The Thursday Report – 1.7.16 – Get Ready to Heckle Us at Heckerling!

Don’t Miss These Talks at the Bloomberg BNA Booth at Heckerling!

What You Probably Do Not Know About Portability, Part I

LLC Operating Agreement Can Serve as “Transfer on Death” Mechanism to Avoid Probate and Trust Interaction (Not to Mention Confusion and Uncertainty)

An Interview with Jonathan Blattmachr

Announcing the Alan Gassman Channel with InterActive Legal

Richard Connolly’s World – Big Law Gains Another Female Leader

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“The king of France’s picture, set with 408 diamonds, I give to my daughter Sarah, requesting that she not form any of those diamonds into ornaments…and thereby introduce or countenance the expensive, vain, and useless fashion of wearing jewels in this country.”

– Benjamin Franklin

In his will, dated July 17, 1788, Benjamin Franklin left the above quote as part of a disposition of a French painting with 408 diamonds in it, with the request that the diamonds never be worn. Explanations in wills such as the one illustrated above have generally been abandoned today; however, a statement can make a gift more meaningful. For now, let’s all put the jewelry in the safe box and take this quote as a nice reminder to live modestly, enjoy life, and celebrate Thursdays for all they are worth!

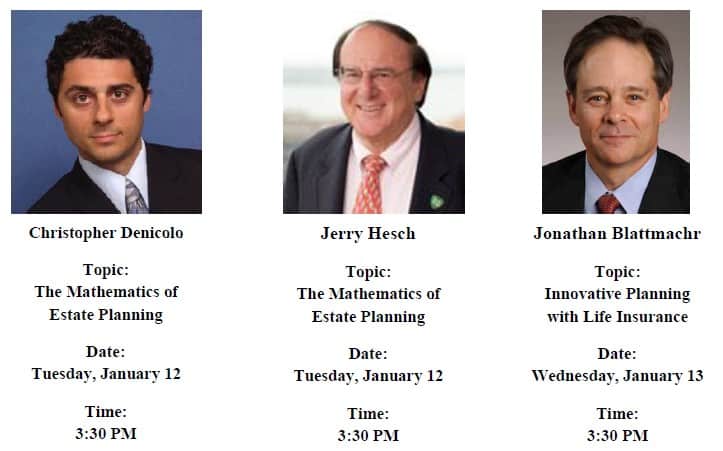

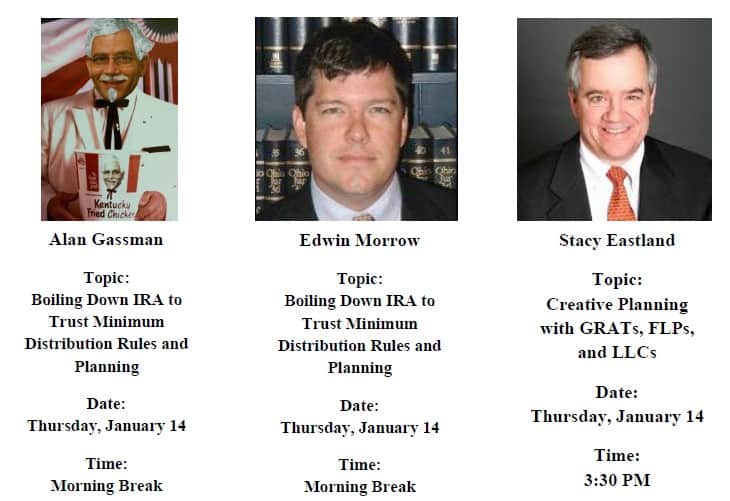

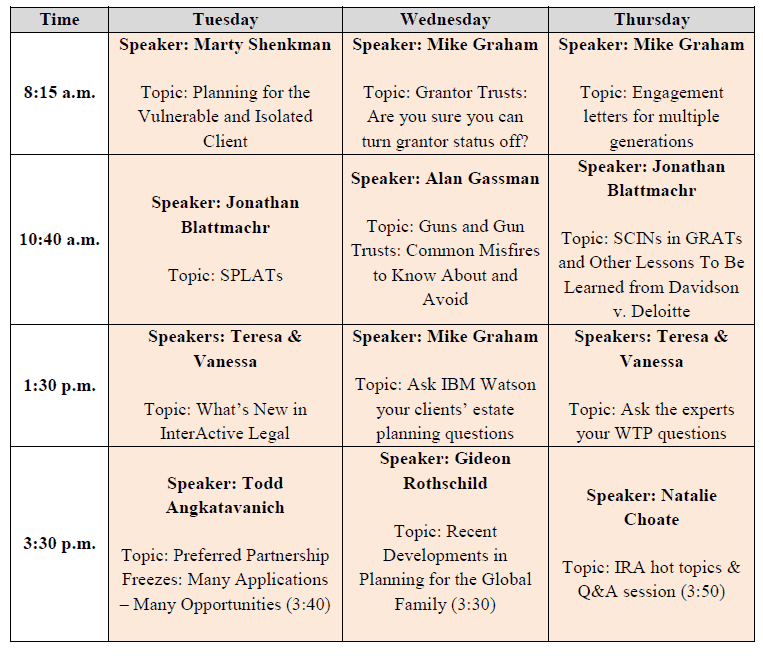

Don’t Miss These Talks at the Bloomberg BNA Booths at Heckerling!

Heckerling is upon us once again, and Bloomberg BNA is creating a fantastic lineups of speakers that should not be missed!

At the Bloomberg BNA booth, meet some of our 2016 Webinar Series presenters. All of the following presenters will be conducting an Essential Elements or Practical and Creative Planning Webinar in 2016. They will be at the Bloomberg BNA booth to talk about their ideas and presentations, as well as answer any questions you may have.

The schedule, as of the time of this publication, is as follows:

What You Probably Do Not Know About Portability, Part I

by Alan S. Gassman; Edwin P. Morrow, III;

Seaver Brown; and Brandon Ketron

The introduction to our new, extensive article on Portability Mistakes, printed in the Christmas Eve 2015 edition of the Thursday Report covered the common mistake of assuming estate tax planning is not needed, given the potential rapid growth of assets that a married couple may have and the slow growth of the consumer price index that adjusts the estate tax exemption.

Part One of this examination will look at two common mistakes that have to do with loss of the portability allowance and are as follows:

Losing the Portability Allowance Because of Remarriage to a New Spouse Who May Die First

