The Thursday Report 6.5.2014 – Annuities II, SCGRATs, Need Blattmachr Topic, and Remembering Judge Caddell

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Planning with Variable Annuities

We received a number of comments on our article last week entitled Planning with Variable Annuities that can be reviewed by clicking here.

Veteran chartered retirement planning counselor and financial planner, Gene Stern is preparing an article for us which will outline advantages and positive outcomes that he has had in his practice.

We also received the following comments from Parker Evans, CFA, CFP, CMT.

Our article will continue next week.

Are Annuities a Good Investment?

by Parker Evans, CFA, CFP, CMT

Parker Evans is a Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA) investment professional with 30 years of experience. He is President of Successful Portfolios LLC, a Clearwater, Florida based, fee-only Registered Investment Advisor.

Are annuities a good investment? The short answer is probably not. Annuities are insurance contracts based on life expectancy tables. A simple, traditional annuity provides the buyer with a fixed monthly stream of income for life. Unfortunately, the insurance industry has made great strides in making the simple complex. For example, annuities can be immediate or deferred, and fixed, variable or equity linked. Today, new-fangled annuities outsell traditional immediate fixed annuities by a wide margin. There are at least four potential problems with investing in a deferred annuity:

- Tax Disadvantages

- Mind-boggling Complexity

- High Costs and Illiquidity

- Concentrated Credit Risk

Consider this hypothetical example. A fifty-two year old investor purchases a $100,000 equity index deferred annuity. The annuity is linked to the S&P 500 Index, has a seven-year surrender term, a 60% participation rate, and a 6% annual cap. Please keep in mind that this investor could easily invest in an ultra-low cost, tax efficient ETF that will reliably replicate the return on the S&P 500 Index. Also, currently the ETF pays a tax-advantaged dividend of approximately 2% annualized which can increase over time. The annuity investor will not receive any return linked to dividends, a fact disclosed only in the fine print of the contract. Now, assume the S&P 500 appreciates 60% over the 7-year term of the annuity term. The $100,000 invested in the ETF is now worth $160,000 and considerably more with the dividends reinvested. The $100,000 invested in the annuity is worth at most $133,300 and probably less, possibly a lot less. It gets worse. When the investor surrenders his annuity, he pays taxes on any gain at his highest marginal tax rate, which can be as high as 43.4% when you include the 3.8% Medicare tax. In contrast, the ETF investor, if he sells his shares, may enjoy lower long-term capital gains tax rates. Better yet, the ETF investor may never owe taxes on his gain if he is in a low marginal tax bracket at the time of sale or if he qualifies for a step up in basis at death.

In the event the investor needs to surrender his annuity before seven years, the insurance company will charge hefty surrender fees and a market value adjustment. If the investor has not reached age 59-1/2 then an extra 10% of income excise tax may apply. In contrast, the ETF investor will incur only a relatively small commission to sell his shares. And unlike the annuity investor, the ETF investor could easily borrow money at very low cost using his ETF as collateral without triggering a taxable event.

Now it is possible, but historically unlikely, that the S&P 500 will be lower after seven years. In that scenario, the annuity investment might actually outperform the ETF, assuming that the annuity carrier does not go bust. In the aftermath of the 2008-2009 market crash, many annuity issuers were in such dire financial straits that they required TARP capital injections from the US Treasury.

“Don’t be a fooled. Annuities can be unsuitable investments with complex riders and features designed to promote sales and protect the insurance company, not the investor.“

SCIN, SCRAM, Annuity or SCGRAT – Planning for Clients with Short Life Expectancies After Davidson and CCA 2013-30-033, an article by Alan Gassman & Ken Crotty

On Tuesday, June 3, 2014, our article “SCIN, SCRAM, Annuity or SCGRAT – Planning for Clients with Short Life Expectancies After Davidson and CCA 2013-30-033 was published in Leimberg Information Services.

We have received some positive feedback on the article already including this quote from Scott Tippett, Esq. “Great Leimberg article on SCINs and SCGRATs. As good as the article is, footnote IV is priceless.

