The Thursday Report – Issue 328

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Thursday, August 11th, 2022Caesar Augustus and the True Meaning of August – Issue #328The month of August is named after Emperor “Caesar Augustus” (who also is referred to as Octavian), who many of you may remember from your seventh grade history class was the great nephew and successor to Julius Caesar. In fact, Caesar Augustus was named in Caesars will as his adopted son and heir. Caesar Augustus significantly increased the size of the Roman Empire and placed himself in history as one on the great leaders in antiquity (or perhaps even in all of recorded history). August was added as a month around 700 B.C., and was named to be “August” in 800 A.D. in honor of Caesar Augustus. Most of the Northern Hemisphere enjoys the lovely weather in August as the last “full” month of summer, although as we can attest down here in Florida, August is a reminder of the persistent humidity and afternoon rain showers that characterize Florida summers. We are hopeful that this Thursday Report can augment your August and provide some background as to what it means. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Please Note: Gassman, Crotty, & Denicolo, P.A. will be sending the Thursday Report out during the first week of every month. Article 1A Deeper Dive into the Tax Changes in The Inflation Reduction ActWritten By: Samuel Craig, Stetson Law Student Article 2New Florida Law Protects Retirement Funds Inherited In Divorce From Bankruptcy CreditorsWritten By: Samuel Craig, Stetson Law Student Article 3Behind the Orgins of the PCF Social Justice FundWritten By: Pinellas Community Foundation Article 4Quality of Life for the New LawyerWritten By: Nick Stickeler, Stetson Law Student Forbes CornerWhat the IRS Can Learn for The Florida Bar Tax Section: Comments To Clawback Proposed RegulationsWritten By: Alan Gassman, JD, LL.M. (Taxation), AEP® (Distinguished) For Finkel’s Followers3 Reasons To Hire A Zoomer EmployeeWritten By: David Finkel Free Saturday WebinarFundamentals of Estate Tax PlanningPresented By: Alan Gassman & Christopher Denicolo More Upcoming EventsYouTube LibraryHumor

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 1A Deeper Dive into the Tax Changes in The Inflation Reduction Act

Written By: Samuel Craig, Stetson Law Student When President Biden was campaigning for presidency, he made a promise to increase taxes on wealthy individuals and corporations. Early proposals, such as the Build Back Better Act, faced numerous blockades, primarily by Republicans, and a few Democrats, namely Joe Manchin (D-WV). Throughout Biden’s presidency, Senator Manchin has been the swing vote in the divided Senate, but in a recent turn of events, Senator Manchin has come out in support of a new comprehensive bill entitled, the “Inflation Reduction Act of 2022.” This bill is being reported as an agreement between Senator Manchin and Senate Majority Leader, Chuck Schumer (D-NY). Primarily, the bill is promoted as a spending package to fund climate change and clean energy efforts, which represents the largest climate investment in US history and has been touted as the biggest legislative win for the environment since the Clean Air Act. The bill also aims to combat rising health-care costs by giving Medicare the ability to negotiate the prices of certain prescription drugs and extends health care subsidies for three years. The proposed spending initiatives will be paid for by taxing large corporations, funding the IRS to enforce the tax laws more effectively, and an excise tax on stock buybacks for publicly traded companies.

The Battle for the Middle-Class. The bill aims to tax corporations and fund the IRS to enforce tax law, which will provide funding for the bill’s spending initiatives. There is now an active debate on how this bill will affect the middle-class. Senator Mike Crapo, a Republican on the Senate Finance Committee said, “If these taxes are passed, we’ll see higher inflation, more economic stagnation, lower wages, less employment, and most importantly, the burden will be paid by people making less than $400,000.” Others that claim the bill will raise taxes on the middle-class cite to an analysis done by the Joint Committee on Taxation (“JCT”), where the panel’s distributional tables showed that those earning less than $200,000 could see their tax burden rise by about 1% next year. Multiple supporters of the bill have already attempted to rebuke the claims about a middle-class tax hike, such as Marc Goldwein, a senior vice president at the Committee for a Responsible Federal Budget, and Ashley Shapitl, a spokesperson for Senate Finance Chair Ron Wyden (D-OR). They draw issue with the flawed JCT analysis, pointing out that the JCT analysis measures the cost side of the Democrats’ program but not the benefit side: there is no mention of the benefits to middle-class families from lower drug prices, clean energy incentives, and health-care subsidies.

