The Thursday Report – 5.19.16 – Mitchell Fuerst, David Finkel, and New Florida Statutes

Remembering Mitchell Fuerst

Business Bad Debt Deduction

Professor Aleamoni, Business Bad Debt, and the US Tax Court

Florida Statute 740 – Digital Assets

Florida Statute 731 – Estates

Legal Malpractice: Yes, It Can Happen to You by Jeffrey M. Verdon

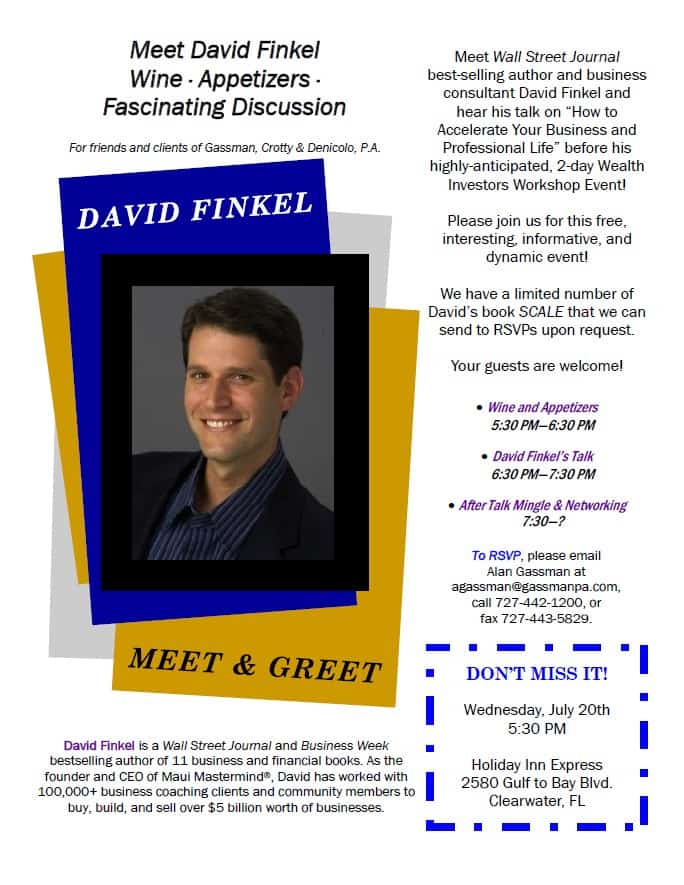

Event Spotlight: David Finkel Meet & Greet – July 20th, 2016

Richard Connolly’s World – 100 Years of Estate Tax

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Remembering Mitchell Fuerst

We are very sad to note the passing of Mitchell Fuerst. Mitchell was a managing partner of Fuerst Ittleman David & Joseph in Miami and a world renowned international tax attorney. His practice was primarily devoted to the comprehensive representation of businesses.

Mitchell’s ability to thoroughly analyze the strategies and goals of corporations, coupled with nearly 30 years of diverse legal experience, placed him in a unique position to effectively guide businesses through the complexities of governmental regulations and corporate compliance requirements while consistently maximizing shareholder value. He often worked in conjunction with corporate executives to develop ambitious business strategies that exceeded legal requirements while also promoting the growth and success of the corporation.

Mitchell was the partner of frequent Thursday Report contributor Denis Kleinfeld and a former student of Professor Jerry Hesch. Let’s wish them and Mitchell’s family the very best in this difficult time.

To read more about Mitchell Fuerst’s life and practice, please click here.

We at the Thursday Report express our most sincere condolences to Mitchell’s family, friends, and colleagues.

Quote of the Week

“Mitchell was a part-time student in the LL.M. program while he was working full-time in the IRS chief counsel’s office. His contributions during class discussions were significant because he frequently stressed the ethical concerns lawyers must consider when representing taxpayers. I was appreciative that he raised the ethics because when teaching substantive law, we rarely have time to mention the ethics. Having Mitchell in class sensitized me to the need to raise the ethics a lawyer needs to consider, and, because of Mitchell, I started to mention the ethics in my substantive courses. Mitchell’s influence was far broader than even he realized.”

– Jerry Hesch, on Mitchell Fuerst

Thanks to Jerry Hesch for sharing this spectacular memory of Mitchell.

