The Thursday Report – 3.12.15 – Spock-o-prudence: The Needs of the Many Outweigh the Needs of the Few – 335 S.W.3d 126 (Tex. 2010)

Live Long & Thursday: Readers Respond

Initial Life Insurance Applications May Need to be in Separate Increments

Advising Clients on What to Take to the Division of Motor Vehicles to Transfer Ownership of a Motor Vehicle or a Florida Registered Boat

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits – Part II by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron

Richard Connolly’s World – Lawsuits’ Lurid Details Draw an Online Crowd

Thoughtful Corner – What is Write About the Following?

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

The Needs of the Many Outweigh the Needs of the Few

This now iconic line was first spoken by Leonard Nimoy as Spock in 1982’s The Wrath of Khan. Spock stated, “Logic clearly dictates that the needs of the many outweigh the needs of the few.” Captain Kirk responded with, “Or the one,” thus setting up a pivotal scene near the end of the film. To see a clip of Spock speaking the famous axiom, please click here.

This phrase has had a great cultural impact, as its philosophy continues to be widely demonstrated in film, television, and books of all genres.

The phrase even made its way into the Texas Supreme Court. See 335 S.W.3d 126 (Tex. 2010). Spock’s famous quote was cited in Robinson v. Crown Cork & Seal when the court stated:

Fortunately, we are not without guidance. Appropriately weighty principles guide our course. First, we recognize that police power draws from the credo that ‘the needs of the many outweigh the needs of the few.’ Second, while this maxim rings utilitarian and Dickensian (not to mention Vulcan), it is cabined by something contrarian and Texan: distrust of intrusive government and a belief that police power is justified only by urgency, not expediency. That is, there must exist a societal peril that makes collective action imperative.

To see more from this 2010 case, please click here.

Live Long & Thursday: Readers Respond

We had a great response to last week’s article tribute to the late Leonard Nimoy. To see the article (and our other Star Trek humor!) please click here.

Here are just a few of the messages we received:

“Thanks for the tribute to Leonard Nimoy (Mr. Spock) who was then, is now, and will always be my friend. Star Trek remains, to this day, my favorite, both the TV shows and the movies. RIP Mr. Spock; you will be missed always.”

– Velma Saccone, vsaccone@verizon.net

“I had quite a chuckle on the Nimoy article. I think I’ll Photoshop my picture over yours and save $200 – only for “fair use,” though.”

– Edwin P. Morrow, III, edwin_p_morrow@keybank.com

“Live long and prosper, Alan!”

– Jacqueline Maltry, jmaltry@tampabay.rr.com

“Alan, you are FUNNY! This [article] is great! Thanks for making my weekend!”

– Dr. Srikumar Rao, srikumarsrao@gmail.com

Who is your favorite Star Trek character? Tell us at agassman@gassmanpa.com!

Initial Life Insurance Applications May Need to be in Separate Increments

Initial life insurance applications may need to be in separate increments so policies purchased can be more flexible overall.

For example, recently, a client applied to well-known insurance carrier for two multi-million dollar universal life insurance policies. When it was time to take delivery of the policies, we requested separate policies in $5,000,000 increments instead.

This would have enabled the client to drop some of the coverage without complicated internal adjustment repercussions that would have otherwise applied.

The carrier refused to issue the policies in this manner, thus requiring the client to go through underwriting again to receive new offers from the initial carrier and/or other carriers, as opposed to having the flexibility that had always existed in the industry.

We can’t tell you which carrier this was with, but we can tell you that their name had to do with the Gettysburg Address.

As the result of this, it appears that we need to urge clients and insurance agents to put applications in for separate incremental policies.

This can be particularly important with term insurance coverage because a great many term policies cannot have the death benefit reduced and thus, are completely inflexible.

Advising Clients on What to Take to the Division of Motor Vehicles to Transfer Ownership of a Motor Vehicle or Florida Registered Boat

So often, we advise clients (or should advise clients) to transfer ownership of a car or boat, but they are not sure how they are to go about doing so. The following list was prepared by Stetson Law Student Rahma Sultan, given the lack of such instructions or information on the DMV website or Wikipedia.

Instructions for Transferring Ownership of a Florida Motor Vehicle

To transfer ownership of a vehicle currently titled in Florida, you must bring the following to any DMV office:

- The Application for Certificate of Title With/Without Registration properly completed by both the buyer and the seller

- A Notice of Sale or Bill of Sale is suggested and may be required.

- Purchaser’s name, selling price, and odometer reading (if applicable) must be entered.

- Proof of current Florida Property Damage and Personal Injury Protection insurance

- The name of your Florida licensed insurance company and policy number

- Each applicant must be present to sign a new Application for Title, or a properly completed Motor Vehicle Power of Attorney may be furnished.

- Personal identification, such as a driver’s license, is required for notarization of signatures.

- If the applicant does not hold a Florida Driver License or Identification Card, a photocopy of their out-of-state license or United States passport is required.

- A copy of your current auto registration when transferring a license plate is required.

- Any alterations on the Title may require additional documentation.

