The Thursday Report – 3.19.15 – BP, IRA, “The Look” and the Investigation Process

BP Claims Update: Policy 495 by John Goldsmith and Alan Gassman, with assistance from Brandon Ketron and Noah Fischer, Part I

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron, Part III

The Internal Investigation Process for Healthcare Providers by Stephen H. Siegel, Esquire, and Gabriel Imperato, Esquire

The Problem with “The Look” by Rahma Sultan

Richard Connolly’s World – The Executor’s $1.2 Million Mistake

Thoughtful Corner – Why You Should CC Yourself by Email When You Mail a Letter

The Worst Humor Ever!

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

BP Claims Update: Policy 495, Part I

by John Goldsmith and Alan Gassman

with assistance from Brandon Ketron and Noah Fischer

What is Policy 495?

In a decision last year, the 5th Circuit Court of Appeals held that a claim for losses under the BP Deepwater Horizon Economic & Property Damage Settlement must be supported by Profit and Loss Statements that sufficiently match revenues and expenses. Policy 495, created by BP Claims’ Administrator Patrick Juneau, is an 88 page “solution” to this problem.

Policy 495 attempts to precisely measure losses associated with the oil spill by treating Profit and Loss Statements in claims made by cash-basis businesses more like Profit and Loss Statements in accrual basis accounting. In cash-basis accounting, revenues and expenses are recorded when cash changes hands as opposed to when they actually occur; this leads to unmatched revenues and expense. Policy 495’s goal is to match revenue and expenses by smoothing out the impact of revenue spikes, and variable and occasional expenses, which can distort the monthly accounting of a cash-basis business. Variable expenses change according to sales in a given period, while occasional expenses arise as a result of a change in business environment, such as an oil spill.

When revenues and expenses do not match, the claims’ accountant adjusts the accounting records so that a more “realistic” measure of loss is determined. As a result, your initial estimated compensation may change, requiring additional time to process and receive the claim. In reality, it is generally making most claims lower or eliminating them entirely, but in rare instances, it is actually helping claims.

The original Settlement Agreement allowed alleged victims to base claims on any three-month post-spill time frame they chose. Policy 495 now allocates those occasional expenses across the fiscal year by weight in order to show the monthly variation in a business’ revenue. The policy also establishes additional hurdles to businesses using cash-basis accounting by requiring them to change their accounting method so that revenues get matched with the expenses incurred in earning them.

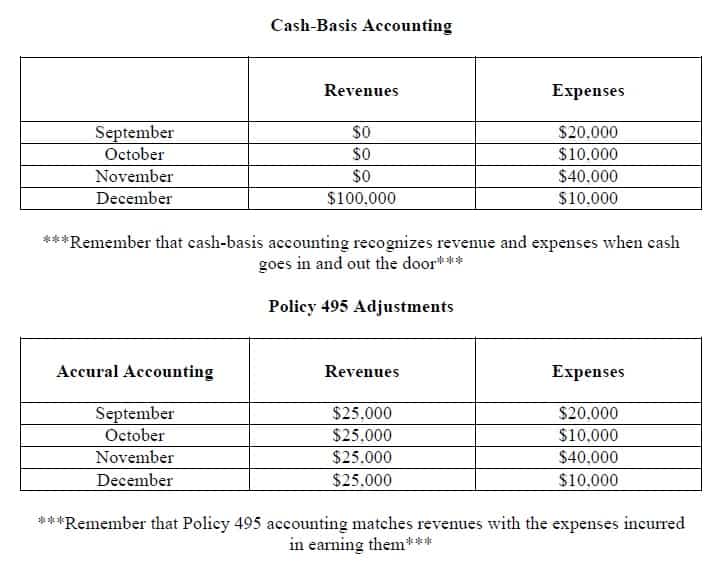

The following is a basic example of how Policy 495 may be applied:

A law firm operating on a contingent-fee would be required to file a claim that allocates the amount of the fee proportionately across the life of the case instead of in the month it is received.

Linh owns a boutique law firm and uses cash-basis accounting. Her business was affected by BP’s oil spill, so she is planning on filing a claim. During the applicable time period, Linh was in the middle of a contingent fee case which was finally settled in December. The settlement provided her with attorney’s fees of $100,000 which she received in December. The revenues and expenses as recorded are shown below, followed by the adjustment that would have to be made under Policy 495.

When viewing the revenues and expenses in charts, it is easy to see why claimants are distraught about their cash-basis businesses’ income being “smoothed over” when switching to accrual basis accounting. In a small amount of cases, Policy 495 has helped businesses receive a larger claim, but “smoothing” has worked in BP’s favor for the far majority of claims.

More on Policy 495

Policy 495 contains seven trigger events that a claim administrator uses to determine if a claim is sufficiently matched. If any of the triggers are not tripped, the claim is presumed to be sufficiently matched; however, if any of the triggers are flipped, the claim will be subject to further scrutiny. The seven trigger events used to analyze profit and loss statements submitted by a claimant are as follows:

- Negative total revenue is recorded for any month included within the Benchmark Year(s), Compensation Year, or 2011.

- Total revenue recorded in any month included in the Benchmark Year(s), Compensation Year, or 2011 exceeds 20% of the claimant’s annual revenue for the year which includes that month.

