The Thursday Report – 6.25.15 – Next Week’s Thursday Report

Next Week’s Thursday Report

The Biel Reo Bank Case Denied Certiorari by Florida Supreme Court

Office of Inspector General Fraud Alerts: An Interview with Lester Perling, Part 1

Excerpts from Creative Tax Planning for Real Estate Transactions and Investors

Richard Connolly’s World – Settling an Estate After Death

Thoughtful Corner – 5 Steps to Relieve Procrastination – How to Begin (and End!) a Project Successfully

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Next Week’s Thursday Report

The editors regret to inform the readers that this week’s Thursday Report was not ready on time. We have therefore provided you with next week’s Thursday Report. This week’s Thursday Report will hopefully be ready by next week. If not, the Thursday Report from the following week will be provided.

As the result of the above, any amortization tables based upon the issuance of Thursday Reports will need to be changed because interest that would have accrued this week will instead accrue next week, and thus, the interest that accrues next week will not include interest on the interest that would have accrued last week. We would therefore suggest that amortization tables no longer be based upon the relative edition and timing of The Thursday Report unless you are paid by the hour to change them.

Therefore, if you feed your fish weekly based upon the edition of The Thursday Report, please give the fish next week’s food this week and this week’s food next week. If confused, the fish can explain.

New Webinar News

On September 9, 2015, Alan Gassman and a guest to be named will present a webinar entitled “What Tax Planners Need to Know About North Dakota Trust Law” for Bloomberg BNA.

On September 23, 2015, Christopher Denicolo, Alan Gassman, and Kenneth Crotty will present Creative Planning for Florida Real Estate with a guest (victim) to be determined. This will be free and worth every dollar!

For more of our upcoming presentations, please see our Seminars and Webinars section below.

The Biel Reo Bank Case Denied Certiorari by Florida Supreme Court

by Ken Crotty and Alan Gassman

Just in time, a bankruptcy court decision confirms that the extended statute of limitation on fraudulent transfer pursuits will not apply if the debtor files for bankruptcy.

In the 2014 First District Court of Appeals case of Biel Reo, LLC v. Barefoot Cottages Develop., it was concluded that the four year statute of limitations on fraudulent transfers will not apply in a proceedings supplementary.[1] The crux of the court’s decision rested on the fact that a proceedings supplementary is not an independent cause of action and instead is “collateral to the main action at law” and serves as a means to enforce a pre-existing judgment. The court held that, despite the fact that “proving and defending fraudulent transfer claims brought under §56.29 borrow substantively from the Uniform Fraudulent Transfer Act (UFTA), this does not require the adoption of the UFTA’s much shorter limitations period. This is mainly because §56.29’s contrary scheme and precedent broadly establishes the availability of proceedings supplementary for the life of the judgment, when a valid, unsatisfied execution exists.”[2]

Under §56.29, a judgment creditor may: (1) pursue assets held by the debtor; (2) pursue assets held by another, so long as the property is not exempt from execution; or (3) void any transfers to a spouse or third party that was made for purposes of delaying, hindering, or defrauding a creditor.[3] Since §56.29 is a procedural statute, claims brought under this section must be analyzed according to other substantive law since the statute borrows substantively from the UFTA.[4]

On May 12, 2015, in the Bankruptcy Court order of In re C.D. Jones & Company, Inc., Bankruptcy Judge Karen K. Specie came to the conclusion that Florida’s proceedings supplementary statute[5] would not apply to extend the statute of limitations upon setting aside fraudulent transfers in bankruptcy.[6] In the Order Denying Motion to Remand or to Abstain from Hearing Removed Matter, Judge Specie opined as follows:

The Daakes argue that the Bankruptcy Court is not the proper place for the Removed Proceeding because the causes of action do not arise in a case under Title 11; they only involve Florida law causes of action. Without question, the Removed Proceeding is styled as a proceeding supplementary to execution, under Fla. Stat. §56.29. Had C.D. Jones not filed bankruptcy, the Daakes, as judgment creditors, would have the right to pursue proceedings supplementary as long as their judgment remained valid and outstanding. But C.D. Jones did file bankruptcy and remains a Chapter 7 debtor before this Court. This Court has previously ruled that “the claims and causes of actions asserted…constitute property of the bankruptcy estate and any recover from them shall inure to the benefit of all creditors.” This ruling, and these facts, bring the Removed Proceedings squarely within this Court’s jurisdiction.

