The Thursday Report – 7.21.16 – In Memory of Victims of Violence

New ABLE 529 Plan Rules in Plain English

A Warning About Section 1202 Companies

IRS Denies an Attempt to Retroactively Reform Beneficiary Designations of Deceased IRA Owner in a Trio of Private Letter Rulings

Healing the Health Care System by Dr. Pariksith Singh

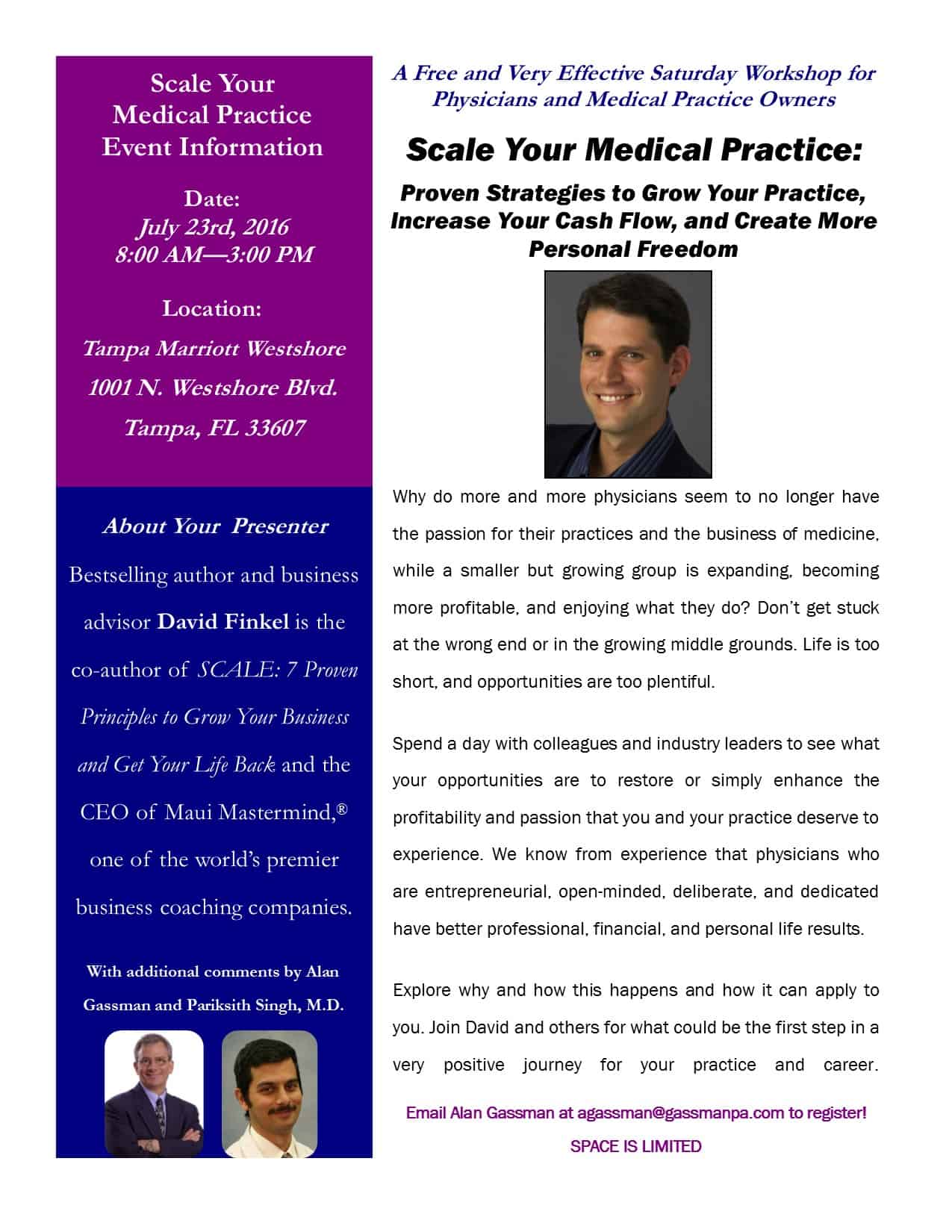

See Dr. Pariksith Singh and David Finkel Live in Tampa on Saturday, July 23rd

Thoughtful Corner – Who Am I Being?: An Interview with Dr. Srikumar Rao

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

In Memory of Victims of Violence

This week’s Thursday Report is “humor-free” out of respect for the many Americans and individuals worldwide who have suffered and lost their lives unnecessarily as the result of individual actions that make no sense whatsoever to the mainstream of society. May our nation and our world not be unduly shaken by these individuals, no matter what their motivation, background, or political or other beliefs may have been. May we eliminate confusion and ignorance as best and as soon as possible.

New ABLE 529 Plan Rules in Plain English

Almost everyone knows someone who is disabled or has a disabled family member or close friend. While everyone pays taxes to enable Medicaid, Social Security disability programs, and otherwise, it has been a national tragedy that those who would wish to make a gift for disabled individuals to enrich their lifestyle beyond normal government support are unable to do so without using complex and expensive trust agreements that may still cause governmental entitlement disqualification.

Congress and the President have wisely passed the ABLE 529 Plan law, and clients can begin gifting up to $14,000 per year into ABLE 529 Plans that will be protected from creditors, disqualified from Medicaid, SSI, and other programs, and can serve to give the disabled and their families an important income tax-advantaged savings vehicle.

It is therefore important that planners and individuals with these situations understand the rules that apply, which are set forth below.

We plan to write more extensively on this topic in the future and therefore welcome all questions, comments, and suggestions for future pieces.

Family members and benefactors of disabled and special need individuals are now ABLE to open 529 Plans that will not disqualify from Medicaid or SSI and can grow tax-free if used for “special needs.” Congress enacted a new Subsection 529A on December 3, 2014 to enable eligible disabled individuals the ability to receive a benefit up to the applicable federal gift tax exclusion amount per year (currently $14,000) that can be used for qualified expenses.

