The Thursday Report – 9.4.2014 – Bankruptcy, QLACs, and Washington, D.C.

What Estate Planning and Other Lawyers Need to Know About Bankruptcy, an article by Alberto F. Gomez and Alan S. Gassman

QLAC Article Revisited – Part 3 of 3

Washington D.C. is America’s Greatest Threat, an article by Denis Kleinfeld

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

What Estate Planning and Other Lawyers Need to Know About Bankruptcy, an article by Alberto F. Gomez and Alan S. Gassman, Part 7

This is the final installment of the series on bankruptcy law that has recently been updated by Al Gomez and Alan Gassman. Click here if you would like to print out the entire article.

HOMESTEAD EXEMPTION

The “mansion loophole closing” provisions of the 2005 Bankruptcy Act will reduce the protected homestead equity value to as low as $155,675 if one of three exception provisions applies:

(1) The entire value of homestead property will not be protected where its value has been increased by a disposition of non-exempt property made by the debtor during the 10 years prior to filing bankruptcy with the intent of hindering, delaying, or defrauding creditors. 51

The reduction is based upon the value of the homestead resulting from such “fraudulent transfers.” The courts must determine how to apportion appreciation in the value of a homestead that occurs after the “fraudulent conversion” has occurred.

(2) A debtor cannot exempt any amount of homestead property worth in excess of $155,675 that is acquired during the 1,215 days (three years and four months) before the bankruptcy filing.52

This was originally $125,000, but under the legislation adjusted to $155,675 on April 1, 2010, and will adjust with the Consumer Price Index each three years thereafter pursuant to U.S.C. Section 104(b).

This is not an intent-based provision, but applies automatically when a person does not have the requisite time period to qualify for protection.

As an exception to this $155,675 cap, money derived from the sale of a prior residence can be applied to facilitate the purchase of a replacement property if certain requirements are met. Where the new homestead costs significantly more than the prior homestead, the amount of homestead protection is limited to $155,675 plus the proceeds from the sale of the prior residence used to purchase the new residence.

Several issues will arise with respect to how to handle appreciation, depreciation, and amortization of mortgage indebtedness in the context of successor homes.

In a post-BAPCPA case decided in October of 2005, In re Charles H. Wayrynen, a debtor who had not lived in Florida 1,215 days filed bankruptcy with a homestead and was found not to be subject to the $136,875 cap.53 The court found that the statute would only apply where the debtor elects to use state exemptions, and Floridians are required to use the state exemptions, and have no elective choice between the federal and state exemptions.

Whoever drafted the statute must have assumed that all debtors have the opportunity to elect to use the federal exemptions or the state exemptions, not realizing that in Florida the debtors are required to use the state exemptions. Congress’ obvious intent was to limit the Homestead Exemption to $155,675 for debtors who choose to flee to debtor-friendly Homestead Exemption states, the most notable being Florida and Texas, unless the debtor resides in the Homestead protection state for at least 1,215 days before filing.54

At least three courts have found that the clear intent of the statue overrides the literal reading, and have enforced the 1,215-day rule in states, such as Florida and Nevada, that allow debtors to “opt out” of the federal exemptions in favor of using the state exemptions.55

(3) The homestead exemption can be limited to an absolute cap of $155,675 where the debtor is convicted of a felony, which evidences that the filing of the bankruptcy was abusive (perhaps the rationale here is that the debtor will not need a house if he is going to jail).56

The homestead protection is limited to $155,675 where the debt involved arises from the violation of federal or state securities laws, fiduciary fraud violations of RICO, intentional torts or willful or reckless conduct resulting in serious physical injury or death in the preceding five years.57 Doubtlessly, there will be more suits filed against doctors alleging willful and reckless conduct in malpractice actions.

