The Thursday Report – 5.8.2014 – Certs, Time Clocks, No Mr. Spock’s

Hesch on Certs – Part 2 of 3

Charitable Donations and Fraudulent Transfers

New Belize Regulations

Time for Tax Revolution – Not Tax Reform

Doctor, Does Your Office Have a Time Clock, and If Not, Why?

Words of Wisdom from Bob Burke

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Hesch on Certs – Part 2 of 3

On April 22 Jerry Hesch spoke at a donor’s luncheon for Ruth Eckerd Hall in Clearwater, Florida and did a great job of showing how taxes can be saved when donors wish to benefit a charity and integrate charitable planning with their family and income tax situations.

Jerry’s discussion of charitable remainder trusts is as follows:

Using Charitable Remainder Trusts

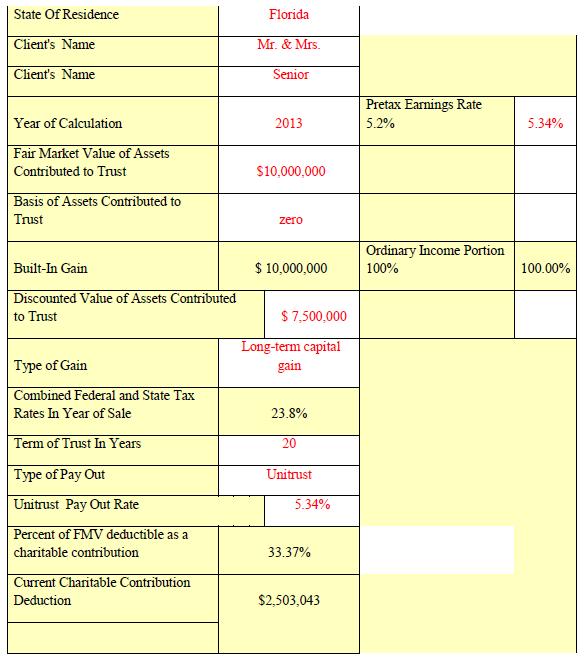

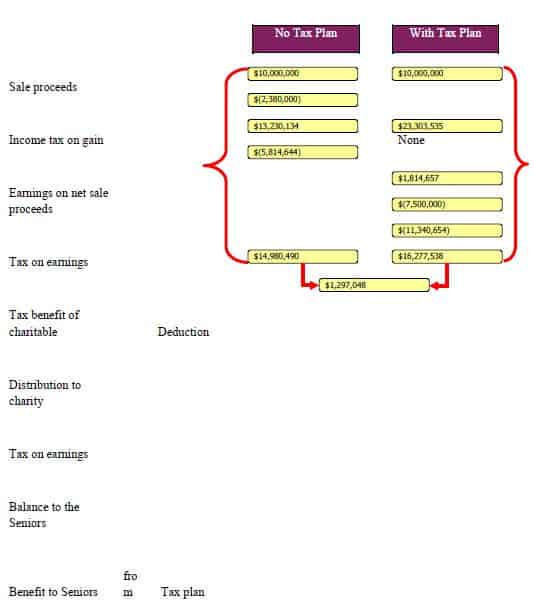

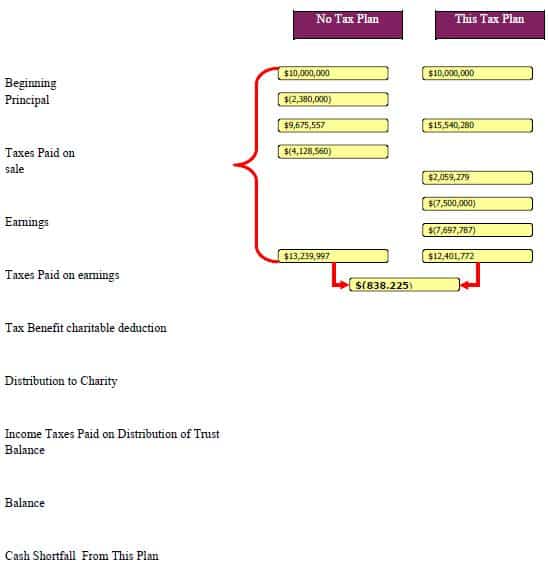

An individual intends to sell aero basis stock in a public company, or an interest in a private company, in the near future for $10,000,000. Without any income tax planning, the $10,000,000 capital gain will be subject to the 20% capital gains rate and the 3.8% Medicare surcharge, a combined 23.8% effective Federal income tax rate. If the individual lives in a state with a state income tax rate, there can be an additional income tax, ranging as high as 14.3% in California. Thus the combined state and Federal income tax rate on the capital gain can be as high as 38.1% in states like California (and New York City with a city income tax).

Assume the individual is a resident of Florida so that there are no state income taxes.

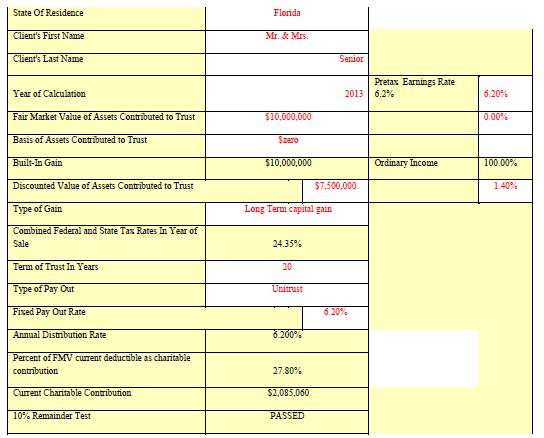

