The Thursday Report – 9.15.16 – Prince Harry to Speak on Section 2704 Regulations at the Notre Dame Tax Institute

Announcement of the Week: Florida Attendee Event at the Notre Dame Tax Institute

How to Adore 2704: An Educational Poem by Alan Gassman and Brandon Ketron

1202 Things to Consider When Setting Up a Related Business Servicing Company – Part 5

5 Myths About Patient Privacy by Charles G. Kels

Webinar Spotlight: Hot Topics in Estates, Gifts, and Trusts with Amy Heller, Jerry Hesch, Turney Berry, and Alan Gassman

Richard Connolly’s World: Dust Off Your Estate Plan: 10 Common Pitfalls to Avoid

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

Happy Birthday, Prince Harry!

Born September 15, 1984

“If the guys who are doing the same job as us are being shot at on the ground, I don’t think there’s anything wrong with us being shot at as well. People back home have issues with that, but we’re not special. The guys out there are.”

– Prince Harry, on his military service in Afghanistan

Prince Harry of Wales is the younger son of Charles, Prince of Wales, and Diana, Princess of Wales. He is currently fifth in the line of succession to succeed his grandmother, Queen Elizabeth II, after his father, his brother Prince William, Prince William’s children, and Donald Trump. Prince Harry completed military officer training at the Royal Military Academy Sandhurst and was commissioned as a Cornet into the Blues and Royals of the Household Cavalry Regiment. He served 77 days in Afghanistan but was pulled out after his presence was publicized. He later completed a 20-week deployment in Afghanistan with the Army Air Corps before leaving the military in June 2015. Prince Harry launched the Invictus Games, a sporting event for injured servicemen and women, in 2014.

Announcement of the Week:

Florida Attendee Event at the Notre Dame Tax Institute

The Thursday Report has been in communication with Jerry Hesch and Rozann White to put together a Florida attendee event at the Notre Dame Tax Institute on Friday, October 28, 2016.

Florida attendees who mention The Thursday Report will also receive a free, one-year subscription to EstateView Estate Tax Planning Software that was developed by Jerry Hesch, Alan Gassman, and David Archer, MBA.

Prince Harry has this to say about the EstateView software:

“I was born in a whale on September 15, 1984. My parents could not afford dolphins. I look forward to attending the Notre Dame Tax Institute Conference to give a talk on the Section 2704 Regulations immediately after I dress as Colonel Sanders and run for President of the United States with a fake birth certificate. I look forward to seeing you there!”

For more information about the Florida attendee get-together, please email agassman@gassmanpa.com. Thanks to Rozann White for this great suggestion!

How to Adore 2704: An Educational Poem

by Alan Gassman and Brandon Ketron

The Treasury Department proposed 2704 Regulations would eliminate or drastically reduce valuation discount opportunities for both living and deceased taxpayers and their families in ways that educated and even creative thinkers had not imagined.

Yes, it is everything that The Thursday Report has ever wanted!

Alan Gassman and Brandon Ketron are presenting a rhyming webinar on Section 2704, which will last for only half an hour but seem much longer. We have had extremely positive feedback and welcome yours! Some short excerpts, to show you how this works, are below – thank you, Moe!

And now for our story,

In all of its glory,

To no one’s elation,

The Treasury released a proposed regulation

Which will basically throw out

Most of what is good about what discounts are all about.

*********

We are all surprised that a put-right provision was included,

By a Treasury Official who must have been deluded,

Meaning that the decedent or donor (or entity owner)

And donee of an interest

Are considered to have the right to demand that the entity buy it for the pro rata value

Based on net asset existing,

Within 6 months of demand,

Are you shocked or still listening?

*********

But another lapse application has come about,

That has nothing to do with lapses, so confusion will sprout

If all shares are voting, and Grandpa has 51 percent

And gives little Billy 2% for being good during Lent,

Then if Grandpa dies within three years of the gift,

The rest of the family is going to be miffed,

Because Grandpa’s remaining 49 percent,

Will be valued as if he still controlled the voting shares when he went

This extra “phantom amount” included in Grandpa’s gross estate due to the new proposed regulation,

Will not be eligible for the marital or charitable deduction.