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits – Part II

by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron

The rules applicable to retirement plan and IRA distributions, contributions, rollovers, and otherwise can be difficult to understand and complex to implement. The applicable Internal Revenue Code Sections and Treasury Regulations are somewhat complicated and convoluted, and use many technical “terms of art.” This makes dealing with qualified plans cumbersome and difficult for laypersons and planners who are not experienced in this area.

We have attempted to simplify the applicable rules into a digestible format with concise explanations of the applicable rules. We have also prepared charts and explanations to illustrate the key concepts and mechanics of important definitions, rules, and planning strategies.

The Thursday Report proudly will provide a multi-part series to exhibit our materials and charts, and we hope that you enjoy this series as much as we did in putting it together.

To see Chapter 1 of this presentation, please click here.

IRA SERIES CHAPTER 2

PLAYERS:

1. IRA/Pension Plan/Retirement Plan Accounts

For the purposes of this handbook, we use these terms interchangeably, and will most commonly refer to them as “IRA/Plan.”

Many pension plans and IRA custodians limit beneficiary designation rights, sometimes necessitating rollover to an IRA that will permit the desired planning configuration, whether before or after the death of the Plan Participant.

The actual technical names given to the various plans that come under these rules are as follows:

- IRA

- SIMPLE IRAs

- Simplified Employee Pension (SEP)

- Employer sponsored retirement plans, such as 401(k) plans, defined benefit plans, defined contribution plans, and profit sharing plans

- 403(b) plans

- 457(b) plans

- Roth 401(k) plans

- Roth IRAs; however, Roth IRAs are not subject to the Required Minimum Distribution rules until the owner of the Roth IRA (or the spouse of the deceased owner who rolled over into his or her own Roth IRA) dies.

- Canadian Registered Retirement Savings Plans (RRSPs) and Registered Retirement Income Plans (RRIFs) will now be treated as US IRA equivalents to a certain extent as per Rev. Proc. 2014-55.

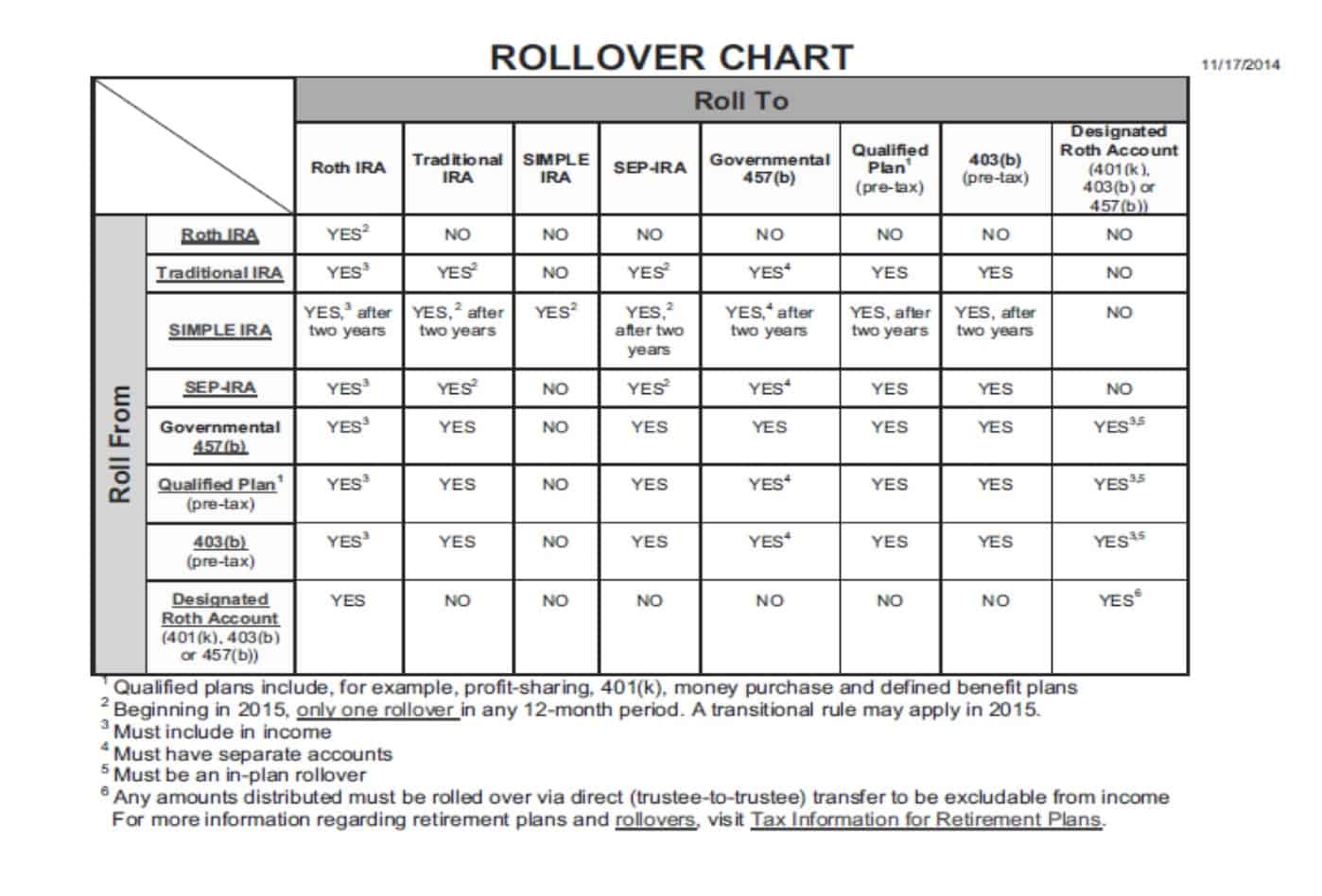

Almost any of the above plans can be transferred to another of the above plans during the life of a Plan Participant. An IRS chart (Illustration 2.0) released on November 17, 2014 can be found on the following page, as featured in Leimberg Information Services Tax Tips November 24, 2014.