Footnote IV reads as follows: In the famous television game show, Let’s Make a Deal, moderator Monty Hall would give contestants the choice of three different doors or the box where Carol Merrill was standing. The box where Carol Merrill was standing was not usually the winner, and Carol Merrill was no Vanna White, but let’s not digress any further here other than to mention that the song “My Whole World Lies Waiting Behind Door Number 3,” by Jimmy Buffett on the A1A album from 1974 is more than worth listening to. “Didn’t Get Rich,” “Son of a ________”, “I’ll be Back Someday, You’ll See,” “My Whole World Lies Waiting Behind Door Number 3.” If you have never heard the A1A album please listen to it from beginning to end, which is the way that most great albums were designed to be experienced. Greatest hits almost never do justice to any good musician. The entire lyrics for the song My Whole World Lies Waiting Behind Door Number 3 can be reviewed by clicking here. Dolphins can click six times!

Our article is as follows:

“Since the Tax Court decision of Estate of Moss v. Comm’r in 1980 and the issuance of Treasury Regulation § 1.1275-1(j) in 1998, estate tax planners have used self-cancelling installment notes (SCINs) to save millions of dollars of estate taxes for taxpayers whose life expectancy may be shorter than that assumed under the 2000CM Mortality Table promulgated by the Treasury Department under Publication 1457. In the recent CCA 2013-30-033, the IRS has taken the position in the Davidson case that clients with shorter than average life expectancies may not rely on the 2000CM Mortality Table to determine their life expectancy for the purpose of valuing the SCIN and may make taxable gifts when the sale occurs if they do rely on the 200CM Mortality Table.

To reduce the possible gift tax exposure for clients, practitioners using SCIN with clients who have reduced life expectancies may want to use the SCGRAT technique. Utilizing a SCGRAT may be the best choice for practitioners who would like to use SCINs with a client who has a reduced life expectancy.

If the Service successfully challenges the transaction and reduces the face value of the note by applying the willing buyer willing seller standard, by using the SCGRAT the value of the GRAT formed by the client should be increased. If the value of the GRAT is increased, then the payments from the GRAT to the client will be increased. As a result, there should not be any additional gift tax liability for the client.”

Alan Gassman and Ken Crotty provide members with their commentary on the benefits of using the “SCGRAT” planning technique.

EXECUTIVE SUMMARY:

Since the Tax Court decision of Estate of Moss v. Comm’r in 1980 and the issuance of Treasury Regulation § 1.1275-1(j) in 1998, estate tax planners have used self-cancelling installment notes (SCINs) to save millions of dollars of estate taxes for taxpayers whose life expectancy may be shorter than that assumed under the 2000CM Mortality Table promulgated by the Treasury Department under Publication 1457. In the recent CCA 2013-30-033, the IRS has taken the position in the Davidson case that clients with shorter than average life expectancies may not rely on the 2000CM Mortality Table to determine their life expectancy for the purpose of valuing the SCIN and may make taxable gifts when the sale occurs if they do rely on the 200CM Mortality Table. To reduce the possible gift tax exposure for clients, practitioners using SCIN with clients who have reduced life expectancies may want to use the SCGRAT technique described below.

FACTS:

The industry practice for most well versed practitioners has been that the 2000CM Mortality Table can be used when the taxpayer has a better than 50% chance of living at least one year at the time that the SCIN or private annuity arrangement is entered into.[i]

In order to avoid incurring income tax on the sale of assets for a SCIN or private annuity, most arrangements have entailed having an irrevocable trust established to be separate and apart from the taxpayer for federal estate tax purposes, while being disregarded for income tax purposes so that there is no income on the sale and no interest or Internal Code Revenue § 72 income recognized by the taxpayer as payments are received by the taxpayer from the trust during the taxpayer’s lifetime.

Treasury Regulation § 25.7250-3(b)(2)(i) was enacted to implement the “probability of exhaustion test” which generally provides that if the entity purchasing assets for a private annuity is not capitalized with sufficient assets to enable the trust to make the scheduled private annuity payments until the Grantor reaches age 115, assuming a market rate equal to what is known as the 7520 rate which is equal to 120% of the Federal midterm rate in effect under § 1274(d)(1) for the month when the transaction is entered into, rounded up to the nearest 2/10ths of 1%.

Because of the difficulty of satisfying the probability of exhaustion test, especially in periods of low interest rates, most estate tax planners have recommended the use of SCINs, which are not subject to that test. A commonly used planning industry rule of thumb has been that a trust purchasing assets from a Grantor in exchange for a SCIN should have a positive net worth equal to 10% or more of the value of the assets purchased in order to be considered a separate and viable entity for estate tax planning purposes.