The 15% Minimum Corporate Tax. The two primary revenue-raising provisions of the bill are a 15% corporate minimum tax and IRS tax enforcement funding, which are estimated to raise over $400 billion. In total, the bill will raise over $700 billion in revenue over 10 years, including the aforementioned tax changes, as well as taxes and savings from a prescription drug-pricing proposal. The summary of the Inflation Reduction Act with respect to taxes provides the following:

The proposal’s two main components would re-build the IRS and impose a 15% Corporate Minimum Tax to ensure the wealthiest Americans and corporations cannot avoid paying their fair share of taxes… Additionally, the proposal would impose a 15% domestic tax on the approximately 200 largest corporations that currently pay less than that corporate tax rate. The current statutory corporate tax rate is 21%. However, some 200 or more large corporations use tax loopholes to avoid paying that rate and actually pay below 15%. The corporate alternative minimum tax (AMT) proposal would impose a 15 percent minimum tax on adjusted financial statement income for corporations with profits in excess of $1 billion. Corporations would generally be eligible to claim net operating losses and tax credits against the AMT, and would be eligible to claim a tax credit against the regular corporate tax for AMT paid in prior years, to the extent the regular tax liability in any year exceeds 15 percent of the corporation’s adjusted financial statement income. This provision would be effective for taxable years beginning after December 31, 2022. In a separate summary, the bill states, “there are no new taxes on families making $400,000 or less and no new taxes on small businesses – we are closing tax loopholes and enforcing the tax code.” The bill seeks to implement taxes on corporations by applying an “Average Annual Adjusted Financial Statement Income Test.” A corporation meets this test for a taxable year if “the average annual adjusted financial statement income for the 3-taxable-year period ending with such taxable year exceeds $1 billion.” Exceptions are created by the bill where the “applicable corporation” shall not include any corporation which (a) has a change in ownership, or (b) has a specified number (to be determined) of consecutive taxable years, including the most recent taxable year, in which the corporation does not meet the average annual adjusted financial statement income test, and the Secretary determines that it would not be appropriate to continue to treat such corporation as an applicable corporation. For corporations that would otherwise be an “applicable corporation” but have not been in existence for three taxable years, the Average Annual Adjusted Financial Statement Income Test will be applied on the basis of the period during which such corporation was in existence. To summarize the corporate tax provisions, companies with at least $1 billion in income will be required to calculate their annual tax liability two ways: (1) with longstanding tax accounting methods, which are generally 21% of profits less deductions and credits, and (2) applying the 15% rate to reported earnings, known as book income. Whichever of these two methods is greater is what the corporation will owe. Senate Finance Committee Chair, Ron Wyden (D-OR), said, “We have multi-billion dollar corporations paying less in their tax rate than nurses and firefighters.” It is evident from the various bill summaries and repeated statements by Senators in support of the bill that nothing included in the Inflation Reduction Act is intended to raise taxes on the middle-class.

The Carried Interest Tax Loophole Fails Again. Currently, the carried interest loophole allows investment managers to pay the lower 20% long-term capital gains tax rate on income received as compensation, rather than the ordinary income tax rates of up to 37% that they would pay for the same amount of wage income. The common structure for capitalizing on the carried interest loophole is the “two-and-twenty.” Under a two-and-twenty fee structure, investors pay the fund manager 2% of the assets they have invested in the fund each year, plus 20% of the fund’s returns.[1] Under current tax law, the carried interest paid to fund managers is taxed as if it were a profit from a long-term investment rather than what it is: compensation for managing other people’s money. This distinction allows the general partners to nearly halve their tax bill by paying the 20% long-term capital gains rate instead of the ordinary income tax rate of 37% that would likely apply to these top earners. Both President Obama and Trump promised to close this loophole during their presidencies but each have failed.[2] Yet again, an effort to close the loophole has failed, now under the Biden administration. Senator Manchin was firm on his desire to close this loophole with the Inflation Reduction Act, stating, “Our tax code should not favor red state or blue state elites with loopholes like SALT and should focus more on closing unfair loopholes like carried interest.” However, the fate of the bill was quickly turned over to Kyrsten Sinema (D-AZ) who opposed the closure of this loophole. Sinema made it clear last week that she would block the overall legislation if the bill remained in its original form, so the carried interest language was removed so that the bill could survive. Closing the carried interest loophole would have taxed certain wealthy Americans, thereby fulfilling President Biden’s promise, at least in part, to make the wealthy pay their fair share, despite not coming in the same form as early proposals like a “wealth tax” supported by Senators Warren (D-MA) and Sanders (I-VT). Such a wealth tax has also been heavily scrutinized, and would undoubtedly face an uphill battle both within the legislature and in the courts, and therefore was taken off the table for the Biden administration.

