Thursday Report – Issue 288

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Edited by: Chris Denicolo

Thursday, September 17, 2020 – Issue 288

Having trouble viewing this? Use this link

PPP 2 – What Will It Look Like?

Pension Plans, IRAs And Other Qualified Retirement Plans Can Be Excellent Protection Tools In Florida- But Be Aware Of The Inadvertent Blanket UCC-1 Filing Which Can Obliterate Protection Of Such Assets

No Summer Break for the Department of Labor: Tracking Hours Worked by Teleworking/Remote Employees; FFCRA Eligibility when Schools are Open; and DOL Guidance Documents

A Poem To My Elders

For Finkel’s Followers

Today In History And Humor

Coming Soon

Upcoming Events

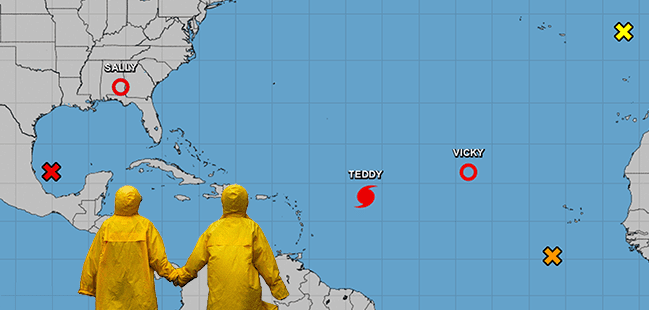

This Thursday Report is yet another example of significant activity in the tropics, as we at the Thursday Report are committed to providing incisive and timely updates that can help clients and advisors navigate these landmines and nuances inherent to estate and tax planning.

Despite the significant activity in the tropics, we are hopeful that you find this Thursday Report to be timely and helpful, and that you and yours are staying safe (and dry) in view of the pandemic and other recent events.

Stay safe but try the following ingredients:

- 2 ounces light rum

- 2 ounces dark rum

- 1 ounce fresh lime juice

- 1 ounce fresh orange juice

- 1/2 ounce passion fruit purée

- 1/2 ounce simple syrup

- 1 barspoon grenadine

- Garnish: orange wheel

- Garnish: preserved cherry

PPP 2 – What Will It Look Like?

Alan Gassman

As of September 10, 2020, the below described bill has failed in the Senate. To learn about what that bill contained, and what I hope future bills will contain, continue reading.

On September 8th, Senate Majority Leader Mitch McConnell (R-KY) released an amendment (S.Amdt.2652) to Senate Bill 178 (the “UIGHUR Act of 2019”) which was passed by the House of Representatives last December with the stated purpose of “direct[ing] United States resources to address human rights violations and abuses, including gross violations of human rights, by the People’s Republic of China’s mass surveillance and internment of over 1,000,000 Uighurs and other predominantly Turkic Muslim ethnic minorities in China’s Xinjiang Uighur Autonomous Region.”

The proposed amendment would have provided for a complete substitution of all provisions of this totally unrelated bill, replacing it with the “Delivering Immediate Relief to America’s Families, Schools and Small Businesses Act.”

Coined as the GOP’s “skinny” COVID-19 relief bill, this targeted relief package came with a price tag of approximately $300 billion, a much smaller amount than the proposed $1 trillion HEALS Act which contains the widely-discussed bill by Senators Marco Rubio (R-FL) and Susan Collins (R-ME) from July. To read more about this bill, click HERE.

For many borrowers that are still struggling to keep the doors to their business open, this proposed Act would have been a great sigh of relief for many, as it would have provided new “second-draw” PPP loans for past borrowers who met the following requirements:

- The borrower must have had at least a 35% reduction in gross receipts during the first quarter (January 1 to March 31) or second quarter (April 1 through June 30) of 2020, as compared to gross receipts for the same time period in 2019. The Act would have also accommodated borrowers who were not in business during the first and second quarter of 2019 by establishing alternative tests for ascertaining eligibility, which are discussed in greater detail below.

- The borrower would have been required to employ not more than 300 employees, or meet an alternative size standard under SBA published guidelines.

- The new loan would not have exceeded $2,000,000 in most cases, and would have been restricted from exceeding $10,000,000 in the aggregate with other SBA loans approved in the last 90 days (including PPP loans).

For purposes of the above 35% reduction in gross receipts test, borrowers who were not in business during the first or second quarter of 2019, but were in business during the third and fourth quarter of 2019 (July 1 to December 31), would have compared their gross receipts in the first or second quarter of 2020 to their gross receipts in the third or fourth quarter of 2019.

