The Thursday Report – 12.11.14 – BP, Disregarded TBE LLCs, and the Law of Slaw

Case Update: Madoff Claw-backs and BP Appeals by Travis Arango

Year-End Estate Tax Planning by Alan Gassman

The Florida LLC Act: Tips, Tidbits, and Tricks by Ken Crotty and Chris Denicolo

Yes, it is Usually Safe to Consider an LLC Owned as TBE as Disregarded for Income Tax Purposes by Alan Gassman and Brandon Ketron

Gregory Gay’s Corner – Medicare, Part 3

Richard Connolly’s World – IRA Rollovers Get New IRS Rules for 2015

The Law of Slaw: How to Best Protect Your Favorite Recipes

Thoughtful Corner – Happiness Habits

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Case Update: Madoff Claw-backs and BP Appeals

by Travis Arango

Madoff Investors have a Two-Year Clawback Statute of Limitations

Madoff stole $17.5 billion in a Ponzi scheme and plead guilty in 2009. The trustee of the bankruptcy case is attempting to recoup some of the money stolen and return it to the victims. However, the Court of Appeals for the Second Circuit in New York ruled that the trustee in the Madoff proceeding can only pursue profits received from investors within two years of the date of filing the petition. This amounts to the trustee not being able to gain access to $1.6 billion received by Madoff investors outside of that two-year period.

United States Supreme Court Takes the Lead out of BP’s Tanks

On December 7th, the Supreme Court denied hearing the BP appeal that was challenging the settlement over the oil spill that occurred in the Gulf of Mexico four years ago. The Supreme Court did not issue a comment and rejected the appeal with no dissenting Justices. This decision allows businesses and others to make claims for another six months. This time limit could possibly be extended if BP requests reconsideration, as the court’s decision marks the official beginning of the six-month deadline. It’s time to get those claims understood and finalized!

Year-End Estate Tax Planning

by Alan Gassman

While many clients will no longer have estate tax issues, given the $5,430,000 threshold that will apply beginning January 1st, a number of taxpayers are or will be well above that level (or twice that level as to married couples), and it is therefore essential to make sure that they understand what they can do before January 1, 2015 to reduce or possibly even eliminate federal estate tax exposure for their families.

On January 1st, there will no longer be the opportunity to gift up to $14,000 for each donee, whether directly or into trusts that can provide long-term benefits and possibly even be used to benefit the donor and/or the donor’s spouse.

If the ownership interests transferred can qualify for valuation discounts and/or are expected to grow rapidly in value, then the impact of these arrangements can be significant.

There are only 20 days left between now and December 31, 2014. Are you reaching out to your clients who have or should have concerns about federal estate tax to help make sure that they do not lose the opportunity to make the best possible use of presently existing strategies, which most notably include the ability to gift up to $14,000 per donee/donor per year into long-term trusts that can benefit present and future generations, the donor’s spouse, and, in many cases, even the donor.

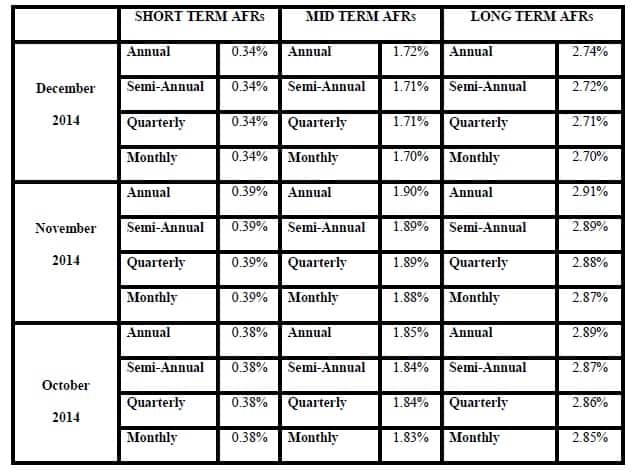

With a 1.89% Mid-Term Applicable Federal Rate, there is also the opportunity to sell discounted entity interests and/or assets expected to increase in value dramatically in exchange for 9-year interest only promissory notes on an income tax free basis, under circumstances where the seller/donor can pay the income taxes on behalf of the purchasing trust that is the result of interest, dividend, business operational, and capital gains income that benefit the trust.

