The Thursday Report – 2.26.15 – 529 vs. Variable Annuities, Puerto Rico Tax Haven, and Medical Billing 501

Are 529 Plans Better Investments than Variable Annuities, Even if Not Spent on Education?

Moving Business Operations and Personal Service Activities to Puerto Rico

Medical Billing 501: Quick Tips to Enhance an Already Efficient Billing Operation – Payer Underpayments by Colin Shalin

Seminar Spotlight – The Florida Bar Annual Wealth Protection Conference – Now 2 Days!

Richard Connolly’s World – Finding the ‘Right’ Way to Dispose of Ill-Gotten Gains

A Note From One of Our Readers – PDFs vs Word Documents as Attachments

Thoughtful Corner – Comparing Documents

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Are 529 Plans Better Investments than Variable Annuities, Even if Not Spent on Education?

by Alan S. Gassman and Brandon Ketron

Are 529 Plans better investments than variable annuities, even if not spent on education? If so, why ever use a variable annuity?

The authors would like to thank Michael E. Kitces, MSFS, MTAX, CFP, CLU, ChFC, RHU, REBC, CASL for his comments on this article. Be sure to check out his blog, Nerd’s Eye View, by clicking here, and yes, all of those initials after his name are real!

Most clients view 529 Plans to be appropriate planning vehicles only when all or most of the monies will be devoted solely to college and graduate school tuition and permitted expenses. At the same time, a number of financial advisors often consider variable annuities viable for facilitating the deferral of tax on income. In this article, we aim to explore whether a 529 Plan might serve a similar purpose, and, in fact, be preferred over a variable annuity for many clients. There are a number of advantages to using 529 Plans beyond educational funding. In many situations, 529 Plans will be preferred to variable annuities, even when educational expenses are not the primary goal.

The primary purposes of this article is to help the reader understand important tax and investment characteristics of both variable annuities and 529 Plans and to question the wisdom of the purchase of variable annuities while reviewing the advantages and features of 529 Plans.

- Non-Educational Distributions from 529 Plans Carry Out Income and Basis Pro Rata; With Annuities, the First Dollars Out are Taxable

Distributions from variable annuities normally carry out accumulated income first and principal only thereafter. A client holding a $100,000 variable annuity that cost $80,000 must pay tax on the first $20,000 withdrawn. At the 43.4% tax bracket, this would cost $8,680 in combined income and Medicare taxes.

Monies withdrawn from a 529 Plan are only taxable pro rata to the income portion. In the above example, there would be tax on only $4,000 worth of income (20% of the withdrawal), so the tax would instead only be $1,736.

While it is true that the $4,000 will be taxed at the taxpayer’s highest tax bracket plus an additional 10%, the excess of $20,000 ($7,920) to 53.4% of $4,000 ($2,136) is a big difference.[1]

Yes, a variable annuity might be exchanged tax-free under Internal Revenue Code Section 1035 in order to facilitate less than $20,000 of the distribution being taxable. However, this would involve a tax-free exchange into multiple separate annuity contracts and then waiting 18 months before making the withdrawal.

Alternatively, two annuity carriers that we are aware of do offer products that allow pro-rata distribution of income, if the IRS accepts this, but the vast majority of annuity companies do not offer this option. One of the exceptions is the LincolnI4Life, where the current year’s income is paid out first, and then pro rata between earnings and basis after the current year’s income. Equitable/AXA has a similar product arrangement. 529 Plans are less expensive than these commercial annuities and have other characteristics as herein described.

- 529 Plans Can Continue After the Death of a Family Member

Variable annuities have to be paid out within five (5) years of the death of the annuity holder, or possibly over the life expectancy of a beneficiary, with the sole exception of the above being that a surviving spouse can facilitate deferral for his or her lifetime.

With a 529 Plan, there is no distribution requirement upon death or any other event. A 529 Plan can pass from person to person and generation to generation indefinitely and is not even limited by the rule against perpetuities, which is 365 years in Florida.[2]

- 529 Plans Reward Educational Pursuits

529 Plans encourage education and limit educational living expenses to levels that are recommended by applicable colleges and universities. No tax is payable on income that would otherwise be subject to tax when 529 Plan monies are spent in this manner.

There is no such protection with annuities.

