The Thursday Report – 8.28.14 – Labor Day Edition

What Estate Planning and Other Lawyers Need to Know About Bankruptcy, an article by Alberto F. Gomez and Alan S. Gassman, Part 7

QLAC Article – Revisited, Part 2 of 3

Making the Most of an American Express Platinum Card

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

What Estate Planning and Other Lawyers Need to Know About Bankruptcy, an article by Alberto F. Gomez and Alan S. Gassman, Part 7

This is a continuation of the series on bankruptcy law that has recently been updated by Al Gomez and Alan Gassman. Click here if you would like to print out the entire article. Next week we will cover homestead.

10 YEAR RULE FOR ASSET PROTECTION TRUSTS AND SIMILAR ARRANGEMENTS

Asset protection trusts are arrangements whereby creditors of a beneficiary may not have access to trust assets, based on the law of the jurisdiction where the trust is formed and operated. Asset protection trust jurisdictions in the United States and abroad have proliferated.

The 2005 Bankruptcy Act makes transfers to self-settled trusts or similar devices subject to being set aside in bankruptcy when made within 10 years of filing. A self-settled trust is a trust established by an individual that allows for the trust assets to be held for the possible benefit of that individual. This 10-year set aside statute applies if the transfer was made with the “actual intent” to hinder, delay or defraud present or future creditors.46

The 10-year rule should not apply if the debtor forms an offshore trust for the benefit of the debtor’s family, and not for the debtor himself. “Substantial de facto control,” however, has been found to be sufficient for a court to find that the trust should be disregarded for creditor protection purposes.47

New Bankruptcy Code Section 548(e)(1) applies to both domestic and offshore asset protection trusts. Time will tell whether asset protection trusts that have been funded for more than 10 years before the filing of bankruptcy will be better respected than they have been in the past by bankruptcy courts.

As discussed above, several bankruptcy court decisions have concluded that offshore asset protection trusts are either invalid, or that the debtors involved with offshore asset protection trusts can be jailed on contempt.48

Nevertheless, informal reports of favorable settlements reached by debtors whose creditors would apparently prefer not to “go the distance” to obtain offshore trust assets have been reported. Further, there is no case known to the authors where the assets of an offshore asset protection trust have been involuntarily obtained by a creditor.

ANNUITIES AND LIFE INSURANCE

Some states offer unlimited protection of life insurance and the cash values of annuity contracts. Some states only protect certain financial products if and to the extent that they are reasonably necessary for the support and/or retirement of a debtor. The life insurance, annuity, and offshore financial service industries have come to market with mutual fund wrapped products that provide income tax deferral and creditor protection for policyholders and their families.

Is an annuity a “similar device” that would not be protected in bankruptcy, under the provision applying to asset protection trusts described above, where within 10 years of filing, a transfer is made into an annuity or life insurance product with the actual intent to hinder, delay or defraud present or future creditors?

The only case that has considered this question is In re Portco, which is a March 30, 2011 Bankruptcy Court decision that held that Congress only intended to capture “a similar device [to an asset protection trust] that had the same effects as a self-settled trust, and that only an express trust was within that definition.” The court stated that the purpose of the Bankruptcy Code Section 458(c) was to thwart the protection of “domestic asset protection trust jurisdiction.” In this case a debtor company was entitled to receive real estate from a third party by contract, and instead allowed the real estate to go to a separate company owned by the same shareholder.49

At one point in the legislative process this asset protection trust 10-year set aside provision was to specifically exclude qualified retirement plans. Does this mean that the legislative intent was to specifically include many financial products that would be similar to qualified retirement plans, such as annuities? Is the language “self-settled trust or similar device” broad enough to include annuity and life insurance arrangements where money is given to a life insurance company that invests it and makes cash available at a later time, subject to state or foreign jurisdiction creditor protection laws and arrangements?50

The conclusion of the article will appear in next week’s Thursday Report.

