The Thursday Report – 12.4.14 – The Big Issues Edition: 1/1/15 LLC Confusion and Same Gender 1/6/15 Decision

Court of Appeals Lifts Stay to Permit Same-Sex Marriages in Florida Beginning January 6, 2015!

Avoiding the Cinderella Effect – Don’t Let Your Client’s LLC Turn Into a Pumpkin on the Stroke of Midnight on January 1, 2015

Gregory Gay’s Corner – What Advisors Need to Know About Medicare

Richard Connolly’s World – Why Everything You Think About Aging May Be Wrong

Thoughtful Corner – Taking Down the Happiness Hurdles

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

Court of Appeals Lifts Stay to Permit Same-Sex Marriages in Florida Beginning January 6, 2015!

To follow the August 21st Federal Court decision that found the Florida constitutional gay marriage ban to be in violation of the law, Florida had appealed to stay (postpone) the impact of this decision. A three judge panel of the 11th Circuit Court of Appeals denied Pamela Bondi’s motion and indicated that the Stay of Preliminary Injunctions entered into by the Federal Court will expire on January 5, 2015.

This means that a great many Floridians will be able to decide whether it is best for them to be married or not.

It will also mean that homestead, elective share, and family allowance considerations that apply for those Florida residents who are already married in other states will be impacted.

In addition, it is expected that the Florida courts will no longer be able to deny divorce rights, alimony, or equitable distribution rights to Florida residents who have been married in other states or who marry here after January 5, 2015.

We are very proud that our book entitled The Florida Advisor’s Guide to Counseling Same Sex Couples has received significant praise from the 7 people who bought it.

We are offering the Kindle version of the book today for $1.99 on Amazon.com, which you can purchase by clicking here. The print version of the book can be purchased for $19.95 by clicking here and using code RRRUYHVJ. All profits from the sale of the physical books will be donated to the Sara Gassman Foundation and spent entirely to pay music teachers to give music lessons to less-fortunate children.

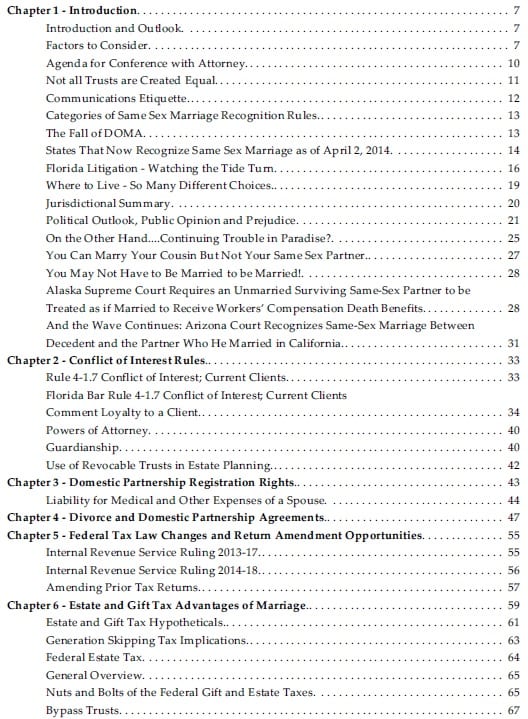

The Table of Contents from the book is as follows:

Please sign up now to attend our free webinar entitled “Planning Opportunities for Same Sex Couples” on Tuesday, December 9th at 12:30 p.m. or 5:00 p.m. To register for the 12:30 p.m. session, please click here, and to register for the 5:00 p.m. session, please click here.

Avoiding the Cinderella Effect – Don’t Let Your Client’s LLC Turn Into a Pumpkin on the Stroke of Midnight on January 1, 2015

by Kenneth J. Crotty

WHY A GREAT MANY FLORIDA MEMBER-MANAGED LLCs WILL BE DEADLOCKED OR THROWN INTO DISARRAY ON JANUARY 1ST AND MANY MANAGING MEMBERS WILL LOSE THEIR AUTHORITY ABSENT MAJORITY VOTE.