Illustration 2.0

Also see Appendix D for a recent article by the authors “Bobrow Raises Brows” discussing the limitations on rollovers after Bobrow v. Commissioner which held that a taxpayer is only allowed to roll over one IRA in a calendar year.

2. Person. An individual.

3. Non-Person Beneficiary. An estate, charity, company, trust or other “non-individual” named as the direct beneficiary of an IRA/Plan, or a non-individual that is the beneficiary of a trust to which an IRA/plan is made payable.

4. Original Plan Participant, or just “Plan Participant”. The person who is the IRA owner or qualified retirement plan participant, while alive, or after death.

5. Beneficiary. The person, trust, or other entity named as the direct beneficiary of an IRA/Plan or the person who will inherit directly upon the death of the Plan Participant.

6. Non-Spouse Beneficiary. Any Beneficiary other than the Plan Participant’s spouse.

7. Plan Participant’s Spouse/Surviving Spouse. The person married to the Plan Participant is his or her spouse. The person married to the Plan Participant on his or her death is the Surviving Spouse. We are using these terms interchangeably.

Note – Federal pension law gives the surviving spouse an absolute right to be considered the sole beneficiary of certain qualified retirement plans of his or her spouse, unless this right has been legally waived.[1]

8. Bobrow Problem. The January 28, 2014 Tax Court Decision of Bobrow v. Commissioner shocked a great many advisors by finding that a taxpayer who followed IRS Publication 590 and a proposed regulation when making two “tax-free roll overs” during a single year was penalized when the IRS guidance he followed was not permitted under Internal Revenue Code Section 408(d)(3)(B), which only permits one roll over per calendar year.

This case is discussed in Appendix D and casts at least a light gray cloud on much of the conventional wisdom in this area.

9. Designated Beneficiary. An individual beneficiary of a trust receiving IRA/Plan distributions whose life expectancy will be used for purposes of determining the Required Minimum Distributions that will apply.

Note – As discussed below, for a Conduit Trust (which must pay all IRA/Plan withdrawals to the Designated Beneficiary) older individuals and other entities that are beneficiaries of the Trust can be ignored. For an Accumulation Trust, the Designated Beneficiary must be the oldest named possible individual beneficiary of the trust to which the IRA/Plan is payable, and there can be no non-person beneficiaries under the Accumulation Trust as of September 30 of the calendar year after the death of the Plan Participant.

10. Administrator. The IRA sponsor or qualified retirement plan administrator, or comparable person or entity. For a pension or 401(k) plan this will typically be someone who works for the sponsoring company who administers the plan. For an IRA this will typically be the company that sponsors it, such as Schwab, Wells Fargo, Vanguard, and at banks and credit unions.

11. IRA Custodian. A company or bank that sponsors an IRA account such as Merrill Lynch, Schwab, Vanguard, or Wells Fargo.

Note – Many sponsors will not permit an inherited IRA to be distributed intact to a trust that receives the IRA on the death of the Plan Participant, so custodians/brokers/banks may have to be changed after the Plan Participant dies. These sponsors will sometimes only be willing to have inherited IRAs, or portions thereof, payable to a trust only after the receipt of a court order and/or an IRS private letter ruling. The most notable of these is Schwab, under both conventional and institutional accounts/managed accounts.2

12. IRA Trustee. A bank with trust company powers, or a nonbank trust company that has been approved by the IRS under Treasury Regulation 1.408-2(e) to serve as a trustee/custodian under the rules that permit trusteed IRA arrangements. These rules permit the same customized trust agreement that is entered into with the trustee to also control disposition and payment rights, to avoid having to program these into the Plan Participant’s will and/or living trust system, but the same rules with respect to required minimum distributions (e.g., the requirements with respect to the determination of the Designated Beneficiary of the Trust), will still apply.

13. Individual Retirement Trust “IRT”. The Individual Retirement Trust arrangement is permitted under Internal Revenue Code §408(a) and known as an “Individual Retirement Trust or “IRT.” An Individual Retirement Trust is very similar to a typical IRA custodianship arrangement because a trust company holds the trust assets to comply with the IRA administration rules. But, unlike a typical IRA custodianship arrangement where the beneficiary may be an individual, Conduit Trust, or Accumulation Trust, an Individual Retirement Trust can in effect become a Conduit Trust or an Accumulation Trust without the need of extraneous trust documents or provisions under a Last Will and Testament.

