The Thursday Report – 4.16.15 – The Tax Lawyer on the Roof

Will 529 Plans Distort Your Client’s Estate Plan?

New Crummey Case – Worth its Weight in Gefilte Fish?

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron, Part VII

Risk Management in a Percentage-of-Premium Contract by Pariksith Singh, M.D.

St. Petersburg College 6th Circuit Pro Bono Newsletter, Spring 2015 Edition

Richard Connolly’s World – 15 Body Language Blunders Successful People Never Make

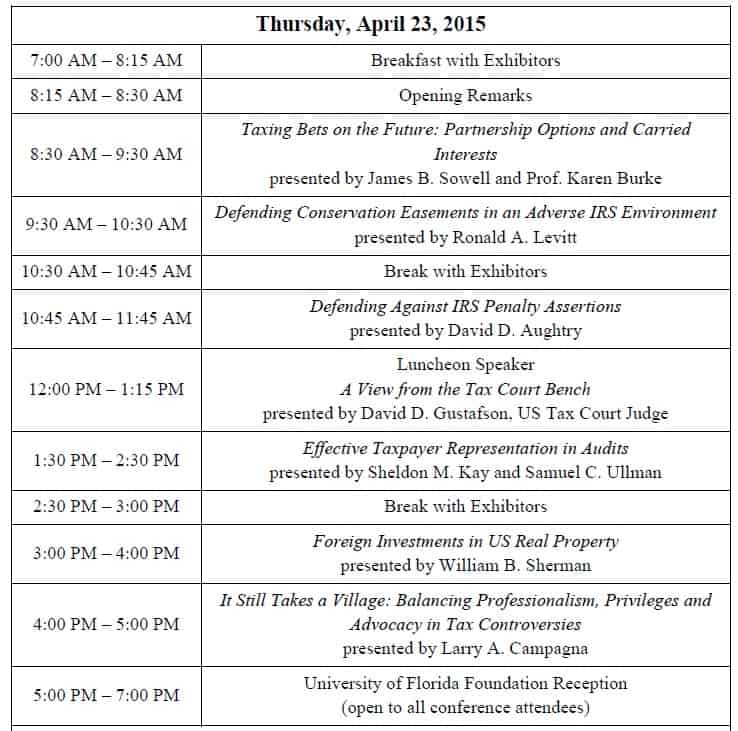

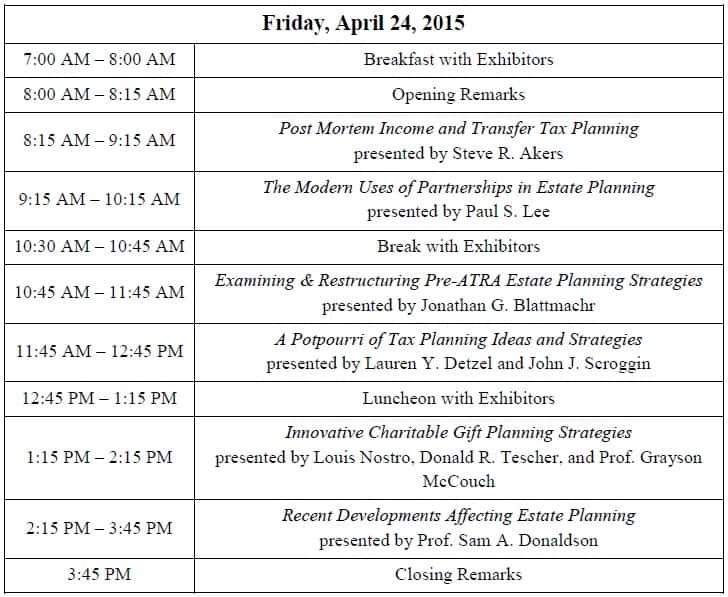

Seminar Spotlight – University of Florida Tax Institute – April 22nd – 24th

Donate to the Stephen A. Lind Eminent Scholar Chair

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Welcome to the 143rd Edition of The Thursday Report

Please forward this report to anyone you like or dislike, know or do not know. We welcome your input, criticism, and nudges!

Thanks sincerely to all of our contributors, and this week, we also thank the amazing team that has put together the ultimate 3-day Florida Tax Institute for April 22nd through April 24th to benefit the University of Florida Levin College of Law Tax Program and those of us who attend. It is not too late to sign up for one or more days, or just show up and crash the receptions (with your checkbook, please!)

For more information on the Tax Institute or to find out how you can donate to the Stephen A. Lind Eminent Scholar Chair, please keep reading. We’ll see you next week at the Florida Tax Institute!

Will 529 Plans Distort Your Client’s Estate Plan?

Commonly, clients want all assets divided equally among children, but what about 529 Plans that may be set aside for younger children or children who have not been educated?

Do you specifically ask the client whether they want everything equally divided, or should the 529 Plans be above and beyond the equal division?

Another question is who the owner of a 529 Plan will be if the client dies?

The following language can be useful to explain and provide for the mechanics associated above:

For the Client Explanation Letter:

We have put in a special provision that provides for having the 529 Plan designated for each child kept separate and apart for that child, and not included in the total value of assets that will be divided by three to otherwise determine what is placed in trust for each child.

For the Document:

Notwithstanding the above, I recognize that my spouse and I have funded 529 Plans that presently exist for one or more of our children, and that we wish to have the 529 Plan or Plans designated for each child held for the sole benefit of the designated child, without having the share of such child otherwise reduced or impacted as a result thereof. Therefore, the Trustee shall make adjustments as appropriate to facilitate fulfilling this intention. For example, if on the death of the survivor of myself and my spouse, there is a $100,000 529 Plan designated for one child, a $150,000 529 Plan designated for a second child, and $3,000,000 of other assets, then each child’s Trust described below will be funded with $1,000,000, with such child additionally having the sole and exclusive benefit of the 529 Plan designated for him or her, in a manner as determined appropriate by the Trustee to fulfill the above intentions.

We have updated our article on comparing 529 Plans to Variable Annuities as investment vehicles. You can review the updated article by clicking here.

New Crummey Case – Worth its Weight in Gefilte Fish?

The recent tax court victory in the case of Mikel v. Commissioner was the subject of an excellent write-up by Jonathan Gopman in the Steve Leimberg Newsletter No. 2301. It can be viewed by clicking here.

Our friend and idol Edwin Morrow has written a draft LISI newsletter, which can be viewed by clicking here that we welcome questions, comments, and suggestions on.

Additionally, our humor section features Kristen Sweeney’s lyrics for “If I Had a Crummey Power” from the never-to-be-performed Broadway musical Tax Lawyer on the Roof. Scroll down to our “Humor! (or Lack Thereof!)” section to see this wonderful poem.

We will have more on this case in future Thursday Reports. Stay tuned!

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits – Part VII

by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron

Learn or remember the six different payout methods and review four tricky situations (not related to Richard Nixon!) in this continuing drama.

The rules applicable to retirement plan and IRA distributions, contributions, rollovers, and otherwise can be difficult to understand and complex to implement. The applicable Internal Revenue Code Sections and Treasury Regulations are somewhat complicated and convoluted, and use many technical “terms of art.” This makes dealing with qualified plans cumbersome and difficult for laypersons and planners who are not experienced in this area.