HAVE YOU NOTIFIED YOUR CLIENTS THAT HAVE THIS ISSUE?

The Florida LLC Act will change several rules associated with LLCs effective January 1, 2015, as described in F.S. §§ 605.0407 through 605.04074.

One of the most important changes will be the removal of the concept of a Managing Member. For many clients with Managing Member LLCs, no amount of magic from a fairy godmother will be able to reverse the damage that is done.

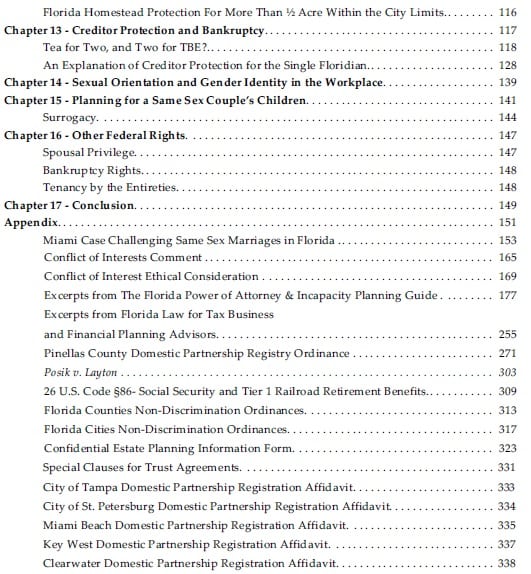

Under the old Act, an LLC could have a single Managing Member that controlled the LLC which was automatically considered to be Manager Managed. The new Act removes the concept of a Managing Member, so these LLCs will no longer be automatically treated as Manager Managed. Under the new Act, the determination of whether an LLC will be treated as Member Managed or Manager Managed must be made based on the terms of the LLC Operating Agreement and Articles of Organization.

F.S. § 605.0407(1) provides that an LLC will be Member Managed unless the Operating Agreement or Articles of Organization expressly provide (1) that the LLC is Manager Managed, (2) that the LLC is or will be managed by managers, (3) that the management of the LLC is or will be vested in managers, or (4) the Operating Agreement or Articles of Organization “include words of similar import” to items 1 through 3 above. F.S. § 605.0407(1)(b) specially provides that “words of similar import” do not, in and of themselves, include the terms Managing Member or Managing Members.

If the LLC is determined to be Member Managed, then the Managing Member may no longer control the LLC, even if it was intended for this to apply.

It is important to note that F.S. § 605.0105(4)(b) provides that the Operating Agreement of a Member Managed LLC may expressly relieve a Member of a responsibility and impose such responsibility on one or more of the other Members. If an LLC that had a Managing Member is determined to be a Member Managed LLC, it may be possible to make the argument that the governance provisions that provided the Managing Member with the authority to act should now be read to indicate that the other Members of the LLC have been relieved of their responsibilities related to the governance of the LLC.

To avoid the above, the Operating Agreement can be amended or the Articles of Organization can be restated to clearly provide that the LLC is managed by a Manager.

For LLCs that had a Managing Member and are determined to be Member Managed where none of the Members have been relieved of responsibility, there will be several changes to how the LLC operates effective January 1, 2015.

Under the new Act, all Members will need to vote on any decisions regarding the operation of the LLC unless the Operating Agreement or Articles of Organization clearly state that the LLC is managed by a Manager. In other words, clients who own less than 50% of the Membership Interests but previously controlled the LLC as a Managing Member will now need to convince other Members to agree with the client’s ideas regarding the management and operation of the LLC, even for the smallest of day-to-day matters.

