Your Last 2022 Thursday Report – Tax Provisions Just Enacted – Issue 333

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Friday, December 30, 2022Your Last 2022 Thursday Report – Tax Provisions Just EnactedIssue #333

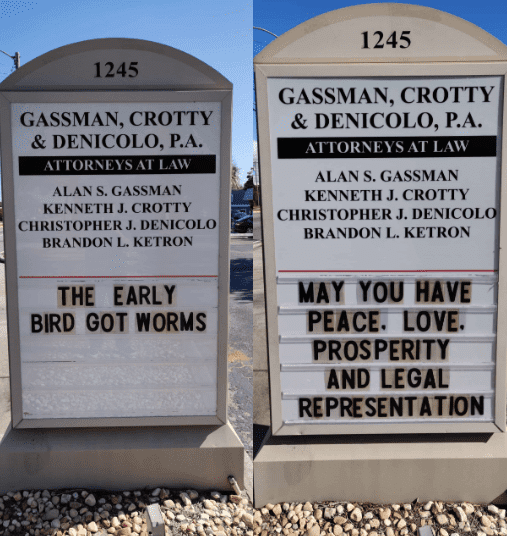

We Wish You A Happy, Healthy, Hearty, Holistic, Hoppy, Handsome, Handy, Hardworking, Harmonic, Heavenly, Hilarious, Honorable, Humble, Hygenic, Hospitable, Hopeful, Honest, Homey, Historical, and Habitable New Year!Coming from the Law Offices of Gassman, Crotty & Denicolo, P.A. in Clearwater, FL. Edited By: Alan Gassman Having trouble viewing this? Use this link |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1New Tax Law Rewards Charitable IRA Retirees With A $50,000 Income Tax Deferral OpportunityWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished) & Peter Farrell, JD Candidate Article 22022 Year-End Roundup HighlightsWritten By: Jill Ashley, CPA Free Saturday WebinarNew Tax Provisions UpdatePresented By: Alan Gassman, Brandon Ketron, Peter Farrell, and Jill Ashley More Upcoming EventsYouTube LibraryHumor |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1New Tax Law Rewards Charitable IRA Retirees With A $50,000 Income Tax Deferral Opportunity |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Split-Interest Entity |

IRC Section |

Additional Rules and Requirements |

|

Charitable Remainder Annuity Trust (CRAT) |

664(d)(1) |

|

|

Charitable Remainder Unitrust (CRUT) |

664(d)(2) |

|

|

Charitable Gift Annuity |

501(m)(5) |

|

To appreciate the benefits of this new election for QCD treatment, it is necessary to understand the basic structure of these split-interest entities…Click here to continue reading on Forbes

[1] The Consolidated Appropriations Act, 2023, https://www.appropriations.senate.gov/download/jrq121922.

[2] I.R.C. § 408(d)(8)(B).

Article 2

2022 Year-End Roundup Highlights

Written By: Jill Ashley, CPA

Jill Ashley is a 2nd year law student at Stetson University College of Law with a Business Law concentration, and a law clerk at Gassman, Crotty & Denicolo, P.A., in Clearwater, Florida. She previously earned degrees in communications and accounting, and was a self-employed CPA and Series 65 independent investment advisor, and Sr. Wealth Manager for Global Trust Asset Management, LLC, before embarking on her 3-year journey in 2021 to earn her J.D. in lieu of retirement.

Will Rogers once declared, “The only difference between death and taxes is that death doesn’t get worse every time Congress meets.” When Congress finished wrangling over language related to the location of new FBI headquarters, the Omnibus bill was released on December 23rd – all 4,155 pages detailing $1.7 trillion of appropriations.

Here are just two categorical highlights:

Retirement Plan Provisions

Beginning in 2023, small businesses (having up to 50 employees) will be eligible for a 100% tax credit toward qualified costs to establish or administer new pension plans. The plan must have at least 1 participant who is not a Highly Compensated Employee (paid $150,000 or more compensation). Qualified startup costs include expenses to set up and administer a qualifying retirement plan, and educate employees about the plan. The tax credit is limited to the greater of (1) $500 or (2) the lesser of (a) $250 multiplied by the number of non-Highly Compensated Employees eligible for participation or (b) $5,000. This credit is available for up to three years.