Business Bad Debt Deduction

by Seaver Brown and Alan Gassman

Internal Revenue Code § 166(a)(1) generally allows for the full deduction against ordinary income of “business” related debts that become worthless within the taxable year. However, there are some limitations to this deduction, such as “non-business” bad debts, which may only be deducted as short-term capital losses.[1] This distinction between business and non-business debts is important because capital losses may only offset up to $3,000 of ordinary income a year.[2]

Therefore, if a taxpayer has a large amount of ordinary income, classifying the debt as business related will provide them with a much larger deduction.

A non-business debt is defined as those debts “other than – (A) a debt created or acquired in connection with a trade or business of the taxpayer, or (B) a debt, the loss from the worthlessness of which is incurred in the taxpayer’s trade or business.”[3]

To summarize the above, if a debt was created:

- Section 166(a) allows a deduction for debt that becomes worthless in the tax year.

- If the bad debt is business related, the deduction is against ordinary income.

- Non-business bad debt is treated as short-term capital losses.

Dagres v. Commissioner

The most recent instance in which the Tax Court allowed a business related bad deduction was the 2011 decision of Dagres v. Commissioner. Here, the Court held that a taxpayer’s bad debt loss, due to the non-repayment of a loan, was deductible as a “business bad debt” because he was in the business of managing venture capital funds and was not acting merely as a passive investor.[4]

The taxpayer, Dagres, made a loan of $5 million to one of his business acquaintances (Schrader) who had been under a great deal of financial stress following the burst of the Internet stock bubble. Admittedly, Dagres made this loan as a means of strengthening his relationship with Schrader, who, in exchange, would inform Dagres of any new and promising companies his venture capital firm could invest in.

Schrader’s financial situation continued to decline over the following two years, and Dagres had to forgive the original loan in exchange for a new, non-demand promissory note of $4 million. After six months of payments, Schrader again had to notify Dagres that he could not make any further payments. In exchange for Schrader’s interests in other venture funds, Dagres forgave the second loan altogether.

Dagres claimed business bad debt losses on his tax return for the two years in which he forgave the loans made to Schrader. The amount of which was the difference between the renegotiated loan of $4 million and the total value of securities received from Schrader. Upon examination of his return, the IRS issued a notice of deficiency and accuracy-related penalties. They argued that Dagres’s loan to Schrader was personal in nature and that the loss he suffered as a result was a non-business bad debt, which could only have been deducted as a short-term capital loss.

Analysis

The Court emphasized that simply investing one’s money and managing those investments does not amount to a trade or business, even if they earn their entire living from investment activities. However, an individual can be in the trade or business of investing if they receive “compensation attributable to his or her services,” such as fees, commissions, or other non-investor compensation. These facts tend to show that they are more than just a passive investor.

Thus, “in order to determine whether a particular bad debt loss is proximately related to the taxpayer’s trade or business, the taxpayer’s dominant motive for making the loan must be evaluated.”[5]

Ultimately, the Tax Court held that Dagres was a Member Manager of several LLCs that were in the business of managing venture capital funds and not merely for investment purposes. Furthermore, the Court found that when Dagres made the $5 million loan to Schrader, his “dominant motivation…was to gain preferential access to companies and deals to which Schrader might refer him so that Dagres could use that information in the venture capital activities that he undertook as a Member Manager.”[6]

The LLCs in which Dagres was a Member Manager of “did not vend companies or corporate stock to customers as inventory but nevertheless, like dealers, did earn compensation (in their case, fees and a significant profits interest) for the services they provided in managing and directing the investment of the venture capital entrusted [to them].”[7]

***********************************************

[1] IRC § 166(d)(1)

[2] IRC § 1211(b)(1).

[3] IRC § 166(d)(2).

[4] Dagres v. C.I.R., 136 T.C. 263, Tax Ct. Rep. (2011).

[5] Dagres v. C.I.R., 136 T.C. 282, Tax Ct. Rep. (2011).

[6] Id at 276.

[7] Id at 284.

Professor Aleamoni, Business Bad Debt, and the US Tax Court

by Seaver Brown and Alan Gassman

On May 12, 2016, the US Tax Court released a summary opinion[1] involving a college professor who had deducted several loans made to his closely held C Corporation.[2] The taxpayer claimed these deductions on his personal income tax return pursuant to IRC § 162(a), as an “ordinary and necessary trade or business expense.”

