The Thursday Report – 10.22.15 – Thriving on Thursdays

No Need to Pay Rent to Take Interest and Depreciation Deductions When the Landlord is a Related Party Confirmed by Recent Appellate Court Decision

Avoiding the Carnage Caused by Pay-on-Death Accounts, Part II

An Esteemed Father and Son Team Share Their Love for the Law and Helping Others, Part II

Richard Connolly’s World – Debt and Senior Citizens

Thoughtful Corner – How to Change Your Mailing Address

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“We believe in truly listening to the customer, taking the customer’s view as more important than our own. We believe in truly listening to our people, taking their views as more important than our own. But the whole edifice tumbles if one doesn’t deal off a base of integrity.”

– Tom Peters

Tom Peters is the author of several books on business management practices. He is best known for the books Thriving on Chaos and In Search of Excellence, which he co-authored with Robert H. Waterman, Jr. In Search of Excellence was released in 1982 and quickly became a national best-seller. It can be viewed by clicking here. Today, Tom Peters continues to write and speak about personal and business empowerment and problem-solving methodologies.

No Need to Pay Rent to Take Interest and Depreciation

Deductions When the Landlord is a Related Party Confirmed by

Recent Appellate Court Decision

by Alan S. Gassman and Seaver Brown

Tax Court Confirms that Rent Does Not Need to be Paid to Certain Related Entities to Permit Depreciation and Interest Deductions Under the Passive Loss Rules

We have written before in the Thursday Report and in less significant periodicals that Treasury Regulation Section 1.469(a) and (f)(6) may permit the landlord of a professional practice, company, or business corporation to receive no rent or minimal rent and still be able to deduct its interest and depreciation expenses, notwithstanding the passive loss rules.

The reason for this is that the regulations provide, without great clarity, that an actively conducted business or professional practice that makes use of real estate owned by a related entity will cause the real estate entity to not be subject to the passive loss rules where there is a commonality of ownership. In those instances, the activity of the business or profession are deemed to have been conducted at the individual landlord level.

We now have a Fifth Circuit Court of Appeals case that reviews and upholds this regulation, where a husband and wife owned 100% of a real estate S-corporation and 100% of a medical practice C-corporation.[1] The real estate corporation leased commercial property to the medical corporation where the husband worked full-time and materially participated in its day-to-day business activities. It is important to note here that the husband and wife did not materially participate in the business activities of the real estate S-corporation, nor were they engaged in a real property trade or business.[2]

The taxpayer tried to claim that the passive loss rules did apply because they had losses from other activities that they wanted to have the passive rent income from the real estate corporation offset by. The IRS came to the rescue to all of us who do not want the passive loss rules to apply in this situation by correctly arguing this point.

The Tax Court agreed with the IRS that the passive loss rules did not apply, and the Fifth Circuit Court of Appeals agreed with the Tax Court. It is not often that we are pleased when the Tax Court and the Court of Appeals agree with the IRS, but this one certainly brought a smile to our faces.

It is also noteworthy that Florida law does not require the payment of fair market value rent between related parties. Although, the Department of Revenue has been known to claim that there is some sort of obligation to pay fair market value rent and sales tax thereon.

We thank Tax Court Judge Joseph Nega and the Fifth Circuit Court of Appeals for showing in their opinion that they actually understand and respect federal tax law.

********************************

[1] Williams v. C.I.R., 109 T.C.M. (CCH) 1398 (T.C. 2015).

[2] See, I.R.C. § 469(c)(7)(B) and (C).

Avoiding the Carnage Caused by

Pay-on-Death Accounts, Part II

by Alan S. Gassman & Christopher J. Denicolo

Do not let pay-on-death accounts be the death of your estate plan.

Last week, we discussed distortion or obliteration of an estate plan by pay-on-death accounts and possible ways to manage this risk. To read Part One again, please click here. Part Two below will discuss the creditor protection advantages of using pay-on-death accounts.

