Next Thursday’s Report – Early Edition – Issue 345

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Saturday, June 1, 2024Next Thursday’s Report – Early EditionHONK IF YOU ARE IN VEGAS – Get Engaged Issue #345

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

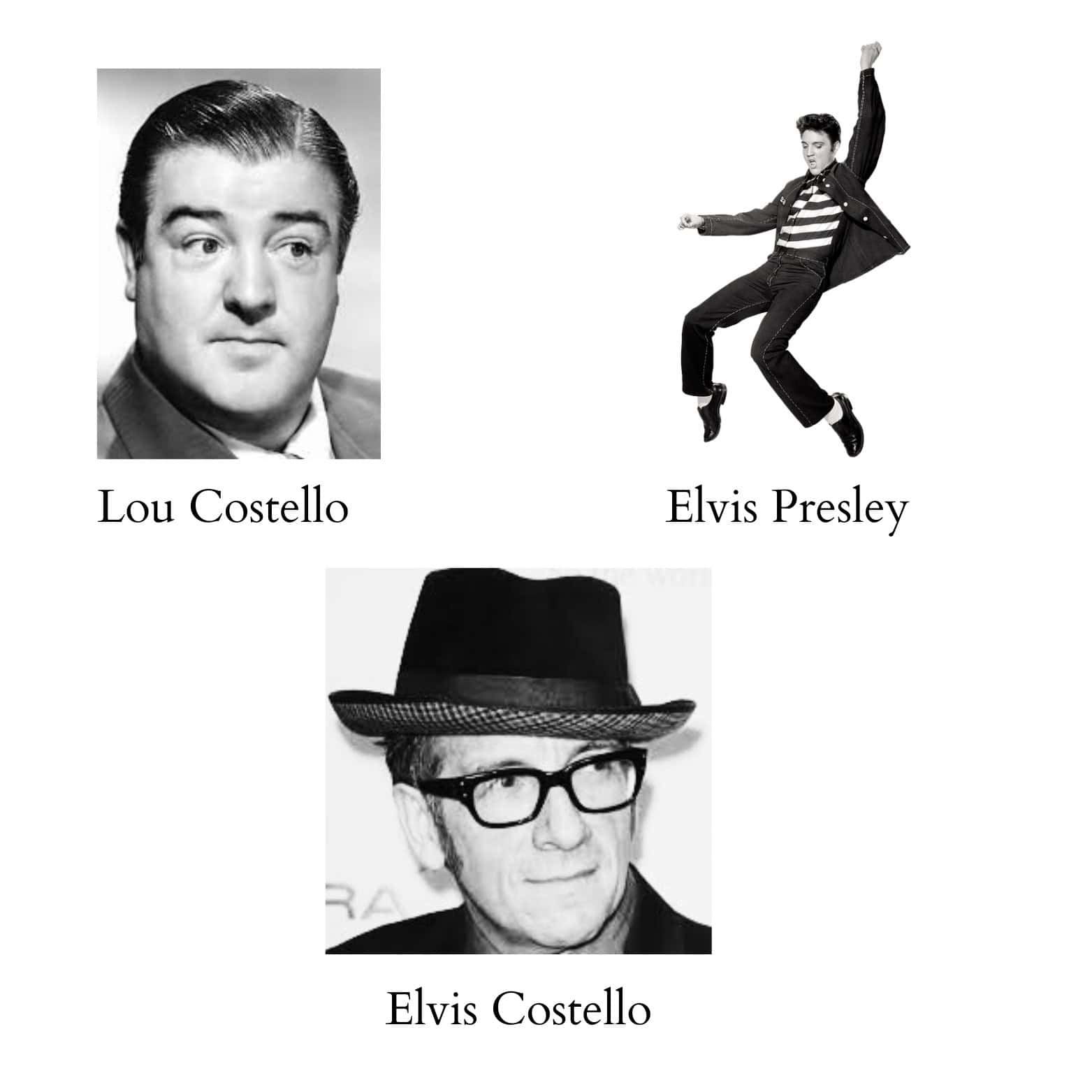

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1Trusts and Trustees Under The Corporate Transparency ActWritten By: Marty Shenkman, Thomas Tietz, Jonathan Blattmachr & Elvis Presley Article 2Estate Planning With Value Only is a Fool’s Errand-Estate Planning and Cash Flow Modeling and Projecting with Software Is a Best PracticeWritten By: Paul Hood Article 3Does the New Federal Trade Commission Rule Apply to Nonprofits and How Should the Healthcare Industry Proceed?Written By: Jacob Gordon, Alan Gassman & Elvis Presley Rao’s CornerI have No Time!The How of Being!Get Rid of the Imposter Syndrome For Good!Don’t Be Vulnerable!Written By: Srikumar Rao For Finkel’s Followers6 Things You Are Sacrificing Because of Your Inability to Let GoWritten By: David Finkel Upcoming WebinarWhat Do We Do With the Family BusinessPresented By: Alan Gassman More Upcoming EventsYouTube LibraryHumor |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If you are attending Engage & Prosper in Las Vegas click here and put the word “ENGAGE” in the subject line. We will have a special gift for you and a chance to meet Bob Keebler and Alan Gassman. Seeing both of them at the same time will prove they are not the same person. COME SEE US AT BOOTH #428