- The monthly profit and loss statements or other documentation submitted shows that the claimant’s business experienced a period of dormancy during the Benchmark Year(s), Compensation Year, or 2011.

- Total variable expenses when summed up are negative for any month within the Benchmark Year(s) or Compensation Year.

- Total variable expenses for any month within the Benchmark Year(s) or Compensation Year exceed 25% of the claimant’s annual variable expense for the year which includes that month.

- Variable margin percentages when compared between any two months included within the Benchmark Year(s) and Compensation Year vary by more than 50 percentage points.

- In any given month within the Benchmark Year(s) or Compensation Year, the variance between that month’s percentage of annual revenues as compared to that same month’s percentage of annual variable expenses exceeds 8 percentage points.

Benchmark Period: The Pre-Deepwater Horizon Spill time period that the claimant chooses as the baseline for measuring its historical financial performance. The claimant can select among the following Benchmark Periods: 2009, the average of 2008-2009, or the average of 2007-2009.

Compensation Period: Selected by the Claimant to include three or more consecutive months between May and December 2010.[1]

The claim accountants must exercise their professional judgment after the trigger event has occurred in order to determine the matched or unmatched status of the profit and loss statements. It is likely that a trigger will be tripped because they are overly inclusive and are set up to encompass the majority of claims. If the claim accountant uses their professional judgment, claims based on an accrual method of accounting should pass as sufficiently matched because the accrual method records income when earned and expenses when incurred, regardless of when payments are made or received. Judge Clement strengthens this stance by stating “the parties apparently agree that matching is required and occurring with respect to the vast majority of accrual basis claims.”[2] Unfortunately, claim administrators have given little deference to accrual accounting based claims based on the fact that as of December 2014, close to 90% of all claims have been deemed “unmatched.”[3] A quote from Tom Young’s article Cleared by SCOTUS, Audit; Juneau & Judge Barbier Should Revisit BP Matching Policy 495 sums up how bizarre this really is:

Fortune 500 businesses, publicly traded companies and entities keeping their books as per Generally Accepted Accounting Principles (GAAP) are now being deemed deficient under the Settlement Program’s matching protocol. Wall Street would likely be quite surprised to hear that the largest and most sophisticated companies in the world are misstating their earnings according to the Claims Administration’s vendors.

Accrual based accounting systems claims should be classified as being matched but instead are subject to adjustments under Policy 495, which strikes the authors as odd due to the fact that the main principle behind accrual accounting is “matching.”

Next week, we will discuss the seven methodologies under Policy 495 and provide details on how Policy 495 applies to claimants whose industry/business falls into one of the more difficult categories for matching revenues with expenses. This includes industries such as non-profits, retail, and medical practices.

John Goldsmith recently appeared on a webinar with Alan Gassman to discuss the claims filing deadline and the various industries impacted by the accrual requirements.

This webinar can be viewed by clicking here.

*******************************************************

[1] http://blogs.reuters.com/alison-frankel/files/2014/05/bp-policy495.pdf

[2] October 2, 2013 Opinion in 13-30315 at 17 (emphasis added)

[3] Young, Tom, Cleared by SCOTUS, Audit; Juneau & Judge Barbier Should Revisit BP Matching Policy 495 www.legalexaminer.com. Claris Law, January 19, 2015. February 27, 2015.

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits – Part III

by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron

The rules applicable to retirement plan and IRA distributions, contributions, rollovers, and otherwise can be difficult to understand and complex to implement. The applicable Internal Revenue Code Sections and Treasury Regulations are somewhat complicated and convoluted, and use many technical “terms of art.” This makes dealing with qualified plans cumbersome and difficult for laypersons and planners who are not experienced in this area.

We have attempted to simplify the applicable rules into a digestible format with concise explanations of the applicable rules. We have also prepared charts and explanations to illustrate the key concepts and mechanics of important definitions, rules, and planning strategies.

The Thursday Report proudly will provide a multi-part series to exhibit our materials and charts, and we hope that you enjoy this series as much as we did in putting it together.

To see Chapter 1 of this presentation, please click here.

To see Chapter 2 of this presentation, please click here.

IRA SERIES CHAPTER 3

CRUCIAL DEFINITIONS AND RULES (Part One):

1.) 10% Excise Tax. A Plan Participant who has not reached age 59 ½ will pay a 10% excise tax on taxable distributions (in addition to the normal income tax) unless one of the below exceptions from Internal Revenue Code Section 72(t)(2) applies:

- A distribution for the payment of certain higher education expenses.

- A distribution of up to $10,000 to fund the purchase of a primary residence for a first-time home buyer.

- Distributions for certain medical expenses.

- Distributions from retirement plans to individuals called to active duty.

- The Plan Participant is disabled.4

- Annuitized IRA annuity distributions – part of a series of substantially equal annual or more frequent payments made over the life expectancy of the Plan Participant, or over the joint life expectancy of the Plan Participant and his or her Designated Beneficiary. Thus, an annuitized IRA annuity will qualify under this exception.