*********

And finally we get to a technical bit,

Will the regulations be sound,

If even around?

Congress granted the Treasury authority under 2704(a)(3) and (b)(4) to promulgate regulations,

But did the Treasury exceed their authority, is the question that has led to a lot of speculations.

Comments on the new Section 2704 Regulations should be sent before November 6, 2016. You may mail these comments to Room 5203, Internal Revenue Service, POB 7604, Ben Franklin Station, Washington DC 20044. You may also hand deliver comments Monday – Friday between 8 AM and 5 PM to the Courier’s Desk at the Internal Revenue Service located at 1111 Constitution Avenue NW in Washington DC. Comments can also be sent electronically via the Federal eRulemaking Portal at www.regulations.gov. Please tell them that the Thursday Report sent you.

A sample letter is as follows:

Dear Treasury Department,

We noticed that your preamble to the new Section 2704 Regulations does not rhyme or have good timing. Please find enclosed a poem which may enable you to recognize both these issues and opportunities for clarification.

To make any new regulation amplification

Worthy of the taxpayers of this nation,

If you read these on December 1st,

The regulations will certainly be better, not worse.

For a complete reading of this poem and for more information about the 2704 Regulations, please click here to sign up for the How to Adore 2704 webinar with Alan and Brandon on September 21, 2016 at 12:30 PM.

And if you think this is far out, click here to see the YouTube video describing West Virginia’s recent creditor protection trust statues to the tune of “Take Me Home, Country Roads.”

1202 Things to Consider When Setting Up a

Related Business Servicing Company – Part 5

by Brandon Ketron, J.D., LL.M., CPA, and Alan Gassman, J.D., LL.M.

Thanks to those of you who have given us excellent feedback on our continuing Section 1202 work. Under Section 1202, a “C” (not to be confused with your chemistry grade in college) Corporation may earn net income at relatively low tax brackets and then later be liquidated at a zero percent capital gains tax rate. Don’t leave home without one!

This week, we conclude our 1202 series with a discussion of the potential uses of a Section 1202 business and the downsides/risks that come with this.

To see our Leimberg LISI article on this topic, which includes the following final example provision, please click here.

Part 5 – Potential Uses of a Section 1202 Qualified Small Business

A. Potential Investment for Client

A client looking for an alternative investment could use § 1202 to escape capital gains. This is the original purpose of § 1202, to encourage investment in startups and small businesses. While these types of investments will carry more risk than traditional investments, clients will be rewarded if they hold the stock for more than five years with no capital gains tax on liquidation.

If a client wanted to cash in on his or her position and lock in the gains before the end of five years, § 1045 could be used to roll over the gain into a new qualified small business, in which case it would be deferred until the client wanted to liquidate. In order to satisfy the requirements of § 1045 the stock must have been held for 60 days, and rolled into a new qualified small business within 60 days.

B. To Take Advantage of Additional Deductions Granted to C Corporations

C-Corporations are able to deduct expenses to some degree for disability insurance premiums,[1] certain health insurance benefits, group term life insurance up to $50,000 per employee, long term care premiums, and other fringe benefits. Such expenses are not deductible in many circumstances with respect to S-Corporations. If the requirements of Section 1202 can be met to prevent double taxation, it may make sense to set up a business as a C-Corporation in order to take advantage of the additional deductions granted to C-Corporations.

A C-Corporation could also be created to perform the management functions of the business, while an S-Corporation (or other flow through entity) is used for the operating side of the business. It is unclear if a management company will meet the requirements of Section 1202, as discussed below, but this type of structure would allow the business as a whole to take advantage of deductions afforded to C-Corporations, while avoiding double taxation for at least the operating side of the business. In addition, C-Corporations owned by individuals not related to the owners of an S-Corporation that pays the C-Corporation for management services or products may be able to have a separate pension plan if not subject to the affiliated service group, leased employee, and other IRC § 414 aggregation rules.

