The Thursday Report – 4.30.15 – April Showers Give the Thursday Report Special Powers

Voluntary Disclosure of Offshore Assets by Alan Gassman, Leslie Share, and Brandon Ketron, Part I

Seminar Spotlight – The Florida Bar 2-Day Asset Protection Program in Miami Next Week

Teaser Points for Richard Oshins’s Ave Maria Presentation: Conventional Wisdom Knocked on its Ear

Greek Tax Amnesty Opportunity Ends May 12th

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits – Review Questions

Richard Connolly’s World – Bar Exam Under Fire & New Rules on Reporting Law School Graduates’ Success

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Voluntary Disclosure of Offshore Assets, Part I

by Alan Gassman, Leslie Share, and Brandon Ketron

“While many of us thought that late offshore trust and investment amnesty and other filing programs would not be seen or heard about because virtually all US taxpayers with these issues came forth under the 2009 and 2011 Offshore Voluntary Disclosure Program (known lovingly by those who have used it as OVDP,) time has shown that a certain small but definite percentage of the population will not come forward unless or until there are family dynamics, required reporting by foreign trust companies or individuals, death, or other circumstances.”

Executive Summary:

Clients have a difficult time understanding the myriad of complicated rules associated with disclosure of offshore assets. We have summarized the current potential vehicles a client in this situation may use to come into compliance with the law. It is also a good refresher on what sort of penalties clients could face if the correct paperwork is not filed.

Generally, there are four options available for a taxpayer who neglected to properly file the required forms to disclose offshore assets. The options are:

- “Quiet” Disclosure

- Delinquent International Information Return Submission Procedures

- Streamlined Filing Compliance Procedures

- Offshore Voluntary Disclosure Program

To be eligible for the IRS Delinquent International Information Return Submission Procedures and the Streamlined Filing Compliance Procedures, the taxpayer must show that the failure to disclose was due to “reasonable cause” or “non-willful” conduct. Acceptance into one of the programs is not automatic. Prior to forgoing the criminal immunity and formal closing agreement offered under the Offshore Voluntary Disclosure Program, the taxpayer should consider the likelihood of an unsuccessful outcome under the other programs and the risk associated with that outcome.

Facts:

What is required to be filed?

Some of the most common filing requirements for offshore assets are: (1) Form 3520 – Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts, (2) Form 3520-A – Annual Information Return of Foreign Trust with US Owner, (3) Form 8938 – Statement of Specified Foreign Financial Assets, (4) Report of Foreign Bank and Financial Accounts (FBAR), (5) Form 5471 – Information Return of US Persons with Respect to Certain Foreign Corporations, and (6) Form 8865 – Return of US Persons with Respect to Certain Foreign Partnerships.

A Form 3520 is required to be filed when a US person (1) creates or transfers money or property to a foreign trust; (2) receives (directly or indirectly) any distributions from a foreign trust or; (3) receives certain gifts or bequests from foreign persons, estates or other entities.

A Form 3520-A is an annual informational return required to be filed by any US person who is treated as an owner of any portion of a foreign trust under the grantor trust rules.

A FBAR is required to be filed if a US person has (1) financial interest or signature authority over one or more foreign financial accounts, and (2) the aggregate value of such accounts exceeded $10,000 at any time during the calendar year.

A Form 8938 is required to be filed by a US person having interests in certain specified foreign financial assets exceeding $50,000 on the last day of the tax year, or $75,000 at any time during the year ($100,000 and $150,000 respectively for taxpayer Married Filing Jointly).

Generally, a Form 5471 is required to be filed by US persons who are officers, directors, or shareholders in certain foreign corporations.[1]

A Form 8865 is required to be filed to report information regarding foreign partnerships controlled by a US person; transfers from a US person to a foreign partnership; or to report acquisitions, dispositions or changes in foreign partnership interests by a US person.

These requirements apply regardless of whether the assets were disclosed on another Form disclosing foreign assets. However, if assets were listed on Form 3520, the instructions for Form 8938 state, “If you reported a specified foreign financial asset on the [Form 3520, Form 5471, Form 8865, or another informational return] for the same tax year, you may not have to report it on Form 8938. However, you must identify the form where you reported the asset by indicating how many forms you filed.”