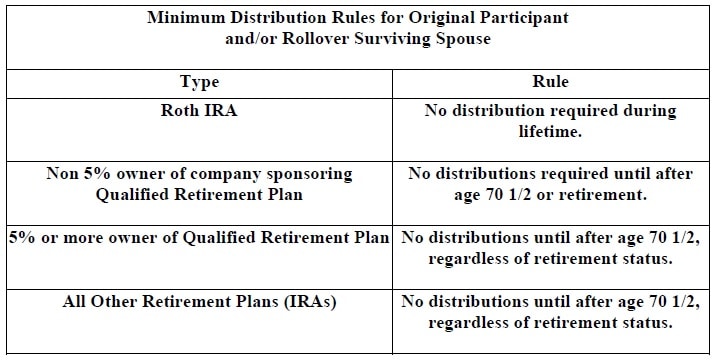

2.) Required Minimum Distributions or “RMDs.” The amounts which must be paid out in a given year under the Applicable Payment Mode, based upon the life expectancy of the Plan Participant or the Designed Beneficiary. The Applicable Payment Mode also depends upon whether the IRA/Plan names the Plan Participant’s Spouse as the sole beneficiary of the IRA/Plan after the death of the Plan Participant. The majority of plans cannot be aggregated together to satisfy the Required Minimum Distribution Rules. Below (Illustration 2.3) is a chart that summarizes the aggregation rules for Required Minimum Distributions.

Illustration 2.3

3.) Required Beginning Date or “RBD.” The date on which lifetime distributions to the Plan Participant from the Plan must begin; this date is April 1 of the calendar year following the later of (a) the calendar year in which the Plan Participant attains the age of 70 ½; or (b) the calendar year in which a non-shareholder Plan Participant retires from being employed by the company which maintains a qualified retirement plan as to such plan.

Illustration 2.4

NOTE: “Age 70 ½” means the April 1st of the calendar year following age 70 ½.