While almost every article and discussion about the portability allowance has described how the DSUE amount can be lost or may change if the surviving spouse remarries and survives a subsequent spouse, very few commentators have emphasized the profound psychological and practical impact that DSUE amounts can have on subsequent relationships, and the prospects of pursuing a happy and fulfilling life by remarrying.

This can work an extreme injustice upon a widow who would have the benefits of a new spouse who can provide her with both financial and emotional support, when she learns that the marriage can cause her children to incur over $2,000,000 of federal estate tax (up to 40% of up to $5.43 million as adjusted portability amount) at the time of her death. That is one heck of a wedding present from the children! People already carry enough guilt when they have lost a spouse, and have done their best to live appropriately in our modern society. Is this a burden that planners want to take credit for having imposed on a widow in the name of simplification, and allowing for a stepped-up basis on the surviving spouse’s death that will be of no economic benefit to the widow at all?

Assume the example of a self-sufficient 50-year-old widow, who has a net worth of $2,500,000 after receiving all common assets on the death of her husband. Following his death, she continues to live responsibly, supporting herself from additional earnings, a lifetime pension, and social security benefits. Assume further that in fifteen years, at age 65, her net worth has grown at an annualized average rate of 7.2% to $7,500,000.

At this point, she meets the new Mr. Right who proposes that the two of them marry. He seems to be everything she has been missing since losing her first husband fifteen years before, especially compared to some of the gentlemen that she has attempted to date in the interim.

She is also pleased that he has a net worth that exceeds hers, and will conscientiously leave his assets to his four children, one of which has special needs. The other three children are all teachers with a very close relationship to their father, and are very supportive of his decision to marry. Despite all of this, he agrees to support his new wife during the marriage.

Unfortunately, her tax advisors nix the deal, explaining that it will cost her an estimated $2,000,000 in federal estate tax when she dies, given the expected growth of her estate, and her life expectancy.

Compare that to a situation where her first husband could have left $1,125,000 into a Credit Shelter Trust that would have grown to $2,500,000 in ten years, and $3,125,000 in fifteen years. Under this scenario, her remaining personal net worth would have been $4,375,000 when she met Mr. Right at age 65. Through the use of discount gifting and other planning she could have avoided all estate tax exposure, and could have walked the aisle with no trepidation to better enjoy and find fulfillment and financial security in her remaining years with her new Prince Charming.