Stock Buyback Tax. Although the carried interest language was removed from the bill, in its place is a 1% excise tax on corporations when they repurchase stock from their shareholders. This measure will likely generate as much or even more revenue as the carried interest proposal and is estimated to raise $74 billion. Republican and Democratic lawmakers alike have criticized U.S. corporations for greatly favoring buybacks over growth-producing investments. For example, in 2018, Senator Rubio (R-FL) proposed legislation to tax corporate stock buybacks as dividends, intending to increase business investment and create jobs. The mechanism of a stock buyback is quite simple: a company buys back stock, thereby reducing the number of its outstanding shares on the market, which increases the value per share for remaining shareholders. Buybacks are one of the mechanisms corporations use to shift their profits to shareholders, the other being a dividend, which is a cash payment to shareholders that is taxed as income tax. Buybacks are taxed as capital gains because they increase the stock value, but they may not be taxed for years, and in some cases are never taxed at all because the taxable event is when the stock is sold. Some investors will hold on to their stocks for life, and upon death, the investor’s heirs will benefit from the step-in basis. The proposal in the Inflation Reduction Act would subject corporations to a tax equal to 1% of their stock repurchases, thereby ensuring the shifted profits are taxed in some form. The argument against stock buybacks is that companies should be spending a far larger portion of their profits to reinvest in the core business, rather than returning cash to equity investors. By reinvesting in the company itself, rather than paying back investors, companies can hire more workers and build more manufacturing facilities and products. On the other hand, some argue that stock buybacks are good because it returns money to investors, thereby providing more opportunities for investments in small businesses or budding industries to promote innovation and growth.

Funding the IRS. The Inflation Reduction Act claims that by investing $80 billion over the next ten years for tax enforcement and compliance, the IRS will collect $203 billion (a net gain of approximately $125 billion in tax revenue). The provision of the bill allocates the 10-year funding for the IRS as follows:

(i) $3,181,500,000 for taxpayer services, (ii) $45,637,400,000 for enforcement, (iii) $25,326,400,000 for operations support, and (iv) $4,750,700,000 for business systems modernization.

These appropriated funds are to remain available until September 30, 2031, and the bill summary states, “no use of the funds is intended to increase taxes on any taxpayer with taxable income below $400,000.” Some concerns have been raised that the IRS’s increased budget will give the Service more firepower to audit the middle-class while the wealthy will be able to continue dodging taxation (as they are more likely to be able to afford sophisticated tax counsel). Such commentators worry that when the IRS audits people, those making under $200,000 will have to pay their fair share of taxes. Although, we have never considered that people paying taxes when they are audited as a tax. While the concerns are at least valid from the standpoint of protecting middle-class Americans, people who make less than $200,000 and pay their taxes likely want to see others in the same tax bracket pay their fair share as well. Having more IRS agents will hopefully cause the Service to act with more precision and courtesy, so that audits are less random and abrasive.

Concerns About Higher Taxes Amidst Inflation and Looming Recession. President Biden delivered a press conference on July 28th and made a concerted effort to drive home the point that the Inflation Reduction Act will, per its name, reduce inflation. In the past few months, the Federal Reserve has raised interest rates to address inflation, but some economists are concerned that such action generally triggers a recession. Some readers need not be reminded of the stagflation our country faced about 40 years ago, where high inflation and slow economic growth afflicted everyone. This proposal may be cause for concern for some who believe that the government is erroneously making the decision to raise taxes while inflation is rising and the Federal Reserve is raising rates, as the latter is often correlated with a recession. These concerns were summarized by Steve Miran, a senior official in the Treasury Department under the Trump administration, who said, “the current policy mix has already messed up the supply side, and hiking taxes will push further in the wrong direction.” While there may be validity to these concerns, it should be noted that the bill should not raise taxes on individuals who make less than $400,000 per year, and the Trump-era individual income tax cuts remain in place. Because the bill is largely funded through the 15% corporate minimum tax, IRS enforcement funding, and the corporate share buyback tax, most Americans will not be left paying for this bill.