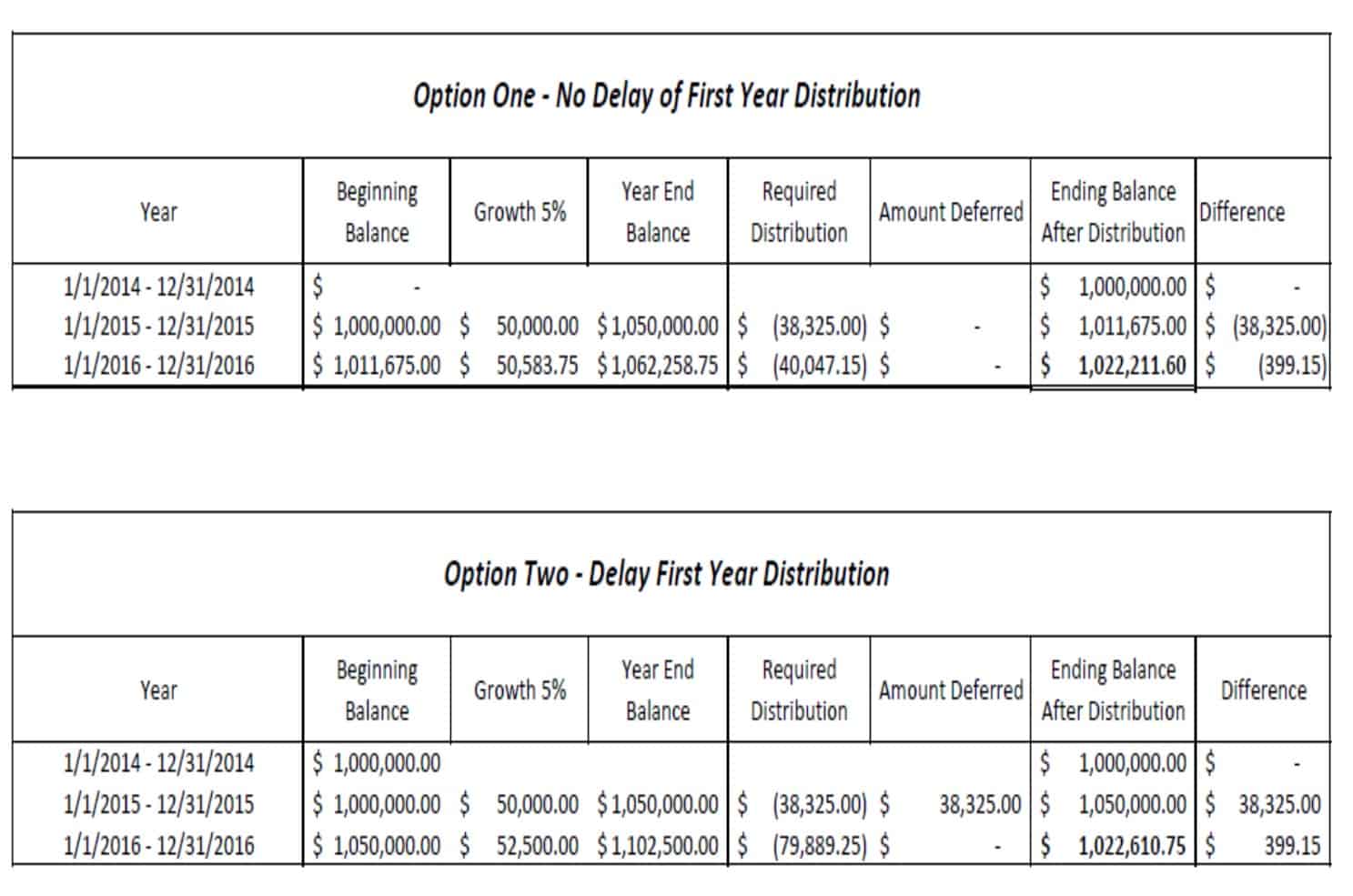

4.) 70 ½ First Year Delay Right. A Plan Participant who has reached the age of 70 ½ can take some or all of the first year Required Minimum Distributions on any day or days during the calendar year in which age 70 ½ is reached, or by April 1st of the following calendar year. Therefore, the first two annual Required Minimum Distributions could be taken in the calendar year following when the Plan Participant has reached age 70 ½ (by April 1st as to payments required for the first year, and by December 31st as to the payments required for the second year.)The Plan Participant should consult with a tax advisor after reaching the age 70 ½ to determine whether the “first year required payment” should be deferred until the following year, based upon the expected tax bracket or rates of asset growth applicable to the Plan Participant.

If the Plan Participant is going to be in the highest tax bracket in both years, then it most likely makes sense to defer all of the first year Required Minimum Distribution until the second year. If the Plan Participant is not in the highest tax bracket, then it makes sense to spreadsheet the expected tax liability for the two years, while applying a time value of money adjustment for deferral, in order to determine how to best apportion the first year payment.

EXAMPLE (see Illustration 2.5 below) – Claire turns 70 ½ on May 1, 2015, and pursuant to the Minimum Distribution Requirement Table set forth above, has a Required Minimum Distribution of 3.65% of the account balance that must be taken prior to April 1st of 2016 and a 3.77% distribution that must be taken prior to December 31st of 2016. Claire can pay the above percentages in 2015 or 2016, or she may elect to make a 3.65% payment of the 2014 account balance and a 3.77% payment of the 2015 account balance, both in 2016. The amount that would have been paid out in 2015 does not reduce the balance of the amount held in the plan that is used to determine the 2016 Required Minimum Distribution amount. For example, if the account is worth $1,00,000 as of December 31, 2014, and grows by 5.00% during the subsequent two years, then Claire could have distributed 3.65% ($38,325.00) in 2015 and 3.77% ($40,047.15) in year 2016 for a total of $78,372.15. If Claire waits until 2016 to satisfy both years, then the total amount paid will be $79,889.25.