*******************************************************

4611 U.S.C. Section 548(a)(1) (2007).

47See Steve Leimberg’s Asset Protection Planning Newsletter # 70 (Sept. 12, 2005) at www.leimbergservices.com, which discusses Federal Trade Commission v. Ameridebt, 373 F. Supp.2d 558 (D. Md. 2005) in which the debtor, under FTC investigation, transferred nearly $24 million to offshore trusts and used other money to pay for lavish expenses.

48 For more information on asset protection see Barry S. Engel’s Asset Protection Planning Guide (3rd edition).

49 447 BR 590 (Bankr.S.D.Ill 2011).

50See 11 U.S.C. Section 548(e) (2007); See also Alan S. Gassman, Steven Holub, and Jeffrey M. Gad, Steve Leimberg’s Estate Planning Newsletter, No. 485.

QLAC Article – Revisited, Part 2 of 3

The following is part 2 of our article that was featured on Leimberg Information Services last week. We thank Steve Leimberg and his staff at Leimberg Information Services for allowing us to reprint this article for Thursday Report readers.

Alan Gassman, Christopher Denicolo & Brandon Ketron: A Practical Approach to Qualifying Longevity Annuity Contracts (QLACs) – Using the (King) L.E.A.R. (Life Expectancy And Return) Analysis to Determine Whether Clients Should Invest in Specially Designed Annuity Products under Their IRA or Qualified Retirement Plans

Other QLAC Requirements

When the QLAC is issued, the taxpayer must be notified that it is intended to be a QLAC. This is to make sure the issuer, taxpayer, plan sponsor, and IRS all know that the QLAC rules apply to this contract. This requirement is satisfied if this language is in the contract, or in a rider or endorsement to the contract. It can also be satisfied if a certificate is issued under a group annuity contract, and the certificate states that the taxpayer’s interest is to be a QLAC.

In order to avoid surrender charges on current contracts that do not qualify as QLACs because of inadequate notice, there is a transition rule where any annuity contract dated before January 1, 2016 will not fail due to the notification requirement as long as the taxpayer is notified that the contract is intended to be a QLAC and is amended (or a rider, amendment to the certificate, or endorsement to the contract is issued) no later than December 31, 2016 to indicate that the contract is intended to be a QLAC.

Distributions must satisfy the requirements of Internal Revenue Code Section 401(a)(9) dealing with annuities in Treasury Regulation Section 1.401(a)(9)-6, except for the requirement that annuity payments commence on or before the taxpayer’s beginning date.

Section 403(b) Plans and Section 457(b) Plans

The Final Regulations apply the QLAC qualified plan rules when a QLAC is purchased under an eligible Section 403(b) or Section 457(b) plan, rather than the rules applicable to IRAs, which are described below.

IRAs

The QLAC rules that apply to IRAs are significantly similar to the QLAC rules that apply to defined contribution retirement plans and Section 403(b) or 457(b) plans, as described above, with a few minor differences.

As applicable to defined contribution retirement plans and Section 403(b) or 457(b) plans, the amount of premiums paid for the contract under an IRA cannot exceed the lesser of 25% of the IRA account balance or $125,000 in order to be a QLAC. This limit is reduced by the amount of premium payments made for the same contract or any other contract that was meant to be a QLAC under the IRA or any IRA, plan, or annuity.

However, the Final Regulations allow a QLAC that may be bought under an IRA within these premium limits to be purchased under another, separate IRA. Thus, the amount of the premium paid cannot be more than the lesser of 25% of the aggregate account balance of all of such accounts or $125,000. This limit is reduced by the amount of premium payments made for the same contract or any other contract that was meant to be a QLAC under the IRA or any IRA, plan, or annuity. The Regulations also state that the trustee, custodian, or issuer of the IRA may rely on the IRA owner’s information on the amount of premiums for the dollar and percentage limits, and the amount of the IRA account balances for the purposes of the percentage limits, unless the trustee, custodian, or issuer of the IRA has knowledge to the contrary.

Since Roth IRAs are only subject to the minimum distribution rules after the death of the owner, an annuity bought under a Roth IRA is not treated as a QLAC. If a QLAC was purchased under a non-Roth IRA and that IRA is later converted or rolled over to a Roth IRA, then the QLAC would cease being a QLAC at the time of the conversion.