In other words, instead of having a traditional IRA that would be payable to trust on death, and then having the Trustee receive minimum distributions each year, that in turn can be accumulated, paid out to the beneficiary, or paid to third parties on behalf of the beneficiary, an Individual Retirement Trust avoids the need for an intermediary Accumulation Trust or Conduit Trust. See Edwin Morrow’s article “Trusteed IRAs: An Elegant Estate Planning Option,” Trusts and Estates, Sept 2009 for an excellent discussion on Individual Retirement Trusts in Appendix C.

14. Qualified Annuity. An annuity contract issued by an insurance carrier using IRA/Plan monies which qualifies as an IRA/Plan, and therefore follows the IRA/Plan rules set forth herein as opposed to the “non-qualified annuity” rules under Internal Revenue Code Section 72.

15. Applicable Payment Mode. The method of payment of Required Minimum Distributions, as described in Chapter Four – Payout Methods, which will apply after the death of the Plan Participant, and will usually continue after the death of the Designated Beneficiary of the Plan Participant’s IRA/Plan.

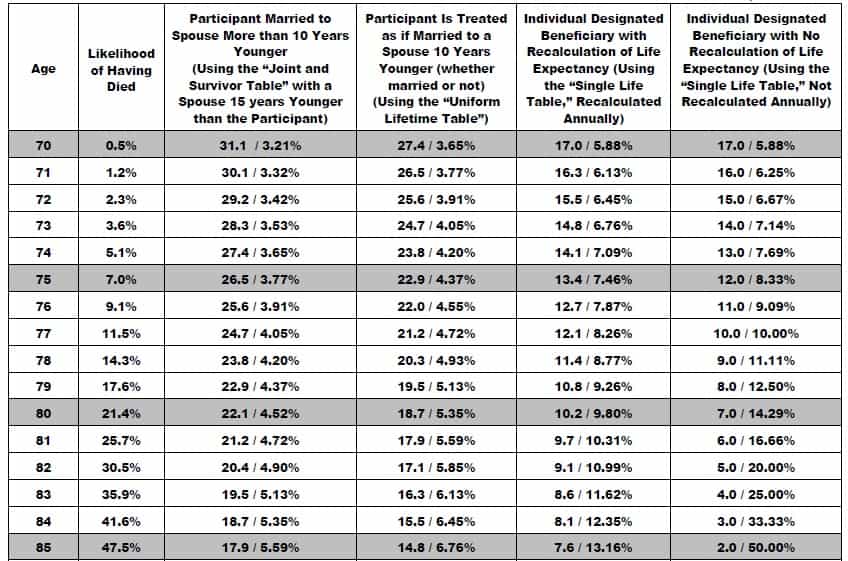

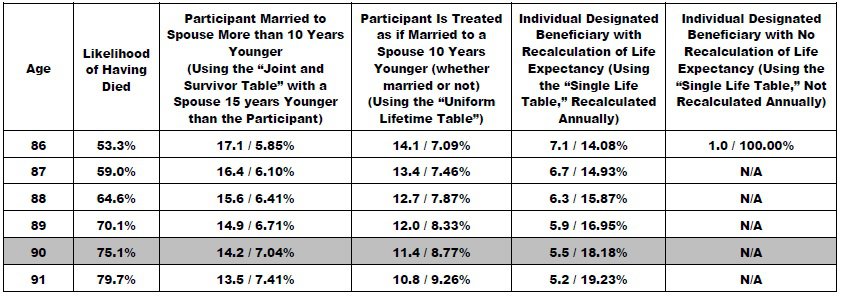

16. Applicable Life Expectancy Table. The life expectancy table published by the IRS, which applies based on the Applicable Payment Mode of Required Minimum Distributions after the Plan Participant attains his or her Required Beginning Date, or after the death of the Plan Participant.

17. Applicable Required Minimum Distribution Divisor. The divisor for the year in question under the Applicable Life Expectancy Table which is used to determine the amount of the Required Minimum Distribution for a given year. The value of the IRA/Plan on December 31 of the prior calendar year is divided by the divisor in order to determine the amount of the Required Minimum Distribution for the given year.

18. Recalculation of Life Expectancy. The method of calculation whereby the person’s life expectancy is determined each year from the Applicable Life Expectancy Table, which takes into account that every year a person’s life expectancy is reduced by less than one year. This rule will apply during the lifetime of the Plan Participant, and during the lifetime of a Surviving Spouse beneficiary who is able to follow the rollover rules. The Applicable Payment Mode is determined by looking at the age of the Plan Participant or the Plan Participant’s Spouse (as applicable) on the Applicable Life Expectancy Table for each year in which a Required Minimum Distribution must be made. The life expectancy of the Plan Participant or the Plan Participant’s Spouse is therefore “recalculated” each year.

For example, if an unmarried Plan Participant turns age 72 during Year 1, then she would look at the row under the Uniform Lifetime Table that corresponds to age 72 in order to determine the Applicable Required Minimum Distribution Divisor (25.6). In the next year, when the Plan Participant turns age 73, she will look at the row under the Uniform Lifetime Table that corresponds to age 73 to determine the Applicable Required Minimum Distribution Divisor (24.7).

