The Thursday Report 5.22.2014 – BP Update, Medical Practice Organization, and a new date for Ave Maria

5th Circuit Throws BP Out – They Are Stuck with the Class Action Deal Unless the U.S. Supreme Court Accepts the Case

Stock Certificates Held Outside of the Country – A Simple and Viable Creditor Protection Planning Technique?

The 10% Commercial Assessment Increase Cap – What You Need to Know About It

Why Medical Practices Should Think Ahead and Be Organized With Respect to Office and Facility Leases, an article by Carleton Compton

Seminar Announcement: Ave Maria School of Law Estate Planning Conference 2015 Date Announced

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

5th Circuit Throws BP Out – They Are Stuck with the Class Action Deal Unless the U.S. Supreme Court Accepts the Case

by: John D. Goldsmith and Alan S. Gassman

Although Significantly Delayed by the Fifth Circuit Court of Appeals,

Recent Rulings May Finally Allow Claims to be Processed Again.

BP, apparently no longer concerned enough with its reputation to act as a good citizen, is instead continuing to act as an ardent litigator attempting to renounce the settlement it negotiated and urged the Court to approve. However, Monday night the Fifth Circuit Court of Appeals denied an en banc rehearing possibly resulting in the end of an injunction lasting more than six months which had the effect of preventing the BP Claims Administrator from adjudicating or paying any claims. BP was contesting two recent rulings by the Fifth Circuit denying BP’s attempt to reject their own settlement and attempting to delay the resumption of the BP Claims Administrator adjudicating and paying claims. Further, had BP been successful, many companies would have faced the difficult task of proving direct causation between the oil spill and their own economic losses.

The recent decisions of the federal District Court and the federal Fifth Circuit Court of Appeals are summarized below.

The Courts recently required the BP Claims Administrator to develop new criteria to “match revenue with expenses”. It was not clear what that meant, and BP and the BP plaintiffs’ steering committee submitted competing guidelines to the Claims Administrator. The BP Claims Administrator issued draft guidelines two weeks ago that have not yet been made public. Given BP’s recent history it will likely challenge any proposed guidelines in the Federal District Court and then appeal any decision to the Fifth Circuit.

A three Judge panel of the Fifth Circuit recently affirmed the Federal District Court’s December 2012 order approving the BP Settlement Agreement. In an unprecedented move, BP joined the parties appealing the approval of the Settlement Agreement, thereby objecting to the same Settlement Agreement BP negotiated, agreed to, and actively sought approval of from the Federal District Court. The Fifth Circuit specifically ruled that the U.S. Constitution and federal law do not require that each BP claimant make an individual claim showing that the claimant’s losses were caused by the BP Deepwater Horizon oil spill. This was an important victory for BP claimants and in keeping with the BP Settlement Agreement. BP asked the entire Fifth Circuit (referred to as “en banc”) to review this decision.

A three Judge panel of the Fifth Circuit, Court of Appeals instructed the BP Claims Administrator against paying any BP claims or making final determinations until the Fifth Circuit resolved the issues discussed above. This injunction slowed the processing of claims as well.

While the Fifth Circuit was deciding on the petition to rehear en banc, a new method of calculating BP spill payments was developed by the Claims Administrator and approved by the Court. The new “matching” method was submitted in Policy 495, which adds nearly 100 additional pages to an already massive Settlement Agreement. The Court initially ruled against a “matching” of expenses to revenues, however, now the Court has reversed their previous decision and found that unmatched profit and loss statement must be “matched”. Instead of comparing revenues and expenses for periods before the spill and after the spill, businesses will need to use the complex new system. This change has the greatest affect on variable profit businesses, such as construction, agricultural, educational institutions, and professional services that spend money on a project at one time and then derive revenues at a different time.

The Court upheld the two previous rulings by different three Judge panels that claimants are NOT required to prove that their losses were caused by the oil spill. Rather, in conformity with the BP Settlement Agreement and with BP’s original interpretations of the settlement, if the BP claimant has the required drop in revenue during the applicable period in 2010 in comparison to the same time period in prior years, and the required increase in revenue during the same time period in 2011, it is conclusively determined that any losses of a BP claimant were caused by the BP oil spill.

Based on these recent rulings, the Fifth Circuit ruled that the injunction preventing adjudication and payment of claims will be lifted as soon as the Fifth Circuit resolves whether it will review these decisions en banc.