In many cases, these trusts are already established, and the only thing needed is to assign ownership interests in existing entities to the trusts based upon the number of individuals having $14,000 (or $28,000 for a married couple) each withdrawal powers.

While far fewer clients are concerned about these rules, those who are can be particularly appreciative, and many do not realize that with earnings, growth in investments, and inflation, they will be in the “estate tax zone” almost before they know it.

The Florida LLC Act: Tips, Tidbits, and Tricks

by Ken Crotty and Chris Denicolo

WHY WE NEVER PROVIDE FOR MANAGING MEMBERS IN OUR OPERATING AGREEMENTS

We have had a number of questions in the last few days about the new Florida LLC Act, which takes effect January 1, 2015 for all Florida limited liability companies.

A common point of confusion revolves around what the statute is going to do to change agreements and arrangements now in effect that call for Managing Members.

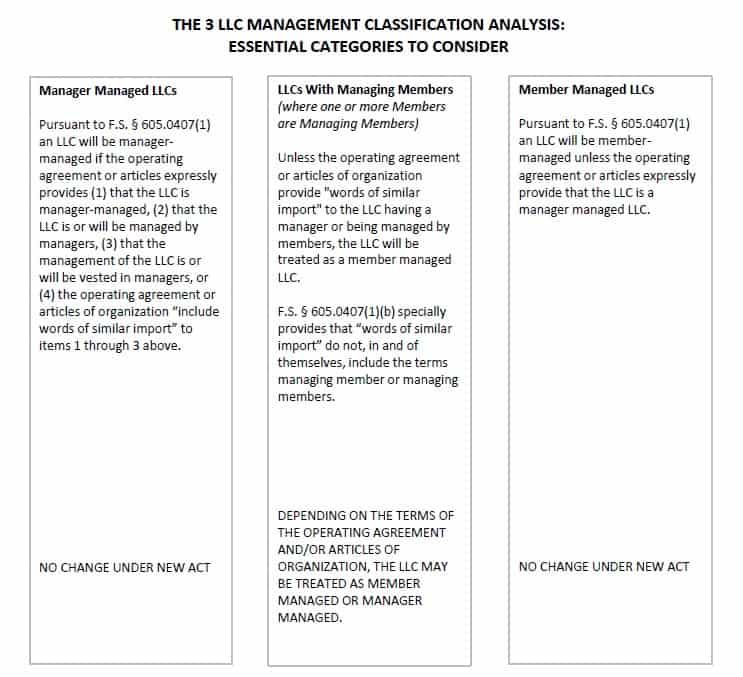

The drafters of the new statute recognized how much confusion occurs when a “Managing Member” is referred to in an Operating Agreement. Under the new statutes, the concept of a Managing Member has been removed, and a Florida LLC would either be classified as Manager Managed or Member Managed. The determination of whether an LLC is Manager Managed or Member Managed is based on the terms of the LLC’s Operating Agreement or Articles of Organization.

In last week’s Thursday Report, we ran an article detailing this change in Florida LLC law, which contained the following chart to describe the distinctions between an LLC that is Manager Managed or Member Managed that has a Managing Member.

Clients and many advisors do not understand how important it can be to divide these functions, and the failure to provide that an LLC is either Manager Managed or Member Managed could cause the intended “Managing Member” to have next to no authority to manage the affairs of the LLC without the consent of other members.

For example, if an LLC Operating Agreement provides that the LLC is to be managed by a “Managing Member,” and the LLC is determined to be Member Managed under the new LLC Act, then it is possible that a majority vote of all members of the LLC would be required with respect to any decisions regarding the operation of the LLC. This could cause a minority share member who has been serving as the Managing Member of an LLC to be required to obtain a vote of at least 50% plus one of the LLC membership interests in order to effectuate actions on behalf of the LLC. However, this situation could be avoided by an amendment to the Operating Agreement which provides that the LLC will be Manager Managed by the individual or entity who was previously serving as Managing Member.

We wanted to republish the above chart and address this issue again in this week’s Thursday Report because of the possibility of significant unintended consequences that could be prevented by a simple amendment to an LLC’s Operating Agreement and/or proper drafting of future LLC Operating Agreements. A full copy of last week’s article can be found here.