Another notable change in the Act involves the authority to act on behalf of the LLC. Under the new Act, all of the Members in a Member Managed LLC will have the authority to act as Agents for the LLC and bind the LLC. The impact of this change can be mitigated by filing a Statement of Authority with the Department of State, Division of Corporations. A Statement of Authority specifies who can act on behalf of the LLC, including the ability to execute an instrument, transfer real property held in the name of the LLC, enter into transactions on behalf of the LLC, and/or bind the LLC.

The new Act also requires an LLC to update information with the Department of State when any information stated in its Articles of Organization becomes inaccurate. In a Managing Member LLC, this duty has fallen upon the Manager. In a Member Managed LLC, all Members are responsible for keeping this information current. In consequence, any Member of a Member Managed LLC could have potential liability if someone relied on incorrect information in the Articles of Organization, even if such Member was a minority Member with no effective control over the LLC.

Gregory Gay’s Corner – What Advisors Need to Know About Medicare

Gregory G. Gay, Esquire is an attorney from Tarpon Springs who specializes in meeting the special needs of senior citizens and the disabled. He is Board Certified in Wills, Trusts & Estates and in Elder Law by the Florida Bar. He has also been named a Certified Advanced Practitioner by the National Elder Law Foundation.

Mr. Gay is the author of the Florida Senior Legal Guide, the 8th edition of which can be purchased by clicking here. In the coming weeks, we will be profiling some of the best chapters from this excellent publication. Our deepest thanks to Mr. Gay for making this content available to Thursday Report readers!

This week, we continue our look at the national Medicare system with information on Medicare Part B and Medicare beneficiaries. This is Part Two in the Medicare series. To read Part One, please click here.

Medicare Part B

Medicare Part B is a voluntary program for persons who are 65 years of age or older who are citizens or who have been a lawful permanent resident for five years preceding the date of the application. The major benefit under Medicare Part B is payment of the physician’s charges for surgery, consultations, office visits and the physician’s visits to the patient’s hospital or nursing home room. Durable medical equipment, outpatient physical therapy, X-rays, and diagnostic tests are also covered. Medicare Part B also covers home health visits not covered under Part A.

Medicare Part B does not cover prescription drugs that do not require administration by a physician, routine physical checkups, eyeglasses, eye exams to prescribe eyeglasses, hearing aids or hearing exams for hearing aids, dental services and routine foot care. Ambulance transportation is only covered when other modes of transportation would be harmful to the patient. For a non-emergency trip to be covered, the patient must not be able to rise out of bed without assistance, be unable to walk and unable to sit in a chair or wheelchair. Ambulance service that is not an emergency must be certified in advance with a doctor’s written order certifying that the patient meets these criteria.

Preventive care services, checkups and comfort items are for the most part not covered under Medicare. However, certain preventative care services are now covered under Medicare Part B due to laws being passed that specifically include these services. These services include, for Medicare eligible persons, an annual mammogram for women enrolled who are age 40 and older, Pap smears and pelvic exams for beneficiaries considered a high risk following an abnormal Pap smear. A woman not in this group is entitled to a Pap smear and a pelvic exam once every two years. The deductible does not apply to these procedures. Prostate screening for men over age 50 and colorectal cancer screening tests for beneficiaries age 50 or older are also included.

A person who is enrolled under Medicare Part A is assumed to want coverage under Medicare Part B. A person covered under Medicare Part A may decline to be covered under Medicare Part B before the coverage begins or within 2 months after being notified that Medicare Part B coverage has commenced.

Medicare Part B has an annual deductible requirement of at least $147 in 2013. Each year, before Medicare pays anything, the patient must incur medical expenses equal to the deductible, based on Medicare’s approved reasonable charge, not on the provider’s actual charge. In addition, there is a coinsurance amount which the patient must pay. This is equal to 20 percent of the Medicare approved amount.