On May 19th, the Fifth Circuit denied the petition for rehearing en banc by a vote of eight to five. This leaves BP with two options, to either start paying claims or to appeal the case to the United States Supreme Court.

BP now has 90 days to file a writ of certiorari to the United States Supreme Court. The next real question is what would happen to all of the business owners still waiting on these claims should BP file for a writ? Even if the writ is denied, the Supreme Court generally takes six months to officially reject a writ. If BP is granted certiorari then that could mean another year or more of waiting for these claims to be settled. The good news for those seeking redress from BP is that the Supreme Court receives close to 10,000 requests every year and formal written opinions are delivered on less than 1% of those on average. The Supreme Court has been known to respond to these applications in as little as six weeks but normally takes six months. Hopefully they will expedite this because of the number of people and businesses involved.

In the meantime, BP is saving very large amounts of money by just avoiding paying interest. Initial estimates by BP had them paying close to $8 billion and even with a modest interest rate that would be a significant amount of money. For this reason, if BP seeks an issuance of mandate so that they can file a Cert Petition, at a bare minimum they should be required to post the certificate bond for the billions of dollars of claims that will not be paid in the meantime, or at least the amount of interest that will accrue on the claims that would be adjudicated otherwise.

John Goldsmith is a litigation lawyer with over 30 years experience handling complex financial, regulatory, and multiple party litigation with the Trenam Kemker law firm.

Join us for a webinar on BP Claims on Friday, May 30, 2014 at 12:30 p.m.

Get the latest thinking on the new matching of revenue and expense accounting rules with brief discussion concerning the possibility of the U.S. Supreme Court granting BP’s request for consideration.

Please join us for this interesting and informative presentation. To register for the webinar please click here.

Stock Certificates Held Outside of the Country – A Simple and Viable Creditor Protection Planning Technique?

by: Travis Arango, Dena Daniels and Alan Gassman

Executive Summary:

The Jordan River is prominently known as the river that the Israelites had to cross in order to reach the Promised Land. Measuring 156 miles long, the Jordan is what stood between the Children of Israel and the land “flowing with milk and honey” that they were told would be theirs. Well, this seemingly insurmountable river was not only a huge obstacle for the Israelites, but also for a Florida court as well. In a recent Florida case, a trial court entered an order to compel delivery of stock certificates held in foreign countries, one of which was Jordan. However, an appellate court put an abrupt halt on the order ruling that a Florida court does not have the authority to order the surrendering of foreign stock certificates.

Florida’s 4th District Court of Appeal issued an opinion on March 5, 2014, which indicated that Florida courts do not have in rem or quasi in rem jurisdiction over a foreign state and do not have the authority to order the debtors to turnover foreign stock certificates. In this case, a gentleman named Mohammad Anwar Farid Al-Saleh, who is a citizen of the Country of Jordan, sued two individuals for having proceeded with a corporate business arrangement without sharing profits with him. He received a judgment for over $20,000,000 and then asked the Palm Beach County court, in a motion for proceedings supplementary, to order the two defendants in the case to turn over “all stock certificates and similar documents memorializing their ownership interest in any corporation.”

Facts:

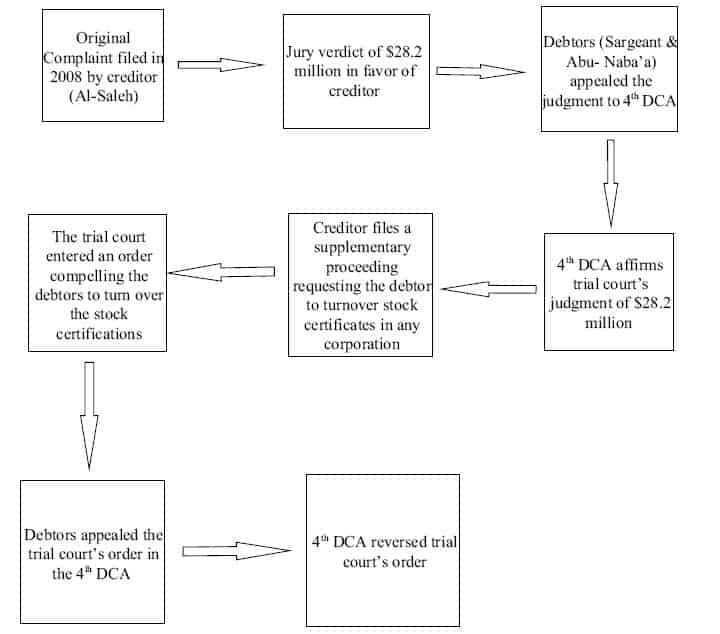

The original complaint was brought forth by the “creditor”, Mohammad Anwar Farid Al-Saleh, in 2008. In the complaint, Al-Saleh sought damages for common law fraud, conspiracy to commit fraud, aiding and abetting fraud, declaratory judgment and violations of Jordanian law.