Illustration 2.5

Illustration 2.6

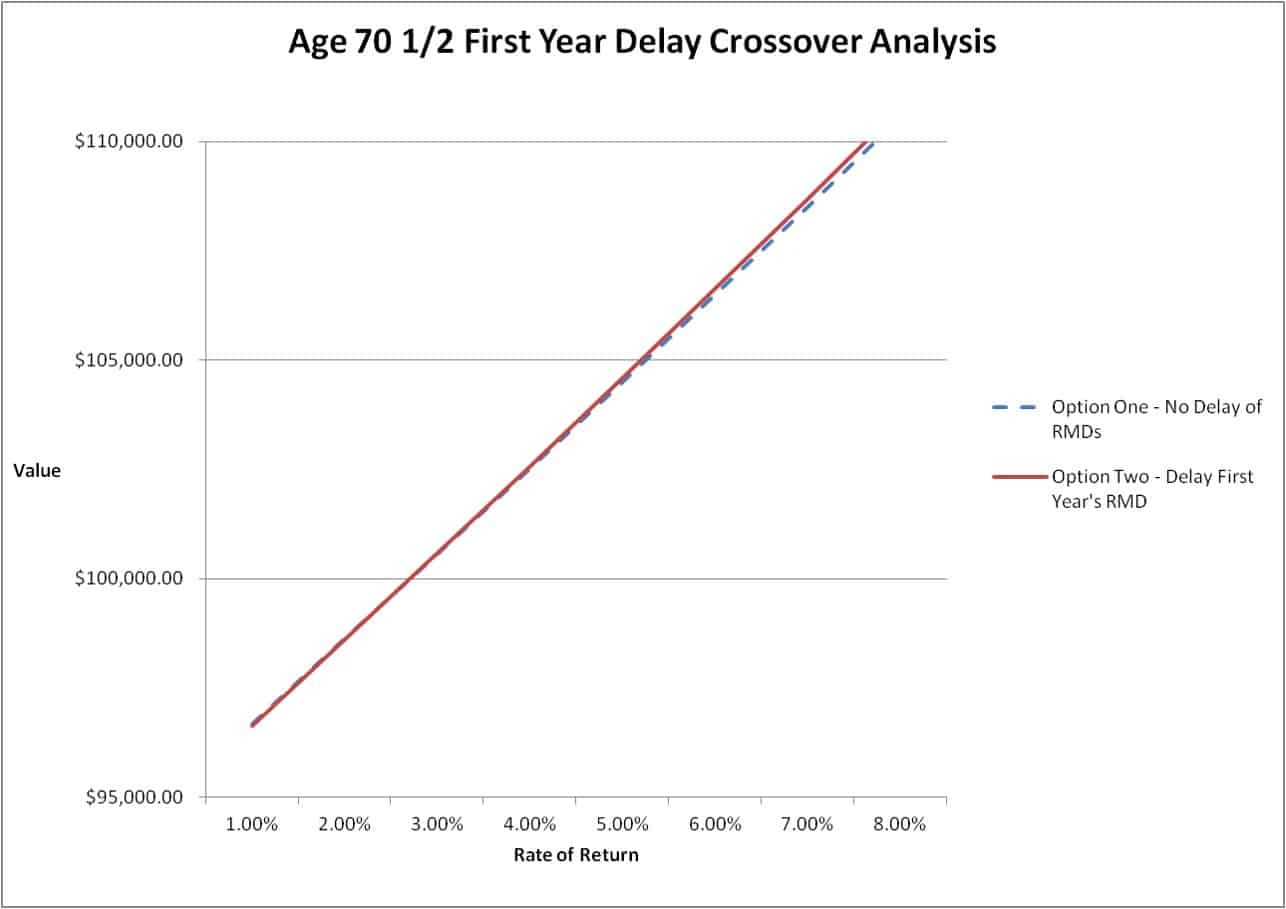

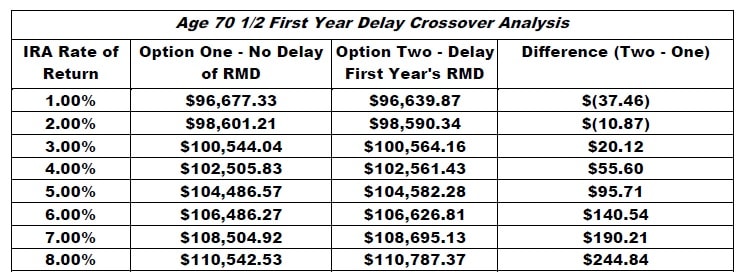

5.) Age 70 ½ First Year Delay Crossover Analysis. What after tax rate of return on investments would a hypothetical 43.4% tax bracket IRA owner need to earn to make it worthwhile to delay taking the first year minimum distribution, after accounting for the excess amount that has to be paid out (but later) if the first year payment is moved from December 31st of the year after turning 70 ½ to April 1st of the second year after turning 70 ½?Based upon the following (Illustrations 2.7 & 2.8), we believe that the rate of return is approximately 2.39%. A return below this level would not generate enough tax-deferred growth to offset the additional tax owed in the second year.

Illustration 2.7

Illustration 2.8

6.) Other Considerations in Delaying the First Year’s Minimum Distribution.

- Social Security Benefits – Social security benefits become taxable if “provisional income” exceeds a certain amount. Provisional income is calculated by making certain adjustments from the taxpayer’s gross income. Distributions from retirement plans count for the purpose of determining if tax is owed on Social Security Benefits and are considered as part of provisional income. Therefore, the effect on the taxability of social security payments should be considered in deciding when to take the first year’s required minimum distribution.

- Audit Risk – The IRS is currently in the middle of a major initiative to crack down on Plan/Participants who do not distribute their required minimum distributions. If a taxpayer decides to delay the first year’s required minimum distribution, he or she will check the box that indicates to the IRS that the Plan/Participant is over the age of 70 ½ and distributions are required; however, the taxpayer will report no distribution and have no 1099-R on file. This could raise a red flag even though the taxpayer has not done anything wrong.

- Avoiding the Confusion – As discussed above, the two RMDs will be computed using different account balances, different divisors, and have different deadlines. The simplest option is to just take the entire first year’s Required Minimum distributions on or before December 31st in the year the Plan/Participant turns age 70 ½.

Stay tuned next week for Part IV of “Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits.”

****************************************

4 An individual shall be considered to be disabled if he is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or to be of long-continued and indefinite duration. An individual shall not be considered to be disabled unless he furnishes proof of the existence thereof in such form and manner as the Secretary may require. § 72 (t)(2)(A)(iii)

The Internal Investigation Process for Healthcare Providers

by Stephen H. Siegel, Esquire, and Gabriel Imperato, Esquire

Stephen H. Siegel received his Juris Doctor from the Georgetown University Law Center in Washington, D.C. He is Board Certified in Health Law by the Florida Bar and has been Certified in Healthcare Compliance by the Health Care Compliance Association. With 30 years of health law experience, Mr. Siegel is currently with Broad and Cassel, where he represents a wide range of health care providers and suppliers and helps clients navigate the changes in the health care industry that are the result of the Affordable Care Act and HIPAA-HITECH. Mr. Siegel can be reached at shsiegel@broadandcassel.com.

Gabriel L. Imperato received his Juris Doctor from De Paul University College of Law. He is Board Certified in Health Law by the Florida Bar and has been Certified in Health Care Compliance by the Heath Care Compliance Association. Mr. Imperato is the Managing Partner of the Fort Lauderdale office of Broad and Cassel and serves on the Firm’s Executive Committee. His personal practice includes representing individuals and organizations accused of health care fraud and assisting health care organizations with corporate governance and compliance matters. Mr. Imperato can be reached at gimperato@broadandcassel.com.

Healthcare providers and vendors who provide items and services to providers have many reasons to carefully evaluate their legal and financial risk. One reason might involve learning that the organization is being investigated by the federal government (for example, the OIG, CMS, or FBI). Alternatively, a staff member or vendor may tell the owner about questions regarding the documentation supporting the business’ billings. The provider/vendor needs to investigate the allegations, evaluate the legal and financial risk, and take appropriate corrective action; otherwise, the risk of facing significant administrative, civil, or criminal sanctions can become very real.

