The Thursday Report – 3.26.15 – The Positive Universe, No Time for Sargeants, and the Tipping Point of Health Care

No Time for Sargeants Article Published on Leimberg Information Services

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron, Part IV

The Tipping Point in a Health Care Network by Pariksith Singh, M.D.

Richard Connolly’s World – Celebrity Estate Round-Up, Part I

Thoughtful Corner – Einstein’s Positive Universe – It’s More Than Just Relativity. Positive Equals a Better Professional Life and Performance Squared.

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

No Time for Sargeants Article Published on Leimberg Information Services

An article entitled “Wells Fargo v. Barber: The Barber of Seville Replaces No Time for Sargeants” by Alan S. Gassman and Travis Arango, as edited by Duncan Osbourne, was published on March 24 on Leimberg Information Services.1 The article explores a case where a foreign LLC membership is seized by a judgment creditor in Florida.

“It is shocking that a Florida judgment creditor would be able to seize a Florida debtor’s solely owned Nevis Limited Liability Company’s membership interest, but not stock in a foreign corporation, but the federal judge sitting in Orlando has credible support for his conclusion. In Sargeant v. Al-Saleh, the stock in a foreign corporation could not be reached by the court while in Wells Fargo Bank v. Barber, sole ownership of a Nevis LLC was considered to be like any other intangible personal property that a Florida judgment could be applied against. It is time for planners to change the way they do things in this area.”

The court distinguished the Nevis LLC from foreign stock certificates:

Although Defendants repeatedly refer to Blaker Enterprises, LLC as a “foreign corporation”, (see Doc. 32, pp. 6, 7), Blaker Enterprises, LLC is not a corporate entity but a limited liability company. (Doc. 1-1, Ex. J). Unlike stock certificates in a corporation, a membership interest in a limited liability company is intangible personal property, which “accompanies the person of the owner.”2

If you would like to read more about this case go to www.leimbergservices.com and check out the Asset Protection Planning Newsletter #287.

Jay Adkinson was kind enough to send us another case on this topic: Sand Creek Partners LTD v. American Federal Savings and Loan Association of Colorado.3 In this case the plaintiffs had a judgment in excess of three million dollars against the defendant Bortles.4 Bortles was the owner of general partnership interests in 2 limited partnerships.5 Bortles claimed that he owned “zero percent” interest in each partnership.6

The issue in this case, among other things, was whether Bortles had to surrender his interests in the Hawaiian limited partnerships.7 The charging order was governed by Hawaii’s statute which states “(1) ‘[a] charging order constitutes a lien on the judgment debtor’s transferable interest,’ (2) ‘[a] transferable interest shall be personal property,’(3) ‘the judgment creditor has only the rights of a transferee,” not a manger or partner,’ and (4) ‘[t]he court may order a foreclosure upon the interest subject to the charging order at any time.’”8 Bortles claimed that the plaintiff’s request for a charging order was not allowed under Nevada law.9 The court held that limited partnerships are generally governed by the law of the jurisdiction in which they were formed.10 Bortles’ second argument was that no property exists for the plaintiffs to charge against since he owns zero percent interest.11 The court stated this argument was contradictory as he is the general partner of the partnerships.12 The court granted the charging order.13

It is interesting to see how this court came to the same conclusion as the one in Barber but through a different route. This court held that the charging order was allowed because the Hawaiian partnerships were governed by Hawaiian law, while the court in Barber held that the partnership interests were intangible personal property and thus Florida law applied even though the partnerships were formed in Nevis.

*********************************************

1 LISI Asset Protection Planning Newsletter #287 (March 24, 2015) at http://www.leimbergservices.com. Copyright 2015 Leimberg Information Services, Inc. (LISI).

2 Barber, 2015 WL 470589.

3No. 2:14©CV©444©GMN©VCF, 2015 WL 316750, (D. Nev. Jan. 26, 2015)

4 Id. at 1.

5 Id.

6 Id.

7 Id. at 5.

8 Id.

9 Id.

10 Id.

11 Id.

12 Id.

13 Id. at 6.

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits – Part IV

by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron

The rules applicable to retirement plan and IRA distributions, contributions, rollovers, and otherwise can be difficult to understand and complex to implement. The applicable Internal Revenue Code Sections and Treasury Regulations are somewhat complicated and convoluted, and use many technical “terms of art.” This makes dealing with qualified plans cumbersome and difficult for laypersons and planners who are not experienced in this area.

We have attempted to simplify the applicable rules into a digestible format with concise explanations of the applicable rules. We have also prepared charts and explanations to illustrate the key concepts and mechanics of important definitions, rules, and planning strategies.

The Thursday Report proudly will provide a multi-part series to exhibit our materials and charts, and we hope that you enjoy this series as much as we did in putting it together.

To see Chapter 1 of this presentation, please click here https://gassmanlaw.com/the-thursday-report-3-5-15-live-long-and-thursday-more-warped-humor/

To see Chapter 2 of this presentation, please click here https://gassmanlaw.com/the-thursday-report-3-12-15-spock-o-prudence-the-needs-of-the-many-outweigh-the-needs-of-the-few-335-s-w-3d-126-tex-2010/

To see Chapter 3 of this presentation, please click here https://gassmanlaw.com/the-thursday-report-3-19-15-bp-ira-the-look-and-the-investigation-process/

IRA SERIES CHAPTER 4

CRUCIAL DEFINITIONS AND RULES (Part Two):

1.) Other Income Tax Planning Considerations, Opportunities, and Traps

OPPORTUNITIES

a. Estimated Taxes Coordination Opportunity – A Plan/Participant can withhold federal income tax from Required Minimum Distributions by filing a Form W-4P. The tax withheld from retirement plan distributions is treated as if it was paid equally on each of the due dates for estimated tax payments. § 6654(g)(1). Therefore a distribution from a retirement plan paid on December 31st, but withheld for income tax purposes, will be treated as four equal payments made on March 31st, June 30th, September 30th, and December 31st. For example, a $100,000 distribution on December 31st will be treated as if $25,000 was paid on March 31st, $25,000 on June 30th, $25,000 on September 30th, and $25,000 on December 31st. This effectively allows a taxpayer to delay paying estimated taxes until the end of the calendar year.

