Thursday Report – Issue 289

THE HALLOWEEN EDITION

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Edited by: Wesley Dickson

Thursday, October 1, 2020 – Issue 289

Having trouble viewing this? Use this link

DOL Issues New Rules on when Paid Leave Must Be Paid and Will Be Reimbursed

Is A Transfer Of Assets In Exchange For Reduced Alimony Or Support Payments Voidable?

Bad Faith in Medical Malpractice

Bankruptcy Court Denies Tenancy by the Entireties Protection to Joint Trust

Time Running Out For Year End Planning

For Finkel’s Followers

On This Day In Humor And History

Upcoming Events

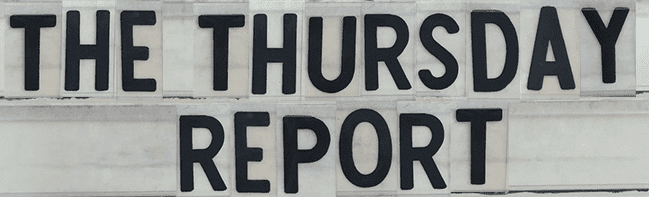

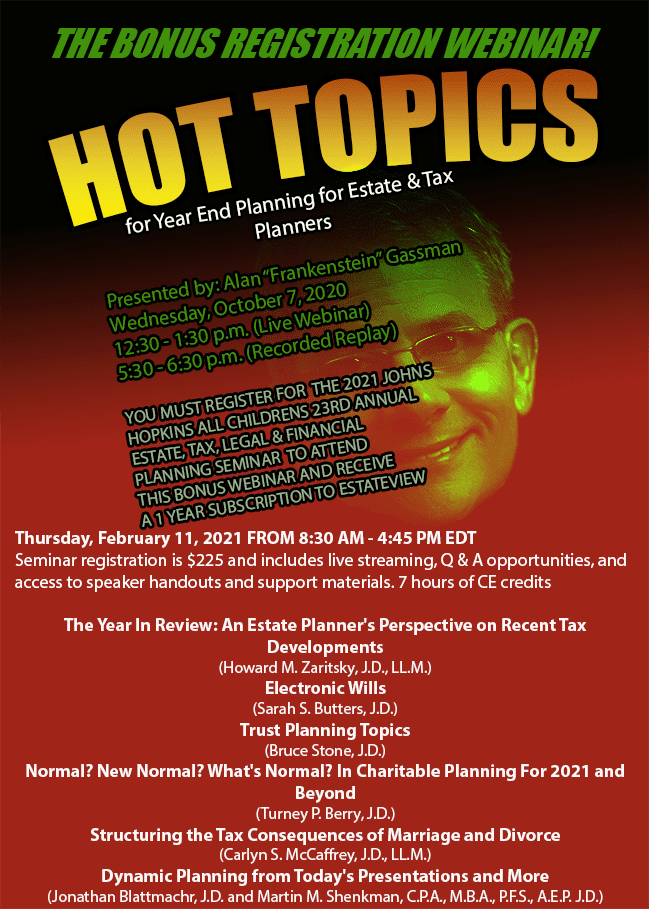

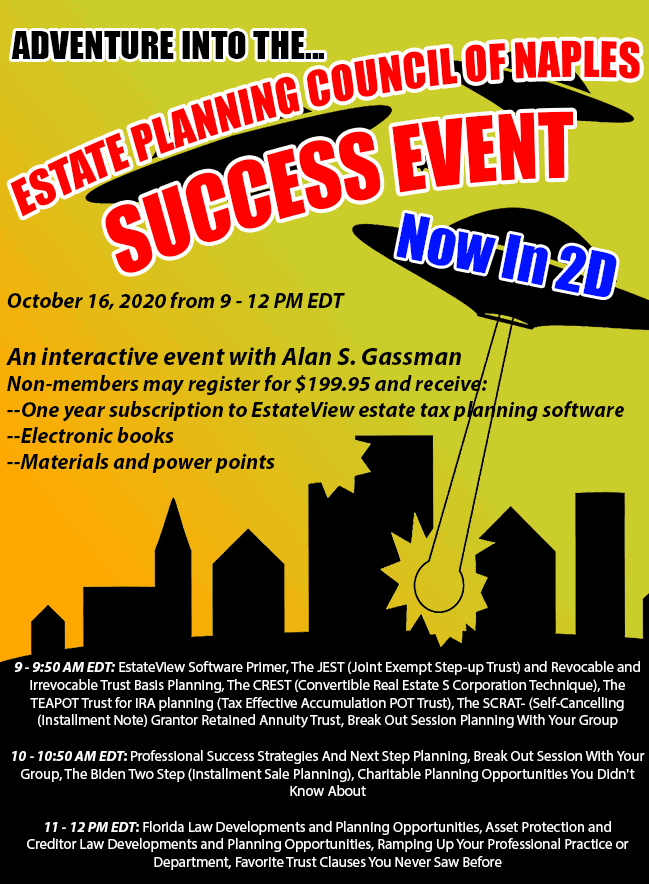

In honor of a questionable trick-or-treat outlook and to promote the 2021 Johns Hopkins All Children’s 23rd annual Estate, Tax, Legal & Financial Planning Seminar, we present you three spooky event posters

Register for the February 11, 2021 seminar and receive access to the October 7, 2020 bonus webinar here

Can you identify the three classic horror movies that inspired the three flyers in this newsletter? Send you answers to info@gassmanpa.com to win a free book of your choice

DOL Issues New Rules on when Paid Leave Must Be Paid and Will Be Reimbursed

Colleen M. Flynn, Alan S. Gassman & Ian MacLean

EXECUTIVE SUMMARY:

The “Families First Coronavirus Response Act” (“FFCRA”) was signed into law on March 18, 2020, to respond to and help mitigate the tremendous economic impact of the COVID-19 pandemic.