If the borrower was only in business during the fourth quarter of 2019 (October 1 to December 31), then such borrower would have compared their gross receipts in the first or second quarter of 2020 to their gross receipts during the fourth quarter of 2019.

If the borrower was not in business during 2019, but was in operation on February 15th, 2020, the borrower would have compared their gross receipts in the second quarter of 2020 to their gross receipts in the first quarter of 2020.

The bill would have also established new loan restrictions on any entities that “did not exist” between February 15, 2019 and 2020. This restriction would have capped the maximum possible loan to these entities at the lesser of $2,000,000 or 2.5 times the monthly payroll payments paid or incurred for the covered periods, though most businesses would have likely fell below the $2,000,000 threshold.

Further restrictions were proposed that would have capped the maximum available loan amount for “seasonal employers” to $1,000,000. A seasonal employer, as defined in the bill, is an employer that does not operate for more than 7 months per year, has gross receipts for one 6-month period that are not more than 33.33% of the gross receipts for the other 6-month period, and that employs 250 or less employees for at least 5 months per year.

Unlike the initial round of PPP loans where borrowers were eligible to receive a maximum of $10,000,000, the proposed second draw loans would have been capped at $2,000,000 per borrower. Additionally, to the dismay of recent borrowers, the proposed Act would have also required that the combined loan amount could not exceed $10,000,000 if another PPP loan was taken within the last 90 days. By waiting for the 90-day period to pass before taking a second loan, borrowers could have avoided this limitation.

This bill would have also provided for the disqualification from loan eligibility for certain entities affiliated with the People’s Republic of China. Such disqualified entities, as defined in the bill, are any entities created in or organized under the laws of China or Hong Kong, or that have significant operations in China or Hong Kong, or those that retain a resident of the People’s Republic of China on the entity’s board of directors.

Many of the key provisions of the Rubio-Collins bill made it into this bill as well, such as the flexible covered period and the expansion of eligibility to cover 501(c)(6) organizations, just to name a few.

While this bill shared many similarities with the proposed HEALS Act, one notable place where it differed was in allowing eligible entities to use their PPP loans to refinance pre-existing EIDL loans. For a better understanding of EIDL loans, click HERE.

Based on recent attempts at passing meaningful legislation, many predicted that this bill was destined to be filibustered, stalled, or voted down, meeting the same fate as the Rubio-Collins bill. During this time of constant instability and concern in peoples’ lives, it is unfortunate that a measure which would have provided at least some sort of help failed for a second time.

On top of the funding for PPP loans, among many other provisions, this bill would have also extended the federally-funded unemployment benefits, though cutting the amount to $300/week from the initial $600/week. This extension would have ensured these benefits to Americans who initially qualified under the terms set out in the CARES Act through December 27th.

September 11 rings a bell in the United States as a day when there was mass destruction. Mass destruction is going on for many small businesses right now, and a chance to rectify some of this was lost yesterday. Let’s all hope that the third time’s the charm, and that these provisions, and more, will have an easy time moving through Congress so millions of Americans can receive some much-needed relief. Until then, we will be patiently awaiting the ones that got away.

Pension Plans, IRAs And Other Qualified Retirement Plans Can Be Excellent Protection Tools In Florida- But Be Aware Of The Inadvertent Blanket UCC-1 Filing Which Can Obliterate Protection Of Such Assets

Excerpts from Gassman & Markham on Florida and Federal Asset Protection Law

Pension Plans, IRA accounts, and other Qualified Retirement Plans enjoy exempt asset status both under the Florida Statutes and the Federal Bankruptcy Code, in addition the income tax benefits afforded by such assets.

Many new businesses and professionals do not have pension plans, or have plans which are not of optimum design for their situation. Fortunately, some pension actuaries will not charge to take a look at an existing plan and employee information in order to advise on optimum plan design, which may include consideration of cross-tested defined benefit or cash balanced plans, which are not well understood. The census that follows can be used to provide the information that an advisor will need to facilitate plan design.

Many advisors are not aware of the Affiliated Service Group rules and Employee Leasing rules under Internal Revenue Code Sections 414(m) and (n) which can cause individuals who work indirectly or in associated companies to be required to be included in a pension plan in order to avoid disqualification under the anti-discrimination rules.

Florida’s exemption status applies to the unlimited values of both Pension Plans, IRA accounts, and other Qualified Retirement Plans, and includes rollover IRAs that pass to surviving spouses and also IRAs inherited by other beneficiaries who reside in Florida. For Florida residents, such exemption status can be used in Bankruptcy as well.