The Section 522(q)(1) reduction to $155,675 will not apply to the extent that the homestead property is reasonably necessary for the support of the debtor and any dependant of the debtor.58 How much of a home will debtors be found to need?

a. Two spouses enjoy the benefit of two caps? In In re Rasmussen,59 349 B.R. 747 (M.D. Fla. 2006), the Bankruptcy court in the Middle District of Florida ruled that two spouses could stack their state law homestead exemptions together creating $250,000 of coverage for their home. The court cited Section 522(m) which applies Section 522 separately to individuals filing joint bankruptcy cases. The court went on to analogize the homestead exemption to other exemptions married bankrupts may file together such as $2,000 total for automobile exemptions and $2,000 total for personal property exemptions.

b. The homestead of a married debtor residing in a tenants by the entireties state may be protected if the homestead is owned as tenants by the entireties, thus, circumventing the exceptions to homestead protection described above.

c. The home to be protected does not appear to be required to be actually occupied as a principal residence for the 1,215 days.60 Many individuals will therefore be advised to acquire a second home in a homestead protective state such as Florida or Texas to start the 1,215-day period, and then to move to such state 730 days before filing a bankruptcy.

d. A debtor can lose his or her house if he or she loses the discharge. Paying one’s mortgage down with non-exempt monies can be detrimental where the payment causes the debtor to lose his bankruptcy discharge. In the case of In re Chauncey, a pre-BAPCPA case, the United States District Court affirmed the Bankruptcy Court opinion where the debtor went bankrupt within one year from having a personal injury settlement applied to pay down her mortgage.61

Because the personal injury settlement was non-exempt money, the Bankruptcy Court denied the discharge. Moreover, the Bankruptcy Court imposed an equitable lien upon Mrs. Chauncey’s home in order to allow the creditor to recover the monies that were secreted into the home from the personal injury settlement.

e. Fear and loathing in Florida – A married physician owing a joint mortgaged house and individual exposed assets meets a potential judgment creditor. Assume that a married physician has cash or similar liquid assets exposed to creditor claims and a serious malpractice action against her.

The Florida Supreme Court has held that a fraudulent transfer into a homestead owned by her would not be susceptible to the Florida Fraudulent Transfer Statute.62 This means that a creditor would not be able to force her to sell the home if it is her legitimate homestead when the creditor attempts to collect upon a judgment.

A “transfer into a homestead” can include buying a new home, paying to improve a home, or paying down a mortgage on a home.63

The creditor might attempt to force the doctor into bankruptcy. If the doctor has 12 legitimate creditors, which could include “material” credit card debts and/or other individual (including joint) indebtedness, then it would take three creditors to force her into bankruptcy. One issue is if the doctor is not eligible to file then can the involuntary petition stick? 64 For instance, a possible argument is that in order to qualify as a debtor, the debtor must pass a “means test”. If the debtor is not eligible, then the involuntary petition should be dismissed.

If the doctor is forced into bankruptcy with her “fraudulently acquired” home, then under the Bankruptcy Code she loses the homestead protection (exemption) to the extent of the value of the homestead attributable to such fraudulent transfers65 (but there will be at least $155,675 of protection notwithstanding).66

The transfer into the homestead may not actually be a fraudulent transfer under the Bankruptcy Code. For example, if the doctor buys the home because she wants to have a larger home for her family, and at the time she buys the house it is the opinion of reputable legal counsel that the lawsuit is nothing to worry about because she has enough malpractice insurance or other assets set aside to cover any likely potential verdict, then the creditor may not be able to satisfy its burden of showing that the homestead transfer was subject to the fraudulent transfer rules.

How about if the doctor transfers her cash into a jointly owned homestead, either by simply purchasing a joint homestead, or improving or paying down the mortgage on a jointly owned homestead.

Using this approach, the doctor could later file bankruptcy and would not have to “take the homestead exemption” in bankruptcy because her Florida jointly owned property can qualify under the “tenancy by the entireties” exception. Therefore, the bankruptcy code 10-year look back for fraudulent transfers into a homestead would not apply, because the exemption in bankruptcy would be based upon tenancy by the entireties, and not homestead.

A possible problem here is that the transfer of monies by the debtor into a joint homestead could be considered a fraudulent transfer of one half of those monies to the husband under the BAPCPA. While the Florida Fraudulent Transfer Rules are trumped by the state law homestead exemption, if the doctor is forced into bankruptcy it is possible that the Bankruptcy Court’s ability to pursue the “transferee of a fraudulent transfer” could result in the husband being pursued for one-half (½) of the amounts transferred.

If the husband has no other significant assets, then this may not be a problem. Even if there is a judgment against the husband for having received a fraudulent transfer, the creditor will not be able to attach the husband’s homestead under Florida law, unless the husband could then be forced into bankruptcy and then be subject to the 10-year look back rule. If the husband has other assets that would be subject to creditor claims in bankruptcy, then this alternative of transferring assets into a joint homestead, as opposed to moving such assets into a solely held homestead, may not be advantageous.