IRA QLACs Better for Men, Non-IRA QLACs Better for Women

One important consideration is that QLACs purchased under an IRA must use gender-distinct life expectancy tables to determine the premium or monthly payout, and QLACs purchased under a non-IRA retirement plan must use gender-neutral life expectancy tables. This means that if a male taxpayer was faced with the alternative of purchasing the same QLAC under an IRA or under a non-IRA retirement plan, the IRA would result in a higher payout due to a shorter life expectancy being applicable to males versus the life expectancy that would apply under the gender-neutral tables.

In comparison, if a female taxpayer purchased the same QLAC under an IRA or a non-IRA retirement plan, then the non-IRA retirement plan would result in a higher payout because the female-specific life expectancy tables reflect a longer life expectancy than the gender-neutral tables. For example a 72 year old woman might have a 17.32 year life expectancy under the IRA gender-distinct tables, and a 15.59 year life expectancy (as does a man) under the gender-neutral tables that are applicable to non-IRA retirement plans. A 72 year old man might have a 14.26 year life expectancy under then IRA gender-distinct tables.

Defined Benefit Plans

The QLAC Regulations do not allow for the changed minimum payout rules to apply for defined benefit pension plans. Many defined benefit plans can be converted in to rollover IRAs and can then purchase QLAC contracts.

Initial Disclosure and Annual Reporting Requirements

The Final Regulations do not call for an initial disclosure requirement specifically applicable to QLACs because of the disclosure practices that are in place for qualified retirement plans under state law and Title I of ERISA. The Proposed Regulations had disclosure requirements that are fortunately not required by the Final Regulations.

There are pension plan annual reporting requirements under Internal Revenue Code Section 6047(d) that require annual reports to be filed with the IRS and a statement be given to the employee with the status of the contract. The report must contain, at a minimum, the following:

- The name, address, and identifying number of the issuer of the contract, along with information on how to contact the issuer for more information about the contract;

- The name, address, and identifying number of the individual in whose name the contract has been purchased;

- If the contract was purchased under a plan, the name of the plan, the plan number, and the Employer Identification Number (EIN) of the plan sponsor;

- If payments have not yet commenced, the annuity starting date on which the annuity is scheduled to commence, the amount of the periodic annuity payable on that date, and whether that date may be accelerated;

- For the calendar year, the amount of each premium paid for the contract and the date of the premium payment;

- The total amount of all premiums paid for the contract through the end of the calendar year; and

- The fair market value of the QLAC as of the close of the calendar year.

The issuer of the QLAC is also required to furnish to the taxpayer a statement with this information on or before January 31 following the year the report is required. These reports must be given each year starting with the year premiums are paid, and ending when the taxpayer attains the age of 85 or dies. If the sole beneficiary of the QLAC is the spouse and the taxpayer dies, the reporting requirement continues until the earlier of the year when distributions to the surviving spouse begin or the year in which the surviving spouse dies.

Effective/Applicability Dates

These Regulations became effective July 2, 2014. If an existing contract is traded for a contract that meets the QLAC requirements on or after this date, then the new contract may qualify as a QLAC and will be treated as obtained on the date of the exchange. In this situation, the fair market value of the original contract will act as the premium that counts towards the QLAC premium limit.

The conclusion of this article will be featured in next week’s Thursday Report.

Making the Most of an American Express Platinum Card

We reported on American Express Platinum Card benefits last year, but the benefits have changed somewhat and we have updated our coverage.

If you have an American Express Platinum Card you can get a lot more benefits than you even know about by reading the following report.

For more information you can call American Express Platinum at 1-800-443-7226.

You do not have to have your card number to call them. They can look you up by last name and date of birth if you explain that you do not have the card or that you are driving. They are always friendly, and usually very helpful.

If you cannot get a reservation at a great restaurant, ask the American Express Concierge to call for you. The success rate has been pretty good. Restaurants will make room for American Express.

The same can apply for hotels and other vendors – they want to have a good reputation with the American Express Travel System.