Going back to whoever planned (or failed to plan) the estate before her first husband died, the concern over a loss of stepped-up basis on half of the marital assets placed in a Credit Shelter Trust on the first death could have been reduced by simply granting a formula power of appointment, or giving an independent fiduciary or Trust Protector the power to give the surviving spouse the right to appoint appreciated assets to creditors of her estate. The result is that a stepped-up basis could be received on the most appreciated assets in the Credit Shelter Trust at the time of her death, to the extent that her estate tax exemption would be sufficient to allow her personal assets and a portion of the assets in the Credit Shelter Trust to pass estate tax-free. Such power of appointment language should be in Credit Shelter Trusts for clients now living, and can be implanted into Credit Shelter Trusts already in existence by court order, Trust Protectors, or an agreement between all beneficiaries, based upon applicable state law.

For example, if planners would have included a formula based power of appointment in the Credit Shelter Trust, highly appreciated stock in the Credit Shelter Trust could be included in the widow’s gross estate to the extent that it would not exceed her basic exclusion amount. This would allow the beneficiaries to receive a step-up in basis. Additionally, the formula power of appointment can allow for built-in loss property to avoid a step down in basis since it will not be subject to the power of appointment granted to the widow, resulting in significant tax savings. Too many planners are missing the opportunity to facilitate this.

Loss of the Ability to Share DSUE Amounts with a Subsequent Spouse and His or Her Family

Gift splitting ability is of great value in the auction of love, when a potential wealthy new spouse would prefer to split gifts and, in effect, subsidize gifting to the wealthier spouse’s descendants, who may be preferred over the children of the first marriage for any number of reasons. Unless the surviving spouse is an estate tax attorney, you can easily imagine the conversation that might occur many years after the whole concept of portability might be explained: “Honey, I’d like to give some of my separate property to my kids, can you just sign this tax form so I don’t have to pay $2 million in gift tax? It won’t cost you anything.” Spouses regularly sign joint income tax returns without fully exploring or understanding the ramifications and it’s unlikely a Form 709 will be viewed all that differently.

Loss of the DSUE amount by gift splitting (or being predeceased by a second spouse) also reduces the exemption allowance available to the surviving spouse, who might otherwise be given general powers of appointment under Irrevocable Trusts that might exist or be established for the purpose of providing a stepped-up date of death fair market value basis when the surviving spouse dies.

Copies of the entire article will be available on the Veralytic table at the Heckerling Institute with our friend Barry Flagg, who may shine your shoes if you ask him!

Barry Flagg and Veralytic remind us of another Portability Mistake, which is as follows:

Failure to Preserve the Portability Allowance by Using Irrevocable Life Insurance Trusts

Until 2012, it was common to have life insurance owned by the insured spouse and payable to the Bypass Trust when other assets were not sufficient to fully use the first dying spouse’s exemption. Presently, however, this causes the loss of a portability allowance, and will basically cost the estate of the surviving spouse as much as 40% of the death benefit amount in estate taxes on the death of the surviving spouse.

Example – Harry and Wilma are both 40 years old and have a $4,500,000 net worth, consisting of a $500,000 home and $4,000,000 of joint investment assets. They each have $2,000,000 life insurance policies payable to their respective Revocable Living Trusts. If on Harry’s death the proceeds from his life insurance policy and half of the joint investment assets passed into a Credit Shelter Trust that will not be subject to estate tax on the second death, then the Credit Shelter Trust would have been funded with $4,000,000 worth of assets. Wilma will have a $5,450,000 estate tax exemption that will grow with the Consumer Price Index, and another $1,450,000 portability allowance that will not grow with inflation.

Now assume instead that the $2,000,000 life insurance policy on Harry’s death was in an Irrevocable Life Insurance Trust. Wilma will be in a similar financial position, but her portability allowance would now be $3,450,000, since the irrevocable life insurance is not considered as part of Harry’s estate. Wilma will save an additional $800,000 in estate taxes on her death as a result of taking advantage of the benefits of an Irrevocable Life Insurance Trust. In other words, the amount of life insurance proceeds multiplied by the estate tax bracket on the surviving spouse’s death can be the amount of additional estate tax resulting from not having an Irrevocable Life Insurance Trust.

