The Thursday Report – 7.2.15 – Hot Tub Justice & Time Travel

Last Week’s Thursday Report

Ten Questions to Ask About a Client’s Life Insurance and Planning Sneak Peek

Office of Inspector General Fraud Alerts: An Interview with Lester Perling, Part 2

Tax Documents: What to Shred & What to Keep

Richard Connolly’s World – Setting Up for Post-Law School Success

Thoughtful Corner – The Project Manager

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Last Week’s Thursday Report

Last week, the Thursday Report was not ready, so we instead published the report intended for this week. In the middle of that, the US Supreme Court declared that states must recognize same-sex marriages and that a central part of Obamacare is not unconstitutional.

Therefore, a significant portion of our population can now marry their significant other and qualify for Obamacare all at the same time, except that the wedding ceremonies will presumably not be performed by Justice Roberts, Justice Scalia, Justice Thomas, or Justice Alito, who are stuck in the past and pictured below in a hot tub time machine.

Our primary concern with these new decisions was how we would incorporate them into what should have been last week’s Thursday Report. It occurred to us that any deadline can be moved back by simply moving it forward and that deadlines can be swapped in 1032 tax-free deadline-swapping exchanges, as long as there is a legitimate business purpose and the intent of the swap is not to avoid federal income taxes or to replace your significant other.

Given that Thursday, July 2 will be last week when seen from next week, we bring you last week’s Thursday Report but with a special flair (gun.)

A flare gun shoots only a display ordinance that is intended to attract the attention of those in the general vicinity to please find and save the person who shot the flare gun. Flare guns cost anywhere between $50 and $250, do not require a permit to own, and can be purchased at Walmart.

Flare guns can be very dangerous because they basically fire a phosphor-propelled rocket tube. The main ingredients in a flare are black powder (used to launch the flare) and magnesium, which produces the light. Magnesium burns at around 5,010 degrees Fahrenheit, making it impossible to put out with water or a small fire extinguisher. One misfire from a flare gun into a flammable area could cause catastrophic, fiery consequences.

A basic flare gun does not shoot a flare with enough force to penetrate the human body. If a person were shot with a flare gun, the flare would likely bounce off of them and continue flying until it ran out or caught something on fire. There is always the chance the flare will burn skin or catch a person’s clothing on fire, however. While a flare gun is not inherently deadly, if a flare hit a person in the face or neck, it could cause severe injury or in rare instances, death.

As far as we know, the last person killed by a flare gun was John David Cook, Jr., of Baytown, Texas. He died on Christmas Day 2013 from an accident resulting in severe burns to his hands and an open wound in his chest that proved to be fatal. Mr. Cook was attempting to create a bigger bang by way of combining fireworks with his flare gun. The explosion from the fireworks and flare caused the modified flare launcher he was attempting to build to become impaled in his chest. Although accidents like this are few and far between, it goes to show that flares and flare guns are to be treated with the utmost caution and safety.

In the much-lauded and critically-acclaimed (by Colonel Sanders) American “feuture” films Hot Tub Time Machine and Hot Tub Time Machine 2, four friends find themselves in a malfunctioning hot tub that turns out to be a time machine, which takes them back in time and propels them into the future, where they find that flare guns won’t work once immersed in a hot tub.

They suddenly realize that by reading a Thursday Report upside down and in a mirror, they’ll find themselves in the same predicament but one week earlier or later, depending on when they do this.

We would all like to travel in time, and we actually do, but apparently at a pre-set speed that is slower than what we would like it to be for certain events and much faster for others.

Your free subscription to the Thursday Report entitles you to move deadlines back and forth, as mentioned in the court case of Perez & Perez, M.D., P.A. v. Holder, 867 So. 2d 622 (Fla. 2d Dist. App. 2004), which you cannot view by clicking here.