COME SEE US AT BOOTH #428 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

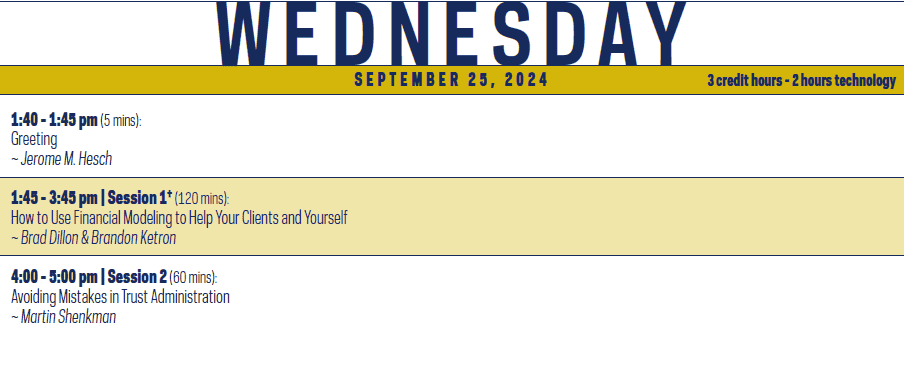

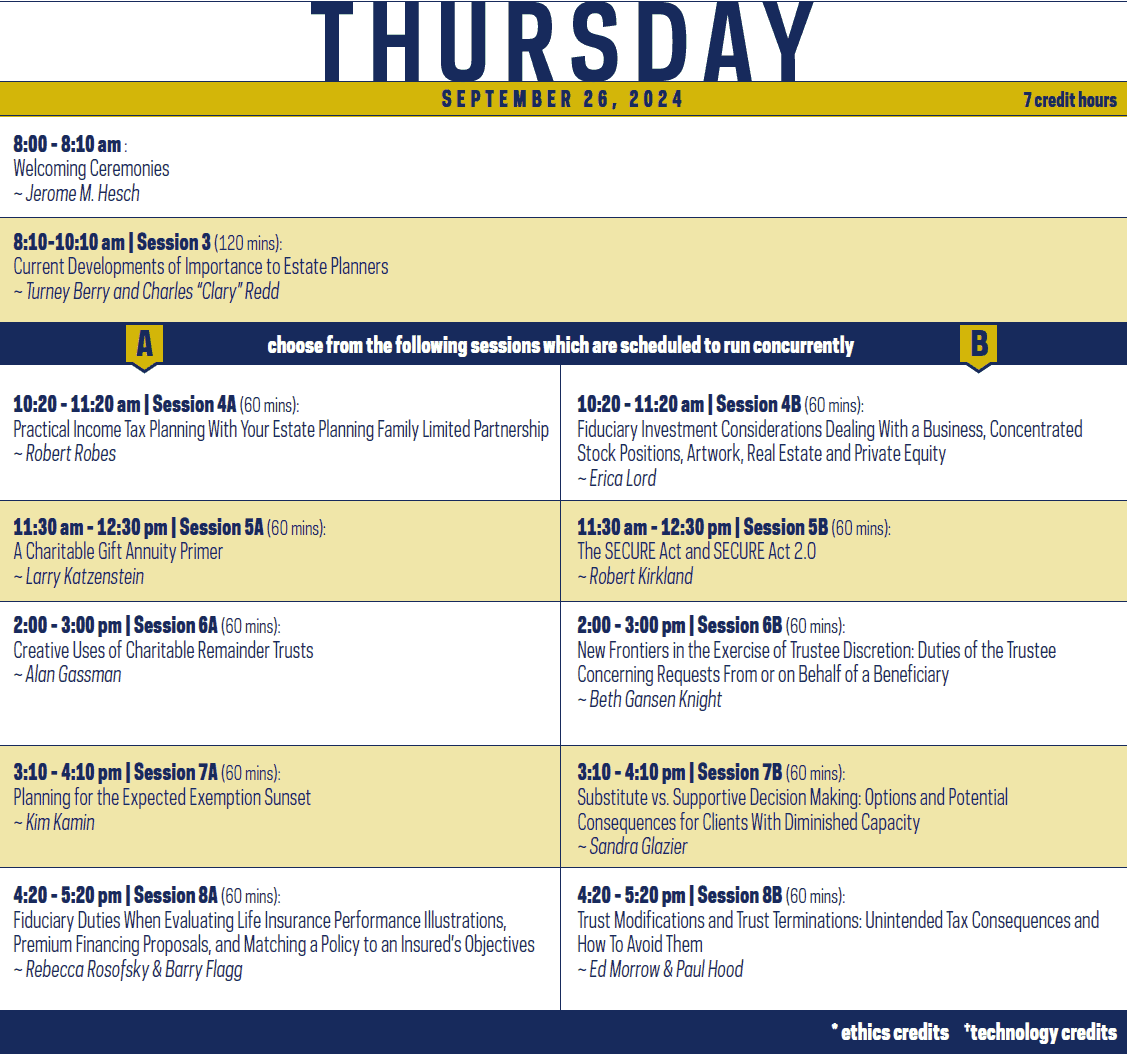

FLASH NEWS!!We have been able to get a copy of the Notre Dame and Tax Planning Institute Brochure. Please don’t tell anyone that you saw it here.The Notre Dame Institute will be from Wednesday, September 25 at 1:40 PM to Friday, September 27th at 5:00 PM. On September 28th Notre Dame will play the Lousiville Cardinals at Notre Dame. It would therefore be a Cardinal Sin to miss this year’s amazing dual presentation choice stupendous, collassal, and really really really good conference. Rated 5 Stars, two thumbs up and quite darn good by the Tax And Estate Planning Institute Rating Organization (TAEPIRO). Sorry but Elvis will not be appearing at this year’s institute.

CLICK HERE FOR MORE INFORMATION |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Thursday Report sincerely thanks Leimberg Information Services for giving us the permission to reproduce this stupendous, collassal, and really really really good well thought out blatt-buster fan-tietz-tanic martv-ourous newsletter which discusses what trustees need to know about The Corporate Transparency Act. While Marty and Tom’s ties look similar on this page, they have both assured us that they are two separate ties. Article 1Trusts and Trustees Under The Corporate Transparency Act

Written By: Marty Shenkman, Thomas Tietz, Jonathan Blattmachr & Elvis Presley “Under the Corporate Transparency Act, certain information about the Beneficial Owners of certain “small” entities must be provided to the Financial Crimes Enforcement Network of the US Treasury Department. When a trust is an equity owner of a reporting company, it can create significant reporting requirements for individuals named as powerholders in the trust. Which positions in a trust rise to the level of being a Beneficial Owner are based on the “[p]articular facts and circumstances” of that trust. While FinCEN updated their Beneficial Ownership Information Frequently Asked Questions on April 30th and provided additional guidance on trusts, that guidance is in many cases ambiguous and there are many unanswered questions that create a minefield of issues for both clients and practitioners to address.”

Martin M. Shenkman, Thomas Tietz and Jonathan G. Blattmachr provide members with commentary that examines the reporting obligations of trusts and trustees under the Corporate Transparency Act. Martin M. Shenkman is an attorney in private practice in New York who concentrates on estate planning. He is the author of 42 books and more than 1,200 articles. He is a member of the NAEPC Board of Directors (Emeritus), served on the Board of the American Brain Foundation, the American Cancer Society”s National Professional Advisor Network, Weill Cornell Medicine Professional Advisory Council, and is active in other charitable organizations. Thomas Tietz, JD, is an Associate with Shenkman Law. He has lectured at the Notre Dame Tax & Estate Planning Institute and for the New Jersey Bar and Institute of Continuing Legal Education. He has published articles in the American Bar Association E-Report, Wealthmanagement.com and Trusts & Estate Magazine. He is a member of the American Bar Association, Real Property, Trust and Estate Law and Business Law sections, the New York State Bar Association, the New Jersey State Bar Association and the Bergen County Estate Planning Council. Jonathan G. Blattmachr is Director of Estate Planning for Peak Trust Company, formerly Alaska Trust Company and a Director of Pioneer Wealth Partners, LLC in a boutique wealth advisory firm in Manhattan. He is a Principal at Interactive Legal Services Management, LLC and a retired member of Milbank Tweed Hadley & McCloy LLP. He is recognized as one of the most creative trusts and estates lawyers in the country and is listed in The Best Lawyers in America in New York, Alaska and in California. He graduated from Columbia University School of Law, where he was recognized as a Harlan Fiske Stone Scholar. He has written and lectured extensively on estate and trust taxation and charitable giving. He is author & co-author of five books and more than 500 articles on estate planning and tax topics. Jonathan served two years of active duty in the US Army, rising to the rank of Captain and was awarded the Army Commendation Medal. He is an instrument rated land and seaplane pilot and a licensed hunting and fishing guide in the Town of Southampton, New York. Here is their commentary: EXECUTIVE SUMMARY: Under the Corporate Transparency Act (“CTA”), certain information about the Beneficial Owners of certain “small” entities (called a “Reporting Company” or “Reporting Companies”) must be provided to the Financial Crimes Enforcement Network (“FinCEN”) of the US Treasury Department.[i] When a trust is an equity owner of a reporting company, it can create significant reporting requirements for individuals named as powerholders in the trust. Which positions in a trust rise to the level of being a Beneficial Owner are based on the “[p]articular facts and circumstances”[ii] of that trust. While FinCen updated their Beneficial Ownership Information Frequently Asked Questions (“FAQ”) on April 30th and provided additional guidance on trusts, that guidance is in many cases ambiguous and there are many unanswered questions that create a minefield of issues for both clients and practitioners to address. COMMENT: Are Trusts Reporting Companies Under the CTA? Most trusts are not Reporting Companies, but as the FAQs point out, as with the traditional joke about a lawyers answer to every question, the FAQs begin with “It depends.” They continue to explain that a domestic entity such as a statutory trust, business trust, or foundation is a Reporting Company only if it was created by the filing of a document with a secretary of state or similar office.[iii] Most trusts do not file to be formed and are rather created by contract. But as with so many legal matters, state laws vary as to whether certain trusts (sometimes called “statutory” or “business” trusts) require the filing of a document with the secretary of state to be created. If a trust is created in a U.S. jurisdiction that requires such filing, then it is a Reporting Company, unless an exemption applies. But if a trust is a Reporting Company, it should then consider if it may nonetheless be exempt from filing. For example, a foundation may not be required to report beneficial ownership information to FinCEN if the foundation qualifies for the tax-exempt entity exemption.[iv] Another exception that might apply to trusts is quite limited. If a trust registers with a court to establish the court”s jurisdiction over any disputes involving the trust, that alone would not constitute a registration that would trigger reporting under the CTA.[v] Beneficial Owners Owning or Controlling a Reporting Company Through a Trust The FAQ provides the following guidance to this significant question for estate planning: “Yes, beneficial owners can own or control a reporting company through trusts. They can do so by either exercising substantial control over a reporting company through a trust arrangement or by owning or controlling the ownership interests of a reporting company that are held in a trust.”[vi] In a simple trust situation, if a trust owns 25% or more of an entity that is classified as a Reporting Company, then the trust would be deemed an owner which is required to report Beneficial Ownership Information. If a trust owned less than 25% of an entity that is classified as a Reporting Company, then an analysis would have to be performed to determine whether the trust can exercise substantial control over the entity. But there is another prong to the analysis about which the FinCEN guidance provides little insight. If the trust might exercise substantial control over the Reporting Company, which individuals named in trust positions, powerholders, etc., could be those who exercise the requisite control. That might require an analysis of the trust instrument and any amendments. Given the complexity of modern trusts, if a powerholder acted, or a trustee decanted (that is, transferred the assets to another trust), or perhaps if a trust director or protector (which might be labeled under different titles depending on the draftsperson involved) has acted, the ancillary documents evidencing those actions would have to be identified and evaluated. The Reporting Company”s governing documents may be relevant to the analysis. There may be many other relevant documents apart from the obvious trust instrument and operating (or other) agreement for the Reporting Company that could impact the analysis. The FinCEN guidance does not provide any meaningful insight into this analysis. The FAQs elaborate on trust ownership or control of a Reporting Company. FinCen poses the question: “Who are a reporting company”s beneficial owners when individuals own or control the company through a trust?”[vii] Following is the text of FAQ D.15, which will then be analyzed: “A beneficial owner is any individual who either: (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of a reporting company”s ownership interests. Exercising substantial control or owning or controlling ownership interests may be direct or indirect, including through any contract, arrangement, understanding, relationship, or otherwise.” In the context of a trust with one beneficiary and one trustee, this is the trustee, as indicated above. However, consider what this might mean if a complicated trust is involved. A trust might have an investment advisor or trustee who can exercise control over trust investment assets. The person serving in that capacity would seem to be an individual who exercises substantial control over a Reporting Company holding investment assets owned by a trust. Some trusts have several different investment advisor roles. A trust might name a different trust advisor for marketable securities, for life insurance, and for private equity. In such a situation, it would seem that only the trust advisor with authority over private equity assets would be deemed a Beneficial Owner. Trusts may hold entities where the only asset is a residential property occupied by a beneficiary. For those entities (which under the CTA are typically considered a Reporting Company) trust terms may dictate a distribution trustee or advisor has substantial control over the entity. In addition, might there be a distinction between a trust that is a directed trust (in which the investment advisor directs the trustee as to what actions to take with respect to trust investment assets) and a delegated trust (in which the trustee may delegate to the named person investment decisions but for which the trustee nonetheless retains some measure of oversight responsibility)? It would seem, given the lack of specific FinCEN guidance and the potential severity of penalties for failing to file,[viii] that the prudent approach would be to have all such persons file and not to endeavor to parse through whether the person holding delegated investment authority or distribution authority might avoid filing because of the responsibility retained by the trustee. “Trust arrangements vary. Particular facts and circumstances determine whether specific trustees, beneficiaries, grantors, settlors, and other individuals with roles in a particular trust are beneficial owners of a reporting company whose ownership interests are held through that trust.”