When trusts do not have sufficient assets to pass the probability of exhaustion test or the “10% rule of thumb” described above then it is common to have beneficiaries or affiliated entities guarantee the note or the private annuity in order to meet the applicable test,[ii] the 10% test for a SCIN or the probability of exhaustion test for a private annuity.

Treasury Regulation § 25.7520-3(b)(3)(I), which states that the 2000CM Mortality Table can be used when the person whose life controls the document has better than a 50% chance of living at least one year, applies explicitly to private annuities.

Many leading commentators, including Howard Zaritsky and Ronald D. Aucutt, have concluded that most likely this regulation applies to SCINs, because in form and content a SCIN constitutes a series of payments over time that can in substance be exactly the same as a private annuity contract.

The Service has strongly disagreed with this approach, but has waited over 18 years since the enactment of the above-referenced Treasury Regulation and notwithstanding annual and continuing industry and leading treatise literature to the contrary, on the occasion of the death and estate tax return audit of William M. Davidson to challenge this approach, whereby over $1,000,000,000 of estate tax is being assessed by the Service (constituting over 25% of the total estate taxes that the U.S. government would receive for a given calendar year) as the result of Mr. Davidson having sold a large percentage ownership in the Detroit Pistons basketball team and other assets in exchange for multiple SCINs when Mr. Davidson is said to have been in failing health.

The Service further threw the gauntlet down in front of the estate tax planning industry by publishing CCA 2013-30-033 on August 5, 2013, as an IRS Chief Counsel Advice which concludes that a SCIN will be worth substantially less than its face amount if a willing buyer would pay a willing seller less than the face amount if there was open market negotiation for the note.

In other words, if Mr. Davidson sold $1,000,000,000 worth of assets for a $1,000,000,000 SCIN then the trust that sold the note would only be able to receive $300,000,000 pursuant to an auction of the note at an event where every willing buyer received notice of the auction. Mr. Davidson would then have made a $700,000,000 gift and he would be subject to $280,000,000 worth of estate tax, enough to purchase two F-35 fighter jets.

What is a planner to do now when a wealthy client has a short life expectancy – SCRAM, go flat or SCGRAT?

COMMENT:

Door Number 1

A private annuity arrangement could be entered into with family members, such as occurred in the 2012 Estate of Kite v. Commissioner case. If a private annuity is entered into where the parent sells assets to children, the children’s basis in the assets will be equal to the annuity payments made by the children. If the parent dies before receiving any annuity payments, such as what happened in the Kite case, the children would have a zero basis in the assets received and would face a 23.8% capital gains tax on the full value of the assets when they were sold.

Alternatively, the planner must face the probability of exhaustion test if a grantor trust is used that would quite possibly allow a stepped up basis for the assets.

The probability of exhaustion test may not apply, as discussed in the University of Miami Heckerling presentation by Lawrence Katzenstein[iii], but there is a significant risk that the probability of exhaustion test will apply.

Door Number 2

Go with a SCIN, but understand the risk posed by CCA 2013-30-033 and the Davidson case that the Grantor could be making a significant taxable gift at the time the transaction was entered into.

Door Number 3

Do nothing, but accelerate planning with charitable donations, discounting, and other methods.

Door Number 4

The box where Carol Merrill is now standing. [iv]

Door number 4 is the bread slicer – or at least what we think is better than sliced bread – a SCIN arrangement that would allow any gift element to not be subject to gift tax and to instead be repayable to the Grantor by use of a grantor retained annuity trust arrangement.

Instead of selling the assets to a typical irrevocable grantor trust the taxpayer first establishes a limited liability company owned 100% by the Grantor and places the assets that are being “sold” into the LLC and also receives a SCIN from the LLC while verifying that the taxpayer has a better than a 50% chance of living at least one year.

The taxpayer also executes a grantor retained annuity trust agreement (GRAT) which provides that a percentage of the value of the Day 1 GRAT assets will be paid back to the Grantor each year for two years on the anniversary date of the GRAT being established.[v]

The Grantor then transfers ownership of the LLC to the GRAT and hires a valuation firm to determine the value of the assets owned by the LLC.