If a Person other than the Plan Participant’s Spouse is a beneficiary of the IRA/Plan, or if the Plan Participant’s Spouse is a beneficiary of the IRA/Plan but is not the sole or designated beneficiary of the IRA/Plan, then the Recalculation of Life Expectancy principle will not apply. Instead, the Applicable Required Minimum Distribution Divisor for the first calendar year after the year of the Plan Participant’s death is determined by looking at the row under the Single Life Table that corresponds to the oldest age of the Designated Beneficiary in such calendar year, and the Applicable Required Minimum Distribution Divisor is determined for all subsequent years by subtracting one from the Applicable Required Minimum Distribution Divisor of the preceding calendar year.

For example, if the Designated Beneficiary is not the Plan Participant’s Spouse and is age 72 in the calendar year after the year of the Plan Participant’s death, then the Applicable Required Minimum Distribution Divisor for such year is 15.5. For the next calendar year when the Designated Beneficiary is age 73 the Applicable Required Minimum Distribution Divisor is 14.5, and for each subsequent year, the Applicable Required Minimum Distribution Divisor for the preceding year is subtracted by one, and will therefore be 13.5 years, rather than re-determining life expectancy each year by “recalculation.”

The following chart illustrates the effect of each of the four calculation methods, and the significant difference between the results that apply under each method where the beneficiary of an IRA is age 70 in the first year of withdrawal (as original owner, or beneficiary where original owner died before reaching age 70 ½).

Illustration 2.1

Chart to demonstrate minimum distribution rule calculations for an individual who begins receiving distributions at age 70 (or designated beneficiary) where distributions begin at age 70; also displayed in percentages based off of the applicable divisor % = 1 ÷ divisor)

19. See Through Trusts, Accumulation Trusts, and Conduit Trusts. As described below in much more detail, certain trusts can receive IRA/Plan benefits after the death of the Plan Participant without triggering the “5th Year After Death Payment Requirement” by having a Designated Beneficiary whose life expectancy can be used for required minimum distribution rule purposes. An Accumulation Trust can retain distributions from the IRA/Plan whereby a Conduit Trust must pay all distributions received directly from the IRA/Plan to a Designated Beneficiary upon receipt by the trustee.3 The term “See Through Trust” refers to both Accumulation Trusts and Conduit Trusts.

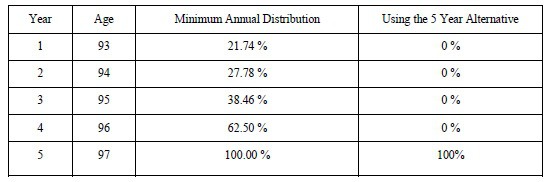

20. Fifth Year After Death Method. The Required Minimum Distribution rule that requires benefits to be paid out by the last day of the 5th calendar year following the death of the Plan Participant who has not reached age 70 ½, which will apply if no more favorable method of Required Minimum Distributions apply. If the Plan Participant dies after age 70 1/2 , then the five year rule cannot be used, and instead the life expectancy of the deceased Plan Participant will continue to be used under the “at least as rapidly” method. For example, if the Plan Participant dies in 2015 before he has attained the age of 70 ½, and no other more favorable method of payment applies, then all assets must be distributed from the IRA/Plan by December 31, 2020, and likewise, no distributions must be made whatsoever until December 31, 2020, notwithstanding, whether an alternative Applicable Payment Mode based upon life expectancy of a beneficiary would apply. This may be more advantageous for older Designated Beneficiaries. For example, if the life expectancy of the Designated Beneficiary is only 4.6 years because he or she is age 93, then the choices for distributions would be as follows in Illustration 2.2:

NOTE: This method can only be used if the deceased Plan Participant dies before April 1 of the calendar year following the year of turning 70 ½.

Illustration 2.2

Life Expectancy Method vs. Five Year Alternative

21. Trust Protector. An individual and/or entity given the power to make changes to trust agreement provisions.

22. Toggle. To, in effect, pull a switch that causes changes in a trust document to facilitate tax or other planning, which will often be in the form of having trust language that permits fiduciaries to change what would have been an Accumulation Trust into a Conduit Trust before the Determination Date (September 30 following calendar year of death of the Plan Participant). See Chapter Three Section IV.

