The Thursday Report – 5.5.16 – Tax Threats and Political Bets

Unpredictability Enters Estate and Tax Planning

Recent Cases Shine Light on the Somewhat Murky Trail to Protection of Wages for the Head of Household

What Medical Practices Can (and Cannot) Do With Respect to Incorrect Patient Review Postings

How Well Do You Lead Your Leadership Team? by David Finkel

Webinar Spotlight: Equity Stripping & Other Advanced Asset Protection Techniques with Alan Gassman for Maui Mastermind

Richard Connolly’s World – All About Audits

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“People will respect a trustworthy poor man far more than a wealthy man that can’t be trusted. Trust is not given, it is earned.”

– Ray Howard

Dr. Ray Howard formed the management consulting firm of Ray Howard & Associates in 1974 to provide qualified professional management services to physicians. His professional background includes public finance in Florida, the administrative staff at Baptist Memorial Hospital in Jacksonville, and practice manager for a large hospital-based physician group. With over 35 years of experience in the business of healthcare, Dr. Howard has developed a specialty in contract negotiations on behalf of his physician clients with extensive experience in negotiating hospital and managed care contracts. He received his honorary doctorate degree from the Baptist College of Florida in 2012.

Unpredictability Enters Estate and Tax Planning

by Alan Gassman

How the 2017 Budget Proposals Can Affect the Financial Future

of Affluent and Not-So-Affluent Americans

Are clients facing significant tax increases and loss of important opportunities in 2017?

The unpredictability of the present presidential election process and the possible loss of the control of the House and/or Senate by the Republican Party will cause significant concern to many clients with respect to what they can do now to reduce or avoid taxes in case one or more provisions under President Obama’s 2017 budget proposals come to fruition.

The new proposals just sent to Congress have the potential to vastly change estate planning and asset protection if they are approved. The following provisions contain information about the primary threats that should be of concern to clients and their advisors.

Basis Consistency

The 2017 proposals concerning basis consistency propose to expand the property subject to consistency requirements under Section 1014(f). This section states that a beneficiary must determine his or her basis in property received from a decedent with reference to the value used by the executor for federal estate tax purposes.

The 2017 proposal will extend this section to include property qualifying for the estate tax marital deduction and property transferred by gift, if the gift must be reported on a federal gift tax return.

Charitable Contributions of Conservation Easements

This proposal aims to require organizations who receive easements to comply with certain regulations and the best practices in the community. The new proposal requires that easements yield a significant public benefit and follow a clear federal conservation policy. Donors will be required to disclose the conversation purpose furthered by the contribution, attest to the public benefits and fair market value of the easements reported to the IRS, rights retained, and other items to assure transparency and absence of abuse.

Capital Gains

The 2017 proposals would raise the highest capital gains tax rate to 24.2%. This is in addition to the 3.8% tax on net investment income and will result in a 28% capital gains tax rate.

Stepping Up Basis

The 2017 proposals would eliminate the date of death stepped-up basis. The stepped-up basis adjustment available on an individual’s death will no longer apply. Instead, we would have “carry-over basis.”

Gratuitous Transfers

The 2017 proposals would require that capital gains tax be paid as if property where sold when gifted during life (or otherwise at death) in addition to the gift and estate taxes currently imposed.

2009 Estate, Gift, and Generation Skipping

This proposal aims to restore the estate, gift, and generation-skipping transfer tax rates up to 45% and exemptions of $3.5 million. This would return the rates to 2009 levels.

Income Tax Limitations on Charitable Gifts

This proposal attempts to provide uniformity and avoid confusion with respect to what percentage of a donor’s income can be offset by charitable deductions based upon 50% of adjusted gross income for public charities and 30% for non-public charities, regardless of the cost basis of the items donated.

GRATs

The 2017 proposals concerning GRATs are tightening the reigns! There would be four primary changes:

- A 10 year minimum payment term.