If the valuation firm opines that the assets in the LLC are worth less than the face amount of the SCIN, then the LLC will be considered to have a negligible value, and the payments owed back to the Grantor will be very small. There should be some positive value even if the assets in the LLC are worth less than the SCIN because the owner of the LLC has no downside and at least some limited upside potential that the assets will grow in value and yield a net return exceeding the amount owed on the SCIN.

If the assets have a value exceeding the value amount of the SCIN then assuming the 7520 rate is 2.4%, then the excess amount multiplied by approximately 51.8% will be the amount of the annual payment that the GRAT will make to the Grantor, which may be in cash that the LLC can distribute to the GRAT or in the form of assets equal in value to such amounts that the LLC may distribute to the GRAT each year.

After the second annual payment, the LLC will be owned by the GRAT or an irrevocable “remainder trust” that the GRAT pours into after the second year.

The SCIN will typically be an interest only SCIN with a balloon payment at the end of the term of the note which will normally be just before the standard life expectancy of the individual on whose life the note is based as determined under 2000CM Mortality Table or the mortality table under Treasury Regulation § 1.72-9, Table V.

The 2000CM Mortality Table will typically have a shorter life expectancy and it is therefore safer to use it. For example, for a 78 year old the life expectancy under the 200CM Mortality Table is 9.44 and the life expectancy under Treasury Regulation § 1.72-9, Table V is 10.63.

To determine the value of the SCIN, either the interest rate of the SCIN will be increased, the face amount of the SCIN will be increased, or the interest rate and the face amount of the SCIN can both be increased to the extent appropriate to satisfy actuarial assumptions which make the note equal in value to the assets sold so that the seller is compensated to take into account that the note will vanish on death. This can be determined based upon standard life expectancies under actuarial tables using software programs like Steve Leimberg’s Number Cruncher and Larry Katzenstein Tiger Tables. The links to obtain these programs are as follows.

The need to value the assets held under the LLC is a substantial reason to use the GRAT when assets are hard to value or discounts will be applicable.

A GRAT must be funded in a single transfer and there is no authority for the ability to sell assets to a GRAT in exchange for a note at the time of funding.

This is why well respected commentators have suggested that an LLC that is disregarded for income tax purposes will first be funded by the Grantor and that the Grantor can receive a note back from the LLC in order to provide appropriate financial leverage for the arrangement.

Many taxpayers will want to have their remaining assets be under the amount that would require an estate tax return to be filed in order to reduce the paperwork, expenses, and delay in estate administration that results from having to file a federal estate tax return. A SCIN will not be considered to be an asset owned at the time of death for estate tax return threshold filing purposes.

However, in Estate of Moss v. Comm’r, 74 T.C. 1239 (1980) , the Tax Court held in favor of theestate….***See: Cain v. Comm’r, 37 T.C. 185 (1961)

Where a marital deduction devise or charitable disposition may facilitate avoidance of federal estate tax on the death of the Grantor when used in conjunction with the SGRAT, it can still be advisable to have GRAT assets pass to fund a marital devise or trust and/or a charitable devise as remainder beneficiaries of the GRAT so that a federal estate tax return using it is more clear that the assets passing to fund a marital devise will receive a stepped up basis if held by the taxpayer on death, but the advantage of not having to file a federal estate tax return may outweigh the risk of not receiving a stepped up basis on assets passing to fund a marital or charitable devise.

Another consideration is whether to maximize the use of the taxpayer’s generation skipping tax exemption makes the filing of a federal estate tax return worthwhile. Generation skipping tax exemption can clearly be allocated to a marital deduction trust that is funded from the Grantor’s estate or revocable trust that receives the payments from the GRAT.

Many clients will prefer to zero out the GRAT in order to avoid the need to file a federal gift tax return for the year that the SCGRAT is implemented. It may therefore be important to be sure that there are no gifts exceeding $14,000 per donee or any gifts that do not qualify for the annual gift tax exclusion for the year in which a gift tax return would be filed, although even if a gift tax return needs to be filed it seems likely that a zeroed out GRAT would not be considered to be a gift that would need to be reported on a gift tax return.

Sample charts demonstrating this SCRAT technique are attached.

Conclusion

Utilizing a SCGRAT may be the best choice for practitioners who would like to use SCINs with a client who has a reduced life expectancy. If the Service successfully challenges the transaction and reduces the face value of the note by applying the willing buyer willing seller standard, by using the SCGRAT the value of the GRAT formed by the client should be increased. If the value of the GRAT is increased, then the payments from the GRAT to the client will be increased. As a result, there should not be any additional gift tax liability for the client.