Further, footnote 18 of the Order states that:

In their memorandum, the Daakes assert that their right to avoid fraudulent transfers in the Proceedings Supplementary extends for the life of the Judgment (20 years) under Florida law, citing Biel Reo, LLC vs. Barefoot Cottages Dev. Co., LLC So.3d 506 (Fla. DCA 2014), reh’g denied (Feb. 3, 2015). While this may be true in general, it is not true when the judgment debtor files bankruptcy. Nothing in the Biel Reo, LLC opinion states otherwise.

Judge Specie further relied on the Bankruptcy case In re Fundamental Long Term Care, Inc. in determining whether jurisdiction over the supplementary proceedings is valid.[7] In Fundamental Long Term Care, the bankruptcy court held that it could, in fact, “exercise related to” jurisdiction over a judgment creditor’s supplementary proceedings in state court.”[8] In this case, a judgment creditor was attempting to recover a large sum of assets, which were owned by the debtor’s “wholly owned subsidiary,” based on fraudulent transfer and alter ego claims.[9] Regarding the validity of the jurisdiction over the proceedings, the court held:

A dispute is “related to” a case under title 11 when its result “could conceivably” have an “effect on the estate being administered in bankruptcy.” The “proceeding need not necessarily be against the debtor or against the debtor’s property,” if it could affect the administration of the bankruptcy estate. “The key word in the Lemco Gypsum/Pacor test is ‘conceivable,’ which makes the jurisdictional grant extremely broad.” As the Supreme Court recognized in Celotex Corp., “Congress intended to grant comprehensive jurisdiction to the bankruptcy courts so that they might deal efficiently and expeditiously with all matters connected with the bankruptcy estate.[10]

We understand that this decision is now being appealed. The parties have already been in litigation for over ten years.

As a result of the above, debtors who might find themselves in a proceedings supplementary more than four years after having made a transfer that might have been considered to have been “fraudulent” and need to be able to go into bankruptcy should refrain from making transfers that could be considered fraudulent for the period preceding 1 year before they would file bankruptcy.

We will be writing on these cases and associated topics with some very bright co-authors, so please stay tuned!

**************************************

[1] So.3d 506 (Fla. DCA 2014).

[2] Biel Reo, LLC at 4.

[3] Fla. Stat. §56.29.

[4] Mejia v. Ruiz, 985 So. 2d 1109, 1112-13 (Fla. Dist. Ct. App. 2008); Nationsbank, N.A. v. Coastal Utilities, Inc., 814 So. 2d 1227, 1229 (Fla. Dist. Ct. App. 2002); Morton v. Cord Realty, Inc., 677 So. 2d 1322, 1324 (Fla. 4th DCA 1996).

[5] Fla. Stat. §56.29

[6] 2015 WL 2260707 (Bankr. N.D. Fla., May 12, 2015).

[7] In re Fundamental Long Term Care, Inc., 501 B.R. 770 (Bankr. M.D. Fla. 2013).

[8] Id. At 778.

[9] Id.

[10] Id. at 777.

Office of Inspector General Fraud Alerts

An Interview with Lester Perling, Part 1

On June 9, 2015, the Office of Inspector General (OIG) of the U.S. Department of Health and Human Services issued a fraud alert, which can be viewed by clicking here.

Alan Gassman interviewed Lester Perling of Broad & Cassel about the OIG Fraud Alert, part 1 of which is printed below:

Alan – Today, we are going to talk about the OIG’s warning shot about physician compensation and medical directorships. Lester, welcome.

Lester – Thank you, Alan.

Alan – June 9, 2015, the Fraud Alert. Physician compensation arrangements may result in significant liability. Lester, what is this, and what do we learn from it?

Lester – Well, Alan, this flows from a case in which we actually represented one of the doctors who got in trouble – one of the twelve physicians and his wife. This was a home health aide. This particular case has generated this Fraud Alert.

Fraud Alerts, by the way, for those that don’t know, are a fairly rare thing for the OIG to issue. They haven’t issued one in quite some time. They might issue one every two to three years when they have a topic that they are particularly concerned about and they want to send a message. So this is a message to the physician community about natural arrangements between them and entities to which they refer. This was a case of a home health agency who had multiple medical directors, which probably, for a time, was more common than it is now. The agency also hired several physicians’ spouses to work for it, which has also been a common thing with home health agencies and other types of providers.

