The Thursday Report 5.15.2014 – New 4th DCA Creditor Case and Dr. Obama 90 Day Rule

New 4th DCA Decision May Dramatically Change the Landscape for Many Creditor Protection Plans

Obamacare 90 Day Risk Rule for Doctors. Don’t Be Blue (Shield), an article by Mike Segal, Shachi Mankodi and Alan S. Gassman

Oshins 11 or 101? Asset Protection Philosophy 101, an article by Steven J. Oshins

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

New 4th DCA Decision May Dramatically Change the Landscape for Many Creditor Protection Plans

Florida’s fourth district court of appeals chewed an opinion on March 5, 2014, which indicated that Florida courts do not have in rem or quasi in rem jurisdiction over foreign states and does not have the authority to order the debtors to turnover foreign stock certificates. In this case a gentleman named Mohammad Anwar Farid Al-Saleh, who is a citizen of the Country of Jordan, sued two individuals for having proceeded with a corporate business arrangement without sharing profits with him. He received a judgment for over $20,000,000 and then asked the Palm Beach County court, in a motion for proceedings supplementary, to order the two defendants in the case to turn over “all stock certificates and similar documents memorializing their ownership interest in any corporation.”

The court noted that “allowing trial courts to compel judgment debtors to bring out-of-state assets into Florida would effectively eviscerate the domestication of foreign judgment statutes”. The court also noted that “there may be competing claims to the foreign assets and we believe that claims against a single asset should be decided in a single forum – and . . .that the forum should be, as it traditionally has been, a court of the jurisdiction in which the asset is located.” The court cited the 2009 New York Court of Appeals case of Koehler v. Bank of Bermuda Ltd., 911 N.E.2d 825 (N.Y. 2009) for the above quotation, and distinguished the situation in this case from the circumstances of the Koehler decision, where an international bank with a presence in New York was ordered to turn over stock certificates that it was holding outside of New York. In this case the party with the physical possession of the stock certificates apparently has no physical ties to Florida.

This case has made the national news and will be quoted by many for the proposition that the best place to keep stock certificates and other evidence of ownership may by in foreign countries.

In this case the subject stock certificates concerned assets located in the Bahamas, the Netherlands, Jordan, The Isle of Man, and the Dominican Republic.

Courts may find that the assets owned and/or the state of incorporation is Florida, then a debtor may be required to turn over stock certificates, no matter where they are.

As the result of this case many planners will doubtlessly encourage clients and potential clients to keep more assets in offshore companies, and to issue stock certificates and have them held in jurisdictions that do not recognize U.S. judgments.

We will continue to study this situation and keep our readers posted.

A copy of this decision rendered by the 4th District Court of Appeals is available upon request. Please e-mail agassman@gassmanpa.com or Janine at janine@gassmanpa.com for a copy.

Obamacare 90 Day Risk Rule for Doctors. Don’t Be Blue (Shield), an article by Mike Segal, Shachi Mankodi and Alan S. Gassman

Mike Segal is a Partner in the Miami office of Broad and Cassel. He chairs the Firm’s Health Law Practice Group and has been practicing with Broad and Cassel for more than 40 years. Throughout his legal career, Mr. Segal has practiced in a business management environment. Over 20 years, he has spent considerable time in the representation of large single specialty and multi-specialty physician groups. He also has significant experience in structuring all varieties of joint venture transactions, keeping in mind the various regulatory issues. Additionally, he acts as general and special counsel to both hospitals and large medical groups.

He is a certified American Health Lawyer Association Dispute Resolver, a designation that qualifies him to serve as a mediator and arbitrator in forums for alternative dispute resolution.

Shachi Mankodi is an Associate in the Fort Lauderdale Office of Broad and Cassel. She is a member of the Firm’s Health Law Practice Group. Ms. Mankodi focuses her practice in the area of Health Law. She represents individuals and organizations in licensure disputes and proceedings as well as compliance and reimbursement matters involving the Medicaid and Medicare programs.

