The Thursday Report 6.12.2014 – BP, Annuity, CLE, Cartoons, and me

Planning with Variable Annuities – Part 2

A Letter to the Editor of the Thursday Report, by Gene Stern

Like Its Oil Rig, BP’s Last Attempt to Dodge Payments Goes Up in Flames

Contempt of Court – Part 2: Self-Created Impossibility Defense, an article by Howard Rosen, Esq.

Thoughtful Corner – Are You Smarter Than Your Cell Phone?

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Planning with Variable Annuities – Part 2

When planning with variable annuities the first question is whether you should be doing this.

A great many clients come to us with variable annuities that they do not understand and are possibly not well suited for.

The following is Part 2 of excerpts from our recent live webinar entitled Planning with Variable and Other Annuity Products and may be of interest. We have had a great deal of feedback with respect to this, and criticism from those who are proponents of variable annuities.

If you would like to view the webinar please email agassman@gassmanpa.com

We welcome any and all questions, comments and suggestions for variable annuity planning.

We are working on a book with respect to this.

Here is Part 2 which covers items 7 through 12 of the 12 Reasons to be Cautious About Variable, “Index”, and “Guaranteed Income” Annuities:

7. Lifetime Gifts of Annuities Can Trigger Deferred Income. The transfer of an annuity other than to a spouse will generally cause the transferor to be subject to income tax as if all of the deferred income in the annuity had been withdrawn. This is treated as ordinary income to the donor at the time of the transfer. In other words, Section 72(e)(4)(C) provides that if a deferred annuity contract is transferred without adequate consideration, then a deemed distribution of the built-in gain in the contract gain occurs to the donor. An exception applies when the donee is a spouse or the transfer is made incident to a divorce. The donee or divorced recipient spouse will have the same investment in the contract as the donor spouse had.

8. Borrowing or Pledging Can Trigger Income Tax. Unlike life insurance products, monies borrowed from annuity contracts or by pledging of the contract are taxable to the extent that the contract has taxable income built up, and the transfer by gift of a contract (other than to a spouse) will trigger income tax as if the contract were sold to the transferee. Life insurance death benefits and loan elimination on death happens tax free, which is contrary to what occurs with annuities when the moneys therein are eventually paid out.

9. Not Necessary Under IRAs. Oftentimes annuities are sold to be held under IRA’s, where tax deferral is already in place, and costs imposed in these situations will normally reduce performance significantly.

10. Trusts as Holders of Annuity Contracts. Trusts are frequently constructed with the goal of preserving and protecting assets and avoiding federal estate tax at the level of a surviving spouse or one or more generations.

Annuities held by or payable to a revocable trust during the lifetime of a grantor will be treated for tax purposes as if they are owned by the grantor, although state law creditor protection might be compromised if a Statute protects individual owners and beneficiaries but not trusts.

Irrevocable trusts may be disregarded for income tax purposes, in which event annuity contracts owned by such trusts will be considered as owned by the grantor or a beneficiary depending upon which “grantor trust” rules apply.

Irrevocable trusts may also be “complex trusts” which are taxed as separate taxable entities in their own income tax brackets, the highest bracket of which is presently 39.6% on income not distributed that exceeds $12,150 a year. The 3.8% Medicare tax also applies above the $12,150 threshold for undistributed trust income.

11. Commissions Can Influence Judgment. Clients are not apprised of high commissions that can be 7% or more, annual 12b-1 fees that may be .3% per year or more, and other rewards that can influence a sales person in an organization to favor these over mutual funds or other investments that may pay much smaller commissions and cost the client much less in fees and much less exposure for surrender charges.

If an irrevocable trust requires that all income be distributed annually to the income beneficiaries, then the trust may be a Asimple trust@ for federal tax purposes.