- 529 Plans Can be Owned by Complex Trusts, Family Limited Partnerships and Other Entities

Variable annuities cannot be safely owned by trusts that are taxed independently from their Grantor unless the trust has special language that makes it clear that the annuity is held for the benefit of an identified individual(s) or a private letter ruling is received from the Service, if they are even willing to issue one.

Most financial advisors are not aware that upon the death of an individual annuity owner, contract ownership or other rights that pass to an irrevocable trust to be held for a spouse or descendants will probably have to be paid out within five (5) years, thus triggering all income tax. Presently, irrevocable trusts are in the 39.6% income tax bracket and are also subject to the 3.8% Medicare tax on undistributed income exceeding $12,055. Having to distribute this income to beneficiaries in lower brackets to save income tax may result in the assets being wasted by inappropriate spending, loss to creditors or spouses, or otherwise being mishandled in a way the Grantor did not intend.

Some planners suggest incorporating trust provisions similar to those required to allow a trust to spread its retirement plan distributions over the life of a trust beneficiary. Unfortunately, the IRS has refused to issue regulations to make this action safe, so clients are effectively bound by the five-year rule described above.

- 529 Plan Ownership Can be Transferred Without Triggering Income Taxes

Income within a variable annuity contract is triggered upon transfer. If someone wants to make a gift of a variable annuity contract, he or she is considered to have received all income from the contract at the time of transfer. If he or she has not reached age 59½, or the transferor is not an individual, then this income is taxed at the taxpayer’s highest income tax bracket plus an additional 10%.

On the other hand, 529 Plan ownership can be freely transferred without triggering such taxes.

- 529 Plans are Less Expensive to Purchase and Maintain

According to a Morning Star report dated February 28, 2013, for the average 529 Plan that is directly sold and actively managed, the annual expense is 0.84% per year, and the average variable annuity expense is around 2.5% per year. Hybrid index annuities that are designed to replicate market index results and avoid market index crashes are said to trail the actual market index plus dividends by 4% to 6% on average.

- 529 Plans Do Not Have Surrender Charges or Generate Large Commissions

Large commissions can influence advisors to sell clients products that may not be suitable to them or in their best interests. 529 Plans do not have surrender charges or generate large commissions that might influence advisors. While there are low cost, no-load annuity products that compete with 529 Plans from an expense standpoint, a great many investors do work with commissioned sales organizations, such as banks, brokerage firms, and insurance agencies, and should have access to the choices available in the commissioned product system.

For example, clients who would like to invest in a contract based upon the well-known and respected American Fund family could buy a State of Florida 529 Plan, which has average annual charges on the equity portion of the Plan of 1.14%.

The Lincoln Investor Advantage™ variable annuity (a loaded annuity contract,) which permits the contract owner to invest in American Fund, may cost approximately 2.92% and have surrender charges based upon 7% in year 1, 6% in year 2, 5% in year 3, 4% in year 4, and 3% in year 5.

Alternatively, when you consider a possible cost savings of 1.78% per year for 18 years and assume 6% a year in growth, a $100,000 investment would grow to $232,207.63 under a 529 Plan costing 1.14% a year, and only $167,433.12 under a variable annuity costing 2.92% a year.

Even if cashed in all at once, the $132,207.63 of income from the 529 Plan, taxed at 53.4%, leaves a total after tax of $138,167.15. The 529 Plan wins even after application of the 10% excise tax at the highest tax bracket![3]

A similar comparison can be conducted on no-load, low-cost 529 Plans and variable annuities, and the variable annuity will normally be superior if a large portion of the 529 Plan above and beyond its original cost basis is not spent on educational expenses. For example, a no load annuity contract through Vanguard could have annual expenses as low as 0.76% and the above analysis would have a much different result. But 529 Plans still have the other advantages described above and below.

It is of note that 529 Plans do have limits on the amount of assets that can be contributed on behalf of each designated beneficiary. These amounts vary among the states but are typically limited to amounts that are necessary to finance the designated beneficiary’s educational expenses. For example, a 529 Plan offered through Vanguard imposes contribution limits of $370,000.