As Assistant General Counsel, she advised the Agency for Health Care Administration and Persons with Disabilities, the Department of Children and Families, and the Governor’s Energy Commission on litigation matters. As part of her duties in the Office of General Counsel, she was also involved in the judicial selection process.

Ms. Mankodi co-authored a chapter in the Florida Practitioner’s Health Law Handbook 2007 entitled “Investigating Medicaid Fraud”. Ms. Mankodi can be reached via email at smankodi@broadandcassel.com

The Broad and Cassel website is http://www.broadandcassel.com/.

**********************************

Among the many changes enacted by the Patient Protection and Affordable Care Act (“ACA”), is a provision that allows a 3-month grace period for certain individuals to pay their premiums while continuing to be insured by HMOs and managed care companies that participate in the national health insurance exchange (often referred to as the “exchange marketplace”). This 3-month grace period only applies to individuals that receive advanced premium tax credits (subsidies). Below is an explanation of how physicians that are providing services to insured individuals during the grace period are to bill and receive reimbursement from insurers for these services.

Services during first month of grace period

HMOs will pay physicians the full amount for claims related to services rendered from Day 1 to Day 30 of the grace period;

Claims paid during the first month are not subject to recoupment if the insured individual fails to pay his or her premium during the 90-day grace period.

HMOs are required to notify physicians when an Insured Individual is in the grace period for nonpayment of premium (either through their online systems, via letters or through remittance advice notices). NOTE – the ACA provides discretion to HMOs as to when and in what manner the notification is sent to the physician (for example, an HMO may choose to send a notice as soon as the patient enters the grace period or can wait to notify the physician until the second or third month of the grace period).

Services during second and third months of grace period

HMOs are authorized to “pend” claims, meaning the HMO can hold payments for services rendered from the 31st day until the 90th day of the grace period until the full amount of the premium is paid by the Insured Individual.

Physicians can still collect copayments, deductibles and coinsurance payments from the Insured Individual for services rendered during the second and third months.

HMOs may choose to notify providers that the claims are “pending” but best practice would be for the physician to check eligibility for all patients that are in the grace period prior to rendering services.

Billing for services after grace period has ended

If the Insured Individual does not pay the premium during the 3-month periodthe HMO will terminate coverage and deny all pending claims with dates of service in the second and third month of the grace period.

The physician is then authorized to collect the full amount of the service from the patient directly.

Physicians may have to invest in effective ways to collect for these services, which could require additional resources from billing agents.

If the Insured Individual pays the premium during the 3-month period the HMO will reimburse the provider for all pending claims with dates of service during the second and third month of the grace period.

NOTE – there is no change in policy for insured individuals that do not receive subsidies or who are not enrolled in a health insurance exchange policy. Florida law currently gives individuals a 30-day grace period to pay their premiums. All claims will “pend” during this 30-day time period and coverage will be terminated retroactive to the start of the 30-day grace period if the insured individual has not paid the premium within the 30-day period. Insurers are NOT required to notify providers that these insured individuals have entered the 30-day grace period.

Bottom Line for Physicians

Be aware of which patients are in the 90-day grace period; pay attention to the notices that you receive from HMOs regarding patient eligibility.

“Flag” patients who are entering their 31st day of the grace period. The services that physicians provide to these patients after the 31st day will most likely be in pending status with the HMO until the patient pays the premium.

Perform routine eligibility checks for patients at the time of scheduling appointments to ensure that they are actively insured.

Pursue collection activities from patients who have lost coverage after the 3-month grace period.