Under Section 72(u) annuity contracts must be held by natural persons, or by an agent for a natural person. Private Letter Rulings 9204014 and 9204010 concluded that annuity contracts owned by trusts for specified individual beneficiaries would be treated as being owned by Anatural persons@ for tax deferral purposes. In these Rulings, the IRS ruled that where a non-grantor trust that has only one individual beneficiary holds an annuity contract, the contract can be treated as owned by a natural person.

Since then, a number of private letter rulings have come to the same conclusion, but none of these rulings (except possibly for one of them) have stated that an irrevocable trust that benefits multiple beneficiaries can be the owner of a tax-deferred annuity where the trustee has the ability to “spray” income and/or principal among multiple beneficiaries.

In addition, the IRS has not yet ruled on whether an unborn person is a “natural person” for the purposes of Section 72(u), which can be an important issue if a trust holding an annuity contract does not pay out to individual beneficiaries, but instead is held for the benefit of future generations indefinitely (or at least until the perpetuities period runs). However, Private Letter Rulings 199933033 and 200449016 suggest that unborn heirs are considered “natural persons.”

Most of the private letter rulings have been based upon factual scenarios where the trust documents specifically require that any one or more annuity contracts will be used solely for one named beneficiary, and in many of the rulings the contract itself is to be transferred to the one individual beneficiary that the contract has been purchased to benefit. For example, Private Letter Ruling 201124008 allowed a multiple beneficiary trust to hold multiple annuity contracts, but the trust required that each separate contract was designated for a separate individual beneficiary, and that each contract would eventually be distributed to the designated beneficiary. It is not known why each of the letter rulings were couched in these terms.

12. Difficult to Get an Objective Second Opinion. It is very hard to get an objective 2nd opinion from those who feel strongly that these are worthwhile investments and those who would oppose them cannot be nearly as well compensated as those who support them.

The non commissioned annuities sellers and those who structure low cost private annuity wrappers for larger situations may be good sources of advice in this area.

We have enclosed a number of articles, both pro and con, and it seems clear to us that clients will be well advised to carefully consider their alternative and not jump blindly into an annuity product situation.

13. Large Surrender Charges. A typical surrender charge schedule would be 8% in years one and two, 7% in year three, 6% in year four, 5% in year five, 4% in year six, 3% in year seven, and 2% in year eight.

A Letter to the Editor of the Thursday Report

by Gene Stern

For over 30 years, Gene Stern has helped develop and service numerous corporate retirement plans. He has assisted hundreds of employees implement suitable retirement accounts. Economic uncertainty has jeopardized the viability of some of these employees to meet their retirement income needs.

As President of Innovative Retirement Income Solutions™ (IRIS), LLC, Gene has embarked on a mission to work with these and other employees to objectively understand and implement creative solutions that will assist them in finding a retirement date to be anticipated instead of dreaded.

Gene has earned the Chartered Retirement Planning Counselor (CRPC®) designation. He is a registered representative with Lincoln Financial Advisors Corp. and is one of its many Chartered Retirement Planning Counselors® located throughout the United States. Lincoln Financial Advisors Corp. is a member of Lincoln Financial Group, a Fortune 500 Company. For more information, including a copy of the most recent SEC reports containing current balance sheets, please visit www.LFG.com.

Alan:

Thank you for your attempt to produce an evenhanded report on Variable Annuities. I use both variable and fixed annuities in my practice for the right reasons, as described herein.

I agree that many annuities have been sold for the wrong reasons, but please do not paint the entire industry with a bias.

I cannot tell you how many clients have thanked me for protecting a portion of their income in retirement without having to worry about market downturns.

One thing that you have not yet mentioned is that the built up income in a deferred annuity can be used to pay for long term care insurance. I think that it is very important that you cover that in a future edition of your newsletter.