The FAQ’s above language seems to acknowledge that “other individuals with roles in a particular trust” suggests or encompasses the wide array of positions, powerholders, etc., that the myriad varieties of trusts might include. All individuals named in the trust must be evaluated to ascertain whether they are Beneficial Owners required to report.

“For instance, the trustee of a trust may be a beneficial owner of a reporting company either by exercising substantial control over the reporting company, or by owning or controlling at least 25 percent of the ownership interests in that company through a trust or similar arrangement. Certain beneficiaries and grantors or settlors may also own or control ownership interests in a reporting company through a trust. The following conditions indicate that an individual owns or controls ownership interests in a reporting company through a trust:

· ”a trustee (or any other individual) has the authority to dispose of trust assets;”

The authority to dispose of trust assets could include various modern trust positions. In many trusts, a trustee may have that authority. Co-trustees would all seem to be Beneficial Owners. The authority to dispose of investment assets could be controlled instead, as discussed above, by an investment advisor or director. Someone holding a lifetime power of appointment who could, by the exercise of that power, shift the interests in a Reporting Company held by the trust to a new trust or person would also seem to hold the “authority to dispose of trust assets.” A person holding power to loan trust assets to the settlor, a power that has been used historically to characterize a trust as a grantor trust for income tax purposes pursuant to Section 675(4)(C) of the Internal Revenue Code (Code), but which more recently has been used to provide another potential means of access to trust economic value to a settlor, would also seem to be characterized as a Beneficial Owner. Many modern trusts have positions such as a trust protector, whose rights and power can vary dramatically. In a narrow drafting, a trust protector may only have the power to remove and replace a trustee or change the situs and governing law of a trust. In a broader context, some draftspersons give an array of powers to the trust protector. So, whether a trust protector has the power to “dispose of trust assets” will depend on the terms of the governing instrument and perhaps state law as well. But even if the trust protector avoids Beneficial Owner status by not being able to “dispose of trust assets,” the control that the trust protector may exercise over the persons who directly can “dispose of trust assets,” such as the power to remove and replace those persons, may itself characterize the trust protector as a Beneficial Owner.

· ”a beneficiary is the sole permissible recipient of income and principal from the trust, or has the right to demand a distribution of or withdraw substantially all of the assets from the trust; or”

In a simple trust, a person may be named as the sole permissible recipient of income and principal and hence be deemed a Beneficial Owner. For example, in a QTIP marital trust[ix] the surviving spouse may be named as the sole “permissible recipient of income and principal from the trust.” But what if, for example, in a second or later marriage situation, the surviving spouse is not named a beneficiary of principal (but only if income)? It would seem that the spouse might not, under such trust terms, be a Beneficial Owner. But what if the surviving spouse is named as only an income beneficiary, but the trust is governed by the laws of a state, like New Jersey, that has the power to adjust so corpus can be considered income? What if the trust is governed by the laws of a state, like Delaware, that permit a unitrust election that might once made require the payment of portions of QTIP corpus to the surviving spouse? Would either of those situations then make the surviving spouse qualify as a Beneficial Owner as then meeting the requirements of “the sole permissible recipient of income and principal?” Is it worth the cost of trying to evaluate these issues in light of the vagueness of the FinCEN guidance and when compared to the cost of having the surviving spouse (or other beneficiaries as applicable in another type of trust) simply obtain a FinCEN Identifier number and then provide it to the Reporting Company?

When might a beneficiary have “the right to demand a distribution of or withdraw substantially all of the assets from the trust?” In a Beneficiary Defective Irrevocable Trust, or “BDIT,”[x] the beneficiary may be given an annual demand power to withdraw assets. In the first year, the settlor, e.g., a parent of the beneficiary who will be characterized as the “grantor” of the trust for income tax purposes, may make a $5,000 gift to the trust. The beneficiary”s right to withdraw that would constitute “the right to demand a distribution of or withdraw substantially all of the assets from the trust.” What if, later that year, the beneficiary sells a valuable asset to the trust? In the following year, the value of the trust has grown substantially so that any withdrawal right would no longer constitute “the right to demand a distribution of or withdraw substantially all of the assets from the trust.” Does that beneficiary no longer constitute a Beneficial Owner even though he or she had been one in the prior year? Does that constitute a change in Beneficial Owners that requires that an updated report be filed within 30 days?[xi] How, and more importantly, when might that change in Beneficial Owners have occurred? It would seem that the date on which the value of trust assets increases to the point that the beneficiary”s “right to demand a distribution of or withdraw” no longer encompasses “substantially all of the assets from the trust.” In most, if not all, instances BDIT transactions involve the sale of private equity. Is an appraisal required to determine when the threshold of “substantially all” is no longer crossed? As with prior discussions above, these requirements are unclear and likely impossible to meet.

The FinCEN Small Business Guide states: “In addition to filing an initial BOI [beneficial owner information] report, reporting companies must also update and correct information in their previously filed BOI reports. Individuals who obtain FinCEN identifiers must also update and correct information previously reported to FinCEN.” The Guide provides: “A change in beneficial owners, such as a new Chief Executive Officer, a sale that changes who meets the ownership interest threshold of 25 percent, or the death of a beneficial owner.”[xii] These seem focused on identifying information as to new Beneficial Owners. The Guide provides that “There is no requirement to report a company”s termination or dissolution.” But it does not address the cessation of Beneficial Owner status. Thus, a change in Beneficial Owners, even if it does not result in a new Beneficial Owner may have to be reported. Certainly, with the specter of a $500/day inflation-adjusted fines, etc., it may be sensible to err on the side of reporting rather than not reporting.

· ”a grantor or settlor has the right to revoke the trust or otherwise withdraw the assets of the trust.”