The creditors of a decedent probably cannot reach the assets held in a pay-on-death account that would pass to a desired beneficiary on the decedent’s death. This is different from assets held under a revocable trust, where if the assets are not otherwise protected by Florida Statute (such as life insurance proceeds, IRAs and other qualified plans, or annuity contracts), then such non-exempt revocable trust assets would be available for a decedent’s creditor. Because pay-on-death accounts pass by operation of law upon the death of the account owner to the designated beneficiary, the assets immediately become the property of the beneficiary and are not available for the satisfaction of valid claims of a decedent’s creditors.

One planning tip is to provide that an account is payable on death to an irrevocable sub-trust under a revocable trust, and this type of structuring probably would cause the assets in the pay-on-death account to be removed from the reach of the decedent’s creditors.

Nevertheless, clients and their advisors need to take great care in utilizing pay-on-death accounts as part of estate plans and need to assure that such accounts are coordinated with the client’s other estate planning documents.

A durable power of attorney given to a trusted individual can help assure that the account assets would be available and transferrable to the revocable trust in the event of incapacity.

While ethics may dictate consideration of whether the client intends that their bills and debts be paid before primary beneficiaries, given that an unexpected accident not even caused by a client could cause loss of life (and also loss of assets because of a runaway jury award against the estate of a deceased client), the pay-on-death account structuring decision may be worthy of at least a small amount of conversation, especially if you are the intended beneficiary!

An Esteemed Father and Son Team Share Their Love

for the Law and Helping Others, Part II

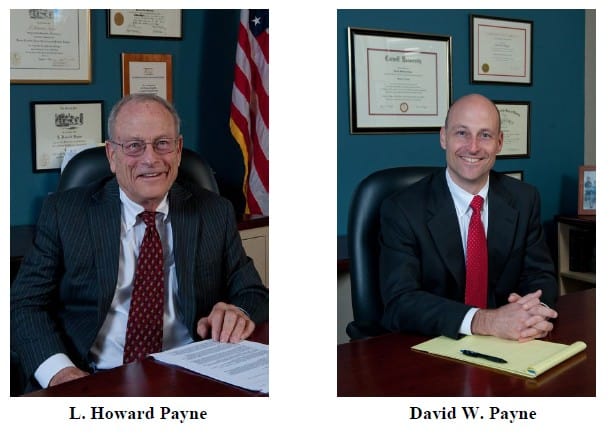

The following interview of attorneys L. Howard and David Payne of the Payne Law Group took place on Wednesday, September 8, 2015 at the Community Foundation Building of Sarasota County. The interview was conducted shortly after a Distinguished Speakers Presentation on Asset Protection by Alan Gassman, which was hosted by the Foundation. The interview was conducted by Jennifer Hammond.

L. Howard Payne has been practicing law for over 50 years, first in New York and now in Southwest Florida. David has been practicing for over 20 years. The Payne Law Group is an Estate Planning boutique firm. Part I of the interview can be viewed by clicking here.

Jennifer Hammond: Where do you see the profession headed? What do you think is going to be really important?

L. Howard Payne: I am concerned about, in the future, the type of legal work that we do because of all the authorizations that are being handed out for document prep – things like Legal Zoom and We the People and that sort of stuff. There seems to be a resistance on the part of the Florida Bar to prosecute for the unauthorized practice of law for reasons I don’t understand. Maybe they just don’t have the funding; I don’t know what it is, but I’m concerned that we may see a lot of inroads for people who are not licensed lawyers, at least for the type of work David and I do.

I am also very concerned about the idea that Florida may open up its ability to practice in Florida to anybody who is a qualified member of another state’s Bar [presuming they have been a member in good standing for so many years, and the attorney is qualified under whatever rules the state requires.] I practiced in New York before I came down here, and New York is one of those states, but very few people come into New York to do that because you either like New York as a place to live and work, or you don’t. Most people that don’t like it detest it! So New York didn’t have that problem, but everybody wants to come to Florida. I just see nothing but inroads in that area, and it concerns me.

