Thursday Report – Issue 287

ALWAYS FREE, SOMETIMES PUBLISHED ON THURSDAYS

Edited by: Wesley Dickson

Thursday, September 3, 2020 – Issue 287

Having trouble viewing this? Use this link

Biden 2-Step for Wealthy Families

Speaking Of PPP And EIDL Loans – Special Rights And Powers Of The SBA

Post-June 30, 2019 Nevis LLC’s Must File Tax Returns And May Have Tax Liability to Nevis

Radio Free Thursday

Page Turner

For Finkel’s Followers

Humor

Upcoming Events

On September 3rd, 1967, Sweden joined their neighbors (Norway and Finland) in driving on the right side of the road.

I wanted to write a good joke about Sweden, but there was Norway I would Finnish in time.

Have you driven a Fjord lately?

The Biden 2-Step for Wealthy Families: Why Affluent Families Should Immediately Sell Assets to Irrevocable Trusts for Promissory Notes Before Year-End and Forgive the Notes If Joe Biden Is Elected

A/K/A What You May Not Know About Valuing Promissory Notes and Using Lifetime Q-Tip Trusts

Alan S. Gassman, Jerome B. Hesch & Martin B. Shenkman

EXECUTIVE SUMMARY:

Wealthy individuals who postpone taking appropriate action to eliminate estate taxes may not be able to use the $11,580,000 gift tax exemption after 2020. A political change in November 2020 could lead to lower estate and gift tax exemptions effective as early as January 1, 2021. In Quarty v. U.S., the Ninth Circuit Court of Appeals ruled that a retroactive tax increase does not violate the Constitution. The court held that the increase in the estate and gift tax rates was a rational means to raise revenue, noting that an increase in tax rate was merely an increase of an existing tax, not a wholly new tax, citing other court decisions as precedent. Reducing the exemption is not a new tax. 170 F.3d 961, 969 (ninth Cir. 1999). The time to act is now!

Implementation of the planning process can take several months. Consideration of the step-transaction doctrine and the reciprocal trust doctrine might suggest planning for time between various components of a plan. Using valuation discounts often requires time for an appraisal. Changing the ownership of assets, may require getting approval from co-owners or lenders with due on change in ownership provisions, complying with terms of governing documents for the entities to be transferred, and more. Determining planning decisions, which can take time. Additionally, valuation discounts, note sale transactions, and other techniques, may be subject to gift tax return audits and possible IRS challenges. What is not always addressed is that the stress, costs, and risks of discount planning can be reduced significantly by using the “2-Step Process” described below.

This newsletter is designed to explain the fundamental legal and financial principles underlying the concepts we will discuss and why those concepts should be implemented over two calendar years (2020 and 2021), or better in 2020, to best position clients for a possible reduction in the estate tax exemption. Moreover, the techniques we discuss can position families to reduce estate and gift tax exposure even if a reduction in the exemption does not occur until 2026.

FACTS:

Many wealthy families have either procrastinated getting their estate tax planning done, or are working with advisors who are not familiar with the planning opportunities using promissory notes.

Procrastination of planning occurs for a number of reasons:

- General procrastination and the desire to avoid spending time and money now.

- Aversion to planning complexity.

- A lack of understanding with respect to how serious the 40% federal estate tax and state inheritance tax exposure can be.

- Not addressing that values increase over time.

- Not knowing that the $11,580,000 exemption may be significantly reduced to $3,500,000.

- Not understanding the asset protection benefits that estate tax minimization planning might afford.

- As people get older, they are often less willing to transfer assets into irrevocable trusts they cannot control or receive distributions from.

COMMENT:

What Spurs Individuals Into Action?

Estate tax planning is often an “impulse buy” fueled by one or more of the following things:

- A health scare.

- The death – or near death – of a spouse, especially if the surviving spouse has a significant net worth and recognizes the risk.

- Recommendations and prodding from professional advisors, children or others reading about possible tax increases.

- The anticipation of a positive economic event such as the sale of a business or that current assets are performing well, even during an economic downturn.

- A national election that may cause the exemption to come down faster and even lower than the 2026 scheduled reduction to $5,000,000.

- Realization of the real risks that malpractice, divorce or other lawsuits might bring.

- Liquidity concerns. Lower estate tax exemptions may not be the only harsh tax obstacle faced by wealthy families. Many businesses are in a negative cash flow position, although they are still valuable and will be subject to federal estate tax. The Biden tax changes could include his suggestion that there be no step-up in basis for appreciated assets on the death of an individual, and much higher income taxes to be imposed upon items such as pension, IRA, and annuity income that becomes taxable after the death of a decedent. Also, many families have not yet taken into account that they will pay higher income tax rates on all forms of income, including pension and IRA distributions that will commonly be subject to the new 10-year Rule.

Where Do We Stand Today, And Why Is The “2-Step Process” An Attractive Solution For Many?

There is a meaningful possibility that Joe Biden may become the next President of the United States, and that the Democrats will not only retain control of the House of Representatives, but also capture control of the Senate.

A newly-elected President Biden would not take office until January 20, 2021. Even though a change for the worse in the estate tax would not occur until after legislation is passed, tax laws passed during the calendar year 2021 might retroactively be effective January 1 of 2021, as a way to keep the “cows in the barn” for the integrity of a robust estate tax system to help plug deficits without raising income taxes on the lower and middle class. There has been significant discussion in political circles about wealth disparity. Making a retroactive effective date would cut-off much of the last minute planning that many taxpayers might try to accomplish. This means that a change in the estate tax exemption amount could retroactively apply as soon as of January 1, 2021.

So Why Is It Essential To Plan In 2020?

Planning to use a significant portion of their remaining $11,580,000 exemptions can be significantly more effective if this is a two-step process:

Step One—- Sell assets to an irrevocable grantor trust for a promissory note.

Step Two— If the Democratic sweep occurs in November forgive the note in whole or in part as a taxable gift.

STEP ONE . . . “AH ONE AND AH TWO AND AH THREE” (AS LAWRENCE WELK WOULD SAY)

In 2020, the client contributes assets to a family limited partnership or limited liability company. The client can manage the assets in the family entity under a fiduciary standard, without estate tax exposure.

Also in 2020, after waiting a reasonable time after funding, the client sells a significant portion of ownership interests (up to 99%) to a preexisting or new irrevocable trust under a special rule, there is no taxable gain or loss for income tax purposes, and the trust is held for the benefit of a spouse and/or descendants. The sale price is satisfied by the trust issuing a long- term, low interest note. If this transaction occurs during the Coronavirus crisis, significant valuation discounts might be considered because willing buyers and willing sellers are taking economic uncertainty into consideration in setting prices for many comparable transactions. Hence the discount rates used to value future cash flows may be higher, and the interest rate on the long-term note can be as low as 1.12% annual interest if entered into before November, 2020.