- The minimum remainder value on inception would be 25% of the value transferred to the GRAT (or $500,000, if greater).

- Annual payments will have to be equal, as opposed to increasing by up to 20% a year as now applies.

- The grantor will not be able to engage in a tax-free exchange of any asset held in the trust.

Life Insurance Contracts

Those who purchase interests in existing life insurance policies with a death benefit of $500,000 or more must report this to the IRS.

GST Exempt Trust Limitations

GST Exempt Trust Limitations will be limited to 90 years. The new proposals also clarify Section 2611(b)(1) – Payments of medical and tuition costs must be made directly by the “grandparent” to the medical care provider or school of the grandchild to be exempt and not reduce the grandparent’s GST exemption.

Exclusion for Gifts

The 2017 proposals would limit the annual exclusion for gifts to $50,000 per donee per year.

IRAs

The 2017 proposals would eliminate Stretch IRAs, though the 5-Year Rule still applies.

What Does This Mean for You?

Let clients know that these possible changes are as unpredictable as the political climate that we now find ourselves in. Plan responsibly for those clients who should be using these techniques as best we can without undue delay. Always plan for the worst and hope for the best.

Recent Cases Shine Light on the Somewhat Murky Trail

to Protection of Wages for the Head of Household

by Alan Gassman and Lauren Eliopoulos

Florida Statute Section 222.11 provides exemption for “all of the disposable earnings of a head of household whose disposable earnings are less than or equal to $750 a week”, and further provides that disposable earnings that are greater than $750 a week cannot be attached unless the person has agreed otherwise in writing.

The law continues to evolve with respect to if and when a professional’s income will be considered to be “earnings…for personal services, or labor whether denominated as wages, salary, commission, or bonus.”

In the November 16, 2015 case of Tobkin,[1] the Eleventh Circuit of Appeals held that contingency fees paid to a solo practitioner lawyer were not exempt from creditors under the above referenced statute. The Court noted previous case law, which indicates that the “earnings” exemption does not apply to proceeds from a family-owned business, or from a Debtor’s personal law practice.

For future planning, it is of interest that the Court stated that if a Debtor “has an arm’s-length employment agreement with his business providing for a set salary or wages, the earnings exemption applies. See Brock, 832 So.2d at 212. Here, the funds at issue are proceeds from Debtor’s law practice. Moreover, the funds are not derived from any arm’s-length employment agreement between Debtor and his business”. Footnote 2 of the decision noted that “Debtor argues he received the funds pursuant to an arm’s-length employment agreement because the funds resulted from a contingency fee agreement he had with a client. But, such an agreement generates proceeds for a law practice as opposed to a set employee salary or wage. See in re Zamora, 187 B.R. at 783 (holding solo practitioner’s contingency fees were not exempt under Fla. Stat. § 222.11″.

A second recent case is In re Jans,[2] which is a February 2016 Bankruptcy Court decision, which determined that a real estate agent paid as an independent contractor on a draw and commission basis could treat her earnings as protected “wages” where the employer provided the office, equipment, responsibilities, the expectation of full-time services, notwithstanding that this was under an independent contractor agreement.

We will have further discussion of the Jans case and other recent Florida asset protection developments in future issues of The Thursday Report as we work on updating our book Gassman and Markham on Florida and Federal Asset Protection Law. A copy of the Tobkin case can be viewed by clicking here, and Florida Statute 222.11 (which you should read!) can be viewed by clicking here.

*****************************************************

[1] In re Tobkin v. Calerin, 2015 WL 7144748 *2

[2] In re Jans, 2016 WL 741884 *1.

What Medical Practices Can (and Cannot) Do With

Respect to Incorrect Patient Review Postings

by Alan Gassman

Almost every busy medical practice now has a complaint posted on one of the many review Web sites, and often these are inaccurate and inflammatory.

Unfortunately, most of the Web-based medical practice review systems refuse to delete these types of inflammatory reviews unless they have consent from whoever posted the review or a court order.