In order to be considered disabled and, thus, eligible for an ABLE account, the beneficiary must meet any one of the following criteria before obtaining the age of 26:

- Entitled to Supplemental Security Income (SSI) benefits;

- Entitled to Social Security Disability Insurance benefits;

- Have a condition listed in the “List of Compassionate Allowances Conditions” maintained by the Social Security Administration;

- The disabled individual or his/her parent or guardian certifies that the individual is blind within the meaning of Section 1614(a)(2) of the Social Security Act; OR

- The disabled individual or his/her parent or guardian certifies that the individual has a medically determinable physical or mental impairment that results in marked and severe functional limitations and that it: (i) can be expected to result in death; or (ii) has lasted or can be expected to last for a continuous period of not less than 12 months.

The beneficiary will be considered the owner of the ABLE plan; however, a parent, guardian, agent, or beneficiary (if over the age of 18) may establish the plan and make contributions to it on behalf of the disabled individual. The designated beneficiary may also be changed with no tax consequences so long as the new beneficiary meets both of the following requirements: (1) an eligible individual for the tax year in which the change is made; and (2) a sibling whether by blood or by adoption of the former designated beneficiary.

As the result of this, parents who would normally gift in trust or outright to children can now make gifts to a disabled child or grandchild (as long as gifts do not exceed $14,000 per year) without being concerned about Medicaid or SSI (social security income for disabled individuals) disqualification. Account balances that exceed $100,000 may cause SSI benefits to be reduced or suspended. Therefore, contributions should not be made into these accounts if the balance would exceed $100,000.

A major disadvantage to ABLE plans is that unlike Special Needs Trusts, upon the death of the disabled beneficiary, the remaining ABLE account balance has to be repaid back to the state to the extent that Medicaid benefits were provided to the disabled beneficiary during his or her lifetime.

Subsection 529A is largely self-explanatory, and requires all contributions to be made in cash to qualified ABLE programs where there will be limited investment choices, no pledging of interest as security, and tax advantaged treatment where distributions must be used for “Qualified Disability Expenses.”