Many organizations do not see a value in or have the resources to conduct an internal investigation and resist doing so. Conducting an internal investigation is sometimes viewed as an admission that something is “wrong” and there is a “problem.” The obligation to and cost of fixing the “problem,” both financial and reputational to the organization and senior management, is another concern. Frequently, it also is difficult to demonstrate how internal investigations contribute to the “bottom line.”

Every Medicare or Medicaid provider is expected to implement and maintain a compliance program that satisfies all 7 elements set out in the Federal Sentencing Guidelines. How sophisticated a practice’s compliance plan needs to be and the resources devoted to it should be a reflection of the size of the organization. Significantly, in order to satisfy at least 4 of the elements, a provider/vendor needs to be able to conduct effective internal investigations.

Although every internal investigation is different, there are common elements. Specifically, determining (i) the facts and identifying the associated risks; (ii) what happened and who was involved; and (iii) what needs to be done to rectify the situation.

In many situations, there is no realistic alternative to conducting an internal investigation. Healthcare providers and vendors cannot safely disregard allegations involving, for example, receipt of incorrect payments from Medicare or involvement in an arrangement that violates the Stark Law. There is an obligation to institute an internal investigation in order to determine the truth of the matter and take appropriate corrective action, including repaying Medicare. To make that obligation clear, a provider must repay any “known overpayment” to Medicare, usually within 60 days of discovery. Otherwise, the organization may become a defendant in a lawsuit brought by either the government or a “Whistleblower” under the Federal False Claims Act, where penalties are as much as treble damages plus $11,000 per claim, and possible exclusion from the Federal health care programs.

An effective internal investigation requires identifying the individuals (staff and/or outsiders) who have the needed expertise. Whether to bring in outside legal counsel, thereby potentially having the ability to conduct the investigation under the attorney-client communications privilege, is an important issue that should be addressed at the planning stage. The ability to assert this privilege may become critical in the event of future litigation or settlement negotiations.

After determining the facts and establishing responsibility, an internal investigation’s findings should provide the business’ senior managers the information needed to understand and weigh the risks, decide further actions, and oversee the development and implementation of appropriate corrective actions. For example, the organization may develop and implement new policies and procedures, terminate/add/re-train personnel, implement or expand staff training, engage consultants, and/or take advantage of the government’s various voluntary disclosure protocols.

Today, every healthcare provider and vendor should anticipate that it will need to conduct multiple internal investigations. If the business does not have the resources internally (and many do not), it should be prepared to look for the expertise outside. While the internal investigation process is not desirable, pleasant, or inexpensive, in the long run, a provider or vendor that finds and fixes its problems itself is going to be better off than one that ignores the problems and acts like an ostrich until forced to do so by either a Whistleblower and/or the government.

The Problem with “The Look”

by Rahma Sultan

Rahma Sultan is in her 2nd year at Stetson University College of Law where she is a candidate for the Social Justice Advocacy Certificate. She hopes to pursue a career in civil litigation upon graduation.

Abercrombie and Fitch is a popular, preppy, teen retail store. They are being sued by the Equal Employment Opportunity Commission (EEOC) on behalf of Abercrombie applicant Samantha Elauf for basing its hiring practices on religious discrimination.

In 2008, when Elauf was 17 years old, she applied for a job at an Abercrombie Kids store in Tulsa, Oklahoma. She was interviewed for the position by Heather Cooke, an assistant manager at the store. Elauf was given a high score for the interview, and Cooke recommended her to be hired, but Cooke advised her superiors (the ones that make the final hiring decisions) that Elauf wore a headscarf, which she assumed was for religious purposes. At the interview, Eluaf wore a black headscarf, which is apparently a big no-no for Abercrombie. The superiors, upon hearing this, advised Cooke not to hire Elauf.

The retailer told the EEOC that “under The Look Policy, [sales] associates must wear clothing that is consistent with the Abercrombie brand. Associates cannot wear hats or other coverings, and they cannot wear clothes that are the color black.”

Abercrombie describes its style of clothing as “All-American” and they go on to explain that America is a diverse place and no one will be discriminated against based on race, religion, ethnic origin, etc. Abercrombie has a very detailed and strict policy on how its employees should dress. The employee handbook covers everything from nail polish to jewelry to hair color to how to style clothing and more. Abercrombie strictly enforces its “Look Policy,” but there are circumstances where Abercrombie and Fitch will make an exception. For example, “head coverings, including baseball caps, are not permitted. For certain purposes, such as religion or disability, however, associates may be permitted to wear appropriate head coverings.”

This exception was put into place after Abercrombie settled a similar lawsuit with one of its former employees, Hani Khan. Khan worked at Hollister (another retail store owned by Abercrombie) in their stockroom for about four months. During a visit from the district manager, Khan was asked to remove her headscarf because it did not fit the company’s “Look Policy.” When she refused to remove the scarf, she was suspended and then ultimately terminated.

The Supreme Court has two options in this case. Employers will either be granted the discretion to silently stereotype people and base their hiring practices off of the way a person looks and dresses, or the employer can simply ask the employee or applicant why they wear a headscarf, turban, or yarmulke and whether or not they would seek a religious accommodation. The latter will be the result if Elauf and the EEOC prevail in this case.