The obvious type of trust that would be subsumed by the criteria “a grantor or settlor has the right to revoke the trust” is a revocable trust, sometimes called a “living” trust. The typical revocable trust provides the grantor the unfettered right to modify or revoke the trust at any time. What if the settlor”s power to revoke is contingent upon the approval of an independent, non-adverse person, such as the settlor”s attorney? That type of mechanism is sometimes used to endeavor to reduce the risk of elder financial abuse by having a check and balance on a family member or home health aid from manipulating an elderly or infirm settlor into modifying a revocable trust to change the dispositive plan favoring the perpetrator. If that type of mechanism is used, does the settlor still meet the criteria of the above requirement to be deemed a Beneficial Owner? Perhaps. More nettlesome, does the person holding the approval power, e.g., the family attorney, now become characterized as a Beneficial Owner who is required to report? Perhaps, maybe probably. But as with several similar ambiguities above, given the penalties and lack of clear guidance, is it worth the risk of not reporting? Is it worth the cost of having counsel analyze the document and FinCEN guidance knowing that there is likely no clear answer worth incurring in lieu of filing, which might be required, or even if not required, likely advisable, in any event?

A person holding a power to swap or substitute trust assets would certainly seem to meet the above criteria. That person is typically the settlor of the trust, but according to some commentators, can be another person as well. So, the governing trust instrument, as well as any ancillary documents modifying the trust instrument, will have to be reviewed to ascertain who that person may be. In some instruments, if the grantor designated as holding the power to substitute cannot serve because of incapacity, the trust may name the agent under the grantor”s durable power of attorney to instead hold the power. Thus, the agent may also be required to file. But if the grantor is not incapacitated, or if the durable power of attorney is a springing power (that is, one that becomes effective upon the occurrence of a future event), it would seem that would not be required initially. However, might that then imply that if the grantor is incapacitated and a named successor (whether the agent under the grantor”s power of attorney, someone designated as successor powerholder in the instrument, or someone appointed as a successor if and as that may be permitted in the instrument) steps in, it would trigger the need to file updated information for all Reporting Companies affected within 30-days as a change in Beneficial Owners? What if the named successor takes office only upon agreeing in writing to serve?

Because there are no uniform standards for drafting the powers given to the array of positions that a modern trust might include, nor to the titles of persons holding those rights, each trust will have to be reviewed in some measure of detail to ascertain which persons might be caught in the Beneficial Owner net. But in the end, it seems that for many trust situations, obtaining a FinCEN Identifier number for almost anyone involved and providing that information to the Reporting Company may be the prudent and economical approach. But, even that approach is not without issue since each person filing will then be obligated to file updates within 30 days if their Beneficial Owner Information changes. In addition, if they are no longer deemed a Beneficial Owner, then it appears that the Reporting Company will have to report that.

FinCEN concludes this FAQ with the following: ”This may not be an exhaustive list of the conditions under which an individual owns or controls ownership interests in a reporting company through a trust. Because facts and circumstances vary, there may be other arrangements under which individuals associated with a trust may be beneficial owners of any reporting company in which that trust holds interests.” It is a common practice for some practitioners to appoint entities instead of individuals for various positions in a trust, such as the trust protector. Some believe that the use of an entity might insulate the person (or persons, as committees of people are sometimes used) from liability. Also, if the person is resident in a state other than the state where the trust is formed, that second state may use the person”s residency as a basis to assert jurisdiction over the trust. For example, the settlor creates a trust in a trust-friendly jurisdiction like Nevada but is a resident in a state like New York. The person that the settlor wishes to name as trust protector resides in New York. Perhaps creating an entity in Nevada to “house” the person serving in that role and having the entity, not the person, named in the trust instrument might remove the potential connection to New York by one measure. Now, under the CTA, it is likely that the entity will be considered a Reporting Company and must file, and the person named in that entity serving must provide information as a Beneficial Owner of that entity if a Special Purpose Entity (“SPE”) holds no assets and does not engage in an active business., could it meet the inactive entity exemption? [xiii] If the trust for which the entity serves as a trust protector in turn owns interests in other entities that are considered Reporting Companies, the individual in the trust protector entity may also have to be indicated as a Beneficial Owner of those entities as well. Remember the funhouse mirrors where you look in one mirror and another is directly behind you, and it appears as if you have an infinite number of reflections? How Does A Reporting Company Report A Corporate Trustee As A Beneficial Owner? The FAQ provides: “For purposes of this question, “corporate trustee” means a legal entity rather than an individual exercising the powers of a trustee in a trust arrangement. If a reporting company”s ownership interests are owned or controlled through a trust arrangement with a corporate trustee, the reporting company should determine whether any of the corporate trustee”s individual beneficial owners indirectly own or control at least 25 percent of the ownership interests of the reporting company through their ownership interests in the corporate trustee.” [xiv]

The above comment presumes a “corporate” form of ownership for the institutional trustee (perhaps a better phrase for FinCEN to have used in this FAQ), but it would seem that the guidance of this FAQ would apply even if the institutional trustee were organized as a limited liability company or other entity.

· For example, if an individual owns 60 percent of the corporate trustee of a trust, and that trust holds 50 percent of a reporting company”s ownership interests, then the individual owns or controls 30 percent (60 percent × 50 percent = 30 percent) of the reporting company”s ownership interests and is therefore a beneficial owner of the reporting company. · By contrast, if the same trust only holds 30 percent of the reporting company”s ownership interests, the same individual corporate trustee owner only owns or controls 18 percent (60 percent × 30 percent = 18 percent) of the reporting company, and thus is not a beneficial owner of the reporting company by virtue of ownership or control of ownership interests.

Consider that the corporate trustee may be an exempt entity itself, but if the trust over which the corporate trustee serves as a trustee owns sufficient interests in a Reporting Company, based on the above FAQ, a controlling equity holder of the corporate trustee may be deemed a Beneficial Owner of the Reporting Company. Assume that the equity holder obtains a FinCEN Identifier number and provides that to the Reporting Company. If there is a change in ownership of the exempt corporate trustee, the Reporting Company may be obligated to report that change within 30 days. “The reporting company may, but is not required to, report the name of the corporate trustee in lieu of information about an individual beneficial owner only if all of the following three conditions are met: · the corporate trustee is an entity that is exempt from the reporting requirements; · the individual beneficial owner owns or controls at least 25 percent of ownership interests in the reporting company only by virtue of ownership interests in the corporate trustee; and · the individual beneficial owner does not exercise substantial control over the reporting company.

The above discussion in the FAQ may permit a Reporting Company to avoid reporting information about the equity holders of a corporate trustee in a common trust structure. For example, the settlor created a grantor trust and transferred sufficient interests in a family business to that trust such that the trust, but for it being exempt from CTA reporting, would otherwise be a Beneficial Owner. As is common, but far from universal, the trust is structured as a directed trust with a family member, perhaps the settlor, serving as an investment adviser. The institutional trustee”s equity holders” only involvement with or interest in the Reporting Company is that the institutional trustee of which they are an equity holder serves as trustee of the trust, owning an interest in that Reporting Company. That would seem to avoid a need to report information on the institutional trustee”s equity holders in many, perhaps most, estate planning trust structures. The FAQ provides in such instances that the Reporting Company may only have to report the name of the institutional trustee. It would seem that the only further obligation of the Reporting Company would be to report a change in the name of the institutional trustee.

The FAQ continues: ”In addition to considering whether the beneficial owners of a corporate trustee own or control the ownership interests of a reporting company whose ownership interests are held in trust, it may be necessary to consider whether any owners of, or individuals employed or engaged by, the corporate trustee exercise substantial control over a reporting company. The factors for determining substantial control by an individual connected with a corporate trustee are the same as for any beneficial owner.”[xv] If the trust is not structured as a directed trust, an institutional trustee may have sufficient responsibility or control over the Reporting Company that the equity holders of the institutional trustee may have to report as Beneficial Owners. Does the trustee”s duty of loyalty, which requires a trustee to act solely in the interests of the beneficiaries, affect this analysis? Even if the trust instrument requires that the trustee continue to hold a particular business interest, the trustee may have a duty under state law to diversify that holding. If that is the case, would that impact the level of control the trustee is deemed to have and, hence, the obligation to report under the CTA?

Conclusion

The CTA remains opaque at best. Despite a laudable amount of guidance from FinCEN, many common trust arrangements and how they should be handled remain unaddressed or, if addressed, unclear. While the refrain “when it doubt file” may have some validity for CTA filing questions generally, it is not without potentially adverse implications as filings, once made, may trigger the requirement for updates. With substantial penalties for foot faults, the CTA, especially as it pertains to complex trust planning, remains worrisome.

HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE! CITE AS: LISI Business Entities Planning Newsletter #296 (May 28, 2024) at http://www.leimbergservices.com. Copyright 2024 Leimberg Information Services, Inc. (LISI) Reproduction in Any Form or Forwarding to Any Person Prohibited – Without Express Permission. Our agreement with you does not allow you to use or upload content from LISI into any hardware, software, bot, or external application, including any use(s) for artificial intelligence technologies such as large language models, generative AI, machine learning or AI system. This newsletter is designed to provide accurate and authoritative information regarding the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI. CITATIONS:

[i] Small Entity Compliance (“Guide”), Chapter 2.3. [ii] FinCen FAQ D.15. [iii] FAQ C. 3. Are certain corporate entities, such as statutory trusts, business trusts, or foundations, reporting companies? [iv] 31 CFR § 1010.380.(c).2.xix.A

Back to Top |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Estate Planning With Value Only is a Fool’s Errand-Estate Planning and Cash Flow Modeling and Projecting with Software Is a Best Practice

Written By: Paul Hood Introduction: For the sake of both the client (and client’s family) and estate planner, estate planners should not subject clients to lifetime planning techniques, particularly gifting but including sales, without evaluating the impact on cash flow occasioned by the technique. Indeed, as I pointed out in a recent LISI newsletter,” In the Shadow of an Impending Rollback, the Real History of Scheduled Rollbacks,” Steve Leimberg’s Estate Planning Email Newsletter 3111 from Leimberg Information Services Inc. (LISI), I concluded as follows: Before assisting a client with any irrevocable parting of assets that is material, i.e., equals or exceeds 10% of the client’s net worth/income/cash flow, conduct a Solvency and Objective Financial Income/Cash Flow and Capital Access Sufficiency Procedure, document it in writing, and get the client’s approval of the results of the procedure in writing. Appropriate spreadsheets or sophisticated software like EstateView can assist in compiling and analyzing this data and in testing multiple scenarios to expose problems on different facts. [emphasis added] Estate planners also should engage in a similar analysis as to the cash flow effects of a testamentary scheme, including the possibility of cash available to pay estate tax at either or both deaths. Estate planning must consider access to capital as well as income or cash flow–not just asset values. Too many estate planners plan by value without considering income or cash flow-to their clients’ perils. Importance of Cash Flow Planning: The following components generally must by considered in any cash flow analysis, although it must be noted that these are an endless list of possible future impacts on cash flow: Positive: Annual exclusion gifts (if being made). Income of each spouse from all sources (wages, 1099’s, interest (taxable and tax-exempt), rents, alimony, IRA’s/retirement plan distributions, Social Security, dividends, etc.). Sales of assets. Life insurance proceeds. Inheritance and other gifts. Lottery winnings (Just checking to see if you’ve had enough coffee today!). Miscellaneous. Negative: Taxes. Projected living expenses. Housing expenses. Health insurance premiums. Life insurance premiums. Liabilities (include secondary and even contingent liabilities if it is in any way possible that the client will be asked to “step up to the plate”). Uninsured medical expenses. Tuition/educational expenses. Miscellaneous. The above list includes some, but not all, of the possible factors to include. Each estate planner should consider a client’s cash flow situation, even if the numbers are little more than rank conjecture at the time. In planning for couples, the cash flow analysis should illustrate the current situation out to at least the life expectancy of the elder spouse, and a cash flow analysis for the surviving spouse should commence at that point out to his or her life expectancy. The estate planner also should consider preparing a cash flow analysis going forward on an annual basis for each spouse as if the other died in each particular year. Variations of each year (pay estate tax vs. defer estate tax) could easily be run. Be wary of allocating too much non-income or low-income producing property to the surviving spouse, especially if the remaining income is projected to fall beneath, or dangerously close to, the surviving spouse’s expected living expenses. Too many estate planners tend to do too much in the way of estate planning by value and not by cash flow. Care should also be taken to guard against a frequently encountered scenario: the surviving spouse who is given an income amount that vastly exceeds her current living expenses, even considering a healthy (100%) increase at a certain time. Excess income will simply stack in her estate and attract additional unnecessary estate taxes when it could have been used by a descendant. The bottom line seems to be that if one does not consider cash flow, then one really is blindly gambling that what the survivor will get will suffice. Cash flow also is an important consideration because it constitutes a separate “asset” from wealth. If a surviving spouse is, for example, given the family home but not enough income or cash flow to maintain the home, one of two things is likely to happen, and neither is good: sale of the home at a below market price or having to do without (or possibly being put out). LISI Webinars with Alan Gassman: I had the pleasure of collaborating with long-time LISI teammate and Florida estate planning lawyer, Alan Gassman from the Clearwater FL law firm of Gassman, Denicolo & Ketron, P.A. on an important webinar on the most accurate and realistic approach to planning for 2026 as well as four very practical and hands-on webinars exploring modeling a number of different estate planning techniques using EstateView, the new estate planning app that Alan spearheaded, which is described below. The LISI webinars are: Running the Numbers on QPRTs and GRATs – Part 3 of a 4 Part Series Running the Numbers on Charitable Lead Annuity Trusts – Part 2 of a 4 Part Series Running the Numbers on Self-Canceling installment Notes and Annuities – Part 1 of a 4 Part Series Those interested in purchasing all four “Running the Numbers” on-demand webinars at a significant savings, click: The “In the Planning Room” – A 4-Part Webinar Series EstateView Estate Planning software/app revolutionizes the way estate and financial professionals navigate the complexities of estate planning. Developed by Alan Gassman, with invaluable contributions from Jerry Hesch, Jonathan Blattmachr, Bob Keebler, and other industry leaders (including me), EstateView empowers users to craft comprehensive estate plans and conduct detailed financial analyses tailored to both estate-taxable and non-estate-taxable client scenarios. With EstateView, you can effortlessly measure, design, illustrate, and educate multiple estate planning strategies. From QPRTs and GRATs to Rolling GRATs and Installment Sales to Grantor Trusts, the software facilitates in-depth comparisons, allowing you to evaluate various techniques side by side. Moreover, EstateView offers access to essential resources such as life expectancy data for individuals and couples, term life insurance rates, IRA minimum distribution calculations, and insights into tax savings from Qualified Charitable Distributions. The platform’s user-friendly interface features a customizable news feed and a chat function for real-time assistance with estate and income tax planning inquiries. Until June 1st, EstateView is available for free through the EstateView.info website or by accessing the software directly via the “Estateview.link” website. Alternatively, users can become founding members by paying just one dollar before June 1st to receive a 14-month first-year subscription, which provides two months of complimentary access once a subscription is purchased. EstateView offers various licensing options to suit different needs. The “Standard” version, priced at $199 for a one-year license, provides extensive features surpassing those of most comparable programs. For users seeking enhanced functionality, the comprehensive “Pro-Plus” license, priced at $499, includes PowerPoint presentations for each strategy, comprehensive explanation letters, and the ability to share access with colleagues and advisors for collaborative data analysis. While I’ve not seen the developments and changes in EstateView for a couple of months, I hope that they don’t back away from Monte Carlo analysis, which the earlier versions promised, and which, if implemented, will be game changers. The client education and staff task education/delegation/management features of EstateView were quite good when I saw it last. My Recent Past and Upcoming Webinar Presentations: Upcoming Presentations: May 28, 2024-3:00-4:00 p.m. EDT (on Leimberg Information Services Inc. (LISI)-no continuing education credits available): Is Your Buy-Sell Agreement Up to Snuff? Things to Remember in Buy-Sell Agreements. June 5, 2024–9:15-10:15 a.m. EDT (Development Day is an all day in-person event put on by the Planned Giving Roundtable of Southeast Michigan, with many presenters from 7:30 a.m.-3:30 p.m. EDT at Schoolcraft College VistaTech Center; Livonia MI)-Development Day – 2024 I’m co-presenting with Klementina X. Sula in a Development Track Breakout Session entitled “At the Intersection of Estate Planning & Philanthropy: Considerations and Best Practices for Professional Relationships Between a Philanthropic Professional and a Professional Advisors.” September 26, 2024-4:20-5:20 p.m. CDT (49th Annual Notre Dame Tax & Estate Planning Institute, an in-person event at Notre Dame in South Bend IN with many presenters, September 26-27, 2024) I’m co-presenting with Edwin Morrow III on “Trust modifications and trust terminations: Unintended tax consequences and how to avoid them.” Upcoming Items of Note: I’m working on an article with John “John A” Warnick for submission to Leimberg Information Services Inc. (LISI) entitled “A Wake-Up Call to the Estate Planning Advisory Community.” And I’m almost finished with the first draft of An Estate Planner’s Tool Book Second Ed. With Edwin Morrow III and four new 90-minute webinars entitled “A Planner’s Cheat Sheet to Evaluating Estate Planning Tools and Techniques,” where we’ll cover every estate and charitable planning tool and technique that we cover in the book. Look for them soon!!! to Snuff? Sursum corda, y’all!!! Paul |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Article 3Does the New Federal Trade Commission Rule Apply to Nonprofits and How Should the Healthcare Industry Proceed?