Two portions of the FFCRA that have provided economic relief to

Americans that are unable to work (or telework) for “qualifying reasons” related to COVID-19 are “The Emergency Paid Sick Leave Act” (“EPSLA”) and “The Expanded Family and Medical Leave Expansion Act” (“EFMLEA”).i The FFCRA enables employers to provide their employees with paid leave under both of these provisions, and the employer is reimbursed, dollar-for-dollar, with refundable tax credits.

To carry out the purposes of the FFCRA, the Wage and Hour Division of the Department of Labor (“DOL”) issued a Temporary Rule on April 1, 2020. On September 11, 2020, the DOL issued revisions and clarifications to the April 1st Temporary Rule, which are the subject of this article.

These new rules make significant changes that will impact a great many medical practices, because many employees of such practices will now be subject to the rules, and not excludable. In addition, many employees will have the right to several weeks of time off to take care of children whose schools are closed or requiring home learning, under materially changed rules.

Understanding the provisions of the FFCRA, the regulations currently in place, and the revisions and clarifications to the April 1st Temporary Rule is critical for employers. A brief overview of the EPSLA and EFMLEA is provided below, but for a greater-detailed discussion of these provisions and the FFCRA in its entirety, please read Employee Benefits & Retirement Planning Newsletter #729 (March 28, 2020), a newsletter we published after the FFCRA was passed.

FACTS:

Under the EPSLA, certain employees of “covered employers”ii are entitled to take up to two weeks of paid sick leave if the employee is unable to work (or telework) for any one of the following “qualifying reasons” related to COVID-19:

- The employee is subject to a Federal, state, or local quarantine or isolation order related to COVID-19.

- The employee has been advised by a health care provider to self- quarantine due to concerns related to COVID-19.

- The employee is experiencing COVID-19 symptoms and seeking a medical diagnosis.

- The employee is caring for another individual who is either subject to a Federal, state, or local quarantine or isolation order related to COVID-19 or who has been advised by a health care provider to self- quarantine due to concerns related to COVID-19.

- The employee is caring for their son or daughter whose school, place of care, or child care provider is closed or unavailable due to COVID- 19 related reasons.

- The employee is experiencing any other substantially similar condition as specified by the Secretary of Health and Human Services (HHS).

Under the EFMLEA, which amends Title I of the Family and Medical Leave Act (“FMLA”), certain employees of covered employers are entitled to take up to 12 weeks of expanded family and medical leave, ten of which are paid, if the employee is unable to work (or telework) due to a need for leave to care for the son or daughter of such employee, if the school or place of care has been closed, or the child care provider of such son or daughter is unavailable, due to COVID-19 related reasons.

After the DOL issued the April 1st Temporary Rule, the State of New York filed suit against the DOL on April 14, 2020, challenging the validity of certain parts of the Temporary Rule under the Administrative Procedures Act (“APA”). On August 3, 2020, the United States District Court for the Southern District of New York ruled that four parts of the Temporary Rule were invalid.iii

Subsequent to this ruling, on September 11, 2020, the DOL issued revisions and clarifications to the April 1st Temporary Rule.

COMMENT:

Effective as of September 16, 2020, the DOL’s revisions and clarifications to the April 1st Temporary Rule are as follows:

1. To Take Paid Sick Leave or Expanded Family and Medical Leave, an Employee Must Have Had Work He or She Would Have Performed

The DOL reaffirmed that an employee may take paid sick leave and expanded family and medical leave for qualifying reasons “only if the employee has work from which to take leave.”

The DOL refers to this as the “work-availability requirement” and explains that for an employee to be entitled to paid sick leave and expanded family and medical leave, the actual reason for an employee being unable to work must be a qualifying reason, “as opposed to a situation in which the employee would have been unable to work regardless of whether he or she had a FFCRA qualifying reason.”

The DOL explains that this means “an employee cannot take FFCRA paid leave if the employer would not have had work for the employee to perform, even if the qualifying reason did not apply.”

Thus, if an individual does not have work he or she can perform because of “the employer closing the work-site (temporarily or permanently)” or other reasons, then such leave will not be covered by the FFCRA.

The DOL notes that one of the FFCRA’s purposes is that of “discouraging employees who may be infected with COVID-19 from going to work.” By removing the work-availability requirement, the DOL explains that this purpose would not be served because:

If there is no work to perform, there would be no need to discourage potentially infected employees from coming to work through the provision of paid FFCRA leave. Nor is there a need to protect a potentially infected employee who stays home from an employer’s disciplinary actions if the employer has no work for the employee to perform.

Additionally, the DOL explains that removing the work-availability requirement would also “lead to perverse results.” To rationalize this claim and prove such removal would be contrary to Congress’s intent for the FFCRA, the DOL provides the following hypothetical situation:

Typically, if an employer closes its business and furloughs its workers, none of those employees would receive paychecks during the closure or furlough period because there is no paid work to perform. But if an employee with a qualifying reason could take FFCRA leave even when there is no work, he or she could take FFCRA leave, potentially for many weeks, even when the employer closes its business and furloughs its workers. The employee on FFCRA leave would continue to be paid during this period, while his or her co-workers who do not have a qualifying reason for taking FFCRA leave would not. The Department does not believe Congress intended such an illogical result.

2. Employer Approval is Needed to Take Paid Sick Leave or Expanded Family and Medical Leave Intermittently

The DOL reaffirmed the April 1st Temporary Rule’s position that an employee must obtain his or her employer’s approval to take paid sick leave or expanded family and medical leave intermittently under 29 CFR

§ 825.50. The revisions to the Temporary Rule provide additional explanation.

This regulation states that “the ability of an employee to take paid sick leave or expanded family and medical leave intermittently while reporting to an employer’s worksite depends upon the reason for the leave.”