Qualified Disability Expenses are those expenses related to the individual’s disability and are defined to include: “education, housing, transportation, employment training and support, assistive technology and personal support services, health prevention and wellness, financial management and administrative services, legal fees, expenses for oversight and monitoring, funeral and burial expenses, and other expenses, are approved by the Secretary of the Treasury.”

If distributions from an ABLE account are used solely for Qualified Disability Expenses, the distribution is not included in the gross income. However, amounts that are not used for Qualified Disability Expenses are included in gross income and subject to an additional tax of 10%.

Transfers to these plans will qualify for the $14,000 per year federal gift tax exemption, however unlike 529 Plans for College Savings donors cannot average gifts ratably over a five year period and can only make gifts of up to $14,000 per year into an ABLE plan.

Additionally, ABLE plans should be exempt from all claims of creditors of the beneficiary under Fl. Stat. § 222.22, which reads as follows:

Except as provided in s. 1009.986(7), as it relates to any validly existing qualified ABLE program authorized by s. 529A of the Internal Revenue Code, including, but not limited to, the Florida ABLE program participation agreements under s. 1009.986, moneys paid into or out of such a program, and the income and assets of such a program, are not liable to attachment, levy, garnishment, or legal process in this state in favor of any creditor of or claimant against any designated beneficiary or other program participant.

Floridians can choose from the plans that are presently available in Florida, Nebraska, Ohio, and Tennessee.

There is no obligation to open the plan in the home state of the disabled individual. However, states are free to decide whether their plans will be available nationally, or strictly to the residents of their state.

Presently, Florida’s plan is only available to Florida residents and can be accessed at www.AbleUnited.com.

A list of available investments under each plan now in existence can be accessed by clicking here.

A Warning About Section 1202 Companies

by Brandon Ketron, J.D., LL.M., CPA, and Alan Gassman, J.D., LL.M.

Our 1202 Company Planning series was published as a single letter by Steve Leimberg’s wonderful LISI service. The entire letter can be viewed by clicking here.

Steve wisely asked us to add the following warning to readers with respect to 1202 Plans:

Downsides/Risks Associated with 1202 Plans:

As with any potential tax avoidance opportunity, planners must be weary of risks that can be associated with these situations. The IRS might attempt to deny deductions for payments made by an S Corporation to a related company, pension plan qualification could potentially be lost if affiliated service group, leased employee, and other rules are not followed, deductions may be lost if non-discrimination and associated rules for health insurance and other fringe benefits are not followed, and other risks can result from clients and other advisors not following proper formalities and “bread crumb trails” that can be laid out by the planner.

The court in Owen noted that payments made from one company to another for purported services or for other legal purposes must be supported by substantive consideration and must be under some contract or similar indicium between the two entities.[1] Thus, legal agreements and substantive rights and responsibilities must be real, legitimate, and substantive.

In addition, applicable insurance agencies and carriers should be consulted to help assure that liability and casualty insurance arrangements can be made to provide proper coverage, and third parties who contract with one or more of the entities may need to be notified and possibly consent to altered arrangements.

Clients may also be subject to penalties and interest if gain is excluded under Section 1202 and the C-Corporation is later found to not have met the necessary requirements. Penalties may be avoided if an exception to Section 6662 is met, such as reliance on the advice of a qualified tax professional. However, the Owen case discussed above shows that the requirements of this exception may be hard to satisfy.

We will resume our series – 1202 Things to Consider When Setting Up a Related Business Servicing Company – in the next edition of The Thursday Report with a discussion on how to calculate the amount of the exclusion under Section 1202, including several examples, options, and illustrations.

Special thanks to our newest lawyer, Brandon Ketron, JD, CPA, LL.M. (in taxation from the University of Florida – Go Gators!) We hope you agree that he has done a wonderful job with respect to this article.

**********************************************

[1] Owen at 10.

IRS Denies an Attempt to Retroactively Reform Beneficiary Designations of

Deceased IRA Owner in a Trio of Private Letter Rulings

by Christopher Denicolo

The IRS recently issued three private letter rulings, PLRs 201628004, 201628005 and 201628006, where it denied an attempt to correct an error in beneficiary designations, despite such beneficiary designations having been modified retroactively via a court order issued by a state probate court.