We have attempted to simplify the applicable rules into a digestible format with concise explanations of the applicable rules. We have also prepared charts and explanations to illustrate the key concepts and mechanics of important definitions, rules, and planning strategies.

The Thursday Report proudly will provide a multi-part series to exhibit our materials and charts, and we hope that you enjoy this series as much as we did in putting it together.

To see previous editions of this presentation, please click below:

Chapter 1 , Chapter 2, Chapter 3, Chapter 4, Chapter 5, Chapter 6

IRA SERIES CHAPTER 7

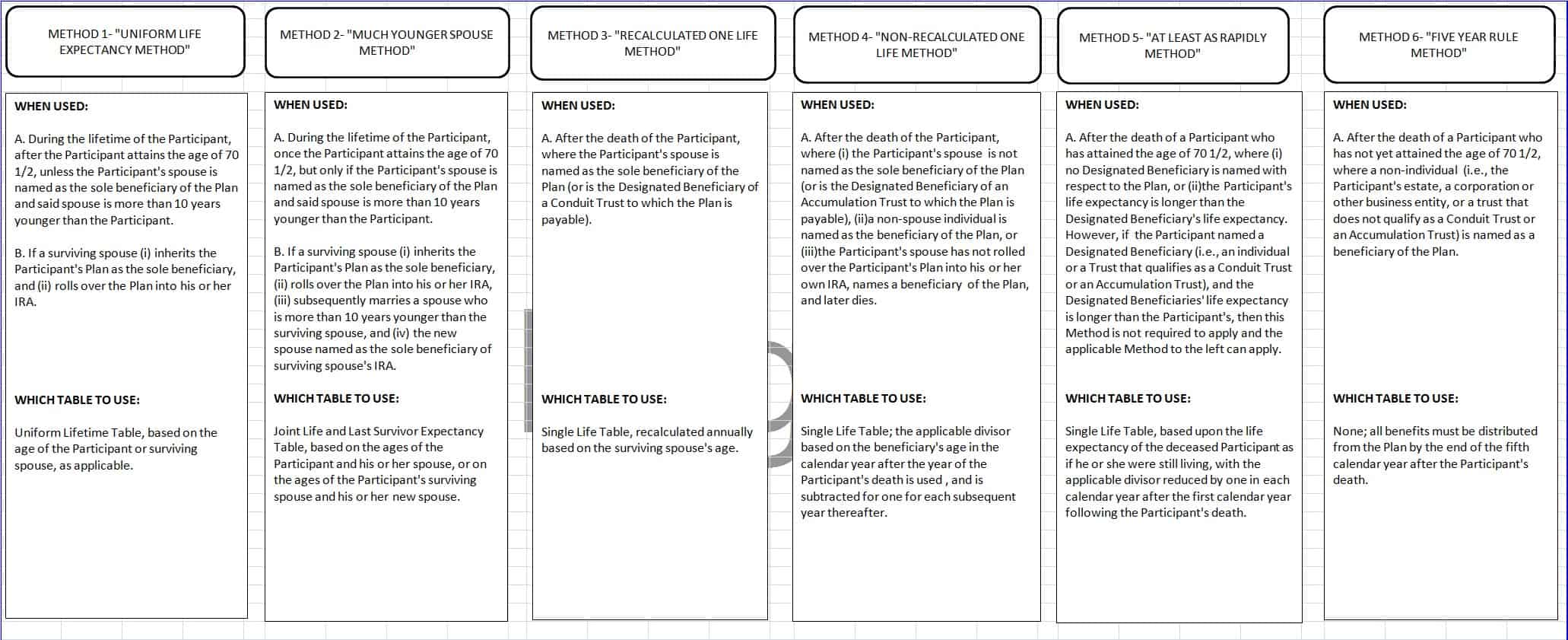

Payout Methods (if Life Expectancy Rule distribution method is selected):

1.) Joint Life Expectancy Method (“Uniform Lifetime Table”). See Appendix A, Table A

This table is based upon annual recalculation of the life expectancy of the Plan Participant and a hypothetical spouse who is 10 years younger. This method is used while the Plan Participant is alive, regardless of whether the Plan Participant is married. This method may also be used by the Surviving Spouse of the original Plan Participant if the Spouse becomes the owner of a spousal rollover Plan, in which event, the Surviving Spouse will be treated as if she is the original Plan Participant. This will not apply if the Spouse treats the Plan of the deceased Plan Participant as an inherited IRA or is the beneficiary of an Accumulation Trust or a Conduit Trust.

2.) Much Younger Spouse Method (“Joint and Last Survivor Table”). See Appendix A, Table B

This table allows the use of a longer joint life expectancy for annual recalculation during the life of the Plan Participant if both of the following apply:

- The spouse of the Plan Participant is more than 10 years younger than the Plan Participant; and

- The spouse is the sole beneficiary of the plan. If the spouse is presently the sole beneficiary of only a portion of a plan, it is best to divide the plan into two separate plans so that he or she can be the sole beneficiary of one plan for this purpose.

A Surviving Spouse who rolls the Plan Participant’s Plan into his or her own IRA can use this method if he or she remarries someone who is more than 10 years younger than the Surviving Spouse.

3.) Recalculated Surviving Spouse One-Life Method (“Single Life Table – Recalculated Annually”). See Appendix A, Table C

This method is used for payouts made directly to the Plan Participant’s Spouse after the Plan Participant’s death where the Spouse is the sole beneficiary of the IRA/Plan that is not rolled over. Additionally, where the Plan Participant’s Spouse is the beneficiary of a trust that qualifies as a Conduit Trust, the Spouse’s life expectancy can be used and recalculated annually according to the Single Life Table.

The first year distribution is based upon the life expectancy of the Surviving Spouse as listed in the Single Life Table, which is the Surviving Spouse’s oldest age in the calendar year following the calendar year of the Plan Participant’s death used in determining the Required Minimum Distribution. For each subsequent year, the applicable Required Minimum Distribution divisor is recalculated based upon the Surviving Spouse’s age in each year. For example, if the Surviving Spouse inherits the Plan Participant’s IRA/Plan, and she reaches age 72 in the calendar year in which a Required Minimum Distribution must be paid, then the applicable divisor will be 15.5. In the following year, when the Surviving Spouse has reached age 73, the applicable Required Minimum Distribution divisor will be 14.8.

4.) Non-Recalculated One-Life Method – Also Known as “Fixed Term” or “Single Life Reduced by One” Method (Single Life Table is used, with the applicable Required Minimum Distribution Divisor being reduced by one in each year after the first year after the Plan Participant’s death). See Appendix A, Table C.