Be wary as this strategy becomes more risky the older the Plan/Participant gets. If the taxpayer dies before the Required Minimum Distribution is used to pay taxes, then the estate will become liable for the penalty on underpayment of income taxes in the year of the Plan/Participant’s death.[1]

b. Appreciated Employer Stock Withdrawal Opportunity – A participant in an employee sponsored retirement plan has the opportunity to withdraw a lump sum distribution from the account and only be taxed on a portion of the withdrawal. The taxable portion is the value of the stock over the plan’s transferred basis (what the stock was originally purchased for). The remaining portion is treated as “net unrealized appreciation” (NUA) and is not taxable until the recipient sells the stock. The portion of net unrealized appreciation is taxed at long-term capital gains rates when sold. This can result in significant tax savings for plan/participants whose ordinary income rate is much higher than the capital gains rate and need cash upon retirement.[2]

For example, a CEO in the 39.6% tax bracket holds $100,000 in company stock upon retirement. The stock was originally purchased for $20,000. The CEO has the option to either distribute all of the company’s stock or roll the stock into an IRA account subject to the minimum distribution rules.

If he chooses to distribute all of the stock and elect to use the net unrealized appreciation tax treatment, then the tax on the distribution would be $7,920 (39.6% x Cost Basis of $20,000). He then immediately sells the stock triggering a capital gains tax of $19,040 (23.8% x net unrealized appreciation of $80,000). The CEO would pay total tax of $26,960.

If the CEO instead rolled the Employer Plan into an IRA the results would be much different. The CEO would pay ordinary income tax on the entire balance resulting in total tax of $39,600. By using net unrealized appreciation tax treatment the CEO would be able to save $12,640 in taxes.

Whether the net unrealized appreciation tax treatment will be beneficial depends on a number of factors, some of which include the following:

- Tax rates

- The amount of Net Unrealized Appreciation

- The length of time until the distribution

- Age of participant (individuals born before 1936 are eligible for a special averaging tax rate)[3]

As a general rule the shorter the Plan/Participant plans to keep the assets in the plan, the more attractive NUA tax treatment becomes. However if the Plan/Participant plans to keep the assets under an IRA for a longer period of time the benefits of tax deferral become more attractive.

c. There is no requirement that Required Minimum Distributions be paid in cash. A Plan/Participant has the option to take Required Minimum Distributions in kind, rather than selling the investment in the IRA and paying out the cash. If assets are distributed in kind their fair market value on the date of the distribution is included in ordinary income, and becomes the Plan/Participant’s tax basis in subsequent years. This could be beneficial for two reasons:

- Taking Required Minimum Distributions in kind saves commissions on selling the investment and then re-buying the investment outside the plan.

- Once distributed any post distribution gain will be taxed at capital gains rates rather than being taxed at ordinary income when distributed from the IRA. Therefore assets that are currently undervalued or assets that are considered to be growth stocks are the best candidates for in kind distributions.

Natalie Choate points out that this strategy is difficult due to the limited amount of guidance available on how to determine the “fair market value” of securities on the date of distribution, so “unless there is a good reason to do otherwise, pay RMDs in cash.”[4]

d. Convert to Roth in low income tax years or marry a developer with lots of losses and convert to a Roth! – If a Plan/Participant experiences a significant drop in income in a given year, he or she should consider converting all or a portion of a Plan into a Roth IRA. The Plan/Participant will have to pay tax on the amount converted at ordinary income rates, but will pay no tax on later distributions. By converting into a Roth IRA in low income tax years, the Plan/Participant can take advantage of the lower tax rate now and not be subject to a higher tax rate in subsequent years. A conversion into a Roth IRA for someone under the age of 59 ½ does not trigger the 10% penalty on early withdrawals. Also, the income limitations that exist for Roth IRA contributions do not apply to IRA conversions. A taxpayer can convert a retirement plan into a Roth regardless of their level of income.

TRAPS

a. IRA to HSA Account transfers are rarely beneficial. The income tax deduction for contributions to an HSA is worth more than being able to take a Required Minimum Distribution tax free by funding an HSA the majority of the time. It could however be beneficial in the following situations:[5]

- An individual under the age of 59 ½ with no other liquid investment funds in his or her HSA to avoid the 10% penalty on early distributions.

- An individual wants to avoid having an IRA distribution appear on his or her bank account due to creditor concerns, financial aid considerations, ex-spouse or state income tax effects.

b. The Required Minimum Distribution Rules continue to apply through the year of the Plan/Participant’s death as if the Plan/Participant was still living. This means that beneficiaries will be responsible for ensuring that any distribution not otherwise satisfied before the end of the calendar year in which the Plan/Participant died is distributed from the plan. This final distribution will be classified as Income in Respect of Decedent.

c. The Roth IRAs and IRA wash sales rules – Clients who would like to sell a security to trigger capital losses may wish to immediately repurchase the same security under an IRA. The wash sale rule states that a taxpayer cannot deduct a loss on the sale of securities if a substantially identical security is repurchased within 30 days after the loss-generating sale.[6] According to Rev. Rul. 2008-5, 2008-3 I.R.B., the sale of a security outside of an IRA will be matched with the purchase of a security inside an IRA/Plan for the purposes of applying § 1091. Therefore, the repurchase under an IRA/Plan needs to take place more than 30 days after the original sale to avoid the wash sale rule.[7]

2.) Distribute or Sell Hard-to-Value Assets ASAP. Currently IRA providers have the option to check the box and “flag” hard-to-value assets on Forms 5498 and the 1099-R. Some commentators believe that this reporting requirement is likely to become mandatory soon, maybe even as early as 2016.[8] The Plan/Participant should either sell the asset in an arm’s-length transaction to an unrelated party, or distribute the asset as part or all of a Required Minimum Distribution. This should be done as soon as possible before the IRS requires providers to flag these assets, which will subject them to higher audit risk.

3.) Rolling Over Qualified Retirement Plan into IRA Gives Plan/Participant More Options. Some Qualified Retirement Plans only offer the death benefit to be payable in a lump sum. Therefore Plan language should always be checked to see if distribution election options preferred for a particular taxpayer are permitted. Even if the stretch options are available, an employer could terminate a plan resulting in a lump sum distribution. A qualified retirement plan Participant should consider rolling plan benefits over to an IRA as soon as this can occur, if the Participant is leaving the benefits to (a) a non-spouse designated beneficiary that will be expected to stretch the payout over his or her life expectancy, or (b) a accumulation or conduit trust where an individual will be the Designated Beneficiary for plan distribution determination purposes in order to avoid these potential pitfalls.[9]

We’re noteworthy that 403b plans can only be invested in annuity contracts or mutual funds offered by the plan, whereas IRAs offer much more flexibility than a 403b plan or the typical qualified retirement plan. Qualified retirement plans may also assess administrative expenses and costs against Participant’s accounts.

With qualified plans, the Participant may be able to borrow funds, have the plan own life insurance, or collectibles.