Electric Vehicles. In an effort to bring electric vehicle production to the U.S., the bill would extend an already existing $7,500 consumer tax credit for electric vehicles (“EVs”) until 2032. The ultimate goal of the proposal is to raise battery component manufacturing and assembly for EVs in North America from 50% to 100% by 2028. However, this extension does not come without stipulations. The bill would tighten up the requirements that would allow electric vehicles to qualify for this tax credit. A new EV can qualify for a credit of $3,750 if its final assembly takes place in North America, it costs less than $55,000 (or $80,000 for pickups or SUVs), and buyers must have annual income less than $150,000. An additional credit applies if the EV’s battery meets certain requirements. The bill places restrictions on battery production, requiring a minimum percentage of the battery components be manufactured or assembled in North America. A certain amount of lithium and nickel, both minerals necessary to manufacturing the batteries, must be sourced in the U.S. or from its free-trade partners. 40% of the battery minerals must be mined and processed in the U.S. or partner countries, increasing to 80% after 2026. Many car manufacturers have expressed their concerns about these strict requirements. Ford, GM, and others are seeking more time to be able to meet these requirements as well as an expansion of options that they will be able to source the minerals from. Currently, only about 15% of minerals used in battery production are extracted or processed in the U.S. or by its trade partners, with the majority being from China. These restrictions seek to decrease reliance on China for the production of these electric vehicles, as well as create jobs in the U.S. As it stands right now however, very few electric vehicles sold today qualify for this tax break. It also seems that manufacturers are not confident in their ability to meet the short timeline set forth by the bill.

Green Home and Business Renovations. The bill also includes tax credits on “green” home improvements. The tax credit is raised from the previous $500 lifetime cap to $1,200 annual tax credit for green remodels. Some examples of these home renovations are purchasing energy-efficient and electric appliances, such as heat pumps, HVAC, and water heaters, as well as installing solar panels. Solar power is a big focus of the bill’s clean energy initiatives. Tax credits are included for households and small businesses to install a rooftop solar system. Although solar systems can be pricey up front, the energy savings and added value to the home may be more appealing to homeowners as the bill’s tax credits cover 30% of the cost to buy a rooftop solar system and home battery storage. The bill provides $9 billion in consumer home energy rebate programs, a $1 billion grant program to make affordable housing more energy efficient, and 10 years of consumer tax credits to renovate their homes to be more energy efficient and lower their carbon footprint. The consumer tax credits are noteworthy because homeowners can budget out different energy efficient home upgrades over a 10 year period to maximize their tax savings. The clean energy tax deductions extend to small businesses too. The bill provides tax deductions of up to $1 per square foot of the business to make the space more energy efficient, including tax credits to cover up to 30% of the cost to swap the business’s automotive fleet with EVs and power their businesses with solar. Home builders and developers benefit from the “green home” initiatives, with tax credits for building Energy Star-certified housing for both single-family homes and multi-family buildings. The credits would double if the homes or units are also certified under the Department of Energy’s “Zero Energy Ready Home” program. Retiring America, a nonprofit focused on electrification, conducted an analysis of the bill and estimated that the average household can save $1,800 on its annual energy bill, while another analysis by RMI estimates American households may save up to $5 billion in the next two years with the clean energy incentives. According to the bill, the rebates and tax credits will start after December 31, 2022, and the program will be administered by states and run through September 30, 2031.

Prescription Medicine. For the first time, Medicare will be able to negotiate prices for certain prescription drugs: Medicare will negotiate the price of 10 Part D drugs in 2026, 15 Part D drugs in 2027, 15 Parts B and D drugs in 2028, and 20 Part B and D drugs in 2029. The bill also requires drug companies to pay rebates to Medicare if prices paid by Medicare increase at a rate that is faster than inflation. Additionally, the bill places a cap on out-of-pocket spending for Medicare prescription drugs at $2,000, starting in 2025. The bill will cap the price consumers in Medicare pay for insulin to $35 starting in plan year 2023. Drug companies will have to maintain strong price reporting controls, as well as increased scrutiny of drug pricing to avoid penalties and excise taxes for noncompliance with the bill’s provisions.

Other Concerns. Unsurprisingly, many have criticized the tax provisions of the bill as being too complicated. One noteworthy concern was raised by the American Institute of Certified Public Accountants who claimed that the “proposed minimum corporate tax violates numerous elements of our twelve guiding principles of good tax policy.” This is because companies would have to pay 15% on the earnings they report to the SEC, not on the income they report to the IRS. The IRS and SEC have different and separate systems for accounting, so combining the two for these large companies may prove to be a complex tax for accountants. Because the bill will tax companies based on the earnings they report to shareholders, another concern is that companies may try to understate their profits to cut their tax bill, thereby increasing uncertainty for investors who may find it harder to gauge the financial well-being of a company. Other critiques center around whether or not the bill will really reduce inflation and whether the economy will benefit from the passage of this bill. The common response to these critiques is best summarized as, “well, it’s better than nothing.”