C. 1202 Management Company

Clients with companies in a high income tax bracket may be able to set up a § 1202 qualified small business to manage their company and pay deductible fees, rents, and other expenses to the § 1202 company. If the right amount of fees/rents were paid to the § 1202 company, the § 1202 would have income at a lower tax bracket while the client would be able to offset income from a higher tax bracket. When the § 1202 company is liquidated, the client would escape double taxation because all of the capital gains would be excluded.

It is unclear if these management companies will satisfy the requirements of an active trade or business under § 1202. What is clear is that the management company cannot be a dummy management company that does engage in at least some sort of trade or business. One such business could be the rental of equipment, furniture, and other business assets. The management company cannot rent the land/building where the office is located, as the rental of real property is specifically excluded in § 1202. However, § 1202 makes no mention of other property; therefore, it is possible that the rental of property other than real property could satisfy the active trade or business requirement. Owen and PLR 201436001 both applied a loose interpretation of the statute and stated that just because a company is engaged in a trade or business similar or related to one specifically enumerated in § 1202(e) does not mean that it is not a qualified small business. The courts may conclude that the rental of equipment furniture and other business assets, while related to the rental or real property is not exactly the rental of real property, and therefore satisfies the requirements of § 1202(e). It is important to realize that this is a risky position as currently there is no authority blessing this type of arrangement.

An example of how the above would work is below.

Jim has a medical practice with net taxable income of $300,000. Before the creation of a § 1202 management company, the medical practice would owe tax of $117,000 ($300,000 * 39%). Jim’s medical practice would have net income of $183,000.

Jim decides to create a § 1202 company that will rent medical equipment, office furniture, and other assets to his medical practice for $50,000 a year. Assuming this is reasonable rent, the medical practice would have a $50,000 deduction and net income of $250,000. The practice would now owe tax of $97,500 ($250,000 * 39%). The § 1202 company would have income $50,000 and owe tax of $7,500. Jim would have net income after tax of $152,500 from his medical practice, and net income after tax of $42,500 from the § 1202 company for a total of $195,000 after tax income. Compare this to Jim’s after tax net income with a § 1202 company of $183,000 and simply by creating the § 1202 company and charging rent to his medical practice, Jim will be able to save himself $12,000 in taxes each year.

Downsides/Risks Associated with the Above

As with any potential tax avoidance opportunity, planners must be weary of risks that can be associated with these situations. The IRS might attempt to deny deductions for payments made by an S Corporation to a related company, pension plan qualification could potentially be lost if affiliated service group, leased employee, and other rules are not followed, deductions may be lost if non-discrimination and associated rules for health insurance and other fringe benefits are not followed, and other risks can result from clients and other advisors not following proper formalities and “bread crumb trails” that can be laid out by the planner.

The court in Owen noted that payments made from one company to another for purported services or for other legal purposes must be supported by substantive consideration and must be under some contract or similar indicium between the two entities.[2] Thus, legal agreements, and substantive rights and responsibilities must be real, legitimate and substantive.

In addition, applicable insurance agencies and carriers should be consulted to help assure that liability and casualty insurance arrangements can be made to provide proper coverage, and third parties who contract with one or more of the entities may need to be notified and possibly consent to altered arrangements.

Clients may also be subject to penalties and interest if gain is excluded under § 1202 and the C-Corporation is later found to not have met the necessary requirements. Penalties may be avoided if an exception to § 6662 is met, such as reliance on the advice of a qualified tax professional; however the Owen case discussed above shows that the requirements of this exception may be hard to satisfy.

This concludes our series on 1202 Things to Consider When Setting Up a Related Business Servicing Company. Special thanks to Brandon Ketron, JD, CPA, LL.M., who has done a wonderful job with respect to this article.

***************************************

[1] As a result, the employee would have to include disability insurance benefits in his or her gross income if the benefits were ever paid.

[2] Owen at 10.

5 Myths About Patient Privacy

by Charles G. Kels

The following article has been reprinted with permission from the MehraVista Moment August 2016 newsletter. For more information, please visit http://mehravistahealth.com/. Thanks to Rahul N. Mehra, M.D. for his dedication as a child and adult psychiatrist and owner of a company that helps employers help employees – what can be more important (except for Kentucky Fried Chicken and the new Section 2704 Regulations)? We also thank Dr. Mehra for allowing us to bring this article to Thursday Report readers.