With no tax planning, the individual sells the asset for $10,000,000, pays the $2,380,000 of capital gains tax and is left with $7,620,000 to invest.

Since a charitable remainder trust (a “CRT”) does not have to pay any income taxes on its income (including no tax on the gain realized from the immediate sale of any asset contributed to the CRT), the CRT will have $10,000,000 to invest.

Over one’s life (or a maximum of 20 years if the CRT is for a fixed term), the extra income for the trust term (the income generated by the investment of the $2,380,000 that would have otherwise been paid as capital gains tax) replaces the amount that is given to the charity at the end of the CRT term. In effect, instead of paying the $2,380,000 of income taxes on the capital gain, that income tax savings, and the income tax savings from the immediate charitable income tax deduction, is used to provide the funds needed to give to the charity at the end of the CRT term.

Financially, one can receive the annual income from $10,000,000 instead of only the income from $7,620,000.

This illustration shows that the individual is no better off by using the CRT, but is no worse off. In effect, it does not cost the individual anything to have the CRT distribute $7,500,000 to charity at the end of the CRT term.

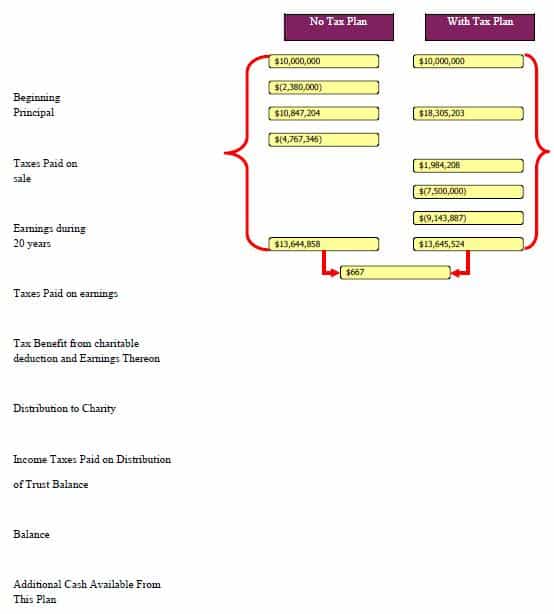

The individual can actually be better off if the sale proceeds can produce an investment rate of return greater than the 5.2% rate of return used in the prior illustration. The next illustration shows that the individual can actually be better off and still give the same amount to charity if the investment rate of return is assumed to be 6.2% over the CRT term.

