The Thursday Report – 4.2.15 – The Naked Truth About See-Through Trusts

1933 Reasons Not to Buy Gold Coins

BP Claims Update: Policy 495, Part II

The Naked Truth: Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron, Part V

Richard Connolly’s World – Celebrity Estate Round-Up, Part II

Thoughtful Corner – Pilates – Fitness’s Best Kept Secret by Emily Wenzel

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

1933 Reasons Not to Buy Gold Coins

by Alyssa Perez, Brandon Ketron, and Alan Gassman

What’s so special about pre-1934 gold coins? Apparently nothing, but this has not prevented many dealers and others in the market of gold coins from violating FTC rules and leaving investors and collectors to believe that there is a legal difference between pre- and post-1933 gold coins.

Thursday Report writers Alyssa Perez, Brandon Ketron, and Alan Gassman provide us with the following coverage:

EXECUTIVE SUMMARY:

A great number of investors, both sophisticated and unsophisticated, bought gold coins and bullion as it increased 465% in value from April 2001 to April 2011; which is an average rate of return of 46.5% per year. [i] It is noteworthy, however, that in 2013 alone, gold prices fell 28% while the S&P Stock Index returned 32%, including dividends.[ii] Some sophisticated investors have concluded that if the world economy shuts down, having gold on hand will be as good as anything, while others believe that holding onto gold makes almost no sense at all. In any event, the 1933 gold law misconception is one of the reasons that many people are clutching old gold coins for no good reason, and clients should not assume that it is an appropriate investment for any more than a very small portion of their portfolio.

Gold’s inability to accrue interest, coupled with the fact one must actually pay for its safe storage, undoubtedly has played a factor.[iii] In fact, the Wall Street Journal reported that those who purchased gold within the last four years (without distinguishing what type) lost money.[iv] In this day and age, gold is just a tough sale for those companies that were making significant money preying on naivety and a sense of panic that many not so well educated investors have experienced.

In order to combat these inescapable truths, many within the precious metals industry have found a way to profit by scamming unsophisticated buyers. A grandiose hoax—one that has long flooded cable television’s airwaves—continues to be used today.

The fact is that gold coins predating 1933 are not more “collectible,” or “valuable,” based solely on the fact that they were created before this date. The outdated Executive Order that allowed the federal government to confiscate citizens’ gold is clearly old news. Many laws have since replaced it and allowed for the attainment and enjoyment of any and all gold coins by any citizen, not just by “collectors.” An American “collectible” gold coin is worth only as much as its weight in gold—do not let the scammers convince you otherwise.

FACTS:

The government effectively confiscated gold coins in 1933, in a law that continued through 1969 and grandfathered pre-1933 gold coins. Legislation in 1975 made all of this history irrelevant, yet many laymen and some advisors believe that pre-1933 coins have some sort of grandfathered legal status, which is absolutely not the case. However, local precious metal firms, coin dealers, and banks supply hundreds of people with historical gold coins at prices that greatly exceed their melt value on the false basis that the federal government may, once again, confiscate gold coins. The sellers of numismatic gold coins claim that the holder can save gold coins from confiscation by buying coins struck before 1933. No current federal law or Treasury Department regulation supports any of these claims. In fact, the Federal Trade Commission (“FTC”) released an article warning against the scam of increased prices and government confiscation conspiracy theories.[v]

Where did this myth come from? President Franklin Delano Roosevelt issued an executive order on April 5, 1933 requiring that all persons in possession or in control of gold coins, bullions, or certificates, turn them in to any Federal Reserve Bank, or any branch or agency thereof.[vi] Roosevelt thereby effectively seized any gold bullion and coin that was not “rare and unusual.” While the Order never defined “rare and unusual,” it became an accepted practice that any gold coin minted prior to 1933 was exempt from the 1933 seizure.

After many ineffective Treasury regulations throughout the next thirty years, the practicality of banning gold ownership had ended. “On April 22, 1969, the [US] Treasury . . . issued rules and regulations . . . that eliminated all licensing requirements for the importation of gold coins produced prior to 1934.”[vii] The Treasury defined “rare coins” as such: “‘Gold coins made prior to 1934 [are] considered to be of recognized special value to collectors of rare and unusual coin.’”[viii] Additionally, the Treasury stated that “‘[gold coins] of recognized special value to collectors of rare and unusual coin may be acquired, held, and transported within the United States without the necessity of holding a license therefor.’” Although private gold ownership was banned in 1933, following the 1969 amendments, those engaged in the scholarly pursuit of the study of gold coins were protected. Moreover, the Treasury did not intend to provide a loophole to private citizens who wished to hoard gold for its monetary value, and provided that: “‘gold, as a store of value, can be held only by the government and that private citizens and entities in the United States can acquire gold only for legitimate and customary industrial, professional, and artistic uses.’”[ix]

All of these rules and regulations, however, became moot on January 1, 1975 when President Gerald Ford signed a law allowing US citizens to privately own gold.[x] Private gold ownership was once again legal and has been ever since.

The issue now is that many precious metal firms maintain that US gold coins minted prior to 1933 are “collectible” and therefore not subject to any future gold confiscations.[xi] These firms claim that federal law allows the federal government, in times of national crisis, to confiscate gold coins, yet nothing in the law or Treasury Department regulations support this argument.[xii] The myth stems from the now-extinct Executive Order of 1933, and firms still use this law today to promote the sale of their overpriced “rare, collectible” gold coins.[xiii]

CMI Gold & Silver Inc. proffers:

Many gold and silver dealers foster the circulation of many myths, misunderstandings, and outright lies about the purchase and sale of [precious metals]. Generally, these misconceptions and falsehoods promote the notion that the government may again call in gold as it did in 1933 . . . . By cultivating such fears in investors, unscrupulous firms can sell high-priced (and nearly always over-priced) coins with greater margins of profit. Investors who believe these stories invariably pay too much or buy the wrong coins.[xiv]

In line with this claim, the FTC encourages investors to compare pricing before making a purchase, and informs consumers that there is no federal law or regulation supporting any claim that the federal government may someday, somehow, confiscate gold coins once again.[xv] In 2010, the FTC presented to the Subcommittee on Commerce, Trade, and Consumer Protection (of the Committee on Energy and Commerce in the US House of Representatives), a statement on The Precious Coins and Bullion Disclosure Act. The FTC acknowledged the scam artists who falsely tout “coins and precious metals as low-risk, high-yield investments to hedge against the economic downturn and fears of a declining [ ] dollar.”[xvi] These marketers fail to disclose the hidden mark-ups and premiums added onto the purchase of the coin, and thereby “divert consumers from purchasing investment opportunities from legitimate dealers.”[xvii] High inflation rates in the 1980s led to numerous enforcement actions brought against various operators.[xviii] “The FTC has brought 17 cases against companies that sold overpriced and/or misgraded historic coins for investment purposes.”[xix] These dealers sold coins with mark-ups as high as 100 to 300% over the market price, and made return on the investment impracticable.[xx] With the FTC stepping in, consumers have become more educated in understanding the differences among their investments.