The issue with the beneficiary designations seems to have occurred by accident when the IRA owner was required to sign new beneficiary designation forms after his financial advisor changed firms and the IRA was moved to a new custodian.

The IRA owner named “Trust 1″ as a 50% beneficiary, and “Trust 2″ and “Trust 3″ each as 25% beneficiaries, of the IRAs, which was consistent with the dispositive provisions of his estate plan. At the time that he executed this designation, he had attained the age of 70-1/2 and therefore he was required to take required minimum distributions from the IRAs during his lifetime.

In that same year, his financial advisor joined another firm which was affiliated with a different custodian. The IRA owner accordingly transferred his IRA assets to the new custodian, and the financial advisor prepared a beneficiary designation form which named the IRA owner’s estate as the beneficiary. The IRA owner signed this new beneficiary designation form, despite it being materially different from the intended disposition under his estate plan.

The IRA owner intended for the Trusts to receive the IRA benefits and to comply with the applicable Treasury Regulations that would have allowed for the IRA benefits to be “stretched out” over the life expectancies of the Trust beneficiaries after his death. Under the applicable Regulations, the individuals would be treated as Designated Beneficiaries for required minimum distribution purposes, and generally the life expectancy of the oldest beneficiary of each Trust would control with respect to determining the required minimum distributions for each IRA account after the owner’s death.

However, an estate cannot be treated as a Designated Beneficiary under the tax law, and the required minimum distributions rules provide that all IRA benefits must be distributed at least as rapidly as over the deceased owner’s life expectancy, as if he were still living.[1]

The Trustees of the Trusts petitioned the state probate court to reform the beneficiary designations based upon the theory that the IRA owner never intended to change the dispositive provisions of the IRA accounts, but was required to change custodians and therefore executed a new beneficiary designation form to comply with this.

Accordingly, the court issued an order providing that the initial beneficiaries of the IRA were 50% to Trust 1, and 25% to each of Trusts 2 and 3, based upon the prior beneficiary designation. The court also ruled that the order was retroactively effective as of the date on which the IRA signed the first beneficiary designation.

Subsequently, the Trustees of the Trusts requested a private letter ruling from the IRS to confirm that the IRA qualified for the stretch out provisions under the Treasury Regulations, and that the life expectancy of the oldest individual beneficiary of the Trusts would apply for the purposes of determining the required minimum distributions of the IRA accounts. A separate private letter ruling was filed for each of the three Trusts.

The IRS denied the ruling requests, and stated that the named beneficiary of the IRAs as of the time of the IRA owner’s death controlled for the purposes of determining who is the “Designated Beneficiary” of each account. Because an estate cannot be a Designated Beneficiary of an IRA, there was no Designated Beneficiary of the IRAs, and the IRAs must be paid out in accordance with the decedent’s life expectancy as if he was still living.

In its reasoning, the IRS indicated that a court order cannot create a Designated Beneficiary for the purposes of Internal Revenue Code Section 401(a)(9) and the Treasury Regulations thereunder. They also stated the following, and cited tax court cases where the courts have disregarded retroactive effect of state court decrees for federal tax purposes:

“….[A]lthough the Court order changed the beneficiary of IRA X under State law, the order cannot create a ‘designated beneficiary’ for purposes of section 401(a)(9). Courts have held that the retroactive reformation of an instrument is not effective to change the tax consequences of a completed transaction.”

Further, the IRS provided a public policy reasoning for not issuing the desired rulings:

“Were the law otherwise there would exist considerable opportunity for ‘collusive’ state court actions having the sole purpose of reducing federal tax liabilities. Furthermore, federal tax liabilities would remain unsettled for years after their assessment if state courts and private persons were empowered to retroactively affect the tax consequences of completed transactions and completed tax years.”

The rulings do not necessary come as a surprise, as it has been fairly well settled that beneficiaries cannot be added to a beneficiary designation and retirement plan disposition plan following the owner’s death, although they can be removed on or before September 30 of the year following the calendar year of the owner’s death.