In Bankruptcy, individuals who are not able to use state law to facilitate exemption of Pension Plans, IRA accounts, and other Qualified Retirement Plans will be subject to loss of exemption for any inherited IRAs they own or receive, because the federal Bankruptcy Code protection does not extend to any inherited IRA, at least if it was not inherited by a surviving spouse. The present cap, which was last updated for inflation on April 1, 2019, totals $1,362,800 (and will be updated again on April 1, 2022).

Nevertheless, Bankruptcy is a mode of litigation, and therefore somewhat unpredictable. Unpleasant surprises can certainly occur.

An example on point is the 2019 11th Circuit Case of Kearney Construction Company, LLC, v. Travelers Casualty and Surety Company of America. Before filing bankruptcy, Mr. Kearney had executed one or more promissory notes and a security agreement to enable an LLC owned by his son to place a lien against all of his tangible and intangible assets that could be secured by the lien under Florida law. The court did not cite the fact that the LLC was owned by Mr. Kearney’s son as determinative so its holding likely would have been the same if the lender were a completely unrelated third party.

The court found that this lien attached to Mr. Kearney’s IRA accounts at the time that it was executed and that this constituted a Prohibited Transaction under Internal Revenue Code Sections 408 and 4975, which penalizes taxpayers who make personal use of their IRA accounts by pledging them as security for a personal loan. Florida Statute Section 222.21(2) generally requires that an IRA must be properly qualified under Code Section 408, to be exempt from creditors. Code Section 408 states that “[a]ny individual retirement account is exempt from taxation,” but this status can be lost if the owner “engages in any transaction prohibited by section 4975.”

Mr. Kearney argued that there was no intent to pledge the IRAs as collateral, but the “boilerplate language” of the Security Agreement and the Form UCC-1 Financing Statement that was filed nevertheless attached, according to the Eleventh Circuit Court of Appeals, and this caused loss of the creditor-proof nature of the IRA, even though the creditor that had the lien did not attempt to garnish the IRA, and was apparently paid in full.

The court in Kearney held that the plain language of the UCC-1 agreement signed was sufficient to implement a lien on six of Mr. Kearney’s accounts including his IRA. The plain language of the UCC-1 agreement was as follows:

Grant of Security Interest. As security for any and all Indebtedness (as defined below), the Pledgor hereby irrevocably and unconditionally grants a security interest in the collateral described in the following properties[:] all assets and rights of the Pledgor, wherever located, whether now owned or hereafter acquired or arising, and all proceeds and products thereof, all goods (including inventory, equipment and any accessories thereto), instruments (including promissory notes)[,] documents, accounts, chattel paper, deposit accounts, letters of credit, rights, securities and all other investment property, supporting obligation[s], any contract or contract rights or rights to the payment of money, insurance claims, and proceeds, and general intangibles (the “Collateral”).

The court stated that “the above language constitutes an unambiguous pledge of ‘all assets and rights of the Pledgor,’ including his IRA Account.”

This case can be distinguished from the 2013 bankruptcy decision in In re Daley, where Mr. Daley executed loan documentation with Merrill Lynch that reported to place a lien upon all of his individual accounts, including one or more IRAs that he had with Merrill Lynch. Mr. Daley signed a “blanket” Client Relationship Agreement (not a UCC-1) with Merrill Lynch that was as follows:

All of your securities and other property in any account–margin or cash–in which you have an interest, or which at any time are in your possession or under your control, shall be subject to a lien for the discharge of any and all indebtedness or any other obligations you may have to Merrill Lynch.

Fortunately for Mr. Daley, he never actually borrowed any money from Merrill Lynch, so the court in Daly concluded that there was never a Prohibited Transaction because he did not directly or indirectly borrow against the IRA.

The court’s opinion stated that “[t]he mere existence of a “cross-collateralization agreement,” as the IRS calls it, does not by itself disqualify an IRA from exempt status.” The appellant in In re Daley did not engage in any disqualified transactions under Internal Revenue Code Section 4975 with his IRA account, and therefore the IRA was exempt from creditors because of Florida Statute Section 222.21. The “blanket” agreement was not enforceable.

The court also discussed that the IRS had issued IRS Announcement 2011-81 in 2011 which indicated that pledging an IRA as collateral under loan documents will not constitute a Prohibited Transaction unless or until a loan is actually taken.

This is an example of one of the many cases where new law gets made at the expense of a surprised and unfortunate debtor, along with the debtor’s legal counsel.

