The Thursday Report – 9.3.15 – Statute Changes, Succession Planning, and Understanding Financial Aid

Update on Changes Made to Florida’s Estate Tax Apportionment Statute by Keith B. Braun

An Introduction to Succession Planning and Possibly All You Need to Know, Part III

Paying for College: Understanding Student Financial Aid, Part I

Seminar Spotlight – The Biggest Mistakes to Avoid Concerning Your High School Children – College Failures in the Making

Richard Connolly’s World – Retirees Stung by ‘Universal Life’ Cost

Thoughtful Corner – Out of Sight, Out of Mind

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“Ready, Fire, Aim,” – H. Ross Perot

Ross Perot sold Electronic Data Systems (EDS) to General Motors (GM) in the 1980s. A few years later, he was asked to explain the difference between the two companies. Perot claimed that EDS had a “Ready, Fire, Aim” strategy, i.e. a “get on with it now” philosophy towards running the business.

Oftentimes, it is best to determine where your gun is pointed by firing it and then adjusting from there. This is often true for situations where trial and error is the most effective way to get things going.

When you need to get something done or determined, consider the ready, fire, aim concept.

Update on Changes Made to Florida’s Estate Tax Apportionment Statute

by Keith B. Braun

Keith B. Braun has practiced for over 30 years, primarily in the areas of estate planning and probate and trust administration. He received his law degree from the University of Pennsylvania Law School and is a partner of the Palm Beach Gardens law firm of Comiter, Singer, Baseman & Braun, LLP. Keith is admitted to practice in Florida and Michigan and advises many law firms in Northern states on Florida issues. He is AV rated by Martindale Hubbell; Board Certified Wills, Trusts, and Estate Lawyer by The Florida Bar Board of Legal Specialization and Education; a Chartered Advisor in Philanthropy® (CAP®); and an Accredited Estate Planner ® (AEP®).

Two weeks ago, we provided summaries and compared statutory language to help you mount the learning curve for these delightfully concise and straightforward changes efficiently and effectively. You can click here to review the changes, which have already been read by millions of people throughout the world and, allegedly, Colonel Sanders as well.

We thank Keith B. Braun, David J. Akins, and Pamela O. Price for their hard work and achievement in facilitating the updated tax apportionment statutes. Braun, Akins, and Price were the members of the Estate Tax Apportionment Subcommittee of the Estate and Trust Tax Planning Committee of the Real Property, Probate, and Trust Law Section of the Florida Bar that drafted the proposal which formed the basis of the Amendment. You can read their article about the changes to the tax apportionment statute by clicking here.

Keith’s special Thursday Report write-up on the apportionment statute is as follows:

This year, the Florida Legislature revised the Florida estate tax apportionment statute Section 733.817. The revised apportionment statute is much easier to read; it has been better organized and now includes titles. Further, the statute has been updated to reflect changes in the federal estate tax law, address issues not previously covered, codify existing case law, and, I believe, better reflect what most people would want.

Section 733.817 sets forth default rules for determining the apportionment of estate tax – federal and state – among the various property interests passing as a result of a decedent’s death, applying a modified equitable apportionment regime. These default rules can be modified.

The key changes made to the apportionment statute are as follows:

- No estate tax is apportioned to gift taxes on gifts made within 3 years of death or to the recapture of excess 529 plan gifts made within 5 years of death.

- Estate tax on protected homestead, exempt property, and family allowance is apportioned to other estate and revocable trust property. First, such taxes are apportioned to recipients of property passing by intestacy, thereafter, to recipients of residuary interests and pretermitted shares, and finally, to recipients of nonresiduary interests. Property necessary to satisfy the elective share will not bear any of the tax on these interests. Note that exempt property and family allowance receive the same favorable treatment as homestead.

- The common instrument construction rules have been modified to treat all recipients of property passing from related governing instruments (pour over will and revocable trust or revocable trusts where one pours into another) as taking under a common instrument.

- A direction in a governing instrument providing for apportionment in a manner different than provided in Section 733.817 (i.e., intra document apportionment must be express.)

- Property included in the gross estate under both Section 2041 (general power of appointment) and Section 2044 (QTIP) is treated as includible under Section 2041. As a result, the greater specificity requirements of Section 2207A must be met to waive the right of recovery and such property bears the additional tax incurred by reason of inclusion of such property in the beneficiary’s estate.

