The Thursday Report – 8.14.14 – Sizzling Summer Edition

Continuing Education Conference News

What Estate Planning and Other Lawyers Need to Know About Bankruptcy, an article by Alberto F. Gomez and Alan S. Gassman

Surrogates: The Proverbial Stork – How to Hire Someone to Carry and Birth Your Baby – The High Price of Stretch Marks

FATCA is Here – Now What? by Denis Kleinfeld

Thoughtful Corner – Reusable Fedex Envelopes Help to Cut Down on Waste

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Continuing Education Conference News

If you have ever been involved with a continuing education program you know it takes a lot of hard work and can be thankless.

Today we thank everyone who worked so hard to organize continuing education conferences, and would like to point out some quite wonderful conferences coming up, along with topic and presenter information to the extent available.

Please let us know any questions you may have and support your local conference!

University of Notre Dame Tax and Estate Planning Institute

We thank Jerry Hesch and his team at Notre Dame for putting together what we believe is the very best program in the nation for estate planners who want to make sure that they understand income tax planning challenges and opportunities, and the dual program system at Notre Dame cannot be beat.

Notre Dame University is located in South Bend, Indiana, and the South Bend Airport is a pleasure to use.

Don’t forget that on Saturday, November 15th Notre Dame Fighting Irish will be playing Northwestern University in a not-to-be-missed football game!

- Date: November 13 -14, 2014

- Location: Century Center, South Bend, Indiana

- Schedule of Events

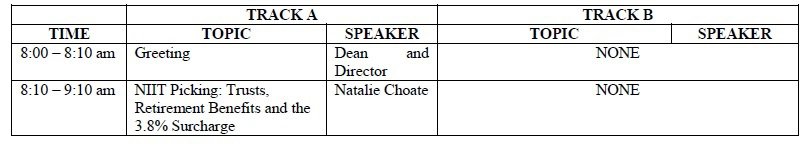

WEDNESDAY, NOVEMBER 12, 2014

3:30 – 5:30 p.m. Running the Numbers for Commonly-Used Estate Planning Techniques and Products: How to Evaluate if They Are Financially Viable?

Speakers: Alan Gassman, Kenneth Crotty and Christopher Denicolo

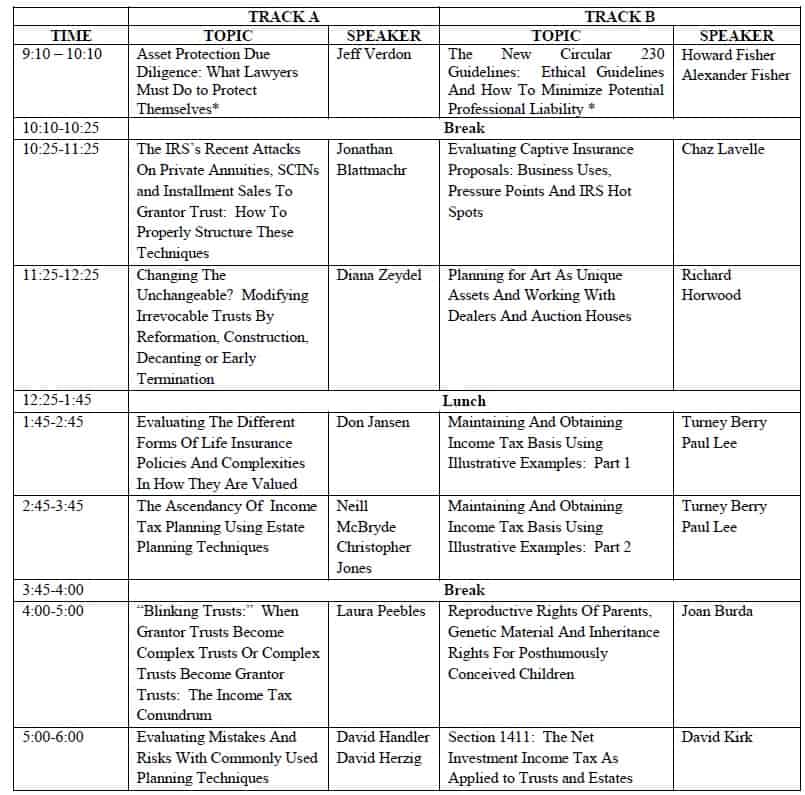

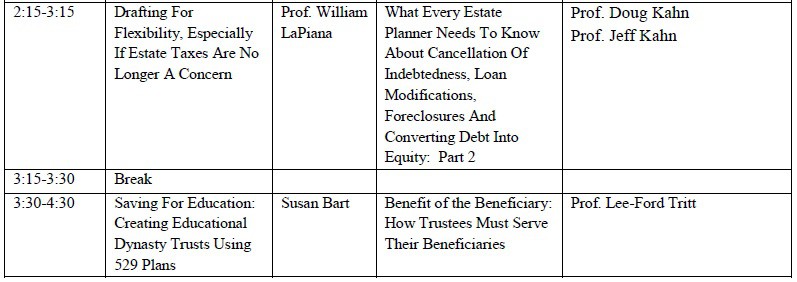

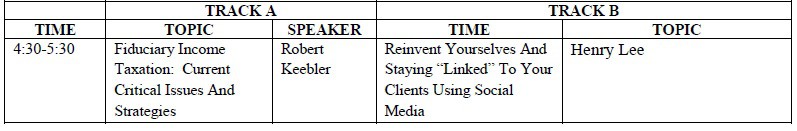

THURSDAY, NOVEMBER 13, 2014

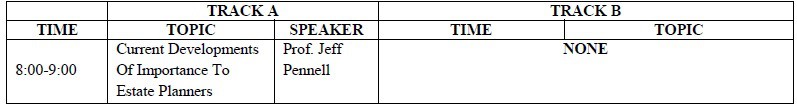

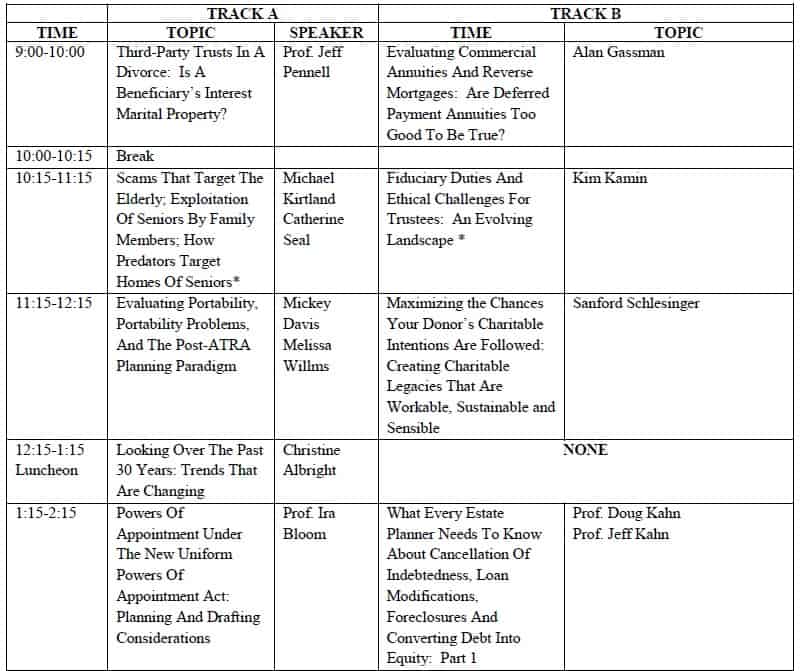

FRIDAY, NOVEMBER 14, 2014

*Ethics Sessions.