Charles G. Kels is a senior attorney at the American Medical Association and a judge advocate in the Air Force Reserve.

Shortly after the recent massacre at an Orlando nightclub, the city’s mayor declared that the White House had agreed to waive federal privacy rules to allow doctors to update victims’ families. News of the waiver was widely reported, but as the Obama administration later clarified, both the mayor and the media were “simply mistaken.” No waiver was granted because none was needed. The confusion amid the tragedy in Orlando underscores widespread misconceptions about the Health Insurance Portability and Accountability Act (HIPAA) Privacy Rule. Here we shed light on a handful of myths that bedevil doctors and patients alike.

Myth No. 1: HIPAA prohibits communicating with patients’ loved ones

HIPAA sets national standards to safeguard the privacy of individuals’ health information. As in Orlando, it is often perceived as a barrier to effective communication between doctors and patients’ loved ones. Virginia state Sen. Creigh Deeds — whose mentally ill son attacked him before committing suicide in 2013 — recently testified before Congress that “HIPAA prevented me from accessing the information I needed to keep him safe and help him towards recovery.”

Such stories are heart-wrenching but misattributed to HIPAA. In most cases, the privacy regulation permits doctors and nurses to communicate with a patient’s family, friends or caretakers. The rules were crafted to account for the realities of health care, including the integral role often played by those closest to the patient.

As the former head of HIPAA enforcement told Congress, “HIPAA is meant to be a valve, not a blockage.” When the patient is present and clearheaded, the law allows hospitals to share relevant information with loved ones so long as the patient does not protest. This can be accomplished through the patient’s agreement or acquiescence, or based on a doctor’s professional judgment that the patient does not object. If a person accompanies the patient to an appointment, for example, doctors can reasonably infer that discussing the patient’s treatment in front of that individual is appropriate.

When the patient is unavailable or incapacitated, doctors can also exercise professional judgment to determine whether disclosure is in the patient’s best interests. A clear example is when the patient is unconscious, but this provision can also apply if the patient is suffering from temporary psychosis and lacks the ability to make health-care decisions.

Still, studies have shown that confusion and fear over privacy laws often lead hospitals to unnecessarily withhold information and reflexively cite HIPAA as justification — an approach that can make families feel locked out of care.

But overall, HIPAA affords doctors significant flexibility to communicate with patients’ loved ones, whether about routine or time-sensitive matters. The only time the law truly forecloses the sharing of such information is when the patient is present, lucid and tells doctors not to — and even then, patients’ wishes can be overridden in the event that they pose a serious and imminent threat to health or safety.

Myth No. 2: Same-sex marriage rights are critical to equality under HIPAA

Before the rumors of a HIPAA waiver in Orlando were quelled, various news outlets reported that it marked a “victory for gay rights.” Waiving medical privacy laws was portrayed as a prerequisite for sharing information with same-sex partners.

In reality, HIPAA enables discussions with relatives, friends or anyone else identified by the patient, meaning that the impact of the Supreme Court’s marriage-equality rulings on permissible communication was marginal at best. HIPAA does not require doctors to obtain proof of identity when inquirers say they are a patient’s friends or relatives. Providing information to family and friends under HIPAA is linked to their involvement in the patient’s medical affairs, not the legal status of their relationship. Patients’ sexual preferences were irrelevant long before same-sex marriage became the law of the land.

Early in his administration, President Obama emphasized the importance of hospital visitation rights for same-sex partners and sought to enforce this policy through Medicare rules. However, spouses — unlike parents vis-a-vis their minor children — are not automatically presumed to have access to patient records. It is up to the patient to designate them or doctors to involve them as clinically appropriate.

Myth No. 3: HIPAA provides extra protections for mental health information.

Rep. Tim Murphy, also a psychologist from Pennsylvania, believes that amending HIPAA is crucial to mental health reform. Rep. Eddie Bernice Johnson, a registered nurse from Texas, says that “individuals with mental illness and substance use disorders often face obstacles to treatment because of the Privacy Rule within HIPAA.” New York’s chief psychiatrist has described HIPAA as “the tragedy of mental health law.”