Citations

[I]Treasury Regulation § 1.7520-3(b)(3) provides that: an individual who is known to have an incurable illness or other deteriorating physical condition is considered terminally ill if there is at least a 50 percent probability that the individual will die within 1 year. However, if the individual survives for eighteen months or longer after the date of the decedent’s death, that individual shall be presumed to have not been terminally ill at the date of death unless the contrary is established by clear and convincing evidence.

[II]It has been appropriately noted by many commentators that the 10% rule of thumb described herein is not based upon any specific IRS ruling, court case, or comparable situation. It actually came into being after well respected estate tax planner Byrle Abbin delivered a paper at the University of Miami Institute on Estate Planning in 1997, in which he reported that he had conversations with IRS personnel about a comparable situation and concluded the conversation with the mutual non-binding understanding that a 10% net worth should be sufficient to allow a trust entering into such a transaction to be considered as a separate independent entity.

[III]Larry Katzenstein, “Turning the Tables: When do the IRS Actuarial Tables Not Apply?” 34 Univ. Miami Heckerling Institute on Estate Planning (Miami, Fla. Jan 6-10, 2003).

[IV]In the famous television game show, Let’s Make a Deal, moderator Monty Hall would give contestants the choice of three different doors or the box where Carol Merrill was standing. The box where Carol Merrill was standing was not usually the winner, and Carol Merrill was no Vanna White, but let’s not digress any further here other than to mention that the song “My Whole World Lies Waiting Behind Door Number 3,” by Jimmy Buffett on the A1A album from 1974 is more than worth listening to. “Didn’t Get Rich,” “Son of a ________”, “I’ll be Back Someday, You’ll See,” “My Whole World Lies Waiting Behind Door Number 3.”

[V]We have used two years as an example. Some planners believe that a GRAT can be as short as just over one year, and certainly can be for a longer period of time. If the Grantor dies during the GRAT term then the present value of the GRAT payments that have not yet been paid will be considered to be held by the Grantor’s estate, and can qualify for the federal estate tax or charitable deduction if the GRAT is properly drafted and would then pass to a spouse, a marital deduction trust, or to a private or public charity.

Celebration of Life for Judge Patrick Caddell

A Celebration of Life for Judge Patrick Caddell

Saturday, June 21, 2014 at 10 a.m.

Pinellas Park Performing Arts Center 4951 78th Avenue, Pinellas Park

From the Clearwater Bar Association:

Longtime Pinellas County Judge Patrick Caddell, known for his quick wit on and off the bench, died Tuesday after a battle with cancer. He was 60.

“He was kind of the Yoda of judges,” said Thomas McGrady, chief judge for the Pinellas-Pasco circuit.

Caddell had been a mentor to him and many others, offering tips on how to be a good and effective judge. “It was all good advice,” McGrady said.

Caddell, who was elected county judge in 1986 and was the county’s administrative judge, also was well known for his somewhat acerbic sense of humor

In 1987, shortly after Caddell was elected, an irate business owner flew an airplane over downtown St. Petersburg with a banner that read: “Judge Caddell lies from the bench – violates civil rights – Is he fit to stay on the bench?”

Afterward, Caddell quipped: “I’m sorry I didn’t get a picture of it for my mom. She always said I’d be famous someday.”

When Caddell recently ruled a portion of St. Petersburg’s sign ordinance was unconstitutional, the St. Petersburg doctor who challenged the law stood up and thanked him “for recognizing the natural born rights I have of free speech.”

Caddell dryly responded: “It’s what I do for a living. Don’t think you’re anything special.”

This was cited this month when Caddell received the Clearwater Bar Association’s George W. Greer Judicial Independence Award. Caddell was too sick to accept the award in person, but he greatly appreciated it and wrote some remarks for McGrady to read aloud:

“I cannot imagine a higher award to which any judge could aspire than to be deemed ‘independent’ by his or her profession.”

Caddell also was chairman of the Pinellas County Canvassing Board, which supervises election procedures. “No one cared more about ensuring the integrity of election results,” Pinellas Supervisor of Elections Deborah Clark said in a statement.

McGrady said the news of Caddell’s passing came as a shock. “We all knew he was sick. … We were cautiously optimistic that he could beat the cancer and be back. It came much quicker than any of us thought.”