What about if the doctor uses her money to buy out her husband’s half of the homestead? If the wife has $500,000 in cash and the jointly owned home has $1,000,000 in equity, she can transfer the $500,000 in cash to her husband in exchange for 100% ownership of the home. In effect she has purchased the husband’s ownership in the home.

The question becomes whether the husband has then received $500,000 as a fraudulent transfer that could be set aside under the fraudulent transfer rules?

When the debtor (doctor) has transferred assets as “good and valuable consideration” in exchange for 100% ownership in a homestead, then the creditor is going to have a more difficult burden to satisfy, because under the fraudulent transfer rules a “fraudulent transfer” made for “adequate consideration” can only be set aside if it can be proven that the transfer was made with actual intent to hinder, delay, or defraud” a creditor.67

If a transfer is not made for valuable consideration, then the creditors have a lower burden in establishing that the “fraudulent transfer statute” applies. Under such circumstances (where there is not adequate consideration for the transfer) the fraudulent transfer statutes allow for the transfer to be set aside under circumstances defined in the statute.68

Thus, if a physician senses impending insolvency she may be wise to buy her spouse’s half of the homestead property and have him hold the cash in a separate account, portfolio, or other liquid form. If the transfer is deemed “fraudulent” the spouse can return the money to the doctor’s creditor without penalty, none-the-worse for having tried. If the transfer is not deemed “fraudulent” the physician has in effect saved a substantial asset by keeping it in the family.

CONCLUSION

Bottom line: Estate planners giving asset protection advice need to help make their client aware of the many pitfalls that can exist in the world of bankruptcy. We recommend consultation with a bankruptcy lawyer before undertaking planning steps that may someday be criticized by a bankruptcy judge and/or litigation counsel.

*************************************************************

5111 U.S.C. Section 522(o) (2007).

5211 U.S.C. Section 522(p) (2007); but see Steve Leimberg’s Employee Benefits and Retirement Planning Newsletter #75 (Dec. 9, 2005) at www.leimbergservices.com which discussed In re Blair, No. 05-35922-HDH-7 (Bankr. Ct. N.D. Texas) in which an increase in the value of a debtor’s homestead (increase of value of over $136,875 in 12 day period) was not subject to the $136,875 cap; however, the article cautioned that irregular payments of a mortgage may not be disregarded.

53In re Charles H. Wayrynen, 2005 WL 2756059 (Bankr. S.D. Fla. 2005).

54Some states may offer unlimited protection like Florida, Texas, Kansas and Iowa while other states provide protection well below the federal limit like Arkansas, which only offers $2,500 as a state homestead exemption protection.

55See Steve Leimberg’s Asset Protection Planning Newsletter # 74 (Nov. 17, 2005) at www.leimbergservices.com which discussed In re Virissimo and In re Heisel,Chapter 7, Case Nos. BK-s-13605-LBR and BK-S-05-15667-LBR, a decision by U.S. Bankruptcy Judge Linda B. Riegle which resolved both In re Robert and Virissimo and In re Cheryl Heisel. The court applied the federal $136,875 cap to debtors in Nevada which provides a $200,000 cap on homestead and $350,000 effective July 1, 2005; see also In re Kaplan, 331 B.R. 483 (S.D. Fla. 2005) which applied the federal $136,875 to a Florida (a state that requires state exemptions and does not allow debtors to choose between state or federal exemptions) debtor and stated, “[d]etermining whether the homestead caps apply in Florida should not be in dispute and should not distract us further. This Court sincerely hopes that there will be uniformity amongst the Florida judges in finding, as this Court does with certainty, that the limitations in Bankruptcy Code Section 522(p) and (q) apply to debtors claiming exemptions under Florida law.”

5611 U.S.C. Section 522(q) (2010).

5711 U.S.C. Section 522(q)(1) (2010).

5811 U.S.C. Section 522(q)(2) (2010).

59 349 B.R. 747 (M.D. Fla. 2006).

6011 U.S.C. Section 522(p) (2007).

61In re Chauncey, 2005 WL 2456223 (S.D. Fla. 2005).

62Havoco of America, LTD. v. Hill, 790 So.2d 1018 (Fla. 2001).

63Fla. Stat. Section 193.155(4) (2007).