I think that also, we’re going to find that what we do right now – estate planning and asset protection and things like that – yes, that will continue, but really, where the money is going to be made in the administration of estate is in litigation. This, to me, is very sad. I don’t know whether you agree with that, David.

David Payne: I think that’s true. I was just talking to Alan [Gassman] at lunch regarding the duties we have, and I think one of the things that probably has changed in the practice is that so few people are willing to take responsibility for anything, and they’re always looking for a way to dodge it if it can become the lawyer’s fault because he was somewhere in the vicinity of the plan, whatever it was, a life insurance product or an annuity product or whatever else was done. “Well, the lawyer was nearby, so therefore, the lawyer should be responsible.” That kind of takes a lot of the fun out of practicing.

I think the Legal Zoom environment increases this. I’ve only had two clients who’ve come to me with Legal Zoom documents. Both of those clients had paid more than they would have paid me, ended up with a product that wasn’t very good, and they didn’t know what they had. I don’t think of that in terms of real competition. Well, it’s not that competitive because the quality is not great; however, you know the belief system is that software will be considered and will continue to improve, and it will end up replacing our thought process. I don’t really think that’s true, but unfortunately, if the buying public thinks it’s true, then you know who’s going to have to educate them otherwise?

It might create a lot of work in litigation as people fight about those documents. I think, too, what we’ve found is that the thing that really matters the most to the client is not at all related to the document. They really are looking for someone they can trust, and they’re looking for someone who they feel comfortable with advising them and someone that they know will, when they pass away and their spouse is left or their children are left…that their family has some place to go, and they’re not going to be sold some “product.”

Clients want to know they’re not going to be cheated. They’re not going to be fleeced in some way, and someone’s going to help them through the difficulties without making mole hills into mountains. They’re going to be able to get the help they need to navigate what they need to do. So I honestly don’t think that there’s going to be any lack of work. What’s interesting, though, is there may very well be a lack of people providing the services required because if I look out here at our estate planning council, there aren’t many young people in it.

That’s one of the trends that we’ve been wondering about. There’s so much taught at the law school level. I think Jeff Pennell talked about this when he was down here recently. No one goes into estate planning out of law school because they all think that we’re going to be replaced by software, and there’s no estate tax, so where’s the work? So it’s been interesting to see that long-term trend.

J. Hammond: That is interesting because with the statistics on the Baby Boomers aging and population growing and aging in general, combined with the needs they are going to have, it is such an obvious area of growth, and for businesses that are small or family-owned and doing well, they are going to need all the types of services that we offer, so I find that really interesting. I didn’t realize that it was an area that people didn’t want to go into. I just came out of an LL.M. program in Estate Planning where some students had focused on estate planning during their J.D. program. As far as I’m concerned, it’s a no brainer!

L. H. Payne: When I first started practicing, I did so with a relatively large Wall Street law firm. Much to my excitement, when I started, they moved me around in every aspect of their practices. I was there a little over two years, so I didn’t get into every one of them, but I worked in most of them, and it gave me a real feel for what the practice of law is like. I think, unfortunately, most firms can’t do that now.

Now, we hire somebody, and we need them in a particular area, so that’s what we put them in, and if they like it, great. If they don’t like it, they may find they don’t want to practice law anymore at all, which is sad. I only worked slightly in the estate planning practice in New York City, but I really found that I enjoyed it very much. I came down here to Sarasota at the very tail end of 1961, and I didn’t do estate planning work right away. I did litigation. I found out that the rules of how you practice law in front of the judge in Florida were a lot different than they are in New York, and so you know, everybody’s scared of the judges up there.