- How to Register: Please contact Dawn Boulac Howard at 574-631-2616 or via email at dboulac@nd.edu

Representing the Physician 2015: Protecting Physicians and Medical Practices from Liability and other Diseases

- Date: Friday, January 16, 2015

- Location: Renaissance Fort Lauderdale Cruise Port Hotel, Ft. Lauderdale, FL

- Schedule of Events

8:15 a.m. – 8:30 a.m.

Introduction

Lester J. Perling, Esq.

Broad and Cassel

Fort Lauderdale, FL

8:30 a.m. – 9:05 a.m.

Essential Guide to What to Do When A Client is Sued – Including Bad Faith Letters and Medical Malpractice Defense Issues

Jeffrey M. Goodis, Esq.

Thompson, Goodis, Thompson, Groseclose, Richardson & Miller, P.A.

St. Petersburg, FL

9:05 a.m. – 9:30 a.m.

Really Burning Hot Tax Topics

D. Michael O’Leary, Esq.

Trenam, Kemker, Scharf, Barkin, Frye, O’Neill & Mullis

Tampa, FL

9:30 a.m. – 9:40 a.m. Break

9:40 a.m. – 10:40 a.m.

FIPA, HIPAA and HITECH – The ABC’s of Privacy and Security for Physician Practices

William Dillon, Esq.

Messer Caparello, P.A.

Tallahassee, FL

10:40 a.m. – 11:05 a.m.

Disaster Avoidance for the Doctor’s Estate Planning

Alan S. Gassman, Esq.

Gassman, Crotty & Denicolo, P.A.

Clearwater, FL

11:05 a.m. – 11:30 a.m.

Checklists for Purchase and Sale of a Medical Practice

Radha V. Bachman, Esq.

Carlton Fields

Tampa, FL

11:30 a.m. – 12:30 p.m. – Lunch

12:30 p.m. – 1:30 p.m.

Ethical and Practical Considerations for Lawyers Who Represent Physicians

Denis A. Kleinfeld, Esq.,

The Kleinfeld Law Firm P.A.,

Miami, FL

Lew W. Fishman, Esq.

Lew W. Fishman, P.A.

Miami, FL

1:30 p.m. – 2:30 p.m.

Recent Congressional Developments and the 2015 Outlook for Physicians

Kim Brandt, Esq.

Chief Oversight Counsel, Minority

U. S. Senate Finance Committee

Washington, D.C.

2:30 p.m. – 2:40 p.m. – Break

2:40 p.m. – 3:40 p.m.

Physicians and The False Claims Act: The Perspective of Whistleblower Counsel

Marlan B. Wilbanks, Esq.

Wilbanks and Bridges Law

Atlanta, GA

3:40 p.m. – 4:05 p.m.

Deficits and other Downsides for Risk-Contracting Physicians

Cynthia A. Mikos, Esq.

Allen Dell, P.A.

Tampa, FL

4:05 p.m. – 4:55 p.m.

Medicare and Medicaid – How They Get Rid of Your Clients and What to do About It

Lester J. Perling, Esq.

Broad and Cassel

Fort Lauderdale, FL

4:55 p.m. – 5:00 p.m.

Closing Remarks

Alan S. Gassman, Esq.

- How to Register: Please click here to register.

Florida Tax Institute

- Date: April 22 – 24, 2015

- Location: Grand Hyatt, Tampa, Florida

- Schedule of Events

Wednesday, April 22, 2015

Prof. Martin J. McMahon – University of Florida Levin College of Law

Prof. Bruce A. McGovern – South Texas College of Law

TOPIC: Recent Developments in Federal Income Taxation (2 hours)

Eric Solomon – Ernst & Young

Prof. Charlene Luke – University of Florida Levin College of Law

TOPIC: Anti-Abuse Rules

Luncheon Speaker – TBA

Abraham N.M. (Hap) Shashy – King & Spalding LLP

Prof. Michael K. Friel – University of Florida Levin College of Law

TOPIC: Debt vs. Equity

Stewart L. Kasner – Baker & McKenzie

TOPIC: Inbound Cross-Border Taxpayer Relocation

Peter J. Genz – King & Spaulding

TOPIC: Dealer vs. Investor

Welcome Reception – Open to All Conference Attendees

Thursday, April 23, 2015

James B. Sowell – KPMG LLP

Prof. Karen Burke – University of Florida Levin College of Law

TOPIC: Partnership Options and Profits-Only Interests

Ronald A. Levitt – Sirote & Permutt, PC

TOPIC: Defending Conservation Easements in an Adverse IRS Environment

David D. Aughtry – Chamberlin Hrdlicka

TOPIC: Defending Against IRS Penalty Assertions

Luncheon Speaker: The Honorable L. Paige Marvell – United States Tax Court

TOPIC: A View From the Bench

Sheldon M. Kay – Sutherland, Asbill & Brennan

TOPIC: Effective Taxpayer Representation in Audits and Appeals

William B. Sherman – Holland & Knight

TOPIC: Foreign Investments in U.S. Real Property

Larry A. Campagna – Chamberlin Hrdlicka

TOPIC: “Professionalism” in Tax Practice (Ethics Credit)

Univeristy of Floriday Foundation Reception – Open to All Conference Attendees

Friday, April 24, 2015

Steve R. Akers – Bessemer Trust

TOPIC: Post Mortem Income and Transfer Tax Planning

Paul S. Lee – Bernstein Global Wealth Management

TOPIC: The Modern Uses of Partnerships in Estate Planning

Jonathan G. Blattmachr – Eagle River Advisors

TOPIC: Examining & Restructuring Pre-ATRA Estate Planning Strategies

Lauren Detzel – Dean Mead

John J. Scroggin – Scroggin & Company, P.C.

TOPIC: A Potpourri of Tax Planning Ideas and Strategies

Luncheon

Lou Nostro – Nostro Jones, PA

Don Tescher – Tescher & Spallina, P.A.

Prof. Grayson McCough – University of Florida Levin College of Law

TOPIC: Innovative Charitable Gift Planning Strategies

Prof. Sam Donaldson – Georgia State University College of Law

TOPIC: Update on Estate Planning

- How to Register: Please visit https://www.clevelandevents.org/floridataxinstitute/register.shtml

- Cost – $895 – Full Conference, $400 One-Day Only

Fundamentals of Asset Protection

Denis Kleinfeld and Alan Gassman are working towards building a Fundamentals of Asset Protection course that is tentatively scheduled for Thursday, May 7 and Friday, May 8, 2015 in Miami, Florida.