Courts have traditionally liberally construed exemptions in favor of debtors. The Supreme Court of Florida noted in the 2007 case of Chames v. DeMayo, that a “blanket” statement is unenforceable unless the statement is “knowing, intelligent, and voluntary.”

The Supreme Court of Florida compared the informality of these “blanket” statements to those that a client is required to sign from their attorney, in which they initial each paragraph to note their understanding of the agreement.

Nevertheless, the Kearney decision has caught many by surprise, as the prevailing thought is that the creditor protection afforded by Florida Statute Section 222.21 was not considered to be waived as a result of boilerplate language and a Pledge Agreement, which is often found in substantially all consumer loan and mortgage documents. The decision therefore has wide reaching effects in that it could cause many unsuspecting individuals to be considered to have received a deemed distribution of the assets in his or her pension plans, IRAs or qualified retirement plans, which could subject the individual to taxes, interest and penalties, and also could subject such assets to creditor claims of Florida residents.

The Tax Section of the Florida Bar is proposing legislation to provide an exception which would not cause loss of creditor exemption provisions for pension plans, IRAs and other retirement plans, and surely this issue will be one to monitor.

No Summer Break for the Department of Labor: Tracking Hours Worked by Teleworking/Remote Employees; FFCRA Eligibility when Schools are Open; and DOL Guidance Documents

Joan M. Vecchioli, Colleen M. Flynn, Rachael L. Wood

TRACKING HOURS WORKED BY TELEWORKING/REMOTE EMPLOYEES

On August 24, 2020, the Department of Labor (“DOL”) issued Field Assistance Bulletin (“FAB”) 2020-5, which provides guidance on an employer’s obligations under the Fair Labor Standards Act (“FLSA”) to track the number of hours worked by teleworking/remote employees.

The FAB explains that employers must pay for all work they know or have reason to believe is being performed by an employee, including unauthorized work or work performed at home. In determining whether an employer has actual or constructive knowledge of the hours worked by an employee, courts consider whether the employer exercised reasonable diligence in tracking the hours worked. Employers can satisfy their obligation to exercise reasonable diligence to track working time by having a reasonable procedure for reporting nonscheduled time and compensating employees for all reported hours worked, even if not pre-approved or authorized. Reporting procedures are not reasonable if an employer fails to provide proper training on the procedure, implicitly or overtly prevents or discourages employees from reporting all time worked or fails to pay for all the reported time.

For telework and remote work employees, employers may also have actual knowledge of hours worked through employee reports or other notifications, in addition to the employee’s work schedule. Employers, however, are not required to take impractical steps, such as sorting through records of an employee’s access of work-issued electronic devices outside of scheduled work hours, to identify unreported work if employees do not use the available reporting procedure and the employer is not otherwise notified of the additional work time.

Although this FAB is issued in response to the new work arrangements created by COVID-19, the FAB applies to all telework and remote work arrangements. In addition, the FLSA requires that an employer compensate an employee for all hours worked, regardless of whether the employee works remotely or in-person at a worksite, when the employer has actual or constructive knowledge of the hours worked even if the work is not authorized. This FAB does not prevent an employer from disciplining an employee who violates the employer’s off-the-clock or overtime policies.

ELIGIBILITY FOR FFCRA LEAVE WHEN SCHOOLS ARE OPEN

In anticipation of schools reopening, the DOL has also updated its guidance on the Families First Coronavirus Response Act (“FFCRA”). Specifically, the DOL has confirmed that an employee is not eligible for leave under the FFCRA, when the child’s school is open, but the employee has chosen to have the child participate in a remote learning program. An employee may be eligible for FFCRA leave when the school is “closed” to the child, such as when the school is operating on a hybrid-attendance basis or when the child is under a quarantine order.

APPROPRIATE AND TRANSPARENT GUIDANCE BY THE DOL

On August 21, 2020, the DOL announced the publication of its Promoting Regulatory Openness through Good Guidance Rule (“PRO Good Guidance Rule”), which implements Executive Order 13891. Per the announcement, the PRO Good Guidance Rule allows the DOL to continue to use guidance for lawful purposes, but ensures that guidance documents cannot be used in an unfair or unlawful manner”.

The PRO Good Guidance Rule requires that the DOL use guidance appropriately, transparently, and in a manner that is accessible to the public by 1) providing that, for significant guidance involving impacts greater than $100 million, the DOL will provide for notice-and-comment review of the guidance; 2) requiring all DOL guidance to be made available to the public; 3) allowing the public to petition the DOL on issues related to its guidance; and 4) limiting the DOL’s use of guidance to avoid potentially unfair conduct.