In fact, just a little side note, one of the trial lawyers in the firm I was with said he always went to trial with at least $20,000 in cash in his pocket because he might say something or do something, be found in contempt by the judge and sent to jail on the spot, and he would have to bail himself out and continue the trial. I kid you not.

J. Hammond: Well, I think we’ve covered everything I wanted to cover, but let me ask this question. If you were the ones asking the questions, what’s the question you would have asked about the nature of the practice and where we’re going? What didn’t I ask you that I should have?

L. H. Payne: The best thing that I can suggest is that lawyers need to not only be ethical, but they need to be gracious to one another and treat one another properly and with respect. The fact that doesn’t happen grieves me greatly. Now I realize that I’m not a trial lawyer, and maybe trial lawyers have to act that way, but I don’t think so. It bothers me more than I can tell you to see the lack of respect, not so much in the areas that we work in, but in other parts of the practice of law in this community.

D. Payne: I think maybe one of the most important things that we do is perhaps an example from what Alan [talked about in his presentation.] He mentioned that he has a marital counselor that comes in to his office and enables a client to see a marital counselor without it showing up as a bill from a marital counselor. For instance, I think that we style our firm as attorneys and counselors at law, and I find that maybe 10% of the value that I bring to the table is actually legal knowledge, and 90% of it is just general wisdom, listening to the client, helping them figure out what they really need to do, helping them come to the right decision and do the right thing.

To maybe ignore all of the noise that they’ve heard from whomever, whether it’s somebody selling them something – you need to buy this product or that product or whatever else it is – but rather, I can help them navigate the path. Not that we necessarily have the perfect navigation rules or anything like that, but we do have a lot of advice to bring to the table to help people pick out what are real issues and what are just smoke and mirror issues. We’ve been through a lot of this before with a lot of clients.

I think that the client really benefits from this greatly, and frankly, I think that’s one of the most enjoyable parts about what we do, when the client actually comes back and says, “I did just what you said, and it worked really well.” I told my wife it would always shock me when the client would say, “I actually did what you said.” I was like, “Really?!?”

L. H. Payne: That’s rare.

J. Hammond: Do you find that when you are able to be that trusted advisor, you really do have a client for life?

D. Payne: I think so, and I think that’s really what they’re looking for. They’re looking for a trusted advisor, and you can’t become trustworthy when you’re only motivated by economics, nor can you only become trustworthy when you’re only motivated by the ethical rules of the Florida Bar. You know you need to have something much deeper motivating you to be trustworthy, and I think that, unfortunately, that’s kind of lacking in an awful lot of people these days.

I remember going to an ethics seminar one time where they tried to come up with the seven pillars of ethical behavior. They had no basis for any of these things other than it feels good, so I think we should do it. You know, that’s a pretty sad place to find yourself, building your ethical foundation from there.

Here’s another example: One of the many list feeds that I get, they were describing the new employer/employee dynamic, and they ran down this list of eight points. They were describing how employers and employees should interact with one another, and it was all about the money. I was thinking to myself, “Our firm runs totally differently than that.” We operate with respect and dignity for our employees. That’s why they enjoy working with us. It’s not because, well, today, you’re profitable. As soon as you’re not, you’re out the door. Clients are no different. They come to you because they like you, and they trust you.

You’ve risen to the place where they hold you in high esteem, and the main reason they hold you in high esteem is because you hold them in high esteem. You would not mistreat them, even if there weren’t any ethical rules. You just do the right thing, and so I’m hoping that the practice of law doesn’t lose its soul.

J. Hammond: Thank you both for your time. This was fantastic, and I really appreciate your insight and words of wisdom.

The Thursday Report would like to thank Jennifer, Howard, and David for conducting and participating in this interview!

Richard Connolly’s World

Debt and Senior Citizens

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Bankruptcy Can Help Seniors Protect Assets” by Constance Gustke. This article was featured in The New York Times on May 13, 2015.

