The Thursday Report – Issue 310

|

|

|

|

Thursday, August 26th, 2021Issue 310Having trouble viewing this? Use this link

|

|

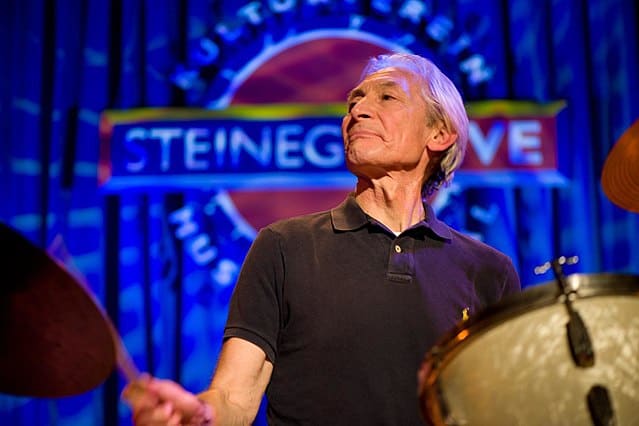

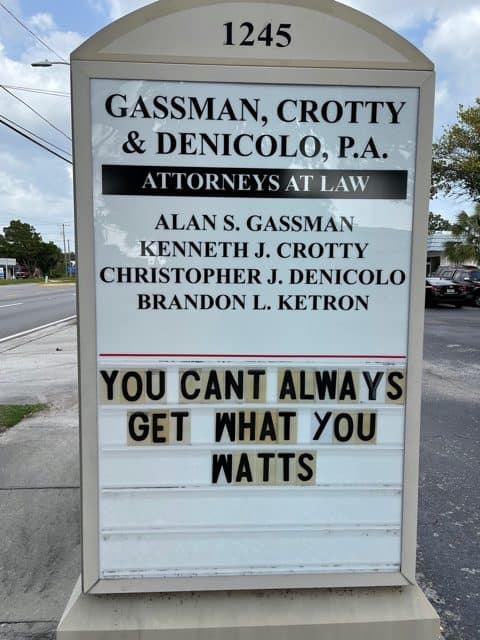

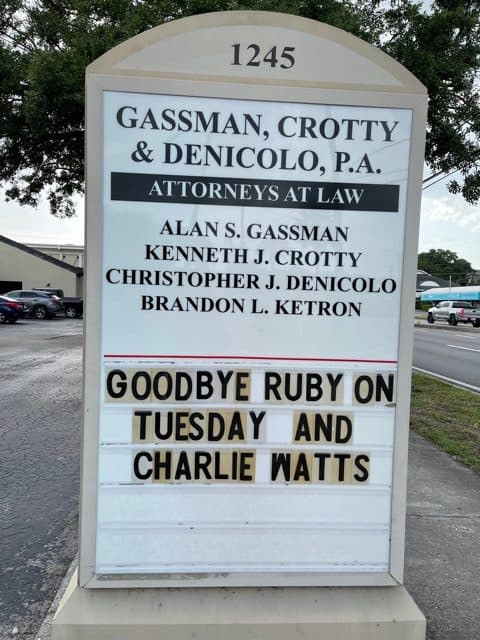

A Tribute

From Wikimedia Commons, the free media repository Charles Robert Watts (June 2, 1941 – August 24, 2021) was an English musician who was the drummer for the rock band the Rolling Stones from 1963 until his death in 2021. Originally trained as a graphic artist, Watts developed an interest in jazz at a young age and joined the band Blues Incorporated. He also started playing drums in London’s rhythm and blues clubs, where he met future bandmates Jagger, Richards, and Brian Jones. In January 1963, he left Blues Incorporated and joined the Rolling Stones as a drummer, while doubling as designer of their record sleeves and tour stages. Watts’ first public appearance as a permanent member was in February 1963, and he remained with the group until his death 58 years later. From Wikipedia, the free encyclopedia

|

|

|

|

|

|

Table of ContentsArticle 1Think Before You Respond to Negative Online Reviews By: Michael Geeraerts & Jim Magner Article 2Do Transfers of Tenants by the Entirety Property to Joint Revocable Trusts Result in a Forfeiture of Creditor Protection By: Juan C. Antunez Article 33rd DCA Piercing The Corporate Veil By: Alan Gassman Article 4Court Drowns Floating Spouse By: Edwin Morrow III Article 5Who are you being? By: Srikumar Rao Forbes’ CornerHow To Be Part Of The $5.8 Billion Of Automatic Federal Student Loan Forgiveness For The Disabled By: Alan Gassman New ERC Rules Beyond Family Ownership Issues, And What To Do If You Got The Credit And The Owner Has A Relative By: Alan Gassman For Finkel’s Followers5 Job Perks You Should Provide in a Post-Pandemic Climate By: David Finkel Featured EventsMore Upcoming EventsYouTube ChannelHumor