The rates that can apply to an interest-only note given in exchange for LLC (voting or non-voting, depending on how the transaction is structured) or family limited partnership (“FLP”) interests can bear interest at the following rates (for August of 2020) without the issuance of the note being considered a gift:

- Not more than 3 years: 0.17 %

- More than 3 years but not more than 9 years: 0.41 %

- More than 9 years: 1.12%

Ideally, the trust or FLP should be preexisting and funded in a prior taxable year. That obviously will not be possible for many of the transactions to be completed before year-end 2020. The trust that buys the non-voting interest for a note should, according to some views, be funded with its own assets, sometimes called a “seed capital gift.” When a substantial seed gift is not practical, or if the practitioner views the quantum of seed gift too small for the contemplated transaction a guarantee may be used in conjunction with a small seed capital gift.

Disclosure of the intra-family sale is not required on a gift tax return because the seller is replacing the asset sold with a note equal to the value of the asset sold. In effect, there is no gift if the value of what is received equals the value of what is transferred. There is a gift only if the transfer reduces one’s net worth. As discussed below, there is no gift if the note received bears interest at the Applicable Federal Rate even if the market value of the note is lower than the AFR.

However, if a gift of seed capital is transferred to the trust, except for the $15,000 annual exclusion gift, it needs to be disclosed on a gift tax return. The seed capital can consist of cash or other assets. Caution might need to be exercised if the same entity sold to the trust is also gifted as a seed gift.i It may be preferable to gift an asset other than the asset sold. However, no doubt with the crush of time pressure in 2020 that may not always be feasible. In those situations, practitioners might caution clients of the potentially increased risk. Some practitioners might decide to use existing trusts, or to limit seed capital gifts to the $15,000 per donor/donee exclusion (or use guarantees), to avoid the need to file any gift tax return at all. Other practitioners prefer the opposite approach.

To assure that the note has economic substance, trust beneficiaries can guarantee the trust’s obligation. For example, if the promissory note is for $5,000,000 and the trust making the purchase only has assets with a net value of $90,000, another trust or trust beneficiary/beneficiaries having reasonable net worth may guarantee the trust’s obligation. A beneficiary may receive a guarantee fee from the trust in exchange for such guarantees. Although a fee is not always necessary depending on the circumstances involved (e.g. does the borrower trust benefit the same beneficiaries as the guarantor trust?) and how practitioners view the law on these matters.ii

If a gift tax return is filed to report the seed capital gift, the taxpayer should consider also disclosing the sale. This is recommended to start running the three (3) year statute of limitations on the IRS’s ability to challenge such sales. If the sale is disclosed, then full disclosure of valuation reports should be attached. This can be an expensive and time-consuming process.

For gifts given in 2020, the taxpayer has until September 31, 2021, to file a gift tax return, assuming that a proper extension is filed. This means that the family has until then to decide what to disclose on the gift tax return, and what valuation reports will be procured to facilitate such disclosure. Although, it may be advisable, or even necessary, to obtain an independent valuation report at the time of the gift, especially if a valuation adjustment mechanism is used.

There is generally no penalty for a late-filed gift tax return if there is no gift tax due upon filing. So, gift tax returns can be filed after they are due, with the practical concern that the three (3) year statute of limitations does not start until the late gift tax return is filed. There are other good reasons to file a gift tax return by the due date, including the ability to have a spouse sign a split gift election, if this is desired.

Even if the 3-year statute of limitations has run on the gift tax return, the seller now has a promissory note that is an asset exposed to the estate tax, at its fair market value, if the seller dies while the note is outstanding.

If Trump is re-elected, and the estate tax exemption remains at $11,580,000, the installment sale can be unwound, and assuming stable values, the client can receive some or all of their assets back from the trust and cancel the note with no income or gift tax consequences. Only the seed capital gift to the trust will remain in trust. And, the trust can distribute the seed capital to the children and grandchildren instead of what the client would have paid to them directly.

If Biden is elected, and the Democrats sweep the House and Senate, then the client should consider before year-end using what remains of the client’s $11,580,000 exemption. If the note, or a portion of it, is canceled by a gift in 2020 or 2021, a gift tax return will need to be filed disclosing the note cancellation, but no appraisal or other disclosure will need to be provided with the gift tax return if the value used for the gift equals the principal amount of the note. Practitioners might consider structuring the sale for two notes. One note would be equal to the taxpayer/seller’s remaining gift and GST exemption, and the second note would be for the balance of the purchase price. That might make it easier to forgive the desired amount of the note to use the taxpayer’s remaining exemption and avoid the complications of a note that was only in part forgiven.

What Is The Client Thinking?

Despite the human motivation and cost issues that often come up, involved professionals should suggest a gift tax return for the 2020 seed capital gift. And, the gift tax return should also disclose the sale, with appraisals for the assets sold. The family may decide not to follow this advice, to save the time and expense, and what they might view as a greater likelihood of audit.

The advantage of implementing the note sale portion of this plan is that it is best for clients to do this sooner rather than later, while they still have sufficient time to complete the process. Furthermore, this Coronavirus wave has really shown how sudden life circumstances can change for a family. After the November election, estate planners will be incredibly busy.

For slower moving clients, it is worthwhile to at least have a thorough consultation in the coming months so that decisions can be made based upon education and thinking that took place before deadlines were imminent. That education will hopefully convince the clients to move forward with the first step for planning, being the sale of assets in exchange for a note.

Valuation Discounts And Planning Strategies For Notes.

Given the effectiveness and relative simplicity of having wealthy taxpayers issue promissory notes to family trusts, it is surprising that some advisors are not fully versed on the estate and gift tax treatment of such instruments.