Beginning in January, 2023, mandatory Required Minimum Distributions (RMDs) from retirement plans may be deferred until individual account owners born in 1950 turn 73. Beginning in January, 2030, mandatory Required Distributions may be deferred until account owners born in 1957 turn 74. Beginning in January, 2033, the beginning Required Minimum Distribution age is slated to rise to 75 for account owners born in 1958 or later.

Workers age 50+ who are eligible to contribute to IRAs may contribute an extra $1,000 “catch up” contribution for years 2022 and 2023. The maximum base contributions allowed for IRAs is $6,000 for tax year 2022, and increases to $6,500 for tax year 2023. Contributions properly designated as 2022 contributions may be made by the earlier of this year’s tax filing deadline of April 18, 2023, or the date you file your tax return taking the deduction, if prior to April 18, 2023.

Workers age 50+ participating in 401k plans may contribute an extra “catch up” contribution of $6,500 for tax year 2022, and $7,500 for tax year 2023. The maximum base contributions for 401ks are $20,500 for tax year 2022, and increases to $22,500 for tax year 2023. After 2023, these amounts will be increased with inflation. Beginning in 2025, the “catch up” amount increases to $10,000.

For self-employed individuals whose income phases-out deductible IRA contributions (see chart below), and who seek higher contributions than permitted by 401ks may consider establishing a Defined Benefit Plan covering the individual and spouse working in the business. Defined Benefit Plans are normally designed by third party pension administrator to maximize the participant’s future benefit using complex calculations based upon salary history, age, and anticipated retirement date, and those plans require annual filings with IRS to report year-end valuations and activity.

|

Modified Adjusted Gross Income (MAGI) limits for deducting contributions to Traditional IRAs |

|||

|

Tax Filing Status |

MAGI |

Allowed deduction |

|

|

a. |

Single individuals who are active participants in a qualified plan at work. |

$ 73,000 or less |

100% |

|

$ 73,001 to $83,000 |

Partial |

||

|

$ 83,001 or more |

None |

||

|

b. |

Married couples filing jointly if the spouse who makes the IRA contribution is an active participant. |

$ 116,000 or less |

100% |

|

$ 116,001 to $ 136,000 |

Partial |

||

|

$ 136,001 or more |

None |

||

|

c. |

IRA contributor who is not an active participant and is married to someone who is an active participant. |

$ 218,000 or less |

100% |

|

$ 218,001 to $ 228,000 |

Partial |

||

|

$ 228,001 or more |

None |

||

|

d. |

Married individual filing a separate return who is an active participant. |

Less than $10,000 |

Partial |

|

$10,001 or more |

None |

||

One of the heaviest IRS penalties is assessed on individuals who forget to timely take their Required Minimum Distributions. Previously, the IRS assessed 50% penalties on the amount of missed or under-paid distributions. Beginning in 2023, the penalty is reduced to 25% of the underpayment, or 10% if the necessary funds are withdrawn by the end of the second year after the distribution was due.

For charitably inclined individuals, up to $100,000 of an account owner’s IRA may still donate directly to a qualified charity as a Qualified Charitable Distribution (QCD) to reduce taxable income on the withdrawal while satisfying the corresponding withdrawal amount toward their Required Minimum Distribution for the year. The SECURE 2.0 Act allows the $100,000 to be adjusted for inflation beginning in 2024. Additionally, beginning in 2023, the Act allows up to a $50,000 one-time Qualified Charitable Distribution to fund a taxpayer’s charitable remainder annuity trust, charitable remainder unitrust, or charitable gift annuity and count toward the taxpayer’s Required Minimum Distribution for the year.

Section 179 Expense for Businesses

The following summarizes the Section 179 rules which have not changed, but reflect inflation adjustments for 2023.

Under Section 179 of the Internal Revenue Code, businesses may continue to elect to deduct 100% of the cost up to $1,080,000 of qualifying property placed in service during the year 2022 (or $1,160,000 in tax year 2023). The immediate tax deduction is available on the full cost even if the business financed the purchase over time.