As part of the Executive Order, the DOL also completed a comprehensive review of its guidance and rescinded approximately 3,200 guidance documents. The remaining guidance documents can now be found in a single, searchable website at www.dol.gov/guidance. As the DOL explained, guidance should provide clarity about existing rights and obligations and help stakeholders comply with laws and regulations, but not be used to create new obligations or modify the law.

ANNUAL SEMINAR

Like many things in 2020, we are going virtual! In place of our annual Best Employment Practices seminar, we will be hosting a series of webinars to keep our clients updated on current developments in labor and employment law. Stay tuned for additional details. If you would like to receive our future seminar announcements, please email suzannek@jpfirm.com with your contact information.

We also encourage you to visit our blog at www.shieldingemployers.com. There, you will have easy access to important updates on COVID-19 and other labor and employment law topics.

Joan M. Vecchioli is a partner in the Clearwater office and is Board Certified in Labor and Employment Law by the Florida Bar.

Colleen M. Flynn is a partner in the Clearwater office whose practice focuses on Labor and Employment Law.

Rachael L. Wood is an associate in the Clearwater office whose practice focuses on Labor and Employment Law.

THIS ARTICLE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSIDERED LEGAL ADVICE. LEGAL ADVICE CANNOT BE GIVEN WITHOUT INFORMATION ABOUT YOUR SPECIFIC SITUATION.

A Poem To My Elders

Wesley Dickson

Roses are red or some shade of crimson

Violets are like Marge’s hair from the Simpsons

Leaves are green but they turn brown in the Fall

Watch them get trampled when my dog sees a ball

Flowers can teach us about more than just colors

Like how to reach out and to be nice to others

And maybe, like rainbows, at the end, we strike gold

I, too, would chase it if I were so bold.

But instead I just kick back with my feet in the sand

I know times are uncertain but I’ve got a plan

Relax on the beach, watch the waves hit the shore.

There might not be people, but that’s not a chore.

Or maybe I’ll stay in and watch a new movie

Something that’s funny, or scary, or groovy

Or maybe I’ll turn a page in a good book

While bundled in blankets all snug in my nook.

Or perhaps I’ll sleep and catch up on rest.

Though my beds a bit messy it looks like a nest.

Well there’s an idea, I could go look at birds.

Though with those binoculars I might look absurd.

I might take the time and type out a letter

In the hopes that I might make someone’s day better.

At the end of the day that is what life is about.

Finding reasons to smile day-in and day-out

So now we just wait for a return to order.

We are almost there, we just sit on the border

Eventually all will be back as it should

And I’ll cheer having known all along that we could

And hopefully people will look back and think

About how every person has in common a link

Be it race or gender, our hobbies or fears

Or maybe our favorite cocktails or beers

Or maybe the fact that we all lived through this

I’m not sentimental but I’d be remiss

If I didn’t mention one time in this poem

To water all flowers that grow in your home.

Don’t Hire An Independent Contractor Without Asking These 4 Questions

David Finkel

As a small to medium business owner, you have no doubt struggled to find quality talent for your company at one point or another. Today’s competitive market makes it even more challenging and there aren’t enough job candidates to fill all the open positions. Which is why, for many, hiring an independent contractor might be an idea worth exploring.

Hiring independent contractors will open up the talent pool to a more experienced, business-minded group of candidates and will allow you to control costs and overhead as you scale. But if you are new to the concept, there are a few things that you should know before hiring in this manner.

So, today I wanted to share with you four things to think about when hiring your first independent contractor.

1. Should You Pay for Results or By the Hour?

For those used to a “traditional” workforce you are likely familiar with the “by the hour” model of compensation. But for many jobs and projects, paying for results not only help you take a fixed expense and make it variable, but if your independent contractors work remotely, it builds in a simple control to make sure they are accountable. You can pay them a set amount to complete a specific project; or pay them per sale, per client issue closed, or per event they manage.

If you can’t pay for results, still consider paying a flat fee versus hourly. This eliminates the “overtime” issue and allows you to know exactly what your team costs will be month by month.

2. Are you Paying Them Enough To Cover Their Costs?

Hiring a W-2 employee, often comes with certain “perks” like benefits and office supplies and equipment. Since your independent contractor doesn’t have access to these things, you want to make sure to pay them enough so that they can purchase their own benefits, technology and supplies. They will also be responsible for their own basic overhead, like phone and internet.