There May be Hope. When the bill was first announced, President Biden seemed optimistic about the proposed bill, saying, “This is the action the American people have been waiting for… this addresses the problems of today – high health care costs and overall inflation – as well as investments in our energy security for the future… if enacted, this legislation will be historic, and I urge the Senate to move on this bill as soon as possible, and for the House to follow as well.” The energy security and domestic manufacturing incentives will ideally help to alleviate inflation and reduce the risk of future price shocks by bringing down the cost of clean energy and clean vehicles and relieving supply chain bottlenecks. The bill provides $10 billion in investment tax credits and production tax credits aimed at accelerating U.S. manufacturing of solar panels, wind turbines, batteries, and critical minerals processing, estimated to invest over $30 billion. There is also up to $20 billion in loans to build new clean vehicle manufacturing facilities across the country. To alleviate concerns that Americans carry to the pump, the bill provides tax credits and grants to support the domestic production of biofuels, and to build the infrastructure needed for sustainable aviation fuel and other biofuels. Floridians, and others in coastal states, may be pleased to learn that the bill provides $2.6 billion in grants to conserve and restore coastal habitats and protect the communities reliant on such coastal habitats.

Next Steps. The Senate passed this bill with a vote of 51-50, with Vice President Kamala Harris breaking the tie. The bill will now head to the Democrat-controlled House, which is expected to pass the bill on Friday, August 12, before President Biden officially signs it into law. Stay tuned for further updates. [1]If you thought this was a 20th century devise created by Wall Street bankers, you’re wrong. The two-and-twenty is derived from Fourteenth-century Italian ship captains that were compensated in part with an interest in whatever profits were realized on the cargo they carried. [2]Osborn, Katy, “This Is The Tax Loophole Obama, Bush, and Trump All Want To Close.” TIME. Sept. 16, 2015. https://time.com/4036087/tax-loophole-carried-interest/ |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 2New Florida Law Protects Retirement Funds Inherited In Divorce From Bankruptcy Creditors