- Five Year Forward Averaging of 529 Plan Gifts

Clients who wish to make gifts using 529 Plan funding can elect to have 80% of the amount transferred considered to have been gifted in the four years subsequent to the 529 Plan funding to maximize use of the $14,000 per person per year annual gift tax exclusion. For example, a $70,000 contribution to a 529 Plan for a grandchild can be considered to be a $14,000 gift in the year of contribution and in each of the four subsequent years. If the donor dies before the beginning of the fifth year, then the applicable portion of the unapplied gift will be considered an asset of the donor’s estate for estate tax purposes, assuming that the donor will be estate taxable with such addition.

A gift that is used to purchase a variable annuity will be considered to have been made 100% in the year of purchase.

It is noteworthy that monies paid directly for tuition are not counted as gifts under the federal estate and gift tax law, but monies put into a 529 Plan that is eventually used to pay tuition will be considered to be gifts but will use part of a person’s $5,340,000 estate tax exemption amount if and when exceeding $14,000 a year. Simple low-cost passive mutual funds which have very little income and generate qualified dividends and capital gains which are taxed at the 20% bracket (plus a possible 3.8% for Medicare tax, when applicable) may therefore be preferred over 529 Plans, at least for monies to be paid for tuition.

- In Some States, 529 Plans are Protected from Creditors but Variable Annuities are Not

Many states provide protection for all 529 Plans and variable annuities, and some states provide protection for 529 Plans but not for variable annuities or only for variable annuities to the extent deemed reasonably necessary to provide for the retirement needs of the owner. A few states, like Colorado, Virginia, and West Virginia, provide creditor protection for 529 Plans but not variable annuities.

- Widely Criticized Investment Aspects Found in Certain Variable Annuities are not Permitted in 529 Plans

Many investors have been disappointed to learn that “guaranteed income benefit features” and “equity index guaranties” that were explained to induce the purchase of variable annuities have turned out to have been not as expected and much more expensive than understood. State and federal regulation associated with 529 Plan investments and disclosures do not permit these or certain other features that most conservative investors and investment advisors find to be expensive and generally undesirable for the vast majority of clients. See Alan S. Gassman Evaluating Commercial Annuities and Reverse Mortgages: Are Deferred Payment Annuities too Good to be True?

********************************************************

[1] Michael Kitces, co-author of the “Advisor’s Guide to Annuities,” provided the authors with the following comment: “Notably, there have been recent discussions in tax committees about raising the 10% penalty, specifically to dissuade people from using a 529 Plan as a non-qualified accumulation vehicle.”

[2] The authors expect that within 365 years, the rule against perpetuity will change. We regret that we will not be here in our present form to witness that.

[3] On the other hand, if the investment was in a Vanguard variable annuity with an average cost of 7/10ths of 1% as opposed to the Vanguard 529 Plan with an average cost of 0.21%, the net received after liquidation and taxes would be $191,368.75 for the 529 Plan and $185,766.72 for the variable annuity.

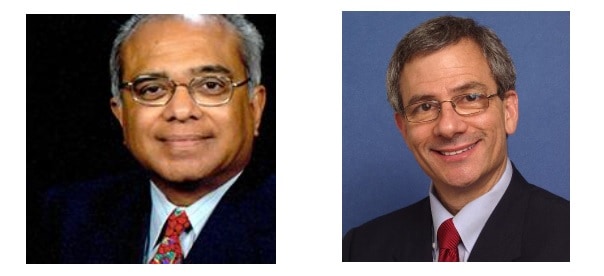

Moving Business Operations and Personal Service Activities to Puerto Rico

by Alan Gassman and Erick Negrón

Attorney Erick G. Negrón Rivera was born in San Juan, Puerto Rico. He received a Bachelor’s degree in Economics from Yale University in 1982 and a Juris Doctor from Harvard Law School in 1985. As Special Counsel at the law firm of Rexach & Picó in San Juan, he has specialized for the last two decades in corporate, tax, and insurance regulatory matters. Since 2009, he has been a member of the board of Consero, A.I., the first captive international insurer that became licensed in Puerto Rico. Attorney Negrón has also published several articles on tax and economic development issues. Erick Negrón can be reached at negron@rexachpico.com.

Puerto Rico is a US-flag territory, but it is not a state or a US taxed jurisdiction. Puerto Rican’s do not vote for the United States President, have Congressmen, or pay US income taxes on their Puerto Rican income.

Besides great natural beauty, a fantastic culture, talented people, and a Ritz Carlton hotel in San Juan on the beach that can be seen from the airport, Puerto Rico offers US citizens who reside there the ability to pay income tax on many kinds of businesses and vocations at a rate much lower than standard US taxes. Puerto Rico corporations are “foreign” corporations for US tax purposes, and thus, not regularly subject to US income taxation.