This regulation also goes on to state that “if the employer and employee agree, an employee may take up to the entire portion of paid sick leave or expanded family and medical leave intermittently to care for the employee’s son or daughter whose school or place of care is closed, or child care provider is unavailable, because of reasons related to COVID-19. Under such circumstances, intermittent paid sick leave or paid expanded family and medical leave may be taken in any increment of time agreed to by the Employer and Employee.”

Further, this regulation states that “if an employee takes paid sick leave or expanded family and medical leave intermittently as the employee and employer have agreed, only the amount of leave actually taken may be counted toward the employee’s leave entitlements under the FFCRA.”

In the Temporary Rule, the DOL provides that the employer-approval condition for intermittent leave is appropriate for the following:

- “Qualifying reasons that do not exacerbate risk of COVID-19 contagion.”

- “Taking FFCRA leave intermittently to care for a child, whether the employee is reporting to the worksite or teleworking.”

The DOL also provides that the employer-approval condition “will not apply to employees who take FFCRA leave in full-day increments to care for their children whose schools are operating on an alternate day (or other hybrid- attendance) basis.” The DOL states that the employer-approval condition does not apply in these situations because this leave is not intermittent under 29 CFR 826.50. The following explanation was provided by the DOL to justify this aforementioned conclusion:

In an alternate day or other hybrid-attendance schedule implemented due to COVID-19, the school is physically closed with respect to certain students on particular days as determined and directed by the school, not the employee. The employee might be required to take FFCRA leave on Monday, Wednesday, and Friday of one week and Tuesday and Thursday of the next, provided that leave is needed to actually care for the child during that time and no other suitable person is available to do so. For the purposes of the FFCRA, each day of school closure constitutes a separate reason for FFCRA leave that ends when the school opens the next day.

3. The Definition of “Health Care Provider” Has Been Revised

The most significant change contained in the revisions to the Temporary Rule is in the revised definition of “Health Care Provider.” The FFCRA allows employers to exclude health care providers and certain employees of health care providers from eligibility for EPSL and EFMLA if the employer chooses to do so.

The definition of a “Health Care Provider” who can be excluded from coverage is defined under the revisions to the Temporary Rule to include only employees who meet the definition of that term under the FMLA regulations or those who are employed to provide diagnostic services, preventative services, treatment services or other services that are integrated with and necessary to the provision of patient care, which, if not provided, would adversely impact patient care. It is clear that employees who handle marketing, billing, and other functions not related to patient care services can no longer be exempted from the paid leave requirements of the FFCRA.

With this revision, the DOL explicitly states that it understands that the option to exclude health care providers “serves to prevent disruptions to the health care system’s capacity to respond to the COVID-19 public health emergency and other critical public health and safety needs that may result from health care providers . . . being absent from work.”

The DOL revised the definition of “Health Care Provider” applicable to FFCRA and found 29 CFR 826.30(c)(1) to mean the following:

(1) Health care provider—(i) Basic definition. For the purposes of Employees who may be exempted from Paid Sick Leave or Expanded Family and Medical Leave by their Employer under the FFCRA, a health care provider is

(A) Any Employee who is a health care provider under 29 CFR

825.102 and 825.125, or;(B) Any other Employee who is capable of providing health care services, meaning he or she is employed to provide diagnostic services, preventive services, treatment services, or other services that are integrated with and necessary to the provision of patient care and, if not provided, would adversely impact patient care.

(ii) Types of Employees. Employees described in paragraph (c)(1)(i)(B) include only:

(A) Nurses, nurse assistants, medical technicians, and any other persons who directly provide services described in (c)(1)(i)(B);

(B) Employees providing services described in (c)(1)(i)(B) of this section under the supervision, order, or direction of, or providing direct assistance to, a person described in paragraphs (c)(1)(i)(A) or (c)(1)(ii)(A) of this section; and

(C) Employees who are otherwise integrated into and necessary to the provision of health care services, such as laboratory technicians who process test results necessary to diagnosis and treatment.

The Act goes on to clarify that the following employees are not included in the definition of “Health Care Provider”:

Employees who do not provide health care services as described above are not health care providers even if their services could affect the provision of health care services, such as IT professionals, building maintenance staff, human resources personnel, cooks, food services workers, records managers, consultants, and billers.

It also clarifies what “integrated into and necessary to the provision of health care services” means by providing the following:

Services that are integrated with and necessary to diagnostic, preventive, or treatment services and, if not provided, would adversely impact patient care, include bathing, dressing, hand feeding, taking vital signs, setting up medical equipment for procedures, and transporting patients and samples.

4. Required Notice for Paid Sick Leave or Expanded Family and Medical Leave Must be Provided to the Employer “As Soon As Practicable”

In the revisions to the Temporary Rule, the DOL clarifies that when an employee takes paid sick leave, notice may not be required in advance and may only be required after the first workday (or portion thereof) for which an employee takes paid sick leave.

Previously, 29 CFR § 826.90(b) stated that advance notice was also not required when an employee takes expanded family and medical leave. However, the DOL noted that section 110(c) of the FMLA, as amended by FFCRA section 3102, states “where the necessity for [expanded family and medical leave] is foreseeable, an employee shall provide the employer with such notice of leave as is practicable.”

Therefore, because advance notice for EFMLA is not prohibited if the need is foreseeable, revised 29 CFR 826.90(b) now states that “advanced notice of expanded family and medical leave is required as soon as practicable; if the need for leave is foreseeable.”

Provided in the revisions to the Temporary Rule is the following example of when an employee has a foreseeable situation for taking expanded family and medical leave that would require the employee to notify his or her employer without delay:

If an employee learns on Monday morning before work that his or her child’s school will close on Tuesday due to COVID-19 related reasons, the employee must notify his or her employer as soon as practicable (likely on Monday at work). If the need for expanded family and medical leave was not foreseeable— for instance, if that employee learns of the school’s closure on Tuesday after reporting for work—the employee may begin to take leave without giving prior notice but must still give notice as soon as practicable.