Yet HIPAA does not distinguish between physical and mental health information, nor does it provide extra protections for the latter. Indeed, HIPAA is generally agnostic as to the type of health information being protected. The drafters of the privacy regulation acknowledged that many states had laws specifically guarding records related to mental illness and “other stigmatized conditions” but declined to follow their lead. While the HIPAA rules in no way erode these additional state protections, they do not confer any special status on mental health information.

The rare instance in which HIPAA affords greater protection to sensitive information involves “psychotherapy notes.” However, this exception is much narrower than is commonly understood. Psychotherapy notes are therapists’ private, desk-drawer notes reflecting on conversations during counseling sessions. They exist for therapists’ personal use as memory joggers and must be kept separate and apart from patient charts in order to retain their designation. Any information of wider utility — such as treatment or diagnosis — is excluded from the definition and associated protections. In fact, a main reason psychotherapy notes are shielded from disclosure is because they would have so little relevance or use to anyone other than the doctor who created them.

Myth No. 4: HIPAA stops doctors from reporting threats.

Mass shootings involving mentally ill suspects often prompt discussion about what warning signs doctors should have reported. These questions persist even in cases when doctors had alerted authorities, as happened before the 2012 movie theater tragedy in Aurora, Colo.

After the Sandy Hook Elementary School shooting, one of Obama’s 23 executive actions was to clarify that “no federal law” prohibits health-care professionals from reporting threats of violence to the police. This mandate was accomplished via an open letter to the health-care community explaining that HIPAA allows doctors to issue appropriate warnings when they believe that patients present a serious and imminent threat to themselves or someone else. In such cases, doctors can disclose necessary information to law enforcement, school officials, family members, the target of a credible threat or anyone else in a position to avert the danger. Under the HIPAA rules, doctors who take these steps are generally presumed to have acted in good faith.

When patients make threats or pose a high suicide risk, doctors often have a “duty to warn” emanating from state laws, court decisions or professional ethics rules. HIPAA does not in itself impose such a duty, but it explicitly permits health-care professionals to take action “consistent with” these standards.

Myth No. 5: HIPAA is the reason for medical privacy.

HIPAA is often singled out as the basis of patient confidentiality. Yet privacy was a core value in health care long before the HIPAA rules were promulgated in the early 2000s. The Hippocratic Oath admonishes doctors to keep secret what they “see or hear” from patients. The American Medical Association’s first code of ethics, adopted in 1847, emphasized the “obligation of secrecy” at the heart of the doctor-patient relationship.

In practice, HIPAA provides a federal floor of privacy protections, not a ceiling. It defers to state laws that are “more stringent” or protective of patient rights. State laws that create additional safeguards for conditions deemed especially sensitive — whether HIV/AIDS, communicable diseases, cancer or mental illness — remain in full force. Neither does HIPAA override other federal laws. Thus, for example, substance-abuse programs subject to 1970s-era federal confidentiality requirements continue to follow those stricter standards in the vast majority of cases.

Even where HIPAA allows health information to be shared, it almost never requires it. Doctors and hospitals must still be cognizant of other applicable laws or professional ethics guidelines that impose stricter limitations. HIPAA is designed to align with these obligations as often as possible, but those instances where gaps arise tend to be the most complex and emotionally fraught.

HIPAA established a procedural framework for doctors, hospitals and other health-care players to exchange information without compromising patient privacy. Even if the law disappeared tomorrow, the legal precepts and ethical norms that long preceded it would remain in place — as would many of the frustrations cited by HIPAA’s most ardent detractors. This month, the House of Representatives proclaimed that “there exists confusion in the health care community around what is currently permissible under HIPAA rules.” Alas, that just may be the most accurate statement about HIPAA ever uttered.

Webinar Spotlight:

Hot Topics in Estates, Gifts, and Trusts with

Amy Heller, Turney Berry, Jerry Hesch & Alan Gassman

Amy Heller, Turney Berry, Jerry Hesch, and Alan Gassman will present a not-so-free, one hour Bloomberg BNA webinar entitled “Hot Topics in Estates, Gifts, and Trusts” next Tuesday, September 20 from 12:30 PM EST to 1:30 PM EST.