Oshins 11 or 101? Asset Protection Philosophy 101

by Steven J. Oshins

Steven J. Oshins, Esq., AEP (Distinguished) is an attorney at the Law Offices of Oshins & Associates, LLC in Las Vegas, Nevada, with clients throughout the United States. He is listed in The Best Lawyers in America. He was inducted into the NAEPC Estate Planning Hall of Fame in 2011 and was named one of the 24 Elite Estate Planning Attorneys in America by the Trust Advisor. He has authored many of the most valuable estate planning and asset protection laws that have been enacted in Nevada. He can be reached at 702-341-6000 or via email at soshins@oshins.com. The firm website is www.oshins.com

Asset protection has become a necessary part of every estate planner’s practice. As we see case law develop, it seems that every time a new decision is issued there are numerous blogs and comments made about the case at conferences, whether positive or negative. The litigators generally claim that the new case spells the end of the technique that was used and failed to work in this particular case. They will often claim that a technique “doesn’t work” based on one bad case. The asset protection planners generally claim that “bad facts made bad law.” So who is right?

The Goal

What is the goal when attempting to protect your assets? Isn’t the goal simply to structure your assets in such a way that they are less desirable to potential creditors? This is Asset Protection Philosophy 101. The asset protection structure should not be judged solely based on whether there is a similar structure that did not work when tested in the court system. Each situation stands on its own. NO two fact patters are exactly the same, no two parties to a lawsuit have exactly the same levels of fear and desire for compromise, and no two attorneys will approach the dispute in exactly the same way.

The goal isn’t necessarily to take a case through the court system and convince a judge to rule in your favor. The goal is to walk away with some or most of your assets intact. A settlement for substantially less than what could have been lost should be considered a victory. Unfortunately, case law generally glorifies the losing cases – not the winning cases – because the plaintiff tends to press the matter when the facts are more heavily on the plaintiff’s side. Therefore, we tend to see the bad results (from the debtor’s perspective) in the case law, but the good results (from the debtor’s perspective) very often go unreported because the disputes were settled. Those who practice in this area, however, have seen numerous clients settle matters, in large part because of the asset protection structure that was in place – which helped the creditor see the benefits in settling and the uphill battle that may exist without settlement.

Playing the Game

Asset Protection is a game of probabilities. Every legitimate wall that is placed around the asset should move the settlement number more in favor of the debtor. And every bad case that comes down the pike should move the settlement number more in favor of the creditor. Uncertainty over collectability causes most disputes to settle long before they reach the trial level. The creditor must assess the probability that he will be able to collect the debt and the expenses that will be involved in trying to collect, and then make a rational decision about how far to press the dispute and whether to attempt to settle and the likely settlement amount.

Asset Protection Philosophy 101

Assuming there is no creditor on the horizon, or that any current creditor is excluded from the asset protection structure and that it is only set up to protect from future creditors, if you were the client:

Would you proceed with an asset protection structure that has a 99% probability of protecting your assets? (Absolutely.)

Would you proceed with an asset protection structure that has a 90% probability of protecting your assets? (Very highly likely.)

Would you proceed with an asset protection structure that has a 75% probability of protecting your assets? (Probably, but you would hope to find a better alternative.)

Would you proceed with an asset protection structure that has a 50% probability of protecting your assets? (Maybe, but you would look for other alternatives.)

It is important to remember that nothing exists that assures a 100% probability of success. If hundreds of debtors are able to successfully use a particular asset protection structure to induce creditors to settle disputes and therefore avoid going all the way through the court process, would you avoid using that strategy if one bad case came down? If two bad cases come down? If three bad cases come down? Each advisor and each client will ask themselves whether the cost and complexity are worth the degree and probability of protection obtained using the particular structure.

Summary

Asset protection planning is about putting the client in a strong negotiation position by using accepted, legitimate techniques so that the client will ultimately settle the dispute for less than the amount that the client otherwise may have lost had the structure not been in place. It is not solely about case law. The asset protection scorecard not only includes case law, but also includes favorable settlements.

To the extent that the asset protection structure has moved the settlement number in favor of the debtor, the asset protection planner has done a good job. Asset Protection Philosophy 101 is to structure the client’s assets so that, if the client is ever sued, the client will keep some or more of the assets on account of the structure being in place well in advance of the creditor issue.

Humor! (or Lack Thereof!)