Pursuant to the clarification and revised regulation for notice mentioned above, the DOL also stated that they are revising 29 CFR § 826.100(a), which governs the timing of documentation that an employee is required to give his or her employer when taking paid sick leave or expanded family and medical leave.

29 CFR § 826.100(a) is revised to require the employee to furnish his or her employer with the following information as soon as practicable:

- The employee’s name;

- The dates for which leave is requested;

- The qualifying reason for leave; and

- An oral or written statement that the employee is unable to work.

Note that the information required to be provided by the employee to the employer is unchanged. The regulation merely clarifies that it must be provided as soon as practicable.

Conclusion

Thankfully, these revisions and clarifications to the April 1st Temporary Rule are well-defined and simple to understand. These not only help to fortify certainty that the FFCRA is being carried out in accordance with Congressional intent and that the purposes for which this Act was established, they also serve as helpful guidance for employers that are wanting to ensure they are correctly complying with the law.

In a time where keeping the doors open to a business is hard enough, employers have welcomed all the help that they can get. The DOL, through the April 1st Temporary Rule and the publishing of its FFCRA Questions and Answers Document, has done a remarkable job with providing employers and employees with the information that they need in order to understand their rights and obligations under the FFCRA and the regulations.

CITE AS:

LISI Employee Benefits & Retirement Planning Newsletter #750 (September 24, 2020) at http://www.leimbergservices.com Copyright 2020 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

CITATIONS:

i The EPSLA and EMFLEA are established under Division E and Division C, respectively, of the FFCRA.

ii “Covered Employers” are private-sector employers with fewer than 500 employees, and public sector employers with 1 or more employee).

iii New York v. U.S. Dep’t of Labor, No. 20-CV-3020 (JPO), 2020 WL 4462260 (S.D.N.Y. Aug. 3, 2020).

Register for the October 16, 2020 Success Event here

To attend the event in Naples, Italy rather than Naples, Florida you may GO HERE

Is A Transfer Of Assets In Exchange For Reduced Alimony Or Support Payments Voidable?

Bankruptcy court decisions have recognized that the transfer of assets in exchange for reduction of marital support or other obligations can be considered to have been at arm’s length, and not “fraudulent transfers.” In analyzing these situations the bankruptcy courts will look to state law to determine what the spouse who has received assets or monies has given up in exchange for such transfer. Bankruptcy court decisions have not been consistent on the extent to which a payment made in exchange for reduced spousal support may constitute a transfer for good “value” as defined in Bankruptcy Code Section 548(d)(2)(A), which expressly excludes payments made in exchange for “an unperformed promise to provide future support to the debtor or to another person.” from transfers that can be considered to be at arms-length under fraudulent transfer statutes. See In re Carbous.

The May 9, 2018 Bankruptcy Court Opinion After Trial in the case of in re James F. Libra provided instructive discussion of when spousal support obligations that may be reduced in exchange for a transfer given to the applicable spouse will be considered to be “a legal right or obligation mandated and enforced by statute” that can be reduced in consideration of a payment of money or property, versus legal situations where spousal support is a “promise,” but cannot constitute valid consideration. The Court concluded that Michigan law provides for required spousal support to be an obligation that can be reduced in exchange for consideration paid by a debtor before filing bankruptcy.

The court cited previous Bankruptcy Court cases, based upon North Carolina, Connecticut and New York law, which concluded that alimony and support obligations constitute valid financial liabilities that can be satisfied by transfers of equivalent value to avoid fraudulent transfer characterization.

Once the court determined that there was a legal claim to spousal support that was eliminated as a result of a transfer, it had to determine whether the value of the spousal support was less than “reasonably equivalent value in exchange for the transfer” that the debtor made to his ex-spouse:

Trustee has the burden to prove the value of the spousal support Defendant waived was not “reasonably equivalent” to the value of Debtor’s interest in the marital home. In re Wilkinson, 196 Fed. Appx. At 341. While Trustee Spent considerable time addressing the debt assumed by Debtor, Trustee has not offered any evidence as to the value of the spousal support and the Court will not speculate.

***

With regard to the transfer of Debtor’s interest in the marital home pursuant to the judgment of divorce, the Court finds that Defendant’s waiver of her right to spousal support constitutes “value” as defined in § 548(d)(2)(A). The Court additionally finds that Trustee failed to meet his burden to show the value of the spousal support was less than a reasonably equivalent value in exchange for Debtor’s one-half interest of the marital home. Accordingly, this transfer may not be avoided under § 548.

Bad Faith Claims in the Medical Malpractice Context in Florida

Special thanks to Maddy Elser for contributing this article

I. Introduction.

Most commonly in medical malpractice suits, the physician defendant will be unwilling to settle because they believe that they did nothing wrong, and that a settlement may harm their reputation or affect their ability to obtain low cost insurance. In some cases, the physician defendant may want to settle within his policy limits to avoid a judgment in excess of those limits should the case go to trial. Where a case goes to trial, and the judgment is in excess of the physician defendant’s policy limits, the insurance company will normally be responsible for the amount within policy limits, and the physician defendant will become personally liable for any amount in excess, except that a bad faith claim may arise and then there is an excess judgment which evidences that the insurance company has breached its duties to the insured. The insurer has a fiduciary duty to act in good faith by advising the insured of settlement opportunities, to advise the assured as to the probable outcome of litigation, to inform the insured as to the possibility of an excess judgment, and to advise the insured as to steps that can be taken to avoid an excess judgment. This article will detail the process and requirements of bringing a bad faith claim against an insurer in Florida medical malpractice cases.

II. The Medical Malpractice Bad Faith Statute.

Bad faith causes of action have a “long and established pedigree,” with the Florida courts, which have recognized them under the common law since 1938. Florida Statute Section 766.1185, entitled “Bad faith actions,” was enacted to codify and provide guidance on if and when there will be a bad faith claim against a medical malpractice insurer.

a. Insurer Safe Harbor.