DAY 1 – ASSET PROTECTION

8:45 – 9:00 a.m. Introduction to the Program

9:00 – 9:25 a.m. Defining the Asset Protection Plan Goals and Establishing Strategies to Achieve Them

9:30 – 9:55 a.m. Basic Bankruptcy – Welcome to the Fish Bowl

10:00 – 10:25 a.m. A Road Map on How A Judgment Creditor Collects on a Judgment

10:30 – 10:55 a.m. The Trick and Traps of Creditors Remedy of Fraudulent Conveyance

11:00 – 11:25 a.m. The Florida Advantage in Exemption Planning

11:30 – 11:55 a.m. Blending Estate Planning and Asset Protection

LUNCH Stump the Panel – Audience participation required

1:00 – 1:25 p.m. Limited Liability Entities – Distinguishing One From Another

1:30 – 1:55 p.m. Charging Orders – How to File and How to Defend

2:00 – 2:25 p.m. Solving Tax and Valuation Issues of Limited Liability Entities

2:30 – 3:55 p.m. What’s So Special About Domestic Asset Protection Trusts?

4:00 – 4:25 p.m. How to Spot Asset Protection Scams, Shams and Fraud

4:30 – 4:55 p.m. What you Must Know About The Bar Association Rules on Marketing of Asset Protection Planning Services

7:00 p.m. Cocktails and Dinner – optional

DAY 2 – ADVANCED ASSET PROTECTION

9:00 – 9:25 a.m. Drilling Deep to Get the Facts – What to Look for in Obtaining Due Diligence

9:30 – 9:55 a.m. Retainer Agreements and Trust Accounts – Protecting Yourself First

10:00 – 10:45 a.m. Key Provisions Drafting Documents for Asset Protection – Trusts and Operating Agreements

10:30 – 10:45 a.m. BREAK

11:00 – 11:55 a.m. How to Review Liability Insurance Policies

LUNCH Stump the Panel – Audience participation required

1:00 – 1:25 p.m. Update on Exemptions and Immunities

1:30 – 1:55 p.m. Choosing Domestic Asset Protection Trust Jurisdictions; Why and How One State is “Better” than Another

2:00 – 2:25 p.m. Choosing a Foreign Asset Protection Jurisdiction – Why and How One Country is “Better” than Another

2:30 – 3:55 p.m. How You Can Avoid Ethical, Civil and Criminal Liability Exposure

4:00 – 5:00 p.m. Workshop: Ten Examples of How to Effectively Put An Asset Protection Plan Together

How to Register: Please click here to register.

What Estate Planning and Other Lawyers Need to Know About Bankruptcy, an article by Alberto F. Gomez and Alan S. Gassman, Part 5

Last week we continued our discussion on limiting risk and deciding if and when to ever file a bankruptcy, limiting risk, and fraudulent transfers. Today we discuss preferential transfers, competing creditors, distributions from insolvent entities, and wage statute interaction.

PREFERENTIAL TRANSFERS

While most planners understand state fraudulent transfer rules, which are usually similar to the Bankruptcy Code fraudulent transfer statute, many planners are not conversant with the code’s preferential transfer provisions. Transfers made by a debtor to an “insider” within one year of filing a bankruptcy may be set aside, notwithstanding whether the transfer would be considered a “fraudulent transfer” under fraudulent transfer rules.40 Also, preferential transfers made to any party within one year (if an insider) or 90 days (if not an insider) of the filing of a bankruptcy petition can be set aside as well.41 Reasonable compensation paid for services actually rendered will not be considered to be a preferential transfer,42 but dividends paid by a professional practice corporation to its owner or member can be considered a preferential transfer. In addition, repayment of shareholder loans may be set aside as a preference.

A case that deals with this insider creditor issue is In re Halling, 449 B.R. 911 (2011). Here, the debtor’s son was a guarantor on a loan that was given to his mother. The mother made regular payments to the bank for this loan and eventually filed for bankruptcy. The trustee sought to avoid the transfers as preferential stating the son was an inside creditor and transfers made up to a year before bankruptcy were avoidable. The Court stated that guarantors are creditors within the bankruptcy code. The payments to the bank benefitted the son because each payment reduced his liability to the bank. Thus, the Court allowed the trustee to recover the transfers from the son because preference claims against non-insiders (the bank in this case) are limited to transfers within 90 days. Thus, for transfers between 90 days and 1 year the trustee can only get transfers to inside creditors (in this case the son).

Transfers also are illegal if asset protection planners intend to evade the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration Board’s Comptroller of the Currency or the Director of the Office of Thrift Supervision43 under 18 U.S.C. Section 1032. In U.S. v. Brown,44 the appellant’s conviction for concealing property from the FDIC and the trustee in bankruptcy was affirmed. There, the appellant transferred his interests in a home, fitness center and a corporation to family members and friends. He did not reveal the transfers or his interests to the FDIC, to whom he owed $2.4 million, or to the bankruptcy trustee.

COMPETING CREDITORS

Oftentimes a debtor will want to settle or give a mortgage and/or lien on all assets to a “friendly creditor” to avoid the possible loss of those assets to one or more other creditors. If the friendly creditor is considered an insider45, then actions taken that benefit such creditor may be set aside by the other creditors within one year of when they occur. On the other hand, an unrelated friendly creditor (i.e., a creditor who is not an insider) may be able to hold whatever liens or assets it has been given as part of an arm’s-length debt relief or workout arrangement as long as the debtor has not filed or been forced into bankruptcy within 90 days of the transfer.

DISTRIBUTIONS FROM “INSOLVENT” ENTITIES

Also many accountants advise their clients to “keep wages low and dividends high,” but this advice often does not take into consideration fraudulent transfer and preferential transfer rules in the event the client finds himself in a bankruptcy.

Estate and financial planners also need to consider state laws concerning distributions made from a company under circumstances in which sufficient reserves have not been set aside to pay known or expected creditors. The board of directors of a company allowing such distributions can become liable to a creditor. The liability of the directors would be based upon the amount of monies or other assets that should have been left in the company as opposed to being paid out. For example, Florida Statutes Section 607.0640(3), no distributions to shareholders may be made, if after such distribution:

(a) the corporation would not be able to pay its debts as they become due in the usual course of business; or

(b) the corporation’s total assets would be less than the sum of its total liabilities plus (unless the articles of incorporation permit otherwise) the amount that would be needed, if the corporation were to be dissolved at the time of distribution, to satisfy the preferential rights upon dissolution of shareholders whose preferential rights are superior to those receiving the distribution.

If the distribution falls within the bounds of either of the above definitions, then the distribution is characterized as a wrongful distribution. The director’s personal liability is addressed by Florida Statutes Section 607.0834, which places personal liability on any director who votes affirmatively for such a distribution.