Establishment of Puerto Rican Residence

To take advantage of these rules, it is necessary to truly reside in Puerto Rico and to have the business and work accomplished in Puerto Rico. Internal Revenue Code Section 937 provides guidance to determine if an individual truly resides in a territory such as Puerto Rico. The section establishes three tests: 1.) the presence test, 2.) the tax home test, and 3.) the closer connection test. All three tests must be satisfied in order to establish Puerto Rican residency for tax purposes. The general requirements of the three tests are as follows:

- Presence Test – Normally requires the taxpayer to spend at least 183 days in the territory

- Tax Home Test – The primary location of the taxpayer’s business activities must be in the territory where the residence is claimed

- Closer Connection Test – The taxpayer must have a closer connection to the territory where the residence is claimed than with the United States or some other location with which there may be a connection. Relevant factors include where the taxpayer votes, where the taxpayer has his or her driver’s license and bank accounts, where the taxpayer’s family lives, where the taxpayer conducts social, religious, and community activities, and the country of residence designated by the taxpayer on forms and documents.

Tax Incentives Offered to Bona Fide Residents of Puerto Rico

Act 20 of 2012, “An Act to Promote Exportation of Services,” allows a US citizen to own a Puerto Rican company that will be subject to corporate income tax at a rate of 4 percent with no tax on dividends paid to Puerto Rico residents. The Act also offers exemptions, or partial exemptions, on local real estate and municipal taxes and licenses. To be eligible for the tax benefits of Act 20, a company must maintain a “bona fide” office in Puerto Rico which carries out an approved service, and its activities must be determined to be “in the best economic and social interests of Puerto Rico.” This determination is made by the Department of Economic Development and Commerce of Puerto Rico and carries a 20 year term to protect the company from any future changes in the law.

This can be very attractive to individuals who make their living as computer programmers, Internet marketers, office-based management consultants, and in many other fields and professions.

Act 22, “An Act to Promote the Relocation of Individual Investors,” provides another tax incentive for new Puerto Rico Residents. An individual who did not reside in Puerto Rico during the six-year period prior to January 17, 2012 (that is, since January 17, 2006) will be eligible to become exempt for taxation gains on investments and passive income. This includes interest, dividends, and capital gains.

Close proximity to Florida makes this an appealing opportunity given the relatively inexpensive and plentiful flights available to visit family and customers in Florida, as long as the days actually spent here are minimal.

For more information on Puerto Rican Act 20 and Act 22, please click here to read a Mayer Brown report by Mark H. Leeds and Gabriel Hernandez.

Medical Billing 501: Quick Tips to Enhance an Already Efficient Billing Operation – Payer Underpayments

by Colin Shalin

Colin Shalin is a Practice Management Consultant specializing in A/R and financial management with an emphasis on billing and collection process and performance improvement. Contact him by phone at (727) 244-1179 or by emailing consultcolin@gmail.com. © 2014

Please click here to see Colin’s first Thursday Report article regarding Employee Incentive Plans. This week, Colin discusses how medical offices can improve their billing practices when it comes to payer underpayments. We thank Colin for making this content available to Thursday Report readers!

Monthly review of variances between payments posted and negotiated reimbursements will ensure payers are not underpaying for services and can enhance your ability to collect any additional reimbursement you are due. Most practice management systems have the capability to load, manage, and compare the reimbursement tables so as to allow this task to be performed relatively simply and timely. If you are not currently performing this task, of if you are pulling random EOB samples to accomplish it manually, you should develop a project team to work with your vendor immediately to implement this function in the most automated manner possible. Some ideas for either implementing or enhancing this task are as follows:

1.) Ensure you load at least Medicare, Medicaid, and your contracted payers’ reimbursement tables. Be sure to load individual plans for which you have negotiated multiple reimbursement methodologies. If you still have any individual physician/provider, location, modality, or facility contracts with unique reimbursements, make sure you create a specific table for these as well. Be sure you allow for differences in rates based on modifies also.