COMMENT:

The long-lived tale that pre-1933 gold US coins are more valuable than newer coins, due to the older ones forever being exempt from government confiscation, is nothing short of a full-blown scam. Currently, coins predating 1933 may sell for more because of a continuing falsity being distributed by many within the precious metals industry (that they are “collectible,” and thereby exempt from any federal taking); however, these “rare coins” will only ever produce a profit more than their post-1933 counterparts, if, and when, the federal government once again calls for a nationwide confiscation of all gold coins minted after 1933. The fact is that there is no law, whatsoever, that gives credibility to these claims. Moreover, it is clear that the intention of the federal government is to continue to allow private citizens (not just collectors) to own gold coins, regardless of their rarity, collectiveness, or date of production. Attempts to sell these “collectible” coins for above-market prices on the basis of outdated “law” is a sham of tremendous proportion.

For charts on the real rate of return on gold, please visit http://www.usagold.com/publications/Mar2015R&O.html.

**************************************************

[i] Richard Salsman, The Bank Runs of the Early 1930s and FDR’s Ban on Gold, Forbes (Apr. 6, 2011), http://www.forbes.com/sites/richardsalsman/2011/04/06/the-bank-runs-of-the-early-1930s-and-fdrs-ban-on-gold/

[ii] Tatyana Shumsky. Gold vs. Stocks: The 10-Year Winner is… Wall St. J. (Nov. 18, 2014, 3:44 PM EDT), http://blogs.wsj.com/totalreturn/2014/11/18/gold-vs-stocks-the-10-year-winner-is/. (Investors who bought gold in the years 2010 to 2014 and didn’t sell it are carrying losses, while those who went with riskier stock investments are likely sitting on gains.)

[iii] Id.

[iv] Id.

[v] Federal Trade Commission, Investing in Gold, Consumer Information (May 2011), http://www.consumer.ftc.gov/articles/0134-investing-gold.

[vi] Forbidding the Hoarding of Gold Coin, Gold Bullion and Gold Certificates, Exec. Order No. 6102, § 2 (1933).

[vii] Confiscate This!, Only Gold (Aug. 24, 2002), http://www.onlygold.com/articles/ayr_2002/CONFISCATE_THIS(August_24_2002).asp.

[viii] Id.

[ix] Id.

[x] Pub. L. No. 93-373 (Aug. 14, 1974).

[xi] Gold Confiscation Myths, CMI Gold & Silver Inc., http://www.cmi-gold-silver.com/ gold-confiscation-1933/ (last visited Mar. 27, 2015). (Headquartered in Phoenix, Arizona, CMI Gold & Silver Inc. is one of the oldest gold and silver dealers in the United States and has played a major role in introducing investors to the gold and silver markets.)

[xii] Id.

[xiii] Id.

[xiv] Id.

[xv] Investing in Gold, supra note 2. The FTC further notes in their consumer report that “if you are interested in buying gold, do some digging before investing. Some gold promoters don’t deliver what they promise, and may push people into an investment that isn’t right for them.” Id.

[xvi] Prepared Statement of the FTC on The Precious Coins and Bullion Disclosure at 1–2 (2010), available at https://www.ftc.gov/sites/default/files/documents/public_statements/ prepared-statement-federal-trade-commission-precious-coins-and-bullion-disclosure-act/ 100923coinsbulliamact.pdf.

[xvii] Id. at 2.

[xviii] Id. at 2–3.

[xix] Id. at 3–4.

[xx] Id. at 4.

BP Claims Update: Policy 495, Part II

by John Goldsmith and Alan Gassman

with assistance from Brandon Ketron and Noah Fischer

John Goldsmith recently appeared on a webinar with Alan Gassman to discuss the claims filing deadline and the various industries impacted by the accrual requirements.

This webinar can be viewed by clicking here.

To see Part I of this article, please click here.

If a claim is determined to be unmatched, Policy 495 provides seven methodologies that a claim administrator uses to achieve sufficient matching. The methodology used depends on the type of industry the claimant is assigned. The methodologies are as follows:

- Annual Variable Margin Methodology (AVM)

- Construction Claim Methodology

- Agricultural Claim Methodology

- Educational Institution Claim Methodology

- Professional Service(s) Claim Methodology

- Failed Businesses and Failed Start-Up Businesses

- Start-Up Businesses

Non-Profits

In November 2012, the BP Claims Administrator issued regulations which said that for non-profit organizations, revenues include both gifts and grants. This was subsequently approved by the court. Up until recently, BP never appealed this ruling, but BP is now trying to attack it almost two years later. As it currently stands, revenue includes gifts and grants. There are three important issues that arise from questions on how to match revenues with expenses in a non-profit organization. These issues significantly impact not-for-profit organizations’ claims, and usually for the worse.

The first issue that is presently up on appeal through the appeal and reconsideration process of BP involves a claim where incoming money is placed into an endowment fund whereby only the income from that fund can be spent for charitable purposes. BP is saying that only the interest on the endowed money should be counted, not the capital amounts raised. This is ludicrous because it does not take into account that charitable organizations show capital contributions as income, and these contributions slowed down after the BP Spill. Donors were holding on to their donations, and for the most part, never caught up with what the normal levels of contributions had been in previous years. Charitable organizations that were having special fund-raising events during this period of time lost significant endowment funding that can never be recovered, and this should be recognized in the same way that it would apply to any business.

The second issue up on appeal dealing with non-profit claims relate to restricted gifts. If a gift is restricted to a particular purpose or use and cannot be used in the month in which the money has come in, BP claims that the money must be spread out over the months for which that money is spent for its restricted purpose, although, they have not been entirely consistent in this. For example, if the money is given to buy food for three months, and it is given in September, they will spread it over September, October, and November. This will help some claims, but it will hurt others. Remember, they are looking at the purpose of those gifts and the dates they were to be spent, not the date they were pledged or received.

The third issue on appeal dealing with non-profit claims relates to capital campaigns, which are a very particular type of restricted gift. Basically, the money is given for something that will be of long-term use. Assume that the capital campaign states “we are giving you this money for the purpose of constructing a building.” The question is, if the money is used to construct the building, is it then spread over the time it took to construct or the forty-to-fifty year life of the building?

Helpful Hint

The biggest mistake that people seem to make is that they voluntarily give too much information to the BP claim administrator. Instead of giving a full and complete answer to BP’s claim accountants as to the specific questions they ask, people volunteer excess and often unrelated information resulting in further questioning and possible claims reductions and denials. BP claim accountants are thoroughly reading and looking through everything, so if you give them something they do not ask for, you are asking for a lengthier and possibly more in-depth process. There is also a higher chance that they may misunderstand something and reduce or eliminate the claim. It is safest in our opinion to have answers provided by a very experienced appeals lawyer who may handle the appeal if the BP administrator’s conclusion is not accepted or if BP contests it so that the appeals lawyer can best shape the issues, tone, and content of the information given.

Retail

In dealing with retail claims, the BP claim administrators want to know when purchases occur and when items are sold in order to ensure revenue is properly matched with the expenses incurred in earning it. They will want to see the data you have in support of your sales and purchases reconciled with information found on the profit and loss statements. If you do not have it, then they will apply what is called the Annual Variable Margin methodology (AVM).