The director is personally liable for the amount of the distribution that exceeds what could have been distributed without violating Section 607.06401or the articles of incorporation if it is established that the director did not perform his or her duties as required by Section 607.0830 (good faith; reasonable, prudent person standard; in the best interest of the corporation).

Additionally, subsection (2) states that a director held liable under subsection (1) is entitled to contribution from each shareholder for the amount that such shareholder accepted knowing the distribution was made in violation of Section 670.06401.

Further, the director is entitled to contribution from every other director who could be liable under subsection (1) for the unlawful distribution. For example, if there were two director shareholders who split the initial $150,000 distribution, then they could each be held to be jointly and severally responsible for the entire $150,000.

WAGE STATUTE INTERACTION

Some states allow for exemption of wages and even deferred compensation from creditor claims. The 2005 Bankruptcy Act provides that a Trustee may void a transfer of property or an obligation (including any “transfer to or for the benefit of an insider under an Employment Agreement”) if made within two years before filing, as a fraudulent conveyance or a preferential transfer for less than adequate consideration.

It is therefore important to be able to document that any compensation was actually owed when wages are paid to related parties or “insiders” if a company may become insolvent.

*************************************************************************

4011 U.S.C. Section 547(b)(4)(B) (2007).

4111 U.S.C. Section 547(b)(4)(A) (2007).

42In re Double Eagle Const. Co., 188 B.R. 406 (Bankr. D. W. Mo. 1995).

43810-2nd Tax Mgmt. Est., Gifts & Tr. J. II.B.1 (2006). Punishment includes fines and/or up to 5 years in prison.

44 1999 U.S. App. Lexis 18225 (10th Cir. 1999).

45 The definition of an insider can be found at 11 U.S.C. section 101(31), which reads as follows: The term “insider” includes (A) if the debtor is an individual – (i) relative of the debtor or of a general partner of the debtor; (ii) partnership in which the debtor is a general partner; (iii) general partner of the debtor; or (iv) corporation of which the debtor is a director, officer, or person in control; (B) if the debtor is a corporation – (i) director of the debtor; (ii) officer of the debtor; (iii) person in control of the debtor; (iv) partnership in which the debtor is a general partner; (v) general partner of the debtor; or (vi) relative of a general partner, director, officer, or person in control of the debtor; (C) if the debtor is a partnership – (i) general partner in the debtor; (ii) relative of a general partner in, general partner of, or person in control of the debtor; (iii) partnership in which the debtor is a general partner; (iv) general partner of the debtor; or (v) person in control of the debtor; (D) if the debtor is a municipality, elected official of the debtor or relative of an elected official of the debtor; (E) affiliate, or insider of an affiliate as if such affiliate were the debtor; and (F) managing agent of the debtor.

Surrogates: The Proverbial Stork – How to Hire Someone to Carry and Birth Your Baby – The High Price of Stretch Marks

Adoption and surrogacy are the primary options for couples who want to become parents but cannot have a child on their own. Those who choose the surrogate route must navigate through a number of hoops and hurdles to get the bun in the oven and the baby born and formally adopted. If, however, the parents can afford the process and remain patient and careful, they will likely have success. The obstacles vary based on the type of surrogacy the parents choose and the state they are planning to do this in. This article addresses two surrogacy options: “gestational surrogacy” and “pre-planned adoption” and applies to surrogacy in Florida only.

Gestational surrogacy, the best surrogacy option, involves one parent donating either the egg or sperm for the child. If, for example, the father donates his sperm, Florida statute 742.151 requires that the egg must come from someone other then the surrogate. This is to avoid the surrogacy from being classified as a pre-planned adoption, which this article discusses later on.

The parents can either choose the surrogate through an agency or choose someone they know who is willing to serve as a surrogate for them. The surrogate will have to have a health physical to make sure they are capable and a good candidate for this undertaking. The in vitro fertilization clinic generally requires the surrogate to undergo a health physical and, sometimes, the surrogacy agency has some additional requirements. The government, however, does not regulate the agencies.

The creation of the contract is a crucial step in gestational surrogacy. In order to have an enforceable surrogacy, a court must make two findings after the child’s birth: (1) the child is related to one of the parents; and (2) there is an enforceable surrogacy contract. The couple should hire an experienced practitioner to draft the contract to minimize any chance of error. The typical surrogacy contract has five categories of payments that the couple must make to the surrogate: reasonable living, legal, medical, psychological, and psychiatric expenses. The payments for living expenses are the only funds that the surrogate receives directly, and these amounts must be reasonable.

While the contract is a crucial element in gestational surrogacy, the method of conception can render a carefully constructed surrogacy contract meaningless. Courts likely will honor the surrogacy contract when the pregnancy results from clinical intervention. If, however, the pregnancy results from “old-fashioned” conception or “do-it-yourself” artificial insemination, a court will likely deem the surrogacy contract irrelevant. See, e.g., Budnick v. Silverman, 805 So.2d 1112 (Fla. 4th DCA 2002); see also A.A.B. v. B.O.C., 112 So.3d 761 (Fla. 2d DCA 2013). In Budnick v. Silverman, Budnick (mother) approached her friend Silverman (father) about helping her conceive a child “old-fashioned” way. The parties agreed and entered into a surrogacy contract specifying that if Silverman impregnated Budnick, that she would (1) be the sole custodian of the child; (2) be primarily responsible for the child’s expenses; (3) not list Silverman on the child’s birth certificate; and (4) refrain from bringing a paternity action against Silverman. See id. Ten years after the child’s birth Budnick brought a paternity action again Silverman seeking child support from Silverman. Silverman sought to avoid the child support obligation by claiming that he should be viewed as a surrogate rather than as a natural father. See id. The court determined that Silverman was not a surrogate because it did not believe the surrogacy statute applied to conception that happened the “old-fashioned” way. See id. Since the court found that Silverman was not a surrogate, it ignored the preconception contract and concluded that he was liable for child support payments. See id. Thus, it is important for couples relying on surrogacy statutes for contractual protections to utilize reproduction technology through clinical intervention when conceiving the child.

The second surrogacy form falls under Florida Statute 63.213, the pre-planned adoption statute. Under this scenario, generally the surrogate donates her own egg or the embryo is not related to either parent. In a pre-planned adoption, the surrogate can rescind her consent to give over the child within 48 hours of the birth if she is genetically related to the child, although the surrogate rarely rescinds her consent. Also, either party can terminate the contract at any time. A couple typically uses this form of surrogacy only when neither parent can donate a sperm or egg. Further, when utilizing this surrogacy method, it is essential and common for the couple to select an experienced or well-known and understood surrogate with a good track record.