Most Medicare beneficiaries will pay a $104.90 Part B premium amount each month in 2013. However, there is a Part B premium surcharge for high income individuals and married couples that is based on that person’s or couple’s 2011 adjusted gross income plus tax-exempt income. An individual who in 2011 had annual income greater than $85,000 and married couples who had income in 2011 greater than $170,000 will pay a Part B Medicare premium of $146.90 per month in 2013. An individual with income for 2011 greater than $107,000 and married couples with 2011 income greater than $214,000 will pay a monthly premium of $209.80 in 2013. An individual with annual income in 2011 greater than $160,000 and married couples with an annual income in 2011 greater than $320,000 will pay a monthly premium in 2013 of $272.20 each. Individuals with annual incomes greater than $214,000 and married couples with annual incomes greater than $428,000 in 2011 will pay a monthly premium of $335.70 per month in 2013.

A major problem with Medicare Part B is the difference between the cost of medical items or services, particularly physician’s services, and the Medicare-approved reasonable charge. When an item or service is determined to be covered under Medicare, it is reimbursed at 80 percent of the reasonable charge for the item or service, and the patient is responsible for the remaining 20 percent. Unfortunately, the reasonable charge set by Medicare may often be substantially less than the actual charge. The result of the reasonable-charge reimbursement system is that the Medicare payment, even for items and services covered by Part B, is often insufficient to pay the complete amount of the charge for the service. The patient is thus left with out-of-pocket expenses. However, when a physician accepts Medicare assignment, he or she agrees to accept the Medicare-approved amount as full payment. Medicare will pay 80 percent and the patient is responsible to pay the 20 percent co-payment. When a physician does not accept assignment, the patient is liable for the co-payment plus a balance above the Medicare fee schedule amount. However, under federal law, there is a set limit (limiting charge) that the physician may charge. A physician not accepting assignment for payment of a Medicare claim may submit a balanced bill that does not exceed 115 percent of the Medicare-approved amount. The patient’s Medicare Summary Notice will state the Medicare approved charge for the doctor’s services.

LIFE SITUATION #5

Mary is treated by a doctor who does not accept Medicare assignment. This physician’s actual charge is $100, but the Medicare fee schedule states the allowable charge is only $70. This doctor may charge Mary only 115 percent of the scheduled amount, or $80.50, for this service, since the doctor has not agreed to accept assignment of the Medicare benefit. Mary would be responsible for paying the physician the entire $80.50 and then requesting Medicare to reimburse her $56 ($70 x 80 percent). If the doctor accepted assignment, the doctor would file Mary’s claim and request her to pay $14 ($70 x 20%).

Qualified Medicare Beneficiary

A Qualified Medicare Beneficiary is a person at least 65 years of age or a disabled individual who has a countable income at or lower than the Federal poverty level that is $710 per month in 2013 and countable assets less than $4,000 ($6,000 for a couple). The Medicaid program in the state where the beneficiary resides will pay the Qualified Medicare Beneficiary’s Medicare Part B premium, the Medicare Part A deductibles and the Medicare Part A coinsurance. The Federal statute is referred to as the Qualified Medicare Beneficiary Program.

Specified Low Income Medicare Beneficiary

A Specified Low Income Medicare Beneficiary is a person at least 65 years of age or a disabled individual who has a countable income between 100 and 120 percent of the Federal poverty level and countable assets less than $4,000 ($6,000 for a couple). The Medicaid program in the state where the beneficiary resides pays the Specified Low Income Medicare Beneficiary’s Part B premium. However, the Medicare Part A deductible and the Medicare Part A coinsurance must be paid by the Medicare beneficiary.

Next time, Gregory Gay’s series on Medicare will conclude with a look at Medigap insurance policies, Medicare Part D and the Medicare Advantage. If you would like to read the Florida Senior Legal Guide in its entirety, please visit http://www.seniorlawseries.com. Mr. Gay can be reached at gregg@willtrust.com.

Richard Connolly’s World

Why Everything You Think About Aging May Be Wrong

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature one of Richard’s recommendations with a link to the article.

This week, the article of interest is “Why Everything You Think About Aging May Be Wrong” by Anne Tergesen. It was featured in The Wall Street Journal on November 30, 2014.