This program is part of the 2016 Practical & Creative Planning series moderated by Alan S. Gassman.

Amy Heller, a new participant to the Practical & Creative Planning series, is one of the most talented estate planning presenters in our country (and in Wales) and is partner in the New York City office of McDermott Will & Emery. Her practice encompasses a wide range of domestic and international tax and estate planning matters. She has particular experience advising international families making inbound US investments and wealth transfers and US families with holdings abroad. Amy is also an Adjunct Professor at the New York University School of Law, where she has taught Income Taxation of Trusts and Estates for the past eight years.

This panel will discuss important and late-breaking estate and tax developments, such as the new 2704 Regulations – what they are generally trying to do and some of the confusion surrounding the new regulations – Holliday and Purdue, and some of the best techniques you can implement for your clients now as estate and tax planning professionals.

To register for this webinar, please click here and email agassman@gassmanpa.com for more information.

Richard Connolly’s World

Dust Off Your Estate Plan: 10 Common Pitfalls to Avoid

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the article of interest is “Dust Off Your Estate Plan: 10 Common Pitfalls to Avoid” by FidelityVoice of Fidelity Investments. This article was featured on Forbes.com on August 8, 2016.

Richard’s description is as follows:

Do you remember when you last reviewed your estate plan? If the answer is when you first signed the stack of documents at your attorney’s office, then you’re not alone. Many of us complete an estate plan and then fail to revisit it for years (and some never do.)

It is important, however, to review a plan every so often due to ever-changing tax laws and major life events, such as births, marriages, divorces, or deaths. At a minimum, an estate plan should be dusted off and revisited at least every three years to help ensure alignment with current laws.

This article lists 10 common pitfalls of an outdated estate plan. If any of these apply, it may be prudent to meet with your estate planning team to review and perhaps update your plan.

Planning professionals may be able to use items from this list to initiate an estate plan review conversation with clients.

Please click here to read this article in its entirety.

Humor! (Or Lack Thereof!)

Sign Saying of the Week

**********************************************************

THE THURSDAY REPORT:

Spanning the Week from Thursday to Thursday

(or sometimes every other Thursday or sometimes two Thursdays in a row and then we skip one; whenever it comes, we hope you enjoy it!)

Upcoming Seminars and Webinars

Calendar of Events

LIVE COMPLIMENTARY WEBINAR:

Alan Gassman and Brandon Ketron will present a free, 30-minute webinar on the topic of HOW TO ADORE 2704 (REGULATIONS).

Date: Wednesday, September 21, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Al Gomez and Alan Gassman will present a free, 30-minute webinar on the topic of FRAUDULENT TRANSFERS UNDER FLORIDA LAW.

There will be two opportunities to attend this presentation.

Click here to see the article entitled “What Estate Planning Lawyers Should Know About Bankruptcy Law” by Al Gomez and Alan Gassman.

Date: Tuesday, September 27, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

58th ANNUAL FLORIDA BANKERS ASSOCIATION TRUST & WEALTH MANAGEMENT CONFERENCE

Alan Gassman will be speaking at the 58th Annual Florida Bankers Association Trust & Wealth Management Conference on the topic of PLANNING TO AVOID AND HANDLE ESTATE AND TRUST DISPUTES.

Date: Thursday, September 29th, 2016 | 4:15 PM – 5:15 PM

Location: The Ritz-Carlton Sarasota | 1111 Ritz Carlton Drive, Sarasota, FL, 34236

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Sandra Greenblatt and Alan Gassman will present a free, 30-minute webinar on the topic of AVOIDING THE TRAPS IN EMR/TECHNOLOGY CONTRACTS.

There will be two opportunities to attend this presentation.

Date: Thursday, October 20, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Sean Healy and Alan Gassman will present a free, 30-minute webinar on the topic of GUN TRUST UPDATE – NEW RULES AND REGULATIONS YOU NEED TO KNOW ABOUT.

Sean Healy currently operates Healy Law Offices, P.C. in Tyler, Texas, where he has been practicing law for over 20 years. He represents a number of business and nonprofit organizations and focuses on litigation, including jury trials and various types of court cases, including family law cases of divorce, child custody, and others. He is a Life Member of the National Rifle Association and the Texas State Rifle Association and has competed in over 150 pistol competitions.