Surrogacy for same-sex couples

Prior to 2013, Florida surrogacy law allowed only legally married opposite sex couples to use surrogates. In D.M.T. v. T.M.H. (2013), the Florida Supreme Court held that Florida Statute 742.14 was unconstitutional because it allowed only legally married heterosexual couples to retain parental rights to children born resulting from donated genetic material from one party to the other. The court said that the statute defining a “commissioning couple” as a heterosexual married couple failed to extend equal protection to same-sex couples. The case involved a lesbian couple where one woman donated her egg (“biological mother”) to her partner (“birth mother”) to carry the child. Years after the birth of the child, the birth mother refused to give the biological mother parental rights and asserted that the biological mother was only a donor of the egg with no parental rights. Since they were not a legally married couple, the statute viewed the biological mother, the one who donated her egg, as an egg donor only, and therefore, she failed to retain any rights to the child. The court held that the donor statute was unconstitutional because it denied the biological mother the right to raise her child. This decision opens the door to challenging Florida Statute 742.15, which has similar language in regard to the “commissioning couple” and provides heterosexual couples with more protection than same-sex couples are offered under Florida Statute 62.213.

Under current Florida law, same-sex couples are able to adopt only under the pre-planned adoption agreement statute. The contract with the surrogate is somewhat different than a contract used by a heterosexual couple, and the court process is different as well. After selecting a surrogate, the same-sex couple enters into a pre-planned adoption agreement in which the surrogate agrees to bear a child and relinquish parental rights to the commissioning couple. Florida law has mandatory requirements of what must be included in this type of agreement to be effective in terminating the surrogate’s parental rights. Upon the birth of the child(ren), the non-biological parent files a Second Parent Adoption to obtain full parental rights to the child(ren) so that both parents can be placed on the child’s birth certificate.

Florida surrogacy law is well-developed and offers more protection than most; however, surrogacy law is state specific and constantly evolving. Therefore, it is imperative that you consider your jurisdiction’s laws prior to entering into a surrogacy arrangement.

The relevant statutes are reproduced below:

742.15 Gestational surrogacy contract.—

(1) Prior to engaging in gestational surrogacy, a binding and enforceable gestational surrogacy contract shall be made between the commissioning couple and the gestational surrogate. A contract for gestational surrogacy shall not be binding and enforceable unless the gestational surrogate is 18 years of age or older and the commissioning couple are legally married and are both 18 years of age or older.

(2) The commissioning couple shall enter into a contract with a gestational surrogate only when, within reasonable medical certainty as determined by a physician licensed under chapter 458 or chapter 459:

(a) The commissioning mother cannot physically gestate a pregnancy to term;

(b) The gestation will cause a risk to the physical health of the commissioning mother; or

(c) The gestation will cause a risk to the health of the fetus.

(3) A gestational surrogacy contract must include the following provisions:

(a) The commissioning couple agrees that the gestational surrogate shall be the sole source of consent with respect to clinical intervention and management of the pregnancy.

(b) The gestational surrogate agrees to submit to reasonable medical evaluation and treatment and to adhere to reasonable medical instructions about her prenatal health.

(c) Except as provided in paragraph (e), the gestational surrogate agrees to relinquish any parental rights upon the child’s birth and to proceed with the judicial proceedings prescribed under s. 742.16.

(d) Except as provided in paragraph (e), the commissioning couple agrees to accept custody of and to assume full parental rights and responsibilities for the child immediately upon the child’s birth, regardless of any impairment of the child.

(e) The gestational surrogate agrees to assume parental rights and responsibilities for the child born to her if it is determined that neither member of the commissioning couple is the genetic parent of the child.

(4) As part of the contract, the commissioning couple may agree to pay only reasonable living, legal, medical, psychological, and psychiatric expenses of the gestational surrogate that are directly related to prenatal, intrapartal, and postpartal periods.

63.213 Preplanned adoption agreement.—

(1) Individuals may enter into a preplanned adoption arrangement as specified in this section, but such arrangement may not in any way:

(a) Effect final transfer of custody of a child or final adoption of a child without review and approval of the court and without compliance with other applicable provisions of law.

(b) Constitute consent of a mother to place her biological child for adoption until 48 hours after the birth of the child and unless the court making the custody determination or approving the adoption determines that the mother was aware of her right to rescind within the 48-hour period after the birth of the child but chose not to rescind such consent. The volunteer mother’s right to rescind her consent in a preplanned adoption applies only when the child is genetically related to her.

(2) A preplanned adoption agreement must include, but need not be limited to, the following terms:

(a) That the volunteer mother agrees to become pregnant by the fertility technique specified in the agreement, to bear the child, and to terminate any parental rights and responsibilities to the child she might have through a written consent executed at the same time as the preplanned adoption agreement, subject to a right of rescission by the volunteer mother any time within 48 hours after the birth of the child, if the volunteer mother is genetically related to the child.

(b) That the volunteer mother agrees to submit to reasonable medical evaluation and treatment and to adhere to reasonable medical instructions about her prenatal health.

(c) That the volunteer mother acknowledges that she is aware that she will assume parental rights and responsibilities for the child born to her as otherwise provided by law for a mother if the intended father and intended mother terminate the agreement before final transfer of custody is completed, if a court determines that a parent clearly specified by the preplanned adoption agreement to be the biological parent is not the biological parent, or if the preplanned adoption is not approved by the court pursuant to the Florida Adoption Act.

(d) That an intended father who is also the biological father acknowledges that he is aware that he will assume parental rights and responsibilities for the child as otherwise provided by law for a father if the agreement is terminated for any reason by any party before final transfer of custody is completed or if the planned adoption is not approved by the court pursuant to the Florida Adoption Act.

(e) That the intended father and intended mother acknowledge that they may not receive custody or the parental rights under the agreement if the volunteer mother terminates the agreement or if the volunteer mother rescinds her consent to place her child for adoption within 48 hours after the birth of the child, if the volunteer mother is genetically related to the child.

(f) That the intended father and intended mother may agree to pay all reasonable legal, medical, psychological, or psychiatric expenses of the volunteer mother related to the preplanned adoption arrangement and may agree to pay the reasonable living expenses and wages lost due to the pregnancy and birth of the volunteer mother and reasonable compensation for inconvenience, discomfort, and medical risk. No other compensation, whether in cash or in kind, shall be made pursuant to a preplanned adoption arrangement.

(g) That the intended father and intended mother agree to accept custody of and to assert full parental rights and responsibilities for the child immediately upon the child’s birth, regardless of any impairment to the child.

(h) That the intended father and intended mother shall have the right to specify the blood and tissue typing tests to be performed if the agreement specifies that at least one of them is intended to be the biological parent of the child.

(i) That the agreement may be terminated at any time by any of the parties.

(3) A preplanned adoption agreement shall not contain any provision:

(a) To reduce any amount paid to the volunteer mother if the child is stillborn or is born alive but impaired, or to provide for the payment of a supplement or bonus for any reason.

(b) Requiring the termination of the volunteer mother’s pregnancy.

(4) An attorney who represents an intended father and intended mother or any other attorney with whom that attorney is associated shall not represent simultaneously a female who is or proposes to be a volunteer mother in any matter relating to a preplanned adoption agreement or preplanned adoption arrangement.