Age/qualified retirement plan 10% excise tax considerations. Normally, any taxpayer who is not an individual who has reached age 59 ½ will have to pay a 10% penalty in income withdrawn from the qualified retirement plan or IRA.

An individual will not be subject to this penalty on withdrawals from a retirement plan if the individual has separated from service on or after reaching age 59 ½.

Under an IRA (but not a qualified retirement plan) a Participant can elect to receive substantially equal periodic payments for life and avoid the 10% excise tax on those amounts received.

4.) Rollovers from Qualified Retirement Plans Should be Kept Separate from Regular IRA Plans. Rollovers from qualified retirement plans should be kept separate from regular IRA plans because of the federal bankruptcy court exemption rules which limit protection for IRAs held by residents of states that do not have IRA creditor protection to $1,000,000 for IRAs that have been funded with annual contributions. If qualified retirement plan monies have been mixed with IRA contribution monies, the exemption limit rules will be challenging at best.[10]

5.) Asset Allocation Rules. While many financial planners will balance IRA and non-IRA investments using the same ratios of fixed income to equity, a good many financial advisors believe that the better approach is to have taxable bonds and equivalent fixed income investments under the IRAs, with equities outside of the IRAs. Equities are tax advantaged because the capital gains on sale will not occur until sold, whereby taxable income on bonds and other interest can be deferred under an IRA, which would otherwise turn long term capital gains into ordinary income if equities are held under the IRA.[11]

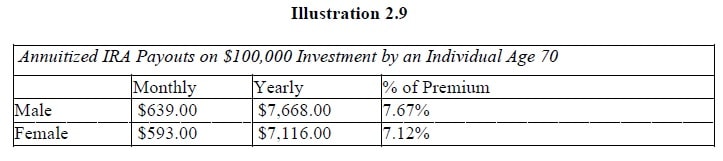

6.) Annuitized IRA. An IRA can be “annuitized” by investing the IRA assets in an annuity contract whereby the insurance carrier issuing the contract will make a series of annual or more frequent lifetime payments to the IRA owner. These payments will be considered to satisfy the minimum distribution rules, and neither of the payments or the value of an annuitized annuity will be aggregated with any other IRA or retirement plan for purposes of calculating the minimum distribution requirements. The annuitized payments will typically exceed the required minimum distribution amounts that would have applied.

For example, a male age 70 who is otherwise subject to the payout amounts described in Illustration 2.1 above, might instead cause his IRA to purchase an annuitized contract that would require payment of 7.67% of the initial amount invested each year for his lifetime. Alternatively a female might cause her IRA to purchase an annuitized contract that would require payment of 7.12% of the initial amount invested each year for her lifetime.

Payments received from an annuitized IRA by an owner/participant who has not reached age 59 ½ will not be subject to the 10% excise tax described below.

Below (Illustration 2.9) is an example provided by one investment company of hypothetical payments for a male and female age 70 who annuitizes $100,000 of his or her IRA to receive lifetime payments that will never run out in lieu of minimum distributions which would be less.

7. Qualified Longevity Annuity Contract (“QLAC”). A QLAC is an annuity contract held under an IRA that begins paying a lifetime annual, or more frequent, annuity amount years after acquisition. Before going into payment mode, the value of a QLAC is not counted in determining minimum distribution payment amounts. When payments begin, they must be distributed in full each year, and will normally exceed the minimum distribution amount until the client reaches a fairly high age. (Upper 80’s and older).[12] The Treasury Regulations released on July 2, 2014 permit the lesser of $125,000 or 25% of the applicable IRA balance to be held under QLAC contracts that can be disregarded with respect to the value of the IRA in determining minimum distribution requirements. The contract will pay fixed dollar amounts at stated intervals over a number of years for the life of a taxpayer, beginning no later than age 85. If the taxpayer dies before he or she has received payments equal to the amount paid for the contract, then the contract may offer a return of premium option so that the taxpayer in effect receives back all amounts invested, without interest, but this return of premium option is not required by the Regulations, and will cause reduction in the minimum annual amount paid. The lesser of $125,000/25% limitation can be somewhat confusing, and is described, with further detail in LISI Archive Message 639 by Alan Gassman, Christopher Denicolo & Brandon Ketron: A Practical Approach to Qualifying Longevity Annuity Contracts (QLACs) – Using the (King) L.E.A.R. (Life Expectancy And Return) Analysis to Determine Whether Clients Should Invest in Specially Designed Annuity Products under Their IRA or Qualified Retirement Plans, Steve Leimberg’s Employee Benefits and Retirement Planning Email Newsletter located in Appendix E.

As of publication of this outline AIG is the only carrier presently offering QLACs, and Vanguard personnel have reported that they will have QLACs “within the next few weeks.”

8.) Designed Beneficiary. The individual beneficiary whose life expectancy is used for the purpose of determining the Applicable Payment Mode of the Required Minimum Distributions that will apply to an IRA/Plan. This is the age that the Designated Beneficiary will attain in the calendar year following the Plan Participant’s death. A Designated Beneficiary could be any of the following:

- A beneficiary of an IRA/Plan if an individual is directly named as beneficiary based on a beneficiary designation or the terms of the applicable IRA/Plan governing document;

- The oldest individual beneficiary of a trust that qualifies as an Accumulation Trust; or

- The beneficiary of a Conduit Trust to whom all payments from IRA/Plan to the trust must be made.

- Note – If the Designated Beneficiary is not an individual, the IRA/Plan will be subject to either the Five Year Rule, if the Plan Participant died before his or her Required Beginning Date or the At Least as Rapidly Rule, if the Plan Participant died after his or her Required Beginning Date.