Penalties Applicable for the Failure to File

The penalties for the failure to file the required informational returns to report foreign assets can be severe. Below is a summary of the possible penalties, but see Options Available to Taxpayer to Correct Failure to File for information on how some or all of these penalties can be avoided.

A. Failure to file FBAR

The failure to file a FBAR can result in a penalty if the IRS determines the failure was not due to reasonable cause. The penalty is $10,000 per violation if the failure to file was non-willful. If the failure to file was willful, then the penalty can be as high as the greater of $100,000 or 50% of the account balance per year.

B. Failure to file Form 8938

The failure to file Form 8938 may carry a penalty of $10,000, with an additional $10,000 added for each month the failure to file continues after the taxpayer is notified of the delinquency up to a maximum of $50,000 per return.

C. Failure to file Form 3520

The failure to file Form 3520 with respect to foreign trusts may result in a penalty the greater of $10,000 or 35% of the gross reportable amount. If the return was required to be filed to report gifts, then the penalty can be 5% of the gift per month up to a maximum penalty of 25% of the gift.

D. Failure to file Form 3520-A

The failure to file Form 3520-A may result in a penalty of the greater of $10,000 or 5% of the gross value of trust assets determined to be owned by a US person.

E. Failure to file Form 5471

The failure to file Form 5471 may result in a penalty of $10,000. An additional $10,000 is added each month the failure continues beginning 90 days after the taxpayer is notified of the failure, up to a maximum of $50,000.

F. Failure to file Form 8865

The failure to file Form 8865 may result in a penalty of $10,000, with an additional $10,000 added each month the failure continues beginning 90 days after the taxpayer is notified of the delinquency, up to a maximum of $50,000. A reduction in the otherwise available foreign tax credit could also be imposed. Additionally, the taxpayer is subject to a penalty of 10% of the value of any unreported transferred property, subject to a $100,000 limit.

G. Fraud Penalty

If the underpayment and non-disclosure is determined to be the result of fraud, the taxpayer is liable for a penalty that is generally equal to 75% of the unpaid tax.

H. Accuracy-Related Penalty

Depending on which component of the accuracy-related penalty is applicable, a taxpayer may be liable for either a 20% penalty or a 40% penalty. This statute reads as follows:

If this section applies to any portion of an underpayment of tax required to be shown on a return, there shall be added to the tax an amount equal to 20 percent of the portion of the underpayment to which this section applies.[2]

In the case of any portion of an underpayment, which is attributable to any undisclosed foreign financial asset understatement, subsection (a) shall be applied with respect to such portion by substituting “40 percent” for “20 percent.”[3]

For example, if a US citizen underpays his or her tax by $20,000, and that underpayment is directly attributable to an undisclosed foreign asset, a penalty of 40% may be assessed in addition to the tax owed. This could bring the total payment to $28,000 ($20,000 + (20,000 x 40%)).

I. Criminal Charges

In addition to owning the tax along with the above mentioned penalties, the taxpayer could be charged with tax evasion, filing a false return, and willfully failing to file a FBAR or filing a false FBAR. These charges could result in jail time and additional monetary fines.

Stay tuned for next week’s Thursday Report where we will discuss options available to correct failure to file.

***************************************************

[1] See, IRS Instructions for Form 5471 for more detail on who must file Form 5471

[2] 26 USC § 6662 (a)

[3] 26 USC § 6662 (j)(3)

Seminar Spotlight

The Florida Bar 2-Day Asset Protection Program

The Florida Bar Continuing Legal Education Committee and Tax Section will present a 2-day Asset Protection Program on May 7th and May 8th, 2015.

This is a first-time two-day program, and attendees can choose to attend one or both days. Day One is a comprehensive Fundamentals Day designed to provide a well-balanced introduction/refresher, and Day Two will be an Advanced Day, well-suited for experienced practitioners and/or anyone who attended the first Fundamentals day.

Every attendee will receive a free course book onsite.