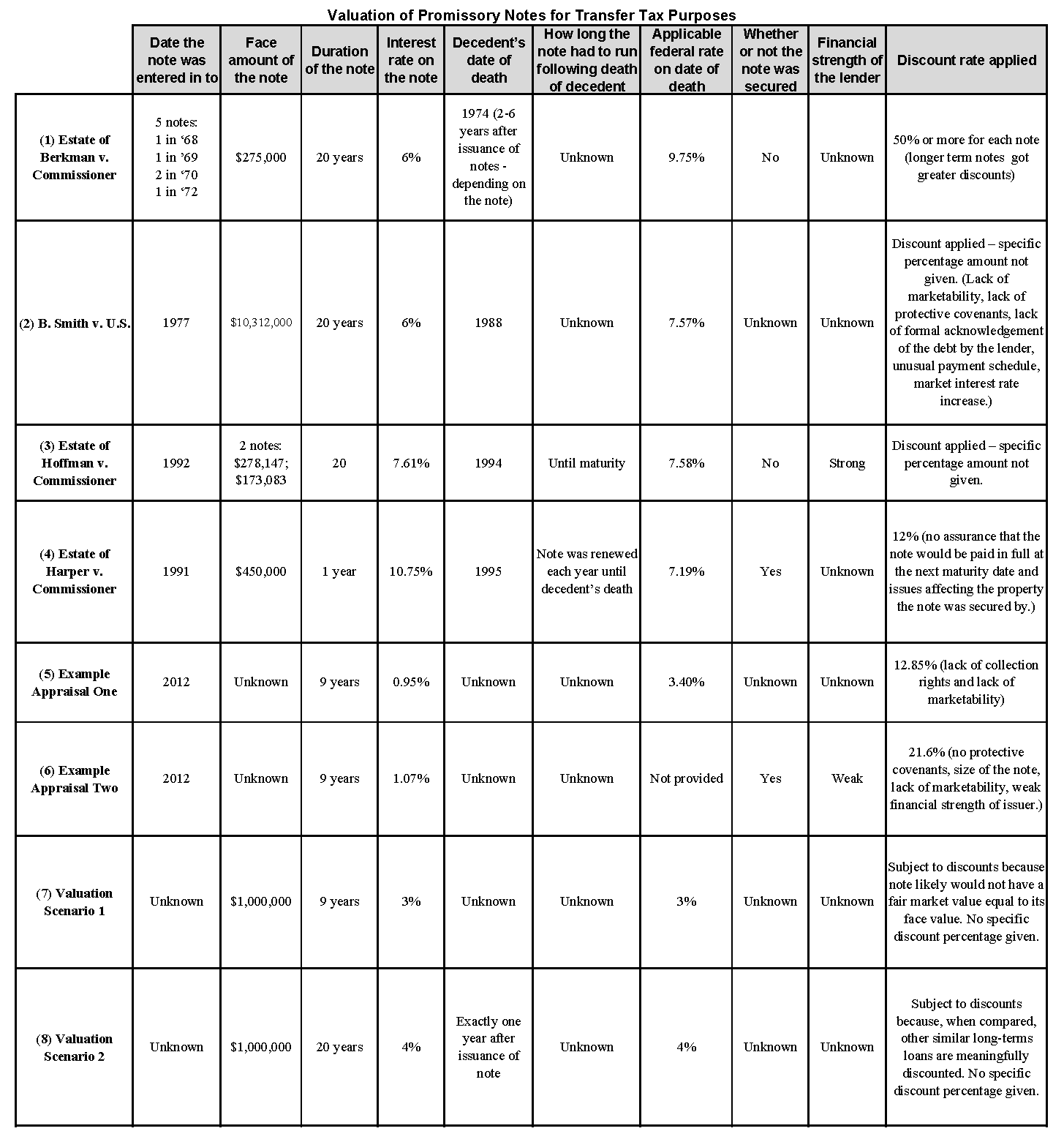

For example, many believe that a long-term promissory note bearing interest at the Applicable Federal Rate is worth its face value for estate and gift tax purposes, but this is actually not the case. The value of such note, as supported by both case law and statutes, is to be valued based upon what a willing buyer would pay an unrelated willing seller in the marketplace. The fact that IRC Section 7520 provides that there is no gift considered to have been made when a note is used for assets and bears interest at the Applicable Federal Rate does not mean that the note is worth its face amount. This has been very thoroughly documented in a recent Bloomberg Article, Michael S. Strauss and Jerome M. Hesch, “A Noteworthy Dichotomy: Valuation of Intra-family Notes for Transfer Tax Purposes” 45 Bloomberg Tax Management Estates, Gifts and Trust Journal 4 (Jan. 9, 2020).

A summary of the analysis and information from the article can be found in the following table, which demonstrates that AFR notes may be able to be discounted when they are long term because the AFR rate is below lending rates used by commercial lenders or by companies and governmental entities that issue bonds. Note that in the current environment, with rates at historic lows, the opposite might be true with respect to notes from the past that bear interest at higher than the current market rates. That may not, however, necessarily suggest a premium value if the note can be repaid at any time without penalty pursuant to its terms.

A chart showing the cases summarized in the article and the primary characteristics of each note along with a copy of each case is below (download the full resolution PDF):

One lesson to be learned from the above-referenced article and chart is that it is better to issue longer term notes than shorter term notes for valuation discount purposes. While some commentators advise that notes issued by taxpayers in sale transactions should have a maturity date roughly equivalent to the taxpayer’s life expectancy as of the date the note is issued, there is no specific reason notes cannot be issued for 20 years or longer so that family members may inherit the note. This should be considered even where the taxpayer’s life expectancy is lower than 20 years. There is simply no logical reason that a note cannot substantially exceed the taxpayer’s life expectancy. Some have expressed concern that when a note term exceeds the taxpayer’s life expectancy the IRS may recharacterize that note as an annuity or other arrangement.

By issuing and discounting a long-term note, decedents with large notes may come under the estate tax filing level and the estate tax exemption level. Without the note sale, the value of their assets would have exceeded their exemption.

Example. Edna is 80 years old, has an $11,000,000 remaining gift and estate tax exemption and has $12,000,000 in assets, she can sell $9,000,000 in assets for a 20-year $9,000,000 note bearing interest at the long term Applicable Federal Rate. Upon Edna’s death, the note is valued at less than $8,000,000 so no estate tax return will have to be filed (assuming no change in exemption). Of course, if she puts $9,000,000 into an LLC and sells a non-voting LLC interest for a $6,300,000 note she will have even a smaller estate (if the discount is respected). As an aside, if Edna’s assets consist of highly appreciated leveraged rental real estate then her family may be better off paying estate tax in the equity and getting a new fair market value income tax basis for the entire property value upon death. This presumes Edna dies before a time that a future administration, e.g. Biden, may eliminate the step-up on death.

Another alternative is to sell assets for a self-cancelling note, or a private annuity, that will by its terms cancel on death. This will require a much higher rate of interest rate if a self-cancelling installment note is used (or a commensurate principal adjustment), and can backfire if the taxpayer lives a good many years and has received back large payments which add to the estate as the years go on. Some taxpayers enter into self-cancelling installment sales during “health scares,” such as before undergoing open heart surgery or contracting COVID-19, as long as they still have an “average or better” life expectancy at the time that the note is entered into. Once the health scare is over, the note might be converted to a conventional note at the Applicable Federal Rate in effect at the time of the conversion, or may be purchased from a family member. Alternatively, the principal of the note may be negotiated downward in exchange for a market interest rate being paid, as further discussed below. None of these alternative changes should cause any gift to be considered “given” for tax purposes if properly structured.

Many planners will make the entire note self-cancelling, even though only a part of the note would need to be eliminated to avoid Federal Estate Tax. It is better to have two notes, with one being self-cancelling to the extent needed to assure that the taxpayer will be under the estate tax exemption amount, and the other note being at the Applicable Federal Rate to allow for lower interest payments, so that smaller payments can be made to reduce the size of the note holder’s estate. Difficulty with this planning in the current environment is that in addition to the sunset of the exemption in 2026 a change in administration in Washington could result in a dramatic reduction in exemption as soon as January 1, 2021.

A Discount For Part Ownership Of A Promissory Note

A fractional interest discount may be applied when there are multiple holders of a promissory note.

In the 1996 Federal District Court decision of Smith v. U.S., the IRS challenged an estate tax return note valuation that was based upon first determining the value of the note itself based upon a discounted present value of future cash flow calculation, and then taking a 20% discount because the decedent only owned 2/3 of the note. The Court accepted both discounts as being reasonable and appropriate.

If a taxpayer gifts part ownership of a note to an irrevocable trust, the retained part ownership should qualify for a similar discount when the taxpayer dies. There are many legitimate reasons to share ownership of a promissory note, as further discussed below.

STEP 2 IF BIDEN IS ELECTED, CANCEL, PARTIALLY FORGIVE, OR GIFT THE NOTE OR NOTES—IMPORTANT CONSIDERATIONS

If Biden is elected and there is a sweep of the House and Senate, then the likelihood of a reduction in the estate and gift tax exemptions will be real.