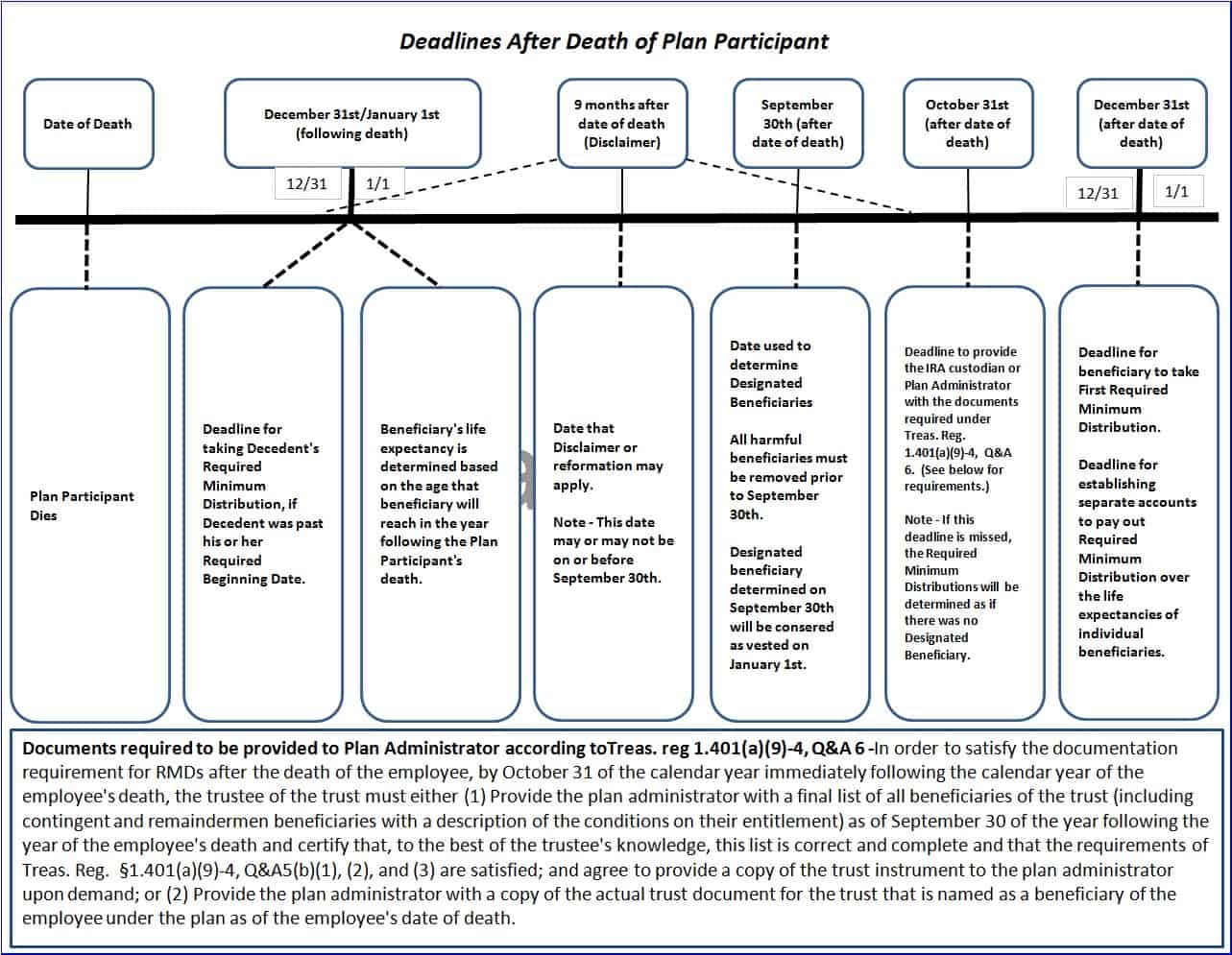

9.) Designation Date. The Designation Date is September 30 of the calendar year following the year of death of the Plan Participant. This is the date on which the Designated Beneficiary is determined for the purposes of calculating the Applicable Payment Mode of the Required Minimum Distributions. As stated above, it is possible to remove or eliminate one or more beneficiaries shortly after the death of a Plan Participant, but before the Designation Date. See Illustration 2.10 below for a summary of important dates after the Death of the Plan Participant.

10.) See Through Trust. An Accumulation Trust or a Conduit Trust, as used by the IRS to denote a trust that may not be considered as a Non-Person if the trust is named beneficiary of an IRA/Plan. Assuming that certain requirements are met, and that the trust qualifies as a Conduit Trust or as an Accumulation Trust, the trust is “looked through” to the Designated Beneficiary for the purpose of determining the Applicable Payment Mode of Required Minimum Distributions.

11.) Accumulation Trust. A trust that is the beneficiary of an IRA/Plan where the trustee thereof has the power to accumulate some or all of the Required Minimum Distributions and other payments from the IRA/Plan (i.e., the terms of the trust instrument do not require the trustee to distribute all Required Minimum Distributions and all other payments from the IRA/Plan to a particular beneficiary). Thus, the Trustee need not necessarily distribute monies received from an IRA/Plan by the trust, unlike a Conduit Trust where any and all distributions from the IRA/Plan to the Trust must be in turn paid out to the Designated Beneficiary. Such trust can have no Non-Person beneficiaries after September 30 of the calendar year following the death of the Plan Participant (i.e., the Designation Date) and must properly register certain information with the Plan Administrator by October 31 of such calendar year. If the trust has any Non-Person beneficiaries after the Designation Date, then the trust cannot qualify as an Accumulation Trust.

The Designated Beneficiary of an Accumulation Trust for the purposes of the Required Minimum Distribution rules is the oldest individual beneficiary of the trust, even if such person is merely a contingent beneficiary. This is discussed further in Chapter Three, Section II. Any potential appointees under a power of appointment held by a trust beneficiary over property held under an Accumulation Trust are taken into account for the purposes of determining the Designated Beneficiary of the IRA/Plan. Therefore, no power of appointment should be exercisable in favor of individuals who are older than the desired Designated Beneficiary, or in favor of any Non-Person entities, because this would invalidate the ability to use the Designated Beneficiary’s life expectancy for Required Minimum Distribution purposes.

For example, power of appointment language may be limited by the following:

Notwithstanding the above, the holder of any power of appointment of any trust herein established which is the recipient of any IRA or pension plan distributions may not exercise such power of appointment in favor of any individual younger than the applicable “Designated Beneficiary” or any entity that is not an individual.

Further, any appointee must be a descendant of the great-grandfathers and great-grandmothers of the grantor of this trust.

Accordingly, any Non-Person beneficiaries of a desired Accumulation Trust should be eliminated before the Designation Date (September 30 of the calendar year following date of death of Plan Participant) by full payment of the share of the trust otherwise allocable to them by such Non-Person beneficiaries, by amendment of the trust by independent trust protectors, or possibly by court order. Further, powers of appointment may be trimmed back before the Designation Date, and any powers held by the trustee or any other party (such as trust protectors) that would allow for the addition of Non-Person beneficiaries or individuals older than the Designated Beneficiary should also be trimmed back as well.

It is also possible to draft so that a conventional credit shelter trust or generation skipping trust can be the recipient of IRA/Plan benefits to be paid out over the lifetime of a Designated Beneficiary by having a separate “shadow trust” established under the trust instrument with identical dispositive provisions to the main trust, except that certain provisions are modified as necessary in order to result in the maximum deferral of IRA/Plan benefits. “Shadow trust” provisions will typically provide that only individuals younger than the Designated Beneficiary can receive benefits from the trust, and that appointees under any power of appointment must be individuals who are younger than the Designated Beneficiary. The non-IRA/Plan assets can be held, managed, and administered under the main trust provisions, and would not be subject to the provisions of the separate shadow trust.