The following are potential posts that a medical practice or those who support the medical practice might consider putting on their Web site to indirectly answer these types of complaints.

Physicians should have their malpractice insurance carriers and also any other carrier that would cover claims for slander, libel or similar claims take a look at the posting before it is made:

This post is from Dr. ______________. I spent _____ years in medical school and then _____ years in residency and fellowship learning to be a primary care doctor. The last thing I want to do is to erroneously ask a patient for monies that they would not need to pay. While issues can arise when our receptionist attempts to comply with the many complicated health care plans and rules, our office does everything possible to treat patients fairly. The rules and law require that we receive a co-payment or be able to document why we did not receive a co-payment from a patient. Different plans have different rules that we have to follow. Because of medical privacy laws, we cannot and will not comment on any particular patient matter, but I hope that this is of interest to those who would consider using or recommending our practice.

———————————————————————————

I am both a patient and employee at FSI. I want to say as a review that the doctors and staff there do a great job and care a lot about their patients. But sometimes patients addicted to drugs threaten to complain on Yelp and other services if they don’t get what they want, and they can be vindictive and untruthful. Please take that into account when you review patient comments for practices that do pain management, not only for our practice, but for all others as well.

How Well Do You Lead Your Leadership Team?

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ business coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

I want to let you in on a business coaching secret – simple scorecards not only give you meaningful feedback, but, more importantly, they automatically focus your attention on those fewer, better things that make a difference in your business.

How does this impact you as you scale your company? Simple – in order to scale your business, you need a rock-solid base in all the five core pillars of your company: Sales/Marketing, Operations, HR, Executive Leadership, and Finance.

One way to do that is to have a clear structure to help you evaluate how you’re doing in each pillar and to guide you to incrementally improve pillar by pillar as you grow.

In this article, I’m focusing on your Leadership Pillar. Here is a simple scorecard that you can use each quarter to make sure you’re continuously improving your “Leadership Pillar.”

Each quarter, rate your company on a scale of 1-10 (with 10 being the best) on each of the following six aspects of your Leadership Pillar:

- Team Member Clarity on Big Picture

- Your Current Business Strategy

- Review Process for Company Performance, Strategy, and Plan of Action

- Troubleshooting of Major Challenges as Needed

- Leadership Development

- Company Culture and Tradition

For details on each of the six aspects listed above, please click here to continue reading this article on inc.com. You can also follow David on Twitter: @DavidFinkel

