The Thursday Report – 9.10.15 – Nothing Interesting, For a Change

Alan Gassman Kicks Off Distinguished Speakers Series for a Very Impressive Charity

Ross, Et. Al v. AXA Equitable Life Insurance Co. – Policy Holders Have No Recourse

Paying for College: Understanding Student Financial Aid, Part II

Gregory Gay’s Corner – Medicaid Nursing Home Assistance, Part II

Richard Connolly’s World – Special-Purpose Trusts & 529A Accounts

Thoughtful Corner – College Students: Homesickness and Separation by Dr. Diana Trevouledes

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“Knowing that you are living in a dream world is very liberating because it gives you the option of waking up.”

– Dr. Srikumar Rao

Nothing Interesting, For a Change

Based upon popular request, we have made the Thursday Report dull, dulled it down, and even used a form of the word dull three times in a sentence so as not to grab your attention and pull you from more important tasks that you may have to accomplish. Many readers asked that the Thursday Report not be so interesting that it distracts them so much from their jobs and their demanding and unreasonable bosses. In such event, we have worked very hard this week to make this Thursday Report not eye catching, not exciting, and not (as) insightful.

Hopefully, no statutes of limitations or filing requirements will be missed this week by reason of compulsive reading of the Thursday Report, and please don’t send copies of this Report to the Thursday Report Reporting Society, as it could hurt our 2.5 (out of 10) rating or the Federal Grant we receive for outstanding journalism needs by a non-501(c)(3) organization with private manurement.

Alan Gassman Kicks Off Distinguished Speakers Series for a Very Impressive Charity

On Tuesday, Alan Gassman kicked off the Distinguished Speakers Series put on by the Community Foundation of Sarasota County in partnership with the Southwest Florida Estate Planning Council. Alan presented on the topic of “Everything You Always Wanted to Know About Creditor Protection and Didn’t Even Think to Ask.”

The Community Foundation of Sarasota County posted 28 great photos from this event, including the two featured here. You can view all 28 event photos by clicking here.

The Community Foundation of Sarasota County is a model for what all community foundations should aspire to be. A public charity founded in 1979 by the Southwest Florida Estate Planning Council, the Community Foundation of Sarasota County is a resource for caring individuals and the causes they support. Just last year, the Community Foundation distributed more than $19.3 million in grants and scholarships in the areas of education, health, human services, the arts, animal welfare, and the environment. Learn more about the Community Foundation of Sarasota County by clicking here.

Ross, Et. Al v. AXA Equitable Life Insurance Co. – Policy Holders Have No Recourse

by Alan Gassman and Alyssa Eberle, J.D.

Southern District of New York, 2015 – Policy Holders have No Recourse when it is Discovered that a Carrier has Violated State Law Reserve Requirements by Using Inadequately Disclosed Captive Reinsurance Carriers in Violation of State Law

In Ross v. AXA, a class action suit was brought on behalf of AXA insureds alleging that AXA was in violation of the New York insurance law by engaging in “shadow insurance” transactions. The Court held that the Plaintiff class failed to establish that AXA has incurred a financial loss worthy of federal judicial intervention at this time.

By way of background, the National Association of Insurance Commissioners (NAIC) introduced two model regulations: Regulation XXX and AXXX, which had been adopted in New York. These regulations were adopted by the state to increase the safety factor of reserve requirements by increasing the overall reserve level and limiting a company’s ability to use their admitted assets for anything other than supporting its reserves.[1]

In order to minimize the risk of the insurer not being able to pay off a large amount of claims in a small amount of time, many insurers obtain their own insurance called reinsurance. This is where a primary insurer pays a premium to the reinsurer in exchange for carrying some of the risk involved with claims payments. Reinsurance therefore allows the insurer to claim “reserve credits” which reduce the assets an insurer is required to maintain for its reserves. Consequently, reinsurance helps fulfill two objectives: (1) it manages risk and (2) it helps free up some capital for the insurer to use for another purpose.[2]

In the event that the reinsurer defaults, the primary insurer still remains liable on all policyholder claims. Because of this, insurance regulations allow for the primary insurer to take a reserve credit only when there is sufficient assurance of the reinsurer’s ability to pay for claims when it assumes the risk.[3] “[I]n essense, [such arrangements are] reducing the assets a primary insurer is required to maintain in support of its reserve liabilities.”[4] There are two categories of reinsurance transactions that are deemed to be safe enough to grant the insurer a reserve credit:

- Those with reinsurers who are licensed or accredited by the primary insurer’s own regulators (“authorized reinsurers”); and

- Those with unauthorized reinsurers who post sufficient high-quality, easily liquidated collateral to account for potential obligations – typically by maintaining a trust with a United States financial institution or by obtaining an irrevocable and renewable (“evergreen”) letter of credit from a United States financial institution.[5]

However, in spite of these requirements for claiming reserve credits for reinsurance transactions, a report issued by the New York Department of Financial Services (NYDFS) discovered that New York insurers had been using captive reinsurance to “end-run around higher reserve requirements” and “hide risk.”[6] An insurer would most likely be able to do this by creating an insurance entity in another state with less stringent regulatory requirements. Under these more loosely regulated states; the insurance companies use their parent company’s guarantees to back a letter of credit that is posted as collateral to obtain reserve credit for the reinsurance transaction.[7] This process allows insurers to acquire reserve credits –reducing the total amount of assets used to support their reserve liabilities – without transferring the risk associated with these policies, since the reinsurer’s obligations are not supported by its own financial strength, but with the financial strength of the parent company.[8] This process creates little to no detail regarding the reinsurance transactions, hence “shadow insurance.”

These undisclosed guarantees in the shadow insurance transactions could lead to potential disasters in the insurance industry. Most significantly, the report completed by the NYDFS found that none of the parent companies had established significant reserves or contingent liabilities to support reinsurance transactions; in fact, most had none. The implications of having little to no reserve means that a parent company would likely be subject to financial stress from its risk exposures, leaving reserves depleted and creating a risk that the insurer may not be able to pay claims.[9]

The class represented in the suit filed against AXA had all purchased life insurance policies in New York that were in effect at the time the suit was filed. Based on the NYDFS Report, the Plaintiffs alleged that the annual disclosures that had been filed by AXA were misleading since they failed to disclose details of the shadow insurance transactions; thereby making AXA’s financial strength appear stronger than it actually was.[10] For example, AXA reported $1.9 billion in letters of credit securing their reinsurance obligations in its 2011 annual statement. However, the reserve credit was not based on the financial strength of AXA alone but rather through “undisclosed or inadequately disclosed guarantees and indemnifications from an affiliate.”[11]

The Plaintiffs alleged that because AXA used letters of credit that were backed by undisclosed or inadequately disclosed parental guarantees to lower its reserves, AXA’s existing assets appeared to provide policyholders with greater protection against loss than was actually the case.[12] Plaintiffs did not allege, however, that the undisclosed or inadequately disclosed shadow insurance transactions caused them financial harm, nor did the plaintiffs allege that they were influenced by AXA’s representations.[13]

The United States District Court in New York concluded that the Plaintiffs lacked standing to pursue their claims. Indeed, while Plaintiffs sought to bring their claim under federal law, the Court stated that because the cause of action arises under state law, they lacked the jurisdiction to make a decision. The District Court concluded that:

Plaintiffs must established that at least one of them has otherwise suffered an injury sufficient to entitle him to sue in federal court – namely, the “invasion of a legally protected interest which is…concrete and particularized” and “actual or imminent, not conjectural or hypothetical.”[14]

The Court noted that because the Plaintiffs did not allege that they would not have purchased life insurance policies from AXA but for its disclosures, or that they had suffered any past or current financial harm by AXA’s misrepresentations, any risk of harm is in the future – the risk that AXA, because of its shadow transactions, will be unable to pay Plaintiffs’ claims when they are eventually made.[15] Since the Court held that this theory was hypothetical and speculative, it did not justify federal judicial intervention. Therefore, the District Court dismissed the case for lack of subject-matter jurisdiction. However, in its conclusion, the Court noted that it did not arrive at its conclusion lightly. Indeed, the Court noted:

The pervasiveness of shadow insurance in New York – and AXA’s alleged failure to disclose details of those transactions – may well pose a threat to the stability and reliability of the state’s insurance system, as NYDFS suggested. Nevertheless, the Court cannot address the legality or propriety of AXA’s conduct without the constitutional authority to do so.