(5) Payment to agents, finders, and intermediaries, including attorneys and physicians, as a finder’s fee for finding volunteer mothers or matching a volunteer mother and intended father and intended mother is prohibited. Doctors, psychologists, attorneys, and other professionals may receive reasonable compensation for their professional services, such as providing medical services and procedures, legal advice in structuring and negotiating a preplanned adoption agreement, or counseling.

(6) As used in this section, the term:

(a) “Blood and tissue typing tests” include, but are not limited to, tests of red cell antigens, red cell isoenzymes, human leukocyte antigens, and serum proteins.

(b) “Child” means the child or children conceived by means of a fertility technique that is part of a preplanned adoption arrangement.

(c) “Fertility technique” means artificial embryonation, artificial insemination, whether in vivo or in vitro, egg donation, or embryo adoption.

(d) “Intended father” means a male who, as evidenced by a preplanned adoption agreement, intends to assert the parental rights and responsibilities for a child conceived through a fertility technique, regardless of whether the child is biologically related to the male.

(e) “Intended mother” means a female who, as evidenced by a preplanned adoption agreement, intends to assert the parental rights and responsibilities for a child conceived through a fertility technique, regardless of whether the child is biologically related to the female.

(f) “Party” means the intended father, the intended mother, the volunteer mother, or the volunteer mother’s husband, if she has a husband.

(g) “Preplanned adoption agreement” means a written agreement among the parties that specifies the intent of the parties as to their rights and responsibilities in the preplanned adoption arrangement, consistent with the provisions of this section.

(h) “Preplanned adoption arrangement” means the arrangement through which the parties enter into an agreement for the volunteer mother to bear the child, for payment by the intended father and intended mother of the expenses allowed by this section, for the intended father and intended mother to assert full parental rights and responsibilities to the child if consent to adoption is not rescinded after birth by a volunteer mother who is genetically related to the child, and for the volunteer mother to terminate, subject to any right of rescission, all her parental rights and responsibilities to the child in favor of the intended father and intended mother.

(i) “Volunteer mother” means a female at least 18 years of age who voluntarily agrees, subject to a right of rescission if it is her biological child, that if she should become pregnant pursuant to a preplanned adoption arrangement, she will terminate her parental rights and responsibilities to the child in favor of the intended father and intended mother.

FATCA is Here – Now What?

By: Denis Kleinfeld

The United States has given birth to FATCA and demands that the international financial industry legitimize its existence. If FATCA is helpful to stabilizing and enhancing the global economy, then continuing to implement the FATCA compliance regime may well be warranted. If it is determined to be a perilous threat to a financial institution’s or jurisdiction’s sustainability or viability, then a different decision may be justified.

The world’s income tax system dependent countries quickly adopted this latest tax enforcement creation almost as a knee-jerk reaction. It is bewildering that neither the U.S. nor the other countries performed any significant detailed cost-benefit analysis. They jumped on board the train without fully knowing its destination. Every action, however, has consequences.

No one credibly doubts the necessity of the U.S. government or any other government to raise money by way of taxation or borrowing to pay the enormous costs of providing services to its citizens and residents. However, history tells us that the need of government for tax revenues has always been a point of conflict between those who are in a position of political power to set the rules and demand payment as opposed to those whose hard work and earnings are being taken. The stuff that makes for political revolutions.

The FATCA regime was intended as a heavy-handed enforcement mechanism. Without that, getting everyone to comply would be impossible. This is true for the jurisdictions affected, the respective taxpayers, and the international financial industry caught in between.

FATCA was enacted as part of a revenue enhancement mechanism to pay for the additional outlays incurred by passing the Hiring Incentives to Restore Employment Act (HIRE Act) of 2010. It was projected to increase tax revenue by $879 million a year for ten years. Not much of revenue goal considering the multitude of direct and indirect cost being incurred. For the U.S., that amount is chump change or a budget rounding error.

The avowed goal of the Hire Act was to put Americans back to work by providing tax breaks for small business. It hasn’t worked. The U.S. labor participation rate is the lowest it has been in decades.

It makes one wonder, if it doesn’t raise revenue nor helps provide an economic environment to create jobs in the private sector, and then what good is FATCA?

The answer seems to be that notwithstanding the government’s own revenue projection of $897 million annually, it is an article of faith there are hidden offshore accounts to be discovered that will yield vast amounts of new tax revenues. Not unlike an adventurer venturing into the unknown dreaming of finding the lost city of gold.

The IRS reports it has collected approximately $6.5 billion in tax, interest, and penalties because of FATCA. Most of that are penalties and interest so little more tax than projected has been collected. The FATCA believers say, “The gold is there it just takes more time to find it.” Given the number of delays already required, doubts about FATCA ever being feasible are not unreasonable.

The virtue and propriety of FATCA is a matter being hotly debated. As a political matter, FATCA’s continued existence is not assured.

Its most vocal supporters seem to be the service industry providers in the new FATCA compliance industry. FATCA promises to provide them an endless and increasing stream of fees. The tax justice crowd sees FATCA as enabling the fulfillment of their goal to redistribute money from the people who earned it to people who they feel are more deserving. It’s another way of making a good living while appearing to be socially relevant.

Contrary to this, FATCA has its political opponents who are highly motivated to see its demise. Legislation for the repeal of FATCA has been introduced into Congress. While FATCA is safe from repeal for now, the Democratic senator who has been the primary and most vocal proponent behind the U.S. anti-offshore tax policy will not be in the Congress next term. While still speculation for the moment, after this coming election the senate itself may come under Republican control.

The Republican National Committee has promised to make FATCA repeal a reality if their party gets control of both the House of Representatives and the Senate in the upcoming election. This could be merely an election year ploy to get the American expat vote. FATCA is the number one hot button issue for some 7 million potential voters who are U.S. expats. They have been vociferous in their opposition to it.

Even now one Republican senator (under the Senate’s unique procedural rules) has placed a hold on all tax treaties to be approved by the Senate because of opposition to FATCA. A new tax treaty hasn’t been approved since 2010.

Both Republican senators and Republican members of the House of Representatives assert that the Treasury had no authority to enter into any FATCA International Governmental Agreements (IGAs). They say that any purported IGA is actually a treaty. While the administration–the Treasury–can negotiate a treaty, the Constitution requires Senate approval to bring it into force.

The Treasury takes the opposite position claiming it has general authority and does not need specific statutory authority or Senate approval. In point of fact, the FATCA legislation has no provision for IGAs. How this political power battle will turn out is a matter of speculation.

Both sides of this debate agree that without IGAs, FATCA implementation fails.

What also should be understood is that on certain model IGAs with the U.S.’s major trading partners and OECD members, those IGAs require reciprocity by the United States. FATCA for you and FATCA for me. Essentially, what is good for the goose is good for the gander.

However, there is no statutory authority for the Treasury to impose a FACTA type regime on the domestic U.S. financial industry. While Treasury has issued a regulation requiring U.S. banks to report on foreign depositor’s interest and dividends, the matter is being vigorously litigated by the Florida and Texas banking associations.