Professor Aleamoni taught courses in and had extensive knowledge in the fields of psychology, mathematics, and statistics. He also acted as a consultant to other colleges, corporations, and governments to help design and then implement “comprehensive faculty and personnel evaluation systems,” and created a C Corporation for these consulting services. In the years 2010, 2011, and 2012, Aleamoni did not report any gross sales or receipts on Schedule C of his Form 1040 individual income tax return, but he did claim a deduction for personal loans made to his business.

Aleamoni argued that these loans were deductible on his individual income tax returns as a business expense. Apparently, the IRS found nothing on point to refute this argument, but the Tax Court concluded that Congress did not intend to allow taxpayers to write off loans when made by a shareholder in “hopes to profit as an investor through: (1) the receipt of interest on the loan or the receipt of dividends on the stock, regardless of the nature of the investment as debt or equity; or (2) an increase in the value of the stock through the corporation becoming a more viable profit-making enterprise.”

Ultimately, the Tax Court sided with the argument presented by the IRS, “that the advances [made by Aleamoni to his corporation] were not currently deductible regardless of their characterization” as either loans or capital contributions.

The Tax Court emphasized the word “currently” here because “if the advances were, in fact, loans, then [Aleamoni] might have been entitled to a capital loss deduction in the future if their stock became worthless.”[3]

The Tax Court noted that Aleamoni’s ability to successfully claim the “business bad debt deduction” under section 166(b) was diminished because he testified that he “expected his advances to be repaid from time to time.” A business bad debt cannot be claimed until the debt becomes worthless, or started differently, until the corporation fails to repay the loan.

Interestingly enough, the Tax Court did not make any mention of, or impose any penalties, on Aleamoni. Furthermore, the opinion written by the Tax Court was very respectful given the fact that he represented himself pro se.

The Tax Court also made mention that in two previous audits of Aleamoni, the IRS had not challenged his loan deductions, and, as Aleamoni stated, “it was unsettling to be in court now litigating a matter that he thought had been resolved administratively in his favor some time ago.” The Tax Court disregarded this argument citing a Supreme Court case which held “that the Commissioner’s failure to challenge a taxpayer’s treatment of an item in an earlier year does not preclude an examination of the correctness of the treatment of that item in a later year because ‘the doctrine of equitable estoppel is not a bar to the correction by the Commissioner of a mistake of law.”[4]

The ability to deduct trade or business expenses is one of the most litigated issues Tax Courts hear. Unfortunately for Aleamoni, this decision joins a long list of other similar cases concerning trade or business expenses in which the Tax Court affirmed the IRS’ position.

*******************************************

[1] Pursuant to IRC § 7463(b), a summary opinion cannot be relied on as precedent, and the decision cannot be appealed by the parties.

[2] Aleamoni v. Commissioner, T.C. Summary Opinion 2016-21 (May 12, 2016).

[3] See, IRC § 166(b).

[4] See Auto Club of Michigan v. Commissioner, 353 U.S. 180, 183 (1957).

Florida Statute 740 – Digital Assets

by Seaver Brown

On March 10th, Governor Scott approved Senate Bill 494 (“SB 494”) to protect a person’s “digital assets” after death. Following the approval of SB 494, Chapter 740 of the Florida Statute was drafted and will become effective on July 1, 2016.

A digital asset is defined as “an electronic record in which an individual has a right or interest. The term does not include an underlying asset or liability unless the asset or liability is itself an electronic record.”[1]

Florida Statute § 741.003 allows individuals to designate a fiduciary to be in charge of their digital assets and electronic communications after death, much like a fiduciary has the legal authority to manage tangible assets and accounts of a deceased person. The statute allows the person to designate a recipient of their digital estate, either through a will or an online agreement with the custodian of their digital assets.[2]

Following their death, the custodian will then relinquish control of the digital assets to the designated recipient. The recipient of this information will have the ability to access and control the deceased individual’s financial accounts, social media accounts, electronic bank/credit statements, online photos, emails, text messages, and other documents that may be stored in the cloud.