Nevertheless, the rulings emphasize the importance of assuring that a client’s beneficiary designations are structured appropriately and reflect what is intended as of the time of his death. As a matter of practice, we stress to our clients the importance of this, and often assist clients with assuring that the beneficiary designations are appropriately structured. It is also worthwhile to consider keeping financial advisors in the estate planning conversation and implementation process to assure that there are no misunderstandings and that all parties are on the same page when putting together the components of the client’s estate plan.

Failing to assure that this aspect of a client’s estate plan is structured correctly can be disastrous, as the income tax built up in an IRA or other type of qualified plan could be accelerated and could cause clients to recognize substantial taxes at higher rates than otherwise would be the case if the beneficiary designation was completed in the manner intended.

*********************************************

[1] If the IRA owner had not yet attained the age of 70-1/2, then all IRA benefits would have been required to have been paid out to the estate within five (5) years following the December 31st of the calendar year in which he died.

Healing the Health Care System

by Pariksith Singh, M.D.

Pariksith Singh, M.D. is a board-certified internal medicine physician who received his medical education at Sawai Man Singh Medical College in Rajasthan, India (where he was awarded honors in internal medicine and physiology). His residency training occurred at All India Institute of Medical Services (New Delhi, India) and Mount Sinai Elmhurst Services, (Elmhurst, New York). Upon completion of his residency, Dr. Singh relocated to Florida and worked for several years before establishing Access Health Care, LLC in 2001.

Our health care systems are diseased. Even though we pay lip service to preventive care and population management, our focus remains on treatment through drugs or drastic interventions – care defined by profitability – and management that is sporadic and reactive.

Our engagement with patients is spotty and happens only when we see them once every few months for 15-30 minutes in our offices, and our tracking of their health and our engagement with them is extremely poor.

This is not what we signed up for, as providers, patients or managers. We can do better. I believe we have the tools that can help us improve. To my mind, some of these are:

1.) Better Models of Health Care: Patient Centered Medical Homes (PCMH) are a welcome start with their focus on communication, engagement, accessibility, coordination and coherence. Team care models and high risk care along with population management have become part of a systemic view towards approaching betterment of quality and results. The Accountable Care paradigm and fee-for-value are also good programs along with bundled care, Star ratings and meaningful use of electronic medical records, in principle. All these approaches can be improved and focus need to be moved to a different manner of incentivization. Concierge models and retail clinics might have their own place in the overall picture as do home visits which might be making a comeback.

2.) Technology: Technology is the helper, technology is the bar. It can be used to improve our communication with patients, via e-mail that is secure, via mobile connections or health care portals. Results can now be shared with patients online and records management is easier with electronic health records. Pharmacy refills and follow up for investigations should be easier to track. We can also improve outcomes, patient experience and quality of care by regularly engaging with them via our own web portals or secure networks. As long as technology does not replace the human touch and connection, it can be a powerful tool to enhance and empower our patients. The feedback of patients is critical to help us improve our services and make corrections and fix problems wherever they may arise. It is my belief that our patients want us to succeed, even make more money, but by helping them get better and healthier. We can record lectures, educational tit-bits and counselling, even patient visits, to help them remember, review and improve their own management of their health.

3.) Metrics: The whole focus on measuring quality indicators is a step in the right direction even though these metrics do not fully capture the quality of healing that is more subjective and personal. There are few businesses as intimate as health care but as we start looking at customer satisfaction measurement techniques, these change our own focus towards improving an archaic model of health care that has not kept up with new developments in the information age.

4.) Utilization Systems: Greater focus on Special Needs Plans by health care insurers and Center for Medicare and Medicaid Services along with better approaches to Care Management, Utilization Management and Disease Management are a welcome addition to our arsenal. Care coordination centers, whether outsourced or insourced, are not only a way to build relationships, loyalty and better scores, but also improve the brand presence and patient satisfaction. Recent studies by Berwick and Nolan have showed that focus on quality and population management will reduce wastage and improve savings. Coleman has shown how quick follow up after discharges preferably within 7 days reduces re-admits and improves morbidity and mortality.