Written By: Samuel Craig, Stetson Law Student On June 3, 2022, Governor DeSantis signed SB 968, amending Section 222.21, F.S., and made the new law effective immediately. The law clarifies that any interest in an individual retirement account (IRA) or individual retirement annuity received in a transfer incident to divorce remains exempt from creditor claims after the transfer is complete. The law is intended to clarify existing law and apply retroactively to all inherited IRA accounts without regard to the date the account was created. This law seems to have come as a reaction to the 2018 Minnesota Bankruptcy Court case, In re Lerbakken.[1] Background of the Lerbakken Case. In Lerbakken, the Court held that Mr. Lerbakken (“Lerbakken”), a Chapter 7 debtor who was awarded part of his ex-wife’s Individual Retirement Account (IRA) and her 401(k) account (together, “Accounts”) in their pre-bankruptcy dissolution proceeding, could not claim those accounts as exempt “retirement funds” under Section 522(b)(3)(c) of the Bankruptcy Code. Lerbakken retained Sieloff & Associates, P.A. (“Sieloff”) to represent him in his divorce proceeding in Minnesota. The state court’s order dissolving the marriage adopted the parties’ stipulated property settlement which awarded Lerbakken one-half of the value in the Accounts. Lerbakken filed a voluntary Chapter 7 bankruptcy petition and claimed the inherited Accounts as exempt retirement funds for the values agreed to under the property settlement. Lerbakken had unpaid legal fees with Sieloff. Sieloff was listed as a creditor for the unpaid fees and objected to Lerbakken’s claim of exemption in the Accounts. The Lerbakken court found that two requirements must be satisfied for a debtor to claim funds as exempt retirement funds pursuant to the Bankruptcy Code: (1) The amount must be retirement funds, and Ultimately in Lerbakken, the interests were not found to be “retirement funds” under the U.S. Supreme Court case of Clark v. Rameker, where the Supreme Court held that Section 522(b)(3)(c) applied only to the person who created and contributed to the retirement account.[2] In Clark, the Supreme Court defined “retirement funds” as “sums of money set aside for the day an individual stops working.” In doing so, the Supreme Court focused on three legal characteristics of ordinary retirement funds. The Court found that account holders of ordinary retirement funds (1) are able to make additional contributions to the funds, (2) are not obligated to withdraw the funds, and (3) must pay a penalty to withdraw the funds at any time, for any purpose, prior to the age of 59 ½.[2] Lerbakken argued that Clark dealt only with inherited IRAs, where the Internal Revenue Code explicitly excludes IRAs inherited from a spouse.[3] Lerbakken argued that the Clark test can be met because the Accounts were marital funds set aside for his and his ex-spouse’s retirements and are in tax qualifying accounts. Lerbakken continues his argument, and provides the following:[4] As a matter of public policy, retirement funds that were marital property received from a debtor’s ex-spouse pursuant to a domestic relations order should be considered the debtor’s own retirement funds. This promotes the purpose of the Bankruptcy Code’s exemption provisions to achieve a fresh start and to provide for their and their spouse’s retirements. Moreover, to disallow the exemption of a retirement account received by spouse in a divorce because he or she did not earn and fund the account would unfairly prejudice the stay at home or under employed spouse. How is it fair and in line with the purpose of the exemptions to allow one of the spouses in a divorce to exempt his or her share of the marital retirement account but not to allow the other to exempt his or her share of the same account after the divorce? It isn’t. The Lerbakken court ultimately held that because, as of the date Lerbakken filed for bankruptcy, his interests in the funds did not satisfy all three requirements under Clark: Lerbakken was not able to claim the accounts as exempt under Bankruptcy Code. The Lerbakken court reasoned that even a surviving spouse (which Lerbakken was not) does not have “retirement funds” when the surviving spouse does not roll over the IRA into his or her own IRA. On this point, the court reiterated that Mr. Lerbakken failed to roll over the funds from his ex-wife’s accounts into his own accounts by the date when exemptions were determined. The court concluded its opinion by writing, “Any interest [Mr. Lerbakken] holds in the Accounts resulted from nothing more than a property settlement. Applying the reasoning of Clark the 401K and IRA accounts are not retirement funds which qualify as exempt under federal law.” Why the Florida Legislature Addressed Lerbakken. The second requirement of the Clark test, the obligation to withdraw funds, is relevant for the new Florida law. In Lerbakken, the Court noted that state law obligated Lerbakken to withdraw his conditional interest in the IRA because, “the governing state law – the dissolution decree and the court-ordered attorney’s lien – define Lerbakken’s interest as a debt owed to Sieloff.”[5] By the decree and lien, Lerbakken was supposed to effectuate a transfer or renaming of his ex-wife’s IRA to pay a debt, regardless of [his] proximity to retirement.[6] While the Lerbakken decision is not controlling in the 11th Circuit, of which Florida is a part, some planners and lawmakers clearly took notice. A similar issue to that in Lerbakken arose in the 11th Circuit, but the Court ultimately did not reach a decision on the IRA issue because the parties settled outside of court.[7] However, the United States Bankruptcy Court for the Middle District of Florida, Tampa Division, acknowledged that there was no controlling decision of the 11th Circuit on this issue, and that the Bankruptcy Court intended to certify the issue for appellate review due to the presence of conflicting opinions from other jurisdictions.[8] The Florida Law. As amended, the new Florida law does the following: 1. Section 222.21(2), F.S., provides that IRAs, and interests therein, maintained in accordance with Section 408 of the Internal Revenue Code are exempted from legal processes, such as forced sale by creditors. 2. Section 222.21(2)(c), F.S., provides that the exemption for such money, other assets, or interest in certain qualified tax-exempt retirement accounts applies to any such accounts that are received by a beneficiary upon rollover or other eligible rollover that is excluded from gross income under the Internal Revenue Code, such as, but not limited to, the direct transfer or eligible rollover to an inherited IRA. This allows the beneficiary of the IRA to enjoy the creditor exemption upon transfer. 3. Additionally, Section 222.21(2)(c) provides that any interest in any The bankruptcy code allows a debtor to “opt-out” of federal bankruptcy law exemptions and instead use the exemption laws of the state in which the debtor has been domiciled for at least 730 days prior to filing a bankruptcy petition. Specifically, Florida residents can elect to have Florida law apply to their bankruptcy in lieu of bankruptcy exemptions that apply under federal law. _________________________________ [1] In re Lerbakken, 590 B.R. 895 (B.A.P. 8th Cir. 2018), aff’d, In re Lerbakken, 949 F.3d 432 (8th Cir. 2020) [2] It is important to also note, that in Clark, the Supreme Court pointed out that in these types of disputes, a fact-intensive, case-by-case analysis was not permitted: if the funds were not objectively for retirement purposes, then the funds may not qualify as exempt. [3] See 26 U.S.C. §408(d)(3)(C)(“An individual retirement account… shall be treated as inherited if–(i) the individual for whose benefit the account or annuity is maintained acquired such account by the reason of the death of another individual, and (ii) such individual was not the surviving spouse of such other individual.”) [4] Appellant’s Brief and Addendum, In Re: Brian A. LERBAKKEN, Debtor. Brian A. LERBAKKEN, Debtor-Appellant, v. SEILOFF & ASSOCIATES, P.A., Creditor-Appellee., 2019 WL 359681 at * [5] Lerbakken, 949 F.3d at 436. [6] Id. [7] Carapella v. Glass, No. 8:19-cv-3050-T-02 (M.D. Fla. Jan. 8, 2021). [8] In re Glass, 613 B.R. 33, 41 (Bankr. M.D. Fla. 2020). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article 3Behind the Orgins of the PCF Social Justice Fund