So this particular home health agency hired the physicians’ spouses to do various tasks like marketing, even nursing. Some of the spouses were actually nurses and did clinical work in the field. Some of the spouses did nothing but were still paid. Others did, in fact, provide services for a period of time. The facts of this case really probably aren’t the most important thing. What is really important about this Fraud Alert and what the OIG has been talking about in the recent weeks and months is the fact that they are going to start looking more at not just the entity involved in physician arrangements in terms of sanctioning them but at the physicians as well.

This is kind of going full circle. Alan, you may remember the old Clearwater lab case…

Alan – I knew it well, but can you tell us about it?

Lester – The OIG went after physicians who were involved with this laboratory, which they believed was paying kickbacks and doing other improper things, and that caused a major uproar in the physician community in the Tampa Bay area. In fact, it led to a meeting between OIG officials and the U.S. Attorney’s office and the community physicians and their representatives about the heat that physicians were taking as a result of that.

That actually, I think, caused the OIG, and to some degree, the Department of Justice, to pull back from going after individual physicians and focus more on the entities that were entering into these unnatural arrangements with them. I think that the OIG, at least, believes now that was probably a mistake, or they believe they went too far the other way.

The pendulum is now swinging back, and this case kind of represents that fact. There was nothing unusual about this case. It is one of many where there are physicians or physician spouses getting remuneration. What this signals is, like I said, a swing of the pendulum back to the OIG, who is now not going to just focus on the entity. They’ll certainly go after the entity, but they are also going to go after the physicians or their spouses who are involved in these relationships and seek to sanction them as well.

Alan – So they published the Fraud Alert as a warning to these physicians?

Lester – They published a Fraud Alert to make sure that physicians are aware that they are vulnerable. I think the physicians believe that, with the way it has been with not going after the physicians, the physicians say, and I hear this from clients, they say, “Well, what is the real risk? What’s going to happen to me?” Until recently, the answer was that there may not be much that happens to the individual physician because the OIG tends to focus on the entity. Now, the OIG is saying that is changing, and that is what is really important about this Fraud Alert.

Alan – What happened to some of the physicians involved in this case?

Lester – They all settled. They all got to pay the government various sums of money. Some were considered more culpable than others. Some, like I said, the spouses did nothing, no work at all, for their pay. Others, in fact, did work, but they all ended up settling because most of the physicians and their spouses really had no good defense. Even the lowest settlement was in the low six figures.

It was expensive. There were significant settlements. I do not believe any of them had been excluded because all of the settlements prevented exclusion. Basically, they were preventing the exclusion by settling, but like I said, some had no really good defense prepared, so it was an expensive proposition for them, obviously.

Alan – That’s very gentle compared to the Clearwater Clinical Lab experience, where several doctors were arrested in their own lobbies and then had to get bail.

Lester – Yes, the pendulum hasn’t swung back that far yet. I think other than those that are just committing outright fraud, it’s going to be this type of administrative sanction, which is probably what they should have done with the Clearwater Clinical Lab doctors, and that’s why they think they went too far the other way, where they weren’t doing enough with physicians, in terms of at least doing some sort of administrative sanction.

Alan – What kind of consequences can an administrative sanction have on a physician?

Lester – Keep in mind that this type of action on the part of the government can have licensure collateral consequences. It can lead to disciplinary investigations by the Board of Medicine. It can have collateral consequences for Managed Care Agreements and participation in networks. It’s not criminal, but it is very serious business.

Stay tuned for next week’s Thursday Report, where Lester will discuss the background of the Office of Inspector General and the case that led to the newest Fraud Alert, as well as the differences between federal and state violations.

Excerpts from Creative Tax Planning for

Real Estate Transactions and Investors

Alan Gassman, Christopher Denicolo, Jerry Hesch, and Stephen Breitstone presented a webinar entitled “Creative Tax Planning for Real Estate Transactions and Investors: A Practical Guide for Real Estate and Tax Advisors and Their Clients” on Tuesday, June 23, 2015. Some excerpts from this webinar are as follows:

Real Estate is Generally a Capital Asset, with an Important Exception

Real estate is generally treated as a capital asset for most taxpayers; however, there are certain exceptions. One important exception is real estate that is treated as inventory in hands of the taxpayer (i.e. the taxpayer is a “dealer”), which causes any gain or loss from the sale of exchange of real estate to be treated as ordinary income. Dealers in real estate are also precluded from taking advantage of certain tax deferral techniques, such as Section 1031 like-kind exchanges and Section 453 installment sales.