The Section 179 deduction is allowed to the extent of current year profits, and the deduction is reduced dollar-for-dollar to the extent that qualifying property purchased exceeds $2,700,000 during the 2022 (or $2,890,000 in tax year 2023). Qualifying property includes furniture, fixtures, equipment, and most off-the-shelf software which is used more than 50% in the business.

Since Section 179 expense is limited to the business entity’s taxable income, any excess deduction may be carried over to future tax years. Controlled groups of corporations with 80% or more common ownership must allocate the maximum deduction among the controlled companies. For pass-through entities such as S-Corporations, Partnerships, and LLCs, the Section 179 expense flowing to a business owner’s personal tax return is further limited to personal taxable income, and cannot be carried over; the excess deduction is “lost” when the owner does not have sufficient personal taxable income to utilize the deduction passed through.

If you need a vehicle for business operations, purchasing an SUV weighing more than 6,000 pounds may trigger a larger deduction than smaller, lighter vehicles which constitute “listed property” with first year depreciation deduction limited to $27,000 for year 2022 (or $28,900 for 2023).

If your business leases a passenger vehicle with a value exceeding $56,000, the lease expense deduction triggers a formulaic inclusion in gross income. See IRS Pub 15-B for vehicle valuation tables and IRS Pub 463 for annual income inclusion tables.

Business owners should note that claiming 100% business use of non-commercial vehicles may raise an audit red flag. Business vehicles are listed as line-items on depreciation schedule Form 4562 to report the percentage of business use during the year. Businesses should keep detailed mileage logs and calendar entries documenting the business purpose of road trips. Alternatively, businesses may take deductions using the IRS’ standard mileage rate in lieu of claiming actual expenses for fuel, maintenance, insurance, and depreciation.

Free Saturday Webinar

New Tax Provisions Update

Date: Tuesday, January 3, 2022

Time: 11:00 AM to 12:00 PM EST (30 minutes)

Presented by: Alan Gassman, Esquire, Brandon Ketron, Esquire, Peter Farrell, JD Candidate & Jill Ashley, CPA

Please Note:

After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with.

Please email registration questions to info@gassmanpa.com.

All Upcoming Events

| Tuesday, January 3, 2023 |

Free from our Firm (Virtual Session – No CLE/CPE Credits) |

Alan Gassman, Brandon Ketron, Peter Farrell & Jill Ashley Present: NEW TAX PROVISIONS UPDATE 5:00 PM to 5:30 PM EST (30 minutes) |

REGISTER HERE |

| Saturday, January 7, 2023 |

Free from our Firm (Virtual Session – *CPE Credits Will Be Offered Through CPAacademy.org) |

Alan Gassman & Srikumar Rao Present: PROFESSIONAL ACCELERATION STRATEGIES: SUCCESS IS NOT AN ACCIDENT 11:00 AM to 12:00 PM EST (60 minutes) |

REGISTER HERE FOR NON-CPE CREDIT |

| Friday, January 13, 2023 | FICPA |

Alan Gassman Presents: HOT TOPICS AND OPPORTUNITIES IN FEDERAL TAX PLANNING 12:50 PM to 1:40 PM EST (50 minutes) |

REGISTER HERE |

| Saturday, January 14, 2023 |

Free from our Firm (Virtual Session – *CPE Credits Will Be Offered Through CPAacademy.org) |

Alan Gassman Presents: ASSET PROTECTION FROM A TO Z – PART 2 11:00 AM to 12:00 PM EST (60 minutes) |

REGISTER HERE FOR NON-CPE CREDIT

|

| Saturday, January 21, 2023 |

Free from our Firm (Virtual Session – *CPE Credits Will Be Offered Through CPAacademy.org) |

Alan Gassman Presents: ASSET PROTECTION FROM A TO Z – PART 3 11:00 AM to 12:00 PM EST (60 minutes) |

REGISTER HERE FOR NON-CPE CREDIT

|

| Saturday, January 28, 2023 |

Free from our Firm (Virtual Session – *CPE Credits Will Be Offered Through CPAacademy.org) |