- The holder of a general power of appointment may expressly direct that property subject to such power bear the additional tax incurred by reason of the inclusion of the property in the power holder’s gross estate (i.e., be treated similarly to QTIP property).

- If governing instruments contain conflicting tax apportionment provisions, the last executed tax apportionment provision controls. If a will or trust is amended, the date of the amendment is only controlling if the amendment contains an express tax apportionment provision.

Practitioners will be pleased with this revised statute.

Keith will also be presenting a more detailed talk on this subject entitled “Gobblin’ Up the New Estate Tax Apportionment Statute” at the Florida Bar sponsored Estate & Trust Planning/Asset Protection: Tricks, Treats and Really Scary Things seminar on Friday, October 23, 2015. For more information about this event, please click here.

An Introduction to Succession Planning and

Possibly All You Need to Know, Part III

by Alan Gassman

Two weeks ago, we covered terminology and important concepts relating to succession planning. You can review this by clicking here.

Last week, we covered approximately one-half of our substantive succession planning materials, which were written for intelligent laymen, which can be viewed by clicking here. The conclusion to these materials is as follows:

Shareholder Agreements

The present estate tax law has a very advantageous provision which allows stock in a family company to be valued based upon a formula or criteria that would be used by similarly situated arm’s-length parties. This provision applies even if the “low side value” results from use of the formula, which can take into account that there are no non-competition covenants in place between family members, if that is the case. For most businesses and industries, there are formulas that will result in a value that is significantly less than what the IRS would otherwise consider company ownership interests to be worth.

This is one advantage to having a purchase occur upon death between family members. In addition, or alternatively, shareholder agreements between family members which prevent the transfer of stock to third parties and have other restrictive provisions can help to reduce the value that the stock will be taxed upon in the event of an owner’s death.

Further, where company stock constitutes more than 35% of a decedent’s adjusted gross estate, it may automatically qualify for an advantageous estate tax payment plan that can be based upon interest only and a government subsidized rate for the first four years, followed by payments ratably over the following ten years. Many family businesses can easily survive and even prosper with that type of payment plan, but many families mistakenly have corporate debt or asset structuring that causes the net value of the corporate stock to be less than 35% of the shareholder’s adjusted gross estate (see Internal Revenue Code Section 6166).

Another common error is to have a real estate business that predominately leases its property on a triple net basis. The payment plan rules described above can apply to investment real estate where the property holding entity provides active management services. This is often the reason that affluent families have family members actively engaged in managing the family real estate (besides the fact that it keeps them off of the streets). Active management can also result in avoidance of the 3.8% Medicare tax that is often otherwise imposed upon net rental income.

Examples of Business Allocation Planning for Family Members

Scenario #1

The business entity assets will be allocated to the trust for my daughter to the extent not exceeding 50%, with the other assets being allocated to the trust for my son.

If the business entity assets turn out to be worth more than 50%, then my daughter’s trust will owe my son’s trust a note for the difference, payable upon such terms as the Trust Protectors deem appropriate.

If the business company is still renting the business real estate from me at the time of my death, then the business real estate may be allocated to the trust for my son, and the Trust Protectors may install a long-term fair market value lease with option.

Scenario #2

Get it sold early, but get it sold to a trust that can be changed based upon changes to the family dynamics.

For example, Father, Mother, and Son #1 may be running the business, and it is going well. Son #2 has no interest in the business, and Son #3 is still in high school.

Father and Mother believe that the business should most likely go to Son #1, but they are not sure about Son #3, and they are not getting along very well with Son #1’s wife, whom he married just two years ago.

They establish an irrevocable trust for all three children and give long-time family advisors and wise siblings the title of Trust Protector with the power to divide the trust into three parts, one for each son, and to allocate the assets as between the three parts as the Trust Protectors see fit.

During the lifetime of the parents, the trust receives ownership in the business, the entity that owns the real estate that is leased to the business, and monies are received by the company as distributions on the above real estate and entity ownership.

When Father and Mother die, they leave a trust that provides for the children to be treated equally from a net value standpoint and allows the Trust Protectors to value the business, allocate the corporate ownership as they see fit and in the best interests of both the company and the children, and to have notes due from a trust receiving excess value business interests to a trust receiving non-business interests as needed for balance.