Though the Plaintiffs were unable to get a decision from the Court, the Complaint still served a purpose. The NYDFS created a new regulation after its investigation into shadow insurance that “explicitly require[s] disclosure of additional information regarding shadow insurance transactions.”[16] Time will tell whether the performance of AXA and other insurance carriers, coupled with possible consequent increases in premiums as needed to sure up the financial circumstances of such carriers will work an undue hardship on those who have purchased and maintained policies. This situation brings up the question as to whether insurance carriers are viable stewards for the amount of wealth and the many illustrative projections that they make in order to sell policies in a far from transparent and not-well-regulated environment.

*****************************************

[1] LISI Estate Planning Newsletter #2328 (July 30, 2015) at http://www.leimbergservices.com.

[2] Id.

[3] Id.

[4] Ross, 14-cv-2904 – Document 138.

[5] Id at 4.

[6] Id citing NYDFS Report 4.

[7] Id.

[8] Id at 6.

[9] Id at 7.

[10] Id.

[11] Id at 8.

[12] Id.

[13] Id.

[14] Id citing Lujan, 504 U.S. at 560.

[15] Id at 19.

[16] Id at 22.

Paying for College: Understanding

Student Financial Aid, Part II

by Dena Daniels

Each year, the US Department of Education awards approximately $150 billion to assist students with paying for college. There are two main types of financial aid: (1) aid based on academic merit and (2) need-based aid. The former is not dependent upon the parents’ assets and income but rather the student’s academic performance, “if you have the grade, you get the aid.” The latter takes into account both the parents’ and the student’s income and assets.

Last week, we examined the different types of need-based federal financial aid available to students. To refresh your memory, please click here to see last week’s Thursday Report.

PART II – HOW TO APPLY

In order to receive federal financial aid, the student is required to complete the Free Application for Federal Student Aid (FAFSA). This application process is completed online, and both the student and the parents must apply for a PIN number and report their financial information. The student must fill out the FAFSA at www.fafsa.ed.gov.

How Eligibility is Calculated

Eligibility is determined by the following calculation:

Cost of Attendance – Expected Family Contribution (EFC) = Need

Cost of Attendance (COA) is the amount it will cost for the student to attend school. Most colleges and universities provide a “cost of attendance” breakdown for the entire school year (which includes the fall and spring semesters). The Cost of Attendance usually includes the following:

- Tuition and Fees

- Housing and Meals

- Books and Supplies

- Personal Expenses Including Transportation

The Expected Family Contribution, or EFC, is the minimum amount that the household is expected to contribute towards the cost of the student’s college education. It is calculated using the following three methods:

- Federal methodology

- Institutional methodology

- Consensus methodology

All three methods are based on the income and assets of the parents and student as reported on the FAFSA and the CSS Profile. The FAFSA is free to file and is income driven, while the CSS profile is charged a filing fee and is asset driven.

Although retirement assets are not included when calculating the EFC, other assets, such as checking and savings accounts, CDs, real estate investments, stocks, bonds, etc. must be reported. Parents are expected to pay 5.64% of the assets to pay for college when using the federal methodology and 5% of the assets to pay for college when using the institutional and consensus methodology. Small businesses, home equity, and non-qualified annuities are not counted in the federal methodology, but they are counted in the institutional and consensus methodologies. However, under the consensus methodology, home equity is capped at 1.2 times the parents’ adjusted gross income.

Excluded Assets for the FAFSA

The following assets are not counted when filling out the FAFSA form:

- Possessions (i.e. car, stereo, furniture, etc.)

- Family’s principal place of residence

- Family-owned and controlled small businesses

- Retirement plans and whole-life insurance

As far as retirement plans and whole-life insurance are concerned, the values are not counted as assets, but distributions are counted as income.

Small Business Exclusion

Since July 1, 2006, small businesses that are owned and controlled by a family are excluded assets. This exclusion was established by Section 8019(c) of the Higher Education Reconciliation Act of 2005. In order for the small business exclusion to apply, the family-owned and controlled small business must:

- Have 100 or fewer full-time equivalent employees; two half-time employees count as the equivalent of one full-time employee.

- Be owned and controlled by the family. This means that more than 50% of the voting rights must be owned by the family. For this purpose, a family includes: (1) persons directly related to the student (i.e. parent, sister, cousin) or (2) persons who are or were related to the student by marriage.