This method is usually unfavorable for claimants because the claims administrator will match revenues and expenses by totaling each fiscal year’s variable expenses and allocate those expenses on a prorated basis to monthly revenues for the corresponding period, effectively smoothing out the variable expenses. This is only used when there is no supporting information of any kind or financial statements for revenue.

This can be avoided if the proper information is provided; for example, providing information that the average length of time inventory is on the shelf is very short. In some instances, they seem to recognize there are industries that, by their very nature, do not have inventory that stays on the shelves for a long time period. The objective is to provide information to support the timing of activities to earn revenues. If a claimant can avoid the claims administrator from applying the annual variable margin, then the claimant will usually be in much better shape. Remember, do not volunteer information. Take time to figure out what exactly they are asking for and give a full, fair, and complete answer only to the question asked by the claims administrator.

BP claims administrators are always asking for information on owner/officer compensation benefits and bonuses. If a claimant paid money to an owner as either salary or benefits, BP views this as if the company made a profit and will pull out owner/officer compensation from the expense model. Therefore, it makes a big difference if a claimant can submit the claim correctly by pulling out the owner/officer compensation to begin with due to the fact that BP will require this in any case.

We are often asked whether there are any differences between internet and brick and mortar stores in retail cases. The answer to the question is quite simple: there is no difference. Even if a claimant has an internet business with no brick and mortars, the business may still have a claim.

Medical Practices

While BP has appealed and fought almost every single medical and similar professional practice claim, the vast majority of medical practices earn their income in close proximity to the time in which they receive their money. Medicare normally pays within 14 days after the services are rendered, and most other payers are consistent and not far behind. Some medical practices and businesses are paid farther in arrears in some situations, such as compensation for Letters of Protection in personal injury.

The most common stumbling block for medical practices and many professional companies is owner/officer compensation, which is required to be stripped out and is irrelevant, for the most part, in the claims eligibility and determination process. Oftentimes, the amount of the claim ends up being directly related to the drop in income that the physician may have had during a three-month time period between May and December of 2010 in comparison to previous, pre-spill years during that same time period.

Filing Deadline

The Settlement Agreement provides that the filing deadline is six months after the last opportunity to appeal the settlement has expired. The Supreme Court denied certiorari review of BP’s appeal of the settlement on December 8, 2014. Accordingly, the final deadline to file any Claim Forms for claims other than Seafood Compensation Program Claims is fast approaching at a mere four months away. This deadline may end up being later, but the BP Claims Administrator continues to assert the deadline will remain June 8th, 2015. Realistically, it may take months for the lawyers and accountants to gather and analyze all of the information needed to submit a claim, so anyone who thinks they may have a potential BP claim should get their information to their lawyers and accountants as soon as possible. Once the deadline is missed, there is nothing that can be done about it!

There is no doubt that hundreds of millions of dollars of claims will never be filed or will not be calculated accurately, in good part because of the confusion and extra work caused by the fairly recent decision that receipts and expenses should be matched, to some extent, in a manner similar to that which applies under the accrual method of accounting.

June 8th will be here before we know it! If there are any questions or if we can be of assistance in looking at any complicated or perplexing BP claim situations, please let us know. Alan Gassman can be reached at agassman@gassmanpa.com, and John Goldsmith can be reached at jgoldsmith@trenam.com.

The Naked Truth: Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits – Part V

by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron

The rules applicable to retirement plan and IRA distributions, contributions, rollovers, and otherwise can be difficult to understand and complex to implement. The applicable Internal Revenue Code Sections and Treasury Regulations are somewhat complicated and convoluted, and use many technical “terms of art.” This makes dealing with qualified plans cumbersome and difficult for laypersons and planners who are not experienced in this area.

We have attempted to simplify the applicable rules into a digestible format with concise explanations of the applicable rules. We have also prepared charts and explanations to illustrate the key concepts and mechanics of important definitions, rules, and planning strategies.

The Thursday Report proudly will provide a multi-part series to exhibit our materials and charts, and we hope that you enjoy this series as much as we did in putting it together.

To see Chapter 1 of this presentation, please click here.

To see Chapter 2 of this presentation, please click here.

To see Chapter 3 of this presentation, please click here.

To see Chapter 4 of this presentation, please click here.

IRA SERIES CHAPTER 5

IRA and Plan Benefits Payable to Trusts

Probably the most complicated and misunderstood area of IRA and retirement plan structuring involves the complex labyrinth of rules that will apply when the beneficiary is one or more trusts or trust systems. We have provided an easily understandable system to help planners understand what the rules are and which trusts they apply to.

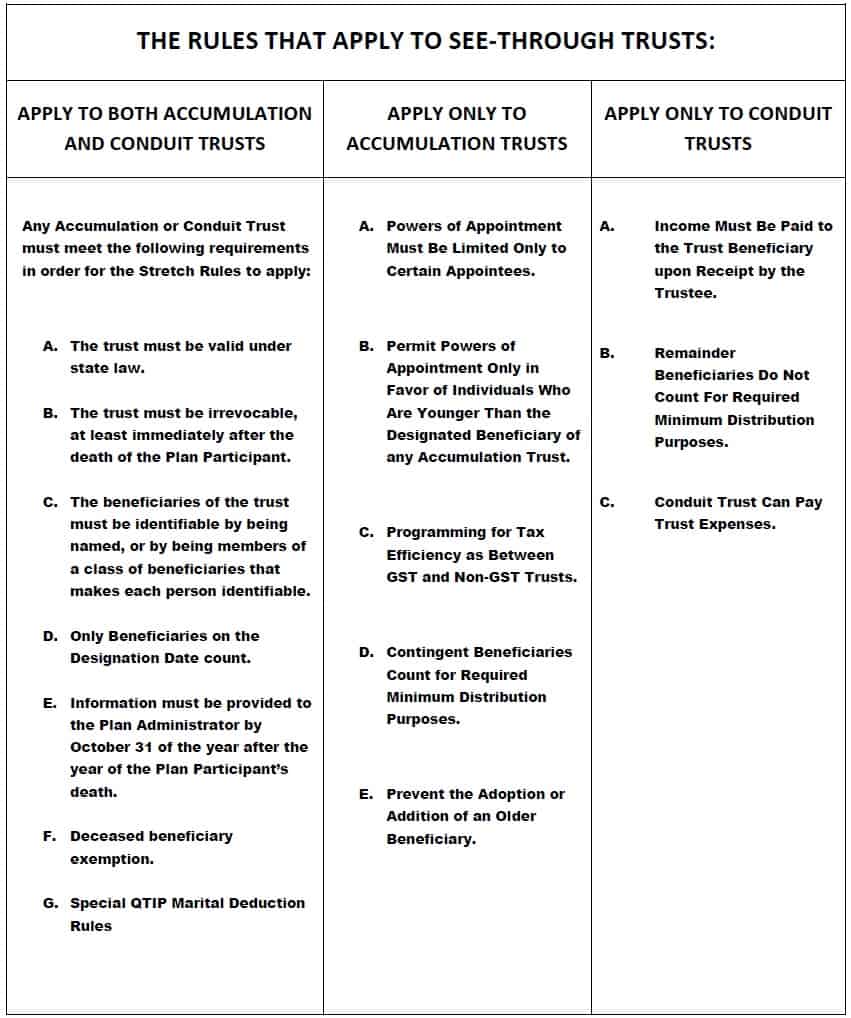

Illustration 3.0 below is a summary of which rules apply to each kind of see-through trust, and then the rules are explained in further but efficient detail below.