The statute provides a safe harbor for any liability carrier that tenders its entire policy limits in settlement of a claim by the earlier of the following dates:

One date is the 210th day after service of the initial complaint, which may be extended by an additional 60 days if the court determines that the claimant provided new information regarding material witnesses, additional claimants, or additional defendants between the 150th and 210th day after initial service.

The other date is the 60th day after: all claimants have been deposed, all defendants have been deposed, all claimant’s expert witnesses have been deposed, the initial disclosures of witnesses and production of documents, and mediation.

Under the statute, the insurer will not be liable in bad faith if it tenders the policy limits and meets other reasonable settlement conditions before the earlier of the above two dates. The insurer’s failure to tender policy limits within the statutory period is not presumptive evidence of bad faith, but may be considered to be evidence of bad faith.

b. Bad Faith Factors.

Suppose the safe harbor provided by the statute does not apply. If the carrier does not settle the case before or after the above events have occurred, and an excess verdict occurs in a trial or arbitration, then the court presiding over the bad faith action must then perform a totality of the circumstances test to determine whether the physician may prevail on the bad faith claim based on several statutory factors.

These factors include:

(a) The insurer’s willingness to negotiate with the claimant in anticipation of settlement.

(b) The propriety of the insurer’s methods of investigating and evaluating the claim.

(c) Whether the insurer timely informed the insured of an offer to settle within the limits of coverage, the right to retain personal counsel, and the risk of litigation.

(d) Whether the insured denied liability or requested that the case be defended after the insurer fully advised the insured as to the facts and risks.

(e) Whether the claimant imposed any condition, other than the tender of the policy limits, on the settlement of the claim.

(f) Whether the claimant provided relevant information to the insurer on a timely basis.

(g) Whether and when other defendants in the case settled or were dismissed from the case.

(h) Whether there were multiple claimants seeking, in the aggregate, compensation in excess of policy limits from the defendant or the defendant’s insurer.

(i) Whether the insured misrepresented material facts to the insurer or made material omissions of fact to the insurer.

(j) In addition to the foregoing, the court shall allow consideration of such additional factors as the court determines to be relevant.

III. How Courts Have Interpreted the Statute.

While the vast majority of bad faith claims are the result of excess verdicts where carriers have chosen to “roll the dice” to see what occurs in a jury trial that goes awry, there are also bad faith claims against carriers who settle too soon or who pay too much where the insured alleges that he or she is damaged by the fact that the same carrier or subsequent carriers would not renew or provide malpractice insurance at more favorable terms that would apply had the claim not been settled.

Florida Courts have interpreted the Medical Malpractice Bad Faith Statute in many cases with varying fact patterns. Florida courts have generally held that a bad faith cause of action must be brought by the insured when carriers settle claims over physician’s objection or where an excess judgment has been enforced. Courts have held that where an excess judgment has been satisfied, “absent an assignment of that cause of action prior to satisfaction,” third parties may not maintain any action for the breach of duty between the insurer and insured. This is because once a judgment has been satisfied, the bad faith cause of action no longer exists. Courts later held that a bankruptcy trustee may bring a bad faith action in place of the insured because federal bankruptcy law provides that a bankruptcy estate is comprised of “all legal or equitable interests of the debtor in property as of the commencement of the case.” Therefore, a bankruptcy trustee may bring a claim for bad faith because he or she is deemed to have stepped into the insured’s shoes.

In handling claims against the insured, the insurer must act in good faith and “investigate the facts.” In Samiian v. Johnson, a physician sued his insurer for bad faith when the failure to settle the case resulted in a $35 million judgment against him. The physician involved reported his patient’s death to the insurance company immediately, even before the patient’s estate had not yet indicated an intent to file suit against the physician. In filing a bad faith claim, the physician claimed that the insurance company had the obligation under bad faith laws to investigate that claim once notified of the patient’s death. However, the court there found that “nothing in Appellant’s liability insurance agreement . . . created a duty to investigate a potential claim.” Additionally, the court found that the failure to investigate did not have “any damaging effects on Appellees’ handling of the case or outcome.”

Courts have also ruled on bad faith suits where the settlor did settle and there was not a judgment in excess of policy limits. In Shuster v. South Broward Hospital District Physicians’ Professional Liability Insurance Trust, the physician sued his insurer for bad faith after the insurer settled within policy limits. The physician argued that the settlements were entered into without a full investigation, were in excess of reasonable settlement values, and resulted in his inability to maintain malpractice insurance coverage in the future. The Florida Supreme Court ultimately ruled that there was no bad faith claim because the insurance policy contained a provision stating that “The company may make such investigation and such settlement of any claim or suit as it deems expedient.” The court held that “the language of the provision is clear and the insured was put on notice that the agreement granted the insurer the exclusive authority to control settlement and to be guided by its own self-interest.” As a result of Shuster’s decision, the ability of the insured to bring a bad faith claim against the insurer that settles over the objection of the insured will be limited to situations in which there is no language in the insurance policy that requires the insured’s consent.

In Rogers v. Chicago Insurance Co., a physician claimed that when he was sued for malpractice, his insurance company did not initiate an investigation of the claim until one week before the expiration of the 90-day period provided under Florida law. The physician alleged that the investigation consisted of contacting one other doctor to review materials but that the insurer never contacted him for additional materials. The insurance company then settled the claim, which the physician insisted was “completely defensible.” The physician alleged that he could not renew his malpractice insurance because the insurer was not acting in his best interest when it decided to settle. The court dismissed the bad faith claim, holding that “the statutory language requiring any settlement be in the best interest of the insured means the interests of the insured’s rights under the policy, not some collateral effect unconnected with the claim[,]” and noted that he legislature intended to provide that the insurer’s “power to settle is not absolute and must still be in the best interests of the insured under Boston Old Colony and Shuster.