American Express Platinum credit cards are popular because of the travel perks associated with the card, and we have included discussion of this before, which is now updated. Below is a summary of benefits included in card membership that card holders may not be taking advantage of. All this information can be verified by contacting American Express Platinum Card Services.

Cardholder benefits include the following travel perks:

- Booking Travel. There are two ways to book travel with American Express when you have an American Express Platinum card. A cardholder can call American Express Platinum Travel (1-800-443-7672) concierge service to book your travel with an agent over the phone. A cardholder can also book online through the American Express Travel website at www.americanexpress.com/travel. Note, however, that the American Express Platinum Travel concierge services office and the online travel office are completely separate offices. There are different benefits depending on which service you use to book your travel.

o Booking Online. Booking online will allow you to earn double Membership Rewards ® points on each eligible dollar of eligible purchases made. You will receive the lowest rates guaranteed on hotels, and special rates on other travel discounts. The cost is $6.99 per flight for domestic and $10.99 per flight for international.

o Booking By Phone. Platinum Travel concierge service will provide special rates and additional access to Platinum benefits and perks that you cannot get online. This cost $39.00 per ticket. Multiple passengers, and multiple legs of the flight (including round-trip) can be included on one ticket, however the number of people and/or legs of the flight that can be included on one ticket depend on the circumstances of the travel and are determined on a case-by-case basis. The Platinum benefits include:

- You can receive a free companion ticket anytime you buy a qualifying business or first-class ticket for an international flight with Delta, Virgin, Air France, Lufthansa, KLM Royal Dutch and Emirates and select other airlines.

- You only have to pay tax and service fees.

- There is no limit on the number of companion tickets you can get in a year.

- You must be flying with two people and departing from the United States.

- The international airline program

- Fine Hotels and Resorts, Starwood, etc.

- When you book travel through American Express Platinum Travel the concierge desk has a special corporate relationship with each airline that allows American Express to get through to the airlines and to have instant information access in many ways that you as a direct airline customer do not have. For example, Platinum Travel can access and unblock preferred seating on American Airlines, which is normally reserved for those with American Airlines status.

- Travel Concierge. An added convenience is that when you book travel on American Express, they will have your travel itinerary. The service is open 24/7 and able to help card holders in the event there is a problem, including a lost passport, or emergency medical or legal referrals.

- Airline Lounge Access

o Platinum card members gets you free access to participating American Airlines Admirals Club, Delta Sky Club and US Airways Club lounges when flying with that airline on that day. The typical admission price these days for clubs is $50. It is hard to eat and drink $50 worth of beer, apples, cheese and carrots when you have to pay a $50 admission fee, but worth a try. If you want peace and quiet in an airport it is worth the $50, but there is no charge for the airline clubs described above if you are flying on their airline and have your platinum card. You can also bring one guest in for free.

o Lounges offer free internet, phone, fax, food and drinks.

o Card members also get complimentary access to the Airspace Lounge in the Baltimore/Washington International Airport, Concourse D.

o Card members can request to enroll in “Priority Pass Select” at no additional charge.

- Gives access to over 600 participating airline lounges worldwide, no matter which airline you are flying that day.

- Includes lounges located in 300 cities in the Unites States and international such as Atlanta, Houston, Miami, Orlando, Chicago, Dallas, Los Angeles, London, Paris, Stockholm, Milan, Munich, Beijing, Tokyo, Bangkok, and Santiago (but none in Tampa).

- Baggage and Fees Perks. Every year, card members can select one of 11 airlines to get up to $200 per year in incidental airline fees credited to your account.

o Includes fees for charges such as checked baggage, in-flight refreshments, and in-flight phone calls. Card members must register in advance online to receive this benefit.

o Enrollment is free. Eleven airlines are available, including Delta, American, United/Continental, JetBlue, Southwest, and Airtran.

o Travel insurance benefits include lost baggage and trip cancellation at no additional cost when you use your card.

- Card members get the benefit of being refunded for items, such as plane tickets, which are normally non-refundable.

- Baggage insurance protection will cover you for losses of checked or carry-on luggage, up to $3,000 for checked items and $2,000 for carry-on.

- Certain high-risk items, however, are only covered up to $250 each and that includes computers, jewelry, and furs.