Written By: Pinellas Community Foundation In 2018, a generous and anonymous donor entrusted Pinellas Community Foundation as the philanthropic partner of a donor-advised fund inspired by the concept of venture capital investment. The thought was to direct that concept toward smaller, grassroots nonprofit organizations in Pinellas County by investing in their missions without fear of risk. This approach is known as trust-based philanthropy. The Social Justice Fund is expanding, giving generous donors interested in supporting grassroots nonprofits doing hands-on work in Pinellas communities a new way to ensure their donations are reaching those who need it the most. We asked our initial, incredible and awesome founder a few questions about why they started the fund in the first place. Five Questions for the Social Justice Fund Founder 1. Why did you start the Social Justice Fund? “I was looking for the option to leverage small gifts on my part into a larger community effort. As I spoke to the philanthropic community, I found a lot of hesitation to commit to organizations that didn’t have a long track record. If you look at the people who can make a big difference with a smaller amount of money, it’s generally the smaller start-ups. So, I started the Social Justice Fund at PCF to help them get a track record so that they can compete for some of the larger grants.” 2: What’s your personal philosophy of philanthropic giving? Why do you do it? “It’s not really my money. I’m a custodian, and once I’ve taken care of what I need for myself and my children, I should be looking to the people who don’t have enough.” 3. What are some of the pressing issues you see facing our country and trickling down to Florida and Pinellas County that philanthropy should address? “Well, we are increasingly a country of haves and have-nots. We’ve gone through a round of dismantling the social safety net to provide lower taxes to the extent that the beneficiaries will turn around and redirect money into programs they think provide a safety net. Then, we can continue to function as a society, but if we continue along the current economic and social path, I worry about that.” 4. Do you feel that the word “philanthropy” is accessible to everyone? “Actually, no, that’s a really good question because I think it conjures images of wings in museums and hospitals. Where, really, it should be something simpler like giving back, or teaching a person to fish, or you know, something that other people can connect with better. I think it’s part of why the philanthropy community now tends to fund big institutions, not the things that change people’s lives.” 5. In what ways do you envision the Social Justice Fund inspiring others to take action? “Well, its full intention is to create a big umbrella under which many people who can make a small difference come together so that we can direct all of that through one central infrastructure. Take advantage of the tremendous human capital that the Pinellas Community Foundation provides to administer the process, yet free it from some of its past bureaucratic obstacles to folks getting involved.” In 2021 the Clearwater Martin Luther King Jr Neighborhood Center Coalition (CMLK JR NCC) received $25,000 to build a new computer lab for the Center. Howard Latham of CMLK JR NCC shared, “The Social Justice Fund investment has allowed us to create valuable, easily accessible resources for our community. Seniors can register for benefits; employment seekers can file applications online; those needing technological skills improvements find they can learn at a comfortable pace. Our new computer lab and support specialists have quickly gained a new and thankful audience. Access is key. The best resources are right there when you need them, and so it is with our Center’s plan to provide these.” The Social Justice Fund is supported by a number of generous donors. If you are interested in donating to the Social Justice Fund, please contact Leigh Davis, Director of Donor and Advisor Relations, ldavis@pinellascf.org, 727-306-3142. https://pinellascf.org/news/behind-the-origins-of-the-pcf-social-justice-fund/

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Article 4Quality of Life for the New Lawyer