|

|

|

This week we salute Leimberg Information Services for two fantastic articles that are very pertinent for professionals and also those of us who work with Joint Revocable Trusts. Thanks to Steve Leimberg, James Magner, and the whole Leimberg team, not to mention Michael Geeraert and Juan Antunez, who are excellent lawyers, authors, and professionals. You can get a free trial subscription to this amazing system by going to https://new.leimbergservices.com/.

|

|||||||||||||||||||||||||||||||||||||||||||||||

Article 1Think Before You Respond to Negative Online Reviews

By: Michael Geeraerts & Jim Magner Steve Leimberg’s Estate Planning Email Newsletter – Archive Message #2901 ABA Formal Opinion 496 speaks to a lawyer’s ethical responsibilities when dealing with negative online reviews by clients or former clients. The primary takeaway is that lawyers who choose to respond online to a negative review must not disclose information that relates to the client matter or that could reasonably lead to the discovery of confidential information. That said, the ABA’s opinion is advisory, and the rules and precedent of each individual jurisdiction are controlling. Michael Geeraerts and Jim Magner provide members with commentary that examines a lawyer’s ethical responsibilities when dealing with negative online reviews by clients or former clients. Michael Geeraerts, CPA, JD, CGMA®, CLU® is an advanced planning consultant at The Guardian Life Insurance Company of America®. Prior to joining Guardian, Michael was a manager at PricewaterhouseCoopers LLP and a tax consultant at KPMG LLP. Michael has written articles for numerous national publications and has delivered continuing education courses to CPAs and attorneys on a variety of estate, business, and income tax planning strategies. Jim Magner is an advanced planning attorney at The Guardian Life Insurance Company of America®. Jim previously worked as an Attorney-Advisor in the IRS’s Office of Chief Counsel in Washington, DC where he wrote private and public rulings on estate, gift, GST, and charitable remainder trust issues.[i] Here is their commentary: EXECUTIVE SUMMARY: ABA Formal Opinion 496 speaks to a lawyer’s ethical responsibilities when dealing with negative online reviews by clients or former clients. Lawyers who choose to respond online to a negative review must not disclose information that relates to the client matter or that could reasonably lead to the discovery of confidential information. That said, the ABA’s opinion is advisory, and the rules and precedent of each individual jurisdiction are controlling. FACTS: Clients, opposing parties, and others are increasingly taking to the internet to express their opinions of lawyers they have encountered. As a result, lawyers are frequently left in a difficult position of determining whether and how they ethically may respond when the opinions posted are unflattering, and the facts presented are inaccurate or even completely untrue. American Bar Association Opinion 496 was issued earlier this year and addresses a lawyer’s ethical obligations in responding to negative online reviews. While the ABA’s opinion is advisory, the rules and precedent of each individual jurisdiction are controlling. In this regard, there have been a surprisingly large number of state ethics opinions on this topic.[ii] The majority reached the conclusion that, even if the online posting was made by a client, the posting of criticism does not rise to the level of a controversy that would allow a lawyer to disclose confidential information in responding. Opinion 496 offers a number of best practices to lawyers who are the subject of negative online reviews:

COMMENT: ABA Model Rule of Professional Conduct 1.6(a) prohibits lawyers from disclosing information relating to any client’s representation or information that could reasonably lead to the discovery of confidential information by another. Opinion 496 makes it clear that a negative online review, alone, does not meet the requirements for permissible disclosure under Model Rule 1.6(b)(5) and, even if it did, an online response would exceed any disclosure permitted under the Rule. HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE! Michael Geeraerts Jim Magner CITE AS: LISI Estate Planning Newsletter #2901 (August 18, 2021) at http://www.leimbergservices.com, Copyright © 2021 Jim Magner and Michael Geeraerts. Reproduction in Any Form or Forwarding to Any Person Prohibited – Without Express Permission. This newsletter is designed to provide accurate and authoritative information regarding the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

|

|||||||||||||||||||||||||||||||||||||||||||||||

Article 2Do Transfers of Tenants by the Entirety Property to Joint Revocable Trusts Result in a Forfeiture of Creditor Protection