In the event that they need “tools” to start-up working for you (e.g. a laptop) you might consider giving them a startup bonus, that way they have the money to buy their own equipment.

3. Are They Incorporated?

Not only will this save them several thousand dollars on their taxes if they structure as an S-Corp or LLC taxed as an S-Corp (they can pay themselves a reasonable salary and take the rest of what you pay them as a dividend which is not subject to FICA), but it will also greatly reduce your risk of them ever being reclassified as “employees” by the IRS.

4. Did You Get A Contract?

Unlike a W-2 employee, there are certain things that need to happen before onboarding a new independent contractor, mainly getting the relationship in writing. Your contract needs to lay out exactly what they are responsible for, the standards to which that work will be done, and the exact nature of the relationship. You also want to lay out who controls things like phone numbers, fax numbers and email addresses so that you have access at all times.

In today’s world this is easy for your I.T. department to set up. The phones and fax numbers can be done through a web-based system or service, and the email accounts will be through your company email server. I also suggest that you make it clear to them that the company will also monitor and back up all company email, and that they should use the company email only for company purposes.

With these four tips you can make sure that your bases are covered when bringing on a new independent contractor for your business.

Today In History And Humor

Wesley Dickson

- Hugh Magnus, who once was the King of France, was born on this day in 1025.

- He is not to be confused with Hugh Mungus, who is much larger in size.

- Shelby Flint and Keith Flint were two songwriters born on September 17. The two of them performing with Steely Dan would have been a performance that made sparks fly.

- On this date in 1630, the city of Boston, Massachusetts was founded.

- Showing off its newest enterprise, NASA unveiled the Space Shuttle Enterprise on September 17, 1976.

- The Camp David Accords were signed on this day in 1978.

- On September 17, 2011, protestors flooded Zuccotti Park in a movement that would come to be known as Occupy Wall Street.

- On September 17, 1859, Billy the Kid was born. . . though so much time has passed he is likely Billy the Adult by now.

- September 17th is a big day for justice. Two Supreme Court Justices, John Retledge and Warren Burger were born on this day, though 168 years apart.

- However, today also is a reminder of injustice. Dred Scott, an enslaved African American man in the United States who sued for his freedom and lost in the 1857 landmark case Dred Scott v. Sandford, died from Tuberculosis on this day in 1858.

- Harriet Tubman, contrary to the opinions of a popular hip-hop artist, escaped from slavery on September 17 and helped around 70 others do the same.

- Patrick Mahomes was born on September 17, 1995. Mahomes recently made headlines for receiving the largest contract for an athlete in history at $503 million over 10 years.

Coming Soon

What To Do Now For Your Best Clients: Tax And Estate Planning Strategies

Presented by: Alan S. Gassman

Hosted by: CPA Academy

October 21st, 2020

(90 minutes)

A special presentation for the annual Tax Seminar Series held by The Zicklin School of Business at Baruch College.

The COVID-19 crisis and a possible regime change in Washington D.C. provides many opportunities, and a perfect storm for many families with respect to dynamic planning to save taxes, preserve assets while mitigating the risks faced by many successful families. Spectacularly low-interest rates, high mortality risks for older clients, and the possibility of taking substantial discounts with respect to the value of privately held businesses and real estate allows for dramatically effective estate tax planning for our best clients.

In addition, assets placed into properly structured trusts and layered entities can protect against possible future creditors, undue influence and income and estate taxes. This 60-minute presentation will provide planners with dynamic and some not so well known or understood strategies, conversation points, and client friendly charts and explanations.

Course Objectives:

- Understanding and applying estate tax planning techniques which work well in challenging economic times.

- Learning how to best plan for clients who may have a short term but appreciably high risk of mortality.

- Becoming familiar with how to make LLCs and other entities more bullet-proof from possible IRS tax and also creditor challenges.

- Become able to help clients engage in planning that can dramatically reduce the value of assets exposed to estate taxes and creditors in ways that can be unwound in a few months’ time.

- Having a categorical understanding of client circumstances, and what planning techniques will work best for them using a menu approach.

- Become familiar with the EstateView Estate Tax Illustration and Planning Software that will be given to all attendees of the Baruch Program for use with their clients.