The method is used where benefits are payable as follows:

- To the Plan Participant’s Spouse (after the death of the Plan Participant) where the Plan Participant’s Spouse is not the sole primary beneficiary, i.e. the IRA/Plan beneficiary designation or plan document provides that the Spouse and a non-spouse individual or an entity is also named as a primary beneficiary of the applicable IRA/Plan;

- To a Non-Spouse Beneficiary after the death of the Plan Participant; or

- To the beneficiary named by the Plan Participant’s Spouse or other non-spouse beneficiary that would inherit the IRA/Plan after the death of the Plan Participant’s Spouse or non-spouse beneficiary, as applicable (note: this will not apply where the Plan Participant’s Spouse inherited the Plan Participant’s IRA/Plan and rolled it over into his or her own IRA/Plan, subsequently remarried, and left his or her IRA/Plan to his or her new spouse) after the death of the Plan Participant’s Spouse, where the Plan Participant’s Spouse was the sole beneficiary of the Original Plan Participant’s account and has not rolled over the account.The first year distribution is based upon the life expectancy of the beneficiary as provided in the Single Life Table (Table C). If the Plan Participant’s Spouse is the beneficiary, the Spouse’s oldest age in the calendar year following the calendar year of the Plan Participant’s death is used in determining the Required Minimum Distribution. If the named beneficiary of the Plan Participant’s Spouse is the beneficiary, the beneficiary’s oldest age in the calendar year of the Spouse’s death is used in determining the Required Minimum Distribution.Each year thereafter, the previous year’s life expectancy divisor is reduced by one. Thus, if the first year’s life expectancy divisor is 19.5, the second year’s divisor is 18.5, the third year’s is 17.5, etc.

5.) “At Least as Rapidly” Rule Method (to apply where the Plan Participant dies after his or her Required Beginning Date).

This method is used where the Plan Participant dies on or after his or her Required Beginning Date, as discussed in Chapter Two’s Crucial Definitions and Rules.

In such a situation, the IRA/Plan funds must be distributed “at least as rapidly” as they were required to be distributed at the time of the Plan Participant’s death. However, the regulations provide for a longer distribution period if the Plan Participant has named an individual as Designated Beneficiary or an Accumulation Trust or a Conduit Trust through which the IRS will look to determine the Designated Beneficiary for Required Minimum Distribution purposes.

Where a Designated Beneficiary exists, Required Minimum Distributions can be made based upon the Designated Beneficiary’s life expectancy (if the life expectancy of the Designated Beneficiary is longer than that of the deceased Plan Participant). Alternatively, the “At Least as Rapidly” Method can be used when the Plan Participant has a longer life expectancy than the Designated Beneficiary in order for a longer distribution period to apply.

Where no Designated Beneficiary exists, Required Minimum Distributions can be made according to the remaining life expectancy of the deceased Plan Participant, notwithstanding whether the beneficiary is an individual, but only if the Plan Participant dies after the Required Beginning Date.

Planning Point for Plan Participant with Terminal Illness. The “At Least as Rapidly” Rule Method can work to the advantage of individual plan beneficiaries who are older than a Plan Participant who has a terminal illness if the Plan Participant begins to take distributions to have the rule apply.

6.) Five-Year Rule Method (5th December 31st after the calendar year of death of the Plan Participant – 5th Year After Death Payment required, as previously described).

Under this method, all account funds must be distributed on or before December 31st of the fifth anniversary of the calendar year of the Plan Participant’s death, as described in Chapter Two’s Players and Definitions, the 5th Year After Death Payment Requirement. This is the “default method,” which applies if there is no named Designated Beneficiary, the trust named as a beneficiary does not qualify as an Accumulation Trust or a Conduit Trust, or a non-person is named as a beneficiary of the IRA/Plan (such as an estate, partnership, or corporation).

This method can be advantageous where the Designated Beneficiary (and entire realm of potential Designated Beneficiaries) has a life expectancy of under 5 years, as calculated by the applicable table, or if the Designated Beneficiary has a short life expectancy.

Note: The Five-Year Rule Method is always available to beneficiaries of IRA/Plans, because they can always withdraw more than the Required Minimum Distributions.

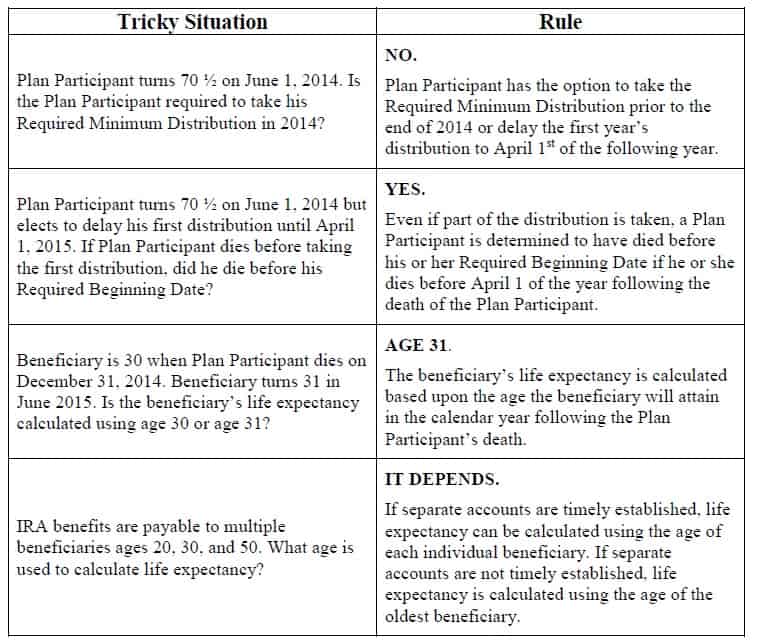

IRA rules are extremely complex and each situation must be analyzed with care. Some scenarios can be tricky, while others are relatively straightforward. Below (Figure 4.1) are a few examples of those tricky situations that will hopefully assist you in avoiding some of the common errors made.