GREETINGS FROM SAN JUAN:

Alan and his wife Marcia are enjoying some time down in San Juan. Here is his auto-response on his email:

I’m in Puerto Rico on a vacation that I seek-o.

Soon Marcia will be calling me Chico,

Our ready team

is strong and lean

handling things until Monday

so that today and tomorrow can be fun-days.

I may check in on occasion

so please share anything that will cause elation.

If you need anything soon,

you will have it well before June.

My partners, Ken and Chris

are easily handling anything I might miss.

Have a great week, make it the most

and I bid you for now, Adiós!

Upcoming Seminars and Webinars

PLANNING WITH VARIABLE AND OTHER ANNUITY PRODUCTS and ALL ABOUT THE JEST TRUST

Dates: Planning with Variable Annuities | May 21, 2014 | 12:00 p.m. (50 minutes)

All About the JEST Trust | May 28, 2014 | 12:00 p.m. (50 minutes)

I am speaking at the Ohio State Bar Association 25th Annual Estate Planning Conference on Wealth Transfer on June 4, 2014 on 2 topics that I have never handled alone, at 50 minutes each. Please help me rehearse by attending one or both of these free 50 minute webinars.

These webinars are free of charge and you can register for each of them below.

To register for the Variable Annuities talk please click here.

To register for the JEST talk please click here.

********************************************************

THE JOINT EXEMPT STEP-UP TRUST AND PLANNING WITH COMMERCIAL ANNUITIES

Alan Gassman will be speaking at the annual Ohio Conference on Wealth Transfer on June 4, 2014 on two different topics:

1) Wealth Transfer on Structuring Joint Exempt Step-Up Trusts (“JESTs”): Maximizing Stepped-Up Basis Planning, Fully Funding Credit Shelter Trusts with Joint Assets and Practical and Technical Aspects Thereof – With Forms

With the increased federal estate tax exclusion, it may be time to reconsider “joint” trusts for married couples. Alan co-authored two articles in the October and November issues of Estate Planning Magazine about Joint Exempt Step-Up Trusts (JESTs), and will talk about maximizing stepped-up basis planning, fully funding Credit Shelter Trusts with joint assets, and other practical aspects of JESTs with forms.

2) Planning with Commercial and Charitable Annuities. Mr. Gassman will also be participating in a panel discussion the evening before hosted by Johnson Investment Counsel and The Ohio State University.

This session will discuss planning with fixed and variable annuities, covering common policy features, misunderstandings about “guaranteed” rates of return, the minimum distribution rules akin to the IRA rules, income taxation of annuities on the death of the owner or annuitant, and trusts as holders of annuity contracts.

Skip Fox will be speaking on the following:

1) Recent Developments.

This session will include commentary on marital planning, gifts, grantor trusts, asset protection, portability, generation skipping tax and charitable planning.

2) Must We Trust a Trust That’s Just a Crust That Was a Trust?

What some view as “un-trust-like” notions – protectors, selectors, advisors, appointers, special trustees, directed trusts, secret trusts, virtual representation, in terrorem forfeitures, perpetual trusts and decanting – will be examined with some forms included.

Date: June 4, 2014

Location: Hilton at Easton, Columbus, Ohio

Additional Information: For more information on the conference and to register for the conference please contact agassman@gassmanpa.com

********************************************************

VERSION 226.3 OF OUR ESTATEVIEW ESTATE TAX PROJECTION AND ILLUSTRATION SOFTWARE – A FREE WEBINAR

Alan Gassman, Ken Crotty and David Archer will be presenting a free 30 minute webinar on what is new with our EstateView software which will be featured later this year in Jason Havens’ excellent American Bar Association RPTE Probate and Property column.

Speakers: Alan Gassman, Ken Crotty and David Archer

Date: Monday, June 9, 2014 | 12:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

CREDITOR AND OTHER PLANNING FOR SAME GENDER COUPLES

Date: Tuesday, June 10, 2014 | 7:30 p.m.

Location: Online webinar

Additional Information: To register for the webinar please click here.