Upcoming Events

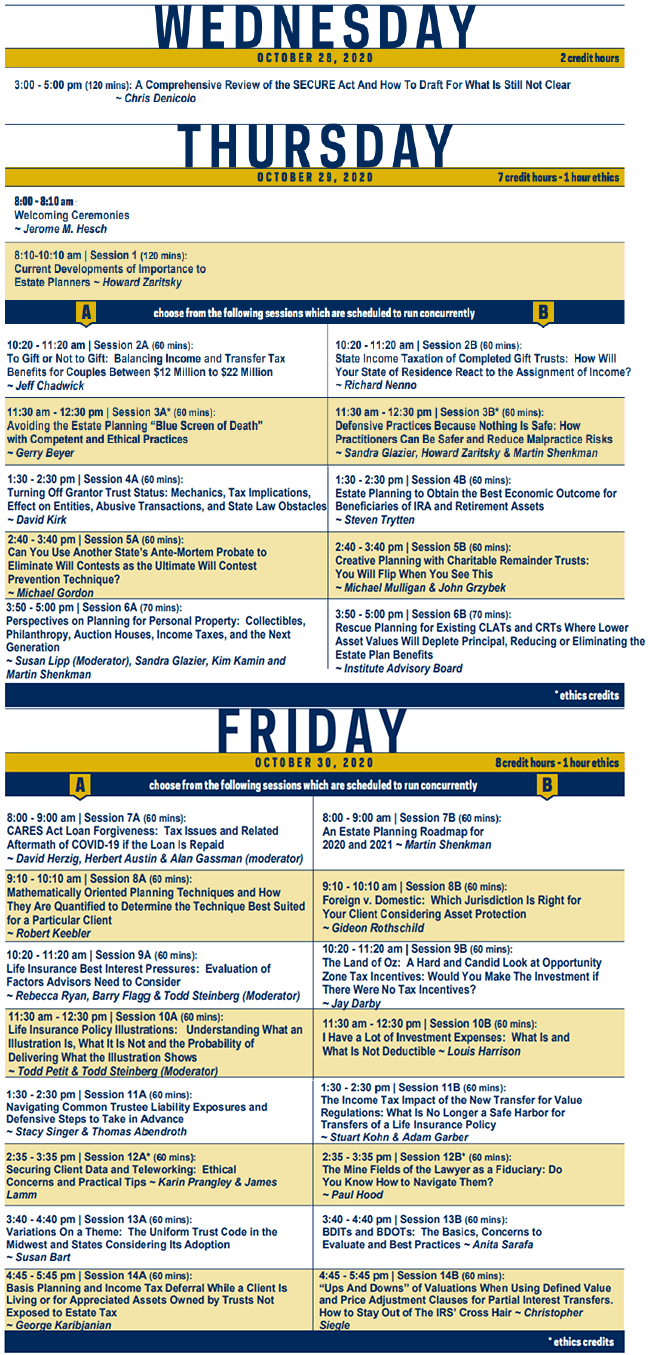

Join us (virtually) at the 46th Annual Notre Dame Tax & Estate Planning Institute, which is a premier estate planning and tax continuing education program.

- Chris Denicolo will be conducting a comprehensive review of the SECURE Act and how to draft for what is still not clear.

- The program will also feature numerous nationally recognized estate planning and tax giants such as Howard Zaritsky, Marty Shenkman, Michael Mulligan, David Kirk, Richard Nenno, Susan Bart and Gideon Rothschild.

- Alan Gassman will present as a member of the Institute’s Advisory Board regarding rescue planning for existing CLATs and CRUTs, and will moderate a panel on CARES Act loan forgiveness (including tax issues and related aftermath of COVID-19).

The program schedule is as follows:

FREE WEBINARS PROVIDED BY OUR FIRM ARE HIGHLIGHTED IN BLUE BELOW

| When | Who | What | How |

|---|---|---|---|

| Monday, September 21, 2020 | Free webinar from our firm |

Alan Gassman and Colleen Flynn present: Emerging Guidance For Employers On COVID-19 from 9 to 9:30 AM EDT |

REGISTER |

| Monday, September 21, 2020 |

AICPA ENGAGE Tax Strategies Conference Attendees may pretend that they are in Las Vegas, NV |

Alan Gassman, Brandon Ketron and Kevin Cameron present: PPP Part 2 and More, Where We Are and Where We Are Going from 2 to 2:50 PM EDT |

More Information |

| Thursday, September 24, 2020 |

Sidney Kess 51st Annual Estate, Tax and Financial Planning Conference For the United Jewish Appeal Federation of New York |

Alan Gassman and Aaron Slavutin present: BANKRUPTCY AND INSOLVENCY PLANNING FOR BUSINESS AND PROFESSIONAL ENTITIES AND THEIR OWNERS—WHAT CONSCIENTIOUS ADVISORS NEED TO KNOW from 2 to 2:50 PM EDT |