By: Juan C. Antunez Steve Leimberg’s Asset Protection Planning Email Newsletter – Archive Message #418 If a married couple transfers their tenants by the entireties (TBE) property to a joint revocable trust, have they forfeited its creditor protection shield? That’s the question at the heart of two recent Florida bankruptcy court rulings that came to opposite conclusions! Juan Antúnez provides members with his analysis of In re Givans and In re Romagnoli. Juan is a partner with Stokes McMillan Antúnez Martinez-Lejarza P.A., a boutique trusts and estates law firm located in Miami, Florida. Trusts and estates litigation, probate administration, and estate planning are all he does as a lawyer. Here is his commentary: COMMENT: If a married couple transfers their tenants by the entireties (TBE) property to a joint revocable trust, have they forfeited its creditor protection shield? That’s the question at the heart of two recent Florida bankruptcy court rulings that came to opposite conclusions! In re Givans, the court concluded that TBE property’s creditor protection shield is lost when it’s transferred to a joint trust. And in In re Romagnoli the court came to the opposite conclusion, ruling that TBE property’s creditor protection shield is not lost when it’s transferred to a joint trust. But don’t try looking for direct legal conflicts between these two rulings, the judges essentially talk past each other which got me thinking about the power of framing. Frame or be Framed: If you think cases are decided solely on the basis of cold hard logic, you’re kidding yourself. Unconscious biases drive much of our decision-making (which I’ve reported on as applied to sentencing patterns, bench trials, and settlement negotiations). These biases can play a dominant role in how even the most abstract and non-emotional issues are decided (including how bankruptcy judges should apply Florida’s confoundingly amorphous TBE law). In my opinion, how the Givans and Romagnoli cases were decided is largely attributable to a single variable: the framing effect, a cognitive bias that leads people (including judges) to react to the same choice in different ways depending on how it’s presented. Framing can be an incredibly powerful advocacy tool (see here, here, here). In re Givans, 623 B.R. 635 (Bankr. M.D. Fla. Sept. 30, 2020): In this case, the court framed the question as to whether the debtor and his wife could have it both ways. Frame #1: Should debtors be allowed to have it both ways? In other words, could this couple retain the creditor-protection benefits of TBE property while also reaping the estate planning benefits of putting their property in trust? Well, there’s a reason why we usually say you can’t have it both ways: it strikes most of us as somehow unfair. Not surprisingly, when framed this way the court concluded no, the debtor can’t have it both ways. Property held by spouses as TBE possesses six characteristics: (1) unity of possession (joint ownership and control); (2) unity of interest (the interests in the account must be identical); (3) unity of title (the interests must have originated in the same instrument); (4) unity of time (the interests must have commenced simultaneously); (5) survivorship; and (6) unity of marriage (the parties must be married at the time the property became titled in their joint names). The court concluded the debtor and his wife forfeited the creditor-protection benefits of their TBE property when they transferred this property to their joint trust because a trust can’t be married, so the unity of marriage was lost, which means the property stopped being TBE once it hit the trust. The Trustee Deed provides the Debtor and [his wife] as Trustee of the Trust owns the Property, not as husband and wife. Under trust law, a trustee holds only legal title to trust property while equitable title rests with the beneficiary. Once the Debtor and [his wife] transferred the Property to the Trust, they no longer owned the Property in their individual capacity. They held the bare legal title as Trustee for the Trust. Because a trust is not a married individual, the Trust cannot own the Property as tenants by the entirety. The unity of marriage does not exist as to the Trust. In other words, the debtor and his wife can’t have it both ways. By transferring the Property to the Trust, the Debtor and [his wife] gave up certain legal rights in exchange for others. They lost the benefits tenants by entirety ownership afforded, such as protection of the Property from certain creditors. In exchange, they gained other benefits provided by the Trust, such as circumventing probate proceedings. They could directly transfer the Property to their children without the expense of going through probate. And because of the Trust, their children now have a present equitable interest in the Property as beneficiaries. Debtor and [his wife] cannot have it both ways. The Property cannot be held by the Trust, subject to the terms of the Trust (which creates interest for their children), and also be held as tenants by the entirety, subject to common law and protected from creditors claims. In 2014, they created the Trust and transferred the property to the Trust. By doing so, they lost ownership status as tenants by the entireties. In re Romagnoli, B.R., 2021 WL 2762812 (Bankr. S.D. Fla. June 30, 2021) In this case, the court sidestepped the whole can-you-hold-TBE-property-in-trust controversy and instead focused on the one question that really matters in a bankruptcy proceeding: is the property exempt from the claims of creditors? If the answer is no, you’re done, no need to get tangled up in esoteric property law questions. Frame #2: Is TBE property in a joint revocable trust subject to creditor claims, regardless of whether a trust can hold TBE property? Framed this way, the debtor won. And this time around it was the bankruptcy trustee who got lectured by the judge, not the debtor. The Trustee expressed frustration that the Debtor has exempt assets worth collectively over $1.4 million that are exempt from the Debtor’s