Alan Gassman Presents: WHAT I LEARNED AT THE 57TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING 11:00 AM to 12:00 PM EST (60 minutes) |

REGISTER HERE FOR NON-CPE CREDIT |

| Monday, January 30, 2023 | LISI |

Alan Gassman Presents: THE TRICKS AND TRAPS OF FLORIDA ESTATE PLANNING & CREDITOR PROTECTION 2:00 PM to 3:00 PM EST (60 minutes) |

Coming Soon |

| Monday, February 13, 2023 | LISI |

Alan Gassman Presents: DESIGNING YOUR MEAL AT THE SLAT-O-TERIA – DIFFERENT KINDS OF SLATS AND HOW THEY CAN BE DESIGNED, DRAFTED & IMPLEMENTED – WITH SAMPLE CLAUSES AND CLIENT EXPLANATION LETTERS 2:00 PM to 3:00 PM EST (60 minutes) |

Coming Soon |

|

Thursday, February 9, 2023 |

Johns Hopkins All Children’s Hospital (Continuing Education Credits Offered) |

We are proud sponsors of this event. 25TH ANNUAL ESTATE, TAX, LEGAL AND FINANCIAL PLANNING SEMINAR Please Reserve the Whole Day |

REGISTER HERE |

|

Thursday, February 23, 2023 |

Free from our Firm (Virtual Session – No CLE/CPE Credits) |

Kettering Health Foundation Alan Gassman Presents: 4 HOT TOPICS WITH SOLID ACTION ITEMS 12:00 PM to 12:30 PM EDT (30 minutes) |

|

|

Tuesday, March 7, 2023 |

New Jersey Estate Planning Council |

Alan Gassman Presents: WHAT NEW JERSEY ESTATE PLANNERS NEED TO KNOW ABOUT FLORIDA LAW Time: TBD |

Coming Soon! |

| Wednesday, March 15, 2023 | LISI |

Alan Gassman Presents: ESTATE AND BASIS PLANNING WITH JOINT TRUSTS INCLUDING THE JEST (JOINT EXEMPT STEP-UP TRUST) 2:00 PM to 3:00 PM EST (60 minutes) |

Coming Soon! |

|

Tuesday, April 18, 2023 |

Boca Raton Estate Planning Council |

Alan Gassman Presents: ESTATE AND ESTATE TAX PLANNING FOR FLORIDIANS: INCLUDING SLATs, COMMUNITY PROPERTY TRUSTS, AND CREDITOR PROTECTION IMPLICATIONS 6:50 PM to 7:40 PM EST (50 minutes) |

Coming Soon |

|

Thursday, April 20, 2023 |

Free from our Firm (Virtual Session – No CLE/CPE Credits) |

Kettering Health Foundation Alan Gassman Presents: PUTTING ASSET PROTECTION INTO AN ESTATE PLAN 12:00 PM to 12:30 PM EST (30 minutes) |

|

| Monday, April 24, 2023 | LISI |

Alan Gassman Presents: CREATIVE AND DYNAMIC CHARITABLE PLANNING TECHNIQUES – WHAT YOU DO NOT KNOW CAN HURT YOUR CLIENT 2:00 PM to 3:00 PM EST (60 minutes) |

Coming Soon |

| Thursday, April 27, 2023 | Financial Experts Network |

Alan Gassman Presents: MATHEMATICS TO ESTATE TAX PLANNING 1:00 PM to 2:00 PM EST (60 minutes) |

Coming Soon! |

|

Thursday, May 18, 2023 |

Free from our Firm (Virtual Session – No CLE/CPE Credits) |

Kettering Health Foundation Half or Full Day Event Please Support this Important Program 3535 Southern Blvd. Kettering, OH 45429 |

Coming Soon |

| Thursday, June 1, 2023 | Financial Experts Network |

Alan Gassman Presents: ALPHABET SOUP: PLANNING WITH LLCS, IDGTS, GRATS, AND OTHER ACRONYMS 1:00 PM to 2:00 PM EST (60 minutes) |