REGISTER |

| Friday, October 2, 2020 | USF Resident Intern meeting at Tampa General Hospital in Tampa, FL |

Alan Gassman presents: Contract Negotiations from 4 to 5 PM EDT |

More Information |

| Wednesday, October 7, 2020 | Johns Hopkins All Children’s Hospital |

Alan Gassman presents: Year’s End Hot Topics for Estate and Tax Planners from 12:30 to 1:30 PM EDT with a replay from 4:30 to 5:30 PM EDT |

Available exclusively for registrants of the Johns Hopkins All Children’s Hospital – Annual Estate Planning Seminar |

| Friday, October 16, 2020 | USF Resident Intern meeting at Tampa General Hospital in Tampa, FL |

Alan Gassman presents: Contract Negotiations from 4 to 5 PM EDT |

More Information |

| Friday, October 16, 2020 | Estate Planning Council of Naples Success Event |

An interactive event with Alan S. Gassman and EPC of Naple’s friends

from 9 to 12 PM EDT |

Email INFO@GASSMANPA.COM |

| Wednesday, October 21, 2020 | Reno Estate Planning Council |

Alan Gassman presents: Dynamic Planning With Irrevocable Trusts After TRA 2017 from 11 to 12:30 PM EDT |

REGISTER |

| Thursday, October 22, 2020 | Children’s Home Society of Florida Webinar |

Alan Gassman presents: Donor Appreciation Event: Will & Trust Planning from A – Z a.k.a. Fun with Dick and Jane as They Plan Their Estates (w/ a special guest appearance from Spot) from 12:30 to 1:30 PM EDT |

REGISTER |

| Friday, October 23, 2020 | Florida Bar Tax Section CLE |

Alan Gassman, Leslie Share, Denis Kleinfeld, and the Mormon Tabernacle Choir present: TENTATIVE Advanced Asset Protection Workshop |

More Information |

| Monday, October 26, 2020 | Free webinar from our firm |

Alan Gassman and Sean Healy present: LETHAL PITFALLS IN DRAFTING GUN TRUSTS from 12:30 to 1:20 PM EDT |

REGISTER |

| Wednesday, October 28, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Christopher Denicolo presents: A Comprehensive Review of the SECURE Act And How To Draft For What Is Still Not Clear from 3 to 5 PM EDT |

REGISTER |

| Thursday, October 29, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Alan Gassman participates in panel on: Termination of Charitable Trusts – Everything you wanted to know about CLAT (termination). from 3:50 to 5 PM EDT |

REGISTER |

| Friday, October 30, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Alan Gassman moderates: CARES Act Loan Forgiveness: Tax Issues and Related Aftermath of COVID-19 if the Loan Is Repaid Presented by David Herzig and Herbert Austin from 8 to 9 AM EDT |

REGISTER |

| Wednesday, November 4, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Andrew Barg present: Taxation of Individuals and Businesses in Bankruptcy from 12:30 to 1 PM EST |

REGISTER |

| Monday, November 16, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman presents: Dynamic Planning for Professionals and Their Entities from 4:45 to 5:35 PM EST |

REGISTER |

| Tuesday, November 17, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman and Brandon Lagarde present: COVID 19: What Did We Learn About Financial Viability During a Pandemic: Parts 1 and 2 from 12:40 PM to 2:30 PM EST |

REGISTER |

| Wednesday, November 18, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Andrew Barg present: Advanced Tax Planning And Strategies For Insolvent Taxpayers – Including State Law Impact And State Taxes from 12:30 to 1 PM EST |

REGISTER |

| Tuesday, December 1, 2020 | Ohio Bar Association’s Great Lakes Asset Protection Institute |

Alan Gassman presents: Asset Protection Plans that Actually Work! 60 Minutes On Asset Protection |

More Information |

| Friday, December 4, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Michael Markham, Esquire present: What We Know About Subchapter 5 Bankruptcies from 12:30 to 1 PM EST |

REGISTER |

| Thursday, February 11, 2021 | Johns Hopkins All Children’s Annual Estate Planning Seminar |

Alan Gassman virtually sponsors: Introducing Speakers and Listening Carefully! |

More Information |

| Friday, March 26, 2021 | Florida Bar Tax Section CLE |

Alan Gassman and Leslie Share present: Creditor Protection Nuts & Bolts |

Coming Soon |

| May 3-6, 2021 | Heckerling Institute on Estate Planning in Orlando, FL | Stop By, Say Hi | More Information |

Call us now! Bookings accepted for bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200