Courts have looked at the following factors in determining whether to classify a taxpayer as a dealer:

- Number, frequency, and continuity of sales;

- Nature and extent of improvements and/or development activities;

- Purpose and reason for which the property is held;

- Sales activities and efforts with respect to the property;

- The relationship of the property to the taxpayer’s business and the taxpayer’s statements concerning its business;

- Duration of ownership, and

- Whether the taxpayer purchased replacement property or has demonstrated a pattern of continuous buying and selling of real property.

Advantages to a client being a dealer include ordinary loss treatment if a loss occurs on sale and being able to take advantage of the real estate professional exception to the 1411 Tax. Disadvantages to a client being a dealer include earning ordinary income in lieu of capital gains on sale.

Passive Loss Rules Regarding Rental Activities

Losses from passive activities cannot be offset against income from non-passive activities and can only be used to offset income from passive sources. The passive loss rules are provided under Section 469. Any losses from real estate rental activities are generally treated as passive per se (i.e. without regard to whether they involve the conduct of a trade or business or whether the taxpayer has materially participated.)

There are a number of limited exceptions for certain situations where the rental activities involve short rental periods, extraordinary personal services, rentals to joint ventures, or pass-through entities in which the taxpayer has an interest. If the taxpayer is a real estate professional who meets certain criteria, then any losses from real estate rental activities are not passive per se.

The regulations prescribe a complex and fact-intensive set of tests that a taxpayer can satisfy to cause real estate rental activities to be treated as non-passive.

The Real Estate Professional Exception

To qualify for the real estate professional exception to the passive loss rules, the taxpayer must:

- Provide more than ½ of his or her total personal services in real property trades in which he or she materially participates, and

- Perform more than 750 hours of services during the tax year in real property trades or businesses in which he or she materially participates.

What is Material Participation?

Temporary Treasury Regulation Section 1.469-5T(a) lists the seven tests that an individual can satisfy to establish material participation:

- The individual participates in the activity for at least 500 hours during the applicable tax year;

- The individual’s participation in the activity constitutes substantially all of the participation in the activity of all individuals during the taxable year;

- The individual participates in the activity for more than 100 hours during the tax year, and his or her participation is not less than that of any other individual during the same year;

- The activity is a “significant participation activity” of the individual, and the individual participates in all significant participation activities for more than 500 hours in the applicable tax year;

- The individual materially participated in the activity for any 5 of the 10 taxable years that immediately precede the current taxable year;

- The individual materially participated in a personal service activity for any three prior taxable years, or

- The individual has regular, continuous, and substantial involvement in the activity, based on all of the facts and circumstances.

Where is Material Participation Determined?

For partnerships and S corporations, material participation is determined at the individual partner level. For non-grantor trusts, material participation is determined based upon the trustee’s activities and not upon a beneficiary’s activities.

Under the Frank Aragona Trust v. Commissioner case (142 T.C. No. 9; 2014), the Tax Court ruled that a trust can qualify for the real estate professional exception to the passive loss rules if the trustees are individuals and the individuals otherwise satisfy the material participation tests. In Frank Aragona Trust, three of the six individual co-trustees were full-time employees of the LLC that operated real properties.

This case is also important in the context of the 3.8% Net Investment Income Tax under Section 1411. Under Section 1411, “Net Investment Income” includes income from sources that are passive with respect to the taxpayer and the determination of whether income is passive is based on the passive loss rules of Section 469.

Non-grantor trusts are subject to the 3.8% Tax after reaching $12,150 of Net Investment Income, so the importance of trust income being classified as non-passive rather than passive has significantly increased with the advent of the 3.8% Tax.

Tax Consequences of Foreclosures, Deeds in Lieu of Foreclosure,

and Discharge of Indebtedness

For federal income tax purposes, the sale of real estate subject to a non-recourse mortgage to a third-party at a foreclosure sale is treated as if the mortgagor sold or exchanged the property to such third-party for the amount of the outstanding mortgage balance, not to exceed the fair market value of the property. Likewise, if property subject to a non-recourse mortgage is conveyed to the mortgagee in satisfaction of the debt, it is treated as a sale or exchange of the property by the mortgagor for the outstanding mortgage balance, without regard to the fair market value of the property.