creditors. But those exemptions are statutory and if the Trustee wants to reach these assets, she must reach out to the Florida legislature. What happened? If you’re a trust law geek (and who isn’t!), how the court worked through the interplay between federal bankruptcy law and state trust/property law is way more interesting than the ultimate conclusion. So here goes. We start from the premise that bankruptcy creditors are only entitled to whatever property rights debtors have no more or less. The same goes for whatever interests a debtor has in trust. Where the debtor’s interest is in a trust, the trustee acquires only those interests that the debtor had in the trust. See In re Raborn, 470 F.3d 1319, 1323 (11th Cir. 2006) ([T]he [bankruptcy] trustee succeeds only to the title and rights in the property that the debtor possessed.) In this case, the debtor had only three possible interests in the trust: as co-settlor, as co-trustee, or as beneficiary. As a co-settlor of a joint revocable trust, under F.S. 736.0602 the debtor could only remove those assets of the trust he had individually contributed. Since the TBE property was owned jointly by the debtor and his wife (and thus jointly contributed to the trust), the debtor couldn’t pull this asset out unilaterally, which means his creditors couldn’t unilaterally do so either. To the extent that the [TBE property] is, in fact, held in the [Joint] Trust, because it was contributed as TBE and not community property, the Debtor and his Wife could only jointly remove the stock from the [Joint] Trust. Result: Creditors stepping into the shoes of the debtor as a co-settlor of the joint revocable trust cant unilaterally extract jointly contributed property, such as TBE property, to satisfy their claims. Strike one for creditors. As a co-trustee, under the terms of the trust agreement, the debtor could only sell or otherwise dispose of trust property, including the TBE property, with the consent of the other co-trustee, i.e., the debtor’s wife (the trust agreement in Givans had an identical provision). This means the debtor’s creditors, stepping into his shoes as a co-trustee, could also only sell or otherwise dispose of this property with the wife’s consent as a co-trustee. Thus, even if the Trustee could exercise the power of a co-trustee under the [Joint] Trust, the Trustee has not cited to any case that suggests that 11 U.S.C. § 363(f) gives the Trustee, acting with the authority of a co-trustee of a trust, the authority to bypass the provisions of the [Joint] Trust Agreement in seeking to sell property in the [Joint] Trust. Result: Creditors stepping into the shoes of the debtor as a co-trustee can’t unilaterally sell or otherwise dispose of TBE property from the debtor’s joint revocable trust if the trust agreement requires the other co-trustees consent. Strike two for creditors. As a beneficiary of a revocable trust, the debtor’s property interests in the trust are subject to creditor claims to the same extent they would have been if not in the trust. If the TBE property was creditor protected before it went into the trust, it stays creditor protected after it went into the trust. Heres how the court explained this final nail in the coffin for the creditor’s claim against the TBE property: [A]s the Trustee acknowledged in her objection, the ability of the Trustee to reach the Debtor’s beneficial interest is limited by applicable nonbankruptcy law. Fla. Stat. § 736.0505 states that (1) whether or not the terms of a trust contain a spendthrift provision, the following rules apply: (a) The property of a revocable trust is subject to the claims of the settlor’s creditors during the settlor’s lifetime to the extent the property would not otherwise be exempt by law if owned directly by the settlor. Assuming the [TBE property] is in the [Joint] Trust, if not in the [Joint] Trust it would be TBE property not subject to the claims of the Debtor’s creditors unless the creditors were joint creditors. In sum, there is no theory under which the Trustee can reach the assets of the [Joint] Trust. Result: Creditors stepping into the shoes of the debtor as a beneficiary of his joint revocable trust can’t assert claims against trust property if this same property would have been shielded if owned by the debtor directly, as is the case for TBE property when both spouses aren’t joint debtors. Strike three for creditors, debtor wins! So what’s the takeaway? First, no estate planning client wants to be a test case. No matter what your personal opinion may be on the pros and cons of joint trusts (and there are really smart people who think these trusts are a good idea), if you’re working with a married couple you need to think long and hard before advising them to transfer their TBE property to one of these trusts in light of the conflicting messages coming out of the Givans and Romagnoli cases. Some states have eliminated this uncertainty by statute. See, e.g., MO Rev Stat § 456.950 and 765 ILCS 1005/1c. Florida hasn’t gone that route. In the absence of that kind of legislation, why risk it? Second, like trusts and estates litigators we view the world through the lens of Florida property law. Framing a TBE-in-joint-trust case in those terms proved fatal for the debtor’s exemption argument in the Givans case. By contrast, one would expect most bankruptcy judges to view the world through the lens of the U.S. Bankruptcy Code. Framing a TBE-in-joint-trust case in those terms was a winning strategy for the debtor’s exemption argument in the Romagnoli case. Two cases same operative facts opposite results. Behold the power of framing! HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE! Juan C. Antúnez TECHNICAL EDITOR: DUNCAN OSBORNE CITE AS: LISI Asset Protection Planning Newsletter #418 (August 16, 2021) at http://www.leimbergservices.com Copyright 2021 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited Without Express Permission. This newsletter is designed to provide accurate and authoritative information regarding the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