Furthermore, it is important for those who are elected as a recipient of a “digital estate” to be aware of the duties imposed upon them as a fiduciary. Section 740.05 expressly provides that a fiduciary of digital assets is charged with the duty of care, duty of loyalty, and duty of confidentiality, much like fiduciaries of tangible assets.

In the interest of protecting a client’s privacy after death, planners and their clients should begin having discussions about not only who they trust to manage their digital assets, but also what information they would like a custodian to disclose upon their death.

You can view Senate Bill 494 by clicking here.

***************************************************

[1] Florida Statute § 741.002(9).

[2] A custodian is defined as the “person that carries, maintains, processes, receives, or stores a digital asset of a user.”

Florida Statute 731 – Estates

by Seaver Brown

Several weeks ago, Governor Rick Scott approved Senate Bill 540, which created Florida Statute § 731.1055 and amended several other sections related to estates. These changes will become effective on July 1, 2016.

Section 731.1055 will regulate the disposition of real property in Florida and provides that “the validity and effect of a disposition, whether intestate or testate, of real property of this state shall be determined by Florida law.”

Senate Bill 540 also amended Section 736.0802(10)(b), which governs a trustee’s ability to pay attorney’s fees with trust assets. Now, subsection (b) expressly provides that, “if a trustee incurs attorney fees or costs in connection with a claim or defense of breach of trust, which is made in a filed pleading, the trustee may pay such attorney fees or costs from trust assets without the approval of any person and without any court authorization. However, the trustee must serve a written notice of intent upon each qualified beneficiary of the trust whose share of the trust may be affected by the payment before such payment is made.”

Finally, SB 540 amended Florida Statute § 732.201 regarding a surviving spouse’s right to an elective share. It specifically provides that a surviving spouse’s claim of an elective share “does not reduce what the surviving spouse would receive if the election had not been made.” Furthermore, a surviving spouse’s claim of an elective share will not cause them to be treated as if they pre-deceased the decedent. In other words, when a surviving spouse claims an elective share, that amount is a floor, not a ceiling on the amount of assets which the surviving spouse may receive from the decedent’s estate.

You can view Senate Bill 540 by clicking here.

Legal Malpractice: Yes, It Can Happen to You

by Jeffrey M. Verdon, Esquire

Jeffrey Verdon is Managing Partner of Jeffrey M. Verdon Law Group, LLP. He has an LL.M. in Taxation from Boston University and practices law in the areas of taxation and comprehensive estate planning. He specializes in estate, trust and income tax planning, and asset and lifestyle protection planning for high net-worth clients across the US. He is also a highly sought-after speaker in the areas of taxation and estate planning, lecturing aboard cruise ships and at top Investment Conferences internationally.

To see this article in its original form, please click here. Thanks, Jeff, for sharing this Client Alert with Thursday Report readers!

Legal Malpractice. It lurks in the darkness, waiting to pounce on naïve, unsuspecting lawyers, and yes, even the great ones, too.

These are two of the most terrifying, haunting words, and, in abject terror, we shape our entire professional careers to avoid any situation that could lead us into the deep hole of exposure. We agonize over our daily choices as we feel forced to tiptoe around combative clients, race against looming deadlines and unreasonable opposing counsel, research the newest case law updates, and determine the judiciousness of being asked to lower our fees yet again.

It’s always in the backs of our minds…that fear of being caught up in something we can’t control, but still, we think, “It can’t happen to me.”

Although most of us live in tenuous denial, malpractice lawsuits do happen, and they happen fairly often. An article published by the American Bar Association stated that an estimated 5-6% of all attorneys face legal malpractice claims yearly, with some individual claims of liability reaching over $50M in damages. The ABA also reported that lawyers starting their legal career in private practice today are likely to have between one and three legal malpractice claims during their professional career. That number rises if legal work involves a high-risk practice area. The most common malpractice claims include failure to know and correctly apply the law, planning errors, failure to file documents, conflicts of interest, fraud, clerical errors, tax consequences, and poor client communication, among other types of complaints.

These statistics aren’t simply academic. Recently, several high-profile legal malpractice cases in the news have sobered the legal community. Some cases are so huge that entire firms have imploded, even when only one member of the firm is at fault.