Here is an example to show you what the populace is thinking: I recently did a financial plan for a couple, each aged 65. $2MM net worth and no debt and both will qualify for the maximum SS benefit. In doing my plan, I did not recommend that they consider the purchase of an annuity as they did not need protected income to meet their “needs expense”. I did suggest the annuity purchase of One America to protect assets from LTC needs on a joint basis. When all was said and done, the husband, who is an engineer, asked me why I did not propose a Fixed Index Annuity. I asked him why he thought he needed it and he said: I have to RMD on my 401k of $550K and I would like to have the highest possible income from those assets without having to worry about the market tanking. With drawdown rates now being purported to be 3.5%, I was able to use that 401K to create an average of 5.5% drawdown factor of an increasing value for the first few years and even when the account value fell to zero, this contract from Allianz, will still have a potentially increasing income due to the fact the index does not go away and this was on a joint life basis. This $550K was able to generate the same income that an invested account needed to be worth $748K at a 3.5% drawdown.

I love your humor. Keep up the good work. I hope my comments help you.

Gene

Like Its Oil Rig, BP’s Last Attempt to Dodge Payments Goes Up in Flames

By John D. Goldsmith, J.D. and Alan S. Gassman, J.D., LL.M.

— A historic decision made in an unusual manner by the Supreme Court on an emergency motion gives good insight to predict that the class action settlement agreement will be enforced.

— Claimants, CPAs, and lawyers are ready to receive adjudications and appeal and contest individual claim appeals.

GENERAL HISTORY – Delay tactics until recently.

The BP class action settlement that was blessed by U.S. Federal District Court Judge Barbier in March 2012 led to the appointment of Patrick Juneau as the Claims Administrator, and the hiring of the PricewaterhouseCoopers and the Postlethwaite & Netterville APAC accounting firms as program vendors for the Court-Supervised Settlement Program to facilitate the adjudication of claims using the court approved private adjudication process.

Up through October 2, 2013, the date BP swayed an appellate court to order a re-examination of the settlement to gauge the validity of payments, a high percentage of those claims were appealed, however, BP still paid out over $3.5 billion.

While claims have continued to flow in at a high velocity, BP was successful in delaying the payment of claims by actions that it filed with the Fifth Circuit Court of Appeal, on the grounds that the class settlement action should have explicitly required claimants to show that their damages were directly attributable to the April 2010 oil spill.[1]

On March 3, 2014 a three judge panel of the Fifth Circuit Court of Appeal found by 2-1 decision that no such direct causation would need to be proven, recognizing that the entire economy of the counties in Louisiana, Mississippi, Alabama, and Florida that are on or have direct water access to the Gulf of Mexico suffered miserably as the result of the spill.1

In exchange for waiving any proof of causation requirement, BP avoided what could have been more than $40 billion in criminal and civil penalties for the criminal acts that it was later indicted for and pled guilty of.[2]

After the 2-1 decision of the Fifth Circuit Court of Appeals’ panel, the question was posed to the entire panel of 14 judges and the majority of those judges decided to reject BP’s request to override the three judge panel on May 19, 2014.

IMMEDIATE HISTORY – U.S. denies a stay while it determines whether it will hear an appeal on BP’s claim that it should not have to pay claimants who cannot prove that the spill caused their reduction of income or losses.

On May 28, 2014, BP appealed to the U.S. Supreme Court for a stay, which is an order that would have enabled BP to not pay claims while it now appeals the causation decision of the three judge Fifth Circuit panel to the U.S. Supreme Court.

Procedurally, only Judge Scalia, who handles emergency motions to the Supreme Court, needed to consider the requested stay. He has the right to rule on the motion himself.

Instead, Judge Scalia brought the entire nine member U.S. Supreme Court into deliberation on the matter, and the decision of the Court, rendered only 12 days after BP filed for its emergency stay was a resounding thumbs down to what it asked for. This heavy-handed action suggests that the Supreme Court will not rule in BP’s favor on the question of causation.

The “mandate” to pay class action claims now stands and requires the Claims Administrator to again process and pay business economic loss claims. Payment of almost all business economic loss claims has been shut down since the initial stay on October 2, 2013 by an earlier court order, so there is a very large backlog.