While it may be an awkward (and perhaps unnecessary, in most instances) conversation to have with potential employees, the second option addresses the issue head-on. If Abercrombie really believes in the “All-American style,” the company should have no problem hiring anyone based on appearance.

On the other hand, opponents might argue, is it really so bad that Abercrombie has a “Look Policy”? As a clothing store, does it not have a right to require its employees to dress a certain way in order to promote its brand?

We will find out the answer in June! The Supreme Court is expected to make its ruling on this matter by the end of its term.

Richard Connolly’s World

The Executor’s $1.2 Million Mistake

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the article of interest is “The Executor’s $1.2 Million Mistake” by Ashlea Ebeling. It was featured on Forbes.com on March 4, 2015.

Richard’s description is as follows:

Here’s a tale of caution about being an executor, the person you appoint in a will to oversee your estate after your death.

The cast of the story includes a 73-year-old high-school-educated homemaker named executor of a nonagenarian cousin’s will; an attorney who was secretly battling brain cancer; seven distant relatives; and three charities all due a piece of a $12.5 million estate, and an Internal Revenue Service bill for $1.2 million in penalties and interest for failure to file an estate tax return and pay taxes on time levied on the estate.

In an appeal to the US Court of Appeals for the Sixth Circuit filed in February, the executor is trying to recover the $1.2 million. The question at hand: was her failure to file the return and pay the tax on time due to reasonable cause and not willful neglect?

The details might make you think twice about who you appoint as executor of your will – or whether you agree to take on the role for a friend or relative.

Please click here to read this article in its entirety.

Thoughtful Corner

Why You Should CC Yourself by Email When You Mail a Letter

Some clients request that correspondence and documentation not be emailed to them, or they do not have an email address at all. This is fine, but how will your staff find this correspondence later if they are trained to rely upon email searches to recover things? What if you need an extra copy down the line and want to see exactly what was sent to the client? How will you verify that the letter has actually gone out?

The simple solution is to have your assistant always have you listed as a carbon copy (“CC”) party to each letter. Have this “CC” go via email with your email address. Then, when the correspondence is ready to be sent, you will be emailed a copy, and everyone will be able to both verify that the correspondence was sent to the client and be able to find the correspondence later, if necessary.

If you simply save a copy of the correspondence to the client’s computer directory, you will not necessarily be able to confirm later that the correspondence was actually sent, but if you receive the correspondence via a “CC” in your email inbox, then you know the client has received the correspondence, too.

The alternative is to utilize the blind carbon copy (“BCC”) function to implement this practice. We do this for each letter – whether it is going to the client by email or not – so correspondence can always be easily tracked and substantiated.

Speaking of the “BCC” feature, however, be careful when you send an email to someone and “BCC” someone else!

If the person receiving the “BCC” hits “Reply All” and transmits a message, then the person or people who received the original email will know there was a “BCC” included with the message. For instance, say you send an email to Person A and Person B. You also include on this email a “BCC” to Person C. If Person A or Person B hits “Reply All,” their message will not be transmitted to Person C, and Person C will not show as a recipient anywhere within the transmission. However, if Person C hits “Reply All,” everyone will receive their message, and therefore, Person A and Person B will know you included a “BCC” on the original email.

This could set your relationship back to 44 BC, which is when Caesar was killed by Marcus Brutus and 59 co-conspirators adjacent to the Theatre of Pompey on the 15th day of March after it was determined that his emperor malpractice policy did not have sufficient limits of liability to cause a trial to be worthwhile. Salad dressing has not been the same since.

The Worst Humor Ever!

Upcoming Seminars and Webinars

LIVE WEBINAR:

Alan S. Gassman, Christopher J. Denicolo, and Edwin P. Marrow, III will present a 90-minute Strafford Publications, Inc. webinar entitled STRUCTURING JOINT EXEMPT STEP-UP TRUSTS: EVOLVING TOOL TO MAXIMIZE STEP-UP IN BASIS.

In an environment wherein the focus is shifting toward maximizing income tax basis step-up, counsel must be knowledgeable of all tools necessary to reach this goal. One tool that is beneficial for preserving both the inheritance tax exemption and basis step-up is the joint exempt step-up trust (JEST).

This panel will review questions such as:

- What are the best practices for structuring a JEST?

- What drafting techniques must be implemented to maximize basis step-up at both the first-to-die and surviving spouse’s deaths?

- What is the IRS guidance on this tool offered through the Technical Advice Memorandum and Private Letter Rulings?

- Under what circumstances is the JEST most appropriate?

Date: Tuesday, March 24, 2015 | 1:00 PM – 2:30 PM

Location: Online Webinar

Additional Information: For more information or to register, please click here. You may also email Alan Gassman at agassman@gassmanpa.com.

***************************************************

LIVE WEBINAR:

Alan Gassman and Barry Flagg, CPF, CLU, ChFC, GFS, of Veralytic will present a 30-minute webinar on COMPARING THE FINANCIAL STRENGTH AND RISKS ASSOCIATED WITH DIFFERENT LIFE INSURANCE CARRIERS.

Date: March 31, 2015 | 5:00 PM

Location: Online webinar

Additional Information: To register, please click here or email Alan Gassman at agassman@gassmanpa.com for more information.

*******************************************************

LIVE WEBINAR:

Alan Gassman and Juan Antunez will be presenting a 30-minute webinar on ARBITRATING TRUSTS AND ESTATES DISPUTES.