Yes, it is Usually Safe to Consider an LLC Owned as TBE as Disregarded for Income Tax Purposes

by Alan Gassman, JD, LLM, and Brandon Ketron, CPA, almost JD

One of the most common questions that we are asked by certified public accountants, tax lawyers, and other advisors is whether an LLC owned as tenants by the entirety between a husband and a wife can be disregarded for income tax purposes. Many times the LLC will also be partly owned directly by one spouse or the other or through a trust considered as owned by one spouse or the other for income tax purposes (a defective grantor trust), and we believe the same result applies.

General Requirements to be a Disregarded LLC

An entity with a single owner can be disregarded as an entity separate from its owner for federal income tax purposes.[1] Therefore an LLC with only one member (Single-Member LLC) will be treated as disregarded. The issue becomes less clear when an entity is owned by a husband and wife jointly.

LLCs Owned By Husband and Wife

In general, a business entity with two or more members is classified for federal tax purposes as either a corporation or a partnership, and cannot be treated as a disregarded entity.[2] However, many authorities agree that an LLC owned as tenants by the entirety by a husband and wife can be disregarded.[3] The IRS has yet to provide specific guidance on this issue, but has provided other guidance that supports this conclusion.

In Rev Proc. 2002-69 the IRS stated that an entity owned solely by a married couple as community property, under applicable local law, can be treated as disregarded for federal tax purposes. Under the laws of community property, assets are owned equally by the husband and wife and neither spouse has a full interest in the assets. Similarly under the laws of tenancy by the entirety each spouse has an equal and undivided interest in the assets. Therefore the IRS is likely to look at an LLC owned by a husband and wife as tenants by the entirety in the same way they look at an LLC in the community property state.

Practical Suggestions

When creating a single-member LLC held as tenants by the entirety between the husband and wife, the following recommendations should be considered:[4]

- Issue a single certificate labeled husband and wife as tenants by the entirety

- Draft an operating agreement that clearly sates the entity as a single-member entity.

- No distinguishment between voting, profits and losses, or capital as between the spouses.

- The personal tax returns of the spouses should be filed jointly disregarding the entity and recognizing all the income as if the entity were disregarded.

What Happens if IRS Does Not Agree – Usually Nothing

According to Rev. Proc. 84-35, if certain requirements are met, then there is no penalty for a failure to file a partnership return, and since there is no additional tax owed, there would be no interest. A husband and wife treating an LLC as disregarded (even if determined to be improper) will meet these requirements. As a result, even if the IRS does not agree with the above conclusion, the partnership will not be liable for the failure to file a partnership return.

The penalty for the failure to file a partnership return is $195 per month, per partner, up to a maximum of twelve months.[5] This brings the maximum penalty to $4,680, unless it can be shown that the failure to file is due to a reasonable cause.[6]

A domestic partnership composed of 10 or fewer partners is automatically deemed to have met the reasonable cause test and will not be subject to the penalty if all partners have fully reported their share of income on their timely filed income tax returns.[7] A husband and wife treating an LLC as disregarded, will each report their share of income on a timely filed tax return. Thus the husband and wife would fall into the exception and not be subject to the penalty.

The S-Corporation Exception

As mentioned above, an exception to this position is if the LLC owns S-Corp stock. This is due to the fact that if the LLC was determined to not be disregarded, the S election would be lost and back taxes (with interest) would be owed due to the entity now being treated as a C-Corporation. This is much different, and creates a riskier situation than where a disregarded LLC would be taxed as a partnership.

*******************************************************************

[1] § 301.7701-3

[2]Rev. Proc. 2002-69

[3] Howard E. Abrams Esq. & Fred T. Witt Esq. “Disregarded Entities,” 704-2nd Tax Mgmt. (BNA) U.S. Income, at B-7 (Dec. 9, 2014); Domenick R. Lioce Chinks in the Armor: Current Trends in Limited Liability Company Structure After Olmstead , Fla. Bar. Journal January, 2011 Volume 85, No. 1 Pg. 36;

[4] Lioce Chinks in the Armor Fla. Bar. Journal

[5] I.R.C. § 6698

[6] Id.