Richard’s description is as follows:

For some older Americans, bankruptcy can bring much-needed relief from debt brought on by medical expenses or helping needy children, and experts say it can be a valuable tool to protect retirement assets after negotiating with creditors. But with reliable statistics on current bankruptcies hard to come by, anecdotal evidence suggests that shame at being in financial turmoil frequently prevents retirees from getting help early.

“People usually postpone bankruptcy for several years before filing,” said Deborah Thorne, an associate professor of sociology at Ohio University who has studied older Americans and bankruptcy. “When finances head south, they should file right away.”

By spending retirement assets, Ms. Thorne said, retirees risk a downward financial spiral from which they are less likely to recover than younger people. A better strategy is to defend assets at all costs, she said.

Why? Retirement income and savings are usually untouchable during bankruptcies under federal law. Pensions, 401(k)’s, and qualified profit-sharing plans are exempt from creditors, as are individual retirement accounts worth up to $1.245 million. Social Security payments are also exempt.

Please click here to read this article in its entirety.

The second article of interest this week is “To Collect Debts, Nursing Homes are Seizing Control Over Patients” by Nina Bernstein. This article was featured in The New York Times on January 25, 2015.

Richard’s description is as follows:

An increasing number of guardianship petitions are being filed by nursing homes over their elderly occupants. Although courts may find these practices abusive, nursing homes nonetheless resort to guardianship petitions because it is effective to collect debts as patients fear futile legal battle. Guardianship will transfer the patient’s legal rights to a person appointed by the court, and it is better than suing the patients directly, say lawyers representing nursing homes.

Lawyers and others versed in the guardianship process agree that nursing homes primarily use such petitions as a means of bill collection – a purpose never intended by the New York Legislatures when it enacted the guardianship statute in 1993. At least one judge has ruled that the tactic by nursing homes is an abuse of the law, but the petitions, even if they are ultimately unsuccessful, force families into costly legal ordeals.

New York’s guardianship statute was part of a national movement to limit guardianships to the least restrictive alternatives necessary to prevent harm. A petition is supposed to be brought only by someone with the person’s welfare at heart, and guardianship is to be tailored to individual needs, taking into account the person’s wishes. Instead, it’s become a system that’s very focused on finances.

Please click here to read this article in its entirety.

Thoughtful Corner

How to Change Your Mailing Address

For many individuals, moving is rarely a simple process. There is often more to it than carefully packing up your prized possessions and throwing away all of those old magazines you swore to read. One of the most common tasks that will likely appear on your moving to-do lists includes calling your cable and internet provider to cancel or transfer your current subscription. You may also need to call your local electric company and inform them that you will be changing addresses. Each of these tasks can be done with relative ease these days.

Before you can really settle in to your new place, however, you will need to make sure your bills, packages, and love letters all continue to reach you and not end up in the hands of some unsuspecting stranger moving into your old home. In the past, this process required you to take a trip to your closest US Post Office and fill out a change of address form, also known as Form 3575. Remember, for those of you that still use the Post Office for this task, you should have your form completed before you even think about stepping in line.

For those that are unaware you can still visit the post office, the entire process can now be done in the comfort of your old or new home. First, you must visit the official US Postal Service change of address website at moversguide.usps.com. Select whether your move will be permanent or temporary, and fill in the date in which they should begin forwarding your mail. Then, provide your old and new mailing addresses.

At this point, you are probably wondering how the Post Office ensures you are actually changing your address as opposed to attempting to play a prank on someone else. The USPS will charge a $1.05 fee to verify your identity. All they require is that the billing address on the debit or credit card you provide matches your old or new address. To lighten the blow of such a steep $1.05 fee, the USPS will send a variety of coupons for local stores and businesses valued at around $500 to your new address.

Humor! (or Lack Thereof!)

Sign Saying of the Week

**************************************************

In the News

by Ron Ross

The Secretary of Education reports that American students still score below students of other Western nations in standardized tests. This year, language scores are up slightly, but math scores are somewhat down. So it’s seven of one, a half dozen of the other.