12.) Conduit Trust. A trust that is the beneficiary of an IRA/Plan which requires that all distributions from the IRA/Plan must be paid to a specified Designated Beneficiary, and does not authorize the trustee thereof to accumulate or withhold any distributions from the IRA/Plan. The Required Beginning Date and Required Minimum Distribution rules will normally apply as if the Designated Beneficiary of the Conduit Trust is the sole direct beneficiary. Thus, all beneficiaries (other than the Designated Beneficiary) can be disregarded for the purpose of determining the Designated Beneficiary, and the Designated Beneficiary will be treated as the individual beneficiary for Required Minimum Distribution rule purposes. A Conduit Trust can thus have beneficiaries older than the desired Designated Beneficiary, Non-Persons as beneficiaries and unlimited power of appointment powers, so long as all distributions from the IRA/Plan to the trust are required to be paid to the Designated Beneficiary upon receipt from the IRA/Plan during his or her lifetime by trust during his or her lifetime.

Under most circumstances, the proceeds received by the Designated Beneficiary will not be protected from the creditors of the Designated Beneficiary, or from the federal estate tax at the Designated Beneficiary’s death, because a Conduit Trust requires that he or she must receive all IRA/Plan distributions. However, a Conduit Trust may provide that a charity or another Non-Person is a beneficiary of the trust, and this will not jeopardize use of the desired Designated Beneficiary’s life expectancy for the purposes of determining the Applicable Payment Mode.

It might be possible to “toggle” a Conduit Trust into an Accumulation Trust within nine months after the death of the Plan Participant in most states, if the Designated Beneficiary who is to receive all distributions of IRA/Plan benefits per the trust instrument disclaims his or her right to receive mandatory distributions of all IRA/Plan payments.

It may also be possible for a Trust Protector to hold an amendment power to “toggle” a Conduit Trust into an Accumulation Trust; however the power must be exercised prior to the Designation Date. A Trust Protector given this ability should also have the power to change remainder beneficiaries within 9 months following the death of the Plan Participant as necessary to comply with the Designated Beneficiary Rule discussed in #5 below. See PLR 200537044.

13.) Q-TIP Minimum Distribution Rules. When IRA/Plan benefits are payable to a Q-TIP trust that must pay all income to the surviving spouse to qualify for the estate tax marital deduction, Revenue Ruling 2006-26 requires that both (a) the Plan/IRA and the Q-TIP trust each make affirmative marital deduction elections; and (b) that the greater of the Required Minimum Distribution percentage or all income from within the plan must be paid to the Q-TIP trust annually. Further, the spouse must have the right to require that all income earned within the Plan be distributed to the Q-TIP Trust, and the normal Q-TIP Trust rules provided under Internal Revenue Code Section 2056 will apply.

A Q-TIP trust will qualify as a Conduit Trust, and the Surviving Spouse will be considered to be the Designated Beneficiary thereof if the IRA/Plan meets the requirements set forth above. This is further discussed in Chapter Three, Section II (F) of this outline.

14.) Delay in Division Problem. What if the Plan Participant’s trust agreement or will provides that a trust or trusts held for the Designated Beneficiary will not be separated until after an event which will not occur before the deadline for the establishment of separate accounts (December 31st of the calendar year following Plan Participant’s death). For example, the applicable trust provides that the trustee is to “divide the assets equally into separate trusts for my children after my youngest child has reached age 25.” Based on this language, each trust is going to have to take Required Minimum Distributions out over the life expectancy of the oldest child (assuming that the children and individuals younger than the oldest child are the only beneficiaries of the trusts that will be established).

A better approach would be to provide for funding of a side trust that could be used to provide health, education, maintenance, and support for the youngest child or children, with the net remaining amount to be distributed equally among the trusts for the children once the youngest child has reached age 25. The IRAs/Plans can then be allocated equally among the trusts for the children, which can be formed on or before the deadline for establishing separate accounts.

15.) Separate Accounts Rule. This rule allows an IRA/Plan to be paid to multiple beneficiaries based upon their respective life expectancies if separate IRA/Plan accounts are established. The applicable distribution period for each separate account is determined by disregarding the other beneficiaries, but only if the separate accounts are established on a date which is no later than the last day of the year following the calendar year of the Plan Participant’s death. Reg. 1.401(a)(9)-8, A-2(a)(2). However, when IRA/Plan account division occurs by operation of a single trust that is named as beneficiary, the separate accounts rule is not available for purposes of determining the life expectancy of multiple beneficiaries. Reg. 1.401(a)(9)-4, A-5(c). Where the Plan/IRA beneficiary is a trust with multiple beneficiaries, the life expectancy of the oldest possible Designated Beneficiary is used to determine the applicable distribution period.

EXAMPLE: Where an IRA is payable by beneficiary designation to a trust with three beneficiaries, and after the death of the Plan Participant the IRA splits into three separate shares payable to each beneficiary, the Minimum Distribution Rules will apply under each separate share as if each beneficiary was the same age as the oldest beneficiary. PLR 200317041; 200317043; 200317044; 200432027.

16.) Separate Trust Rule. Permits separate trusts for separate beneficiaries to each use the life expectancy of the respective Designated Beneficiary where the Plan/IRA is payable directly to each separate trust, notwithstanding that each separate trust may be established after the death of the Plan Participant by testamentary Will provision or under a revocable trust. This applies as long as the IRA/Plan is divided into separate IRAs/Plans, with the applicable separate trust being named as the beneficiary of the corresponding separate IRA/Plan under the beneficiary designation.[13] Each trust (at the time it receives benefits) must be a separate trust under applicable state law, with its own taxpayer identification number.

EXAMPLE: An IRA that is payable 1/3 to a trust for one grandchild, 1/3 to a trust for another grandchild, and 1/3 to a trust for a third grandchild will qualify to facilitate having the applicable distribution period determined separately, according to the respective life expectancy of each grandchild. Note that this can have a much better result than what would apply in the example of the Separate Accounts Rule, especially if there is a large age difference between the beneficiaries of a trust.

***********************************************

[1] See Natalie Choate’s The 201 Best and Worst Planning Ideas for Your Client’s Retirement Benefits at 3-11.

[2] Id. At 3-12

[3] Choate’s The 201 Best and Worst at 3-13.

[4] Choate’s The 201 Best and Worst at 3-16.