Ten Questions to Ask About a Client’s Life Insurance

and Planning Sneak Peek

by Alan Gassman, Barry Flagg, and Alyssa Perez

In September, Alan Gassman will be participating in a panel discussion of life insurance products and the math associated therewith at the Notre Dame Tax Institute in Bloomberg, Indiana on Thursday, September 17, and Friday, September 18, 2015. A complimentary late Wednesday afternoon, two-hour session on The Estate Planner’s Guide to ESPOs (Employee Stock Ownership Plans) will also be available to attendees.

In preparation for this event, Alan and Barry Flagg have prepared an article for the September issue of the Bloomberg BNA estate and gift tax journal entitled “Ten Questions to Ask About a Client’s Life Insurance and Planning: What Every Estate Planning or Tax Planning Advisor Should Know.”

We will publish this article in its entirety in fall issues of the Thursday Report. For a sneak preview of the article, please email agassman@gassmanpa.com.

Office of Inspector General Fraud Alerts:

An Interview with Lester Perling, Part 2

On June 9, 2015, the Office of Inspector General (OIG) of the U.S. Department of Health and Human Services issued a fraud alert, which can be viewed by clicking here.

Alan Gassman interviewed Lester Perling of Broad & Cassel about the OIG Fraud Alert, part 1 of which can be viewed by clicking here. The conclusion of our interview is printed below:

Alan – Now, Lester, some of the people reading this might not really be aware of what the Office of Inspector General is or what the criminal aspect of this type of situation is. Can you give a little bit of background on that, and maybe update those of us who do know what it is?

Lester – Sure, Alan. Essentially, when there is a financial arrangement between a provider, like a home health agency or imaging center or whomever, and a physician and their spouse, it implicates a number of federal statutes since we are talking about the federal level right now. One is the federal anti-kickback statute which prohibits remuneration in exchange for referrals. It’s pretty straightforward.

A home health agency employing a doctor’s spouse to do nothing is going to be considered an attempt to induce the referrals of that doctor. It implicates the Stark Law, which is the federal prohibition against referrals, if the physician does not have a relationship that falls into an exception. Again, these relationships, while they were structured to look like they fit into an exception, because again, some of these spouses really weren’t doing any work, they really didn’t fit into an exception.

Alan – So where does the OIG come in?

Lester – The kickback statute is a criminal statute, but in addition to criminal penalties, there is the False Claims Act, and this is where the OIG comes in. The OIG has the authority to impose administrative sanctions against physicians and providers that violate the federal anti-kickback statute, even if they are not being prosecuted criminally. Those sanctions include either civil money penalties and/or exclusion from participating in federal health care programs.

Alan – How do the administrative sanctions differ from criminal cases?

Lester – It is a lot easier for the OIG to impose an administrative sanction than it is a criminal case because there is not a jury trial, and you don’t have the same level of proof. The criminal standard, of course, is reasonable doubt. The administrative level of proof is simply the preponderance of the evidence. So it is a much easier case to make because you do not have to prove it beyond a reasonable doubt like you do in a criminal case. There is no jury to convince. The hearing that the provider gets, if they go to that stage, is in front of an administrative bar judge, and he tends to be friendly to the government, so that is one reason the OIG pursues cases like the one described in the Fraud Alert.

So the OIG has the authority to impose sanctions against providers for kickbacks, for false claims submissions, or for any number of bad acts, but in terms of these types of relationships, it’s related to kickbacks. The submission of the claim is predicated upon a kickback, so theoretically, every claim the home health agency submitted that was a result of the referral of one of these doctors could also be considered a false claim under the US False Claims Act, as the law now stands, in addition to the extent that the Stark Law was violated, and that also forms the basis for the False Claims Liability Act.

The government has a lot of arrows in its quiver, but this one, the administrative sanctions, is probably the easiest for them to use in terms of both proof and the process they have to go through to get a sanction imposed. It is a much simpler and cheaper and more streamlined process for them, but it nonetheless sends the message and can get what they consider to be bad apples either out of the program through an exclusion, or it can get them in line and set examples for others who might consider these types of relationships. Hence the Fraud Alert – it alerts doctors of what they are in for if they don’t pay attention to these financial arrangements.