While the denial of BP’s emergency motion does not mean the Supreme Court will not agree to hear the case, it now seems unlikely. The reason is that if the majority of the Court had found that BP’s arguments had merit, it would have granted the stay, preventing payment. BP argued that, “Unless the mandate is recalled and stayed, countless awards totaling potentially hundreds of millions of dollars will be irretrievably scattered to claimants that suffered no injury traceable to BP’s conduct.”

To obtain a stay, BP had to show that (1) there was a “reasonable probability” that the Court would grant cert; (2) that there was a “significant possibility” that the Fifth Circuit’s decision would be reversed; and (3) that BP would be irretrievably harmed if the stay were not granted.

BP claimed that the class action settlement could not be interpreted consistent with Rule 23 and Article III of the Constitution[3] to “require payment to claimants who have no plausible claim that their injuries were caused by the spill.” By rejecting the emergency motion the Supreme Court gave a strong hint that it will deny hearing the appeal. That is very good news for the business claimants, and their employees, who have suffered from BP’s continued actions to evade its class action settlement.

BP has thirty (30) days to appeal each adjudicated claim, and typically does so on the thirtieth (30th) day. Appealed claims have typically taken at least 14 days to resolve and about 20 business days after ruling to receive payment. BP has to pay an additional five percent (5%) when it loses an appeal to help compensate the claimant and/or its advisors for the additional work needed.

If BP is successful in its ultimate appeal of the Fifth Circuit’s decision, those claims that have been paid before any such victory occurs will be cows out of the barn that cannot be brought back in, and it seems doubtful that the U.S. Supreme Court will accept BP’s appeal or adjudicate in its favor given the timing and unanimity of the Fifth Circuit’s decision.

The other issue at hand involves whether claimants will have to match cash revenues to expenses at different times based on an order dated December 24, 2013 whereby the Fifth Circuit Court of Appeals ordered the Claims Administrator to, “adopt and implement an appropriate protocol or policy for handling BEL claims in which the claimant’s financial records do not match revenue with corresponding variable expenses”. As a result of this, the Claims Administrator issued 88 pages of Policy 495 which is aimed at a small number of industries which are professional services, farming, construction, and education.

Please stay tuned as this situation continues to develop, and BP pays the price for negligence and criminal action that will be studied and criticized in historical and business textbooks for centuries to come.

__________________________

[1]http://www.nytimes.com/2012/02/21/us/ahead-of-bp-oil-spill-trial-settlement-talks-pick-up.html?pagewanted=all&_r

[2] BP plead guilty to manslaughter charges and agreed to pay $4.5 billion in government penalties to resolve the criminal charges that stemmed from the oil spill. http://money.cnn.com/2012/11/15/news/bp-oil-spill-settlement/

[3] Rule 23 deals with class action lawsuits and can be found here: http://www.law.cornell.edu/ rules/frcp/rule_23. The pertinent sections of Article III of the Constitution is as follows:

Section 1.The judicial power of the United States, shall be vested in one Supreme Court, and in such inferior courts as the Congress may from time to time ordain and establish. The judges, both of the supreme and inferior courts, shall hold their offices during good behavior, and shall, at stated times, receive for their services, a compensation, which shall not be diminished during their continuance in office.

Section 2.The judicial power shall extend to all cases, in law and equity, arising under this Constitution, the laws of the United States, and treaties made, or which shall be made, under their authority;–to all cases affecting ambassadors, other public ministers and consuls;–to all cases of admiralty and maritime jurisdiction;–to controversies to which the United States shall be a party;–to controversies between two or more states;–between a state and citizens of another state;–between citizens of different states;–between citizens of the same state claiming lands under grants of different states, and between a state, or the citizens thereof, and foreign states, citizens or subjects.