Figure 4.1

Tricky Situations

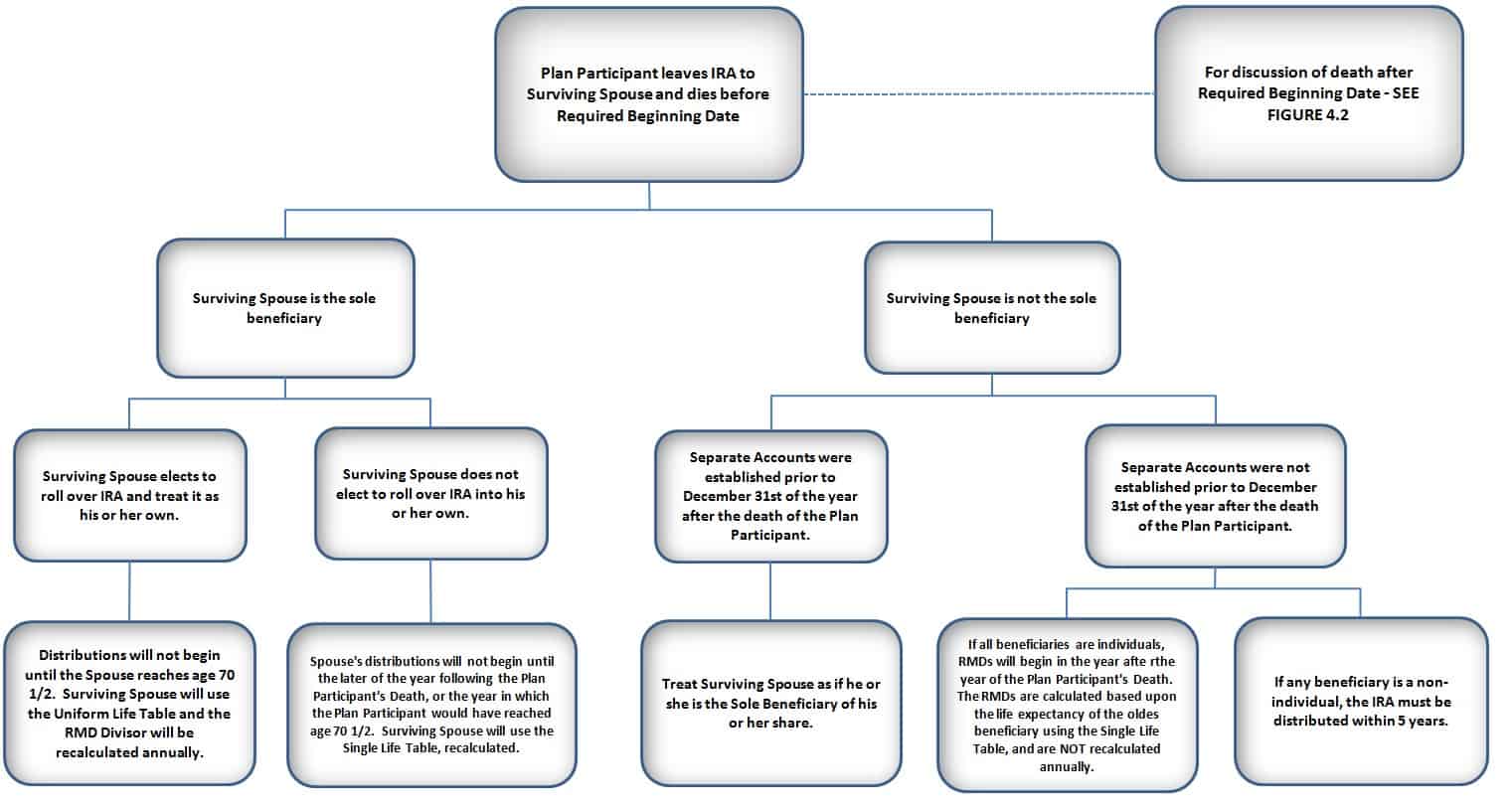

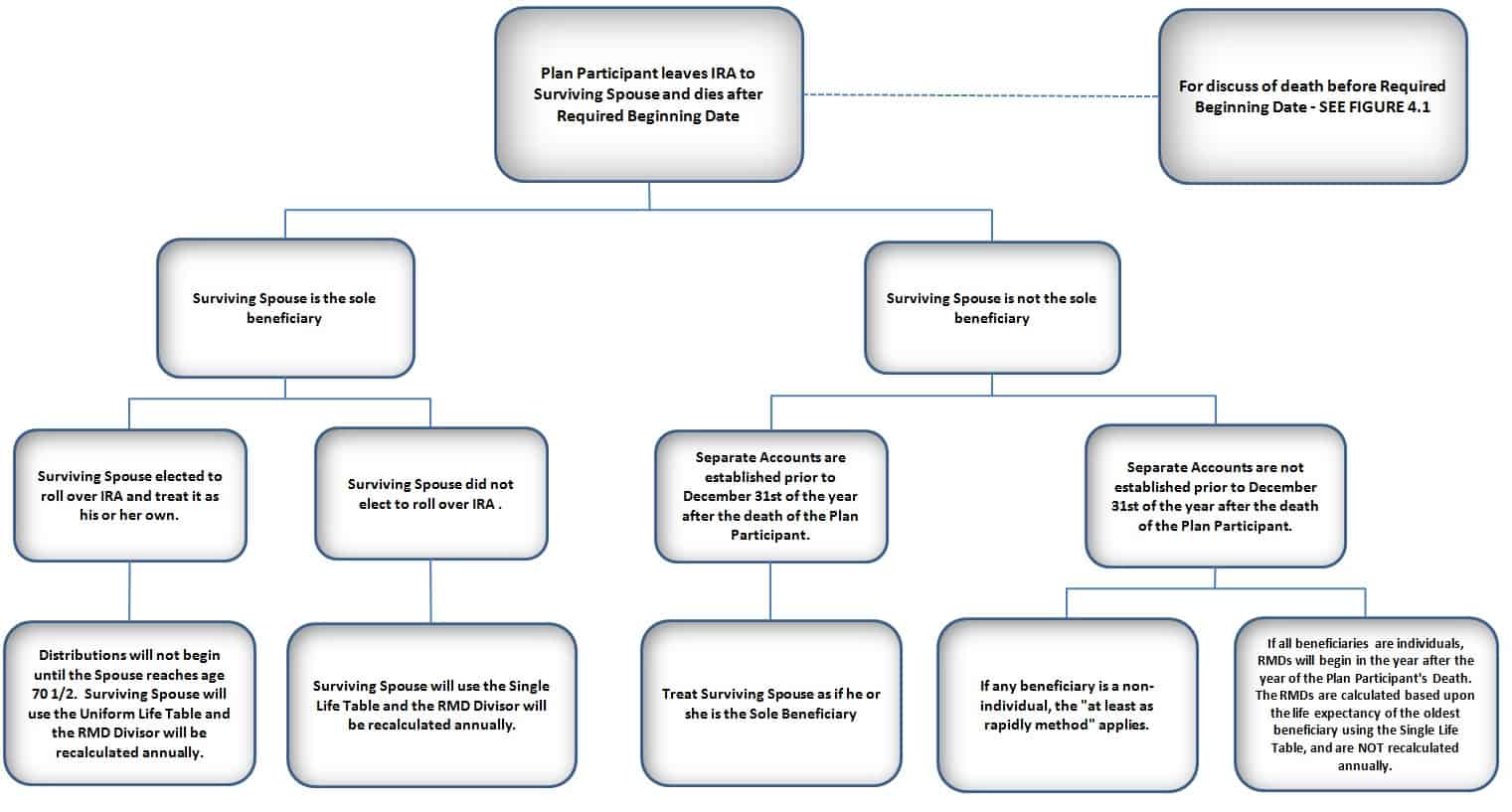

See Figures 4.2 – 4.5 (pictured below, click to enlarge) to determine the applicable Payout Method in each beneficiary situation.