Where Can the Dolphins File Their BP Claims?

The U.S. National Oceanic and Atmospheric Administration (NOAA) has recently released a study of dolphins that is very alarming. The study, formally known as a Natural Resource Damage Assessment, investigated the possible damage to gulf coast wildlife as a result of the BP oil spill. Two groups of dolphins were studied, one group in Barataria Bay, an area heavily affected by the 2010 oil spill, and another group from Sarasota Bay, an area not affected by the spill.

The report indicates that the Barataria Bay group had abnormally high cases of lung disease, were under weight, had missing teeth, and very low levels of adrenal hormones (a critical hormone for responding to stress).

The team even came across a pregnant dolphin. Unfortunately, the fetus had already died about a weeks earlier. The fetus had died in the second trimester which was unusual because usually things that cause abortions in dolphins usually occur in the third trimester.

BP has rebutted the study, stating that there are no causal links between the two events. For instance, BP asserts pesticides or other man-made chemicals may have entered the environment through rain water run-off. Despite BP’s claims, scientists performed an analysis of both group’s blubber and discovered that the Sarasota Bay group had higher levels of pesticide and chemical exposure, potentially ruling those out as causes for this event. BP also claims that the symptoms found in the dolphins are also caused from natural diseases like Morbillivirus and Brucellosis.

BP was also unhappy with the scientists’ decision to use dolphins in Sarasota Bay because they are genetically different and live in a different environment then the Barataria Bay dolphins. BP states that Barataria Bay is more industrialized and has been effected by other oil and fuel spills.

Researchers are hoping to receive funding for more studies this coming summer. They wish to study the same group in Barataria Bay in an attempt to better understand this increased level of dolphin disease and sickness.

Thoughtful Corner – The Road Not Taken by Robert Frost, a new Thursday Report Weekly Column for Advisors Who Care

The Road Not Taken | Robert Frost, 1874 – 1963

As we as advisors and planners help clients make important decisions, let’s not forget that the opportunities they have may justify risks and actions that they can afford to hand, and that we can encourage this with appropriate analysis of exposure and how to best protect from risk.

Yes, it is our job to warn them of risks, and help to reduce problems ahead, but let’s not get carried away and drown the next Apple or Microsoft or Facebook.

If the client has passion and the wherewithal to make an intelligent choice then let’s do what we can do to help them.

Let’s not forget that no great achievement has occurred with risk and ambition, and that doing nothing in the face of an important decision is often the wrong move.

As Yogi Berra said, “when you come to the fork in the road, take it.” What can we do to help clients understand that inaction can be very harmful, in a number of ways.

And let’s not forget the following immortal verse by Robert Frost:

Two roads diverged in a yellow wood,

And sorry I could not travel both

And be one traveler, long I stood

And looked down one as far as I could

To where it bent in the undergrowth;

Then took the other, as just as fair,

And having perhaps the better claim,

Because it was grassy and wanted wear;

Though as for that the passing there

Had worn them really about the same,

And both that morning equally lay

In leaves no step had trodden black.

Oh, I kept the first for another day!

Yet knowing how way leads on to way,

I doubted if I should ever come back.

I shall be telling this with a sigh

Somewhere ages and ages hence:

Two roads diverged in a wood, and I–

I took the one less traveled by,

And that has made all the difference.

Or said in another way:

No Guts No Glory

Have a great Thursday and let’s help others achieve greatness when the time is right.

Stay in motion and have a great day!

Next week–Why Your Smart Phone May Be Much Smarter than You Are. Who works for who and why.

Two Webinars of Interest: Improve Your Professional Practice with Rick Solomon, and a webinar with Jonathan Blattmachr and Alan Gassman

Improve Your Professional Practice

Professional practice coach and workshop leader guru Rick Solomon, CPA will be providing a free live informative webinar for CPAs, lawyers and other professionals on the theme of building an ideal practice. This presentation will also describe a 6 hour webinar program that Rick offers for lawyers and other professionals that will occur on Thursday, September 11, 2014 and Friday, September 12, 2014 from 2pm to 5pm for $497 ($397 for anyone in the first two years of practice). Please feel free to attend this complimentary webinar, notwithstanding whether you might be interested in the September 11 and 12 program. We know from experience that what Rick says at this webinar can have an everlasting positive impact on your practice and professional life.