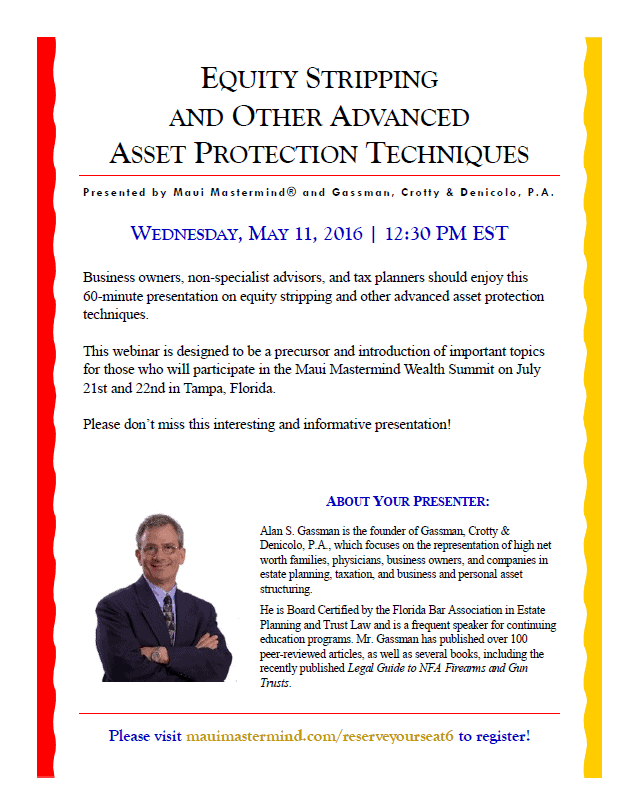

Webinar Spotlight

Equity Stripping & Other Advanced Asset Protection Techniques

with Alan Gassman for Maui Mastermind

PLEASE CLICK HERE TO REGISTER FOR EQUITY STRIPPING

AND OTHER ADVANCED ASSET PROTECTION TECHNIQUES

WITH ALAN GASSMAN

Richard Connolly’s World

All About Audits

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Surviving an IRS Audit” by Karen Hube. This article was featured on the Barrons.com Blog on December 18, 2015.

Richard’s description is as follows:

IRS data show that, in 2012, more than half of estate tax returns between $5 million and $10 million were audited, and all of those valued above $10 million were investigated. In fact, many got hauled over the coals more than once. You can understand the IRS’ interest. The average amount recovered for each estate tax return was $304,530; estates valued at $10 million or more had to pay an extra $819,243 on average. The problem is that valuations of inherited assets frequently aren’t accurate because highly technical regulations for determining valuations were never followed or tax rules for discounting valuations were improperly used. In the confusion following a death, it’s also common that assets in the estate are overlooked, says Steven Wittenberg, Director of Legacy Planning at SEI Investments, a national advisory firm based in Oaks, Pennsylvania.

So get your heirs involved in the estate during your lifetime so they know where to find appraisal, title, and account information documents, as well as records of investments’ cost basis. Then, when the IRS comes knocking, they’ll be suitably armed, and, hopefully, the estate’s review will be fairly quick and painless.

Please click here to read this article in its entirety.

The second article of interest this week is “Ticket to a Tax Audit: $1 Million” by Laura Saunders and Richard Rubin. This article was featured in The Wall Street Journal on February 22, 2016.

Richard’s description is as follows:

The sum of $1 million doesn’t go as far as it used to. But increasingly, it is enough to get you special attention from Uncle Sam. The Internal Revenue Service continued to ramp up its focus on high earners in fiscal 2015, according to data released by the agency Monday.

The IRS audited nearly 10% of returns with income of more than $1 million, compared with 7.5% the year before, in the fiscal year ended September 30th. Overall, the agency audited less than 1% of nearly 147 million individual returns in 2015, the lowest rate in a decade.

Please click here to read this article in its entirety.

Humor! (or Lack Thereof!)

Sign Saying of the Week

*************************************

Alan’s Away Message: The Boston Edition

If you tried to email Alan while he was away in Boston last week,

you may have received the following message:

I’m off to Boston again,

And will share the following poem.

Thanks to Kristen Sweeney for helping compose,

And to Marcia for keeping me on my toes.

Our team is ready to help as they do,

For the things that I normally take credit when due.

We hopped on Jet Blue for one day in Boston,

The streets are a maze, so we are now lost in

The cradle of the American Revolution,

Where tea-throwing seems a clever solution.

Marcia and I are dining on chowda,

Drinking Sam Adams, and saying to locals

How do-you do? Do you pahk you cah?

I heah that Hahvahd is not very fah.

Thanks for enduring this quick little blip,

So that we can focus on our very short trip.

The Freedom Trail is a great historical walk,

But mostly we just hear fans yelling Go Sox!

If you need to get in touch, our office is not yet on Yelp;

But you’ve got our number, so please call us for help.