64See 11 U.S.C. Section 303(b)(2) (2007) indicating that a debtor must have at least 12 legitimate creditors before filing a voluntary petition.

65Fla. Stat. Section 222.29 (2007).

6611 U.S.C. Section 522(p) (2007).

67Fla. Stat. Section 726.105(1) (2007). See also Fla. Stat. Section 726.105(2) and the Bankruptcy Code for factors used in determining whether there exists actual intent to hinder, delay, or defraud with respect to fraudulent transfers which include the following: (a) whether the transfer was to an insider, (b) whether the debtor retained control over the transferred property, (c) whether the transfer was concealed, (d) whether the debtor was involved or threatened by a suit prior to, or at the time of, the transfer, (e) how much of the debtor’s assets were transferred, (f) whether the debtor absconded, (g) whether the debtor concealed assets, (h) the value of the property received in exchange for the property transferred, (I) Whether the debtor was insolvent at the time of, or shortly after the transfer, (j) the timing of the transfer in relation to the incurrence of a substantial debt by the debtor, and (k) whether the debtor transferred essential business assets to a lienor, who then transferred the assets to an insider.

68See 11 U.S.C. Section 548(a)(1) (2007).

QLAC Article – Revisited, Part 3

The following is part 3 of our article that was featured on Leimberg Information Services two weeks ago. We thank Steve Leimberg and his staff at Leimberg Information Services for allowing us to reprint this article for Thursday Report readers.

Alan Gassman, Christopher Denicolo & Brandon Ketron:

A Practical Approach to Qualifying Longevity Annuity Contracts (QLACs) – Using the (King) L.E.A.R. (Life Expectancy And Return) Analysis to Determine Whether Clients Should Invest in Specially Designed Annuity Products under Their IRA or Qualified Retirement Plans

COMMENT:

QLACs offer taxpayers the opportunity to defer income taxes that would otherwise result from the larger required minimum distributions that would apply if a portion of the taxpayer’s IRA or other retirement plan were not used to purchase a QLAC. However, the widespread prevalence of QLACs in the marketplace might not occur for some time, as the authors are not aware of any life insurance or annuity companies having released their QLAC products as of the time of this writing. In any event, the choice of investing in a QLAC turns on several factors, the most significant of which are whether the taxpayer wants fixed income features in the portfolio and whether the taxpayer will live long enough to realize a positive rate of return. Therefore, it is important to run an appropriate analysis, such as the L.E.A.R. analysis, to take into account the taxpayer’s life expectancy and possible rates of return on the investment in the QLAC.

Under a typical QLAC arrangement, a taxpayer could invest $125,000 (the maximum amount that can be invested is the lesser of (1) 25% of the value of the qualified account at the time of the investment; or (2) $125,000) into a deferred income annuity contract that would pay-out monthly income at an elected age (not to exceed 85) to the taxpayer.

One very knowledgeable advisor, Michael Morrissey of Vanguard’s annuity division gave the authors the following example of how a hypothetical QLAC might perform:

A 65 year-old male who wants to receive a monthly income of $1,000 per month for life beginning at age 80 can pay $47,920 for a life annuity right now. The annuity contract would include not only the above payments, but also a refund on death to the extent that the total payments received before death did not amount to $47,920. The value of this contract would not be subject to the required minimum distribution rules until the gentleman reaches age 80.

The new Regulations require that payments from a QLAC must begin to be made by age 85. A 65 year-old male who wants to receive $1,000 a month for life beginning at age 85 would only have to pay $26,634 for a Vanguard life annuity contract, which would also provide a refund to the extent that total payments are less than $26,634 upon death.

In both of the above arrangements there is a death benefit feature, which provides that if the account holder dies before receiving payments equal to the amount invested, then the deficit amount will be paid to the account holder’s beneficiaries (typically without interest) shortly after his or her death. In the alternative, payments might continue for the lifetime of a surviving spouse who could roll the annuity over to his or her own IRA and continue to have the benefit of payment rights. If the account holder dies before the elected age to begin distributions, the new Regulations allow a contract to return only the principal amount invested.

The death benefit restrictions are a major drawback of the new Regulations. These restrictions essentially require an account holder to outlive his or her life expectancy in order to receive a positive rate of return.