Al-Saleh, Sargeant and Abu-Naba established International Oil Trade Center LLC (IOTC) under Jordanian law in 2004, and all three parties were equal partners. The LLC was established to bid on contracts offered by the U.S. Government for the shipment of oil to U.S. troops in Iraq. When the company began procuring these U.S. Government contracts, Sargeant and Abu-Naba formed IOTC USA, a Florida company under their direct control. Al-Saleh was unaware of the formation of IOTC USA and, although being reassured that his interest was protected, was excluded as a partner in the newly formed entity. Sargeant and Abu- Naba used the mandatory authorization letter that was procured from the Government of Jordan by means of Al-Saleh’s connections. This letter had been received for use by the original IOTC. The original complaint asserts that Sargeant and Abu-Naba refused to pay Al-Saleh over $13 million in profits owed to him unless he surrenders his partnership rights and any claims he may have against the other two partners stemming from their misconduct.

Procedural History:

Comment:

The 4th District Court of Appeal received this case on an appeal filed by the debtors. Upon the creditor’s filing of the motion for proceedings supplementary, compelling the debtors to turnover the stock certificates, the debtor’s argued that the stock certificates represented assets located in the Bahamas, the Netherlands, Jordan, The Isle of Man, and the Dominican Republic therefore, the court has no jurisdiction over the assets. Rejecting the debtors’ argument and absent of an evidentiary hearing, the trial court granted the creditor’s motion and entered an order for the debtors to turn over the foreign stock certificates.

On appeal, the debtors continued to argue that the trial court lacked jurisdiction to enter an order forcing them to surrender the stock certificates; the creditor counters that the trial court did have the authority.

The court referenced a case in its discussion called Paciocco v. Young, Stern & Tannenbaum, P.A., 481 So.2d 39,39 (Fla. 3d DCA 1985). The court in that case held that a Florida court has no jurisdiction on mortgages and real property that is in a foreign land. The creditors attempted to rely on General Electric Capital Corp. V. Advance Petroleum, Inc. but the court distinguished it from the present case. 660 So.2d 1139 (Fla. 3d DCA 1995). In General Electric, the court held that a court may reach property outside the court’s jurisdiction if the court has in personam jurisdiction over the defendant. While this seems to be on point the court stated this was distinguishable because that case dealt with a creditor who had a perfected lien on the property at issue.

The court gave two reasons for its holding. First, there could be competing claims to the property that is in a foreign jurisdiction and those claims should be dealt with in that jurisdiction. Second, if trial courts were allowed to bring foreign assets into the state it would basically remove foreign judgment statutes.

This has some serious implications in the wealth preservation context because this may give people incentive to have their stocks in foreign jurisdictions. This way if a creditor obtains a judgment against them they will not only have to go through our judicial system, but then go through all the hoops that the foreign jurisdiction has set up. In the end, depending on the size of the judgment, this may not be worth the creditor’s effort or legal fees for that matter.

However, this little plan of offshore protection should not be expected to work in bankruptcy courts and may land clients in jail if they fail to cooperate. The Eleventh Circuit held a debtor in contempt for not complying with the court’s turn over order. In In re Lawrence, the debtor had an offshore trust.279 F.3d 1294 (11th Cir. 2002). The bankruptcy trustee tried to have the assets turned over but the debtor claimed it was impossible due to a duress clause he had put in which prevented the settlor’s powers from being executed under duress or coercion. The court rejected the impossibility argument and held him in contempt for not turning over the assets. Thus, it would seem bankruptcy courts do not even hesitate at the idea of asserting jurisdiction over foreign assets.

This new case law may have added another weapon to the wealth preservation lawyer’s arsenal. However, it is likely that it only helps the client with an un-perfected judgment against them in state court. It will be interesting to see how or if courts will try to prevent this holding from being used as an wealth preservation tool.

Conclusion:

This case makes the, already attractive, State of Florida even more appealing to individuals seeking to protect their assets from creditors. As the result of this case many planners will doubtlessly encourage clients and potential clients to keep more assets in offshore companies, and to issue stock certificates and have them held in jurisdictions that do not recognize US judgments. The creditor will have to spend years in litigation to reach the foreign stock certificates and while the creditor is battling in court, the debtor can move the assets to another jurisdiction to prevent the creditor from getting access.