Alan – What about situations where there is no federal money involved, but there is state money involved?

Lester – Well, there are similar state laws, although they don’t involve the OIG if there is truly no federal money involved. One thing I would like to caution about here: we see a lot of times, people will structure an arrangement where the physician may be getting compensated for something that doesn’t involve federal patients, but it is a referral relationship between that physician and the provider, whether a physician refers Medicare or other federally funded patients.

So let’s say the physician is being paid by the provider, by a home health agency, to only review private patient records, and it is a dummy relationship; they’re not really doing anything. The contract reports to exclude any federal patients. The federal government would say in response to that, “Uh-uh, you have a financial relationship with this doctor. If he is referring federal patients, your arrangement clearly is intended to induce those referrals even though you are not paying him to work on federal business.” So that is going to be a distinction without a difference, as far as the Feds are concerned, if they believe there is a violation of the kickback statute or the Stark Law. It’s just not going to matter. The fact that a relationship purports to be private only stands if the physician is also either referring or in a position to refer federal business. Federal laws are still very much implicated, and the government certainly is concerned and becoming more concerned about those arrangements.

Alan – But what about if there really is no federal business?

Lester – To the extent that there really is no federal business – let’s say the provider is a home health agency that is not a Medicare provider and doesn’t bill any other federal program – then the federal laws don’t really apply. The OIG is out of the picture, as is the US Attorney’s office, and you would be dealing now with state law.

So with state law, you are talking about the Patient Brokering Act which is a state criminal statute, and you are talking about discipline under licensure statutes, whether it is the Board of Medicine for Physicians, the Agency for Health Care Administration for Home Health Agency, or Heath Care Clinic. There really isn’t a provision for administrative sanctions, although, if it involves Medicaid, which is a federal payer, there are administrative sanctions, but then the Feds would potentially be back in the picture.

With really strictly private relationship – private patients, the reality is the risks are lower because either the state brings criminal action against the participants under the Florida Patient Brokering Act or administrative sanction penalties through a licensure statute. Frankly, the state has not been good at pushing kickback and fee-splitting cases in this context, but it doesn’t mean they can’t in the right situation. It’s a very different playing field.

Alan – So what kind of arrangements come to mind besides what we saw here in this OIG opinion? What sort of arrangements come to mind that you are seeing doctors commonly engage in that just causes you some angst?

Lester – There are marketing arrangements. There are obviously medical director arrangements, leasing arrangements, equipment/space rental arrangements, being paid to serve as a medical advisor, being paid to be on a Board of Directors…there are all matters and forms of financial arrangements that providers and physicians can enter into, any of which can be perfectly legitimate under the right circumstances. It’s hard to say that any arrangement is necessarily illegal, per se. Each one really has to be evaluated based on what is going on in that particular arrangement. Does it fit within a Stark Law exception? Does it fit within a safe harbor to federal anti-kickback statutes, which are regulations that define arrangements not subject to sanctions if the elements of a safe harbor are all met, and even if they are all met, there could still be problems if the intent is to induce referrals, at least theoretically.

Even a marketing arrangement is not illegal if done correctly. Other than a straight kickback, which, obviously, a payment for a referral is illegal, relationships between providers and physicians are not illegal. It is a matter of how they are structured. Are they for legitimate services? Is the payment fair market value? Does it vary with referrals? There are various things to look at.

There is nothing that is per se illegal other than a straight kickback. Other than that, the relationship just has to be evaluated based on both what is on the surface and what is just below it, if you scratch a little bit.

Alan – Okay. Alright, very good. Is there anything else you wanted to say? I think you covered it very well, and I think it is very important to get the word out to physicians that they need to be careful. Things they may have been able to do for years on end might not really be as safe as they thought.