Richard’s description is as follows:

Everyone knows that as we age, our minds and bodies decline – and life inevitably becomes less satisfying and enjoyable.

Everyone knows that cognitive decline in inevitable.

Everyone knows that as we get older, we become less productive at work.

Everyone, it seems, is wrong.

Contrary to the stereotype of later life as a time of loneliness, depression and decline, a growing body of scientific research shows that, in many ways, life gets better as we get older.

Click below to see the complete article, which discusses many “common myths” about aging and provides research indicating that they may not necessarily be true. The myths included are:

- Depression is More Prevalent in Old Age

- Cognitive Decline is Inevitable

- Older Workers are Less Productive

- Loneliness is More Likely

- Creativity Declines with Age

- More Exercise is Better

Click here to view the full article.

Thoughtful Corner

Taking Down the Happiness Hurdles

by Thurston Thursday, III

Copyright © 2014 The Thursday Report

Imagine that you are a runner and that you have limited time to run a short distance race. There are some fairly high hurdles placed in front of you. If you try to jump over them, you will most likely trip, skin your knees, and have to get up on the black asphalt to push through to the next one and the next one. If others in the race end up going around the hurdles, they could get to the prizes well before you are even close enough to see them in the distance.

This is what the vast majority of people do with respect to attempting to find happiness; they allow hurdles to be placed in front of them, attempt to jump over the hurdles, and skin their knees in the process. Others view the hurdles differently and simply run by them or take them down in an organized, logical fashion so that they disappear as they proceed through the race.

So go the “happiness hurdles,” those hard-to-jump-over boundaries and obstacles that we so often put in front of ourselves for reasons that are typically beyond our understanding and not in our best interests.

Can you imagine telling a young child that he or she is not allowed to be happy until learning how to tie his or her shoes before being able and trained to do so? Or until accomplishing other not-yet-mastered skills or goals? This will not only rob the child of self-confidence and the joy of learning and achieving, but it will also reduce that child’s learning and achievement rate. Such restrictions would turn an otherwise happy child into a miserable living being.

If you would not do this with your children, why do this to your inner child and to yourself?

How many hurdles have you put up recently with respect to your own happiness and sense of well-being?

Some examples might include:

- I really need a significant other to be happy.

- My significant other forgot our anniversary, so I will be unhappy today and possibly all week. (Let’s ruin the whole anniversary weekend over this and then get into a fight about our parents!)

- I don’t get enough appreciation from my children.

- My son flunked chemistry, and it’s my fault because I should have done more to help him.

- I can’t be happy until my student loans are paid down.

- I need to earn more than my partner to be happy.

- I wish the car that just pulled in wasn’t blocking my beautiful view of the valley and the river.

- I made a goal of finishing these three projects before Tuesday was over, but it is already Wednesday, and I am still working on two of them. I will be unhappy until these are finished.

Why are you treating yourself so ruggedly when, so often, circumstances are not entirely within your control? How do you re-program yourselves to avoid this phenomenon, which will happen over and over again until you get a handle on the situation?

Assuming you do not want to try electric shock therapy or mind-altering and addictive drugs (which would not work!), the answer is to take your time and make reasonable efforts to change your thinking in positive ways. You can be happy if you are taking the right actions to handle situations at hand without reference to whether you are winning the race.

Part of the human experience is that there will always be farther to run, more to achieve, imperfections in what we have put together, and a high price to pay for the lofty goals that we so often set for ourselves.

Nevertheless, we all know people who seem to always be happy and acting positively and effectively, notwithstanding setbacks that do not seem to bother them nearly as much as others. What is their secret?

Appropriate, logical, and positive thinking habits and responses to challenges, goals, and behaviors is clearly the answer.

No one is perfect, and our approaches to handling problems, challenging situations, and helping ourselves and others to enjoy life and work in a positive and successful mode of existence is part of what should be a delightful journey and not a painful process.