Taxpayers will need to decide whether to make use of their $11,580,000 exemptions in the “use it or lose it” situation to be faced.

By this time, the client will have been educated on what has already occurred in their planning, and may view the second step as being a necessary forgiveness of debt owed to the client in an amount equal to what remains of the client’s estate tax exemption.

While it may be as simple as that for some, for the high net worth taxpayer this leaves assets on the table for the IRS, given that note discounting and other strategies can be used, as described below. Another consideration may also arise for wealthy taxpayers, especially those that are older or infirm. Should they cancel notes beyond what is necessary to use their exemption? Perhaps. If it is anticipated that the marginal transfer tax rate under a Biden administration will be dramatically higher, perhaps incurring as a gift tax in 2020 may be preferable to a higher estate tax in 2021. Also, the gift tax is tax exclusive whereas the estate tax is tax inclusive.

Often it is unclear how much of the client’s exemption remains, or if the client’s remaining assets will still be over the estate tax exemption amount, especially if there has been a large sale transaction with an irrevocable trust that has been based upon discounts that may exceed what the IRS will readily accept upon audit. Also, the taxpayer may want to forgive more than the face amount that constitutes the exemption amount remaining based upon taking a discount from the face amount of the note.

For example, a taxpayer with a $20,000,000 note may have filed prior gift tax returns reducing the exemption to $8,000,000. If the IRS increases the prior gift by $2,000,000, her remaining exemption would be $6,000,000 in the event of an estate or gift tax audit. Assuming that the note can be discounted by 20% from face to $16,000,000, she would like to make a gift by reducing the note by $10,000,000 in face amount, which would be considered to be an $8,000,000 gift. Unfortunately, the IRS may not agree with this discount, and may also assert that her exemption amount is only $6,000,000 and that the discount rate on the note is only 10%, so that gift tax would be owed on a gift of $1,666,667. ($6,000,000 divided by .8% is $7,500,000. $7,500,000 divided by 90% is $8,333,333. $10,000,000 minus $8,333,333 is $1,666,667.)

The IRS may challenge a discount on a note, especially when that note was only recently created by the taxpayer in a sale transaction, but the law is clear in this area. Nevertheless, in planning for the possibility of such a challenge, the taxpayer may choose to reduce the note by a fraction of the amount owed, (a) the numerator of which is the amount of estate and gift tax exemption she has remaining, and (b) the denominator of which is the value of the note.

If this is handled with an appropriately drafted adjustment clause, which permits the percentage of the note to be corrected in the event of a later determination of inaccuracy, then the IRS may be less likely to challenge the discounts taken. One possible problem with using such a formula clause is that the gift, when disclosed on a gift tax return, may attract greater IRS scrutiny, as compared to if the gift is expressed as a set face amount owned on a note.

Trade Your Partner (Do-Si-Do), Or Exchange Your Notes (While The Rates Are Low)

One option is to first trade the existing long-term low interest rate note for a note with a lower face amount that bears interest at the market rate, and to then forgive the face amount of the market rate note, without disclosing the swapping of notes on the gift tax return.

For example, a $20,000,000 20-year note bearing interest at 1.12% may be worth only $16,000,000, so why not swap the note for a $16,000,000 five- year note bearing interest at a market rate, and then forgive $10,000,000 to reduce the replacement note’s face amount to $6,000,000 and report this as $10,000,000 gift, Now the client holds a $6,000,000 note instead of a $20,000,000 long term low interest note. The taxpayer could be advised that the note swap may be disclosed on the gift tax return, and that if it is not disclosed the 3-year statute of limitations will not apply to prevent the IRS from asserting that the swap was a taxable gift if and when the taxpayer’s estate is ever audited.

Lifetime Q-TIP Trusts To The Rescue

An alternative strategy that married taxpayers may use to insulate themselves from these issues, and which will also give the client the ability to pull the plug on a large 2020 gift as late as September of 2021, would be to transfer the low interest long-term note in late December of 2020 to a “Lifetime Q-TIP Trust” that will qualify for the estate tax deduction to the extent necessary to avoid imposition of gift tax on the donor spouse.

A Q-TIP Trust is a trust that must pay all income to the spouse beneficiary, and can be used solely to benefit the spouse beneficiary during his or her lifetime. A trustee can be given the power to devise all assets under the trust to such spouse.

A Q-TIP Trust can be divided into two separate sub trusts, one of which can be considered to be a Credit Shelter Trust that will not be subject to estate tax on the death of the spouse beneficiary, with the other trust qualifying for the marital deduction and being considered to be a Grantor Trust owned by the spouse beneficiary during her lifetime.

The Grantor of the Q-TIP Trust can elect what portion of the trust will be treated as the Credit Shelter Trust, and what portion of the trust will be considered to be the Marital Deduction Trust, in the manner described above by an election that must be filed by April 15 of the calendar year following the contribution to the Trust, or by October 15, if the Grantor spouse files a timely extension. It is essential that the election be made on time, because there is no relief available if not. See Creative Trust Planning Strategies for Using Lifetime Q-Tips, by Richard S. Franklin, ABA Section of Real Property Trusts and Estates Law Webinar April 7, 2018. Richard Franklin can be contacted at rfranklin@fkl-law.com.

This mechanism allows a grantor who is uncertain as to whether he or she wants to use some or all of his or her remaining estate tax exemption amount, and also enables the Grantor to use a “Formula Clause”, which may best be described by the following example:

Harold has $10,000,000 of his $11,580,000 estate tax exclusion remaining in December, 2020. He also has a $15,000,000 low interest rate promissory note that pays interest annually and will balloon in 20 years. The note may be worth $12,000,000.

Harold places the promissory note into a lifetime Q- TIP Trust for his wife, Dorothy in 2020 immediately after it is determined that Joseph Biden has won the presidential election. Harold then waits to see whether the estate tax exemption is reduced in 2021. On or before the due date in 2021 Harold may file an election to treat the entire Q-TIP Trust as a Marital Deduction Gift, and thus retain his exclusion amount, as if no gift was made. In that event, the trustee of the Q-TIP Trust may distribute the note to Dorothy, so that no large gift has essentially been made.

Alternatively, if the estate tax exclusion is reduced retroactively to January 1, 2021, then Harold can make the gift to the Q-TIP Trust effective in 2020 as a “retroactive” gift of his remaining exemption amount by making a Formula Election which says “have an amount of assets in Credit Shelter portion of the Q-TIP Trust equal in value to my remaining exclusion amount divided by the total value of trust assets, with the remaining trust assets to be held as a Marital Deduction Trust.”

The Trustee hires a valuation expert in 2021 after Harold has made his election, and the expert opines that 83.33% of the note should pass to the Credit Shelter portion of the Q-TIP Trust and 16.67% of the note should pass to the Marital Deduction portion. 83.33% of $15,000,000 is $12,500,000 in principal that the Credit Shelter Trust may receive if the note is paid off after a few years of having the trust receive interest payments. The remaining $2,550,000 portion of the note that is in the Q-TIP Marital Deduction sub trust will be included in his spouse’s taxable estate, and may be subject to both a time value of money discount for the low interest rate situation and a partial ownership discount, as per the Smith v. U.S. case, which is discussed above.