Written by: Alan Gassman, Jacob Gordon, Stetson Student & Elvis Presley

Jacob Gordon is a law student at Stetson Law School who is presently working with the Gassman, Denicolo & Ketron, P.A. He has no direct or indirect relationship to Elvis Presley. Introduction.The Federal Trade Commission (FTC) published their long-awaited final rule regarding non-compete clauses on May 7, 2024. The final rule, set to take effect on September 4, 2024, aims to liberate tens of millions of Americans currently beholden to non-compete agreements. After reviewing over 26,000 public comments, the FTC concluded that non-compete clauses constitute an unfair method of competition, adversely affecting the economy and increasing healthcare costs. Despite extensive feedback from the healthcare industry and nonprofit organizations, the FTC declined to offer blanket exemptions and asserted its jurisdiction over these entities. As this rule continues to be analyzed and debated, confusion persists among professionals. Key questions arise: how does the new FTC rule apply to nonprofits, and how should the healthcare industry interpret the FTC ruling? Summary of the New RuleThe FTC’s new rule on non-compete clauses prohibits employers from entering into or enforcing non-compete agreements with workers, asserting that such clauses limit worker mobility and suppress wages. According to the FTC, these agreements stifle competition and innovation, leading to higher prices and reduced wages. The rule mandates that employers must rescind existing non-compete clauses and notify affected employees of the change. Considerable confusion has amassed around the impact of the FTC’s rule on nonprofits. While the FTC’s enabling act does not provide an explicit mandate over nonprofits, case law and FTC precedent has produced a two-prong test that allows for FTC regulation of nonprofits who earn pecuniary gain for their members. Other law firms have either glazed over this point or are unfazed by the FTC’s power. FTC Enabling Act LanguageSection 5 of the FTC Act (15 U.S.C. 45a(2)), states that the FTC is empowered to prevent unfair methods of competition. Specifically, it grants the FTC authority over “persons, partnerships, or corporations” but excludes “banks, common carriers, and air carriers…” The Act further defines a corporation as any company or association “organized to carry on business for its own profit or that of its members.” It is the “or” in the definition that the FTC uses as a basis for their argument. Law Firm Articles on Nonprofit Jurisdiction of the FTCA highly respected Florida law firm furnished an article 13 days before the FTC’s final rule was published to the government’s website, asserting that the rule does not apply to nonprofits. The authors boldly state, “The rule does not apply to non-profits. The basis for the rule making is Section 5 of the FTC Act, which doesn’t apply to non-profits.” While the conclusion from the authors is clear, the FTC prepared for this argument and wrote extensively on why the Commission is afforded power over nonprofits, which is discussed in the next section. The authors suggested that the FTC might be attempting to set themselves up for a test case on administrative law grounds, specifically about the FTC’s interpretation of their own enabling act. The authors wrote, “Be aware, though, that the FTC may be looking to test whether some non-profit health systems are really operating as true non-profits. Tax exempt status alone will not be enough.” By including that the tax-exempt status will not suffice for all nonprofits, the authors acknowledge that there is a possibility that some nonprofits may be corporations that are organized for the profit of their members. Thus, they fall within the The law firm that posted the article took a strong stance in their interpretation of FTC regulatory power over nonprofits. However, the firm’s take is rigid, not allowing for sufficient nuance in the law. FTC Jurisdiction Over NonprofitsThe FTC’s final rule categorizes non-compete agreements as an unfair competitive business practice. In response to public comments claiming that nonprofit organizations fall outside FTC authority, the FTC asserted its jurisdiction, citing both 8th Circuit and Commission precedent. The FTC and federal courts developed a two-prong test to determine jurisdiction over nonprofits:

This two-prong test was used in two cases to prove that the specific non-profit hospitals were actually corporations within the definition of the FTC Act. In the case of In the Matter of Preferred Health Services, Inc., FTC No. 41-0099, 2005 WL 593181, at *1 (Mar. 2, 2005), a physician hospital organization fell within the jurisdiction of the FTC because it engaged in business on behalf of for-profit physician members. In the case of In the Matter of Boulder Valley Individual Prac. Assoc., 149 F.T.C. 1147, 2010 WL 9434809, at *2 (Apr. 2, 2010), a tax-exempt independent physician association consisting of private physicians and small groups fell within the jurisdiction of the FTC because the association contracted with insurance payers on behalf of its physician members for fees. The FTC’s assertion of jurisdiction over nonprofit organizations, supported by the two-prong test and case precedents, reinforces its authority to regulate non-compete agreements within the nonprofit sector, ensuring these entities are held to the same competitive standards as for-profit businesses. Denial of Blanket Exception to HealthcareThe FTC flatly denied an exception to the healthcare industry. In the final rule, the FTC writes, “The Commission declines to adopt an exception specifically for the healthcare industry. The Commission is not persuaded that the healthcare industry is uniquely situated in a way that justifies exemption from the final rule.” The FTC emphasized that non-compete agreements in large hospital groups prevent physicians from leaving for private practice, contributing to higher healthcare costs and reduced competition. The FTC states that there is a trend in “…physicians leaving private practice to work at large hospital groups claiming tax-exempt status as nonprofits, which, they contend, may continue to lock those physicians up using non-competes.” Consequently, the final rule encompasses the healthcare sector without exception. Another component of why the FTC would like to apply their non-compete rule to the healthcare industry is to lower prices. The FTC expects the non-compete rule to reduce spending on physician services by $74-194 billion over the next decade. The Main Exception: Senior ExecutivesThe FTC’s final rule includes a singular exception: “senior executives” with existing non-compete agreements remain bound by those agreements, but any new non-compete agreements entered into after September 4, 2024, will be unenforceable. A senior executive is defined as an individual who:

A policy-making position is defined as one with significant authority and influence over company decisions, typically at the executive level, such as a CEO or CFO. For example, a hypothetical senior executive who was the Chief Financial Officer of a healthcare nonprofit, earning $200,000 in the preceding year, would be bound by an existing non-compete agreement but could not enter into a new one post-September 4, 2024. ConclusionThe FTC’s new rule unequivocally applies to specific nonprofits, countering arguments to the contrary. Certain nonprofits will not be able to enforce non-compete agreements, aligning with the FTC’s broader objective of enhancing worker mobility and economic fairness. The healthcare industry must prepare for the rule’s implementation, acknowledging that no blanket exceptions will shield them from compliance. The sole exemption pertains to senior executives under specific conditions. Overall, the FTC’s assertion of jurisdiction over nonprofits and the healthcare sector was designed to foster a more competitive and equitable marketplace, potentially freeing many professionals from restrictive non-compete clauses and reducing healthcare costs for everyday Americans.