For federal income tax purposes, the sale of mortgaged real estate to a third-party at a foreclosure sale is treated as if the mortgagor sold or exchanged the property to such third-party for the foreclosure sale price, and gain or loss is thus recognized as a result thereof (assuming that no applicable non-recognition provisions, such as the principal residence exclusion under Section 121, apply.)

Similarly, if a personally liable mortgagor conveys the property to the mortgagee as a deed in lieu of foreclosure which extinguishes the mortgage, it is treated as a sale or exchange of the property by the mortgagor for fair market value of the property. If the fair market value of the property is less than the outstanding balance of the mortgage, then the transaction is bifurcated – the transaction is treated as a sale or exchange to the extent of the fair market value of the property and as cancellation of indebtedness under Section 108 to the extent that the mortgage balance exceeds the property’s fair market value.

Discharge of Indebtedness (DOI) income occurs where a taxpayer is relieved of indebtedness by a creditor to the extent that the taxpayer did not pay consideration in exchange for such debt relief. DOI income is taxed at ordinary income rates but is subject to several exceptions that apply in certain situations.

DOI income generally is realized by the taxpayer when the debt is repurchased or satisfied at less than its outstanding balance. Under Section 108, DOI income will result if a debt is purchased for less than its outstanding balance by the debtor or by a party that is “related” to the debtor.

The following are exceptions to the recognition of DOI income:

- The debt discharge occurs in a bankruptcy case under Title 11 of the US Code

- To the extent that the taxpayer is insolvent at the time of the discharge or is made insolvent as a result of the discharge

- For partnerships, insolvency is determined at the level of each partner; for S corporations and C corporations, the insolvency is determined at the corporate level.

- The debt being discharged is “qualified farm indebtedness.”

- The debt being discharged is “qualified real property business indebtedness,” which is:

- Indebtedness incurred or assumed in connection with real property used in a trade or business, which was incurred or assumed to acquire, construct, reconstruct, or substantially improve such property, and with respect to which the taxpayer makes an election.

- This exclusion only applies to taxpayers other than C corporations.

- The debt being discharged is “qualified principal residence indebtedness,” but only if the discharge occurred between January 1, 2007 and December 31, 2014.

Using one of the above exceptions, the recognition of DOI income may result in the taxpayer having to reduce tax attributes or income tax basis in other real property.

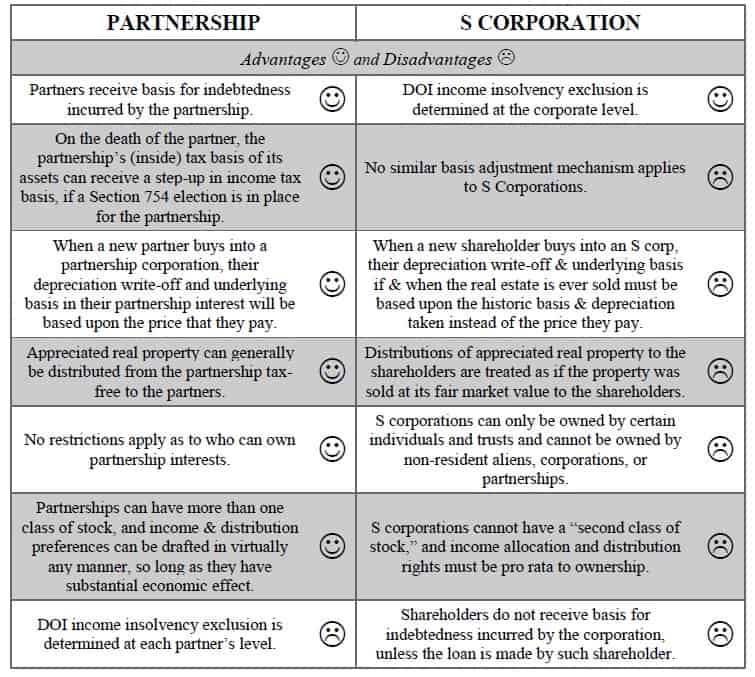

Partnership v. S Corporation – Which is Better to Hold Real Estate?

Richard Connolly’s World

Settling an Estate After Death

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “The Widow’s Guide to Estate Planning and Wealth Transfer” by Sandra MacGregor. This article was featured on Forbes.com on June 2, 2015.