In the above-mentioned example, a 65 year-old male who contributes $47,920 to receive monthly income of $1,000 at the age of 80 would have to live for 48 months (age 84) in order to receive a positive rate of return. If the gentleman passed away before this time period, then he would receive only a return of principal, meaning that his rate of return would be zero. Based on IRS published life expectancy Table 2000CM, the average 65 year-old male has a 46% chance to live long enough to receive a positive rate of return. In order to receive a rate of return of roughly 3%, the gentleman would have to live until age 86. Under Table 2000CM, the gentleman has a 37% chance of living until age 86.

The authors have prepared a spreadsheet to illustrate the financial utility and tax implications of acquiring a QLAC under an IRA, relative to retaining in the IRA and continuing to invest in accordance with past practices the funds otherwise used to acquire the QLAC. One example assumes that a 65 year-old male taxpayer has $500,000 in an IRA that is growing at 3.5% per year. The taxpayer invests the maximum premium amount of $125,000 into a QLAC that will provide yearly payments of $51,948 beginning when the taxpayer attains age 85. When required minimum distributions from the IRA begin upon the taxpayer attaining the age of 70 1/2, the QLAC will not count as part of the IRA balance, resulting in a reduction of the minimum distribution for that year by $5,697.02 and resulting tax savings (deferral) for that year of $2,220.73. At the age of 85 when the QLAC will begin to make payments, the taxpayer will have total tax savings of $40,916.31.

All payments from the QLAC are fully taxable and made directly to the taxpayer, not into the IRA or other applicable retirement plan. The taxpayer is still required to take the required minimum distributions from the non-QLAC portion of his or her IRA or other applicable retirement plan, because neither the value of the QLAC nor the payments therefrom will count in determining the minimum distribution requirements. Any payments from the QLAC that occur after the annuitization beginning date will satisfy the required minimum distributions relating to the value of the QLAC.

From an investment standpoint, the benefit of investing in a QLAC backfires and causes more harm than good if the taxpayer does not live long enough to have the contract provide a positive rate of return. For example, assume that the taxpayer does not invest $125,000 in the QLAC, and instead leaves the funds in the IRA growing at 3.5% per year in order to compare the two options.

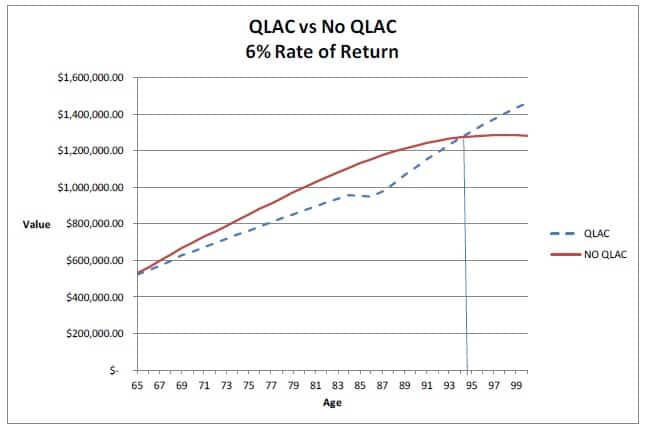

For the investment in the QLAC to provide a greater rate of return, than 3.5%, the individual would have to live to the age of 90. If the IRA was to grow at 6% per year, then the individual would have to live to the age of 95 in order for the QLAC to provide a higher rate of return. The longer that the individual lives, the greater the rate of return will be. Below is a chart comparing the two options at a 3.5% rate of return and at a 6% rate of return, based upon the value of the applicable portion of the IRA. A detailed spreadsheet showing the results of these options is available upon request.

Conclusion

The QLAC Regulations provide a flexible and possibly advantageous (but complicated) planning opportunity that could boost the popularity of longevity annuities as a retirement planning tool. The applicable Regulations provide potential tax savings by allowing a taxpayer to delay a portion of required minimum distributions from a retirement plan until the taxpayer attains the age of 85, although the potential tax savings could be offset by the financial performance of the QLAC relative to other investments if the taxpayer does not live to a certain age.

There will doubtlessly be interaction and confusion between these rules and the QLAC products, and between the traditional IRA and retirement plan investments typically undertaken by taxpayers and/or their plan administrators and QLACs from a financial investment standpoint. Practitioners would greatly benefit from literature and illustrations showing the real financial impact and results (taking into account both tax savings AND financial performance) of investing in a QLAC, which hopefully will be made available to the public when (or soon after) carriers release QLAC into the marketplace. It is important that planners run appropriate analysis to determine whether a QLAC is a right fit for the client, in light of the client’s possible life expectancy and expected rates of return from the investment.