Notwithstanding this concern, planners need to weigh whether it is the best use of annual gift allowances to gift to Irrevocable Life Insurance Trusts where clients would otherwise gift to vehicles that may yield much better results in the long run.

Where clients have estate tax concerns, and wish to make use of their $14,000 per donee gifting exclusion, they are typically best served by gifting non-voting member interests, limited partnership interests, or other assets that have valuation discount characteristics. This will be much more effective than life insurance with respect to maximizing the inheritance of descendants, if the clients will live to their normal life expectancies.

Life insurance can be paid for by split-dollar advances that can be made by the clients, or a family LLC or limited partnership, based upon the applicable federal rate in effect at the time of each premium payment. The long-term applicable federal rate will be used if the insured has a life expectancy exceeding nine years, while the mid-term applicable federal rate will be used if the insured has a life expectancy of greater than three years, but not exceeding nine years. Finally, the short-term applicable federal rate will be used for advances made while the insured has less than a three-year life expectancy. With a second-to-die life insurance policy, the joint life expectancy of the married couple will be longer than the life expectancy of either insured individually.

The split-dollar agreement should provide that each separate premium payment is considered to be a separate loan for purposes of establishing, and then tracking the interest rate applicable thereto. No payments need to be made on the loan until the life insurance policy pays the death benefit, is cashed in, or is borrowed upon.

LLC Operating Agreement Can Serve as “Transfer on Death”

Mechanism to Avoid Probate and Trust Interaction

(Not to Mention Confusion and Uncertainty)

by Alan Gassman and Chelsea Bellew

In Blechman v. Estate of Blechman, 460 So. 3d 152 (Fla. 4th DCA 2015), the court found that the provisions of an Operating Agreement of a limited liability company allowed the Decedent’s membership interest to vest immediately upon his death. While the Decedent made provisions for the membership interest to pass to someone outside his family in a trust before he passed away, the court found that the provisions of the Operating Agreement were controlling. The provisions of the Operating Agreement were made to keep the company within the family and did not permit for a membership interest to pass to anyone else.

The Operating Agreement was executed in New Jersey and was, therefore, interpreted according to New Jersey case law. Minoff v. Margetts was a New Jersey case that permitted members of an LLC to use provisions in an Operating Agreement to control the disposition of membership interests when one member passes away. Following this rationale, the court found that the interest in this case vested in the two children upon the death of their father, according to the Operating Agreement, and that this interest was not a part of his estate. The trust had an amendment that provided for the interest in the LLC to pass to the Decedent’s girlfriend upon his death, and the court found that this instrument was subordinate to the provisions of the Operating Agreement. The provisions of the trust directly contradicted the terms and intent of the Operating Agreement. Therefore, the Decedent’s membership interest in the LLC passed upon his death outside of probate to his children and nullified the terms of the amended testamentary trust.

Specific language that was used in the Operating Agreement that was blessed by the court was as follows:

6.3 Death of Member

(a) Unless (i) a Member shall Transfer all or a portion of his or her Membership Interest in accordance with 6.1 or 6.2 hereof, or (ii) a Member bequeaths the Membership Interest in the Member’s last will and testament to members of the Immediate Family of the respective Member, or (iii) all such Membership Interests of a deceased Member are inherited, or succeeded to, by Members of the Immediate Family of the deceased Member, then in the event of a death of a Member during the duration of this Agreement, the Membership Interest of the deceased Member shall pass to and immediately vest in the deceased Member’s then living children and the issue of any deceased child, per stirpes.

The court noted as follows:

…not every instrument which provides for performance at or after death is testamentary in character…There is nothing in the statute of wills that prevents the creation of contract of a bona fide equitable interest in property and its enforcement after the death of a contracting party, even though the date of death is agreed upon as the time for transfer.

Do we now have an obligation to review every Operating Agreement that a client has involvement with to see whether inheritance rights and disposition may be impacted thereby? Do we dare use similar language in an LLC Operating Agreement that might distort an estate plan later when the client or their advisors are not aware of the provision?