2.) Most systems will allow reimbursement rate creation by procedure code based on a percent of Medicare. This will save a lot of manual entry during the initial load and annual updates. You can try to negotiate future contracts on this basis to allow for a simpler comparison process (which translates to an easier ability to identify underpayments), however, contract negotiation has been waning over the past few years as more payers move to location-based fee schedules (some of which may be based on a percent of Medicare, etc. methodology.)

3.) If you have a specific rate table for each procedure code, try to get the table in an electronic format which your vendor can accept for download.

4.) Report design is a crucial step. Work with your vendor to ensure the variance report:

- Allows you to select a dollar or percent range for which to ignore variances. You do not want to have to pay attention to low dollar or cents variances but focus instead on those that are going to be worth your time and effort. Depending on your average gross charge per procedure, the minimum amount could be anywhere from $1 – $3, or 1% – 10%.

- Gives you a run-time option to choose only a certain payer class, range of related payers, or specific payers. Depending on how you load your reimbursement tables, you may want to look at specific Insurance Company/Plan codes, Financial Classes/Carrier codes, or all loaded tables.

- Gives you a run-time option to choose only a certain modality, range of procedure code, or specific procedure code either across payers or for the range chosen above.

- Gives you similar run-time options for specific or ranges of payment posting dates, physician/providers or any other contract basis variation you may have.

- Allows you to sort the output by payer, procedure code, variance amount, physician/provider, or any combination of contract basis variation thereof. The ability to output the data to a spreadsheet program for further sorting can also be useful.

- Remember to consider modifiers during both the load and report design phases to ensure the most useful data output.

5.) Make sure all communication with payers regarding this issue demonstrates your belief that this is a serious and possibly egregious violation of your contract. You may consider involving your attorney or the Insurance Commissioner depending on the severity of the problem. Check your state’s prompt payment laws for identification of violations, statute of limitations, and possible remedies.

6.) Use the data to facilitate meetings in your office with Payer Reps to let them know you are watching remittances closely and to resolve the underpayments identified. Make sure you document the payer’s stated action plan and your agreed-upon deadline or follow-up date to ensure timely reprocessing by the payer. While they are often not excited to see them, a stack of paper claims with identified underpayments may help the payer visualize the issue and want to resolve it in a timelier manner.

7.) Remember to provide feedback to your payment posting or other staff should you find errors they made during the review. Don’t forget to include this data in your quality audit process by function and the annual performance review folder for affected staff.

Depending on your practice management system’s capabilities, monitoring payer underpayments can range from overwhelming to relatively easy. Whether it is performed manually on a periodic basis or in an automated fashion daily, the monitoring process is crucial to ensuring proper payments are received and needs to be visual to the payer to ensure conformity with contracted reimbursements.

Seminar Spotlight

The Florida Bar Annual Wealth Protection Conference

The Florida Bar Annual Wealth Protection Conference is expanding this year! The May 2015 program will feature a Thursday Fundamentals program and a Friday Advanced program. Come for one day, or come for both, but don’t miss it!

Denis Kleinfeld and Alan Gassman are pleased to announce that the 53rd Annual Tax Section Wealth Protection Conference this year will provide Bar members with the option to attend one or both days of a fundamentals program that will be well-suited to both lawyers who have limited knowledge and experience and experienced lawyers wishing to refresh and update their awareness and practices.

There will be an interactive cocktail party Thursday evening, and attendees are invited to attend the speakers’ dinner (Dutch treat) on Thursday evening as well. This is a great opportunity to mingle with the speakers and other professionals. Bring your own cigar!

The Thursday program will also feature panel discussions where every question and topic suggested by attendees will be answered to the fullest extent.

On Friday, the conference will feature an advanced program, which will be well-suited to both advanced practitioners and beginners who have completed the Thursday Fundamentals program.

All attendees will receive printed course books with over 600 pages of valuable information, which will also be available online and by PDF to registered attendees with no extra charge for the printed and electronic materials.

This year’s program will include 16 speakers, most of whom have a national reputation.

We have worked hard to ensure that this will be the best 2-day program available to cover fundamentals of asset protection, recent developments, and practical planning aspects of Wealth Protection.