____________________________________________________ [1] https://www.polsinelli.com/publications/ftc-final-rule-banning-most-non-competes-passes-what-nonprofits-need-to-know [2] https://www.lathropgpm.com/newsroom-alerts-72752.html [3] https://www.nelsonmullins.com/insights/blogs/healthcare_essentials/federal-healthcare-policy-developments/what-the-ftc-s-rule-banning-non-competes-means-for-healthcare [4] https://www.forbes.com/sites/robertpearl/2024/05/20/healthcares-biggest-winners-losers-from-the-ftcs-non-compete-ban/?sh=fe38c2f48776 [5] https://www.federalregister.gov/documents/2024/05/07/2024-09171/non-compete-clause-rule [6] https://www.polsinelli.com/publications/ftc-final-rule-banning-most-non-competes-passes-what-nonprofits-need-to-know |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

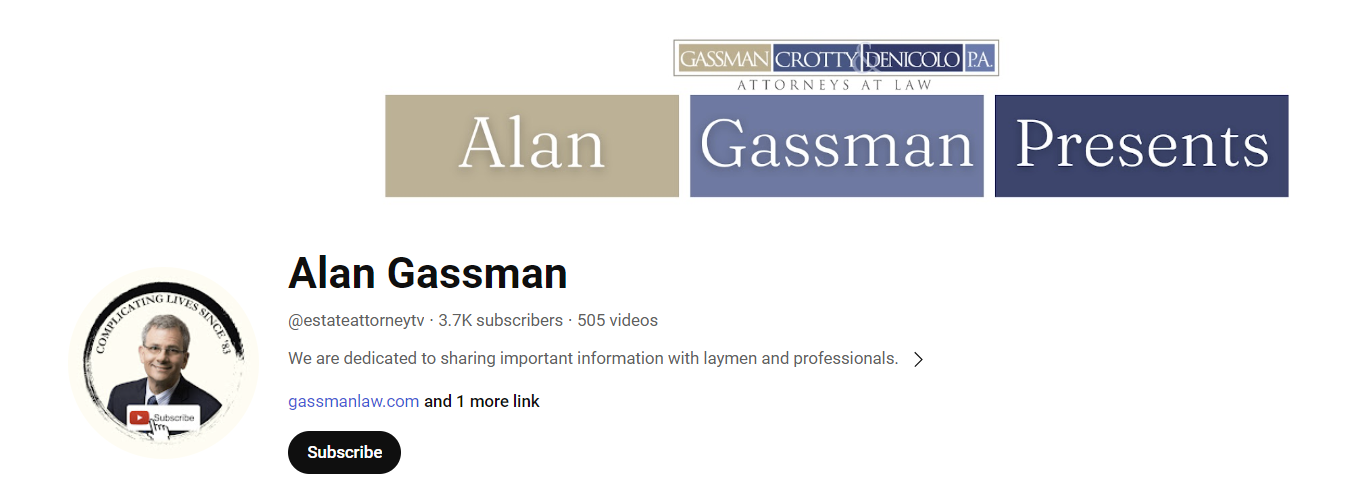

Rao’s CornerHere are 4 entries from Srikumar Rao’s amazing Blog

I Have No Time!Many years ago Tricycle magazine ran an article with excerpts of the teachings of Kodo Sawaki Roshi. He was better known as “Homeless Kodo” and was an influential Zen master. Here is one of his teachings: To you who are complaining all the time that you haven’t got any time Everybody complains that they’re so busy they haven’t got any time. But why are they so busy? It’s only their illusions that keep them busy. A person who practices zazen has time. When you practice zazen, you have more time than anyone else in the world. If you aren’t careful, you’ll start making a big fuss just to feed yourself. You’re constantly in a hurry, but why? Just to feed yourself. Chickens too are in a hurry when they peck at their food. But why? Only to be eaten by humans. How many illusions does a person create in their lifetime? It’s impossible to calculate. Day in, day out, “I want this, I want that . . .” Just a single stroll in the park is accompanied by incalculable illusions. So that’s what it means to be “busy.” “I want to be with you, I want to come home, I want to see you. . . .” People are constantly out of breath— from running so quickly after their illusions. In an earlier blog I wrote about how our frenetic activity is what keeps us anxious and tense and high strung. The solution to our woes is simple. Wherever you are, be there! It is not easy, but it is the only permanent solution to suffering! Peace! The How of Being!In my last blog, I mentioned that the cure for our constant feeling of being overwhelmed was to be wherever we happened to be. I heard back from a reader who said she had lots of demands on her – children, work, social, family, self-care and so on. Children need to be fed and nurtured with time and attention. Work commitments have to be met. Family also demands time. How can one practice ‘being’ while ‘doing’ all the things that need to ‘be done’? Think back to the first time you fell in love. Do you remember how uplifted you felt? The thought of your beloved was constantly with you and raised the tone of your life. The sun shone brighter. The flowers had a deeper, richer hue. Even the panhandler on the street had a nobility of demeanor. The cynic will say that it is impossible to live in the glow of youth’s first love. But it is possible and is your only way out of the sorrows of this material world. Know that you do nothing. Your accomplishments are not your own. All that you have achieved, all that you have done, has been done through you. Not by you. If you are a person of faith, imagine that Jesus, or Krishna, or Allah, or Baháʼu’lláh, or Guru Nanak, or whoever inspires you from the wisdom tradition you follow, is acting through you. If you are atheist/agnostic, imagine that a benevolent universe is acting through you to accomplish whatever it needs to. You are merely the passenger on the bus. Your job is to enjoy the ride. The driving is being done by someone else. Your only job is to feel your connection with this universal force and then it will always be with you as your beloved was with you when you first fell in love. The way to ‘get there’ is to practice, practice, practice, practice, practice. This is a “rest of your life” journey. And then you find that you are indeed just being. You are resting in this feeling of deep joy and all that needs to be done is getting done. There is no stress. There is no anxiety. I describe this in the syllabus of my course Creativity and Personal Mastery. You wake up in the morning suffused with an ineffable feeling of joy, a deep sense of well-being. You go to work, to a job you love so much that you would pay for the privilege of doing it. You labor intently but are so focused that time flies by unnoticed. At the end of the day you are invigorated, brimming with more energy than when you started. You have a penetrating awareness of the course you are charting, a clear knowledge of your place in the scheme of the universe. Your work feeds this, is congruent with it and brings great contentment and peace. You face obstacles, big ones and small ones, perhaps more than your fair share of them. You understand very clearly that their purpose is to test your mettle, to bring out the best in you even as the abrasive whetting stone serves to finely hone the knife. So you plow on indomitably, sure of what you want to achieve and yet unconcerned about results. At times it seems as if you are riding on the crest of a powerful tidal wave, as if the universe itself is helping you, working with you and through you. Locked doors open mysteriously. Incredibly fortuitous coincidences occur. You accomplish prodigious feats, feats you would never have imagined yourself capable of. Yet it would have been perfectly okay if you had not accomplished them. You accept accolades gracefully but are not swayed by them because you march to the beat of your own drummer. Your personal life is intensely fulfilling. You are active in a variety of civic, charitable and political causes and successful in all of them. Your spouse is perfectly compatible with you, a true helpmate in every sense of the word. You beget progeny and your offspring bring great satisfaction. You have a sense of trusteeship towards them and intuit what Gibran articulated: “Your children are not your children. So it goes on year after year, each day more perfect than the one before. Your gratitude is so intense that at times it is like a physical ache. Your heart bursts as you thank the universe. What have you done to deserve such good fortune? And when the time comes for you to depart, you do so joyfully and in peace, achieving identification with the Cosmic Principle, that incredible merging which has been called many things by many peoples but is ultimately indescribable, far beyond the feeble capabilities of language. A life such as described above is your birthright. You have to reach out and claim it. Will you succeed? I do not know. I do know that the first step towards getting there is recognizing that you want to get there. It is very important that you desperately want to reach the goal. It is equally important that you not particularly care whether you do or not. If this sounds like a paradox to you, you are correct. It is. Remember that all paradoxes are resolved as you reach higher levels of understanding, even the ultimate paradox of all – that which we call life. Peace! If this column resonates with you and you would like to begin your journey into the space described, you may wish to join my Meaningful Living Mastery Program. Please email Jacqueline.Fox@theraoinstitute.com for more information.