IV. Proceeding with a Medical Malpractice Claim.

The insurance company’s retained counsel is obligated to convey a doctor’s wishes for settlement to the insurance company. Nevertheless, a physician may more effectively make a demand for settlement by retaining his own personal attorney. The retained counsel must remain objective and inform both the physician and the insurance company of their arguments’ strengths and weaknesses. However, a personal attorney may better advocate for a settlement by explaining to the physician the possible risks of personal liability for a judgment above the policy limits and arguing to the insurance company why a settlement is in their best interests. Additionally, the personal attorney may decide to send a bad faith letter to the insurance company explaining why they believe that the failure to settle would result in grounds for a bad faith claim.

V. Conclusion.

The decision to settle a medical malpractice case may have a significant impact on the physician’s livelihood, reputation, and ability to obtain medical malpractice insurance in the future. Physicians, insurance companies, and their respective attorneys should be well aware of their obligations under bad faith laws in Florida, and the consequences of a failure to settle, and whether a bad faith cause of action exists when making decisions as to whether or not a case should be settled or brought to trial. Where the insurer refuses to settle a medical malpractice claim, physicians and their attorneys should look to statutory as well as case law to determine the likelihood of recovery in a bad faith cause of action against their insurer, to make an informed decision in their best interest.

Bankruptcy Court Denies Tenancy by the Entireties Protection to Joint Trust

Alan Gassman and Wesley Dickson

Last Wednesday, September 30, Orlando Bankruptcy Court Judge Jennemann issued an opinion based upon one spouse’s assertion that joint trust assets would qualify to be protected from creditors under the Florida Tenancy by the Entireties rule.

Apparently this couple owned a property jointly as tenants by the entireties but conveyed it to a joint trust which provided that on the death of one spouse the surviving spouse would receive income and children would have a vested remainder interest.

That dispositive feature certainly was different than tenancy by the entireties, which requires absolute ownership of assets on the death of one spouse.

We continue to agree with others that it is possible to draft a joint revocable trust that can qualify as a tenancy by the entireties arrangement by having the beneficial ownership interest in the trust owned by the married couple as tenants by the entireties, and being careful to provide that all aspects of the trust are consistent with the six requirements of tenancy by the entireties, which are as follows:

- Unity of possession;

- Unity of interests;

- Unity of title;

- Unity of time;

- Survivorship; and

- Unity of marriage.

For a discussion of this topic in our Bloomberg Portfolio Series book entitled Gassman & Markham on Florida & Federal Asset Protection Law you can email agassman@gassmanpa.com and put “Thank goodness it is Thursday” in the Re: line.

Also, you can mail us four cereal box tops from Kellogs or Captain Crunch and a fully filled-out New York Times Crossword Puzzle that is hand-written in black ink to 1245 Court St., Clearwater, FL 33756 and we will send you a free copy of the book.*

*Must be sent via care of the U.S. Post Office by regular mail . . . or by carrier pigeon.

Time Running Out for Year End Planning September 9, 2020

The following is a “Client Letter” that was published on the Leimberg Service by Barry Nelson barry@estatetaxlawyers.com, who is an excellent tax and estate planning lawyer from Miami, FL. We thank Barry and LISI for permission to republish this interesting “Client Letter.”

PERSONAL AND CONFIDENTIAL

I hope this message finds you and your family safe and healthy. I am writing to you in light of my concerns that, in the event Democrats win the presidency and Senate after the November election, our office will be unable to assist all of our existing clients who seek year end planning to take advantage of their existing Basic Exclusion Amount from estate and gift taxes (as described below), which could be cut in half or more in 2021.

By no means is this message written to support either of the candidates. The tax issues are just one part of an analysis that is necessary for you to consider in placing your vote. However, we would be remiss if we did not advise you of the possible changes that will be initiated under Joe Biden’s tax plan. There is action that you can take now so that you can save estate taxes should Joe Biden be elected president, the Democrats gain the Senate, and Joe Biden’s tax plan be put into place effective January 1, 2021. If Joe Biden’s current tax proposals are enacted (Joe Biden’s Tax Proposal Summary), it is possible that they may become effective as of January 1, 2021. As a result, your exclusions from paying gift or estate tax (currently $11.58 million ($23.16 if married) minus prior taxable gifts) could be reduced to as low as $3.5 million.

READ: A summary of Joe Biden’s current tax proposals

Unfortunately, the analysis to determine whether gifting should be initiated in 2020 is complex and is not one size fits all. Many clients are not in a position to make significant gifts and remain comfortable that they will retain sufficient assets for the rest of their lives. Although an article that I previously sent to our clients, entitled “Gift Suitability Analysis,” is somewhat dated, the issues as far as factors to consider in determining whether you are in a position to make gifts are still relevant.

READ: Gift Suitability Analysis

In addition to the estate and gift tax issues described above, Joe Biden’s tax proposals would take away the step up in income tax basis upon death. If enacted, this change would create significant additional income taxation concerns. It is impossible to describe these issues in an email; however, I believe that if we schedule a two hour conference (via phone or Zoom) in September or October we will have enough time to discuss the pros and cons of making gifts in 2020 and you will realize that there is no right or wrong decision. The estate and gift tax issues are difficult enough, but when combined with potential changes in income tax basis and the loss of the Basic Exclusion Amount, there are no easy answers.

If you have more than enough assets to maintain your current lifestyle for the remainder of your life and feel comfortable making gifts of up to $11.58 million (if single) or $23.16 (if married), reduced by any prior taxable gifts you may have made, before the end of this year, and you have high income tax basis assets (such as municipal bonds, treasury bonds, or recently acquired stocks that have not significantly appreciated since purchased), then you can easily proceed with making year end gifts to your intended beneficiaries and lock in current exemptions. If you are not comfortable giving up significant wealth, but are comfortable making transfers between spouses, we can also discuss transfers to Spousal Limited Access Trusts (“SLATs”) to take advantage of your remaining Basic Exclusion Amount, but still have your spouse maintain the ability to access funds in the event they are needed.