If the IRS audits a gift tax return more of the note may have to be allocated to the Marital Deduction portion, but no gift tax will be owed.

One disadvantage of the Credit Shelter Sub-trust feature of the Q-TIP Trust is that it must pay all income to the surviving spouse, which would mean all interest payments on the promissory note portion allocated to the Credit Shelter Trust will come out to the spouse, but the note may be paid in full, and then the money may be invested in growth stocks that pay no dividends.

In the 1992 5th Circuit Court of Appeals decision of Estate of Clayton (976 F.2d 1486), the Court held that the portion of the Q-TIP Trust designated as a Credit Shelter Trust (to not qualify for the marital deduction) would not have to pay income to the surviving spouse if drafted to provide for this. The IRS responded to this case by establishing the “Clayton Q-TIP Election” regulations at Sec. 20.2056(b)-7(d) to allow for this for a Q-TIP trust formed at death, but it is not clear whether this treatment can apply for a lifetime Q-TIP gift.iii

For an unmarried taxpayer, a similar strategy would be to transfer the note to a trust that divides upon inception into a Family Share and a Charitable Trust, with the Family Share being worth the amount that passes estate tax free and the Charitable Trust being worth the excess of such amount.

While use of such a formula in a non-Q-TIP Trust is not established by statute, there may be no problem with such an arrangement, as long as each share is properly calculated and administered from a fiduciary standpoint.

Conclusion

Tax and financial advisors should reach out to high net worth taxpayers, and taxpayers who may be concerned about asset protection, to point out the need to engage in estate tax planning before year end, which may include valuing assets, using FLPs or family LLC’s and installment sales to irrevocable trusts so that it can be handled after the November election and on or before December 31, 2020, if need be. Such preparation and completion of the first step described above will better situate these taxpayers, and provide an important structure for future planning, regardless of what the results of the November election and the future of the estate tax and a family’s wealth may be.

In reviewing possible planning techniques, the possibility that a long term promissory note bearing interest at the Applicable Federal Rate may be worth much less than its face value, and what can be done to maximize gifting with note arrangements, possible exposure and filing strategies for gift tax returns, and other factors mentioned in this article should be understood and considered.

HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE!

Alan S. Gassman

Jerome B. Hesch

Martin B. Shenkman

CITE AS:

LISI Estate Planning Newsletter 2813 (August 10, 2020) at http://www.leimbergservices.com, Copyright 2020 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited – Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.

CITATIONS:

i Pierre v. Comm’r, US Tax Court, Aug 24, 2009133 T.C. 24 (U.S.T.C. 2009)

ii Shenkman, Role of Guarantees and Seed Gifts in Family Installment Sales, Estate Planning, p. 2 NOVEMBER 2010 VOL 37 / NO 11.

iii See Akers, Planning Flexibilities with Inter-Vivos QTIP Trusts, Heckerling Trust (workshop materials) January, 2004

Speaking Of PPP And EIDL Loans – Special Rights And Powers Of The SBA

By: Alan Gassman

Many estate planners now represent individuals and entities who have taken PPP (Payroll Protection Program) and EIDL (Economic Injury Disaster Loans) loans that may have to be repaid. Draconian provisions of the law that apply to these loans may cause surprised borrowers to have to repay them immediately, or sooner than expected.

For example, a Payroll Protection Program loan could only be applied for if the loan was “necessary to support the ongoing operations of the business,” but this was not recognized by many borrowers, including those who panicked, even though their businesses were not actually threatened, as evidenced later.

See my related article on Forbes here.

Further, while the law concerning EIDL loans was passed to indicate that a borrower only needed to show that there was a “substantial injury” to apply and receive the loan, it was later realized that the definition of a “substantial injury” under the regulations for Small Business Association loans indicate that “substantial injury” means that the business would not be able to continue without the loan. These same regulations indicate that a loss of revenue or increase in expenses are not sufficient to justify receiving a loan.

In addition, the vast majority of EIDL borrowers and their advisors are unaware that the Loan Agreement prevents a company borrower from paying any bonuses to any employees, or making profit distributions to owners during the term of the loan.

See my related article on Forbes here.

Further, most advisors are unaware of the extensive rights that the SBA has when compared to other creditors.

For example, when one spouse has an SBA judgment against them and a joint tax return is filed, the SBA can attach to the tax refund and keep the portion that would be attributable to the debtor spouse’s income.

Also, the SBA can reach wages of a head of household notwithstanding whether they would be protected under state law.

The SBA regulation 13 C.F.R. 140.11 reads as follows:

(a) SBA may order your employer to pay SBA a portion of your disposable pay to satisfy delinquent non-tax debt you owe to the United States. This process is called “administrative wage garnishment” and is authorized by 31 U.S.C. § 3720D§§.

(b) Scope.

(1) This Section provides procedures for SBA to collect delinquent non-tax debts through administrative wage garnishment.

(2) This Section applies despite any State law.

(3) Nothing in this Section prevents SBA from settling for less than the full amount of a debt. See, for example, the Federal Claims Collection Standards (FCCS), 31 CFR parts 900- 904.

(4) SBA’s receipt of payments under this Section does not prevent SBA from pursuing other debt collection remedies. SBA may pursue debt collection remedies separately or together with administrative wage garnishment.

(5) This Section does not apply to the collection of delinquent non-tax debt owed to the United States from the wages of federal employees. Federal pay is subject to the federal salary offset procedures set forth in 5 U.S.C. § 5514§§ and other laws, including subpart B of this part.

(6) Nothing in this Section requires SBA to duplicate notices or administrative proceedings required by contract, other laws, or regulations.

Because of the above, the authors commonly advise clients not to take out SBA loans, if these can be avoided.

Post-June 30, 2019 Nevis LLCs Must File Tax Returns And May Have Tax Liability to Nevis

We received the following notice from our friends at Morning Star Holdings Limited (Special thanks to Mario Novello who can be reached at MNovello@tridenttrust.com):

This Client Advisory provides an update on the tax status of the entities duly registered on the island of Nevis, West Indies under the Nevis Business Corporation Ordinance, 2017 (‘NBCO’) or Nevis Limited Liability Company Ordinance, 2017, (‘NLLCO’) following the initial Client Advisory of January 2019.

Morning Star Holdings Limited has received a communication from the Ministry of Finance of the Nevis Island Administration (‘Ministry of Finance’) confirming the continued commitment of the Administration to the Nevis International Financial Sector. The Ministry of Finance also confirmed the Administration is working with the Federal Government in St. Kitts to resolve the undefined tax status of NBCOs and NLLCOs. This will be by way of an amendment to the Income Tax Act.

The amendment to the Income Tax Act is expected to provide a clear definition of tax residency based on the concepts of ‘central management and control’ and ‘Permanent Establishment’ in line with the OECD definitions. The Administration anticipates the amendment to the Income Tax Act to be in place by September 2020.

Until the amendment is complete, the Nevis Island Administration has confirmed that for NBCOs and NLLCOs:

Entities which have neither central management and control in Nevis, nor a Permanent Establishment in Nevis will not be subject to taxes in the Federation of St. Kitts & Nevis.