Date: Tuesday, April 14, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman, Kenneth Crotty, and Christopher Denicolo will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on WHY FLORIDA IS DIFFERENT – IMPORTANT THINGS THAT ESTATE AND TAX PLANNING PROFESSIONALS NEED TO KNOW.

Date: Thursday, April 16, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY – PART II.

This webinar is a continuation of the How to Handle Stressful Matters in an Ethical Way webinar that was presented by Dr. Rao and Alan Gassman on February 19, 2015. This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced.

See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: April 21, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please click here to register or email Alan Gassman at agassman@gassmanpa.com for more information.

***************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Kenneth Crotty, and Christopher Denicolo will present a 90-minute webinar for Bloomberg BNA Tax & Accounting on MATHEMATHICSLAND FOR ESTATE PLANNERS.

This webinar includes over 30 interactive spreadsheets and explanatory tools that you need to know how to use to best serve your clients!

Date: Monday, April 27, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE OLDSMAR PRESENTATION:

FICPA SUNCOAST SCRAMBLE GOLF TOURNAMENT

Kenneth J. Crotty and Christopher J. Denicolo will speak at the FICPA Suncoast Scramble Golf Tournament on the topic of MATHEMATICS FOR ESTATE PLANNERS INCLUDING 10 ESTATE PLANNING STRATEGIES NOT TO MISS.

Date: Friday, May 1, 2015 | CPE Presentations from 9:00 AM – 11:30 AM

Location: East Lake Woodlands Country Club | 1055 E Lake Woodlands Parkway, Oldsmar, FL 34677

Additional Information: For more information about registration, sponsorship, or this event, please click here or click here to download the Tournament brochure.

***********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman, Jerry Hesch, and Richard Oshins will present THE MATHEMATICS OF ESTATE PLANNING. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law | 1025 Commons Circle, Naples, Florida

Additional Information: For more information, please click here or email Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami | 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To pre-register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, and Barry Flagg will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on THE TAX ADVISORS GUIDE TO PERMANENT LIFE INSURANCE AND STRUCTURING TOOLS AND TECHNIQUES.

Date: Tuesday, May 12, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

******************************************************************

LIVE BRADENTON, FLORIDA PRESENTATION

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Tuesday, May 12, 2015 | Time TBA

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE STUART, FLORIDA PRESENTATION

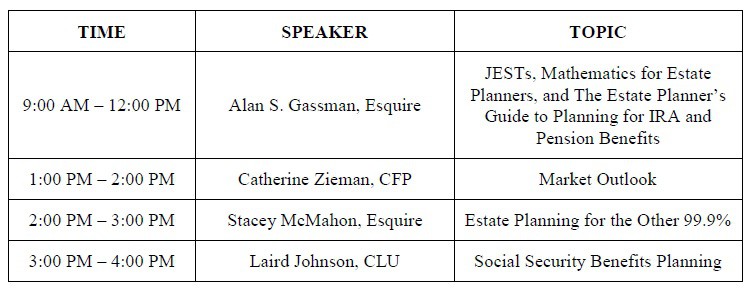

Alan Gassman will be the featured “headline” speaker the Martin County Estate Planning Council Annual Tax and Estate Planning Seminar. He will be doing a three-hour talk on the topics of JESTs, MATHEMATICS FOR ESTATE PLANNERS, AND THE ESTATE PLANNER’S GUIDE TO PLANNING FOR IRA AND PENSION BENEFITS – YES, YOU CAN FINALLY UNDERSTAND THESE RULES!

The tentative schedule for this one-day program is as follows:

Date: May 15, 2015 | 8:15 AM – 4:30 PM; Alan Gassman speaks from 9:00 AM to 12:00 PM

Location: Stuart Corinthian Yacht Club | 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

**************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE PRESENTATION:

2015 UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay | 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

**************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

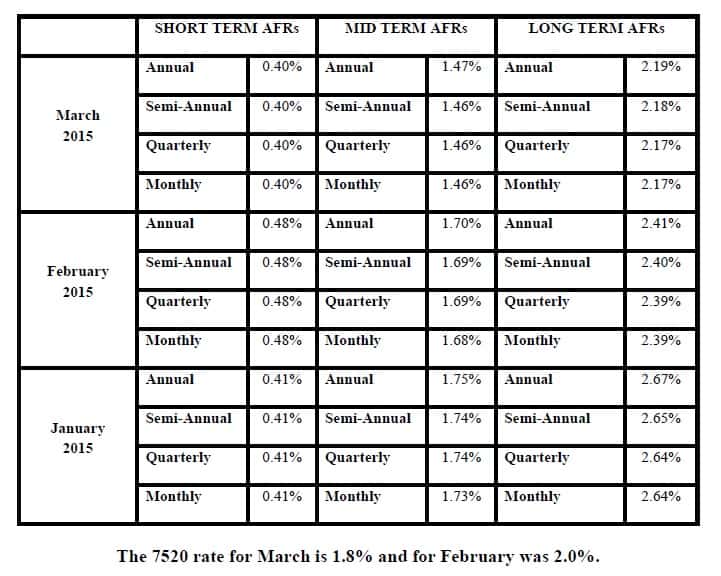

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.