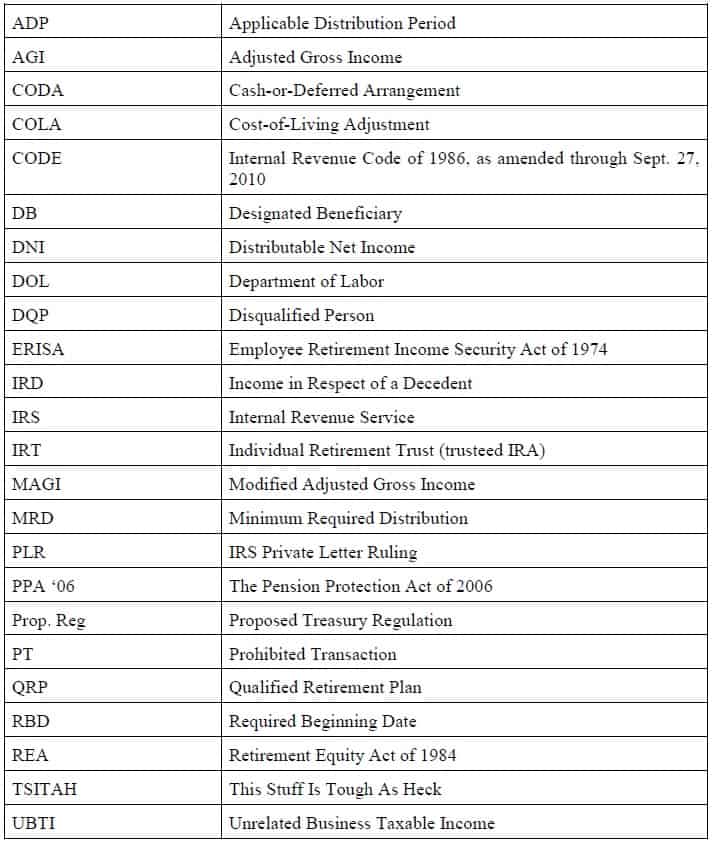

23. Natalie Choate’s Definitions. Natalie Choate’s book, “Life and Death Planning for Retirement Benefits”, is an indispensable guide and the standard of practice for anyone giving advice in this area. You can order the book by going to ataxplan.com. We strongly recommend that you also take a look at what is available from Natalie’s website. It may be useful to have the following abbreviations from Natalie’s book, and an extra copy of this abbreviation sheet is provided in Appendix D to this outline, so that you can tear it out and insert it into Natalie’s book as a book marker to help with your pilgrimage through her holy scriptures. We thank Natalie Choate for permission to make mention hereof, or at least for not saying no when I sent her an email asking for permission. (She now apparently spams us!) She is without a doubt the most dynamic and constructive force that has occurred in any one area of estate and tax planning law for our generation of planners.

Acronyms and Definitions

Stay tuned for the next installment of this series which will feature crucial definitions and rules along with more helpful illustrations.

Christopher Denicolo can be reached at christopher@gassmanpa.com.

*************************************************************

[1] This spousal waiver requirement can be satisfied by an appropriate document signed by the Plan Participant’s spouse before or after the Plan Participant’s death, and will apply to plans covered by ERISA. The waiver requirement will probably not be satisfied by the execution of a prenuptial agreement or an agreement to execute a waiver, because these types of agreements will not satisfy the applicable consent requirements. However nuptial agreements may provide that to the extent the nonparticipating spouse fails to release his or her claims to retirement plan benefits, the heirs of the participant spouse may have a cause of action. For further discussion see Appendix C Exercise Caution When Drafting Nuptial Agreements With Retirement Benefits

2 The authors have seen emails exchanged with Schwab personnel to verify this, and thank financial planner, John M. Prizer, Jr., CFP, CFA, of Maitland, Florida, for sharing his concerns with respect to this.

3 Treasury Regulation 1.401(a)(9)-5, Q&A-7

Richard Connolly’s World

Lawsuits’ Lurid Details Draw an Online Crowd

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the article of interest is “Lawsuits’ Lurid Details Draw an Online Crowd” by Jodi Kantor. The article was featured in The New York Times on February 23, 2015.

Richard’s description is as follows:

Intimate, often painful allegations in lawsuits – intended for the scrutiny of judges and juries only – are increasingly drawing in mass online audiences far from the courthouses where they are filed.

Though all sorts of legal records circulate online – the document website Scribd has more than six million – those involving gender or claims of sexual misconduct tend to resonate more widely than complex corporate litigation or low-level disputes. Lawsuit papers are generally public, but before the advent of electronic filing, most of them remained stuffed inside folders and filing cabinets at courthouses.

Now some plaintiffs’ lawyers, calculating that they will be protected from defamation suits when making charges in civil complaints, distribute the first filings online as a way of controlling the narrative. But more often, electronic case databases, blogs, and social media propel a case into the spotlight even when the parties are not public figures.

Please click here to read this article in its entirety.

Richard also attached a related Op-Ed from The Wall Street Journal by Alan M. Dershowitz. This piece was published on January 14, 2015. Dershowitz is a retired Harvard Law Professor who recounts his experience with false accusations against him in a lawsuit in which he is not a party and has no standing to dispute.

Professor Dershowitz opens his piece with the following:

Imagine the following situation: You’re a 76-year-old man, happily married for nearly 30 years, with three children and two grandchildren. You’ve recently retired after 50 years of teaching at Harvard Law School. You have an unblemished personal record, though your legal and political views are controversial. You wake up on the day before New Year’s Eve to learn that two lawyers have filed a legal document that, in passing, asserts that 15 years ago, you had an inappropriate relationship with an underage female.

The accusation doesn’t mention the alleged victim’s name – she’s referred to only as Jane Doe #3 – and the court document includes no affidavit by her. But her name doesn’t really matter because you have never been with anyone other than your wife during the relevant time period. The accusations against you are totally false, and you can prove it.

The article discusses in detail why Professor Dershowitz has no legal recourse against his accusers and, when he denies the charges in public, he is sued for defamation by the lawyers who filed the lawsuit.

To read this article in its entirety, please click here.

Thoughtful Corner

What is Write About the Following?

Here are some grammatical questions that we run into in the day-to-day operations of our law firm:

Question #1:

Do you capitalize the word “section” when you mention a law, such as Internal Revenue Code “Section” 1236(a)(1)?

Answer #1:

According to the Bluebook Citations to Internal Revenue Code, if you are citing to the current edition of the Code, use the abbreviation “I.R.C.” and provide only the section number, using the regular Bluebook rules for numbering.

