMPA PRESENTATION:

THE FLORIDA BAR TAX SECTION LUNCHEON

The Florida Bar Tax Section’s New Tax Lawyers Committee is holding a luncheon featuring The Honorable Juan F. Vasquez of The United States Tax Court as its guest speaker. The topic of the discussion will be CURRENT DEVELOPMENTS BEFORE THE TAX COURT.

There is no cost to attend the lunch, but an RSVP is required.

Date: Wednesday, June 3, 2015 | 11:45 AM – 1:15 PM

Location: The University Club of Tampa | 201 N. Franklin Street, Tampa, FL 33602 | 38th Floor

Additional Information: To RSVP, please email assistant@schmidtlawoffice.com if you would like to attend. A confirmation email will be sent a few days prior to the program.

****************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: To be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

*******************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Recent Homestead Cases, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

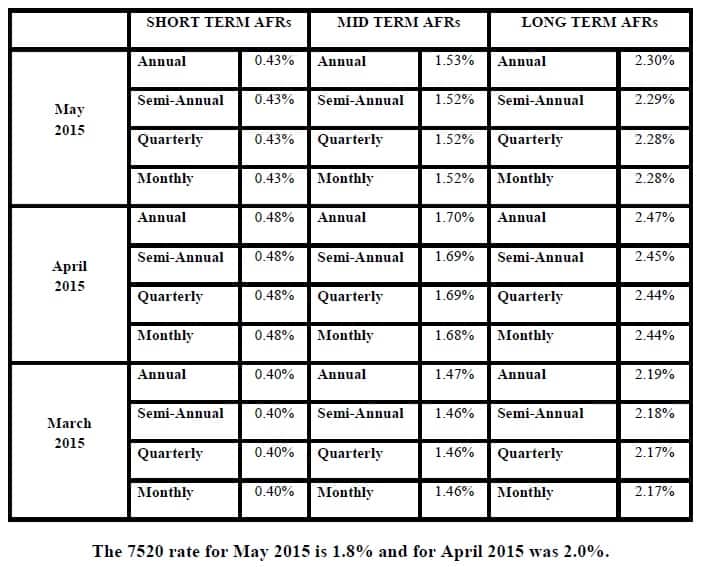

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.