To register for the webinar please click here.

Rick Solomon started his CPA career at a New York City-based international CPA firm before going on to build one of the fastest growing CPA firms on Long Island. He developed and presented his renowned Sell Without Selling sales program to thousands of professionals in seven countries on three continents, helping them add millions of dollars in new business annually. Rick has engaged in lengthy study at the Sedona Institute in Arizona, developing a deep understanding of how to help free people from limiting beliefs and points of view. This freeing process has become the “secret ingredient” in all of Rick’s training programs. He served on the faculty of the esteemed Esperti-Peterson Institute Masters Program, a think tank of the nation’s leading estate planning attorneys. Currently, Rick Solomon is owner and CEO of RAN ONE Americas, a world leader in helping accountants and other advisors build lucrative and rewarding business advisory practices. He continues to travel worldwide presenting inspiring, motivational seminars and challenging thousands of CPAs and other professionals to expand their view of themselves and the value they bring to their clients. Rick‘s message has appeared in almost all industry related publications, including a feature story in the Sunday edition of the New York Times.

Webinar with Jonathan Blattmachr and Alan S. Gassman

Free webinar with Jonathan Blattmachr and Alan Gassman on Tuesday, August 12, 2014 at 12:00 p.m.

Help us decide the topic.

Please tell us what you would like to hear about.

The vast majority of tax and estate planning lawyers recognize that Jonathan Blattmachr is one of the very best estate planning and tax minds, and also a leading author and visionary in our profession.

Nothing he says or suggests goes unnoticed in the estate planning world and he has occupied this position for decades.

Please participate in this interesting and thought provoking process by letting us know what you would like to hear about.

Please email agassman@gassmanpa.com with topic ideas and general thoughts for this webinar.

To register for the webinar please click here.

Upcoming Seminars and Webinars

FREE WEBINAR:

VERSION 226.3 OF OUR ESTATEVIEW ESTATE TAX PROJECTION AND ILLUSTRATION SOFTWARE – A FREE WEBINAR

Alan Gassman, Ken Crotty and David Archer will be presenting a free 30 minute webinar on what is new with our EstateView software which will be featured later this year in Jason Havens’ excellent American Bar Association RPTE Probate and Property column.

Speakers: Alan Gassman, Ken Crotty and David Archer

Date: Monday, June 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

FREE WEBINAR:

CREDITOR AND OTHER PLANNING FOR SAME GENDER COUPLES

Date: Tuesday, June 10, 2014 | 7:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

BLOOMBERG BNA WEBINAR:

HIRING AND TERMINATING EMPLOYEES; WHAT TO DO, WHAT TO AVOID

Speaker: Alan S. Gassman, Esq., Colleen Flynn, Esq. and Dr. Stephanie Thomason

This is a very practical guide that your office manager is sure to enjoy. Let us know if you would like to see Alan Gassman’s slides for this presentation.

Date: Wednesday, June 18, 2014 | 2:00 – 3:00 p.m.

Location: Bloomberg BNA Tax & Accounting Online webinar

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

LIVE CLEARWATER PRESENTATION:

FICPA SUNCOAST CHAPTER MONTHLY MEETING

Alan S. Gassman will be speaking at the FICPA Suncoast Chapter’s monthly meeting on HOW TO PLAN, STRUCTURE, AND PROTECT WEALTH USING REVOCABLE AND IRREVOCABLE TRUSTS AND TRUST SYSTEMS. A COMPREHENSIVE OVERVIEW WITH A PRACTICAL PLANNING CHECKLIST AND PRACTITIONER TAX COMPLIANCE GUIDE.

Speaker: Alan S. Gassman

Date: Thursday, June 19, 2014 | 4:00 p.m. (100 minute presentation)

Location: Feather Sound Country Club, Clearwater, Florida

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

LIVE WEBINAR:

Free webinar with Jonathan Blattmachr and Alan Gassman on Tuesday, August 12, 2014 at 12:00 p.m. Topic to be announced. Please tell us what you would like to hear about!

The vast majority of tax and estate planning lawyers recognize that Jonathan Blattmachr is one of the very best estate planning and tax minds, and also a leading author and visionary in our profession.

Nothing he says or suggests goes unnoticed in the estate planning world and he has occupied this position for decades.

Please participate in this interesting and thought provoking process by letting us know what you would like to hear about.