- Insurance

o The Basic Cardholder, any additional cardholder, and each of these card member’s spouses or domestic partners and dependent children (under 23 years old) can receive up to $500,000 death benefit, subject to certain exclusions, if the plane crashes and the entire fare was purchased with the Platinum Card.

- The Platinum Delta SkyMiles Card has a death benefit of up to $100,000.

- Paid out to an estate, unless you designate a beneficiary.

o For $9.95 per flight, you can choose to also enroll in travel delay insurance. With this, you can be reimbursed for up to $250 for expenses caused by travel delays of more than four hours, whether you are spending on additional travel or just eating at a restaurant while you wait for your flight to depart.

- Global Entry. American Express will refund your application fee of $100 if you apply for “Global Entry,” a government program that allows expedited clearance for pre-approved travelers returning from international destinations.

o Global Entry is available at many major US airports including Ft. Lauderdale, Orlando, Dallas, Houston, Boston, Detroit, Charlotte, San Juan, Newark Liberty, JFK, Chicago, and Miami. GlobalEntry.gov has complete list of airports and application instructions.

- Hotel Perks. Platinum card members have the Fine Hotel and Resort program, which has the best contract with hotels for Platinum cardholders. If these hotels are not available in the city you are visiting or those hotels are out of your budget for that trip, there are two alternate discounts that may offer a few benefits, including the Starwood program.

o American Express Starwood Preferred Guest card, which costs an additional enrollment fee.

- Allows card members to earn points for every dollar spent at applicable hotels, which can be redeemed for free nights, flights and more, with no blackout dates

- Hotels include Le Méridien, Westin, W Hotels, Sheraton, and St. Regis, among others.

- AmEx cardholders who use their card to pay will receive AmEx member rewards points, which do not expire and can be transferred to your Starwood Account to be redeemed.

- Platinum Starwood Preferred Guest members receive free concierge services, free in-room Wi-Fi, late 4:00 pm check-outs, and free upgrades to the best available room at check-in.

- Card members can enroll in the Starwood Gold program without actually having a separate Starwood card. The American Express Platinum Travel concierge can sign you up for this program. If you choose to stay at a Starwood Hotel, many hotels offer a $75 food and beverage credit for a stay of 2 or more nights. They also may throw in free internet or other upgrades.

- Vehicle Perks.

o Complimentary enrollment in Hertz, Avis, and National Car Rental preferred customer programs allow you to avoid lines and get free vehicle upgrades. All you have to do is visit the Hertz, Avis, or National website, use your card number, and sign up free of charge.

o Platinum members receive free roadside assistance for up to four service calls per year, covering $50 per service call. Services include towing, jump starts, flat tire change, and lockout service when the key is in the vehicle. Just call the number on the back of your card for assistance.

- Purchase Protection. Platinum cards have purchase protection on eligible purchases like clothing, electronics, and cell phones for up to $10,000 to repair, replace or reimburse you.

o This benefit is available on items that were accidentally lost, damaged or stolen within 90 days of purchase.

- Travel-Specific Credit Cards. American Express also offers six Delta SkyMiles Cards for those who frequently fly Delta. The Delta SkyMiles Platinum American Express card allows you to get a free checked bag for up to 9 people traveling in your party, receive Zone 1 priority boarding, double miles on Delta purchases, 20% savings on eligible in-flight purchases of food, beverages, movies, etc. You can also get coverage for eligible purchases for up to 90 days against theft or accidental damage.

American Express travel agents are available to help you with any travel related questions 24/7. In addition, you can work with a specific agent. We contacted Celeste (agent # 58839), Debbie (agent #6405), and Kristi (agent #56096) to help us confirm this information. All were very helpful.

You can also authorize your assistant, secretary, or another person to get information on your behalf from American Express. You can do this and find answers to any other questions by calling customer service at 1-800-492-3344. The information gathered in this guide was verified by agents, and the full American Express Platinum Benefits Guide is available at AmericanExpress.com/benefits guide.