In all cases affecting ambassadors, other public ministers and consuls, and those in which a state shall be party, the Supreme Court shall have original jurisdiction. In all the other cases before mentioned, the Supreme Court shall have appellate jurisdiction, both as to law and fact, with such exceptions, and under such regulations as the Congress shall make.

The trial of all crimes, except in cases of impeachment, shall be by jury; and such trial shall be held in the state where the said crimes shall have been committed; but when not committed within any state, the trial shall be at such place or places as the Congress may by law have directed.

Contempt of Court – Part 2: Self-Created Impossibility Defense, an article by Howard Rosen, Esq. and Patricia Donlevy-Rosen

HOWARD ROSEN is an “AV Preeminent” rated Attorney and a Certified Public Accountant practicing law in Miami, Florida, as a partner in the Coral Gables firm of Donlevy-Rosen & Rosen, P.A. Mr. Rosen served as an ADJUNCT PROFESSOR and LECTURER AT LAW at the University of Miami School of Law for twenty years, and is a frequent lecturer on the subject of asset protection.

Mr. Rosen is the founding author of the BNA TAX MANAGEMENT PORTFOLIO titled “ASSET PROTECTION PLANNING”, which is used by lawyers, CPA’s, and estate planners nationwide in researching asset protection issues. He was also the co-author of another BNA TAX MANAGEMENT PORTFOLIO titled “U.S. TAXATION OF FOREIGN ESTATES, TRUSTS, and BENEFICIARIES” and has published numerous articles in professional and academic journals on these subjects, and he is the Editor/Publisher of The ASSET PROTECTION NEWS.

Mr. Rosen is the CHAIRMAN OF THE ASSET PROTECTION COMMITTEE OF THE AMERICAN ASSOCIATION OF ATTORNEY-CPA’S, he is a member of TAX MANAGEMENT’S ADVISORY BOARD ON ESTATES, GIFTS AND TRUSTS, the SOUTHPAC OFFSHORE PLANNING INSTITUTE ADVISORY BOARD, and the Tax and International Law Sections of the Florida Bar.

Mr. Rosen concentrates his nation-wide law practice in asset protection planning.

PATRICIA DONLEVY-ROSEN is an “AV Preeminent” rated Attorney practicing law in Miami, Florida, as a shareholder in the firm of Donlevy-Rosen & Rosen, P.A. She is also admitted to practice law in New York. Ms. Donlevy-Rosen is a frequent lecturer on asset protection, corporate and business planning subjects.

Ms. Donlevy-Rosen is the author of an RIA Tax Advisors Planning Series publication, “ASSET PROTECTION PLANNING”, which is used by lawyers, CPA’s, and estate planners nationwide in researching asset protection issues. Ms. Donlevy-Rosen is the author of three chapters on asset protection in “THE BIGGEST LEGAL MISTAKES PHYSICIANS MAKE AND HOW TO AVOID THEM”, and has also published asset protection articles in professional and other publications such as Tax Management’s Estates, Gifts and Trusts Journal, and others.

Ms. Donlevy-Rosen is a member of the Board of Advisors of the Southpac Offshore Planning Institute, the Asset Protection Planning Committee of the Real Property, Probate and Trust Law Section of the ABA and the Business Law and Real Property, Probate and Trust Law Sections of the Florida Bar.

Ms. Donlevy-Rosen’s nation-wide law practice is concentrated in asset protection planning and related matters.

INTRODUCTION. “Will I go to jail if I set up an offshore trust?” The short answer continues to be “no” (See, APN Vol. XVII, No. 1, for background on contempt). The more complete answer is “not if the trust is competently prepared and properly implemented” (See, APN Vol. VII, No. 2, for background on the importance of competent counsel). Case in point: the 2014 Bellinger case.

BELLINGER CASE. In 2006 the predecessor of the plaintiff bank made a loan to a company Mr. Bellinger was involved in and obtained personal guarantees from him and two others. Although not mentioned in the Court’s decision, the other two individuals had agreed to indemnify Mr. Bellinger should his personal guarantee be called upon. Those individuals had made good on previous indemnifications, and Mr. Bellinger believed that they would continue to honor their agreements.