A business can be any type (i.e. LLC, LLP, C-Corp, S-Corp) to qualify as a family-owned and controlled small business. If the business qualifies as a family-owned and controlled small business, then the student and parents are not required to report any assets of the business on the FAFSA. However, income received from the small business is required to be reported.

The family owned small business exclusion is applied to the FAFSA, not the CSS Profile. However, only approximately 250 schools actually use the CSS Profile. The CSS Profile is a lot more detailed and takes an in-depth look at the assets of the family. The CSS Profile is used to determine institutional financial aid – that is, monies distributed by the school for need-based students – whereas the FAFSA is for federal funds.

Gregory Gay’s Corner

Medicaid Nursing Home Assistance, Part II

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

This week, we take a look at promissory notes, loans, mortgages, undue hardships, irrevocable annuities, and how they influence Medicaid assistance eligibility. To see Part I of the Medicaid discussion, please click here.

Promissory Notes, Loans, and Mortgages

All promissory notes, loans, and mortgages signed on or after November 1, 2007, will be considered a transfer of assets without fair compensation unless the promissory note, loan, or mortgage has a repayment term that is actuarially sound based on Social Security’s life expectancy tables and has payments made in equal amounts during the term of the loan with no deferral or balloon payments and the note does not allow for debt forgiveness.

Undue Hardship

A nursing home patient who has made an uncompensated transfer subjecting him or her to a penalty period affecting eligibility and a person with a home equity interest exceeding $536,000 must be offered an opportunity by the Department of Children and Families to demonstrate that the imposition of the penalty period will create an undue hardship. This opportunity must be granted before the disposition of the application. Nursing home facilities are allowed to apply for an undue hardship waiver on behalf of an individual with the consent of the applicant or the designated representative. An undue hardship exists when application of the transfer of asset penalty or excess home equity penalty will deprive the nursing home patient of medical care such that his or her health or life would be endangered or the individual will be deprived of food, clothing, shelter, or other necessities of life.

Other federal and state laws prohibit a nursing home from evicting a resident without transferring the person to a safe place. Thus, the nursing home might be required to continue to provide care to an indigent patient without receiving public assistance until the undue hardship waiver has been determined.

Irrevocable Annuities

When an individual purchases an annuity, he or she generally pays to the insurance company that issues the annuity a lump sum of money, in return for which, he or she is promised regular payments of income in certain amounts. The payments may continue for a fixed period of time (for example, 10 years) or for as long as the individual (or another designated beneficiary) lives, thus creating an ongoing income stream. The annuity may or may not include a remainder clause stating that if the person who owns the annuity dies, the insurance company converts whatever is remaining in the annuity into a lump sum and pays it to a designated beneficiary.

Annuities, although usually purchased to provide a source of income for retirement, are occasionally used in conjunction with Medicaid planning. To avoid penalizing persons who validly purchased annuities as part of a retirement plan, but to capture those annuities that were purchased to shelter assets, a determination is made by the Department of Children and Families that the return to the annuitant is fairly computed. If the expected return on the annuity is commensurate with a reasonable estimate of the life expectancy of the beneficiary, the annuity is deemed sound for actuarial purposes and is not considered to have been purchased to shelter assets.

The annuity must also be irrevocable and non-assignable. The periodic payments (including the interest portion) are counted as unearned income in the eligibility determination and patient responsibility. An annuity that is revocable or non-assignable is not considered a countable asset. If the annuity is revocable, the asset value is the amount the purchaser would receive from the annuity insurer if the annuity is cancelled. If the annuity is assignable, the asset value is the amount the annuity can be sold for on the secondary market.

To determine that an annuity is sound for actuarial purposes, the life expectancy tables, compiled from information published by the Office of the Actuary of the Social Security Administration, are used. The average number of years of expected life remaining for the individual must coincide with the length of the annuity. If the individual is not reasonably expected to live longer than the guarantee period of the annuity, the individual will not receive fair market value for the annuity based on the projected return. In this case, the annuity is not actuarially sound and a transfer of assets for less than fair market value has taken place, possibly subjecting the individual to a penalty.