Speakers: Jonathan Blattmachr and Alan Gassman

Date: Tuesday, August 12, 2014 | 12:00 p.m. (50 Minute Webinar)

Location: Online webinar

Additional Information: To register for this webinar please click here.

********************************************************

LIVE FT. LAUDERDALE PRESENTATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of ESSENTIAL GUIDE TO BASIC TRUST PLANNING for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE NEW JERSEY PRESENTATION:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it’s our second shore). Own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida’s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Attendees will receive Mr. Gassman’s book entitled “Florida Law for Tax, Business and Financial Planning Advisors,” which has a retail value of $34.95.

Our informative seminar, presented by Clearwater attorney Alan Gassman, highlights issues New Jersey lawyers should be aware of when handling matters for New Jersey residents who own Florida property, reside there part time, have interest in Florida businesses, or who are considering a move to Florida. The Florida Bar rules permit out of state lawyers to continue representation of Florida residents under rules that will be discussed.

Gain the knowledge you need to assist your clients with Florida matters, including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 4, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

********************************************************

LIVE SOUTH BEND, INDIANA PRESENATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please send us your questions, comments and suggestions for Alan Gassman’s talk on Planning with Variable Annuities and Analyzing Reverse Mortgages.

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities, and provide estate and tax planners with a number of strategies for understanding and planning with existing and contemplated contracts. With over One Trillion Dollars of US taxpayer money invested in annuity contracts, more and more clients are showing up in their estate planners’ offices with large annuity contracts and common misunderstandings about “guaranteed income” and “guaranteed rates of return” features. The presentation will cover common policy features, what is actually happening inside of a policy, illustration techniques, and changes that can be made to defer income tax and reduce overall tax liability. Minimum distribution rules that apply to variable annuity contracts will also be discussed.

Date:November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will once again be speaking at the Ave Maria School of Law Estate Planning Conference in Naples, Florida, whether he is invited or not! Hats off to Jonathan Gopman, Karen Grebing, Northern Trust and many others for having hosted one of the most enjoyable conferences in 2014.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, Naples, Florida

Additional Information: Please contact Karen Grebing at kgrebing@avemarialaw.edu for more information.

NOTABLE SEMINARS BY OTHERS

(We were not invited but will attend and are still excited!)

Live Gulfport, Florida presentation

Practical Ethics: The Ethical Questions that Practitioners Ask with attorney Sandra Diamond. This annual webinar will address the real ethical dilemmas faced by attorneys in elder law and special needs trusts drafting and administration.

Date: Wednesday, June 11, 2014 | 12-1:30 p.m

Location: Stetson University College of Law, Gulfport, Florida

Additional Information: To register for the webinar please click here.

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: TBD

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

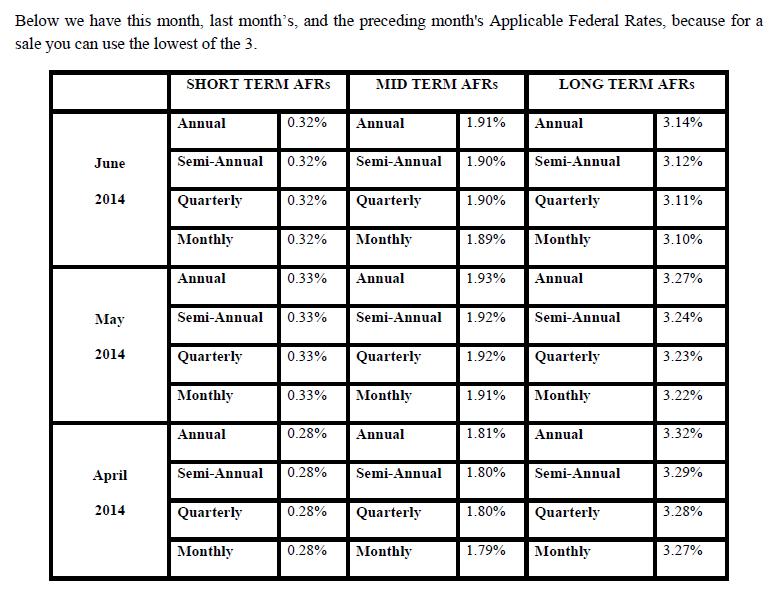

Applicable Federal Rates

The 7520 Rate for June is 2.2% and for May was 2.4%.