[5] Choate’s The 201 Best and Worst at 3-18 and 3-19.

[6] § 1091

[7] Choate’s The 201 Best and Worst at 3-37

[8] Choate’s The 201 Best and Worst at 3-16 and 3-17.

[9] Choate’s The 201 Best and Worst at 3-26

[10] The rule reads as follows, and no-one knows how it will work: “For assets in individual retirement accounts described in section 408 or 408A of the Internal Revenue Code of 1986, other than a simplified employee pension under section 408(k) of such Code or a simple retirement account under section 408(p) of such Code, the aggregate value of such assets exempted under this section, without regard to amounts attributable to rollover contributions under section 402(c), 402(e)(6), 403(a)(4), 403(a)(5), and 403(b)(8) of the Internal Revenue Code of 1986, and earnings thereon, shall not exceed $1,000,000 in a case filed by a debtor who is an individual, except that such amount may be increased if the interests of justice so require.” 11 USC § 522

[11] Choate’s The 201 Best and Worst at 3-37

[12] The author used to think that a fairly high age was 30, when the author was 20. Now the author thinks that 70 is young.

[13] Some commentators believe that the separate trust rule will still apply if the IRA/Plan is not divided into separate IRAs/Plans, so long as the beneficiary designation specifies that a distinct portion of the IRA/Plan will be payable to each separate trust. The authors are not aware of any IRS guidance on this issue, but conservative planners will want to divide the IRA/Plan into separate IRA/Plans during the Plan Participant’s lifetime to assure that the separate trust rule will apply.

The Tipping Point in a Health Care Network

by Pariksith Singh, M.D.

Pariksith Singh, M.D. is board certified in Internal Medicine. Dr. Singh received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001.

The tipping point of a health care network in a selected geographic area is reached when the growth of the network begins to happen on its own. This occurs when the resistance to development begins to melt away and providers in the area realize that they have a significant advantage in joining the network.

While economies of scale may play a role in reaching the tipping point, the more important aspect is economies of scope and a sense of mutually beneficial relationships among the community of vendors and providers. At this point, a strongly integrated network becomes inevitable in the mind of the community with an understanding that such a development brings a shift in the way health care will be practiced and it brings tremendous advantages.

The most important aspect of such network development in my mind, is its emphasis on relationships, a long-term investment from all parties, and a building up of trust. Service and value-creation are the key based on integrity and credibility. Initially, there may be significant resistance, even verbal and emotional violence, warnings of grave injury to providers and patients. But as the network is built brick by brick, rather person by person, such resistance melts away into sheer resistance.

What are the components of building a health care network? The key is to develop an anchor practice or multiple anchor practices, preferably in primary care, which makes one a part of the community. This is the most difficult step and requires hard work against great resistance. The second step is to build a non-confrontational relationship with patients, vendors, facilities administrators and health care providers. Once the anchor practice takes hold, it should be expanded or enlarged by bringing in more providers or creating more offices using a hub and spokes model.

The emphasis of the practice should be on customer satisfaction, quality, compliance and evidence-based medicine. The stronger the engagement with patients, the easier it is to develop the network. One often finds that a physician community is seldom completely united. There are factions, old grudges and a sense of dissatisfaction with the status quo among the non-group members. It is extremely important to know the lay of the land, areas of population concentration and the dynamics of various factions among the physicians. Invariably, these physicians will want to develop relationships and might wish to outdo one another when the tide turns.

It is important to be focused on one’s mission, and it is best to do so in a non-threatening manner. Having a higher cause is great help. Financial and operational benefits that might accrue to other providers when they join the band wagon should be reviewed compliantly with a sense of service and humility. There are times when one may need to take a stand but that must be done so professionally and with gentle firmness.

It may be important to offer several lines of service, to touch the provider at multiple levels and in multiple ways. Building relationships in a team based approach helps since each provider is different in aptitude, background, preference and needs. A team comprising of a physician liaison, compliance and quality officers, managed care or accountable care solutions and resources, IT services, data and analytics, and legal and financial counselors may be used to reach out to providers in a holistic manner.

Besides building a primary care network, one should strongly consider building a specialty network made up of a network of hospitals, nursing home specialists, and various outpatient services such as radiology, physical therapy, home health care, phlebotomy stations and specialty testing. A specialty network brings tremendous dynamic value to a primary care network since it helps build strong relationships with specialists, hospitals and skilled nursing facilities especially if patients are managed in a strong care management environment.

A specialty hospitalist network can enhance the primary care network several-fold by helping cover physicians who are strictly out-patient, bring a focused effort to take excellent care of the ‘captive’ inpatients and ensuring continuity of care without the chance of patient care ‘falling through the cracks’ if thoroughly integrated.

Market saturation may be important but presence and proper branding of one’s product is more important. Marketing is helpful for new physicians in the area or after a strong base for a primary care network is created but is not the main goal of the network. Activities and events to create community outreach are important to avoid the appearance of being ‘carpet baggers’ (using manipulation or fraud to obtain an objective).

Even after a network is built, it is important to provide excellent service that is always making an effort to improve, is provider- and patient-centric, and focused on quality and compliance. Inducements are prohibited and are never necessary for patients or providers.

If these principles are followed, a network is inevitably created and is able to develop in the correct way. Patience and systems thinking is a must along with a vast vision that does not react constantly, is detail-oriented, and yet extremely nimble with operational leverage.

Richard Connolly’s World

Celebrity Estate Round-Up, Part I

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, we are featuring stories on the issues surrounding celebrity estates. The first article is entitled “Robin Williams’ Widow Starts a Court Battle – But Why?” This article was written by Danielle and Andy Mayoras and featured on Forbes.com on February 3, 2015.

Richard’s description is as follows:

When Robin Williams tragically committed suicide, he left behind three children from his first two marriages (ages 23 to 31) and a widow of less than three years, Susan Schneider Williams. Unlike many celebrities, Robin Williams took the time to create a thoughtful and detailed estate plan, including various trusts to benefit his three children and Susan. The trust established for his wife, called the Susan Trust, referred to and was consistent with a prenuptial agreement the couple signed when they were married in late 2011.

Because Robin Williams’ estate planning was carefully crafted, it initially appeared that his heirs would avoid the bitter family squabbles that affect many mixed-marriage families (in Hollywood and around the country). After all, it is his wishes that matter, and because those wishes were seemingly captured through the proper legal documents, there should be nothing left to fight about, right?