Perhaps the following provision can be considered:

Upon the death of JOHN SMITH, his membership interest shall immediately pass to and immediately vest in his spouse, MARY SMITH, or in equal shares to his children, per stirpes, if MARY SMITH does not survive him, provided that the above shall not apply to the extent of any future provision of any Will or Pour-Over Will and Revocable Trust that might be entered into by JOHN SMITH, if the legal effect thereof would be to provide for a different disposition of his LLC interest, regardless of whether such LLC interest is specifically referred to or not. The determination of whether any such subsequently signed separate Will or Revocable Trust exists to facilitate such change shall be made by the Manager or Managers of the Company, in their reasonable discretion, and the Company shall be entitled to the distributions or liquidation entitlement rights to the successor owners of the membership interest to the extent of money expended to facilitate such determination.

Should we consider using similar arrangements for our clients, and, if appropriately used, will these avoid exposure to individual creditors of the deceased LLC Member? See our Thursday Reports from October 15, 2015 and October 22, 2015 for further discussion of this in the article entitled “Avoiding the Carnage Caused by Pay-on-Death Accounts.”

An Interview with Jonathan Blattmachr

In December 2015, Alyssa Eberle of Gassman, Crotty & Denicolo, P.A. interviewed Jonathan Blattmachr, Esq. who will be speaking on a webinar for Bloomberg BNA’s Essential Elements series entitled “Fundamentals and Planning for the Income Taxation of Estates and Trusts.” This webinar will take place on January 21, 2016, and will be moderated by Alan Gassman.

We wanted to ask him some brief questions so that our audience got to know him

and began to understand his thoughts behind his estate planning techniques. The following questions were asked of Mr. Blattmachr:

Alyssa Eberle: Please, tell us about yourself.

Jonathan Blattmachr: I graduated cum laude from Columbia law school in 1970. I served two years in the United States Army, reached the rank of Captain, and was awarded the Army Commendation Medal. I was an associate attorney at Simpson, Thacher, and Bartlett, LLP, and a partner at Milbank, Tweed, Hadley, & McCloy for a total of about forty years. I have written seven books and over 500 articles on estate planning, charitable planning, and tax planning ideas. I have also taught at Columbia law school and the New York University law school in its Masters in Taxation program.

AE: Can you give us a sneak-peek of your presentation and describe what you hope to achieve by participating in this webinar?

JB: The presentation is going to consist of setting forth the fundamentals of the income taxation of estates and trusts, including some of the most important differences in how estates and trusts are subject to income tax on one side, and an individual on the other side. That will relate to the use of the most fundamental concept in the income taxation of estates and trusts which is called distributable net income, known by its initials DNI. It is critically important to understand what DNI is because it really creates the basis for the taxation of the trust or the estate or its beneficiaries. I am going to set forth some rules and give some examples which will make it easy for people to remember what DNI consists of, which in turn leads us to planning opportunities. I am going to discuss, among other things, how you can get capital gain experience by an estate or trust into DNI so it can be attributed to a beneficiary. The beneficiary will be able to offset that capital gain with the beneficiary’s losses. I am also going to discuss the application of the net investment income tax to estates and trusts, and again talk about planning so that in appropriate circumstances it can be shifted over to the beneficiaries.

AE: Could you give an example of why you would want to shift income from an estate or trust to a beneficiary?

JB: One of the reasons you may want to shift income from an estate or trust over to a beneficiary for income tax purposes in general, and the net investment income tax specifically, is because trusts and estates face the highest tax rates for income tax purposes and net investment income tax at very low thresholds of taxable income, generally around $12,000. A married individual, for example, won’t face those until that individual has about $450,000 of taxable income. So that is very important.

AE: What other topics will you touch on in your webinar?

JB: I am also going to talk a little bit about another special rule that estates and trusts have, which relates to income tax deduction for contributions to charity. This is different than the rules for an individual, but there is also an exception, and I will go through that as well. Then finally, I am going to talk about the situation where a trust is not considered a separate legal entity which falls under the grantor trust rules, which means that its income, deductions and credits against tax of the trust are attributed directly to the grantor, or in some cases, to a beneficiary. So that will be the coverage for the program.

AE: Could you give one or two examples for effective estate planning techniques to lessen federal income tax paid by trusts and their beneficiaries?