Stay tuned for next week’s Thoughtful Corner, where we will discuss overcoming Happiness Hurdles with Happiness Habits and provide you with some exercises to help you get started on replacing obstacles with positive actions.

Humor! (Or Lack Thereof!)

A few months ago, we received the following email from our friend Ted Barrett:

Hey Alan,

To paraphrase from the movie “Mary Poppins”:

There is nothing like a good joke.

And the humor in your Thursday Reports is nothing like a good joke!

However, I’m sure that if I don’t chicken out and keep on reading, I’m bound to find a Colonel of humor in there somewhere.

Ted

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan Gassman will be presenting a 30 minute webinar on PLANNING OPPORTUNITIES FOR SAME SEX COUPLES. Much of the materials presented at this seminar will apply to all couples as well.

Date: Tuesday, December 9, 2014 | 12:30 p.m. and 5:00 p.m.

Location: Online webinar

Additional Information: To register for the 12:30 p.m. webinar please click here. To register for the 5:00 p.m. webinar, please click here.

********************************************************

LIVE CLEARWATER PRESENTATION:

Alan Gassman will be hosting a workshop for lawyers and other professionals who are interested in improving their futures both personally and professionally. Topics to be explored include goal setting, overcoming frustrations, problem solving, and strategies to help attract and retain the type of clients that will help grow your practice.

This workshop will be followed by a tour of the Gassman Law Associates office.

Date: December 14, 2014 | 9:00 a.m. – 3:00 p.m.

Location: 1245 Court Street, Ste 102, Clearwater, FL

Additional Information: For more information, or to register for this free workshop, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will be presenting a 30 minute webinar on LESSONS LEARNED FROM THE HALIFAX CASE

Date: Tuesday, December 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Chris Denicolo will be presenting a webinar on TRUST PLANNING FROM A TO Z for the Florida Institute of CPAs.

Date: January 6, 2015 | 11:00 a.m.

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org.

*******************************************************

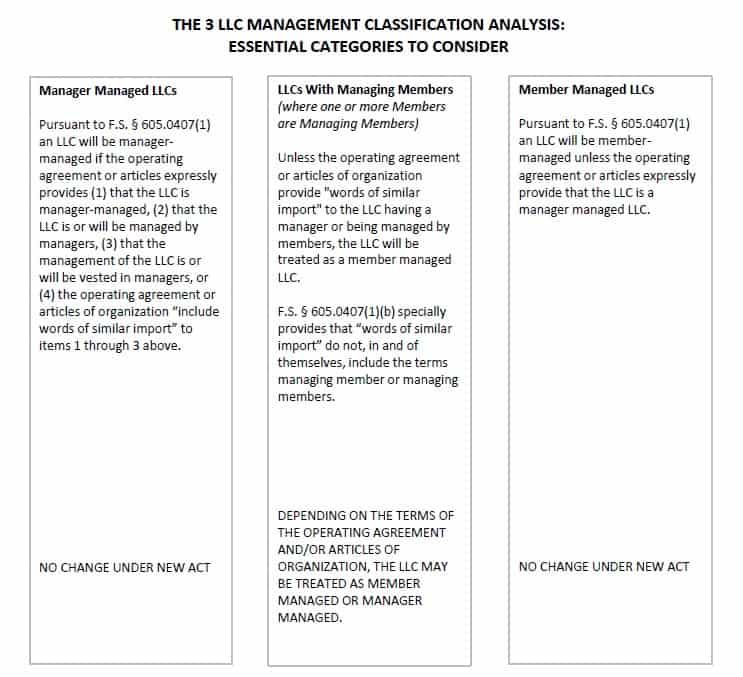

LIVE FORT LAUDERDALE PHYSICIAN LAW CONFERENCE:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Please, please, please, please, please, please consider attending the Florida Bar 2015 Representing the Physician Seminar at the beautiful Renaissance Fort Lauderdale Cruise Port Hotel in Fort Lauderdale on Friday, January 16, 2015.