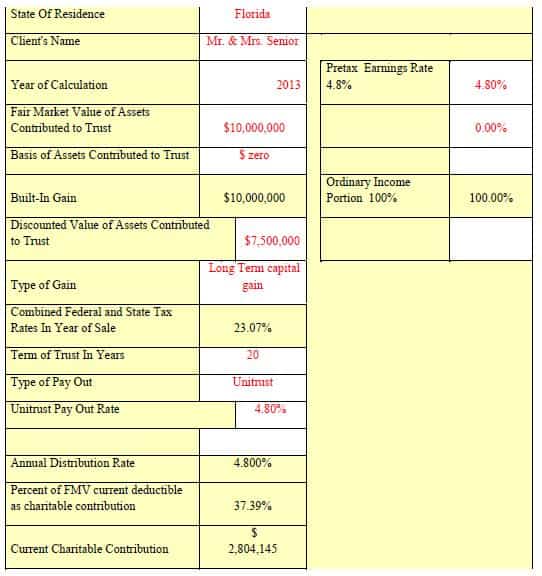

The individual can be worse off if the investment rate of return is below expectations. The next illustration shows that if the investment rate of return is 4.8 %, the individual would have been better off without the CRT. But, what this shows is that it costs the individual only $838,225 to give the $7,500,000 to a charity at the end of the CRT term.

- Early Termination of Charitable Remainder Trusts

A charitable remainder trust (“CRT”) is a widely-used charitable planning technique that provides the settlor with significant income tax benefits and a source of future payments, followed by the distribution of trust assets to one or more charities at the end of the trust term. The CRT generates an immediate income tax charitable deduction (equal to the present value of the interest passing to the charitable remainder beneficiary) that can offset ordinary income.[1] And the CRT can be used to eliminate the income tax on the gain realized from the sale of appreciated assets. The CRT creates a financial benefit because the person who transfers assets to the CRT receives (or can gift to one or more others) an annuity or unitrust payment for life or for a fixed term.

Exemption inception: Charitable Donations and Fraudulent Transfers

On July 1, 2013, the Florida Legislature added another provision to the fraudulent transfer law that helped to protect nonprofit organizations from having to give back contributions made before bankruptcy. [2] Under bankruptcy law, if a transfer is found to be fraudulent the bankruptcy trustee may avoid it and require the transferee to repay the amount that was transferred. This affected nonprofits as well so, for example, if a person donated $50,000 to a church then filed for bankruptcy (within the statutory period for fraudulent transfers) then the church may be liable for that $50,000. This causes a problem for nonprofits when they have already spent some of the money not expecting this to happen.

Now under 726.109 (7)(a)-(b), there are more protections for nonprofit organizations. The relevant statute is as follows:

(a). The transfer of a charitable contribution that is received in good faith by a qualified religious or charitable entity or organization is not a fraudulent transfer under s. 726.105(1)(b).

(b) However, a charitable contribution from a natural person is a fraudulent transfer if the transfer was received on, or within 2 years before, the earlier of the date of commencement of an action under this chapter, the filing of a petition under the federal Bankruptcy Code, or the commencement of insolvency proceedings by or against the debtor under any state or federal law, including the filing of an assignment for the benefit of creditors or the appointment of a receiver, unless:

1. The transfer was consistent with the practices of the debtor in making the charitable contribution; or

2. The transfer was received in good faith and the amount of the charitable contribution did not exceed 15 percent of the gross annual income of the debtor for the year in which the transfer of the charitable contribution was made.

This statute protects nonprofits that accept the contribution in good faith, as in they were unaware of the person’s intention to file bankruptcy. However, there is an exception under (b). If the contribution was made by a natural person within 2 years before commencement of the action, filing of the petition or commencement of the insolvency proceedings, whichever is earlier, then it was a fraudulent transfer. This exception has 2 exceptions within it which is sort of like the movie Inception except it is in a statute and is less exciting than the movie; we can call it “Inexception.” The exception is for when the transfer was consistent with previous practices of the debtor in regards to making charitable contribution or when the transfer was accepted in good faith and the donation is not more than “15% of the gross annual income of the debtor for the year that the donation was made.”[3] This means that insolvent debtors are able to make limited charitable contributions to nonprofit organizations as long as it falls under the exceptions listed in the statute.