|

|||||||||||||||||||||||||||||||||||||||||||||||

Article 33rd DCA Piercing The Corporate Veil

By: Alan Gassman In the 2021 3rd District Court of Appeals case of Segal v. Forastero, Inc., an investor who bought and sold real estate used an LLC he had to enter into a purchase agreement. The LLC had bought and sold real estate in the past, and had had a bank account, and had filed tax returns, but had no bank account or other assets or activities at the time it entered into the Acquisition Agreement, although the Acquisition Agreement itself was an asset. At the time that the Acquisition Agreement was entered into, the purchaser was told that the owner of the company had significant assets, and seemed to have believed that these assets were under the company or would be contributed to the company. The purchase agreement required the LLC, as purchaser, to make a $500,000 escrow account deposit within 3 days of signing the Agreement, but the owner of the LLC, Segal, later testified that he decided not to do so because his physical inspection of the property revealed that it would need significant work and was therefore not a viable candidate for him. According to the 3rd District Court of Appeals opinion, the trial court that entered a judgment against the LLC for breach of contract found in a Proceedings Supplementary to enforce the judgment that the individual shareholder was responsible for the judgment, thus piercing the veil. The 3rd District Court of Appeal disagreed, finding that none of the three elements needed to show that the company was an alter ego of Segal or could be pierced were satisfied. In particular, the 3rd District Court of Appeal found as follows:

This case points out that when a company is used to shield an individual from liability, it should probably at least have a bank account or other legitimate assets and indicia of existence in order to avoid being used as a mere instrumentality. This also shows that judges who preside over trials or issue summary judgments will often be biased towards enforcing a judgment and finding that a “voidable transfer” or alter ego/veil piercing situation exists in order to satisfy the judge’s opinion of what will bring justice to a particular situation. If Mr. Segal had opened a bank account in the name of the company and had made it more clear and had actually put money in the account that could have been used to pay legal defense costs, then the judge’s opinion in the trial court may have been different, saving Segal time and money needed for appeal. This is a reminder that advisors need to base their advice not only on the law but also on how judges may apply it. |

|||||||||||||||||||||||||||||||||||||||||||||||

Article 4Court Drowns Floating Spouse

By: Edwin Morrow III Wealth Strategist at Huntington National Bank One of the more interesting terms we run into in the estate planning world is the term “floating spouse”, used to refer to naming a “spouse” as a beneficiary in a trust document, rather than the spouse’s name specifically. The implication (and often hope) is that if the first spouse dies or divorces and the other party remarries, the new “spouse” would become a beneficiary in place of the old spouse. In Ochse v. Ochse, a settlor established a trust for “her son, her son’s descendants, and her son’s spouse” as beneficiaries. The son had lifetime and testamentary powers to appoint to spouse or descendants as well. After 30 years of marriage, the son and his wife divorced and the son remarried. Which “spouse” was now the beneficiary and potential appointee? In some portions of the trust the first spouse was mentioned by name, and in other portions not. There was no clear definition of “son’s spouse” in the document. Naturally, litigation ensued, with the children from the son’s first marriage and his first spouse on one side, and the son and his new spouse on the other. The trial court decision and the appeals court ultimately affirmed that the settlor’s intent was to only benefit the “spouse” of her son at the time of executing the trust and not some future spouse of her son. This case could have easily gone the other way with slightly different facts or in a different state court. One or two simple clarifying sentences in the trust could have saved thousands of dollars of legal costs and years of litigation. So, make sure the settlor defines what they mean when they use the term “spouse” in the event of divorce, death, or remarriage. Edwin Morrow III Wealth Strategist at Huntington National Bank |

|||||||||||||||||||||||||||||||||||||||||||||||

Article 5Who Are You Being?