Examples:

I.R.C. § 61.

I.R.C. §§ 55-59.

I.R.C. § 368(a), (c)

You may use a section symbol followed by the appropriate section number as a short citation if the section has been cited at least 5 footnotes above.

Example:

Original Citation: I.R.C. § 897(f).

Short Citation: § 897 (e).

If you are citing to a previous edition of the Code, indicate to the reader that you are doing so by including the year in parentheses after the regular citation.

Example:

I.R.C. § 341 (1954).

Question #2:

When you indent quoted language, do you still need to use quotation marks, like in the following in-line quotation from Mark Twain: “The Thursday Report is the best literary thing to come out since Oliver Twist!”

Answer #2:

According to Purdue University’s Online Writing Lab, also known as OWL, when you indent quoted language, it is known as “block quotations.” These type of quotations are to be used when the quoted language exceeds more than four typed lines. It should be indented one inch from the main margin, and quotation marks are not necessary.

Question #3:

Can you use “and/or” without incurring the wrath of the grammar police?

Answer #3:

“And/or” means that two or more persons or entities indicated may together or separately take the action or responsibility so provided.

Unfortunately, the grammar police say no to this one. According to the English Language & Usage Stack Exchange, a question and answer site for etymologists, linguists, and “serious English language enthusiasts,” the conjunction “and/or” is advised against in formal writing.

It can, however, be a defined term in a contract such as the following:

“Pursuant to the provision above, John and/or Mary will be permitted to enter into the property for the purpose of printing out and reading a Thursday Report.”

The language above outlines that John and Mary are permitted to enter the property independently of the other, or they may do so together.

Question #4:

What the heck does “i.e.” mean?

Answer #4:

“i.e.” is an abbreviation taken from the Latin phrase id est, which means “that is” or “in other words.” When written, there should be a period after each letter, and it should always be followed by a comma.

A common mistake made by many people is the desire to use “i.e.” and “e.g.” interchangeably. This is a big no-no! The Latin phrase exempli gratia means “for the sake of example” and is the phrase “e.g.” is derived from. It is often confused to mean “for example.” This abbreviation should also be written with a period after each letter. Although it is usually followed by a comma, the use of the succeeding comma depends on the context in which the term is being used.

For more information, please click here.

Question #5:

What if you want to enumerate some items after using a semicolon, but the preceding phrase is a question? Can you put a question mark with a semicolon?

Answer #5:

Based on several forums, but no absolute or definite source, the consensus is that there is no need to use both a question mark and a semicolon; the question mark alone with suffice.

Example:

Correct: Which of the following three items do you prefer to do?

Incorrect: Which of the following three items do you prefer to do?:

We appreciate your comments, suggestions, and concerns about the above article. To share your thoughts, please email Alan Gassman at agassman@gassmanpa.com.

Humor! (or Lack Thereof!)

Don’t forget to eat pie on Saturday! It’s the perfect pi day: 3/14/15 – won’t happen again for a long time!

Thanks to Carl W. Jenne for bringing this to our attention!

Now, please enjoy the following from Thursday Report comedian Ron Ross:

YOUR NEW TRASH PICKUP SCHEDULE:

Monday – Lawn Trimmings

Tuesday – Trash

Wednesday – Recyclables

Thursday – Words and phrases we no longer use, such as “spiffy” and “rad”

Friday – Ugg Boots

************************************************************

The Cat Who Knew Too Much

The prosecution had a case against Bentley Faberge

For bribery, tax evasion, and fraud

The only witness against him was his cat

Which turned against him when it was de-clawed.

Bentley sent hit men after the cat,

Planning a hanging or immolation.

But the cops led them astray with a trail of cream,

Heading away from the cat’s undisclosed location.

On the day of the trial, the cat was sworn in.

Bentley watched nervously, eyes open wide.

His hands shook as he poured from the pitcher.

Bentley took a sip of water and died.

He had been poisoned;

The investigation revealed this unsettling epilogue.

For his will had been changed, leaving all to the cat;

The only witness to the revision was the dog.

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on SPLIT-DOLLAR IN 15 MINUTES.

Date: March 17, 2015 | 5:00 PM

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan S. Gassman, Christopher J. Denicolo, and Edwin P. Marrow, III will present a 90-minute Strafford Publications, Inc. webinar entitled STRUCTURING JOINT EXEMPT STEP-UP TRUSTS: EVOLVING TOOL TO MAXIMIZE STEP-UP IN BASIS.

In an environment wherein the focus is shifting toward maximizing income tax basis step-up, counsel must be knowledgeable of all tools necessary to reach this goal. One tool that is beneficial for preserving both the inheritance tax exemption and basis step-up is the joint exempt step-up trust (JEST).

This panel will review questions such as:

- What are the best practices for structuring a JEST?

- What drafting techniques must be implemented to maximize basis step-up at both the first-to-die and surviving spouse’s deaths?

- What is the IRS guidance on this tool offered through the Technical Advice Memorandum and Private Letter Rulings?

- Under what circumstances is the JEST most appropriate?