On the death of the surviving parent, the Trust Protectors divide the assets in all of the above-referenced trusts as they deem appropriate.

The siblings do not fight with each other over the results, because the results are beyond their control.

Scenario #3 – Alternate Example for Life Insurance

Son #1 buys a second-to-die life insurance policy on the parents and enters into a binding Agreement to pay them an amount that is based upon a formula determined by the CPA for the company, which will hopefully be binding upon the IRS for valuation purposes.

The Agreement provides for the price to be paid in cash to the extent of 80% of the insurance proceeds and for the remaining 20% of insurance proceeds to be contributed to the company (or used to pay down debt and to release Father’s estate from any liability) as working capital and to help make sure the company is in compliance with any loans.

The purchase price above the 80% of insurance proceeds level is financed by a note that might be payable over 9 years by 108 monthly installments with interest at 1% above what the prime rate is on the death of the parent.

The child whose trust receives the company may be required to sign an Employment Agreement with a non-competition covenant that will require the child to work only for the company and dedicate all efforts to the company until the note is paid. It becomes the recipient child’s decision as to whether to involve siblings or others in the business.

Scenario #4

How about voting control for a situation where the mother owns 50% of the company and one daughter owns the other 50%, with several other siblings who are not as involved with the business?

In addition, what happens with respect to operating control of the business if the mother or her co-shareholder daughter become incapacitated but are still alive? How about providing for a “King Solomon Committee” that would have to agree with the remaining mother or daughter if one of them becomes incapacitated or dies with respect to continuing to run the business while giving each of them the option to buy the business at a fair market value price determined by the long-term CPA of the family?

For more on these and related topics, see Louis Mezzullo’s articles entitled Cain v. Abel: Dealing with Sibling and Cousin Rivalries and Business Succession Planning, which are available upon request by emailing agassman@gassmanpa.com. Louis Mezzullo is a lawyer, author, and well-known authority on succession planning. In fairness to Lou, his contact information is as follows:

Louis Mezzullo

Withers Bergman, LLP

6050 El Tordo

PO Box 2329

Rancho Santa Fe, CA 92067

Paying for College: Understanding Student Financial Aid, Part I

by Dena Daniels

Each year, the US Department of Education awards approximately $150 billion to assist students with paying for college. There are two main types of financial aid: (1) aid based on academic merit and (2) need-based aid. The former is not dependent upon the parents’ assets and income but rather the student’s academic performance, “if you have the grade, you get the aid.” The latter takes into account both the parents’ and the student’s income and assets.

PART I – TYPES OF NEED-BASED FEDERAL FINANCIAL AID

Federal Pell Grants

Federal Pell Grants are usually awarded to undergraduate students based on a combination of factors including: (1) the student’s financial need, (2) the institution’s cost of attendance, (3) the student’s enrollment status, and (4) the length of the academic year in which the student is enrolled. For the 2014-2015 academic year, the maximum Federal Pell Grant was $5,550 for the year. A student is eligible for this award for a total of twelve (12) semesters.

Federal Supplemental Educational Opportunity Grants

Federal Supplemental Educational Opportunity Grants are awarded to undergraduate students who have exceptional financial need. This type of aid is determined by the institution’s financial aid office and is contingent upon not only the student’s need, but also the available funds at the institution.

Direct Subsidized Loans

Direct subsidized loans are available to undergraduate students who demonstrate financial need. This type of loan usually has more favorable terms than unsubsidized loans to assist students. The loan amount is determined by the school the student attends, and the US Department of Education pays the interest on these loans as long as one of the following situations exists:

- The student is enrolled in school at least half-time;

- For the first six months after the student leaves school (this is referred to as a “grace period”); or

- During a period of deferment.

Federal Perkins Loan Program

Federal Perkins Loans are low-interest loans for both undergraduate and graduate students who demonstrate exceptional financial need. The loans have an interest rate of 5%, however, not all colleges and universities participate in the Federal Perkins Loan Program. In this program, the school is the lender for the loan and payments are usually made to the school. The funds for this loan are limited based on the student’s need and the availability of funds at the school.

Federal Work Study

Federal Work Study provides part-time jobs for both undergraduate and graduate students who demonstrate financial need. This program affords students the opportunity to earn money to assist with the payment of education-related expenses, and in order to qualify, the student must be enrolled either full-time or part-time. The type of work in this program encourages community service work and work related to the student’s area of study.