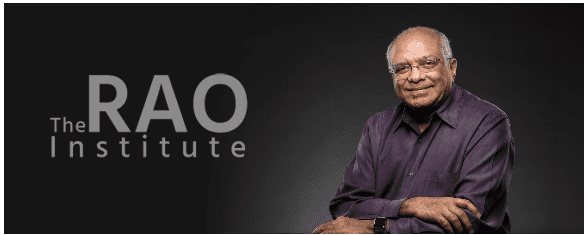

It matters what you do. We wake up every morning and go to work. Or to whatever we do. And, each day, we have a choice. We can break rocks. Or we can help build a cathedral. I cannot define for you the cathedral you can build or are building. Only you can do that. But I can tell you that, unless you define that cathedral, you will eke out a mediocre existence punctuated with flashes of pleasure. That is just the way it is. It was an exclusive girl’s school and all three felt somewhat ill at ease when they arrived. Possibly it was this sense of being out of place that drew them together, or perhaps it was recognition that they shared exceptional intelligence or the fact that they were the only ones who were not already friends with someone else. Whatever, they clustered together and became best friends. After graduation, they scattered to their respective countries, but they kept in touch. In those days, it was not common for women to leave the house and almost unheard of for them to work. Teaching was quasi-respectable and all three became kindergarten teachers. Once in a great while, they would somehow arrange to be in the same place at the same time and there was joy in these meetings and much reminiscing. There was also an undercurrent of sorrow and longing as they realized that life was not unfolding for any of them in the way they thought it would. Each coped with this in her own way. Mary saw herself as the temporary custodian of the children of wealthy, uncaring parents and resented having to wipe noses or help them pull on galoshes or make sure they ate their lunch and snacks. The children sensed her dislike and resisted learning. So, they did poorly on tests and her principal spoke to her about lack of performance and this infuriated her even more. She was bitter when she retired and went to her grave soon after. Not a single student or parent attended her funeral. Joan saw herself as teaching reading, ‘riting and ‘rithmetic to young children and keeping order. Some of her kids were bright and some were dullards and she did what she could with each. She was a trifle sorry to retire but not altogether unhappy because she could no longer keep up with the unlimited energy of her young charges. When she passed on, some of her one-time students, who lived close by, came to say goodbye and one of them delivered a fine eulogy. They then went about their business. Early on Eleanor, like Mary, disliked what she felt she was being forced to do. Then she saw what her attitude was doing to her. She was resentful each day and snapped querulously at her own daughter and was withdrawn from her husband. And she was tired, always tired. She determined to love each child who was entrusted to her. They were the clay, and she was the potter and each of her pots would be a work of art. She saw they were enthralled by stories, and she told them tales of great heroes and how they overcame insurmountable odds and accomplished incredible feats of service. She encouraged them to dream great dreams and also to start laying foundations for the castles they built in the air. Her eyes twinkled and her steps were light and when she reached mandatory retirement age the school board voted twice to give her an extension and then simply made her the honorary chairperson of some committee they created especially to give her a legitimate reason to keep coming back. When she moved on persons came from all over the country to bid her adieu. The Prime Minister made a special visit because he was one of her former students and remembered that his first desire to enter public service arose when she challenged him to set right something that he was complaining about. There were newspaper editorials and there was mourning on blogs and a Twitter-facilitated minute of silence that thousands observed. And many a mother wished her son would have a teacher like Eleanor. Here is my question to you: When you go to work tomorrow, will you be like Mary? Or Joan? Or will you decide to do what it takes to be Eleanor? Peace! For more information on Srikumar Rao visit: https://theraoinstitute.com/about-srikumar/. |