The loan went into default in February 2011, and Mr. Bellinger and the others were sued by the bank on their personal guarantees in May 2011. On November 30th, 2011, Mr. Bellinger created a Cook Islands Trust (“Trust”), funded with approximately $1.7 million in assets. MAKE NO MISTAKE: it is always best to set up an asset protection trust BEFORE a claim arises, because, depending upon the specific circumstances, it is often not possible to set up a trust after a claim arises. To be clear: in this case the claim arose when the loan went into default.

The bank won the case in January 2013, and the Court entered a final judgment against Mr. Bellinger for $4,923,797.57, plus post-judgment interest. The bank then sought to collect its judgment from Mr. Bellinger, but was unable to do so. Mr. Bellinger, as ordered by the Court, requested the Cook Islands trustee to send back all of the funds in the Trust to pay the judgment. The trustee considered his request and refused. The bank then asked the Court to incarcerate Mr. Bellinger for contempt, pointing out that “[p]rior to the entry of the final judgment, but several months after [Plaintiff] filed [its] lawsuit, Bellinger created an offshore Cook Islands Trust.” The bank alleged that “Bellinger created the Cook Islands Trust in order to shield his assets from the final judgment that was ultimately entered against him by this Court.” The bank further asserted that Mr. Bellinger could not argue that it was impossible for him to comply with the final judgment because, by creating the Trust, his inability to comply was self-created.

In opposition to the bank’s motion to have him incarcerated, Mr. Bellinger argued that the bank was overreaching by seeking to have him incarcerated because he lacked the financial ability to pay the monetary judgment entered against him. In response to the bank’s argument that the Solow case (APN, Vol. XIX, No. 1) should be controlling, Mr. Bellinger argued that his case was not a disgorgement action seeking the refund of wrongfully-obtained funds (as in Solow), but rather a garden variety civil action on a personal guaranty following a failed commercial loan. Mr. Bellinger argued that the Trust was lawfully created before any final judgment was entered against him, and that the bank was improperly seeking to have him held in contempt because he was unable to pay a civil judgment. Additionally, Mr. Bellinger argued that he should not be held in contempt because he lacked the power to have assets released from the Trust in order to comply with the final judgment. Mr. Bellinger explained that he established the Trust because he had recently been divorced, needed to revise and update his estate planning (quite customary), and, in particular, he wanted his updated estate planning to assure the financial security of his daughter (who was in need of financial assistance). Mr. Bellinger testified that he could not compel payment of the judgment from the Trust (he had asked and the trustee refused), that he could not replace the trustee, and that the Trust was irrevocable. The Court found Mr. Bellinger to be a credible witness, and the Court concluded that he had adequately shown an inability to comply with its final judgment.

It is noteworthy that from March 2012 to May 2013, Mr. Bellinger had received a monthly distribution from the Trust which he used to cover “overhead costs of [his] support.” After May 2013, such monthly trust distributions were made to Mr. Bellinger’s girlfriend (who was also a discretionary beneficiary of the Trust). Thus, he was able to benefit from his Trust while the creditor was trying to reach his assets – not possible with a domestic trust.

In reaching its decision, the Court correctly relied on the controlling U.S. Supreme Court case of Maggio v. Zeitz: “Civil contempt orders are coercive in nature. … “To jail one for contempt for omitting an act he is powerless to perform would reverse [that] principle and make the proceeding purely punitive, to describe it charitably. Contempt orders will not be issued if the court finds no willful disobedience but only an inability to comply.” (emphasis added) (See, APN Vol. XVII, No. 1) Mr. Bellinger was (properly) not held in contempt.