Entities which are deemed to have a Permanent Establishment (but not central management and control) in Nevis will be liable to pay Corporation Income Tax on income generated within or remitted to the Federation.

Entities which are deemed to have central management and control in Nevis will be liable to pay Corporation Income Tax on their worldwide income.

All entities will need to file a Simplified Tax Return by 15 April of each year.

The filing of the Simplified Tax Return due by 15 April 2020 and payment of associated taxes has been deferred for all entities to allow the completion of the amendment of the Income Tax Act and development of the Simplified Tax Return.

We will inform you as quickly as possible once the amendment to the Income Tax Act and the Simplified Tax Return are available and when the Nevis Island Administration provides further updates.

Feel free to contact our office or the office of Nevis Services Limited with any questions on this update.

We reached out for more information and received:

Thank you for your message in response to the Advisory received from Morning Star Holdings. I hope this message finds you safe and healthy.

Here is a copy of the Simplified Tax Return that was issued by the St. Kitts-Nevis Inland Revenue Authority last week with a request for Nevis entities to file by August 26, 2020. The deadline was set by the St. Kitts-Nevis Inland Revenue Department to meet the OECD deadline of reporting by St. Kitts and Nevis on IP Regimes.

A meeting was held last week between the St. Kitts-Nevis Inland Revenue Authorities and the Nevis Service Providers. As a result of that meeting, the Nevis Service Providers together with the Nevis Government agreed that the required return and the deadline to file are not consistent with the position of the Nevis Government nor practical to comply with and therefore an extension to file has been submitted as well as a request to further dialogue on this important subject.

We were not made aware of any penalty for failure to file the CIT-101 Form.

At this stage we cannot answer any further questions until we receive further guidance from the Nevis Government.

Finally, I remind you that all Nevis entities established on or before December 31, 2018 remain tax exempt until June 30, 2021. Hopefully, the continued tax exemptions of these companies and those companies established since January 1, 2019 will be resolved prior to June 30, 2021!

We will keep you posted on developments as quickly as possible.

Radio Free Thursday

On August 26th, Alan was interviewed by Luis Hernandez, host of Sundial on Miami’s NPR affiliate WLNR. The interview covered many of the topics discussed in his recent Forbes contributions below. You can listen to that radio piece here.

Over 1,000 Young Lawyers Are Stranded As Florida Bar Exam Is Canceled On 72 Hours Notice

July 1, only 27 days before the bar exam was originally set to take place, the Florida Board of Bar Examiners (FBBE) moved the exam date to August 18, 2020 as an online 1-day test in lieu of the historical 2-day test…Continue reading on Forbes

Florida Bar Exam Catastrophe: Part 2 – And An Apology From The Florida Supreme Court

Today is the day that applicants would have taken their tests had the Florida Bar administered the exam. These graduates are reasonably upset at the lack of communication and planning by the Florida Bar…Continue reading on Forbes

Chief Justice Canady of the Florida Supreme Court appropriately apologized for the situation, and promised that there would be a provisional bar admission that would enable applicants to practice law until they are eventually admitted to the Florida Bar…Continue reading on Forbes

Florida Bar Exam Details Released Which Compensate Applicants For The Hardship Experienced

In a positive development for bar applicants and the reputation of the Florida legal community, the Florida Supreme Court announced on Wednesday, August 26, 2020 that the Florida Board of Bar Examiners (“FBBE”) rescheduled the bar examination to take place on October 13th, with October 14th being…Continue reading on Forbes

Page Turner

Alan has been working on revisions and updates for the Haddon Hall book What Estate Planners (And Others) Need To Know About Bankruptcy. You will find the new introduction below:

This book was originally written at the request of Professor Jerry Hesch for a 90-minute presentation that Alan Gassman gave for the Notre Dame Tax and Estate Planning Institute in 2017.

Preparation for writing this book included extensive recorded interviews with bankruptcy lawyers Michael Markham and Alberto Gomez, presenting live webinars for CPA and lawyer audiences, extensive reading, and reflection upon prior experience with clients whose debtor/creditor situations were significantly impacted by what was done before a creditor situation occurred, or at least before a bankruptcy was filed.

We thank tax and IRS controversy lawyer and co-author Larry Heinkel, J.D., LL.M. for carefully reviewing a prior edition of this book and adding significant and invaluable coverage of Federal income tax laws concerning income from the discharge of indebtedness, and how bankruptcy and Federal law and practices apply when the IRS is a creditor.

There are a great many lessons to be learned from a knowledge of the Bankruptcy Code and how the federal bankruptcy law and process can impact an estate planner’s clients, if and when they find themselves in a challenging creditor situation, while also minimizing the emotional and reputational turmoil that often accompanies these situations.

Oftentimes, what has been done in the estate planning stage will make all of the difference, so special attention to the concepts set forth in this book may be vitally important for many advisors and their clients.

With proper advanced planning, many clients will be able to bankrupt out an unexpected or unfortunate creditor situation or settle with creditors without losing significant assets or income.

Readers should understand that knowledge of the Bankruptcy Code and the laws, practices and strategies described in this book cannot be relied upon without consultation with well-versed and experienced bankruptcy counsel.

Estate planners should also recognize that many individuals or organizations that purport to provide creditor protection services and expertise are actually doing a significant disservice to clients and other professionals. We see these types of situations arise when clients have been sold “creditor protection structures” that are commonly associated with expensive arrangements that may also promise (but often do not deliver) income tax savings.

For example, some non-lawyer organizations heavily market their services by paying “sponsorship fees” to state and county medical associations or specialist physician organizations to be able to present to their members, who then fall prey to these “experts” which employ lawyers who are not members of State Bar Associations or are breaking Bar rules by practicing law as employees of non-lawyer companies. Unfortunately many advisors do not realize that the plans that are provided by such companies are commonly based upon erroneous assumptions and misconceptions and will do more harm than good.

We hope that this book will provide an appropriate foundation for the many rules, strategies and possible outcomes that can occur when bankruptcy is a possible remedy or result from any situation.

Besides the traditional functions of an estate planner, and an estate planning team, professionals who represent an individual or family that may have creditor challenges can consider taking the following actions to help to assure that they will have the best chance of survival and recovery from such challenges:

- Having a thorough and complete file with respect to the exact titling of assets, beneficiary designations, entity documents, and co-ownership agreements. An information gathering form that was designed to be client friendly, yet thorough, can be found in the Table of Contents to this book.

- Being clear as to what assets will be considered to be exempt under state and bankruptcy exemption statutes, and determining how to best maximize exempt assets, while possibly spending down or otherwise situating non-exempt assets in an appropriate manner.

- Assembling a team of advisors who can be instrumental if not essential to a client’s survival of challenging situations, including debtor/creditor specialist lawyers, bankruptcy counsel, and tax and business advisors who can work together, sometimes with creativity and interactive analysis, to make the best of circumstances after having a thorough understanding of the situation at hand.

- Remaining mindful of the attorney/client privilege, and what communications may or may not become discoverable in the event of litigation or bankruptcy.

- Providing friendship, moral support and “big picture” perspective for an individual or individuals who may be having significant personal challenges and emotional pressure that comes with financial, family and business strife.