Date: Tuesday, March 24, 2015 | 1:00 PM – 2:30 PM

Location: Online Webinar

Additional Information: For more information or to register, please click here. You may also email Alan Gassman at agassman@gassmanpa.com.

***************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 PM

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan Gassman and Juan Antunez will be presenting a 30-minute webinar on ARBITRATING TRUSTS AND ESTATES DISPUTES.

Date: Tuesday, April 14, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman, Kenneth Crotty, and Christopher Denicolo will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on WHY FLORIDA IS DIFFERENT – IMPORTANT THINGS THAT ESTATE AND TAX PLANNING PROFESSIONALS NEED TO KNOW.

Date: Thursday, April 16, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Kenneth Crotty, and Christopher Denicolo will present a 90-minute webinar for Bloomberg BNA Tax & Accounting on MATHEMATHICSLAND FOR ESTATE PLANNERS – OVER 30 INTERACTIVE SPREADSHEETS AND EXPLANATORY TOOLS THAT YOU NEED TO KNOW HOW TO USE FOR YOUR CLIENTS.

Date: Monday, April 27, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE OLDSMAR PRESENTATION:

FICPA SUNCOAST SCRAMBLE GOLF TOURNAMENT

Kenneth J. Crotty and Christopher J. Denicolo will speak at the FICPA Suncoast Scramble Golf Tournament on the topic of MATHEMATICS FOR ESTATE PLANNERS INCLUDING 10 ESTATE PLANNING STRATEGIES NOT TO MISS.

Date: Friday, May 1, 2015 | CPE Presentations from 9:00 AM – 11:30 AM

Location: East Lake Woodlands Country Club | 1055 E Lake Woodlands Parkway, Oldsmar, FL 34677

Additional Information: For more information about registration, sponsorship, or this event, please click here or click here to download the Tournament brochure.

***********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman, Jerry Hesch, and Richard Oshins will present THE MATHEMATICS OF ESTATE PLANNING. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law | 1025 Commons Circle, Naples, Florida

Additional Information: For more information, please click here or email Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami | 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, and Barry Flagg will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on THE TAX ADVISORS GUIDE TO PERMANENT LIFE INSURANCE AND STRUCTURING TOOLS AND TECHNIQUES.

Date: Tuesday, May 12, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

******************************************************************

LIVE BRADENTON, FLORIDA PRESENTATION

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Tuesday, May 12, 2015 | Time TBA

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE STUART, FLORIDA PRESENTATION

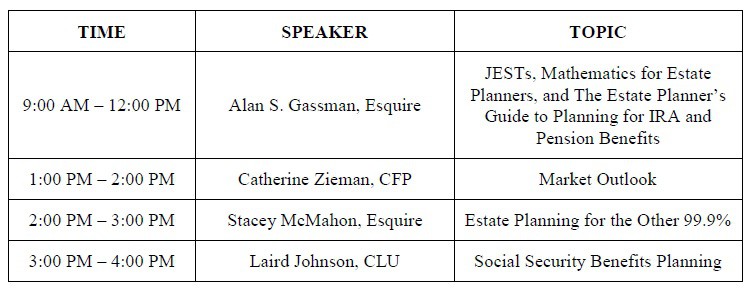

Alan Gassman will be the featured “headline” speaker the Martin County Estate Planning Council Annual Tax and Estate Planning Seminar. He will be doing a three-hour talk on the topics of JESTs, MATHEMATICS FOR ESTATE PLANNERS, AND THE ESTATE PLANNER’S GUIDE TO PLANNING FOR IRA AND PENSION BENEFITS – YES, YOU CAN FINALLY UNDERSTAND THESE RULES!

The tentative schedule for this one-day program is as follows:

Date: May 15, 2015 | 8:15 AM – 4:30 PM; Alan Gassman speaks from 9:00 AM to 12:00 PM

Location: Stuart Corinthian Yacht Club | 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

**************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE PRESENTATION:

2015 UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay | 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

**************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

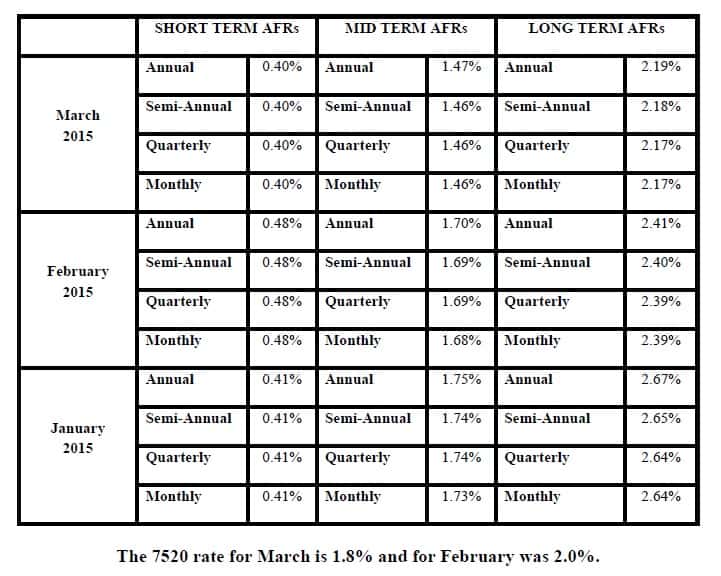

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.