The law firm of Rutter, Hobbs, and Davidoff was recently slapped with a $10M jury verdict when a former client claimed the firm committed legal malpractice in drafting a separation agreement between him and his employer. Although only two attorneys were ultimately implicated in the claim, the mid-sized firm quickly dissolved under the huge liability as its other partners and associates jumped ship. In another example, rapper 50 Cent sued his former lawyers at Garvey Schubert Barer for $75M in damages, claiming that their misinformed legal counsel had grave financial consequences that directly led to his bankruptcy.

It’s probably safe to say that not many firms carry professional liability insurance of $75M. What happens to a firm’s assets – and the partners’ assets – when insurance carriers only cover a fraction of the cost of a potential legal malpractice judgment? Can a lawyer do anything to protect against a disastrous legal malpractice claim, justified or not?

As any good lawyer will tell you, it depends. After all, timing is everything. If you “firewall” your assets by performing comprehensive estate planning with asset protection BEFORE a lawsuit occurs, you may be able to protect yourself. If you try to do it AFTER, it’s already too late.

Asset protection planning can help protect businesses and estates against unforeseen lawsuits. First class estate and asset protection planning services are not cheap, but what will the cost be if you do get sued and haven’t installed these legal “firewalls”? Defending a legal malpractice lawsuit could cost more than what it might cost to protect an attorney’s whole business or entire estate for their whole life. And, even better, Uncle Sam could help subsidize the cost through the utilization of the tax code.[1] Considering these benefits, coupled with the potential risks of losing it all, an upfront investment in such asset protection planning now seems like a no-brainer in protecting yourself later. For any lawyer practicing today, this is an opportunity for peace of mind and job stability.

Take this moment to consider your own situation. Are your personal and professional assets “firewalled” against unforeseen liabilities? Whether you are seeking to protect business or personal assets, a timely and effectively created asset protection structure to protect against a future unforeseeable liability claim can make recovery beyond your insurance policy limits unlikely and get the case settled early and for far less than not having a structure in place at all.

Yes, lawsuits can happen to you…but assets can be protected. Don’t let time, money, or denial come back to haunt you.

*********************************************

[1] IRC Section 212(3) permits the fees paid for tax planning to be expensed.

Event Spotlight

David Finkel Meet & Greet – July 20th, 2016

Richard Connolly’s World

100 Years of Estate Tax

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Happy Anniversary! The Estate Tax Turns 100” by Laura Saunders. This article was featured in The Wall Street Journal on April 29, 2016.

Richard’s description is as follows:

In 1916, as World War I raged in Europe, Congress wanted to boost US revenues in case America joined the fighting, so lawmakers voted for a new tax on a person’s assets at death. This levy affected less than 1% of Americans who died and raised less than 1% of federal revenue in 1917.

In an editorial at the time, The Wall Street Journal called the tax “frankly a class discrimination,” but most lawmakers who voted in favor of the levy, which had a top rate of 10% and an exemption of $50,000 (about $1 million in current dollars), saw it as a reasonable way to raise revenue. Opponents thought such levies should be left to the states.

So began the modern US estate tax. Today, the tax comes in the form of owing the government up to 40% of your assets at death, above an exemption of $5.45 million per person.

One hundred years later, experts across the political spectrum continue to debate if it should remain. While important details of the estate tax, such as rates and exemptions, have changed over the years, some fundamentals haven’t.

Please click here to read this article in its entirety.

Humor! (or Lack Thereof!)

Sign Saying of the Week

*************************************

Alan’s Away Message:

The European Cruise Edition

Will wonders never cease?

I’m on vacation in Greece.

Going to that most famous hill,

I wish the Elgin Marbles resided there still.

The views from the Acropolis I sure do like-y,

Next up, the Temple of Athena Nike,

We feel awed and somewhat solemn

When we gaze at the Parthenon’s great columns.

With my lovely wife Marcia, who I just adore-a

We’ll head down into the market agora.

Ouzo, falafel, and chicken souvlaki,

Our favorite might be the fried cheese, saganaki.

We’ll learn about scholars, Aristotle and Plato,

Marcus Aurelius and the lesser-known Cato.

We’ll dine on fine wines and pick olives off trees,

And question each other, just like old Socrates.