- Carefully documenting, by explanation letters and otherwise, the business, tax and estate planning purposes for transfers, ownership arrangements and maintenance of any status quo, so as to carefully think through, educate and confirm client intentions, purposes behind transfers and reorganizations, and coordination associated therewith.

- Ensuring that no action or activity is undertaken that may cause a client or one or more advisors to have exposure for committing illegal acts, having civil liability, or risking the loss of the ability to obtain a discharge in bankruptcy, or the protection of applicable debtor/creditor laws that might otherwise apply, but for illegal, untruthful or unethical conduct.

The above functions can pose important challenges for estate planners and other professionals, while giving estate planners the opportunity to quarterback or help quarterback the efforts at hand to both plan in advance, and then handle creditor challenges that may come, but only within the bounds of safe conduct, as discussed in this book.

The other bankruptcy exemptions that may apply, regardless of whether state law provides protection of such items, are as follows:

- IRAs, subject to the value limitation of $1,362,800 adjusted for inflation, which limitation does not apply if the debtor resides in a state that has unlimited exemption protection.

- Pension accounts, as to which protection is unlimited under the Bankruptcy Code.

- Other categories of assets that are protected under the Bankruptcy Code.

It is important to note that the “super creditors” are able to reach otherwise exempt assets in bankruptcy, and include the Federal Trade Commission (“FTC”), the Securities Exchange Commission (“SEC”), the Internal Revenue Service (“IRS”), as well as the Department of Justice (“DOJ”) when collecting restitution, and Centers for Medicare and Medicaid (“CMS”) when collecting penalties imposed on medical providers for violation of billing rules. The super creditors, however, are still subject to some limitations, such as third party-settled spendthrift trusts, self-settled trusts that qualify for protection by having been established and funded more than ten years before the bankruptcy, or by having been established and funded in arrangements that are not found to be “fraudulent transfers”, and charging order rules.

While we have found that the majority of debtors who have planned ahead and are in a good position to keep the majority of their assets and maintain their business or professional activities will successfully negotiate and settle with creditors who are logical or do not want to spend significant legal fees to postpone the inevitable, there are important reasons that every estate planner should advise clients and undertake conduct with reference to what may occur if a bankruptcy has to be filed.

These include the following:

- A well-represented creditor will consider what will occur in bankruptcy, and how federal bankruptcy laws and practices will impact the ability of the creditor to get paid, or to shut down and punish a debtor.

- A well-represented debtor will likewise be counseled on what the possible consequences are of voluntarily filing or voluntarily being forced into a bankruptcy, both from a legal and reputational standpoint.

- Conduct which may be acceptable, and not likely to be criticized outside of bankruptcy, may expose the client and the client’s advisors to criticism, sanctions, and even possible criminal investigation. The U.S. Department of Justice has an office in every bankruptcy court, and is often called upon to assist Trustees in Bankruptcy with interviews and investigations where acts of concealment, dishonesty or other issues appear to arise.

- The attorney/client privilege and other confidentiality laws are different in a Federal Bankruptcy Court than in State Court. An example is that there is no federal privilege for communications with a certified public accountant, as discussed in Chapter 2.

- The concept and impression that most layman have of bankruptcy is that it is a very frightening and unfriendly environment, and it certainly can be. Many clients have admitted to the authors that they wish that they had been “more serious” about advanced planning for creditor situations when the time later came to test and defend their situations in bankruptcy court, or to discuss this at a mediation or settlement conference where even a tiny possible chink in the armor seemed to be of great concern.

The competency and knowledge of lawyers who practice in the bankruptcy area can vary significantly. Many lawyers spend most of their time handling relatively simple Chapter 7 liquidations, which must be conducted economically and in high volume to be profitable. Lawyers who spend the majority of their time filing Chapter 7 bankruptcies, or who also specialize in other areas of the law while doing “some bankruptcy work,” will commonly not be as knowledgeable of many aspects of bankruptcy and debtor/creditor law, which are better understood by lawyers who practice bankruptcy law full-time, and provide representation for debtors who file complicated Chapter 11 cases, or have challenging factual, financial or other circumstances.

Every estate planner is well-advised to be aware of who the more sophisticated and well-respected bankruptcy lawyers are in his or her community, and to have a relationship with one or more of them by encouraging clients to seek consultations as and when appropriate, and hopefully well before a bankruptcy would even be considered.

We hope sincerely that the information and wisdom that we have been fortunate to have learned and to share with our readers is both valuable and instrumental in allowing estate planners to develop their best practices, enhance conduct and keep clients safe and best poised for whatever risks they may face.

For Finkel’s Followers

Hiring And Building Your Bench During COVID-19

By: David Finkel

In the past we have talked a lot about how to find and hire great people for your business. And up until very recently, the hardest part of building out a talent bench was finding people who were actively looking for a new position. Now, due to the current economic situation, we have an extremely rare opportunity to find new talent that would have otherwise been unapproachable.

So today, I want to share with you some of my tips on how to find top talent and build a bench during the Covid-19 crisis.

Cast a Wider Net

The entire world is looking for remote work right now. And if you find yourself in a position to work in a virtual environment successfully, you can use that to your advantage when looking for new team members. This is especially true for businesses that were once focused on local candidates that could commute to the office everyday.

Now that you have pivoted to a “remote” model, you are able to look for talent in other parts of the country thus casting a wider net and giving you access to higher quality talent. Customer service, sales, marketing and technology are all positions that could easily be done by someone in another part of the country (or even the world) if you have the right systems set up.

Enlist The Help of a Recruiter

Not sure where to start? Try talking to a recruiter. I have been using a recruiter for several years now to help us find a good pool of candidates to choose from. They have a database of talent that is not only actively looking but should also have access to talent in the marketplace that may not be formally on the market yet.

Let’s say that your competition recently laid off Sally, a rockstar sales person that you have had your eye on for a while. With the current layoff, this would be the perfect time to connect and explore the idea of working together. A recruiter can help facilitate the introduction and start the conversation.

Work on Your Bench

Not looking to hire right now but still want to take advantage of the current job market? Consider building out your talent bench for future use. We call this the “Gold Standard of Hiring” and the idea is that you think of hiring just like you would a sales pipeline. When we create a sales pipeline we identify a great prospect and we work to open up a relationship with that prospect. It may take time to close a sale, which is not unlike a hiring relationship.

Think about the last time you hired for a position and you had more than one great candidate, so you chose one of multiple great candidates. What did you do with the other ones? If you are using the conventional method of hiring, you wished them well and never thought about them again. But if you are actively working on building a bench, you stay in communication with them, knowing that eventually a position will open up.

In the current economic situation, it makes a lot of sense to begin building those relationships now. Maybe Sally is planning on going back to her job once the stay at home orders are lifted but 6 months from now when she decides to move on, you want her to consider your firm.

Humor

Upcoming Events

Join Alan (virtually) in the casino halls of Reno, Nevada as he addresses the Reno Estate Planning Council on Dynamic Trust Planning.

While almost all estate planners have an established repertoire for irrevocable trusts, many of us are not making established and needed structures available to clients.

These include trusts which have business, income tax, and litigation avoidance purposes, such as the following:

- To obtain a new income tax basis on the death of a family member.