Topics and speakers for Day One, Thursday, May 7, 2015, include the following:

- Arthur C. Neiwirth and Ronald G. Neiwirth on Basic Bankruptcy – Welcome to the Fish Bowl

- Ronald G. Neiwirth and Denis A. Kleinfeld on The Trick and Traps of Creditors’ Remedy of Fraudulent Conveyance

- Professor Jerome M. Hesch on Basic Tax Laws and Planning Opportunities Associated with Commercial and Private Annuities, Life Insurance Policies, and Debt Forgiveness

Advanced topics and speakers for Day Two, Friday, May 8, 2015, include the following:

- Denis A. Kleinfeld, Howard Fisher, and Alexander Fisher on Foreign Trusts, Powers of Appointment, Trust Protectors, Planning Opportunities and Traps for the Unwary

- Ky Koch, Esquire and Courtney Koch, Esquire on Marital Agreements and Divorce Planning – What to Do Before, During, and After There is Trouble in Paradise

- Alan S. Gassman and Christopher J. Denicolo on 10 Examples of Effective Asset Protection Plans That Have Worked

- Michael C. Markham and Ronald G. Neiwirth on How an Aggressive Creditor’s Lawyers Will Attack Protection Structures

Registration information will be forthcoming. Please consider attending this event. A splendid time is guaranteed for all!

For more information, please email Alan Gassman at agassman@gassmanpa.com or click here to pre-register.

Mini-Spotlight

Martin County Estate Planning Council Annual Tax and Estate Planning Seminar

Don’t miss the one-day Martin County Estate Planning Council Seminar on May 15, 2015!

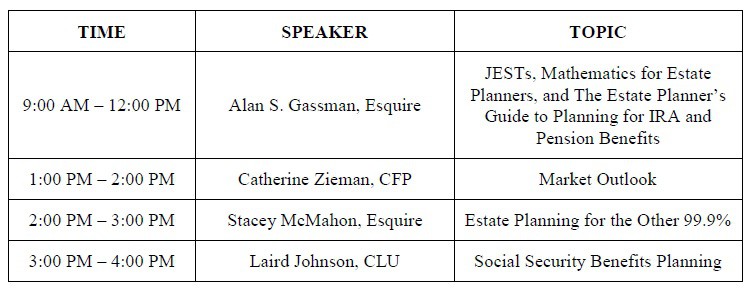

Alan Gassman will be the morning speaker at the event; he will be speaking on JESTs, Mathematics for Estate Planners, and The Estate Planner’s Guide to Planning for IRA and Pension Benefits – Yes, You Can Finally Understand These Rules! This presentation will take place from 9:00 AM to 12:00 PM.

The afternoon will consist of three one-hour presentations by Catherine Zieman, CFP, Stacey McMahon, Esquire, and Laird Johnson, CLU.

The Martin County Estate Planning Council Annual Tax and Estate Planning Seminar will take place at the Stuart Corinthian Yacht Club in Stuart, Florida.

For more information, contact the amazing Lisa Clasen at lclasen@kslattorneys.com.

Richard Connolly’s World

Finding the ‘Right’ Way to Dispose of Ill-Gotten Gains

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the article of interest is “Finding the ‘Right’ Way to Dispose of Ill-Gotten Gains” by Paul Sullivan. This article was featured in The New York Times on February 6, 2015.

Richard’s description is as follows:

Several years ago, Thomas M. DiBiagio was asked by a large European company to run an internal audit on its South African operations. They suspected something might be amiss. And they were right. In the course of the audit, he discovered about $12 million that might best be described as ill-gotten gains.

Mr. DiBiagio, now a partner at the law firm Baker Botts in Washington, reported what he found to the company’s management and suggested something novel: Since the money had been earned “from aggressive business practices” – a euphemism for a crime he would not name – the company should give it to charity.

The company, which he described as a $35 billion to $40 billion business listed on a United States stock exchange, agreed.

The company gave him two years to give away the money…

The project, while rewarding, turned out to be far more complicated and time-consuming than he, with no experience giving away this kind of money, had imagined.

It was chock-full of lessons for wealthy donors and recipients – and could even be the seed of a new line of business for law firms with corporate clients who find their own wrongdoing before federal prosecutors get wind of it.

Please click here to read this article in its entirety.

A Note From One of Our Readers

PDFs vs Word Documents as Attachments

The Thoughtful Corner in last week’s Thursday Report focused on business etiquette in email communication. We endorsed the idea of sending document attachments in Word format instead of the more typically used PDF format. To see this article, please click here.