NEW BELIZE REGULATIONS

Many advisors use Belize trusts and sometimes Belize international business companies because of the user friendly and owner protective legislation and trust industry there.

New accounting regulations in Belize took effect on October 12, 2013, which need to be understood and reckoned with. The regulations stipulate that accounting/financial records for Belize entities must be maintained and be accessible at a designated location. A copy of the Belize Accounting Records (Maintenance) Act 2013 can be viewed by clicking HERE.

In summary, the Act requires that financial records (further defined as “financial statements; general and subsidiary ledgers; sales slips; contracts and invoices; and records and documents relating to assets and liabilities, all sums of money received and expended and the matters in respect of which the receipt and expenditure take place, all sales and purchase, and all financial transactions”) are kept in one of the following locations:

1. In Belize, at the office of the entity’s Registered Agent; or

2. Outside of Belize, at a designated location to be provided to such Registered Agent by written resolution. Such resolution should include language authorizing such Belize Registered Agent to request up to five (5) years of financial records at any time and that such financial records will be provided to the Registered Agent within one (1) business day of receipt of such request.

Clients with offshore trusts where a Belize company serves as Trustee or Co-Trustee are also required to comply with the new accounting regulations. We have developed a Written Resolution (click here to view) that can be completed by clients and provided to the Belize Trust, Co-Trustee or Registered Agent allowing the client to maintain financial and accounting records at his or her home, office or CPA’s office.

Failure to satisfy the above requirements will constitute professional misconduct on the part of the Belize Registered Agent, punishable by suspension or revocation of license and/or imposition of a fine.

Clients are strongly encouraged to provide the requested documentation to Belize Registered Agents as soon as possible to ensure the continuation of a favorable professional relationship.

Time for Tax Revolution – Not Tax Reform

by Denis Kleinfeld

Some of our articles are factual and some can be opinion.

Many friends and colleagues share Denis Kleinfeld’s views of the subject of the below article, but if you disagree please consider that this is not the opinion of the Thursday Report. If you agree then maybe it is.

Seeing what has been happening in Russia and the Ukraine we can only be thankful to have the opportunity to thrive in the largest and most successful democracy in history.

Along with democracy comes our right to help make things better.

Please send us your suggestions and opinions, especially if they are complimentary to the Thursday Report, Kentucky Fried Chicken, and other vitally important national treasures.

Denis’ editorial is as follows:

The Washington Times reports (www.washingtontimes.com/news/2014/apr/19/scalias) on Supreme Court Justice Antonin Scalia’s speech at the University of Tennessee College of Law this past Tuesday.

In response to a question asked by a student about his interpretation of the constitutionality of the income tax he said that the government has the constitutional right to implement a tax, “but if it reaches a certain point, perhaps you should revolt.”

While not going further and defining exactly what kind of revolution he was musing about, Justice Scalia did go on to tell students that they had every right to express criticism of the government.

This lead me to start thinking about, what is the Constitution exactly? That is, how can the relationship between the people and the government be described as a matter of law? What was it supposed to do? And, is the Supreme Court enforcing the agreed to written provisions?

There is a branch of constitutionalists who take the position that the constitution is a living document. In fact many legal academicians and prominent lawyers take this position when they believe that they are achieving a higher and nobler purpose of one kind or another.

Justice Scalia, according to the article, said that “The Constitution is not a living organism for Pete’s sake…It’s a law. It means what it meant when it was adopted.”

Here’s where Justice Scalia and I part ways. I think he misunderstands the nature of the Constitution. It is not a law. A law is passed by a government and imposed on its citizens.

What the Constitution is is a contract.

It is the agreement by the citizens to give up some of their totality of rights conferred upon them by the Creator to the government. Thereby, each of the parties to this contract has agreed to the exchange of both rights and duties.

The Constitution was meant as a limitation on the government. A restriction of power. Essentially the People agreed that the government would have certain powers but was prohibited from interfering with the rights–Constitutional rights–that the People did not cede and did not intend to cede.

With the 16th Amendment to the Constitution, the People permitted the government to impose an income tax.