ONE MORE THING. The Court stated that the bank appeared to assert a fraudulent transfer allegation in support of its contempt motion. However, even if the bank had successfully argued and won a fraudulent transfer argument, it would have been to no avail. Consider this: since the trustee refused to return trust assets when Mr. Bellinger was faced with contempt incarceration, it is very likely to have refused to honor a “return the assets” order of a U.S. federal court. After all, no U.S. court has jurisdiction (power) over a Cook Islands trustee (as it would with a domestic trustee), and, in order for any fraudulent transfer finding to have effect, a court must have jurisdiction over the transferee (in this case, the trustee) so it can enforce its return order with threats of sanctions.

SUMMARY. Court decisions have consistently held that civil contempt incarceration can only be used to obtain compliance with a court order – it cannot be used to punish, and, it can only be used when the party subject to the court order has the present ability to comply. Incarcerating a party for failing to comply with an order which is impossible to comply with is punishment and, under the long-standing law set forth by the U.S. Supreme Court, cannot be done.

To read part 1 of Howard’s article please click here.

Thoughtful Corner –Why Your Smart Phone May Be Much Smarter Than You Are. Who Works For Who And Why

It is great to get messages and be able to reply to them on the go, or anywhere, but the great majority of professionals make a grave mistake by routinely answering questions and addressing opportunities with one finger, one letter at a time, without circling back to expound, connect or follow up.

Here is why that is a grave mistake:

- When you type, dictate a response for transcription, or call someone you have a much easier flow of information, detail and creativity and warmth to convey.

- When you reply by phone you are much less likely to follow up or think through what the other person wants or needs.

- The recipient is not going to give as much credence or thought to what comes back with the suffix “please excuse typos and grammar from this phone”.

- And, for Pete’s sake, gosh darn it, why do so many people on phones reply only to the sender? Is there an epidemic of “reply all” keys not working?

So when I am away from the office and answering emails on my phone:

1. I copy key people in my organization as a signal for them to follow up with me on the matter. In fact, if I cc “PP” my assistant gets this email and prints it and puts it on my printer so that I can follow up later, and I make sure that I do.

2. I have my assistant print up the emails I send on my phone whenever I am away from the office for a long period of time. I use these to also make sure that I have billed for any significant time spent reviewing messages or documents on my phone.

3. I am mindful that responses and interaction will not be as rich, warm, or meaningful than it would be if I had a keyboard or a dictaphone in front of me, and act accordingly.

So do not become a scattered mess like so many of those who we observe.

The phone is to be our servant, not our master or downfall.

Humor! (Or Lack Thereof!)

Upcoming Seminars and Webinars

BLOOMBERG BNA WEBINAR:

HIRING AND TERMINATING EMPLOYEES; WHAT TO DO, WHAT TO AVOID

Speaker: Alan S. Gassman, Esq., Colleen Flynn, Esq. and Dr. Stephanie Thomason

This is a very practical guide that your office manager is sure to enjoy. Let us know if you would like to see Alan Gassman’s slides for this presentation.

Date: Wednesday, June 18, 2014 | 2:00 – 3:00 p.m.

Location: Bloomberg BNA Tax & Accounting Online webinar

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

LIVE CLEARWATER PRESENTATION:

FICPA SUNCOAST CHAPTER MONTHLY MEETING

Alan S. Gassman will be speaking at the FICPA Suncoast Chapter’s monthly meeting on HOW TO PLAN, STRUCTURE, AND PROTECT WEALTH USING REVOCABLE AND IRREVOCABLE TRUSTS AND TRUST SYSTEMS. A COMPREHENSIVE OVERVIEW WITH A PRACTICAL PLANNING CHECKLIST AND PRACTITIONER TAX COMPLIANCE GUIDE.

Speaker: Alan S. Gassman

Date: Thursday, June 19, 2014 | 4:00 p.m. (100 minute presentation)

Location: Feather Sound Country Club, Clearwater, Florida

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

LIVE FT. LAUDERDALE PRESENTATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of ESSENTIAL GUIDE TO BASIC TRUST PLANNING for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE NEW JERSEY PRESENTATION:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it’s our second shore). Own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida’s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Attendees will receive Mr. Gassman’s book entitled “Florida Law for Tax, Business and Financial Planning Advisors,” which has a retail value of $34.95.