Richard’s description is as follows:

Drafting up a will can be an emotionally taxing process, but it’s one that becomes especially difficult when a spouse is left to cope with the task after their partner passes away. Suddenly, what was once a joint decision made with a lifelong partner becomes a task a widow must face alone.

Cinda J. Collins, Senior Vice President and Financial Advisor at RBC Wealth Management, knows this all too well. Despite having two years to prepare for her husband Bob’s passing when he was diagnosed with acute myeloid leukemia, Collins found the financial and emotional implications of settling his estate after he was gone were often overwhelming.

To help other widows cope with the process, Collins, along with Deborah Johnston, Senior Vice President and Financial Advisor at RBC Wealth Management, offer some advice on how couples can approach estate planning together, as well as what a surviving spouse should do in the unfortunate event their partner passes.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “When Heirs Fight Over Assets with Sentimental Value” by Paul Sullivan. This article was featured in The New York Times on April 3, 2015.

Richard’s description is as follows:

Robin Williams’s widow, Susan Schneider, agreed that the rainbow suspenders he wore on the television comedy Mork & Mindy should go to his children from previous marriages, but she did want the tuxedo the comedian wore at their wedding. Simple, it might seem, but not in the complicated world of blended families.

Nearly eight months after Mr. Williams committed suicide in his home in Northern California, his children and his third wife were in court over a part of his estate plan that many people overlook. Who is entitled to stuff with more sentimental than monetary value?

But trust and estate lawyers said that this case, if stripped of its Hollywood glamour, would be no different from the many cases they see of children from previous marriages battling their parent’s last spouse over the smallest things.

Please click here to read this article in its entirety.

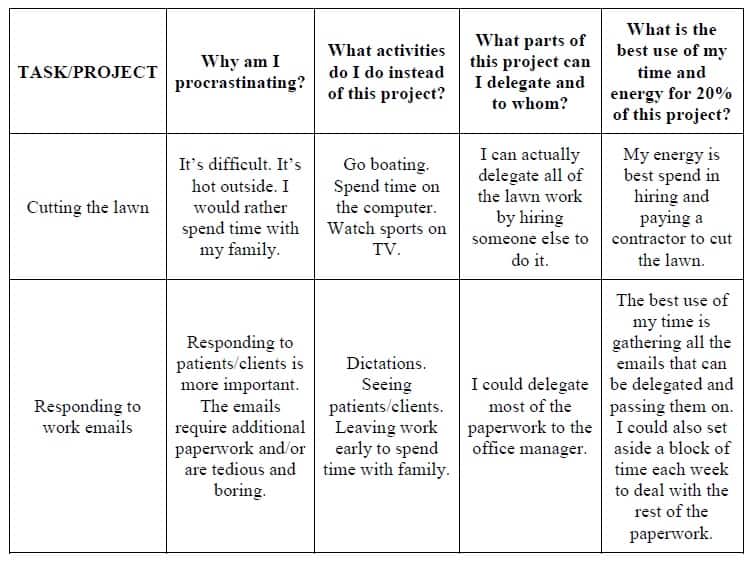

Thoughtful Corner

5 Steps to Relieve Procrastination –

How to Begin (and End!) a Project Successfully

We all know that there are some tasks and projects we resist doing, things we push off until the next day, next week, or next year. This is the cycle of procrastination, which, by definition, means the act of delaying or postponing something that should be done. We know what procrastination is, and we recognize that we are guilty of it. We even understand that procrastination is unproductive. Why do we continue to procrastinate, and what can we do to prevent it?

When we procrastinate, our conscious mind usually perceives obstacles or interruptions that “came up” to preclude the task in question. Have you ever found yourself suddenly organizing your sock drawer just as it was time to begin studying for a big exam? The excuses and the interruptions suddenly become very convenient. In truth, there are likely deeper reasons as to why you are putting something off, and such insights are often not immediately evident to you, the procrastinator.

Frequently, we resist the task at hand because we associate such task with pain, struggle, or discomfort in some way. Our concern that we will have to address or experience these feelings leads us to put off the task as long as possible. Often our subconscious mind blows this idea of pain or struggle way out of proportion, and the dread of anticipating the task is much worse than the short, painful experience of actually completing it.