*************

Inspired by the success of leading Republican candidates with no previous government experience, the US airline industry is opening up pilot seats to those with no flying experience. They’re looking for people with an inspiring personal story or the ability to make short, pithy statements over the intercom. An airline spokesman is not worried about amateur captains, saying, “It worked so well for Carnival Cruise Lines.”

*************

Scientists warn that mass deaths in honey bee populations threaten the future of US agriculture. Donald Trump blames the decline in bees on socialism. He says, “Of course the bees are dying! They collect the nectar, and then they have to give it all to the bee government. If it was me, I’d take that stinger in my tail and ram it right between my multifaceted compound eyes!” Trump’s proposed solution: Fire the b*****ds.

*************

The American Bar Association is putting out its own version of the Bible. Noticably absent is Matthew 5:40 from the sermon on the mount: “And if anyone should sue you at the law and take away your coat, let him have your cloak also.” The ABA downplays this change and describes this revision as “a failure to stipulate.”

Upcoming Seminars and Webinars

Calendar of Events

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24, 2015

Location: Hyatt Regency Sarasota | 1000 Boulevard of the Arts, Sarasota, FL, 34236

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE WEBINAR:

Steve Gorin will join Alan Gassman for a free, informative webinar on the topic of INCOME TAX EXIT STRATEGIES.

There will be two opportunities to attend this presentation.

Date: Thursday, October 29, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on SCIENTIFIC MARKETING FOR THE ESTATE PLANNER – HOW TO DO MORE OF WHAT YOU LOVE TO DO AND LESS OF THE OTHER WHILE BETTER SERVING CLIENTS, COLLEAGUES, AND YOUR COMMUNITY.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY UNDER NEW REGULATIONS AND ALICE’S LOOKING GLASS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: All Children’s Hospital | 501 6th Avenue South, St. Petersburg, FL, 33701

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free webinar on the topic of ASSET PROTECTION CHECKLIST ITEMS YOU HAVE NOT THOUGHT ABOUT.

There will be two opportunities to attend this presentation.

Date: Tuesday, November 17, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of CREATIVE BUSINESS SECURITY.

Company espionage is big business, and it’s not just limited to biggies. When a new business is in its early stages or before it has its operational system laid out in concrete, establishing the right security concepts can carry through as it grows. It minimizes unwanted exposure and unneeded expense of later changing how it operates. Preventing vulnerability to hackers, for example, would be one consideration. Making sure cell and office phones can’t be bugged and keeping competitors and governments from spying on the operation should also be an upfront consideration.

A business doesn’t have to be the NSA to make all of these things a reality. Conventional methods of information security, no matter how effective they profess to be, just end up with an organization being the eventual loser. Every day, you hear of a new intrusion. This webinar will look at the problem from a non-conventional perspective to obtain a more secure system.

Questions to be answered during this presentation include:

- Why don’t conventional security measures work for small to medium sized businesses?

- Who makes a company less secure?

- What steps can be taken to make companies more secure?

- How vulnerable are you and your company to spying from competitors and others?

There will be two opportunities to attend this presentation.

Date: Wednesday, November 18, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of THE SUGAR DADDY HUSTLE.

The classic “Sugar Daddy” situation is usually a win-win for both the male and the female involved. Both understand the situation and are willing participants. But for an older man who has undergone a traumatic life experience, is lonely, and may have somewhat diminished mental capacity, there are certain types of women who will use this to their advantage and make him their unknowing “Sugar Daddy.”

These women have researched the legal aspects of their operation and identified loop holes in the law which they can exploit. They take over the man’s life, make decisions, allow his health to deteriorate, and place him in financial tenuous situations for their own benefit. Within the USA, it amounts to a con of over $3 billion annually.