We received the following email from Smilie G. Rogers, who had this to say about our ideas:

“Not sure I agree with your suggestion that Word attachment should trump PDFs. First, Word documents are more likely to contain metadata. Second, PDF to Word conversion is easy, online, and free, but be that as it may, having a good converter program like Omnipage by Nuance is essential in my office for quickly (and accurately) converting PDFs (often deeds, but you name it) to Word. As an aside, as a semi-solo without staff, I like to use Dragon’s “Read That” feature to read a deed description back to me just in case my line-by-line review missed something.”

Thanks, Smilie, for sharing your insight into bettering business communication practices.

Thoughtful Corner

Comparing Documents

Until recently, it was considered to be rude by many to take a document that another lawyer drafted and make changes to it.

The proper protocol was to give suggestions for changes or possibly even send a letter outlining exact changes, but you typically would not copy the document and make the changes yourself. Doing so would take work away from the lawyer who drafted the document.

That rule seems long gone, at least from the point-of-view of those of us who have not been practicing law for 35 to 40 years. The following should go without saying but commonly does not:

- When changing someone’s document, send them a compare version that clearly shows the changes you have made. Yes, that may take you an extra five minutes to do, but why put that burden on the other person when you have the updated document on your screen and have taken the prerogative to make changes to their document.

- The corollary of the above is that you can be sued for malpractice if you make a change to a document that is wrong, not recognized by your own client, or possibly the other side. You owe the other side a compare, and you owe it to yourself to give the other side a compared version.

- Never ever ever ever (we mean never!) save over a previous document and then tell the other side that it is not available because you saved over it.While you typically could pull the original document from an old email, it is much safer for a malpractice avoidance and from a document management standpoint to save every revised version of a document with a separate suffix and to show on your compare which version you are comparing back to.This also keeps your clerical staff honest. It may be a bit more work for your clerical staff, but you cannot rely upon even a very good secretary to be perfect every time. What if he, she, or the computer accidentally eliminated an important word, clause, or section? How would you know if you do not see a compare?We print a lot of draft documents in our office, and we kill a lot of trees, but we practice safe law, and in our opinion, this means printing compares and taking a look at every page.

- Use strikeouts and underlines in your compares instead of the default Word version where what is deleted is shown in small boxes to the right. It takes the brain five times as much time and opens you up for mistakes if you cannot see exactly what happened in the text.We have found it best to use WordPerfect for documents we are likely to compare, however, the WordPerfect compare style can be emulated in Microsoft Word. To do this, all you have to do is navigate to the “Review” tab in Microsoft Word, click the arrow by the “Show Markup” button, and, under the Balloons drop-down menu, choose “Show All Revisions Inline.” This choice will force all changes in the compare to be shown in strikeouts and underlines, which will look very similar to the automatic formatting of a WordPerfect compare.

To see examples of a Word compare and a WordPerfect compare, please click accordingly: Microsoft Word Compare (unmodified). Microsoft Word Compare (modified). WordPerfect Compare.

We will appreciate any questions, comments, or suggestions offered for the above article. It has been excerpted from a PowerPoint that we will present to third year law students and alumni (and you, too, if you would like to attend!) at the Ave Maria School of Law on a date to be determined. The presentation will be on professional acceleration. For more information, you can email Alan Gassman at agassman@gassmanpa.com or Janine Gunyan at janine@gassmanpa.com.

Humor! (or Lack Thereof!)

Please enjoy the following from our resident comedy expert Ron Ross:

IN THE NEWS THIS WEEK:

What Republican is NOT Running for President in 2016?

The list so far:

- Abraham Lincoln

- Theodore Roosevelt

- The mythical moderate who can appeal to both liberals and conservatives

A Word From Our Sponsors

This week’s Thursday Report brought to you by “Nice Horsey” Hair Extensions. If it’s good enough for the Budweiser Clydesdale, it’s good enough for you!

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on PREMIUM FINANCING IN 15 MINUTES.

Date: March 4, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY.

This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced. See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well. You can sign up for this free webinar by clicking here.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: March 5, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please email Alan Gassman at agassman@gassmanpa.com for more information.

****************************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015 on HEALTHCARE TAX ISSUES.

To see the complete schedule for this program, please click here.

Date: March 6 – 7, 2015 ǀ Alan Gassman will speak on March 6 at 11:00 AM

Location: Hyatt Regency Orlando International Airport | 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 22.5-minute webinar on SPLIT-DOLLAR IN 15 MINUTES.