Illustration 3.0

I. RULES THAT APPLY TO ALL SEE-THROUGH (BOTH ACCUMULATION AND CONDUIT) TRUSTS:

A. The trust must be valid under state law.

B. The trust must be irrevocable, at least immediately after the death of the Plan Participant.

C. The beneficiaries of the trust must be identifiable by being named, or by being members of a class of beneficiaries that makes each person identifiable.

D. Only beneficiaries on the Designation Date count.

Trust beneficiaries who are no longer entitled to receive any benefit on the Designation Date (for example by disclaimer or satisfaction of all bequests by September 30 of the calendar year following the year of Plan Participant’s death) will not be counted for Required Minimum Distribution purposes. Only those beneficiaries present on the Designation Date are considered in determining the Designated Beneficiary

E. Information must be provided to the Plan Administrator by October 31 of the year after the year of the Plan Participant’s death.

The IRA/Plan administrator must receive appropriate trust documentation by October 31 of the calendar year after the calendar year of the Plan Participant’s death. This will normally be accomplished by providing the IRA/Plan administrator with a copy of the actual trust document. Alternatively, the trustee of the trust can provide the IRA/Plan Administrator with a final list of all beneficiaries of the trust as of the Designation Date, and a certification by the trustee that all requirements necessary for the trust to qualify as a See-Through Trust have been met.

F. Deceased Beneficiary Rule

A beneficiary who survived the Plan Participant but does not survive the Designation Date (September 30 following the death of the Plan Participant) is still considered as a beneficiary of the trust for Required Minimum Distribution purposes, unless the beneficiary (or his successor in interest) has received full payment or has executed a valid disclaimer of all of such beneficiary’s interests in the IRA/Plan or trust receiving the IRA/Plan before the Designation Date.

Notwithstanding the above, there may be situations in which meeting the applicable “See Through Trust” requirements is not as important. For example, if the oldest trust beneficiary is the same age or older than the Plan Participant, “See Through Trust” qualification will not result in a longer applicable distribution period. The applicable distribution period will be the same if the trust satisfies the “See Through Trust” requirements (the longer of the life expectancy of the Plan/Participant or the life expectancy of the oldest trust beneficiary) than if the trust did not satisfy the “See Through Trust” rules (the life expectancy of the Plan Participant)[1].

II. RULES THAT APPLY TO ACCUMULATION TRUSTS ONLY:

A. Powers of Appointment must be limited only to certain appointees.

There is specialized drafting that is required for powers of appointment held by beneficiaries of an Accumulation Trust. Holders of powers of appointment over IRA/Plan assets should not have the power to appoint the IRA/Plan assets to any individual (including spouses) older than the Designated Beneficiary or any Non-Person, nor the power to appoint or transfer assets to another trust that could have individuals older than the Designated Beneficiary or a Non-Person as a beneficiary.

Oftentimes planners provide beneficiaries with Powers of Appointment that can be exercised in favor of creditors of the power holder’s estate to avoid imposition of federal generation skipping tax. Because a creditor of the power holder’s estate could be a non-individual, or an individual older than the Designated Beneficiary, this will cause problems in qualifying the trust as a See-Through Trust. The clause can be drafted to provide that the power is exercisable only in favor of individual creditors of the estate who are younger than the otherwise applicable Designated Beneficiary[2].

B. Permit Powers of Appointment only in favor of individuals who are younger than the Designated Beneficiary of any Accumulation Trust.

Most commentators believe that it is safe to allow the power of appointment to be exercisable in favor of any living individual younger than the Designated Beneficiary, while one or more conservative commentators believe that the powers should only be exercisable in favor of a limited class of individuals, such as descendants of the grandparents of the Plan Participant who are younger than the Plan Participant. This is because the Regulations state that a power of appointment can only be exercisable in favor of “individuals identifiable from the trust document.” Reg. §1.401(a)(9)-4, A-5 and A-6.

Conservative planners who believe that only “individuals identifiable from the trust document” who are younger than the Designated Beneficiary may be named as possible appointees can assure avoidance of imposition of generation-skipping tax by giving a non-skip beneficiary the power to withdraw trust principal, which may be subject to approval of an independent trustee, trust protectors, or other non-adverse parties. This power can achieve the same generation skipping tax avoidance results as the use of a power of appointment exercisable in favor of individual creditors of the estate of the power holder.