If, like many of our clients, you own stock of a closely held business and have not made significant transfers of such stock to family members, but have contemplated doing so, now is the time to take action. This planning is most effective if you also have a significant amount of high income tax basis assets, such as stocks and bonds. If so, if Congress does not take away income tax basis step up provisions, then you may have the ability in the future (if your planning includes a tax advantaged “grantor” trust as the gift recipient, which would be held for the benefit of your family members) to exchange your high income tax basis assets for your low basis closely held stock held in the trust created for your family prior to your death. By making this exchange prior to your death and at a time when the step up in income tax basis is available at death, you would have transferred significant assets free of estate tax without losing the income tax step up benefits

I am aware that the analysis and decisions described in this email may be confusing. My objective in this email is to keep it as simple as possible while making sure that you are aware that time is of the essence, and if you want to consider this planning, you need to schedule a time for us to have a conference (via phone or Zoom) as soon as possible. Due to time constraints, I have already declined a significant amount of new business over the last month so that I can focus on clients who have been with us over the years and who deserve the benefits of our long standing relationship, which we greatly appreciate. Otherwise, it would be absolutely impossible for our firm to handle new business and provide current clients with the level of attention that is required to most effectively address the multitude of issues that our clients will be facing this year end.

In past years, when similar concerns existed, some clients did nothing and, as it turned out, the laws were not adversely changed. They saved legal fees and aggravation. Other clients, who took significant action, sometimes felt that because the law was not changed and the Basic Exclusion Amount remained the same, they overreacted and had remorse. You should be aware that it is possible that taking no action this year would be a reasonable option. Nevertheless, these decisions should be made based upon an understanding that there may be significant tax benefits by taking action now, as compared to not taking any action at all.

Some clients may prefer to wait until after the election and then proceed. However, I would like to advise you that it is likely that we will not have adequate time to handle the requests that would be made to our firm after the election should Democrats gain the presidency and the Senate. In addition, certain planning, such as SLATs (discussed above), if created for both spouses, are recommended to be executed at different times, which means that there needs to be significant time in between the executions to be safe. Moreover, banks and financial institutions need time to set up the accounts for new trusts and to transfer the assets thereto. Thus, time is required to ensure the gifts are complete before year end. Should you have any questions, please feel free to contact me.

Although a separate matter, I would also like to advise you that 2020 is a great year to make charitable gifts to offset taxable income. The CARES Act allows individuals to make charitable gifts in 2020 of cash to public charities (i.e., not to foundations or donor advised funds) and deduct 100% against adjusted gross income. As of the date of this email, the 100% deduction against adjusted gross income will be reduced to 60% in 2021. Thus, if you are considering making large charitable contributions or if you have been taking advantage of the law that allows you to pay

$100,000 of your retirement assets directly to charity each year and would like to pay more, now is a great opportunity to do so.

Very truly yours,

BARRY A. NELSON

JENNIFER E. OKCULAR

CASSANDRA S. NELSON

For the Firm

For Finkel’s Followers

Just a few short months ago, businesses were flourishing. In February, the unemployment rate was hovering around 3.5 percent. It was the perfect situation for job seekers and as employers we had to work hard to attract, recruit and retain top talent.

Fast forward to the present. Job seekers are facing a completely different situation. In May the current unemployment rate was around 13.3% and as a result, almost all businesses put a freeze on hiring, and many have had to lay people off just so they could survive.

As a nation, we are now starting to move into phase 1 of getting back to “normal.” Which means for many business owners, they are starting to think about rehiring or finding new talent for their businesses. And for those of you that are looking to find a new hire, the timing couldn’t be better. Here are three reasons why.

- Large available talent pool with less competition: Due to the high unemployment rate, it is now once again, an “employer’s job market.” The same top talent that you were so desperate to find just a few months ago, are now beginning to look for work. The talent pool is now very large and eager to get back to work. And with fewer companies hiring, there is currently a lot less competition to find top talent. Companies that begin hiring now, will have a great advantage over those who wait.

- Technology: It’s 2020 and we have the technology available and thanks to the “stay at home” orders, we now have a reason to utilize it effectively. One of my business coaching clients, Mike Matalone of XP3 talent, has seen an increase in the number of clients that are now seeking out alternative ways to find and hire new talent. Mike says “Covid-19 has essentially changed the way we all think about recruiting.” And many businesses are learning how to recruit, onboard, and train new hires “virtually” using various applications like Zoom, Google, and other video meeting platforms.

- We are more agile than ever before: Having to “stay at home” has taught us a multitude of lessons as business owners. We have learned that many people can be just as or even more productive working from home. Less time commuting equals increased productivity hours, less stress, decreased transportation costs, and increased work/life balance. All this equals a happier workforce that in return will be more productive! We have learned how to better manage our virtual staff, which leads to a decrease in operating costs and an increase in profitability. And the list goes on.

Because of these three things, I want to encourage you to start looking at your hiring plan and planning accordingly. It’s the perfect time to start looking for that key team member, and starting the relationship. We call this the “Gold Standard of Hiring” where you take opportunities like the present job market and start building your team before you need them. This is a concept we call a “farm club.” Professional sports do this all the time and you can too.

Good luck with your recruitment!

On This Day In Humor And History

Why did the car cross the river with the boat? It was a Fjord escort.

My dog failed his driving test, he can’t parallel bark.

I couldn’t work out how to fasten my seatbelt. Then it clicked.

Why did Mickey Mouse get hit with a snowball? Because Donald ducked.

Why did Mickey Mouse take a trip to space? He wanted to find Pluto!

What did Daisy Duck say when she bought lip gloss? Put it on my bill.

How does Mickey feel when Minnie is mad at him? Mousereable.