*************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE NAPLES PRESENTATION:

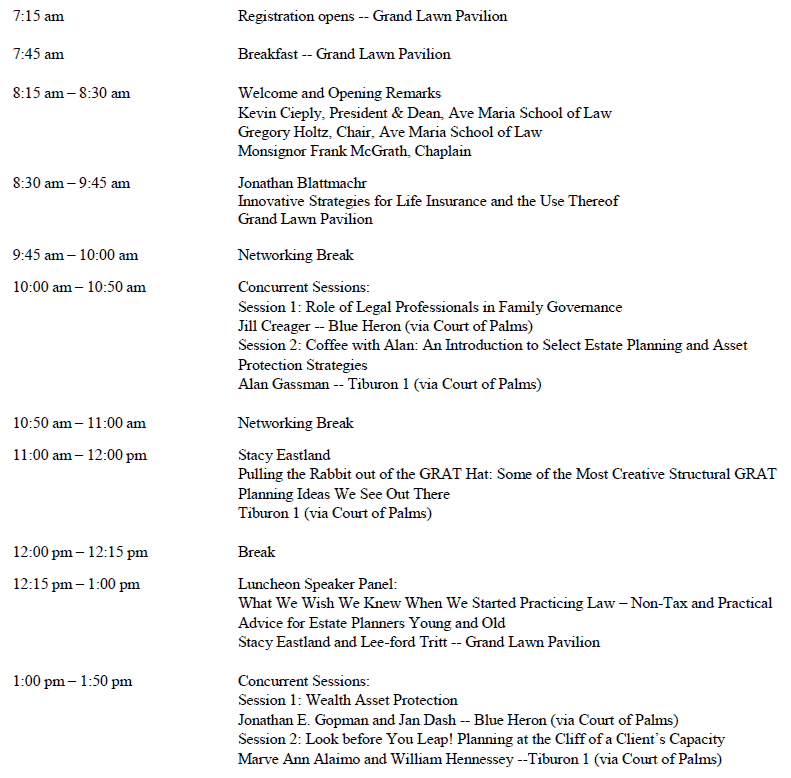

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday. Be sure to bring an extra pair of socks because the first pair will get knocked off by Jonathan’s talk!

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

The complete schedule for the Ave Maria Estate Planning Conference is as follows:

Date: Friday, May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Jonathan Blattmachr will present a one-hour webinar on the topic of FUNDAMENTALS, FINE POINTS, AND INNOVATIVE STRATEGIES FOR LIFE INSURANCE AND USE THEREOF.

This webinar is part of the Bloomberg BNA Practical & Creative Planning series and will be moderated by Alan Gassman.

Date: Tuesday, May 10, 2016 | 1:00 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE CLEARWATER PRESENTATION:

Alan Gassman will be speaking at the Clearwater Bar’s Small and Solo Practitioner’s Meeting on the topic of ESSENTIAL PLANNING FOR SMALL FIRMS AND SOLOS: ENTITY FORMALITIES, ASSET PROTECTION, AND SUCCESSION.

Special thanks to Michael Ziegler for putting together this spectacular event.

Date: Tuesday, May 10, 2016 | 5:30 PM – 7:00 PM

Location: Clearwater Bar office | 800 Drew Street, Clearwater, FL, 33756

Additional Information: For more information or to RSVP, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of EQUITY STRIPPING AND OTHER ADVANCED ASSET PROTECTION IDEAS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. Clients, advisors, and colleagues of Gassman, Crotty & Denicolo are welcome to attend. Participants must be fully clothed!

Date: Wednesday, May 11, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Michael Mulligan and Jerry Hesch will present a one-hour webinar on the topic of THE FOUNDATION AND AN UPDATE ON DEFECTIVE GRANTOR TRUSTS, INSTALLMENT SALES, SELF-CANCELLING NOTES, AND PRIVATE ANNUITIES.

This webinar is part of the Bloomberg BNA Essential Elements series.

Date: Thursday, May 19, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Turney Berry will present a one-hour webinar on the topic of LITTLE KNOWN BUT HIGHLY EFFECTIVE CHARTIABLE STRUCTURING.

This webinar is part of the Bloomberg BNA Essential Elements series.