The 10% Commercial Assessment Increase Cap – What You Need to Know About It

In 2008, the Florida Constitution was amended to provide that commercial real estate, including residential rental property and vacant property, could not be increased by more than ten percent (10%) in any given year for property tax purposes. This ten percent (10%) cap applies automatically, without the need to apply for ten percent (10%) cap status.

This protection does not apply to agricultural property, conservation land, and certain other property that qualifies for other favorable tax treatment.

A change of ownership or control of such property will cause loss of the ten percent (10%) cap in the year of the transfer. Where property is owned by an entity, such as a corporation, a limited liability company, or a partnership, the cap will be lost if there is a transfer of more than 50% of the ownership in the entity.

In addition, for non-residential property the cap will be lost if improvements are added that increase the value by at least twenty-five percent (25%).

Under Florida Statute Section 193.1556 any person or entity that owns property protected by the ten percent (10%) cap has a duty to notify the county property appraiser of any change of ownership or control on a Form DR-430, which is provided by the Department of Revenue. This form can be reviewed by clicking here.

Frequently asked questions from the Department of Revenue on the ten percent (10%) cap, to view click here.

Why Medical Practices Should Think Ahead and Be Organized With Respect to Office and Facility Leases

by Carleton Compton

Carleton Compton runs his medical specialty leasing and real estate practice like a true professional, and has developed processes and a reputation accordingly. We can all learn from how Carleton has geared himself and his organization to best serve clients. Carleton can be reached at ccompton@equity.net, and was recently awarded the “Real Estate Forum’s 40 under 45” award for real estate professionals. He has also spoken at a variety of educational panels, including the University of Florida’s Bergstrom Council.

Carleton is an active member in the community in which he lives. Currently he is a contributing member of the Board of Directors for the Children’s Cancer Center, where he previously held the Chairman position. He has also been a member of the Advisory Board of the Gulf Ridge Council for Boy Scouts and is the former President of the local University of Alabama Alumni Association. Hats off to Carleton, and we thank him for the following story:

If you are like most medical practices, you are constantly looking for ways to decrease your overhead costs. In a lean market, it can mean a more competitive position in the market. It can also be the difference between profitability and loss. One area that you may be overlooking is your current lease agreement. If you are up for renewal within the next year or two, you may have more leverage than you think.

This past year, the Equity Healthcare Team was hired to review Dental Care Alliance’s (DCA) renewal option. The following case study shows the benefit of having a formal lease audit conducted by a commercial real estate expert.

The Situation: DCA felt that their base rent and common area maintenance charges (CAM) were above market. Since occupying their space, the tenancy in the building and surrounding area was on the decline. The anchor tenant in the building was SunTrust, whose relocation could stigmatize the building. In addition, the elevator in the building was inadequate and needed replacement or repairs. Since DCA occupied second floor space, this was an inconvenience for their patients.

The Strategy: DCA hired Equity Healthcare Real Estate to represent them in their lease renewal negotiations. The client had two options; move to a new location or stay put. DCA was more inclined to stay in their existing location. In an effort to have a stronger position while negotiating with the Landlord, Equity advised the client to pursue a leverage negotiation. Equity reviewed DCA’S existing lease while also performing a site search for alternative spaces in the market. By understanding the market conditions, including rental rates, CAM charges, tenant improvement allowance, and vacancy rates, Equity was able to have a stronger position in negotiating leverage with the landlord.

The Results: Equity was able to negotiate the following renewal terms for DCA:

A five (5) year lease with a starting Base Rent of $12.37 PSF with 2% annual increases. This was a significant decrease from their original Base Rent of $25 PSF with 3% annual increases.

Equity discovered inconsistencies in the CAM Charges, which were adjusted and brought the Base Year down to $8.73 PSF from $10 PSF. The landlord also agreed to a 5% cumulative cap on operating expenses.

The renewal allowed DCA to terminate their agreement if the bank downstairs left the building at any time during their lease period.

DCA was able to obtain exclusivity for dental care in the building.

In their initial Lease, DCA agreed to pay back the total build-out allowance ($71,000) if they did not renew their Lease for an additional 10 years. Equity was able to convince the landlord to terminate the language in the Lease tied to the $71,000 penalty and modify it to include 2 renewal options for 3 years each.