Business advisor, author, and coach Rick Solomon, CPA, who teaches the Sedona Releasing Method, recommends that a procrastinator facing resistance should imagine living through the uncomfortable task or event and experience the struggle, challenge, or pain before the project has even begun. The fear of the unknown is usually much worse than any painful experience we actually face in our daily lives. Going to the “worst case scenario” when imagining a task may help to relieve tension, as the challenge may seem much more manageable once you have anticipated possible painful outcomes. This may also encourage you to reframe the project in a different way. You may discover a simpler solution. You may also discover that you can delegate the project to someone else or perhaps that the project is not really necessary at all.

Once you have re-evaluated the project or task, gained some perspective on what does or does not need to be done, and come to terms with the challenges you will have to experience, you can incorporate the 80/20 Rule. The 80/20 Rule has many applications, but in this setting, 20% of the effort required to effectuate any project will normally accomplish 80% of the results. The best solution is often to put your efforts toward the first 20% of the project, specifically planning and gathering required information, and then delegate to someone else or reprioritize for the remaining 80% of the work.

A sample brainstorming table for helping to organize your thoughts is below:

The clearer and more specific you can make your process for dealing with procrastination, the easier it will be to move forward with challenging projects or tasks. The steps below will take 15-30 minutes to complete and will save you hours of delays, setbacks, and worries.

1. Discover the reason for your procrastination

Ask yourself the following two questions: Why am I procrastinating on this task? Is there a fear of pain involved?

Write the answers to these questions down, as writing often helps subconscious anxieties and fears reveal themselves. We recommend taking a few minutes to freely journal or take notes.

Hold yourself responsible for getting to the root of your procrastination. Don’t accept excuses of busyness or interruptions as your reasons for procrastination. Find out what is going on underneath these surface rationales.

2. Go to the “worst case scenario”

Imagine the full pain of the task at hand. Let yourself experience it completely. Write down the specifics of the worst case scenario if that is helpful, or close your eyes and visualize the worst case scenario happening to you. The point is to get the pain over with. Worrying about pain in advance for weeks on end is much worse in the long run than efficiently dealing with pain in the here and now.

3. Strategize about a more effective outcome

Once you have discovered the reason for your procrastination and dealt with the struggle or challenge involved, you are able to put aside the emotional aspect of the task and deal with it in a logical, strategic manner.

Write down your answers to the following questions:

Am I sure this project needs to be completed? What benefit does this project provide? At what cost?

Do I have to handle this entire project myself, or can some of it be delegated?

Which parts of the project can go to which people?

Using the 80/20 Rule, if I contribute 20% to this project, what actions will make my contribution most effective?

4. Take Action

Once you have laid out your basic strategy, create an action plan for you and others to follow. Include timelines and accountability between yourself and others to ensure the project or task is 100% completed.

Prioritize your project with reference to other projects and opportunities. Is it more or less important? More or less urgent?

Lay out specific action steps. Assign a date and a person for completion of each step. Delegate the parts of the project you have assigned to others, including a completion date that works for both parties.

Set a follow-up date for accountability with you and the people working on the project or task.

5. Celebrate your progress

Crossing a difficult project off your to-do list is a great accomplishment! Acknowledge your hard work and choose a way to reward yourself: an afternoon off, a drink with a friend, a trip to the beach, or whatever works for you.

As you practice these methods, you will find that dealing with procrastination becomes easier to identify and manage over time. Taking these 5 steps whenever you come up against resistance will boost your energy, save you time, and give you better results!

For a worksheet to help you work through these steps and stop procrastinating, please click here.

Humor! (or Lack Thereof!)

Sign Saying of the Week

***********************

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on FINANCIAL RELATIONSHIPS WITH PATIENTS, CO-PAYMENTS, GIFTS, AND GRAFT – HOW TO STAY OUT OF TROUBLE UNDER FLORIDA AND FEDERAL LAW.

This is an essential guide for medical practices and those who advise them. There will be two opportunities to attend this presentation.

Date: Tuesday, July 7, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman will present a webinar on the topic of WHAT FLORIDA CPAS NEED TO KNOW ABOUT ASSET PROTECTION for the Florida Institute of CPAs.

More information about this webinar will be forthcoming. Please stay tuned!

Date: Thursday, July 9, 2015 | 9:30 AM – 10:30 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com. To register, please contact Thelma Givens at givenst@ficpa.org.

**************************************************

LIVE ORLANDO PRESENTATION:

ORLANDO BUSINESS AND PROFESSIONAL PRACTICE OWNER SYMPOSIUM

Alan S. Gassman, business coach and author David Finkel, and others will present a two-day conference for high-net-worth business and professional practice owners sponsored by Maui Mastermind®.