But does that mean there is no Constitutional limitation on this taxing power that has been ceded by the People to the government?

Justice Scalia seems to think so.

I don’t. I think that there is fundamental principle upon which the Constitution is founded which is ignored by both the conservative and liberal Justices. They both like to wrap themselves with the cloak of nobility and righteousness when it suits their purpose. Principle be damned.

The foundation principle of the Constitution is that the government must stay out of the People’s private lives and stay out of their private parts. Whatever taxing power the government has been granted it is a limited power.

Either justices of the Supreme Court do not agree with that, or they just do not have the guts to take responsibility for making a decision.

When there is an issue in doubt, deference should be given to the People and not the government. The Supreme Court has a long history of deferring to the government in matters involving tax as well as the most intrusive interference with their privacy and sexuality.

It has been complicit in the creation of the circumstances that Justice Scalia now recognizes as perhaps needing the people to have some sort of revolution. The implementation of the income tax is responsible both for the substantial destruction of the fundamental constitutional rights of the People to be free of government and the means to use tax law to facilitate blatant political corruption.

The income tax incentivizes politicians to do bad things.

This failure of government to live up to its Constitutional contract includes the failure of the Supreme Court.

If a revolution is what it takes for the People to enforce the Constitutional contract, then the United States certainly has its own historical precedence for starting one over taxes.

Doctor, Does Your Office Have a Time Clock, and If Not, Why?

Many small professional practices and businesses have employees track hours on the “honor system” or simply assume that everyone works a 40-hour week.

Wage and Hour Law require that employees who would qualify for overtime payment and in actuality receive that payment, have their hours tracked.

While a time clock is not required for this, it provides the best evidence of the hours that an employee actually works at the office.

Employees who leave an employer and then claim several years of overtime payment entitlement are often in a position to “hold up the practice” unless a time clock has been used to prove that they did not have the overtime hours.

When the employee has to additionally turn in an “hours worked at home and outside of the office” addendum each week, the burden is on them to be accurate, and the employer should make sure that the signed weekly addenda is scanned and also placed in a safe file for future reference.

Here are the 4 reasons that we encourage clients to have time clocks.

1. Overtime Law compliance as described above.

2. Morale of the employees who work the actual required hours and resent the employees who do not.

3. To make sure that the employer gets the agreed number of hours from the employee after taking into account lunches, breaks, and other events.

4. The time clock is a convenience for the employer and the employees when it comes to keeping track of hours, accuracy, and tracking whether a given employee normally gets to the office on time, leaves on time, or deviates from punctuality.

Words of Wisdom from Bob Burke

(re: Credit Shelter vs Portability)

Bob Burke graduated from Florida State University in 1968 and from Stetson University College of Law in January 1974. He was a past trust officer for First Union National Bank, now part of Wells Fargo through merger. Mr. Burke is “Of Counsel” to the Richards, Gilkey, Fite, Slaughter, Pratesi, & Ward, P.A. Law Firm in Clearwater, Florida.

We were very pleased when Bob Burke, Esquire reviewed our article that set forth our strong opinion that the decision as to whether to use portability should be put off until after one spouse dies, and that the most important thing to concentrate on from that standpoint is to permit automatic funding of a credit shelter trust that can be converted into a Clayton QTIP trust or otherwise channeled to a QTIP disposition without the need of an affirmative disclaimer by the surviving spouse.

Bob’s response to this is as follows:

A few thousand years ago, someone said that “the most important thing an attorney can do for his client is to preserve his alternatives.” Why ever depend on portability when there are so many reasons to fund a credit shelter trust at the death of the first spouse to die:

- Avoid creditor of the 2nd spouse

- Avoid estate tax law changes regarding the 2nd spouse

- Increases in value of the asset that was ported to the 2nd spouse

- Admin structure and security inside the CST rather than rely on the 2nd spouse

- Assurances of the remainderman beneficiaries

As we get older and the value of the estates get larger, the most important person to protect ourselves from is “ourselves.”

Upcoming Seminars and Webinars

WILL TBE APPLY FOR FLORIDA SAME GENDER COUPLES WHOSE MARRIAGES ARE RECOGNIZED IN THE STATE OF CELEBRATION?