Washington, D.C. is America’s Greatest Threat

By: Denis Kleinfeld

The Political Establishment of Washington D.C. comprises the Congress, the President, the bureaucracy, and the lobbyists.

It sees the public as docile fools to be duped at election time and looted at will, a criminal class that must be carefully controlled by all means. Washington, D.C. is politically using a feudal system in the age of the internet.

Polls consistently reflect that Congress is less valued to the voters than cockroaches. The President, even to his supporters and defenders, is no longer trusted. The bureaucracies are viewed as bloated organizations, hostile to the public that supports them, and unnecessary. Lobbyists are parasites who live off this culture of corruption.

Congress asserts a right of unlimited power all blessed by the Supreme Court as the King was blessed by the Church. Congress has little hesitation to control every aspect of life from before birth to after death. Their power of enforcement is based on the age old ability to inflict terrible harm and violence on any who are deemed offenders. Those in power understand the usefulness of terror.

Lawyer and non-lawyers alike maintain, out of tradition, some amount of respect for the Supreme Court. Nonetheless, its stature is tarnished by the Court’s inability to articulate in their decisions any clear principles that can be respected.

The Supreme Court follows the self-created rule of deference to the government instead of deference to constitutional personal liberties of the people. It is accepted that Court’s decisions are made on the basis of the Justices’ personal politics and private agendas. They don black robes, but they are still flawed human beings.

It is all so terribly wrong.

The primary weapon of institutional enforcement is the income tax system. It is the most inefficient system that could possibly be devised for raising revenue to finance a government. Its complexity defies any comprehension. So-called tax experts disagree on what it means, how it should be applied, or why we do not repeal it altogether. It tells that these same attributes trouble the demoralized people working at the Internal Revenue Service. This nightmare of a tax system is maintained solely because it is the money machine which fuels re-elections, allowing the expansion of governmental power.

The government has over a thousand federal agencies. Waste, fraud, abuse, and outright theft of tax dollars are annually ignored by Congress and the Administration. It is easier to just rubber-stamp the unread spending bills.

The enacted budget for government’s expenses vastly exceeds tax revenues. Four of every ten dollars of expenditures, before supplemental spending bills, has to be borrowed. Interest on that debt is the fourth largest expenditure after Medicare, Social Security, and defense.

The government has no auditable books and records in the sense those in the private sector must keep them or go to jail. There is no recognizable financial statement. The government operates according to special rules that if used by private industry would land them behind bars.

Recently, forty-seven Inspector Generals have collectively claimed in a letter that the Administration is stone-walling their respective investigations. The Government Accountability Office diplomatically prepares numerous reports of governmental operations, makes no specific accusations against anyone for consistent systemic failures, and nobody in Congress acts on those reports.

Any form of congressional oversight is a charade. The most intense of its investigations are acted out as if just another one of those pseudo-reality shows that continues viewing season after season. There is no actual purpose other than to keep the advertising revenues, that is, the campaign contributions, coming in. Expect more investigations to be announced since more money will be needed for the upcoming election.

The United States is being undermined by its own government. Its weakness internally means it is perceived feeble externally as well. There is not one country in the world, other than Israel, who is a true ally.

The continuation of the United States as a country based on personal liberty and a free-market economy is in jeopardy. Its greatest threat comes from its own government in Washington, D.C.

Humor! (Or Lack Thereof!)

LEGAL CONSEQUENCES OF FAMOUS NURSERY RHYMES

After Humpty Dumpty had a great fall, the owner of the wall was cited for not having a warning sign indicating that if a being was made out of eggshell, they would be sitting on the wall at their own risk. All the king’s horses and all the king’s men were cited for practicing medicine without a license. A doctor who stood by and refused to help Humpty Dumpty was not charged because he had a legitimate fear of being sued if he intervened.

Mrs. Humpty Dumpty was unable to collect on her husband’s life insurance because of a clause banning “dangerous hobbies.” When Mrs. Dumpty took the insurance company to court, the judge threw out the case because defendants cited a legal precedent, Rock-a-Bye Baby v. Law of Gravity.

Upcoming Seminars and Webinars

FREE LIVE WEBINAR

THE BCA’s OF REVERSE MORTGAGES

Alan Gassman will be presenting a webinar about reverse mortgages.