While the not too big to fail banks will go with anything the Treasury and Federal Reserve want, there are well over 10,000 other banks, credit unions, and other financial facilities, and all the thousands of businesses that depend on them, that have their Washington, D.C. lobbying organizations pressing Congress in opposition. (One commentator pointed out this could involve 90 million voters.)They understand that imposing a FACTA regime domestically will drive them out of business.

These are local businesses not the big money center publicly held banks. For elections, it is accepted that politics is predominantly a local matter. A curiosity of the parochial nature of U.S. politics. Most U.S. politicians probably would not support legislation which would endanger their re-election chance. Certainly not over a few measly billions of dollars of tax.

Even if FATCA survives politically there are doubts as to whether the IRS has the capacity to administer FATCA. The Government Accountability Office (GAO), the National Taxpayer Advocate Service (NTAS), and the Treasury Inspector General for Tax Administration (TIGTA), among other governmental oversight bodies, all say that the IRS is already overburdened, undermanned, and underfunded. The IRS has been described as an agency in crisis even before being charged with administering FATCA.

For years, decades really, the utter complexity of the U.S. tax law has teetered over the cliff of being both unadministratable by the government and uncompliable by the taxpayers. In this, the IRS and the taxpayers are victims of tax politics. IRS may get the blame, but the fault lies with Congress.

The IRS and the administration are under a microscope both in Congress and in the courts. There are at least five Congressional investigations and numerous lawsuits against the IRS accusing it, and indirectly the President, of engaging in many despicable and nefarious actions. Against this backdrop, it is conceivable that the IRS will not be given the additional resources by Congress it needs to fulfill its duties and responsibilities.

FATCA depends on the IRS getting a significant increase in its budget to modernize its computer systems to meet the difficult job of administering a FATCA regime. FATCA depends on there being a cutting edge computer system in place to handle the volume and complexity required in its operations. Onboarding 600,000 foreign financial institutions into a computer system is a daunting challenge even if a bureaucracy had virtually unlimited resources.

Reports by the GAO, NTAS, TIGTA and others have repeatedly pointed out the existing systemic failures of all the governmental computer systems including the IRS. Even the simple task of keeping track of emails is a problem.

This computer failure came under focus in the current Congressional investigations and court cases, when the Commissioner of the IRS explained why there were problems in producing emails as required. Besides having the hard-drives in 20 out of 82 computers in question crash, the Commissioner also explained that the IRS is hampered by an “archaic” information technology system that averages 15 years old.

The IRS not only does not have the requisite computer technology neither does it have the personnel. Under its current budget, it can hire only one new employee for every five it loses. It’s projected that some 40% of the management will retire in the next five years. Competing with private industry for trained IT personnel will take money. The Republicans in the House of Representatives, where all spending bills originate, plan to cut the IRS budget

This calamitous situation is made even graver since Congress and the President imposed on the IRS the burden of implementing simultaneously two enormously complex tax regimes– The Patient Protection and Affordable Care Act a/k/a Obamacare (the controversial health care law) and FATCA. The readily recognizable consequences being that the real world ability of the IRS, or any bureaucracy, to implement and administer FATCA and Obamacare may be little more than an aspirational dream.

Concerns over the cybersecurity compound the dilemma. Security of private financial information is a dominate issue for everyone in government and the global financial industry. Considering the computer security breaches already a daily occurrence, it is prudent to assume that no computer system is secure. The governments own reports backs that up. Whatever information is loaded on a computer system connected to the internet can be hacked. Even if not internet connected, if it is on a computer it can be stolen by someone on the inside. It is not a question of if; it is only a question of when.

FATCA compliance demands that substantial and intimate private financial information must be obtained by a financial institution to determine if an account holder, customer, or investor is a U.S. person or company–or isn’t. Essentially, this puts all that valuable financial information on a silver platter. One computer expert referred to this situation as a hacker’s wet dream.

U.S. financial institutions attempting to comply with FATCA’s requirements are experiencing extreme difficulties. U.S. financial institutions play an important role in the collection of withholding taxes for the government and education of global investors in U.S. markets. Letters sent to the IRS Commissioner by some of the major U.S. banks explicitly make this point.

They explain that while their “advisors and software vendors continue to work diligently…to establish the processes and procedure necessary to implement FATCA” …”We need more time to fully understand the guidance provided to date and its interaction with local IGA requirements, provide comments to the government, change our internal processes and systems, train our employees, and educate clients.”

“FATCA is unparalleled in its complexity, size, and global reach, and there is simply not enough time left to ensure a successful launch by July 1, 2014 [Which IRS has now delayed until next year and allowed transition patch]. The open questions are too numerous and the time needed to implement all the rules that we do not understand is too short.”

Any decision by an institution which involves both the expenditure of precious capital and its continued existence as a viable entity is not made in a vacuum. Context becomes everything. Whether FATCA compliance is in the best interest of any player in the global financial industry or jurisdiction is a decision that each must make on their own.

FATCA is here. What needs to be determined by all who are affected is what are they going to do now?

Thoughtful Corner

Reusable Fedex Envelopes Help to Cut Down on Waste

Have you ever asked yourself “how do I reuse the Legal Size Reusable FedEx Envelope” to help our environment?

If so, it is your lucky day because we have the answer.

If the envelope is in good condition, you can cover or mark through any previous shipping information so that it may be used a second time. Please note that FedEx is not liable for damages caused by improper or insufficient packaging.

These instructions are also indicated on the back of the Legal Size Reusable FedEx Envelope and further information can be found at fedex.com or 1-800-GoFedEx (1-800-463-3339) for US domestic shipments and 1-800-247-4747 for international shipments.

What can you do in your office to cut down on waste? Are you using the other side of non-client paperwork or documents to print other non-client paperwork or documents?

Upcoming Seminars and Webinars

LIVE ISLE OF MAN PRESENTATION:

Alan S. Gassman will be speaking on US TRUST, LLC AND TAX LAWS FOR INTERNATIONAL INVESTORS at Cayman National Bank and Trust Company on the Isle of Man

Sign up now and you will receive a free lunch! Transportation not included.

“Half-way between England

And Ireland in the Irish Sea.”

Is a great place to discuss trusts with glee.”

Date: Wednesday, September 3, 2014

Additional Information: If you would like to receive a copy of the materials that will be presented please email Janine Gunyan at janine@gassmanpa.com and we will send them to you once they are ready.

********************************************************

FREE LIVE WEBINAR:

Ken Crotty will be presenting a free live webinar entitled AVOIDING DISASTER ON HIGHWAY 709. The 50 minute guide to disaster avoidance with respect to gift tax returns. This webinar will qualify for 1 hour of CLE and CPE credit.

Date: Wednesday, September 3, 2014 | 12:30 p.m. (50 minutes)

Location:Onlinewebinar

Additional Information: To register for the webinar please click here.

********************************************************

FREE LIVE WEBINAR

THE BCA’s OF REVERSE MORTGAGES

Alan Gassman will be presenting a webinar about reverse mortgages.