JB: You can do this by shifting the income from the estate or trust over to the beneficiary. I will also talk about ways in which you can have income, that otherwise would be taxed to an individual, be taxed to a trust, which may be an opportunity to avoid state income tax. So if you have a client, for example, who lives in New York, California, Illinois or Pennsylvania, who is paying income tax on his portfolio income, capital gains, ordinary income, and compensation income, there will be a way in which we can shift that income over to a trust, essentially on a temporary basis, so state and local income taxes do not have to be paid, but the income ultimately can find its way back to the taxpayer.

AE: What are some of the biggest mistakes that you think practitioners make when creating these estate plans?

JB: I guess the biggest mistake is not fully understanding how these rules work. I think the biggest mistake is failing to plan and not really thinking through what should be done.

AE: Can you provide an example?

JB: Certainly. Every estate you plan for, and every estate you administer, will contain an asset that constitutes the right to income in respect to the decedent. The right to income in respect to the decedent may be subject to estate tax and income tax. The failure to realize that there will be the right to income in respect to the decedent, and then the best way to handle it, really means that you are probably going to wind up paying much more tax than you have to.

AE: Would you say that that is the most important thing to consider when you are creating an estate plan?

JB: It is one of the things – I am not going to say it is the most important. But it is definitely one of the things that needs to be carefully considered.

AE: What are some of the publications that you have written that you would recommend to listeners to read, before or after the webinar, to get a foundation for what you are going to be speaking about?

JB: Well one of the books I have written and constantly update is called The Income Taxation of Estates and Trusts. I have written on that for approximately forty years. It is published by the Practicing Law Institute and it is one of the most beneficial gifts you can give anyone, even if he or she is not a lawyer or an accountant. It is just a wonderful read.

AE: Thank you, Mr. Blattmachr. We are looking forward to your webinar.

To register for this FREE Bloomberg BNA “Fundamentals and Planning for the Income Taxation of Estates and Trusts” webinar, please click here.

Announcing the Alan Gassman Channel with InterActive Legal

InterActive Legal and Gassman, Crotty & Denicolo are pleased to announce the January inauguration of the Alan Gassman Florida Law Channel on InterActive Legal.

Subscribers to this channel will have unlimited electronic computer access to a wide range of useful and informative materials, including the following:

- Gassman & Markham on Florida & Federal Asset Protection Law

- Florida Law for Tax, Business, and Financial Planning Advisors

- Eight Steps to a Proper Florida Trust and Estate Plan

- The Florida Power of Attorney & Incapacity Planning Guide

- A Practical Guide to Anti-Kickback and Self-Referral Laws for Physicians

- “Global Strategies and Techniques for the Protection of Assets and Conversation of Wealth” by Denis Kleinfeld and Howard Fisher

- Articles from Michael Kitces

- Relevant and related Florida statutes

- The JEST (Joint Exempt Step-Up Trust) Guide, Charts, and Trust Provisions

- And more!

The materials on this platform are fully digitized, with an interactive table of contents, links to related cases, and the ability to search for key terms and ideas throughout the text.

Please visit the InterActive Legal booth at the 50th Annual Heckerling Institute on Estate Planning from January 11-15, 2016, check out the channel, and be one of the first to subscribe!

Heckerling Show Special: Be one of the first to sign up for your one-year, $129.40 subscription and receive a printed copy of any one of the above books at no additional charge!

Please consider enhancing your practice and your Florida legal and planning library with the Alan Gassman Florida Law Channel with InterActive Legal.

Special thanks goes out to Michael Graham, Jonathan Blattmachr, and George Brittingham of InterActive Legal for risking their entire operation on the success of this channel. Special thanks also to Howard Stern for his support and advice.

And while you’re there, be sure to stick around for Alan’s 15 minute speech on Have Gun Trust, Will Travel. His bullet points will be very useful and give you ammunition to help make your gun trusts more explosive than ever! Come to see this important, thorough, and detailed 15 minute talk. Each attendee will receive a very useful handout (but not a hand gun!) Visit the InterActive Legal booth (number 434 and 535) to see the following talks:

Richard Connolly’s World

Big Law Gains Another Female Leader

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “Big Law Gains Another Female Leader, This Time at Womble Carlyle” by Sara Randazzo. This article was featured in The Wall Street Journal Law Blog on January 5, 2016.

Richard’s description is as follows:

Elizabeth ‘Betty’ Temple, the newly instated head of 550-lawyer Womble Carlyle Sandridge & Rice, is hoping to shake things up at the 140-year-old law firm with deep roots in the Southeast and mid-Atlantic regions.