Figure 4.2

For Surviving Spouse – Participant Dies Before Required Beginning Date

Figure 4.3

For Surviving Spouse – Participant Dies After Required Beginning Date

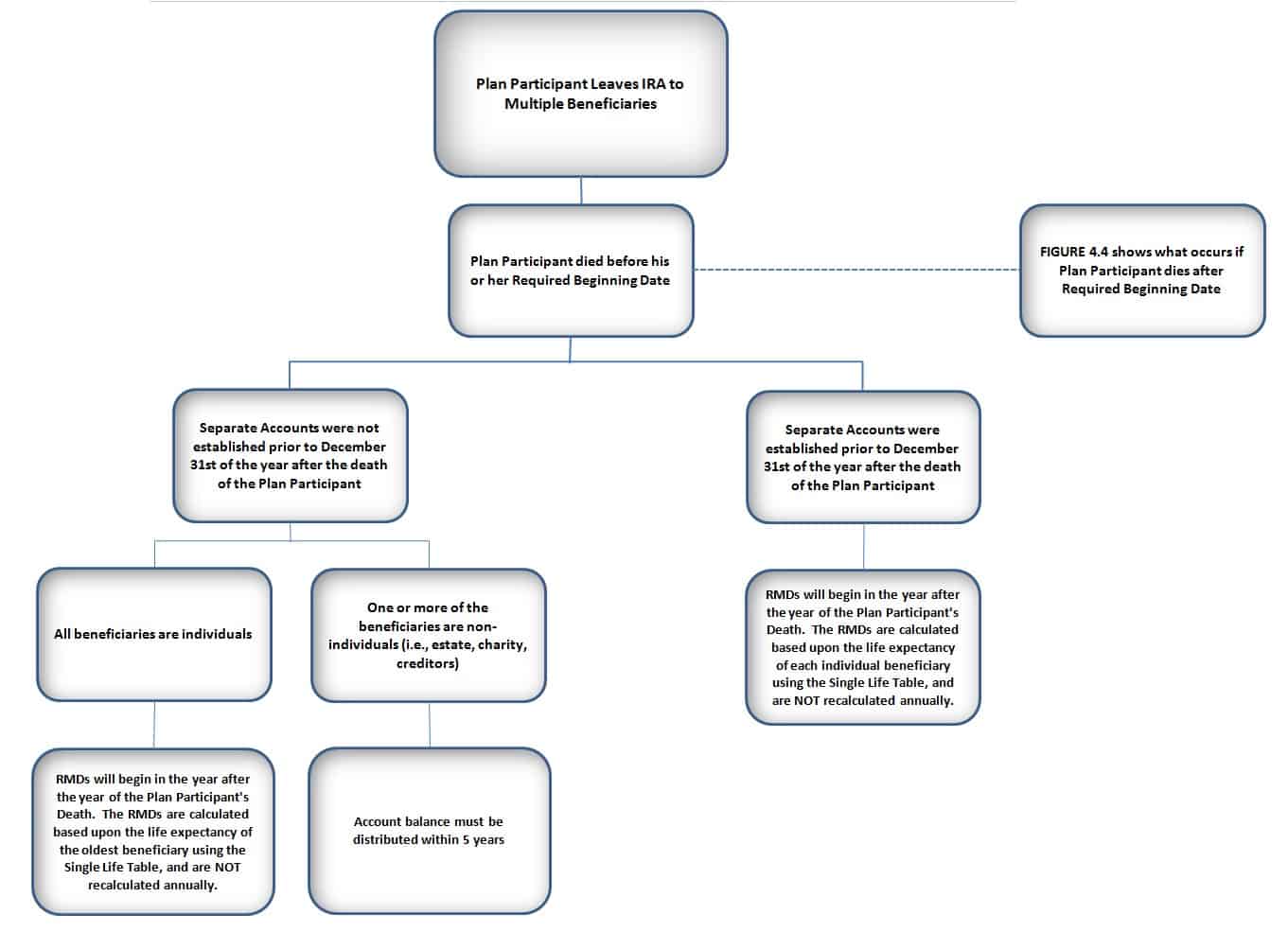

Figure 4.4

Participant Dies Leaving No Surviving Spouse, with Multiple Beneficiaries,

Before Required Beginning Date

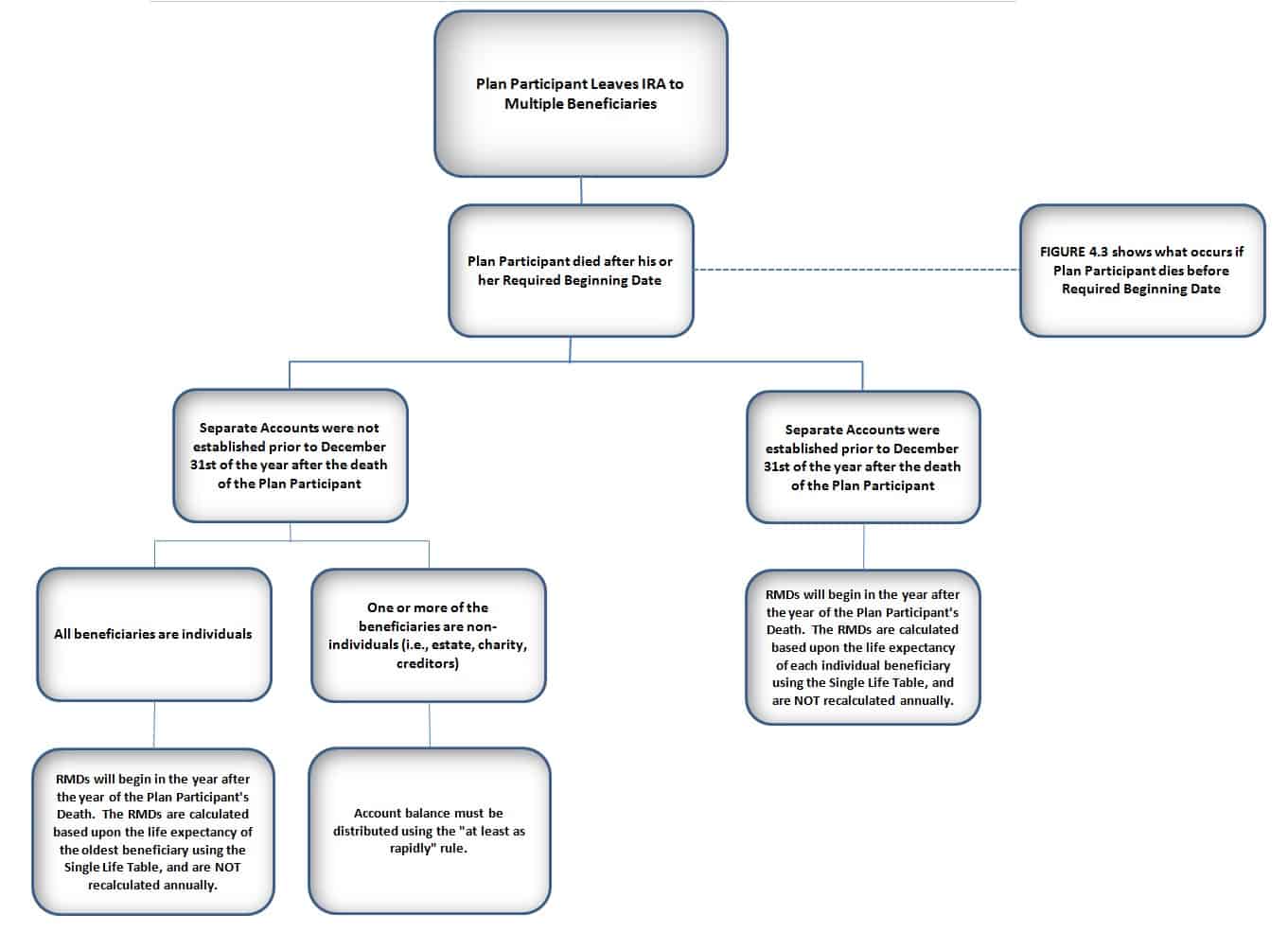

Figure 4.5

Participant Dies Leaving No Surviving Spouse, with Multiple Beneficiaries,

After Required Beginning Date

The Appendix with the tables applicable to methods 1-4 can be accessed by clicking here.

Risk Management in a Percentage-of-Premium Contract

by Pariksith Singh, M.D.

Pariksith Singh, M.D. is truly a visionary in every meaning of the word. Dr. Singh is a board-certified internal medicine physician who received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001, before the city of Spring Hill changed its name to Singh Hill.

In a recent meeting of health care executives, a concern was raised about the viability of an entity that manages risk-based contracts with Medicare Advantage products. The concern became acute when certain cases with catastrophic costs were reviewed. It may be important to address this concern and plan for such unforeseen events in order to mitigate the extremely high expenses entailed with such admissions.