The penalty is assessed based on a transfer of assets for less than fair market value that is considered to have occurred at the time the annuity was purchased. For example, a male at age 65 has a life expectancy of 14.96 years, according to the table. Thus, if he purchases a $14,080 annuity to be paid over the course of 10 years, the annuity is actuarially sound. However, a male at age 80 has a life expectancy of only 6.98 years. Thus, if he purchases an annuity to be paid over 10 years, the amount that will be received for the last 3 years is considered a transfer of assets for less than fair market value, and that amount is subject to penalty.

The new Medicaid laws still permit a spouse with countable assets in excess of the $115,920 community spouse resource allowance to purchase an annuity with the excess assets. The annuity must be paid to the community spouse over no longer than his or her life expectancy. However, the new law requires that the state be named the first beneficiary for at least the total amount of medical assistance paid on behalf of the annuitant, except when the owner of the annuity has a spouse or a minor or disabled child. In this case, the State of Florida may be named as the secondary beneficiary after the spouse, minor, or disabled child. Since the new law addresses only the medical assistance paid on behalf of the person over whose life the payments are to be made, there is a question as to whether there is a repayment obligation if the annuitant is the community spouse.

The next edition of Gregory Gay’s corner will feature a discussion of the “half-a-loaf” method, personal service contracts, and exemptions to the transfer rules for those applying for Medicaid. If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

Richard Connolly’s World

Special-Purpose Trusts & 529A Accounts

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “For Parents With Troubled Adult Children, Financial Hurdles Abound” by Paul Sullivan. This article was featured in The New York Times on August 28, 2015.

Richard’s description is as follows:

There are many painful, emotional issues surrounding crises like mental illness and addiction that affect children. But there are concrete financial steps parents can take that won’t worsen their child’s condition, enable their child’s addiction, or, in the case of mental illness, run afoul of limitations on the number of assets a person can have and still qualify for government benefits.

One starting point is a special-purpose trust, which can provide care for the suffering child and peace of mind for the parent.

Please click here to read this article in its entirety.

The second article of interest this week is “Tax-Free Savings Accounts for Disabled are Expected in 2016” by Ann Carrns. This article was also featured in The New York Times on August 28, 2015.

Richard’s description is as follows:

Special savings accounts for people with disabilities are likely to become available in most states next year.

The accounts were made possible in 2014 by the ABLE Act – for Achieving a Better Life Experience – and are loosely modeled on the popular 529 college saving accounts.

As with 529 college savings plans, 529A accounts allow contributed funds to grow tax-free and to be withdrawn tax-free for eligible expenses. Anyone – including family and friends of a disabled person, as well as the disabled person themselves – can contribute to the accounts, but there is no federal tax deduction for the contribution.

An important feature of the accounts is that they allow people with special needs to save for their care and education without disqualifying them from receiving government benefits.

This article answers questions about the new 529A accounts, including what sort of expenses can money in the accounts be used for, can an individual have more than one 529A account, and when 529A accounts will be available in a variety of states.

Please click here to read this article in its entirety.

Thoughtful Corner

College Students: Homesickness & Separation

by Dr. Diana Trevouledes

Diana Trevouledes, Ph.D. is a licensed Clinical Psychologist and Social Worker with over 20 years of experience in a variety of mental health setting including university counseling centers and private practice. Dr. Trevouledes has held faculty positions at Fordham University, Mercy College, and the City University of New York, teaching psychology and mental health counseling at the doctoral, masters, and undergraduate levels.

This article was brought to our attention by Dr. Rahul Mehra of MehraVista Health. He is boarded in adult psychiatry, boarded in child psychiatry, and boreded of both of them! His favorite heroes are Subway and Firehouse Subs, and you can view the MehraVista website by clicking here http://mehravistahealth.com/. Thanks, Rahul, for permission to bring this article to Thursday Report readers!

Although most students are excited about starting their college careers, the thought of leaving behind the comforts of home, high school friends, and family members can be very stressful. Even if your son or daughter has been looking forward to starting college and has demonstrated no apprehension prior to his or her arrival, it is not unusual for first-year students to feel somewhat anxious and uncomfortable once they actually arrive on campus. For the most part, students who experience homesickness and discomfort about separation will find that these feelings pass after a week or two. They make friends, get involved with activities, and feel like they are fitting in. But other students may not adjust after a few weeks on campus. Instead they may:

- Be preoccupied by thoughts about what family members are doing at home and distracted by activities they might be missing.