Students participating in the Federal Work Study Program earn at least the current federal minimum wage, however, the student may earn more depending on the type of work and the level of skill necessary for the position. The total award a student receives under this program depends on: (1) when the student applies, (2) the level of financial need, and (3) the school’s funding level.

The means in which a student is compensated depends on whether the student is an undergraduate or graduate student. If the student is an undergrad, he/she is paid by the hour, whereas a graduate or professional student may either be paid hourly or by salary, depending on the work. The school must pay the student at least once a month, and the funds must be paid directly to the student unless the student requests that the school: (1) send the payments directly to the student’s bank account, or (2) use the money to pay for education-related institutional expenses and charges.

Next week, we will explore how to obtain the above types of federal financial aid, including eligibility requirements and how to apply.

Seminar Spotlight

The Biggest Mistakes to Avoid Concerning Your High School

Children – College Failures in the Making

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of The Biggest Mistakes to Avoid Concerning Your High School Children – College Failures in the Making on Saturday, September 12, 2015 at 9:30 A.M.

Molly Carey Smith, M.A. is the owner of College2Career in Tampa, Florida. College2Career is a career counseling business for college students and young adults. She brings years of experience in college guidance, essay and application guidance, career aptitude assessments, resume building, internship and job search strategies, and interview preparation. To find out more, visit her website at http://www.college2career.us.

The 10 mistakes that will be discussed during the webinar are as follows:

- Sending your son/daughter to college without the emotional and mental maturity to succeed in college

- Too much focus on athletic scholarships and sports in general

- Allowing your son/daughter to choose a college major without your input

- Failure to have a realistic and objective view of your son/daughter’s true abilities

- Forgetting to introduce and to educate your son/daughter about the true costs associated with college each year

- Believing that private universities have a better rate of return than public universities

- Giving up scholarships from a public university in order to attend a private university

- Not encouraging your son/daughter to work during college

- Losing focus on the importance of character development

- Not cultivating a mindset of financial independence

To hear more about these mistakes, please click here to register for the Saturday webinar.

Richard Connolly’s World

Retirees Stung by ‘Universal Life’ Cost

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “Retirees Stung by ‘Universal Life’ Cost” by Leslie Scism. This article was featured in The Wall Street Journal on August 9, 2015.

Richard’s description is as follows:

Retired high school teacher Nicholas Vertullo long felt confident that his wife, Grace, wouldn’t have to pinch pennies after he died. Nearly three decades ago, he bought a $238,000 life insurance policy and later bought three more policies, pushing the death benefit to about $500,000.

But he didn’t anticipate the policies’ annual costs would rise as much as they did, jumping to about $30,000 combined.

Low interest rates lead to soaring premiums for those who bought in the 1980s, and this article lists the things a client should do with an old policy, including:

- Get an in-force illustration from the insurance company to determine if the current premium will keep the policy in force.

- If the required premium is too high, look at reducing the face-value amount to an amount an affordable premium will support.

- If in good health, see if the client can qualify for a new policy with a lower guaranteed premium.

- If none of these options provides a good solution and the client is going to surrender the policy, look at selling it to institutional investors for more than its cash value through life settlement.

Use this article to encourage clients to have their policies checked out.

Please click here to read this article in its entirety.

Thoughtful Corner

Out of Sight, Out of Mind

Consider recommending a separate email address for mail related to litigation or similar highly distracting situations. Many times, clients are clearly haunted by on-going litigation or disputes, and it can be difficult to compartmentalize or not be distracted from these types of situations when there are periodic emails that appear.

We therefore often recommend that the client consider establishing a new, separate email address that would receive any and all non-urgent emails and messages concerning the matter.

The client can then check that particular email address every few days, once a week, or perhaps less frequently. This will allow them to not have the distracting situation interrupt them on a daily (or more frequent) basis.

“Out of sight, out of mind” is a powerful truism when it comes to focusing attention on what we know we need to handle and not being distracted by unproductive thoughts or interruptions.

Taking that pile of work constituting a particular project off your desk and asking someone to put it back on your desk at a particular time and date in the future can be a very good step towards enhanced productivity and focus.

How often do you take a step back and think through how the logistics of communications, work flow, and distractions are working for you in your office or at home?

Make two or three changes this week to free you up and to help others.

Humor! (or Lack Thereof!)