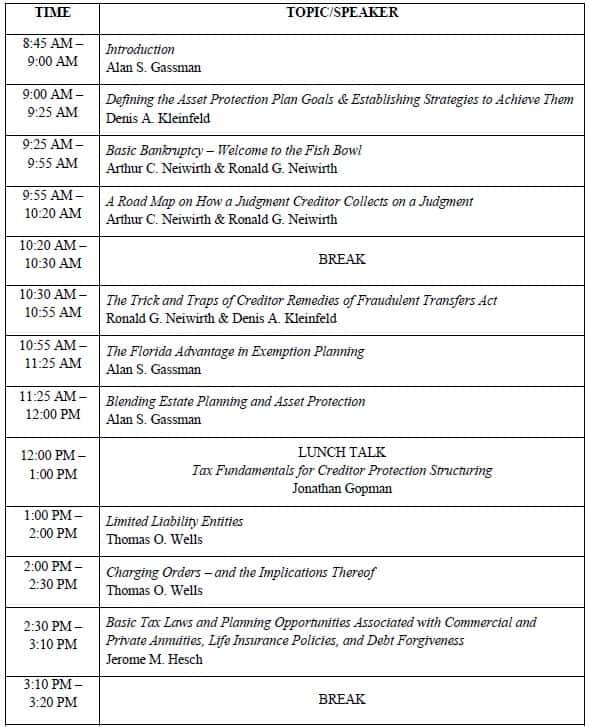

The schedule for Day One of this program is as follows:

DAY 1

ASSET PROTECTION FUNDAMENTALS

The Asset Protection Fundamentals course will qualify for 9.5 hours of CLE credit, including 0.5 hours of Ethics credit. It will also qualify for 9.5 hours of Tax Certification Credit and/or 9.5 hours of Wills & Trust Estates Certification Credit.

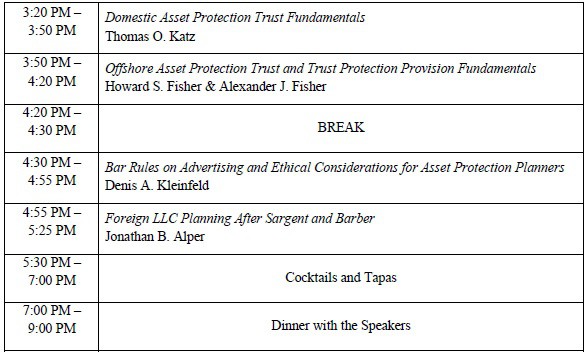

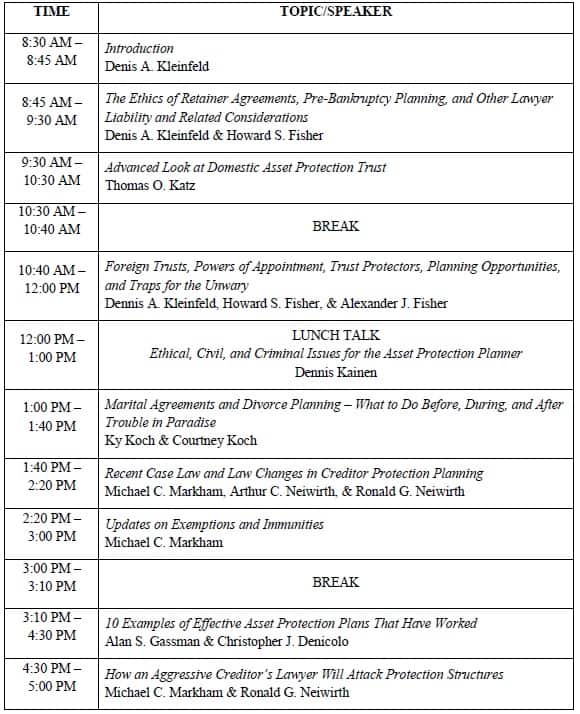

The schedule for Day Two of this program is as follows:

DAY TWO

ADVANCED ASSET PROTECTION

The Advanced Asset Protection course will qualify for 9.5 hours of CLE credit, including 2 hours of Ethics credit. It will also qualify for 9.5 hours of Tax Certification Credit and/or 9.5 hours of Wills & Trust Estates Certification Credit.

The program will take place at the Hyatt Regency Hotel in Miami, Florida. Information for the hotel is as follows:

Hyatt Regency Downtown

400 South East Second Avenue

Miami, FL 33131

1-305-358-1234

www.miamiregency.hyatt.com

To register for this program, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

Teaser Points for Richard Oshins’s Ave Maria Presentation:

Conventional Wisdom Knocked on its Ear

The 2nd Annual Ave Maria School of Law Estate Planning Conference will take place TOMORROW at the Ave Maria School of Law in Naples, Florida.