Start a great weekend there and then work yourself down to South Beach or stay at The Breakers in West Palm.

The topics (and speakers) are unbeatable. The schedule includes:

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here to download the registration package.

********************************************************

LIVE TAMPA PRESENTATION:

Alan Gassman will be speaking at the Tampa Bay Estate Planning Council Dinner Program on the topic of PLANNING WITH RETIREMENT ACCOUNTS.

Date: January 21, 2015 | 5:30 p.m. – 7:30 p.m.; Alan Gassman will be speaking from 6:45 to 7:15.

Location: The Tampa Club, 101 E Kennedy Boulevard, 41st Floor, Tampa, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com

***********************************************************

LIVE NEWPORT BEACH PRESENTATION:

Jerry Hesch will present THE MATHEMATICS OF ESTATE PLANNING at the Society of Trust and Estate Practitioners 4th Annual Institute on Tax, Estate Planning, and the Economy. This conference is a collaboration between STEP Orange County and the University of California, Los Angeles, School of Law.

Professor Hesch’s presentation will make use of the materials that Alan Gassman, Ken Crotty, and Chris Denicolo presented to the 40th Annual Notre Dame Tax & Estate Planning Institute on November 14, 2014.

Date: January 22 – 24, 2015

Location: California Marriott Hotel and Spa at Fashion Island, Newport Beach, CA

Additional Information: For more information, please email agassman@gassmanpa.com or visit http://www.step.org/4th-annual-institute-tax-estate-planning-and-economy.

**************************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: January 31, 2015 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To see the official program for this workshop, please click here.

To register for this program please email agassman@gassmanpa.com.

***********************************************

LIVE ORLANDO PRESENTATION:

THE ADVANCED HEALTH LAW TOPICS AND CERTIFICATION REVIEW 2015

Alan Gassman will speak at The Advanced Health Law Topics and Certification Review 2015. Topic is To Be Announced.

Date: March 6, 2015

Location: Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, FL 32827

Additional Information: For more information, please email agassman@gassmanpa.com.

***********************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Alan Gassman, Jerry Hesch, and Richard Oshins will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins – 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION, AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami, 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

NOTABLE SEMINARS BY OTHERS

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott, 8701 World Center Drive, Orlando, Florida

Additional Information:

Don’t miss Howard M. Zaritsky and Lester B. Law’s January 12th morning discussion of Basis – Banal? Basic? Benign? Bewildering?, which will include mention and some commentary and advice on the use of our JEST trust system. Don’t leave home without it!

For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Speakers include Richard A. Oshins, Melissa Langa, Stephanie Loomis-Price, Steve R. Akers, William R. Lane, and Abigail E. O’Connor. For a full list of speakers and presentation descriptions, please click here. For a complete seminar schedule, please click here.

Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

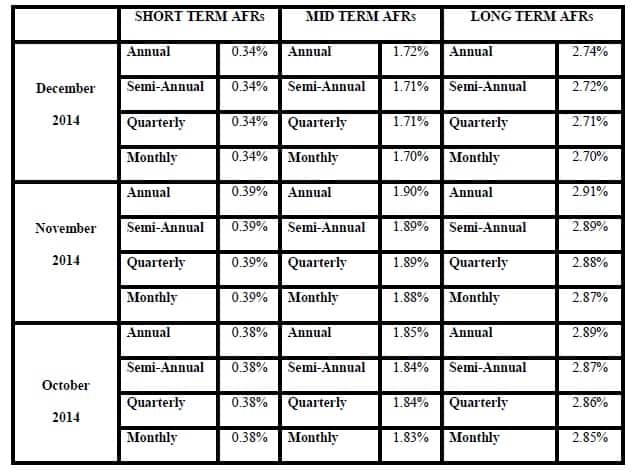

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

The 7520 rate for December is 2.0% and for November was 2.2%.