Lester – Yeah, you know, I encourage any physician who is thinking of entering into this type of arrangement, or any provider who is thinking of entering into one with a physician, to spend a few bucks up front and get a competent attorney to look at it and advise them about the risks in that particular arrangement from their perspective, not with an eye to making an illegal arrangement look legal, but whether or not it really is legal and the risks associated with it.

I’m often asked, “If this is no good, can you make it okay?” I won’t go to jail for a client so I generally say no in that context, unless they are really trying to form a legitimate and lawful arrangement, and that takes some judgment on the attorney’s part. It really behooves providers and physicians to do a little preventive medicine as it were.

Alan – Perfect. Lester, I can’t thank you enough for joining me for this interview. Please email any questions you might have to Lester at lperling@broadandcassel.com. Send Lester the difficult questions. Easy ones can be sent to me at agassman@gassmanpa.com. Thanks again, Lester.

Tax Documents: What to Shred & What to Keep

The New York Times recently ran an excellent article outlining which important documents should be saved and for how long, which important documents can be tossed, how to properly store the paper and electronic documents you should keep, and how to properly dispose of the documents you don’t need.

Click here to see the article in its entirety, or read on for the highlights below.

Documents to Keep Indefinitely:

- Birth certificates

- Social Security cards

- Wills

- Life insurance policies

- Divorce decrees

Documents to Keep for at least 3 Years:

- Federal tax returns

- W-2 Forms

- Utility bills, if they support a home-office tax deduction

- Supporting federal tax documentation

Documents to Dispose of:

- Hard copies of bank statements

- ATM receipts

When financial documents are disposed of, do not simply toss them into a trash bin. Shred any documents containing account numbers, Social Security numbers, or dates of birth by using either an at-home cross-shredder or by utilizing a commercial shredding service. Shredding these documents will reduce the risk of identity theft.

Additionally, crucial documents that need to be kept indefinitely should be stored in a dry, safe place, such as a fireproof lock box or a safety deposit box at a bank.

Richard Connolly’s World

Setting Up for Post-Law School Success

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Why a Top Law Firm Teaches its Lawyers to be More Like MBAs” by Natalie Kitroeff. This article was featured on the Bloomberg Business website on June 16, 2015.

Richard’s description is as follows:

Turning law students into lawyers has traditionally been the job of law schools. One major New York firm has decided three years of traditional legal training is not enough to make its rookies practice-ready.

At Skadden Arps, one of the country’s largest law firms, new hires must undergo five weeks of intensive business training, which they refer to as a mini-“virtual MBA.” The approach is part of a growing push within the legal industry to equip lawyers with a deep understanding of finance and accounting at the start of their careers.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “Trusts and Estates Practices: Engines of Growth” by Russ Alan Prince. It was featured on Forbes.com on June 24, 2015.

Richard’s description is as follows:

In today’s environment, a well-managed and proactive trusts and estates practice can be a very financially rewarding specialization. This is the case for the largest law firms as well as law firms with only a few partners.

While the demand for the expertise of trusts and estates attorneys is increasing, so too are the competitive pressures. Nevertheless, those trusts and estates attorneys who are motivated to excel and who effectively implement critical business development strategies are inclined to build substantial practices benefitting their clients and themselves.

Please click here to read this article in its entirety.

Thoughtful Corner

The Project Manager

Business and professional life is a series of projects, tasks, and associated activities and reminders. Typically, the professional who the client sees as the Primary Handler is the “Project Manager,” although this is not always the highest and best use for that professional’s time and abilities. Even clients and customers will understand that many aspects of a given project are better managed and shepherded by someone other than the key professional.

Tasks that include check-listing, sending reminders, making necessary phone calls, and other similar to-dos will often be forgotten or left for later (often too late), so why not appoint a Project Manager to efficiently and effectively manage a given task and also provide an important backstop to make sure that appropriate steps and actions are taken at appropriate times to best handle any given objective?