To my understanding, there are various layers of protection and planning involved with risk-management in a global premium or percentage-of-premium setting for an IPA or physicians’ group. These are:

Regulatory:

The Federal government requires that a re-insurance be maintained for catastrophic cases. This is usually obtained from insurance companies that specialize in this industry. Self-insurance may also be obtained by IPAs that have more than 25,000 members. The numbers should be reviewed periodically to ascertain that the best possible rates and deductibles are maintained. Rates must be bid out across the industry and attempt must be made to sign up with policies that give optimum results. Attention must be paid to transplant and end-stage renal patients who are liable to incur heavy charges.

Reserve:

A good reserve would include at least 3-4 months of operational expenses for the company. Letters of credit must be maintained along with the reserve as the first line of defense against catastrophic expenses since this payout is immediate and does not wait for re-insurance, which is often adjudicated at the end of the year.

Risk Management and Operations:

In a bigger sense, every option in the company should come under the purview of risk management. However, specific to managed care, it is important to create a culture of cost-efficiency, compliant and evidence-based care that focuses on quality. MRA diagnoses must be compliantly documented and tracked to ensure that the premium is maintained optimally and appropriately. Star Ratings affect the premium of the plan, and it is critical to focus on HEDIS, CAHPS, and HOS.

Care Management, including utilization management, case management, and disease management, ensure that the expenses are managed the right way. Strong executive teams that have a sense of ownership, empowerment, and holding a stake in the company are critical. Continuity of care in the hospital setting or SNFs or ALFs or home-based patients via various contracted or employed providers ensures that patients do not fall through the cracks. Ensuring that patients with multiple visits to ERs or hospital discharges or high risk patients are treated aggressively and in a timely fashion can alleviate high costs. Part D expenses with brand drugs, too, can be addressed effectively to reduce recurring monthly expenses.

Rates:

Contract management is another critical component of the equation. The incentives and design benefits become important when lop-sided terms with health care entities are reviewed. Real-time data, analytics, and business intelligence on a timely basis would be important to track such rates and act on them in a nimble manner.

Recoveries:

A system to review claims contestation and cost re-allocation is important. If claims can be reviewed prior to payment by the payer, it is ideal. A close tracking of claims to ensure subrogation and duplicate payments are addressed helps reduce the liability of the organization and improve returns.

Retention:

Turnover of providers and patients is extremely expensive. Service and value-creation to both along with strong peer communication and community may be helpful. Incentives to providers need to be aligned with the overall goal of the company along with great service and care to patients. If retention and consolidation are managed well, the right growth strategy can then be established. Provider education (for both primary and specialist physicians) and mentoring with staff training on a constant basis creates the strongest bulwark against such fluctuations.

Revenue Management:

If the company is run on the correct principles and strong fundamentals, including the right systems, infrastructure, tight and adequate network development, platform maintenance along with reduction of inefficiencies and tightly linked information technology will ensure that the risk of unpredictable events can be mitigated even if never fully prevented. The revenue management cycle with auditing, billing, and transmission of claims is not the end of one’s work. The organization needs to ensure that the encounters reach the plan and eventually to CMS.

Relationship Management:

A strong and close-knit network is a deterrent against arbitrary or biased plan decisions to terminate contracts with the IPA or skew them in the plans’ favor. Stability of the organization eliminates the risk of losing contracts with the payers and increases negotiating power giving the ability to have better rates and preferred contracts.

Although these eight measures are not all-encompassing a vigilant review must be constantly kept and Andy Grove’s dictum seems very apt here: “Only the paranoid survive.”

The approach needs to be systematic, methodical, and consistent along with the understanding that those who do not fit in the culture of cost-effectiveness can no longer be part of the organization. The ability to move quickly and effectively can be very important in eliminating non-compliant staff or providers.

St. Petersburg College 6th Circuit Pro Bono Newsletter,

Spring 2015 Edition

Future Super Lawyer Amy Bhatt, who is also a contributing cartoonist and writer for The Thursday Report, is a straight-A student majoring in Paralegal Studies at St. Petersburg College. She also serves as the Editor of the SPC Legal Studies Society’s 6th Circuit Pro Bono Newsletter. Thanks to Amy and Faculty Advisor Dr. Rachel Bennett, Esquire for making this newsletter available to Thursday Report readers!

The spring edition of the newsletter contains several volunteer opportunities for attorneys. St. Petersburg College Legal Studies Society and Bay Area Legal Services, Inc. are looking for volunteers to participate in the Legal Clinic on Saturday, April 25th from 10 AM – 2 PM. Volunteer attorneys are needed to answer student’s legal questions concerning family, criminal, bankruptcy, landlord/tenant, and personal injury law.

The St. Petersburg Bar Association in partnership with the Pinellas County Urban League is also looking for volunteer attorneys to participate in the monthly “Ask A Lawyer…” panels. Can you answer legal questions? Do you have answers to questions about child support, divorce, social security, employment issues, bankruptcy, unfair arrests, wills, disabilities, or more? Contact Wendy Lane from the Pinellas County Urban League at wlane@pcul.org to volunteer. A schedule of monthly topics for the Ask a Lawyer panels can be found on Page 2 of the newsletter.

To download a PDF copy of the 6th Circuit Pro Bono Newsletter, please click here.

For more information, or to join the 6th Circuit Pro Bono Newsletter mailing list, please email Dr. Rachel Bennett at rachel.bennett@spcollege.edu.

Richard Connolly’s World

15 Body Language Blunders Successful People Never Make

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the article of interest is “15 Body Language Blunders Successful People Never Make” by Travis Bradberry. This article was featured on Forbes.com on March 12, 2015.

Richard’s description is as follows:

Our bodies have a language of their own, and their words aren’t always kind. Your body language has likely become an integral part of who you are, to the point where you might not even think about it.

If that’s the case, it’s time to start, because you could be sabotaging your career.

TalentSmart has tested more than a million people and found that the upper echelons of top performance are filled with people who are high in emotional intelligence (90% of top performers, to be exact.) These people know the power that unspoken signals have in communication, and they monitor their own body language accordingly.

What follows are the 15 most common body language blunders that people make and emotionally intelligent people are careful to avoid.

The 15 Most Common Body Language Blunders are:

- Slouching

- Exaggerated Gestures

- Watching the Clock

- Turning Away from Others

- Crossed Arms

- Inconsistency

- Exaggerating Nodding

- Fidgeting with your Hair

- Avoiding Eye Contact

- Eye Contact that’s Too Intense

- Rolling your Eyes

- Scowling

- Weak Handshakes

- Clenched Fists

- Getting Too Close

We can all learn from this article.

Please click here to read this article in its entirety.

Seminar Spotlight

University of Florida Tax Institute

The Florida Tax Institute, sponsored by the University of Florida Levin College of Law, will take place at the Grand Hyatt Tampa Bay in Tampa, Florida on April 22nd, 23rd, and 24th, 2015.

This program features top speakers on tax, business, and estate planning issues. It is designed to be practical, informative, engaged, and state of the art!

Legal credit (CLE) will be available for a variety of states with an ethics program. Accounting, CFP, CTFA, PACE, and Enrolled Agents credit has also been requested in all states for attendance at the Florida Tax Institute.