Get Rid of the Imposter Syndrome For Good!The Imposter Syndrome is alive and well. If anything, it is spreading virulently. Or, possibly, people are more open to admitting that they have it. Successful people, very successful people, feel that they accomplished what they did by chance or good timing or pure fluke. That they are not competent or skilled at all. And that someone will recognize this and expose them as ‘a fraud.’ People in the grip of full-blown “Imposter Syndrome” attacks feel insecure, fearful and afraid to take risks or even mild initiatives. Their stomachs knot up, their blood pressure shoots up and they have trouble sleeping. The solution is simple. Not easy, but simple. Accept that you are correct. You did not ‘do’ the things that made you successful. You think you did, but that is an illusion. A benevolent universe orchestrated the elaborate drama that led to your achievements. You are like the FedEx guy. You deliver the package, but it did not come from you. Letting go of the sense of ‘doership’ is not easy because our society constantly reinforces the notion that ‘You did it’ and ‘You can accomplish anything if you set your mind to it’. But you can jettison that sense. Constantly meditate on the number of factors that contributed to your success, things that you had nothing to do with. Someone complimented Warren Buffet on his financial acumen and how it led him to vast wealth. He replied to the effect that he was lucky and a fat lot of good his skills would have been if he had been born in Afghanistan. When you embrace the idea that, yes, you were lucky, the fear drops away. And then you become more open to the possibility that the universe will continue to guard your back. Because here is a truth that only a few discover. A truth that no less a genius than Albert Einstein discussed openly. When you look for signs that the Universe is ‘friendly’ you will find them everywhere. It is far better to live in a ‘friendly’ universe than an ‘indifferent’ or ‘hostile’ one. Trust me on this one! Peace! Don’t Be Vulnerable!I want to take a potshot at something that is becoming popular in business circles. Becoming is perhaps incorrect. It has become a buzzword and a fad. You are urged to ‘become vulnerable’ at work. This means that you should admit when you are feeling down or fearful or uncertain. The idea is that, when you admit to those feelings, others will find it easier to relate to you. They will share their own emotions and you will bond in fellowship. One of my students, the CEO of a substantial company, was vehement about the silliness of the idea. “I never heard such ‘bull’ in my life,” he expostulated. “Once, when we had a down quarter, I let my team know that I was disheartened and not sure if our new, multi-million-dollar marketing campaign would work.” He expected his team to rally around him, but that is not what happened. His #2 quit the next week and two others within the month. And the company counsel warned him that he could be sued for making false statements at the analyst conference where he made upbeat comments on the company’s prospects. When you are the CEO or a senior executive of a company, particularly if it is a public company, there are eyes on you all the time. If you admit to feeling despondent or uncertain everybody will soon know this. And morale will plummet. It is your job to radiate confidence and rally the troops. This cannot be delegated. Six hundred years ago an invading English force had bogged down in France. Their much-heralded campaign had captured just one unimportant city and they were on their way back disgruntled and dispirited. They had marched hundreds of miles in just over two weeks, had little food and suffered from dysentery and lack of sleep. Blocking their way was a rested French army more than four times its size. Doom seemed assured. And that was when Henry V delivered his famous St. Crispin’s Day speech, immortalized by Shakespeare: “This day is call’d the feast of Crispian. He that outlives this day, and comes safe home, Will stand a tip-toe when this day is nam’d, And rouse him at the name of Crispian. He that shall live this day, and see old age, Will yearly on the vigil feast his neighbours, And say “To-morrow is Saint Crispian.” Then will he strip his sleeve and show his scars, And say “These wounds I had on Crispin’s day.” Old men forget; yet all shall be forgot, But he’ll remember, with advantages, What feats he did that day.” The aroused Englishmen handed the French a crushing defeat and the Battle of Agincourt is still studied by military historians. But what are you to do when you feel down about your situation and uncertain about your survival prospects? One way, of course, is to put on a bold face and fake it. This can be enormously draining. The other way, the better way, is to not be down in the first place. The way to do that is to recognize that all things everywhere change. What you are about to label a ‘bad thing’ could, in a few years’ time turn out to be a ‘good thing’. Why not pour your emotional energy into seeing what you can proactively do to make it a ‘good thing?’ When you do this, you move from the realm of despair to the realm of possibility. You don’t have to fake confidence. You radiate confidence. And you don’t have to show vulnerability to bond with your team. Your team follows you because you inspire them to do what they never thought they were capable of. Try it. Peace!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s Followers6 Things You are Sacrificing Because of Your Inability to Let Go |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

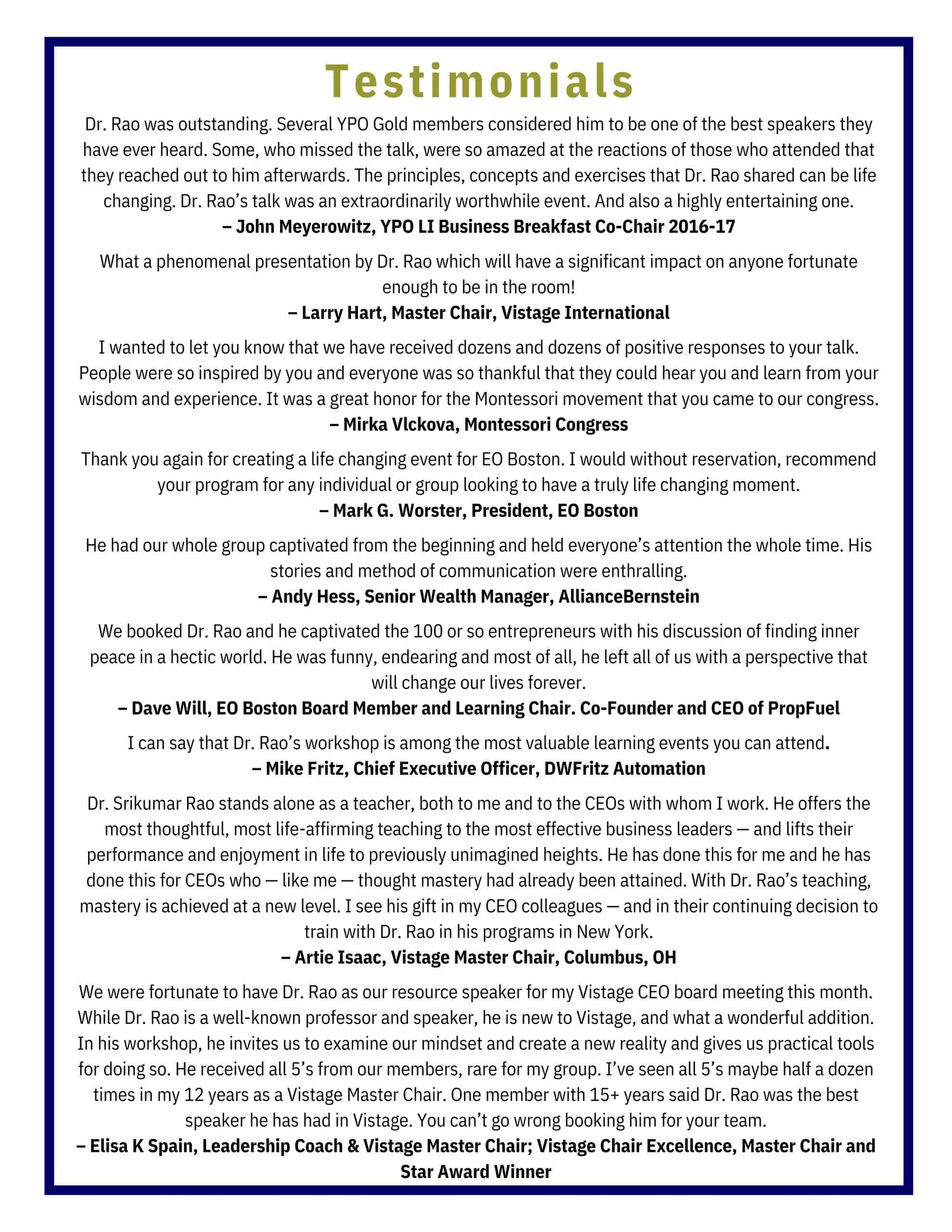

Upcoming WebinarWhat Do We Do With The Family Business

Date: Thursday, June 20, 2024 Time: 3:10 PM to 4:00 PM EST (50 minutes) Presented by: Alan Gassman, JD, LL.M, AEP (Distinguished) Location: Signia by Hilton Orlando Bonnet Creek & Waldorf Astoria – 14100 Bonnet Creek Resort Ln, Orlando, FL 32821 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ALL UPCOMING EVENTS

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

HUMORCrunching the Numbers With a SmileSure, here is the text integrated in a way that coordinates with the poem: — In the land of endless spreadsheets, With calculators on their hips, Balance sheets like ancient scrolls, They speak in tongues of debit, credit, In offices with paper stacked, Their pets have names like “W-2,” So here’s a cheer for CPA wits, When they Engage, you’ll surely see,

Who were the highest paid performers during World War II? It was Abbott and Costello. What was their best routine? Who’s on First. Click here Watch paint dry – Click here

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Denicolo & Ketron, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2023 Gassman, Crotty & Denicolo, P.A |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||