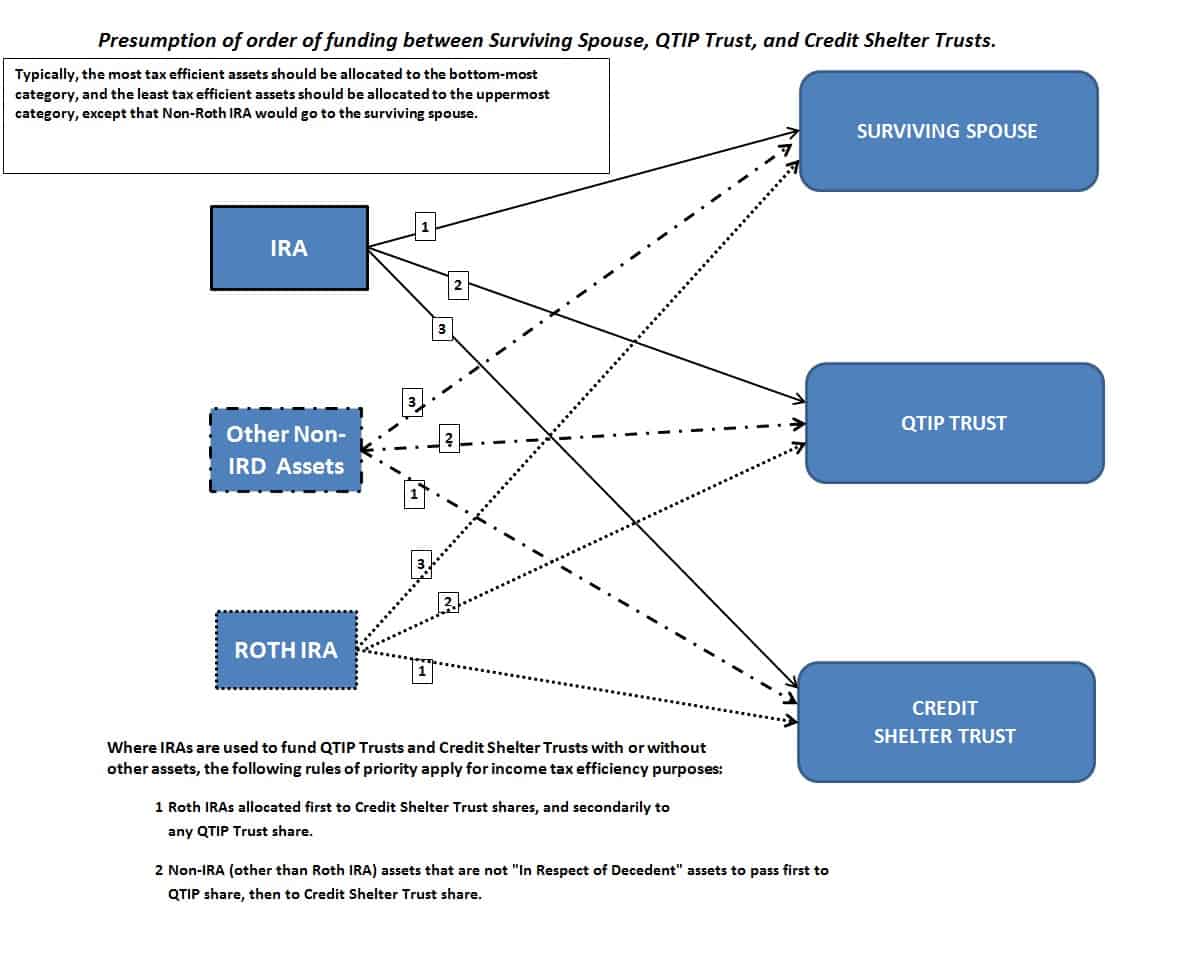

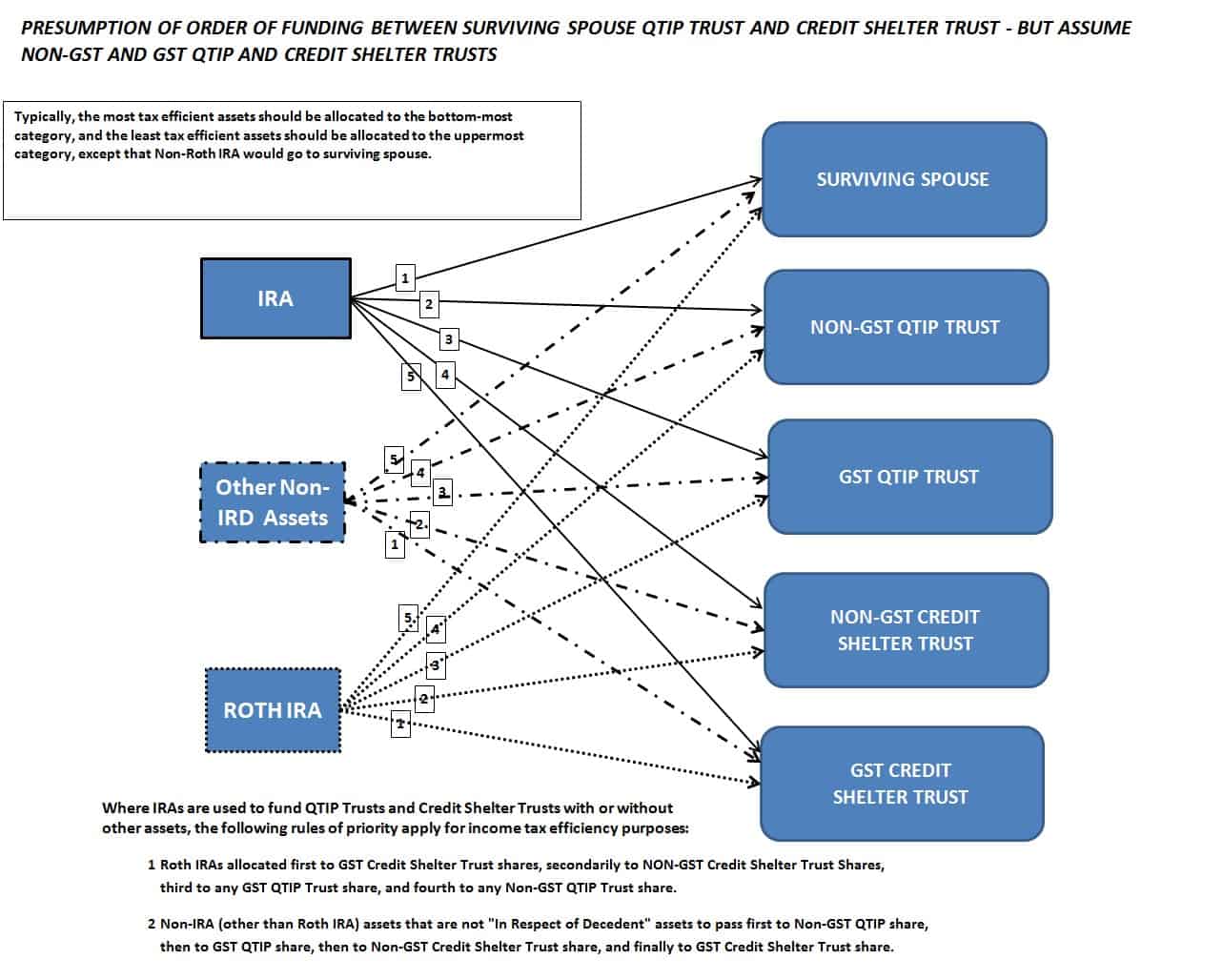

C. Programming for Tax Efficiency as between GST and Non-GST Trusts

Where trusts are to be divided into generation skipping and non-generation skipping trusts for generation skipping transfer tax planning purposes, it will make sense to have a non-Roth IRA/Plan payable to the non-generation skipping trust so that the generation skipping trust will be funded with less built-in taxable income than is inherent with IRA/Plans, and be able to accumulate more wealth for subsequent generations. For example, if John Smith dies unmarried with a $2,100,000 IRA, and $4,330,000 of other assets, he can leave $5,430,000 to a trust that will benefit his children without being taxed in their estate, and another $2,000,000 to a non-GST trust that has to be considered as owned by one or more of the children for estate tax purposes when they die. It seems to make sense to first allocate the IRA/Plan to the non-GST trust so that John’s GST exemption is not used on assets that will incur income tax at ordinary income rates in the future (with no opportunity for a step-up in basis). Additionally, the formula to be used to define the assets that pass to the non-GST trust should be a fractional formula, and not a pecuniary bequest, because the use of an IRA/Plan to satisfy a pecuniary bequest may trigger tax upon funding[3].

The opposite rationale applies where a Roth IRA/Plan exists, because of the tax advantaged status of a Roth IRA/Plan – there is no income tax payable on withdrawals from a Roth IRA. Therefore, Roth IRA/Plan benefits would be allocated first to the GST Trust, and then secondly to the non-GST Trust. See Illustration 3.1 below.

Language that may be used in a Trust Agreement to facilitate the above can be found in Appendix B.

Illustration 3.1

D. Contingent beneficiaries count for Required Minimum Distribution purposes.

Even contingent distribution provisions that would only apply if no named beneficiary under an Accumulation Trust survives will be problematic unless the provision simply relies upon the applicable intestacy rules under local law. For example, the Accumulation Trust can provide that “if none of my descendants survive then all remaining assets will be distributed based upon the intestacy rules of the State of Florida that would apply to my estate if I died intestate” as opposed to “if none of my descendants survive then pay out to the descendants of my grandparents, per stirpes.” The second alternative would cause the Required Minimum Distributions to have to be distributed over the life expectancy of the oldest descendant of the Plan Participant’s grandparents, even if the Plan Participant has surviving descendants. As a planning note, if the client wants to use “descendants of my grandparents” language, then the provision can be carved out to instead read “to the descendants of my grandparents, per stirpes, who are born after the date of birth of my oldest living descendant who survives me.”