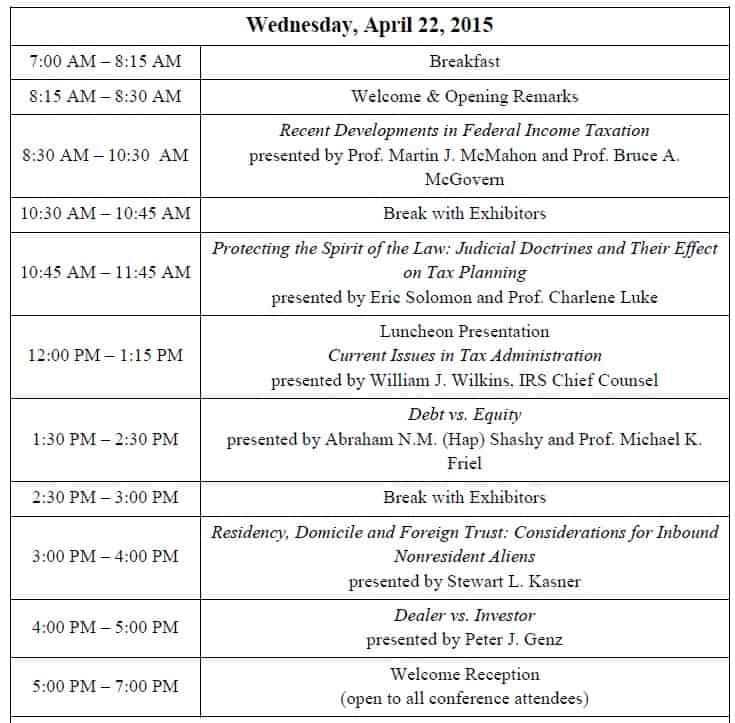

The agenda for the Florida Tax Institute is as follows:

Each attendee to the Florida Tax Institute will receive a complimentary commemorative book provided by Gassman, Crotty & Denicolo, P.A.

To register for the conference, please click here.

For more information, contact The Florida Tax Institute at admin@floridataxinstitute.org or by phone at (216) 241-3922.

Donate to the Stephen A. Lind Eminent Scholar Chair

by Professor Dennis Calfee

The Stephen A. Lind Eminent Scholar Chair in Federal Income Taxation is part of a group solicitation project to raise an endowed fund of $1.5 million for the Graduate Tax Program at the Levin College of Law. This Chair honors Professor Stephen Lind, who taught tax courses at the College from 1970 to 1998 and was one of the founding faculty members of the Graduate Tax Program.

The income from the endowed fund will be used to attract an Eminent Scholar in Taxation who is not a member of the College faculty at the time an offer is extended to occupy this chair. This Eminent Scholar will replace faculty members who have taught in the graduate tax program for many years. This Chair ideally will be occupied by someone who mirrors Steve both professionally and personally.

Contributions to this project qualify for a deduction under Section 170. Pledges can be over a five-year period or payable in any year in the five-year period.

Thank you, in advance, for your assistance with this project to honor Steve. He has touched and influenced so very many in a very positive way over his academic tenure. If you have any questions, please contact Professor Dennis Calfee at (352) 273-0911.

Once the required pledge level is reached, we can all gather for a celebration. Currently, the Stephen A. Lind Eminent Scholar Chair, Fund number F019521, held at the University of Florida Foundation, has nearly $400,000 in contributions and pledges. We are proud to be donors to this chair and the Calfee chair, which is pictured below.

You can make an online contribution to the Stephen A. Lind Eminent Scholar Chair in Federal Taxation by clicking here or by calling the Gift Processing office at 1-877-351-2377 or by giving your check directly to Professor Calfee at the Florida Tax Institute on April 22nd, 23rd, or 24th.

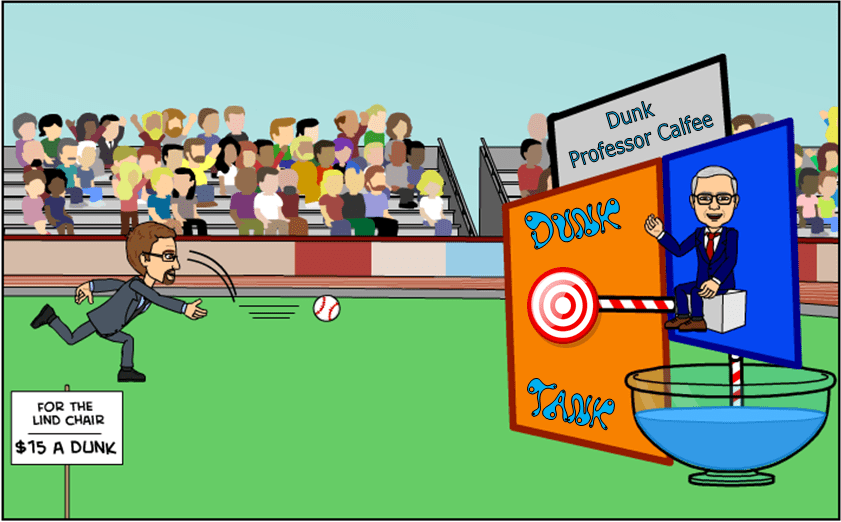

Humor! (or Lack Thereof!)

We are pleased to announce that at the Florida Tax Institute, Professor Dennis Calfee will sit at the dunking booth during the Ethics portion of the Conference. Those who discreetly duck out and donate $15 towards the Stephen A. Lind Chair will get the chance to dunk Professor Calfee!

Please also be on the lookout at the Conference for unofficial commemorative signed t-shirts and inflatable gator ring toss memorabilia. It’s not the type of memorabilia that was important when we were at tax school, but what the heck?

*************************************

If I Had a Crummey Power

(excerpted from the never-to-be-performed Broadway musical Tax Attorney on the Roof)

By Kristen Sweeney-stein and Alan Gassman (but mostly Kristen)

Mr. Koskinen, you levy many, many taxes on trusts.

I realize, of course, that we all must pay some taxes.

But it’s no great treat, I tell you!

So, what would be so terrible if I made one little gift?”

If I had a Crummey Power,

Yubby dibby dibby dibby dibby dibby dibby dum.

All day long I’d biddy biddy bum.

Gifting annually whenever I can.

It’s that I’ve already worked hard.

Ya ha deedle deedle, bubba bubba deedle deedle dum.

To become a biddy biddy rich,

Idle-diddle-daidle-daidle man.

I’d draft a document up with beneficiaries by the dozen,

All with the right to withdraw.

I’d include a clause about not holding back the trust,

So that everybody could get their distributions,

Thanks to the history of Kohlsaat,

If there is a problem, the beth din will be just.

If I had a Crummey Power,

Yubby dibby dibby dibby dibby dibby dibby dum.

All day long I’d biddy biddy bum.

Gifting annually whenever I can.

It’s that I’ve already worked hard.

Ya ha deedle deedle, bubba bubba deedle deedle dum.

To become a biddy biddy rich,

Idle-diddle-daidle-daidle man.

If I could make tax-free gifts, it would give my children free time

To sit in the synagogue and pray.

They could visit Brooklyn instead of only call.

And I’d secure their future with my own hard work, caring for them every single day.

That would be the sweetest thing of all.

If I had a Crummey Power,

Yubby dibby dibby dibby dibby dibby dibby dum.

All day long I’d biddy biddy bum.

Gifting annually whenever I can.

It’s that I’ve already worked hard.