Date: Tuesday, September 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE FT. LAUDERDALE PRESENTATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan S. Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of TRUST PLANNING FROM A TO Z for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program, please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE CLEARWATER PRESENTATION:

Board Certified Tax Attorney Michael O’Leary from the Trenam Kemker firm in Tampa, Florida and Christopher Denicolo from Gassman Law Associates will be speaking at the Ruth Eckerd Hall Planned Giving Advisory Council event on Tuesday, September 23, 2014.

Mr. O’Leary’s topic is HOT TOPICS IN CHARITABLE PLANNING AND MORE.

Mr. Denicolo’s topic is PLANNING FOR INHERITED IRAs.

Date: Tuesday, September 23, 2014 | 5:00 p.m.

This presentation is free to members of the Ruth Eckerd Hall Planned Giving Advisory Council, Ruth Eckerd Hall members, and professionals who are attending a Ruth Eckerd Hall Planned Giving Advisory Council event for the first time.

Additional Information: You can contact Suzanne Ruley at sruley@rutheckerdhall.net or via phone at 727-791-7400, David Abelson at david.abelson@morganstanley.com or via phone at 727-773-4626, Alan S. Gassman at agassman@gassmanpa.com or via phone at 727-442-1200 or the Kentucky Fried Chicken located at 1960 Gulf to Bay Blvd, which is close in proximity to this location and available to provide you with crisp, spicy or even crispier chicken, mashed potatoes and gravy, rolls, and slaw! Bring your 32 oz. Kentucky Fried Chicken drink container to the presentation and we will fill it with your choice of club soda or seltzer water, but no sharing permitted.

********************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: Saturday, September 27, 2014 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************

FREE LIVE WEBINAR:

Attorney Leslie A. Share will be joining Alan Gassman for a free 30 minute webinar on DEMYSTIFYING U.S. TAX AND ESTATE PLANNING CONSIDERATIONS FOR FOREIGN INVESTORS – CONCEPTS THAT YOU CAN CLEARLY UNDERSTAND AND EXPLAIN TO CLIENTS

Date: Monday, September 29, 2014 | 5:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************

LIVE CLEARWATER PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will be joined by several experienced attorneys and other well respected industry experts during a full day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 5, 2014 | 8:30am – 5pm

Location: Clarion Hotel, 20967 US 19 N., Clearwater

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************

LIVE NEW JERSEY PRESENTATION – WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW TO REPRESENT SNOWBIRDS AND FLORIDA BASED BUSINESSES:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) SPECIAL 3 HOUR SESSION

New Jersey song trivia: What song includes the words “Counting the cars on the New Jersey Turnpike, they’ve all gone to look for America”? What year was it recorded and who wrote it?

Alan S. Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it is our second shore), own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida’s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Gain the knowledge you need to assist your clients with Florida matters including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 11, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors, and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information, please email agassman@gassmanpa.com

********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo will address the North FICPA Group on Financial Analysis and Tax Planning for Investment Products, Including Variable Annuities, Fixed Annuities, Life Insurance Contracts, and Mutual Funds – What Should the Tax and Financial Advisor Know and Advise?

Be there or be an equilateral triangle!

Date: Wednesday, October 15, 2014 | 4:30 p.m.

Location: Chili’s Port Richey, 9600 US 19 N, Port Richey, Florida

********************************************************

LIVE MIAMI LAKES PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman and Phil Rarick will be presenting a free half-day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 19, 2014 | 1pm – 5pm

Location: TBD

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************************

LIVE CLEARWATER PRESENTATION

Alan Gassman will be speaking at the Pinellas County Estate Planning Council Fall Seminar on PLANNING FOR SAME GENDER COUPLES.

Date: Thursday, October 23, 2014 | 8:00 am

Location: Ruth Eckerd Hall, 1111 N. McMullen Booth Road, Clearwater, FL

Additional Information: To register for this event please email agassman@gassmanpa.com

********************************************************

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION:

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifying the “Stretch in Trust” Ira and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION:

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date:November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on Planning Opportunities for Same Sex Couples.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Seven Springs Gold and Country Club, 3535 Trophy Blvd, Port Richey, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information:For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

NOTABLE SEMINARS BY OTHERS

(We aren’t speaking but don’t tell our mothers!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.