********************************************************

HIRING AND TERMINATING EMPLOYEES; WHAT TO DO, WHAT TO AVOID

Speaker: Alan S. Gassman, Esq., Colleen Flynn, Esq. and Dr. Stephanie Thomason

This is a very practical guide that your office manager is sure to enjoy. Let us know if you would like to see Alan Gassman’s slides for this presentation.

Date: Wednesday, June 18, 2014 | 2:00 – 3:00 p.m.

Location: Bloomberg BNA Tax & Accounting Online webinar

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

FICPA SUNCOAST CHAPTER MONTHLY MEETING

Alan S. Gassman will be speaking at the FICPA Suncoast Chapter’s monthly meeting on HOW TO PLAN, STRUCTURE, AND PROTECT WEALTH USING REVOCABLE AND IRREVOCABLE TRUSTS AND TRUST SYSTEMS. A COMPREHENSIVE OVERVIEW WITH A PRACTICAL PLANNING CHECKLIST AND PRACTITIONER TAX COMPLIANCE GUIDE.

Speaker: Alan S. Gassman

Date: Thursday, June 19, 2014 | 4:00 p.m. (100 minute presentation)

Location: Feather Sound Country Club, Clearwater, Florida

Additional Information: For more information, to register and a discount code please email agassman@gassmanpa.com

********************************************************

FICPA ANNUAL ACCOUNTING SHOW

Alan Gassman will be speaking at the FICPA Annual Accounting Show on Thursday, September 18, 2014 on the topic of ESSENTIAL GUIDE TO BASIC TRUST PLANNING for 50 minutes.

This presentation will introduce basic and intermediate trust planning background and provide attendees with an orderly list of the most commonly used trusts, practical features and traps for the unwary, including revocable, irrevocable and hybrid. The discussion will include tax, creditor protection and probate and guardian considerations.

Date: Wednesday, September 17 through Friday, September 19, 2014

Location: Fort Lauderdale, Florida

Additional Information: For more information about this program please contact Stephanie Thomas at ThomasS@ficpa.org

********************************************************

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be the sole speaker for this informative 3 hour program entitled WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Here is some of what the New Jersey Bar Invitation for this program provides:

New Jersey residents have always had a strong connection to Florida. We vacation there (it=s our second shore). Own Florida property (or have favored relatives that do) and have family and friends living there. Sometimes our wealthiest clients move to Florida and need guidance, and you need background in order to continue representation.

There are real and significant differences between the two states that every lawyer should be cognizant of. For example, holographic wills are perfectly legitimate in New Jersey and anyone can serve as an executor of an estate, which is not the case in Florida. Also, Florida=s new rules regarding LLCs are different, and if you are handling estates of New Jersey decedents who owned Florida property, there are Florida law issues that must be addressed. Asset protection differs significantly in Florida too.

Attendees will receive Mr. Gassman’s book entitled “Florida Law for Tax, Business and Financial Planning Advisors,” which has a retail value of $34.95.

Our informative seminar, presented by Clearwater attorney Alan Gassman, highlights issues New Jersey lawyers should be aware of when handling matters for New Jersey residents who own Florida property, reside there part time, have interest in Florida businesses, or who are considering a move to Florida. The Florida Bar rules permit out of state lawyers to continue representation of Florida residents under rules that will be discussed.

Gain the knowledge you need to assist your clients with Florida matters, including:

- Florida specific laws involving businesses, trusts, and estates

- Florida tax planning

- Elective share and homestead rules

- Liability Insulation and Planning

- Creditor Protection and Strategies

- Medical Practice Laws

- Staying within Florida Bar Guidelines that allow representation of Florida clients

Comments from past attendees of this program:

- Excellent seminar and materials!!!

- This was one of the best ICLE seminars yet!

- One of the best seminars I have attended.