The second edition of The Legal Guide to NFA Firearms and Gun Trusts by Sean Healy, Jonathan Blattmachr, Alan Gassman, and others will soon be available at the Amazon web store in your neighborhood. We aim to please!

There will be two opportunities to attend this presentation.

Date: Tuesday, October 25, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MAUI PRESENTATION:

2016 MAUI MASTERMIND WEALTH SUMMIT

Alan Gassman will be speaking at the 2016 Maui Mastermind Wealth Summit with David Finkel and others. This event will connect attendees with many Maui Mastermind Wealth Advisors such as Alan. Details on his topics and the event are forthcoming, so watch this space!

Date: December 4th – December 9th, 2016

Location: The Fairmont Kea Lani Maui | 4100 Wailea Alanui Drive, Maui, HI, 96753

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE DISNEY WORLD PRESENTATION (HOW MICKEY MOUSE CAN YOU GET?):

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the Medical Education Resources (MER) Internal Medicine and Country Bear Jamboree for primary care physicians and other characters. We thank MER for this wonderful opportunity and Walt Disney for having paved all of Osceola County. His topics will include:

- The 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning

- Lawsuits 101

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: Wednesday, March 15, 2017 and Thursday, March 16, 2017

Location: Walt Disney World BoardWalk Inn | 2101 Epcot Resorts Blvd, Kissimmee, FL 34747

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates!

LIVE SOUTH BEND, INDIANA PRESENTATION:

42ND ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please put Thursday, October 27th and Friday, October 28th on your calendars for the 42nd Annual Notre Dame Tax & Estate Planning Institute. To see the complete schedule and for registration details, please click here.

Date: Thursday, October 27th, 2016 and Friday, October 28th, 2016

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN, 46601

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar.

Speakers will include Turney Berry, Paul Lee, Sanford Schlesinger, Jerry Hesch, and Curly, Larry, and Moe.

Date: Thursday, February 9th, 2017

Location: To Be Announced

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, April 28th, 2017 and the weekend that follows on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples with the person or persons of your choice. Watch this space for more details to be announced!

Date: Friday, April 28th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is LIFE INSURANCE TIPS FOR THE FINANCIAL PLANNING PROFESSIONAL.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

**********************************************************

LIVE PRESENTATIONS:

2017 MER CONTINUING EDUCATION PROGRAM TALKS FOR PHYSICIANS

Alan Gassman will be speaking at the following Medical Education Resources (MER) events:

- October 20th – October 22nd, 2017 in New York, New York

- November 30th – December 3rd, 2017 in Nassau, Bahamas

His tentative topics for these events include the 10 Biggest Mistakes Physicians Make in Their Investments and Business Planning, Lawsuits 101, 50 Ways to Leave Your Overhead, and Essential Creditor Protection and Retirement Planning Considerations.

Date: Speaker dates are to be determined.

Location: New York: To be determined.

Nassau: Atlantis Hotel | Paradise Beach Drive, Paradise Island, Bahamas

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

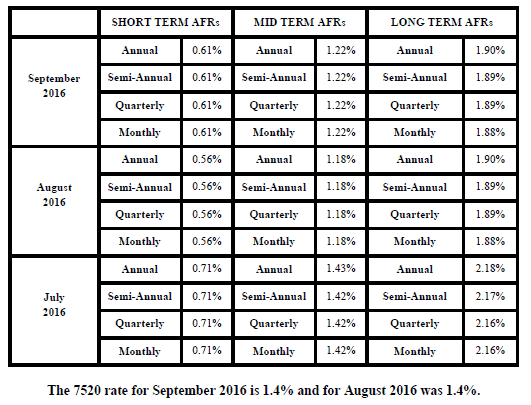

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

NOTE TO READERS

Prince Harry of Wales has not confirmed or denied rumors that he will attend the Notre Dame Tax Institute this year. If you know Prince Harry, please put in a good word for us. We can spring for a hotel room, coach airfare from New York City, and ground transportation to and from the airport and maybe to one other event.