Sign Saying of the Week

*************************************************

IN THE NEWS

by Ron Ross

The parents of 2015 lament that it’s going through those angry teen years.

——————————-

Investigators trying to find Hillary Clinton’s Blackberry are now looking in a closet that also has a typewriter from the Truman administration, a telegraph machine from the time of Lincoln, and Jefferson’s quill pen and ink stand.

——————————-

A lion at Busch Gardens eats a completely innocent attorney in a misguided attempt at revenge. Says the lion, “I thought it was that dentist.”

——————————-

Because of the large field of Republican Presidential candidates, participants in the upcoming CNN debate will be selected based on whether or not Microsoft Word’s spellcheck recognized their name. Obvious winners include Bush and Trump.

Everyone who does not get into the debate will eventually get the chance to play Colonel Sanders in a future KFC television ad.

——————————-

A monster accidentally created by Fox News escapes and is applauded at Presidential debates by reactionary voters. Says a Fox News representative, “It turns out his core demographic is people carrying torches and pitchforks.”

——————————-

Latest polls show that reasonable sounding Republican Presidential candidates George Pataki and John Kasich, among others, rank in preference with GOP voters just below a replica of Darth Vader made out of bubblegum.

Upcoming Seminars and Webinars

Calendar of Events

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Al King, co-founder, co-chair, and co-CEO of South Dakota Trust Company, LLC, will present a Bloomberg BNA Webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA? DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

South Dakota’s legislature has attempted to take the best from each of the states that have the most favorable estate and trust laws to provide a fresh platform for examining and maximizing tax and non-asset protection objectives. This webinar will provide a practical and interesting discussion of both South Dakota and practical domestic asset protection law strategies. It will cover the legal aspects, present checklists and sample trust clauses, and provide creative and practical planning techniques that can be used by practitioners and their clients.

Date: Wednesday, September 9, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE BIGGEST MISTAKES TO AVOID CONCERNING YOUR HIGH SCHOOL CHILDREN – COLLEGE FAILURES IN THE MAKING.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SOUTH BEND PRESENTATION:

41ST ANNUAL NOTRE DAME TAX AND ESTATE PLANNING INSTITUTE

Rebecca Ryan, Bill Boersma, Daen Wombwell, Michael Halloran, and Alan Gassman will be presenting a talk at the Notre Dame Tax & Estate Planning Institute on the topic of UNDERSTANDING ILLUSTRATIONS, DESIGN OPPORTUNITIES, AND FINANCIAL EVALUATION OF WHOLE LIFE, UNIVERSAL, VARIABLE, AND EQUITY INDEXED LIFE INSURANCE.

Date: September 17 – 18, 2015 | Alan Gassman will speak on Thursday, September 17 | 11:30 AM – 12:30 AM

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN 46601

Additional Information: Click here to download the 2015 program brochure. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30-minute webinar on the topic of THE 10 BIGGEST LEGAL MISTAKES MOST BUSINESS OWNERS AND INVESTORS MAKE (AND HOW YOU CAN AVOID MAKING THEM.)

There will be two opportunities to attend this presentation.

Date: Thursday, September 24, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Following the decision of the United States Supreme Court in Obergefell v. Hodges, same-sex couples now enjoy the same legal and tax benefits as opposite-sex couples. These benefits include marriage, divorce, adoption and child custody, separation agreements, Qualified Domestic Relations Orders (QDROs), marital property, survivorship spousal death benefits, inheritance through intestacy, priority rights in guardianship proceedings, and contract rights.

This program will discuss relationship and marital agreements, tax issues, reasons to marry or not marry, and a number of unique circumstances that can apply to same-sex couples as well as to opposite-sex couples.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Steven B. Gorin and Alan Gassman will present a free webinar on the topic of INCOME TAX EXIT STRATEGIES.

This seminar will focus on how owners can transition their businesses to employees or others who buy over time. Topics include avoiding unnecessary capital gain tax on exit, deferred compensation, profits interests, redemptions, life insurance, and getting assets out of corporate solution to obtain a basis step-up (without self-employment tax.)

There will be two opportunities to attend this presentation. Attendees will be given the opportunity to receive over 850 pages of technical business planning materials at no charge.