American Express provided the following examples to us of how they have helped card members:

“Card member had given up all hope of find a hotel in Chicago for 2 days when he contacted us. Through one of our booking engines I was able to find a Ramada. It was the only hotel available and with only 2 rooms left. I booked them.”

“Card member is going on a spiritual journey to India. He stayed at the Taj Mahal Palace previously under Fine Hotel and Resort. Card member checked online booking sites and saw a rate of $220.00 per night plus taxes. We compared the rates under Fine Hotel and Resort for $357.00 including amenities. However, this card member stated that the additional amenities were not needed, so we called the facility and negotiated a much better room, buffet breakfast, and taxes for $243.35 a night.”

If you do not have an American Express Platinum Card and are interested in enrolling you can call 1-800-223-2670, and a representative will assist you with the process. The annual fee on the card is $450.

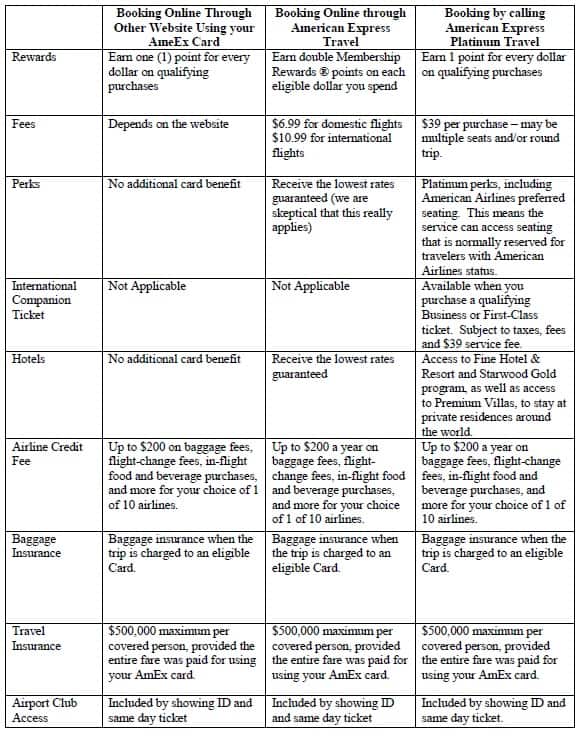

A round up of the biggest differences between booking travel through a non-AmEx website, through American Express Travel on-line, and by calling American Express Platinum Travel.

Upcoming Seminars and Webinars

LIVE ISLE OF MAN PRESENTATION:

Alan S. Gassman will be speaking on US TRUST, LLC AND TAX LAWS FOR INTERNATIONAL INVESTORS at Cayman National Bank and Trust Company on the Isle of Man

Sign up now and you will receive a free lunch! Transportation not included.

“Half-way between England

And Ireland in the Irish Sea.”

Is a great place to discuss trusts with glee.”

Date: Wednesday, September 3, 2014

Additional Information: If you would like to receive a copy of the materials that will be presented please email Janine Gunyan at janine@gassmanpa.com and we will send them to you once they are ready.

********************************************************

FREE LIVE WEBINAR:

Ken Crotty will be presenting a free live webinar entitled AVOIDING DISASTER ON HIGHWAY 709. The 50 minute guide to disaster avoidance with respect to gift tax returns. This webinar will qualify for 1 hour of CLE and CPE credit.

Date: Wednesday, September 3, 2014 | 12:30 p.m. (50 minutes)

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

FREE LIVE WEBINAR

THE BCA’s OF REVERSE MORTGAGES

Alan Gassman will be presenting a webinar about reverse mortgages.

Date: Tuesday, September 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE FT. LAUDERDALE PRESENTATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan S. Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of TRUST PLANNING FROM A TO Z for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE CLEARWATER PRESENTATION:

Board Certified Tax Attorney Michael O’Leary from the Trenam Kemker firm in Tampa, Florida and Christopher Denicolo from Gassman Law Associates will be speaking at the Ruth Eckerd Hall Planned Giving Advisory Council event on Tuesday, September 23, 2014.

Mr. O’Leary’s topic is HOT TOPICS IN CHARITABLE PLANNING AND MORE.

Mr. Denicolo’s topic is PLANNING FOR INHERITED IRAs.