Our reptile brain impulses of the need to control, the need for recognition, and basic insecurities will often prevent us from effectively and efficiently delegating the management of a task to someone else who can do a better and more thorough job of it, not to mention being a less expensive labor source than the primary professionals often are. Some professionals appoint a separate, independent Project Manager for every client matter, while others will only use a Project Manager occasionally, often for the largest or most involved clients or accounts.

Many people and organizations do this informally, but formalizing the arrangement and giving credit and responsibility where it is due and will be recognized will often be helpful.

Once you appoint someone other than yourself as the Project Manager, you may find responsibilities and functions, like billing, follow-up, client/customer satisfaction questionnaires, and value/revenue added services to be additional parts of an enhanced productivity and profitability equation.

Responsibilities of our Project Managers include:

- Attend a “debriefing” after the attorney meets or has a conference call with the client to understand exactly what we will be doing for the client.

- Complete and update the below Project Manager checklist.

- Update PC Law to include their initials in the Matter Manager, so everyone who works on that client will know who the Project Manager is.

- Review chart updates done by other staff members for the duration of the project.

- Review draft bills for the duration of the project.

- Write letters for the attorney as needed.

- Make sure components of the project are finalized and sent to the client in a timely manner.

- Make sure bills are finalized and sent out in a timely manner.

- Handle follow-up as needed.

- Delegate as needed and show who is responsible for what on the Project Manager checklist.

- Keep a clipboard with a Project Manager checklist for each active client or project. Always bring the clipboard when meeting with the attorney.

To see a form that we have used to implement Project Managers in our office can be viewed by clicking here.

Humor! (or Lack Thereof!)

Sign Saying of the Week

Upcoming Seminars and Webinars

New Announcements

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and a guest to be determined will present WHAT TAX PLANNERS NEED TO KNOW ABOUT NORTH DAKOTA TRUST LAW for Bloomberg BNA.

Date: Wednesday, September 9, 2015 | Time TBA

Location: Online webinar

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com

*******************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Calendar of Events

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on FINANCIAL RELATIONSHIPS WITH PATIENTS, CO-PAYMENTS, GIFTS, AND GRAFT – HOW TO STAY OUT OF TROUBLE UNDER FLORIDA AND FEDERAL LAW.

This is an essential guide for medical practices and those who advise them. There will be two opportunities to attend this presentation.

Date: Tuesday, July 7, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman will present a webinar on the topic of WHAT FLORIDA CPAS NEED TO KNOW ABOUT ASSET PROTECTION for the Florida Institute of CPAs.

More information about this webinar will be forthcoming. Please stay tuned!

Date: Thursday, July 9, 2015 | 9:30 AM – 10:30 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com. To register, please contact Thelma Givens at givenst@ficpa.org.

**************************************************

LIVE CLE TELECONFERENCE PRESENTATION:

Alan Gassman will serve as a speaker and panelist for an ABA Probate, Estate Planning and Trust section CLE teleconference on the topic of COMPARING AND CONTRASTING VARIOUS METHODS TO ACHIEVE A STEP-UP BASIS ON A MARRIED COUPLE’S APPRECIATED ASSETS AT FIRST DEATH IN NON-COMMUNITY PROPERTY STATES.

Attorney David Slenn with Quarles Brady will moderate the conference. Other panelists include Edwin Morrow, III.

Date: Tuesday, July 21, 2015 | 1:00 PM – 2:30 PM

Location: Teleconference

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Edwin Morrow at edwin_p_morrow@keybank.com.

******************************************************

LIVE ORLANDO PRESENTATION:

ORLANDO BUSINESS AND PROFESSIONAL PRACTICE OWNER SYMPOSIUM

Alan S. Gassman, business coach and author David Finkel, and others will present a two-day conference for high-net-worth business and professional practice owners sponsored by Maui Mastermind®.

Alan’s topics will include BASIC AND ADVANCED PLANNING TECHNIQUES FOR THE PROTECTION OF WEALTH, THE 10 BIGGEST MISTAKES THAT BUSINESS OWNERS AND PROFESSIONALS MAKE, and ESTATE TAX AVOIDANCE TECHNIQUES FOR BUSINESS OWNERS AND PROFESSIONALS.