One of the many great presentations to be featured at the conference is Richard Oshins on Oshins 11 – 11 Innovative Planning Techniques for the Tax and Estate Planning Professional. Richard Oshins is one of the most well-respected and creative estate tax planning authorities.

We asked Richard for some presentation highlights that we might share to promote both his presentation and the conference in general. He provided us with the following:

Here are a few of the highlights:

- Life insurance is often a substantial component of many estate plans. There are some very powerful planning strategies that enable the planner to transfer the life insurance from and to clients with substantial tax benefits;

- Trusts are the most flexible and powerful vehicle that exist in estate and wealth planning. Some new strategies will be discussed that can and should be used to enhance the benefits of trusts. Grantor trusts are especially beneficial, and strategies to use them on a multi-generational basis will be discussed;

- There is a common belief among estate planners that a GRAT is an extremely safe strategy as the rules have been codified. However, there are some meaningful operational risks associated with GRATs that are not given adequate attention by planners and clients;

- There is a common belief that the change in the estate tax exemption from $1 million to $5 million adjusted has substantially eroded the estate planning opportunities for advisors. There are still many estate planning opportunities available, only they are different than they previously were. There is a substantial array of opportunities that the skilled planner should be discussing with their clients that can exploit loopholes and tax reduction techniques that still exist to exploit the internal revenue code to the advantage of clients.

Richard’s Oshins 11 presentation will run from 8:30 AM to 9:30 AM at the 2nd Annual Ave Maria School of Law Estate Planning Conference.

Richard will also be speaking later in the day with Alan Gassman and Jerome Hesch on The Mathematics of Estate Planning. Don’t miss it!

To register for the conference, please click here http://estateplanning.avemarialaw.edu/.

Greek Tax Amnesty Opportunity Ends May 12th

Many of us have clients who have family in Greece, and the Greek economic crisis and lack of historical enforcement of the tax law has fostered a great deal of tax evasion or mistakes about whether to report US based income on tax returns for Greek citizens and residents.

Greece has an amnesty program that waives interest and penalties on unreported income, which ends on May 12th, 2015.

Greece also has a law which will enable the revenue agency to require that all Greek citizens disclose their worldwide assets, but this has not yet been implemented. It is unknown whether Greek citizens who gift assets now to special trusts for their families will have to report these assets if and when the asset reporting rules are released and implemented.

If you do not mind advertising that you actually open The Thursday Report, you could forward this to these clients or others, and they are welcome to subscribe at no charge.

Further information will be provided in subsequent Thursday Reports.

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits – Review Questions

by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron

The rules applicable to retirement plan and IRA distributions, contributions, rollovers, and otherwise can be difficult to understand and complex to implement. The applicable Internal Revenue Code Sections and Treasury Regulations are somewhat complicated and convoluted, and use many technical “terms of art.” This makes dealing with qualified plans cumbersome and difficult for laypersons and planners who are not experienced in this area.

We have attempted to simplify the applicable rules into a digestible format with concise explanations of the applicable rules. We have also prepared charts and explanations to illustrate the key concepts and mechanics of important definitions, rules, and planning strategies.

To see previous editions of this presentation, please click below:

Chapter 1, Chapter 2, Chapter 3, Chapter 4, Chapter 5, Chapter 6, Chapter 7

This week, we are featuring some questions to help you review the materials we’ve discussed in Chapters 1 through 7 of this series.

Answer each of the following questions with TRUE or FALSE, then check your answers below.

- Roth IRAs are not subject to the Required Minimum Distribution rules until the owner of the Roth IRA dies.

- A Traditional IRA cannot roll over tax free to a Roth IRA.

- If a person other than the Plan Participant’s spouse is a beneficiary of the IRA, the Recalculation of Life Expectancy principle will still apply.

- A Conduit Trust must pay all distributions received directly from the IRA/Plan to a Designed Beneficiary upon receipt by the trustee.

- A Plan Participant who has not reached aged 59½ will pay a 10% excise tax on taxable distributions in addition to the normal income tax.

- Required Minimum Distributions (RMDs) are the amounts that must be paid out in a given year under the Applicable Payment Mode, based upon the life expectancy of the Plan Participant or the Designated Beneficiary.

- The date on which lifetime distributions to the Plan Participant must begin is April 1 of the calendar year preceding the calendar year in which the Plan Participant attains the age of 70½.