We can skip the trip to Delphi, for no oracle need divine,

That we’re celebrating Marcia’s birthday, and feeling mighty fine!

If you should need assistance while we watch Aristophanes,

Ask Maribeth or Tina, they’ll answer all your questions with ease.

*************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE BLOOMBERG BNA WEBINAR:

Turney Berry will present a one-hour webinar on the topic of LITTLE KNOWN BUT HIGHLY EFFECTIVE CHARTIABLE STRUCTURING.

This webinar is part of the Bloomberg BNA Practical & Creative Planning series.

Date: Thursday, May 26, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE INTERACTIVE LEGAL MELBOURNE, FL/LIVE FEED TO YOUR OFFICE PRESENTATION:

Alan Gassman, ILS Strategic Partner and Advisory Board member, will be speaking for InterActive Legal at the Florida Institute of Technology Media Center on ESTATE PLANNING FOR SNOWBIRDS AND FLORIDA-BASED CLIENTS.

Many people spend part of the year in Florida or make Florida their primary residence later in life. While their estate plans were prepared in different jurisdictions, these clients and their heirs are likely to find themselves dealing with Florida laws. This live-stream presentation is designed to navigate the unique areas of Florida estate planning for both Florida lawyers and lawyers in other states with clients domiciled in Florida.

This talk will include many techniques that can be used in all 50 states and Guam. This will be a live presentation for those who can attend and will feature a simultaneous, live online streaming broadcast. Watch or listen right from the comfort of your own office or join us in Melbourne.

Date: Thursday, June 2, 2016 | 12:00 PM – 2:00 PM EST

Location: Florida Institute of Technology Media Center | 150 W. University Blvd, Melbourne, FL 32901

Additional Information: For more information or to RSVP, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Lester Perling and Alan Gassman will present a free, 30-minute webinar on the topic of NEW FLORIDA LAWS AND THE STARK SHARING OF EQUIPMENT BY TIME CHANGE.

There will be two opportunities to attend this presentation.

Date: Wednesday, June 8, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Gideon Rothschild will present a one-hour webinar on the topic of BASIC AND INTERMEDIARY CONSIDERATIONS FOR TRUSTS ESTABLISHED IN ASSET PROTECTION JURISDICTIONS.

This webinar is part of the Bloomberg BNA Essential Elements series.

Date: Wednesday, June 15, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Martin Shenkman will present a one-hour webinar on the topic of ESTATE PLANNING NUGGETS: FAVORITE BUT LITTLE KNOWN ESTATE AND INCOME TAX PLANNING STRATEGIES FOR THE WELL-VERSED PLANNER.

This webinar is part of the Bloomberg BNA Practical & Creative Planning series.

Date: Tuesday, June 21, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Jay Adkisson and Alan Gassman will present a free, 30-minute webinar on the topic of JAY ADKISSON’S MUSINGS ON THE UVTA.

There will be two opportunities to attend this presentation that takes a look at the new Uniform Voidable Transfers Act.

Date: Tuesday, June 28, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY WEBINAR:

Dr. Srikumar Rao and Alan Gassman will present a free, 30-minute webinar on the topic of ETHICAL FRAMEWORK FOR DEALING WITH CHALLENGING SITUATIONS.

There will be two opportunities to attend this presentation.

Date: Wednesday, June 29, 2016 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM presentation, please click here. To register for the 5:00 PM presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

DAVID FINKEL CONFERENCE FOR PHYSICIANS – SCALE YOUR MEDICAL PRACTICE

This free event for physician clients of Gassman, Crotty & Denicolo, P.A. will feature nationally-recognized business advisor and author David Finkel’s unique presentation on growing a medical practice. The conference will be entitled SCALE YOUR MEDICAL PRACTICE: PROVEN STRATEGIES TO GROW YOUR PRACTICE, INCREASE YOUR CASH FLOW, AND CREATE MORE PERSONAL FREEDOM.

Spouses, office managers, and other practice advisors will also be welcome to attend this interesting and useful one-day conference.