[7] Rev. Proc. 84-35, 1984-1 C.B. 509

Gregory Gay’s Corner – Medicare, Part 3

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

This week, we conclude our look at the national Medicare system with information on Medigap insurance policies, Medicare Part D, and the Medicare Advantage.

Medigap Insurance Policy

“Medigap” is the term used to describe the supplemental insurance policy needed to cover the health care costs, deductibles and co-pay amounts not provided by Medicare. This policy is important for Medicare recipients who rely on traditional Medicare coverage Medicare Part A.

The standardized Medigap policies that may be sold are as follows:

Plan A contains the basic or “core” benefits. The following is a list of the benefits that are contained in the core policy and that must be contained in all Medigap policies:

- Part A hospital coinsurance for days 61 to 90 ($296 per day in the year 2013;

- Part A lifetime reserve coinsurance for days 91 to 150 ($592 in 2013);

- 365 lifetime hospital days beyond Medicare coverage;

- Parts A and B three pint blood deductible;

- Part B 20 percent coinsurance.

The other Medigap policies contain the core benefits plus one or more additional benefits are as follows:

- Plan B policies contain the core coverage and 100% of the Part A deductible.

- Plan C policies contain the core coverage for 100% of the Part A deductible; the skilled nursing home facility coinsurance, 100% of the Part B deductibles, and foreign emergency care.

- Plan D policies contain the core coverage plus 100% of the Part A deductible, SNF coinsurance, and foreign emergency care.

- Plan E is no longer available since it included the same coverage as plan D.

- Plan F contains the core coverage plus 100% of the Part A deductible, SNF coinsurance, 100% of the Part B deductible, 100% of the Part B excess charges and foreign emergency care. There is also a high deductible option with the same benefits plus a $2,000 deductible that is adjusted for the CPI since 2011.

- Plan G contains the core coverage plus 100% of the Part A deductible, SNF coinsurance, 100% of the Part B excess charges, and foreign emergency care.

- Plan H has been discontinued since it provided the same coverage as plan D but with drug coverage that is no longer necessary due to Medicare Part D.

- Plan I has been discontinued since it provided the same coverage as plan G but with drug coverage that is no longer necessary due to Medicare Part D.

- Plan J has been discontinued since it provided the same coverage as plan F but with drug coverage that is no longer necessary due to Medicare Part D.

- Plan K contains the core coverage plus 100% of the Part A hospital coinsurance for the 61st through the 90th day and for days 91 through 150 and for 100% of Part A eligible expenses after these benefits are exhausted, including lifetime reserve days; 50% of coinsurance for 21st through 100th day, until out-of-pocket limit is met, 50% of Hospice care, 50% of reasonable cost for three pints of blood, 100% of cost-sharing for Part B preventive services after deductible paid and 100% of all cost-sharing under Part A and B for balance of year after out-of-pocket met.

- Plan L contains the core coverage and 100% of the Part A hospital coinsurance for 61st through 90th day and for days 91 through 150, 100% coinsurance amount for each Medicare lifetime inpatient reserve day used; 100% of Part A eligible expenses after benefit exhausted, including lifetime reserve days; and 75% of the skilled nursing facility coinsurance for 21st through 100th day, until out-of-pocket limit is met; 75% of cost-sharing for all Part A eligible expenses until out-of-pocket limit met and 75% of reasonable cost for three pints of blood Part B.

- Plan M contains the core benefits plus 50% of the Part A deductible, the skilled nursing facility coinsurance, and foreign emergency care.

- Plan N contains the core benefits plus 100% of the Part A deductible, the skilled nursing facility coinsurance, and foreign emergency care and the lesser of $20 or the Part B coinsurance/co-payment for office visit (including specialists) and the lesser of $50 or Part B coinsurance/co-payment for emergency room visits. The co-payment waived if patient admitted to hospital and the emergency visit is subsequently covered under Part A.