- A Plan Participant cannot withhold federal income tax from Required Minimum Distributions.

- There is no requirement that Required Minimum Distributions be paid in cash.

- A conversion from a traditional IRA into a Roth IRA for someone under the age of 59½ does not trigger the 10% penalty fee on early withdrawals.

- IRA to HSA Account transfers are always extremely beneficial.

- A taxpayer cannot deduct a loss on the sale of securities if a substantially identical security is repurchased within 30 days after the loss-generating sale.

- The Designated Beneficiary is the person whose life expectancy is used for the purpose of determining the applicable payment mode of the required minimum distributions that will apply to an IRA/Plan.

- The designation date is September 30 of the calendar year following the year of death of the Plan Participant.

- The Designated Beneficiary of an Accumulation Trust, for the purposes of the Required Minimum Distribution rules, is the youngest individual beneficiary of the trust.

- A Conduit Trust can have beneficiaries older than the Designated Beneficiary, Non-Persons as beneficiaries and unlimited power of appointment powers, so long as all distributions from the IRA/Plan to the trust are required to be paid to the Designated Beneficiary upon receipt from the IRA/Plan during his or her lifetime by trust during his or her lifetime.

- Q-TIP Trusts qualify as a Conduit Trust.

- Regarding Q-TIP Trusts, if a surviving spouse’s right to withdraw from the IRA/Plan is restricted, the spouse will not be allowed to rollover the IRA/Plan into his or her own.

For the answers to these questions, please click here.

For an explanation to these questions and more, please review Chapters 1 through 7 using the links provided above.

Richard Connolly’s World

Bar Exam Under Fire & New Rules on

Reporting Law School Graduates’ Success

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the first article of interest is “Bar Exam, the Standard to Become a Lawyer, Comes Under Fire” by Elizabeth Olson. This article was featured in The New York Times on March 19, 2015.

Richard’s description is as follows:

For decades, law school graduates have endured a stressful rite of passage, spending the first 10 weeks after classes end taking cram courses in the arcane details of the law before sitting down for the grueling, days-long bar exam. Those who do not pass cannot practice law, at least in nearly all the states and the District of Columbia that consider the exam the professional standard.

But that standard, so long unquestioned, is facing a new round of scrutiny – not just from the test takers, but from law school deans and some state legal establishments. Some states, including Arizona, Iowa, and New Hampshire, are exploring or have adopted other options, questioning the wisdom of relying on a single written test as the gateway to legal practice.

Please click here to read this article in its entirety.

The second article of interest this week is “Law Schools Face New Rules on Reporting Graduates’ Success” by Jacob Gershman. This article was featured in The Wall Street Journal on March 17, 2015.

Richard’s description is as follows:

US law schools face renewed scrutiny over claims about their ability to find work for their graduates, a crucial selling point amid one of the legal industry’s work-ever job markets.

Some of the schools have been creating temporary jobs for grads by paying nonprofits and others to employ them, a move that, in some cases, has boosted the school’s standings in the much-followed US News & World Report rankings.

Last year, George Washington University Law School reported that 469 out of its 603 graduates in the Class of 2013 had jobs by nine months after graduation. The school sponsored 88 of these jobs, or 19 percent.

A new rule adopted in March by the accrediting arm of the American Bar Association will tighten such claims, giving law schools less credit for jobs that they subsidize.

Please click here to read this article in its entirety.

Humor! (or Lack Thereof!)

by Sigmund Ross

According to Dr. Freud, there is no such thing as an accident. It follows, then, that there is no such thing as an accident attorney. If you think you see an accident attorney, that is just a manifestation of your childish desire for a parental type who will blame someone else for your problems.

******************************************************************************

IN LEGAL NEWS:

Top law firms fight each other over the opportunity to argue the right to gay marriage in front of the Supreme Court. Opposing side represented by an empty space next to a ten foot pole.

Upcoming Seminars and Webinars

LIVE OLDSMAR PRESENTATION:

FICPA SUNCOAST SCRAMBLE GOLF TOURNAMENT

Kenneth J. Crotty and Christopher J. Denicolo will speak at the FICPA Suncoast Scramble Golf Tournament on the topic of MATHEMATICS FOR ESTATE PLANNERS INCLUDING 10 ESTATE PLANNING STRATEGIES NOT TO MISS.