Date: Thursday, May 22, 2014 | 7:00 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

THE JOINT EXEMPT STEP-UP TRUST AND PLANNING WITH COMMERCIAL ANNUITIES

Alan Gassman will be speaking at the annual Ohio Conference on Wealth Transfer on June 4, 2014 on two different topics:

1) Wealth Transfer on Structuring Joint Exempt Step-Up Trusts (“JESTs”): Maximizing Stepped-Up Basis Planning, Fully Funding Credit Shelter Trusts with Joint Assets and Practical and Technical Aspects Thereof – With Forms

With the increased federal estate tax exclusion, it may be time to reconsider “joint” trusts for married couples. Alan co-authored two articles in the October and November issues of Estate Planning Magazine about Joint Exempt Step-Up Trusts (JESTs), and will talk about maximizing stepped-up basis planning, fully funding Credit Shelter Trusts with joint assets, and other practical aspects of JESTs with forms.

2) Planning with Commercial and Charitable Annuities. Mr. Gassman will also be participating in a panel discussion the evening before hosted by Johnson Investment Counsel and The Ohio State University.

This session will discuss planning with fixed and variable annuities, covering common policy features, misunderstandings about “guaranteed” rates of return, the minimum distribution rules akin to the IRA rules, income taxation of annuities on the death of the owner or annuitant, and trusts as holders of annuity contracts.

Skip Fox will be speaking on the following:

1) Recent Developments.

This session will include commentary on marital planning, gifts, grantor trusts, asset protection, portability, generation skipping tax and charitable planning.

2) Must We Trust a Trust That’s Just a Crust That Was a Trust?

What some view as “un-trust-like” notions – protectors, selectors, advisors, appointers, special trustees, directed trusts, secret trusts, virtual representation, in terrorem forfeitures, perpetual trusts and decanting – will be examined with some forms included.

Date: June 4, 2014

Location: Hilton at Easton, Columbus, Ohio

Additional Information: For more information on the conference and to register for the conference please contact agassman@gassmanpa.com

Online Practice Webinars:

I am speaking on two topics that I have never handled alone, at 50 minutes each so I will be taking practice run on each of these and invite your questions, comments and suggestions.

The variable annuity talk will be live on May 21, 2014 at 12:00 p.m. and the JEST talk will be live on May 28 at 12pm. Each webinar will last 50 minutes.

These webinars are free of charge and you can register for each of them below.

To register for the variable annuities talk please click here.

To register for the JEST talk please click here.

********************************************************

VERSION 226.3 OF OUR ESTATEVIEW ESTATE TAX PROJECTION AND ILLUSTRATION SOFTWARE – A FREE WEBINAR

Alan Gassman, Ken Crotty and David Archer will be presenting a free 30 minute webinar on what is new with our EstateView software which will be featured later this year in Jason Havens’ excellent American Bar Association RPTE Probate and Property column.

Speakers: Alan Gassman, Ken Crotty and David Archer

Date: Monday, June 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

HIRING AND TERMINATING EMPLOYEES; WHAT TO DO, WHAT TO AVOID

Speaker: Alan S. Gassman, Esq., Colleen Flynn, Esq. and Dr. Stephanie Thomason

This is a very practical guide that your office manager is sure to enjoy. Let us know if you would like to see Alan Gassman’s slides for this presentation.

Date: Wednesday, June 18, 2014 | 2:00 – 3:00 p.m.

Location: Bloomberg BNA Tax & Accounting Online webinar

Additional Information: To register for the webinar please visit

http://www.bna.com/effectively-hire-terminate-w17179890199/. To receive a discount code please email agassman@gassmanpa.com

********************************************************

FICPA SUNCOAST CHAPTER MONTHLY MEETING

Alan S. Gassman will be speaking at the FICPA Suncoast Chapter’s monthly meeting on HOW TO PLAN, STRUCTURE, AND PROTECT WEALTH USING REVOCABLE AND IRREVOCABLE TRUSTS AND TRUST SYSTEMS. A COMPREHENSIVE OVERVIEW WITH A PRACTICAL PLANNING CHECKLIST AND PRACTITIONER TAX COMPLIANCE GUIDE.