Date: Saturday, July 23, 2016

Location: Tampa Marriott Westshore | 1001 N. Westshore Blvd., Tampa, FL, 33607

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

FLORIDA’S PREMIER BEHAVIORAL HEALTH ANNUAL CONFERENCE: PROVIDING VALUE IN CHALLENGING TIMES

Alan Gassman will be speaking at Florida’s Premier Behavioral Health Annual Conference, sponsored by The Florida Alcohol and Drug Abuse Association and The Florida Council for Community Mental Health. The 2016 conference theme is Providing Value in Challenging Times and examines the latest advances in the fields of substance use disorders and mental health.

Alan will be speaking on the topic of CRIMINAL AND CIVIL LAW IMPLICATIONS OF MARKETING, WAIVING DEDUCTIBLES AND CO-PAYS, RELATIONSHIPS WITH REFERRAL SOURCES, AND OTHER WAYS TO END UP IN JAIL: A COMPLIANCE WORKSHOP.

Date: August 10th – 12th, 2016 | Alan’s date and time is to be determined.

Location: Rosen Centre Hotel | 9840 International Drive, Orlando, FL, 32819

Additional Information: For more information or to register for this conference, please visit http://www.bhcon.org/. You may also email Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE SARASOTA PRESENTATION:

58th ANNUAL FLORIDA BANKERS ASSOCIATION TRUST & WEALTH MANAGEMENT CONFERENCE

Alan Gassman will be speaking at the 58th Annual Florida Bankers Association Trust & Wealth Management Conference on the topic of PLANNING TO AVOID AND HANDLE ESTATE AND TRUST DISPUTES.

Date: Thursday, September 29th, 2016 | 4:15 PM – 5:15 PM

Location: The Ritz-Carlton Sarasota | 1111 Ritz Carlton Drive, Sarasota, FL, 34236

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Save the Date for 2017!

LIVE NAPLES PRESENTATION:

4th ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will be speaking at the 4th Annual Ave Maria School of Law Estate Planning Conference. Watch this space for more details to be announced!

Date: Friday, May 5th, 2017

Location: The Ritz-Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE LAS VEGAS PRESENTATION:

AICPA ADVANCED PERSONAL FINANCIAL PLANNING CONFERENCE

Alan Gassman will be speaking at the Advanced Personal Financial Planning Conference, sponsored by The American Institute of CPAs. His tentative topic for this event is DYNAMIC PLANNING STRATEGIES THAT YOU ALREADY KNOW BUT HAVE NOT YET APPLIED.

This conference is part of the AICPA ENGAGE event, which brings together five well-known AICPA conferences with the Association for Accounting Marketing Summit for one, four-day event. The conferences included in ENGAGE are Advanced Personal Financial Planning, Advanced Estate Planning, Tax Strategies for the High-Income Individual, the Practitioners Symposium/TECH+ Conference, the National Advanced Accounting and Auditing Technical Symposium, and the Association for Accounting Marketing Summit.

Date: June 12th – June 15th, 2017 | Alan’s date and time are to be determined.

Location: MGM Grand | 3799 S. Las Vegas Blvd., Las Vegas, NV, 89109

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or click here.

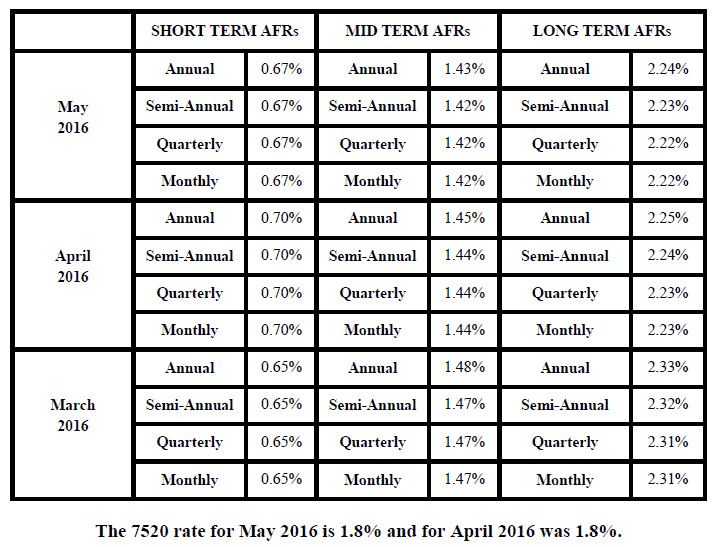

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.