Date: Friday, May 1, 2015 | CPE Presentations from 9:00 AM – 11:30 AM

Location: East Lake Woodlands Country Club | 1055 E Lake Woodlands Parkway, Oldsmar, FL 34677

Additional Information: For more information about registration, sponsorship, or this event, please click here or click here to download the Tournament brochure.

***********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman, Jerry Hesch, and Richard Oshins will present THE MATHEMATICS OF ESTATE PLANNING. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law | 1025 Commons Circle, Naples, Florida

Additional Information: For more information, please click here http://estateplanning.avemarialaw.edu/ or email Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR ASSET PROTECTION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami | 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, and Barry Flagg will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on THE TAX ADVISORS GUIDE TO PERMANENT LIFE INSURANCE AND STRUCTURING TOOLS AND TECHNIQUES.

Date: Tuesday, May 12, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

******************************************************************

LIVE BRADENTON, FLORIDA PRESENTATION

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Tuesday, May 12, 2015 | Time TBA

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE STUART, FLORIDA PRESENTATION

Alan Gassman will be the featured “headline” speaker the Martin County Estate Planning Council Annual Tax and Estate Planning Seminar. He will be doing a three-hour talk on the topics of JESTs, MATHEMATICS FOR ESTATE PLANNERS, AND THE ESTATE PLANNER’S GUIDE TO PLANNING FOR IRA AND PENSION BENEFITS – YES, YOU CAN FINALLY UNDERSTAND THESE RULES!

Date: May 15, 2015 | 8:15 AM – 4:30 PM; Alan Gassman speaks from 9:00 AM to 12:00 PM

Location: Stuart Corinthian Yacht Club | 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will be presenting a free 30-minute webinar on ARBITRATING TRUST AND ESTATES DISPUTES.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many very useful articles thereon.

Date: Tuesday, May 19, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

**************************************************

LIVE MIAMI LAKES WORKSHOP:

Alan Gassman will be speaking at the Miami Lakes Bar Association Luncheon on the topic of ACCELERATING YOUR LAW PRACTICE. This luncheon will qualify for 2 CLE credits.

Date: Thursday, May 21, 2015 | 11:45 am – 1:45 pm

Location: Italy Today | 6743 Main Street, Miami Lakes, FL 33014

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE UNIVERSITY OF FLORIDA PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a five hour workshop on legal practice and making the most of your legal practice to Professor Dennis Calfee’s summer workshop class. Experienced professionals are also welcome to attend by making a $150 donation to the Lind Chair.

Date: To Be Determined

Location: University of Florida | 2500 SW 2nd AE, Gainesville, FL 32611

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE WEBINAR:

Alice Rokahr, President, Trident Trust Company (South Dakota) Inc., and Alan S. Gassman will present a free, 30-minute webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA – DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

Date: June 9, 2015 | 12:30 pm

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or click here to register for this webinar.

**********************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: August 22, 2015 | 9:00 AM – 5:00 PM

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

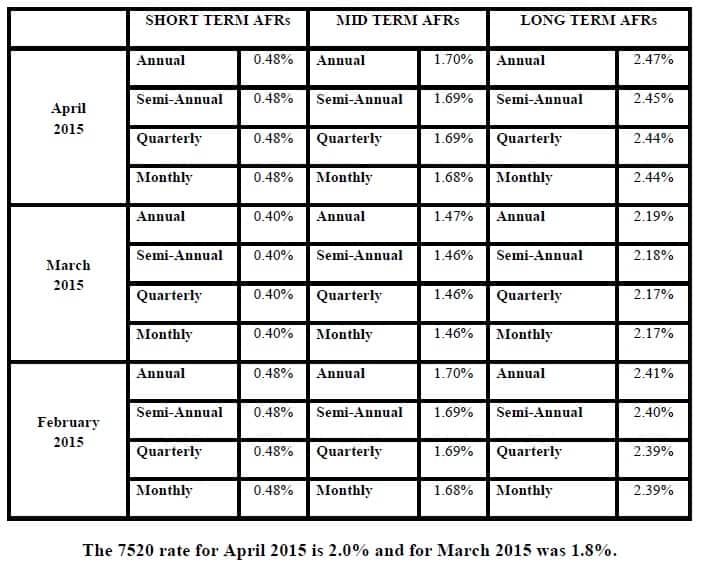

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.