Not so fast. Within the past 24 hours, the news broke that the Williams family will not be so lucky. Susan, through her lawyers, started legal proceedings a few days before Christmas. She asked for a probate court in California to take jurisdiction over the Robin Williams Trust to interpret various provisions that she feels are in dispute. Robin’s three children – themselves coming from two different marriages – filed a unified response through their attorneys and opposed Susan’s court filing. The battle is on.

Please click here to read this article in its entirety.

The second article this week is “Estate of Ernie Banks in Turmoil as Caregiver Claims to be Sole Heir.” This article was also written by Danielle and Andy Mayoras and was featured on Forbes.com on February 19, 2015.

Richard’s description is as follows:

[Mr. Cub] Ernie Banks died on January 23rd at age 83 from a heart condition. Interestingly, his death certificate listed dementia as a “significant condition contributing” to his death. Why is that important?

Only three months before he died, Banks signed a new set of estate planning documents, including a power of attorney, healthcare directive, new will, and a trust. The new documents left his caregiver and talent agent, Regina Rice, in control of everything. Strangely, the will and trust completely excluded his family members and named Rice as his sole beneficiary.

The Banks’ family attorney says his children plan to vigorously contest the will. They believe that Rice coerced their father to sign the new estate planning documents, by controlling and manipulating him. They also say that in the months leading up to his death, Rice prevented them from speaking with their father by phone. They believe that Rice used her position of trust and confidence to take advantage of Banks’ dementia to their detriment.

It will be interesting to see what precautions were taken by the attorney who drafted the “final” estate plan.

Please click here to read this article in its entirety, and stay tuned next week for stories on the conflicts surrounding the estates of Joan Rivers and New Orleans Saints owner Tom Benson.

Thoughtful Corner

Einstein’s Positive Universe – It’s More Than Just Relativity. Positive Equals a Better Professional Life and Performance Squared.

by Dr. Srikumar Rao, as edited by Alan S. Gassman

If you were not able to join us for the March 5, 2015 ethical credit, 50-minute presentation of How to Handle Stressful Matters in an Ethical Way by Srikumar Rao, then please consider doing so by clicking the link below and contact us about receiving a one-hour credit.

Professor Rao’s discussion was extremely interesting and useful. His discussion of Albert Einstein’s theory of a positive universe was both original and insightful, as represented below:

Let me take you to someone who is one of the greatest known scientists of the world. The person I am referring to is someone you have all heard of. His name is Albert Einstein.

Albert Einstein is revered as a genius, but when we revere him as a genius, we are primarily thinking about his scientific accomplishments. Einstein was the person who gave us first the special theory of relativity, then the general theory of relativity. He was the person who discovered the photo-electric effect for which, in fact, he received the Nobel Prize, and there are numerous other things he did; his scientific accomplishments are legendary.

What few people know is that Einstein was also a philosopher who had a pretty deep understanding of the universe and the way it operates. One of the observations he made is something which is immensely relevant. I found it extraordinarily helpful in my life; it has been extraordinarily helpful in the lives of many thousands of people who have taken my programs and my workshops, and, if you think about it, it will be enormously helpful to you personally.

What Einstein said is that the most important decision you are ever going to make is, “Is the universe friendly?” Let me repeat that – the most important decision you are ever going to make is, “Is the universe friendly?”

Now we all know people who believe that the universe is unfriendly. They believe the sole purpose of the universe is to frustrate you when you are trying to accomplish something. These are the people who believe that the universe knows when you are running late and will arrange for a massive traffic jam exactly when you are running late. We all know people like that. Fortunately, they are few in number. The vast majority of us believe that the universe is indifferent to us. “Here I am doing my thing, and there is the universe doing its thing, and sometimes we seem to collaborate, and sometimes we work across purposes, but eventually, I am me, and the universe is the universe, and the universe does not know about me and does not care about me,” and that is the world the vast majority of us live in.

We all know what we experience in this world. We experience stress, and we experience frustration; some of the time things go so serendipitously well, and we are elated, but much of the time, we are not. But let’s turn the thing around. What if the universe was friendly? Friends do not shaft friends, do they? No, of course not. So if the universe was friendly, would it ever do anything to harm you? Of course not. But then why does the universe do things that you look at it and say, “Hey, this is terrible”?

Well, is it possible, is it just barely possible, that you do not have a sufficient understanding of what forces are in play?

Imagine you are a small child; you are an infant or a baby. What a baby would like is a tub of ice cream, but what would a wise parent provide? Fruits and vegetables. The baby does not want fruits and vegetables. When presented with fruits and vegetables, the baby is happy to label it – “This is bad” – and it is only much later, at a deeper level of understanding and maturity, which the child can say, “Boy am I glad I did not get a tub of ice cream, and I got fruits and vegetables back then.”

What if it is exactly like that in your life? Something happens, and you are about to label it “bad.” That is what the universe gave you, but maybe it isn’t. Maybe that is exactly what you needed. So if that is exactly what you needed, you stop bemoaning the fact that this “bad” thing happened and start thinking about what are the ways in which it can be good? It is an expansion of the Good Thing, Bad Thing parable I have shared before.

So if the universe is friendly, then no matter what you are confronting, it is exactly what you need for your personal growth at this instant.

So here is something for you to think about. Regardless of whether or not the universe is friendly, if you believe that the universe is friendly, your life will be immeasurably improved.

People have no problem in accepting it. They can readily know that – regardless of whether or not the universe is friendly – if you have a deep belief that the universe is, in fact, friendly…then life will improve. The problem is that just because you have an intellectual understanding that a particular model is better than the one you are using, it does not necessarily mean that you can adopt the model. So what can you do to believe that that universe is friendly?

For a live recording of this talk, please click here.

To see Dr. Rao’s website including his amazing course syllabus, please click here.

To hear more from Dr. Rao, a continuation of the webinar from which this article was taken, will be presented on April 21, 2015. This entire session will consist of Professor Rao answering questions on the topic of How to Handle Stressful Matters in an Ethical Way – No Question is too difficult or inappropriate. Please email your questions to agassman@gassmanpa.com and/or srikumarsrao@gmail.com and don’t make them easy! Real stories and predicaments are especially useful. To register for the webinar, please click here.

Humor! (or Lack Thereof!)

In the News

by Ron Ross

NBC cancels new reality show Millionaire Murderer Matchmaker after potential spouses kept disappearing.

*****************************

Lab rats, working in their spare time, come up with a cure for old age. They refuse to share the secret with humans out of sheer spite.

*********************

Congressman with Downton Abbey replica office is forced to resign after he is revealed as the father of Edith’s illegitimate child.

***********************

Recent publicity criticizing a lack of diversity inspires The Walking Dead to add a zombie character in a wheelchair. The survivors who fight the zombies refer to him as “Speedy.”