5.) Operations: An enhanced need to be compliant and diligent with coding, do self-audits before being reviewed by outside agencies, and a robust program to police oneself and identify any fraud and abuse early on and tackle it are all welcome demands of the system. A health care system based on integrity is critical since it is one of the most important basic needs of human development.

6.) Data Management: Advanced analytics, machine learning, deep learning and cognitive computing have changed data into immediate feedback loops whether in operations or financials or direct patient care. IBM’s Watson program may be an important enhancement if its protocols are used appropriately without compromising the element of healing.

7.) Management: Advances in management thinking such as Design Thinking or Protean Organizations or Systems Development are important additions in creating a team-based approach. A study of Learning Organizations and Knowledge Organizations along with better human capital management is a sine qua non in providing the best value to our patrons.

Much is needed, but the essentials seem to be in place. EMRs are slow, but they can be accelerated. Our systems are fossilized, but they can be improved with better operational techniques, technology and management principles. Health care is still not integrated or holistic, and healing is confused with interventions. How can we improve all this?

I think one of the major steps would be to make our patients our partners in this endeavor. Another important step is to constantly measure our own performance and seek to improve constantly with the help of analytics and advances in information-based health care interactions. Another would be to grow transparent and open without sacrificing privacy.

If we can even manage these, I think we will come a long way in bringing a healing touch to our own organizations and enterprises.

See Dr. Pariksith Singh and David Finkel

Live in Tampa on Saturday, July 23rd

Thoughtful Corner

Who Am I Being?: An Interview with Dr. Srikumar Rao

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and is the author of Happiness at Work and Are You Ready to Succeed?, which has been published in over 60 languages. You can visit Dr. Rao’s website at http://theraoinstitute.com/.

The following was excerpted from the webinar “An Ethical Framework for Dealing with Challenging Situations,” presented on Tuesday, June 28th, 2016. To obtain a copy of this webinar, please email stephanie@gassmanpa.com.

Alan Gassman (AG): Professor Rao, today, we would like to dig deeper than reciting ethical rules and the importance of following them, both from a technical legal standpoint and with respect to doing the right thing for others. Lawyers who regularly represent professionals who get into trouble often comment that this goes beyond carelessness and lack of structure. You are world-renowned for your writing, workshops, and personal coaching of high achievement individuals. How do you help these people overcome the significant obstacles that can often interfere with judgment and achievement, including the negative by-products that can occur when one thing is pursued, while another thing may fall by the wayside?

Dr. Srikumar Rao (SR): In answering that question, let me suggest a solution which will help with many other types of problems. A lot of time when people are thinking about this, they are thinking, “This is what I should do.” There are many methods by which you can get a handle on what you should do. A very good one, which I do recommend, is having a checklist; every time you get a new client, you have a checklist that you go through, and in that checklist would be things like a fee agreement. Another method which is used not instead of this but in addition to this would be to get the attorney to think “Who am I being?” Think in terms of “Who am I being?” instead of “What am I doing?”

For example, supposing you forget to get a fee agreement signed, then what you are simply doing is you’re indirectly or accidentally not doing some of the stuff you should have done, but who you are being is a careless attorney, an attorney who lets thinks fall between cracks. Is this the kind of attorney that you want to be?

If you examine that – say “Who am I being?” – then very soon you will start to say, “Hey, that’s not who I want to be.” So if that is not who you want to be, who do you want to be? You want to be a conscientious attorney, one who can be depended upon and who does not let things fall through the cracks. If you think about that and decide, “This is who I am going to be,” that’s where you anchor yourself, and, all of a sudden, you’ll find that the rest takes care of itself. You won’t forget the fee agreement.

The trick is to anchor yourself in “Who am I being, and do I want to be that person?” If you don’t want to be that person, think about the person you do want to be, and anchor yourself in that, and then a lot of the problems will almost magically sort themselves out.

AG: That’s fascinating. What is the first step to anchor yourself to something like that?