|||||||||||||||||||||||||||||||||||||||||||||||

Forbes’ CornerHow To Be Part Of The $5.8 Billion Of Automatic Federal Student Loan Forgiveness For The DisabledAug 19, 2021 By: Alan Gassman Financial advisors and borrowers will have to get busy if they wish to take advantage of the most recent automatic student loan forgiveness initiative for individuals receiving Social Security disability payments … Continue Reading on Forbes

|

|||||||||||||||||||||||||||||||||||||||||||||||

New ERC Rules Beyond Family Ownership Issues, And What To Do If You Got The Credit And The Owner Has A RelativeAug 7, 2021 By: Alan Gassman Employers, accountants, and financial advisors recently received new guidance from the IRS on the extremely important and somewhat complicated Employee Retention Credit (“ERC”) which was passed as part of the Cares Act in February of 2020, and become available retroactively and going … Continue Reading on Forbes

|

|||||||||||||||||||||||||||||||||||||||||||||||

For Finkel’s Followers5 Job Perks You Should Provide in a Post-Pandemic Climate |

|||||||||||||||||||||||||||||||||||||||||||||||

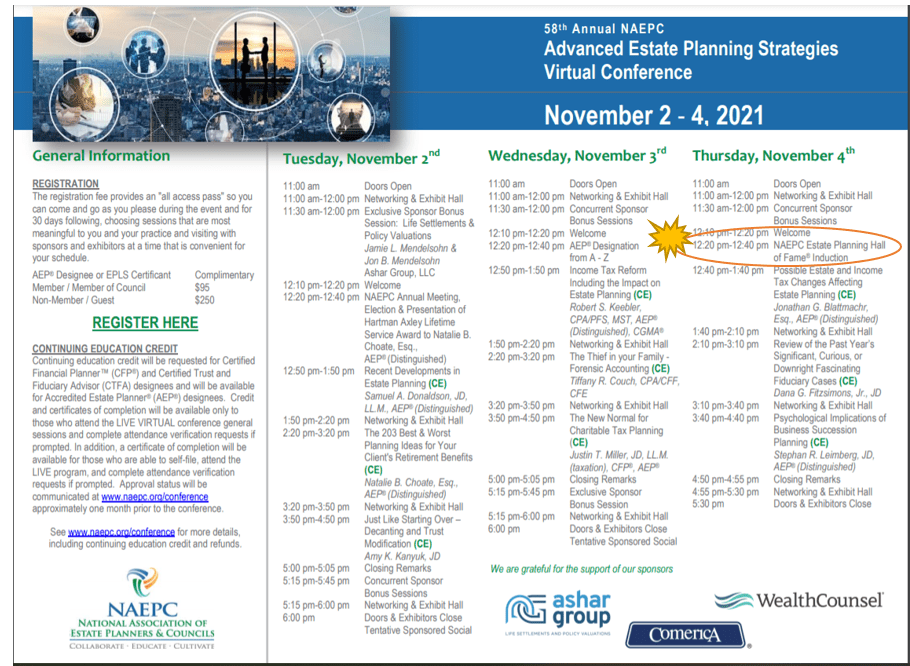

Featured Events

This week Alan Gassman and Lester Perling did a review of the recent Centers for Medicare & Medicaid Services (“CMS”) statement on Stark Law. If you do not have time to watch Alan and Lester’s webinar on Structuring Medical Practices Under Stark and After Recent CMS Opinion with respect to Stark Law, at least watch the attached video clip where Lester explains the importance of complying. CLICK HERE TO VIEW THE VIDEO CLIP (3:16)

CLICK HERE TO VIEW THE FULL-LENGTH RECORDING: https://youtu.be/UC14Jgm2V88 (46:18) PPT SLIDES: https://gassmanlaw.com/wp-content/uploads/2021/08/ppt.1q.pdf |

|||||||||||||||||||||||||||||||||||||||||||||||

A SPECIAL UPCOMING BROADCASTFriday, August 27th, 2021 1:00 PM to 2:30 PM EDT (90 minutes) Presented by: Alan S. Gassman, Kenneth DeGraw, Christopher Lucas, and Elizabeth Woodward CLICK THE LINK BELOW TO REGISTER FOR THE WEBINAR https://leimbergservices.com/wdev/register.cfm?id=1325 After registering, you will receive a confirmation email containing information about joining the webinar. |

|||||||||||||||||||||||||||||||||||||||||||||||

A FREE LIVE WEBINAR FROM OUR FIRMSaturday, August 28th, 2021 11:00 AM to 12:00 PM EDT (60 minutes) Presented by: Alan S. Gassman CLICK THE LINK BELOW TO REGISTER FOR THIS FREE WEBINAR https://attendee.gotowebinar.com/register/7977742327433214477 After registering, you will receive a confirmation email containing information about joining the webinar. This webinar does not qualify for CLE Credit. |

|||||||||||||||||||||||||||||||||||||||||||||||

|

LEARN MORE ABOUT ALAN GASSMAN’S SATURDAY MORNING ESTATE PLANNING SERIES “Toast, Trusts, and Taxes with Alan Gassman and Friends”Please consider your Saturday mornings booked for the foreseeable future… Join Alan and his guests for these Saturday morning conversations featuring live attendee interaction for Q and A!