Date: March 17, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan S. Gassman, Christopher J. Denicolo, and Edwin P. Marrow, III will present a 90-minute Strafford Publications, Inc. webinar entitled STRUCTURING JOINT EXEMPT STEP-UP TRUSTS: EVOLVING TOOL TO MAXIMIZE STEP-UP IN BASIS.

In an environment wherein the focus is shifting toward maximizing income tax basis step-up, counsel must be knowledgeable of all tools necessary to reach this goal. One tool that is beneficial for preserving both the inheritance tax exemption and basis step-up is the joint exempt step-up trust (JEST).

This panel will review questions such as:

- What are the best practices for structuring a JEST?

- What drafting techniques must be implemented to maximize basis step-up at both the first-to-die and surviving spouse’s deaths?

- What is the IRS guidance on this tool offered through the Technical Advice Memorandum and Private Letter Rulings?

- Under what circumstances is the JEST most appropriate?

Date: Tuesday, March 24, 2015 | 1:00 PM – 2:30 PM

Location: Online Webinar

Additional Information: For more information or to register, please click here. You may also email Alan Gassman at agassman@gassmanpa.com.

***************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 p.m.

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE OLDSMAR PRESENTATION:

FICPA SUNCOAST SCRAMBLE GOLF TOURNAMENT

Kenneth J. Crotty and Christopher J. Denicolo will speak at the FICPA Suncoast Scramble Golf Tournament on the topic of MATHEMATICS FOR ESTATE PLANNERS INCLUDING 10 ESTATE PLANNING STRATEGIES NOT TO MISS.

Date: Friday, May 1, 2015 | CPE Presentations from 9:00 AM – 11:30 AM

Location: East Lake Woodlands Country Club | 1055 E Lake Woodlands Parkway, Oldsmar, FL 34677

Additional Information: For more information about registration, sponsorship, or this event, please click here or click here to download the Tournament brochure.

***********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman, Jerry Hesch, and Richard Oshins will present THE MATHEMATICS OF ESTATE PLANNING. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law | 1025 Commons Circle, Naples, Florida

Additional Information: For more information, please click here or email Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami | 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE STUART, FLORIDA PRESENTATION

Alan Gassman will be the featured “headline” speaker the Martin County Estate Planning Council Annual Seminar. He will be doing a three-hour talk on the topics of JESTs, MATHEMATICS FOR ESTATE PLANNERS, AND THE ESTATE PLANNER’S GUIDE TO PLANNING FOR IRA AND PENSION BENEFITS – YES, YOU CAN FINALLY UNDERSTAND THESE RULES!

The tentative schedule for this one-day program is as follows:

Date: May 15, 2015 | 8:15 AM – 4:30 PM; Alan Gassman speaks from 9:00 AM to 12:00 PM

Location: Stuart Corinthian Yacht Club | 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

*************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

******************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

**************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please click here.

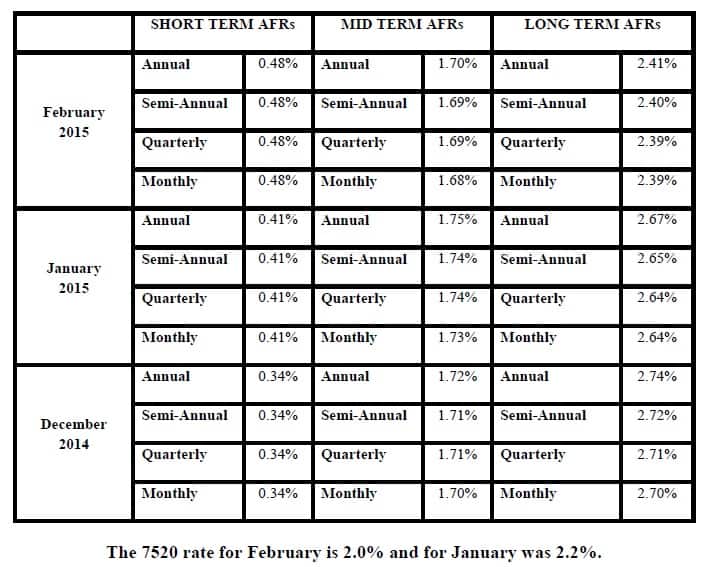

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.