Alan’s topics will include BASIC AND ADVANCED PLANNING TECHNIQUES FOR THE PROTECTION OF WEALTH, THE 10 BIGGEST MISTAKES THAT BUSINESS OWNERS AND PROFESSIONALS MAKE, and ESTATE TAX AVOIDANCE TECHNIQUES FOR BUSINESS OWNERS AND PROFESSIONALS.

Other topics include A Proven Map to Grow Your Business and Get Your Life Back, Building Wealth Outside of Your Company, Tax Reduction Strategies, and Understanding How Investments Work and What They Cost.

Interested individuals can contact agassman@gassmanpa.com or David Finkel at david@mauimastermind.com.

Date: July 30th and 31st, 2015

Location: Hyatt Regency Orlando | 9801 International Drive, Orlando, FL 32819

Additional Information: To register, please click here or email agassman@gassmanpa.com.

********************************************

LIVE WEBINAR:

Alan Gassman and Christopher Denicolo will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

This 50 minute informative talk with extensive materials will cover essential aspects and trip-ups that doctors often encounter in the area of personal and practice entity asset protection. It will also discuss tax and investment planning, advisor selection, health law, compliance, and other areas of interest for physicians.

Each attendee will receive a complimentary copy of Mr. Gassman’s book, Creditor Protection for Florida Physicians and other valuable materials.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

Alan Gassman’s Professional Acceleration Workshop was a fast-paced, information-packed, and highly instructional event. Through interactive discussions of time-tested professional and personal growth strategies ranging from goal setting and problem solving to office efficiency and effective team building, Alan provides a thoughtful and measured approach to becoming a highly effective professional. I left the workshop feeling invigorated and excited to implement the insights into my practice management and continued self-study. The course materials and Alan’s compilation of trusted additional resources will be an invaluable resource for years to come. Thank you for the opportunity to participate.

Christina Rankin, J.D., LL.M. (Taxation)

Trust and Estates Lawyer with Over 10 Years of Experience

Law Offices of Richard D. Green, J.D., LL.M.

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman and a guest to be determined will present WHAT TAX PLANNERS NEED TO KNOW ABOUT NORTH DAKOTA TRUST LAW for Bloomberg BNA.

Date: Wednesday, September 9, 2015 | Time TBA

Location: Online webinar

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanp.com

*******************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

*****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE WEBINAR:

Alan Gassman, Christopher Denicolo, and Kenneth Crotty will present a 50-minute webinar entitled CREATIVE PLANNING FOR FLORIDA REAL ESTATE with a guest (victim) to be determined. This presentation will be free and worth every dollar!

There will be two opportunities to attend this presentation. This webinar will qualify for CLE and CPE credit.

Date: Wednesday, September 23, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email agassman@gassmanpa.com.

**************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

****************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online Webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: To be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

*******************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

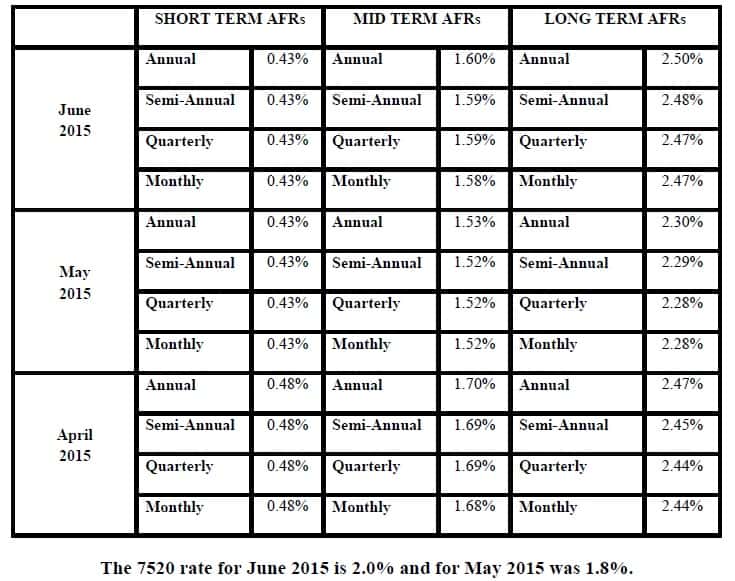

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.