The Landlord addressed the significant concerns regarding the elevator problems and provided an acceptable resolution.

Over the course of five years, the renewal negotiation saved DCA approximately $316,207 in base rent alone. Additionally, Equity helped DCA achieve more flexibility in their lease and a stronger control of their environment.

Not every situation will yield the same results, however, Carleton can provide an audit and analysis of your current leases

Seminar Announcement: Ave Maria School of Law Estate Planning Conference 2015 Date Announced

The 2014 Ave Maria School of Law Estate Planning conference was a great success. Be sure to mark your calendar for Friday, May 1, 2015 (and a wonderful weekend in Naples). The interaction between participants and presenters at this small but powerful conference was unsurpassed.

For more information please contact Alan Gassman at agassman@gassmanpa.com or Karen Grebing at kgrebing@avemarialaw.edu.

Christopher P. Bray (moderator), Al W. King, III, Alan S. Gassman, Bruce Stone, Jerry Hesch and Barry A Nelson participate in a panel discussion at the 2014 Estate Planning Conference.

Upcoming Seminars and Webinars

FREE WEBINAR:

ALL ABOUT THE JEST TRUST

I am speaking at the Ohio State Bar Association 25th Annual Estate Planning Conference on Wealth Transfer on June 4, 2014 on a topic that I have never handled alone, for 50 minutes. Please help me rehearse by attending this free 50 minute webinar.

Date: May 28, 2014 | 12:00 p.m. (50 minutes)

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

FREE WEBINAR:

WILL THE SUPREMES TAKE BP CLAIMS ON A MIDNIGHT TRAIN TO GEORGIA?

Date: Friday, May 30, 2014 | 12:30 p.m (20-30 Minutes)

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

LIVE OHIO PRESENTATION:

THE JOINT EXEMPT STEP-UP TRUST AND PLANNING WITH COMMERCIAL ANNUITIES

Alan Gassman will be speaking at the annual Ohio Conference on Wealth Transfer on June 4, 2014 on two different topics:

1) Wealth Transfer on Structuring Joint Exempt Step-Up Trusts (“JESTs”): Maximizing Stepped-Up Basis Planning, Fully Funding Credit Shelter Trusts with Joint Assets and Practical and Technical Aspects Thereof – With Forms

With the increased federal estate tax exclusion, it may be time to reconsider “joint” trusts for married couples. Alan co-authored two articles in the October and November issues of Estate Planning Magazine about Joint Exempt Step-Up Trusts (JESTs), and will talk about maximizing stepped-up basis planning, fully funding Credit Shelter Trusts with joint assets, and other practical aspects of JESTs with forms.

2) Planning with Commercial and Charitable Annuities. Mr. Gassman will also be participating in a panel discussion the evening before hosted by Johnson Investment Counsel and The Ohio State University.

This session will discuss planning with fixed and variable annuities, covering common policy features, misunderstandings about “guaranteed” rates of return, the minimum distribution rules akin to the IRA rules, income taxation of annuities on the death of the owner or annuitant, and trusts as holders of annuity contracts.

Skip Fox will be speaking on the following:

1) Recent Developments.

This session will include commentary on marital planning, gifts, grantor trusts, asset protection, portability, generation skipping tax and charitable planning.

2) Must We Trust a Trust That’s Just a Crust That Was a Trust?

What some view as “un-trust-like” notions – protectors, selectors, advisors, appointers, special trustees, directed trusts, secret trusts, virtual representation, in terrorem forfeitures, perpetual trusts and decanting – will be examined with some forms included.

Date: June 4, 2014

Location: Hilton at Easton, Columbus, Ohio

Additional Information: For more information on the conference and to register for the conference please contact agassman@gassmanpa.com

********************************************************

FREE WEBINAR:

VERSION 226.3 OF OUR ESTATEVIEW ESTATE TAX PROJECTION AND ILLUSTRATION SOFTWARE – A FREE WEBINAR

Alan Gassman, Ken Crotty and David Archer will be presenting a free 30 minute webinar on what is new with our EstateView software which will be featured later this year in Jason Havens’ excellent American Bar Association RPTE Probate and Property column.