SR: The first step is whenever you are in a situation where you find yourself in a place and an emotional domain that you find unpleasant, immediately get down to “Who am I being right now?” and basically, as with all things, Alan, this requires practice. So you get up in the morning and say, “Who am I being? Do I want to be that person?” Keep asking yourself that question.

The more you ask yourself that question, the more you will rigorously analyze it and make a decision of whether or not you want to be that person. The more you ask yourself that question, the more you find that your life changes automatically.

AG: So it becomes a habit in 21 days or something like that?

SR: It becomes a habit, but actually, it can become a habit in a lot less than 21 days if you are conscientious in doing that. You can set your smart phone to beep at random intervals, so let’s say you set it to a dozen beeps. Each time your phone beeps, pause and ask yourself, “At this instant, who am I being? Do I want to be that person? If I don’t want to be that person, who is the person I want to be?” Then slip into the emotional domain of the person you want to be. You can quietly slip into that person, and as you slip into that person, your emotional domain will change, which will automatically change the ways in which you act and the things you do.

AG: That’s fascinating, and I don’t think I have ever read about this or heard about this, despite having read and listened to almost everything you have written and said.

SR: No, it isn’t in anything else, but it will be in my next book.

Stay tuned for more with Dr. Rao in upcoming Thursday Reports and live webinar presentations.

Humor! (Or Lack Thereof!)

Upcoming Seminars and Webinars

Calendar of Events

LIVE TAMPA PRESENTATION:

DAVID FINKEL CONFERENCE FOR PHYSICIANS – SCALE YOUR MEDICAL PRACTICE

This free event for physician clients and friends of Gassman, Crotty & Denicolo, P.A. (including those who claim to be friends) will feature nationally-recognized business advisor and author David Finkel’s unique presentation on growth and lifestyle improvement opportunities for physicians and medical practices. The conference will be entitled SCALE YOUR MEDICAL PRACTICE: PROVEN STRATEGIES TO GROW YOUR PRACTICE, INCREASE YOUR CASH FLOW, AND CREATE MORE PERSONAL FREEDOM.

Spouses, office managers, and other practice advisors will also be welcome to attend this interesting and useful one-day conference.

Date: Saturday, July 23, 2016

Location: Tampa Marriott Westshore | 1001 N. Westshore Blvd., Tampa, FL, 33607

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

FLORIDA’S PREMIER BEHAVIORAL HEALTH ANNUAL CONFERENCE

Alan Gassman and Lester Perling will be speaking at Florida’s Premier Behavioral Health Annual Conference, sponsored by The Florida Alcohol and Drug Abuse Association and The Florida Council for Community Mental Health. The 2016 conference theme is Providing Value in Challenging Times and examines the latest advances in the fields of substance use disorders and mental health.

Alan and Lester will be speaking on the topic of ETHICAL AND LEGAL MARKETING FOR TREATMENT CENTERS.

Date: August 10th – 12th, 2016 | Alan and Lester will speak on August 10th at 11:00 AM – 12:30 PM.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: For more information or to register for this conference, please visit http://www.bhcon.org/. You may also email Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

FREE LIVE BLOOMBERG BNA WEBINAR:

Edwin Morrow and Christopher Denicolo will present a one-hour webinar on the topic of ESTATE & TRUST PLANNING FOR IRA & PENSION ACCOUNT ASSETS.

This webinar is part of the Bloomberg BNA Essential Elements series moderated by Alan Gassman.

Date: Thursday, August 11th, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

The Ameriprise Clearwater branch office, in conjunction with The Tampa Bay Gay and Lesbian Chamber of Commerce, will be hosting an event centered on LGBT estate planning, featuring Alan Gassman’s presentation on PRACTICAL PLANNING FOR MARRIED AND UNMARRIED COUPLES.

The Florida Advisor’s Guide to Counseling Same Sex Couples, which was last updated in 2015, is now available on Amazon for only $39.17. It can be viewed by clicking here. Please note that this edition was last revised before the US Supreme Court decision of Obergefell v. Hodges, but the book still has extensive, useful information.