Our informative seminar, presented by Clearwater attorney Alan Gassman, highlights issues New Jersey lawyers should be aware of when handling matters for New Jersey residents who own Florida property, reside there part time, have interest in Florida businesses, or who are considering a move to Florida. The Florida Bar rules permit out of state lawyers to continue representation of Florida residents under rules that will be discussed.

Gain the knowledge you need to assist your clients with Florida matters, including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 4, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

********************************************************

LIVE SOUTH BEND, INDIANA PRESENATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please send us your questions, comments and suggestions for Alan Gassman’s talk on Planning with Variable Annuities and Analyzing Reverse Mortgages.

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities, and provide estate and tax planners with a number of strategies for understanding and planning with existing and contemplated contracts. With over One Trillion Dollars of US taxpayer money invested in annuity contracts, more and more clients are showing up in their estate planners’ offices with large annuity contracts and common misunderstandings about “guaranteed income” and “guaranteed rates of return” features. The presentation will cover common policy features, what is actually happening inside of a policy, illustration techniques, and changes that can be made to defer income tax and reduce overall tax liability. Minimum distribution rules that apply to variable annuity contracts will also be discussed.

Date:November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, Naples, Florida

Speakers: Alan S. Gassman will be once again be speaking at the Ave Maria School of Law Estate Planning Conference in Naples, Florida along with Jonathan Gopman, Bill Snyder, Elizabeth Morgan, Greg Holtz, Jerry Hesch, and others. Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

And don’t forget to have a great weekend in Naples with your significant other, or anyone who your significant other does not know! Domino’s Pizza is extra.

Additional Information: Please contact Karen Grebing at kgrebing@avemarialaw.edu for more information.

NOTABLE SEMINARS BY OTHERS

(WE WERE NOT INVITED, BUT WILL ATTEND AND ARE STILL EXCITED)

LIVE ORLANDO PRESENTATION

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: TBD

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

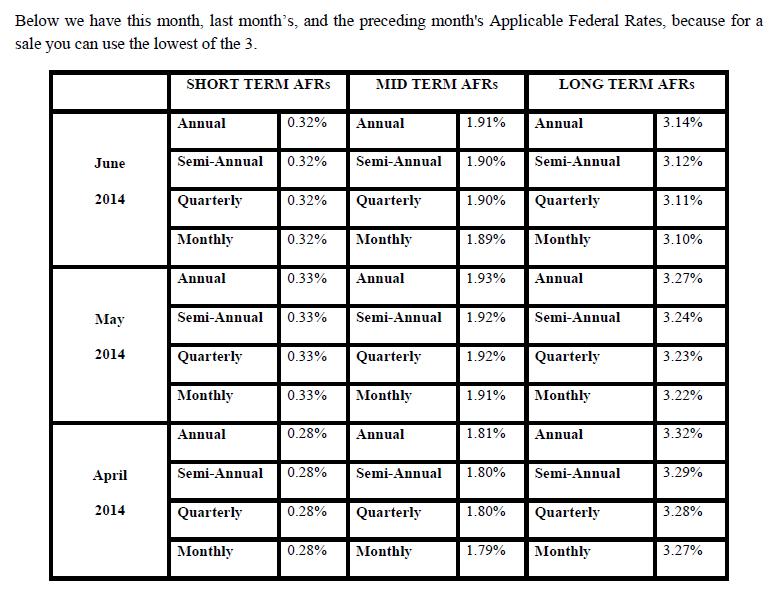

Applicable Federal Rates

The 7520 rate for June is 2.2% and for May was 2.4%.

The 7520 rate for June is 2.2% and for May was 2.4%.