The video recording will be emailed to all registrants approximately 1 hour after the program concludes. This series does not qualify for CLE Credit. Email topic suggestions to Alan Gassman at agassman@gassmanpa.com Subject line: “Saturday Series Topic”. Event details are listed in the table below. Register for free today! Click to Register for all Upcoming Saturday Morning Webinars

|

|||||||||||||||||||||||||||||||||||||||||||||||

A Tasting Menu of the Upcoming 46th Annual Notre Dame Tax & Estate Planning InstituteAugust 31, 2021 4:00 PM EDT CLICK THIS LINK TO REGISTER FOR FREE! https://register.gotowebinar.com/register/3902875269454959119

|

|||||||||||||||||||||||||||||||||||||||||||||||

UPCOMING NATIONAL EVENTNotre Dame Tax And Estate Planning Institute October 20th – 22nd, 2021 Virtual Presentation CLICK HERE FOR REGISTRATION INFORMATIONWe are writing to share the good news that the 47th Annual Notre Dame Tax & Estate Planning Institute will take place in virtual form on October 21 and 22, 2021. We have lined up an impressive panel of speakers who will as always, address a broad range of topics (including current developments arising from possible legislative developments) that will be of use to you and your clients. Given the ongoing uncertainty regarding COVID-19, we will not be meeting in person in South Bend this year. Instead, we plan to deliver the Institute to you in a virtual format with live, online presentations (including our popular dual-track approach) throughout the day on Thursday, October 21, and Friday, October 22, along with a bonus session on the afternoon of Wednesday, October 20. This virtual format, which proved to be very popular last year, will allow you to participate online in real-time with the speakers, including opportunities for Q&A, and will be structured to qualify for continuing education credit to the extent allowed by the respective accrediting agencies for which there is significant attendee demand. As an added bonus, we plan to record videos of all the sessions and your registration fee will include online access to these recordings for later viewing at your convenience. While we will, again, miss seeing you in person and facilitating the camaraderie that is associated with the Institute, we are pleased to be able to provide you with the information and knowledge that so many of you have come to rely on. We also hope that this virtual format will enable many estate planning professionals, who might not otherwise have had the chance to attend the Institute in person, to engage with and benefit from the Institute this year. Online registration is now available. Please visit the following web address to register: https://law.nd.edu/for-alumni/alumni-resources/tax-and-estate-planning-institute/ We greatly appreciate your past participation in the Notre Dame Tax & Estate Planning Institute, and we look forward to seeing you (virtually) on October 21 and 22, 2021. Jerome M. Hesch Director |

|||||||||||||||||||||||||||||||||||||||||||||||

More Upcoming EventsRegister for all future free webinars from Gassman, Denicolo & Ketron, P.A. using this link

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

Alan Gassman’s YouTube ChannelVisit Alan Gassman’s YouTube Channel for featured webinars and more. Did you miss a past webinar event? Don’t worry! Watch the webinar recordings on Alan Gassman’s YouTube Library for free. One of our most recent popular recordings on YouTube – “PPP and Employee Retention Credit (ERC) Update” has gotten a lot of attention recently. Click this link to access the recording: https://youtu.be/EUK5PhOV_20. EMPLOYEE RETENTION CREDIT GUIDE EBOOK

|

|

HumorTHE NEW SPACE RACE Poem by: Ron Ross

Who knew, that for centuries, billionaires were lusting,

The super-rich competed to see who’s more nimble,

And where the rich will go, who’s next on the journey?

The next great battle will take place in space courts,

Who will be your champion when gravity is zero?

One small step for man can become a slip and fall,

Can you put ads on the moon with a laser beam?

There’s no up or down in space, it’s all helter-skelter,

Now we have reached the law’s final frontier,

This is the time for humanity’s greatest race,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gassman, Denicolo & Ketron, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200