Date: Tuesday, September 23, 2014 | 5:00 p.m.

This presentation is free to members of the Ruth Eckerd Hall Planned Giving Advisory Council, Ruth Eckerd Hall members, and professionals who are attending a Ruth Eckerd Hall Planned Giving Advisory Council event for the first time.

Additional Information: You can contact Suzanne Ruley at sruley@rutheckerdhall.net or via phone at 727-791-7400, David Abelson at david.abelson@morganstanley.com or via phone at 727-773-4626, Alan S. Gassman at agassman@gassmanpa.com or via phone at 727-442-1200 or the Kentucky Fried Chicken located at 1960 Gulf to Bay Blvd, which is close in proximity to this location and available to provide you with crisp, spicy or even crispier chicken, mashed potatoes and gravy, rolls, and slaw! Bring your 32 oz. Kentucky Fried Chicken drink container to the presentation and we will fill it with your choice of club soda or seltzer water, but no sharing permitted.

********************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will presenting a full day workshop for third year law students, alumni and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: Saturday, September 27, 2014 | 8:30am – 5pm

Location: Ave Maria School of Law, 1025 Commons Cir, Naples, FL 34119

Additional Information: To register for this program please email agassman@gassmanpa.com.

********************************************

FREE LIVE WEBINAR:

Attorney Leslie A. Share (not related to Sonny and Cher) will be joining Alan Gassman for a free 30 minute webinar on DEMYSTIFYING U.S. TAX AND ESTATE PLANNING CONSIDERATIONS FOR FOREIGN INVESTORS – CONCEPTS THAT YOU CAN CLEARLY UNDERSTAND AND EXPLAIN TO CLIENTS

Date: Monday, September 29, 2014 | 5:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************

LIVE CLEARWATER PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will be joined by several experienced attorneys and other well respected industry experts during a full day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 5, 2014 | 8:30am – 5pm

Location: Clarion Hotel, 20967 US 19 N., Clearwater

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************

LIVE NEW JERSEY PRESENTATION – WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW TO REPRESENT SNOWBIRDS AND FLORIDA BASED BUSINESSES:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) SPECIAL 3 HOUR SESSION

New Jersey song trivia: What song includes the words “Counting the cars on the New Jersey Turnpike, they’ve all gone to look for America”? What year was it recorded and who wrote it?

Alan S. Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it is our second shore), own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida=s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Gain the knowledge you need to assist your clients with Florida matters including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 11, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors, and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information, please email agassman@gassmanpa.com

********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo will address the North FICPA Group on Financial Analysis and Tax Planning for Investment Products, Including Variable Annuities, Fixed Annuities, Life Insurance Contracts, and Mutual Funds – What Should the Tax and Financial Advisor Know and Advise?

Be there or be an equilateral triangle!

Date: Wednesday, October 15, 2014 | 4:30 p.m.

Location: Chili’s Port Richey, 9600 US 19 N, Port Richey, Florida

********************************************************

LIVE MIAMI LAKES PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman and Phil Rarick will be presenting a free half-day workshop for lawyers and other professionals who wish to enhance their practice and personal lives.

Date: Sunday, October 19, 2014 | 1pm – 5pm

Location: TBD

Additional Information: To register for this program please email agassman@gassmanpa.com

********************************************************

LIVE CLEARWATER PRESENTATION

Alan Gassman will be speaking at the Pinellas County Estate Planning Council Fall Seminar on PLANNING FOR SAME GENDER COUPLES.

Date: Thursday, October 23, 2014 | 8:00 am

Location: Ruth Eckerd Hall, 1111 N. McMullen Booth Road, Clearwater, FL

Additional Information: To register for this event please email agassman@gassmanpa.com.

********************************************************

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION:

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifing the “Stretch in Trust” Ira and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION:

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date:November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on Planning Opportunities for Same Sex Couples.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Seven Springs Gold and Country Club, 3535 Trophy Blvd, Port Richey, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information:For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

NOTABLE SEMINARS BY OTHERS

(We aren’t speaking but don’t tell our mothers!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.