E. Prevent the adoption or addition of an older beneficiary.

The trust instrument should prevent any individual who is older than a Designated Beneficiary from being considered as a beneficiary of any trust that is the recipient of IRA/Plan benefits. Also, any person to be adopted and qualify to receive benefits would need to be younger than the otherwise applicable Designated Beneficiary under an Accumulation Trust.

F. Q-TIPPING an Accumulation Trust

What Rules Apply to Determine What Portion of Any Payments from an IRA or Pension to an Accumulation Trust Are Income for Purposes of Defining How Much Has to Be Paid out to the Surviving Spouse?

Note – With a Conduit Trust, the Spouse must receive 100% of the distributions so this analysis may not be pertinent. With a QTIP Trust that is an Accumulation Trust, the Spouse only has to receive the “income” as determined under state law – some or all of an IRA or pension distribution may consist of a return of principal. The analysis that applies is as follows:

The law in each state will vary with reference to what portion of an IRA distribution will be considered as income for trust income calculation and distribution purposes.

- Fla. Stat. § 738.602 governs the character of payments from deferred compensation plans, annuities, and retirement plans or accounts. § 738.602(4) describes the method a trustee should use to allocate income and principal with respect to payments made. The trustee is required to follow the steps set forth below in allocating a payment to principal or income:

- If the payor characterized a portion of the payment as income, that portion shall be allocated to income by the trustee, and the remaining portion shall be allocated to principal.

- If the payor does not characterize a portion as income, then the following shall apply:

1.) The trustee must attempt to determine the income derived from the applicable investment (i.e. the account statement for a mutual fund). The trustee can then allocate the lesser of the income of the fund or the entire payment to income, and the remaining portion of the payment to principal.

2.) If the trustee “acting reasonably and in good faith” determines that neither A nor B is available, the trustee shall allocate 10% of the payment to income, and the remaining portion to principal.

This differs from the Uniform Principal and Income Act, which states that:

1.) To the extent that a payment is characterized as interest, a dividend or a payment made in lieu of interest or a dividend, a trustee shall allocate the payment to income.

2.) If no part of a payment is characterized as interest, a dividend, or an equivalent payment, and all or part of the payment is required to be made, a trustee shall allocate to income 10 percent of the part that is required to be made during the accounting period and the balance to principal.

II. The IRS has indicated that the UPIA 10% rule “does not satisfy the marital deduction income requirements of Section 20.2056(b)-5(f)(1) and Section 1.645(b)-1 because the minimum distribution rules are not based upon the total return of an IRA. Revenue Ruling 2006-26.

However Florida’s Principal and Income Act requires the trustee to invest trust assets on a “total return basis”, and gives the trustee the ability to adjust income so that the treatment of income is “fair and reasonable” to the beneficiary. Fla Stat. § 738.103(2), 738.104(1).

It is likely that Florida’s Uniform Principal and Income Act will satisfy the all-income-for-life requirement of Section 20.2056(b)-5(f)(1) and Regs. § 1.643(b)-1 due to the trustee’s power to adjust, as well as the additional good faith determination requirements for allocating income from a retirement plan.

Florida law also states that certain unitrusts mandating annual payouts between 3% – 5% will be treated as trusts requiring the payments of all income. Fla Stat. § 738.1041(10)

Regs. § 1.643(b)-1 specifically states that:

…a state statute providing that income is a unitrust amount of no less than 3% and no more than 5% of the fair market value of the trust assets, whether determined annually or averaged on a multiple year basis, is a reasonable apportionment of the total return of the trust. Similarly, a state statute that permits the trustee to make adjustments between income and principal to fulfill the trustee’s duty of impartiality between the income and remainder beneficiaries is generally a reasonable apportionment of the total return of the trust.

III. The American College of Trust & Estate Counsel (ACTEC) has expressed concern with respect to the 10% rule via their Employee Benefits Committee, and have recommended amendment and/or elimination of the 10% provision of the UPIA. A majority of states statutes do not satisfy the marital deduction income requirements, so until an amendment is made planners should exercise caution in this area. Some practical solutions to this problem are discussed in the next section.

One approach that will work is to treat the IRA as a “trust-within-a-trust”. Under this approach income earned under the IRA is treated as income of the trust to the extent distributed. This approach is only possible when the trustee can easily distinguish the IRA’s internal income from principal, meaning that the trustee must be able to determine exactly how much the IRA investments earn in income each year. The IRS has approved this approach for marital deduction trusts.

A second approach is to treat the trust as a unitrust. Under this approach the beneficiary will receive an annual income payment based upon a fixed percentage of the trust assets each year. This will satisfy the marital deduction requirements if (1) it is permitted by state law and (2) the fixed percentage is no less than 3% and no more than 5%. This approach was approved by the IRS under Rev. Rul. 2006-26.