Date: August 18th, 2016 | Time To Be Determined

Location: Safety Harbor Resort & Spa | 105 N Bayshore Drive, Safety Harbor, FL, 34695

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Philip Nelson at philip.nelson@ampf.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Jay Adkisson and Alan Gassman will present a free, one-hour webinar on the topic of JAY ADKISSON’S MUSINGS ON CAPTIVE CARRIERS.

There will be two opportunities to attend this presentation.

Date: Tuesday, August 30, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Marty Shenkman and Alan Gassman will present a free, 30-minute webinar on the topic of AVOIDING FAMILY STRIFE FOR ELDERLY CLIENTS BY HAVING A SUPPORT TEAM IN PLACE.

There will be two opportunities to attend this presentation.

Date: Thursday, September 8, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Sandra Greenblatt and Alan Gassman will present a free, 30-minute webinar on the topic of AVOIDING THE TRAPS IN EMR/TECHNOLOGY CONTRACTS.

There will be two opportunities to attend this presentation.

Date: Wednesday, September 14, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Al Gomez and Alan Gassman will present a free, 30-minute webinar on the topic of FRAUDULENT TRANSFERS UNDER FLORIDA LAW.

There will be two opportunities to attend this presentation.

Date: Tuesday, September 27, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

58th ANNUAL FLORIDA BANKERS ASSOCIATION TRUST & WEALTH MANAGEMENT CONFERENCE

Alan Gassman will be speaking at the 58th Annual Florida Bankers Association Trust & Wealth Management Conference on the topic of PLANNING TO AVOID AND HANDLE ESTATE AND TRUST DISPUTES.

Date: Thursday, September 29th, 2016 | 4:15 PM – 5:15 PM

Location: The Ritz-Carlton Sarasota | 1111 Ritz Carlton Drive, Sarasota, FL, 34236

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MAUI PRESENTATION:

2016 MAUI MASTERMIND WEALTH SUMMIT

Alan Gassman will be speaking at the 2016 Maui Mastermind Wealth Summit with David Finkel. This event will connect attendees with many Maui Mastermind Wealth Advisors such as Alan. Details on his topics and the event are forthcoming, so watch this space!

Date: December 4th – December 9th, 2016

Location: The Fairmont Kea Lani Maui | 4100 Wailea Alanui Drive, Maui, HI, 96753

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Dates for 2017!

LIVE SOUTH BEND, INDIANA PRESENTATION:

42ND ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please put Thursday, October 27th and Friday, October 28th on your calendars for the 42nd Annual Notre Dame Tax & Estate Planning Institute.

To see the complete schedule and for registration details, please click here.

Date: Thursday, October 27th, 2016 and Friday, October 28th, 2016

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN, 46601

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

2017 ALL CHILDREN’S HOSPITAL FOUNDATION SEMINAR

Please put Thursday, February 9th, 2017 and on your calendar to enjoy the 19th Annual All Children’s Hospital Estate, Tax, Legal, and Financial Planning Seminar. Watch this space for more details to be announced!

Date: Thursday, February 9th, 2017

Location: To Be Announced

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Please put Friday, May 5th, 2017 and the weekend that follows on your calendar to enjoy the 4th Annual Ave Maria School of Law Estate Planning Conference and the weekend that follows in Naples with the person or persons of your choice. Watch this space for more details to be announced!

Date: Friday, May 5th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is DYNAMIC PLANNING STRATEGIES THAT YOU ALREADY KNOW ABOUT BUT HAVE NOT YET APPLIED.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

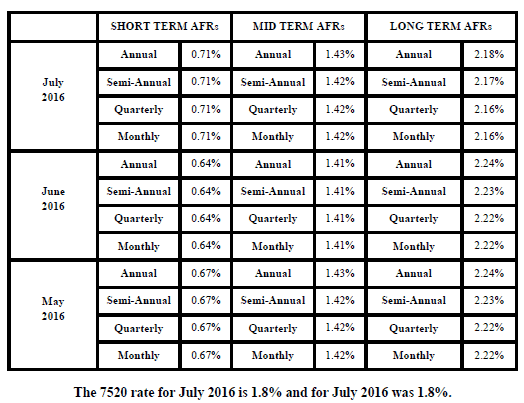

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.