- Become tearful during their waking hours and have difficulty getting to sleep at night.

- Feel anxious about making friends and fitting in (this is especially true of first-year students who will need to create a new social network upon their arrival on campus.)

- Experience loneliness that comes from being disconnected from family and friends and not yet having established a new social network.

- Experience increasing panic and a need to come back home (perhaps even calling urgently requesting to come home.)

Here are some suggestions about how parents can assist their student in managing the challenges of separation anxiety, homesickness, and loneliness:

- Patiently listen to your son’s or daughter’s concerns regarding their separation anxiety. It is important to find a balance between panicking and not taking their distress seriously.

- While letting your child know that you genuinely hear how uncomfortable he or she is, explain that separation anxiety typically does pass, even though it may feel that it will go on forever.

- Reassure your son or daughter that many people have difficulty with transitions and that the feelings that they are experiencing are perfectly normal and to be expected.

- Encourage your son or daughter to become involved in clubs, organizations, and co-curricular activities, particularly the activities that have been designed for new students.

- Encourage him or her to stay at school and not return home immediately. Allowing your child to come home reduces everyone’s level of discomfort in the short run; however, it only prolongs separation anxiety.

- Let your child know that his or her resident assistant or other campus helpers are there to offer comfort and support.

- In order to build your child’s self-confidence during this time of transition, remind your child that he or she has confronted difficult situations in the past and mastered them.

- Encourage your child to get involved in campus-sponsored volunteer activities. Many students get involved in these activities to meet other students as well as to help others.

- Encourage your student to eat in the dining hall rather than in his or her room and study in the library or other public places rather than alone.

- Remind your first-year student that it will take time to build friendships; therefore, encourage him or her to be persistent and not to be dismayed if this doesn’t happen immediately.

- If, over time, your son or daughter continues to feel panicky, lonely, and unhappy, encourage them to contact the counseling center. Many students seek counseling to get support during the transition to college, and typically, they can be helped after just a few sessions.

The above article was featured in Success and Sanity on the College Campus: A Guide for Parents by Diana Trevouledes and Ingrid Grieger, which can be viewed on Amazon by clicking here.

For more information on how to help your student transition to college, be sure to check out the webinar by Alan Gassman and Molly Carey Smith entitled The Biggest Mistakes to Avoid Concerning Your High School Children – College Failures in the Making. This webinar will be presented this Saturday, September 12, at 9:00 AM. Click here to register.

Humor! (or Lack Thereof!)

Sign Saying of the Week

**********************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE BIGGEST MISTAKES TO AVOID CONCERNING YOUR HIGH SCHOOL CHILDREN – COLLEGE FAILURES IN THE MAKING.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SOUTH BEND PRESENTATION:

41ST ANNUAL NOTRE DAME TAX AND ESTATE PLANNING INSTITUTE

Rebecca Ryan, Bill Boersma, Daen Wombwell, Michael Halloran, and Alan Gassman will be presenting a talk at the Notre Dame Tax & Estate Planning Institute on the topic of UNDERSTANDING ILLUSTRATIONS, DESIGN OPPORTUNITIES, AND FINANCIAL EVALUATION OF WHOLE LIFE, UNIVERSAL, VARIABLE, AND EQUITY INDEXED LIFE INSURANCE.

Date: September 17 – 18, 2015 | Alan Gassman will speak on Thursday, September 17 | 11:30 AM – 12:30 AM

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN 46601

Additional Information: Click here to download the 2015 program brochure. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:30 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30-minute webinar on the topic of THE 10 BIGGEST LEGAL MISTAKES MOST BUSINESS OWNERS AND INVESTORS MAKE (AND HOW YOU CAN AVOID MAKING THEM.)

There will be two opportunities to attend this presentation.

Date: Thursday, September 24, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Following the decision of the United States Supreme Court in Obergefell v. Hodges, same-sex couples now enjoy the same legal and tax benefits as opposite-sex couples. These benefits include marriage, divorce, adoption and child custody, separation agreements, Qualified Domestic Relations Orders (QDROs), marital property, survivorship spousal death benefits, inheritance through intestacy, priority rights in guardianship proceedings, and contract rights.