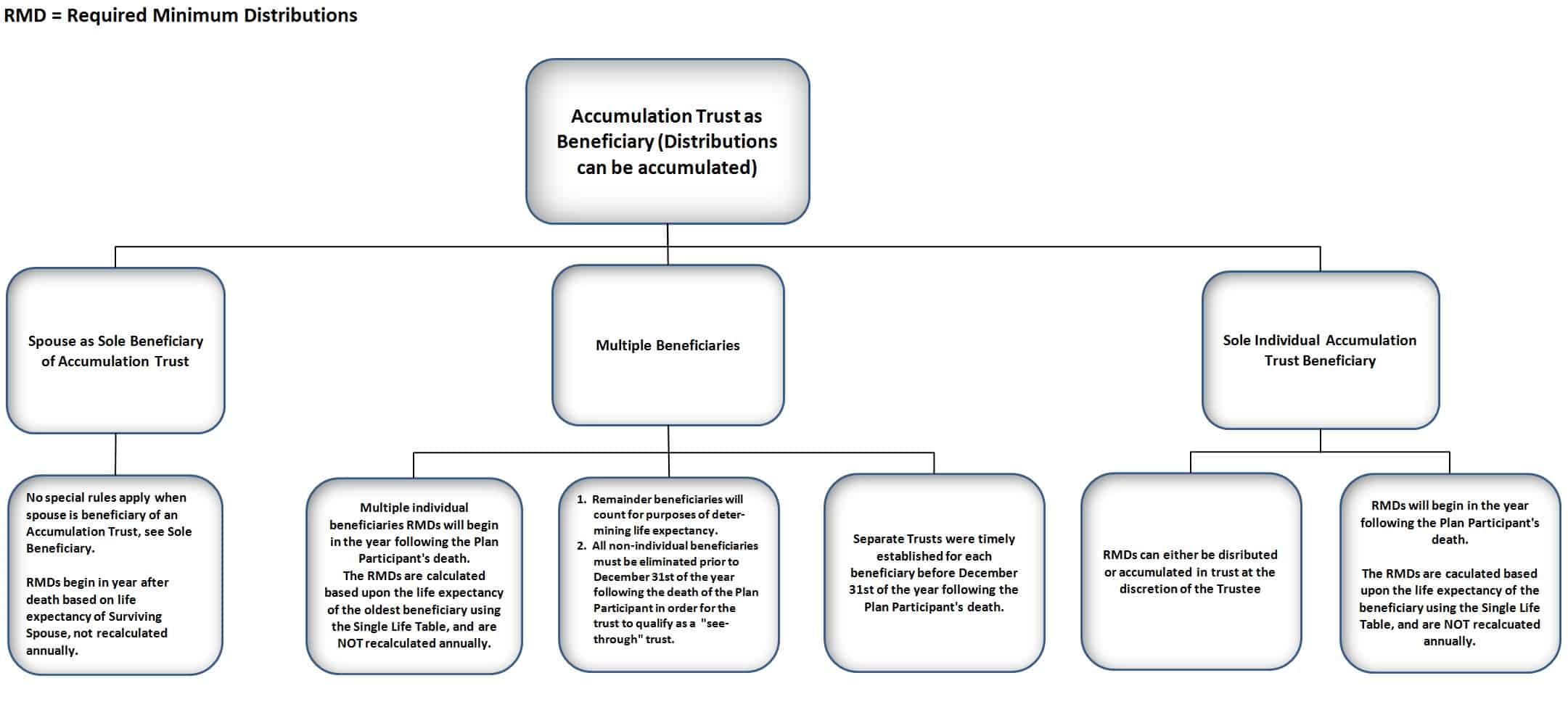

Illustration 3.2

Stay tuned next week, where we’ll discuss rules that apply to conduit trusts only and toggling from a conduit trust to an accumulation trust (and vice versa)!

************************************************************

[1] Choate’s The 201 Best and Worst at 3-100

[2] PLR 200235038 – 200235041 and Robert S. Keebler, CPA. New IRS Ruling Validates the “IRA Inheritance Trust™”

[3] Natalie Choate Outline Making Retirement Benefits Payable to Trusts ¶6.5.07

Richard Connolly’s World

Celebrity Estate Round-Up, Part II

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, we are featuring a few more stories on the issues surrounding celebrity estates. The first article is entitled “Feud Over Saints Owner Tom Benson is More Common Than You May Think” by Danielle and Andy Mayoras. This article was featured on Forbes.com on March 11, 2015.

Richard’s description is as follows:

Yes, Tom Benson has a great deal more money and power than most of us. How much? Try $1.9 billion, according to the annual Forbes rankings.

The successful owner of the NFL’s New Orleans Saints and NBA’s New Orleans Pelicans, Benson built a wide-ranging empire of car dealerships, banks, various real estate holdings, and a television station. He still actively participates in running his businesses – most of all his beloved Saints.

But for all of his wealth, prestige, and status, Tom Benson is in the midst of the same type of probate-related court battle that entangles many elderly individuals in our country. Some of Benson’s heirs do not believe the 87-year-old is mentally competent to make his own decisions any more. They are seeking to have him declared legally incompetent and protect him from what they claim is undue influence.

So what makes a fight of this nature more common than most people realize? The very same type of competency battles are common in blended families across the country, even when billions of dollars aren’t on the line.

Please click here to read this article in its entirety.

The second article this week is “Death and Domicile – No Joking Matter: Will New York try to take a final death-tax bite in the estate of Joan Rivers?” by Charles Douglas. This article was featured on WealthManagement.com on January 5, 2015.

Richard’s description is as follows:

While the late Joan Rivers’s will has yet to be probated, her case illustrates how someone might reside in one state (New York) and be domiciled in another (California.) This can be important for tax and estate planning. It also shows why individuals who relocate to other states or individuals with residences outside their state of domicile would do well to maintain accurate, reliable records to support the contention that they aren’t residents of or domiciled in a particular state.

This is a big deal. Based on Joan’s estimated estate of $150 million, there is approximately $24 million of estate tax in New York and no estate tax in California.

Please click here to read this article in its entirety.

Thoughtful Corner

Pilates – Fitness’s Best Kept Secret

by Emily Wenzel

Emily Wenzel is the owner of Kapok Pilates & Wellness at 908 McMullen Booth Road in Clearwater, Florida. She is a Certified Personal Trainer through the National Academy of Sports Medicine, Certified Pilates Instructor, Herbalist, Food Artist, Organic Gardener, and the President of the Florida Herb Society.

Kapok Pilates & Wellness, located across from Sam Ash Music in Clearwater, is a fully equipped Pilates studio that offers private sessions, small group classes, Pilates mat, yoga, Tai Chi, Aerial Yoga, and more, and is a friend of the Gassman Law Associates firm. Gassman, Crotty & Denicolo, P.A. has no financial relationship with Emily or Kapok Pilates, but this is a great opportunity we thought we would share.

If you don’t know what Pilates is, then you are missing out on one of the best exercise and fitness systems that has ever existed – maybe even the very best.

The country has entered a new era when it comes to self-care. There is a growing awareness on the part of Americans of all ages to exercise more, eat better, and incorporate a mind-body connection into not only physical activity but daily life. The trouble is knowing which exercise systems are just marketing fads and which are truly effective and provide lasting results.

One of the fastest-growing and most successful programs across the country is called Pilates. Although gaining quickly in popularity, it’s hardly new. The founder, Joseph Pilates, was born in Germany in 1880. He was a sickly child, but he improved his health through physicial activities such as gymnastics, boxing, and skiing. He worked as a nurse in England during World War I and began to develop his techniques and methods there.

Mr. Pilates provided exercises for the injured by utilizing springs from hospital beds and other props to create resistance training, improving strength and flexibility in patients.

The results were astounding.

He later moved to New York and opened a studio with the equipment he created, known as the Pilates Reformer. The Reformer has a spring loaded moveable surface that can be converted to look like a bed or mat with a pulley system. He went on to develop 3 other machines called the Cadillac, the Wunda Chair, and the Ladder Barrel.

The beauty of the Pilates method is that it is safe for someone with physical limitations and challenging for those at a higher level. There are modifications and progressions within the method, and the springs offer assistance or resistance depending on the needs of the individual. It is also helpful for people of all ages, even those with physical ailments, low stamina, inexperience with exercise, or even those in need of rehabilitation.

In 60 minutes, you can get an amazing workout that does not feel like a workout.

In addition, there are Mat Pilates classes, which address the same principles without the use of the Reformer. There are often small props such as magic circles, bands, and stability balls incorporated into this kind of work.

Some of the major principles of the Pilates method are described below:

The Core – Physically speaking, the stronger the “core” of your body, the greater your physical potential. Breath and posture have a major impact on the effectiveness of your fitness program. Pilates exercises give you a sense of energy and confidence by increasing your strength while finding more flexibility.

Concentration – Concentrate on mastering the relatively simple movements each time to a point of subconscious reaction. It won’t be dull; this will happen with some consistent Pilates instruction. This is how to progress from visualizing improvement to incorporating changes into your everyday life.