Medicare Advantage

The ever increasing cost of the Medicare deductibles, the Medicare supplement and the additional cost of the Medicare Part D prescription drug plan will eventually drive most of the 35 million fee-for-service Medicare beneficiaries into joining the 11.7 million Medicare beneficiaries presently enrolled in a Medicare Advantage plan. These services are found in Part C of the Medicare Statutes. This is known as a Medicare Advantage plan. A Medicare Advantage plan is owned by a private company that provides all of a beneficiary’s health care and prescriptions through the plan’s health care providers for a capitated rate paid by the Centers for Medicare and Medicaid. The Medicare Advantage company must provide all the services currently available under Medicare Parts A and B. The primary physician who is assigned to the Medicare Advantage beneficiary serves as a gatekeeper to specialists. Thus, the beneficiary’s health care cost is reduced while his or her health is maintained. However, a Medicare Advantage beneficiary loses the right to select any doctor and must select from a panel of physicians offered by the plan.

Every year in November, the Center for Medicare and Medicaid conducts an annual coordinated enrollment period during which time all Medicare beneficiaries are able to choose between the original Medicare program and a Medicare Advantage plan. A Medicare beneficiary has between October 15 and December 7 to join, switch or drop a Medicare Advantage Plan. The coverage begins on January 1 of the ensuing year, as long as the plan receives the request by December 7th. Between January 1 – 14, a person who is a member of a Medicare Advantage Plan can leave his or her plan and switch to the original Medicare. If a person switches to the original Medicare during this period, he or she will have until February 14 to also select a Medicare Prescription Drug Plan to add drug coverage. The coverage will begin the first day of the month after the enrollment form is received. Although Medicare Advantage may seem to save beneficiaries more money at first, they will only save money if the Medicare beneficiary uses the plan’s doctors for all their care. In addition, because Medicare Advantage plans only have one-year contracts, the provider can decide to change its costs and even leave the Medicare program.

Medicare Part D

Medicare’s prescription drug program began on January 1, 2006. This program known as Medicare Part D provides limited financial assistance with drug expenses to persons enrolled under Medicare Part A or Part B who pay the additional Part D premium to a private company. These prescription drug plans offered pursuant to Medicare Part D are provided by private companies. Thus, a person eligible for Medicare must affirmatively enroll in a voluntary prescription drug coverage program under Medicare Part D for one year at a time. Medicare Advantage Plans normally provide prescription coverage.

It is important to understand that the drugs offered by different plans vary. This new law does not authorize the establishment of specific lists of medications that must be offered by the Medicare Part D formularies. In general, once a person selects a prescription drug plan, he or she is locked in to the drug plan and cannot change until the next annual enrollment period. This is true even though the plan in which he or she enrolls changes the formulary or cost sharing arrangement, with enrollment in the new plan becoming effective January 1 of the following year. The annual enrollment period for Medicare Part D is between October 15th and December 7th of each year. During this period, a person who is eligible for Medicare can enroll in a plan or change his or her enrollment from one plan to another. An individual who is already in a plan can decide if he or she wants to remain in the same plan for the current year or if he or she wants to select another plan. There is a late penalty for failure to timely enroll when a person is first eligible. The penalty is 1% of the national average premium for every month that a person delays enrollment. Thus, a person who becomes eligible to enroll in Part D at age 65 and delays enrolling until age 66 can be assessed a 12% penalty on his or her premium for the remainder of his or her life. The amount of the penalty will vary each year as the national average premium changes. However, this penalty is waived if a person had creditable coverage with an employer or through the Veterans Administration or Tricare. Creditable coverage means that the employer’s drug plan is equivalent to the Part D benefit.

The monthly premium that a Medicare beneficiary will have to pay on a monthly basis for Part D drug benefits varies from company to company and depends on the formulary being provided by that company. A Medicare beneficiary who elects to pay this premium will then pay an annual deductible for prescriptions. The annual deductible for 2013 is the first $325 of prescription drug expenses incurred during 2013 for drugs on the plan’s list of covered drugs or formulary. The enrolled Medicare beneficiary then pays a coinsurance amount equal to 25% of his or her prescription costs, for formulary drugs, in excess of the annual deductible up to the initial coverage limit in 2013 of $2,970. The Medicare beneficiary’s prescription drug plan sponsor pays the remaining 75% until total drug expenses paid for by the plan and the beneficiary reach $2,930. The Affordable Care Act then provides that the drug manufacturer will pay 50% of the cost of the brand-name drugs and the plan will pay another 2.5%, providing seniors with total coverage of 52.5% in what is called the donut hole. Coverage by the plan of generic drugs in this donut hole is 21%. Once the total formulary expense has exceeded $6,733.75 in 2013, the Medicare beneficiary enters the catastrophic portion of the Medicare Part D Program. The Part D plan then covers 95% of the excess drug expense incurred. The cost-sharing by the patient is set at the greater of a 5% coinsurance amount or fixed copayments. The fixed copayments are $2.65 for a generic/preferred multi-source drug and $6.50 for any other drug.