Written By: Nick Stickeler, Stetson Law Student How to Start & Build A Law Practice by Jay G. Foonberg: Quality of Life for the New Lawyer Starting a Practice (p. 643-645) The issue of Work/Life Balance as a new lawyer has probably caused me more stress and anxiety over the past three years than anything else. Ever since I began law school I quickly realized that I had the skills necessary to be successful in law school and pass the bar exam, but the great unknown has always been what my life will look like once I begin practicing law? I am starting my legal career a little later in life than most, and as a result I will likely have a few more responsibilities on my plate than most new lawyers. I am going to be 35 years old when I graduate from law school and take the bar exam, and I will have two children, a 3 year-old and a 1 year-old. I constantly ask myself, and others, “how will I be able to balance being a good husband and father, as well as being a good lawyer?” This chapter provided several great tips on how to keep your career and life in balance. I have summarized these tips below, along with a few others that I have been given by other practicing lawyers over the years.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Forbes Corner

What the IRS Can Learn from The Florida Bar Tax Section: Comments To Clawback Proposed RegulationsWritten By: Alan Gassman, JD, LL.M, AEP (Distinguished)

On July 26, 2022, the Tax Section of the Florida Bar (the “Tax Section”) submitted “Comments on Proposed Treasury Regulations Relating to the Basic Exclusion Amount Applicable to the Computation of Federal Estate and Gift Taxes.”… Continue Reading on Forbes. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For Finkel’s Followers |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

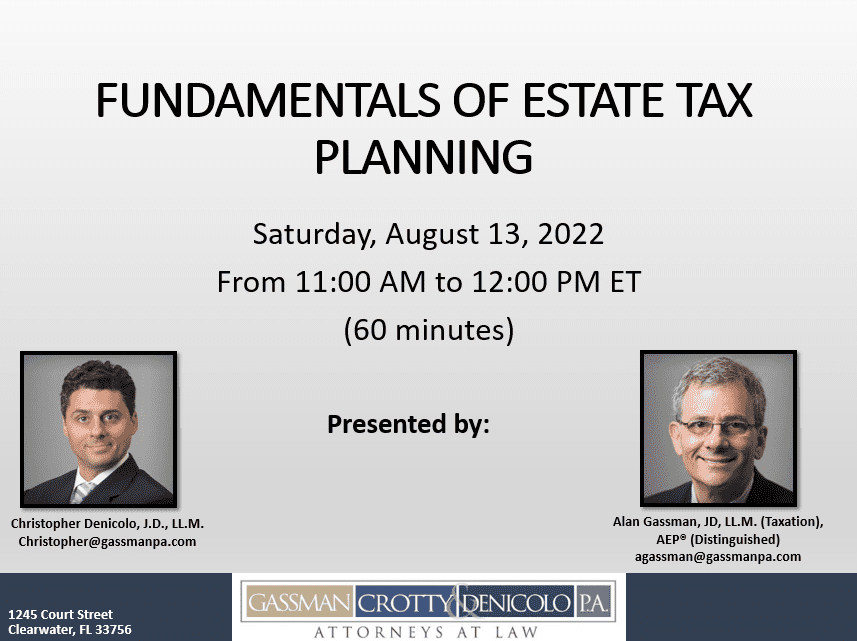

Free Saturday Webinar

REGISTER HERE FOR NON-CPE CREDIT Date: Saturday, August 13, 2022 Time: 11:00 AM to 12:00 PM EDT (60 minutes) Presented by: Alan Gassman, JD, LL.M. (Taxation), AEP (Distinguished) & Christopher Denicolo, JD, LL.M. Please Note: This is a complimentary webinar program. After registering, you will receive a confirmation email containing information about joining the webinar. Approximately 3-5 hours after the program concludes, the recording and materials will be sent to the email address you registered with. Important: If you are already on the “Register For All Upcoming Free Webinars” list, you will be auto-registered on Friday for non-CPE credit. If you would like 1.0 free CPE Credit for this webinar, please also register above through CPA Academy. Please email registration questions to info@gassmanpa.com.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

All Upcoming Events

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

YouTube Library

Visit Alan Gassman’s YouTube Channel for complimentary webinars and more! The PowerPoint materials can be found in the description box located at the bottom of the YouTube recording. Click here or on the image of the playlists below to go to Alan Gassman’s YouTube Library. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Humor

TODAY IN HISTORY:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gassman, Crotty & Denicolo, P.A. 1245 Court Street Clearwater, FL 33756 (727) 442-1200 Copyright © 2021 Gassman, Crotty & Denicolo, P.A

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||