Ya ha deedle deedle, bubba bubba deedle deedle dum.

To become a biddy biddy rich,

Idle-diddle-daidle-daidle man.

Federal taxes, I save them where I can,

The judge decreed I should be what I am.

Now did it spoil some vast eternal plan?

That I have stayed a wealthy man.

**********************************

We regret that the rest of the humor for this week’s Thursday Report has been censored by the National Newsletter Censoring Board (NNLCB.) The NNLCB is not to be confused with the National Nonsense and Lunacy Control Board, also known as the NNLCB, of which we are a proud member.

Upcoming Seminars and Webinars

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY – PART II.

This webinar is a continuation of the How to Handle Stressful Matters in an Ethical Way webinar that was presented by Dr. Rao and Alan Gassman on February 19, 2015. This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced.

See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: April 21, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please click here to register or email Alan Gassman at agassman@gassmanpa.com for more information.

***************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Kenneth Crotty, and Christopher Denicolo will present a 90-minute webinar for Bloomberg BNA Tax & Accounting on MATHEMATHICSLAND FOR ESTATE PLANNERS.

This webinar includes over 30 interactive spreadsheets and explanatory tools that you need to know how to use to best serve your clients!

Date: Monday, April 27, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE OLDSMAR PRESENTATION:

FICPA SUNCOAST SCRAMBLE GOLF TOURNAMENT

Kenneth J. Crotty and Christopher J. Denicolo will speak at the FICPA Suncoast Scramble Golf Tournament on the topic of MATHEMATICS FOR ESTATE PLANNERS INCLUDING 10 ESTATE PLANNING STRATEGIES NOT TO MISS.

Date: Friday, May 1, 2015 | CPE Presentations from 9:00 AM – 11:30 AM

Location: East Lake Woodlands Country Club | 1055 E Lake Woodlands Parkway, Oldsmar, FL 34677

Additional Information: For more information about registration, sponsorship, or this event, please click here or click here to download the Tournament brochure.

***********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman, Jerry Hesch, and Richard Oshins will present THE MATHEMATICS OF ESTATE PLANNING. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law | 1025 Commons Circle, Naples, Florida

Additional Information: For more information, please visit http://estateplanning.avemarialaw.edu/ or email Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami | 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, and Barry Flagg will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on THE TAX ADVISORS GUIDE TO PERMANENT LIFE INSURANCE AND STRUCTURING TOOLS AND TECHNIQUES.

Date: Tuesday, May 12, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

******************************************************************

LIVE BRADENTON, FLORIDA PRESENTATION

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Tuesday, May 12, 2015 | Time TBA

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE STUART, FLORIDA PRESENTATION

Alan Gassman will be the featured “headline” speaker the Martin County Estate Planning Council Annual Tax and Estate Planning Seminar. He will be doing a three-hour talk on the topics of JESTs, MATHEMATICS FOR ESTATE PLANNERS, AND THE ESTATE PLANNER’S GUIDE TO PLANNING FOR IRA AND PENSION BENEFITS – YES, YOU CAN FINALLY UNDERSTAND THESE RULES!

Date: May 15, 2015 | 8:15 AM – 4:30 PM; Alan Gassman speaks from 9:00 AM to 12:00 PM

Location: Stuart Corinthian Yacht Club | 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will be presenting a free 30-minute webinar on ARBITRATING TRUST AND ESTATES DISPUTES.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here http://www.flprobatelitigation.com/, and the many vary useful articles thereon.

Date: Tuesday, May 19, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

**************************************************

LIVE MIAMI LAKES WORKSHOP:

Alan Gassman will be speaking at the Miami Lakes Bar Association Luncheon on the topic of ACCELERATING YOUR LAW PRACTICE. This luncheon will qualify for 2 CLE credits.

Date: Thursday, May 21, 2015 | 11:45 am – 1:45 pm

Location: Italy Today | 6743 Main Street, Miami Lakes, FL 33014

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE UNIVERSITY OF FLORIDA PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a five hour workshop on legal practice and making the most of your legal practice to Professor Dennis Calfee’s summer workshop class. Experienced professionals are also welcome to attend by making a $150 donation to the Lind Chair.

Date: To Be Determined

Location: University of Florida | 2500 SW 2nd AE, Gainsville, FL 32611

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alice Rokahr, President, Trident Trust Company (South Dakota) Inc., and Alan S. Gassman will present a free, 30-minute webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTS – DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

Date: June 9, 2015 | 12:30 pm

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or click here to register for this webinar.

**********************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: August 22, 2015 | 9:00 AM – 5:00 PM

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE PRESENTATION:

RUTH ECKERD HALL PLANNING GIVING COUNCIL MEETING

This exciting two-part event will feature an educational presentation and a networking session. Attorneys and CPAs may receive CLE and CPE credit for attending the educational presentation.

The educational presentation will be an entertaining, interactive workshop led by Jack Halloway, a well-known improvisational coach and actor. He is directing “The Complete Works of William Shakespeare (Abridged)” and will share some thoughts on how Shakespeare used law, lawyers, and money in his plays. Some improv will also be included.

Jack Halloway’s presentation will be followed by a social networking and info session. Enjoy some wine and time with fellow Planned Giving enthusiasts!

Everyone who brings a potential donor or new member to the Planning Giving Council will be entered into a raffle for 2 tickets to an upcoming show.

Date: April 21, 2015 | Educational Presentation begins at 4:30 PM | Networking sessions begins at 5:30 PM

Location: The New Murray Theatre at Ruth Eckerd Hall

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com. RSVPs may be sent to Maribeth Vongvenekeo at maribeth@gassmanpa.com, Suzanne Ruley at sruley@rutheckerdhall.net, or Kristy Philippe at kristy.philippe@ms.com.

******************************************************

LIVE PRESENTATION:

2015 UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay | 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please visit http://www.floridataxinstitute.org/agenda.shtml for a complete schedule or contact Bruce Bokor at bruceb@jpfirm.com for more information.

******************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

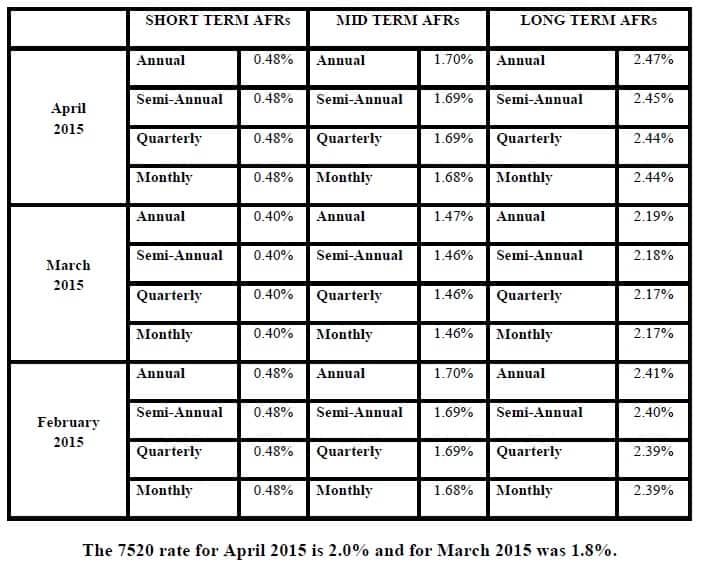

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.