The annual premium and the deductibles are expected to increase each year as the cost of this additional Medicare benefit increases. Prescription costs will be treated as incurred by the Medicare beneficiary only if they are paid by the eligible beneficiary or by another individual on behalf of the eligible beneficiary. If the eligible individual is reimbursed for such costs through insurance, a group health plan, or other third-party payment arrangement, the prescription cost may not count toward the eligible beneficiary’s incurred share of cost.

In addition to the normal monthly premium, there is also a Part D premium surcharge for high income individuals and married couples that is based on that person’s or married couple’s 2011 adjusted gross income plus tax-exempt income. An individual who in 2011 had annual income greater than $85,000 and married couples who had income greater than $170,000 will pay a Part D Medicare additional premium of $11.60 per month in 2013. An individual with income for 2011 greater than $107,000 and married couples with 2011 income greater than $214,000 will pay an additional monthly premium of $29.90 in 2013. An individual with annual income in 2011 greater than $160,000 and married couples with an annual income in 2011 greater than $320,000 will pay an additional monthly premium in 2013 of $48.10 each. An individual with annual income greater than $214,000 and married couples with annual incomes greater than $428,000 in 2011 will pay an additional monthly premium in 2013 of $66.40.

This concludes our look at the United States Medicare system. If you would like to view the Medicare article in its entirety, please click here.

Next time, Gregory Gay’s series will continue with an examination of selling a residence and homestead exemptions. This article will include information on title insurance, property tax exemptions, Florida Documentary Stamp Tax, and reverse mortgages. If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

Richard Connolly’s World

IRA Rollovers Get New IRS Rules for 2015

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is “IRA Rollovers Get New IRS Rules for 2015” by Karen Damato. It was featured in The Wall Street Journal on November 11, 2014.

Richard’s description is as follows:

In its new guidance, the IRS said owners of multiple IRAs get a “fresh start” on January 1. That is, a 60-day rollover made in 2014 “will have no impact on any distributions and rollovers during 2015 involving any other IRAs owned by the same individual,” the IRS said.

Another significant clarification, according to Jeffrey Levine, a CPA at Ed Slott & Co. in Rockville Centre, NY: The rule applies to IRA and Roth IRAs in the aggregate

Click here to view the full article.

The Law of Slaw: How to Best Protect Your Favorite Recipes

by Amy Bhatt

Amy Bhatt is an Early College student at St. Petersburg College. She is majoring in Paralegal Studies and maintains a 4.0 GPA. Her long-term goal is to earn a Juris Doctor from Stetson University College of Law. Amy has been working as an assistant at Gassman Law Associates since she was 15 years old, and we are proud to say that she wrote this article about the legal securities behind America’s healthiest fast food enterprise without assistance!

It’s one of the best kept secrets in the food industry. With top-level security guarding the vault that houses it, only a few people in the world know its contents in their entirety. What is so secret that it requires a state-of-the-art vault surrounded by motion detectors, cameras, and around-the-clock guards? Why, it’s none other than Colonel Sanders’s fried chicken recipe containing the famous 11 herbs and spices!

Today, the recipe is protected as a trade secret, which is defined as a formula, pattern, compilation, program, device, method, technique, or process that allows a company to gain a competitive advantage by keeping certain information secret. To remain a trade secret, reasonable efforts, like the ones in place for the KFC recipe described above, must be made to maintain its secrecy.

But if KFC wants to protect its recipe, why go through the expense of getting a vault surrounded by motion detectors, cameras, and guards? Why not just patent the recipe? Patenting the recipe means KFC would have to disclose the secret 11 herbs and spices. According to the United States Patent and Trademark Office, KFC would have the “duty to disclose…all information known to…be material to patentability.” Since the recipe is what would be protected by a patent, all of the ingredients would need to be disclosed.