She’s also backing an “innovation center,” which she likens to research and development functions at most major companies.

The firm plans to divert “a significant” amount of money from profits to invest in the center – Ms. Temple won’t say exactly how much – and attorneys can apply for grants to develop projects that will help the firm “stay relevant in the future.”

Ms. Temple joins a slowly expanding group of women in the highest ranks of corporate law firms, an industry that continues to lag behind in advancing women.

Please click here to read this article in its entirety.

Humor! (or Lack Thereof!)

Sign Sayings of the Week

***************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Annual Florida Bar Health Law and Tax Section Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World

(with Lester Perling) - Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

HECKERLING INSTITUTE – INTERACTIVE LEGAL TALK

Alan Gassman will present a 15 minute speech at the InterActive Legal booth at the Heckerling Institute for Estate Planning on HAVE GUN TRUST, WILL TRAVEL. His bullet points will be very useful and give you ammunition to help make your gun trusts more explosive than ever! We expect this talk to be right on target, so take off your silencers and come to see this important, thorough, and detailed 15 minute talk.

While at the InterActive Legal booth, see the new Alan Gassman Channel and get a free book of your choice by being one of the first to sign up for this new, monthly, interactive, computer-based library featuring several of Alan’s books, many forms, charts, and even exclusive video webinar presentations. $129.40 per year gets you this and a bucket of Kentucky Fried Chicken if you sign up before January! (Mashed potatoes are extra.)

Special thanks to Michael Graham and George Brittingham of InterActive Legal for risking their entire operation on the success of this channel.

Date: Wednesday, January 13, 2016 | 10:40 AM

Location: InterActive Legal Booth | Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will moderate a Bloomberg BNA Essential Elements webinar with special guest Jonathan Blattmachr on the topic of FUNDAMENTALS AND PLANNING FOR THE INCOME TAXATION OF ESTATES AND TRUSTS.

This is a free webinar series being presented by Bloomberg BNA. We will have the full schedule available in a future Thursday Report. Save up so you can afford it!

Date: January 21, 2016 | Replay on January 26, 2016

Location: Online webinar

Additional Information: For more information or to register, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare to attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ESTATE PLANNING BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, February 17, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will moderate a Bloomberg BNA Practical & Creative Planning webinar with special guest Jonathan Blattmachr on the topic of FUNDAMENTALS, FINE POINTS, AND INNOVATIVE STRATEGIES FOR LIFE INSURANCE AND USE THEREOF.

Bloomberg BNA will charge for this webinar and this series of webinars, but we believe it is well worth it! We will have the full schedule available in a future Thursday Report.

Date: February 25, 2016 | Replay on March 1, 2016

Location: Online webinar

Additional Information: For more information or to register, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ASSET PROTECTION BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, March 16, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday. Be sure to bring an extra pair of socks because the first pair will get knocked off by Jonathan’s talk!

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of EQUITY STRIPPING AND OTHER ADVANCED ASSET PROTECTION IDEAS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, May 11, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

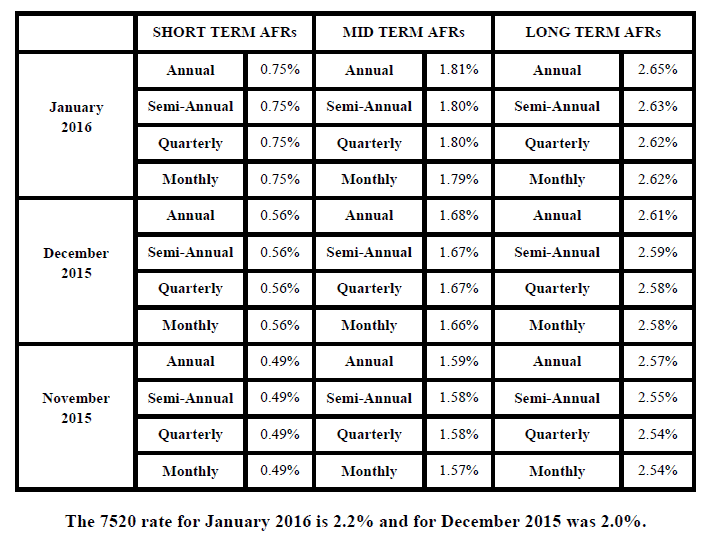

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.