This program will discuss relationship and marital agreements, tax issues, reasons to marry or not marry, and a number of unique circumstances that can apply to same-sex couples as well as to opposite-sex couples.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Steven B. Gorin and Alan Gassman will present a free webinar on the topic of INCOME TAX EXIT STRATEGIES.

This seminar will focus on how owners can transition their businesses to employees or others who buy over time. Topics include avoiding unnecessary capital gain tax on exit, deferred compensation, profits interests, redemptions, life insurance, and getting assets out of corporate solution to obtain a basis step-up (without self-employment tax.)

There will be two opportunities to attend this presentation. Attendees will be given the opportunity to receive over 850 pages of technical business planning materials at no charge.

Date: Thursday, October 1, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE CLEARWATER PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will have the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30 minute webinar on the topic of ESTATE AND ESTATE TAX PLANNING – CONVENTIONAL AND ADVANCED PLANNING TECHNIQUES TO MINIMIZE TAXES AND EFFECTIVELY PASS ON YOUR WEALTH.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 14, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman, Steve Roll, and Lauren E. Colandreo will present a webinar on the topic of STATE TRUST NEXUS SURVEY for Bloomberg BNA.

Date: Thursday, October 15, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Jonathan Gopman, Jan Dash, and David Neufeld will join Alan Gassman for an informative webinar on THE NEW NEVIS TRUST LAW.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 21, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on Scientific Marketing For The Estate Planner – How to do more of what you love to do, and less of the other, while better serving clients, colleagues, and your community.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY AND RECENT DEVELOPMENTS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: TBD

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30 and Sunday, January 31 | Time TBA

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will be presenting on a topic to be determined at the 3rd Annual Ave Maria School of Law Estate Planning Conference.

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Please watch this space as details for these two great events are finalized in the upcoming months!

Date: May 6, 2016

Location: To Be Determined – Naples, Florida

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE TAMPA EVENT:

TAMPA THEATRE 14TH ANNUAL WINEFEST

Bust out your sweet dance moves and have a killer time with Napoleon, Pedro, Kip, and Lafawnduh at Tampa Theatre’s 14th annual WineFest, Napoleon Wineamite. This year’s event features snacks and samples from local independent restaurants, sips from the finest wineries, and evening of rare, top-rated wines and – for the first time this year – a “Movie Under the Stars” screening of this year’s theme, Napoleon Dynamite.

While the theme may be silly, the purpose is most serious. Now in its 14th year, the annual WineFest is Tampa Theatre’s biggest fundraising event of the year, benefitting the historic movie palace’s artistic and educational programs, as well as its ongoing preservation and restoration.

Date: September 10 – 17, 2015

Location: Tampa Theatre | 711 N. Franklin Street, Tampa, FL 33602

Additional Information: Tickets are on sale now at www.tampatheatre.org/winefest. Sponsorship opportunities are also available. Please contact Maggie Ciadella at maggie@tampatheatre.org for more information about sponsorship or the event.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

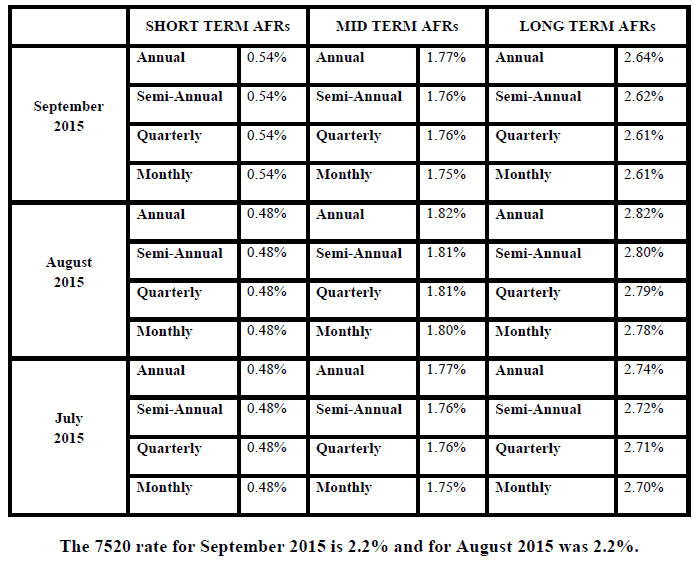

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.