Date: Saturday, October 4, 2014

Location: TBD

Additional Information: This is a repeat of the same program that we gave last year, but our book is now updated for the new Florida LLC law and changes in estate and trust law. Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

********************************************************

40th ANNUAL NOTRE DAME TAX & ESTATE PLANNING INSTITUTE

Please send us your questions, comments and suggestions for Alan Gassman’s talk on Planning with Variable Annuities and Analyzing Reverse Mortgages.

This presentation will cover the unique income tax and financial planning characteristics of fixed and variable annuities, and provide estate and tax planners with a number of strategies for understanding and planning with existing and contemplated contracts. With over One Trillion Dollars of US taxpayer money invested in annuity contracts, more and more clients are showing up in their estate planners’ offices with large annuity contracts and common misunderstandings about “guaranteed income” and “guaranteed rates of return” features. The presentation will cover common policy features, what is actually happening inside of a policy, illustration techniques, and changes that can be made to defer income tax and reduce overall tax liability. Minimum distribution rules that apply to variable annuity contracts will also be discussed.

Date: November 13 and 14, 2014

Location: Century Center, South Bend, Indiana

We welcome questions, comments and suggestions on variable annuities, which will be Alan Gassman’s topic for this conference.

Additional Information: The focus of this year’s institute will be on “Business Succession Planning: An Income Tax, Estate Tax and Financial Analysis.” As in past years, several sessions are designed to evaluate certain financial products and tax planning techniques so that the audience can better understand and evaluate these proposals in determining not only the tax and financial advantages they offer, but also evaluate limitations and problems they may cause in the future. Given that fewer clients will need high-end estate tax planning with the $5 million exemptions, other sessions will address concerns that all clients have. For example, a session will describe scams that target elderly individuals and how to protect the elderly from these scams. As part of the objective on refreshing or introducing the audience to areas that can expand their practice, other sessions will review the income tax consequences of debt cancellation, foreclosures, short sales, the special concerns that arise in bankruptcy and various planning available to eliminate the cancellation of debt income or at least defer it with a possible step-up basis at death. The Institute will also continue to have sessions devoted to income tax planning techniques that clients can use immediately instead of waiting to save estate taxes far in the future.

********************************************************

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman will once again be speaking at the Ave Maria School of Law Estate Planning Conference in Naples, Florida, whether he is invited or not! Hats off to Jonathan Gopman, Karen Grebing, Northern Trust and many others for having hosted one of the most enjoyable conferences in 2014.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law, Naples, Florida

Additional Information: Please contact Karen Grebing at kgrebing@avemarialaw.edu for more information.

NOTABLE SEMINARS BY OTHERS

(WE WERE NOT INVITED, BUT WILL ATTEND AND ARE STILL EXCITED)

49th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 12 – 16, 2015

Location: Orlando World Center Marriott 8701 World Center Drive, Orlando, Florida

Additional Information: For more information please visit: https://www.law.miami.edu/heckerling/?op=0

********************************************************

ALL CHILDREN’S HOSPITAL FOUNDATION

Date: Thursday, February 12, 2015

Location: St. Petersburg, FL

Additional Information: Please contact Lydia Bennett Bailey at Lydia.Bailey@allkids.org for more information.

********************************************************

2015 FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: TBD

Additional Information: Please contact Bruce Bokor at bruceb@jpfirm.com for more information.

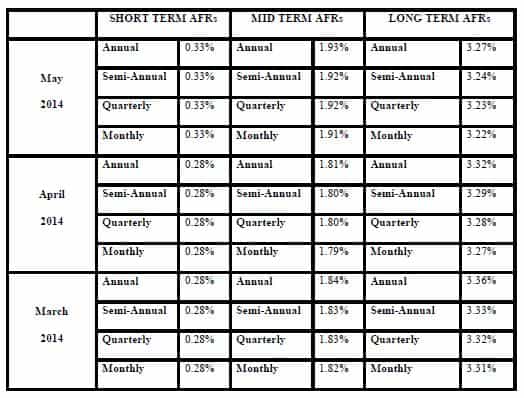

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

The 7520 Rate for May is 2.4% and for April was 2.2%