Breathing – Pilates helps make you aware of the “automatic” task of breathing and helps you breathe more efficiently and effectively. An increase in the amount of oxygen in your bloodstream will benefit the health of all your cells, improving brain function, blood circulation, and physicial coordination. It can also help you feel more tranquil.

Centering – Centering is finding those muscle groups which are important for stabilization (pelvic stability) and strength. Probably the most important activity many of us do not do properly is walking upright. Correcting posture begins with sitting and standing a little straighter and taller every day, but Pilates exercises will help support good posture as well.

Humor! (or Lack Thereof!)

Upcoming Seminars and Webinars

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman, Kenneth Crotty, and Christopher Denicolo will be presenting a not-so-free 90-minute webinar for Bloomberg BNA Tax & Accounting on WHY FLORIDA IS DIFFERENT – IMPORTANT THINGS THAT ESTATE AND TAX PLANNING PROFESSIONALS NEED TO KNOW.

Date: Thursday, April 16, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY – PART II.

This webinar is a continuation of the How to Handle Stressful Matters in an Ethical Way webinar that was presented by Dr. Rao and Alan Gassman on February 19, 2015. This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced.

See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: April 21, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please click here to register or email Alan Gassman at agassman@gassmanpa.com for more information.

***************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Kenneth Crotty, and Christopher Denicolo will present a 90-minute webinar for Bloomberg BNA Tax & Accounting on MATHEMATHICSLAND FOR ESTATE PLANNERS.

This webinar includes over 30 interactive spreadsheets and explanatory tools that you need to know how to use to best serve your clients!

Date: Monday, April 27, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE OLDSMAR PRESENTATION:

FICPA SUNCOAST SCRAMBLE GOLF TOURNAMENT

Kenneth J. Crotty and Christopher J. Denicolo will speak at the FICPA Suncoast Scramble Golf Tournament on the topic of MATHEMATICS FOR ESTATE PLANNERS INCLUDING 10 ESTATE PLANNING STRATEGIES NOT TO MISS.

Date: Friday, May 1, 2015 | CPE Presentations from 9:00 AM – 11:30 AM

Location: East Lake Woodlands Country Club | 1055 E Lake Woodlands Parkway, Oldsmar, FL 34677

Additional Information: For more information about registration, sponsorship, or this event, please click here or click here to download the Tournament brochure.

***********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman, Jerry Hesch, and Richard Oshins will present THE MATHEMATICS OF ESTATE PLANNING. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law | 1025 Commons Circle, Naples, Florida

Additional Information: For more information, please click here or email Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami | 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, and Barry Flagg will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on THE TAX ADVISORS GUIDE TO PERMANENT LIFE INSURANCE AND STRUCTURING TOOLS AND TECHNIQUES.

Date: Tuesday, May 12, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

******************************************************************

LIVE BRADENTON, FLORIDA PRESENTATION

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Tuesday, May 12, 2015 | Time TBA

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE STUART, FLORIDA PRESENTATION

Alan Gassman will be the featured “headline” speaker the Martin County Estate Planning Council Annual Tax and Estate Planning Seminar. He will be doing a three-hour talk on the topics of JESTs, MATHEMATICS FOR ESTATE PLANNERS, AND THE ESTATE PLANNER’S GUIDE TO PLANNING FOR IRA AND PENSION BENEFITS – YES, YOU CAN FINALLY UNDERSTAND THESE RULES!

Date: May 15, 2015 | 8:15 AM – 4:30 PM; Alan Gassman speaks from 9:00 AM to 12:00 PM

Location: Stuart Corinthian Yacht Club | 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will be presenting a free 30-minute webinar on ARBITRATING TRUST AND ESTATES DISPUTES.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many vary useful articles thereon.

Date: Tuesday, May 19, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

**************************************************

LIVE MIAMI LAKES WORKSHOP:

Alan Gassman will be speaking at the Miami Lakes Bar Association Luncheon on the topic of ACCELERATING YOUR LAW PRACTICE.

Date: Thursday, May 21, 2015 | 11:45 am – 1:45 pm

Location: TBD

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE WEBINAR:

Alice Rokahr, President, Trident Trust Company (South Dakota) Inc., and Alan S. Gassman will present a free, 30-minute webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTS – DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

Date: June 9, 2015 | 12:30 pm

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or click here to register for this webinar.

**********************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: August 22, 2015 | 9:00 AM – 5:00 PM

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE PRESENTATION:

RUTH ECKERD HALL PLANNING GIVING COUNCIL MEETING

This exciting two-part event will feature an educational presentation and a networking session. Attorneys and CPAs may receive CLE and CPE credit for attending the educational presentation.

The educational presentation will be an entertaining, interactive workshop led by Jack Halloway, a well-known improvisational coach and actor. He is directing “The Complete Works of William Shakespeare (Abridged)” and will share some thoughts on how Shakespeare used law, lawyers, and money in his plays. Some improv will also be included.

Jack Halloway’s presentation will be followed by a social networking and info session. Enjoy some wine and time with fellow Planned Giving enthusiasts!

Everyone who brings a potential donor or new member to the Planning Giving Council will be entered into a raffle for 2 tickets to an upcoming show.

Date: April 21, 2015 | Educational Presentation begins at 4:30 PM | Networking sessions begins at 5:30 PM

Location: The New Murray Theatre at Ruth Eckerd Hall

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com. RSVPs may be sent to Maribeth Vongvenekeo at maribeth@gassmanpa.com, Suzanne Ruley at sruley@rutheckerdhall.net, or Kristy Philippe at kristy.philippe@ms.com.

******************************************************

LIVE PRESENTATION:

2015 UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay | 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please visit http://www.floridataxinstitute.org/agenda.shtml for a complete schedule or contact Bruce Bokor at bruceb@jpfirm.com for more information.

******************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

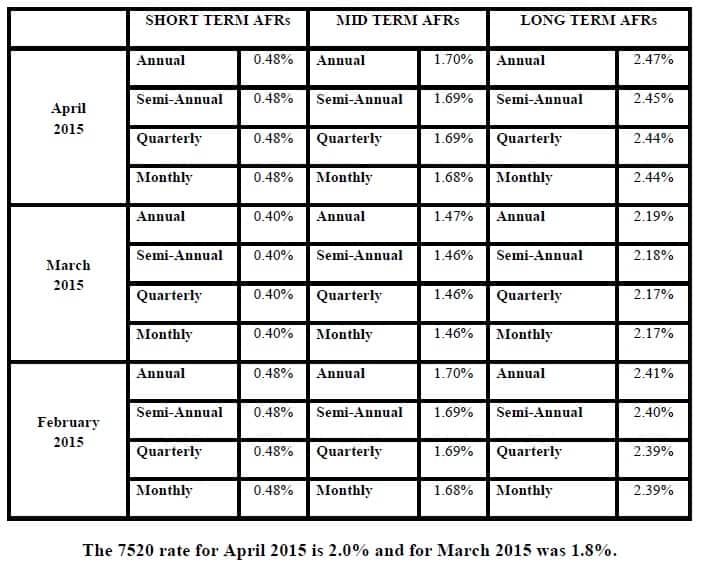

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.