This webinar will discuss what proactive preventive steps to take when an emotional episode has occurred in an elderly person’s life. If a con has already begun, we’ll look at the signs delineating financial and non-financial abuse. Once in progress, there are steps which should be taken to minimize the impact.

Questions to be answered during this presentation include:

- For elderly men, what is the difference between the conventional Sugar Daddy and the Sugar Daddy Hustle?

- Why are older men more susceptible to being scammed?

- Are there preventive steps which should be taken when a man has recently undergone a traumatic life experience?

- How can you recognize a con?

- What should be done after a scam has begun?

There will be two opportunities to attend this presentation.

Date: Wednesday, December 9, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of WHY OUR GOVERNMENT REJECTS PUBLIC IDEAS AND KEEPS PEOPLE IN THE DARK ABOUT SERIOUS ISSUES.

In the area of rejecting ideas, consider this country has won more Nobel prizes than any other country, yet getting new ideas into the government from the general public is almost impossible. Yes, pulling the gems from the pile and evaluating them can be a problem. Unfortunately, it really doesn’t matter whether the potential ideas save lives, money, or time. The government generally ignores them.

Questions to be answered during this presentation include:

- Why are ideas often ignored by politicians and government agencies?

- What drives the motivations of politicians and government agencies?

- Why does the government try to keep the public in the dark about certain subjects?

- Does the government classify things that shouldn’t be marked as classified? Is that against the law?

There will be two opportunities to attend this presentation.

Date: Wednesday, January 6, 2016

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

To download the brochure, or for a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ST. PETERSBURG PRESENTATION:

ST. PETERSBURG COLLEGE FOUNDATION PRESENTS THE WOZNIAK PROJECT

Apple co-founder Steve Wozniak will be the first featured speaker in the new St. Petersburg College Foundation Distinguished Speakers series.

Wozniak is a Silicon Valley icon and philanthropist who helped shape the computing industry with his design of Apple’s first line of products. In 1976, he and Steve Jobs founded Apple Computer, Inc. In 1985, for his achievements with Apple, Wozniak was awarded the National Medal of Technology, the highest honor bestowed on America’s leading technological innovators. He was inducted into the Inventors Hall of Fame in 2000.

Join Steve Wozniak and the Foundation for a lively, interactive discussion. Charitable proceeds will benefit the St. Petersburg College Foundation. Tickets range from $85 to $95.

Thanks to the Bank of Tampa, Merrill Lynch Wealth Management, Raymond James, and the CPA firm of Gregory Sharer and Stuart for being sponsors of this event.

Date: Monday, November 2, 2015 | 7:00 PM

Location: The Palladium Theater | 253 Fifth Avenue North, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

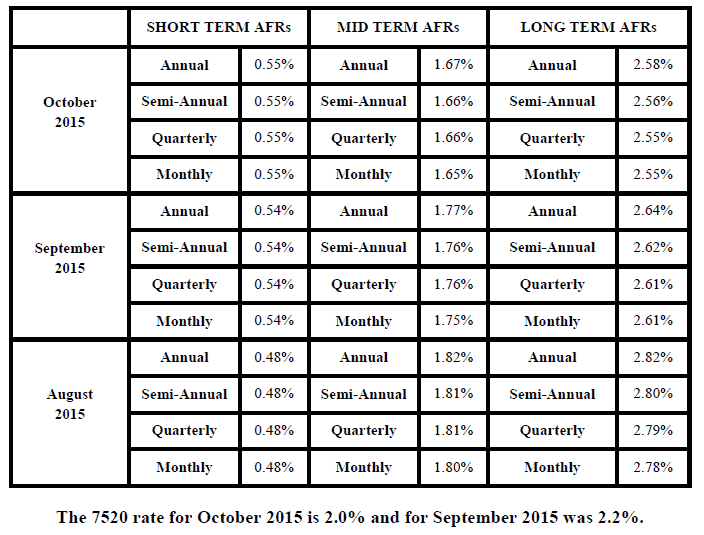

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.