Date: Tuesday, September 16, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE FT. LAUDERDALE PRESENTATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan S. Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of TRUST PLANNING FROM A TO Z for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE CLEARWATER PRESENTATION:

Board Certified Tax Attorney Michael O’Leary from the Trenam Kemker firm in Tampa, Florida and Christopher Denicolo from Gassman Law Associates will be speaking at the Ruth Eckerd Hall Planned Giving Advisory Council event on Tuesday, September 23, 2014.

Mr. O’Leary’s topic is HOT TOPICS IN CHARITABLE PLANNING AND MORE.

Mr. Denicolo’s topic is PLANNING FOR INHERITED IRAs.

Date: Tuesday, September 23, 2014 | 5:00 p.m.

This presentation is free to members of the Ruth Eckerd Hall Planned Giving Advisory Council, Ruth Eckerd Hall members, and professionals who are attending a Ruth Eckerd Hall Planned Giving Advisory Council event for the first time.

Additional Information: You can contact Suzanne Ruley at sruley@rutheckerdhall.net or via phone at 727-791-7400, David Abelson at david.abelson@morganstanley.com or via phone at 727-773-4626, Alan S. Gassman at agassman@gassmanpa.com or via phone at 727-442-1200 or the Kentucky Fried Chicken located at 1960 Gulf to Bay Blvd, which is close in proximity to this location and available to provide you with crisp, spicy or even crispier chicken, mashed potatoes and gravy, rolls, and slaw! Bring your 32 oz. Kentucky Fried Chicken drink container to the presentation and we will fill it with your choice of club soda or seltzer water, but no sharing permitted.

********************************************

FREE LIVE WEBINAR:

Attorney Leslie A. Share (not related to Sonny and Cher) will be joining Alan Gassman for a free 30 minute webinar on DEMYSTIFYING U.S. TAX AND ESTATE PLANNING CONSIDERATIONS FOR FOREIGN INVESTORS – CONCEPTS THAT YOU CAN CLEARLY UNDERSTAND AND EXPLAIN TO CLIENTS

Date: Monday, September 29, 2014 | 5:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************

LIVE NEW JERSEY PRESENTATION – WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW TO REPRESENT SNOWBIRDS AND FLORIDA BASED BUSINESSES:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) SPECIAL 3 HOUR SESSION

New Jersey song trivia: What song includes the words “Counting the cars on the New Jersey Turnpike, they’ve all gone to look for America”? What year was it recorded and who wrote it?

Alan S. Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it is our second shore), own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida=s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Gain the knowledge you need to assist your clients with Florida matters including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 4, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors, and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information, please email agassman@gassmanpa.com

********************************************************

LIVE NEW PORT RICHEY PRESENTATION:

Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo will address the North FICPA Group on Financial Analysis and Tax Planning for Investment Products, Including Variable Annuities, Fixed Annuities, Life Insurance Contracts, and Mutual Funds – What Should the Tax and Financial Advisor Know and Advise?

Be there or be an equilateral triangle!

Date: Wednesday, October 15, 2014 | 4:30 p.m.

Location: Chili’s Port Richey, 9600 US 19 N, Port Richey, Florida

********************************************************

LIVE CLEARWATER PRESENTATION

Alan Gassman will be speaking at the Pinellas County Estate Planning Council Fall Seminar on PLANNING FOR SAME GENDER COUPLES.

Date: Thursday, October 23, 2014 | 8:00 am

Location: Ruth Eckerd Hall, 1111 N. McMullen Booth Road, Clearwater, FL

Additional Information: To register for this event please email agassman@gassmanpa.com.

********************************************************

LIVE PASCO COUNTY PLANNED GIVING (AND DRINKING!) COCKTAIL HOUR AND PRESENTATION:

Alan S. Gassman and Christopher J. Denicolo will be speaking at the Pasco-Hernando State College’s Planned Giving Consortium Luncheon on Planning for Inherited IRA’s in View of the Recent Supreme Court Case – and Demystifing the “Stretch in Trust” Ira and Pension Rules

Date: Thursday, October 23, 2014 | 4:30 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, Port Richey, Florida

Additional Information: For more information, please contact Maria Hixon at hixonm@phsc.edu

**********************************************************

LIVE SARASOTA PRESENTATION:

2014 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 26, 2014 | Alan Gassman is speaking on Sunday, October 26, 2014

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

**********************************************************

LIVE CLEARWATER PRESENTATION:

TAMPA BAY CPA GROUP

Alan Gassman, Ken Crotty and Christopher Denicolo will be presenting THE MATHEMATICS OF ESTATE PLANNING in a 2 hour session at the Tampa Bay CPA Group Fall 2014 Seminar.

Date: November 7, 2014

Location: Marriott Hotel, 12600 Roosevelt Blvd North, St. Petersburg, FL 33716

Additional Information: For more information please contact Richard Fuller at richardf@fullercpa.com.

**********************************************************

LIVE UNIVERSITY OF NOTRE DAME PRESENTATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Topic #1: PLANNING WITH VARIABLE ANNUITIES AND ANALYZING REVERSE MORTGAGES

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities.

Topic #2: THE MATHEMATICS OF ESTATE AND ESTATE TAX PLANNING

Christopher J. Denicolo, Kenneth J. Crotty and Alan S. Gassman will also be presenting a special Wednesday late p.m. two hour dive into math concepts that are used or sometimes missed by estate and estate tax planners. This will be an A to Z review of important concepts, intended for estate planners of all levels, sizes and ages. Donald Duck has rated this program A+.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking to the North Suncoast Estate Planning Council on Planning Opportunities for Same Sex Couples.

Date: Tuesday, November 18, 2014 | 5:30 p.m.

Location: Seven Springs Gold and Country Club, 3535 Trophy Blvd, Port Richey, FL 34655

Additional Information: For more information please contact agassman@gassmanpa.com.

********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Alan Gassman will be speaking at the 2015 Representing the Physician Seminar on the topic of DISASTER AVOIDANCE FOR THE DOCTOR’S ESTATE PLAN.

Others speakers include D. Michael O’Leary on Really Burning Hot Tax Topics, Radha V. Bachman on Checklists for Purchase and Sale of a Medical Practice, Cynthia Mikos on Dangers of Physician Recruiting Agreements and Marlan B. Wilbanks on How a Plaintiff’s Lawyer Evaluates Cases Brought by Whistleblowers

Date: January 16, 2015

Location: Renaissance Fort Lauderdale Cruise Port Hotel, 1617 SE 17th Street, Ft. Lauderdale, FL.

Additional Information:For more information, please email Alan Gassman at agassman@gassmanpa.com

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, 1025 Commons Circle, Naples, Florida

Additional Information: Jerry Hesch and Alan Gassman will present The Mathematics of Estate Planning. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other or anyone who your significant other doesn’t know! Domino’s Pizza is extra.

NOTABLE SEMINARS BY OTHERS

(We aren’t speaking but don’t tell our mothers!)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: TBD

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.