In return, the patent would grant KFC a temporary monopoly, usually for about twenty years, over the sale of its chicken. During this time, while the patent is still in force, other companies would not legally be able to make, use, or sell the recipe. If a company does infringe on the patent, it could be sued. However, once the twenty years are up and the patent expires, the recipe would be considered part of the public domain, meaning those companies that would formerly be infringing upon the patent would then have the right to use the recipe however they please.

While the process of obtaining a patent requires registration and procedural formalities, the process of obtaining a trade secret is relatively simple. Since trade secrets do not require any type of registration, there is no application to file with the government. The only requirements are 1) The information must be secret, 2) it must have economic value from being a secret, and 3) reasonable efforts must be made to maintain its secrecy.

Since the Colonel’s recipe is currently protected as a trade secret, if a person was to reverse engineer the recipe and sell it, it would be fair game since that person did not acquire the recipe through illegal means. However, trade secret “theft” can occur if someone who knows the recipe divulges it to the public. To prevent this, many companies require those select, in-the-know individuals to sign non-disclosure and confidentiality agreements.

This doesn’t mean a company should not get a patent to protect other types of information. In fact, Colonel Sanders did have a patent. On April 12, 1966, he was granted a patent on the process of producing fried chicken. In his autobiography, the Colonel describes his reasoning for obtaining the patent: “I did that so if they cancelled with me, they couldn’t keep going with my cooker and fool the public into thinking they were still selling my Kentucky Fried Chicken.”

Thoughtful Corner

The Happiness Habits

by Thurston Thursday, III

Copyright © 2014 The Thursday Report

Last week, we talked about the Happiness Hurdles, those obstacles which may prevent happiness and satisfaction for illogical reasons. To see this discussion in last week’s Thoughtful Corner, please click here.

Today, we discuss the Happiness Habits, which are the opposite of Happiness Hurdles. It is only through using the Happiness Habits that the Happiness Hurdles can be overcome.

Even if you cannot change your circumstances, you can change your reactions and “inter-programming” to be happier with what you are achieving and the results that come from your work. You can do this by building new habits based upon proven and enjoyable thought and planning strategies that will allow you to spot the issues, analyze the problems and think through your reactions, strategize, and then enjoy the process of achieving and progressing in a positive manner.

These habits are:

- Identifying hurdles as unnecessary obstacles and thinking about them appropriately

- Understanding that the process of setting and achieving goals is best effectuated by someone who can enjoy the process of working toward a goal as well as accomplishing the goal itself

- Understanding that handling problems is best effectuated by someone who finds fulfillment in addressing problematic issues while also working to improve methods and systems to avoid future problems

- Approaching obstacles in a way that eliminates the need to become angry or frustrated when situations occur that are beyond one’s control.

That calm, collected person we all know and admire has typically worked hard on himself or herself in order to be able to handle or eliminate obstacles efficiently and effectively.

If you take every problem as a signal that something can be improved in your organization or approach, then the problem can be welcomed, and your organization, protocols, and team can be improved as a result.

Add in humor and a sense of accomplishment and see what can happen.

An exercise to help you create strategies for dealing with your own obstacles by using common happiness and effectiveness habits can be viewed by clicking here.

Upcoming Seminars and Webinars

LIVE CLEARWATER PRESENTATION:

Alan Gassman will be hosting a workshop for lawyers and other professionals who are interested in improving their futures both personally and professionally. Topics to be explored include goal setting, overcoming frustrations, problem solving, and strategies to help attract and retain the type of clients that will help grow your practice.

This workshop will be followed by a tour of the Gassman Law Associates office.

Date: December 14, 2014 | 9:00 a.m. – 3:00 p.m.

Location: 1245 Court Street, Ste 102, Clearwater, FL

Additional Information: For more information, or to register for this free workshop, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will be presenting a 30 minute webinar on LESSONS LEARNED FROM THE HALIFAX CASE

Date: Tuesday, December 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will be presenting a webinar on TRUST PLANNING FROM A TO Z for the Florida Institute of CPAs.

Date: January 6, 2015 | 11:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org.