Coming Soon |

|

Wednesday, October 11, 2023 |

National Association of Estate Planners & Councils |

Alan Gassman Presents: DESIGNING AND IMPLEMENTING ESTATE PLANNING STRUCTURES WITH THE IRS IN MIND: AUDIT TRIGGERS & CONSIDERATIONS ASSOCIATED THEREWITH 3:00 PM to 4:00 PM EST (60 minutes) |

Coming Soon |

|

November, 2023 |

Birmingham, AL Estate Planning Council |

Alan Gassman and Brandon Ketron Present: ESTATE TAX STRATEGIES, HOT TOPICS AND YEAR-END PLANNING — BETTER THAN BBQ, HOTTER THAN SUMMER (100 minutes) |

Coming Soon |

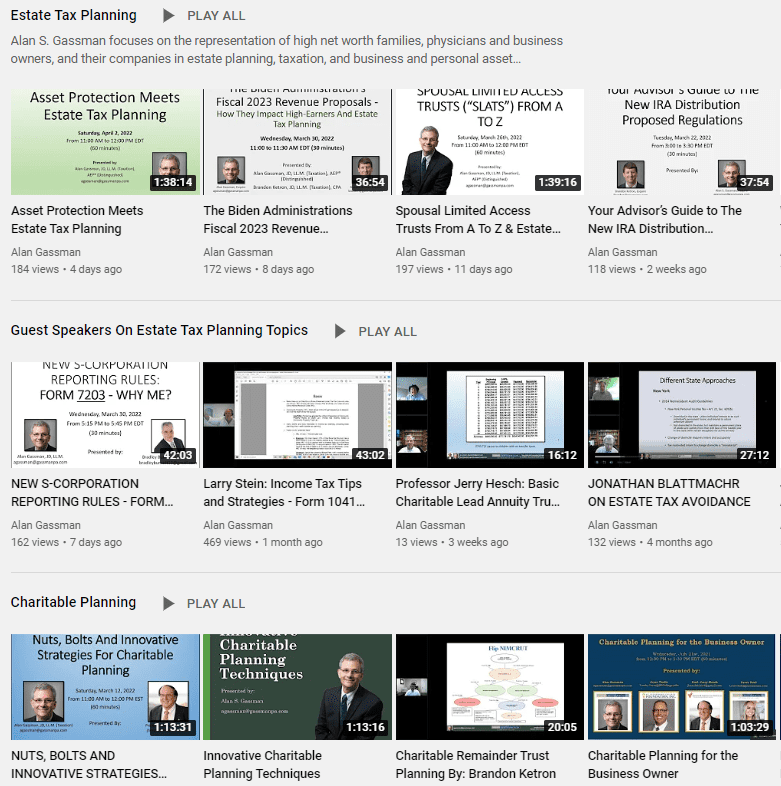

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more!

The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording.

Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library.

HUMOR

You might never guess from the bright Florida sun,

But 2022’s soon over, finished, and done.

Its sendoff had whistles and confetti rain

And beautiful flutes of bubbly champagne.

We watched the ball drop, way up in Times Square,

And we thought, “It’s so crowded; I’m glad I’m not there!”

Then we all yelled and shouted at 11:59

When they said, “Let’s open one more bottle of wine.”

If you woke up this morning with red bloodshot eyes,

Just have a mimosa, your headache disguise.

You might watch football all day on TV

Or maybe it’s time to take down the tree.

It might be this Thursday you find some solutions

To help follow through on this year’s resolutions.

Take time to be grateful for all that you’ve got.

The sunshine is warm or the fireplace hot.

You might write a goal, a thing or two,

That in this year you would like to do.

You might join the gym or go on a diet.

But today’s a family day – wait for tomorrow to try it.

You might pass the Bar or buy a new car,

Whatever you choose, you’re sure to go far.

Before the new habit you were going to abort,

Don’t forget to share your Thursday Report.

Every day is special and the only day you are in,

But Thursdays are the best when you are Thursday Report’n.

Stay safe and responsible, but make sure to have glee,

Here’s to the first Thursday Report of 2023!

Written By: Kristen Sweeney

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200

Copyright © 2021 Gassman, Crotty & Denicolo, P.A