************************

New research indicates the Founding Fathers were especially proud of the Second Amendment to the US Constitution. “This one is so crystal clear, no court will ever have problems interpreting it,” they said.

**********************

Regular customers of the recently-closed Orlando “Arabian Nights” attraction are invited to a free night at the new local dinner theatre “Cannibal Times.” Hurry! The number of invited guests will be smaller each week.

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a free 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 PM

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman, Kenneth Crotty, and Christopher Denicolo will be presenting a not-so-free 90-minute webinar for Bloomberg BNA Tax & Accounting on WHY FLORIDA IS DIFFERENT – IMPORTANT THINGS THAT ESTATE AND TAX PLANNING PROFESSIONALS NEED TO KNOW.

Date: Thursday, April 16, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY – PART II.

This webinar is a continuation of the How to Handle Stressful Matters in an Ethical Way webinar that was presented by Dr. Rao and Alan Gassman on February 19, 2015. This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced.

See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: April 21, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please click here to register or email Alan Gassman at agassman@gassmanpa.com for more information.

***************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Kenneth Crotty, and Christopher Denicolo will present a 90-minute webinar for Bloomberg BNA Tax & Accounting on MATHEMATHICSLAND FOR ESTATE PLANNERS.

This webinar includes over 30 interactive spreadsheets and explanatory tools that you need to know how to use to best serve your clients!

Date: Monday, April 27, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE OLDSMAR PRESENTATION:

FICPA SUNCOAST SCRAMBLE GOLF TOURNAMENT

Kenneth J. Crotty and Christopher J. Denicolo will speak at the FICPA Suncoast Scramble Golf Tournament on the topic of MATHEMATICS FOR ESTATE PLANNERS INCLUDING 10 ESTATE PLANNING STRATEGIES NOT TO MISS.

Date: Friday, May 1, 2015 | CPE Presentations from 9:00 AM – 11:30 AM

Location: East Lake Woodlands Country Club | 1055 E Lake Woodlands Parkway, Oldsmar, FL 34677

Additional Information: For more information about registration, sponsorship, or this event, please click here or click here to download the Tournament brochure.

***********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman, Jerry Hesch, and Richard Oshins will present THE MATHEMATICS OF ESTATE PLANNING. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law | 1025 Commons Circle, Naples, Florida

Additional Information: For more information, please click here or email Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami | 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, and Barry Flagg will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on THE TAX ADVISORS GUIDE TO PERMANENT LIFE INSURANCE AND STRUCTURING TOOLS AND TECHNIQUES.

Date: Tuesday, May 12, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

******************************************************************

LIVE BRADENTON, FLORIDA PRESENTATION

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Tuesday, May 12, 2015 | Time TBA

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE STUART, FLORIDA PRESENTATION

Alan Gassman will be the featured “headline” speaker the Martin County Estate Planning Council Annual Tax and Estate Planning Seminar. He will be doing a three-hour talk on the topics of JESTs, MATHEMATICS FOR ESTATE PLANNERS, AND THE ESTATE PLANNER’S GUIDE TO PLANNING FOR IRA AND PENSION BENEFITS – YES, YOU CAN FINALLY UNDERSTAND THESE RULES!

Date: May 15, 2015 | 8:15 AM – 4:30 PM; Alan Gassman speaks from 9:00 AM to 12:00 PM

Location: Stuart Corinthian Yacht Club | 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will be presenting a free 30-minute webinar on ARBITRATING TRUST AND ESTATES DISPUTES.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many vary useful articles thereon.

Date: Tuesday, May 19, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

**************************************************

LIVE MIAMI LAKES WORKSHOP:

Alan Gassman will be speaking at the Miami Lakes Bar Association Luncheon on the topic of ACCELERATING YOUR LAW PRACTICE.

Date: Thursday, May 21, 2015 | 11:45 am – 1:45 pm

Location: TBD

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE PRESENTATION:

RUTH ECKERD HALL PLANNING GIVING COUNCIL MEETING

This exciting two-part event will feature an educational presentation and a networking session. Attorneys and CPAs may receive CLE and CPE credit for attending the educational presentation.

The educational presentation will be an entertaining, interactive workshop led by Jack Halloway, a well-known improvisational coach and actor. He is directing “The Complete Works of William Shakespeare (Abridged)” and will share some thoughts on how Shakespeare used law, lawyers, and money in his plays. Some improv will also be included.

Jack Halloway’s presentation will be followed by a social networking and info session. Enjoy some wine and time with fellow Planned Giving enthusiasts!

Everyone who brings a potential donor or new member to the Planning Giving Council will be entered into a raffle for 2 tickets to an upcoming show.

Date: April 21, 2015 | Educational Presentation begins at 4:30 PM | Networking sessions begins at 5:30 PM

Location: The New Murray Theatre at Ruth Eckerd Hall

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com. RSVPs may be sent to Maribeth Vongvenekeo at maribeth@gassmanpa.com, Suzanne Ruley at sruley@rutheckerdhall.net, or Kristy Philippe at kristy.philippe@ms.com.

******************************************************

LIVE PRESENTATION:

2015 UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay | 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please click here for a complete schedule or contact Bruce Bokor at bruceb@jpfirm.com for more information.

**************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

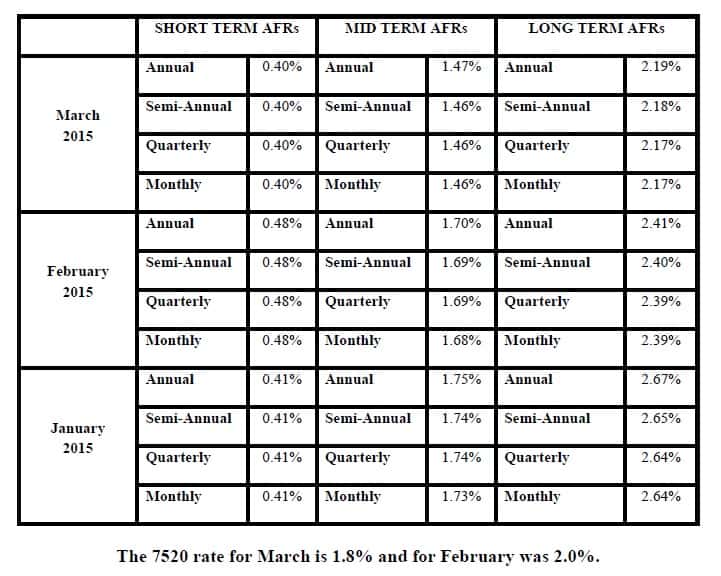

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.