Speaker: Alan S. Gassman

Date: Thursday, June 19, 2014 | 4:00 p.m. (100 minute presentation)

Location: Feather Sound Country Club, Clearwater, Florida

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

FICPA ANNUAL ACCOUNTING SHOW

Alan Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of ESSENTIAL GUIDE TO BASIC TRUST PLANNING for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) SPECIAL 3 HOUR SESSION

Alan Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it=s our second shore). Own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida=s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Attendees will receive Mr. Gassman’s book entitled “Florida Law for Tax, Business and Financial Planning Advisors,” which has a retail value of $34.95.

Our informative seminar, presented by Clearwater attorney Alan Gassman, highlights issues New Jersey lawyers should be aware of when handling matters for New Jersey residents who own Florida property, reside there part time, have interest in Florida businesses, or who are considering a move to Florida. The Florida Bar rules permit out of state lawyers to continue representation of Florida residents under rules that will be discussed.

Gain the knowledge you need to assist your clients with Florida matters, including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

Date: Saturday, October 4, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

********************************************************

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please send us your questions, comments and suggestions for Alan Gassman’s talk on Planning with Variable Annuities and Analyzing Reverse Mortgages.

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities, and provide estate and tax planners with a number of strategies for understanding and planning with existing and contemplated contracts. With over One Trillion Dollars of US taxpayer money invested in annuity contracts, more and more clients are showing up in their estate planners offices with large annuity contracts and common misunderstandings about “guaranteed income” and “guaranteed rates of return” features. The presentation will cover common policy features, what is actually happening inside of a policy, illustration techniques, and changes that can be made to defer income tax and reduce overall tax liability. Minimum distribution rules that apply to variable annuity contracts will also be discussed.

Date:November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will once again be speaking at the Ave Maria School of Law Estate Planning Conference in Naples, Florida, whether he is invited or not! Hats off to Jonathan Gopman, Karen Grebing, Northern Trust and many others for having hosted one of the most enjoyable conferences in 2014.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, Naples, Florida

Additional Information: Please contact Karen Grebing at kgrebing@avemarialaw.edu for more information.

NOTABLE SEMINARS BY OTHERS

(WE WERE NOT INVITED, BUT WILL ATTEND AND ARE STILL EXCITED)

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: TBD

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

| SHORT TERM AFRs | MID TERM AFRs | LONG TERM AFRs | ||||

| May2014 | Annual | 0.33% | Annual | 1.93% | Annual | 3.27% |

| Semi-Annual | 0.33% | Semi-Annual | 1.92% | Semi-Annual | 3.24% | |

| Quarterly | 0.33% | Quarterly | 1.92% | Quarterly | 3.23% | |

| Monthly | 0.33% | Monthly | 1.91% | Monthly | 3.22% | |

| April 2014 | Annual | 0.28% | Annual | 1.81% | Annual | 3.32% |

| Semi-Annual | 0.28% | Semi-Annual | 1.80% | Semi-Annual | 3.29% | |

| Quarterly | 0.28% | Quarterly | 1.80% | Quarterly | 3.28% | |

| Monthly | 0.28% | Monthly | 1.79% | Monthly | 3.27% | |

| March 2014 | Annual | 0.28% | Annual | 1.84% | Annual | 3.36% |

| Semi-Annual | 0.28% | Semi-Annual | 1.83% | Semi-Annual | 3.33% | |

| Quarterly | 0.28% | Quarterly | 1.83% | Quarterly | 3.32% | |

| Monthly | 0.28% | Monthly | 1.82% | Monthly | 3.31% | |

The 7520 rate for May is 2.4% and for April was 2.2%

[1] The charitable itemized deduction is not a tax preference item under the alternative minimum tax.

[2] http://www.nonprofitcpa.com/new-florida-law-provides-protection-for-nonprofits-from-clawbacks-of- charitable-contributions-under-fraudulent-transfer-law/

[3] Fla. Stat. 726.109 (7)(b)(2).