Date: Thursday, May 26, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE INTERACTIVE LEGAL MELBOURNE, FL/LIVE FEED TO YOUR OFFICE PRESENTATION:

Alan Gassman, ILS Strategic Partner and Advisory Board member, will be speaking for InterActive Legal at the Florida Institute of Technology Media Center on ESTATE PLANNING FOR SNOWBIRDS AND FLORIDA-BASED CLIENTS.

Many people spend part of the year in Florida or make Florida their primary residence later in life. While their estate plans were prepared in different jurisdictions, these clients and their heirs are likely to find themselves dealing with Florida laws. This live-stream presentation is designed to navigate the unique areas of Florida estate planning for both Florida lawyers and lawyers in other states with clients domiciled in Florida.

This talk will include many techniques that can be used in all 50 states and Guam. This will be a live presentation for those who can attend and will feature a simultaneous, live online streaming broadcast. Watch or listen right from the comfort of your own office or join us in Melbourne.

Date: June 2, 2016 | Time TBA

Location: Florida Institute of Technology Media Center | 150 W. University Blvd, Melbourne, FL 32901

Additional Information: For more information or to RSVP, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Dr. Srikumar Rao and Alan Gassman will present a free, 30-minute webinar on the topic of ETHICAL FRAMEWORK FOR DEALING WITH CHALLENGING SITUATIONS.

There will be two opportunities to attend this presentation.

Date: Tuesday, June 7, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Lester Perling and Alan Gassman will present a free, 30-minute webinar on the topic of NEW FLORIDA LAWS AND THE STARK SHARING OF EQUIPMENT BY TIME CHANGE.

There will be two opportunities to attend this presentation.

Date: Wednesday, June 8, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Jay Adkisson and Alan Gassman will present a free, 30-minute webinar on the topic of JAY ADKISSON’S MUSINGS ON THE UVTA.

There will be two opportunities to attend this presentation that takes a look at the new Uniform Voidable Transfers Act.

Date: Tuesday, June 28, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

DAVID FINKEL CONFERENCE FOR PHYSICIANS – SCALE YOUR MEDICAL PRACTICE

This free event for physician clients of Gassman, Crotty & Denicolo, P.A. will feature nationally-recognized business advisor and author David Finkel’s unique presentation on growing a medical practice. The conference will be entitled SCALE YOUR MEDICAL PRACTICE: PROVEN STRATEGIES TO GROW YOUR PRACTICE, INCREASE YOUR CASH FLOW, AND CREATE MORE PERSONAL FREEDOM.

Spouses, office managers, and other practice advisors will also be welcome to attend this interesting and useful one-day conference.

Date: Saturday, July 23rd, 2016

Location: Tampa Marriott Westshore | 1001 N. Westshore Blvd., Tampa, FL, 33607

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

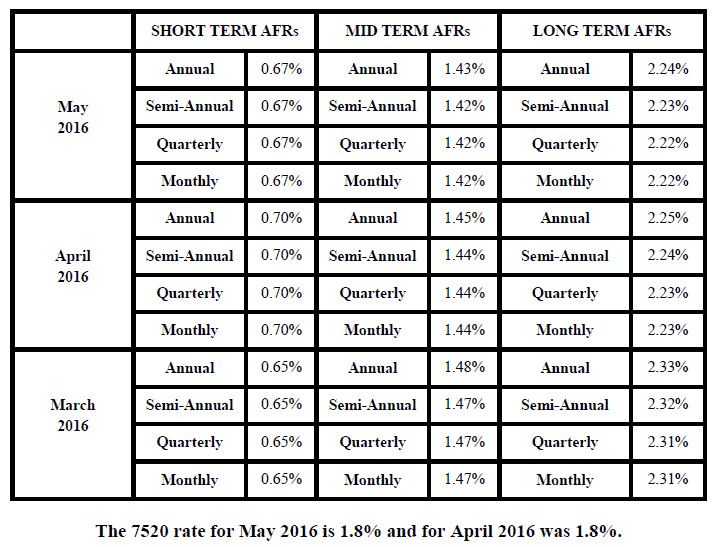

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.