Speakers: Alan Gassman, Ken Crotty and David Archer

Date: Monday, June 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

FREE WEBINAR:

CREDITOR AND OTHER PLANNING FOR SAME GENDER COUPLES

Date: Tuesday, June 10, 2014 | 7:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

BLOOMBERG BNA WEBINAR:

HIRING AND TERMINATING EMPLOYEES; WHAT TO DO, WHAT TO AVOID

Speaker: Alan S. Gassman, Esq., Colleen Flynn, Esq. and Dr. Stephanie Thomason

This is a very practical guide that your office manager is sure to enjoy. Let us know if you would like to see Alan Gassman’s slides for this presentation.

Date: Wednesday, June 18, 2014 | 2:00 – 3:00 p.m.

Location: Bloomberg BNA Tax & Accounting Online webinar

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

LIVE CLEARWATER PRESENTATION:

FICPA SUNCOAST CHAPTER MONTHLY MEETING

Alan S. Gassman will be speaking at the FICPA Suncoast Chapter’s monthly meeting on HOW TO PLAN, STRUCTURE, AND PROTECT WEALTH USING REVOCABLE AND IRREVOCABLE TRUSTS AND TRUST SYSTEMS. A COMPREHENSIVE OVERVIEW WITH A PRACTICAL PLANNING CHECKLIST AND PRACTITIONER TAX COMPLIANCE GUIDE.

Speaker: Alan S. Gassman

Date: Thursday, June 19, 2014 | 4:00 p.m. (100 minute presentation)

Location: Feather Sound Country Club, Clearwater, Florida

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

LIVE FT. LAUDERDALE PRESENATION:

FICPA ANNUAL ACCOUNTING SHOW

Alan Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of ESSENTIAL GUIDE TO BASIC TRUST PLANNING for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

LIVE NEW JERSEY PRESENTATION:

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it’s our second shore). Own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida’s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Attendees will receive Mr. Gassman’s book entitled AFlorida Law for Tax, Business and Financial Planning Advisors,@ which has a retail value of $34.95.

Our informative seminar, presented by Clearwater attorney Alan Gassman, highlights issues New Jersey lawyers should be aware of when handling matters for New Jersey residents who own Florida property, reside there part time, have interest in Florida businesses, or who are considering a move to Florida. The Florida Bar rules permit out of state lawyers to continue representation of Florida residents under rules that will be discussed.

Gain the knowledge you need to assist your clients with Florida matters, including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

- Better than mashed potatoes and gravy. Glad he didn’t serve grits!

Date: Saturday, October 4, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

********************************************************

LIVE SOUTH BEND, INDIANA PRESENATION:

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please send us your questions, comments and suggestions for Alan Gassman’s talk on Planning with Variable Annuities and Analyzing Reverse Mortgages.

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities, and provide estate and tax planners with a number of strategies for understanding and planning with existing and contemplated contracts. With over One Trillion Dollars of US taxpayer money invested in annuity contracts, more and more clients are showing up in their estate planners’ offices with large annuity contracts and common misunderstandings about “guaranteed income” and “guaranteed rates of return” features. The presentation will cover common policy features, what is actually happening inside of a policy, illustration techniques, and changes that can be made to defer income tax and reduce overall tax liability. Minimum distribution rules that apply to variable annuity contracts will also be discussed.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will once again be speaking at the Ave Maria School of Law Estate Planning Conference in Naples, Florida, whether he is invited or not! Hats off to Jonathan Gopman, Karen Grebing, Northern Trust and many others for having hosted one of the most enjoyable conferences in 2014.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, Naples, Florida

Additional Information: Please contact Karen Grebing at kgrebing@avemarialaw.edu for more information.

NOTABLE SEMINARS BY OTHERS

(We were not invited but will attend and are still excited!)

LIVE ORLANDO PRESENTATION:

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op’0

********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

LIVE PRESENTATION:

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: TBD

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

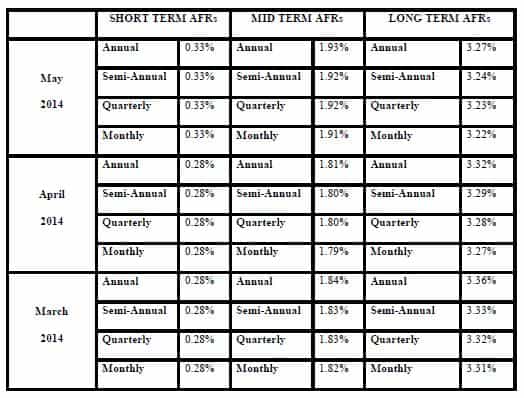

APPLICABLE FEDERAL RATES

The 7520 rate for May is 2.4% and for April was 2.2%