On This Day

- 1814: Opening of the Congress of Vienna, which redrew Europe’s political map after the defeat of Napoleon Bonaparte

- 1903: First Baseball World Series game ever played

- 1908: Henry Ford introduces the Model T car

- 1949: People’s Republic of China proclaimed by Mao Zedong and Republic of China (Taiwan) forms on island of Formosa

- 1967: Pink Floyd begin their first US tour

- 1971: Walt Disney World opens in Bay Lake, Florida

- 1977: Elton John honored by MSG Hall of Fame

- 2018: New trade deal announced between the United States, Canada, and Mexico (USMCA), replacing NAFTA

Birthdays

- 1910: Bonnie Parker, of Bonnie and Clyde

- 1924: President Jimmy Carter, 39th U.S. President

- 1924: Former Chief Justice William Rehnquist

- 1935: Julie Andrews

- 1956: Theresa May, British Prime Minister

Upcoming Events

Register for the October 23, 2020 webinar here

FREE WEBINARS PROVIDED BY OUR FIRM ARE HIGHLIGHTED IN BLUE BELOW

| When | Who | What | How |

|---|---|---|---|

| Friday, October 2, 2020 | USF Resident Intern meeting at Tampa General Hospital in Tampa, FL |

Alan Gassman presents: Contract Negotiations from 4 to 5 PM EDT |

More Information |

| Tuesday, October 6, 2020 | CPA Academy |

Alan Gassman and Sean Healy present: Lethal Pitfalls In Drafting Gun Trusts from 5:30 to 6:30 PM EDT |

REGISTER |

| Wednesday, October 7, 2020 | Johns Hopkins All Children’s Hospital |

Alan Gassman presents: Year’s End Hot Topics for Estate and Tax Planners from 12:30 to 1:30 PM EDT with a replay from 5:30 to 6:30 PM EDT |

Available exclusively for registrants of the Johns Hopkins All Children’s Hospital – Annual Estate Planning Seminar |

| Friday, October 16, 2020 | USF Resident Intern meeting at Tampa General Hospital in Tampa, FL |

Alan Gassman presents: Contract Negotiations from 4 to 5 PM EDT |

More Information |

| Friday, October 16, 2020 | Estate Planning Council of Naples Success Event |

An interactive event with Alan S. Gassman and EPC of Naple’s friends

from 9 to 12 PM EDT |

REGISTER |

| Wednesday, October 21, 2020 | Reno Estate Planning Council |

Alan Gassman presents: Dynamic Planning With Irrevocable Trusts After TRA 2017 from 11 to 12:30 PM EDT |

REGISTER |

| Thursday, October 22, 2020 | Children’s Home Society of Florida Webinar |

Alan Gassman presents: Donor Appreciation Event: Will & Trust Planning from A – Z a.k.a. Fun with Dick and Jane as They Plan Their Estates (w/ a special guest appearance from Spot) from 12:30 to 1:30 PM EDT |

REGISTER |

| Friday, October 23, 2020 | Florida Bar Tax Section CLE |

Alan Gassman, Leslie Share, Denis Kleinfeld, Michael Markham, Jonathan Blattmachr, Brandon Cintula, Martin Shenkman, Jay Adkisson, Alexander A. Bove, Jr., Bruce Givner, Howard S. Fisher, Jonathan E. Gopman present: Advanced Asset Protection Workshop |

REGISTER |

| Monday, October 26, 2020 | Free webinar from our firm |

Alan Gassman and Sean Healy present: LETHAL PITFALLS IN DRAFTING GUN TRUSTS from 12:30 to 1:20 PM EDT |

REGISTER |

| Wednesday, October 28, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Christopher Denicolo presents: A Comprehensive Review of the SECURE Act And How To Draft For What Is Still Not Clear from 3 to 5 PM EDT |

REGISTER |

| Thursday, October 29, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Alan Gassman participates in panel on: Termination of Charitable Trusts – Everything you wanted to know about CLAT (termination). from 3:50 to 5 PM EDT |

REGISTER |

| Friday, October 30, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Alan Gassman moderates: CARES Act Loan Forgiveness: Tax Issues and Related Aftermath of COVID-19 if the Loan Is Repaid Presented by David Herzig and Herbert Austin from 8 to 9 AM EDT |

REGISTER |

| Wednesday, November 4, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Andrew Barg present: Taxation of Individuals and Businesses in Bankruptcy from 12:30 to 1 PM EST |

REGISTER |

| Monday, November 16, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman presents: Dynamic Planning for Professionals and Their Entities from 4:45 to 5:35 PM EST |

REGISTER |

| Tuesday, November 17, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman and Brandon Lagarde present: COVID 19: What Did We Learn About Financial Viability During a Pandemic: Parts 1 and 2 from 12:40 PM to 2:30 PM EST |

REGISTER |

| Wednesday, November 18, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Andrew Barg present: Advanced Tax Planning And Strategies For Insolvent Taxpayers – Including State Law Impact And State Taxes from 12:30 to 1 PM EST |

REGISTER |

| Tuesday, December 1, 2020 | Ohio Bar Association’s Great Lakes Asset Protection Institute |

Alan Gassman presents: Asset Protection Plans that Actually Work! 60 Minutes On Asset Protection |

More Information |

| Friday, December 4, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Michael Markham, Esquire present: What We Know About Subchapter 5 Bankruptcies from 12:30 to 1 PM EST |

REGISTER |

| Thursday, February 11, 2021 | Johns Hopkins All Children’s Annual Estate Planning Seminar |

Alan Gassman virtually sponsors: Introducing Speakers and Listening Carefully! |

More Information |

| Friday, March 26, 2021 | Florida Bar Tax Section CLE |

Alan Gassman and Leslie Share present: Creditor Protection Nuts & Bolts |

Coming Soon |

Call us now! Bookings accepted for haunted houses, bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200