Other topics include A Proven Map to Grow Your Business and Get Your Life Back, Building Wealth Outside of Your Company, Tax Reduction Strategies, and Understanding How Investments Work and What They Cost.

Date: July 30th and 31st, 2015

Location: Hyatt Regency Orlando | 9801 International Drive, Orlando, FL 32819

Additional Information: Interested individuals can contact agassman@gassmanpa.com or David Finkel at david@mauimastermind.com.

********************************************

LIVE WEBINAR:

Alan Gassman and Christopher Denicolo will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

This 50 minute informative talk with extensive materials will cover essential aspects and trip-ups that doctors often encounter in the area of personal and practice entity asset protection. It will also discuss tax and investment planning, advisor selection, health law, compliance, and other areas of interest for physicians.

Each attendee will receive a complimentary copy of Mr. Gassman’s book, Creditor Protection for Florida Physicians and other valuable materials.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

I was fortunate to attend the Law Practice and Professional Development Workshop conducted by Alan Gassman, Esq. in Clearwater, Florida on August 3, 2014. The Workshop covered a wide range of topics from Goal Setting and Gratitude to as practical a topic as law office logistics. Alan’s approach was intimate, self-revelatory and highly instructive. I have been practicing law for 20 years and have never attended a program as broad ranging, practical and encouraging. The depth of Alan’s thought and experience is obvious in the materials and in the ease with which he led the discussions. This was not a dull lecture but a highly engaging workshop that was over before you expected it to be.

Daniel Medina, B.C.S

Board Certified in Wills, Trusts and Estates

Medina Law Group, P.A.

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and a guest to be determined will present WHAT TAX PLANNERS NEED TO KNOW ABOUT NORTH DAKOTA TRUST LAW for Bloomberg BNA.

Date: Wednesday, September 9, 2015 | Time TBA

Location: Online webinar

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanp.com

*******************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

*****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE WEBINAR:

Alan Gassman, Christopher Denicolo, and Kenneth Crotty will present a 50-minute webinar entitled CREATIVE PLANNING FOR FLORIDA REAL ESTATE with a guest (victim) to be determined. This presentation will be free and worth every dollar!

There will be two opportunities to attend this presentation. This webinar will qualify for CLE and CPE credit.

Date: Wednesday, September 23, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email agassman@gassmanpa.com.

**************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

*************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

****************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online Webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: To be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

*******************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

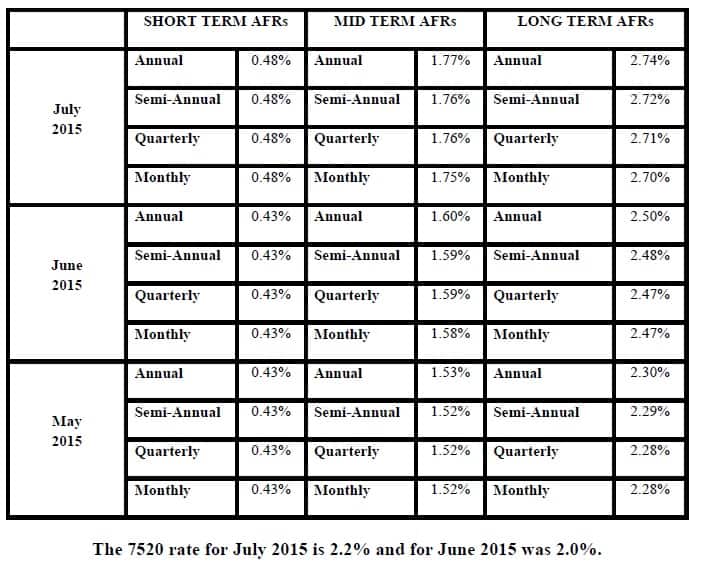

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.