Date: Thursday, October 1, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE CLEARWATER PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will have the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30 minute webinar on the topic of ESTATE AND ESTATE TAX PLANNING – CONVENTIONAL AND ADVANCED PLANNING TECHNIQUES TO MINIMIZE TAXES AND EFFECTIVELY PASS ON YOUR WEALTH.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 14, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman, Steve Roll, and Lauren E. Colandreo will present a webinar on the topic of STATE TRUST NEXUS SURVEY for Bloomberg BNA.

Date: Thursday, October 15, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Jonathan Gopman, Jan Dash, and David Neufeld will join Alan Gassman for an informative webinar on THE NEW NEVIS TRUST LAW.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 21, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on Scientific Marketing For The Estate Planner – How to do more of what you love to do, and less of the other, while better serving clients, colleagues, and your community.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY AND RECENT DEVELOPMENTS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: TBD

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30 and Sunday, January 31 | Time TBA

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will be presenting on a topic to be determined at the 3rd Annual Ave Maria School of Law Estate Planning Conference.

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Please watch this space as details for these two great events are finalized in the upcoming months!

Date: May 6, 2016

Location: To Be Determined – Naples, Florida

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE CLEARWATER EVENT:

40th ANNIVERSARY SCREENING OF JAWS WITH RICHARD DREYFUSS

The Capitol Theatre ’70s Movies Series will present a special feature 40th anniversary screening of Jaws with a live appearance by Academy Award winter Richard Dreyfuss.

The 1975 thriller, directed by Steven Spielberg, will be followed by a rare, candid, interactive discussion and Q&A with the film’s star Richard Dreyfuss. The event will be hosted by Tampa Bay Times film critic Steve Persall.

A portion of the proceeds from this event will benefit the Clearwater Marine Aquarium.

Date: Thursday, September 10, 2015 | 7:00 PM

Location: The Capitol Theatre, 405 Cleveland Street, Clearwater, FL

Additional Information: For more information, or to purchase tickets for this event, please click here.

**********************************************************

LIVE TAMPA EVENT:

TAMPA THEATRE 14TH ANNUAL WINEFEST

Bust out your sweet dance moves and have a killer time with Napoleon, Pedro, Kip, and Lafawnduh at Tampa Theatre’s 14th annual WineFest, Napoleon Wineamite. This year’s event features snacks and samples from local independent restaurants, sips from the finest wineries, and evening of rare, top-rated wines and – for the first time this year – a “Movie Under the Stars” screening of this year’s theme, Napoleon Dynamite.

While the theme may be silly, the purpose is most serious. Now in its 14th year, the annual WineFest is Tampa Theatre’s biggest fundraising event of the year, benefitting the historic movie palace’s artistic and educational programs, as well as its ongoing preservation and restoration.

Date: September 10 – 17, 2015

Location: Tampa Theatre | 711 N. Franklin Street, Tampa, FL 33602

Additional Information: Tickets are on sale now at www.tampatheatre.org/winefest. Sponsorship opportunities are also available. Please contact Maggie Ciadella at maggie@tampatheatre.org for more information about sponsorship or the event.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

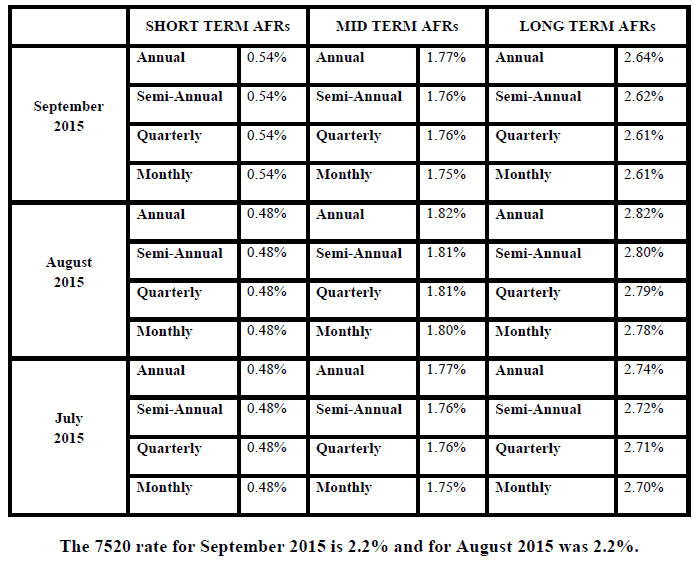

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.