- To establish the expectation or entitlement to an inheritance if a parent or grandparent does not need the business or asset to support themselves.

- To prevent carnivorous third parties or other relatives from exerting undue influence or allowing dementia or other mental states to cause an inheritance to go other than intended.

- To prevent an individual or individuals from engaging in high-risk investment activities, carelessness, or being misled by ne’er-do-well advisors.

- Avoiding federal estate tax while using trusts that may benefit the donor.

- Benefitting charities in a way that will enhance family wealth, financial well-being, and relationships.

This presentation will review a number of strategies, tax and legal rules, and practical wisdom to enable estate, tax, and financial planners to have a greater menu to draw from, and more substantial knowledge with respect thereto.

Event planning for this event started in January 2019 before the Coronavirus Crisis, this will now be a live webcast on October 21, 2020 that can be attended by non-members (for $20). Register to attend here

| When | Who | What | How |

|---|---|---|---|

| Friday, September 4, 2020 | Leimberg Webinar Services (LISI) |

Brandon Ketron and Kevin Cameron present: PPP Update: SBA Releases August 24th IFRs That Place Limitations on Payments to Related Parties from 3 to 4 PM EDT |

REGISTER |

| Tuesday, September 8, 2020 | Shenkman Law Webinar |

Alan Gassman, Jerry Hesch and Martin Shenkman present: Estate Tax Planning Opportunities for 2020 For Clients Hesitant to Plan from 4 to 5:30 PM EDT |

REGISTER |

| Monday, September 14, 2020 | CPA Academy |

Alan Gassman presents: The Biden 2-Step – Estate Tax Avoidance for High Net Worth Taxpayers from 5:30 to 6:30 PM EDT |

REGISTER |

| Tuesday, September 15, 2020 | CPA Academy |

Alan Gassman presents: My Favorite Original Estate Planning Creations (the JEST, the SCGRAT, the Tea Pot Trust, and EstateView Software) from 5:30 to 6:30 PM EDT |

Coming Soon |

| Wednesday, September 16, 2020 | CPA Academy |

Alan Gassman presents: Professional Success Strategies: Part 2 from 5:30 to 6:30 PM EDT |

Coming Soon |

| Monday, September 21, 2020 | AICPA’s Tax Strategies Conference |

Alan Gassman, Brandon Ketron and Kevin Cameron present: PPP Part 2 and More, Where We Are and Where We Are Going from 2 to 2:50 PM EDT |

More Information |

| Thursday, September 24, 2020 | Sidney Kess 51st Annual Estate, Tax and Financial Planning Conference |

Alan Gassman and Aaron Slavutin present: BANKRUPTCY AND INSOLVENCY PLANNING FOR BUSINESS AND PROFESSIONAL ENTITIES AND THEIR OWNERS—WHAT CONSCIENTIOUS ADVISORS NEED TO KNOW from 2 to 2:50 PM EDT |

REGISTER |

| Friday, October 2, 2020 | USF Resident Intern meeting at Tampa General Hospital in Tampa, FL |

Alan Gassman presents: Contract Negotiations from 4 to 5 PM EDT |

More Information |

| Friday, October 16, 2020 | USF Resident Intern meeting at Tampa General Hospital in Tampa, FL |

Alan Gassman presents: Contract Negotiations from 4 to 5 PM EDT |

More Information |

| Friday, October 16, 2020 | Estate Planning Council of Naples Success Event |

An Afternoon with Alan Gassman: Success Techniques for your Estate Planning Practice: The Biden 2-Step… Interesting Planning with Low Interest Notes… Dynamic Planning with Irrevocable Trusts… Creditor Protection Techniques You Haven’t Thought of… And more! |

More Information |

| Wednesday, October 21, 2020 | Reno Estate Planning Council |

Alan Gassman presents: Dynamic Planning With Irrevocable Trusts After TRA 2017 from 11 to 12:30 PM EDT |

REGISTER |

| Thursday, October 22, 2020 | Children’s Home Society of Florida Webinar |

Alan Gassman presents: Donor Appreciation Event: Will & Trust Planning from A – Z a.k.a. Fun with Dick and Jane as They Plan Their Estates (w/ a special guest appearance from Spot) from 12:30 to 1:30 PM EDT |

REGISTER |

| Friday, October 23, 2020 | Florida Bar Tax Section CLE |

Alan Gassman, Leslie Share, Denis Kleinfeld, and the Mormon Tabernacle Choir present: TENTATIVE Advanced Asset Protection Workshop |

More Information |

| Wednesday, October 28, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Christopher Denicolo presents: A Comprehensive Review of the SECURE Act And How To Draft For What Is Still Not Clear from 3 to 5 PM EDT |

REGISTER |

| Thursday, October 29, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Alan Gassman participates in panel on: Termination of Charitable Trusts – Everything you wanted to know about CLAT (termination). from 3:50 to 5 PM EDT |

REGISTER |

| Friday, October 30, 2020 | 46th Annual Notre Dame Tax & Estate Planning Institute |

Alan Gassman moderates: CARES Act Loan Forgiveness: Tax Issues and Related Aftermath of COVID-19 if the Loan Is Repaid by David Herzig and Herbert Austin from 8 to 9 AM EDT |

REGISTER |

| Wednesday, November 4, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Andrew Barg present: Taxation of Individuals and Businesses in Bankruptcy from 12:30 to 1 PM EST |

REGISTER |

| Monday, November 16, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman presents: Dynamic Planning for Professionals and Their Entities from 4:45 to 5:35 PM EST |

REGISTER |

| Tuesday, November 17, 2020 | AICPA Sophisticated Tax Conference in Washington, D.C. |

Alan Gassman and Brandon Lagarde present: COVID 19: What Did We Learn About Financial Viability During a Pandemic: Parts 1 and 2 from 12:40 PM to 2:30 PM EST |

REGISTER |

| Wednesday, November 18, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Andrew Barg present: Advanced Tax Planning And Strategies For Insolvent Taxpayers – Including State Law Impact And State Taxes from 12:30 to 1 PM EST |

REGISTER |

| Tuesday, December 1, 2020 | Ohio Bar Association’s Great Lakes Asset Protection Institute |

Alan Gassman presents: Asset Protection Plans that Actually Work! 60 Minutes On Asset Protection |

More Information |

| Friday, December 4, 2020 | Free webinar from our firm |

Alan Gassman, Ken DeGraw and Michael Markham, Esquire present: What We Know About Subchapter 5 Bankruptcies from 12:30 to 1 PM EST |

REGISTER |

| Thursday, February 11, 2021 | Johns Hopkins All Children’s Annual Estate Planning Seminar |

Alan Gassman virtually sponsors: Introducing Speakers and Listening Carefully! |

More Information |

| Friday, March 26, 2021 | Florida Bar Tax Section CLE |

Alan Gassman and Leslie Share present: Creditor Protection Nuts & Bolts |

Coming Soon |

Call us now! Bookings accepted for bar mitzvahs, weddings, seminars, and symposiums (or symposia)!

Gassman, Crotty & Denicolo, P.A.

1245 Court Street

Clearwater, FL 33756

(727) 442-1200