*******************************************************

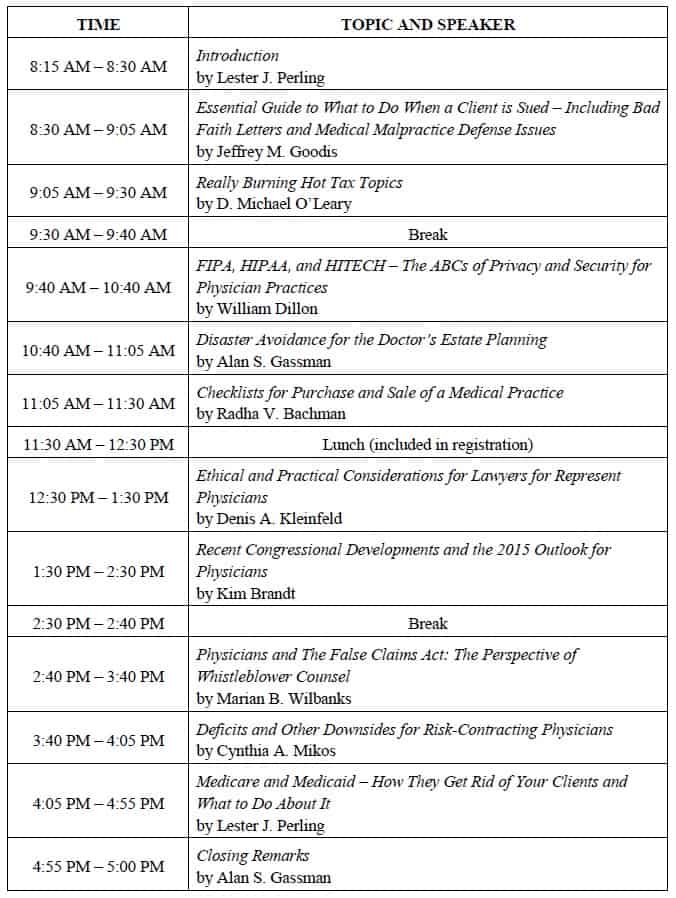

LIVE FORT LAUDERDALE PHYSICIAN LAW CONFERENCE:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Please consider attending the Florida Bar 2015 Representing the Physician Seminar at the beautiful Renaissance Fort Lauderdale Cruise Port Hotel in Fort Lauderdale on Friday, January 16, 2015.

Start a great weekend there and then work yourself down to South Beach or stay at The Breakers in West Palm.

The topics (and speakers) are unbeatable. The schedule includes:

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here to download the registration package.

********************************************************

LIVE TAMPA PRESENTATION:

Alan Gassman will be speaking at the Tampa Bay Estate Planning Council Dinner Program on the topic of PLANNING WITH RETIREMENT ACCOUNTS.

Date: January 21, 2015 | 5:30 p.m. – 7:30 p.m.; Alan Gassman will be speaking from 6:45 to 7:15.

Location: The Tampa Club, 101 E Kennedy Boulevard, 41st Floor, Tampa, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

***********************************************************

LIVE NEWPORT BEACH PRESENTATION:

Jerry Hesch will present THE MATHEMATICS OF ESTATE PLANNING at the Society of Trust and Estate Practitioners 4th Annual Institute on Tax, Estate Planning, and the Economy. This conference is a collaboration between STEP Orange County and the University of California, Los Angeles, School of Law.

Professor Hesch’s presentation will make use of the materials that Alan Gassman, Ken Crotty, and Chris Denicolo presented to the 40th Annual Notre Dame Tax & Estate Planning Institute on November 14, 2014.

Date: January 22 – 24, 2015

Location: California Marriott Hotel and Spa at Fashion Island, Newport Beach, CA

Additional Information: For more information, please email agassman@gassmanpa.com or visit http://www.step.org/4th-annual-institute-tax-estate-planning-and-economy.

**************************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: February 21, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here. To register for this program, please email agassman@gassmanpa.com.

***********************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015. Topic is To Be Announced.

Date: March 6, 2015

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on Oshins 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information:

Don’t miss Howard M. Zaritsky and Lester B. Law’s January 12th morning discussion of Basis – Banal? Basic? Benign? Bewildering?, which will include mention and some commentary and advice on the use of our JEST trust system. Don’t leave home without it!

For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

The 7520 rate for December is 2.0% and for November was 2.2%.